Attached files

| file | filename |

|---|---|

| EX-32.2 - DIEGO PELLICER WORLDWIDE, INC | ex32-2.htm |

| EX-32.1 - DIEGO PELLICER WORLDWIDE, INC | ex32-1.htm |

| EX-10.3 - DIEGO PELLICER WORLDWIDE, INC | ex10-3.htm |

| EX-31.2 - DIEGO PELLICER WORLDWIDE, INC | ex31-2.htm |

| EX-31.1 - DIEGO PELLICER WORLDWIDE, INC | ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| [X] | ANNUAL REPORT UNDER TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

or

| [ ] | TRANSITIONAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transitional period from _____________ to ______________

Commission file number 333-189731

| DIEGO PELLICER WORLDWIDE, INC. |

| (Exact name of registrant as specified in its charter) |

| Delaware | 33-1223037 | |

| (State

or other jurisdiction of incorporation or organization) |

(I.R.S.

Employer Identification No.) |

3435 Ocean Park Blvd., #107-610, Santa Monica, CA 90405

(Address of principal executive offices) including zip code)

Registrant’s telephone number, including area code: (516) 900-3799

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class registered: | Name of each exchange on which registered: | |

| None | None |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act: Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 day. Yes [ ] No [X]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 if the Exchange Act.

| Large Accelerated filer | [ ] | Accelerated filer | [ ] | ||

| Non-accelerated filer | [ ] | Smaller reporting company | [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

There was no active public trading market as of the last business day of the Company’s second fiscal quarter, so there was no aggregate market value of common stock held by non-affiliates.

As of April 18, 2016, the registrant had 41,572,082 shares issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

| 2 |

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K (the “Annual Report”) contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements discuss matters that are not historical facts. Because they discuss future events or conditions, forward-looking statements may include words such as “anticipate,” “believe,” “estimate,” “intend,” “could,” “should,” “would,” “may,” “seek,” “plan,” “might,” “will,” “expect,” “anticipate,” “predict,” “project,” “forecast,” “potential,” “continue” negatives thereof or similar expressions. Forward-looking statements speak only as of the date they are made, are based on various underlying assumptions and current expectations about the future and are not guarantees. Such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, level of activity, performance or achievement to be materially different from the results of operations or plans expressed or implied by such forward-looking statements.

We cannot predict all of the risks and uncertainties. Accordingly, such information should not be regarded as representations that the results or conditions described in such statements or that our objectives and plans will be achieved and we do not assume any responsibility for the accuracy or completeness of any of these forward-looking statements. These forward-looking statements are found at various places throughout this Annual Report on Form 10-K and include information concerning possible or assumed future results of our operations, including statements about potential acquisition or merger targets; business strategies; future cash flows; financing plans; plans and objectives of management; any other statements regarding future acquisitions, future cash needs, future operations, business plans and future financial results, and any other statements that are not historical facts.

These forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors. Many of those factors are outside of our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of the Annual Report on Form 10-K. All subsequent written and oral forward-looking statements concerning other matters addressed in this Annual Report on Form 10-K and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Annual Report on Form 10-K.

Unless otherwise provided in this Annual Report, references to the “Company,” “Diego,” “we,” “us” and “our” refer to Diego Pellicer Worldwide, Inc.

| 3 |

Business Overview

Diego is a real estate and a consumer retail development company that is focused on developing “Diego Pellicer” as the world’s first “premium” marijuana brand by adhering to the highest quality and standards for its facilities along with both cannabis and non-cannabis products. The Company’s initial focus is to acquire and develop legally compliant real estate locations for the purposes of leasing them to state licensed companies in the cannabis industry. Diego does not grow or sell marijuana or marijuana infused products in the early stages of this plan.

Diego’s initial revenues derive from leasing real estate and selling non-cannabis related products; however, when it is federally legal to do so, Diego will be properly positioned to take advantage of pre-negotiated acquisition contracts with selected Diego tenants in marijuana retail and production facilities throughout the country. Diego’s business model will allow it to become a nationally branded marijuana retailer and producer, instantaneously, with the change of federal law. The Company will not implement this business model until it becomes legal under federal law to sell and produce marijuana.

To operate within the constraints set forth by the US government, the purpose of this business plan is to describe Diego; however, to better describe the future growth plan for the Company, we will also describe the grow and retail operations of other entities with which Diego has pre-negotiated acquisition contracts or plans to have pre-negotiated acquisition contracts in the future. At this time, we only have one pre-negotiated acquisition contract in place with Diego Pellicer, Inc. a Washington Corporation. These external operations are presented as DP Grow and DP Retail, and the results of these operations as presented will not directly benefit Diego until after Federal legalization.

Merger and Share Exchange Agreement

On March 13, 2015 (the “Closing Date”), Diego Pellicer Worldwide, Inc. (f/k/a Type 1 Media, Inc.) (the “Company” or “PubCo”) closed on a merger and share exchange agreement (the “Merger Agreement”) by and among (i) the Company, and (ii) Diego Pellicer World-wide 1, Inc., a Delaware corporation, (“Diego”), and (iii) Jonathan White, the majority shareholder of the Company (the “Majority Shareholder”). Pursuant to the terms of the Merger Agreement, Diego shall be merged with and into the Company, with the Company to continue as the surviving corporation (the “Surviving Corporation”) in the Merger, and the Company succeeding to and assuming all the rights, assets, liabilities, debts, and obligations of Diego (the “Merger”).

In connection with the closing of the Merger, on the Closing Date, Jonathan White and Thomas Baxter submitted to the Company a resignation letter pursuant to which they resigned from their positions as officers and members of the Board of Directors of the Company. Messrs. White and Baxter’s resignations were not a result of any disagreements relating to the Company’s operations, policies or practices. On the Closing Date, the board of directors of the Company (the “Board”) and the majority stockholders of the Company (the “Shareholders”) accepted the resignations of Messrs. White and Baxter and, contemporaneously appointed: (i) Philip Gay to serve as the Chief Executive Officer and member of the Board of Directors, (ii) Ron Throgmartin to act as Chief Operating Officer, (iii) Nick Roberts to act as Chief Financial Officer; and (iv) Alan Valdes, Douglas Anderson, and Stephen Norris to serve as members of the Board of Directors.

Subsequent to the Merger and Share Exchange Agreement, on May 22, 2015, Philip Gay resigned as the Chief Executive Officer and as a member of the board of directors, and Nick Roberts resigned as Chief Financial Officer. Mr. Gay and Mr. Roberts resignations were not the result of any disagreement with the Company on any matter relating to its operation, policies (including accounting or financial policies), or practices. The board of directors of the Company appointed Ron Throgmartin, the Company’s Chief Operating Officer as the Chief Executive Officer and David R. Wells as the Company’s Interim Chief Financial Officer.

On January 29, 2016, the Board of Directors accepted the resignation of David R. Wells as Chief Financial Officer of the Company. On January 29, 2016, the Board appointed Christopher Strachan, as the Company’s new Chief Financial Officer.

Our Corporate History and Background

Diego Pellicer Inc. was formed in the state of Washington of December 5, 2012, with the intent to produce and sell cannabis in the state of Washington. The Company determined that in order to be successful and avoid any potential violation of federal law, it would form a new corporation that would not produce or sell cannabis directly. Therefore, Diego Pellicer Worldwide, Inc. was formed as a Delaware corporation, on August 26, 2013. The Company was developed to position itself in such a way that if the cannabis industry were to federally legalize, then it would be in an advantageous position to quickly become one of the first luxury integrated brands in the industry. Currently, the Company’s focus is to acquire and develop legally compliant real estate locations for the purposes of leasing them to state licensed companies in the cannabis industry. Diego does not grow or sell marijuana or marijuana infused products at this time.

| 4 |

Mission

At this time, Diego Pellicer is a development stage company and is only in the early stages of implementing its business plan. In states where recreational and/or medical marijuana sales and cultivation is legal under State law, the Company plans to lease property to tenants who will grow and/or sell the highest quality of marijuana. As a tenant of Diego, these operators will have access to Diego’s world class management team with expertise in real estate, retail management, agriculture and USDA experts, legal, marketing and branding, product development and creative teams.

