Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - HTG MOLECULAR DIAGNOSTICS, INC | htgm-ex312_8.htm |

| EX-32.1 - EX-32.1 - HTG MOLECULAR DIAGNOSTICS, INC | htgm-ex321_6.htm |

| EX-23.1 - EX-23.1 - HTG MOLECULAR DIAGNOSTICS, INC | htgm-ex231_966.htm |

| EX-32.2 - EX-32.2 - HTG MOLECULAR DIAGNOSTICS, INC | htgm-ex322_7.htm |

| EX-31.1 - EX-31.1 - HTG MOLECULAR DIAGNOSTICS, INC | htgm-ex311_9.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

OR

|

¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number 001-37369

HTG Molecular Diagnostics, Inc.

(Exact name of Registrant as specified in its Charter)

|

Delaware |

|

86-0912294 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer |

|

3430 E. Global Loop Tucson, AZ |

|

85706 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (877) 289-2615

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

Common Stock, par value $0.001 per share |

|

The NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ¨ NO x

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

¨ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

¨ (Do not check if a small reporting company) |

|

Small reporting company |

|

x |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES o NO x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant, based on the closing price of the shares of common stock on The NASDAQ Global Market on June 30, 2015, was $45,920,851.

The number of shares of Registrant’s Common Stock outstanding as of March 18, 2016 was 6,977,421.

|

|

|

Page |

|

PART I |

|

|

|

Item 1. |

1 |

|

|

Item 1A. |

39 |

|

|

Item 1B. |

65 |

|

|

Item 2. |

66 |

|

|

Item 3. |

66 |

|

|

Item 4. |

66 |

|

|

|

|

|

|

PART II |

|

|

|

Item 5. |

67 |

|

|

Item 6. |

68 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

69 |

|

Item 7A. |

80 |

|

|

Item 8. |

80 |

|

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

116 |

|

Item 9A. |

116 |

|

|

Item 9B. |

117 |

|

|

|

|

|

|

PART III |

|

|

|

Item 10. |

118 |

|

|

Item 11. |

126 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

139 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

141 |

|

Item 14. |

145 |

|

|

|

|

|

|

PART IV |

|

|

|

Item 15. |

145 |

i

Unless the context requires otherwise, references to “HTG,” “HTG Molecular Diagnostics,” “we,” “us” and “our” refer to HTG Molecular Diagnostics, Inc.

Forward-Looking Statements

This Annual Report on Form 10-K, including the sections entitled “Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” may contain “forward-looking statements.” We may, in some cases, use words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would” or the negative of those terms, and similar expressions that convey uncertainty of future events or outcomes, to identify these forward-looking statements. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. Forward-looking statements in this Annual Report include, but are not limited to, statements about:

|

|

· |

our ability to successfully commercialize our HTG Edge or HTG EdgeSeq systems and related applications and assays; |

|

|

· |

our ability to generate sufficient revenue or raise additional capital to meet our working capital needs; |

|

|

· |

our ability to secure regulatory clearance or approval, domestically and internationally, for the clinical use of our products; |

|

|

· |

our ability to develop new technologies beyond mRNA and miRNA to include DNA fusions and mutations or other technologies to expand our product offerings; |

|

|

· |

the implementation of our business model and strategic plans for our business; |

|

|

· |

the regulatory regime for our products, domestically and internationally; |

|

|

· |

our strategic relationships, including with manufacturers of next generation sequencing products used with our product offerings, pharmaceutical companies, manufacturers and distributors of our products, and third parties who conduct our clinical studies; |

|

|

· |

our intellectual property position; |

|

|

· |

use of available operating cash; |

|

|

· |

our ability to comply with the restrictions of our debt facility and meet our debt obligations; |

|

|

· |

our expectations regarding the market size and growth potential for our life sciences and diagnostic businesses; |

|

|

· |

any estimates regarding expenses, future revenues, capital requirements, and stock performance; |

|

|

· |

our expected use of proceeds from our initial public offering; and |

|

|

· |

our ability to sustain and manage growth, including our ability to develop new products and enter new markets. |

These forward-looking statements reflect our management’s beliefs and views with respect to future events and are based on estimates and assumptions as of the filing date of this Annual Report and are subject to risks and uncertainties. We discuss many of these risks in greater detail under “Risk Factors.” Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Except as required by law, we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise.

Overview

We are a commercial stage company that develops and markets products based on a novel technology platform to facilitate the routine use of complex molecular profiling. Our HTG Edge and HTG EdgeSeq platforms automate sample processing and can quickly, robustly and simultaneously profile hundreds or thousands of molecular targets from samples a fraction of the size required by most current technologies. Our objective is to establish the HTG Edge and HTG EdgeSeq platforms as the standards in molecular profiling and make this capability accessible to all molecular labs from research to the clinic. We believe that our target customers

1

desire high quality molecular profiling information in a multiplexed panel format from increasingly smaller and less invasive samples, with the ability to collect such information locally to minimize turnaround time and cost. The HTG Edge and HTG EdgeSeq platforms were designed to meet these needs and empower pathologists, translational researchers and, in the future, clinical molecular labs to directly control the molecular profiling of patient samples. Our platform’s capabilities are also enabling biopharmaceutical companies to better leverage the power of molecular profiling in their preclinical and clinical research and biomarker development applications.

Molecular profiling is the analysis of multiple DNA, RNA and/or protein targets in biological samples, such as tissue, cells, blood or other biofluids, to identify expression patterns or genomic changes. Molecular profiling is enabling a paradigm shift from the traditional approach of looking at one molecule at a time to the simultaneous analysis of hundreds or thousands of molecules. There are numerous applications of molecular profiling, such as whole genome sequencing for the discovery of novel genetic variants and the assessment of patient samples to identify biomarkers or molecular markers of disease that can aid in diagnosis, gauge patient prognosis or predict response to an available therapy. Significant discoveries of new molecular targets, such as in the field of immuno-oncology, are creating substantial growth in targeted tumor profiling for molecular diagnostic testing, biomarker development and translational research in oncology and other diseases. Based on published industry reports, the cancer profiling market is estimated to be $17.8 billion today and is expected to grow to $35.0 billion by 2018.

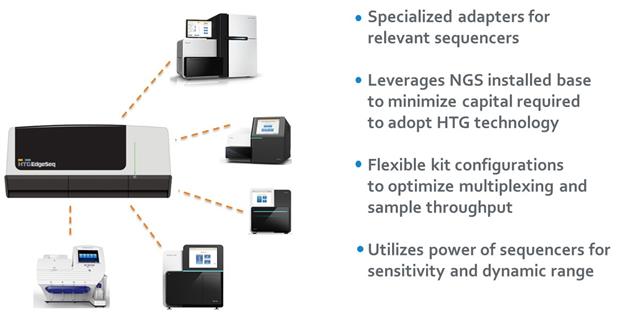

Our HTG Edge and HTG EdgeSeq platforms consist of instrumentation, consumables and software analytics that automate the molecular profiling of genes and gene activity using our proprietary nuclease protection chemistry to deliver extraction-free, multiplexed results on a wide variety of biological samples. We believe that our platforms provide significant workflow and performance advantages in molecular profiling applications including tumor profiling, biomarker development and, prospectively, molecular diagnostic testing. In 2014 we launched our HTG EdgeSeq chemistry that, together with our HTG Edge or HTG EdgeSeq instrumentation and software, automates and adapts our nuclease protection chemistry to enable analysis using next generation sequencing, or NGS, instrumentation. The HTG EdgeSeq system utilizes substantially the same sample preparation reagents as our original chemistry, but allows for read out on an NGS instrument. We believe that the HTG EdgeSeq chemistry is disruptive as it substantially simplifies current sample and library preparation methods, greatly reduces the complexity of data analytics, and provides customers additional value by expanding the utilization of their NGS instruments. By combining the power of the HTG EdgeSeq chemistry with the capabilities of NGS, we are able to analyze a wide variety of genomic profiles and sample types with high sensitivity and broad dynamic range. These technologies offer the potential to develop additional profiling panels and grow our market opportunities, and we expect to include RNA gene fusions and rearrangements, DNA mutations, detection of copy number variations, or CNV’s, and analysis of cell-free circulating DNA from liquid biopsies to our HTG EdgeSeq product portfolio.

