Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION - PeerLogix, Inc. | peerlogix_10k-ex3101.htm |

| EX-32.1 - CERTIFICATION - PeerLogix, Inc. | peerlogix_10k-ex3201.htm |

| EX-16.1 - LETTER FROM JOHN SCRUDATO CPA - PeerLogix, Inc. | peerlogix_10k-ex1601.htm |

| EX-31.2 - CERTIFICATION - PeerLogix, Inc. | peerlogix_10k-ex3102.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| [X] | Annual Report Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934 |

For the Fiscal Year Ended December 31, 2015

or

| [ ] | Transition Report Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934 |

For the transition period from _____ to _____

Commission File Number: 333-191175

PEERLOGIX, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 46-4824543 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

119 West 24th Street, 4th Floor, New York, New York 10011

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: (914) 550-9993

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [_]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant based on the closing sales price, or the average bid and asked price on such stock, as June 30, 2015 was $318,582

The number of shares of the registrant’s common stock outstanding as of April 14, 2016 was 23,345,035.

PEERLOGIX, INC.

TABLE OF CONTENTS

| PART I | ||

| Item 1. | Business. | 4 |

| Item 1A. | Risk Factors. | 13 |

| Item 1B. | Unresolved Staff Comments. | 22 |

| Item 2. | Properties. | 22 |

| Item 3. | Legal Proceedings. | 22 |

| Item 4. | Mine Safety Disclosures. | 22 |

| PART II | ||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. | 23 |

| Item 6. | Selected Financial Data. | 25 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. . | 25 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk. | 32 |

| Item 8. | Financial Statements and Supplementary Data. | 32 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. | 32 |

| Item 9A. | Controls and Procedures. | 33 |

| Item 9B. | Other Information. | 34 |

| PART III | ||

| Item 10. | Directors, Executive Officers and Corporate Governance. | 35 |

| Item 11. | Executive Compensation. | 36 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | 39 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence. | 39 |

| Item 14. | Principal Accounting Fees and Services. | 41 |

| PART IV | ||

| Item 15. | Exhibits, Financial Statement Schedules | 43 |

| SIGNATURES | 45 |

| 2 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The information contained in this Annual Report on Form 10-K for year ended December 31, 2015 (the “Report”), including in documents that may be incorporated by reference into this Report, includes some statements that are not purely historical and that are “forward-looking statements.” Such forward-looking statements include, but are not limited to, statements regarding the Company and its management’s expectations, hopes, beliefs, intentions or strategies regarding the future, including its financial condition and results of operations. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipates,” “believes,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “might,” “plans,” “possible,” “potential,” “predicts,” “projects,” “seeks,” “should,” “will,” “would” and similar expressions, or the negatives of such terms, may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained in this Report are based on current expectations and beliefs concerning future developments. There can be no assurance that future developments actually affecting the Company will be those anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond the Company’s control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements, some of which are described in the section of this Report entitled “Risk Factors”.

Should one or more of these risks or uncertainties materialize, or should any of the Company’s assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Unless specifically set forth to the contrary, when used in this Report the terms “PeerLogix,” "we"", "our", the "Company" and similar terms refer to PeerLogix, Inc., a Nevada corporation and where the context is applicable, to our business operations, inclusive of those undertaken by our operating subsidiary, PeerLogix Delaware. “PeerLogix Delaware” refers solely to our wholly-owned subsidiary, PeerLogix Technologies, Inc., a Delaware corporation.

| 3 |

PART I

Item 1. Business.

OVERVIEW

We are an advertising technology and data aggregation company providing a proprietary software as a service (“SAAS”) platform which enables the tracking and cataloguing of Torrent files and Torrent networks in order to determine consumer trends and preferences based upon media consumption. We have recently developed and deployed a proprietary mobile and digital ad serving platform utilizing such data to provide highly targeted placement of digital advertisements. Our patent pending platform collects Torrent data, including IP addresses of the uploading and downloading parties (e.g., location), the name, file type, media type (whether movie, television, documentary, music, e-books, software, etc.), and genre of media downloaded, and utilizes licensed and publicly available demographic and other databases to further filter the collected data to provide insights into consumer preferences to digital advertising firms, product and media companies, entertainment studios and others.

The Company was incorporated on February 14, 2014 in Nevada under the name of Realco International, Inc. The Company previously offered real estate marketing and sales services to individuals and businesses seeking to purchase international real estate, with a particular focus on the European and Middle Eastern markets.

On August 14, 2015, the Company entered into a share exchange transaction whereby all of the shareholders of PeerLogix Technologies, Inc., a privately held Delaware corporation (“PeerLogix Delaware”), exchanged all of their shares of common stock for newly issued shares of common stock of the Company (the “Share Exchange”). As a result of the Share Exchange, PeerLogix Delaware has become a wholly-owned subsidiary of the Company and its business operations are assumed by the Company. On September 3, 2015, the Company filed a Certificate of Amendment to its Articles of Incorporation changing its name from Realco International, Inc. to PeerLogix, Inc.

Industry Background

Brand advertisers and consumer product companies utilize a broad array of consumer data on which to base advertising decisions. They have traditionally relied upon information collected from legacy media distribution providers to base their research (e.g., Comcast and other cable providers). These traditional methods are inherently inefficient by today’s standards and are often cost-prohibitive due to their fragmented nature, relying upon separate, non-integrated legacy providers for television and music research related to consumer preferences.

Digital surveying methods provide a solution to many of the inefficiencies present with traditional methods. As a result, advertisers, agencies, entertainment studios and others are rapidly adopting digital methodologies to augment their traditional practices. One such digital surveying method yet to be widely implemented is Torrent measurement, which the Company believes is a significant market opportunity.

In today’s digital world, consumers have access to media, television shows, music, movies, video games and software through a number of growing and fragmented methods and providers. This change in behavior and habits is an evolution resulting from technological innovation, and has resulted in greater choice and democratization amongst consumers. The resulting digital empowerment has directly lead to the birth of platforms providing consumers direct access to media, which often times circumvents legacy providers previously relied upon for distribution (such as traditional cable providers).

One of the more prominent digital platforms to arise has been Torrent (e.g., Popcorn Time, BitTorrent, Vuse). Torrent enables consumers to share TV shows, music, movies, video games and software directly with one another, rather than relying on a centralized source (e.g., iTunes, Netflix). Since Torrent is such a widely used platform for digital media consumption, demographic data related to its use can provide digital agencies and consumer product companies with a wide variety of critical and yet untapped information about consumers enabling them to target their messages and offerings to such consumers.

| 4 |

Marketing and Advertising Industry Implications

The Company believes Torrent data represents a substantial improvement over search and other tracking data utilized to obtain marketing insights, as Torrent data reflects actual consumption of media with respect to which the downloading party has taken an affirmative effort to obtain, as opposed to search data, such as Google, which can reflect pure curiosity.