When the US and countries around the world legalize commerce of marijuana on a national and international platform, Diego hopes to be in a position to dominate the marijuana marketplace. Diego will accomplish this by positioning the Company, through its business model, to be the first fully integrated marijuana retail operation and premium brand, known for its beautifully designed user friendly retail stores offering the finest quality products at competitive prices, when the US and other countries legalize the sale of marijuana.

Philosophy

We believe that legalizing marijuana, regulating it and taxing it, will cause less harm and do more good than the prohibition environment. We believe marijuana should be elevated to its proper place among other legal recreational intoxicants such as fine wines, liquors, beers, cigars, etc. There is an overwhelming amount of scientific evidence that supports our philosophy, as well as a growing number of supporters ranging from high-ranking US and foreign politicians to prominent figures in the entertainment industry. In addition, we believe that legalization will help unlock the phenomenal power of cannabis as a medicinal treatment for numerous ailments from headaches to cancer.

Brand History

Diego Pellicer was a Spanish colonial vice governor of Cebu, a major island in the Philippine archipelago. He grew to become the largest grower of hemp in the world and is our name sake. He serves as an inspiration to our executive team, as well as distinctive brand befitting the quality of Diego Pellicer Worldwide.

Vision

Our vision is to continue to develop Diego Pellicer as a premium brand that is valued and positioned to appeal to a broad customer base.

In addition, Diego believes that in the very near future, the US and other countries will embrace the will of the people, and legalize the responsible adult use of marijuana. Legalizing national and international commerce of marijuana, will allow Diego to take its brand and unmatched quality standards to markets all around the globe.

Value Proposition

The initial value proposition of Diego consists of a standardized approach to the build-outs of real estate holdings, customized for premium marijuana grow and retail operations. The build-out model is optimized to maximize resources while minimizing costs and overhead. With each build-out, Diego pre-negotiates with select tenants, acquisition contracts with licensed DP Grow and DP Retail tenants, which, upon changes to federal law, introduces our second value proposition—ownership of operations from seed to sale in an industry that is projected to exceed $8 billion by 2018 and we hope will soon rival that of traditional markets such as tobacco and alcohol.

Market Size

The US state-sanctioned medical and recreational marijuana market generated a total revenue of $5.4 billion in 2015, boosted by an incredible growth in the recreational sector of sales, from $351M to $998M, an estimated increase of 184% over 2014. By comparison, the marijuana market is less than 3% of the US tobacco market, a $144 billion market that has no medicinal value, and less than 3% of the alcohol market, which valued at $113.5 billion in 2014 (Marijuana Business Daily 2016; 2016 Statistic Brain Research Institute). As states legalize marijuana, and international markets develop, the emerging legalized marijuana industry will begin to rival that of tobacco and alcohol and could see $45B in revenues by 2020.

Target Geographies

Diego has entered a rapid growth and expansion stage in its evolution toward becoming an internationally recognized brand. The target geographies for Diego are all US states in which recreational or medicinal marijuana is legalized. This is a phased implementation that carefully pre-stages funding and materials to be first to market, as each state rules on legalization. In certain scenarios, Diego may choose to allow weak competitors to fail, making available prime real estate that otherwise would be inaccessible.

Target Consumers

There are an estimated 1.5 million medical marijuana patients in the US and more than 4,500 retailers. California and Washington have the largest number of marijuana patients at more than 775,000 for each state, followed by Michigan at 344,000 and Colorado with 107,534. (Marijuana Business Daily 2016).

The demographics for consumers that have tried marijuana at least once, range between ages 18 to 49, with the greatest numbers between the ages 26 and 34. These consumers are predominantly male and college educated.

| 5 |

Alaska has the fastest growing population of potential consumers, followed by Washington DC, Colorado, New Mexico and Hawaii, with Washington just a few points below. In 2012, Montana, Colorado, California, and Washington had the greatest increase in disposable income, thus increasing the breadth of target consumers.

Material Agreements

On April 19, 2014, the Company entered into a commercial agreement and merger agreement with Diego Pellicer, Inc., a Washington corporation (“Diego Washington”). Diego Washington agreed to making a capital contribution from its current investors of not less than $350,000 in the Company and that the Company agreed to offer to the holders of Series A Preferred Stock of Diego Washington and to current holders of convertible promissory notes convertible for shares of Diego Washington, the right to exchange that same number of shares to shares the Company.

On September 19, 2013, the Company entered into a Lease Agreement with M-P Properties whereby the Company agreed to lease the property located at 2215 4th Avenue, Seattle, Washington, for a term of five years with an option to renew. The Company agreed to pay $78,000 per year.

On March 1, 2014, the Company entered into a Sublease Agreement with Diego Pellicer, Inc., a Washington entity whereby the Company agreed to sublease the property located at 2215 4th Avenue, Seattle, Washington, for a term of four years.

On June 12, 2014, the Company entered into a Lease Agreement with Shamira, LLC whereby the Company agreed to lease the property located at 4242 Elizabeth Street, Denver, Colorado, for five years with an option to renew. The Company agreed to pay $360,000 per year for the first year of the agreement, with an increase of 3% for year subsequent year.

On August 14, 2014, the Company entered into a Commercial Sublease Agreement with DPCO, Inc., a Colorado corporation, whereby the Company subleased the property located at 4242 Elizabeth Street, Denver, Colorado for a term of five years.

On July 14, 2014, the Company entered into a Lease Agreement with 2949 W. Alameda Ave LLC whereby the Company agreed to lease the property located at 2949 W. Alameda Avenue, Denver, Colorado, for five years with an option to renew. The Company agreed to pay $20,000 per month in rent.

On August 14, 2014, the Company entered into a Sublease Agreement with DPCO, Inc., a Colorado corporation, whereby the Company agreed to sublease the property located at 2949 W. Alameda Avenue, Denver Colorado for a year of five years.

On August 13, 2014, the Company entered into a Sublease Agreement with M and S LLC whereby the Company agreed to lease the property located at 755 South Jason Street, Denver, Colorado, for four years. The Company agreed to pay $25,000 per month in rent.

On August 14, 2014, the Company entered into a Sublease Agreement with DPCO, Inc. a Colorado corporation, whereby the Company subleased the property located at 755 South Jason Street, Denver, Colorado for a term of four years.

Our Industry

We are in a burgeoning industry, centered on the production and sales of medical and recreational marijuana. Diego Pellicer is focused on providing legally compliant retail and production facilities to State licensed operators. In addition, Diego Pellicer offers branding opportunities to state licensed producers and retailers that meet our stringent qualifications.

In addition to providing fully branded and built real estate to qualified tenants, Diego Pellicer offers non-cannabis infused products, apparel, and other tangible products at a wholesale rate. To become a qualified tenant, Diego requires its tenants to strictly adhere to testing and labeling requirements along with all state laws and federal guidelines to assure quality and consistency of marijuana products, ensuring safe sale and consumption. Table 7 provides a list of our current property portfolio.

Our Business Strategy

Market Definition and Roles

The marijuana market consists of medical and recreational regulators, producers, testers, processors, wholesalers, retailers, collectives, consumers and real estate holders. Since data pertaining to specific aspects of marijuana sales, such as processor revenues, is virtually non-existent for the marijuana market, the market is valued according to retail sales data provided by state and federal governing bodies. Below is a brief summary of each role:

| ● | Regulators: State and federal lawmakers. | |

| ● | Producer or Grower: Cash crop farmers and grow shops. | |

| ● | Tester: Testers of marijuana for quality and other required measures. | |

| ● | Processor or Infuser: Processers of marijuana into a commercial product (flower, concentrates, and edibles). | |

| ● | Wholesaler: Buyers from producers or processors that sell in bulk to other processers and retailers. | |

| ● | Retailer: For profit (proprietorship, partnerships, or for-profit business) sellers to consumers and patients. | |

| ● | Collective or Cooperative: Non-profit organizations selling mostly to patients. | |

| ● | Recreational Consumers or Patients (local and marijuana tourist): Consumers of marijuana products, recreationally or by medical prescription. | |

| ● | Real Estate Holdings: Companies that specialize in building-out and managing real estate for all aspects of operations (e.g., grow, retail, processing and packaging, etc.) |

| 6 |

Market Strategy

Our short-term strategy is to profit only from the lease payments of our real estate holdings and from the sale of branded, non-cannabis products. Diego will have pre-negotiated acquisition contracts with selected tenants that trigger only when it is legal, or not illegal, to conduct interstate commerce in marijuana. We intend to enter into branding agreements with our tenants going forward that will require our tenants to have certain quality controls and procedures to ensure our they comply with the law, safety and quality. In addition, part of the vetting process in finding the proper tenant is selecting a tenant that shares the Company’s values and strictly complies with state laws, safety and testing requirements and provides consistent, high-quality products. If the tenants do not comply, they will not be allowed to use the brand. At this time, we have one pre-negotiated acquisition contract in place with Diego Pellicer Worldwide Washington and are in the process of negotiating additional pre-negotiated acquisition contracts with other tenants.

