Attached files

| file | filename |

|---|---|

| EX-31.1 - VanEck Merk Gold Trust | exh31-1.htm |

| EX-4.1(C) - VanEck Merk Gold Trust | exh4-1c.htm |

| EX-32.1 - VanEck Merk Gold Trust | exh32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10‑K

|

(Mark One)

|

|

|

☒

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended January 31, 2016

|

|

|

or

|

|

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from to

|

|

Commission File No. 001‑36459

VANECK MERK GOLD TRUST

(Exact name of registrant as specified in its charter)

|

New York

(State or Other Jurisdiction of Incorporation or Organization) |

46‑6582016

(I.R.S. Employer Identification No.) |

|

c/o Merk Investments LLC

555 Bryant St #455, Palo Alto, California (Address of principal executive offices) |

94301

(Zip Code) |

(650) 323-4341

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|

VanEck Merk Gold Shares

|

NYSE Arca

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well‑known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S‑T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S‑K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10‑K or any amendment to this Form 10‑K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non‑accelerated filer, or a smaller reporting company.

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

Non‑accelerated filer ☒

(Do not check if a smaller reporting company) |

Smaller reporting company ☐

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑2 of the Exchange Act). Yes ☐ No ☒

As of January 31, 2016, there were 7,576,528 VanEck Merk Gold Shares outstanding.

Documents incorporated by reference: None.

VANECK MERK GOLD TRUST

ANNUAL REPORT ON FORM 10‑K

TABLE OF CONTENTS

Cautionary Note Regarding Forward Looking Statements

|

PART I

|

1

|

|

|

Item 1

|

Business

|

1 |

|

Item 1A

|

Risk Factors

|

22 |

|

Item 1B

|

Unresolved Staff Comments

|

34 |

|

Item 2

|

Properties

|

34 |

|

Item 3

|

Legal Proceedings

|

34 |

|

Item 4

|

Mine Safety Disclosures

|

35 |

|

|

||

|

PART II

|

35

|

|

|

Item 5

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

35 |

|

Item 6

|

Selected Financial Data

|

36 |

|

Item 7

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

36 |

|

Item 7A

|

Quantitative and Qualitative Disclosures About Market Risk

|

40 |

|

Item 8

|

Financial Statements and Supplementary Data

|

40 |

|

Item 9

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

41 |

|

Item 9A

|

Controls and Procedures

|

41 |

|

Item 9B

|

Other Information

|

42 |

|

|

||

|

PART III

|

43

|

|

|

Item 10

|

Directors, Executive Officers and Corporate Governance

|

43 |

|

Item 11

|

Executive Compensation

|

43 |

|

Item 12

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

43 |

|

Item 13

|

Certain Relationships and Related Transactions, and Director Independence

|

44 |

|

Item 14

|

Principal Accountant Fees and Services

|

44 |

|

|

||

|

PART IV

|

44

|

|

|

Item 15

|

Exhibits and Financial Statement Schedules

|

44 |

|

|

|

|

|

SIGNATURES

|

S-1

|

|

VANECK MERK GOLD TRUST

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, or Report, includes statements which relate to future events or future performance. In some cases, you can identify such forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or the negative of these terms or other comparable terminology. All statements (other than statements of historical fact) included in this Report that address activities, events or developments that may occur in the future, including such matters as changes in commodity prices and market conditions (for gold and the shares), the operations of VanEck Merk Gold Trust, or Trust, the plans of Merk Investments LLC, the sponsor of the Trust, or Sponsor, and references to the Trust’s future success and other similar matters are forward-looking statements. These statements are only predictions. Actual events or results may differ materially. These statements are based upon certain assumptions and analyses made by the Sponsor on the basis of its perception of historical trends, current conditions and expected future developments, as well as other factors it believes are appropriate in the circumstances. Whether or not actual results and developments will conform to the Sponsor’s expectations and predictions is subject to a number of risks and uncertainties, including the special considerations referenced in this Report, general economic, market and business conditions, changes in laws or regulations, including those concerning taxes, and other world economic and political developments. Consequently, all the forward-looking statements made in this Report are qualified by these cautionary statements and there can be no assurance that the actual results or developments the Sponsor anticipates will be realized or, even if substantially realized, that they will result in the expected consequences to, or have the expected effects on, the Trust’s operations or the value of the shares issued by the Trust. Moreover, neither the Sponsor, nor any other person assumes responsibility for the accuracy or completeness of the forward-looking statements. Neither the Trust nor the Sponsor undertakes an obligation to publicly update or conform to actual results any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

PART I

References in this Annual Report on Form 10-K (“Report”) to the “Trust” refer to the VanEck Merk Gold Trust, and references to the “Sponsor” refer to Merk Investments LLC, the sponsor of the Trust. References in this Report to the “Trustee” refer to The Bank of New York Mellon, the trustee of the Trust, and references to the “Custodian” refer to JPMorgan Chase Bank N.A., London branch, the custodian of the Trust. As used in this Report: (i) an “Ounce” means one troy ounce, equal to 31.103 grams; (ii) a “Fine Ounce” means an Ounce of 100% pure gold; (iii) “LBMA” means the London Bullion Markets Association; and (iv) “NYSE Arca” means the NYSE Arca Marketplace operated by NYSE Arca Equities, Inc.

Item 1. Business

The Trust is an investment trust formed on May 6, 2014 under New York State law pursuant to the Depositary Trust Agreement (“Trust Agreement”), which was amended effective October 26, 2015, to effectuate a name change to Van Eck Merk Gold Trust. The Trust Agreement was further amended on April 28, 2016, to effectuate a second name change to VanEck Merk Gold Trust. The purpose of the Trust is to own gold transferred to the Trust in exchange for shares issued by the Trust (the “Shares”). Each Share represents a fractional undivided beneficial interest in and ownership of the Trust. Shares are issued by the Trust in blocks of 50,000 called “Baskets” in exchange for gold from certain registered broker-dealers or other securities market participants (“Authorized Participants”). The assets of the Trust are anticipated to consist solely of gold bullion. On May 6, 2014, the date the Trust was formed, Virtu Financial (the “Initial Purchaser”) contributed 1,000 ounces of gold in exchange for 100,000 Shares (or two Baskets). At contribution, the value of the gold deposited with the Trust was based on the price of an “Ounce” of gold of $1,306.25. The Initial Purchaser is not affiliated with the Sponsor or the Trustee.

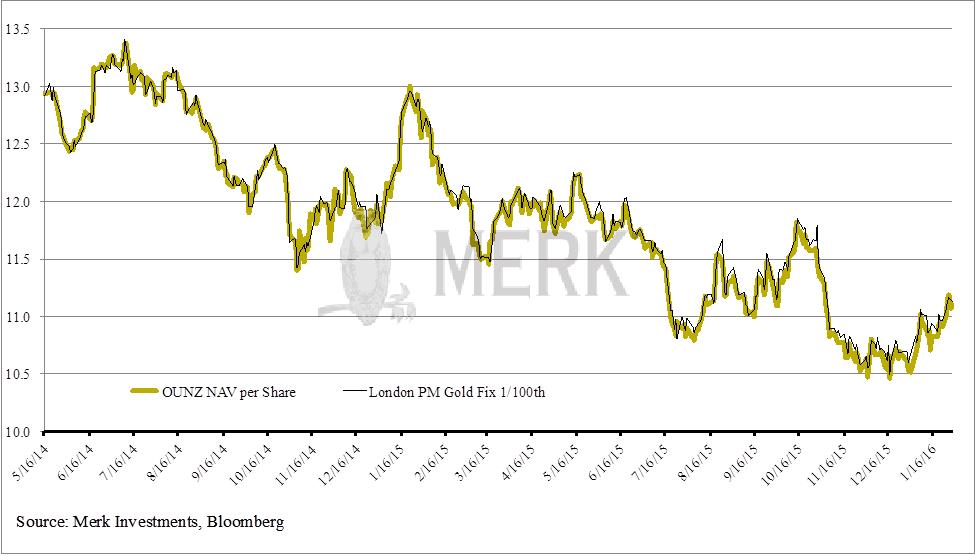

The redeemable value of the Shares decreased from $12.79 at January 31, 2015 to $11.10 at January 31, 2016, the Trust’s fiscal year end. Outstanding Shares in the Trust increased from 5,152,630 Shares at January 31, 2015 to 7,576,528 Shares outstanding at January 31, 2016.

