Attached files

| file | filename |

|---|---|

| EX-4.1 - SPECIMEN COMMON STOCK CERTIFICATE - Peekay Boutiques, Inc. | pkay_ex41.htm |

| EX-32.2 - CERTIFICATION - Peekay Boutiques, Inc. | pkay_ex322.htm |

| EX-32.1 - CERTIFICATION - Peekay Boutiques, Inc. | pkay_ex321.htm |

| EX-31.2 - CERTIFICATION - Peekay Boutiques, Inc. | pkay_ex312.htm |

| EX-31.1 - CERTIFICATION - Peekay Boutiques, Inc. | pkay_ex311.htm |

| EX-10.31 - FORBEARANCE AND NINTH AMENDMENT AGREEMENT - Peekay Boutiques, Inc. | pkay_ex1031.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2015

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________ to _______________

Commission File No. 333-193618

PEEKAY BOUTIQUES, INC. |

(Exact name of registrant as specified in its charter) |

Nevada | 46-4007972 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

901 West Main Street, Suite A, Auburn, WA 98001

(Address of principal executive offices)

1-800-447-2993

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $0.0001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer | ¨ | Accelerated Filer | ¨ |

Non-Accelerated Filer | ¨ | Smaller reporting company | x |

(Do not check if a smaller reporting company) |

|

| |

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

As of June 30, 2015 (the last business day of the registrant's most recently completed second fiscal quarter), there were 597,111 shares of the registrant's common stock issued and outstanding (as adjusted for a one-for-six reverse split of the registrant's outstanding shares of common stock effected on October 28, 2015), all of which were held by affiliates of the registrant. The aggregate market value could not be determined because we only had nominal trading volume as of June 30, 2015.

There were a total of 600,949 shares of the registrant's common stock outstanding as of April 14, 2016.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Peekay Boutiques, Inc.

Annual Report on Form 10-K

Year Ended December 31, 2015

TABLE OF CONTENTS

PART I | |||||

Item 1. | Business. | 5 | |||

Item 1A. | Risk Factors. | 14 | |||

Item 1B. | Unresolved Staff Comments. | 31 | |||

Item 2. | Properties. | 32 | |||

Item 3. | Legal Proceedings. | 32 | |||

Item 4. | Mine Safety Disclosures. | 32 | |||

| |||||

PART II | |||||

| |||||

Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. | 33 | |||

Item 6. | Selected Financial Data. | 34 | |||

Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations. | 38 | |||

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk. | 58 | |||

Item 8. | Financial Statements and Supplementary Data. | 58 | |||

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. | 58 | |||

Item 9A. | Controls and Procedures. | 58 | |||

Item 9B. | Other Information. | 59 | |||

| |||||

PART III | |||||

Item 10. | Directors, Executive Officers and Corporate Governance. | 60 | |||

Item 11. | Executive Compensation. | 66 | |||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | 69 | |||

Item 13. | Certain Relationships and Related Transactions, and Director Independence. | 72 | |||

Item 14. | Principal Accounting Fees and Services. | 74 | |||

PART IV | |||||

| |||||

Item 15. | Exhibits, Financial Statement Schedules. | 75 | |||

| 2 |

Special Note Regarding Forward Looking Statements

In addition to historical information, this report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. We use words such as "believe," "expect," "anticipate," "project," "target," "plan," "optimistic," "intend," "aim," "will" or similar expressions which are intended to identify forward-looking statements. Such statements include, among others, those concerning market and industry segment growth and demand and acceptance of new and existing products; any projections of sales, earnings, revenue, margins or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements regarding future economic conditions or performance; as well as all assumptions, expectations, predictions, intentions or beliefs about future events. You are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, including those identified in Item 1A "Risk Factors" herein, as well as assumptions, which, if they were to ever materialize or prove incorrect, could cause the results of the Company to differ materially from those expressed or implied by such forward-looking statements.

Readers are urged to carefully review and consider the various disclosures made by us in this report and our other filings with the SEC. These reports attempt to advise interested parties of the risks and factors that may affect our business, financial condition and results of operations and prospects. The forward-looking statements made in this report speak only as of the date hereof and we disclaim any obligation, except as required by law, to provide updates, revisions or amendments to any forward-looking statements to reflect changes in our expectations or future events.

Use of Terms

Except as otherwise indicated by the context and for the purposes of this report only, references in this report to:

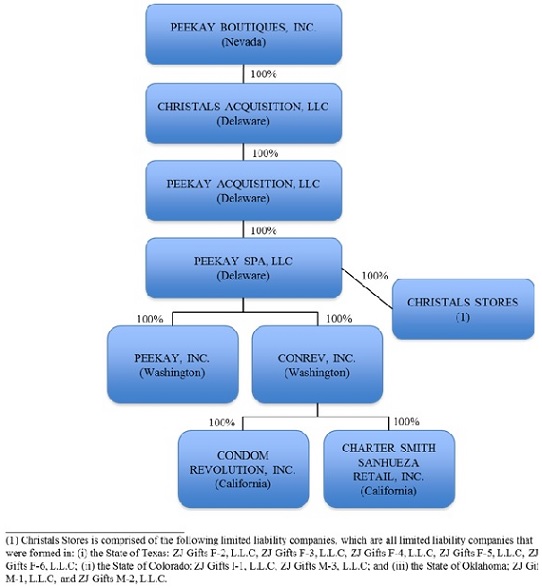

| · | "the Company," "we," "us," or "our" are to Peekay Boutiques, Inc., a Nevada corporation (formerly Dico, Inc.); |

|

|

|

| · | "Christals Acquisition" are to Christals Acquisition, LLC, a Delaware limited liability company and a wholly-owned subsidiary of Peekay Boutiques, Inc.; |

|

|

|

| · | "Peekay Acquisition" are to Peekay Acquisition, LLC, a Delaware limited liability company and wholly-owned subsidiary of Christals; |

| 3 |

| · | "Peekay SPA" are to Peekay SPA, LLC, a Delaware limited liability company and the wholly-owned subsidiary of Peekay Acquisition; |

|

|

|

| · | "Peekay" are to Peekay, Inc., a Washington corporation and wholly-owned subsidiary of Peekay SPA; |

|

|

|

| · | "Conrev" are to Conrev, Inc., a Washington corporation and wholly-owned subsidiary of Peekay; |

|

|

|

| · | "Condom Revolution" are to Condom Revolution, Inc., a California corporation and wholly-owned subsidiary of Conrev; |

| · | "Charter Smith" are to Charter Smith Sanhueza Retail, Inc., a California corporation and wholly-owned subsidiary of Conrev; |

|

|

|

| · | "Christals Stores" are to the following entities which each operate one store: ZJ Gifts F-2, L.L.C, ZJ Gifts F-3, L.L.C, ZJ Gifts F-4, L.L.C, ZJ Gifts F-5, L.L.C, ZJ Gifts F-6, L.L.C, ZJ Gifts I-1, L.L.C, ZJ Gifts M-1, L.L.C, ZJ Gifts M-2, L.L.C, and ZJ Gifts M-3, L.L.C.; |

|

|

|

| · | "SEC" are to the Securities and Exchange Commission; |

|

|

|

| · | "Exchange Act" are to the Securities Exchange Act of 1934, as amended; |

|

|

|

| · | "Securities Act" are to the Securities Act of 1933, as amended; and |

|

|

|

| · | "U.S. dollars," "dollars" and "$" are to the legal currency of the United States. |

All share and per share information in this report has been adjusted to give retroactive effect to a one-for-six reverse split of our authorized and outstanding common stock that was effected on October 28, 2015.

| 4 |

PART I

ITEM 1. BUSINESS.