The three pillars of our strategy are:

| 1. | Acquire compliant properties legally, and build-out high-quality marijuana grow and retail locations, and lease these locations to tenants that are stand-alone, independent corporations with the ability to meet Diego Pellicer quality and branding standards | |

| 2. | While initially Diego does not have an ownership stake in grow or retail companies, our strategy is to execute pre-negotiated acquisition contracts with its select tenants whereby Diego has the exclusive option to acquire these independent operator lessees. These options shall only be executed when and if the company deems it sufficiently legal to do so and there is no guarantee these options will be exercised. | |

| 3. | Develop and sell quality non-cannabis ancillary products including apparel, luxury merchandise products, non-cannabis chocolates and pastries, just to name a few. These products will be sold in DP retail outlets where allowed or in proximate independent stores. |

A very important aspect of our marketing plan is to build Diego Pellicer as a luxury brand. This not only enables us to establish further and exploit Diego Pellicer as a premium brand, but also to generate significant revenues off of non-cannabis products.

Market Size

The US marijuana market has experienced rapid, chaotic growth in recent years, which is set to continue beyond the forecast target of 2019 due primarily to regulatory misalignment between state and federal governments.

The marijuana secondary and tertiary markets have not yet been analyzed as sources of revenue; however, emerging secondary markets such as marijuana tourism could become a significant source of income for recreational legal states. As a point of comparison, Holland earns $48.55 billion per year in tourist dollars. Of the 10 million tourists, 5.5 million or 55% of tourists visit bars and cafes, generating a total of nearly $27 billion and 220,000 jobs (NBTC, 2009). This equals roughly 30% of all business revenue generated in Washington state in 2012 (Washington State Department of Revenue, 2014).

The US state-sanctioned medical and recreational marijuana market generated a total revenue of $5.4 billion in 2015, boosted by an incredible growth in the recreational sector of sales, from $351M to $998M.=, an estimated increase of 184% over 2014. By comparison, the marijuana market is less than 3% of the US tobacco market, a $144 billion market that has no medicinal value, and less than 3% of the alcohol market, which valued at $113.5 billion in 2014 (2016 Statistic Brain Research Institute). As states legalize marijuana, and international markets develop, the emerging legalized marijuana industry will begin to rival that of tobacco and alcohol and could see $45B in revenues by 2020.

Marijuana has become a major issue in state elections as voters are seeking politicians that support legalization (Gutwillig, 2014). As states legalize marijuana, and international markets develop, the emerging legalized marijuana industry will begin to rival that of tobacco and alcohol. Table 1 summarizes 2016 estimated revenues generated by marijuana retail sales based on a number of sources, including state marijuana program reports.

| 7 |

Table 1: Projected US Marijuana Retail Sales, 2016

| State | 2016 | |||

| Alaska | $ | 40,000,000 | ||

| Arizona | $ | 300,000,000 | ||

| California | $ | 1,000,000,000 | ||

| Colorado | $ | 1,100,000,000 | ||

| Connecticut | $ | 18,000,000 | ||

| DC | $ | 8,000,000 | ||

| Delaware | $ | 2,000,000 | ||

| Hawaii | $ | 22,000,000 | ||

| Illinois | $ | 25,000,000 | ||

| Maine | $ | 35,000,000 | ||

| Maryland | $ | 35,000,000 | ||

| Massachusetts | $ | 32,000,000 | ||

| Michigan | $ | 170,000,000 | ||

| Minnesota | $ | 8,000,000 | ||

| Montana | $ | 4,000,000 | ||

| Nevada | $ | 32,000,000 | ||

| New Hampshire | $ | 4,000,000 | ||

| New Jersey | $ | 16,000,000 | ||

| New Mexico | $ | 47,000,000 | ||

| New York | $ | 13,000,000 | ||

| Oregon | $ | 340,000,000 | ||

| Rhode Island | $ | 24,000,009 | ||

| Vermont | $ | 5,000,000 | ||

| Washington | $ | 775,000,000 | ||

Source: (Marijuana Business Daily 2016; Illinois Cannabis Patients Association, 2010; Leal, 2014; Marijuana Business Daily, 2013)

Figure 2 illustrates the market structure by state and estimated retail sales revenues for 2016. Of the 24 states in which marijuana is legal, Colorado is expected to generated the most revenue at $51,100M, followed by California at $1,000M and Washington at $775M. Most States operating in 2014 experienced double and triple digit growth into 2015, with the exception to California, which has leveled out.

Figure 1 Estimated US Marijuana Retail Sales, 2016

Various industry reports estimate that marijuana sales could generate as much as $8.7 billion in state and federal taxes; however, data to support that estimate is not yet available. (Marijuana Business Daily 2016)

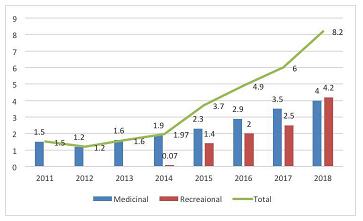

Market Growth

The performance of the market is forecast to accelerate, with an anticipated growth of an average of 27% over the next four years to an expected market value greater than $45 billion by the end of 2020. Table 2 and Figure 3 provide estimated market growth from 2011 to 2018. This growth assumes that no additional states legalize. If additional states legalize, growth estimates will likely increase significantly.

| 8 |

Table 2: US Industry Estimates, 2013 to 2018

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | |||||||||||||||||||||||||

| Medicinal | 1.5 | 1.2 | 1.6 | 1.9 | 2.3 | 2.9 | 3.5 | 4 | ||||||||||||||||||||||||

| Recreational | 0.07 | 1.4 | 2 | 2.5 | 4.2 | |||||||||||||||||||||||||||

| Total | 1.5 | 1.2 | 1.6 | 1.97 | 3.7 | 4.9 | 6 | 8.2 | ||||||||||||||||||||||||

Billions of Dollars, US

Source: (Brown and Resnick, 2013; California Department of Public Health, 2014b; CannaBusiness Media, 2014; Colorado Office of Research and Analysis, 2013a, 2013b, 2013d, 2013e, 2014; Fairchild, 2013a, 2013b; Galvin, 2013; Illinois Cannabis Patients Association, 2010; Leal, 2014; Marijuana Business Daily, 2013; Office of Financial Management, 2012)

Figure 3: US Industry Estimates, 2011 to 2018

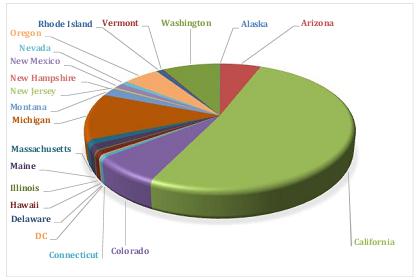

Market Distribution

Market distribution must be measured indirectly with registered medical consumers and dispensaries. As expected, California has the largest number of marijuana patients at more than 775,000, followed by Michigan at 179,000 and Colorado with 107,000. Washington is at 125,000 registered patients as listed in Table 3 and illustrated in Figure 4. There are currently an estimated 1.5 million medical marijuana patients in the US.

