Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT321 - ORANGEHOOK, INC. | exhibit321.htm |

| EX-31.1 - EXHIBIT311 - ORANGEHOOK, INC. | exhibit311.htm |

| EX-10.23 - EXHIBIT1023 - ORANGEHOOK, INC. | exhibit1023.htm |

| EX-10.25 - EXHIBIT1025 - ORANGEHOOK, INC. | exhibit1025.htm |

| EX-10.24 - EXHIBIT1024 - ORANGEHOOK, INC. | exhibit1024.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

(Mark One)

|

|

|

☑

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

| For the fiscal year ended December 31, 2015 | |

|

|

|

|

OR

|

|

|

|

|

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

For the transition period from _________ to __________

|

|

Commission file number: 0-54249

Nuvel Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

Florida

|

|

27-1230588

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

20 S. Santa Cruz Avenue

Los Gatos, California 95030

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: (408) 899-5981

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act:

Common Stock, par value $0.001 per share

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No þ

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

|

Non-accelerated filer ☐

|

Smaller reporting company ☑

|

|

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

The aggregate market value of the registrant's Common Stock held by non-affiliates as of June 30, 2015 was $1,594,737 at $0.15 per share, based on the price of the registrant's common equity was last sold.

As of April 4, 2016 the registrant had 15,384,032 shares of common stock, par value $0.001 per share, issued and outstanding.

Nuvel Holdings, Inc.

FORM 10-K

For The Fiscal Year Ended December 31, 2015

|

|

|

|

|

Page

|

|

|

|

|

3

|

|

|

|

|

|

|

|

|

ITEM 1.

|

|

|

3 | |

|

ITEM 1A.

|

|

|

10 | |

|

ITEM 1B.

|

|

|

10 | |

|

ITEM 2.

|

|

|

10 | |

|

ITEM 3.

|

|

|

10 | |

|

ITEM 4.

|

|

|

10 | |

|

|

|

|||

|

|

|

|

11 | |

|

ITEM 5.

|

|

|

11 | |

|

ITEM 6.

|

|

|

13 | |

|

ITEM 7.

|

|

|

13 | |

|

ITEM 7A.

|

|

|

17 | |

|

ITEM 8.

|

|

|

17 | |

|

ITEM 9.

|

|

|

17 | |

|

ITEM 9A.

|

|

|

17 | |

|

ITEM 9B.

|

|

|

19 | |

|

|

|

|

||

|

|

|

|

20

|

|

|

|

|

|

|

|

|

ITEM 10.

|

|

|

20 | |

|

ITEM 11.

|

|

|

22 | |

|

ITEM 12.

|

|

|

25 | |

|

ITEM 13.

|

|

|

28 | |

|

ITEM 14.

|

|

|

28 | |

|

|

|

|||

|

|

|

|

29 | |

|

|

|

|

|

|

|

ITEM 15.

|

|

|

29 | |

Explanatory Notes

The Business section and other parts of this Annual Report on Form 10-K ("Form 10-K") contain forward-looking statements that involve risks and uncertainties. Many of the forward-looking statements are located in "Management's Discussion and Analysis of Financial Condition and Results of Operations." Forward-looking statements provide current expectations of future events based on certain assumptions and include any statement that does not directly relate to any historical or current fact. Forward-looking statements can also be identified by words such as "future," "anticipates," "believes," "estimates," "expects," "intends," "plans," "predicts," "will," "would," "could," "can," "may," and similar terms. Forward-looking statements are not guarantees of future performance and the Company's actual results may differ significantly from the results discussed in the forward-looking statements. The Company assumes no obligation to revise or update any forward-looking statements for any reason, except as required by law.

In this Annual Report on Form 10-K, Nuvel Holdings, Inc. is sometimes referred to as the "Company," "Nuvel" "we," "our," "us" or "registrant" and U.S. Securities and Exchange Commission is sometimes referred to as the "SEC".

Our History

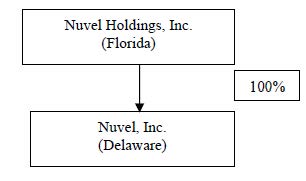

The Company is a Florida corporation incorporated on October 19, 2009. On December 30, 2011, the Company completed an acquisition of Nuvel, Inc. ("Nuvel DE") pursuant to a Share Exchange Agreement, among the Company, certain shareholders of the Company, Nuvel DE and all shareholders of Nuvel DE (the "Share Exchange Transaction"). As a result of the Share Exchange Transaction, Nuvel DE, which was incorporated in Delaware on January 20, 2010, became our direct wholly-owned subsidiary of the Company effective on December 30, 2011. Such acquisition of Nuvel DE was accounted for as a reverse merger and recapitalization effected by a share exchange transaction. Nuvel DE is considered the acquirer for accounting and financial reporting purposes. The assets and liabilities of the acquired entity were brought forward at their book value and no goodwill was recognized.

On March 20, 2012, the Company changed the Company's name to "Nuvel Holdings, Inc." to better reflect the business and operations of the Company. The Company's stock symbol was changed from "HRMY" to "NUVL," effective on April 10, 2012.

The following diagram sets forth the structure of the Company as of the date of this Report herein:

Recent Developments

As reported by the Company on its Form 8-K filed with the SEC on February 27, 2015, on January 27, 2015, Richard Resnick was appointed as the Company's Acting Chief Executive Officer.

As reported by the Company on its Form 8-K filed with the SEC on August 4, 2015, on July 30, 2015, Mr. Richard Resnick and Mr. James L. Mandel were appointed as members of the Company's Board of Directors and Jay Elliot resigned from his position as a director of the Company. Mr. Mandel Is the President and Chief Executive Officer of OrangeHook.

Our Planned Acquisition of OrangeHook, Inc.

OrangeHook Letter of Intent.

On October 24, 2014, the Company entered into a letter of intent (the "Letter of Intent") with OrangeHook, Inc., a Minnesota corporation ("OrangeHook"). The Letter of Intent contemplates that the Company will acquire all of the equity or assets of OrangeHook (the "Transaction")and that the Company will issue common stock to the shareholders of OrangeHook such that after the Transaction (and prior to any financing at the time of the Transaction), OrangeHook shareholders will own approximately 85% of the Company and the pre-Transaction Nuvel shareholders will own approximately 15% of the Company, which is subject to adjustment by negotiations of the parties. The Company currently expects to structure the Transaction as a reverse triangular merger in which a to-be-formed wholly owned subsidiary of the Company would merge with and into OrangeHook, with OrangeHook continuing as the surviving entity and becoming a wholly owned subsidiary of the Company as a result of the Transaction. The Company anticipates that the closing date for the Transaction will occur during the second quarter of 2016 (the "Closing"), subject to the negotiation and execution of definitive Transaction agreements and the satisfaction of applicable Closing conditions. Conditions to Closing will include, among other things, that the Company be current in its SEC reports, that each of the financings set forth in the Letter of Intent has occurred and that any necessary shareholder approval has been obtained. Although the Company plans to consummate the Transaction, there can be no assurance that the Transaction will occur on the terms contemplated by the Letter of Intent or at all.