Overview

Based on our management's belief and experience in the industry, we are a leading specialty retailer of lingerie, sexual health and wellness products. Our company was founded in 1982 in Auburn, Washington by a mother and daughter team with a focus on creating a comfortable and inviting store environment catering to women and couples. We are dedicated to creating both a place and attitude of acceptance and education for our customers. Today, our company is a leader in changing the perception of sexual wellness throughout the United States with 47 locations across 6 states.

Our stores offer a broad selection of lingerie, sexual health and wellness products and accessories. We offer over 5,000 stock keeping units, or SKUs. We strive to create a visually inspiring environment at our stores and employ highly trained, knowledgeable sales staff, which ensures that our customers leave our stores enlightened by new information, great ideas and fun products.

Our mission is to provide a warm and welcoming retail environment for individuals and couples to explore sexual wellness.

Our Corporate History and Background

Our company, Peekay Boutiques, Inc., was incorporated in the State of Nevada on October 30, 2013 under the name Dico, Inc.

On December 31, 2014, we entered into the Exchange Agreement with Christals Acquisition and its members, pursuant to which we acquired 100% of the issued and outstanding equity capital of Christals Acquisition in exchange for approximately 420,812 shares of our common stock, which constituted 70.5% of our issued and outstanding capital stock on a fully-diluted basis as of and immediately after the consummation of the transactions contemplated by the Exchange Agreement. In addition, at the closing of the share exchange, Christals paid us $350,000 in cash. This cash was immediately used for the following purposes (i) to pay down all of our outstanding liabilities, (ii) $308,436 of this cash was used as a partial payment toward the redemption of a total of 2,500,000 of our restricted shares from David Lazar, our former Chief Operating Officer and Secretary, pursuant to a redemption agreement that we entered into with Mr. Lazar on December 31, 2014, and (iii) to satisfy aggregate purchase price payable to holders of a total of approximately 175,434 shares of our common stock, which shares were transferred to the members of Christals Acquisition as a condition to the closing of the exchange transaction. In addition to receiving the $308,436 payment for the redemption of his 2,500,000 shares of our common stock, we also transferred to Mr. Lazar our remaining inventory of loose diamonds pursuant to a bill of sale and assignment agreement as the balance of the consideration for the redemption of his shares. Immediately following the closing of the exchange transaction and the related transactions described above, the former members of Christals Acquisition and certain equity owners of such members who immediately received distributions of such securities, became the owners of approximately 596,245 shares of our common stock, constituting 99.9% of our issued and outstanding common stock as of such closing. For accounting purposes, the exchange transaction with Christals Acquisition was treated as a reverse acquisition, with Christals Acquisition as the acquirer and Peekay Boutiques, Inc. as the acquired party.

As a result of our acquisition of Christals Acquisition, we now own all of the issued and outstanding equity capital of Christals Acquisition, a holding company, which in turn owns all of the equity capital of Peekay Acquisition and its several subsidiaries, which are engaged in the retail sale of lingerie, sexual health and wellness products.

| 5 |

Christals Acquisition was formed on January 3, 2012 for the purpose of acquiring all of the equity interests in each of the Christals Stores. The Christals Stores were comprised of several limited liability companies that operated as a retailer of lingerie, sexual health and wellness products. The acquisition of the Christals Stores was consummated on October 9, 2012. Thereafter, on December 31, 2012, Christals Acquisition, through its indirect subsidiary, Peekay SPA, acquired Peekay and ConRev, both of which operated as retailers of lingerie, sexual health and wellness products. Peekay was incorporated in the state of Washington on November 5, 1982. ConRev was incorporated in the state of Washington on December 29, 2004.

On January 23, 2015, we changed our name to Peekay Boutiques, Inc. to more accurately reflect our new business.

Our Corporate Structure

All of our business operations are conducted through our several operating subsidiaries. The chart below presents our corporate structure as of December 31, 2015:

| 6 |

Our principal executive offices are located at 901 West Main Street, Suite A, Auburn, Washington 98001. The telephone number at our principal executive office is 1-800-447-2993.

Our Industry

Based on our management's belief and experience in the industry, we are a specialty retailer at the forefront of the growing mainstream acceptance of sexual health and wellness products. We participate in the health, wellness and lifestyle industry, which includes beauty and anti-aging products, fitness and exercise, mind/body products and experiences, healthy eating, nutrition and weight loss sales. It also includes OTC drugs, complementary and alternative medicines and devices. On a global basis, this industry is estimated at over one trillion dollars, according to Women's Marketing. Product categories within the sexual health and wellness continuum, which we offer in our stores and on our website, include personal care products (including lubricants, lotions and moisturizers), nutritional supplements, gifts, contraceptives, and sexual products and devices. Based on our management's belief and experience in the industry, the rapid growth of this consumer sector is driven by the influence that the aging of the population of baby boomers has on the current consumer market and the increased pursuit across all ages of activities and behaviors that promote longevity and quality of life. We further believe that the increased acceptance of this sector by shoppers of all ages, especially women, has led to retailers serving the health and wellness segment to introduce a wider assortment of products. Sexual health and wellness products now grace the shelves and websites of some of America's most prominent retailers - from Walmart to Amazon. Another important factor in the growing mainstream acceptance of sexual wellness products is the change in attitudes among major publications. National periodicals such as Men's Health, Rolling Stone, Redbook, Maxim and Cosmopolitan regularly feature articles and accept advertising for vendors such as Trojan, Durex, Liberator and Lelo. Cable television is also beginning to echo the trends of sexual health and wellness in advertising by Trojan, Durex and Adam and Eve and programming like Sex and the City, Two Broke Girls, Two and a Half Men, Dr. Oz, Oprah and regular and repeat exposure in reality-based programming.

We also participate in the U.S. intimate apparel market, which is estimated at approximately $13 billion, according to WeConnectFashion.com. Our stores carry a selection of lingerie, bodystockings, undergarments and other soft goods, not unlike those carried in Victoria's Secret, Nordstrom and Macy's, to address the needs of our customer base.

Store Design and Operations

Our stores are designed and built to appeal to a mainstream customer base. Exterior signage is designed, constructed and installed by professional signage partners. Signage and logos are visible, well-lit and easy to read. The entrance to our stores typically consists of glass windows featuring high-end lingerie displays coordinated by our corporate visual merchandising department. Every detail of our stores is intended to convey a welcoming, open and friendly shopping environment.