Table 3: Registered Medical Marijuana Patients 2015

| State | Registered Patients | |||

| Alaska | 1,127 | |||

| Arizona | 87,733 | |||

| California | 775,000 | |||

| Colorado | 107,534 | |||

| Connecticut | 8,201 | |||

| DC | 3,577 | |||

| Delaware | 776 | |||

| Hawaii | 13,150 | |||

| Illinois | 4,400 | |||

| Maine | 20,000 | |||

| Massachusetts | 19,000 | |||

| Michigan | 344,000 | |||

| Montana | 30,000 | |||

| New Hampshire | 1,600 | |||

| New Jersey | 6,354 | |||

| New Mexico | 19,629 | |||

| Nevada | 13,561 | |||

| Oregon | 77,620 | |||

| Rhode Island | 12,815 | |||

| Vermont | 2,477 | |||

| Washington | 125,000 | |||

| Estimated Total Patients | 1,508,594 | |||

Source: (Marijuana Business Daily 2016; Illinois Cannabis Patients Association, 2010; Leal, 2014; Marijuana Business Daily, 2013)

| 9 |

Figure 4: Registered Medical Marijuana Patients

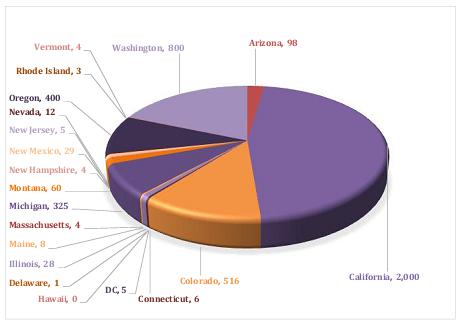

Another indirect measure of market distribution is the number of medical marijuana dispensaries. Table 4 and Figure 5 provide the distribution of dispensaries across the US. The number of patients and dispensaries are mostly aligned; however, certain states such as Michigan have much higher ratio of patients to dispensaries than other states. This could be the result of inaccurate data.

Table 4: Registered Medical Marijuana Dispensaries

| State | Registered Dispensaries | |||

| Alaska | 0 | |||

| Arizona | 98 | |||

| California | 2,000 | |||

| Colorado | 516 | |||

| Connecticut | 6 | |||

| DC | 5 | |||

| Delaware | 1 | |||

| Hawaii | 0 | |||

| Illinois | 28 | |||

| Maine | 8 | |||

| Massachusetts | 4 | |||

| Michigan | 325 | |||

| Montana | 60 | |||

| New Hampshire | 4 | |||

| New Jersey | 5 | |||

| New Mexico | 29 | |||

| Nevada | 12 | |||

| Oregon | 400 | |||

| Rhode Island | 3 | |||

| Vermont | 4 | |||

| Washington | 800 | |||

| Estimated Total Dispensaries | 4,308 | |||

Source: (Marijuana Business Daily 2016; Illinois Cannabis Patients Association, 2010; Leal, 2014; Marijuana Business Daily, 2013)

| 10 |

Figure 5: Registered Medical Marijuana Dispensaries

Competitive Analysis and Benchmarking

Diego was one of the first to the market with a real estate holding and branding business model; however, other companies have since adopted similar strategies. Key differentiators between Diego and its competitors are superior branding, optimized build-out and turnkey grow and retail development, and, most importantly, pre-negotiated acquisition contracts. As with other marijuana-related financial data, collecting benchmark data on Diego competitors was especially challenging in that many of these companies fail to report or are unable to report the fundamentals of financial information. Table 5 provides a financial benchmark of Diego’s nearest competitors.

Table 5: 2013 Real Estate Holding and Branding Financial Benchmark-$000

| Market Cap | Rev | Cost of Rev | Gross

Margin % | EBITDA

Margin % | Net Profit | |||||||||||||||||||

| Medbox, Inc. (MDBX) | $ | 258,700 | $ | 5,203 | $ | 2,657 | 51.1 | % | -14.8 | % | $ | (660 | ) | |||||||||||

| Advanced Cannabis Solutions, Inc. (CANN) Grey Market (3 Qtrs) | $ | 59,600 | $ | 129 | $ | 23 | 82.2 | % | (542 | %) | $ | (1,277 | ) | |||||||||||

| Mountain High Acquisitions Corp. (MYHI) OTCQB | $ | 14,300 | - | - | - | $ | (1,336 | ) | ||||||||||||||||

| Agritek Holdings, Inc. (AGTK) | $ | 8,410 | $ | 79 | $ | 86 | 7.6 | % | (1189 | %) | $ | (1,453 | ) | |||||||||||

| Home Treasure Finders, Inc. (HMTF)(MJ real estate lessor) | $ | 4,160 | $ | 203 | $ | 0 | INF | (44 | %) | $ | (92 | ) | ||||||||||||

Source: Finance.yahoo.com and CNBC.com

Tourism Effect

The secondary and tertiary effects of the marijuana market have received little attention by market analyst; however, markets such as marijuana tourism could become a significant source of revenue for recreationally legal states. For example, The Netherlands earns $48.55 billion per year in tourist dollars. Of the 10M tourists, 5.5 million or 55% visit marijuana bars and cafes, generating a total of nearly $27 billion and 220,000 jobs. Likewise, Colorado reported note that marijuana tourism is responsible for 90% of all retail sales in resort towns (Weissmann, 2014).

Peak Sales and Product Segmentation

Peak marijuana sales occur during two calendar periods: December/January and July/August. Smokable Marijuana sales exceed other product categories representing 87% of the market, which is followed by concentrates at 7% and edibles at 4% while drinks, topicals, accessories and clones generate the least amount of revenue at less than 1% each. The top marijuana product according to an analysis of a market leading dispensary is Bruce Banner followed by 303 Kush.

| 11 |

Legalization by State

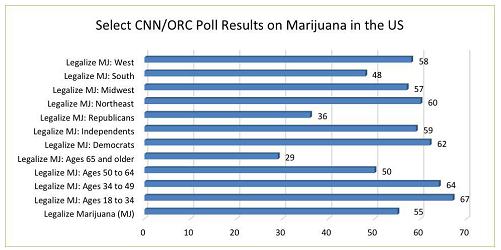

Support for medical and recreational marijuana use has increased significantly over the past 20 years. According to a recent CNN poll, greater than 50% of the US population supports marijuana legalization. Figure 6 illustrates a select set of CNN poll results.

Figure 6: CNN/ORC Poll Results on Marijuana Use in the US

Two states, Colorado and Washington, have passed legislation for recreational marijuana. As the popularity of recreational marijuana becomes more accepted by Americans, it is the Company’s belief that several of the States in which medical marijuana is currently legal will likely follow suit and legalize recreational marijuana. States are learning from one another, refining legislation and establishing realistic tax strategies. The Obama administration has pledged to end Federal raids on state-sanctioned dispensaries (Furlow, 2012). Similar movements are occurring in other democratic countries such as Australia in which several states have decriminalized possession (Thies, 2012). Table 6 lists recreational and medicinal marijuana legalization status by state.

Table 6: State Recreational Marijuana Laws

| State | Status/Year | Type of Legalization | ||||

| Alaska | Passed (2014) | Medical and Recreational | ||||

| Arizona | Passed (2010) | Medical | ||||

| California | Passed (2015) | Medical | ||||

| Colorado | Passed (2012) | Medical and Recreational | ||||

| Connecticut | Decriminalized | Medical | ||||

| Delaware | Decriminalized | Medical | ||||

| Florida | Pending | Medical | ||||

| Hawaii | Passed (2000) | Medical | ||||

| Illinois | Passed (2013) | Medical | ||||

| Maine (Portland only) | Decriminalized (2013) | Medical | ||||

| Maryland | Decriminalized (2014) | Medical | ||||

| Massachusetts | Decriminalized (2012) | Medical | ||||

| Michigan | Passed | Medical | ||||

| Minnesota | Passed (2014) | Medical | ||||

| Mississippi | Pending | Pending | ||||

| Montana | Decriminalized | Medical | ||||

| Nebraska | Pending | Pending | ||||

| Nevada | Passed (2000) | Medical | ||||

| New Hampshire | Passed (2013) | Medical | ||||

| New Jersey | Passed (2010) | Medical | ||||

| New Mexico | Passed (2007) | Medical | ||||

| New York | Passed (2014) | Medical | ||||

| North Carolina | Pending | Medical | ||||

| Ohio | Decriminalized | Medical | ||||

| Oregon | Passed (2015) | Medical and Recreational | ||||

| Pennsylvania | Pending | Medical | ||||

| Rhode Island | Decriminalized | Medical | ||||

| Vermont | Decriminalized (2013) | Medical | ||||

| Washington | Passed (2012) | Medical and Recreational | ||||

| Washington DC | Decriminalized | Medical |

Source: (Marijuana Business Daily 2016; California State Board of Equalization, 2009; Gacek, 2014; ProCon.org, 2014; U.S. Office of National Drug Control Policy, 2014)

| 12 |

Target Geographies

Diego has entered a rapid growth and expansion stage in its evolution toward becoming an internationally recognized brand. The target geographies for Diego are all US states in which recreational or medicinal marijuana is legalized. This is a phased implementation that carefully pre-stages funding and materials to be first to market, as each state rules on legalization. In certain scenarios, Diego may choose to allow weak competitors to fail, making available prime real estate that otherwise would be inaccessible.

