Attached files

| file | filename |

|---|---|

| 8-K - 8-K - YADKIN FINANCIAL Corp | a8kinvestorconference.htm |

(NYSE: YDKN) Gulf South Bank Conference May 2 – 3, 2016

Forward Looking Statements Information in this presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties that could cause actual results to differ materially, including without limitation, reduced earnings due to larger than expected credit losses in the sectors of our loan portfolio secured by real estate due to economic factors, including declining real estate values, increasing interest rates, increasing unemployment, or changes in payment behavior or other factors; reduced earnings due to larger credit losses because our loans are concentrated by loan type, industry segment, borrower type, or location of the borrower or collateral; the rate of delinquencies and amount of loans charged-off; the adequacy of the level of our allowance for loan losses and the amount of loan loss provisions required in future periods; costs or difficulties related to the integration of the banks we acquired or may acquire may be greater than expected; our ability to achieve the estimated synergies from the NewBridge transaction and once integrated, the effects of such business combination on our future financial condition, operating results, strategy and plans; our ability to integrate NewBridge on our schedule and budget; results of examinations by our regulatory authorities, including the possibility that the regulatory authorities may, among other things, require us to increase our allowance for loan losses or writedown assets; the amount of our loan portfolio collateralized by real estate, and the weakness in the commercial real estate market; our ability to maintain appropriate levels of capital; adverse changes in asset quality and resulting credit risk-related losses and expenses; increased funding costs due to market illiquidity, increased competition for funding, and increased regulatory requirements with regard to funding; significant increases in competitive pressure in the banking and financial services industries; changes in political conditions or the legislative or regulatory environment, including the effect of recent financial reform legislation on the banking industry; general economic conditions, either nationally or regionally and especially in our primary service area, becoming less favorable than expected resulting in, among other things, a deterioration in credit quality; our ability to retain our existing customers, including our deposit relationships; changes occurring in business conditions and inflation; changes in monetary and tax policies; ability of borrowers to repay loans; risks associated with a failure in or breach of our operational or security systems or infrastructure, or those of our third party vendors and other service providers or other third parties, including as a result of cyber attacks, which could disrupt our businesses, result in the disclosure or misuse of confidential or proprietary information, damage our reputation, increase our costs and cause losses; changes in accounting principles, policies or guidelines; changes in the assessment of whether a deferred tax valuation allowance is necessary; our reliance on secondary sources such as Federal Home Loan Bank advances, sales of securities and loans, federal funds lines of credit from correspondent banks and out-of-market time deposits, to meet our liquidity needs; loss of consumer confidence and economic disruptions resulting from terrorist activities or other military actions; and changes in the securities markets. Additional factors that could cause actual results to differ materially are discussed in the Company’s filings with the Securities and Exchange Commission ("SEC"), including without limitation its Annual Report on Form 10-K, its Quarterly Reports on Form 10-Q, and its Current Reports on Form 8-K. The forward-looking statements in this presentation speak only as of the date of the presentation, and the Company does not assume any obligation to update such forward-looking statements. Non‐GAAP Measures Statements included in this presentation include non‐GAAP measures and should be read along with the accompanying tables to the April 21, 2016 presentation and earnings release which provide a reconciliation of non‐GAAP measures to GAAP measures. Management believes that these non‐GAAP measures provide additional useful information that allows readers to evaluate the ongoing performance of the Company. Non‐GAAP measures should not be considered as an alternative to any measure of performance or financial condition as promulgated under GAAP, and investors should consider the Company's performance and financial condition as reported under GAAP and all other relevant information when assessing the performance or financial condition of the Company. Non‐GAAP measures have limitations as analytical tools, and investors should not consider them in isolation or as a substitute for analysis of the Company's results or financial condition as reported under GAAP. Important Information 2

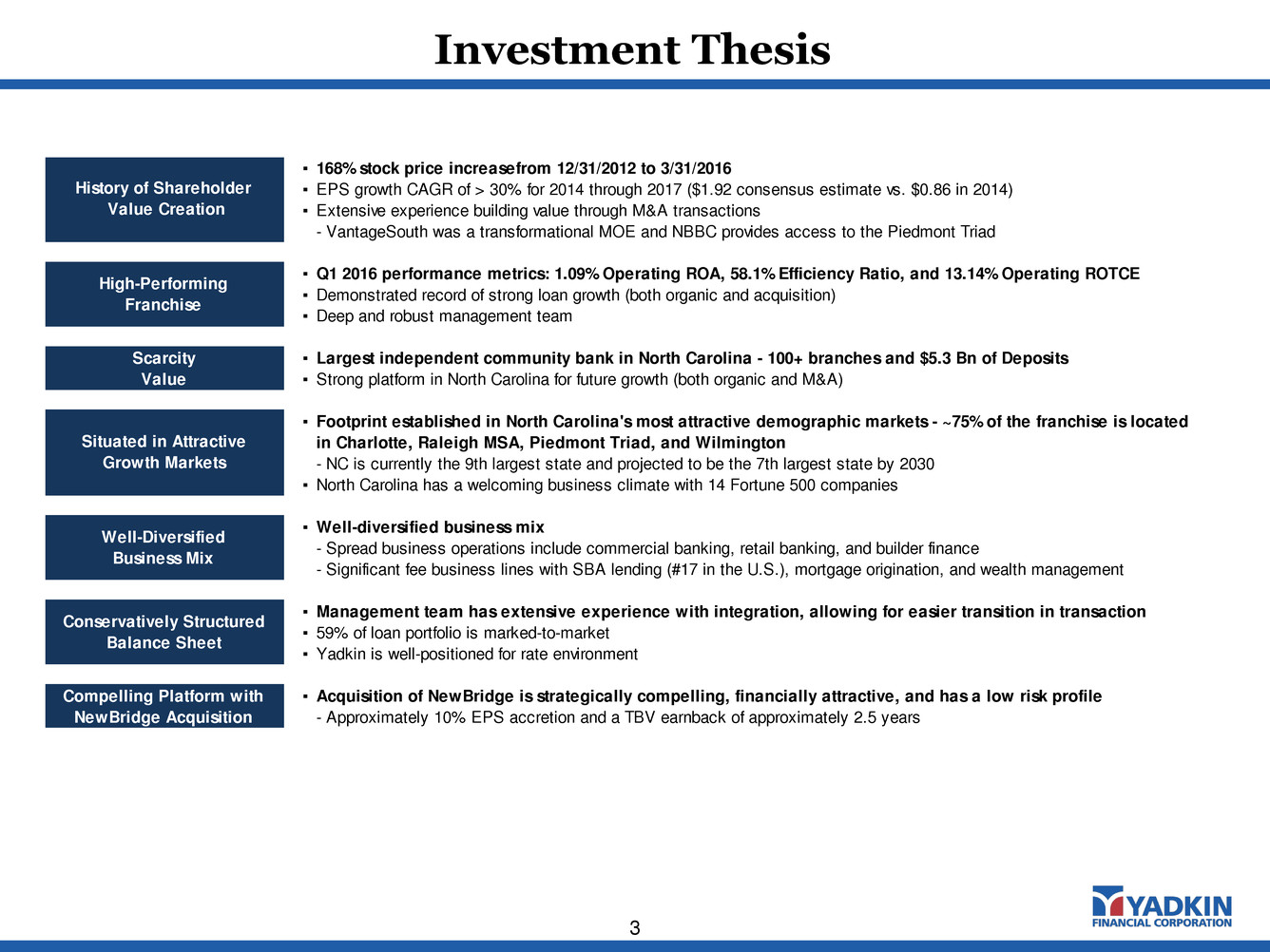

Investment Thesis 3 ▪ 168% stock price increasefrom 12/31/2012 to 3/31/2016 ▪ EPS growth CAGR of > 30% for 2014 through 2017 ($1.92 consensus estimate vs. $0.86 in 2014) ▪ Extensive experience building value through M&A transactions - VantageSouth was a transformational MOE and NBBC provides access to the Piedmont Triad ▪ Q1 2016 performance metrics: 1.09% Operating ROA, 58.1% Efficiency Ratio, and 13.14% Operating ROTCE ▪ Demonstrated record of strong loan growth (both organic and acquisition) ▪ Deep and robust management team ▪ Largest independent community bank in North Carolina - 100+ branches and $5.3 Bn of Deposits ▪ Strong platform in North Carolina for future growth (both organic and M&A) ▪ Footprint established in North Carolina's most attractive demographic markets - ~75% of the franchise is located in Charlotte, Raleigh MSA, Piedmont Triad, and Wilmington - NC is currently the 9th largest state and projected to be the 7th largest state by 2030 ▪ North Carolina has a welcoming business climate with 14 Fortune 500 companies ▪ Well-diversified business mix - Spread business operations include commercial banking, retail banking, and builder finance - Significant fee business lines with SBA lending (#17 in the U.S.), mortgage origination, and wealth management ▪ Management team has extensive experience with integration, allowing for easier transition in transaction ▪ 59% of loan portfolio is marked-to-market ▪ Yadkin is well-positioned for rate environment ▪ Acquisition of NewBridge is strategically compelling, financially attractive, and has a low risk profile - Approximately 10% EPS accretion and a TBV earnback of approximately 2.5 years Compelling Platform with NewBridge Acquisition History of Shareholder Value Creation Scarcity Value Situated in Attractive Growth Markets Well-Diversified Business Mix High-Performing Franchise Conservatively Structured Balance Sheet

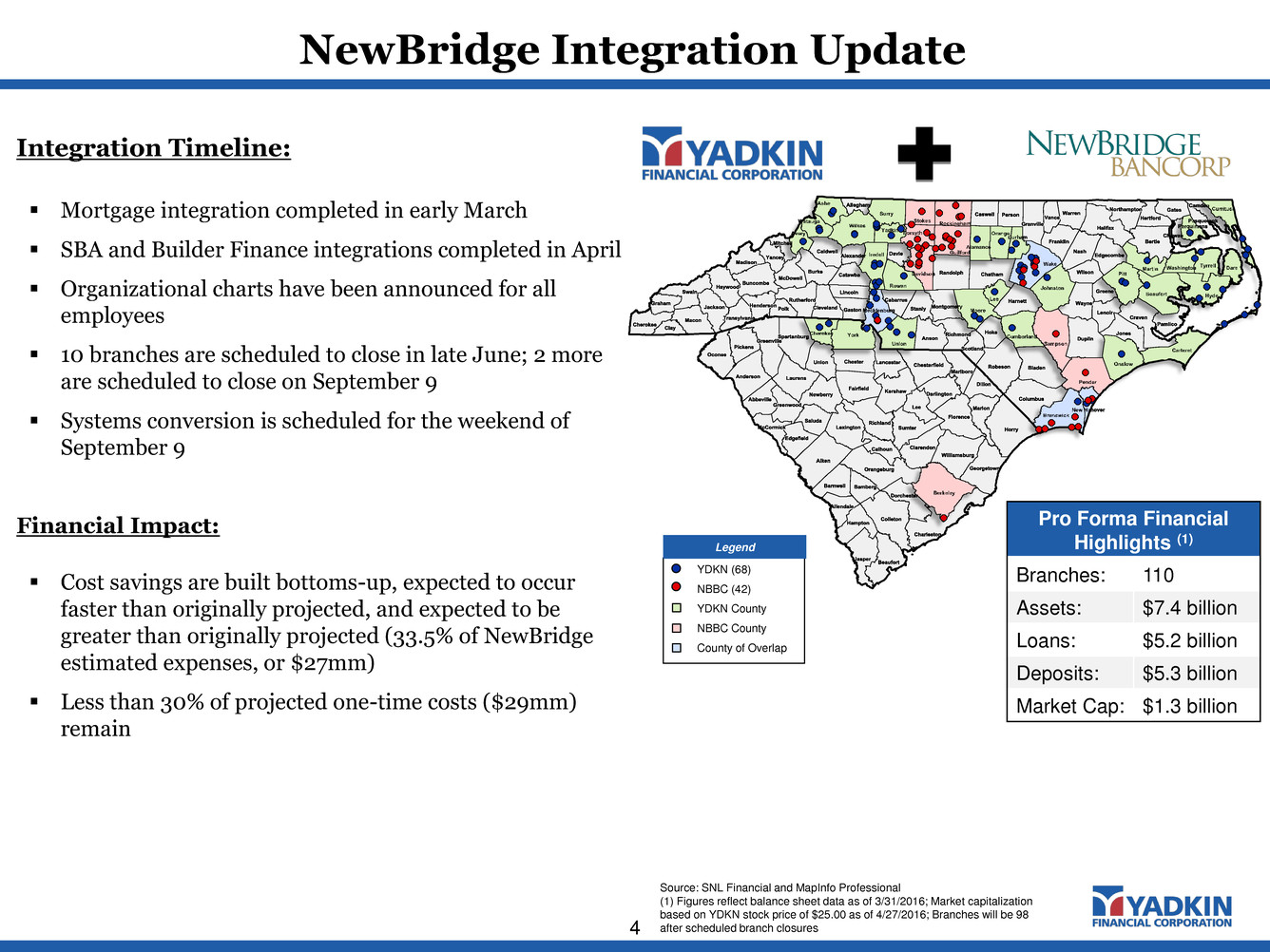

NewBridge Integration Update 4 YDKN (68) NBBC (42) YDKN County NBBC County County of Overlap Legend Pro Forma Financial Highlights (1) Branches: 110 Assets: $7.4 billion Loans: $5.2 billion Deposits: $5.3 billion Market Cap: $1.3 billion Source: SNL Financial and MapInfo Professional (1) Figures reflect balance sheet data as of 3/31/2016; Market capitalization based on YDKN stock price of $25.00 as of 4/27/2016; Branches will be 98 after scheduled branch closures Integration Timeline: Mortgage integration completed in early March SBA and Builder Finance integrations completed in April Organizational charts have been announced for all employees 10 branches are scheduled to close in late June; 2 more are scheduled to close on September 9 Systems conversion is scheduled for the weekend of September 9 Financial Impact: Cost savings are built bottoms-up, expected to occur faster than originally projected, and expected to be greater than originally projected (33.5% of NewBridge estimated expenses, or $27mm) Less than 30% of projected one-time costs ($29mm) remain