As of the date of this report, OrangeHook has provided $931,249 as bridge financing to the Company, in the form of unsecured loans to assist the Company in completing the necessary filings with the SEC.

OrangeHook Business

Overview

OrangeHook was formed as a holding company to incubate selective and unique consumer, business, and governmental software applications which, OrangeHook believes in its opinion can have the ability to change the world we live in to be a better and safer place. From safety to medicine to banking, OrangeHook is focused on accelerating the delivery of the products and services offered by its acquisitions in far reaching, broad, and dynamic sectors with the common denominator of unbridled market potential. In today's economy, scores of entrepreneur backed concepts have spent personal capital to develop their products and services to the point of revenue generation. Many of these businesses simply run out of capital just when their product is ready to go to market and potentially generate sales and profitability. OrangeHook has acquired a number of these opportunities and understands the need for a sophisticated and structured approach to providing the necessary capital to unleash the upside of these businesses through the creation of visibility, reduction of redundant selling, general and administrative expenses, and the amalgamation of the inherent talent residing in these seemingly unconnected businesses. By providing a central and combined force, OrangeHook believes that it can achieve critical mass and distributed risk scenarios with even greater upside for investors and participants.

OrangeHook acquired Salamander Technologies, Inc., a Michigan corporation ("Salamander") on October 1, 2015. Salamander is engaged in the business of providing installed software and Software as a Service ("SaaS") for situational awareness of all resources during emergency or catastrophic situations (responders, assets, volunteers, and victims). Awareness of available resources before, during, and after an incident or planned event – ranging from routine incidents like car accidents to disasters such as 9/11, Hurricane Katrina, Deepwater Horizon, Tornados, Sandy Hook, etc. – is absolutely critical to saving lives. OrangeHook believes that Salamander's products provide an easy to use, affordable, scalable, and redundant platform for interagency personnel accountability in these types of situations, and such products are positioned to comply with the federal mandate for the National Incident Management System ("NIMS").

OrangeHook acquired Agilivant, LLC, a Washington, limited liability company ("Agilivant") on February 12, 2016. Agilivant offers a real-time debit based banking and payment system. There are more than 2.8 billion unbanked people around the world, with over 50 million in the U.S. alone. Many of these people are poor, not creditworthy and remotely located. Further, many are in communities not serviced by banks. Accordingly, their cash is constantly exposed to the risk of loss and/or theft. These people are deprived of the opportunity to grow with the world of e-commerce, and stand to be left behind in the 21st century economy. This population could either be a liability or an economic asset to their home country. OrangeHook believes that this population is a huge untapped asset.

OrangeHook also plans to acquire LifeMed ID, Inc., a California corporation ("LifeMed ID") in the second quarter of 2016. OrangeHook believes that LifeMed ID is the leading U.S. identity solution that automates patient identity validation, record matching, and overall registration workflow using healthcare providers' current point-of-service terminals and software vendors. OrangeHook believes that LifeMed ID provides a secure, user-friendly healthcare solution that allows clinicians to identify and utilize the correct patient records across disparate systems. Once the LifeMed ID solution is connected to any electronic medical records ("EMR"), admission, discharge transfer ("ADT") or patient management system ("PMS"), its solution ensures increased patient safety, satisfaction, and care outcomes. In emergency situations, the emergency room ("ER") needs the most accurate, comprehensive data possible on a situation to make the best decisions. Unfortunately, it is next to impossible to consolidate data from so many sources to one location with a click of a button. LifeMed ID believes that it can provide a solution to this issue.

Description of the Nuvel Business

In addition to operating the OrangeHook business after the Transaction, the Company, through its wholly-owned subsidiary Nuvel DE, plans to continue its business of seeking to engage in the business of designing, developing and selling a family of proxy and other appliances, and related software and services that can secure, accelerate and optimize the delivery of business applications, Web content and other information to users over private Enterprise networks, or across an enterprise's gateway to the public Internet (also known as the Web). Our products will strive to provide our end user customers with information about the applications and Web traffic running on their networks, including the ability to discover, classify, manage and control communications between users and applications across internal networks, the WAN and the Internet. Our products are also designed with the intent to accelerate and optimize the performance of our end users' business applications and content, whether used internally or hosted by external providers.

Our primary activities have been working on developing the design and development of our products, seeking to negotiate strategic alliances and other agreements and attempting to raise capital. We have not commenced our principal operations, nor have we generated any material revenues. Since inception, we have incurred substantial losses. As of December 31, 2015, our accumulated deficit was $16,010,743 our stockholders' deficiency was $4,351,270, and our working capital deficiency was $4,351,270. We have not yet generated material revenues and our losses have principally been operating expenses incurred in design, development, marketing and promotional activities in order to commercialize our products. We expect to continue to incur additional costs for operating and marketing activities over at least the next year.

The Company plans to consummate the Transaction with OrangeHook, but there can be no assurance that such Transaction will occur on the terms described above or at all, or if it does occur that it will be successful, which may require the Company to raise additional capital through private debt and equity investors in order to be able to accomplish its business plan objectives. No assurance can be provided that the Company will be able to do so. There is no assurance that any funds it raises will be sufficient to enable the Company to attain profitable operations or continue as a going concern. To the extent that the Company is unsuccessful, the Company may need to curtail or cease its operations and implement a plan to extend payables or reduce overhead until sufficient additional capital is raised to support further operations. There can be no assurance that such a plan will be successful.

Product Offerings

Our principal product offerings are the following:

Network Data Tunnel ("NDT")

Our purpose-built Network Data Tunnel application is designed from inception for high-performance software-based data acceleration and broadband optimization. Our NDT application provides high data throughput and reduced latency, or the time between initiating a request for data and the completion of the actual data transfer. Our application simultaneously retrieves numerous objects from the origin server. In many cases, our solution offers upward of 10 times to 200 times speed improvement. Our products are designed for easy installation and maintenance, reducing the costs and time required for implementation and use. In many cases, our Network Data Tunnel can be installed in under ten minutes. All of our products provide customers with a range of management features, functions, user interfaces and modes of operation. In addition, our application solutions are designed to efficiently interact with our customers' existing networking equipment. By accelerating the transfer of data, especially across longer distances (Hops), enterprises and ISPs employing our Network Data Tunnel require less network capacity and can reduce data transmission costs. Our customers better utilize the capacity of their existing network and are able to move data far more efficiently and quickly. The need for enterprises to engage in a myriad of business operations requires purchases of additional servers. Nuvel has the opportunity to reduce these costs since our Network Data Tunnel eliminates a significant amount of traffic that could otherwise overload their existing servers, requiring incremental server capacity. Our NDT products also help to improve the productivity of Internet users by reducing web response time. Faster downloading of web content increases productivity and end-user satisfaction. Our applications run on existing Enterprise deployed networks and data center equipment, in both a dedicated and virtual environment, which means that it is designed to be less vulnerable to unauthorized entry than the deployment of new hardware or dedicated appliances. The Network Data Tunnel Solution was designed specifically for data acceleration and broadband optimization. In addition, NDT employs authentication and filtering capabilities that prohibit unauthorized users from accessing or penetrating the application by adhering to the clients' security protocols.

