Attached files

| file | filename |

|---|---|

| EX-99.2 - PRESENTATION IN PDF - WESBANCO INC | ex992.pdf |

| 8-K - FORM 8-K ON SHAREHOLDERS MEETING PRESENTATION AND 1Q EARNINGS RELEASE - WESBANCO INC | fin8k041916.htm |

| EX-99.1 - 1ST QTR 2016 EARNINGS RELEASE - WESBANCO INC | ex991.htm |

20 April 2016 Annual Shareholders MeetingOglebay Park, Wheeling, WV

Forward-looking statements in this report relating to WesBanco’s plans, strategies, objectives, expectations, intentions and adequacy of resources, are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The information contained in this report should be read in conjunction with WesBanco’s 2015 Annual Report on Form 10-K and documents subsequently filed by WesBanco with the Securities and Exchange Commission (“SEC”), which are available at the SEC’s website, www.sec.gov or at WesBanco’s website, www.wesbanco.com. Investors are cautioned that forward-looking statements, which are not historical fact, involve risks and uncertainties, including those detailed in WesBanco’s most recent Annual Report on Form 10-K filed with the SEC under “Risk Factors” in Part I, Item 1A. Such statements are subject to important factors that could cause actual results to differ materially from those contemplated by such statements. WesBanco does not assume any duty to update forward-looking statements. Forward-Looking Statements *

James C. Gardill Chairman of the Board

* 2015 in Review: Operational Highlights Grew to $8.5 billion in total assets with completion of our largest acquisition to-date – ESB Financial CorporationStrong expense management delivered positive operating leverage and continued improvement in efficiency ratioGenerated solid returns on average tangible assets and average tangible equity of 1.08% and 14.58% (excluding merger-related costs)Maintained strong capital position with both consolidated and bank-level regulatory capital ratios well above applicable, revised “well-capitalized” standards promulgated by bank regulators and BASEL III capital standardsContinued recognition by the financial pressNamed one of the best banks in America by a leading financial magazineOne of only 25 U.S. banking institutions named to KBW Honor RollTop 100 Bank Performance Scorecard ranking by Bank Director magazineRegularly achieve “five-star” ratings from Bauer Financial Note: financial data as of year ending 12/31/2015, which reflects impact of the ESB merger, and compared the year ending 12/31/2014; efficiency ratio, ROAA, and ROATE are non-GAAP measures, please see the reconciliations to GAAP results in the appendix of the Q1 2016 investor presentation on www.wesbanco.com

* 2015 in Review: Financial Highlights Net income up 24.2% to $88MM (excluding merger-related costs)6.8% organic loan growth since 12/31/2014 (exclusive of ESB merger)Non-interest income increased 8.7% year-over-year driven by higher e-banking and deposit fees, trust and brokerage fees, and other incomePositive operating leverage of 1.5x driven by a core focus on return on investment, allowing a strong efficiency ratio of 57.1%, improved 254 basis points compared to a year agoContinued improvement in asset quality as non-performing loans to total loans ratio of 1.04%, improved 21 basis points from a year agoLoan pipelines in 2016 remain robust Note: financial data as of year ending 12/31/2015, which reflects impact of the ESB merger, and compared the year ending 12/31/2014; please see the reconciliations to GAAP results in the appendix of the Q1 2016 investor presentation on www.wesbanco.com

Executive Position Years inBanking Years atWSBC James Gardill Chairman of the Board 44* 44 Todd Clossin President & Chief Executive Officer 32 3 Robert Young EVP & Chief Financial Officer 30 15 Ivan Burdine EVP & Chief Credit Officer 36 3 Jonathan Dargusch EVP – Wealth Management 35 6 Jay Zatta EVP – Chief Lending Officer 30 8 Lynn Asensio EVP – Retail Administration 38 11 Michael Perkins EVP – Chief Risk & Admin Officer 21 21 Experienced and Stable Management Team * as legal counsel to WesBancoNote: all key operating executives listed have large firm experience *