Target Consumers

There are an estimated 1.5M medical marijuana patients in the US and over 5,000 retailers. California has the largest number of marijuana patients at more than 775,000, followed by Colorado with 625,000 and Michigan at 179,000. Washington is a close 4th at 125,000 registered patients.

The demographics for consumers that have tried marijuana at least once, range between ages 18 to 49, with the greatest numbers between the ages 26 and 34. These consumers are predominantly male, and college educated.

Alaska has the fastest growing population of potential consumers, followed by Washington DC, Colorado, New Mexico and Hawaii, with Washington just a few points below. In 2012, Montana, Colorado, California, and Washington had the greatest increase in disposable income, thus increasing the breadth of target consumers.

Future Markets

Studies on marijuana use in The Netherlands have demonstrated that the availability of marijuana in café’s has had very little effect on increasing or decreasing marijuana use (MacCoun, 2011). As such, the next progression in the US market, following Federal legalization, is the establishment of café’s or other types of service centers for marijuana consumption. The number of café’s in The Netherlands has ranged between 700 and 800 over the past 15 years, and currently operates about 700 or 1 per 29,000 citizens, employing 4,000 workers and generating $832.2M annually (Monshouwer, Van Laar, and Vollebergh, 2011). Extrapolating this to the US market would indicate approximately 10,000 café’s and service centers where actual consumption of cannabis can take place.

Primary Service

Our primary service is fully branded and built real estate to qualified tenants. Our branding includes non-cannabis infused products, apparel, and other tangible products at a wholesale rate. To become a qualified tenant, Diego requires its tenants to strictly adhere to testing and labeling requirements along with all state laws and federal guidelines to assure quality and consistency of marijuana products, ensuring safe sale and consumption. Table 7 provides a list of our current property portfolio.

Table 7: Property Portfolio

| Purpose | Size | City | State | |||||||||

| Retail (recreational and medical) | 3,300 sq.ft. | Denver | CO | |||||||||

| Grow Warehouse | 18,600 sq.ft. | Denver | CO | |||||||||

| Grow Warehouse | 14,800 sq.ft. | Denver | CO | |||||||||

| Flagship recreational MJ store w/café and apparel | 4,500 sq.ft. | Seattle | WA |

Diego Pellicer creates a user friendly customer experience regardless of venue or form of media making it easy and safe for them to purchase. A major aspect of our marketing plan is to inform and educate consumers in a way that allows them to rely on DP as a trusted and valued brand. DP information and products will be available in all forms of media with a variety of different forms of content including videos, social media, online newsletters and blogs and TV.

| ● | Consumers will find Diego on websites and via online syndication at web portals, mobile and video destinations (Yahoo!, MSN, Google/YouTube, Hulu, Verizon, etc.) as a dedicated selling platform that will serve Diego created video as information and entertainment. The Company will not develop a website that sells marijuana or marijuana-infused products. | |

| ● | Consumers will find our custom content via a cooperative syndication platform in which product partners leverage each other’s audiences for the distribution of their content and products. | |

| ● | Through events in Diego stores and outlets | |

| ● | Mass audiences could find Diego on network or cable television as the setting for a reality show or documentary series. | |

| ● | Mobile marketing and Mobile apps |

This will give our brand, products and content the flexibility and portability that consumers demand. This digital syndication strategy will be executed through a series of revenue sharing deals with partners through viral seeding strategies and via paid media through specific targeted websites and venues.

| 13 |

Revenue Generation and Growth

Diego generates current revenue and stages future revenue streams through the following processes:

| ● | Acquire via lease or purchase, target properties to be improved for the growing, processing, distribution, and sale of medical and recreational marijuana, extracts and ancillary products. | |

| ● | Sub-leases or leases these properties to state licensed operators. | |

| ● | Capitalizes, where possible, on the build-out and leases near turnkey Retail, Processing and/or Growing facilities. | |

| ● | Creates future merger agreements with those operators deem capable of carrying the Diego brand. | |

| ● | Hold Merger Agreements with Diego and other favored partners that will trigger when marijuana commerce becomes legal (or not illegal) federally. | |

| ● | Own DP Brands and other Intellectual Property (IP) in all places filed. | |

| ● | Charge reasonable Market Net-Rents to the store owners/Operators to recover all build-out and start-up investment plus profit margin over the first lease term (generally five years.) | |

| ● | Sell non-cannabis branded products lines such as apparel and edibles at wholesale to leased stores. | |

| ● | Create an e-commerce platform selling non-cannabis branded merchandise | |

| ● | Continue to build and market the brand utilizing all forms of media including traditional and digital media, social media, e-commerce, and strategic partners. |

U.S. Federal Law

While marijuana is legal under the laws of several U.S. States (with vastly differing restrictions), at the present time, the concept of “medical marijuana” and “retail marijuana” do not exist under U.S. federal law. The United States Federal Controlled Substances Act classifies “marijuana” as a Schedule I drug. Under U.S. federal law, a Schedule I drug or substance has a high potential for abuse, no accepted medical use in the United States, and a lack of safety for the use of the drug under medical supervision.

The United States Supreme Court has ruled in a number of cases that the federal government does not violate the federal constitution by regulating and criminalizing cannabis, even for medical purposes. Therefore, federal law criminalizing the use of marijuana pre-empts state laws that legalizes its use for medicinal purposes.

In a memorandum dated August 29, 2013 addressed to “All United States Attorneys” from James M. Cole, Deputy Attorney General (“Cole Memo”), the U.S. Department of Justice acknowledged that certain U.S. States had enacted laws relating to the use of marijuana and outlined the U.S. federal government’s enforcement priorities with respect to marijuana notwithstanding the fact that certain U.S. States have legalized or decriminalized the use, sale and manufacture of marijuana:

| ● | Preventing the distribution of marijuana to minors; | |

| ● | Preventing revenue from the sale of marijuana from going to criminal enterprises, gangs, and cartels; | |

| ● | Preventing the diversion of marijuana from U.S. states where it is legal under state law in some form to other U.S. states; | |

| ● | Preventing U.S. state-authorized marijuana activity from being used as a cover or pretext for the trafficking of other illegal drugs or other illegal activity; | |

| ● | Preventing violence and the use of firearms in the cultivation and distribution of marijuana; | |

| ● | Preventing drugged driving and the exacerbation of other adverse public health consequences associated with marijuana use; | |

| ● | Preventing the growing of marijuana on public lands and the attendant public safety and environmental dangers posed by marijuana production on public lands; and | |

| ● | Preventing marijuana possession or use on U.S. federal property. |

There is no guarantee that the current presidential administration will not change its stated policy regarding the low-priority enforcement of U.S. federal laws that conflict with state laws. Additionally, any new U.S. federal government administration that follows could change this policy and decide to enforce the U.S. federal laws vigorously. Any such change in the U.S. federal government’s enforcement of current U.S. federal laws could cause adverse financial impact to the Company’s business. See “Risk Factors.”

In February 2014, FinCEN issued guidelines allowing banks to legally provide financial services to Licensed Operators that hold a valid License (“FinCEN Memo”). The rules re-iterated the guidance provided by the Cole Memo, stating that banks can do business with Licensed Operators and “may not” be prosecuted. The guidelines provide that “it is possible [for the banks] to provide financial services” to Licensed Operators and while remaining in compliance with federal anti-money laundering laws. The guidance falls short of the explicit legal authorization that banking industry officials anticipated and the outcome of the banks relying on this guidance in transacting with Licensed Operators is currently unclear. See “Risk Factors.”

| 14 |

Employees

We presently have 5 full-time employees and 0 part-time employees. We consider our relationship with our employees to be excellent. We also had independent consultants under contract to provide financial management services, business development services, and sales management services. In addition to the diverse technical, intellectual property, legal, financial, marketing and business expertise of our professional team, from time to time we rely on advice from outside specialists to fulfill unique technology and other needs.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

Item 1B. Unresolved Staff Comments

None.

