Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NATIONAL FUEL GAS CO | d159854d8k.htm |

Investor Presentation

Scotia Howard Weil Energy Conference

March 21 – 23, 2016 Exhibit 99 |

Safe Harbor For Forward Looking Statements

2 This presentation may contain “forward-looking statements” as defined by the Private Securities Litigation Reform Act of

1995, including statements regarding future prospects, plans,

objectives, goals, projections, estimates of oil and gas quantities, strategies, future events or performance and underlying assumptions, capital structure, anticipated capital expenditures, completion of construction projects, projections for pension and other post-retirement benefit obligations,

impacts of the adoption of new accounting rules, and possible

outcomes of litigation or regulatory proceedings, as well as

statements that are identified by the use of the words “anticipates,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “predicts,” “projects,” “believes,” “seeks,”

“will,” “may,” and similar expressions. Forward-looking statements involve risks and uncertainties which could cause actual results or outcomes to differ materially from those expressed in the forward-looking statements. The Company’s

expectations, beliefs and projections are expressed in good faith

and are believed by the Company to have a reasonable basis, but there can be no assurance that management’s expectations, beliefs or projections will result or be achieved or accomplished. In addition to other factors, the following are important factors that, in the view of the Company, could cause actual results to differ

materially from those discussed in the forward-looking

statements: Impairments under the SEC’s full cost ceiling test for natural gas and oil reserves; changes in the price of natural gas or oil; financial and economic conditions, including the availability of credit, and occurrences affecting the Company’s ability to obtain financing on acceptable

terms for working capital, capital expenditures and other

investments, including any downgrades in the Company’s credit ratings and changes in interest rates and other capital market conditions; delays or changes in costs or plans with respect to Company projects or related projects of other companies, including difficulties or delays in obtaining necessary

governmental approvals, permits or orders or in obtaining the

cooperation of interconnecting facility operators; factors affecting the Company’s ability to successfully identify, drill for and produce economically viable natural gas and oil reserves, including among others geology, lease availability, title disputes, weather conditions,

shortages, delays or unavailability of equipment and services

required in drilling operations, insufficient gathering, processing

and transportation capacity, the need to obtain governmental

approvals and permits, and compliance with

environmental laws and regulations; changes in laws, regulations or judicial

interpretations to which the Company is subject, including those involving derivatives, taxes, safety, employment, climate change, other environmental matters, real property, and exploration and production activities such as hydraulic

fracturing; governmental/regulatory actions, initiatives and

proceedings, including those involving rate cases (which address, among other things, target rates of return, rate design and retained natural gas), environmental/safety requirements, affiliate relationships, industry structure, and franchise renewal; changes in price differentials

between similar quantities of natural gas or oil at different

geographic locations, and the effect of such changes on commodity production, revenues and demand for pipeline transportation capacity to or from such locations; other changes in price differentials between similar quantities of natural gas or oil having different quality, heating value, hydrocarbon

mix or delivery date; the cost and effects of legal and

administrative claims against the Company or activist shareholder campaigns to effect changes at the Company; uncertainty of oil and gas reserve estimates; significant differences between the Company’s projected and actual production levels for natural gas or oil; changes in demographic

patterns and weather conditions; changes in the availability, price

or accounting treatment of derivative financial instruments; changes in economic conditions, including global, national or regional recessions, and their effect on the demand for, and customers’ ability to pay for, the Company’s products and services; the creditworthiness or

performance of the Company’s key suppliers, customers and

counterparties; economic disruptions or uninsured losses resulting from major accidents, fires, severe weather, natural disasters, terrorist activities, acts of war, cyber attacks or pest infestation; significant differences between the Company’s projected and actual capital expenditures and operating

expenses; changes in laws, actuarial assumptions, the interest rate

environment and the return on plan/trust assets related to the Company’s pension and other post-retirement benefits, which can affect future funding obligations and costs and plan liabilities; increasing health care costs and the resulting effect on health insurance premiums and

on the obligation to provide other post- retirement

benefits; or Increasing costs of insurance, changes in coverage and

the ability to obtain insurance. Forward-looking statements

include estimates of oil and gas quantities. Proved oil and gas reserves are those quantities of oil and gas which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible under existing economic conditions, operating

methods and government regulations. Other estimates of oil

and gas quantities, including estimates of probable reserves, possible reserves, and resource potential, are by their nature more speculative than estimates of proved reserves. Accordingly, estimates other than proved reserves are subject to substantially greater risk of being actually

realized. Investors are urged to consider closely the disclosure in

our Form 10-K available at www.nationalfuelgas.com. You can also obtain this form on the SEC’s website at www.sec.gov.

For a discussion of the risks set forth above and other factors that could cause

actual results to differ materially from results referred to in the

forward-looking statements, see “Risk Factors” in the

Company’s Form 10-K for the fiscal year ended September 30, 2015 and the Form 10-Q for the quarter ended December 31, 2015. The Company disclaims any obligation to update any forward-looking statements to reflect events or circumstances after the date thereof or to reflect the

occurrence of unanticipated events. |

• 2.3 Tcfe Proved Reserves (1) • 785,000 net acres in Marcellus Shale • 3 million Bbls/year California crude oil production 3 (1) Total proved reserves are as of September 30, 2015. (2) For the trailing twelve months ended December 31, 2015. A reconciliation of Adjusted EBITDA to Net Income as presented on the Consolidated Statement of Income and Earnings Reinvested in the Business is included at the end of this presentation. National Fuel Gas Company Upstream Downstream Quality Assets | Exceptional Location | Unique Integration

• $252 million adjusted EBITDA (2) • $1.2 billion midstream investments since 2010 • Coordinated infrastructure build-out in Appalachia with NFG Upstream • 740,000 Utility customer accounts • Stable, regulated earnings & cash flows • Generates operational and financial synergies with other segments Midstream |

200,000 “Tier 1” fee-held acres in Pa.

1,200 locations economic < $2.25/MMBtu

with minimal lease expiration

Just-in-time build-out of Clermont

Gathering System limits stranded

pipeline assets/capital

Northern Access projects to

transport 660 MDth/d of Seneca-

operated WDA production by FY18

Integrated Vision for Long-term Growth in Appalachia

4 Pipeline & Storage Gathering 1 2 3 1 2 Long-term, return- driven approach to developing vast acreage position Connecting Our Production to Our Interstate Pipeline System 3 Exploration & Production Expanding Our Interstate Pipeline System to Reach Premium Markets |

Integrated Upstream & Midstream Development

5 WDA Well Costs ($millions) WDA Clermont / Rich Valley Economics Normalized for a 8,800 ft. Lateral Length Realized Price Required for 15% IRR (1) Normalized for a 8,800 ft. Lateral Length (1) Internal Rate of Return (IRR) is pre-tax and includes estimated well costs under current cost structure, LOE and gathering tariffs

anticipated for each prospect. Assumes Dawn is on par with NYMEX.

While Seneca has consistently driven down its well costs and improved

break-even economics … Marcellus Drilling Cost per

Foot Marcellus Completion Cost per Stage ($000s)

|

1-Rig Program/Northern Access 1-year Delay

Integrated Upstream & Midstream Development

6 WDA Clermont /Rich Valley Economics vs. NYMEX Futures Strip FT Cost (2) Northern Access In-Service (+490 MDth/d) (1) Internal Rate of Return (IRR) is pre-tax and includes estimated well costs under current cost structure, LOE and gathering tariffs

anticipated for each prospect. Assumes Dawn is on par with NYMEX.

(2) Reflects $0.70 per Dth reservation charge, including the cost of non-affiliated downstream transportation from the Canadian border to

Dawn, and assumes approximately $0.06 per Dth of variable fees

(commodity, fuel, etc.).