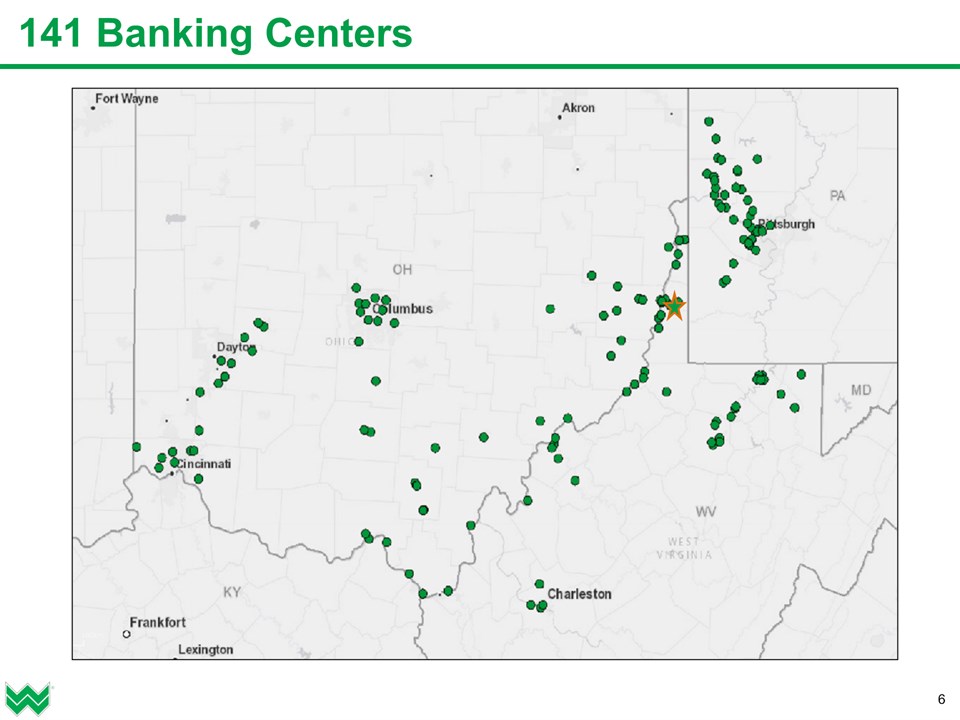

* 141 Banking Centers

* Balance Sheet Growth: Assets, Deposits, Capital Note: financial data as of periods ending 12/31; reflects Fidelity Bancorp merger (Nov-2012) and ESB Financial merger (Feb-2015) CAGR = 10% Total Assets Total Deposits Total Shareholders Equity ($MM) ($MM) ($MM) Fidelity ESB Fidelity ESB Fidelity ESB CAGR = 8% CAGR = 13%

* Fee-Based Services Solid, and growing, non-interest income generationEstablished wealth management, insurance, and private banking services are keys to fee income strategyOperating fee-based revenue contributed 24% of net revenue in 2015 Note: financial data as of quarter ending 12/31/2015; operating non-interest income (excludes gain/loss on securities and sale of OREO property) is a non-GAAP measure, please see the reconciliations to GAAP results in the appendix of the Q1 2016 investor presentation on www.wesbanco.com Operating Fee-Based Services Revenue ($MM)