We have engaged an architectural firm to develop a brand new retail store design. The all-female design team has decades of experience in retail store design and execution. The new store layout is designed to flourish in the highest-end shopping centers with its fun, welcoming and open atmosphere. With an energetic color palette and dynamic lighting, the new store design is aligned with the shopping preferences of today's mainstream women and couples. Our new prototype was rolled out at five locations in California, namely, North Hollywood, San Bernardino, Valencia, Palmdale and Northridge.

Merchandise

We employ a five member merchandising team responsible for product sourcing, vendor negotiations and relationship management, purchasing, planning and analysis, as well as visual merchandising. We utilize "trend-right" in-store displays, which are custom-made, feature tables designed to show elegant collections of seasonal merchandise. Our merchandising philosophy is focused on understanding our customers' needs.

| 7 |

We offer our customers a variety of wellness- and sexual health-related products. Products are designed for women and couples to enhance their sexual satisfaction and meet their broad range of expectations. We offer a variety of quality products ranging from entry-level price points to premium, high-end brands. We have over 5,000 SKUs available ranging from $1 condoms to $265 vibrators. Seasonally, new products represent 20-25% of our overall product assortment.

During the fiscal year ended December 31, 2015, our breakdown of sales by product category was as follows:

· | Sales of wellness products constituted approximately 47% of our sales. These items include massagers, vibrators, personal care, and restraints, including brands such as Jimmy Jane, Pipedream, We Vibe and SuteraTM Toys. | |

· | Sales of gift items and essentials constituted approximately 37% of our sales. These items include personal lubricants, apothecary, candles, condoms, sensitizers and desensitizers, including brands such as Crazy Girl, Kamasutra, Earthly Body and System Jo. | |

· | Sales of lingerie constituted approximately 16% of our sales. Lingerie includes a broad range of sleepwear, bodystockings, clubwear, costumes, corsets, babydolls, hosiery and panties, including brands such as Dreamgirl, Coquette, Escante and Rene Rofe. |

In addition to our broad retail brand portfolio, we also provide SuteraTM private label merchandise. Due to supply chain issues, we made a decision to sell our remaining inventory of Sutera products and not replenish our assortment, until we find a more reliable manufacturer. Our sales during 2015 have been impacted by that decision, as the table below illustrates. We expect to have a new private label assortment ready for market in 2017. As part of our change in merchandising strategy to a "wellness" focus, we have minimized our visual category, which constitutes DVD/video sales (products not targeted at our key demographic). Both of these changes have had a material impact on overall revenue and gross margin for 2015, but we believe that these changes will be accretive to our financial performance in coming years.

|

| Fiscal Year Ended December 31, |

| |||||

|

| 2015 |

|

| 2014 |

| ||

|

|

|

|

|

|

| ||

Revenue from financial statements |

| $ | 41,417,014 |

|

| $ | 39,624,783 |

|

Deduct: DVD sales |

|

| 432,480 |

|

|

| 868,576 |

|

Sutera sales |

|

| 1,429,548 |

|

|

| 2,762,817 |

|

Adjusted revenue |

| $ | 39,554,986 |

|

| $ | 35,993,390 |

|

Adjusted revenue growth – YOY |

|

| 9.9 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross margin from financial statements |

| $ | 26,591,538 |

|

| $ | 25,884,435 |

|

Deduct: DVD gross margin |

|

| 275,922 |

|

|

| 552,415 |

|

Sutera gross margin |

|

| 1,150,195 |

|

|

| 2,249,340 |

|

Adjusted gross margin |

| $ | 25,165,421 |

|

| $ | 23,082,680 |

|

Adjusted margin % |

|

| 63.6 | % |

|

| 64.1 | % |

| 8 |

The adjusted revenue, adjusted revenue growth percentage, adjusted gross margin and adjusted gross margin percentage numbers in the above table are non-GAAP financial measures. The above table includes a reconciliation of such non-GAAP financial measures to revenue and gross margin, their GAAP counterparts. Management believes that the non-GAAP financial measures contained in the table above, when viewed with our results of operations in accordance with GAAP, provide additional information to investors about how changes in our assortment impact sales, sales growth and margin. By providing these non-GAAP financial measures, we believe we are enhancing investors' understanding of our business, our results of operations and our core profitability, as well as assisting investors in evaluating how well we are executing strategic initiatives.

Marketing and Advertising

We market our retail stores through a variety of channels, including billboards, direct mail, radio, interactive and social media and grassroots events. All new stores are allotted a special marketing budget dedicated to a grand opening event. We have an integrated marketing plan that extends from out-of-store to in-store elements, including posters, signage and displays created by a professional in-house design staff.

Store Locations

We select geographic areas and store sites on the basis of demographic information, the quality and nature of neighboring tenants, store visibility and location accessibility. We seek to locate stores primarily in or near centers with major national brands and regional brands such as Target, Walgreens, TJ Maxx, Sally Beauty Supply, Starbucks and others. Based on our management's belief and experience in the industry, our customer demographics also align well with those of Nordstrom, Macy's and other higher-end specialty retailers.

We balance our store expansion between new and existing marketplaces. In our existing marketplaces, we add stores as necessary to provide additional coverage. In new marketplaces, we generally seek to expand in geographically contiguous areas to leverage our experience. We believe that our knowledge of local marketplaces is an important part of our success.

The following table provides a history of our store count from January 2013 through December 2015:

|

| Fiscal Year Ended |

| |||||

|

| 2015 |

|

| 2014 |

| ||

Stores open at beginning of period |

|

| 47 |

|

|

| 44 |

|

Net store openings during period |

|

| 1 |

|

|

| 3 |

|

Stores acquired during period |

|

| - |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

Stores open at end of period |

|

| 48 |

|

|

| 47 |

|

Our Stores

We currently operate our stores under four banners: Lovers, A Touch of Romance, ConRev and Christals. The Christals stores, located in Texas, Tennessee and Iowa, were acquired in October 2012. The Lovers, A Touch of Romance and ConRev stores were acquired on December 31, 2012, and are located in Washington, Oregon and California. As of December 31, 2015, the average life of these stores is just over 15 years, so we believe they have demonstrated marketplace acceptance, through longevity and financial performance, and they continue to be a significant, producing asset for our company. For the fiscal year ended December 31, 2015, our stores achieved a same store revenue increase of 3.1% as compared to same period in 2014. For the purpose of calculating our same store sales metrics, we compare the current period sales for stores open for 14 months or longer as of the last day of a month with the sales for these stores for the comparable period in the prior fiscal year.

| 9 |

The six new stores opened in 2014 and 2015 are located in Southern California and were opened under the A Touch of Romance banner. The new store model calls for a payback of the initial cash outlay for improvements, fixtures and store opening costs within a three year period. Half of these new California stores are close to breakeven or have started to generate positive store contribution, and the Beaverton, Oregon store, which opened in February 2013, has generated $1.8 million in revenue and $346 thousand in store contribution during its first three years of operation. Our Santa Monica, California store did not produce the results we expected, so we closed that location at the end of February 2016. We believe, as the rest of the stores opened during 2014 and 2015 will mature and be fully capable of producing similar volumes and contributions as our legacy stores.