Nuvel WAN acceleration and optimization

The Company seeks to design, develops, market, and sell Internet acceleration applications and management solutions which include specialized software tools that are purpose-built to accelerate and optimize the flow of information over the Internet. Our products improve response time for Internet users and provide network administrators and managers a high degree of control over the access, flow and delivery of Internet content. Our products work in conjunction with caching technologies to reduce the number of redundant requests for information that must be processed and delivered, thus reducing the load on the Internet and corporate networks. We have developed an innovative and comprehensive solution that broadly addresses the inter-related root causes of poor performance of wide-area distributed computing: latency and protocol inefficiencies, and bandwidth limitations. By simultaneously addressing these causes, we are able to improve significantly the performance of applications and access to data across WANs and enable the consolidation of costly IT infrastructure.

NDT Packaging

Enterprise Edition (Available in 50Mbps, 100Mbps & 1Gbps+)

The Nuvel Network Data Tunnel Enterprise Edition is focused on the larger corporate bandwidth customers looking to move time sensitive and very large data sets. The Enterprise Edition is available in three options based on bandwidth.

Small Business Edition (Available in 5Mbps & 10Mbps)

Targeted at the small business market where Internet upload and download speeds are limited and yet the demand still warrants efficient use and time is most important.

Service Provider Edition

Our XaaS edition is tailored to each service provider based on their unique challenges and target customers.

Technologies

Our products are based on three core technologies:

WAN optimization

The new global enterprise is burdened with several challenges, which include a diverse workforce, multiple software applications and varying means of data access. Driven by an increasing demand for bandwidth to reliably and effectively support remote offices, the need for a better-functioning, faster, cheaper, and easier to implement and use WAN solution, has never been greater. Hardware-based application acceleration and WAN optimization solutions available today address only a part of the problem faced by the modern global enterprises. What these traditional solutions do not address are the needs for ease of deployment, ease of use and operation, better economics and fit for purpose – crucial requirements of modern businesses. The hardware approach to WAN optimization requires numerous costly and complex appliances resulting in exponentially increasing hardware, operations and maintenance costs. Furthermore, the "optimization in hardware" approach results in other undesirable characteristics that include costly and often delayed upgrades, and significant staff and time commitments to provide, manage and maintain complex installations of appliances. Our WAN optimization products are deployed by our customers throughout their network infrastructures to improve the performance of their networks and reduce network costs, while enhancing network security. Our target customers include large and small ISPs, large corporate enterprises and small and medium size businesses in industries such as finance, engineering, professional services, manufacturing, media, healthcare, utilities, telecom, gaming, retail and cloud-based service providers. These companies would purchase our products in order to improve the performance of their networks and to accelerate and optimize the delivery of content to other companies or end-users over the Internet. Our WAN optimization products are designed to help distributed enterprises optimize the transferring of data both internally and externally.

Compared with the traditional WAN optimization solutions, our WAN optimization and acceleration technology provides key capabilities that are designed to optimize the delivery of data to users across the distributed enterprise, and to customers. As compared to traditional solutions, the NDT solution achieves speeds of up to 200X faster and is not bound by either point to point transmission or network equipment constraints including:

|

●

|

Bandwidth management—the ability to assign a set level of bandwidth to specific users and applications and prioritize delivery of that traffic over the WAN;

|

|

●

|

Protocol optimization—a technique that enhances the efficiency of protocols by reducing the communication required between the user and the application; and

|

|

●

|

Compression—a technique that uses an industry standard algorithm to package and unpackage information for efficient transmission across the WAN. It is important to note that we do not use compression in our software; however, we are complimentary to any existing compression technology currently deployed in a customer's environment.

|

The Network Data Tunnel enhances the performance of the TCP protocol by increasing the amount of data carried per TCP round trip, thereby reducing the number of round trips required to move a given amount of data over the WAN.

Enterprises and ISPs have varying capacity, reliability and data throughput needs, depending on the size and nature of their operations. We offer a wide range of products to meet different price, performance and reliability requirements, and provide an upgrade path to our customers as they expand their networks. Our products can be deployed in a variety of environments, ranging from small or remote network locations to large ISPs or enterprise headquarters. Trying to store content closer to the user may increase network efficiency, but creates the risk that the content delivered is not up-to-date, or fresh. Network Data Tunnel avoids this by increasing the speed in which original content can be moved to the serving location. Unlike traditional software or hardware cache solutions that have no mechanisms to monitor and ensure freshness, our Network Data Tunnel can actively check the origin servers and update content through efficient and sophisticated algorithms. Additionally, Network Data Tunnel also ensures all data that is sent is received completely and accurately at the far end.

Cloud Computing

Based on cloud computing models, we strive to achieve a revolutionary approach to data acceleration, and a fundamental architectural shift in the delivery of this solution. Instead of a data acceleration optimization controller or a managed appliance model per customer, Nuvel is a true innovator in software-based data optimization, designed for an enterprise. It offers data acceleration, as well as cost-effective, scalable and reliable connectivity between enterprise locations. Our revolutionary technology offers enterprises enhanced performance throughout their global network. With Nuvel, users can start with a network of any size, configuration and scale based on the organization's demands. Nuvel allows users to quickly access their cloud-based data wherever they are at and at dramatically accelerated speeds.

Services and Support

We provide a comprehensive range of service and support options to our end user customers and our channel partners, which will be delivered directly by our service and support personnel. Additionally, our professionally skilled staff ensures all installations are performed to the client's exact specifications on a "white glove" basis.

Research and Development

We believe that innovation and strong internal product development capabilities are essential to our continued success and growth. We continue to add new features, strengthen existing features of our products and invest in exploring new and adjacent markets and products that build on our core competence. In the past, we have invested in developing our cloud-based service, which we anticipate that this subscription-based service will generate revenue in the next few years. We anticipate the development of a consumer centric application in the next few years to take advantage of the proliferation of mobile devices and a mobile centric customer base.

For the years ended December 31, 2015 and December 31, 2014, the Company incurred research and development expenses of $2,535 and $8,271, respectively.

Intellectual Property

We depend significantly on our ability to develop and maintain the proprietary aspects of our technology. To protect our proprietary technology, we rely primarily on a combination of contractual provisions, confidentiality procedures, trade secrets, copyright and trademark laws and patents. Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy aspects of our products or obtain and use information that we regard as proprietary.

We currently have one pending U.S. patent application, although this application has been marked as abandoned by the United States Patent and Trademark Office (the "USPTO"), the Company plans to reinstate this application in 2016. Once this patent is issued, we plan to apply for foreign patents.

|

Title of Patent Application

|

|

Date of Filing

|

|

Application No.

|

|

|

|

|

|

|

|

System and method for providing a network proxy data tunnel

|

|

12/14/2011

|

|

13/326,189

|

There can be no assurance that our patent application referenced above which has been marked as abandoned by the USPTO will be allowed to be reinstated and there can be no assurance that any of our pending patent applications will be issued or that the patent examination process will not result in our narrowing the claims applied for. Furthermore, there can be no assurance that we will be able to detect any infringement of patents or, if infringement is detected, that our patents will be enforceable or that any damages awarded to us will be sufficient to adequately compensate us. In addition, the laws of some foreign countries do not protect our proprietary rights as fully as do the laws of the United States. Any issued patent may not preserve our proprietary position, and competitors or others may develop technologies similar to or superior to our technology. Our failure to enforce and protect our intellectual property rights could harm our business, operating results and financial condition.