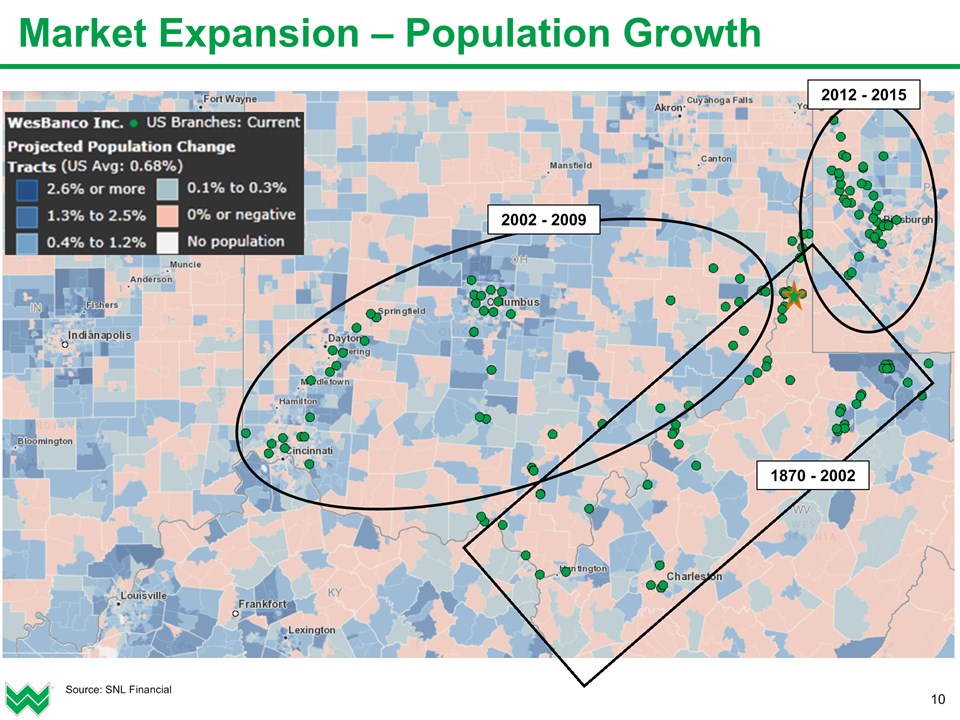

* Historical Growth – Setting the Stage for the Future Ohio Market1992: entered Ohio with acquisition of First National Bank of Barnesville2002: entered Columbus market with acquisition of Wheeling National Bank (American Bancorporation)2004 – 2009: continued expansion in Southeast and Southwest Ohio2004: Western Ohio Financial Corporation of Springfield2005: Winton Savings & Loan Co. in Cincinnati2007: Oak Hill Financial in Jackson2009: five Columbus banking offices of AmTrust BankPennsylvania Market2002: entered Western Pennsylvania market with American Bancorporation acquisition2012: entered Pittsburgh market with acquisition of Fidelity Bancorp2015: continued expansion in Western Pennsylvania to achieve top ten market share with acquisition of ESB Financial CorporationThe Future …. continued expansion in contiguous markets within a five to six hour driving radius of our Wheeling, WV headquarters

* Market Expansion – Population Growth 2012 - 2015 2002 - 2009 1870 - 2002 Source: SNL Financial

2012 - 2015 2002 - 2009 1870 - 2002 * Market Expansion – Median Net Worth Source: SNL Financial