2

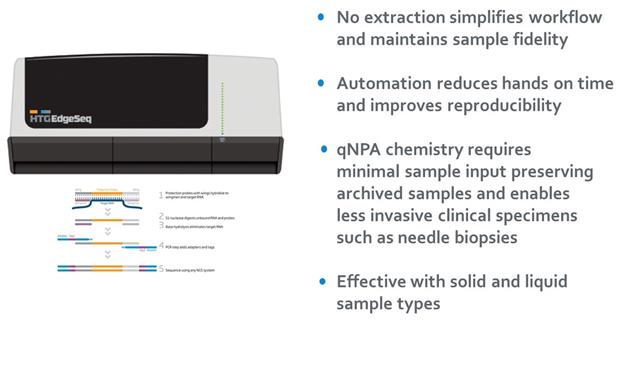

The following features of our platforms are designed to enable the rapid delivery of a comprehensive molecular profile from extremely small samples:

Optimization of Sample Preparation

Improved Detection and Quantitation

3

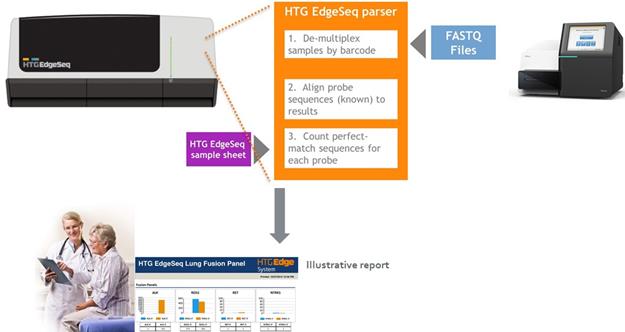

An area of dissatisfaction for customers performing NGS tests is the difficulty of analyzing the data. HTG’s platforms are designed to greatly reduce the complexity of the data analysis tasks via the HTG Parser software. The FASTQ files are downloaded from the sequencer into the HTG Parser software where standard reports are available for our research customers and, in the future, custom clinical reports will be generated for physicians and molecular lab management.

Our innovative platforms and menu of molecular profiling panels are being utilized by a wide range of customers including biopharmaceutical companies, academic institutions and molecular labs to simultaneously analyze a comprehensive set of molecular information from valuable clinical samples and substantially improve their workflow efficiency. We currently market several proprietary molecular profiling panels that address the needs of customers in high impact areas of translational research and biopharmaceutical biomarker and companion diagnostics.

Our platforms’ proprietary chemistry allows for extraction-free analysis of solid and liquid tumors including difficult clinical samples such as formalin-fixed paraffin embedded, or FFPE, tissue with as little as a single five micron section of tissue, a fraction of the amount of sample required by other technologies. The ability to provide robust data from minute samples is critically important in areas such as cancer where biopsies are becoming less invasive and smaller while the number of tests competing for the sample is growing. Our platform was designed to fit seamlessly into current surgical pathology workflows, minimize technician labor and set a new standard for ease of use.

We have a focused development pipeline of new profiling products that includes planned panels for translational research, drug development, and molecular diagnostics. Our product strategy is to build complete profiling panels of established and emerging molecular targets for broader and disease-specific approaches. For our molecular diagnostic customers where the reimbursement path is critical we expect that our planned panels will conform to approved reimbursement codes for genomic sequence procedures. We believe this will facilitate clinical customer adoption and avoid the high costs and time required to prove medical utility and seek unique reimbursement codes.

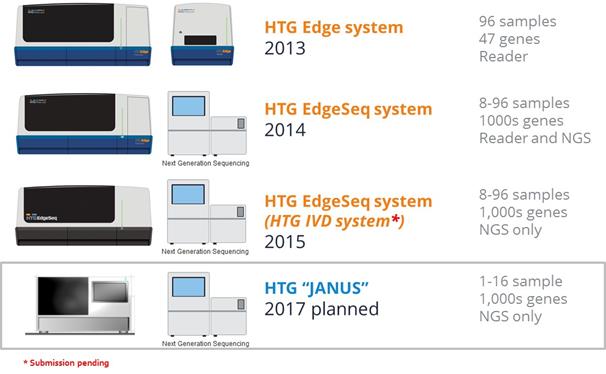

Our HTG Edge system is capable of running both our original, plate-based chemistry, which quantifies RNA using our plate reader included with the system, and our HTG EdgeSeq chemistry, which is detected using NGS instrumentation provided by the end user. We also have the flexibility to provide the HTG Edge instrument without our plate reader or, since December 2015, our dedicated HTG EdgeSeq system for those customers whose focus is NGS readout of our HTG EdgeSeq chemistry. We plan to launch a new version of our HTG EdgeSeq system in 2017 that will target the lower sample throughput clinical lab market. This program, which we refer to as “Project JANUS”, is expected to increase our addressable market by enabling efficient molecular profiling of smaller quantity batches of samples.

4

We continue to expand and evolve our assay and panel offerings, primarily focusing on our HTG EdgeSeq platform. During 2015, we launched several new HTG EdgeSeq research-use-only product offerings, including our HTG EdgeSeq Oncology Biomarker Panel, HTG EdgeSeq Immuno-Oncology Assay, HTG EdgeSeq Lymphoma Panel and HTG EdgeSeq Diffuse Large B-Cell Lymphoma Cell of Origin Assay.

We have incurred significant losses since our inception, and we have never been profitable. We incurred net losses of $21.4 million and $14.0 million for the years ended December 31, 2015 and 2014, respectively. As of December 31, 2015, we had an accumulated deficit of $89.6 million and we had available cash and cash equivalents totaling approximately $3.3 million and investments in short-term corporate and government debt securities totaling $28.2 million.

Our Strategy

Our objective is to establish the HTG Edge and HTG EdgeSeq platforms as the standards in molecular profiling, and to make their benefits accessible to all molecular labs from research to the clinic. The key components of our strategy are:

|

|

· |

Grow our installed base and promote our consumables-based business model. We plan to promote global adoption of our HTG Edge and HTG EdgeSeq platforms, including our growing menu of consumables, in molecular labs, biopharmaceutical companies and major translational research centers by demonstrating the key differentiating aspects of our platforms, such as small sample utilization, multiplexing and multi-parameter testing. These advantages result in cost, time and ease of use benefits for our global customers. We plan to expand our direct sales and support team in the United States and Europe, continue to transition from a contract sales team to our own direct sales and support team in Europe and expand our global distributor network. |

|

|

· |

Establish our systems’ workflow as the best solution for clinical sequencing. We intend to continue to establish our technology as the best sample and library preparation method for clinical applications of next generation sequencers. We believe our differentiated HTG EdgeSeq chemistry will accelerate adoption of our platforms by leveraging the large existing and growing installed base of next generation sequencers. We are engaged with industry and corporate partners to position our HTG EdgeSeq products as the benchmark for workflow in targeted sequencing applications. |

|

|

· |

Develop new molecular diagnostic panels with high medical utility. The HTG Edge and HTG EdgeSeq systems were developed with features that we believe will enhance the capabilities of local molecular labs to routinely test large panels of proven-utility RNA expression, RNA fusions and rearrangements, DNA mutations and protein expression, all from extremely small samples, such as a single five micron section of tissue. We plan to add disease-specific panels such as lung cancer and broader profiling panels that allow our customers to use existing reimbursement codes. |

|

|

· |

Increase and strengthen companion diagnostics collaborations with biopharmaceutical companies. We believe collaborations with biopharmaceutical companies with late-stage drug development programs will lead to us generating companion diagnostic consumables revenue. We are currently working with 30 active development programs across 14 leading biopharmaceutical companies who are incorporating companion diagnostics in their drug development programs, where they are purchasing our HTG Edge and HTG EdgeSeq consumable panels, including immuno-oncology, oncology biomarker and diffuse large B-cell lymphomas, or DLBCL, panels. We plan to continue to expand our number of collaborations. In addition, we intend to opportunistically perform sample processing services for our collaboration customers, as we believe this will further strengthen our position as the technology of choice for certain of these companion diagnostic programs. |

|

|

· |

Expand the addressable market of HTG technology through new applications. We have demonstrated feasibility to add new applications in RNA-based gene fusions, expressed DNA mutations, CNVs and protein immunoassays. These new applications will allow us to develop multiple panels for use in translational, research, companion diagnostics and molecular diagnostics. We believe these applications and panels can be developed efficiently with reasonable capital investment. |

Our Market

Development of Molecular Profiling

Molecular profiling is the analysis of multiple DNA, RNA and protein targets in biological samples, such as tissue, cells, blood and other biofluids, to identify expression patterns or genomic changes. New molecular approaches are making it possible to perform these characterizations in unprecedented ways, resulting in a shift from the traditional approach of looking at one target at a time to the simultaneous analysis of hundreds or thousands of targets. There are numerous applications of molecular profiling such as whole genome sequencing for the discovery of novel genetic variants or the assessment of patient samples to identify biomarkers or molecular markers of disease that can aid in diagnosis, gauge patient prognosis or predict response to an available therapy. The

5

fundamental shift towards personalized medicine, or the use of an individual’s molecular profile to guide treatment, has led to significant growth in molecular profiling technologies and applications. We estimate that the global molecular profiling market is approximately $27.0 billion today. Based on published industry reports, cancer profiling makes up the largest segment of this market at an estimated $17.8 billion, the substantial majority of which we believe currently consists of research-use-only products, and is expected to grow to $35.0 billion by 2018. Research-use-only products are used in a wide variety of applications, including large-scale clinical trials of targeted therapies that are under development as well as basic medical research to understand and characterize tumors and tumor biology. We also estimate that genomic research makes up approximately $7.7 billion of the global molecular profiling market. Currently we are limited to marketing our HTG Edge and HTG EdgeSeq systems and proprietary profiling panels for research use only, which means that we cannot make any diagnostic or clinical claims. We intend to seek regulatory clearances and/or approvals in the United States and other jurisdictions to market certain panels for diagnostic purposes.