… near-term commodity prices prompted modification to upstream &

midstream development pace $0.76

Original Northern Access

in-service date (11/1/16)

Revised Northern Access

in-service date (11/1/17)

$2.68 $1.92 NYMEX Natural Gas Futures Strip (3/16/16) CRV Break-even Realized Price (NYMEX/Dawn) CRV Break-even Realized Price (well-head) |

$72 $89 $94 $75-$100 $95-$105 $56 $140 $230 $500-$550 $125-$175 $55 $138 $118 $100-$125 $85-$95 $533 $603 $557 $400-$475 $150-$200 $717 $970 $1,001 $1,075-$1,250 $455-$575 $0 $500 $1,000 $1,500 2013 2014 2015 2016E (March '15) 2016E (Current) Exploration & Production Segment Gathering Segment Pipeline & Storage Segment Utility Segment Energy Marketing & Other Consolidated Capital Expenditures 7 (1) FY2016 capital expenditure guidance reflects the netting of up-front proceeds received from joint development partner for capital

spent on wells drilled and/or completed prior to the execution date of the joint development agreement. The E&P segment’s FY16 & FY17 capital budgets would be reduced by an additional $90-$110 million if joint development partner exercises right to participate in remaining 38 wells. Note: A reconciliation to Capital Expenditures as presented on the Consolidated Statement of Cash Flows is included at the end of this presentation. (1) Exercising Capital Flexibility and Discipline to Respond to Commodity Price Environment (1) Executed “Drill-Co” JDA (2) 1-rig Marcellus program (3) Northern Access delay (4) Gathering build-out slow-down (5) Reduced spending in CA Key Capital Budget Actions 56% cut in FY16 |

National Fuel is Well Positioned

8 Flexibility to Deploy Capital Strong Hedge Book and Firm Sales Portfolio Stable, Growing Base of Regulated Earnings & Cash Flows Strong Balance Sheet and Liquidity Investment grade credit rating $1.25 billion short-term credit facilities can accommodate modest

outspend in fiscal 2017 No near-term debt maturities to refinance Fee ownership on Marcellus acreage limits drilling commitments (& royalties)

Just-in-time midstream development model for upstream affiliate limits

risk of idle capital

and minimizes contractual commitments to 3 rd party pipelines Modest 1-rig program, curtailed volumes and DUC well inventory allow for a steady

ramp-up of productive capacity to fill Northern Access by end of fiscal

2018 78% of remaining fiscal 2016 natural gas production hedged

at $3.53/MMbtu 45% of remaining fiscal 2016 crude oil production

hedged at $87.70/Bbl Allows E&P segment to live within cash

flows in FY16 and FY17 at current strips Preserves near-term

well economics and protects affiliated midstream throughput

Utility segment provides stable, predictable earnings and cash

flows Pipeline & Storage EBITDA growth from 2015 projects and

on-going expansions Supports investment grade

rating Covers commitment to dividend, debt service and

maintenance expenditures |

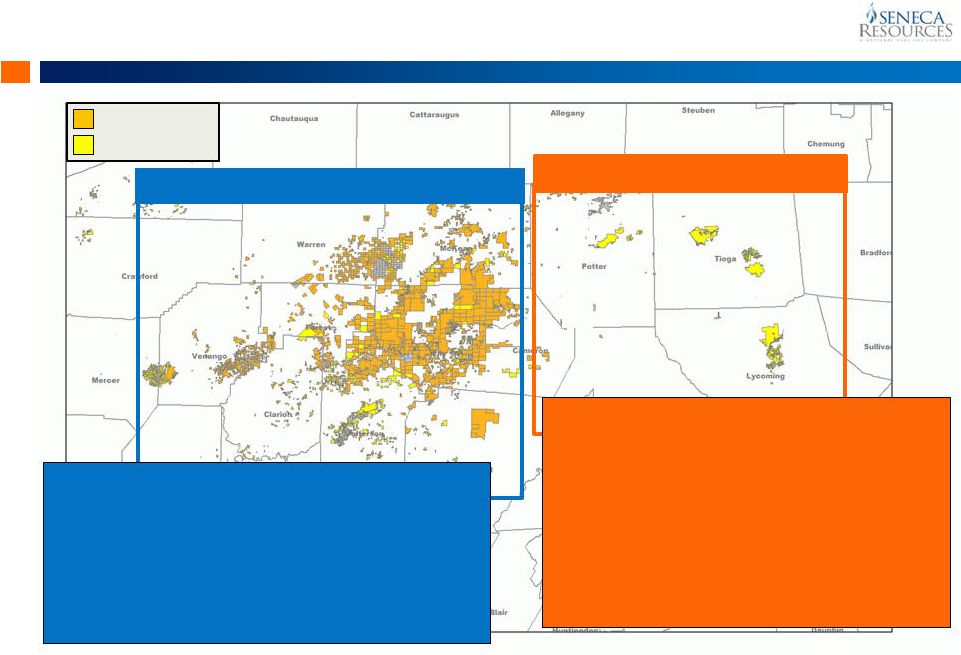

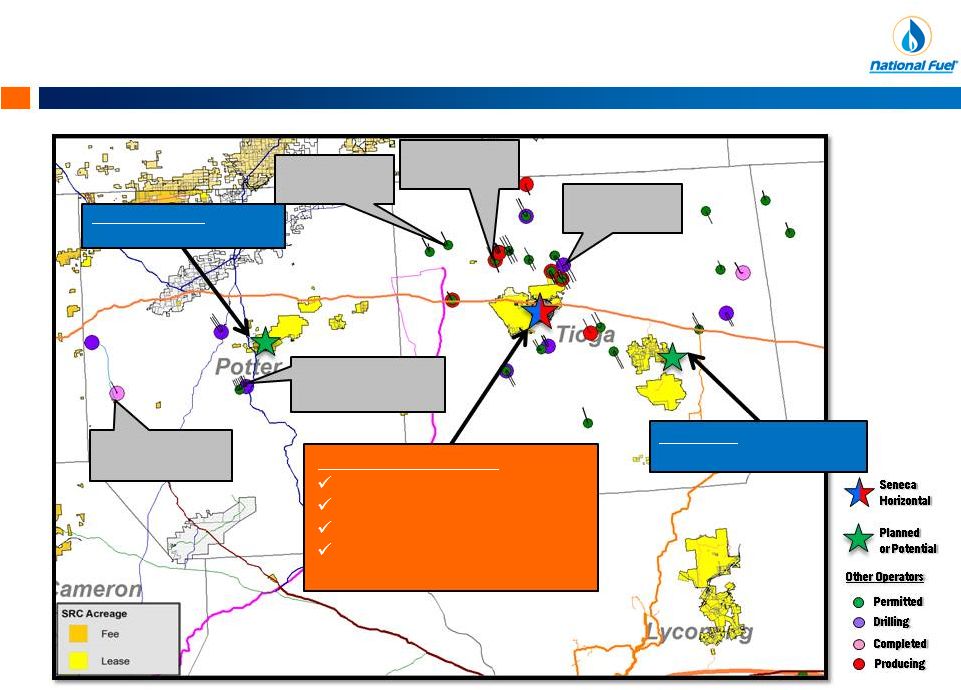

Appalachia Overview

Exploration & Production | Gathering | Pipeline

& Storage 9 |

Exploration & Production

Appalachia Significant Appalachian Acreage Position 10 • 153 wells able to produce 350 MMcf/d • 40-50 remaining Marcellus locations • Additional strong Utica & Geneseo potential • Limited development drilling until firm transportation on Atlantic Sunrise (190 MDth/d) is available in late 2017 • Mostly leased (16-18% royalty) • No near-term lease expirations • 83 wells able to produce 255 MMcf/d • Large inventory of high quality Marcellus acreage • NFG midstream infrastructure supporting growth • 660 MDth/d firm transportation by fiscal 2018 • Mineral fee ownership enhances economics • Highly contiguous nature drives efficiencies Seneca Lease Seneca Fee 715,000 Acres 70,000 Acres Western Development Area (WDA) Eastern Development Area (EDA) |