Through rigorous testing and analysis, the Company has been able to show that on a general basis, the domestic population of Torrent users most commonly resides in middle to upper-middle class households, possessing greater than average levels of discretionary income. These results run contrary to general public perception of Torrent users, which are individuals who are unable to afford market priced content and unlikely to convert into sales for consumer product companies. The Company sees this dichotomy as a significant opportunity in the marketplace, as the Company’s prospective core client base, digital agencies and consumer product companies, proactively seek new audiences deemed financially worthy of sales and advertising efforts.

PeerLogix Torrent Opportunity

Torrent Usage and Activity

Torrent is a geography agnostic platform used by approximately 130-150 million people worldwide to share TV shows, movies, music, video games and software with one another. All major entertainment content is available to consumers using Torrent to access media. Of this population of Torrent users, approximately 40 million reside in the United States and 90-110 million are distributed throughout all major and developing countries of the world.

Torrent activity represents one of the most significant categories of global Internet usage, comprising up to 22% of all Internet traffic. Although Torrent data available at any one point in time is ephemeral and is then lost, the Company has been storing and continues to store all such data in a fully scalable database which has been aggregating the results since approximately January 1, 2014, providing the distinctive ability to provide trend data on the basis of media consumption. The Company’s proprietary platform operates on an automatic basis with little human interaction and continually acquires and catalogues Torrent data in real time, obtaining millions of data points daily.

PeerLogix Platform

The Company’s proprietary technology enables the tracking and cataloguing of Torrent files and Torrent networks in order to determine consumer trends and preferences based upon media consumption. The Company’s patent pending platform collects Torrent data, including IP addresses of the uploading and downloading parties (e.g., location), the name, file type, media type (whether movie, television, documentary, music, e-books, software, etc.), and genre of media downloaded. The Company utilizes licensed and publicly available demographic and other databases to further filter the collected data to provide insights into consumer preferences to digital advertising firms, product and media companies, and others.

How is Torrent Utilized?

Typical steps taken for an “everyday person” to download media using Torrent are: a) search for a respective piece of media (e.g., Classic Rock Music) using a commonly accessible search engine (e.g., Google, Yahoo); b) download a small .torrent file representing the internet coordinates of the desired media content to the consumer’s local computer; and c) open the aforementioned .torrent file utilizing a commonly available Torrent client (e.g., BitTorrent, Vuze) to download the entirety of the desired media content to the consumer’s local computer.

| 5 |

PeerLogix Application

Market

Understanding customer and target audience information is of the upmost importance for organizations undertaking media planning activities. As marketing becomes increasingly data-centric, the ability to obtain rich insights about consumers’ media preferences is expected to represent a significant competitive advantage for the Company’s clients.

According to International Data Corporation (IDC), the big data technology and services market will grow at a compound annual growth rate (CAGR) of 23.1% over the 2014-2019 forecast period with annual spending reaching $48.6 billion in 2019. This is the market targeted by the Company.

The Company’s platform analyzes its proprietary Torrent Library of over 600 million media downloads and overlays it with select third party demographic and behavioral datasets to determine the degree of likelihood a client’s target audience is to be interested in a specific TV show, musical artist, movie, video game and/or commercial software package. By blending Torrent data with third party datasets, the Company’s platform enables media pattern identification and tracking and furthermore, enables clients to test assumptions about who their customers really are and the specific media those customers truly value.

Services Offered

The services to be offered by the Company are two-fold:

1) A Software-as-a-Service (SaaS) application that is a personalized dashboard delivering fully automated, real-time insights and analysis. The application automatically updates information, visualizations and stated trends based on on-going worldwide Torrent activity.

2) A digital advertising platform that enables advertising to Torrent households, effectively providing a gateway for entertainment industry, lifestyle brand and other clients to promote products and messages to users of Torrent.

Application Main Features

Simplicity

To facilitate easy adoption, the Company’s SaaS application does not require any download or installation from clients. Users are provided a login and are able to gain easy access from anywhere in the world.

Ease of Use

The Company has invested resources into user design, and prioritized user-experience within the product. The result is an easy to use interface that reflects the psychology and preferences of its clients. The Company’s application incorporates cutting-edge charts and visualizations to enhance user experience, to meet the demands of companies in today’s marketplace. The result is a format that the Company believes will result in faster adoption and market penetration for its solution.

Compliance

Working under a client-server architecture, usage and adoptability statistics are monitored and consequently viewable by the management of the Company’s clients, enabling them to effectively gauge ROI directly attributable to the Company’s solution.

| 6 |

Product Architecture

Architecture

The client-server cloud-based architecture provides several key advantages for the security, scalability and redundancy of the infrastructure.

Client Security

The Company’s application is a “thin client”, meaning all requests, proprietary data and algorithms reside on the server side. All communications between the Dashboard and servers are through an encrypted channel.

Server Scalability and Redundancy

All of the Company’s web services are hosted on the Amazon EC2 cloud, which is a web service that provides resizable compute capacity in the cloud. The Company’s current architecture allows it to further scale out (add more servers) and/or scale up (add more capacity to an existing server) within minutes, and its current architecture has been tested successfully under heavy stress tests. Additionally, the Company’s load balancers enable updates and maintenance without any downtime and all of its data is backed up and mirrored between two SQL servers (An SQL server is a Microsoft product used to manage and store information. The aforementioned data stored inside an SQL server will be housed in a archived database).

Server Security

The Company’s web services on Amazon EC2 have gone through a hardening process to enhance their security according to known practices, and all algorithms and data servers are isolated from the internet. Only requests originating from the Company’s Dashboard are delivered to its data servers, with all other connection requests ignored.