Sales and Marketing

Our objective is to be a leading provider of software-based data acceleration by delivering a high-performance, innovative Network Data Tunnel solution. Key elements of our strategy include applying our data acceleration focus to targeted market segments. Since our inception, we have focused on developing a software only data acceleration product line. We believe this focus helps us to rapidly identify and target attractive market opportunities. We are directing our product development; marketing and sales activities at specific market segments that we believe represent attractive opportunities based on a demonstrated need for software-based data acceleration, the opportunity to sell to numerous customers and the level of existing competition. We focus on three market segments: service providers, enterprise proxy server replacement, and XaaS applications. We intend to use our customer relationships in these market segments to further penetrate these segments as well as other related markets.

We intend to utilize a combination of our direct sales force, resellers, systems integrators and original equipment manufacturers as appropriate for each of our target markets. We intend to support our distribution channels with systems engineers and customer support personnel that provide technical service and support to our customers.

We intend to pursue relationships with additional resellers and original equipment manufacturers to implement our distribution strategy and to expand our customer base. We also plan to expand our sales force in the future. Our marketing efforts focus on increasing the market awareness of our products and technology and promoting the Nuvel brand. Our strategy is to create this awareness by distinguishing our products based on their high level of performance.

Broaden Distribution Channels

We intend to extend our distribution channels to meet the anticipated growth in demand for software-based data acceleration. We plan to continue to expand both our direct and indirect sales channels in order to continue to extend our marketing reach and increase our volume distribution. In particular, we plan to enter into relationships with additional resellers, systems integrators and original equipment manufacturers to increase penetration of the enterprise and ISP markets.

Marketing Programs

We intend to have a number of marketing programs to support the sale and distribution of our products and to inform existing and potential customers within our target market segments about the capabilities and benefits of our products. Our marketing efforts will include participation in industry trade shows, sales training, maintenance of our website, on-line advertising and public relations. Affiliate programs and marketing efforts through them will be key for Nuvel's growth going forward.

Our Business Strategy

We intend to establish Nuvel as the premier brand in software-based data acceleration. We believe that brand awareness is important to increase market acceptance of Network Data Tunnel and to identify us as a leading provider of software-based data acceleration solutions. Our intent is to market our services and solutions to a wide variety of service providers in order to allow them to differentiate their solutions to clients. The amount of noise and confusion in this market makes it very challenging. We intend to continue to educate customers, resellers, systems integrators and original equipment manufacturers about the value of implementing all of our current and future products. We believe a thorough process of explanation and education of our products will help to promote brand recognition and to further an overall acceptance and understanding of our solutions. To this end, we intend to increase our investments in a broad range of marketing and educational programs. It should be also noted that we intend to pursue a secondary "wholesale" strategy to embed our products in a variety of service providers' product offerings on a "white label" basis.

Customers

Our NDT products can be installed for in some of the largest companies worldwide in major industries including: finance, engineering, professional services, manufacturing, media, healthcare, utilities, telecom, gaming, retail, and technology. Our products can be deployed in a wide range of organizations, from large global organizations with hundreds or thousands of locations to smaller organizations with as few as two locations.

In 2014, the Company began to install its solution in a number of beta customer locations which still continues.

Industry Background

The Global Demand for Data

Organizations have become more geographically dispersed, and increasingly mobile workforces depend on access to data from remote locations and a variety of client devices such as cellular telephones, personal digital assistants and notebook computers. In addition, we believe the continued growth of Internet usage will be driven by new applications, such as "Web Services" and "Voice over IP", the growth of mobile and broadband Internet access, and new usage and infrastructure models such as cloud computing. In conjunction with the growth of Internet traffic, the proliferation of data and, in particular, unstructured data such as voice, video, images, email, spreadsheets and formatted text files, presents an enormous and increasing challenge to IT organizations. Along with the growing volume of unstructured data that is business critical and must be retained and readily accessible to individuals and applications, new regulations mandate that company email, web pages and other files must be retained indefinitely.

Gartner, Inc. ("Gartner"), a leading technology information group, estimates the number of U.S. companies with remote offices in excess of 4 million and many indications are that the mobile workforce is here to stay. The increased demand for data acceleration is not just domestic but spans the globe. The good news for Nuvel is this means a growing dependence on the performance of every network, real-time access to data, anytime and anywhere.

The Internet continues to dramatically change the way businesses and individuals communicate and conduct commerce. As a result, the increasing volume of Internet traffic is much more than just web surfing; it is big business. According to Gartner, the amount of data produced across the world will grow by 650 percent over the next few years, and 80 percent of it will be unstructured. The research firm adds that 40 exabytes of new data are expected over the next five years, which is greater than all the data of the past 5,000 years. With this rising volume of traffic, Internet and Intranet infrastructures are quickly reaching capacity. Slow response times and site outages due to heavy demand are common outcomes of these overburdened network infrastructures. For organizations that rely on the web for commerce and/or operational purposes, these problems can be expected to have a direct, adverse impact on both the top and bottom lines. In the past, sites that wanted to avoid these issues had few choices but to invest in more infrastructure--more servers, more network equipment, more staff and more data center space. Now, through the emergence of data acceleration technology, these sites can effectively address the problems of performance, scaling and management. Nuvel optimizes how content is delivered by accelerating it either direction. There are two primary types of data acceleration solutions: software-based solutions and hardware based groups. Software-based approaches consist of a software application running on a general-purpose operating system like Solaris, Linux or Windows. These systems offer superior flexibility. Hardware providers promote a singular design, simple install, but have been significantly overpriced for many companies. Much as network routing has evolved from a general-purpose to a purpose-built solution, so has data acceleration. The advantages of a specialized application are clear. When an application is designed to perform a dedicated task, it will perform that task more effectively than a multi-function alternative. The results of a proxy-based application approach to optimization are significant: reduced web response times, simpler administration and management, lower network and data center costs, higher reliability, robust data security and always-accurate content.

Increasingly Distributed Organizations and Workforces

Organizations are becoming more geographically distributed, placing operations closer to customers and partners to improve efficiency and responsiveness. Businesses are becoming more global by expanding into new markets, migrating manufacturing facilities to lower-cost locations and outsourcing certain business processes. In addition, mergers, acquisitions, partnerships and joint ventures continue to expand the geographic scope of existing enterprises.

Organizations are Increasingly Dependent on Timely Access to Critical Data and Applications

Application performance and effective access to data are critical to executing, maintaining and expanding business operations. Employees are increasingly dependent on a wide array of software applications to perform their jobs effectively, such as E-mail, document management, enterprise resource planning and customer relationship management.