Competition

Our major competitors for our sexual health and wellness products include such mainstream retailers as Walmart, Rite Aid, CVS Pharmacy, GNC and Walgreens. For our lingerie products, we compete with traditional department stores such as Macy's and Nordstrom and specialty stores such as Victoria's Secret. We compete with the online businesses of the aforementioned retailers, as well as pure play e-commerce businesses such as Amazon, Overstock.com and Drugstore.com. We also compete with certain adult stores including Adam & Eve, Lovers Lane, Good Vibrations and Fascinations; however, we do not carry pornographic media. Our competitive advantages are the quality and assortment of our merchandise and services, the quality of our customers' shopping experience brought about as the result of our knowledgeable and welcoming sales personnel and the convenience of our stores and website as a one-stop destination for lingerie, sexual health and wellness products.

Customer Service

We strive to complement our extensive merchandise selection and innovative store design with superior customer service. We actively recruit individuals with significant knowledge and experience in the field of lingerie, sexual health and wellness products. We try to ensure that our customers walk out of our stores enlightened with new information, great ideas and fun products. We seek individuals with retail experience because we believe their general retail knowledge can be leveraged in the lingerie, sexual health and wellness products industry. We believe that employees' knowledge of the products and ability to explain the advantages of the products increases sales and that their prompt, knowledgeable service fosters the confidence and loyalty of customers and differentiates our business from other professional retailers of lingerie, sexual health and wellness products. Our employees are trained to foster a warm and welcoming retail environment for individuals and couples to explore sexual wellness. We believe that this attitude of acceptance and education for consumers sets us apart from our competitors.

We emphasize product knowledge during initial training as well as during ongoing training sessions, with programs intended to provide new associates and managers with significant training. The training programs encompass operational and product training and are designed to increase employee and store productivity. Store employees are also required to participate in training on an ongoing basis to keep up-to-date on new products and operational practices.

Most of our stores are staffed with a store manager, assistant store manager and two or three part-time associates. A district manager, who reports directly to the Vice President of Retail, supervises the operations of each store.

| 10 |

Relationships with Vendors

We employ a variety of vendors with no single vendor representing 10% or more of our total purchases. We maintain close relationships with our domestic and foreign vendors. We believe that our broad store footprint and geographic reach provides us with an ability to form long-standing relationships with suppliers. We source more than 85% of our products directly from U.S. based companies. Our private label brand, SuteraTM, constitutes about 6% of our sales and is sourced from manufacturers in China. We believe that our relatively large industry presence allows us privileged access to premium factories resulting in a reliable and responsive supply chain.

Top 20 Vendors

(#s are in thousands)

Vendor |

| 2015 |

|

| 2014 |

|

| % of |

| |||

Vendor # 1 |

| $ | 942 |

|

|

| 1,050 |

|

|

| 7.5 | % |

Vendor # 2 |

|

| 923 |

|

|

| 765 |

|

|

| 7.3 | % |

Vendor # 3 |

|

| 775 |

|

|

| 708 |

|

|

| 6.1 | % |

Vendor # 4 |

|

| 731 |

|

|

| 802 |

|

|

| 5.8 | % |

Vendor # 5 |

|

| 650 |

|

|

| 559 |

|

|

| 5.1 | % |

Vendor # 6 |

|

| 540 |

|

|

| 569 |

|

|

| 4.3 | % |

Vendor # 7 |

|

| 539 |

|

|

| 747 |

|

|

| 4.3 | % |

Vendor # 8 |

|

| 526 |

|

|

| 427 |

|

|

| 4.2 | % |

Vendor # 9 |

|

| 462 |

|

|

| 398 |

|

|

| 3.7 | % |

Vendor # 10 |

|

| 396 |

|

|

| 403 |

|

|

| 3.1 | % |

Vendor # 11 |

|

| 328 |

|

|

| - |

|

|

| 2.6 | % |

Vendor # 12 |

|

| 326 |

|

|

| 262 |

|

|

| 2.6 | % |

Vendor # 13 |

|

| 275 |

|

|

| 236 |

|

|

| 2.2 | % |

Vendor # 14 |

|

| 267 |

|

|

| 306 |

|

|

| 2.1 | % |

Vendor # 15 |

|

| 237 |

|

|

| 262 |

|

|

| 1.9 | % |

Vendor # 16 |

|

| 216 |

|

|

| 209 |

|

|

| 1.7 | % |

Vendor # 17 |

|

| 214 |

|

|

| 228 |

|

|

| 1.7 | % |

Vendor # 18 |

|

| 210 |

|

|

| 146 |

|

|

| 1.7 | % |

Vendor # 19 |

|

| 209 |

|

|

| 214 |

|

|

| 1.7 | % |

Vendor # 20 |

|

| 205 |

|

|

| 155 |

|

|

| 1.6 | % |

|

| $ | 8,970 |

|

| $ | 8,447 |

|

|

| 71.2 | % |

Products are purchased from these vendors on an at-will basis or under contracts which can be terminated without cause upon 90 days' notice or less or expire without express rights of renewal. Such manufacturers could discontinue sales to us at any time or upon short notice. If any of these suppliers discontinued selling or were unable to continue selling to us, there could be a material adverse effect on our business and results of operations.

| 11 |

As is typical in the distribution businesses, relationships with vendors are subject to change from time to time. Changes in our relationships with vendors occur often, and could positively or negatively impact our net sales and operating profits. However, we believe that we can be successful in mitigating negative effects resulting from unfavorable changes in the relationships between us and our vendors through, among other things, the development of new or expanded vendor relationships.

Management Information Systems

Our management information systems provide order processing, accounting and management information for the marketing, distribution and store operations functions of our business. The enterprise resource planning functionality is built on the Microsoft Dynamics platform with custom add-ons from certified solutions providers. The information gathered by the enterprise resource planning software supports automatic replenishment of in-store inventory and provides support for product purchase decisions.

Trademarks and Other Intellectual Property Rights

Our trademarks, certain of which are material to our business, are registered or legally protected in the U.S. Together with our subsidiaries; we own 10 trademark registrations in the U.S. We also rely upon trade secrets and know-how to develop and maintain our competitive position. We protect intellectual property rights through a variety of methods, including reliance upon trademark, patent and trade secret laws and confidentiality agreements with many vendors, employees, consultants and others who have access to our proprietary information. The duration of our trademark registrations is generally 2 years.

Regulation

We are subject to a wide variety of laws and regulations, which historically have not had a material effect on our business. For example, in the U.S., most of the products sold and the content and methods of advertising and marketing utilized are regulated by a host of federal agencies, including, in each case, one or more of the following: the Food and Drug Administration, or FDA, the Federal Trade Commission, or FTC, and the Consumer Products Safety Commission. Since we are a retailer (and not a manufacturer) of these products, responsibility for compliance generally falls upon the manufacturer. In marketplaces outside of the U.S., regulation is also comprehensive and focused upon product labeling and safety issues.

Employees

As of December 31, 2015, we had a total of 337 employees, 144 of whom are full-time employees. The following table sets forth the number of our full-time employees by function.