1

The Trust is not managed like a corporation or an active investment vehicle. The Trust has no directors, officers or employees. It does not engage in any activities designed to obtain a profit from or to improve the losses caused by changes in the price of gold. The gold held by the Trust will only be distributed to Authorized Participants (defined below) in connection with the redemption of Baskets or sold (1) on an as-needed basis to pay Trust expenses not assumed by the Sponsor, (2) in the event the Trust terminates and liquidates its assets, or (3) as otherwise required by law or regulation.

The Trust is not registered as an investment company under the Investment Company Act of 1940, as amended, and is not required to register under such act. The Trust does not and will not hold or trade in commodities futures contracts regulated by the Commodity Exchange Act, as amended (the “CEA”), as administered by the Commodity Futures Trading Commission (the “CFTC”). The Trust is not a commodity pool for purposes of the CEA and neither the Sponsor nor the Trustee is subject to regulation as a commodity pool operator or a commodity trading advisor in connection with the Shares. The Trust has no fixed termination date.

The Sponsor of the registrant maintains an Internet website at www.merkfunds.com and www.merkgold.com, through which the registrant’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are made available free of charge after they have been filed or furnished to the Securities and Exchange Commission (the “SEC”). Additional information regarding the Trust may also be found on the SEC’s EDGAR database at www.sec.gov.

Trust Objective

The primary objective of the Trust is to provide investors with an opportunity to invest in gold through the Shares and be able to take delivery of physical gold in exchange for their Shares. The Trust’s secondary objective is for the Shares to reflect the performance of the price of gold less the expenses of the Trust’s operations. The Trust is not actively managed. It does not engage in any activities designed to obtain a profit from, or to compensate investors for losses caused by, changes in the price of gold.

The Trust holds “London Bars” and, in connection with a Delivery Applicant’s (as defined below) exchange of Shares for physical gold, physical gold of other specifications as requested by the Sponsor. The Trust receives gold deposited by Authorized Participants in exchange for the creation of Baskets and delivers gold to Authorized Participants in exchange for Baskets surrendered to it for redemption. In connection with the delivery of Shares by a Delivery Applicant as described below, the Sponsor may engage in over-the-counter transactions with a precious metals dealer to exchange gold for physical gold of different specifications.

Investors may contact their broker-dealer to purchase and sell Shares. An investor who would like to take delivery of physical gold for its Shares is referred to as a Delivery Applicant:

|

·

|

A Delivery Applicant wishing to deliver Shares in exchange for physical gold must submit to the Sponsor a delivery application (“Delivery Application”) and payment for (1) the applicable processing fees, and (2) the applicable delivery fees to cover the cost of preparing and transporting physical gold from the Custodian or the precious metals dealer from which they were obtained to the location specified by the Delivery Applicant in the Delivery Application. The number of Shares to be delivered must (i) correspond to at least one Fine Ounce of gold and (ii) have a minimum dollar value in an amount that is specified by the Sponsor from time to time on the Trust’s website. Taking delivery of physical gold is subject to guidelines intended to minimize the amount of cash that will be distributed with physical gold. The Delivery Application is not binding until the Shares are delivered to the Trust.

|

|

·

|

Upon pre-approval of the Delivery Application by the Sponsor, a Delivery Applicant shall instruct its broker dealer to submit the Delivery Application and transfer the Shares to the Trustee; the submission and transfer by the broker-dealer will be a binding and irrevocable request to take delivery of physical gold in exchange for Shares based on instructions in the Delivery Application (a “Share Submission”).

|

2

|

·

|

Once the Trustee has received a Delivery Applicant’s Share Submission, a number of Fine Ounces of physical gold not exceeding the Fine Ounces represented by the Shares surrendered will be delivered to the Delivery Applicant based on instructions in the Delivery Application. To the extent a Delivery Application specifies London Bars, physical gold will be delivered by the Custodian; to the extent the Delivery Application specifies physical gold other than London Bars, if available, gold held by the Trust will be exchanged with the help of a precious metals dealer and delivered to the Delivery Applicant. The Delivery Application process is designed to keep the Fine Ounces represented by the Share Submission as close as possible to the Fine Ounces of the gold delivered. Any excess Fine Ounces included in the Share Submission will be sold by the Custodian and the Trustee will deliver proceeds to DTC with instructions to credit the Delivery Applicant’s brokerage account.

|

The Shares are intended to constitute a cost-efficient mechanism for investors to make an investment in gold. Although the Shares are not the exact equivalent of an investment in gold, they provide investors with an alternative that allows a level of participation in the gold market through the securities market. The Shares are:

|

·

|

Listed and trade on NYSE Arca like other exchange-traded securities under the symbol “OUNZ.”

|

|

·

|

Easily accessible to investors through traditional brokerage accounts.

|

|

·

|

Backed by allocated gold held by the Custodian and no more than 430 Fine Ounces of unallocated gold held with the Custodian.

|

|

·

|

Different from other financial products that gain exposure to gold in that other financial products may use derivatives to gain exposure to the price of gold.

|

|

·

|

Cost efficient because the expenses involved in an investment in physical gold are dispersed among all investors in the Shares.

|

Overview of the Gold Industry

Gold demand

Today, gold is used as both a commodity and a store of value. The first category includes gold jewelry and the gold that has been manufactured into industrial products. The second category includes gold reserves held by the official sector and private investors.

Jewelry demand

Jewelry demand has historically accounted for the largest component of total gold demand. At the end of 2015 the estimated total existing above-ground stock of gold amounted to 5.9 billion ounces1, and about half of the estimated total has been used in jewelry.

The motivation behind gold jewelry demand differs in various regions of the world. In the developed countries, gold jewelry is primarily bought for adornment purposes, while in the developing world, gold jewelry has also been used as a store of value. India, East Asia (excluding Japan) and the Middle East are the major gold jewelry markets by volume in the developing world; gold jewelry is generally of higher cartage and the price more closely reflects the value of gold in these regions compared to developed countries.

Gold jewelry demand has been steady annually around 70.8 million Ounces from the period of 2006 to 2015. Total annual jewelry demand amounted to 69.6 million Ounces in 2015. The largest decline was in 2009, down 19.0% or 13.5 million Ounces, as a result of economic recession, elevated gold prices, and a contraction in consumer spending. Gold jewelry demand, as a proportion of total gold demand, has been trending downward, from 89.6% of total demand in 2000 to 48.56% in 2013. However, in 2014 and 2015, gold jewelry demand rose to 72.1 million and 69.6 million Ounces, respectively, boosted by the lower gold price environment.

1 Source: Thomson Reuters GFMS Gold Survey 2015

3

Industrial and medical demand

In addition to its application in jewelry, gold has been widely used in manufacturing and medical treatment. Approximately 8.38%2 of above-ground gold has been manufactured into industrial and dental products. Recently, from the period of 2006 to 2015, over half of industrial demand has been derived from electronic component manufacturing, in large part due to gold’s high electronic conductivity and natural resistance to corrosion. Gold is also used for industrial decoration, such as gold plating and coating.

Industrial use of gold is more common in the developed world, whereas most of the gold fabrication in developing nations is typically for jewelry. Demand for gold used in electronics manufacturing fell sharply in 2009, down 12.1% from 2008, likely caused by weak economic conditions, but it rebounded 7.4% in 2010 before falling 11.2% again in 2015.

Additionally, gold has long been used for medical and dental purposes. Its outstanding bio-compatibility, malleability and resistance to bacterial colonization make it a well-suited material for various biomedical applications in the human body. Dental use is the primary medical application. Other medical uses include gold wires used in heart transplants and gold-plated stents to support blood vessels. Demand for gold from this sector was down slightly in recent years.

Investment demand

Around 2.2 billion ounces of above-ground gold was held as an investment or store of value, accounting for 37.1% of the estimated total: around 16.5% was held by the official sector and approximately 20.5% was held by the private sectors in 20153.

Central banks and supranational organizations (e.g., the International Monetary Fund (the “IMF”) and Bank of International Settlements (the “BIS”)) hold gold as part of their reserve assets. The largest proportion of official sector gold holdings at the end of 2015 was held in the United States, with 27.8%; 11.6% was held by Germany; and 8.4% by Italy. Central banks affect the gold market through buying, selling and lending, as well as swaps and other derivative activities.