Wide-Area Distributed Computing Challenges

Technological advances in computing, networking, semiconductor and storage technologies have improved users' ability to access data and use applications rapidly across their Local Area Networks ("LANs") and store enormous amounts of information economically. However, these same applications and storage technologies, which were often designed to operate optimally on LANs, perform slowly across WANs and frequently exhibit performance challenges such as: delays in accessing, saving and transferring files, incomplete or inconsistent back-up and recovery of sensitive data and loss of worker productivity and increased end-user frustration.

Although many companies have attempted to solve these problems solely by adding bandwidth, we believe these performance problems can best be solved by addressing not only bandwidth challenges but also, and usually more importantly, the effects of latency and protocol inefficiencies:

Latency and protocol inefficiencies — "Latency" is the amount of time it takes data to travel distances across a network. The inefficiencies come from the numerous interactions between clients and servers that are often required by applications or network transport protocols to complete an operation or transfer data. When combined in geographically distributed computing environments, latency and these inefficiencies result in dramatically slower performance. For example, a simple request to open a file may require hundreds if not thousands of sequential round-trip interactions that, when aggregated, can result in substantial delays. This problem arises from two distinct sources:

|

●

|

Network Protocol inefficiencies — Most business applications were designed for optimal use within LAN environments and employ unique communications procedures that result in slow performance when transmitted over a WAN. Transmission Control Protocol (TCP), the underlying transport protocol for most WAN traffic, divides data into relatively small packets that are sent sequentially across the WAN, and require return acknowledgement from the recipient. These numerous round trips across the WAN result in slow performance for the end-user.

|

|

●

|

Bandwidth limitations — Bandwidth is defined as the amount of data that can traverse a network in a given amount of time and is typically measured in megabits per second (Mbps). While most organizations' LANs typically operate at 100 or 1,000 Mbps, their remote office WAN connections typically operate at speeds equal to or less than their corresponding LAN's. This often results in WAN congestion and poor application and data services performance. In addition, WAN outages limit the effectiveness of workers who are dependent on remote access to data and applications.

|

Critical Partners

We believe that our business will benefit greatly from working closely with other leading companies and suppliers in each market. By collaborating with others, we are able to design products that integrate more easily with other devices, add features and functionality to our products and expand our distribution channels, enabling us access to additional customers and markets. We are focusing our strategic relationships internationally with the intent to have more than 50% of our revenue from international sales within 5 years.

Competition

The expanding capabilities of our product offerings have enabled us to address a growing array of opportunities, many of which are not addressed by our competitors. The design of the Network Data Tunnel is unique compared to the other products in this market and we are truly a disruptive technology for existing solutions. Our competitor's product offerings include hardware appliances as a major part of their solution. The major benefits of our Network Data Tunnel are: software only solution, easy to install and implement, completely non-intrusive to any customer data, scalable from very small to very large networks and priced extremely competitive with a subscription model. With this model, we can easily migrate down to the consumer level, which is where the biggest demand will come in the future.

In the WAN Acceleration market, we compete with large companies such as IBM, Cisco Systems, Citrix Systems, Riverbed Technology, Silver Peak and Blue Coat Systems. The principal competitive factors in the market in which we compete include: product performance and features; customer support; brand recognition; the scope of distribution and sales channels; and pricing. Many of our competitors have a longer operating history and greater financial, technical, marketing and other resources than we do. These larger competitors also have a more extensive customer base and broader customer relationships, including relationships with many of our current and potential customers.

Employees

The Company currently employs four full time and two contract employees.

Financing Activities

Recent Note Amendments

On January 1, 2015, an event of default occurred under notes (the "ACA Notes") held by Alpha Capital Anstalt ("ACA") and, the interest rate under the ACA Notes was increased from 10% per annum to 16% per annum. ACA did not take any action in response to any defaults under the ACA Notes. The Company and ACA entered into a note extension agreement on July 7, 2015, pursuant to which ACA waived the event of default provisions. As consideration for the waiver, the Company increased the principal amounts on the ACA Notes from $686,249 to $878,904. The maturity dates of the ACA Notes were extended to September 30, 2015. All remaining terms of the ACA Notes remained the same.

As of the date of this filing, the ACA Notes have passed their respective maturity dates and have not been repaid, further as of the date of this filing the Company is the Company is not current with its tax filings and its Common Stock is traded on OTC Pink. Due to the preceding, as of October 1, 2015, the interest rates on the ACA notes increased to the default rate of 16%.

On December 15, 2015, the Company and ACA entered into a Note Conversion Agreement pursuant to which ACA agreed to convert the ACA Notes, ACA Warrants, and its shares of the Company's Series D preferred stock into 222,857 shares of the Company's Common Stock after the occurrence of the Transaction, as that term is defined elsewhere in this document under the heading "Our Planned Acquisition of OrangeHook, Inc." and following a planned reverse stock split. The Note Conversion Agreement contains a general release of the Company by ACA for anything related to the ACA Notes. A copy of the Note Conversion Agreement is filed herewith as Exhibit 10.23.

On December 15, 2015, the Company and Chi Squared Capital, Inc. ("Chi") entered into a Note Conversion Agreement pursuant to which Chi agreed to convert (1) the Company's secured convertible promissory note (the "Chi Note") held by Chi with a principal balance of $30,778 and (2) 67,975 shares of the Company's Series D Stock held by Chi into 9,286 shares of the Company's Common Stock after the occurrence of the Transaction, as that term is defined elsewhere in this document under the heading "Our Planned Acquisition of OrangeHook, Inc.," and a planned reverse stock split. The Note Conversion Agreement contains a general release of the Company by Chi for anything related to the Chi Note and the Series D preferred stock. A copy of the Note Conversion Agreement is filed herewith as Exhibit 10.24.

Disclosure in response to this item is not required of a smaller reporting company.

None.

Our principal executive offices are located at 20 S. Santa Cruz Ave., Los Gatos, California. We occupy the premises pursuant to a pay as we use basis. We are able to take fully advantage of this office space as needed for business activities. Pursuant to the lease, we have the right to extend the term of the lease any time prior to its expiration.

From time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. Litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business.

On February 10, 2016, the Company entered into a mutual general release and settlement agreement (the "Settlement Agreement") with Appcellence LLC (which does business as "Apptology") to settle a judgment against the Company in the sum of $49,200 entered pursuant to a lawsuit filed by Apptology against the Company (the "Action") in the Santa Clara County, California, Superior Court (Case Number 115C281865). In the Action, the plaintiff alleged that the Company owed the plaintiff past due amounts for research and development services provided to the Company. Pursuant to the Settlement Agreement, the Company agreed to pay Apptology $35,000.00 to be paid in installments with the total amount to be paid by February 12, 2017. The Settlement Agreement also contains a general release by Apptology of the Company relating to the Action, such release however is predicated on the Company making timely payments pursuant to the Settlement Agreement. Pursuant to the Settlement Agreement, within ten (10) business days after receipt of the full $35,000 by Apptology, the Company and Apptology shall execute a written stipulation to set aside the default and judgment against the Company and dismiss the Action with prejudice. As of December 31, 2015, the Company had accrued a liability of $49,200 related to the judgment and is included in accounts payable at December 31, 2015.