Function |

| Number |

| |

Retail Sales |

|

| 102 |

|

Retail Management & Support |

|

| 8 |

|

Retail Marketing & E-commerce |

|

| 8 |

|

Warehousing and Distribution |

|

| 7 |

|

Merchandising and Inventory Management |

|

| 5 |

|

Accounting, Payroll and Benefits Administration |

|

| 4 |

|

IT Support |

|

| 3 |

|

Loss Prevention |

|

| 3 |

|

Executive Management |

|

| 3 |

|

Maintenance |

|

| 1 |

|

Total |

|

| 144 |

|

| 12 |

None of our employees belong to a union or are a party to any collective bargaining or similar agreement. We consider our relationships with our employees to be good.

Legal Proceedings

From time to time, we may become involved in various lawsuits and legal proceedings, which arise, in the ordinary course of business. However, litigation is subject to inherent uncertainties, and an adverse result in these, or other matters, may arise from time to time that may harm our business. We are currently not aware of any such legal proceedings or claims that we believe will have a material adverse effect on our business, financial condition or operating results.

Emerging Growth Company Status

We qualify as an "emerging growth company" under the JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements. For so long as we are an emerging growth company, we will not be required to:

· | have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act; | |

· | comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor's report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); | |

· | submit certain executive compensation matters to shareholder advisory votes, such as "say-on-pay" and "say-on-frequency;" and | |

· | disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the CEO's compensation to median employee compensation. |

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

| 13 |

We will remain an "emerging growth company" for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our total annual gross revenues exceed $1 billion, (ii) the date that we become a "large accelerated filer" as defined in Rule 12b-2 under the Securities Exchange Act of 1934, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

ITEM 1A. RISK FACTORS.

Risks Related To Our Business

Our auditor has raised substantial doubt about our ability to continue as a going concern. If we are unable to refinance our existing senior debt or otherwise raise capital, we may be forced to cease operations and liquidate.

Our financial statements have been prepared assuming that we will continue as a going concern, which contemplates the realization of assets and the liquidation of liabilities in the normal course of business. During 2014 and 2015, we incurred net losses of $4.2 million and $46.7 million (including a $40.6 million goodwill impairment charge), respectively. Our net losses are largely a result of interest expense on the approximately $51 million of debt, which exceeds the operating profits generated through the operations of our business. Approximately $38.2 million in senior secured debt matured on February 15, 2016, and we do not have the resources necessary to pay this debt and we have been unable to find replacement financing. We are currently operating under a Forbearance Agreement with our lenders, but we may be forced to file for bankruptcy and/or liquidate our assets if we are unable to meet the terms of the agreement. Our ability to continue our operations and execute our business plan is dependent on our ability to refinance this debt and/or to raise sufficient capital to pay this debt and other obligations as they come due (or are extended through a refinancing) and to provide sufficient capital to operate our business as contemplated. If we are unable to refinance our existing senior debt or raise equity capital we may have to cease operations and liquidate our assets and the holders of our equity may lose all or a significant portion of the value of their equity.

Our substantial indebtedness could adversely affect our financial condition.

We have a significant amount of indebtedness. As of December 31, 2015, our total debt, including accrued interest and fees, was approximately $56 million.

Subject to the limits contained in our existing debt instruments, we may be able to incur substantial additional debt from time to time to finance working capital, capital expenditures, investments or acquisitions, or for other purposes. Due to the capital intensive nature of our business and our growth strategy, we expect that we will incur additional indebtedness in the future. If we do so, the risks related to our high level of debt could intensify. Specifically, our high level of debt could adversely affect our financial condition by, for example:

· | making it more difficult for us to satisfy our obligations with respect to our existing debt; | |

· | limiting our ability to obtain additional financing to fund future working capital, capital expenditures, acquisitions or other general corporate requirements; |

| 14 |

· | requiring a substantial portion of our cash flows to be dedicated to debt service payments instead of other purposes, thereby reducing the amount of cash flows available for working capital, capital expenditures, acquisitions and other general corporate purposes; | |

· | increasing our vulnerability to general adverse economic and industry conditions; | |

· | exposing us to the risk of increased interest rates as certain of our borrowings may be at variable rates of interest in the future; | |

· | limiting our flexibility in planning for and reacting to changes in the industry in which we compete; | |

· | placing us at a disadvantage compared to other, less leveraged competitors; and | |

· | increasing our cost of borrowing. |

We may not be able to generate sufficient cash to service all of our indebtedness, and may be forced to take other actions to satisfy our obligations under our indebtedness, which may not be successful.

Our ability to make scheduled payments on or refinance our debt obligations, depends on our financial condition and operating performance, which are subject to prevailing economic and competitive conditions and to certain financial, business, legislative, regulatory and other factors beyond our control. We may be unable to maintain a level of cash flows from operating activities sufficient to permit us to pay the principal, premium, if any, and interest on our indebtedness.

If our cash flows and capital resources are insufficient to fund our debt service obligations, we could face substantial liquidity problems and could be forced to reduce or delay investments and capital expenditures or to dispose of material assets or operations, seek additional debt or equity capital or restructure or refinance our indebtedness, including the notes. We may not be able to affect any such alternative measures, if necessary, on commercially reasonable terms or at all and, even if successful, those alternative actions may not allow us to meet our scheduled debt service obligations.

Approximately $38.2 million in senior secured debt matured on February 15, 2016, and we do not have the resources necessary to pay this debt and we have been unable to find replacement financing. We are currently operating under a Forbearance Agreement with our lenders, but we may be forced to file for bankruptcy and/or liquidate our assets if we are unable to meet the terms of the agreement. See "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations – Loan Commitments – Financing Agreement; Amendments and Waivers" for more information regarding our Financing Agreement with our senior lenders and the related forbearance agreement that we entered into with our senior lenders.

| 15 |

We may need to raise additional funds to pursue our growth strategy, and we may be unable to raise capital when needed, which could have a material adverse effect on our business, financial condition, profitability and cash flows.

From time to time we may seek additional equity or debt financing to provide for capital expenditures and working capital consistent with our growth strategy. In addition, if general economic, financial or political conditions in our markets change, or if other circumstances arise that have a material effect on our cash flow, the anticipated cash needs of our business as well as our belief as to the adequacy of our available sources of capital could change significantly. Any of these events or circumstances could result in significant additional funding needs, requiring us to raise additional capital to meet those needs. If financing is not available on satisfactory terms or at all, we may be unable to execute our growth strategy as planned and our results of operations may suffer.

The health of the economy in the channels we serve may affect consumer purchases of discretionary items such as lingerie, sexual health and wellness products, which could have a material adverse effect on our business, financial condition, profitability and cash flows. In addition, the recent global economic crisis and volatility in global economic conditions and the financial markets may adversely affect our business, financial condition, profitability, and cash flows.