Our principal executive office is located at 3435 Ocean Park Blvd., #107-610, Santa Monica, CA 90405, and our telephone number is (516) 900-3799.

From time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. However, litigation is subject to inherent uncertainties and an adverse result in these or other matters may arise from time to time that may harm our business. We are currently not aware of any such legal proceedings or claims that we believe will have a material adverse effect on our business, financial condition or operating results.

Item 4. Mine Safety Disclosures

Not applicable.

| 15 |

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

There is no established public trading market for our Common Stock. As of the date of this Report, there are outstanding options and warrants to purchase 3,425,798 shares of Common Stock of the Registrant.

Record Holders

As of April 19, 2016, there were approximately 143 shareholders of record holding a total of 41,572,082 shares of Common Stock. The holders of the Common Stock are entitled to one vote for each share held of record on all matters submitted to a vote of shareholders. Holders of the Common Stock have no preemptive rights and no right to convert their Common Stock into any other securities. There are no redemption or sinking fund provisions applicable to the Common Stock.

Dividends

The Registrant has not declared any cash dividends since inception and does not anticipate paying any dividends in the foreseeable future. The payment of dividends is within the discretion of the Board of Directors and will depend on the Company’s earnings, capital requirements, financial condition and other relevant factors. There are no restrictions that currently limit the Registrant’s ability to pay dividends on its Common Stock other than those generally imposed by applicable state law.

Unregistered Sale of Equity Securities

In November 2015, the Company issued 1,100,000 shares of common stock to a third party for service rendered and 3,381,251 shares of common stock for cash received in amount of 1,014,374.

| 16 |

Item 6. Selected Financial Data

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

Diego Pellicer Worldwide, Inc.

December 31, 2015 and 2014

Index to the Consolidated Financial Statements

| 17 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors and Stockholders

Diego Pellicer Worldwide, Inc.

| F-1 |

Diego Pellicer Worldwide, Inc.

| December 31, 2015 | December 31, 2014 | |||||||

| ASSETS | ||||||||

| Current Assets: | ||||||||

| Cash and equivalents | $ | 36,001 | $ | 33,101 | ||||

| Accounts receivable | 1,110 | - | ||||||

| Prepaid expenses | - | 8,946 | ||||||

| Inventory | 80,971 | - | ||||||

| Other receivable | 17,817 | - | ||||||

| Total current assets | 439,667 | 42,047 | ||||||

| Property and Equipment, net | 838,754 | 253,990 | ||||||

| Other Assets: | ||||||||

| Investments, at cost, net of impairment of $408,900 and $0 | 116,667 | 525,567 | ||||||

| Security deposits | 173,000 | 173,000 | ||||||

| Deposits - end of lease | 150,000 | 150,000 | ||||||

| Total other assets | 439,667 | 848,567 | ||||||

| Total assets | $ | 1,414,320 | $ | 1,144,604 | ||||

| Liabilities and Stockholder’s Deficiency | ||||||||

| Current liabilities: | ||||||||

| Accounts payable and accrued expense | $ | 585,997 | $ | 298,939 | ||||

| Accrued expenses - related party | 511,454 | 124,333 | ||||||

| Accrued compensation | 6,250 | 1,176,563 | ||||||

| Deferred rent | 120,234 | - | ||||||

| Deferred revenue | 53,000 | 53,000 | ||||||

| Note Payable | 846,628 | - | ||||||

| Convertible debt | 300,000 | - | ||||||

| Derivative Liabilities | 208,795 | - | ||||||

| Total current liabilities | 2,632,358 | 1,652,835 | ||||||

| Deferred Revenue | 370,000 | 424,000 | ||||||

| Total liabilities | 3,002,358 | 2,076,835 | ||||||

| Stockholder’s Deficiency | ||||||||

| Series A and B Preferred Stock, $0.0001 par value, 5,000,000 shares authorized, 0 and 5,036,769 shares issued and outstanding as of December 31, 2015 and 2014, respectively | - | 5 | ||||||

| Common Stock, $0.000001 par value, 95,000,000 shares authorized, 37,805,416 shares were issued and outstanding as of December 31, 2015, and 13,520,000 shares issued and outstanding as of December 31, 2014 | 38 | 14 | ||||||

| Treasury stock at cost, 0 and 58,200 shares as of December 31, 2015 and 2014, respectively | - | (87,300 | ) | |||||

| Additional paid-in capital | 20,111,077 | 4,335,816 | ||||||

| Accumulated deficit | (21,699,153 | ) | (5,180,766 | ) | ||||

| Total stockholder’s deficiency | (1,588,038 | ) | (932,231 | ) | ||||

| Total liabilities and stockholder’s equity | $ | 1,414,320 | $ | 1,144,604 | ||||

See accompanying notes to the consolidated financial statements

| F-2 |

Diego Pellicer Worldwide, Inc.

Consolidated Statements of Comprehensive Loss

| For

The Year Ended | For

The Year Ended | |||||||

| December 31, 2015 | December 31, 2014 | |||||||

| REVENUES | ||||||||

| Rental income | $ | 1,059,631 | $ | 497,638 | ||||

| Licensing revenue | 54,000 | 48,567 | ||||||

| Provision for uncollectible rents | (809,101 | ) | (497,638 | ) | ||||

| Total Revenues | 304,530 | 48,567 | ||||||

| Cost of Good Sold | - | - | ||||||

| COSTS AND EXPENSES (other income) | ||||||||

| General and administrative expenses | 14,268,072 | 3,624,507 | ||||||

| Impairment of investment | 408,900 | - | ||||||

| Rent expense | 1,228,028 | 487,533 | ||||||

| Write-off credit line receivable (net of interest income) | 240,000 | 777,846 | ||||||

Change in fair value of derivative liabilities | (133,809 | ) | ||||||

Interest expense (income), net | 811,726 | (73,198 | ) | |||||

| Total Costs and Expenses | 16,822,917 | 4,816,688 | ||||||

| Loss before provision for taxes | (16,518,387 | ) | (4,768,121 | ) | ||||

| Provision for taxes | - | - | ||||||

| NET LOSS | $ | (16,518,387 | ) | $ | (4,768,121 | ) | ||

| Loss per share - basic and fully diluted | $ | (0.65 | ) | $ | (0.35 | ) | ||

| Weighted average common shares outstanding - basic and fully diluted | 25,485,231 | 13,520,000 | ||||||

See accompanying notes to the consolidated financial statements

| F-3 |

Diego Pellicer Worldwide, Inc.

Consolidated Statement of Stockholders’ Deficit

For the Year Ended December 31, 2015 and 2014

| SHARES | $ | |||||||||||||||||||||||||||||||||||||||||||

| Common | Treasury | Preferred | Common | Treasury | Preferred | Additional | Accumulated | Common Stock | Subscription | |||||||||||||||||||||||||||||||||||

| Shares | Shares | Shares | Shares | Shares | Shares | Paid-in Capital | Deficit | to be issued | Receivable | Total | ||||||||||||||||||||||||||||||||||

| Balance - December 31, 2013 | 13,520,000 | - | 561,676 | 14 | - | 1 | 528,357 | (412,646 | ) | - | (1,352 | ) | 114,374 | |||||||||||||||||||||||||||||||

| Sale of Preferred stock and warrants | - | - | 4,475,093 | - | - | 4 | 3,807,460 | - | - | - | 3,807,464 | |||||||||||||||||||||||||||||||||

| Treasury shares acquired | - | (58,200 | ) | - | - | (87,300 | ) | - | - | - | - | - | (87,300 | ) | ||||||||||||||||||||||||||||||

| Subscription received | - | - | - | - | - | - | - | - | 1,352 | 1,352 | ||||||||||||||||||||||||||||||||||

| Net Loss | - | - | - | - | - | - | - | (4,768,120 | ) | - | - | (4,768,120 | ) | |||||||||||||||||||||||||||||||