A copy of the Settlement Agreement is filed herewith as Exhibit 10.25.

We are not currently a party to any legal proceedings, nor are we aware of any threatened litigation.

ITEM 4. MINE SAFETY DISCLOSURES.

Not applicable.

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Market Information

Our common stock is currently quotes under the symbol "NUVL" on OTC Pink Marketplace. Our common stock did not have any trading activities until February 2012.

Trading in stocks quoted on the OTC Pink Marketplace is often thin and is characterized by wide fluctuations in trading prices due to many factors that may have little to do with a company's operations or business prospects. OTC Pink securities are not listed or traded on the floor of an organized national or regional stock exchange. Instead, OTC Pink securities transactions are conducted through a telephone and computer network connecting dealers in stocks.

The following table sets forth, for the calendar quarters indicated, the reported high and low bid quotations per share of the Common Stock as reported on the OTC Pink Marketplace. Such quotations reflect inter-dealer quotations without retail mark-up, markdowns or commissions, and may not necessarily represent actual transactions.

| High | Low | |||||

| Fiscal Year Ended December 31, 2014 | ||||||

|

First Quarter

|

$

|

0.50

|

$

|

0.12

|

|

|

|

Second Quarter

|

$

|

0.37

|

$

|

0.37

|

|

|

|

Third Quarter

|

$

|

0.39

|

$

|

0.31

|

|

|

|

Fourth Quarter

|

$

|

0.51

|

$

|

0.22

|

|

| Fiscal Year Ended December 31, 2015 | ||||||

|

First Quarter

|

$

|

0.58

|

|

$

|

0.10

|

|

|

Second Quarter

|

$

|

0.28

|

|

$

|

0.15

|

|

|

Third Quarter

|

$

|

0.15

|

|

$

|

0.15

|

|

|

Fourth Quarter

|

$

|

0.22

|

|

$

|

0.14

|

|

The transfer agent for the Company's common stock is Globex Transfer, LLC at the address of 780 Deltona Blvd., Suite 202, Deltona, FL 32725.

Stockholders

As of the date of this Report, there were approximately 74 holders of record of our Common Stock.

Dividends

The Company has never paid a cash dividend on its common stock and has no present intention to declare or pay cash dividends on the common stock in the foreseeable future. The Company intends to retain any earnings which it may realize in the foreseeable future to finance its operations. Future dividends, if any, will depend on earnings, financing requirements and other factors.

Securities authorized for issuance under equity compensation plans

We do not expect to adopt an equity incentive plan during the next 12 months. When we adopt an equity incentive plan, the purposes of the proposed equity incentive plan are to attract and retain qualified persons upon whom our sustained progress, growth and profitability depend, to motivate these persons to achieve long-term company goals and to more closely align these persons' interests with those of our other shareholders by providing them with a proprietary interest in our growth and performance. Our executive officers will be eligible to participate in the plan. We have not determined the amount of shares of our common stock to be reserved for issuance under the proposed equity incentive plan.

Purchases of Equity Securities by the Registrant and Affiliated Purchasers

We have not repurchased any shares of our common stock during the fiscal year ended December 31, 2015.

Penny Stock Regulations

The Securities and Exchange Commission has adopted regulations which generally define "penny stock" to be an equity security that has a market price of less than $5.00 per share. Our Common Stock, when and if a trading market develops, may fall within the definition of penny stock and be subject to rules that impose additional sales practice requirements on broker-dealers who sell such securities to persons other than established customers and accredited investors (generally those with assets in excess of $1,000,000, or annual incomes exceeding $200,000 individually, or $300,000, together with their spouse).

For transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchase of such securities and have received the purchaser's prior written consent to the transaction. Additionally, for any transaction, other than exempt transactions, involving a penny stock, the rules require the delivery, prior to the transaction, of a risk disclosure document mandated by the Securities and Exchange Commission relating to the penny stock market. The broker-dealer must also make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. In addition, the broker-dealer must disclose the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and, if the broker-dealer is the sole market-maker, the broker-dealer must disclose this fact and the broker-dealer's presumed control over the market. Finally, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. Consequently, the "penny stock" rules may restrict the ability of broker-dealers to sell our Common Stock and may affect the ability of investors to sell their Common Stock in the secondary market.

In addition to the "penny stock" rules promulgated by the Securities and Exchange Commission, the Financial Industry Regulatory Authority ("FINRA") has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low-priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit the investors' ability to buy and sell our stock.

Recent Sales of Unregistered Securities

During the first quarter of 2015, the Company issued unsecured loans totaling $154,000 to OrangeHook, Inc.

During the first quarter of 2015, the Company issued 125,000 shares to an investor in conjunction with an August 2014 amendment to a note subscription agreement with a principal amount of $100,000. The Company agreed to pay back the investor $60,000 in principal within five business days after the Company raises gross proceeds of at least $2 million in securities offerings, and the Company agreed to pay back the investors the remaining $40,000 in principal within five business days after the Company raises gross proceeds of at least $3 million securities offerings, but in no event later than December 31, 2014. As of the date of this filing, the note has not been repaid.

During the second quarter of 2015, the Company issued 50,000 shares of its Common Stock to a consultant pursuant to the termination of a 2013 services agreement.

On May 5, 2015, the Company issued unsecured loans totaling $58,000 to OrangeHook, Inc.

On June 10, 2015, the Company issued unsecured loans totaling $50,000 to OrangeHook, Inc.

On June 30, 2015, the Board of Directors granted the issuance of warrants to purchase shares of common stock with a five year term and a $0.20 exercise price as a bonus for professional services rendered by the following parties:

● 1,500,000 warrants were issued to a law firm

● 1,418,846 warrants were issued to a CFO outsourcing firm

● 8,513,078 warrants were issued to Mr. Resnick, Acting Chief Executive Officer

On July 13, 2015, the Company issued unsecured loans totaling $82,000 to OrangeHook, Inc.

On July 30, 2015, the Company issued unsecured loans totaling $20,000 to OrangeHook, Inc.

On August 14, 2015, the Company issued unsecured loans totaling $60,000 to OrangeHook, Inc.

On September 14, 2015, the Company issued unsecured loans totaling $45,000 to OrangeHook, Inc.

On October 13, 2015, the Company issued 249,999 fully vested common shares to two board members for board services.

On October 19, 2015, the Company issued unsecured loans totaling $100,000 to OrangeHook, Inc.

On November 16, 2015, the Company issued unsecured loans totaling $40,000 to OrangeHook, Inc.

On December 18, 2015, the Company issued unsecured loans totaling $90,000 to OrangeHook, Inc.

On February 1, 2016, the Company issued unsecured loans totaling $25,000 to OrangeHook, Inc.

On February 19, 2016, the Company issued unsecured loans totaling $20,000 to OrangeHook, Inc.

On February 24, 2016, the Company issued unsecured loans totaling $30,000 to OrangeHook, Inc.