Our results of operations may be materially affected by conditions in the global capital markets and the economy generally, both in the U.S. and internationally. Concerns over inflation, employment, tax laws, energy costs, healthcare costs, geopolitical issues, terrorism, the availability and cost of credit, the mortgage market, sovereign and private banking systems, sovereign deficits and increasing debt burdens and the real estate and other financial markets in the U.S. and Europe have contributed to increased volatility and diminished expectations for the U.S. and certain foreign economies. We appeal to a wide demographic consumer profile and offer an extensive selection of lingerie, sexual health and wellness products sold to retail consumers. Continued uncertainty in the economy could adversely impact consumer purchases of discretionary items across all of our product categories. Factors that could affect consumers' willingness to make such discretionary purchases include: general business conditions, levels of employment, interest rates, tax rates, the availability of consumer credit and consumer confidence in future economic conditions. In the event of a prolonged economic downturn or acute recession, consumer spending habits could be adversely affected and we could experience lower than expected net sales.

In addition, the recent global economic crisis and volatility and disruption to the capital and credit markets have had a significant, adverse impact on global economic conditions, resulting in recessionary pressures and declines in consumer confidence and economic growth. While these declines have moderated, the level of consumer spending is not where it was prior to the global recession, and economic conditions could lead to further declines in consumer spending in the future. Additionally, there can be no assurance that various governmental activities to stabilize the markets and stimulate the economy will restore consumer confidence or change spending habits. Reduced consumer spending could cause changes in customer order patterns and changes in the level of merchandise purchased by our customers, and may signify a reset of consumer spending habits, all of which may adversely affect our business, financial condition, profitability and cash flows.

Recent economic conditions have also resulted in a tightening of the credit markets, including lending by financial institutions, which is a source of capital for our borrowing and liquidity. This tightening of the credit markets has increased the cost of capital and reduced the availability of credit. Concern about the stability of the markets generally and the strength of counterparties specifically has led many lenders and institutional investors to reduce, and in some cases, cease to provide credit to businesses and consumers. These factors have led to a decrease in spending by businesses and consumers alike, and a corresponding decrease in global infrastructure spending. While global credit and financial markets appear to be recovering from extreme disruptions experienced over the past few years, uncertainty about continuing economic stability remains. It is difficult to predict how long the current economic and capital and credit market conditions will continue, the extent to which they will continue to recover, if at all, and which aspects of our products or business may be adversely affected. Current market and credit conditions could continue to make it more difficult for developers and landlords to obtain the necessary credit to build new retail centers. A significant decrease in new retail center development could limit our future growth opportunities as long as the aforementioned conditions exist.

| 16 |

Additionally, the general deterioration in economic conditions could adversely affect our commercial partners including our product vendors as well as the real estate developers and landlords who we rely on to construct and operate centers in which our stores are located. A bankruptcy or financial failure of a significant vendor or a number of significant real estate developers or shopping center landlords could have a material adverse effect on our business, financial condition, profitability, and cash flows.

We may be unable to compete effectively in our highly competitive markets.

The markets for lingerie, sexual health and wellness products are highly competitive with few barriers to entry. We compete against a diverse group of retailers, both small and large, including regional and national department stores, specialty retailers, drug stores, mass merchandisers, Internet businesses, and catalog retailers. We believe the principal bases upon which we compete are the breadth of merchandise, the quality of our customers' shopping experience and the convenience of our stores as one-stop destinations for lingerie, sexual health and wellness products and services. Many of our competitors are, and many of our potential competitors may be, larger and have greater financial, marketing and other resources and therefore may be able to adapt to changes in customer requirements more quickly, devote greater resources to the marketing and sale of their products, generate greater national brand recognition or adopt more aggressive pricing policies than we can. As a result, we may lose market share, which could have a material adverse effect on our business, financial condition, profitability and cash flows.

If we are unable to stay abreast of trends in the lingerie, sexual health and wellness products market and react to changing consumer preferences in a timely manner, our sales will decrease.

We believe our success depends in substantial part on our ability to:

· | create a warm and welcoming retail environment for individuals and couples to explore sexual wellness; | |

· | recognize and define trends in lingerie, sexual health and wellness products; |

· | anticipate, gauge and react to changing consumer demands in a timely manner; | |

· | translate market trends into appropriate, saleable product and service offerings in our stores in advance of our competitors; | |

· | source, develop and maintain vendor relationships that provide us access to the newest merchandise on reasonable terms; and | |

· | distribute merchandise to our stores in an efficient and effective manner and maintain appropriate in-stock levels. |

| 17 |

If we are unable to anticipate and fulfill the merchandise needs of the regions in which we operate, our net sales may decrease and we may be forced to increase markdowns of slow-moving merchandise, either of which could have a material adverse effect on our business, financial condition, profitability and cash flows.

If we fail to retain our existing senior management team or attract qualified new personnel, such failure could have a material adverse effect on our business, financial condition, profitability and cash flows.

Our business requires disciplined execution at all levels of our organization. This execution requires an experienced and talented management team. Lisa Berman was appointed as our Chief Executive Officer upon the consummation of the reverse acquisition on December 31, 2014. Janet Mathews was appointed Chief Financial Officer of Christals Acquisition effective April 2014 and became our Chief Financial Officer upon the closing of the reverse acquisition, and Bob Patterson was appointed as the Chief Information Officer of Christals Acquisition effective January 2013, was promoted to Chief Operating Officer of Christals Acquisition in October 2014 and became our Chief Operating Officer upon the consummation of the reverse acquisition. If we were to lose the benefit of the experience, efforts and abilities of key executive personnel, it could have a material adverse effect on our business, financial condition, profitability and cash flows. Furthermore, our ability to manage our retail expansion will require us to continue to train, motivate and manage our associates. We will need to attract, motivate and retain additional qualified executive, managerial and merchandising personnel and store associates. Competition for this type of personnel is intense, and we may not be successful in attracting, assimilating and retaining the personnel required to grow and operate our business profitably.

Our comparable store sales and quarterly financial performance may fluctuate for a variety of reasons, which could result in a decline in the price of our common stock.

Our comparable store sales and quarterly results of operations have fluctuated in the past, and we expect them to continue to fluctuate in the future. A variety of factors affect our comparable store sales and quarterly financial performance, including:

· | general U.S. economic conditions and, in particular, the retail sales environment; | |

· | changes in our merchandising strategy or mix; | |

· | performance of our new and remodeled stores; | |

· | the effectiveness of our inventory management; |

· | timing and concentration of new store openings, including additional human resource requirements and related pre-opening and other start-up costs; | |

· | cannibalization of existing store sales by new store openings; | |

· | levels of pre-opening expenses associated with new stores; | |

· | timing and effectiveness of our marketing activities; | |

· | seasonal fluctuations due to weather conditions; and | |

· | actions by our existing or new competitors. |

| 18 |

Accordingly, our results for any one fiscal quarter are not necessarily indicative of the results to be expected for any other quarter, and comparable store sales for any particular future period may decrease. In that event, the price of our common stock would likely decline. For more information on our quarterly results of operations, see "Management's Discussion and Analysis of Financial Condition and Results of Operations."

We may not be able to sustain our growth plans and successfully develop and implement our long-range strategic and financial plan, which could have a material adverse effect on our business, financial condition, profitability and cash flows. In addition, we intend to continue to open new stores, which could strain our resources and have a material adverse effect on our business, financial condition, profitability and cash flows.