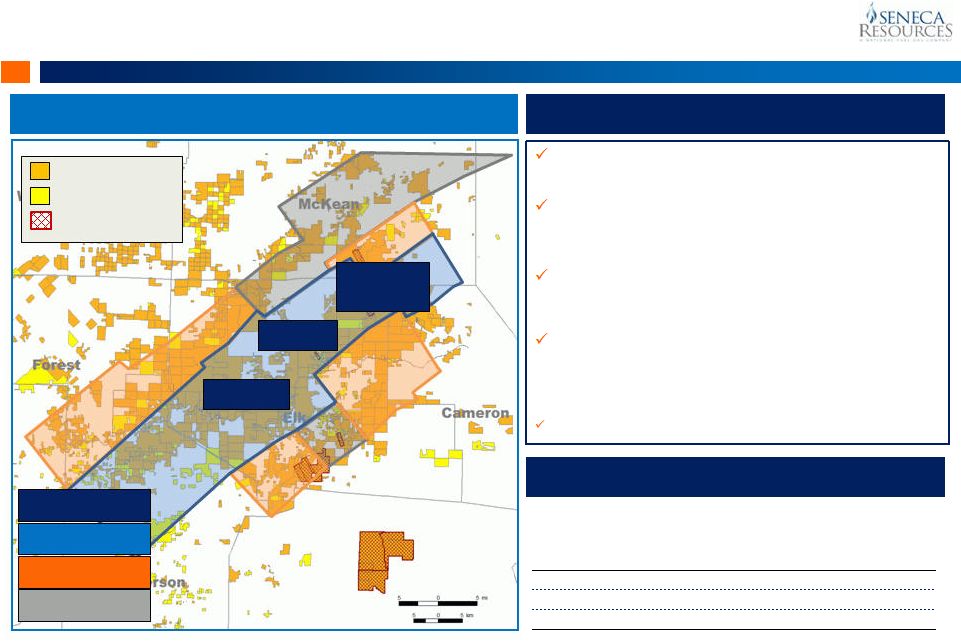

Exploration & Production

Appalachia Marcellus Shale: Western Development Area 11 WDA Tier 1 Acreage – 200,000 Acres WDA Tier 1 Marcellus Economics (1) WDA Highlights Large drilling inventory of quality Marcellus dry gas o ~1,200 locations economic < $2.25/MMBtu realized NFG midstream infrastructure supporting growth o NFG Clermont Gathering System o 660 MDth/d firm transport on NFG projects by FY18 Fee acreage provides flexibility /enhances economics o No royalty on most acreage o No lease expirations or requirements to drill acreage Highly contiguous position drives D&C efficiencies o Multi-well pad drilling averaging 10 wells per pad o Average lateral length to date = 7,800 ft. o Centralized water sourcing & disposal infrastructure 2 Utica tests expected in fiscal 2016/2017 SRC Lease Acreage SRC Fee Acreage SRC / EOG Earned Acreage Clermont/ Rich Valley Hemlock Ridgway 2 - 4 BCF/well 7-11 BCF/well 4 - 6 BCF/well EUR Color Key Avg $3.00 15% IRR Locations EUR NYMEX/Dawn Realized Remaining (Bcf) IRR% Price CRV 72 10-11 23% $1.92 Hemlock/Ridgway 662 8-9 16% $2.14 Other Tier 1 423 7-8 14% $2.21 (1) Internal rate of return (IRR) is pre-tax and includes estimated well costs under the current well design and cost structure and

projected firm transportation, gathering, LOE and other operating

costs. CRV and Hemlock/Ridgway well designs assume 8,800 ft. lateral and 190 ft. frac stage spacing. Other Tier 1 well designs assume 8,500 ft. lateral and 190 ft. frac stage spacing. |

Exploration & Production

Appalachia Transaction Seneca WDA Joint Development Agreement 12 Key Terms On December 2, 2015, Seneca entered into an asset-level joint development agreement with IOG CRV-Marcellus

Capital, LLC, an affiliate of IOG Capital, LP, and funds managed by affiliates

of Fortress Investment Group, LLC, to jointly develop Marcellus

Shale natural gas assets located in Elk, McKean and Cameron counties in north-central PA. Assets: 80 current and future Marcellus development wells

in the Clermont/Rich Valley region of Seneca’s WDA.

Partner’s Initial Obligation: 42

wells Partner Option:

Partner has one-time option to participate in remaining 38 wells on or before July 1, 2016. Economics: Partner participates as an 80% working interest owner until the Partner achieves a 15% IRR hurdle. Seneca retains a 7.5% royalty and remaining 20% working interest. Strategic Rationale Significantly reduced near-term upstream capital spending Initial 42 wells - $200 million (1) 38 well option

- $180 million (1) Validated quality of Seneca’s Tier 1 Marcellus WDA acreage Seneca maintained activity levels driving additional Marcellus drilling and completion efficiencies Solidified NFG’s midstream growth strategy: Gathering - All production from JV wells will flow through NFG Midstream’s Clermont Gathering System Pipeline & Storage

- Provides production growth that will utilize the 660 MDth/d of firm transportation capacity on NFG’s Northern Access pipeline expansion projects Strengthened balance sheet and makes Seneca cash flow positive in near-term Marketing: Partner to receive same realized price before

hedging as Seneca on production from the joint

development wells, including firm sales and the cost of firm

transportation.

Interests on Initial 42

Wells Seneca Partner Working Interest 20% 80% Net Revenue Interest 26% 74% (1) Estimated reduction in capital expenditures from joint development agreement assumes current wells costs.

|

Exploration & Production

Appalachia Integrated WDA Development - Upstream 13 Clermont/Rich Valley Development Map Clermont/Rich Valley Area Legend Drilled Wells Planned Wells Clermont Gathering System (in-service) Clermont Gathering System (future) CRV Development Summary • Current: 62 wells able to produce ~200 MMcf/d •

200+ MMcf/d gross firm sales in fiscal 2016

• Dropped to 1 rig in March 2016 (down from 3 rigs to start fiscal 2016) • Just-in-time gathering infrastructure build-out provides significant capital flexibility based on pace of Seneca’s development program • Regional focus of development minimizes capital outlay and improves returns Pittsburgh |

Appalachia Gathering Integrated WDA Development - Gathering 14 Current System In-Service • ~60 miles of pipe/13,800 HP of compression • Current Capacity: 470 MMcf per day • Interconnects with TGP 300 • Total CapEx To Date: $235 million Fiscal 2016 Build Out • FY16 CapEx (1) : $60 to $75 million • Adjusted timing of gathering & compression investment to match Seneca’s modified development schedule/Northern Access • Will exit FY16 with > 72 miles of pipe installed and >26,220 HP commissioned Future Build-Out (FY17+) • Ultimate capacity can exceed 1 Bcf/d • Over 300 miles of pipelines and five compressor stations (+60,000 HP installed) • Deliverability into TGP 300 and NFG Supply Gathering System Build-Out Tailored to Accommodate Seneca’s WDA Development Clermont Gathering System Map (1) For the remaining 9-months of fiscal 2016. |