On March 16, 2016, the Company issued unsecured loans totaling $20,000 to OrangeHook, Inc.

The above issuances of the Company's securities were not registered under the Securities Act of 1933, as amended (the "1933 Act"), and the Company relied on an exemption from registration provided by Section 4(a)(2) and Rule 506 under the 1933 Act for such issuance.

Except as disclosed above, all unregistered sales of the Company's securities have been disclosed on the Company's current reports on Form 8-K and the Company's quarterly reports on Form 10-Q.

Not applicable.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion of our financial condition and results of operations should be read in conjunction with our audited consolidated financial statements and the notes to those consolidated financial statements appearing elsewhere in this Annual Report on Form 10-K.

Certain statements in this Report, and the documents incorporated by reference herein, constitute forward-looking statements. Such forward-looking statements include statements, which involve risks and uncertainties, regarding, among other things, (a) our projected sales, profitability, and cash flows, (b) our growth strategy, (c) anticipated trends in our industry, (d) our future financing plans, and (e) our anticipated needs for, and use of, working capital. They are generally identifiable by use of the words "may," "will," "should," "anticipate," "estimate," "plan," "potential," "project," "continuing," "ongoing," "expects," "management believes," "we believe," "we intend," or the negative of these words or other variations on these words or comparable terminology. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this filing will in fact occur. You should not place undue reliance on these forward-looking statements.

The forward-looking statements speak only as of the date on which they are made, and, except to the extent required by federal securities laws, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which the statements are made or to reflect the occurrence of unanticipated events.

Recent Developments

As reported by the Company on its Form 8-K filed with the SEC on August 4, 2015, on July 30, 2015, Mr. Richard Resnick and Mr. James L. Mandel were appointed as members of the Company's Board of Directors and Jay Elliot resigned from his position as a director of the Company.

Letter of Intent with OrangeHook

On October 24, 2014, the Company entered into a letter of intent (the "Letter of Intent") with OrangeHook, Inc., a Minnesota corporation ("OrangeHook"). The Letter of Intent contemplates that the Company will acquire all of the equity or assets of OrangeHook (the "Transaction") and that the Company will issue common stock to the shareholders of OrangeHook such that after the Transaction (and prior to any financing at the time of the Transaction), OrangeHook shareholders will own approximately 85% of the Company and the pre-Transaction Nuvel shareholders will own approximately 15% of the Company, which is subject to adjustment by negotiations of the parties. The Company currently expects to structure the Transaction as a reverse triangular merger in which a to-be-formed wholly owned subsidiary of the Company would merge with and into OrangeHook, with OrangeHook continuing as the surviving entity and becoming a wholly owned subsidiary of the Company as a result of the Transaction. The Company anticipates that the closing date for the Transaction will occur during the second quarter of 2016 (the "Closing"), subject to the negotiation and execution of definitive Transaction agreements and the satisfaction of applicable Closing conditions. Conditions to Closing will include, among other things, that the Company be current in its SEC reports, that each of the financings set forth in the Letter of Intent has occurred and that any necessary shareholder approval has been obtained. Although the Company plans to consummate the Transaction, there can be no assurance that the Transaction will occur on the terms contemplated by the Letter of Intent or at all, or if it does occur, that it will be successful.

As of the date of this report, OrangeHook has provided $951,249 as bridge financing to the Company, in the form of unsecured loans to assist the Company in completing the necessary filings with the SEC.

Plan of Operations

In addition to operating the OrangeHook business after the Transaction, the Company, through its wholly -owned subsidiary Nuvel DE, plans to engage in the business of designing, developing and selling a family of proxy and other appliances, and related software and services that secure, accelerate and optimize the delivery of business applications, Web content and other information to distributed users over private Enterprise networks, or across an enterprise's gateway to the public Internet (also known as the Web). Our products will strive to provide our end user customers with information about the applications and Web traffic running on their networks, including the ability to discover, classify, manage and control communications between users and applications across internal networks, the WAN and the Internet. Our products are also designed with the intent to accelerate and optimize the performance of our end users' business applications and content, whether used internally or hosted by external providers.

Our primary activities have been working on developing the design and development of our products, seeking to negotiate strategic alliances and other agreements and attempting to raise capital. We have not commenced our principal operations, nor have we generated any material revenues. Since inception, we have incurred substantial losses. As of December 31, 2015 and 2014, our accumulated deficit was $16,089,955 and $14,528,573, respectively, our stockholders' deficiency was $4,439,266 and $2,885,184, respectively, and our working capital deficiency was $4,439,266 and $2,885,184, respectively. Furthermore, as of the date of this filing, the Company has $295,000 and $1,490,359 of notes payable and convertible notes payable, respectively, that have matured and are in default. We have not yet generated material revenues and our losses have principally been operating expenses incurred in design, development, marketing and promotional activities in order to commercialize our products. We expect to continue to incur additional costs for operating and marketing activities over at least the next year.

Based upon our working capital deficiency as of December 31, 2015 and 2014 and the lack of any revenues, we require equity and/or debt financing to continue our operations. Subsequent to December 31, 2015, the Company secured additional debt financing from OrangeHook in the form of Notes Payable resulting in gross proceeds of $95,000. The Company intends to raise additional capital from private debt and equity investors. The Company needs to raise additional capital in order to be able to accomplish its business plan objectives. The Company is continuing its efforts to secure additional funds through debt or equity financings. Management believes that it will be successful in obtaining additional financing based on its limited history of raising funds; however, no assurance can be provided that the Company will be able to do so. There is no assurance that any funds it raises will be sufficient to enable the Company to attain profitable operations or continue as a going concern. To the extent that the Company is unsuccessful, the Company may need to curtail or cease its operations and implement a plan to extend payables or reduce overhead until sufficient additional capital is raised to support further operations. There can be no assurance that such a plan will be successful. See "Liquidity and Capital Resources" and "Availability of Additional Funds" below.

Year Ended December 31, 2015 compared with Year Ended December 31, 2014

Marketing and promotion expenses

Marketing and promotion expenses include costs related to the advertising, marketing, and promotion of our products. For the year ended December 31, 2015, marketing and promotion expenses decreased by $7,599 as compared to the year ended December 31, 2014, as the Company had limited marketing and promotional efforts due to cost cutting efforts.

Payroll and benefits

Payroll and benefits consist primarily of salaries and benefits to employees. For the year ended December 31, 2015, payroll and benefits increased by $99,849 as compared to the year ended December 31, 2014. Due to loan funds received during the current year, the Company was able to resume operations on a limited basis and engage Richard Resnick as its acting Chief Executive Officer.

General and administrative expenses

General and administrative expenses consist primarily of corporate support expenses such as legal and professional fees, investor relations and telecommunications expenses. For the year ended December 31, 2015, general and administrative expenses increased by $167,124 as compared to the year ended December 31, 2014. The increase was primarily attributable to an increase in legal services pertaining to becoming current on the Company's public filings, the planned OrangeHook merger, and increased consulting fees partially offset by minor decreases in accounting and auditing services.