Our continued and future growth largely depends on our ability to implement our long-range strategic and financial plan and successfully open and operate new stores on a profitable basis. Our senior management is currently evaluating our long-range strategic and financial plan to align and prioritize our growth strategies, as well as additional investments that will be needed to support continued and future growth. There can be no assurance that we will be successful in implementing our growth plan or long-range strategic initiatives, and our failure to do so could have a material adverse impact on our business, financial condition, profitability and cash flows. During fiscal 2013, we opened 2 new stores and in fiscal 2014, we opened 5 new stores with a sixth store opened in March 2015. Due to operating shortfalls, one of the stores opened in 2014 was closed on February 29, 2016. We intend to continue to grow our number of stores for the foreseeable future. During fiscal 2014/2015, the average investment required to open a typical new store, including inventory, was approximately $260,000. Our continued expansion places increased demands on our financial, managerial, operational, supply-chain and administrative resources. For example, our planned expansion will require us to increase the number of people we employ as well as to monitor and upgrade our management information and other systems and our distribution infrastructure. These increased demands and operating complexities could cause us to operate our business less efficiently and could have a material adverse effect on our business, financial condition, profitability and cash flows.

A reduction in traffic to, or the closing of, the other destination retailers in the shopping areas where our stores are located could significantly reduce our sales and leave us with unsold inventory, which could have a material adverse effect on our business, financial condition, profitability and cash flows.

As a result of our real estate strategy, most of our stores are located in off-mall shopping areas known as strip centers and power centers. Power centers typically contain three to five big-box anchor stores along with a variety of smaller specialty tenants and a strip center has two to six retail co-tenants. As a consequence of most of our stores being located in such shopping areas, our sales are derived, in part, from the volume of traffic generated by the other destination retailers and the anchor stores in the retail areas and power centers where our stores are located. Customer traffic to these shopping areas may be adversely affected by the closing of destination retailers or anchor stores, or by a reduction in traffic to such stores resulting from a regional or global economic downturn, a general downturn in the local area where our store is located, or a decline in the desirability of the shopping environment of a particular retail area. Such a reduction in customer traffic would reduce our sales and leave us with excess inventory, which could have a material adverse effect on our business, financial condition and results of operations. We may respond by increasing markdowns or initiating marketing promotions to reduce excess inventory, which would further decrease our gross profits and net income. This risk is more pronounced during the recent economic downturn that has resulted in a number of national retailers filing for bankruptcy or closing stores due to depressed consumer spending levels.

| 19 |

We may acquire entities with significant leverage, increasing the entity's exposure to adverse economic factors.

Our future acquisitions could include entities whose capital structures may have significant leverage. Although we will seek to use leverage in a manner we believe is prudent, any leveraged capital structure of such investments will increase the exposure of the acquired entity to adverse economic factors such as rising interest rates, downturns in the economy or deteriorations in the condition of the relevant entity or their industries. If an entity cannot generate adequate cash flow to meet its debt obligations, we may suffer a partial or total loss of capital invested in such entity. To the extent there is not ample availability of financing for leveraged transactions (e.g., due to adverse changes in economic or financial market conditions or a decreased appetite for risk by lenders); our ability to consummate certain transactions could be impaired.

We may not be able to successfully identify acquisition candidates or successfully complete desirable acquisitions.

In the past several years, we have completed multiple acquisitions and we intend to pursue additional acquisitions in the future. We actively review acquisition prospects, which would complement our existing lines of business, increase the size and geographic scope of our operations or otherwise offer growth and operating efficiency opportunities. There can be no assurance that we will continue to identify suitable acquisition candidates.

If suitable candidates are identified, sufficient funds may not be available to make such acquisitions. We compete against many other companies, some of which have greater financial and other resources than we do. Increased competition for acquisition candidates could result in fewer acquisition opportunities and higher acquisition prices. In addition, we are highly leveraged and the agreements governing our indebtedness contain limits on our ability to incur additional debt to pay for acquisitions. Additionally, the amount of equity that we can issue to make acquisitions or raise additional capital is severely limited. We may be unable to finance acquisitions that would increase our growth or improve our financial and competitive position. To the extent that debt financing is available to finance acquisitions, our net indebtedness could increase as a result of any acquisitions.

If we acquire any businesses in the future, they could prove difficult to integrate, disrupt our business or have an adverse effect on our results of operations.

Any acquisitions that we do make may be difficult to integrate profitably into our business and may entail numerous risks, including:

· | difficulties in assimilating acquired operations, stores or products, including the loss of key employees from acquired businesses; | |

· | difficulties and costs associated with integrating and evaluating the distribution or information systems and/or internal control systems of acquired businesses; |

| 20 |

· | difficulties in competing with existing stores or business or diverting sales from existing stores or business; | |

· | expenses associated with the amortization of identifiable intangible assets; |

· | problems retaining key technical, operational and administrative personnel; | |

· | diversion of management's attention from our core business, including loss of management focus on marketplace developments; | |

· | adverse effects on existing business relationships with suppliers and customers, including the potential loss of suppliers of the acquired businesses; | |

· | operating inefficiencies and negative impact on profitability; | |

· | entering geographic areas or channels in which we have limited or no prior experience; and | |

· | those related to general economic and political conditions, including legal and other barriers to cross-border investment in general, or by U.S. companies in particular. |

In addition, during the acquisition process, we may fail or be unable to discover some of the liabilities of businesses that we acquire. These liabilities may result from a prior owner's noncompliance with applicable laws and regulations. Acquired businesses may also not perform as we expect or we may not be able to obtain the expected financial improvements in the acquired businesses.

If we are unable to profitably open and operate new stores, our business, financial condition and results of operations may be adversely affected.

Our future growth strategy depends in part on our ability to open and profitably operate new stores in existing and additional geographic areas. In the U.S., the capital requirements to open a new store, including inventory, average approximately $260,000. We may not be able to open all of the new stores we plan to open and any new stores we open may not be profitable, either of which could have a material adverse impact on our financial condition or results of operations. There are several factors that could affect our ability to open and profitably operate new stores, including:

· | the inability to identify and acquire suitable sites or to negotiate acceptable leases for such sites; | |

· | proximity to existing stores that may reduce the new store's sales or the sales of existing stores; | |

· | difficulties in adapting our distribution and other operational and management systems to an expanded network of stores; |

| 21 |

· | the level of sales made through our internet channels and the potential that sales through our internet channels will divert sales from our stores; | |

· | the potential inability to obtain adequate financing to fund expansion because of our high leverage and limitations on our ability to issue equity under our credit agreements, among other things; | |

· | difficulties in obtaining any governmental and third-party consents, permits and licenses; | |

· | limitations on capital expenditures in our financing agreement with our senior creditors and in other credit agreements that we may enter into in the future; and | |

· | difficulties in adapting existing operational and management systems to the requirements of national or regional laws and local ordinances. |

In addition, as we continue to open new stores, our management, as well as our financial, distribution and information systems, and other resources will be subject to greater demands. If our personnel and systems are unable to successfully manage this increased burden, our results of operations may be materially affected.