Gold is also favored by the private sector as a store of value and a means of investment. Unlike equities, bonds and currencies, gold does not run the risk of issuers’ default or mismanagement and is not a liability of any government or corporation. Many investors may consider gold to be a safe haven investment, a portfolio diversifier and inflation hedge.

Over the past decade, there has been a steady rise in the number of investors worldwide holding gold. A large part of this trend has been the advent and proliferation of gold-tracking exchange-traded funds, which allow investors greater access to investments in gold. In 2015, net private investment demand represented 25.9% of the total annual gold demand, up substantially from 1.7% in 2000.

Sources of gold supply

Sources of gold supply include mine production, secondary supply from recycled gold and official sector sales.

Mine production

The largest portion of gold supply comes from mine production, including gold produced both from primary deposits and from secondary deposits where the gold is mined as a by-product. All the recorded gold ever mined in human history amounts to approximately 5.99 billion Ounces, or 186,200 metric tons. To put this in perspective, all the gold ever mined would only fill two Olympic-sized swimming pools.

2 Source: Thomson Reuters GFMS Gold Survey 2015

3 Source: Thomson Reuters GFMS Gold Survey 2015

4

Gold is produced from mines on every continent except Antarctica (where mining is forbidden by the Antarctica Treaty). Until recently, South Africa was the world’s largest gold producing country. At its peak in the early 1970s, South Africa contributed over 70% of world production. However, over the past four decades, South African output has been declining while other countries have expanded gold mining considerably.

Over recent years, gold has been increasingly mined in developing countries; China is currently the world’s largest gold producing country. In 2015, gold output in China was 14.7 million Ounces, accounting for 14.5% of total world production, followed by Australia and Russia, with 8.7% and 8.0% of total production respectively. South African gold production further declined to 4.8 million Ounces in 2015, accounting for 4.8% of total annual output.

Recycled gold

Recycled gold, or scrap gold, is the second largest source of gold supply. Gold’s indestructibility means it can be recovered from recycled jewelry and industrial products. This gold can then be melted, refined and cast into bullion bars for resale in the gold market. Supplies emanating from recycled gold have risen steadily in the past two decades, and are predominantly sourced from recycled gold jewelry.

Recycled gold supply is highly affected by gold prices and economic conditions. Supplies reached elevated levels during the 1997-1998 Asian financial crisis, and more recently hit a record of 41.2 million Ounces in 2009, spurred by the global financial crisis and rising gold prices. Since then, the total amount of scrap gold has come down to 37.7 million Ounces in 2015.

Asia, India, and the Middle East are the three major regions supplying recycled gold, accounting for 63.9% of total recycled gold recovered in 2015. China is now the largest scrap-supplying nation, supplying 7.2 million Ounces, or 19.2% of total secondary supply, in 2015. East and Southeast Asia and the Middle East contributed 35.1% and 19.2% to the total secondary gold supply, respectively, in 2015.

Official sector sales

Approximately 16.6%4 of total above-ground gold stock is held by the official sector, a proportion that had declined over recent years before the global financial crisis. During 1989-2007, official sector sales outstripped annual purchases, meaning the official sector became a net seller of gold to the private sector.

From 1989 to 2007, the official sector supplied an approximate total of 238.8 million Ounces in gold to the private sector. In 1999, the European Central Bank and 14 other central banks signed the first Central Bank Gold Agreement (a “CBGA”). The signatory institutions agreed not to enter the gold market as sellers except for already decided sales. In the second CBGA, Bank of Greece replaced the Bank of England. In August 2009, 19 central banks announced the third CBGA. Under this agreement, the annual ceiling for gold sales was reduced to 12.9 million Ounces.

Since the onset of the financial crisis, the official sector reversed its role as a net seller over the previous nineteen years. From 2008 to 2013, the official sector was a net purchaser of 60.0 million Ounces of gold. Central banks of major developing economies, including the People’s Bank of China, the Reserve Bank of India and the Russian central bank, have substantially increased gold reserves. In September 2009, the IMF Executive Board approved the sale of 13.0 million Ounces, approximately one-eighth of the Fund’s total holdings of gold, to help boost its lending resources. The IMF completed the gold sales program in December 2010. In 2015, heightened geopolitical tensions resulted in net central bank buying reaching 15.5 million Ounces.

The gold market and price movement

Global gold trade consists of the over-the-counter (“OTC”) market, the futures and options markets and the London interbank market.

4 Source: Thomson Reuters GFMS Gold Survey 2015

5

OTC market

The OTC market accounts for the largest percentage of global gold trading volume. It trades on a 24-hour per business day continuous basis and provides a relatively flexible market in terms of quotes, size, price, destinations for delivery and other factors. The standard trade size ranges between 5,000 and 10,000 Ounces.

OTC market makers include the nine market-making members of the LBMA, and the main centers are London, New York and Zurich. Market participants include jewelry manufacturers, mining companies, central banks, investors and speculators. Liquidity in the OTC market varies during the day, with the most liquid time periods generally occurring in New York business day mornings, when trading hours in European time zones overlap with trading hours in the United States.

The London Bullion Market is the largest wholesale OTC market for gold and is operated by the LBMA, which acts as the principal point of contact between the market and its regulators. Gold bars must meet the requirements defined by the LBMA.

Futures and options exchanges

The major futures and options exchanges include the New York Commodities Exchange (“COMEX”) (an affiliate of the Chicago Mercantile Exchange, Inc.), the Multi Commodity Exchange of India (“MCX”), the Tokyo Commodities Exchange (“Tocom”), and the Shanghai Futures Exchange. Other leading exchanges for gold derivatives trading include NYSE Liffe and Dubai Gold & Commodities Exchange. Gold futures and options are traded on these exchanges in standardized transaction sizes and delivery dates. Only a small portion of the gold futures market turnover is typically physically delivered.

The COMEX is the largest gold futures and options exchange. In 2013, it represented approximately 71% of global futures and options trading volume5. In 2007, the Chicago Mercantile Exchange merged with the CBOT to form the Chicago Mercantile Exchange Group (the “CME Group”), and in 2008 the CME Group acquired the COMEX.

In 2015, the Shanghai Futures Exchange (“SHFE”) replaced the MCX as the world’s second largest futures exchange in terms of gold futures trading volume, accounting for around 13.7% of the world total. The SGE accounted for about 6.5% of total gold futures trading volume in 2015. During the same period, all of the four largest exchanges experienced an increase in the trading volume of gold futures and options, with SGE gaining 59% year-over-year.

In November 2013, the Intercontinental Exchange acquired NYSE Liffe, the sixth largest exchange for gold futures trading, as part of the acquisition of NYSE Euronext.

Allocated and Unallocated Gold

Allocated gold is stored in a vault under a custody arrangement, and the individual bars are the property of the owner. When held in this fashion, allocated gold is neither an asset, nor a liability, of a financial institution. As it is typically held under a custody relationship, storage fees and insurance premiums are common when holding gold in allocated form.

From an investor’s standpoint, unallocated gold (sometimes referred to as “paper gold”) is a claim on a non-specific pool of gold held by a financial institution. It is typically held in a gold account at the financial institution. There are no tangible gold bars stored in the investor’s name; rather, the investor has a claim on the financial institution’s assets (the underlying gold).

Both methods of investing give investors exposure to gold. However, some have been cautious of utilizing unallocated gold, as it represents a liability from a financial institution’s standpoint and such a financial institution may lend out the underlying gold an investor has a claim on.