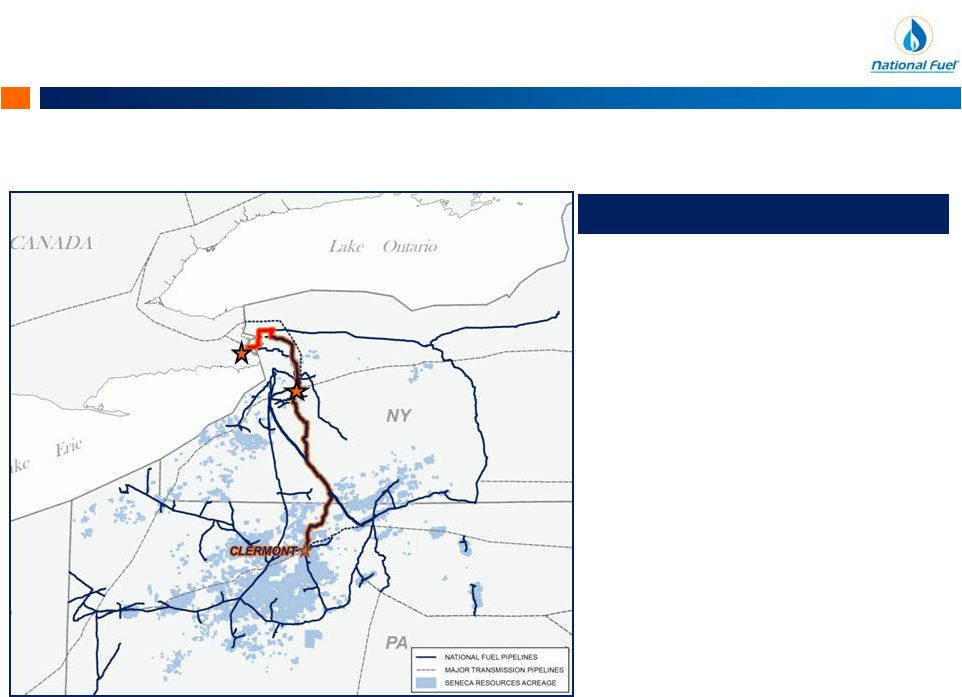

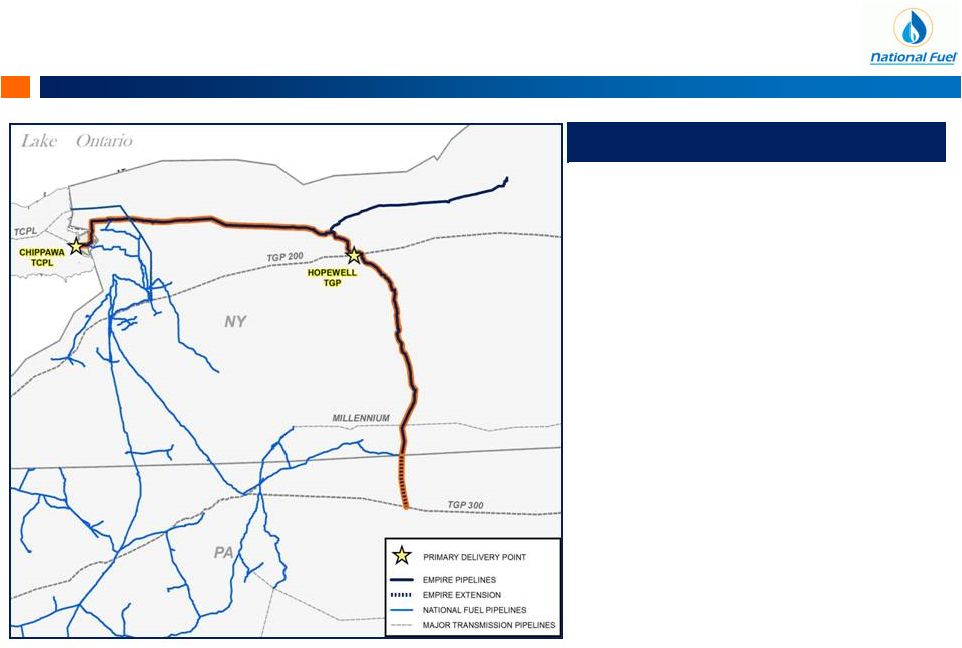

Appalachia Pipeline & Storage Integrated WDA Development - Interstate Pipelines 15 (1) 40,000 Dth per day went in-service on November 1, 2015. The remaining 100,000 Dth per day was placed in-service on December

1, 2015. Northern Access 2015

• Customer: Seneca Resources (NFG) • In-Service: November 2015 (1) • System: NFG Supply Corp. • Capacity: 140,000 Dth per day o Leased to TGP as part of TGP’s Niagara Expansion project • Interconnect o Niagara (TransCanada) • Major Facilities o 23,000 hp Compression • Total Cost: $67.5 million • Annual Revenues: $13.3 million Expanding Our Interstate Pipelines to Deliver Seneca’s WDA Production to Canada |

Appalachia Pipeline & Storage 16 Northern Access 2016 • Customer: Seneca Resources (NFG) • In-Service: Now targeting Nov. 1, 2017 • Capacity: 490,000 Dth/d • Interconnects: o TransCanada – Chippawa (350 MDth/d) o TGP 200 – East Aurora (140 MDth/d) • Total Cost: ~$455 Million • Major Facilities: o 98.5 miles – 16/24” Pipeline o 22,214 hp & 5,350 hp Compression • FERC/Regulatory Status o FERC Certificate filing: March 2015 o Certificate amendment filed Nov. 2015 o 401 Water Quality Joint Application to NYDEC & USACE: February 2016 Northern Access 2016 to Increase Transport Capacity out of WDA to Canada by 490,000 Dth/d by FY18 Integrated WDA Development - Interstate Pipelines Chippawa East Aurora |

Exploration & Production

Appalachia Marcellus Shale: Eastern Development Area 17 (1) One well included in the total for both Tract 595 and Tract 100 is drilled into and producing from the Geneseo

Shale. EDA Acreage –

70,000 Acres 1 2 3 EDA Highlights 1 Covington & DCNR Tract 595 o Tioga County, Pa. o 92 wells (1) with 110 MMcf/d productive capacity o 75 MMcf/d firm sales/FT in FY16 o NFG Covington Gathering System o Opportunity for future Geneseo & Utica dev. DCNR Tract 100 & Gamble o Lycoming County, Pa. o 61 wells (1) with 240 MMcf/d productive capacity o 130-185 MMcf/d firm sales/FT in FY16 o Atlantic Sunrise capacity (190 MDth/d) in FY18 o NFG Trout Run Gathering System o Geneseo to provide additional 100-120 locations DCNR Tract 007 o Tioga County, Pa. o 1 Utica and 1 Marcellus exploration well o Utica well 24 IP = 22.7 MMcf/d o Utica Resource potential = ~1 Tcf 2 3 |

Appalachia Gathering Integrated EDA Development - Gathering 18 • In-Service Date: November 2009

• Capital Expenditures (to date): $33 Million • Capacity: 220,000 Dth per day • Production Source: Seneca Resources –

Tioga Co. (Covington and DCNR Tract 595 acreage) • Interconnect: TGP 300 • Facilities: Pipelines and dehydration

• Future third-party volume opportunities • In-Service Date: May 2012 • Capital Expenditures (to date): $166 Million

• Capacity: 466,000 to 585,000 Dth per day

• Production Source: Seneca Resources –

Lycoming Co.

(DCNR Tract 100 and Gamble acreage)

• Interconnect: Transco –

Leidy Lateral

• Facilities: Pipelines, compression, and dehydration

• Future third-party volume opportunities Covington Gathering System Trout Run Gathering System Gathering Segment Supporting Seneca’s EDA Production & Future Development

Interconnects |

Exploration & Production

Appalachia Utica Shale Opportunities in EDA & WDA 19 Range 59 MMcf/d Rice 42 MMcf/d Shell 26.5 MMcf/d Permitted Drilling Completed Production Seneca Vert. Seneca Horiz. EQT 73 MMcf/d Color-filled contours are Trenton TVDSS; CI = 1000’ Seneca – Mt. Jewett IP: 8.9 MMcf/d CNX 61 MMcf/d MHR 46 MMcf/d Seneca – WDA 2 Utica Test Wells Planned for FY16/17 Seneca - DCNR 007 IP: 22.7 MMcf/d CNX 61.9 MMcf/d CNX 44 MMcf/d |

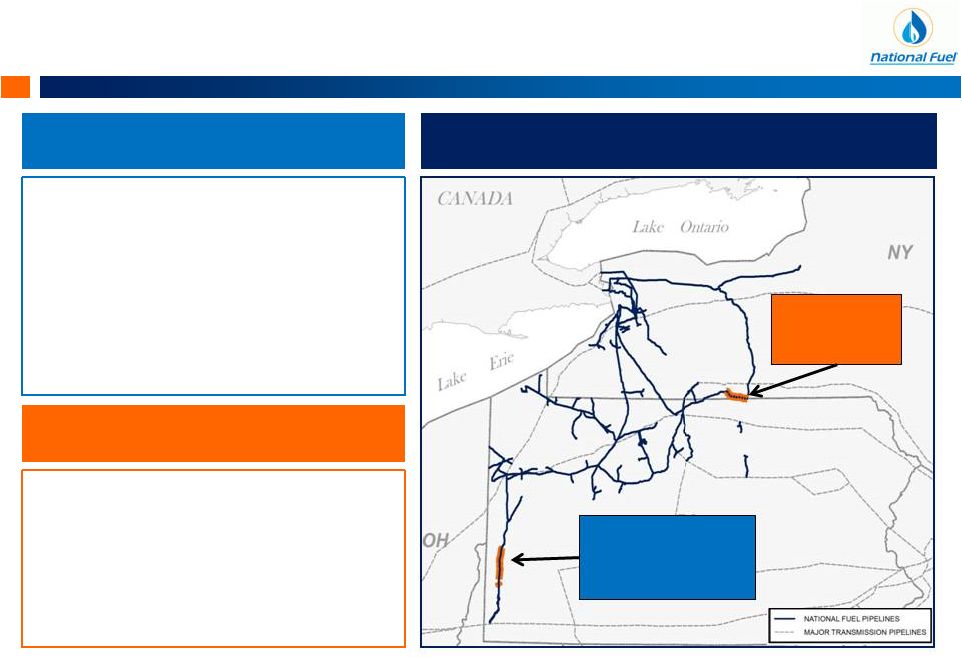

Pipeline & Storage: Premier Appalachian Position

20 In addition to serving our own upstream and downstream subsidiaries, NFG is uniquely positioned to expand our regional pipeline systems and provide

valuable outlets for 3

rd party producers and shippers in Appalachia Canada & Michigan New England & Northeast Midwest & Southeast Mid-Atlantic Appalachia Pipeline & Storage |