Proprietary Torrent Monitoring System

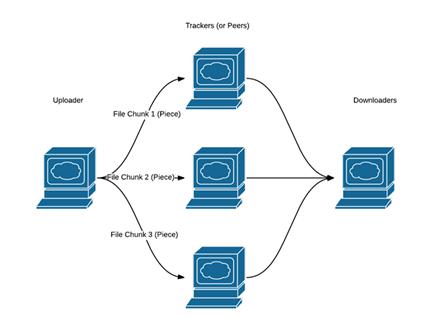

The Torrent protocol is a communications protocol that enables computers to share Media Files (e.g., TV shows, movies, music, video games and commercial software). Rather than making a single TCP connection (TCP enables two hosts to establish a connection and exchange streams of data), Torrent enables a single user to download Media Files over many small data requests over different IP connections from a multitude of distributing computers simultaneously, resulting in quicker and more reliable download speeds for the user. A Torrent Client utilized by an individual uses files with an extension of “.torrent” to coordinate Media File distribution by locating other computers in any geography of the world sharing part or the entirety of the contents of said Media File. To accomplish this series of actions, the Torrent Client running on the distributing/sharing individual’s computer breaks the Media File into a number of smaller but identically sized pieces. Pieces are typically downloaded non-sequentially by the Torrent Client on the downloading individual’s computer, and are rearranged into the correct order by the Torrent Client on the downloading individual’s computer (see below). Typical Media File sharing architecture utilizing Torrent Protocol (the Company’s technology is not depicted):

| 7 |

Search Scraper

The Company’s Search Scraper scans websites and message forums to find .torrent files, extracts their web addresses, and subsequently downloads any .torrent files found into a MySQL database (MySQL is an open source relational database management system. Information in a MySQL database is stored in the form of related tables). This process mimics the behavior a person would undertake to obtain .torrent files. The Company believes its proprietary search technology is capable of finding the vast majority of .torrent files in existence on the internet.

Accuracy & Geo-location

The Company incorporates a third party geo-location service provided by Digital Element to determine authenticity of IP Addresses as well as their physical geographic location to an accuracy of a few hundred yards. IP Addresses deemed to be virtual private networks (VPNs) or using an alternative masking service are flagged, giving the Company the ability to filter them out during later analysis steps, if deemed necessary. Information the Company is able to directly conclude about Torrent users as a result of their IP Address are: Country, Region/State, City, ZIP/Postal Code, Internet Connection Type & Speed, Mobile Carrier (if applicable), Latitude/Longitude (approximate), Internet Service Provider, Home/Business, and Company Name (if applicable).

Consumer Privacy

The Company’s Torrent data meets anonymity standards necessary to be classified as non-personally identifiable information (Non-PII), and all contributors have taken an affirmative effort to participate in, or contribute to the respective Torrent Network or Networks containing media files of interest. As a result, the Company’s data collection methods meet or exceed the current accountability and data collection standards of domestic and international government and regulatory agencies.

| 8 |

Market Positioning & Product Expansion

Worldwide Solution

The Company sees its large swath of international data as a significant competitive advantage compared to alternative data offerings. Its data is contributed to by individuals from the vast majority of countries in the world. As a result, the Company has the ability to offer clients information giving them a strategic advantage when entering new markets, such as understanding the cultural preferences of local populations, consequently better positioning products with locally preferred music artists, television or movie content.

Competitive Advantages

The Company, and the Torrent data it collects possess three significant competitive advantages to other data sources.

| · | Scale – Torrent users, and consequently each data point the Company collects, represent individuals from the vast majority of countries around the world. As a result, the Company is able to measure specific media preferences of populations in most countries, and is not limited to predefined major markets. Clients of the Company are able to gain significant competitive advantages understanding media preferences within new markets they choose to enter with their products (e.g., introducing a new consumer packaged goods into a select province of India or Indonesia). | |

| · | Granularity – The Company’s Torrent tracking mechanisms are location agnostic, and its incorporated geo-location service is able to identify the physical location of a Torrent user within the accuracy of a few hundred yards. As a result, the Company’s technology is able to determine media preferences on a neighborhood-by-neighborhood level (e.g., television preferences in Manhattan vs Brooklyn), providing clients first of its kind abilities previously unattainable with transactional data. | |

| · | Transactional Data – Each Torrent user and Torrent transaction the Company collects in its database represents an affirmative action taken by the Torrent user to obtain and watch/listen to the content. The Company believes that it is the only company able to provide transactional media information on a worldwide basis, in every major and developing country. |

Expanding Value of Torrent Data

Third Party Datasets

The Company has also collected third party nonproprietary datasets from a multitude of data brokers. These datasets include: Consumer Lifestyles, Sports, Household Characteristics, Financial, Apparel Preferences, Charitable Causes, Political Leanings, Parenting, Hobbies, Food, Travel, Pets, Automotive, Income, Home Market Valuations, Net Worth, Credit Worthiness, Languages, Ethnicities, Gender, Education, Occupation, Children, Marital Status and Religion. All third party data is collected anonymously and aggregated by zip code. By aggregating in this method, the Company is able to overlay information from one or a combination of these datasets to build a profile of popular characteristics associated with Torrent populations.

The Company believes the following implementations, which further-enhance Torrent analysis, provide significant market opportunities for the Company, as well as unique value propositions not identically available from alternative data solutions. Implemented applications include:

PeerLogix Dashboard Primary Features

Audience Analysis - Clients of the Company are able to select a single musical artist, television show, movie, ebook or video game, and discover generalized audience characteristics of the population of downloaders (e.g., the demographics of Jay-Z listeners). This analysis has many applications, and provides entertainers, content owners and studios an easier ability to understand the underlying audience characteristics of content they produce. This facilitates simpler and more efficient marketing efforts and better evaluation of potential merchandising opportunities.

| 9 |

Media Analysis – Conversely to the aforementioned Audience Analysis, clients of the Company are able to select a single or multitude of demographics and behaviors from its aggregated third party data, and the PeerLogix Dashboard will calculate highly correlated Torrent downloads associated with those demographics and behaviors. This enables the determination of preferred media preferences of people exhibiting said characteristics (e.g., soccer fans who have a high degree of credit worthiness prefer watching Breaking Bad and Game of Thrones). This analysis has many applications, including but not limited to determining ideal placement of advertising in respect to television programming, assisting agencies and others to direct advertising spend across campaigns and projects.