6

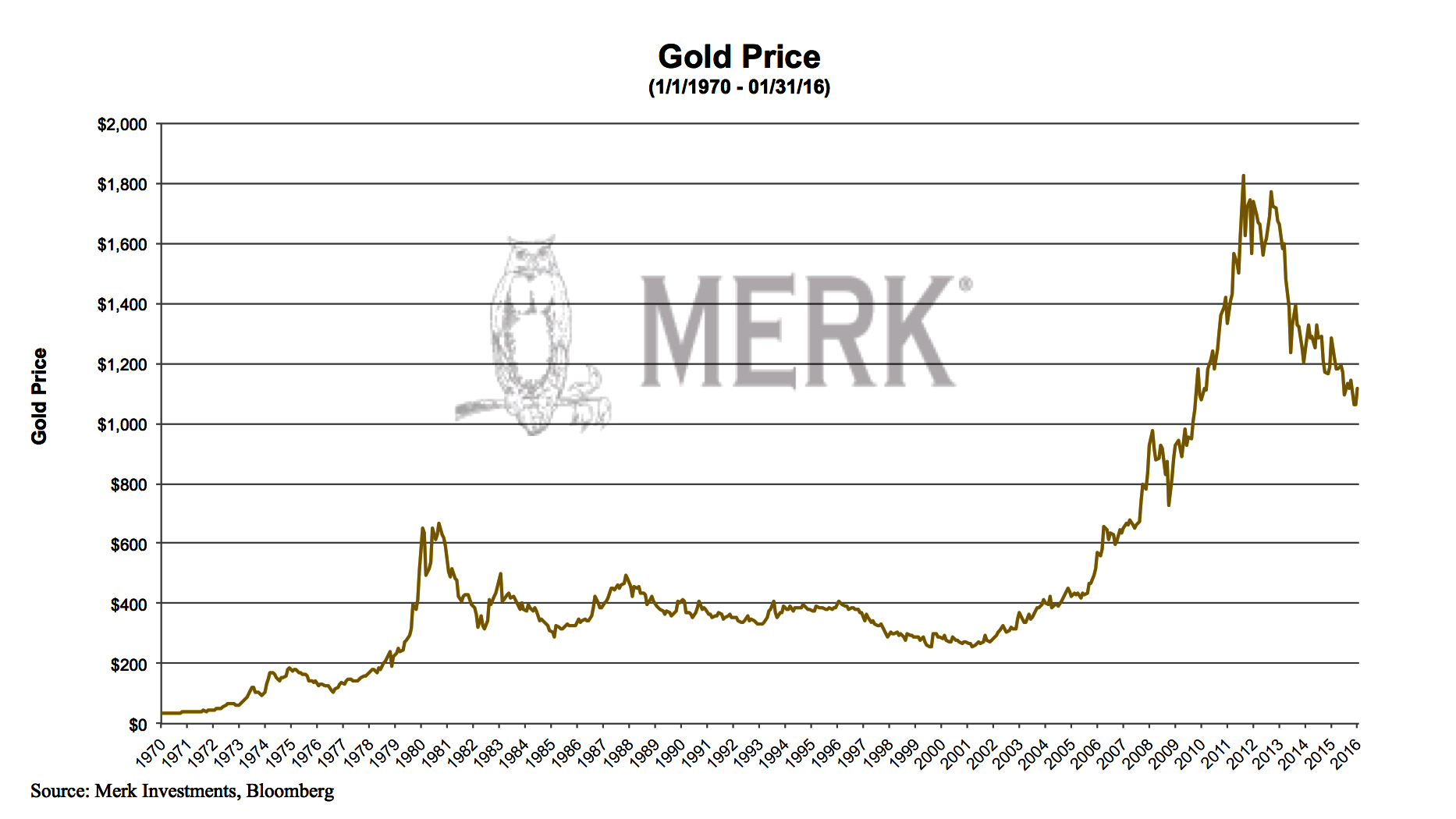

Historical movements in the gold price

The following chart illustrates the historical movements in the price of gold for the period January 1970 to January 2016, measured in U.S. dollar per Ounce.

5 Source: Thomson Reuters GFMS Gold Survey 2015

5 Source: Thomson Reuters GFMS Gold Survey 2015

After reaching a 20-year low of just over $250 per Ounce in the summer of 1999, the price of gold gradually increased, as a result of the strong rise in physical demand, especially in the major gold markets, including China, Egypt, India and Japan. The upward price trend that began in 2001 continued through May 2006.

Following a peak around $725 per Ounce in May 2006, the gold price fell to just over $560 in October 2006. Investors’ concerns that monetary authorities would move to counter the threat of rising inflation by aggressively raising interest rates is frequently cited as the reason for this price correction.

|

·

|

However, as the Federal Reserve Bank began to reduce interest rates in response to the subprime mortgage crisis in August 2007, the gold price rallied again. The continued reduction in the Federal Funds rate may have helped drive the price of gold to a fresh high above $1,010 in March 2008.

|

|

·

|

As the subprime mortgage problems escalated into a global financial crisis in late 2008 and the Eurozone debt crisis deepened in 2011, the gold price successively reached new record highs. The gold price reached a historically high level of $1,900.23 on September 5, 2011. Market concerns surrounding the implications of monetary policies, political uncertainty, sovereign credit risks and U.S. dollar weakness may have underpinned gold demand as a store of value through this period.

|

Gold continued to decline in 2015, in part from market expectations of a Fed rate hike.

7

Volatility

Annualized Standard Deviation

|

|

S&P 500

|

Spot Gold

|

Spot Silver

|

|

1991-1995

|

10.31%

|

10.57%

|

24.83%

|

|

1996-2000

|

18.42%

|

12.98%

|

22.08%

|

|

2001-2005

|

18.22%

|

14.45%

|

22.86%

|

|

2006-2010

|

24.95%

|

22.28%

|

38.40%

|

|

2011-2015

|

15.46%

|

17.01%

|

30.84%

|

Source: Bloomberg

Gold price volatility has picked up in recent years. It was 10.57% during 1991-1995 and rose to 12.98% for the period of 1996- 2000, 14.45% of 2001-2005 and 22.28% of 2006-2010. It went up further in the recent price correction in April 2013. But the price of gold is still less volatile than other commodities such as silver. This lower volatility may reflect gold’s role as a financial asset and the much broader liquid financial market that gold has compared to other commodities. Also, the daily return on gold price was less volatile than the S&P 500 index during 1996-2010, but it has been slightly higher than that of the S&P 500 from January 2011 to December 2015.

Valuation of Gold and Computation of Net Asset Value

On each business day that the NYSE Arca is open for regular trading, as promptly as practicable after 4:00 PM (New York time) the Trustee will value the gold held by the Trust and will determine the net asset value (“NAV”) of the Trust, as described below.

The NAV of the Trust is the aggregate value of gold and other assets, if any, of the Trust (other than any amounts credited to the Trust’s reserve account, if any) and cash, if any, less liabilities of the Trust, which include estimated accrued but unpaid fees, expenses and other liabilities.

All gold is valued based on its Fine Ounce content, calculated by multiplying the weight of gold by its purity; the same methodology is applied independent of the type of gold held by the Trust; similarly, the value of up to 430 Fine Ounces of unallocated gold the Trust may hold is calculated by multiplying the number of Fine Ounces with the price of gold determined by the Trustee as follows. The Trustee values the gold held by the Trust based on the afternoon session of the twice daily fix of the price of a Fine Ounce of gold which starts at 3:00 PM London, England time and is performed in London by the ICE Benchmark Administration as an independent third-party administrator (the “LBMA PM Gold Price”). The Trustee also determines the NAV per Share. If on a day when the Trust’s NAV is being calculated the LBMA PM Gold Price for that day is not available, the Trustee will value the gold held by the Trust based on that day’s morning session of the twice daily fix of the price of a Fine Ounce of gold, which starts at 10:30 AM London, England time and is performed in London by the ICE Benchmark Administration as a independent third-party administrator (the “LBMA AM Gold Price”). If no fix is available for the day, the Trustee will value the Trust’s gold based on the most recently announced LBMA AM Gold Price or LBMA PM Gold Price. Prior to March 20, 2015, the Trustee utilized the daily fix of the price of a Fine Ounce of gold as performed by the five members of the London gold fix, which has now been replaced by the ICE Benchmark Administration as an independent third-party administrator.

The Trustee’s estimation of accrued but unpaid fees, expenses and liabilities will be conclusive upon all persons interested in the Trust, and no revision or correction in any computation made under the Trust’s Depository Trust Agreement (the “Trust Agreement”) will be required by reason of any difference in amounts estimated from those actually paid.

The Sponsor and the investors may rely on any evaluation or determination of any amount made by the Trustee, and except for any determination by the Sponsor as to the price to be used to evaluate gold, the Sponsor will have no responsibility for the evaluation’s accuracy. The determinations the Trustee makes will be made in good faith upon the basis of, and the Trustee will not be liable for any errors contained in, information reasonably available to it. The Trustee will not be liable to the Sponsor, Authorized Participants, the investors or any other person for errors in judgment. However, the preceding liability exclusion will not protect the Trustee against any liability resulting from bad faith or gross negligence in the performance of its duties.