For decades, the treatment of disease was dominated by one-size-fits-all drug regimens. Over the last 10 years numerous molecular markers and profiling techniques have transitioned from discovery and research to inclusion in clinical guidelines. Today, there are many drugs in clinical development with a companion biomarker strategy, including many oncology drugs. Among the first of these personalized treatments were hormone therapies for breast cancer patients whose tumors expressed the estrogen receptor protein. This was followed by the use of trastuzumab for treating patients with HER2-positive breast cancers. The evolution of molecular profiling has also taken shape over the last decade in non-small cell lung cancer (NSCLC). NSCLC patients were first molecularly profiled for EGFR mutations to select patients most likely to respond to the drug, erlotinib, which was followed by ALK rearrangement testing for potential response to crizotinib. Now, additional mutations and rearrangements such as ROS1, RET, HER2, BRAF and MET, have been integrated into the NCCN guidelines for the treatment of lung cancer.

The NCCN Guidelines acknowledge that broad molecular profiling is key in improving the care of lung cancer patients. Similar trends are unfolding in other diseases such as thyroid cancer, colon cancer, and melanoma. These trends are fueling rapid growth of new molecular profiling offerings, technologies and industry business models to support the demand. The fastest growing segment of the estimated $10.6 billion molecular diagnostics market, a subset of the estimated $27.0 billion global molecular profiling market, is clinical testing in oncology. As oncologists rapidly integrate this new level of molecular profiling information into patient management strategies, a growing number of highly specialized central laboratories now offer tests that address specific clinical questions. The trend towards highly multiplexed profiling is not limited to oncology; other examples of expanding demand include prenatal, neonatal, inherited disease, and organ transplant and rejection profiling.

In addition, biopharmaceutical companies utilize molecular profiling in numerous applications. Preclinical applications include screening of compound libraries for target identification and preclinical testing for safety and fit for human use. For example, the FDA and European Medicines Agency require drug metabolism and pharmacokinetic, or DMPK, profiling studies to be performed as part of the drug development process. Metabolic gene expression response to the drug in human liver cells is assessed for each candidate drug, and it is common for biopharmaceutical companies to test the expression of three to 10 genes per drug candidate. Among the various DMPK testing technologies, such as RT-qPCR, branched DNA and microarrays, the most common is RT-qPCR. In DMPK studies, liver cells from several different human donors are challenged with the drug at various concentrations to predict how the drug will be metabolized. A large number of drug candidates are screened at this phase of development, creating significant demand for DMPK molecular profiling.

More recently, molecular profiling has moved into clinical applications. These include molecular profiling to develop clinical biomarker strategies, patient stratification for clinical trials, and companion diagnostics. The primary objective of these efforts is to improve response rates by understanding, at the molecular level, why a drug does or does not work in a patient population. Response rates for oncology therapeutics, at 25%, are among the lowest of all disease states. Combined with third-party payor pressures to lower patient treatment costs, most biopharmaceutical companies develop biomarker strategies to increase the rate of patient response to new drugs in development. Typically, they will look at a variety of biological profiling markers that include RNA expression, RNA fusions and rearrangements, DNA mutations and protein expression. Currently, it is estimated that there are over 2,000 clinical trials underway in oncology, and the vast majority of drug developers believe personalized and targeted therapy development is important to the future success of drug development.

When a molecular biomarker panel is used for selection of patients in a Phase 3 clinical trial to demonstrate safety and efficacy of a new drug, the drug and biomarker test are often submitted to the applicable regulatory agency for approval together. Upon FDA approval of the molecular biomarker panel, or companion diagnostic, the patient must be tested with the companion diagnostic prior to treatment with the drug. Companion diagnostic tests have a clear clinical utility which generally supports favorable reimbursement. We believe there are over 900 active oncology drug development programs, most of which have molecular biomarker strategies, creating a significant opportunity for molecular diagnostic companies with the right molecular profiling solutions. We estimate this molecular profiling market for companion diagnostics to be $2.5 billion and growing to $5.6 billion by 2019.

6

Complexities and Challenges of Molecular Profiling Today

Currently, molecular profiling is conducted using a variety of profiling techniques across multiple laboratory departments, and, in many situations, sent to distant labs. These techniques include immunohistochemistry, or IHC, fluorescent in situ hybridization, or FISH, polymerase chain reaction, or PCR, gene expression arrays, or GEA, and NGS. This distributed profiling approach has accelerated the use of molecular profiling and increased the need to make the process more accessible and routine. However, molecular profiling is also highly specialized because current technologies are complex, require multiple capital-intensive workflows, and are not economically scalable to the case volume of the local laboratory. The fragmentation of methods, sample logistics, and information flows has created significant challenges for labs, physicians, and patients as discussed below.

Insufficient Sample Availability

The proliferation of new molecular profiles and technologies has led to the need for more biopsy material. However, the trend is toward less invasive procedures that produce smaller biopsies and as a result, in many situations there simply is not enough collected sample to meet all the profiling requirements. For example, the standard method of collecting tumor samples for testing in oncology is via a surgical procedure where the tumor is resected or biopsied and then stabilized, or fixed, in a formaldehyde-based fixative known as formalin. From 24 to 72 hours after the tissue is harvested, it is permanently stabilized in a hard block of paraffin where it can be stored at room temperature for decades. This preservation technique was developed over 100 years ago, well in advance of the discovery of nucleic acids such as DNA and RNA. While techniques to recover nucleic acids from these FFPE tissue samples have been developed, formalin fixation presents several technical challenges in analyzing DNA and RNA sequences. Because of the convenience of this preservation method, though, FFPE samples are the starting material for almost all tumor-profiling testing in oncology today. Very thin slices of tissue from these FFPE blocks, typically five microns in thickness, are affixed to glass slides for testing.

Most commonly, a histological stain called an H&E, for the combination of hematoxylin and eosin that comprise it, is used to differentially mark cellular structures, making it simple for a pathologist to examine the patterns of the normal and diseased tissue under a microscope. IHC stains are also performed to aid diagnosis, prognosis or help guide therapy selection, with each IHC stain consuming two slides, one for the stain, and the other for a negative control. Historically, five to ten slides in total were consumed in the complete diagnostic workup for each tumor. With the advent of new molecular techniques there are additional demands for tissue, and the molecular tests on the market today require much more than a single slide. In many of these situations there simply is not enough collected tissue to meet all the profiling requirements. The growing number of specialized tumor-profiling tests, and their appetite for FFPE tissue or other sample material, is in direct conflict with the trend towards smaller, less-invasive testing approaches.

Slow Turnaround Times

In many cases, turnaround times for comprehensive profiling are several weeks due to the logistical time to route samples to various laboratory departments and to distant specialized labs. A number of technologies for sample characterization have been introduced that determine the status of various molecular characteristics for a sample. These include RNA expression, RNA fusions and rearrangements, DNA mutations and protein expression. For example, a single tumor specimen from a cancer patient is often profiled for multiple molecular characteristics where each characteristic is measured using a different platform. These platforms are utilized in separate laboratory departments or institutions with different technicians and clinicians, requiring that the sample and data be split into multiple workflows.

The time it takes to deliver the final report so that informed treatment decisions may be made is dependent on the turnaround time of the slowest test. A single laboratory with well-choreographed routing of tissues and information may be able to complete profiling within a week, but if part of the sample needs to be sent for additional profiling at a specialty lab, the total turnaround time may be lengthened by one or two weeks due to shipping, accessioning by the receiving laboratory, and integration of the testing results into the final report.

7

Implications of Workflow Inefficiencies on Data Quality and Integration

In addition to the challenges of splitting a single sample into multiple testing workflows, the individual workflow for molecular profiling of biological samples, including FFPE tissues, is complicated. Many of the steps from sample to result require manual intervention by a molecular technician. While these technicians are trained to standard operating procedures and proficiency tested, the levels of proficiency and precision vary among technicians. Variability introduced by technicians performing manual steps can translate to variability of results, with a test sample frequently at risk of experiencing losses of fidelity through the series of separation and transformation steps.