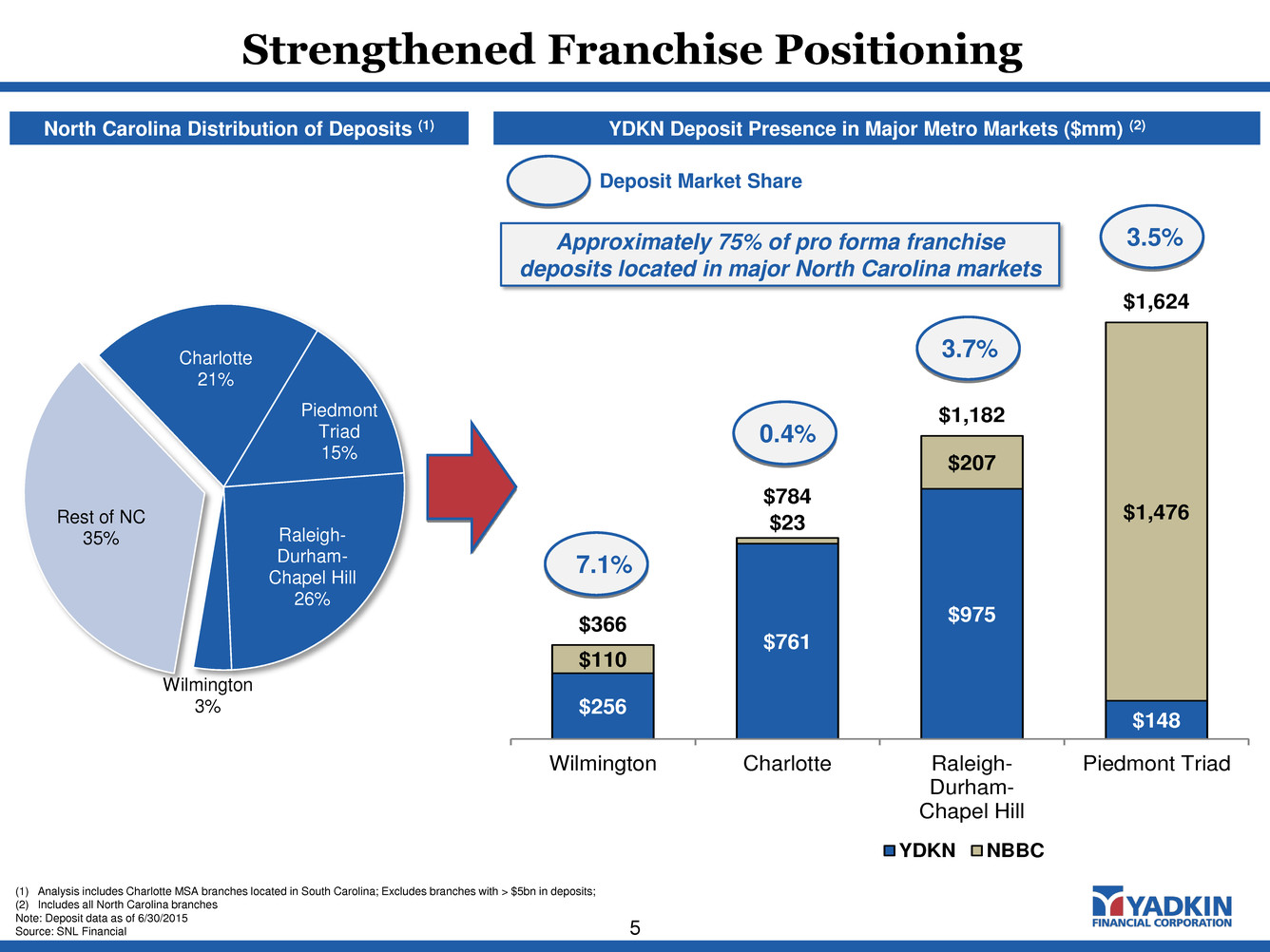

5 Charlotte 21% Piedmont Triad 15% Raleigh- Durham- Chapel Hill 26% Wilmington 3% Rest of NC 35% Strengthened Franchise Positioning $256 $761 $975 $148 $110 $23 $207 $1,476 $366 $784 $1,182 $1,624 Wilmington Charlotte Raleigh- Durham- Chapel Hill Piedmont Triad YDKN NBBC (1) Analysis includes Charlotte MSA branches located in South Carolina; Excludes branches with > $5bn in deposits; (2) Includes all North Carolina branches Note: Deposit data as of 6/30/2015 Source: SNL Financial YDKN Deposit Presence in Major Metro Markets ($mm) (2) North Carolina Distribution of Deposits (1) 7.1% 0.4% 3.7% 3.5% Deposit Market Share Approximately 75% of pro forma franchise deposits located in major North Carolina markets

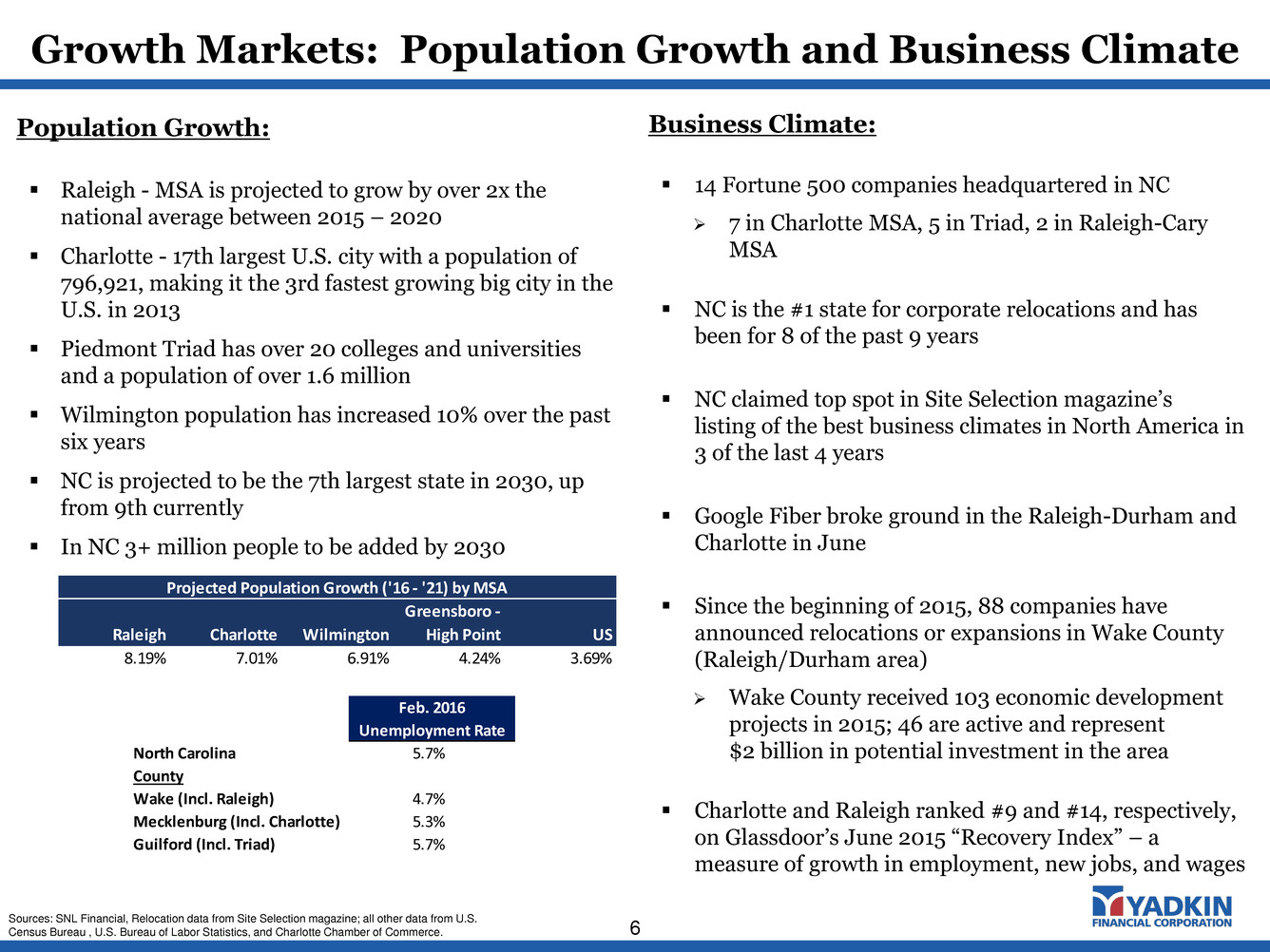

Growth Markets: Population Growth and Business Climate 6 Business Climate: 14 Fortune 500 companies headquartered in NC 7 in Charlotte MSA, 5 in Triad, 2 in Raleigh-Cary MSA NC is the #1 state for corporate relocations and has been for 8 of the past 9 years NC claimed top spot in Site Selection magazine’s listing of the best business climates in North America in 3 of the last 4 years Google Fiber broke ground in the Raleigh-Durham and Charlotte in June Since the beginning of 2015, 88 companies have announced relocations or expansions in Wake County (Raleigh/Durham area) Wake County received 103 economic development projects in 2015; 46 are active and represent $2 billion in potential investment in the area Charlotte and Raleigh ranked #9 and #14, respectively, on Glassdoor’s June 2015 “Recovery Index” – a measure of growth in employment, new jobs, and wages Sources: SNL Financial, Relocation data from Site Selection magazine; all other data from U.S. Census Bureau , U.S. Bureau of Labor Statistics, and Charlotte Chamber of Commerce. Population Growth: Raleigh - MSA is projected to grow by over 2x the national average between 2015 – 2020 Charlotte - 17th largest U.S. city with a population of 796,921, making it the 3rd fastest growing big city in the U.S. in 2013 Piedmont Triad has over 20 colleges and universities and a population of over 1.6 million Wilmington population has increased 10% over the past six years NC is projected to be the 7th largest state in 2030, up from 9th currently In NC 3+ million people to be added by 2030 Feb. 2016 Unemployment Rate North Carolina 5.7% County Wake (Incl. Raleigh) 4.7% Mecklenburg (Incl. Charlotte) 5.3% Guilford (Incl. Triad) 5.7% Proj cted Population Growth ('16 - '21) by MSA Raleigh Charlott Wilmington Greensboro - High Point US 8.19% 7.01% 6.91% 4.24% 3.69%

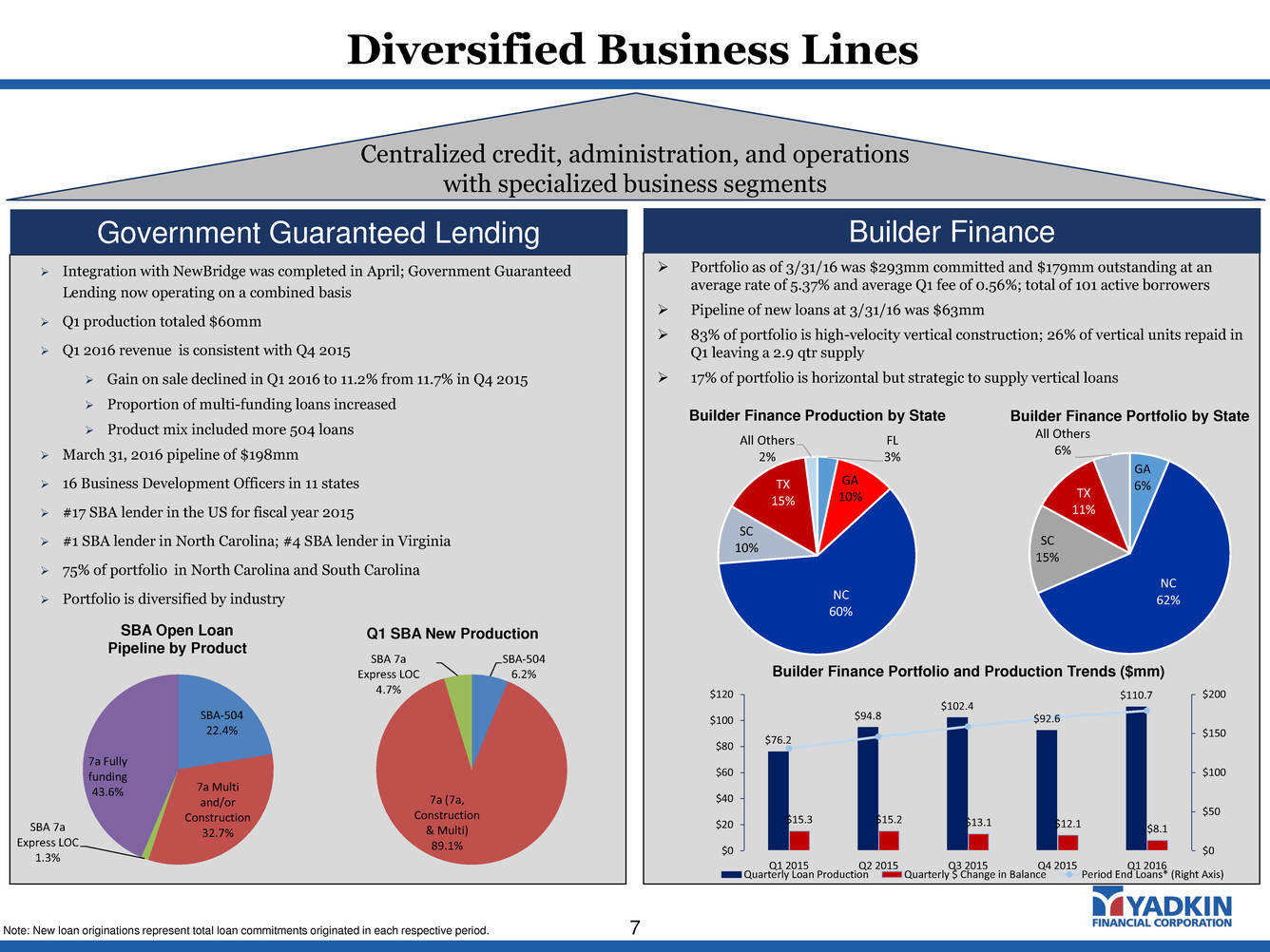

Integration with NewBridge was completed in April; Government Guaranteed Lending now operating on a combined basis Q1 production totaled $60mm Q1 2016 revenue is consistent with Q4 2015 Gain on sale declined in Q1 2016 to 11.2% from 11.7% in Q4 2015 Proportion of multi-funding loans increased Product mix included more 504 loans March 31, 2016 pipeline of $198mm 16 Business Development Officers in 11 states #17 SBA lender in the US for fiscal year 2015 #1 SBA lender in North Carolina; #4 SBA lender in Virginia 75% of portfolio in North Carolina and South Carolina Portfolio is diversified by industry Portfolio as of 3/31/16 was $293mm committed and $179mm outstanding at an average rate of 5.37% and average Q1 fee of 0.56%; total of 101 active borrowers Pipeline of new loans at 3/31/16 was $63mm 83% of portfolio is high-velocity vertical construction; 26% of vertical units repaid in Q1 leaving a 2.9 qtr supply 17% of portfolio is horizontal but strategic to supply vertical loans Diversified Business Lines 7 Centralized credit, administration, and operations with specialized business segments Government Guaranteed Lending Builder Finance Builder Finance Portfolio and Production Trends ($mm) Builder Finance Portfolio by State Note: New loan originations represent total loan commitments originated in each respective period. Builder Finance Production by State SBA Open Loan Pipeline by Product Q1 SBA New Production SBA-504 22.4% 7a Multi and/or Construction 32.7% SBA 7a Express LOC 1.3% 7a Fully funding 43.6% SBA-504 6.2% 7 (7a, Construction & Multi) 89.1% SBA 7a Express LOC 4.7% $76.2 $94.8 $102.4 $92.6 $110.7 $15.3 $15.2 $13.1 $12.1 $8.1 $0 $50 $100 $150 $200 $0 $20 $40 $60 $80 $100 $120 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Quarterly Loan Production Quarterly $ Change in Balance Period End Loans* (Right Axis) GA 6% NC 62% SC 15% TX 11% All Others 6% FL 3% GA 10% NC 60% SC 10% TX 15% All Others 2%