8

Trust Expenses

The Trust’s only ordinary recurring expense is the remuneration due to the Sponsor of 0.40% of the NAV of the Trust (the “Sponsor’s Fee”). In exchange for the Sponsor’s Fee, the Sponsor has agreed to assume the following administrative and marketing expenses incurred by the Trust: the Trustee’s monthly fee and out-of-pocket expenses; the Custodian’s fee; the fees and expenses of Foreside Fund Services, LLC; expenses reimbursable under the Trust’s Custody Agreement with the Custodian (the “Custody Agreement”); the precious metals dealer’s fees and expenses reimbursable under its agreement with the Sponsor; exchange listing fees; SEC registration fees; printing and mailing costs; maintenance expenses for the Trust’s website; audit fees and up to $100,000 per annum in legal expenses. The Sponsor also paid the costs of the Trust’s organization and the initial sale of the Shares, including applicable SEC registration fees.

The Sponsor’s Fee will accrue daily based on the prior business day’s NAV and will be payable in Shares corresponding to the NAV of the Shares at the time of payment on a monthly basis in arrears. The fee will be paid by delivering that number of Shares which equals the daily accrual of the Sponsor’s Fee for such prior month based on the NAV of the Shares on the first business day of the following month.

In addition to the Sponsor’s Fee, the Sponsor receives the exchange fee paid by Delivery Applicants in the exchange process. Such fees are used to recoup the expenses the Sponsor bears for over-the-counter transactions. The Sponsor may earn a profit on its fees.

From time to time, the Sponsor may waive all or a portion of the Sponsor’s Fee at its discretion. The Sponsor is under no obligation to continue a waiver after the end of a stated period, and if such waiver is not continued, the Sponsor’s Fee will thereafter be paid in full. Presently, the Sponsor does not intend to waive any of its fees.

Furthermore, the Sponsor may, in its sole discretion, agree to rebate all or a portion of the Sponsor’s Fee attributable to Shares held by certain institutional investors subject to minimum share holding and lock up requirements as determined by the Sponsor to foster stability in the Trust’s asset levels. Any such rebate will be subject to negotiation and written agreement between the Sponsor and the investor on a case by case basis. The Sponsor is under no obligation to provide any rebates of the Sponsor’s Fee. Neither the Trust nor the Trustee will be a party to any Sponsor’s Fee rebate arrangements negotiated by the Sponsor.

The Sponsor will assume certain extraordinary expenses which are not usually incurred during the normal course of business, such as litigation expenses, subject to a total of $100,000 per annum. Extraordinary expenses of the Trust that are not assumed by the Sponsor may be paid by the Sponsor at its sole discretion and reimbursed by the Trust in Shares corresponding to the value of gold at the time of reimbursement.

Otherwise, the Trustee will, when directed by the Sponsor, and, in the absence of such direction, in its discretion, sell gold in such quantity and at such times as may be necessary to permit payment in cash of the Trust’s extraordinary expenses not assumed by the Sponsor. The Trustee is authorized to sell gold as directed by the Sponsor or otherwise at such times and in the smallest amounts required to permit such payments as they become due, it being the intention to avoid or minimize the Trust’s holdings of assets other than gold. Accordingly, the amount of gold to be sold will vary from time to time depending on the level of the Trust’s expenses and the market price of gold. The Custodian may purchase from the Trust, at the request of the Trustee, gold needed to cover Trust expenses not assumed by the Sponsor at the price used by the Trustee to determine the value of gold held by the Trust on the date of the sale.

Cash held by the Trustee pending payment of the Trust’s expenses will not bear any interest.

The Sponsor’s Fee for the year ended January 31, 2016 was $277,150.

9

Creations & Redemption of Shares

Authorized Participants

The Trust issues and redeems Baskets only to Authorized Participants. The creation and redemption of Baskets will only be made in exchange for the delivery to the Trust or the distribution by the Trust of the amount of gold represented by the Baskets being created or redeemed, the amount of which will be based on the combined Fine Ounces represented by the number of Shares included in the Baskets being created or redeemed determined on the day the order to create or redeem Baskets is properly received.

Orders to create and redeem Baskets may be placed only by Authorized Participants. An Authorized Participant must: (1) be a registered broker-dealer or other securities market participant, such as a bank or other financial institution, which, but for an exclusion from registration, would be required to register as a broker-dealer to engage in securities transactions; (2) be a participant in the Depository Trust Company (“DTC”); and (3) must have an agreement with the Custodian establishing an unallocated account in London or have an existing unallocated account meeting the standards described in the Trust Agreement. To become an Authorized Participant, a person must enter into an Authorized Participant Agreement with the Sponsor and the Trustee (“Authorized Participant Agreement”). The Authorized Participant Agreement provides the procedures for the creation and redemption of Baskets and for the delivery of the gold required for such creations and redemptions. The Authorized Participant Agreement and the related procedures attached thereto may be amended by the Trustee and the Sponsor, without the consent of any investor or Authorized Participant. A transaction fee of $500 will be assessed on all creation and redemption transactions. Multiple Baskets may be created on the same day, provided each Basket meets the requirements described below and that the Custodian is able to allocate gold to the Trust allocated account (the “Trust Allocated Account”) such that the Trust’s unallocated account (the “Trust Unallocated Account”) holds no more than 430 Fine Ounces of gold at the close of a business day.

Authorized Participants who make deposits with the Trust in exchange for Baskets will receive no fees, commissions or other form of compensation or inducement of any kind from either the Sponsor or the Trust, and no such person has any obligation or responsibility to the Sponsor or the Trust to effect any sale or resale of Shares.

Delivery Applicants

In exchange for its Shares and payment of a processing fee, a Delivery Applicant will be entitled to one or more bars or coins of physical gold having approximately the total Fine Ounces represented by the Shares on the day on which the Delivery Applicant’s broker-dealer submits his or her Shares to the Trust in exchange for physical gold (a “Share Submission Day”). As it is unlikely that the total Fine Ounces of physical gold will exactly correspond to the Fine Ounces represented by a specific number of Shares, a Delivery Applicant will likely receive some cash representing the net sale proceeds of any excess Fine Ounces (i.e., the cash proceeds). To minimize the cash proceeds of any exchange, the Delivery Application requires that the number of Shares submitted closely correspond in Fine Ounces to the Fine Ounces of physical gold that is held or that is to be acquired by the Trust for which the delivery is sought. Share submissions are processed in the order approved.

Creation Procedures — Authorized Participants

On any business day, an Authorized Participant may place an order with the Trustee to create one or more Baskets. For purposes of processing both purchase and redemption orders, a “business day” means any day other than a day: (1) when the NYSE Arca is closed for regular trading; or (2) if the order or other transaction requires the receipt or delivery, or the confirmation of receipt or delivery, of gold in the United Kingdom or in some other jurisdiction on a particular day, (A) when banks are authorized to close in the United Kingdom or in such other jurisdiction or when the London gold market is closed or (B) when banks in the United Kingdom or in such other jurisdiction are, or the London gold market is, not open for a full business day and the order or other transaction requires the execution or completion of procedures which cannot be executed or completed by the close of the business day. Purchase orders must be placed by 3:59:59 PM (New York time). The day on which the Trustee receives a valid purchase order is the purchase order date.

By placing a purchase order, an Authorized Participant agrees to deposit gold with the Trust, as described below. Prior to the delivery of Baskets for a purchase order, the Authorized Participant also must have wired to the Trustee the amount of the non-refundable transaction fee due for the purchase order and an amount equal to all taxes, governmental charges and fees payable in connection with such deposit, the transfer of gold and the issuance and delivery of Shares.

10

Determination of Required Deposits

The amount of the required gold deposit for a Basket is determined by dividing the number of Fine Ounces of gold held by the Trust by the number of Baskets outstanding, as adjusted for the amount of gold constituting estimated accrued but unpaid fees and expenses of the Trust. The number of Baskets outstanding is determined by dividing the number of Shares outstanding by 50,000 (or other number of Shares in a Basket for such business day).

Fractions of a Fine Ounce of gold smaller than 0.001 of a Fine Ounce included in the gold deposit amount are disregarded in the foregoing calculation. All questions as to the composition of a gold deposit for a Basket will be finally determined by the Trustee. The Trustee’s determination of the required gold deposit for a Basket shall be final and binding on all persons interested in the Trust.