| Balance - December 31, 2014 | 13,520,000 | (58,200 | ) | 5,036,769 | 14 | (87,300 | ) | 5 | 4,335,817 | (5,180,766 | ) | - | - | (932,230 | ) | |||||||||||||||||||||||||||||

| Sale of Preferred stock | - | - | 753,332 | - | - | 75 | 1,129,916 | - | - | - | 1,129,991 | |||||||||||||||||||||||||||||||||

| Sale of Common stock | 3,881,251 | - | - | 4 | 1,164,371 | 1,164,375 | ||||||||||||||||||||||||||||||||||||||

| Effect of reverse merger | 7,743,333 | - | 50,996 | 8 | - | - | - | - | - | - | 8 | |||||||||||||||||||||||||||||||||

| Cancellation of Treasury Shares | (58,200 | ) | 58,200 | - | - | 87,300 | - | (87,300 | ) | - | - | - | - | |||||||||||||||||||||||||||||||

| Conversion of Preferred shares to common | 5,841,097 | - | (5,841,097 | ) | 6 | - | (80 | ) | 74 | - | - | - | - | |||||||||||||||||||||||||||||||

| Issuance of common shares for consulting services | 4,699,355 | - | - | 3 | - | - | 9,523,905 | - | - | - | 9,523,908 | |||||||||||||||||||||||||||||||||

| Common stock issued for note payable | 126,000 | - | - | - | - | - | 84,000 | - | - | - | 84,000 | |||||||||||||||||||||||||||||||||

| Non-employee stock compensation | 2,052,580 | - | - | 3 | - | - | 3,069,561 | - | - | - | 3,069,564 | |||||||||||||||||||||||||||||||||

| Warrants issued for services | - | - | - | - | - | - | 574,250 | - | - | - | 574,250 | |||||||||||||||||||||||||||||||||

| Warrants issued for note | - | - | - | - | - | - | 316,483 | - | - | - | 316,483 | |||||||||||||||||||||||||||||||||

| Net Loss | - | - | - | - | - | - | - | (16,518,387 | ) | - | - | (16,745,350 | ) | |||||||||||||||||||||||||||||||

| Balance - December 31, 2015 | 37,805,416 | - | - | 38 | - | - | 20,111,077 | (21,699,153 | ) | - | - | (1,588,038 | ) | |||||||||||||||||||||||||||||||

See accompanying notes to the consolidated financial statements

| F-4 |

Diego Pellicer Worldwide, Inc.

Consolidated Statements of Cash Flows

| For the Year Ended | For the Year Ended | |||||||

| December 31, 2015 | December 31, 2014 | |||||||

| Operating Activities | ||||||||

| Net Loss | $ | (16,518,387 | ) | $ | (4,768,121 | ) | ||

| Adjustments to reconcile Net Loss to net cash provided by Operations: | ||||||||

| Amortization of deferred revenue | (54,000 | ) | (48,567 | ) | ||||

| Amortization of debt discount | 400,483 | - | ||||||

| Interest Income | - | (70,596 | ) | |||||

| Accrued expenses - related party | 387,121 | 48,603 | ||||||

| Interest on convertible note | 342,604 | - | ||||||

| Change in derivative | (133,809 | ) | - | |||||

| Impairment of investment | 408,900 | - | ||||||

| Non-cash stock compensation | 13,167,772 | 1,176,563 | ||||||

| Write-off credit line receivable (includes interest income) | 200,000 | 777,846 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Prepaid Expenses | 8,946 | (1,140 | ) | |||||

| Deferred rent | 120,234 | - | ||||||

| Inventory | (80,971 | ) | - | |||||

| Other receivable | (17,817 | ) | - | |||||

| Accounts Receivable | (1,110 | ) | - | |||||

| Accrued compensation | (1,170,313 | ) | - | |||||

| Accounts Payable | 287,059 | 283,368 | ||||||

| Net cash used in operating activities | (2,653,338 | ) | (2,602,044 | ) | ||||

| Investing Activities | ||||||||

| (Advances to) repayment from related party | - | 54,341 | ||||||

| Acquisition of property and equipment | (584,764 | ) | (253,990 | ) | ||||

| Security deposits | - | (153,000 | ) | |||||

| Deposits - end of lease | - | (150,000 | ) | |||||

| Advances under line of credit | (200,000 | ) | (707,250 | ) | ||||

| Net cash used in investing activities | (784,764 | ) | (1,209,899 | ) | ||||

| Financing Activities | ||||||||

| Proceeds from sale of Preferred stock and warrants | 1,129,999 | 3,807,908 | ||||||

| Collection of subscriptions receivable | - | 1,352 | ||||||

| Proceeds from (repayment) of loan - related party | - | (17,000 | ) | |||||

| Acquisition of treasury stock | - | (87,300 | ) | |||||

| Proceed from note payable | 846,628 | - | ||||||

| Proceed from convertible note payable | 300,000 | - | ||||||

| Proceed from sale of common stock | 1,164,375 | - | ||||||

| Net cash provided by financing activities | 3,441,002 | 3,704,960 | ||||||

| Net Increase (Decrease) in Cash | 2,900 | (106,983 | ) | |||||

| Cash - beginning of period | 33,101 | 140,084 | ||||||

| Cash - end of the period | $ | 36,001 | $ | 33,101 | ||||

See accompanying notes to the consolidated financial statements

| F-5 |

Diego Pellicer Worldwide, Inc.

December 31, 2015 and 2014

Notes to the Consolidated Financial Statements

Note 1 – Organization and Operations

History

On March 13, 2015 (“closing date”), Diego Pellicer Worldwide, Inc. (f/k/a Type 1 Media, Inc.) (the “Company”) closed on a merger and share exchange agreement (the “Merger Agreement”) by and among (i) the Company, and (ii) Diego Pellicer World-wide 1, Inc., a Delaware corporation, (“Diego”), and (iii) Jonathan White, the majority shareholder of the Company (the “Majority Shareholder”). Pursuant to the terms of the Merger Agreement, Diego was merged with and into the Company, with the Company to continue as the surviving corporation (the “Surviving Corporation”) in the Merger, and the Company succeeding to and assuming all the rights, assets, liabilities, debts, and obligations of Diego (the “Merger”).

Prior to the merger, Type 1 had 62,700,000 shares issued and outstanding. The principal owners of the company have agreed to transfer their 55,000,000 issued and outstanding shares to a third party in consideration for $169,000 and cancellation of their 55,000,000 shares. The remaining issued and outstanding shares are still available for trading in the marketplace. At the time of the merger, Type 1 had no assets or liabilities. Accordingly, the business conducted by Type 1 prior to the Merger is not being operated by the combined entity post-Merger.

At the closing of the Merger, Diego common stock issued and outstanding immediately prior to the closing of the Merger was exchanged for the right to receive 1 share of the surviving legal entity. An aggregate of 21,632,252 common shares of the surviving entity were issued to the holders of Diego in exchange for their common shares, representing approximately 74% of the combined entity.

The Merger has been accounted for as a reverse merger and recapitalization in which Diego is treated as the accounting acquirer and Diego Pellicer Worldwide, Inc. (f/k/a Type 1 Media, Inc.) is the surviving legal entity.

Business Operations

The Company leases real estate to licensed marijuana operators, including but not limited to, providing complete turnkey growing space, processing space, recreational and medical retail sales space and related facilities to licensed marijuana growers, processors, dispensary and recreational store operators. Additionally, the Company plans to explore ancillary opportunities in the regulated marijuana industry as well as offering for wholesale distribution branded non-marijuana clothing and accessories.

The Company does not and will not, until such time as Federal law allows, grow, harvest, process, distribute or sell marijuana or any other substances that violate the laws of the United States of America, or any other country.

Note 2 – Significant and Critical Accounting Policies and Practices

The Management of the Company is responsible for the selection and use of appropriate accounting policies and the appropriateness of accounting policies and their application. Critical accounting policies and practices are those that are both most important to the portrayal of the Company’s financial condition and results and require management’s most difficult, subjective, or complex judgments, often as a result of the need to make estimates about the effects of matters that are inherently uncertain. The Company’s significant and critical accounting policies and practices are disclosed below as required by generally accepted accounting principles.