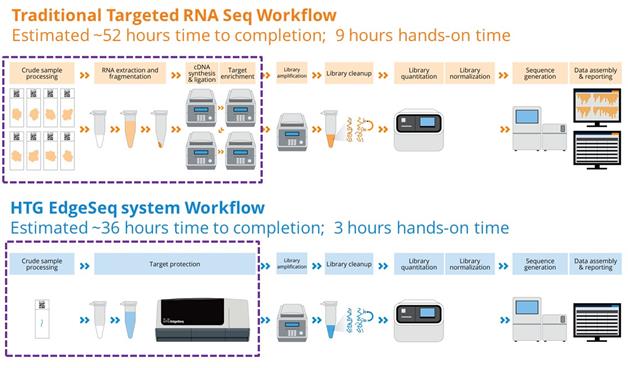

Sample to RNA Seq profiling of FFPE tissues

Further, the increase in number of technologies for sample characterization and fragmentation of the testing workflows can also create challenges in putting all of the results together in a timely, complete profiling report. This level of data integration is critical for the treating physicians to assure they have the complete molecular assessment prior to the patient consult. Without a complete molecular assessment, there is limited ability to discuss the diagnosis, prognosis and treatment options. Overall, we believe the critical relationship between the local pathologist and treating physician has been fractured as many tests results are now sent directly to the treating physician from these specialized and centralized CLIA labs. We believe the pathologist is critical to aggregating the diagnostic, prognostic and predictive information in a single patient molecular profile that can be utilized by the treating physician for therapeutic decisions.

Case Study of the Current Limitations in Molecular Profiling: Immuno-Oncology

A rapidly developing area of oncology drug development is the broad grouping of approaches referred to as immuno-oncology therapies. These immuno-oncology therapeutics include checkpoint inhibitors such as Keytruda (pembrolizumab) for melanoma and NSCLC, cancer vaccines such as chimeric antigen receptors in development by various companies, tyrosine kinase inhibitors such as Ibruvica (ibrutinib) for B-cell malignancies, and immunomodulatory therapies such as interferon-alpha.

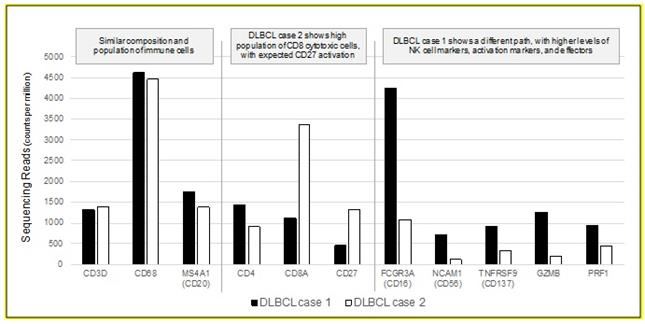

Recently, single-marker IHC tests have been approved as companion or complimentary diagnostics for anti-PD-1 checkpoint-inhibiting therapies. A proliferation of checkpoint inhibitors targeting additional ligands and receptors for CTLA4, OX40, LAG3, Tim-3 and others, coupled with combination approaches, is challenging the one-marker / one-drug diagnostic paradigm that previously advanced IHC-based companion diagnostics (e.g. HER2, ALK, c-KIT, etc). Understanding the complex biological framework of the tumor microenvironment is becoming increasingly important in interpreting the host immune response to tumors and developing the best single or combination therapy approach. The need for multiplexed gene expression assessment is illustrated in the graphic below where two histologically similar DLBCL tumors elicit very different host immune responses. Both cases have similar tumor

8

composition and populations of tumor infiltrating lymphocytes. In case 1, however, the immune system is responding primarily with natural killer lymphocytes whereas in case 2 the immune system has deployed CD8 cytotoxic lymphocytes. Based on this information and other clinical parameters, very different immunotherapeutic strategies may be deployed to combat the tumor. We believe that current molecular profiling techniques, like IHC or FISH or RT-qPCR, are ill-suited for comprehensive assessment of the tumor microenvironment.

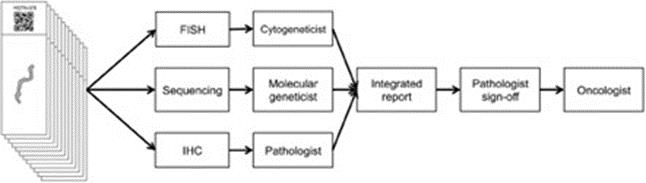

Case Study of the Current Limitations in Molecular Profiling: NSCLC

The complexities and potential inefficiencies present in current molecular profiling techniques can be seen in non-small cell lung cancer, or NSCLC. Several clinical parameters are typically assessed using multiple testing methodologies. Personalized therapy and entry into clinical trials for NSCLC are heavily dependent on accurate histological classification, most often performed by IHC. Tumor samples are also typically tested for gene mutations, and gene rearrangements, with each of these tests performed on a different platform and separate workflow. About 70% of initial lung cancer diagnoses now have to be made based on small biopsies or cytological specimens. It is common for each of these platforms to be in separate laboratory departments with different technicians and clinicians, requiring that the already small sample be split into multiple workflows. The results from the individual testing workflows are typically aggregated into a single report, signed off by the pathologist and transmitted to the oncologist. As outlined in the diagram below, the multiple steps involved in the process may substantially slow turnaround times and result in an incomplete molecular profile not suitable to inform clinical decision making.

Example of Typical NSCLC Testing Workflow

9

We have developed a novel technology platform that allows for precise, efficient molecular profiling of samples for clinical and research purposes. Our proprietary HTG Edge and HTG EdgeSeq platforms have the flexibility to work with many different biological sample types, are able to generate robust results from very small samples, and employ simple, proprietary chemistries that obviate the need for many of the steps associated with traditional molecular profiling techniques. Our platforms and chemistries enable the simultaneous detection and quantitation of hundreds or thousands of molecular targets and are capable, now or in the future, of profiling multiple parameters such as RNA expression, RNA fusions and rearrangements, DNA mutations and protein expression in a single testing workflow that can use NGS detection for quantitative measurement.

Our HTG Edge and HTG EdgeSeq platforms, comprising instrumentation, software analytics and proprietary consumables designed exclusively for use with each respective platform. We manufacture the consumables utilized with our platforms specifically for our platforms and these consumables cannot be obtained from other sources. At the core of our solution is our proprietary chemistry called quantitative nuclease protection, or qNPA. Nuclease protection is an extremely efficient method for analyzing DNA and RNA as it eliminates the need for DNA or RNA extraction or reverse transcription. We have enhanced this method by combining it with our patented HTG Edge and HTG EdgeSeq chemistries. We designed and developed our HTG Edge and HTG EdgeSeq automation platforms to optimize the capabilities of our chemistries, provide fast turnaround time and enable ease of use to molecular labs. Our chemistries and automation platforms are highly adaptable, so when molecular profiling needs change or emerge, we expect to be able to efficiently add new applications to address these needs.

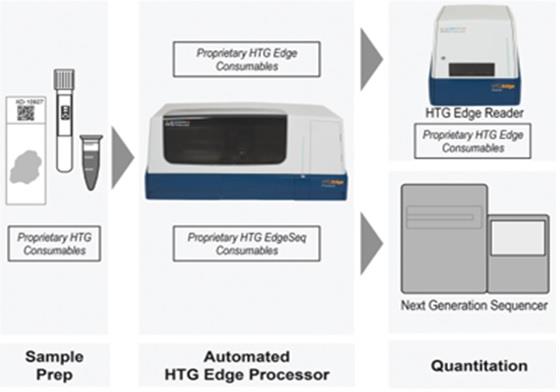

As the following diagram shows, the HTG Edge processor, software and consumables now support two methods for quantifying results, the HTG Edge reader for lower multiplexed panels and the recently launched HTG EdgeSeq chemistry for quantitation of high-plexed panels for utilizing NGS. In addition, we now offer an HTG EdgeSeq system that is dedicated to performing our HTG EdgeSeq chemistry with NSG detection.

The HTG Edge and HTG EdgeSeq platforms provide data in a simple easy to use format. The entire workflow for both platforms from sample preparation to a molecular profiling report can be accomplished in 24-36 hours.

10

We believe the majority of customers in our target markets would prefer to maintain control of their samples and perform the profiling internally but are challenged by limitations in available technologies. We believe we are well positioned to democratize molecular profiling with the following key benefits:

|

|

· |

Optimize sample utilization. The HTG Edge and HTG EdgeSeq systems can analyze at least 2,500 genes from extremely small sample volumes such as a single five micron section of tissue or 12.5 microliters of plasma or serum. Our technology allows customers to do more with less, which meets the needs of clinical laboratories where today there is often not enough patient sample to do all the testing available. We believe providing customers the ability to work with extremely small sample volumes will be a significant driver of adoption of our platform. |

|

|

· |

Compatibility with multiple sample types. Our HTG Edge and HTG EdgeSeq platforms allow customers to profile and unlock genomic information from a wide variety of biological samples such as FFPE tissue, cells, blood serum and plasma. We have successfully demonstrated the ability to profile all of these and other sample types, and believe we ultimately can profile most clinically relevant sample types, including cell-free circulating nucleic acids from tumors, a rapidly developing area of investigation which is referred to as a liquid biopsy. We believe that the capabilities of our platform will allow us to efficiently expand applications, regardless of sample type. |