Appalachia Pipeline & Storage Recent 3 rd Party Expansions Highly Successful 21 Expansions for 3 rd Parties since 2010 Line N Projects +633 MDth/d Northern Access 2012 +320 MDth/d Empire & Lamont Expansions +489 MDth/d 3 rd Party Expansion Capital Cost ($MM) Annual Expansion Revenues Added ($MM) $72 $132 $183 Northern Access 2012 Empire & Lamont Line N Projects $387 million since FY 2010 1,442 MDth/d since FY2010 $4 $37 $19 $4 $5 $25 ~$95 $0 $25 $50 $75 $100 $125 FY11 FY12 FY13 FY14 FY15 FY16E Cum. |

Appalachia Pipeline & Storage Planned Empire System Expansion 22 Empire North Expansion Project • Target In-Service: Late 2018 • System: Empire Pipeline • Target Market: o Marcellus & Utica producers in Tioga & Potter County, Pa. • Open Season Capacity: 300,000 Dth/d • Delivery Points: o 180,000 Dth/d to Chippawa (TCPL) o Up to 158,000 Dth/d to Hopewell (TGP) • Estimated Cost: $185 million • Major Facilities: o 3 new compressor stations • FERC Status: o Open Season concluded in Nov. 2015 o Preparing precedent agreements |

Appalachia Pipeline & Storage 2015 Pipeline Expansion Projects In-Service 23 Westside Expansion & Modernization In-Service (October 2015) Tuscarora Lateral In-Service (November 2015) 2015 Completed Pipeline Expansion Projects • Total Cost: $60.0 million • Incremental annual revenues of $10.9 million on 49,000 Dth per day capacity • Preserves $16.1 million in annual revenues on existing FT (192,500 Dth/d) and retained storage (3.3 Bcf) services • Total Cost: $86 million o Expansion: $45 million o Modernization: $41 million • Incremental Annual Revenues: $8.8 million • Capacity: 175,000 Dth per day o Range Resources (145,000 Dth/d) o Seneca Resources (30,000 Dth/d) Tuscarora Lateral Westside Expansion & Modernization |

Appalachia Pipeline & Storage Producer 36% LDC 48% Marketer 9% Outside Pipeline 6% End User 1% Pipeline & Storage Customer Mix 24 60% 40% FT Capacity - LDCs Affiliated Non-Affiliated 6% 94% FT Capacity - Producers Affiliated Non-Affiliated 23% 77% FT Capacity - Marketers Affiliated Non-Affiliated 46% 54% Firm Storage Capacity Affiliated Non-Affiliated Contracted Transportation by Shipper Type (1) (1) Contracted as of 1/15/2016. 4.1 MMDth/d 68 MMDth |

Production and Marketing

Exploration & Production

25 |

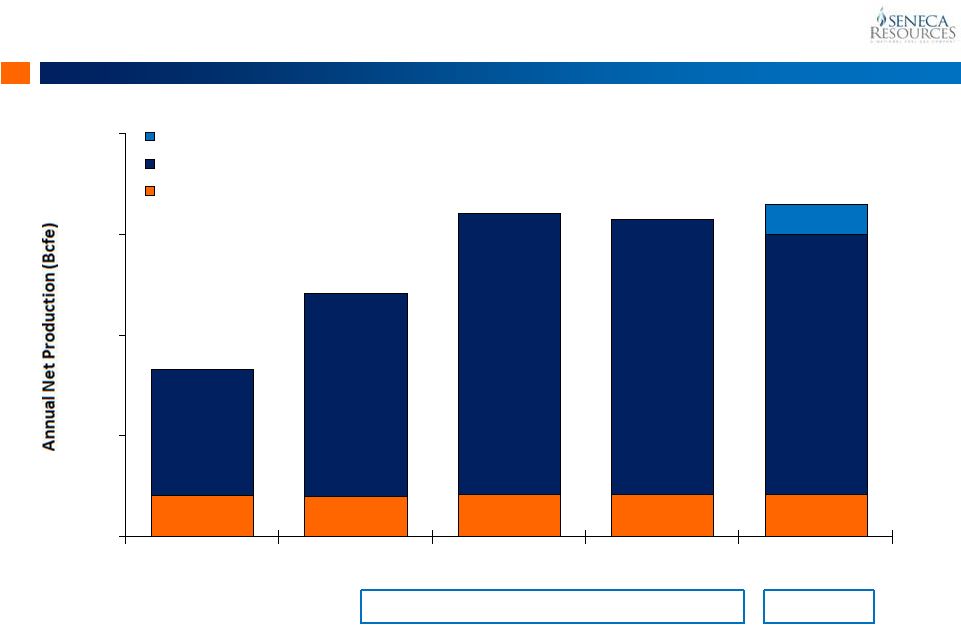

Production & Marketing

Proved Reserves & Development Costs

26 (1) Includes approximately 150 Bcf of natural gas PUD reserves in Clermont/Rich Valley that will be transferred in fiscal 2016 as interests in the joint development wells are conveyed to the partner. (2) Represents a three-year average U.S. finding and development cost. 43.3 42.9 41.6 38.5 33.7 675 988 1,300 1,683 2,142 935 1,246 1,549 1,914 2,344 0 500 1,000 1,500 2,000 2,500 3,000 2011 2012 2013 2014 2015 At September 30 Natural Gas (Bcf) Crude Oil (MMbbl) Fiscal Years 3-Year F&D Cost (2) ($/Mcfe) 2008-2010 $2.37 2009-2011 $2.09 2010-2012 $1.87 2011-2013 $1.67 2012-2014 $1.38 2013-2015 $1.12 • 2015 F&D Cost = $0.96 • Marcellus F&D: $0.79 • 373% Reserve Replacement Rate • 65% Proved Developed (1) |

Production & Marketing

Seneca Production

27 20.5 20.0 21.2 21.2 ~21 62.9 100.7 139.3 136.6 129 Appalachia Spot Sales 67.6 120.7 160.5 157.8 150-180 Bcfe 0 50 100 150 200 2012 2013 2014 2015 2016E Appalachia - Spot Exposure Appalachia - Firm Commitments West Coast (California) (1) Joint Development Partner Production (2) + 21Bcf (1) (1) Refer to slide 32 for additional details on fiscal 2016 firm sales and local Appalachian spot market exposure. (2) Represents joint development partner’s share of production from Seneca operated wells, which is incremental to the 150 – 180