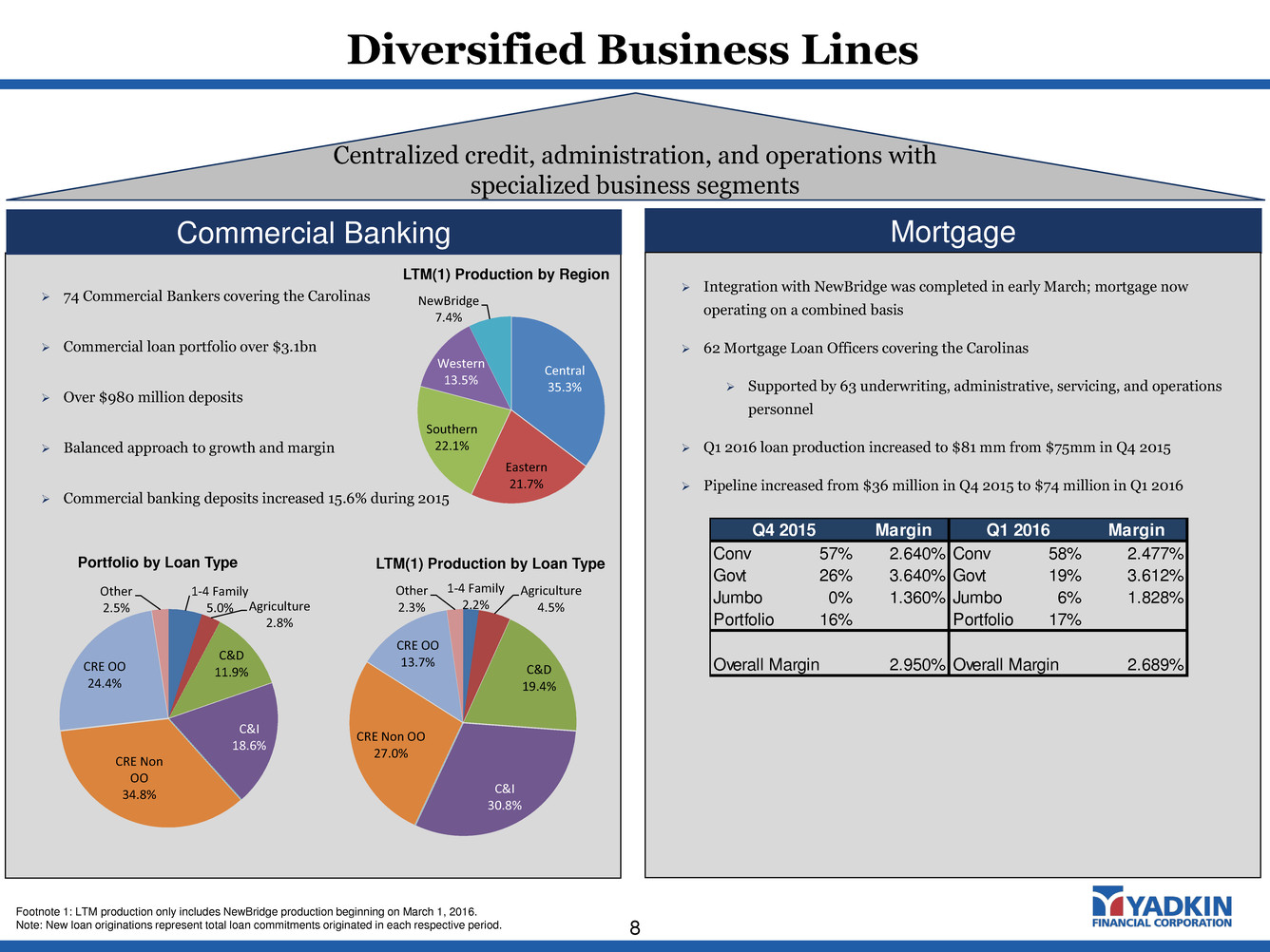

Diversified Business Lines 8 Footnote 1: LTM production only includes NewBridge production beginning on March 1, 2016. Note: New loan originations represent total loan commitments originated in each respective period. Centralized credit, administration, and operations with specialized business segments Commercial Banking Mortgage Integration with NewBridge was completed in early March; mortgage now operating on a combined basis 62 Mortgage Loan Officers covering the Carolinas Supported by 63 underwriting, administrative, servicing, and operations personnel Q1 2016 loan production increased to $81 mm from $75mm in Q4 2015 Pipeline increased from $36 million in Q4 2015 to $74 million in Q1 2016 74 Commercial Bankers covering the Carolinas Commercial loan portfolio over $3.1bn Over $980 million deposits Balanced approach to growth and margin Commercial banking deposits increased 15.6% during 2015 LTM(1) Production by Region Portfolio by Loan Type LTM(1) Production by Loan Type Margin Margin Conv 57% 2.640% Conv 58% 2.477% Govt 26% 3.640% Govt 19% 3.612% Jumbo 0% 1.360% Jumbo 6% 1.828% Portfolio 16% Portfolio 17% Overall Margin 2.950% Overall Margin 2.689% Q1 2016Q4 2015 1-4 Family 5.0% Agriculture 2.8% C&D 11.9% C&I 18.6% CRE Non OO 34.8% CRE OO 24.4% Other 2.5% Central 35.3% Eastern 21.7% Southern 22.1% Western 13.5% NewBridge 7.4% 1-4 Family 2.2% Agriculture 4.5% C&D 19.4% C&I 3 .8% CRE Non OO 27.0 CRE OO 13.7% Other 2.3%

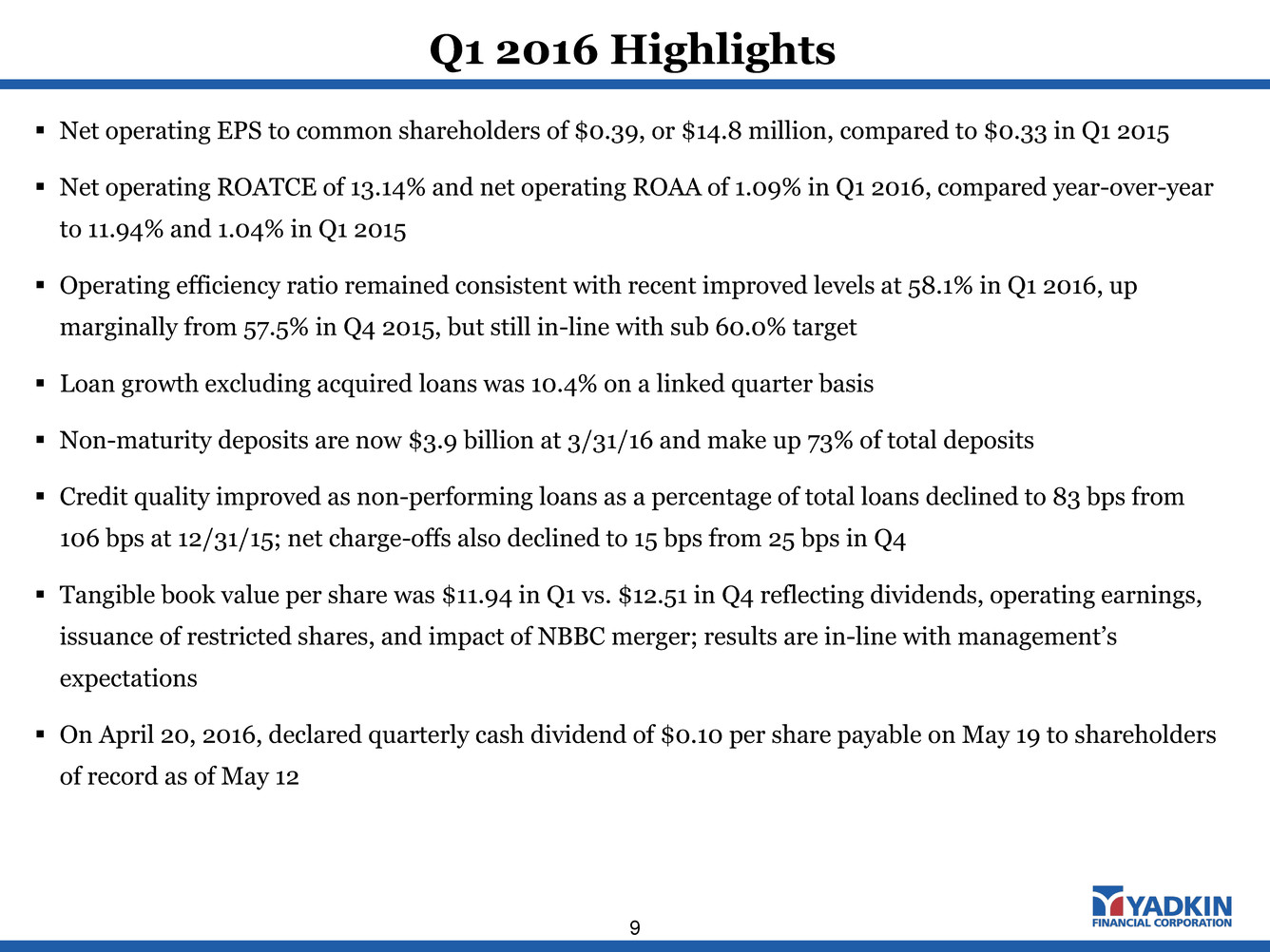

Q1 2016 Highlights 9 Net operating EPS to common shareholders of $0.39, or $14.8 million, compared to $0.33 in Q1 2015 Net operating ROATCE of 13.14% and net operating ROAA of 1.09% in Q1 2016, compared year-over-year to 11.94% and 1.04% in Q1 2015 Operating efficiency ratio remained consistent with recent improved levels at 58.1% in Q1 2016, up marginally from 57.5% in Q4 2015, but still in-line with sub 60.0% target Loan growth excluding acquired loans was 10.4% on a linked quarter basis Non-maturity deposits are now $3.9 billion at 3/31/16 and make up 73% of total deposits Credit quality improved as non-performing loans as a percentage of total loans declined to 83 bps from 106 bps at 12/31/15; net charge-offs also declined to 15 bps from 25 bps in Q4 Tangible book value per share was $11.94 in Q1 vs. $12.51 in Q4 reflecting dividends, operating earnings, issuance of restricted shares, and impact of NBBC merger; results are in-line with management’s expectations On April 20, 2016, declared quarterly cash dividend of $0.10 per share payable on May 19 to shareholders of record as of May 12