|

|

· |

Flexible and adaptable chemistry allows for use on multiple platforms. We believe our proprietary chemistry provides the ability to measure multiple molecular targets in all the necessary applications, including RNA expression, RNA fusions and rearrangements, DNA mutations and protein expression and offers the ability to quantify on the HTG Edge Reader as well as a variety of NGS platforms. This flexibility provides customers the ability to optimize their use of HTG Edge and/or HTG EdgeSeq technologies based on their specific throughput, workflow and application needs. Our proprietary chemistry is simple, with fewer steps than competing technologies. For example, compared to RT-qPCR, our chemistry does not require extraction or cDNA synthesis. Compared to RNA sequencing, our chemistry does not require extraction, cDNA synthesis, shearing, rRNA depletion, ligation, adenylation, or size selection. We believe that the elimination of these steps helps prevent biases associated with these steps, sample degradation and increased opportunities for technician error. |

|

|

· |

Robust data. Molecular profiling produces large amounts of information that is used, among other things, to make important decisions, such as identifying potential drug targets or selecting a patient for a therapeutic treatment. This information is valuable only to the extent it accurately represents the true biology of the test sample and the same answer can be produced under many different conditions. Our HTG Edge and HTG EdgeSeq chemistries are highly specific and sensitive, meaning they can detect the right target even when very little is present in the sample. Our platform produces consistent results on a replicate-to-replicate, day-to-day and instrument-to-instrument basis. |

|

|

· |

Automation provides superior workflow and ease of use. Our HTG Edge and HTG EdgeSeq technologies are designed with fewer workflow steps in part due to the elimination of the need for complex biochemical processes such as extraction, cDNA synthesis, labeling, selection, depletion and shearing. This enables customers to limit hands-on time and the need for specialized skills, resulting in turnaround times of approximately 24-36 hours. Additionally, our HTG EdgeSeq application now further integrates sample preparation for targeted sequencing and greatly simplifies the bioinformatics back-end, so customers looking to leverage their NGS instrument can seamlessly add this capability to their current workflows. |

|

|

· |

Simplified bioinformatics. Our HTG Edge and HTG EdgeSeq software provides data in a simple and easy to use format through a simple graphical user interface, or GUI, that is flexible enough for researchers yet structured enough for clinical laboratories. The software is modular so that new applications can be downloaded without any changes to hardware. For applications that pair our HTG Edge processor and reader results are accessible in multiple formats through the GUI on the host computer. For HTG EdgeSeq applications, the HTG Edge and HTG EdgeSeq parser software processes the data from the NGS platform. We believe the simplicity of our bioinformatics solution will help drive the adoption of our platform. |

Current Commercial Panels Offered on the HTG Edge and HTG EdgeSeq Platforms

We currently market proprietary molecular profiling panels targeting late stage drug development programs with potential breakthrough therapies, such as immuno-oncology. We market these panels to biopharmaceutical companies, with which we collaborate in biomarker development programs. We believe these programs could facilitate our commercialization of companion diagnostic tests. In addition, our panels are used in pre-clinical and clinical research areas. Our currently marketed panels are:

11

|

|

responsive and non-responsive groups. The HTG EdgeSeq Immuno-Oncology Assay measures the expression of 549 of these immuno-oncology-associated genes. |

|

|

· |

HTG EdgeSeq Diffuse Large B-Cell Lymphoma Cell of Origin Assay. DLBCL tumors are frequently classified into either the activated B-cell like, or ABC, or germinal center B-cell like, or GCB, sub-types by measuring the molecular profile of the tumor. These two subtypes display different clinical pathologies, as patients with the GCB subtype of DLBCL tend to respond differently than those of the ABC sub-type. With many of the large number of new DLBCL-targeting drugs appearing to have greater efficacy in one of the sub-types, a need for a reliable, FFPE-based cell of origin classification assay has emerged. The HTG EdgeSeq Diffuse Large B-Cell Lymphoma Cell of Origin Assay is our most frequently purchased panel and is being utilized in numerous late-stage drug programs. |

|

|

· |

HTG EdgeSeq Oncology Biomarker Panel. We recently completed development and are now marketing our HTG EdgeSeq Oncology Biomarker Panel. This RNA expression panel measures the expression of up to 2,560 genes implicated in cancer for profiling tumor tissues, analyzing cancer pathways and identifying new biomarkers across both solid tumors and hematolymphoid neoplasms (or Heme). We worked with leading key opinion leaders to identify these genes, which we believe are a comprehensive list of genes targeting known signaling pathways and receptor gene families implicated in cancer such as the EGFR, HER2, HER3, HER4, PD-1 and FGFR genes. When paired with our existing miRNA Whole-transcriptome assay, we provide customers with a comprehensive solution for profiling their large sample archives for novel expression signatures. |

|

|

· |

HTG EdgeSeq Lymphoma Panel. Measures the expression of 93 genes frequently assessed in lymphomas, including 22 common non-Hodgkins B-Cell lymphoma markers from just 1.5mm2 of a 5 micron thick FFPE section. This is designed to enable detailed molecular profiles of lymphomas using a single FFPE slide. |

|

|

· |

HTG EdgeSeq microRNA Whole-transcriptome Assay. Human microRNAs are short non-coding strands of RNA that are used by the cell for gene regulation. The HTG EdgeSeq microRNA Whole-transcriptome assay enables the simultaneous profiling of 2,255 microRNAs, allowing new, potentially clinically relevant miRNA profiles to be discovered. This is our first marketed product on the NGS-integrated HTG EdgeSeq chemistry. Our ability to profile small FFPE samples is a significant differentiator in the rapidly growing microRNA market. |

|

|

· |

HTG Edge DMPK Assays. Biopharmaceutical companies often perform DMPK profiling studies as part of the drug development process to adhere to regulatory guidance. A set of genes known as the cytochrome P450 family is known to predict both the toxicity and stability of drugs in the human body. The HTG Edge DMPK Core CYP assay enables DMPK scientists to measure six cytochrome P450 genes recommended for in vitro pharmacokinetic studies. We are also marketing an expanded 45-gene panel that measures the expression of additional transporter genes to allow for in-depth profiling of the drug candidate. The DMPK area is a high-volume profiling market segment and creates synergies with down-stream clinical drug development programs. |

We utilize several alternative arrangements to sell our HTG Edge and HTG EdgeSeq systems and profiling panels. Our HTG Edge and HTG EdgeSeq systems can be purchased directly by our customers, who also then purchase profiling panels and other consumables from us on an as-needed basis. In some instances we provide our equipment free of charge on a limited basis to facilitate customer evaluation. We also install systems for our customers at no cost, in exchange for an agreement to purchase profiling panels and other consumables from us at a stated price over the term of the agreement. As of December 31, 2015, we had an installed base of 49 HTG Edge and HTG EdgeSeq instruments (consisting of 22 systems sold, five covered under reagent rental agreements, 19 evaluation units and three systems with key opinion leaders).

12

Product and Technology Pipeline Plan

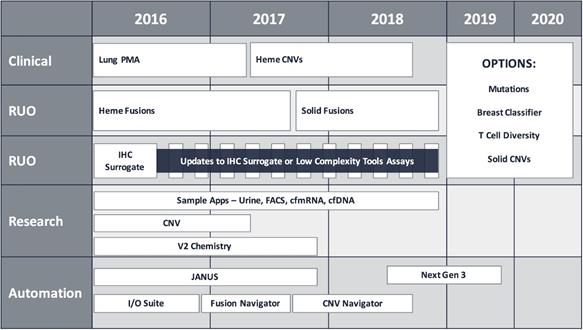

Our objective is to establish the HTG EdgeSeq platform as a standard in molecular profiling, making this capability broadly accessible. We are leveraging our flexible and adaptable platform to develop comprehensive molecular profiling panels across an increasing set of molecular applications. We believe it is important to include applications that cover a broad set of genomic variation as well as expression-based clinical biomarkers in order to continually increase the value of the HTG Edge platform and provide a more complete profiling solution for our customers. The diagram below depicts our planned expansion of systems, applications and profiling panels which are being adding in a phased approach.

Opportunities for Comprehensive Molecular Profiling in Diagnostics

We are planning to develop a portfolio of molecular diagnostic products using our proprietary technology to provide a single, efficient testing platform for sample profiling that integrates seamlessly into a customer’s NGS testing workflow.

We are initially focused on areas where the diagnostic testing paradigm has significant inefficiencies. For example, many leading medical institutions are shifting from a single-drug / single-test approach to a broader tumor profiling strategy for their oncology practices. Rather than testing for single mutational analyses, such as KRAS for colorectal cancer, these institutions use their NGS platforms to assess the mutational status of 50 or more genes. In addition, the information a physician needs to make clinical decisions often comes from tests conducted using various testing modalities such as IHC, FISH and NGS. These complexities lead to a growing and unmet demand in clinical diagnostics for more comprehensive molecular profiles that can include RNA expression, RNA fusions and rearrangements, DNA mutations and protein expression.

We are developing solutions to address the detection and measurement of gene rearrangements such as gene fusions and insertions. A fusion gene is a hybrid gene formed from two previously separate genes. A well-established example is the EML4-ALK fusion gene found in a subset of malignant lung cancers. Our research team previously demonstrated feasibility to simultaneously detect and measure key gene fusions in lung cancer such as ALK, ROS1, RET and NTRK1 from multiple small sample types including FFPE, cell lines and purified RNA. An insertion is the addition of one or more nucleotides into a genomic sequence; a small percentage of NSCLC exhibit HER2 exon 20 insertions.