Delivery of Required Deposits

An Authorized Participant who places a purchase order is responsible for crediting its unallocated account, if held at the Custodian, with the required gold deposit amount in gold and, if the Authorized Participant does not maintain its unallocated account with the Custodian, causing the required gold deposit to be transferred to the Custodian, by 11:00 AM, London, England time, on the third business day following the purchase order date. No Shares are issued unless and until the Custodian has informed the Trustee that it has credited to the Trust Allocated Account at the Custodian the corresponding amount of gold. If the Custodian has notified the Trustee and the Sponsor that it is unable to move the gold from the Trust Unallocated Account to the Trust Allocated Account in connection with a particular purchase order or generally, the Trustee will, unless otherwise instructed by the Sponsor, reject the particular purchase order as well as any other subsequent purchase orders on the same business day. Upon receipt of the gold deposit amount, the Custodian, after receiving appropriate instructions from the Authorized Participant and the Trustee, will use commercially reasonable endeavors to transfer by 2:00 PM (London, England time) on the third business day following the purchase order date the gold deposit amount in gold to the Trust Unallocated Account, and on the same business day, acting on standing instructions given by the Trustee, the gold deposit amount from Trust Unallocated Account to the Trust Allocated Account by allocating specific bars of gold such that no more than 430 Fine Ounces remain in the Trust Unallocated Account. Upon transfer of the gold deposit amount to the Trust Allocated Account, the Trustee will direct DTC to credit the number of Baskets ordered to the Authorized Participant’s DTC account. The expense and risk of delivery, ownership and safekeeping of gold until such gold has been received by the Trust shall be borne solely by the Authorized Participant.

Because gold is allocated only in multiples of whole bars, the amount of gold allocated from the Trust Unallocated Account to the Trust Allocated Account may be less than the total Fine Ounces credited to the Trust Unallocated Account. Any balance will be held in the Trust Unallocated Account. The Custodian may hold no more than 430 Fine Ounces of gold (maximum weight corresponding to one London Bar) in the Trust Unallocated Account at the close of a business day.

Rejection of purchase orders

The Trustee may reject a gold deposit at any time when the Trustee’s transfer books are closed or if the Sponsor thinks it necessary or advisable for any reason. None of the Trustee, the Sponsor or the Custodian will be liable for the rejection of any purchase order or gold deposit.

Redemption Procedures — Authorized Participants

The procedures by which an Authorized Participant can redeem one or more Baskets mirror the procedures for the creation of Baskets. On any business day, an Authorized Participant may place an order with the Trustee to redeem one or more Baskets. Redemption orders must be placed no later than 3:59:59 PM (New York time) on each business day the NYSE Arca is open for regular trading. A redemption order so received is effective on the date it is received in satisfactory form by the Trustee. The redemption procedures allow only Authorized Participants to redeem Baskets. An investor may not redeem Baskets other than through an Authorized Participant.

11

By placing a redemption order, an Authorized Participant agrees to deliver the Baskets to be redeemed through DTC’s book-entry system to the Trust no later than the third business day following the effective date of the redemption order. Prior to the delivery of the redemption distribution for a redemption order, the Authorized Participant must also have wired to the Trustee the non-refundable transaction fee due for the redemption order.

The redemption distribution from the Trust will consist of a credit to the redeeming Authorized Participant’s unallocated account representing the amount of the gold held by the Trust evidenced by the Shares being redeemed as of the date of the redemption order. Fractions of a Fine Ounce included in the redemption distribution smaller than 0.001 of a Fine Ounce are disregarded. Redemption distributions will be subject to the deduction of any applicable tax, fees or other governmental charge that may be due, as well as any charges or fees in connection with the transfer of gold and the issuance and delivery of Shares, and any expense associated with the delivery of gold other than by credit to an Authorized Participant’s unallocated account with the Custodian.

Delivery of redemption distribution

The redemption distribution due from the Trust is delivered to the Authorized Participant on the third business day following the redemption order date if, by 9:00 AM (New York time) on such third business day, the Trustee’s DTC account has been credited with the Baskets to be redeemed.

The Custodian will arrange for the redemption amount in gold to be transferred from the Trust Allocated Account to the Trust Unallocated Account and, thereafter, to the redeeming Authorized Participant’s unallocated account. The Authorized Participant and the Trust each are at risk in respect of gold credited to their respective unallocated accounts in the event of the Custodian’s insolvency. See “Risk Factors— The Trust Would Be An Unsecured Creditor of the Custodian in the Event of Insolvency.”

As with the allocation of gold to the Trust Allocated Account that occurs upon a purchase order, if in transferring gold from the Trust Allocated Account to the Trust Unallocated Account in connection with a redemption order there is an excess amount of gold transferred to the Trust Unallocated Account, the excess over the gold redemption amount will be held in the Trust Unallocated Account. The Custodian may hold no more then 430 Fine Ounces of gold (maximum weight corresponding to one London Bar) in the Trust Unallocated Account at the close of each business day.

Suspension or rejection of redemption orders

The Trustee may, in its discretion, and will when directed by the Sponsor, suspend the right of redemption, or postpone the redemption settlement date or reject a particular redemption order (1) for any period during which the NYSE Arca is closed other than customary weekend or holiday closings, or trading on the NYSE Arca is suspended or restricted or (2) for any period during which an emergency exists as a result of which delivery, disposal or evaluation of gold is not reasonably practicable. Neither the Sponsor nor the Trustee will be liable to any person or in any way for any loss or damages that may result from any such suspension or postponement.

The Trustee will reject a redemption order if the order is not in proper form as described in the Authorized Participant Agreement or if the fulfillment of the order, in the opinion of its counsel, might be unlawful.

The Sponsor

The Sponsor, Merk Investments LLC, is a Delaware limited liability company. The Sponsor’s office is located at 555 Bryant Street, #455, Palo Alto, California, 94301. The Sponsor has provided investment advisory services to mutual funds since 2005. As of December 31, 2015, the Sponsor had approximately $253 million of assets under management. The Sponsor’s role is discussed below, and it has undertaken the responsibilities set forth below.

The Sponsor’s Role

The Sponsor arranged for the creation of the Trust, the registration of the Shares for their public offering in the United States and the listing of the Shares on the NYSE Arca. In exchange for the Sponsor’s Fee, the Sponsor has

12

agreed to assume the following administrative and marketing expenses incurred by the Trust: the Trustee’s monthly fee and out-of-pocket expenses; the Custodian’s fee; the fees and expenses of Foreside Fund Services, LLC and other marketing expenses; expenses reimbursable under the Custody Agreement; the precious metals dealer’s fees and expenses reimbursable under its agreement with the Sponsor; exchange listing fees; SEC registration fees; printing and mailing costs; maintenance expenses for the Trust’s website; audit fees and up to $100,000 per annum in legal expenses. The Sponsor is paid in Shares in lieu of cash.

The Sponsor will not exercise day-to-day oversight over the Trustee or the other service providers to the Trust. The Sponsor may remove the Trustee and appoint a successor Trustee if: (1) the Trustee ceases to meet certain objective requirements (including the requirement that it have capital, surplus and undivided profits of at least $150 million); (2) having received written notice of a material breach of its obligations under the Trust Agreement, the Trustee has not cured the breach within 30 days; or (3) the Trustee fails to consent to the implementation of an amendment to the Trust’s initial Internal Control Over Financial Reporting deemed necessary by the Sponsor and, after consultations with the Sponsor, the Sponsor and the Trustee fail to resolve their differences regarding the proposed amendment. The Sponsor also has the right to replace the Trustee during the 90 days following any merger, consolidation or conversion in which the Trustee is not the surviving entity or, in its discretion, on the fifth anniversary of the creation of the Trust or on any subsequent third anniversary thereafter. The Sponsor also has the right to direct the Trustee to appoint any new or additional Custodian that the Sponsor selects.

The Sponsor: (1) will develop a marketing plan for the Trust on an ongoing basis; (2) will prepare marketing materials regarding the Shares; (3) will maintain the Trust’s website; (4) may engage in over-the-counter transactions with a precious metals dealer to exchange the Trust’s gold for gold of different specifications as requested by a Delivery Applicant in a Delivery Application; (5) may provide instructions for assaying gold, and other instructions relating to custody of the Trust’s gold, as necessary; (6) may request the Trustee to order Custodian audits (to the extent permitted under the Custody Agreement); and (7) will review Delivery Applications from Delivery Applicants wishing to take delivery of physical gold for their Shares and coordinate the delivery of physical gold to the Delivery Applicants.