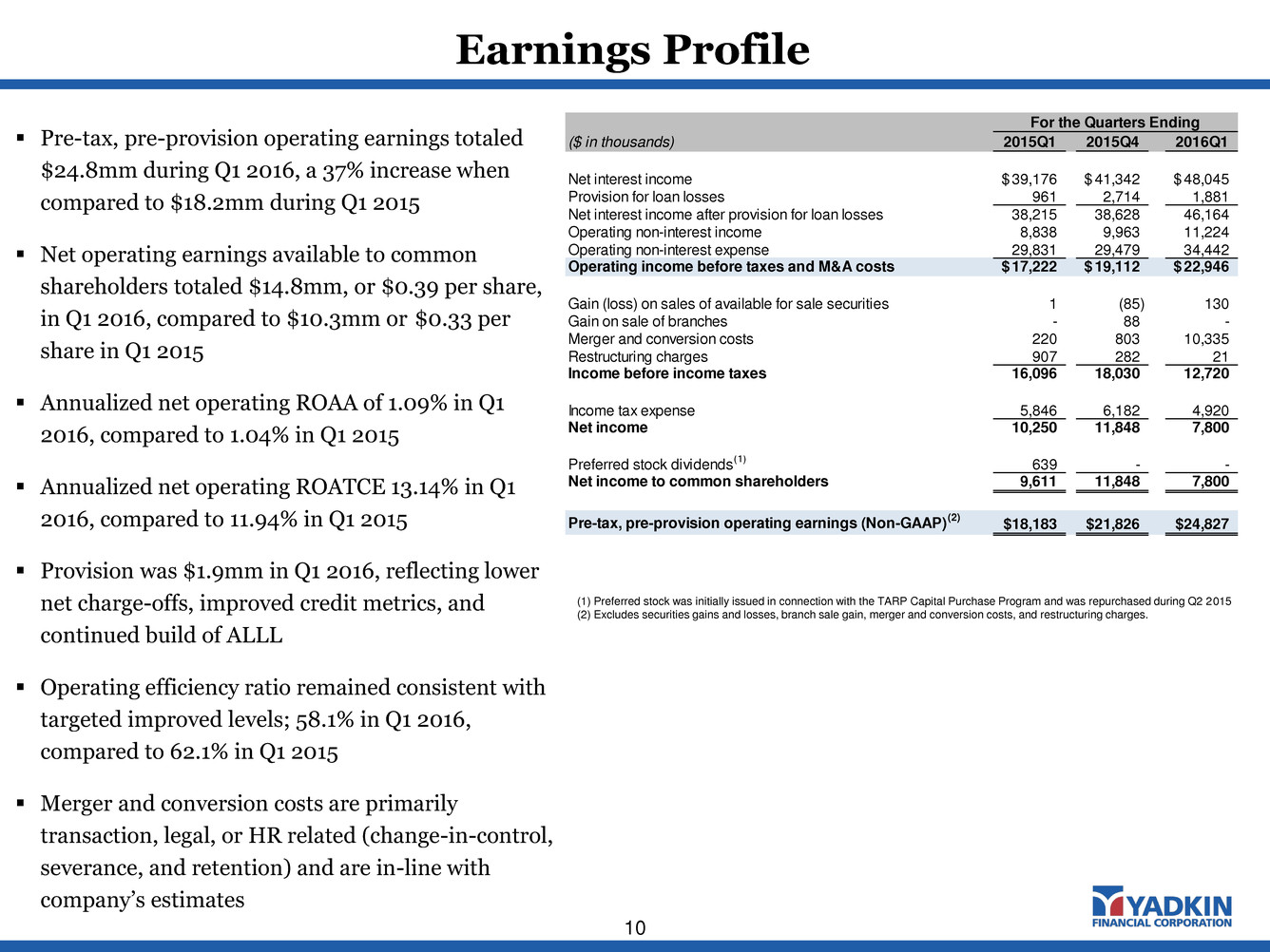

Pre-tax, pre-provision operating earnings totaled $24.8mm during Q1 2016, a 37% increase when compared to $18.2mm during Q1 2015 Net operating earnings available to common shareholders totaled $14.8mm, or $0.39 per share, in Q1 2016, compared to $10.3mm or $0.33 per share in Q1 2015 Annualized net operating ROAA of 1.09% in Q1 2016, compared to 1.04% in Q1 2015 Annualized net operating ROATCE 13.14% in Q1 2016, compared to 11.94% in Q1 2015 Provision was $1.9mm in Q1 2016, reflecting lower net charge-offs, improved credit metrics, and continued build of ALLL Operating efficiency ratio remained consistent with targeted improved levels; 58.1% in Q1 2016, compared to 62.1% in Q1 2015 Merger and conversion costs are primarily transaction, legal, or HR related (change-in-control, severance, and retention) and are in-line with company’s estimates (1) Preferred stock was initially issued in connection with the TARP Capital Purchase Program and was repurchased during Q2 2015 (2) Excludes securities gains and losses, branch sale gain, merger and conversion costs, and restructuring charges. Earnings Profile 10 For the Quarters Ending ($ in thousands) 2015Q1 2015Q4 2016Q1 Net interest income 39,176$ 41,342$ 48,045$ Provision for loan losses 961 2,714 1,881 Net interest income after provision for loan losses 38,215 38,628 46,164 Operating non-interest income 8,838 9,963 11,224 Operating non-interest expense 29,831 29,479 34,442 Operating income before taxes and M&A costs 17,222$ 19,112$ 22,946$ Gain (loss) on sales of available for sale securities 1 (85) 130 Gain on sale of branches - 88 - Merger and conversion costs 220 803 10,335 Restructuring charges 907 282 21 Income before income taxes 16,096 18,030 12,720 Income tax expense 5,846 6,182 4,920 Net income 10,250 11,848 7,800 Preferred stock dividends (1) 639 - - Net income to common shareholders 9,611 11,848 7,800 Pre-tax, pre-provision operating earnings (Non-GAAP) (2) $18,183 $21,826 $24,827

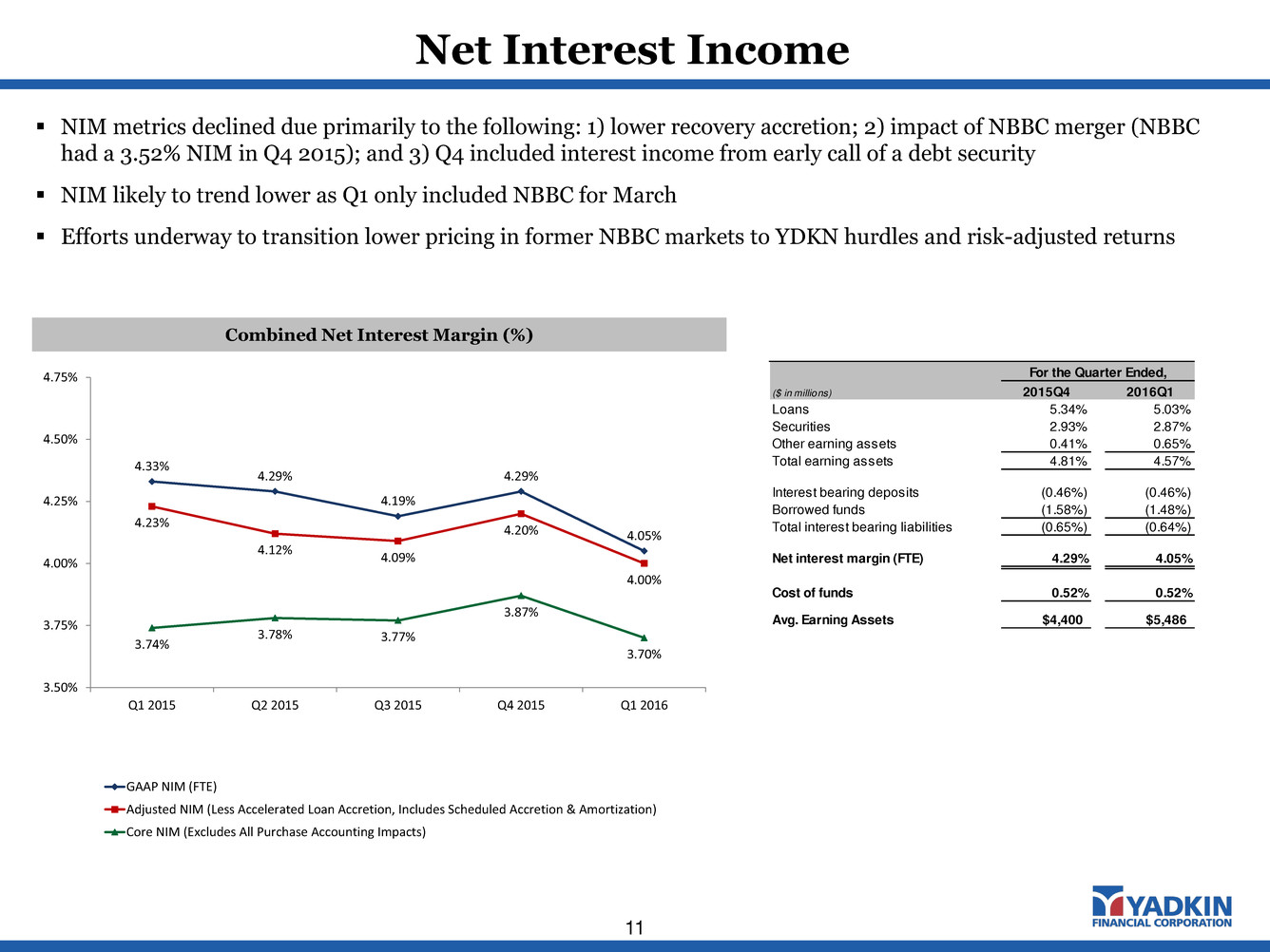

Net Interest Income 11 Combined Net Interest Margin (%) NIM metrics declined due primarily to the following: 1) lower recovery accretion; 2) impact of NBBC merger (NBBC had a 3.52% NIM in Q4 2015); and 3) Q4 included interest income from early call of a debt security NIM likely to trend lower as Q1 only included NBBC for March Efforts underway to transition lower pricing in former NBBC markets to YDKN hurdles and risk-adjusted returns 4.33% 4.29% 4.19% 4.29% 4.05% 4.23% 4.12% 4.09% 4.20% 4.00% 3.74% 3.78% 3.77% 3.87% 3.70% 3.50% 3.75% 4.00% 4.25% 4.50% 4.75% Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 GAAP NIM (FTE) Adjusted NIM (Less Accelerated Loan Accretion, Includes Scheduled Accretion & Amortization) Core NIM (Excludes All Purchase Accounting Impacts) For the Quarter Ended, ($ in millions) 2015Q4 2016Q1 Loans 5.34% 5.03% Securities 2.93% 2.87% Other earning assets 0.41% 0.65% Total earning assets 4.81% 4.57% Interest bearing deposits (0.46%) (0.46%) Borrowed funds (1.58%) (1.48%) Total interest bearing liabilities (0.65%) (0.64%) Net interest margin (FTE) 4.29% 4.05% Cost of funds 0.52% 0.52% Avg. Earning Assets $4,400 $5,486

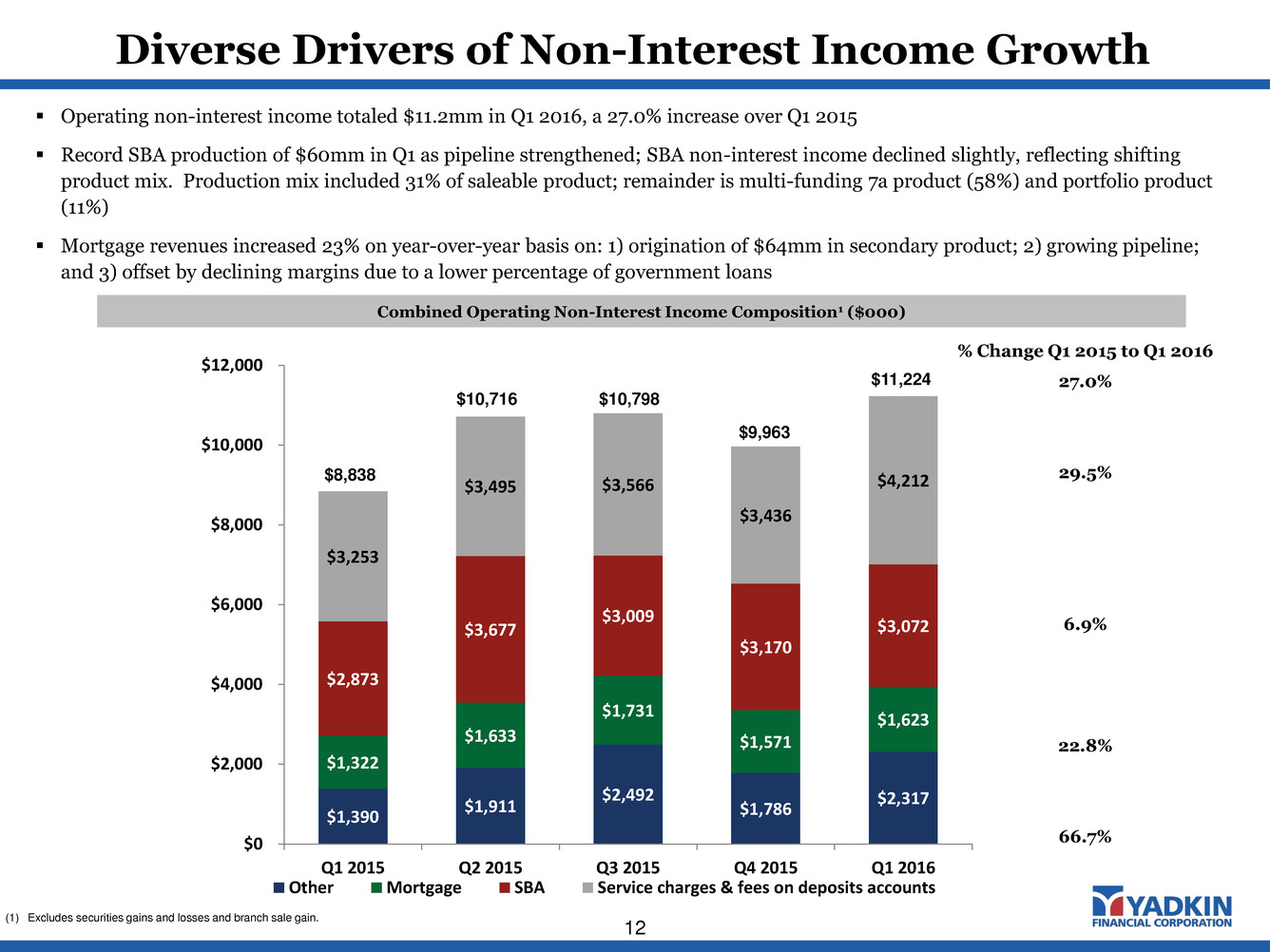

$1,390 $1,911 $2,492 $1,786 $2,317 $1,322 $1,633 $1,731 $1,571 $1,623 $2,873 $3,677 $3,009 $3,170 $3,072 $3,253 $3,495 $3,566 $3,436 $4,212 $0 $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Other Mortgage SBA Service charges & fees on deposits accounts Diverse Drivers of Non-Interest Income Growth Combined Operating Non-Interest Income Composition1 ($000) $11,224 Operating non-interest income totaled $11.2mm in Q1 2016, a 27.0% increase over Q1 2015 Record SBA production of $60mm in Q1 as pipeline strengthened; SBA non-interest income declined slightly, reflecting shifting product mix. Production mix included 31% of saleable product; remainder is multi-funding 7a product (58%) and portfolio product (11%) Mortgage revenues increased 23% on year-over-year basis on: 1) origination of $64mm in secondary product; 2) growing pipeline; and 3) offset by declining margins due to a lower percentage of government loans (1) Excludes securities gains and losses and branch sale gain. $8,838 $10,716 $10,798 % Change Q1 2015 to Q1 2016 27.0% 29.5% 6.9% 22.8% 66.7% $9,963 12