We intend to develop our ALKPlus assay as our initial clinical diagnostic test. Our ALKPlus assay is a comprehensive fusion panel that includes rearrangements with the following genes: ALK, ROS1, RET and NTRK1 as well as insertions in HER2. This test panel is in formal development with plans to submit a modular PMA to the FDA and to seek CE/IVD marketing authorization for this panel in Europe in 2016. We have completed the initial pre-submission meeting with the FDA and expect to commence clinical trials in the second quarter of 2016. We intend to seek pre-market approval as a companion diagnostic for crizotinib therapy for ALK positive NSCLC cases. The ROS1, RET, NTRK1 and HER2 genes are expected to have RUO status, but we believe they could also be labeled as investigational use only (IUO) for certain late-stage drug development trials.

13

We are also developing enhancements to our chemistry, which we refer to as V2, that will enable a single testing workflow that provides, in parallel, reactions from a single unstained slide, histological classification of the tumor and DNA mutation status of key genes previously shown to be associated with NSCLC, such as EGFR, KRAS, BRAF and HER2, in combination with the ALKPlus panel. We refer to this as the HTG total lung solution. We intend to extend this capability to all solid tumor sample types.

We will need to develop, refine and implement new panel protocols and make changes or adjustments to our chemistry and software in order to optimize these planned applications and panels for use with our HTG EdgeSeq system. This will require substantial effort from our research scientists and the use of various laboratory equipment, supplies and materials, which combined represent the most significant costs that we expect to incur in connection with the development of these applications and profiling panels.

HTG is uniquely positioned to replace FISH testing for Heme

Another area we believe the HTG EdgeSeq platform can provide significant value to clinicians is in the diagnosis of hematolymphoid neoplasms such as leukemias, lymphomas, myelomas, and myelodysplastic syndromes. This is a large market opportunity with over 170,000 new cases reported in 2014. Across the spectrum of these diseases there is a large number of gene rearrangements and CNVs, typically performed by FISH, which physicians evaluate in a patient’s sample to make clinical decisions. The diagnoses of leukemias and lymphomas are complex and initial FISH panels are often followed with additional FISH panels, resulting in a possible delay of diagnosis and treatment.

We are in early stage development of highly multiplexed, NGS-based panels to assess most known gene rearrangements and CNVs in hematolymphoid neoplasms in a single NGS workflow. We believe improved turnaround time coupled with changing dynamics of reimbursement are causing laboratories to consider molecular options to replace FISH-based testing. The HTG EdgeSeq Heme Fusion and HTG EdgeSeq CNV / Karyotyping product concepts, with expected sample-to-answer time of 36 hours, should meet the turnaround time requirement while providing the comprehensive tumor profiling information for accurate diagnosis of hematolymphoid neoplasms.

The HTG EdgeSeq system can augment or, in some cases, replace IHC testing

IHC tests are integral to the diagnostic workup for most tumor types, providing qualitative protein expression data within the morphological context of the tissue tested. While there are over 400 different biomarkers tested by IHC in clinical practice today, we believe it is rare to test more than ten; this is due in part to tissue availability, especially for minimally invasive core needle biopsies, and limitations on the number of tests reimbursed per case. The HTG EdgeSeq IHC surrogate product concept is intended to enable the assessment of the RNA analogues for all clinical IHC biomarkers in a single NGS-based test. We believe this single-test concept will provide pathologists a standard by which to measure all tumors, augmenting or in some cases replacing their IHC testing with a quantitative assessment of the tumor biology.

Serving the decentralized markets with Project JANUS

In addition to continued menu expansion for clinical diagnostics we are now in development of our next generation instrument targeting the lower throughput clinical market segment. We believe this segment will potentially increase our addressable market for instrument sales from 100’s of labs to 1000’s of labs. The solid tumor testing market is served by a mix of centralized reference laboratories, comprehensive cancer centers, and decentralized regional hospital laboratories. Volumes of particular case types and downstream testing needs for solid tumors are somewhat unpredictable; we believe Project JANUS is well suited for managing low, medium, and surge testing volumes. Testing panels for Project JANUS include mutations, fusions, CNVs, expression classifiers, and a molecular surrogate for IHC. Our approach is to serve centralized markets with the HTG EdgeSeq system and expand to the decentralized market with Project JANUS. We believe our current HTG EdgeSeq instrument has the throughput capabilities that match the needs of the centralized market. Project JANUS is our development effort to expand our addressable market to the lower sample throughput labs and further decentralize the market.

14

Project JANUS began with the selection of our engineering partner. Project JANUS demonstrates the continuing innovation of HTG’s instrumentation platform and workflow benefits.

15

HTG Chemistries

Our core chemistry, known as qNPA, is a biochemical process capable of measuring messenger RNA, or mRNA, and microRNA gene expression levels from very small amounts of difficult to handle samples without the need for conducting RNA extraction, cDNA synthesis, RNA amplification or RNA-labeling steps. Our proprietary chemistry is well suited to measure RNA due to its simple, yet robust biochemistry designed to handle highly multiplexed assays. Two primary elements of our chemistry process are DNA to RNA hybridization and S1 nuclease digestion. Both of these elements have been widely researched for decades and are well understood.

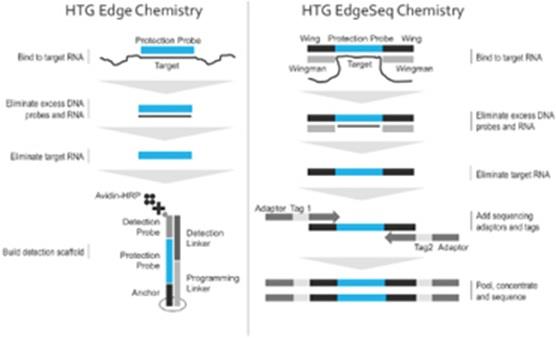

HTG Edge Chemistry

DNA nuclease protection probes, 50 bases in length, are added to the sample and hybridized to targeted RNAs, which can be both soluble and cross-linked in the biological matrix. S1 nuclease is added to remove excess, unhybridized DNA probes and RNA; the only remaining DNA protection probes are those hybridized to targeted RNA. This produces a virtual 1:1 ratio of DNA protection probes to the RNA initially targeted in the sample. Alkaline hydrolysis of the RNA releases the protection probes from the DNA:RNA duplexes. The released DNA protection probes are ready for quantitation. One of 47 unique anchor spots arrayed on the bottom of each well of a multi-well plate captures a programming linker that in turn captures a DNA protection probe. A detection scaffold consisting of a detection linker and a biotinylated detection probe is captured when a protection probe is present. After treatment with an avidin-HRP enzyme and a chemiluminescent substrate, the well is imaged and quantitated in the HTG Edge Reader. The HTG Edge system host software reports data from the reader.

HTG EdgeSeq Chemistry

DNA nuclease protection probes, which include a target-specific region flanked by universal wing sequences are hybridized to targeted RNAs, which can be both soluble and cross-linked in the biological matrix. Universal DNA wingmen probes are hybridized to the wings to prevent S1 nuclease digestion. S1 nuclease is added to remove excess, unhybridized DNA probes and RNA; the only remaining DNA protection probes are those hybridized to targeted RNA and wingmen probes. This produces a virtual 1:1 ratio of DNA detection probes to the RNA initially targeted in the sample. Alkaline hydrolysis of the RNA releases the protection probes from the DNA and RNA duplexes. The released DNA protection probes are ready for quantitation. DNA protection probes are labeled with sequencing adaptors and tags in a thermocycler. The labeled DNA protection probes are concentrated, pooled, and ready for sequencing using standard NGS protocols. Data from the NGS instrument is processed and reported by the HTG EdgeSeq Parser software.