Bcf net production range. The joint development

partner’s production will utilize gathering and transportation capacity on

NFG-affiliated pipelines. |

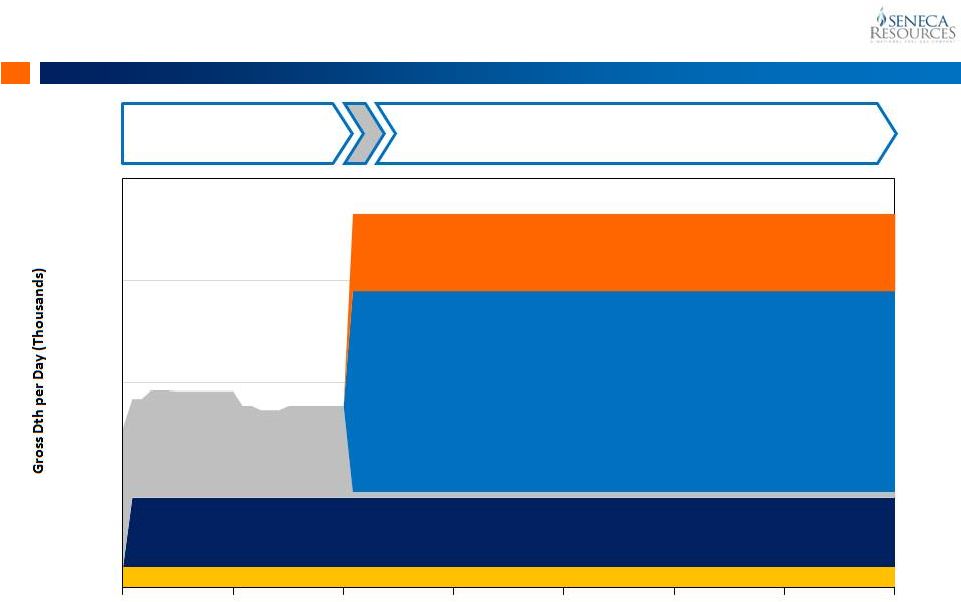

Production & Marketing

Significant Base of Long-Term Firm Contracts

28 Atlantic Sunrise (Transco) Delivery Markets: Mid-Atlantic & Southeast U.S. 189,405 Dth/d Northern Access 2016 (NFG (2) , TransCanada & Union) Delivery Markets: Canada-Dawn & NY-TGP200 490,000 Dth/d Niagara Expansion (TGP & NFG) Delivery Markets: Canada-Dawn & TETCO 170,000 Dth/d Firm Sales (1) Northeast Supply Diversification 50,000 Dth/d

FY2016 to FY2017

~450,000 Dth/d

Fiscal 2018 and beyond

914,405 Dth/d 2016 2017 2018 2019 2020 2021 2022 2023 Fiscal Year Start (1) Includes base firm sales contracts not tied to firm transportation capacity. Base firm sales are either fixed priced or priced at

an index (e.g., NYMEX ) +/- a fixed basis and do not carry

any transportation costs. See slide 32 for details on firm sales

portfolio for fiscal 2016. (2) Includes capacity on both National Fuel Gas Supply Corp. and Empire Pipeline, Inc., both wholly owned subsidiaries of National Fuel Gas

Company. - 250 500 750 1,000 |

Production & Marketing

Firm Transportation Commitments

29 (1) WMB is now targeting second half of calendar 2017 following the change in the timing of the environmental review from

FERC. Volume

(Dth/d) Production Source Delivery Market Demand Charges ($/Dth) Gas Marketing Strategy Northeast Supply Diversification Project Tennessee Gas Pipeline Atlantic Sunrise WMB - Transco In-service: Late 2017 (1) Niagara Expansion TGP & NFG Northern Access NFG – Supply & Empire In-Service: Nov. 1 2017 50,000 189,405 158,000 350,000 EDA -Tioga County Covington & Tract 595 EDA - Lycoming County Tract 100 & Gamble WDA – Clermont /Rich Valley WDA – Clermont /Rich Valley 12,000 140,000 Canada (Dawn) Mid-Atlantic/ Southeast Canada (Dawn) TETCO (SE Pa.) Canada (Dawn) TGP 200 (NY) $0.49 $0.73 NFG pipelines = $0.29 3 rd party = $0.38 NFG pipelines = $0.12 NFG pipelines = $0.38 NFG pipelines = $0.50 3 rd party = $0.20 Firm Sales Contracts 50,000 Dth/d Dawn/NYMEX+ 10 years Firm Sales Contracts 140,000 Dth/d Dawn/NYMEX+ 15 years Firm Sales Contracts 189,405 Dth/d NYMEX+ First 5 years Firm Sales Contracts 145,000 Dth/d Dawn/Fixed Price First 3 years Weighted Average Transportation Charge on Volumes Transported $0.63/Dth Annualized Gross FT Demand Charges – 3rd Parties Annualized Gross FT Charges – NFG Affiliates $107 MM $88 MM FY16/FY17 FY18+ $17 MM $31 MM $0.60/Dth |

Production & Marketing

219,698 Plus $0.07 178,098 Less: $0.01 178,098 Less: $0.01 65,000 Less: $0.55 50,000 Less: $0.33 50,000 Less: $0.33 25,000 Less: $0.02 65,000 Less: $0.01 65,000 Less: $0.01 160,000 $2.78 175,000 $2.61 175,000 $2.61 469,698 468,098 468,098 0 200,000 400,000 600,000 Q2 Q3 Q4 Fixed Price Dawn Dominion SP NYMEX Firm Sales Provide Market for Appalachian Production 30 (1) Reflects gross firm sales volumes before impact of lease royalties in EDA or net revenue interests assigned to joint

development partner on certain contracts in WDA.

(2) Values shown represent the price or differential to a reference price (netback price) at the point of sale.

WDA (1) 209,600/d 263,000/d 263,000/d EDA (1) 260,098/d 205,098/d 205,098/d Fiscal 2016 Firm Sales by Fiscal Quarter Pricing Index Key: EDA/WDA Split: Gross Contracted Volumes (Dth per day) (1) Contracted Index Price Differentials ($ per Dth) (2) |

Production & Marketing

28.5 29.5 20.4 11.4 14.1 12.7 19.0 22.1 30.4 32.9 8.0 5.8 92.0 97.2 30.2 17.2 4.9 0 50 100 150 FY 2016 FY 2017 FY 2018 FY 2019 FY 2020 NYMEX Dominion Dawn & MichCon Fixed Price Physical Sales Strong Hedge Book in Fiscal 2016 and 2017 31 (1) Assumes midpoint of natural gas production guidance, adjusted for year-to-date actual results.

(2) For the remaining nine months ended September 30, 2016. (3) Fixed price physical sales exclude joint development partner’s share of fixed price contract WDA volumes as specified under the joint development agreement. FY 2016 = 78% hedged (1) at $3.53 per MMBtu Natural Gas Swap & Fixed Physical Sales Contracts (Million MMBtu) (3) (2) (2) |

Production & Marketing

FY 2016 Production –

Firm Sales & Spot Exposure

32 (1) Average realized price reflects uplift from financial hedges less fixed differentials under firm sales contracts and firm transportation

costs. (2)

Indicates firm sales contracts with fixed index differentials to NYMEX but not

backed by a matching NYMEX financial hedge. (3)

Represents 45% of remaining projected oil production at the midpoint of

guidance. (4)

Represents 2.5 Bcf of non-operated production from Western Development Area

. Fiscal 2016 Price Certainty

88.7 Bcf realizing net ~$3.25/Mcf

(1) 4.9 Bcf of Additional Basis Protection (2) 1 million Bbls crude oil hedged at $87.70/Bbl (3) 32.8 Bcf 150-180 Bcfe 59.4 Bcf 29.3 Bcf 0-30 Bcf ~21 Bcfe 4.9 Bcf (2) 2.5 Bcf (4) 0 50 100 150 200 Q1 FY16 Appalachia Production Firms Sales + Hedges Fixed Price Sales Spot Sales California Total Seneca |

Production & Marketing

$0.50 $0.56 $0.24 $0.25 $0.33 $0.35 $0.12 $0.11 $1.19 $1.27 FY 2014 FY 2015 LOE (Affiliated Gathering) LOE (non-Gathering) G&A Taxes & Other Operating Costs 33 $0.44 $0.49 $0.50 $0.59 $0.57 $0.55 $0.40 $0.42 $0.38 $0.22 $0.22 $0.20 $1.65 $1.70 $1.63 FY 2014 FY 2015 FY 2016E $17.74 $16.17 $5.03 $5.29 $5.20 $5.70 $27.97 $27.16 FY 2014 FY 2015 Appalachia Division $/Mcfe West Division (California) $/Boe Seneca Resources Consolidated $/Mcfe Competitive, low cost structure in Appalachia and California supports strong cash margins Gathering fee generates significant revenue stream for affiliated gathering company DD&A decrease due to improving Marcellus F&D costs ($0.79 /Mcf in FY15) and reduction in net plant resulting from ceiling test impairments DD&A $/Mcfe $1.85 $1.52 $0.90 - $1.00 FY 2014 FY 2015 FY 2016E (1) Excludes impact of professional fees relating to the joint development agreement announced in December 2015.