Development Pipeline

The Company plans to expand its product and service offerings by including additional products that cater to the marketing and advertising needs of its core client base. These offerings include:

| – | Digital Advertising Delivery | ||

| · | A data pipeline to Digital Advertising Exchanges (an advertising exchange is an automatic platform for selling and buying online advertising inventories where space buyers (advertisers, media agencies, retargeting networks) and suppliers (networks, publisher) meet. An advertising exchange allows automation for buying / selling phases and campaign implementation), enabling direct advertising to Torrent users for clients of said Digital Advertising Exchanges. Utilizing this model, the Company expects that it would receive a royalty payment for each advertising impression shown. The primary advantage of this model is immediate scalability to hundreds (and perhaps thousands) of clients who are already customers of said Digital Advertising Exchanges. | ||

| · | PeerLogix Digital Advertising Server, enabling website owners who are frequented by Torrent users to receive advertising campaigns facilitated by the Company to their websites. Music and entertainment marketers are increasingly appropriating advertising budgets to target users using music streaming services (e.g., Pandora, Spotify), and the Company sees this model as a compliment to such efforts. | ||

Revenue Model

Revenue from Clients

The Company anticipates that after initial client validation, its solution will be sold on a subscription basis, with estimated annualized revenues per client between $24,000 and $96,000. The Company intends to offer various pricing modules to accommodate Agencies, Entertainment Studios, Trading Desks, and others. As with most subscription based services, the Company intends to offer different subscription packages for ongoing support, such as an ongoing support license. Over time, the Company intends to apply optimization techniques to determine different pricing schemes. The Company has retained 6 clients to-date, and continues ongoing relationships with each. Revenues from each are invoiced on a per-project basis, and the Company is either engaged with, or is negotiating proposals with clients whom are now deemed recurring.

The Company will offer its clients both online and invoice billing. Online billing will enable easy payment from the client’s business checking account or check card. Invoice billing will require a traditional commercial document being issued by the Company to clients on a monthly basis, typically providing net 30 payment terms.

Foundational Marketing Efforts

Public Relations. The Company intends to generate both international and local media coverage for its services, through a variety of channels, including media articles and interviews with management. To date, we have been approached by representatives of several international media companies expressing interest in covering the Company’s developments through earned media, such as news announcements and content creation. The Company’s proactive efforts will be supported by local public relations agencies. It will attempt to focus its efforts on media channels and publications that target advertising and marketing issues, as well as small cap financial industry publications.

Online Marketing. The Company intends to utilize online campaigns that are designed to direct additional potential customers to its services. Rigorous social media profiles on top platforms will assist in bolstering the Company’s value proposition to the market; top platforms include: Facebook, LinkedIn, Twitter, Wikipedia.

| 10 |

The Company believes in utilizing Earned Media to bolster its value proposition to both client and investor markets. Core areas of concentration will include: publishing company news and industry news via distribution channels, including 1st party blogs and investor relations webpages; social media feeds, including: Facebook, LinkedIn and Twitter; weekly and quarterly newsletters intended to provide proprietary value to companies in the industry (e.g., ADP Quarterly Jobs Report vs PeerLogix Quarterly Media Report).

Thought Leadership. Management intends to develop periodic thought leadership pieces on advertising data and the current and future state of media trends. By participating in industry events and conferences, the Company plans to position itself as a source of imminent and forthcoming insight for emerging trends in media and consumer data sciences. The Company intends to originate much of this messaging from events, both hosted by and participated in by the Company, to then continue the topics and conversation through aforementioned social media channels. These “Community Building” efforts are intended to organically build interest in the Company both in its industry and in the financial markets.

Acquisition Costs

Because the Company offers a software solution, its primary variables in respect to expenses are sales efforts, customer acquisition costs and customer churn.

Customer Acquisition Costs.

The Company continually evaluates its customer acquisition costs with the intent of optimizing its marketing channels and marketing messages. The Company anticipates Investor and Public Relations costs to comprise a noteworthy percentage of its overall budget. Management intends to implement a broadly inclusive plan, with the intention of drawing a significant amount of attention to the Company’s value proposition for client industries, as well as the Company’s compelling investment thesis to the public markets. Furthermore, these efforts are intended to augment efforts undertaken by the Company’s presales partner, Corporate Rain International (see below), to prompt quicker market penetration of the PeerLogix Dashboard. Specific efforts will include, but are not limited to: public relations strategy, media relations, news announcements, content creation, thought leadership development and traditional and digital advertising. As the Company has experienced and continues to have insufficient working capital to effect its business plan, while it planned on allocating approximately $350,000 to customer acquisition, marketing, sales, public relations and investor relations efforts over an initial 12 month period, with further budgeting to be determined thereafter, to date the Company has allocated only approximately $120,000.

Churn

SaaS churn is the rate at which SaaS customers, such as those who become clients of the Company, cancel their recurring revenue subscription. It is a general indicator of customer dissatisfaction, cheaper and/or better offers from competitors, more successful sales and/or marketing by competitors, or reasons having to do with the customer life cycle. 5-8% annual churn rates are generally experienced by SaaS companies offering analytics products, and management anticipates similar results with its own customer retention.

Customer Support

To ensure customer satisfaction, the Company’s customer support efforts include both proactive and responsive models.

Proactive

The Company has developed an event-driven automatic system that notifies its support to errors faced by clients. Errors that could potentially be present in new releases of the Company’s platform are able to be detected by its support staff immediately after a client experiences them.

Responsive Model

The Company intends to offer online and telephone support for clients to support its products and services.

| 11 |

Intellectual Property

The Company has filed a patent application, including a secondary continuation-in-part (CIP) patent, on its proprietary Torrent tracking technology and business applications. The Company has patent pending status currently in the United States (US 13/847,418), Europe, Australia, Canada, Japan and Israel.

The Company has also filed a PCT (Patent Cooperation Treaty) application in China, India, Brazil and Mexico to preserve its ability to later file in these countries.

In addition to the Company’s patent portfolio, the Company’s proprietary database contains 18 months of Torrent media consumption that cannot be acquired or recreated by new market entrants, as Torrent data is ephemeral and is therefore lost if not captured. By possessing this historical information, the Company is afforded the unique ability to analyze historical trends that a potential future competitor would not be capable of upon entrance to the market.

Competition

The Company’s primary competitors are TruOptik, Muzit, Nielsen, Kantar (a subsidiary of WPP Group) and Rentrak. Secondary competitors include Google’s Trends products and Facebook’s suite of advertising tools. Most of these companies have significantly greater resources than the Company. Nielsen’s and Rentrak’s services are largely based on sampling methodologies with a small sample in each market used to measure television and movie viewing behaviors. These are the standards currently employed for the measurement of television and movie behavior for advertising purposes, referred to often times as the “sample currency.” Facebook’s and Google’s services are based on sampling of their users’ posts and search activity which is used to determine present and emerging curiosity of people who participate on their platforms. TruOptik and Muzit also employ a Torrent sampling methodology, each respectively stating they track Torrent users. TruOptik’s service is principally a Data Management Platform, built for advertisers, and Muzit focuses on providing services to music artists. It is unknown as to the extent or depth of either of their respective technology’s Torrent tracking and cataloguing capabilities.