16

Key Advantages of HTG Chemistries

|

|

· |

Multiplexing hundreds or thousands of targets. Measuring multiple genes in a single reaction can be challenging with competitive technologies due to the complex interactions of the assay sub-components. Our proprietary HTG Edge chemistry allows for 47 independent genes to be profiled in a sample. While we are currently marketing a panel with our HTG EdgeSeq chemistry that can profile up to 2,500 genes in a sample, we believe we can develop applications using our chemistry for multiplexing more than 2,500 genes if there is a customer need. The high level of gene multiplexing allows for significantly lower amounts of tissue to be used per sample than in competitive low-plex profiling technologies. |

|

|

· |

No RNA extraction. Competitive technologies for assessing RNA require RNA that is isolated and purified from other components found in the sample. These time-consuming and bias-inducing steps lead to some target loss. In FFPE tissues, a fraction of the RNA is lost in the purification process because it cannot be separated from insoluble tissue components and the fixation and embedding process or long storage times for FFPE tissue may damage the RNA and break it into smaller, more difficult to analyze fragments. This makes working with small FFPE tissues extremely challenging and can result in testing failures and loss of precious samples due to insufficient RNA recovery. These biases introduced by RNA extraction cannot be overcome and may be magnified throughout the subsequent analysis. Our proprietary chemistry does not require RNA extraction for most sample types, improves utilization of precious samples, improving workflow and reducing costs by eliminating a step known to cause bias in the data. |

|

|

· |

No cDNA synthesis. Many competitive technologies, most prominently qRT-PCR and RNA sequencing, require conversion of RNA into DNA for analysis. This process requires a viral enzyme to move along the extracted RNA to create a DNA copy of the molecule. When damaged and fragmented RNA is used, these small RNA strands become increasingly difficult to convert into DNA in an accurate and reproducible manner. Our proprietary chemistry does not require conversion of the RNA to DNA, removing a major source of bias experienced with competitive technologies. |

|

|

· |

Short protection probes. Many samples contain RNA degraded by various combinations of heat, age, poor processing, and fixation. In these samples, the RNA is damaged and fragmented into smaller strands. Utilizing short protection probes of 50 bases or less, our proprietary chemistry is more efficient than competitive technologies that require longer strands of RNA for quantitation. |

|

|

· |

Simplicity. Our proprietary chemistry is simple, with fewer steps than competing technologies. Compared to RT-qPCR, our chemistry does not require extraction or cDNA synthesis. Compared to RNA sequencing, our chemistry does not require extraction, cDNA synthesis, shearing, rRNA depletion, ligation, adenylation, or size selection. We believe that the accumulation of these steps required by other technologies results in amplification of biases, sample degradation and increased opportunities for technician error. |

HTG Edge and HTG EdgeSeq Platforms

Our HTG Edge and HTG EdgeSeq platforms were developed and are manufactured under ISO 13485:2003 guidelines using our proprietary chemistry to simplify multiplexed nucleic acid testing in research and clinical laboratories. The entire HTG Edge or HTG EdgeSeq workflow from sample preparation to a molecular profiling report can be accomplished in 24-36 hours for 96 samples. With the speed, flexibility, sensitivity, and accuracy of our HTG Edge and HTG EdgeSeq platforms, combined with the system’s ability to work effectively with small sample volumes, researchers can profile hundreds or thousands of different genes per sample.

The HTG Edge platform consists of processor and reader instruments, a host computer, and software. The HTG Edge processor is a fully automated instrument that prepares biological samples for quantitation using proprietary, electronically barcoded, single-use consumables. Both the processor and the reader have barcode scanners units to process the two-dimensional, or 2D, barcodes printed on the consumables loaded in each instrument. The barcoded consumables are single-use in order to reduce operator errors and provide chain of custody traceability for the samples. The robotic systems within each instrument are engineered for reliable performance and low maintenance. The walking path of each robot is programmed to minimize any chance of contamination of the reagents or samples.

17

Quantitation of results from the HTG Edge platform may be performed on either the proprietary HTG Edge Reader or an NGS platform. If the reader is utilized for quantitation, proprietary consumables are used in a chemiluminescent detection reaction, and the reader captures and processes these images in less than an hour to produce a quantitative result. The software reports the result on the host computer. One host computer supports up to five processors and one reader. This allows laboratories to easily expand their capacity by adding processors without purchasing an additional reader instrument.

HTG EdgeSeq applications combine either the HTG Edge processor or a dedicated HTG EdgeSeq processor with an NGS platform to enable the quantitative analysis of hundreds or thousands of targeted RNAs in a single assay. The sample is prepared for quantitation on the HTG Edge or HTG EdgeSeq processor, then labeled with molecular sequencing adaptors and tags. The labeled samples are concentrated, pooled, and sequenced on an NGS platform using standard protocols. Data from the NGS instrument are processed and reported by the HTG EdgeSeq Parser software. The HTG EdgeSeq applications currently process samples in sample volumes ranging from eight to 96.

HTG Edge and HTG EdgeSeq Platform Workflow

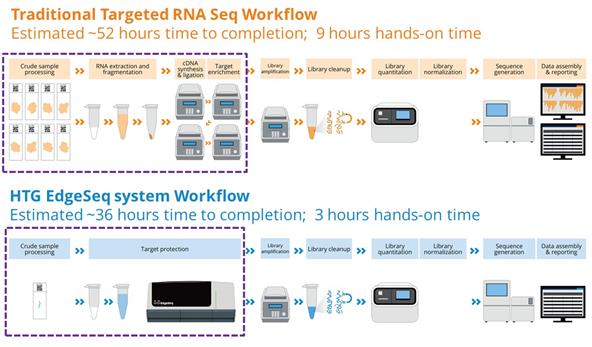

Our HTG Edge and HTG EdgeSeq platforms deliver complex molecular profiling information in a simple four step workflow. A technician spends minimal time preparing samples which are easily loaded into the applicable processor. Once the sample is loaded, the processor performs our proprietary chemistry protocol with no technician intervention, which is commonly referred to as walk away automation. Once the sample is processed, a technician prepares the sample for quantitation on either the HTG Edge reader, for HTG Edge systems, or an existing NGS instrument. This flexibility in quantifying molecular information provides customers the ability to optimize their use of the HTG Edge or HTG EdgeSeq platform based on their specific throughput, workflow and application requirements. Having both quantitation options allows HTG to offer a broader set of molecular profiling panels and leverage the growing NGS installed base. In comparison to RNA sequencing, there are many fewer steps required for molecular profiling using HTG EdgeSeq applications as shown in the diagrams below.

HTG Edge and HTG EdgeSeq Platform Performance

The HTG Edge and/or HTG EdgeSeq platforms enable our customers to quantitatively profile from one to thousands of genes in a single reaction using very small samples. Our chemistry works with many biological sample types including FFPE, frozen tissue, plasma, serum, whole blood preserved in PAXgene, and cultured cells. We plan to enable our customers to use a single profiling workflow for the analysis of multiple parameters such as RNA expression, RNA fusions and rearrangements, DNA mutations and protein expression. As part of our development process for new products we perform several analytical studies to demonstrate performance of the applicable platform, and we believe that our approach to multi-parameter molecular profiling is highly repeatable and reproducible.

18

Equivalent quantitative expression results from large as well as very small samples

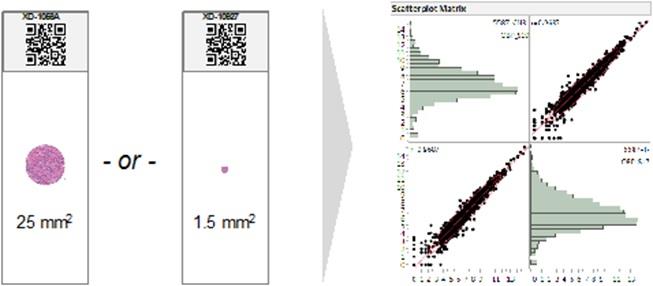

HTG EdgeSeq assays are validated with sample inputs ranging from as much as 25 mm2 down to 1.5 mm2 tumor surface area from a single 5 µm section, enabling comprehensive molecular profiling on a large surgical resection or very small needle core biopsy. Needle core biopsies are often the only tissue available for profiling. A representation of the difference in the amount of tissue available in a surgical resection versus a core needle biopsy is shown in the graphic below. In an internal study of resections versus core needle biopsies from the same non-small cell lung cancers, Pearson correlations (log2 transformed counts) greater than 0.96 were observed.

19

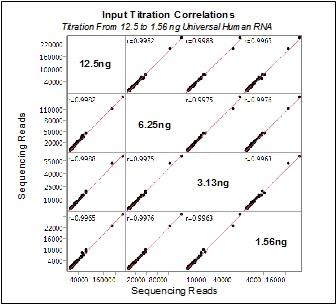

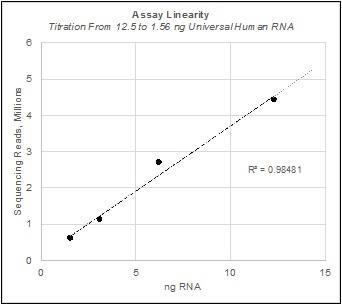

We believe obtaining molecular profiles from very small samples is of critical importance to researchers. We have demonstrated reproducible, quantitative results from a fraction of the more than 100 ng of input RNA typically required for competitive technologies. In the study shown below, the HTG EdgeSeq Oncology Biomarker Panel was used to measure mRNA expression levels in a dilution series from 12.5 ng to 1.56 ng of Universal Human RNA. In the figure titled Input Titration Correlations below, correlations between each dilution were measured by Pearson’s r and are displayed in each comparison field. A Pearson correlation between two perfectly identical molecular profiles will produce an r-value of 1.0. The r-values obtained in the study shown below, of greater than 0.99, indicate nearly identical molecular profiles were obtained. In the figure titled Assay Linearity below, the raw number of sequencing reads for each of the samples in the dilution series are shown, with the statistical measure of how close the data are to the fitted regression line, R-squared, of 0.98481. These plots demonstrate the capability of the HTG EdgeSeq applications on the HTG Edge or HTG EdgeSeq platform to deliver equivalent molecular profiles over a range of sample inputs.