(2) The total of the two LOE components represents the midpoint of LOE guidance of $1.00 to $1.10 per Mcfe for fiscal 2016. (1) (2) (2) |

Production & Marketing

$3.15 $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 NFG P1 P2 P3 P4 P5 P6 P7 P8 Before Hedging Hedging Uplift $1.95 $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 NFG P1 P2 P4 P6 P5 P3 P8 P7 Peer Average $1.52/Mcfe Appalachian Price Realizations & Margins 34 (1) Appalachian peer group includes AR, CNX, COG, EQT, GPOR, RICE, RRC & SWN. Peer group information obtained or estimated by

National Fuel Gas Company from peer company quarterly public

filings (press release & Form 10-K) for the quarter-ended December 31, 2015. Where applicable and when information was available, peer company realizations and margins were adjusted to reflect cash settled hedges and results of exploration and production operations only. Accounting

methodology for transportation expense (included in price

realizations vs. operating expense) varies between companies. NFG deducts transportation costs from revenues to calculate its price realizations. Q1 FY16 Average Natural Gas Realizations per Mcf vs. Appalachian Peer Group (1) Q1 FY16 Adjusted EBITDA per Mcfe vs. Appalachian Peer Group (1) Peer Average $2.92/Mcf Appalachia Appalachia Strong hedge book, firm sales portfolio, and cost discipline generating impressive natural gas price realizations and margins in challenging commodity environment |

California Overview

Exploration & Production

35 |

Upstream California: Stable Production; Modest Growth 36 East Coalinga Temblor Formation Primary North Lost Hills Tulare & Etchegoin Formation Primary/Steamflood South Lost Hills Monterey Shale Primary North Midway Sunset Tulare & Potter Formation Steamflood South Midway Sunset Antelope Formation Steamflood Sespe Sespe Formation Primary North Midway Sunset South Midway Sunset South Lost Hills North Lost Hills Sespe East Coalinga |

Upstream FY16 Budgeted D&C Portfolio Modest near-term capital program focused on locations that earn attractive returns in current oil price environment A&D will focus on low cost, bolt-on opportunities Sec. 17 and Hoyt farm-ins to provide future growth • F&D (est.) = $6.50/Boe Economic Development Focused on Midway Sunset 37 (1) Reflects pre-tax IRRs at a $40/Bbl realized price. Hoyt South MWSS Acreage North MWSS Acreage Sec. 17N North South South North Midway Sunset Economics MWSS Project IRRs at $40/Bbl (1) 25% 36% NMWSS SMWSS |

Upstream 8,773 9,322 9,078 9,699 9,674 9,560 0 2,500 5,000 7,500 10,000 2011 2012 2013 2014 2015 2016 Forecast Fiscal Year California Average Daily Net Production 38 $35-$40 Million Annual Capital Spending Will Keep Production Flat |

Upstream Strong Margins Support Significant Free Cash Flow 39 (1) Average revenue per BOE includes impact of hedging and other revenues.

Note: A reconciliation of Adjusted EBITDA margin to Net Income as presented on the Consolidated Statement of Income and Earnings Reinvested in

the Business is included at the end of this presentation.

EBITDA per BOE includes Seneca corporate results and eliminations.

$12.74 $3.37 $5.56 $2.90 $2.58 $33.69 Non-Steam Fuel LOE Steam Fuel G&A Production & Other Taxes Other Operating Costs Adjusted EBITDA West Division Adjusted EBITDA per BOE (1) Trailing 12-months Ended 12/31/15 DD&A Average Revenue for TTM 12/31/15 (1) $60.84 per BOE |

Downstream Overview

Utility | Energy Marketing

40 |

Downstream New York & Pennsylvania Service Territories 41 (1) As of September 30, 2015. New York Pennsylvania Total Customers (1) : 526,323 ROE: 9.1% (NY PSC Rate Case Settlement, May 2014)

Rate Mechanisms:

o Earnings Sharing o Revenue Decoupling o Weather Normalization o Low Income Rates o Merchant Function Charge (Uncollectibles Adj.) o 90/10 Sharing (Large Customers) Total Customers (1) : 213,652 ROE: Black Box Settlement (2007) Rate Mechanisms: o Low Income Rates o Merchant Function Charge |

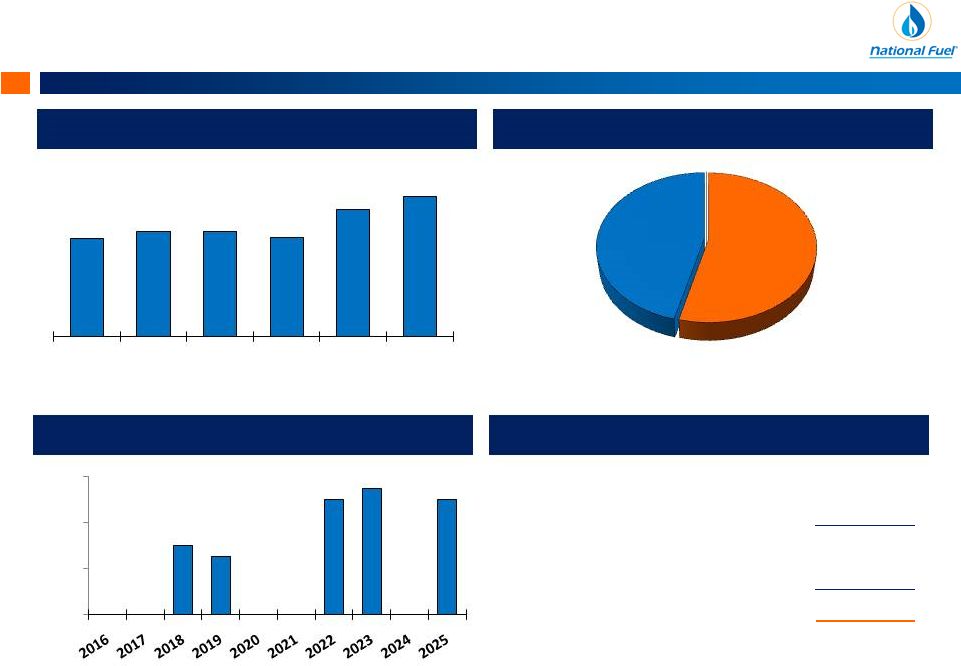

Downstream Utility: Shifting Trends in Customer Usage 42 (1) Weighted Average of New York and Pennsylvania service territories (assumes normal weather).

Residential Usage

Industrial Usage

12-Months Ended December 31

12-Months Ended December 31 |

Downstream A Proven History of Controlling Costs 43 (1) $10 million of increase in pension costs from fiscal 2013 primarily due to the NY PSC rate case settlement in May

2014. (1)

$152 $152 $152 $151 $163 $160 $16 $16 $20 $33 $28 $28 $11 $9 $6 $10 $9 $10 $179 $177 $178 $193 $200 $198 $0 $50 $100 $150 $200 $250 2011 2012 2013 2014 2015 12 Months ended 12/31/15 Fiscal Year All Other O&M Expenses O&M Pension Expense O&M Uncollectible Expense |

Downstream Utility: Strong Commitment to Safety 44 The Utility remains focused on maintaining the ongoing safety and reliability of its system Recent increase due to ~$60MM upgrade of the Utility’s Customer Information System and anticipated acceleration of pipeline replacement program $44.3 $43.8 $48.1 $49.8 $54.4 $58.4 $58.3 $72.0 $88.8 $94.4 $95 - $105 0 30 60 90 120 150 2011 2012 2013 2014 2015 2016E Fiscal Year Capital Expenditures for Safety Total Capital Expenditures |