The Company expects to enjoy a unique competitive position, derived from the scale, granularity and the transactional nature of its data. Its services and systems differ from a sampling service (e.g., Nielsen) in that the Company possesses a measurement system based on a massive amount of passively-collected viewing and listening activity. This results in far more granular, reliable and predictable determination of consumers’ actual preferences as compared to either a small, compensated sample approach (e.g., Nielsen) or search engine data which is merely an expression of interest and not listening or viewing intent.

Although the Company believes that it is currently able to compete effectively in the market, it may not be able to do so in the future or be capable of maintaining or further increasing its market share. A failure to compete successfully in its market could adversely affect its business and financial condition.

Employees

The Company currently has four employees located in the United States, and one independent contractor in New Zealand. The independent contractor and one of the Company’s domestic employees focus on research and development. None of the Company’s employees are represented by a labor union, and the Company considers its employee relations to be good. The Company also utilizes a number of consultants to assist with research and development and commercialization activities, generally on a monthly retainer basis.

The Company intends to hire additional personnel to focus on account management, development, marketing, customer support and technological support.

| 12 |

AVAILABLE INFORMATION

The Company is subject to the reporting requirements of the Securities Exchange Act of 1934 (“Exchange Act”). Reports filed with the Securities and Exchange Commission (the “SEC”) pursuant to the Exchange Act, including annual and quarterly reports, and other reports it files, can be inspected and copied at the public reference facilities maintained by the SEC at 100 F Street, N.E., Washington, D.C. 20549. Investors may obtain information on the operation of the public reference room by calling the SEC at 1-800-SEC-0330. Investors can request copies of these documents upon payment of a duplicating fee by writing to the SEC. The reports we file with the SEC are also available on the SEC’s website (http://www.sec.gov).

Item 1A. Risk Factors

If any of the following or other risks actually materialize, our business, financial condition, prospects and/or operations could suffer. In such event, the value of our securities could decline.

This Report contains forward-looking statements.

Information provided in this Report and in the Exhibits hereto may contain forward-looking statements, which reflect management’s current view with respect to future events and the Company’s performance. Such forward-looking statements may include projections with respect to market size and acceptance, revenues and earnings and marketing and sales strategies.

The Company operates in a highly competitive and highly regulated business environment. The Company’s business can be expected to be affected by government regulation, economic, political and social conditions, business’ response to new and existing products and services and services, technological developments and the ability to obtain and maintain patent and/or other intellectual property protection for its products and intellectual property. The Company’s actual results could differ materially from management’s expectations because of changes both within and outside of the Company’s control.

Risks Related To Our Business and Our Industry

We have suffered from a lack of working capital which, if not remedied, will have a material adverse effect on our ability to execute our business strategy.

The Company has suffered from a lack of working capital which has materially limited its ability to execute its business strategy, including the development and marketing of its products and services, the development of an effective sales and marketing force, and the ability to dedicate adequate resources to investor and public relations. Currently, the Company has no material operating funds. As a result, our financial resources will not be sufficient to satisfy our capital requirements for this period. As a result, we require additional financing in order to meet or execute our business strategy. We cannot predict whether this additional financing will be in the form of equity or debt, or be in another form. We may not be able to obtain the necessary additional capital on a timely basis or on acceptable terms, if at all. In any of these events, we will be unable to implement our current strategy or to repay our debt obligations as they become due. In the event that any future financing should take the form of equity securities, the holders of our common stock may experience additional dilution.

The assets of the Company are subject to senior liens.

At March 11, 2016, there exists a lien covering the assets of the Company securing the repayment by the Company of a promissory note in the amount of $131,250. The promissory note is due on July 28, 2016 or earlier in the event that the gross proceeds of any Company offering equals or exceeds $300,000. The Company does not currently have the ability to repay this loan. The security interest granted to the lender could reduce the Company’s options to raise additional capital. In the event that the Company fails to repay this loan when due, the lender would have the option of commencing a foreclosure proceeding and potentially causing all of the Company’s assets to be sold to repay the loan. In the event that the Company is successful in raising additional capital, the loan repayment would reduce the amount of working capital available to the Company.

| 13 |

We are a company that has a limited operating history and it is difficult to predict our future growth and operating results.

As of the date of this Report, the Company had limited capital and no operating history. Therefore, the Company is subject to the risks involved with any speculative early-stage enterprise. There is no assurance that the Company will be able to successfully structure, market and distribute its products or services. The Company may experience continuing net losses and negative cash flows from operations. The extent of continuing losses and negative cash flows from operations and the time required to reach profitability are highly uncertain. There is no assurance that the Company will be able to achieve profitability or that profitability, if achieved, can be sustained on an ongoing basis. Such risks for the Company include, but are not limited to:

| · | An evolving, unpredictable and unproven business model; | |

| · | An intensely competitive developing market with low barriers to entry; | |

| · | Rapidly changing technology; | |

| · | Managing growth; | |

| · | Dependence on key personnel; | |

| · | Limited operating capital and limited access to credit; and | |

| · | Other unforeseen changes and developments. |

In order to address these risks, the Company must, among other things:

| · | Implement and successfully execute its business strategy; | |

| · | Provide superior customer service; | |

| · | Respond to competitive developments; | |

| · | Attract, retain and motivate qualified personnel; and | |

| · | Respond to unforeseen and changing circumstances. |

The Company cannot assure you that it will succeed in addressing these risks.

We have not generated any revenues to date and have a history of losses since inception

The Company has not generated material revenue to date and, through December 31, 2015, has incurred net losses of approximately $1.5 million since its formation. It can be expected that the Company will continue to incur significant operating expenses and continue to experience losses in the foreseeable future. As a result, the Company cannot predict when, if ever, it might achieve profitability and cannot be certain that it will be able to sustain profitability, if achieved.

Our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern.

In its audit opinion issued in connection with our consolidated balance sheets as of December 31, 2015 and 2014 and our consolidated statements of operations, stockholder’s deficit and cash flows for the years ended December 31, 2015 and 2014, our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern given our recurring net losses, negative cash flows from operations and working capital deficiency. The accompanying financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities and commitments in the normal course of business. The financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts or amounts of liabilities that might be necessary should we be unable to continue in existence.

| 14 |

The Company will face substantial competition

The technology, information, data aggregation and measurement industries are very competitive, and are characterized by large, global businesses that utilize technological solutions as well as physical data aggregation and audience measurement systems to capture and obtain data and segregate such data into products and solutions for sale to various industries. The technology utilized by these businesses is rapidly evolving and the business is intensely competitive. The Company expects such competition to intensify in the future. Barriers to entry are minimal, allowing current and new competitors to launch new services at a relatively low cost. The Company currently or potentially competes with a variety of other companies. These competitors include major companies such as Neilsen, Comscore, Facebook, Google, Twitter and others. Competition may also arise from the local, national and global companies that may enter the industry such as advertising agencies, media companies and others which, if successful, could have a material adverse effect on the Company’s business, prospects, financial condition and results of operations.