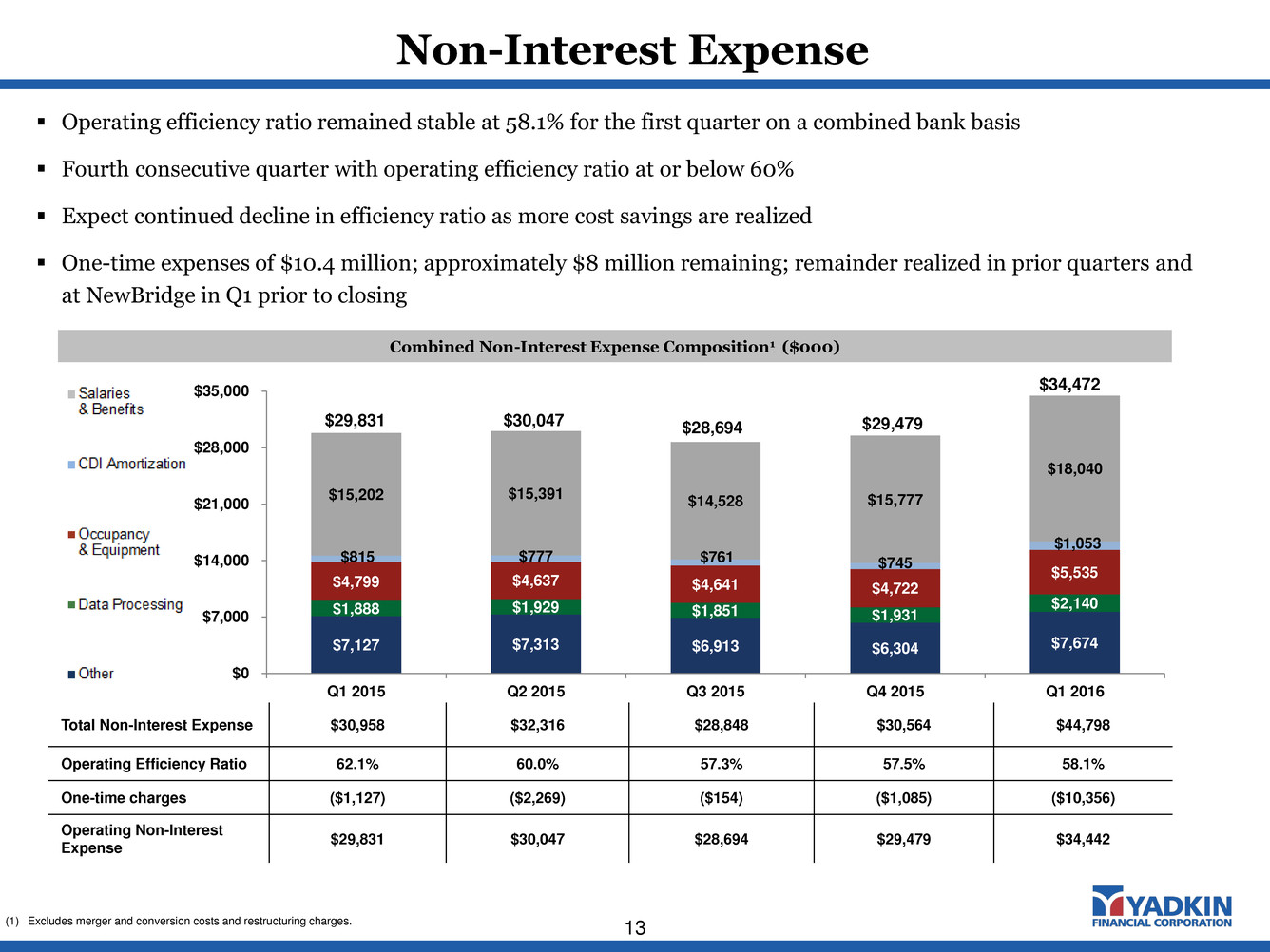

$7,127 $7,313 $6,913 $6,304 $7,674 $1,888 $1,929 $1,851 $1,931 $2,140 $4,799 $4,637 $4,641 $4,722 $5,535 $815 $777 $761 $745 $1,053 $15,202 $15,391 $14,528 $15,777 $18,040 $0 $7,000 $14,000 $21,000 $28,000 $35,000 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Non-Interest Expense 13 Combined Non-Interest Expense Composition1 ($000) Operating efficiency ratio remained stable at 58.1% for the first quarter on a combined bank basis Fourth consecutive quarter with operating efficiency ratio at or below 60% Expect continued decline in efficiency ratio as more cost savings are realized One-time expenses of $10.4 million; approximately $8 million remaining; remainder realized in prior quarters and at NewBridge in Q1 prior to closing Total Non-Interest Expense $30,958 $32,316 $28,848 $30,564 $44,798 Operating Efficiency Ratio 62.1% 60.0% 57.3% 57.5% 58.1% One-time charges ($1,127) ($2,269) ($154) ($1,085) ($10,356) Operating Non-Interest Expense $29,831 $30,047 $28,694 $29,479 $34,442 $34,472 $29,831 (1) Excludes merger and conversion costs and restructuring charges. $30,047 $28,694 $29,479

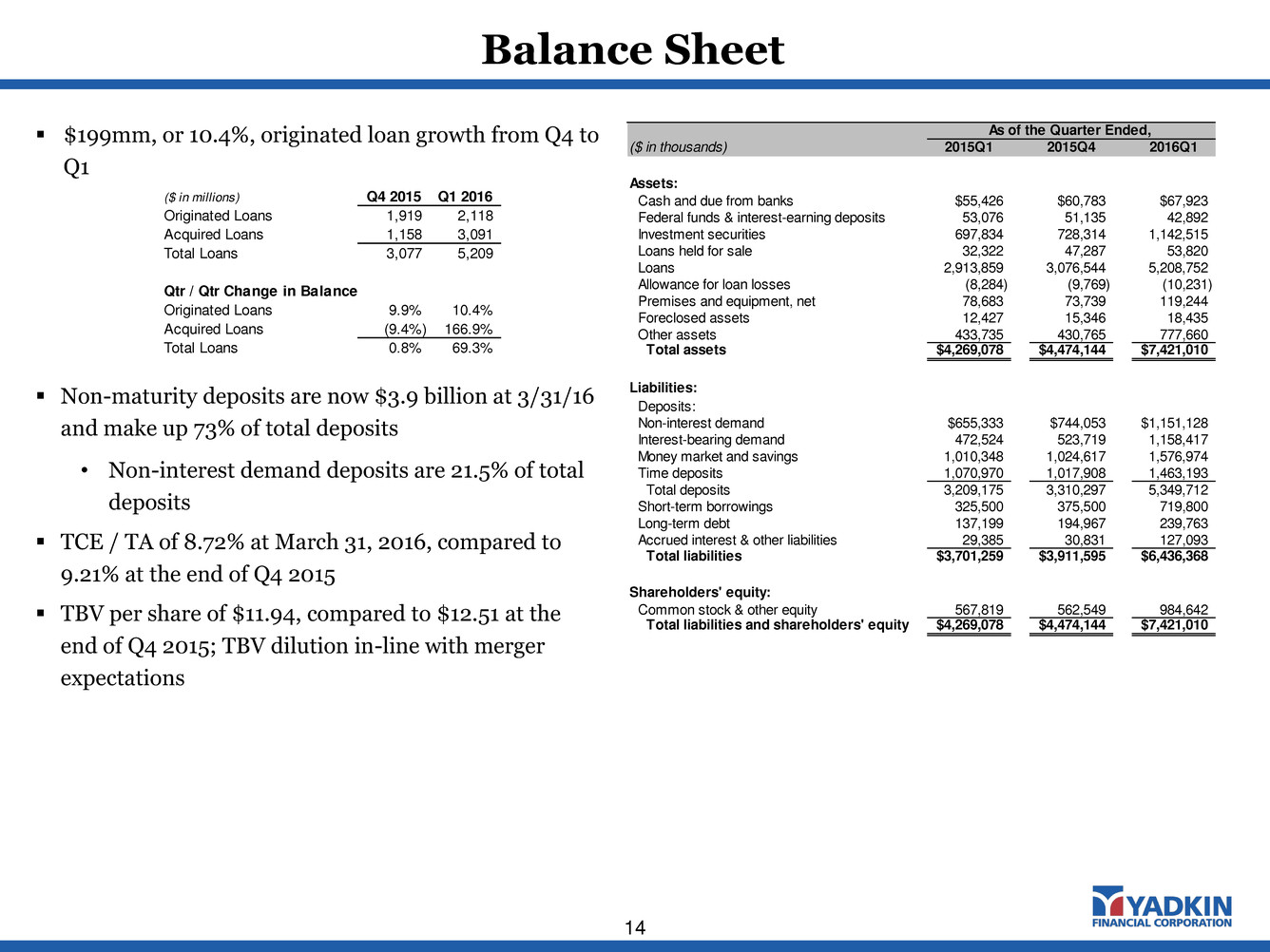

Balance Sheet 14 $199mm, or 10.4%, originated loan growth from Q4 to Q1 Non-maturity deposits are now $3.9 billion at 3/31/16 and make up 73% of total deposits • Non-interest demand deposits are 21.5% of total deposits TCE / TA of 8.72% at March 31, 2016, compared to 9.21% at the end of Q4 2015 TBV per share of $11.94, compared to $12.51 at the end of Q4 2015; TBV dilution in-line with merger expectations ($ in millions) Q4 2015 Q1 2016 Originat Loans 1,919 2,118 Acquired Loans 1,158 3,091 Total Loans 3,077 5,209 Qtr / Qtr Change in Balance Originated Loans 9.9% 10.4% Acquired Loans (9.4%) 166.9% Total Loans 0.8% 69.3% As of the Quarter Ended, ($ in thousands) 2015Q1 2015Q4 2016Q1 Assets: Cash and due from banks $55,426 $60,783 $67,923 Federal funds & interest-earning deposits 53,076 51,135 42,892 Investment securities 697,834 728,314 1,142,515 Loans held for sale 32,322 47,287 53,820 Loans 2,913,859 3,076,544 5,208,752 Allowance for loan losses (8,284) (9,769) (10,231) Premises and equipment, net 78,683 73,739 119,244 Foreclosed assets 12,427 15,346 18,435 Other assets 433,735 430,765 777,660 Total assets $4,269,078 $4,474,144 $7,421,010 Liabilities: Deposits: Non-interest demand $655,333 $744,053 $1,151,128 Interest-bearing demand 472,524 523,719 1,158,417 Money market and savings 1,010,348 1,024,617 1,576,974 Time deposits 1,070,970 1,017,908 1,463,193 Total deposits 3,209,175 3,310,297 5,349,712 Short-term borrowings 325,500 375,500 719,800 Long-term debt 137,199 194,967 239,763 Accrued interest & other liabilities 29,385 30,831 127,093 Total liabilities $3,701,259 $3,911,595 $6,436,368 Shareholders' equity: Common stock & other equity 567,819 562,549 984,642 Total liabilities and shareholders' equity $4,269,078 $4,474,144 $7,421,010

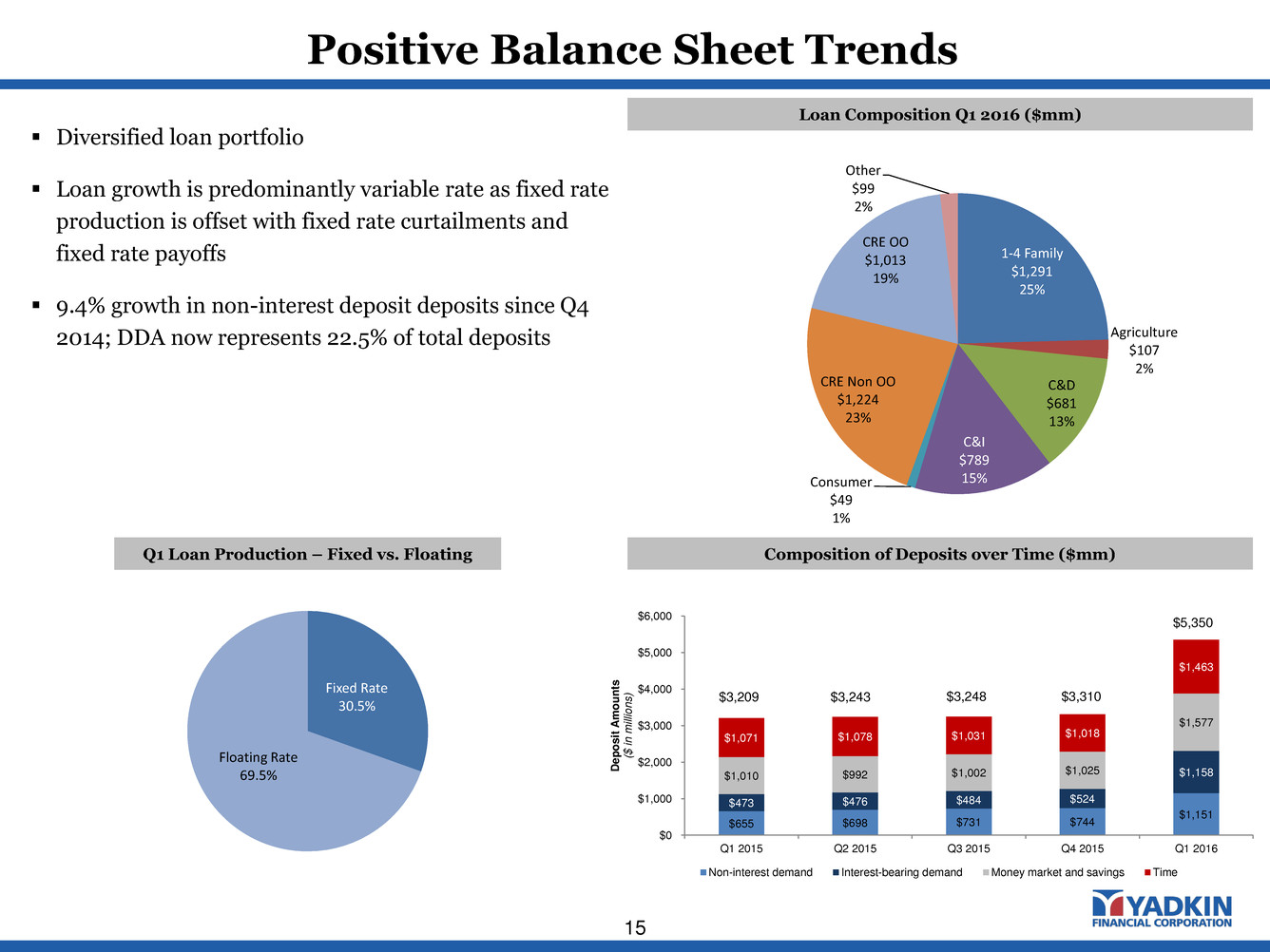

$655 $698 $731 $744 $1,151 $473 $476 $484 $524 $1,158 $1,010 $992 $1,002 $1,025 $1,577 $1,071 $1,078 $1,031 $1,018 $1,463 $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 De po sit Am ou nts ($ in mi llio ns ) Non-interest demand Interest-bearing demand Money market and savings Time Positive Balance Sheet Trends 15 Composition of Deposits over Time ($mm) Loan Composition Q1 2016 ($mm) Diversified loan portfolio Loan growth is predominantly variable rate as fixed rate production is offset with fixed rate curtailments and fixed rate payoffs 9.4% growth in non-interest deposit deposits since Q4 2014; DDA now represents 22.5% of total deposits Q1 Loan Production – Fixed vs. Floating $5,350 $3,209 $3,243 $3,248 $3,310 Fixed Rate 30.5% Floating Rate 69.5% 1-4 Family $1,291 25% Agriculture $107 2% C&D $681 13% C&I $789 15%Consumer $49 1% CRE Non OO $1,224 23% CRE OO $1,013 19% Other $99 2%