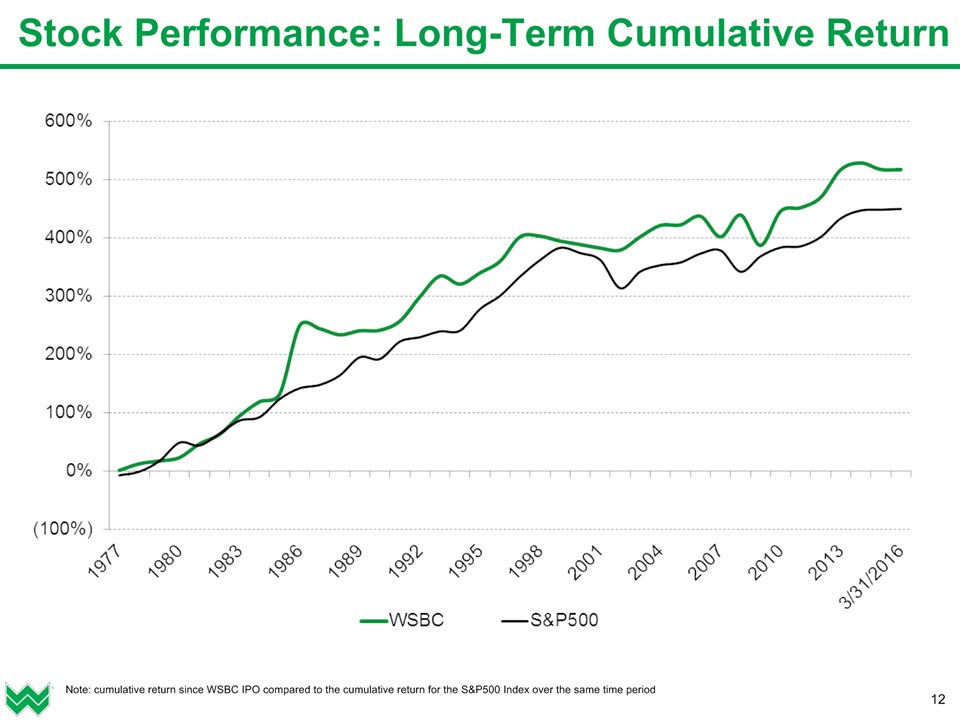

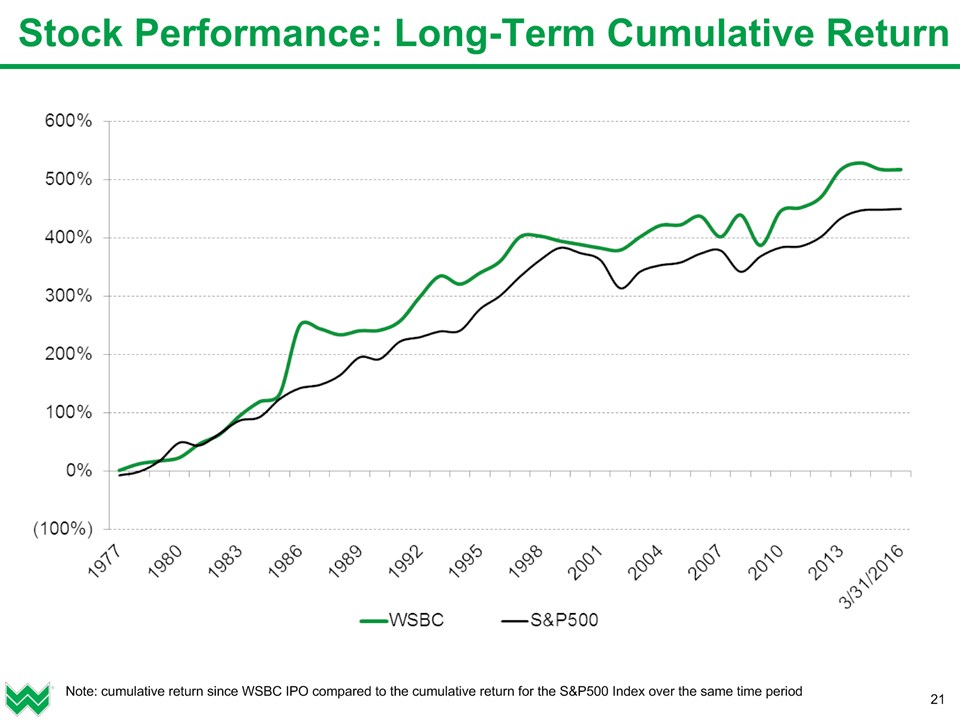

Stock Performance: Long-Term Cumulative Return * Note: cumulative return since WSBC IPO compared to the cumulative return for the S&P500 Index over the same time period

Todd F. Clossin President and Chief Executive Officer

* Talent from ESB Financial Merger Expanded the talent base of the combined companyDan SwartzVice President & Regional Marketing OfficerMarketing and Digital DeliveryRon MannarinoVice President, ProfitabilityAsset Liability ManagementRocco AbbatangeloSenior Vice PresidentWesBanco Insurance Services – Title Insurance