Research and development expenses

Research and development expenses consist primarily of consulting fees paid to develop our software products. Research and development expenses are expensed as they are incurred. For the year ended December 31, 2015, research and development expenses decreased by $5,736 as compared to the year ended December 31, 2014. The Company has limited capital, resulting in a limited research and development budget.

Interest expense

For the year ended December 31, 2015, interest expense decreased by $26,114, or 8%, as compared to the year ended December 31, 2014. The decrease was attributable to the conversion of debt into Series B and Series C Preferred Stock during the summer of 2014 partially offset by new debt agreements entered into over the current year and an increase in the interest rate on certain debt in default.

Amortization of debt discount

For the year ended December 31, 2015, amortization of debt discount increased by $20,463 as compared to the year ended December 31, 2014. During the year ended December 31, 2015 the Company recorded amortization of the debt discount of $87,029 related to the July 2015 debt modifications of certain notes. During the year ended December 31, 2014, the Company recorded amortization of the debt discount of $67,232 primarily related to the amortization of the debt discount on the November 2012 Notes which was almost fully amortized by the end of the first quarter of 2014.

Amortization of deferred financing costs

For the year ended December 31, 2015, amortization of deferred financing costs decreased by $14,495 as compared to the year ended December 31, 2014. The decrease was attributable to the extinguishment of the November 2012 Notes in April 2014.

Change in fair value of derivative liabilities

For the year ended December 31, 2015, change in fair value of derivative liabilities was $0, compared to $964,430 during the year ended December 31, 2014. The decrease was attributable to the decrease in the fair value of the Company's common stock in 2014, thus resulting in a de minimus value to the warrants and conversion feature of the Company's convertible notes.

Gain on settlement of accounts payable

For the year ended December 31, 2014, a gain on settlement of accounts payable of $677,487 was recorded as compared to $0 for the year ended December 31, 2015. During the second and third quarters of 2014, the Company settled several outstanding accounts payable balances with a combination of debt and equity securities.

Gain on settlement of accounts payable – related parties

For the year ended December 31, 2014, a gain on settlement of accounts payable – related parties of $28,300 was recorded as compared to $0 during the year ended December 31, 2015. During the second quarter of 2014, the Company settled an outstanding payable balance with a related party with equity securities.

Loss on extinguishment of debt

For the year ended December 31, 2014, the Company recorded a loss on extinguishment of debt $4,308,622 as compared to $0 for the year ended December 31, 2015. The prior year amount was attributable to the losses on the extinguishment of the November 2012 Notes and the conversion of debt into Series B and Series C Preferred Stock during the second and third quarters of 2014.

Net loss

For the year ended December 31, 2015, the net loss was $1,561,582 versus $3,966,495 for the year ended December 31, 2014. The decrease in the loss compared to the prior year is primarily attributable to the other expense items discussed above, particularly the loss on extinguishment of debt which was partially offset by the gain on the change in fair value of derivative liabilities and gain on settlement of accounts payable and accrued expenses.

Liquidity and Capital Resources

We measure our liquidity in a number of ways, including the following:

|

|

December 31, 2015

|

December 31, 2014

|

||||||

|

|

||||||||

|

Cash

|

$

|

49,938

|

$

|

36,871

|

||||

|

Working Capital Deficiency

|

$

|

(4,439,266

|

)

|

$

|

(2,885,184

|

)

|

||

|

Debt (Current)

|

$

|

2,641,608

|

$

|

1,769,288

|

||||

Net Cash Used in Operating Activities

We experienced negative cash flows from operating activities for the year ended December 31, 2015 and 2014 in the amounts of $(665,933) and $(443,328), respectively. The cash used in operating activities during the year ended December 31, 2015 was primarily due to cash used to fund operations of the Company and to become current on its public filings. The Company depleted its cash reserves by the end of the first quarter of 2013, which caused the Company to curtail operations for approximately one year. Due to the bridge notes and unsecured loan funds received subsequent to March 31, 2014, the Company was able to resume operations on a limited basis.

Net Cash Provided by Financing Activities

Net cash provided by financing activities for the year ended December 31, 2015 and 2014 was $679,000 and $480,199, respectively. The cash provided by financing activities for the year ended December 31, 2015 was attributable to the proceeds from the unsecured loans from Orange Hook while the cash provided by financing activities for the year ended December 31, 2014 was attributable to proceeds from the issuance of convertible notes payable and unsecured loans from Orange Hook. In addition, during the year ended December 31, 2015 the Company repaid note principal in the amount of $20,000.

Availability of Additional Funds

Based upon our working capital deficiency as of December 31, 2015 and the lack of any revenues, we require equity and/or debt financing to continue our operations. Subsequent to December 31, 2015, the Company secured additional debt financing from OrangeHook in the form of Notes Payable resulting in gross proceeds of $95,000. The Company is seeking to raise additional capital through private debt and equity investors. The Company needs to raise additional capital in order to be able to accomplish its business plan objectives. The Company is continuing its efforts to secure additional funds through debt or equity financings. Management believes that it will be successful in obtaining additional financing based on its limited history of raising funds; however, no assurance can be provided that the Company will be able to do so. There is no assurance that any funds it raises will be sufficient to enable the Company to attain profitable operations or continue as a going concern. To the extent that the Company is unsuccessful, the Company may need to curtail or cease its operations and implement a plan to extend payables or reduce overhead until sufficient additional capital is raised to support further operations.

We may be unable to raise sufficient additional capital when we need it or to raise capital on favorable terms. Debt financing may require us to pledge certain assets and enter into covenants that could restrict certain business activities or our ability to incur further indebtedness, and may contain other terms that are not favorable to our stockholders or us. If we are unable to obtain adequate funds on reasonable terms, we may be required to significantly curtail or discontinue operations or to obtain funds by entering into financing agreements on unattractive terms.

These matters raise substantial doubt about our ability to continue as a going concern. Our consolidated financial statements included elsewhere in this quarterly report have been prepared in conformity with accounting principles generally accepted in the United States of America, which contemplate our continuation as a going concern and the realization of assets and satisfaction of liabilities in the normal course of business. The carrying amounts of assets and liabilities presented in the consolidated financial statements do not necessarily purport to represent realizable or settlement values. The consolidated financial statements do not include any adjustment that might result from the outcome of this uncertainty.

Critical Accounting Policies and Estimates Use of Estimates

The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent liabilities at dates of the consolidated financial statements and the reported amounts of revenue and expenses during the periods. Actual results could differ from these estimates. Our significant estimates and assumptions include amortization, the fair value of our stock, debt discount, warrant liabilities, and the valuation allowance relating to the Company's deferred tax assets.

Recently Issued Accounting Pronouncements

See Note 3 to our consolidated financial statements for the year ended December 31, 2015, included elsewhere in this document.

Off Balance Sheet Arrangements

As of December 31, 2015 and 2014, there were no off balance sheet arrangements.

Contractual Obligations

The following is a summary of our contractual obligations as of December 31, 2015 and 2014:

|

Contractual Obligations

|

2015

|

2014

|

||||||

|

|

||||||||

|