The Sponsor periodically engages in over-the-counter transactions to exchange London Bars for physical gold of other specifications. The Sponsor engages in such transactions pursuant to instructions from a Delivery Applicant who requests 10 Ounce Bars (containing 10 Fine Ounces of gold), 1 Ounce Bars (containing 1 Fine Ounce of gold) and gold coins in exchange for their Shares. The Sponsor pays for such conversion but seeks to recover these costs by charging an exchange fee to Delivery Applicants exchanging Shares for physical gold. The exchange fee will not exactly reflect the actual cost of conversion to the Sponsor and may reflect a markup to compensate the Sponsor for the risk the Sponsor is taking on by exchanging physical gold for physical gold other than London Bars before knowing investor demand for delivery or market conditions at the time investor demand for delivery changes. The Sponsor selects the precious metals dealers with whom it seeks to exchange the Trust’s physical gold.

The Trustee

The Bank of New York Mellon, a banking corporation organized under New York State law with trust powers, serves as the Trustee. The Trustee has a trust office at 2 Hanson Place, Brooklyn, New York 11217. The Trustee is subject to supervision by the New York State Financial Services Department and the Board of Governors of the Federal Reserve System. Information regarding creation and redemption Basket composition, NAV of the Trust, transaction fees for the creation and redemption of Baskets and the names of the parties that have executed an Authorized Participant Agreement may be obtained from the Trustee. A copy of the Trust Agreement is available for inspection at the Trustee’s trust office identified above. Under the Trust Agreement, the Trustee is required to maintain capital, surplus and undivided profits of at least $150 million.

The Trustee’s Role

The Trustee is generally responsible for the day-to-day administration of the Trust, including keeping the Trust’s operational records. The Trustee’s principal responsibilities include: (1) valuing the Trust’s gold and calculating the NAV per share of the Trust, (2) supplying inventory information to the Sponsor for the Trust’s website; (3) receiving and processing orders from Authorized Participants for the creation and redemption of Baskets; (4) coordinating the processing of orders from Authorized Participants with the Custodian and DTC, including

13

coordinating with the Custodian the receipt of unallocated gold transferred to the Trust in connection with each issuance of Baskets; (5) cooperating with the Sponsor, the Custodian and the precious metals dealer in connection with the delivery of physical gold to Delivery Applicants in exchange for their Shares; (6) issuing and allocating Shares to the Sponsor in lieu of paying the Sponsor’s Fee in cash; (7) issuing and allocating Shares to the Sponsor to reimburse cash payments owed by the Trust, but undertaken by the Sponsor; (8) selling the Trust’s gold pursuant to the Sponsor’s direction or otherwise as needed to pay any extraordinary Trust expenses that are not assumed by the Sponsor; (9) holding the Trust’s cash and other financial assets, if any; (10) when appropriate, making distributions of cash or other property to investors; and (11) receiving and reviewing reports on the custody of and transactions in the Trust’s gold from the Custodian and taking such other actions in connection with the custody of gold as the Sponsor instructs. The Trustee shall, with respect to directing the Custodian, act in accordance with the instructions of the Sponsor. If the Custodian resigns, the Trustee shall appoint any replacement Custodian selected by the Sponsor in accordance with the Trust Agreement. Under the agreement with the Custodian, the Trustee, the Sponsor and the Sponsor’s auditors and inspectors may visit the premises of the Custodian for the purpose of examining the Trust’s gold and certain related records maintained by the Custodian.

The Trustee intends to regularly communicate with the Sponsor in connection with the administration of the Trust. The Trustee does not monitor the performance of the Custodian other than to review the reports provided by the Custodian pursuant to the Custody Agreement. The Trustee, along with the Sponsor, will liaise with the Trust’s legal, accounting and other professional service providers as needed. The Trustee will assist and support the Sponsor with the preparation of all periodic reports required to be filed with the SEC on behalf of the Trust. The Trustee’s monthly fees and out-of-pocket expenses will be paid by the Sponsor. Affiliates of the Trustee may from time to time act as Authorized Participants or purchase or sell gold or Shares for their own account, as agent for their customers and for accounts over which they exercise investment discretion.

The Trustee will keep proper books of registration and transfer of Shares at its office located in New York or such office as it may subsequently designate. These books and records are open to inspection by any person who establishes to the Trustee’s satisfaction that such person is an investor at all reasonable times during the usual business hours of the Trustee. The Trustee will keep a copy of the Trust Agreement on file in its office which will be available for inspection on reasonable advance notice at all reasonable times during its usual business hours by any investor.

The Custodian

JPMorgan serves as the Custodian for the Trust. The Custodian is a national banking association organized under the laws of the United States. The Custodian is subject to supervision by the Federal Reserve Bank of New York and the Federal Deposit Insurance Corporation. The Custodian’s office is located at 25 Bank Street, Canary Wharf, London E14 SJP. In addition to supervision and examination by the federal banking authorities, London custodian operations are generally subject to supervision by the Financial Services Authority.

The Custodian’s Role

The Custodian is responsible for holding the Trust’s allocated gold as well as receiving and converting allocated and unallocated gold on behalf of the Trust. Unless otherwise agreed between the Trustee (as instructed by the Sponsor) and the Custodian, physical gold must be held by the Custodian at its London vault premises. At the end of each business day, the Custodian will hold no more than 430 Fine Ounces of unallocated gold for the Trust, which corresponds to the maximum Fine Ounce weight of a London Bar. The Custodian converts the Trust’s gold between allocated and unallocated gold when: (1) Authorized Participants engage in creation and redemption transactions with the Trust; (2) gold is sold to pay Trust expenses; or (3) physical gold is converted into unallocated form to facilitate the exchange of Shares by a Delivery Applicant for gold. The Custodian will facilitate the transfer of gold in and out of the Trust through the unallocated gold accounts it may maintain for each Authorized Participant and the precious metals dealer and through the unallocated gold accounts it will maintain for the Trust. The Custodian is responsible for allocating specific bars of gold to the Trust Allocated Account.

The Custodian will provide the Trustee with regular reports detailing the gold transfers in and out of the Trust Unallocated Account with the Custodian and identifying the gold bars held in the Trust Allocated Account.

14

The Custodian’s fees and expenses are paid by the Sponsor. The Custodian and its affiliates may from time to time act as Authorized Participants or purchase or sell gold or Shares for their own account, as an agent for their customers and for accounts over which they exercise investment discretion. The Trustee, on behalf of the Trust, has entered into the Custody Agreement with the Custodian, under which the Custodian maintains the Trust Unallocated Account and the Trust Allocated Account.

Pursuant to the Trust Agreement, if, upon the resignation of the Custodian, there would be no custodian acting pursuant to the Custody Agreement, the Trustee shall, promptly after receiving notice of such resignation, appoint a substitute custodian or custodians selected by the Sponsor pursuant to custody agreement(s) approved by the Sponsor (provided, however, that the rights and duties of the Trustee under the Trust Agreement and the custody agreement(s) shall not be materially altered without its consent). When directed by the Sponsor, and to the extent permitted by, and in the manner provided by, the Custody Agreement, the Trustee shall remove the Custodian and appoint a substitute or additional custodian or custodians selected by the Sponsor. After the entry into the Custody Agreement(s), the Trustee shall not enter into or amend any Custody Agreement with a custodian without the written approval of the Sponsor (which approval shall not be unreasonably withheld or delayed). When instructed by the Sponsor, the Trustee shall demand that a custodian of the Trust deliver such of the Trust’s gold held by it as is requested of it to any other custodian or such substitute or additional custodian or custodians directed by the Sponsor. Each such substitute or additional custodian shall, forthwith upon its appointment, enter into a Custody Agreement in form and substance approved by the Sponsor.

Under the Trust Agreement, the Sponsor is responsible for appointing accountants or other inspectors to monitor the accounts and operations of the Custodian and any successor custodian or additional custodian and for enforcing the obligations of each such custodian as is necessary to protect the Trust and the rights and interests of the investors. The Trustee has no obligation to monitor the activities of the Custodian other than to receive and review such reports of the gold held for the Trust by such Custodian and of transactions in gold held for the account of the Trust made by such Custodian pursuant to the Custody Agreement.