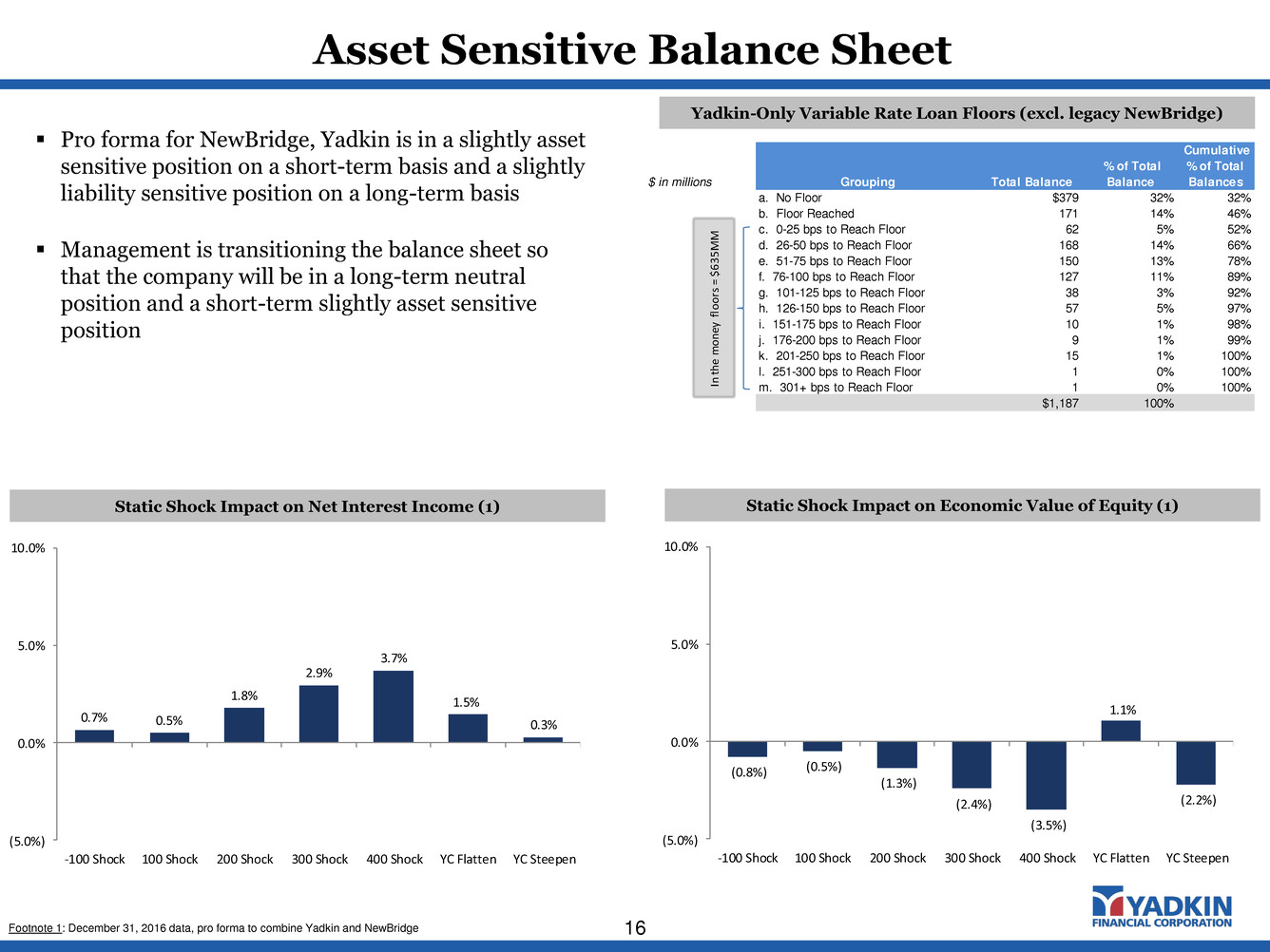

Asset Sensitive Balance Sheet 16 Static Shock Impact on Economic Value of Equity (1) Static Shock Impact on Net Interest Income (1) Yadkin-Only Variable Rate Loan Floors (excl. legacy NewBridge) Pro forma for NewBridge, Yadkin is in a slightly asset sensitive position on a short-term basis and a slightly liability sensitive position on a long-term basis Management is transitioning the balance sheet so that the company will be in a long-term neutral position and a short-term slightly asset sensitive position 0.7% 0.5% 1.8% 2.9% 3.7% 1.5% 0.3% (5.0%) 0.0% 5.0% 10.0% -100 Shock 100 Shock 200 Shock 300 Shock 400 Shock YC Flatten YC Steepen Footnote 1: December 31, 2016 data, pro forma to combine Yadkin and NewBridge (0.8%) (0.5%) (1.3%) (2.4%) (3.5%) 1.1% (2.2%) (5.0%) 0.0% 5.0% 10.0% -100 Shock 100 Shock 200 Shock 300 Shock 400 Shock YC Flatten YC Steepen $ in millions Grouping Total Balance % of Total Balance Cumulative % of Total Balances a. No Floor $379 32% 32% b. Floor Reached 171 14% 46% c. 0-25 bps to Reach Floor 62 5% 52% d. 26-50 bps to Reach Floor 168 14% 66% e. 51-75 bps to Reach Floor 150 13% 78% f. 76-100 bps to Reach Floor 127 11% 89% g. 101-125 bps to Reach Floor 38 3% 92% h. 126-150 bps to Reach Floor 57 5% 97% i. 151-175 bps to Reach Floor 10 1% 98% j. 176-200 bps to Reach Floor 9 1% 99% k. 201-250 bps to Reach Floor 15 1% 100% l. 251-300 bps to Reach Floor 1 0% 100% m. 301+ bps to Reach Floor 1 0% 100% $1,187 100% In t he mo ney flo ors = $ 635 MM

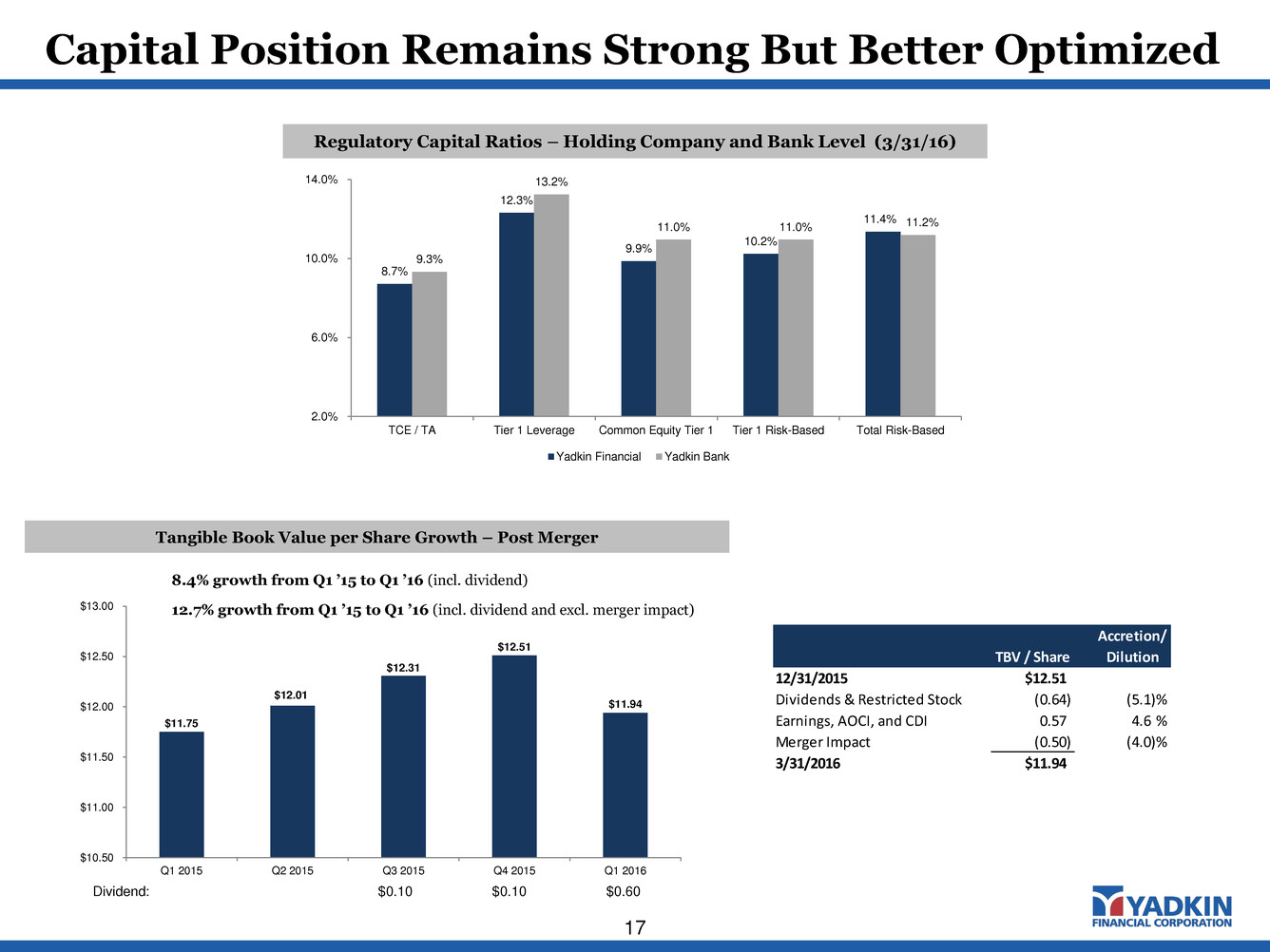

$11.75 $12.01 $12.31 $12.51 $11.94 $10.50 $11.00 $11.50 $12.00 $12.50 $13.00 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Capital Position Remains Strong But Better Optimized 17 Regulatory Capital Ratios – Holding Company and Bank Level (3/31/16) Tangible Book Value per Share Growth – Post Merger Dividend: $0.10 $0.10 $0.60 8.4% growth from Q1 ’15 to Q1 ’16 (incl. dividend) 8.7% 12.3% 9.9% 10.2% 11.4% 9.3% 13.2% 11.0% 11.0% 11.2% 2.0% 6.0% 10.0% 14.0% TCE / TA Tier 1 Leverage Common Equity Tier 1 Tier 1 Risk-Based Total Risk-Based Yadkin Financial Yadkin Bank 12.7% growth from Q1 ’15 to Q1 ’16 (incl. dividend and excl. merger impact) Accretion/ TBV / Share Dilution 12/31/2015 $12.51 Dividends & Restricted Stock (0.64) (5.1)% Earnings, AOCI, and CDI 0.57 4.6 % Merger Impact (0.50) (4.0)% 3/31/2016 $11.94