The Company believes that the principal competitive factors in the data aggregation industry are:

| · | Brand name recognition; | |

| · | Customer service; | |

| · | Technological capabilities; | |

| · | Quality of data; | |

| · | Ease of use; and | |

| · | Online availability. |

All of the Company’s competitors have operating histories, significant customer bases, greater brand recognition and significantly greater financial, marketing and other resources. Competitors devote greater resources to marketing and promotional campaigns and devote substantially more resources to website and systems development. Increased competition may result in reduced operating margins. The Company cannot assure potential investors that the Company will compete successfully against existing or future competitors.

The Company’s products will represent new and rapidly evolving technologies

The Company’s products depend on new, rapidly evolving technologies and on the marketability and profitability of these products. The Company’s ability to commercialize its products and services will depend upon its ability to develop new products and services to remain competitive; its ability to develop, adopt or have access to new technologies; its ability to successfully implement its marketing and promotion strategy; its ability to have access to Torrent data; its ability to retain and grow the customer base; its ability to provide adequate server, network and system capacity through the Amazon Cloud services or otherwise; the risk of unanticipated increased costs for network services; increased competition from providers of Internet and peer-to-peer services; its ability to maintain and grow market share in the industry; and the risks from changes in U.S. and international regulatory environments affecting Torrent data and data and information aggregation services. The occurrence of any of these risks could have a material adverse effect on the business, prospects, financial condition and results of operations of the Company. In addition, if the Company were unable, for technical, legal, financial or other reasons, to obtain Torrent data, the Company’s business, prospects, financial condition and results of operations would be materially adversely affected.

The Company will need to manage growth

In order to maximize the potential growth in the Company’s market opportunities, the Company believes that it must expand rapidly and significantly. The impetus for expansion will place a significant strain on the Company’s management, operational and financial resources. In order to manage growth, the Company must implement and continually improve its operational and financial systems, expand operations, attract and retain superior management and train, manage and expand its employee base. The Company can give no assurance that it will effectively manage its operations, that its systems, procedures, or controls will adequately support its operations or that the Company’s management will successfully implement its business plan. If the Company cannot effectively manage its growth, the Company’s business, prospects, financial condition and results of operations could be materially adversely affected.

| 15 |

The Company may experience fluctuations in operating results

Given the early stage of the Company and the rapidly evolving nature of the markets in which the Company will be competing, the Company expects to experience significant fluctuations in the future operating results due to a variety of factors, many of which are outside of its control. Factors that may adversely affect the Company’s operating results include, without limitation, the following:

| · | The continued acceptance and use of the Internet and Torrent downloads by consumers; | |

| · | The ability of the Company to develop and upgrade its systems and infrastructure; | |

| · | The announcement or introduction of new products and services by the competitors of the Company; | |

| · | The amount and timing of operating costs and capital expenditures relating to the expansion of the Company’s business, operations and infrastructure; and | |

| · | General economic conditions and economic conditions specific to the Internet. |

Dependence on Management

The success of the Company is highly dependent upon the capabilities of the management of the Company, as is the success of any business dependent upon the ability of those responsible for making the important business decisions. Although the Company will seek to hire and retain qualified software engineers, technical personnel and managers with business experience and abilities commensurate with the needs of the Company, there is no assurance that the Company will succeed despite its collective efforts.

The loss of the services of the principal members of the Company’s management could hinder the Company’s ability to fulfill its business plan and further develop and commercialize its products and services. The Company faces intense competition for such personnel from other companies. There is no assurance that the Company will be successful in hiring or retaining qualified personnel.

The Company’s performance will depend substantially on the continued services and performance of its senior management and other key personnel. The Company’s performance will also depend on its ability to retain and motivate its other qualified officers and key employees. The loss of the services of any of its executive officers or other key employees could have a material adverse effect on the Company’s business, prospects, financial condition and results of operation. The Company’s future success also depends on its ability to identify, attract, hire, train, retain and motivate other highly skilled technical, marketing, managerial and financial personnel. Competition for such personnel is intense, and the Company’s failure to attract and retain the necessary technical, marketing, managerial and financial personnel could have a material adverse effect on the Company’s business, prospects, financial condition and results of operations.

Intellectual property and proprietary rights

The Company’s success depends upon proprietary technology and the execution thereof. The Company will rely on a combination of patent, trademark, copyright and trade-secret laws, as well as confidentiality agreements and technical measures to protect its proprietary rights. Much of the Company’s proprietary information may not be patentable, and the Company does not currently possess any patents, although the Company does have a single patent pending currently. The Company cannot assure that it will develop proprietary products or processes that are patentable, and that if issued, that any patent will give a competitive advantage or that such patent will not be challenged by third parties, or that the patents of others will not have a material adverse effect on the Company’s ability to do business. The Company may apply to register certain trademarks in, or claim certain trademark rights in, the United States and/or foreign jurisdictions. The Company cannot assure that its means of protecting its proprietary rights will suffice or that the Company’s competitors will not independently develop competitive technology or duplicate services or design around patents or other intellectual property rights issued to the Company.

| 16 |

Uninsured losses

The Company may not be able to arrange for comprehensive insurance, including liability, fire, and extended coverage and where economically feasible, earthquake and flood insurance for its business, which is customarily obtained for similar businesses. The lack of comprehensive insurance could materially adversely affect the Company and the value of its securities in the event of an uninsured loss.

Market size

Management has attempted to determine the potential market for the Company’s products and services, which attempt is based on assumptions. All projections or predictions with respect to market size are for purposes of illustration only. The Company cannot predict the size of the market with any guarantee of accuracy. Accordingly, the size of the market anticipated by the Company may be materially greater or lesser than the actual market size.

Developing market; unproven acceptance of the Company’s services

The markets for the Company’s services are rapidly evolving and are characterized by an increasing number of market entrants who have introduced or developed competitive services and products. As is typical in the case of a new and rapidly evolving industry, demand and market acceptance for recently introduced products and services are subject to a high level of uncertainty and risk. If the market fails to develop, develops more slowly than expected or becomes saturated with competitors, or if the Company’s products and services do not achieve or sustain market acceptance, the Company’s business, prospects, financial condition and results of operations would be materially adversely effected.