When instructed by the Sponsor, the Trustee will take action to remove gold from one custodian to another custodian selected by the Sponsor. In connection with such transfer of physical gold, the Trustee will, at the direction of the Sponsor, cause the physical gold to be weighed or assayed. The Trustee shall have no liability for any transfer of physical gold or weighing or assaying of delivered physical gold as directed by the Sponsor, and in the absence of such direction shall have no obligation to effect such a delivery or to cause the delivered physical gold to be weighed, assayed or otherwise validated.

Inspection of Gold

Under the Custody Agreement, the Custodian will allow the Sponsor and the Trustee and their physical gold auditors (currently Inspectorate), access to its premises during normal business hours, to examine the physical gold and such records as they may reasonably require to perform their respective duties with regard to investors in Shares. The Trustee agrees that any such access shall be subject to execution of a confidentiality agreement and agreement to the Custodian’s security procedures, and any such audit shall be at the Trust’s expense.

The Sponsor exercised its right to visit the Custodian’s premises and inspect the Trust’s gold and related records on October 28, 2015.

On February 1, 2016, Inspectorate International Limited, a leading commodity inspection and testing company, conducted a physical gold audit of the Trust as of January 29, 2016.

Description of the Shares

General

The Trustee is authorized under the Trust Agreement to create and issue an unlimited number of Shares. The Trustee will create Shares in Baskets (a Basket equals a block of 50,000 Shares) only upon the order of an Authorized Participant. The Shares represent units of fractional undivided beneficial interest in the net assets of the Trust and

15

have no par value. The Trust also may issue Shares to compensate and reimburse the Sponsor in Shares rather than in cash.

Description of Limited Rights

The Shares do not represent a traditional investment and you should not view them as similar to “shares” of a corporation operating a business enterprise with management and a board of directors. As an investor, you will not have the statutory rights normally associated with the ownership of Shares of a corporation, including, for example, the right to bring “oppression” or “derivative” actions. All Shares are of the same class with equal rights and privileges. Each share is transferable, is fully paid and non-assessable and entitles the holder to vote on the limited matters upon which investors may vote under the Trust Agreement. The Shares are entitled to be redeemed or exchanged for gold as described in this Report. The Shares do not entitle their holders to any conversion or pre-emptive rights or redemption rights for single Shares.

Redemption of and Taking Delivery of Physical Gold in Exchange for the Shares

The Shares may be redeemed by or through an Authorized Participant in Baskets. Investors may also take delivery of physical gold in exchange for their Shares. See “Creations & Redemption of Shares” for details.

Distributions

If the Trust is terminated and liquidated, the Trustee will distribute to the investors any amounts remaining after the satisfaction of all outstanding liabilities of the Trust and the establishment of such reserves for applicable taxes, other governmental charges and contingent or future liabilities as the Trustee shall determine. Investors of record on the record date fixed by the Trustee for a distribution will be entitled to receive their pro rata portion of any distribution.

Voting Rights

Under the Trust Agreement, except in limited circumstances, investors do not have voting rights. However, registered holders of at least 25% of the Shares have the right to require the Trustee to cure any material breach by it of the Trust Agreement, and registered holders of at least 75% of the Shares have the right to require the Trustee to terminate the Trust Agreement. In addition, certain amendments to the Trust Agreement require advance notice to the investors before the effectiveness of such amendments, but no investor vote or approval is required for any amendment to the Trust Agreement.

Book-Entry Form

Individual certificates will not be issued for the Shares. Instead, one or more global certificates will be deposited by the Trustee with DTC and registered in the name of Cede & Co., as nominee for DTC. The global certificates will evidence all of the Shares outstanding at any time. Under the Trust Agreement, investors may only hold Shares through (1) participants in DTC, such as a bank, broker-dealer or trust company (“DTC Participants”), (2) those who maintain, either directly or indirectly, a custodial relationship with a DTC Participant (“Indirect Participants”), and (3) those banks, brokers, dealers, trust companies and others who hold interests in the Shares through DTC Participants or Indirect Participants. The Shares are only transferable through the book-entry system of DTC. Investors who are not DTC Participants may transfer their Shares through DTC by instructing the DTC Participant holding their Shares (or by instructing the Indirect Participant or other entity through which their Shares are held) to transfer the Shares. Transfers will be made in accordance with standard securities industry practices.

DTC may decide to discontinue providing its service with respect to Baskets and/or the Shares by giving notice to the Trustee and the Sponsor. Under such circumstances, the Sponsor will find a replacement for DTC to perform its functions at a comparable cost or, if a replacement is unavailable, the Trustee will terminate the Trust.

The rights of the investors generally must be exercised by DTC Participants acting on their behalf in accordance with the rules and procedures of DTC. Because the Shares can only be held in book-entry form through DTC and

16

DTC Participants, investors must rely on DTC, DTC Participants and any other financial intermediary through which they hold the Shares to receive the benefits and exercise the rights described in this section. Investors should consult with their broker or financial institution to find out about procedures and requirements for securities held in book-entry form through DTC.

United States Federal Income Tax Consequences

This section summarizes the material federal income tax consequences that generally will apply to the purchase, ownership and disposition of Shares by a “U.S. Investor” (as defined below) and certain federal tax consequences that may apply to the purchase, ownership and disposition of Shares by a “non-U.S. Investor” (as defined below). The following discussion represents, insofar as it describes conclusions regarding federal tax law and subject to the limitations and qualifications described therein, the opinion of K&L Gates LLP, special federal income tax counsel to the Sponsor. The discussion is based on the Internal Revenue Code of 1986, as amended (the “Code”), final and temporary Treasury regulations promulgated thereunder and judicial and administrative interpretations of the Code, all as in effect on the date of this Prospectus; no assurance can be given that future legislation, regulations, court decisions and/or administrative pronouncements will not significantly change applicable law and materially affect the conclusions expressed herein, and any such change, even though made after an investor has invested in the Trust, could be applied retroactively. This discussion does not purport to be complete or to deal with all aspects of federal income taxation that may be relevant to an investor in light of its particular circumstances or to an investor mentioned in the second sentence of the next paragraph.

The tax treatment of investors may vary depending on their own particular circumstances. Certain investors — including banks, thrift institutions and certain other financial institutions, insurance companies, tax-exempt organizations, brokers and dealers in securities or currencies, certain securities traders, persons holding Shares as a position in a “hedging,” “straddle,” “conversion” or “constructive sale” transaction (as those terms are defined in the authorities mentioned above), qualified pension and profit-sharing plans, individual retirement accounts (“IRAs”), certain other tax-deferred accounts, U.S. expatriates, persons whose “functional currency” is not the U.S. dollar, persons subject to the federal alternative minimum tax, foreign investors (except as specifically provided under “Income Taxation of Non-U.S. Investors” and “Estate and Gift Tax Considerations for Non-U.S. Investors” below) and other investors with special circumstances — may be subject to special rules not discussed below. In addition, the following discussion applies only to investors who will hold Shares as “capital assets” (as defined in section 1221 of the Code).

The discussion below does not address the effect of any state, local or foreign tax law on an investor. Purchasers of Shares are urged to consult their own tax advisers with respect to all federal, state, local and foreign tax law considerations potentially applicable to their investment in Shares.

For purposes of this discussion, a “U.S. Investor” is an investor who or that is:

|

·

|

An individual who is treated as a citizen or resident of the United States for federal tax purposes;

|

|

·

|

A corporation or partnership (or other entity treated as such for those purposes) that is created or organized in the United States or under the laws of the United States or any state thereof or the District of Columbia;

|

|

·

|

An estate other than an estate the income of which, from non-U.S. sources that is not effectively connected with the conduct of a trade or business within the United States, is not includible in gross income;

|

|

·

|

A trust if a court within the United States is able to exercise primary supervision over the administration of the trust and one or more persons described in any of the three preceding clauses have the authority to control all substantial decisions of the trust; or

|

|

·

|

An eligible trust that has made a valid election under applicable Treasury regulations to continue to be treated as a domestic trust.

|

17

An investor that is not a U.S. Investor as so defined is referred to below as a “non-U.S. Investor.” For federal tax purposes, the treatment of any beneficial owner of an interest in a partnership (including any entity classified as such for those purposes) will generally depend on the partner’s status and the partnership’s activities. Partnerships and partners should consult their tax advisers about the federal income tax consequences of purchasing, owning and disposing of Shares.

Taxation of the Trust