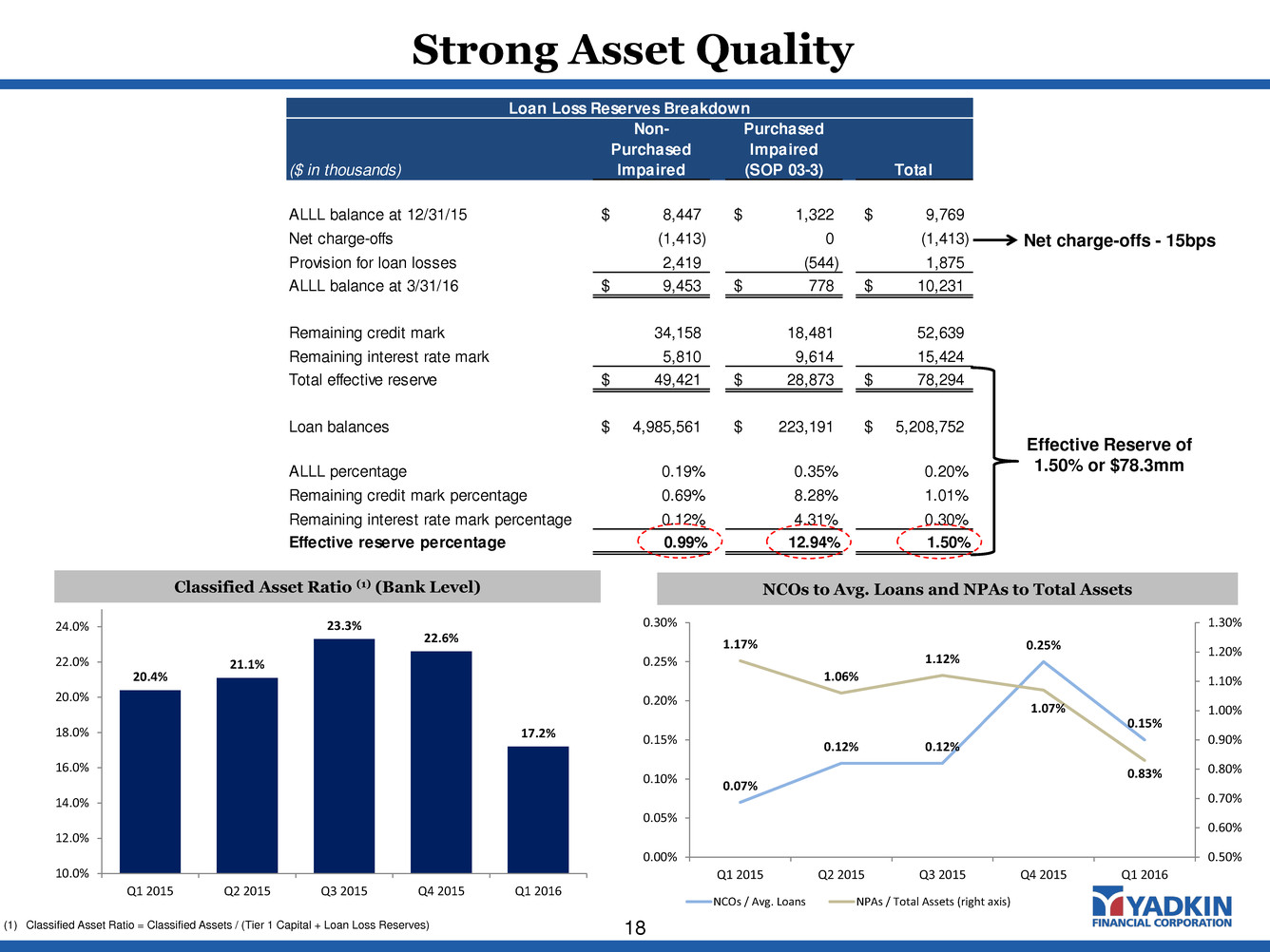

Loan Loss Reserves Breakdown ($ in thousands) Non- Purchased Impaired Purchased Impaired (SOP 03-3) Total ALLL balance at 12/31/15 8,447$ 1,322$ 9,769$ Net charge-offs (1,413) 0 (1,413) Provision for loan losses 2,419 (544) 1,875 ALLL balance at 3/31/16 9,453$ 778$ 10,231$ Remaining credit mark 34,158 18,481 52,639 Remaining interest rate mark 5,810 9,614 15,424 Total effective reserve 49,421$ 28,873$ 78,294$ Loan balances 4,985,561$ 223,191$ 5,208,752$ ALLL percentage 0.19% 0.35% 0.20% Remaining credit mark percentage 0.69% 8.28% 1.01% Remaining interest rate mark percentage 0.12% 4.31% 0.30% Effective reserve percentage 0.99% 12.94% 1.50% Strong Asset Quality 18 Effective Reserve of 1.50% or $78.3mm Classified Asset Ratio (1) (Bank Level) (1) Classified Asset Ratio = Classified Assets / (Tier 1 Capital + Loan Loss Reserves) Net charge-offs - 15bps 20.4% 21.1% 23.3% 22.6% 17.2% 10.0% 12.0% 14.0% 16.0% 18.0% 20.0% 22.0% 24.0% Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 NCOs to Avg. Loans and NPAs to Total Assets 0.07% 0.12% 0.12% 0.25% 0.15% 1.17% 1.06% 1.12% 1.07% 0.83% 0.50% 0.60% 0.70% 0.80% 0.90% 1.00% 1.10% 1.20% 1.30% 0.00% 0.05% 0.10% 0.15% 0.20% 0.25% 0.30% Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 NCOs / Avg. Loans NPAs / Total Assets (right axis)

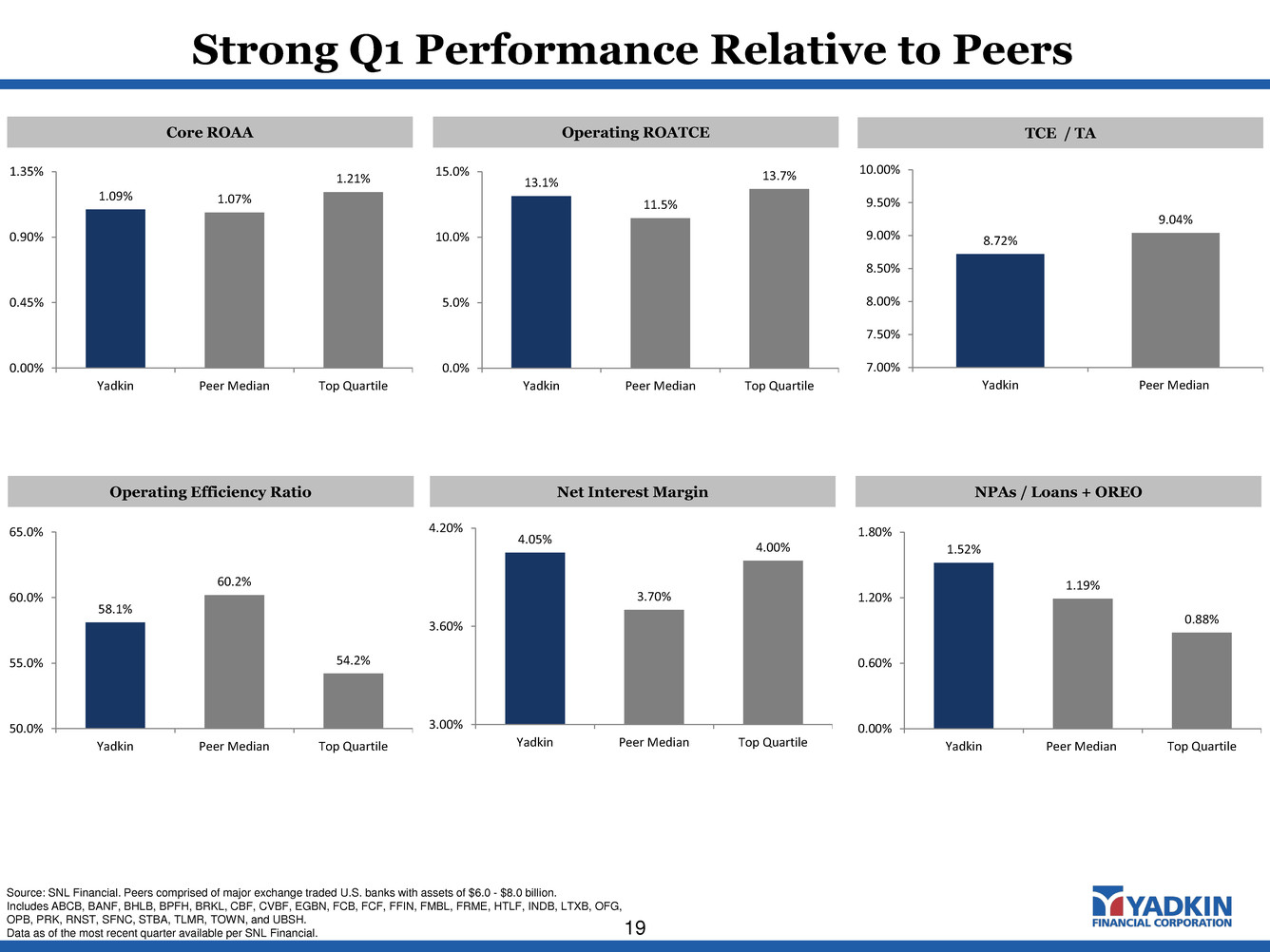

Strong Q1 Performance Relative to Peers 19 Core ROAA Operating ROATCE Operating Efficiency Ratio Net Interest Margin NPAs / Loans + OREO TCE / TA Source: SNL Financial. Peers comprised of major exchange traded U.S. banks with assets of $6.0 - $8.0 billion. Includes ABCB, BANF, BHLB, BPFH, BRKL, CBF, CVBF, EGBN, FCB, FCF, FFIN, FMBL, FRME, HTLF, INDB, LTXB, OFG, OPB, PRK, RNST, SFNC, STBA, TLMR, TOWN, and UBSH. Data as of the most recent quarter available per SNL Financial. 1.09% 1.07% 1.21% 0.00% 0.45% 0.90% 1.35% Yadkin Peer Median Top Quartile 13.1% 11.5% 13.7% 0.0% 5.0% 10.0% 15.0% Yadkin Peer Median Top Quartile 58.1% 60.2% 54.2% 50.0% 55.0% 60.0% 65.0% Yadkin Peer Median Top Quartile 1.52% 1.19% 0.88% 0.00% 0.60% 1.20% 1.80% Yadkin Peer Median Top Quartile 4.05% 3.70% 4.00% 3.00% 3.60% 4.20% Yadkin Peer Median Top Quartile 8.72% 9.04% 7.00% 7.50% 8.00% 8.50% 9.00% 9.50% 10.00% Yadkin Peer Median

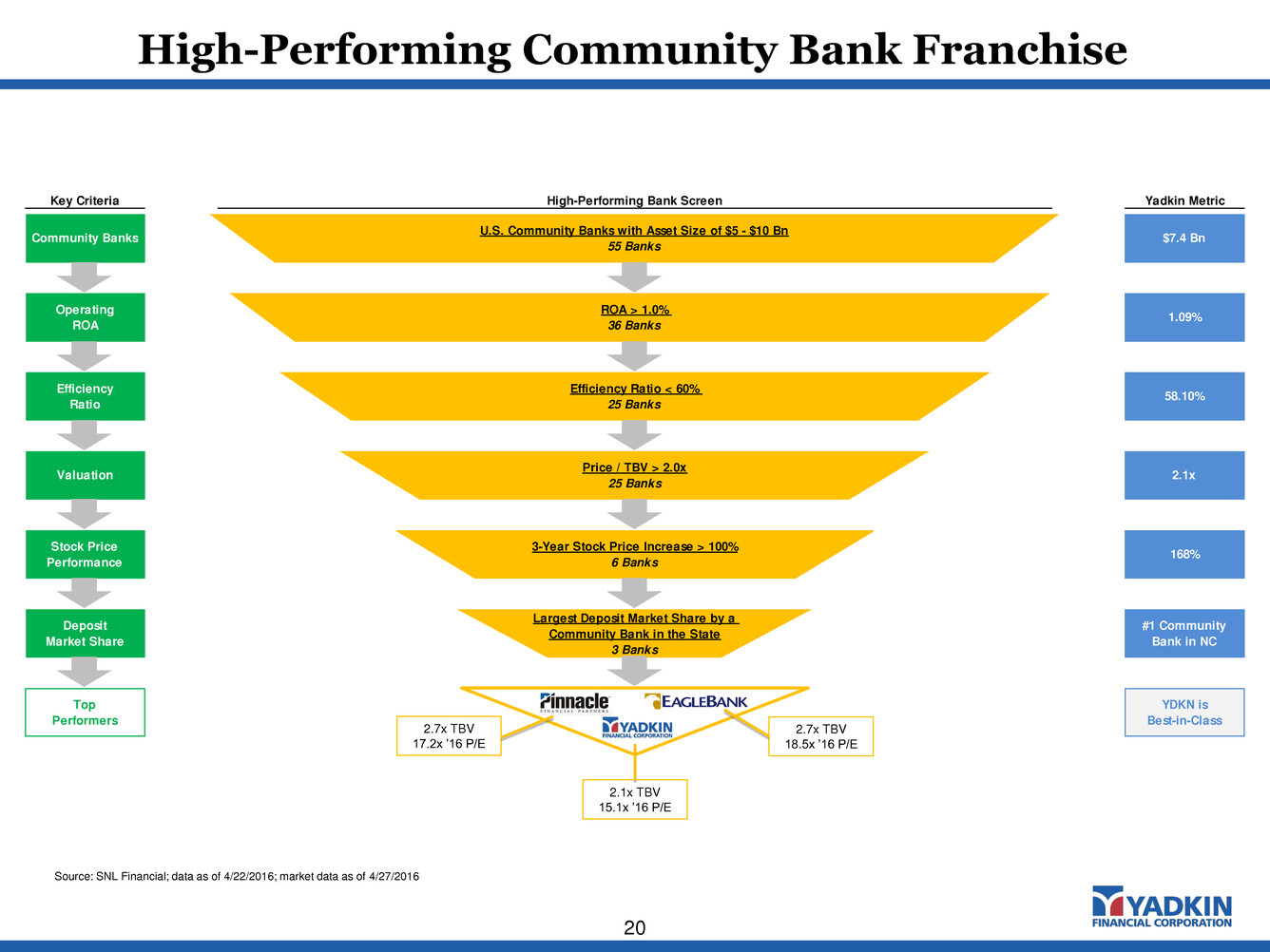

Key Criteria High-Performing Bank Screen Yadkin Metric Top Performers YDKN is Best-in-Class Efficiency Ratio < 60% 25 Banks Price / TBV > 2.0x 25 Banks 3-Year Stock Price Increase > 100% 6 Banks Largest Deposit Market Share by a Community Bank in the State 3 Banks 58.10% 2.1x 168% #1 Community Bank in NC Efficiency Ratio Valuation Stock Price Performance Deposit Market Share Community Banks $7.4 Bn Operating ROA ROA > 1.0% 36 Banks U.S. Community Banks with Asset Size of $5 - $10 Bn 55 Banks 1.09% High-Performing Community Bank Franchise 20 Source: SNL Financial; data as of 4/22/2016; market data as of 4/27/2016 2.7x TBV 18.5x ’16 P/E 2.1x TBV 15.1x ’16 P/E 2.7x TBV 17.2x ’16 P/E