Basis of Presentation

The Company’s consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

New accounting pronouncements

From time to time, new accounting pronouncements are issued by the Financial Accounting Standards Board or other standard setting bodies that may have an impact on the Company’s accounting and reporting. The Company believes that such recently issued accounting pronouncements and other authoritative guidance for which the effective date is in the future either will not have an impact on its accounting or reporting or that such impact will not be material to its financial position, results of operations and cash flows when implemented.

| F-6 |

Use of Estimates

The preparation of the financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the dates of the financial statements and the reported amounts of revenue and expenses during the reporting periods. Actual results could differ from those estimates. These estimates and assumptions include valuing equity securities and derivative financial instruments issued in financing transactions and share based payment arrangements, determining the fair value of the warrants received for the licensing agreement, the collectability of accounts receivable and deferred taxes and related valuation allowances.

Certain of our estimates, including evaluating the collectability of accounts receivable, could be affected by external conditions, including those unique to our industry, and general economic conditions. It is possible that these external factors could have an effect on our estimates that could cause actual results to differ from our estimates. We re-evaluate all of our accounting estimates at least quarterly based on these conditions and record adjustments when necessary.

Derivative Financial Instruments

The Company evaluates its financial instruments to determine if such instruments are derivatives or contain features that qualify as embedded derivatives. For derivative financial instruments that are accounted for as liabilities, the derivative instrument is initially recorded at its fair value and is then re-valued at each reporting date, with changes in the fair value reported in the condensed consolidated statements of operations. The classification of derivative instruments, including whether such instruments should be recorded as liabilities or as equity, is evaluated at the end of each reporting period. Derivative instrument liabilities are classified in the balance sheet as current or non-current based on whether or not net-cash settlement of the derivative instrument could be required within 12 months of the balance sheet date.

Fair value of financial instruments

As required by the Fair Value Measurements and Disclosures Topic of the FASB ASC, fair value is measured based on a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair value as follows:

Level 1: Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities;

Level 2: Quoted prices in markets that are not active, or inputs that are observable, either directly or indirectly, for substantially the full term of the asset or liability; and

Level 3: Prices or valuation techniques that require inputs that are both significant to the fair value measurement and unobservable (supported by little or no market activity).

Fair value estimates discussed herein are based upon certain market assumptions and pertinent information available to management as of and December 31, 2015 and December 31, 2014. The respective carrying value of certain on-balance-sheet financial instruments approximated their fair values. These financial instruments include cash, prepaid expenses and accounts payable. Fair values were assumed to approximate carrying values for cash and payables because they are short term in nature and their carrying amounts approximate fair values or they are payable on demand.

Cash

The Company maintains cash balances at various financial institutions. Accounts at each institution are insured by the Federal Deposit Insurance Corporation up to $250,000. The Company’s accounts at these institutions may, at times, exceed the federal insured limits. The Company has not experienced any losses in such accounts.

Property and equipment and depreciation policy

Property and equipment are stated at cost less accumulated depreciation. Depreciation is provided for on a straight-line basis over the useful lives of the assets. Expenditures for additions and improvements are capitalized; repairs and maintenance are expensed as incurred.

The Company intends to take depreciation or amortization on a straight-line basis for all properties, beginning when they are put into service, using the following life expectancy:

Equipment – 5 years

Leasehold Improvements – 10 years, or the term of the lease, whichever is shorter

Buildings – 20 years

| F-7 |

Accounts Receivable and Allowance for Doubtful Accounts

Accounts receivable are presented at their face amount, less an allowance for doubtful accounts, on the balance sheets. Accounts receivable consist of revenue earned and currently due from sub lessee. We evaluate the collectability of accounts receivable based on a combination of factors. We recognize reserves for bad debts based on estimates developed using standard quantitative measures that incorporate historical write-offs and current economic conditions. As of December 31, 2015, the outstanding balance allowance for doubtful accounts is zero.

The policy for determining past due status is based on the contractual payment terms of each customer. Once collection efforts by the Company and its collection agency are exhausted, the determination for charging off uncollectible receivables is made.

Revenue recognition

The Company recognizes revenue from rent, tenant reimbursements, and other revenue sources once all of the following criteria are met in accordance with SEC Staff Accounting Bulletin 104, Revenue Recognition , (“SAB 104”): (a) the agreement has been fully executed and delivered; (b) services have been rendered; (c) the amount is fixed or determinable; and (d) the collectability of the amount is reasonably assured.

In accordance with ASC 840 (“Leases”), as amended and interpreted, minimum annual rental revenue is recognized in rental revenues on a straight-line basis over the term of the related lease. Rental revenue recognition commences when the tenant takes possession or controls the physical use of the leased space. In order for the tenant to take possession, the leased space must be substantially ready for its intended use. To determine whether the leased space is substantially ready for its intended use, management evaluates whether the Company or the tenant is the owner of tenant improvements for accounting purposes. When management concludes that the Company is the owner of tenant improvements, rental revenue recognition begins when the tenant takes possession of the finished space, which is when such tenant improvements are substantially complete. In certain instances, when management concludes that the Company is not the owner (the tenant is the owner) of tenant improvements, rental revenue recognition begins when the tenant takes possession of or controls the space.

When management concludes that the Company is the owner of tenant improvements, for accounting purposes, management records the cost to construct the tenant improvements as a capital asset. In addition, management records the cost of certain tenant improvements paid for or reimbursed by tenants as capital assets when management concludes that the Company is the owner of such tenant improvements. For these tenant improvements, management records the amount funded or reimbursed by tenants as deferred revenue, which is amortized as additional rental income over the term of the related lease. When management concludes that the tenant is the owner of tenant improvements for accounting purposes, management records the Company’s contribution towards those improvements as a lease incentive, which is amortized as a reduction to rental revenue on a straight-line basis over the term of the lease.

In January 2014, the Company entered into an agreement to license certain intellectual property to a third party. In consideration, the Company received warrants to purchase shares of common stock, which were valued based on an appraisal of the warrants by an independent third party appraiser. The revenue from the licensing agreement, which is initially recorded as deferred revenue, is being amortized over the ten year term of the licensing agreement.

The Company records rents due from the tenants on a current basis. However, as part of the Line of Credit Agreement, the Company has deferred collection of such rents until the tenants receive the proper governmental licenses to begin operation. It is anticipated that such licenses should be obtained prior to 3rd quarter 2016. Management has decided to take the approach and reserve these amounts due to the contingency factor and experience with typical delays in governmental action.

Leases as lessor

The Company currently leases properties in locations that would be acceptable for regulatory purposes and acceptable to sub-lessees for the manufacturing and development of their products. The Company evaluates the lease to determine its appropriate classification as an operating or capital lease for financial reporting purposes. The Company currently has a number of leases, which are all classified as operating leases.

Minimum base rent for the Company’s operating leases, which generally have escalating rentals over the term of the lease, is recorded on a straight-line basis over the lease term. The initial rent term includes the build-out, or may include a short rent holiday period, for the Company’s leases, where no rent payments are typically due under the terms of the lease.

Leases

For lease agreements that provide for escalating rent payments or free-rent occupancy periods, the Company recognizes rent expense on a straight-line basis over the non-cancelable lease term and option renewal periods where failure to exercise such options would result in an economic penalty in such amount that renewal appears, at the inception of the lease, to be reasonably assured. The lease term commences on the date that the Company takes possession of or controls the physical use of the property. Deferred rent is presented on current liabilities section on the consolidated balance sheets.

Income Taxes

Income taxes are provided for using the liability method of accounting in accordance with the Income Taxes Topic of the FASB ASC. Deferred tax assets and liabilities are determined based on differences between the financial reporting and tax basis of assets and liabilities and are measured using the enacted tax rates and laws that will be in effect when the differences are expected to reverse. A valuation allowance is established when necessary to reduce deferred tax assets to the amount expected to be realized and when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. The computation of limitations relating to the amount of such tax assets, and the determination of appropriate valuation allowances relating to the realizing of such assets, are inherently complex and require the exercise of judgment. As additional information becomes available, the Company continually assesses the carrying value of their net deferred tax assets.

| F-8 |

Research and development costs

Research and development costs are charged to the statement of operations as incurred.

Preferred Stock