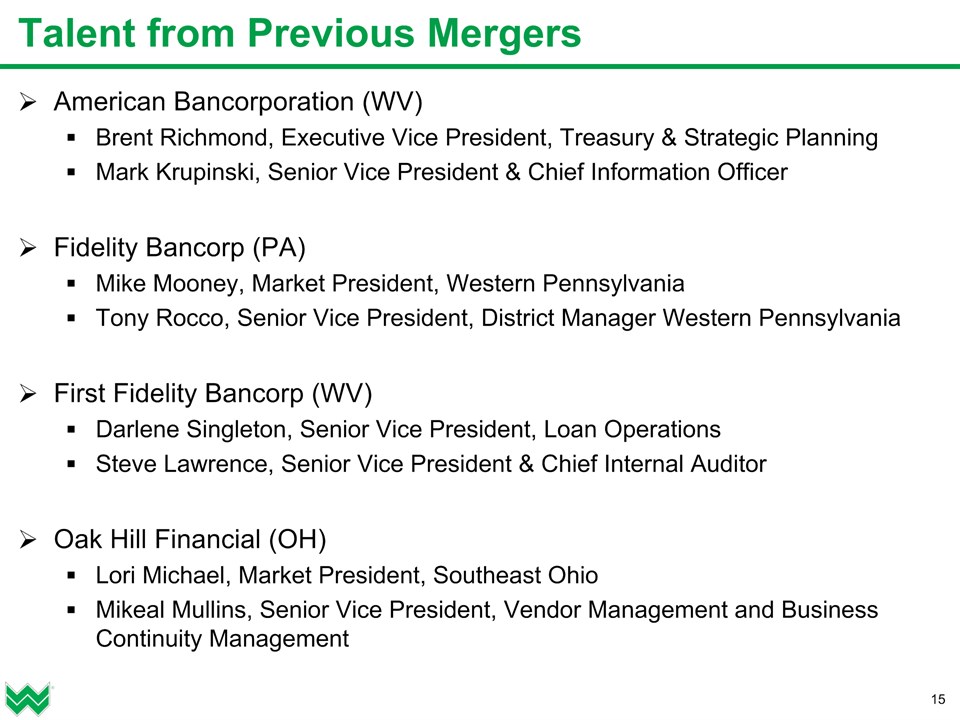

* Talent from Previous Mergers American Bancorporation (WV)Brent Richmond, Executive Vice President, Treasury & Strategic PlanningMark Krupinski, Senior Vice President & Chief Information OfficerFidelity Bancorp (PA)Mike Mooney, Market President, Western PennsylvaniaTony Rocco, Senior Vice President, District Manager Western PennsylvaniaFirst Fidelity Bancorp (WV)Darlene Singleton, Senior Vice President, Loan OperationsSteve Lawrence, Senior Vice President & Chief Internal AuditorOak Hill Financial (OH)Lori Michael, Market President, Southeast OhioMikeal Mullins, Senior Vice President, Vendor Management and Business Continuity Management

* 2016 Challenges Global growth concerns due to lower oil prices and an economic slowdown in many parts of the worldTiming and pace of future Federal Reserve interest rate increases continue to remain uncertain – expect continued low interest rates with flat yield curve monetary policiesIntensifying competition for loan growth with deteriorating competitor lending standards and pricingContinued focus on expense management to help offset rising regulatory, healthcare, and lengthening deposit base costs WesBanco continues to position itself for long-term growth while planning for a wide variety of possible interest rate scenarios during the coming years

* 2016 Business Plan and Initiatives Improving financial performance without taking significant additional riskAnticipating mid-single digit overall loan growthMaintaining asset and liability pricing disciplineProviding superior service across all customer channelsEffectively and efficiently delivering entire product suite across footprintContinue to control discretionary expenses Focused on long-term success of WesBanco, its shareholders, employees, and customers

* Key Differentiators Growing financial services company with a community bank at its coreDiversified revenue growth engines with a critical focus on credit qualityWell-balanced loan and deposit distribution across footprintRobust legacy market share combined with three major metropolitan marketsTop ten market share in the Pittsburgh and Columbus MSAsStrong legacy of credit and risk managementSolid, and growing, non-interest income generation$3.6B of assets under management through our 100-year old trust business$900MM AUM through our proprietary mutual funds, the WesMark FundsFocus on cross-selling – average cross-sell ratio on new consumer relationships has increased from 3.25 to 4.3 over the past several yearsStrong expense management culture with an efficiency ratio of 57.1% Note: financial data as of year ending 12/31/2015; market share based on MSAs (source: SNL); cross-sale data is measured 90 days after relationship opening and reflects Sep-2015 compared to Oct-2013; please see the efficiency ratio reconciliation in the appendix of the Q1 2016 investor presentation on www.wesbanco.com Well-positioned for continued, high-quality growth

Returning Value to Shareholders Since 2010, dividend has increased 71%4Q15 dividend payout ratio 38.3%, compared to 33.7% for SNL $5-10B bank peer group4Q15 dividend yield 3.28%, compared to 2.49% for SNL $5-10B bank peer group * Dividends per Share ($) Note: dividend increase is through Feb-16 announced dividend increase; WSBC dividend yield based upon 2/2/16 closing stock price of $28.09; SNL bank peer group dividend data as of 3Q2015

Well-positioned for continued, high-quality growth withstrong upside market appreciation potential * Investment Rationale Diversified and well-balanced financial services company, with a community bank at its coreDisciplined growth, balanced by a fundamental focus on expense management, that delivers positive operating leverage and increases shareholder valueStrong legacy of credit and risk managementFavorable asset quality when compared to regional and national peersWell-defined growth strategies for long-term success of key stakeholders Focus on returning value to shareholders

Stock Performance: Long-Term Cumulative Return * Note: cumulative return since WSBC IPO compared to the cumulative return for the S&P500 Index over the same time period

20 April 2016 Annual Shareholders MeetingOglebay Park, Wheeling, WV