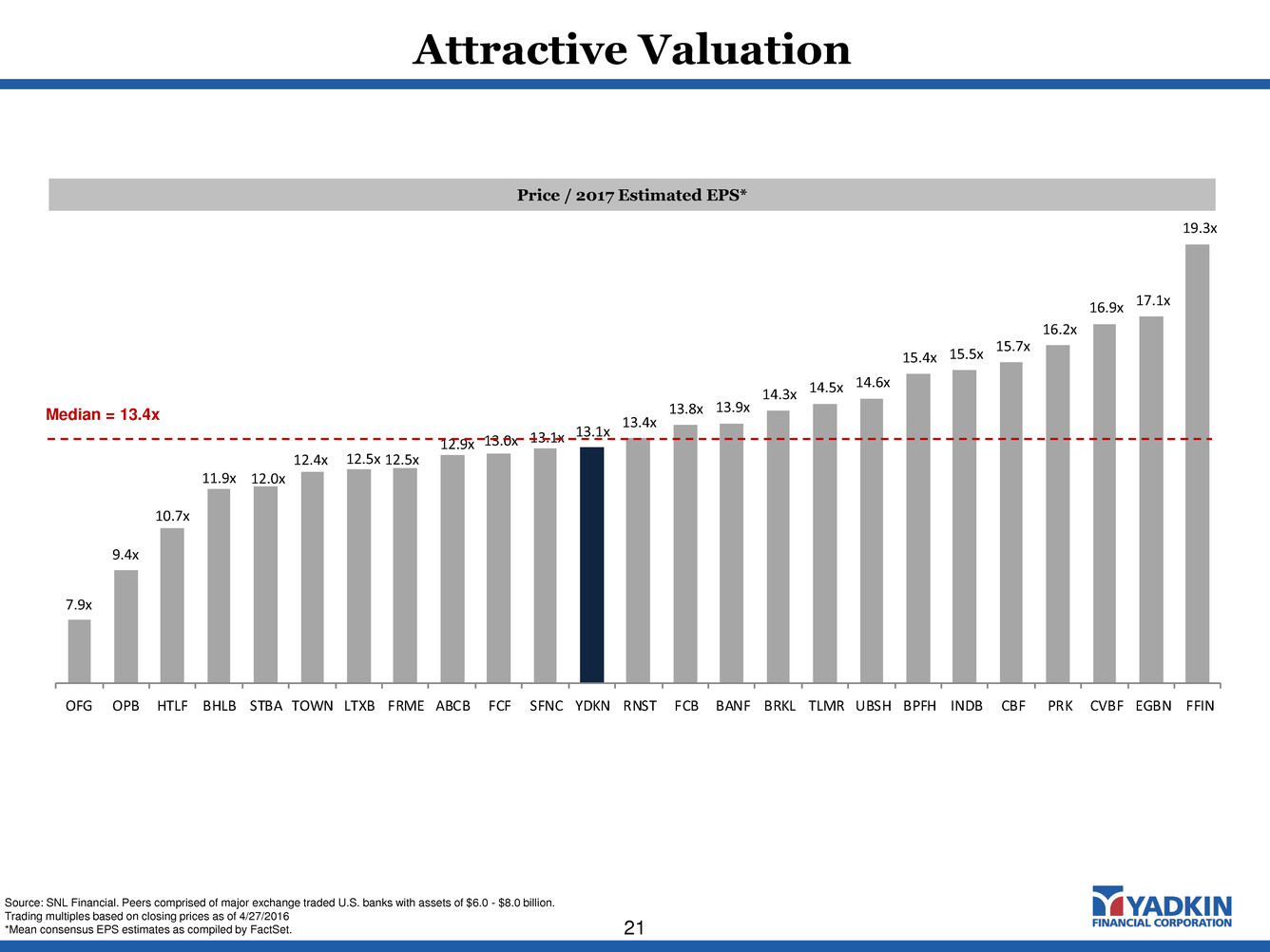

Attractive Valuation 21 7.9x 9.4x 10.7x 11.9x 12.0x 12.4x 12.5x 12.5x 12.9x 13.0x 13.1x 13.1x 13.4x 13.8x 13.9x 14.3x 14.5x 14.6x 15.4x 15.5x 15.7x 16.2x 16.9x 17.1x 19.3x OFG OPB HTLF BHLB STBA TOWN LTXB FRME ABCB FCF SFNC YDKN RNST FCB BANF BRKL TLMR UBSH BPFH INDB CBF PRK CVBF EGBN FFIN Price / 2017 Estimated EPS* Median = 13.4x Source: SNL Financial. Peers comprised of major exchange traded U.S. banks with assets of $6.0 - $8.0 billion. Trading multiples based on closing prices as of 4/27/2016 *Mean consensus EPS estimates as compiled by FactSet.

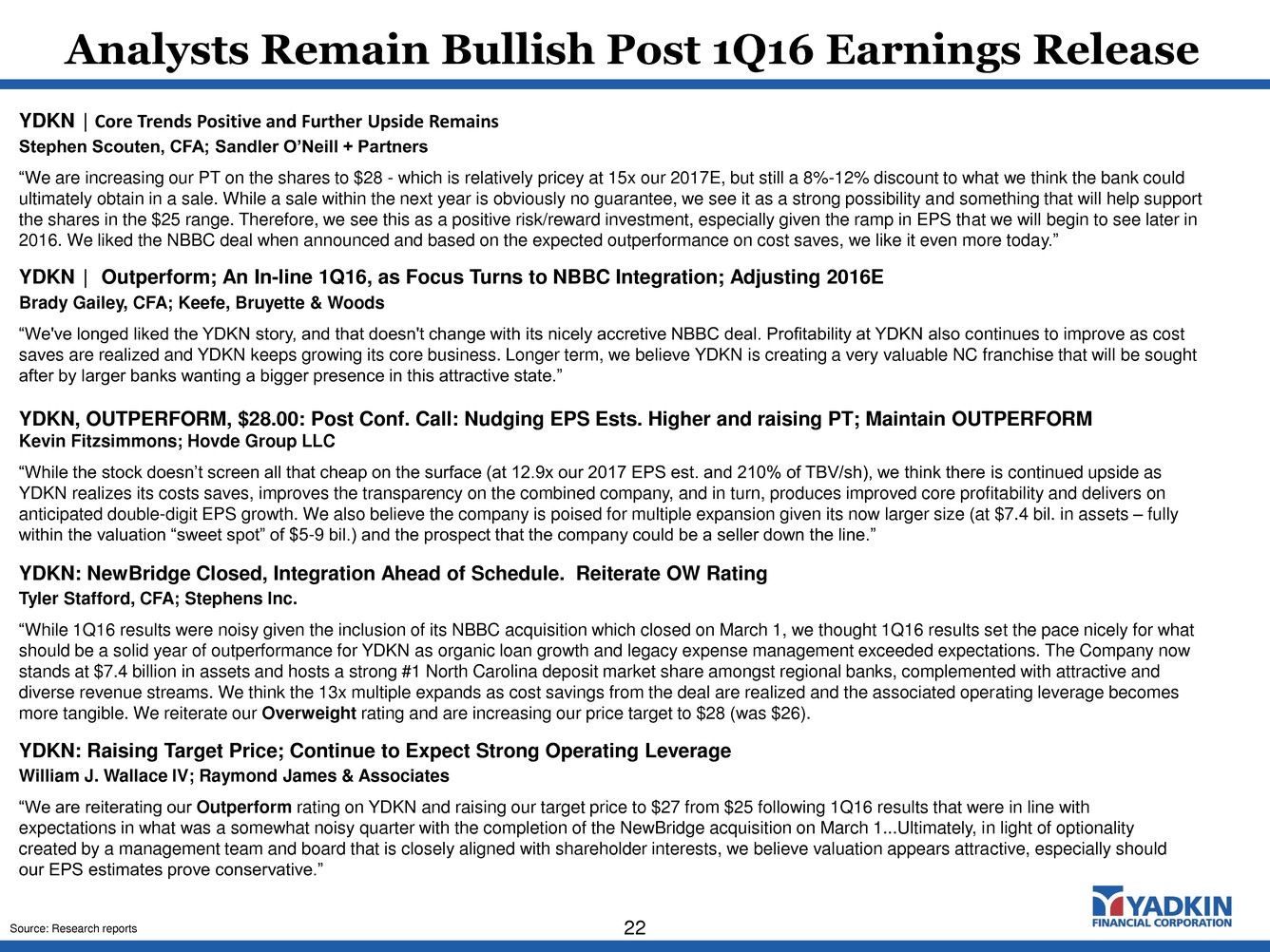

Analysts Remain Bullish Post 1Q16 Earnings Release 22 YDKN, OUTPERFORM, $28.00: Post Conf. Call: Nudging EPS Ests. Higher and raising PT; Maintain OUTPERFORM Kevin Fitzsimmons; Hovde Group LLC “While the stock doesn’t screen all that cheap on the surface (at 12.9x our 2017 EPS est. and 210% of TBV/sh), we think there is continued upside as YDKN realizes its costs saves, improves the transparency on the combined company, and in turn, produces improved core profitability and delivers on anticipated double-digit EPS growth. We also believe the company is poised for multiple expansion given its now larger size (at $7.4 bil. in assets – fully within the valuation “sweet spot” of $5-9 bil.) and the prospect that the company could be a seller down the line.” YDKN: Raising Target Price; Continue to Expect Strong Operating Leverage William J. Wallace IV; Raymond James & Associates “We are reiterating our Outperform rating on YDKN and raising our target price to $27 from $25 following 1Q16 results that were in line with expectations in what was a somewhat noisy quarter with the completion of the NewBridge acquisition on March 1...Ultimately, in light of optionality created by a management team and board that is closely aligned with shareholder interests, we believe valuation appears attractive, especially should our EPS estimates prove conservative.” Source: Research reports YDKN │ Outperform; An In-line 1Q16, as Focus Turns to NBBC Integration; Adjusting 2016E Brady Gailey, CFA; Keefe, Bruyette & Woods “We've longed liked the YDKN story, and that doesn't change with its nicely accretive NBBC deal. Profitability at YDKN also continues to improve as cost saves are realized and YDKN keeps growing its core business. Longer term, we believe YDKN is creating a very valuable NC franchise that will be sought after by larger banks wanting a bigger presence in this attractive state.” YDKN │ Core Trends Positive and Further Upside Remains Stephen Scouten, CFA; Sandler O’Neill + Partners “We are increasing our PT on the shares to $28 - which is relatively pricey at 15x our 2017E, but still a 8%-12% discount to what we think the bank could ultimately obtain in a sale. While a sale within the next year is obviously no guarantee, we see it as a strong possibility and something that will help support the shares in the $25 range. Therefore, we see this as a positive risk/reward investment, especially given the ramp in EPS that we will begin to see later in 2016. We liked the NBBC deal when announced and based on the expected outperformance on cost saves, we like it even more today.” YDKN: NewBridge Closed, Integration Ahead of Schedule. Reiterate OW Rating Tyler Stafford, CFA; Stephens Inc. “While 1Q16 results were noisy given the inclusion of its NBBC acquisition which closed on March 1, we thought 1Q16 results set the pace nicely for what should be a solid year of outperformance for YDKN as organic loan growth and legacy expense management exceeded expectations. The Company now stands at $7.4 billion in assets and hosts a strong #1 North Carolina deposit market share amongst regional banks, complemented with attractive and diverse revenue streams. We think the 13x multiple expands as cost savings from the deal are realized and the associated operating leverage becomes more tangible. We reiterate our Overweight rating and are increasing our price target to $28 (was $26).

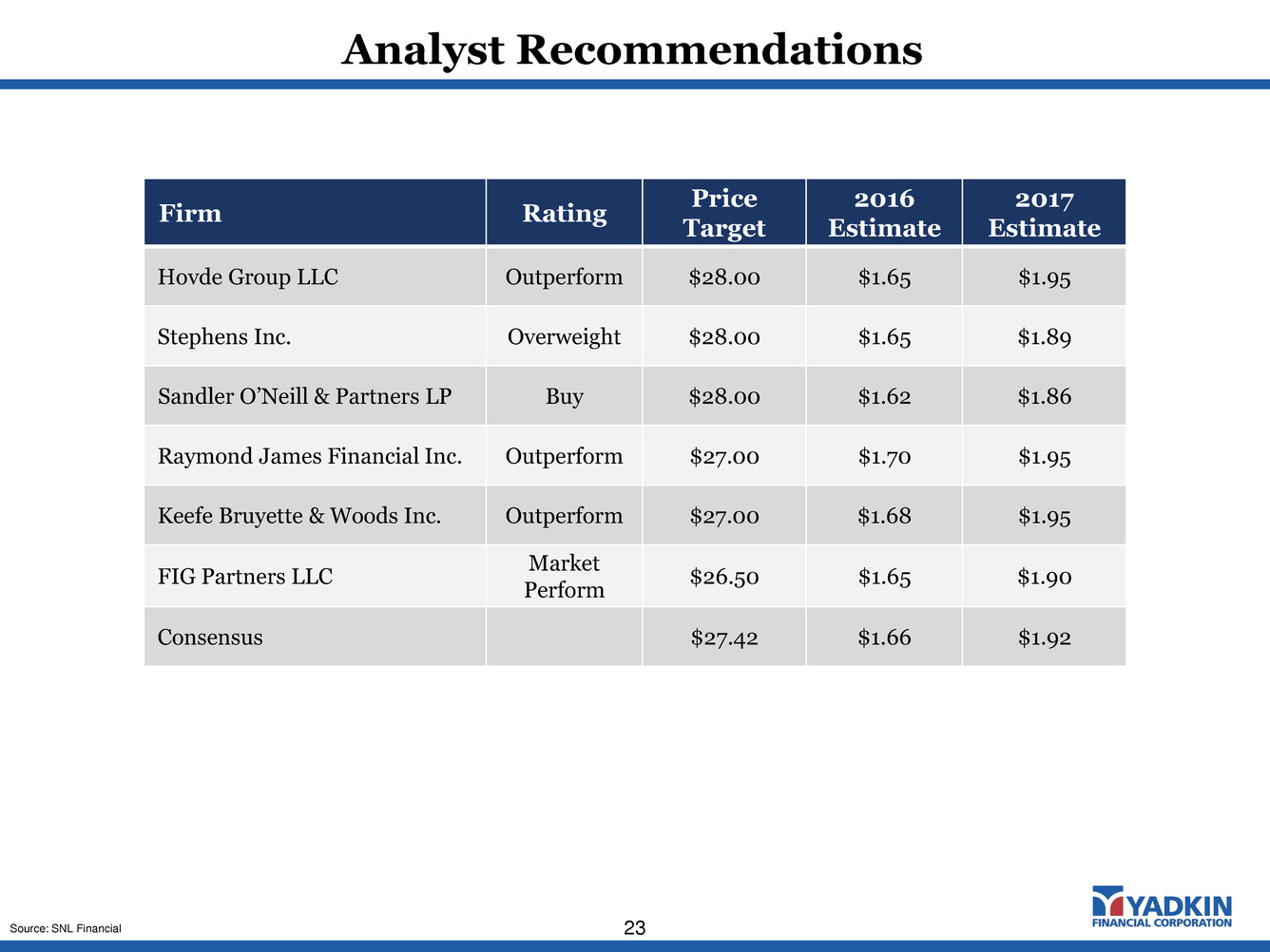

Analyst Recommendations 23 Firm Rating Price Target 2016 Estimate 2017 Estimate Hovde Group LLC Outperform $28.00 $1.65 $1.95 Stephens Inc. Overweight $28.00 $1.65 $1.89 Sandler O’Neill & Partners LP Buy $28.00 $1.62 $1.86 Raymond James Financial Inc. Outperform $27.00 $1.70 $1.95 Keefe Bruyette & Woods Inc. Outperform $27.00 $1.68 $1.95 FIG Partners LLC Market Perform $26.50 $1.65 $1.90 Consensus $27.42 $1.66 $1.92 Source: SNL Financial

Contact: Terry Earley (919) 659-9015 terry.earley@yadkinbank.com