We have identified material weaknesses in our internal control over financial reporting. If we fail to develop or maintain an effective system of internal controls, we may not be able to accurately report our financial results and prevent fraud. As a result, current and potential stockholders could lose confidence in our financial statements, which would harm the trading price of our common stock.

Companies that file reports with the SEC, including us, are subject to the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or SOX 404. SOX 404 requires management to establish and maintain a system of internal control over financial reporting and annual reports on Form 10-K filed under the Exchange Act to contain a report from management assessing the effectiveness of a company's internal control over financial reporting. Separately, under SOX 404, as amended by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, public companies that are large accelerated filers or accelerated filers must include in their annual reports on Form 10-K an attestation report of their regular auditors attesting to and reporting on management's assessment of internal control over financial reporting. Non-accelerated filers and smaller reporting companies, like us, are not required to include an attestation report of their auditors in annual reports.

We are a smaller reporting company and, consequently, are not required to include an attestation report of our auditor in our annual report. However, if and when we become subject to the auditor attestation requirements under SOX 404, we can provide no assurance that we will receive a positive attestation from our independent auditors.

| 22 |

During its evaluation of the effectiveness of internal control over financial reporting as of December 31, 2015, management identified material weaknesses. These material weaknesses were associated with separation of duties, internal control process documentation and testing of controls, and uninstalled software updates. We are undertaking remedial measures, which measures will take time to implement and test, to address this material weakness. There can be no assurance that such measures will be sufficient to remedy the material weakness identified or that additional material weaknesses or other control or significant deficiencies will not be identified in the future. If we continue to experience material weaknesses in our internal controls or fail to maintain or implement required new or improved controls, such circumstances could cause us to fail to meet our periodic reporting obligations or result in material misstatements in our financial statements, or adversely affect the results of periodic management evaluations and, if required, annual auditor attestation reports. Each of the foregoing results could cause investors to lose confidence in our reported financial information and lead to a decline in our stock price.

We depend upon manufacturers who may be unable to provide products of adequate quality or who may be unwilling to continue to supply products to us.

We do not manufacture any products we sell, and instead purchase our products from manufacturers and private label fillers. Since we purchase products from many manufacturers and fillers under at-will contracts and contracts which can be terminated without cause upon 90 days' notice or less, or which expire without express rights of renewal, manufacturers and fillers could discontinue sales to us immediately or upon short notice. In lieu of termination, a manufacturer may also change the terms upon which it sells, for example, by raising prices or broadening distribution to third parties. For these and other reasons, we may not be able to acquire desired merchandise in sufficient quantities or on acceptable terms in the future.

Any significant interruption in the supply of products by manufacturers and fillers could disrupt our ability to deliver merchandise to our stores and customers in a timely manner, which could have a material adverse effect on our business, financial condition and results of operations.

Manufacturers and label fillers are subject to certain risks that could adversely impact their ability to provide us with their products on a timely basis, including inability to procure ingredients, industrial accidents, environmental events, strikes and other labor disputes, union organizing activity, disruptions in logistics or information systems, loss or impairment of key manufacturing sites, product quality control, safety, and licensing requirements and other regulatory issues, as well as natural disasters and other external factors over which neither they nor we have control. In addition, our operating results depend to some extent on the orderly operation of our receiving and distribution processes, which depend on manufacturers' adherence to shipping schedules and our effective management of our distribution facilities and capacity.

If a material interruption of supply occurs, or a significant manufacturer or filler ceases to supply us or materially decreases its supply to us, we may not be able to acquire products with similar quality as the products we currently sell or to acquire such products in sufficient quantities to meet our customers' demands or on favorable terms to our business, any of which could adversely impact our business, financial condition and results of operations.

| 23 |

If products sold by us are found to be defective in labeling or content, our credibility and that of the brands we sell may be harmed, marketplace acceptance of our products may decrease, and we may be exposed to liability in excess of our products liability insurance coverage and manufacturer indemnities.

We do not control the production process for the products we sell. We may not be able to identify a defect in a product we purchase from a manufacturer or label filler before we offer such product for resale. In many cases, we rely on representations of manufacturers and fillers about the products we purchase for resale regarding the composition, manufacture and safety of the products, as well as the compliance of our product labels with government regulations. Our sale of certain products exposes us to potential product liability claims, recalls or other regulatory or enforcement actions initiated by federal, state or foreign regulatory authorities or through private causes of action. Such claims, recalls or actions could be based on allegations that, among other things, the products sold by us are misbranded, contain contaminants or impermissible ingredients, provide inadequate instructions regarding their use or misuse, or include inadequate warnings concerning flammability or interactions with other substances. Claims against us could also arise as a result of the misuse by purchasers of such products or as a result of their use in a manner different than the intended use. We may be required to pay for losses or injuries actually or allegedly caused by the products we sell and to recall any product we sell that is alleged to be or is found to be defective.

Any actual defects or allegations of defects in products sold by us could result in adverse publicity and harm our credibility or the credibility of the manufacturer, which could adversely affect our business, financial condition and results of operations. Although we may have indemnification rights against the manufacturers of many of the products we distribute and rights as an "additional insured" under the manufacturers' insurance policies, it is not certain that any manufacturer or insurer will be financially solvent and capable of making payment to any party suffering loss or injury caused by products sold by us. Further, some types of actions and penalties, including many actions or penalties imposed by governmental agencies and punitive damages awards, may not be remediable through reliance on indemnity agreements or insurance. Furthermore, potential product liability claims may exceed the amount of indemnity or insurance coverage or be excluded under the terms of an indemnity agreement or insurance policy and claims for indemnity or reimbursement by us may require us to expend significant resources and may take years to resolve. If we are forced to expend significant resources and time to resolve such claims or to pay material amounts to satisfy such claims, it could have an adverse effect on our business, financial condition and results of operations.

We rely on our good relationships with vendors to supply lingerie, sexual health and wellness products on reasonable terms. If these relationships were to be impaired, or if certain vendors were to change their distribution model or are unable to supply sufficient merchandise to keep pace with our growth plans, we may not be able to obtain a sufficient selection or volume of merchandise on reasonable terms, and we may not be able to respond promptly to changing trends in lingerie, sexual health and wellness products, either of which could have a material adverse effect on our competitive position, business, financial condition, profitability and cash flows.

We have no long-term supply agreements or exclusive arrangements with vendors and, therefore, our success depends on maintaining good relationships with our vendors. Our business depends to a significant extent on the willingness and ability of our vendors to supply us with a sufficient selection and volume of products to stock our stores. Some of our vendors may not have the capacity to supply us with sufficient merchandise to keep pace with our growth plans. If we fail to maintain strong relationships with our existing vendors, or fail to continue acquiring and strengthening relationships with additional vendors of lingerie, sexual health and wellness products, our ability to obtain a sufficient amount and variety of merchandise on reasonable terms may be limited, which could have a negative impact on our competitive position.

| 24 |

Any material disruption of our information systems could negatively impact financial results and materially adversely affect our business operations, particularly during the holiday season.