Rapid technological change

To remain competitive, the Company will be required to continually enhance and improve the responsiveness, functionality and features of its technology. The Internet, mobile phone and social networking industries are characterized by rapid technological change, changes in user and customer requirements and preferences, frequent new product and service introductions embodying new technologies and the emergence of new industry standards and practices that could at any time render its then existing products and services, as well as proprietary technology and systems, obsolete. The Company’s future success will depend, in part, on its ability to develop leading software and technologies useful in its business, enhance its existing services, develop new services and technologies that address the increasingly sophisticated and varied needs of its prospective customers, and respond to technological advances and emerging industry standards and practices on a cost-effective and timely basis. The development of other proprietary technology entails significant technical and business risks. There can be no assurance that the Company will successfully use new technologies effectively or adapt its software and technology (proprietary or otherwise) to customer requirements or emerging industry standards. If the Company were unable, for technical, legal, financial or other reasons, to adapt in a timely manner in response to changing market conditions or customer requirements, the Company’s business, prospects, financial condition and results of operations would be materially adversely affected.

Liability exposure

Although the Company intends to obtain appropriate liability insurance in the future, it cannot guarantee that it will be able to obtain such insurance or that any such insurance will be sufficient to cover all possible liabilities. Liability claims, regardless of their ultimate outcome, could result in costly litigation and could have a material adverse effect on the Company’s business, prospects, financial condition and results of operations.

There is a substantial risk that we may be exposed to litigations in connection with claims arising out of our failure to file registration statement(s).

In August 2015, we entered into registration rights agreements with all of our then shareholders, pursuant to which we committed to file a registration statement covering the resale of certain shares of common stock and shares of common stock underlying warrants issued in our offerings within 60 days from August 14, 2015, and shall use commercially reasonable efforts to cause the registration statement to become effective no later than 90 days after it is filed. However, as of the date of this filing, we have not filed a registration statement. The registration rights agreements do not contain a penalty clause for the failure to file a registration statement within the period agreed upon. However, we do not exclude the possibility that our shareholders may bring litigations against us in connection with claims arising out of our failure to file a registration statement pursuant to the registration rights agreements and seek remedies under the common law.

The Company will rely on Amazon Cloud for hosting services

The Company utilizes and intends to continue to utilize the Amazon Cloud to host its overall technology platforms. If the Amazon Cloud business services were to be interrupted for any material period of time, breached by hackers, or otherwise be non-functioning or unavailable for use, this could have a material adverse effect on the Company’s business, prospects, financial condition and results of operations. Replication of the network infrastructure of the Amazon Cloud would be costly and time consuming, and the Company can give no assurance that such replication, in whole or in part, could be achieved in a short time frame or at all, which could have a material adverse effect on the Company’s business, prospects, financial condition and results of operations.

| 17 |

Our future potential products in our development pipeline are in the early stages and may never be commercially successful.

Our future potential products in our development pipeline are either at very early stages of product development or pre-definition and may never be developed or commercialized. The progress and results of any future products are uncertain, and may result in a failure to develop additional effective products. Even if we successfully complete one or more of our future potential products’ development, they may not be commercially successful due to, among other things, low market acceptance. Third parties may develop superior products or have proprietary rights that preclude us from marketing our products.

We only recently established limited sales and marketing capabilities, and we may be unable to effectively sell, market and distribute our products in the future, and the failure to do so would have an adverse effect on our business and results of operations.

We only recently established limited sales and marketing capabilities. If we are unable to develop an effective sales, marketing, customer relationship management and distribution capabilities or enter into agreements with third parties to perform these functions, we will not be able to successfully commercialize our services and products. We currently have only limited internal sales and marketing capabilities. In order to successfully commercialize any of our products, we must either further internally develop sales, marketing, and customer relationship management and distribution capabilities or make arrangements with third parties to perform these services.

If we do not develop a skilled marketing and sales force and supporting customer relationship management, we will be unable to successfully market any of our services and products directly. To promote any of our potential products through third parties, we will have to locate acceptable third parties for these functions and enter into agreements with them on acceptable terms, and we may not be able to do so.

We may be unable to obtain requisite data and other content to source our services and products.

Our products and services rely on data collected from Torrent networks. Once received, the data must be reviewed, processed and integrated. If we are unable to obtain quality Torrent data, for reasons such as, but not limited to: changing technology protocols, or changing behavior in respect to how consumers’ obtain media, we may not be able to meet the needs of our clients, and we could lose clients, and therefore impact on our ability to grow our business, which could result in a material adverse effect on our results of operations, financial condition and cash flows.

The future success of our company is highly dependent on our ability to maintain and grow our base of clients who subscribe to our services and products.

Our success depends on effective software solutions, marketing, sales and customer relations for our services and products, as well as acceptance of future enhancements and new products and services by our prospective clients. If we are unable to both retain clients and secure new clients, our results of operations, financial condition and cash flows will be adversely affected.

Our services and products are highly dependent on employees who are skilled and experienced in information technologies.

If we are unable to attract, hire and retain high quality information technology personnel at a reasonable cost, we may not be able to meet the needs of clients, enhance existing services, or develop new lines of business. This inability could have a material adverse effect on our results of operations, financial condition and cash flows.

| 18 |

Measurement services are receiving a high level of consumer group and government scrutiny relating to the privacy issues around the methodologies used in targeted advertising.

Although we are confident that our anonymous data aggregation methodologies are compliant with all current privacy laws, it is possible that privacy trends and market perceptions of the transparency of data could result in additional government restrictions or limitations on the use of that data, which would adversely affect many of our products. We believe it is unlikely that we will be required to change or limit our products. Nonetheless, if additional government restrictions are imposed, such restrictions could slow our ability to realize a return on our investments in new data-driven products or result in additional costs not currently anticipated.

Our services are highly dependent on the effective and efficient use of technology and our overall information management infrastructure.

If we are unable to acquire, establish and maintain our information management systems to ensure accurate, reliable and timely data processed in an efficient and cost effective manner, we may not be able to meet the needs of clients, enhance existing services or develop new lines of business. This inability could have an adverse effect on our business and long-term growth prospects.

Interruption or failure of our information technology and communications systems could hurt our ability to effectively provide our products and services, which could damage our reputation and harm our operating results.

The availability of our products and services depends on the continuing operation of our information technology and communications systems. Some of our systems are not fully redundant, and our disaster recovery planning cannot account for all eventualities. The occurrence of a natural disaster, a decision to close a facility we are using without adequate notice for financial reasons, or other unanticipated problems at our data centers could result in lengthy interruptions in our service. In addition, our products and services are highly technical and complex and may contain errors or vulnerabilities. Any errors or vulnerabilities in our products and services, or damage to or failure of our systems, could result in interruptions in our services, which could reduce our revenue and results of operations.