|

|

|

|

20

Leveraging the dynamic range and sensitivity of NGS

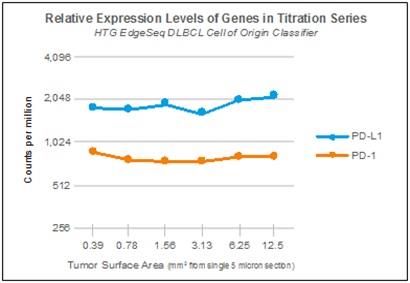

The end product of the HTG EdgeSeq chemistry process is a library of genomic fragments which, once sequenced, are compared to a reference genome consisting of one sequence per probe in the assay. NGS platforms individually sequence each genomic fragment that binds to its detection media, obtaining highly specific information about each of one of the genomic fragments analyzed in a single sequencing run. Each fragment sequence is stored as a single read. With the potential capacity of a single sequencing run numbering in the millions of reads, NGS assays are highly sensitive, detecting low abundance or rare sequences, while having a wide dynamic range, accurately counting the relative number of abundant sequences. In the development and validation of gene expression classifiers, we believe it is important that the assay system reliably measure differential gene expression for both high and low abundance genes. As an example of how the HTG EdgeSeq assays leverage the sensitivity of NGS, the graphic below shows the relative expression of the low-abundance immunotherapy targeted genes PD-1 and PD-L1 across a wide range of sample inputs using the HTG EdgeSeq Diffuse Large B-Cell Lymphoma Cell of Origin Assay.

High fidelity between processing conditions

One of the greatest challenges faced in molecular profiling of formalin fixed samples is the poor fidelity routinely seen when comparing the results across various processing conditions. One example in particular is the fidelity seen between formalin fixed samples such as FFPE to non-fixed tissue. It has been repeatedly demonstrated that the fixation process can lead to different molecular profiles in otherwise identical samples. We believe researchers often obtain sub-optimal molecular profiling results solely due to the formalin fixation process. We further believe that our chemistry overcomes the losses in fidelity between non-fixed and FFPE tissues, enabling users to obtain an accurate assessment of tumor biology from FFPE tissues.

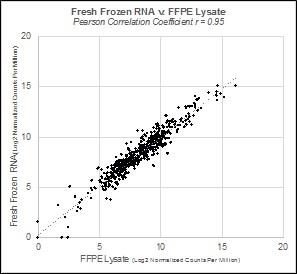

21

To demonstrate fidelity between non-fixed and FFPE tissues that may be achieved using the HTG EdgeSeq system, a resection from a breast cancer tumor was prospectively harvested and split, with half of the specimen immediately frozen and the other formalin fixed and paraffin embedded (FFPE). RNA from the non-fixed, fresh frozen specimen was extracted and added to the HTG lysis buffer (we recommend extracting the RNA from fresh tissue samples). The matched FFPE tissue was directly lysed in the HTG lysis buffer without extraction. Both specimens were then profiled using the HTG EdgeSeq Immuno-Oncology Assay. The scatterplot below shows the correlation between the non-fixed, fresh frozen tissue and the FFPE tissue, with a Pearson correlation coefficient of r = 0.95, indicating that the fixation process did not materially alter the molecular profile of the sample when our proprietary chemistry was used. We believe our platform enables researchers and clinicians to access their large collections of archived FFPE tissues to deliver reproducible, biologically relevant molecular profiles.

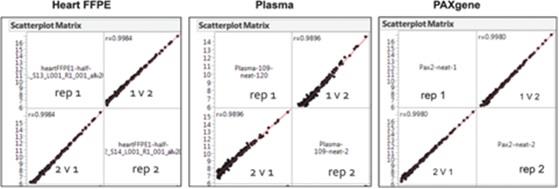

Compatibility with multiple sample types

Compatibility of our proprietary chemistry with ovarian FFPE, extracted RNA, and fresh or fixed cultured cells is shown above. Below are technical replicates of heart FFPE, plasma and whole blood preserved in PAXgene profile using the HTG EdgeSeq microRNA whole transcriptome panel. We believe our proprietary chemistry is robust across many biological sample types.

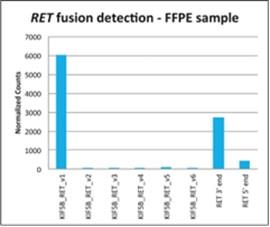

Detection of gene fusions

HTG EdgeSeq chemistry has demonstrated the ability to accurately detect gene rearrangements in patient-derived FFPE tissues. The example below demonstrates detection in a patient sample with a characterized gene fusion involving the KIF5B and RETS genes. Using multiple DNA protection probes, the HTG EdgeSeq platform can detect gene rearrangements and fusions. Rearrangements and fusions are detected in two ways. First is the direct measurement and detection of the unique RNA sequence created at the gene fusion site. This is indicated by the strong signal obtained from the KIF5B-RET v1 probe. The second approach involves calculating the ratio of signals obtained from probes targeting both the 5’ and 3’ end of the RET gene. Samples which do not contain a RET gene fusion will have similar RET 5’ and RET 3’ expression. In the sample above, however, which contains a RET

22

gene fusion, we see significantly higher signal from the RET 3’ probe implying the two parts of the RET gene are no longer connected, indicating a gene rearrangement has occurred.

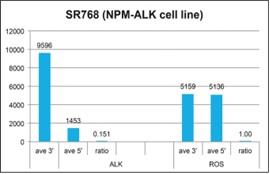

A cell line with a known ALK fusion and normal ROS1 was tested using the same 5’ and 3’ probe ratio methodology described for the RET fusion above. As expected with a fused ALK gene, the expression of the 3’ portion of the transcript is much higher than the 5’ portion, indicating a fusion event has occurred. An example of a known non-fusion gene, ROS1, is also shown in the example where the 5’ and 3’ ends of the ROS1 are expressed at a 1:1 ratio, indicating this gene is intact.

23

Discriminating between closely related sequences

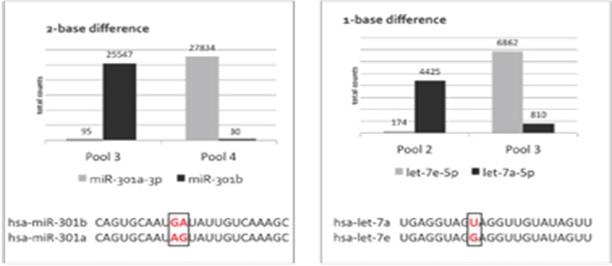

The specificity of our proprietary chemistry is demonstrated in the data chart below. Closely related synthetic miRNA pools supplied by Association of Biomolecular Resource Facilities were split between pools. All possible probes were used to profile individual pools. From 3-11% of NPP probes bound to off-target sequences with a 1-base difference (Figure 1A) while only 0.1-0.3% of NPP probes bound to off-target sequences with a 2-base difference (Figure 1B). In both examples, the on-target hybridization signal is at least 8X greater than off-target hybridization. Data was generated using the Illumina MiSeq v2 1x50 reagent kit. We believe that our proprietary chemistry is highly specific and will enable our customers to discriminate between closely related sequences.

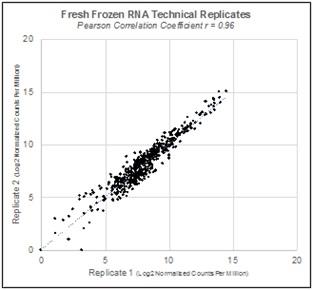

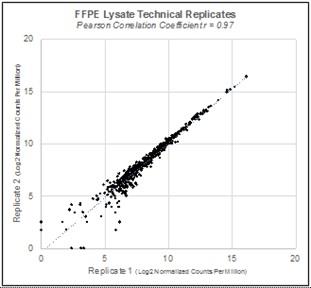

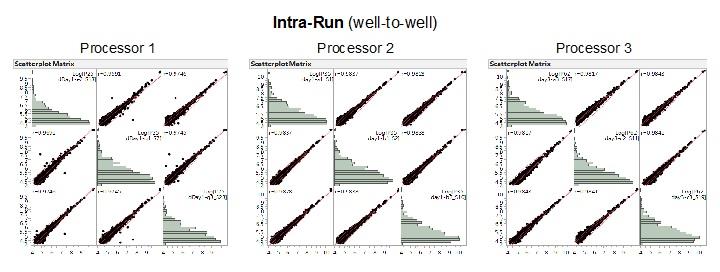

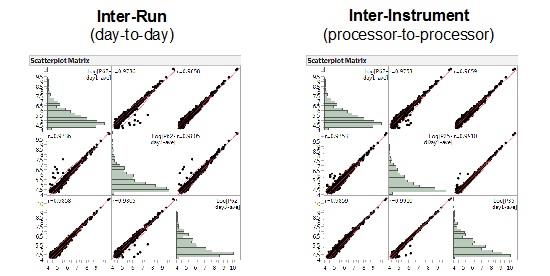

Repeatability