Risks Related to Our Common Stock; Liquidity Risks

Our securities are “Penny Stock" and subject to specific rules governing their sale to investors.

The SEC has adopted Rule 15g-9 which establishes the definition of a “penny stock,” for the purposes relevant to the Company, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require that a broker or dealer approve a person’s account for transactions in penny stocks; and the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

In order to approve a person’s account for transactions in penny stocks, the broker or dealer must obtain financial information and investment experience objectives of the person; and make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which, in highlight form sets forth the basis on which the broker or dealer made the suitability determination; and that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for Company’s shareholders to sell shares of our common stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

| 19 |

There is very limited recent trading activity in our common stock and there is no assurance that an active market will develop in the future.

There is only very limited trading activity in our common stock and essentially no liquidity for our securities. Further, although the common stock is currently quoted on the OTC Pink Market, maintained by OTC Markets, Inc., trading of our common stock may be extremely sporadic. For example, several days may pass before any shares may be traded. As a result, an investor may find it difficult or impossible to dispose of, or to obtain accurate quotations of the price of, the common stock. There can be no assurance that an active market for our common stock will ever develop, or if one should develop, there is no assurance that it will be sustained. This severely limits the liquidity of the common stock and our ability to raise capital.

Because we became public by means of a Share Exchange, we may not be able to attract the attention of major brokerage firms.

Additional risks may exist since we became public through a “Share Exchange.” Securities analysts of major brokerage firms may not provide coverage of us since there is little incentive to brokerage firms to recommend the purchase of our Common Stock. No assurance can be given that brokerage firms will want to conduct any secondary offerings on behalf in the future.

Compliance with the reporting requirements of federal securities laws can be expensive.

The Company is a public reporting company in the United States, and accordingly, subject to the information and reporting requirements of the Exchange Act and other federal securities laws, and the compliance obligations of the Sarbanes-Oxley Act. The costs of preparing and filing annual and quarterly reports and other information with the SEC and furnishing audited reports to stockholders are substantial. In addition, the Company will incur substantial expenses in connection with the preparation of the Registration Statement and related documents with respect to the registration of resales of the Common Stock owned by its shareholders.

Applicable regulatory requirements, including those contained in and issued under the Sarbanes-Oxley Act of 2002, may make it difficult for the Company to retain or attract qualified officers and directors, which could adversely affect the management of its business and its ability to obtain or retain listing of its Common Stock.

The Company may be unable to attract and retain those qualified officers, directors and members of board committees required to provide for effective management because of the rules and regulations that govern publicly held companies, including, but not limited to, certifications by principal executive officers. The enactment of the Sarbanes-Oxley Act has resulted in the issuance of a series of related rules and regulations and the strengthening of existing rules and regulations by the SEC, as well as the adoption of new and more stringent rules by the stock exchanges. The perceived increased personal risk associated with these changes may deter qualified individuals from accepting roles as directors and executive officers.

Further, some of these changes heighten the requirements for board or committee membership, particularly with respect to an individual’s independence from the corporation and level of experience in finance and accounting matters. The Company may have difficulty attracting and retaining directors with the requisite qualifications. If the Company is unable to attract and retain qualified officers and directors, the management of its business and its ability to obtain or retain listing of our shares of Common Stock on any stock exchange (assuming the Company elects to seek and are successful in obtaining such listing) could be adversely affected.

The Company may have undisclosed liabilities and any such liabilities could harm the Company’s revenues, business, prospects, financial condition and results of operations.

Even though we represented in the Share Exchange Agreement that we had no liabilities at the closing of the Share Exchange, there can be no assurance that there are no unknown liabilities. Any such liabilities that survive the Share Exchange could harm the Company’s revenues, business, prospects, financial condition and results of operations upon the Company’s acceptance of responsibility for such liabilities.

| 20 |

If the Company fails to maintain an effective system of internal controls, it may not be able to accurately report its financial results or detect fraud. Consequently, investors could lose confidence in the Company’s financial reporting and this may decrease the trading price of its stock.

Effective internal control is necessary for us to provide reliable financial reports and prevent fraud. If we cannot provide reliable financial reports or prevent fraud, we may not be able to manage our business as effectively as we would if an effective control environment existed, and our business and reputation with investors may be harmed.

We currently have insufficient written policies and procedures for accounting and financial reporting with respect to the requirements and application of US GAAP and SEC disclosure requirements. Additionally, there is a lack of formal process and timeline for closing the books and records at the end of each reporting period. Such a documented weakness could restrict our ability to timely gather, analyze and report information relative to our financial statements.

Because of our limited resources, there are limited controls over our information processing. There is inadequate segregation of duties consistent with control objectives. Our management is composed of a small number of individuals resulting in a situation where limitations on segregation of duties exist. In order to remedy this situation we would need to hire additional staff. Currently, we are unable to afford to hire additional staff to facilitate greater segregation of duties but will reassess our capabilities in the following year.

Management believes that the material weaknesses set forth above are the result of the lack of scale of our operations and are intrinsic to our small size. Nonetheless, our small size and our current internal control deficiencies may have a material adverse effect on our ability to accurately and timely report our financial information which, in turn, may have a material adverse effect on our financial condition.

As a result of our small size and our current internal control deficiencies, our financial condition, results of operation and access to capital may be materially adversely affected.

The price of the Common Stock may become volatile, which could lead to losses by investors and costly securities litigation.

The trading price of the Common Stock is likely to be highly volatile and could fluctuate in response to factors such as:

| · | actual or anticipated variations in the Company’s operating results or financial condition; | |

| · | announcements of developments by the Company or its competitors; | |

| · | regulatory actions regarding the Company’s products | |

| · | announcements by the Company or its competitors of significant acquisitions, strategic partnerships, joint ventures or capital commitments; | |

| · | adoption of new accounting standards affecting the Company’s industry; | |

| · | additions or departures of key personnel; | |

| · | introduction of new products by the Company or its competitors; | |

| · | sales of the Company’s Common Stock or other securities in the open market; and | |

| · | other events or factors, many of which are beyond the Company’s control. |

The stock market is subject to significant price and volume fluctuations. In the past, following periods of volatility in the market price of a company’s securities, securities class action litigation has often been initiated against such a company. Litigation initiated against the Company, whether or not successful, could result in substantial costs and diversion of its management’s attention and resources, which could harm the Company’s business and financial condition.

| 21 |

Investors may experience dilution of their ownership interests because of the future issuance of additional shares of the common stock.