45 Consolidated Financial Overview Upstream | Midstream | Downstream |

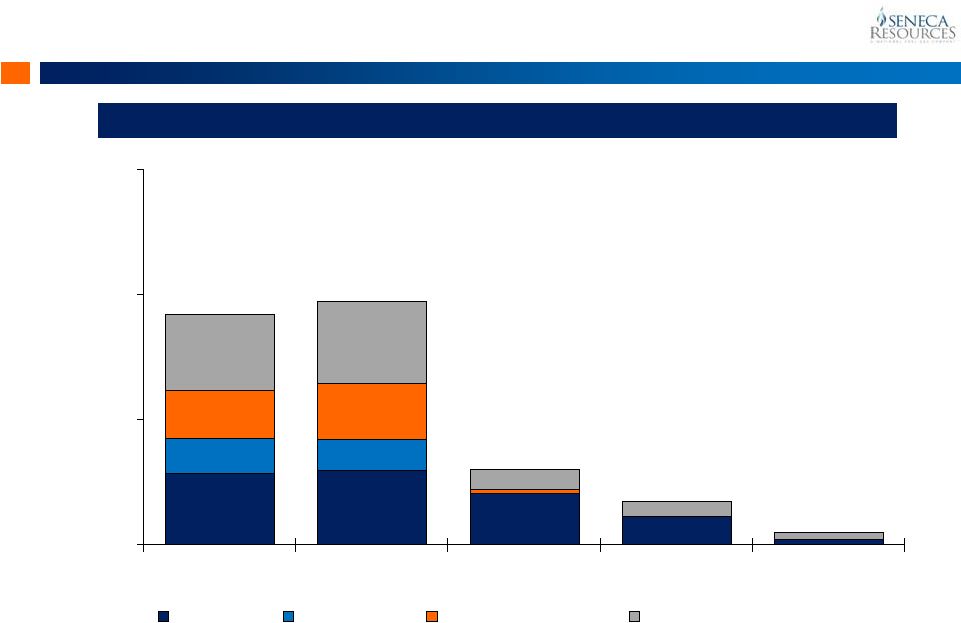

Corporate EBITDA Contribution by Segment 46 Note: A reconciliation of Adjusted EBITDA to Net Income as presented on the Consolidated Statement of Income and Earnings Reinvested in

the Business is included at the end of this presentation. $160

$172

$165 $164 $157 $137 $161 $186 $188 $190 $64 $69 $62 $397 $492 $539 $422 $378 $704 $852 $953 $843 $785 $0 $250 $500 $750 $1,000 $1,250 2012 2013 2014 2015 TTM 12/31/15 Fiscal Year Exploration & Production Segment Gathering Segment Pipeline & Storage Segment Utility Segment Energy Marketing & Other |

Corporate Capital Expenditures by Segment 47 (1) FY2016 capital expenditure guidance reflects the netting of up-front proceeds received from joint development partner for capital

spent on wells drilled and/or completed prior to the execution date of the joint development agreement. The E&P segment’s FY16 capital budget would be reduced by an additional $90-$110 million if

joint development partner exercises right to participate in remaining 38 wells. Note: A reconciliation to Capital Expenditures as presented on the Consolidated Statement of Cash Flows is included at the end of this presentation. (1) $58 $72 $89 $94 $95-$105 $144 $56 $140 $230 $125-$175 $80 $55 $138 $118 $85-$95 $694 533 $603 $557 $150-$200 $977 $717 $970 $1,001 $0 $500 $1,000 $1,500 2012 2013 2014 2015 2016E Fiscal Year Exploration & Production Segment Gathering Segment Pipeline & Storage Segment Utility Segment Energy Marketing & Other $455-$575 |

Corporate Financial Position & Liquidity 48 Note: A reconciliation of Adjusted EBITDA to Net Income is included at the end of this presentation.

Total Debt 54% $3.9 Billion Total Capitalization as of December 31, 2015 Debt/Adjusted EBITDA Capitalization Debt Maturity Profile ($MM) Liquidity Committed Credit Facilities Short-term Debt Outstanding Available Short-term Credit Facilities Cash Balance at 12/31/15 Total Liquidity at 12/31/15 $ 1,250 MM $ 31 MM $ 1,219 MM $ 36 MM $ 1,255 MM 1.75 x 1.89 x 1.89 x 1.77 x 2.27 x 2.52 x 2011 2012 2013 2014 2015 TTM

12-31-15

Fiscal Year $300 $250 $500 $549 $500 $0 $200 $400 $600 Total Equity 46% |

Corporate Dividend Track Record 49 (1) As of March 16, 2016. Current Dividend Yield (1) 3.1% Dividend Consistency Consecutive Dividend Payments 113 Years Consecutive Dividend Increases 45 Years Current Annualized Dividend Rate $1.58 per Share $0.00 $1.00 $1.50 $2.00 $0.50 Annual Rate at Fiscal Year End |

Corporate Unique Asset Mix and Integrated Model Provide Balance and Stability The National Fuel Value Proposition 50 Fee ownership on ~715,000 net acres in WDA = limited royalties or drilling commitments

Seneca has >900,000 Dth/day of firm transportation & sales contracts

by start of fiscal 2018 Stacked pay potential in Utica and

Geneseo shales across Marcellus acreage Coordinated gathering

& interstate pipeline infrastructure build-out with NFG midstream Opportunity for further pipeline expansion to accommodate Appalachian supply growth

Creating long-term sustainable value remains our #1 shareholder

priority Considerable Upstream and Midstream Growth Opportunities in

Appalachia Geographical and operational integration drives

capital flexibility and reduces costs Cash flow from

rate-regulated businesses supports interest costs and funds the dividend NFG is Well Positioned to Endure Current Commodity Price Environment Investment grade credit rating and liquidity to support long-term Appalachian growth strategy

Strong hedge book helps insulate near-term earnings and cash flows from

commodity volatility Disciplined and flexible capital investment

that is focused on economic returns |

Appendix 51 |

Appendix Total Seneca Capital Spending by Division 52 $63 $105 $83 $57 $40-$50 $631 $428 $520 $500 $110-$150 $694 $533 $603 $557 $150 - $200 $0 $200 $400 $600 $800 $1,000 2012 2013 2014 2015 2016E Fiscal Year Appalachia West Coast (California) (2) (1) (1) FY2016 capital expenditure guidance reflects the netting of up-front proceeds received from joint development partner for capital

spent on wells drilled and/or completed prior to the execution date of the joint development agreement. The FY16 capital budget would be reduced by an additional $90-$110 million if joint development partner

exercises right to participate in remaining 38 wells.

(2) Seneca’s West Coast division includes Seneca corporate and eliminations. |

Appendix Marcellus Operated Well Results 53 (1) Excludes 2 wells now operated by Seneca that were drilled by another operator as part of a joint-venture. 30-day average excludes 2 wells that have not been on line 30 days. (2) Does not include 1 well drilled into and producing from the Geneseo Shale. EDA Development Wells: Area Producing Well Count Average IP Rate (MMcfd) Average 30-Day (MMcf/d) Average Treatable Lateral Length (ft) Covington Tioga County 47 5.2 4.1 4,023’ Tract 595 Tioga County 44 (2) 7.4 4.9 4,754’ Tract 100 Lycoming County 57 (2) 16.8 12.6 5,270’ Area Producing Well Count Average IP Rate (MMcfd) Average 30-Day (MMcf/d) Average Treatable Lateral Length (ft) Clermont/Rich Valley (CRV) & Hemlock Elk, Cameron & McKean counties 56 (1) 7.5 5.7 (1) 6,823’ WDA Development Wells: |

Appendix Marcellus Shale Program Economics ~1,200 WDA Locations Economic Below $2.25/MMBtu $3.00 IRR % (1) $2.75 IRR % (1) $2.50 IRR % (1) DCNR 100 Dry Gas 12 5,400 13-14 1033 59% 43% 25% $1.57 Gamble Dry Gas 44 4,600 11-12 1033 35% 22% 11% $1.83 CRV Dry Gas 72 8,800 10-11 1045 23% 17% 10% $1.92 Hemlock / Ridgway Dry Gas 662 8,800 8-9 1045 - 1110 16% 11% 6% $2.14 Remaining Tier 1 Dry Gas 423 8,500 7-8 1030 - 1110 14% 10% 5% $2.31 15% IRR (1) Realized Price NYMEX / DAWN Pricing Prospect Product Locations Remaining to Be Drilled Completed Lateral Length (ft) Average EUR (Bcf) BTU (1) Internal Rate of Return (IRR) is pre-tax and includes estimated well costs under current cost structure, LOE, and Gathering tariffs

anticipated for each prospect. 54

|

Appendix Volume Avg. Price Volume Avg. Price Volume Avg. Price Volume Avg. Price Volume Avg. Price NYMEX Swaps 28,440 $3.92 29,530 $4.20 20,350 $3.62 11,400 $3.39 2,000 $3.49 Dominion Swaps 14,130 $3.78 12,720 $3.87 - - - - - - MichCon Swaps 9,000 $4.10 3,000 $4.10 - - - - - - Dawn Swaps 9,990 $3.92 19,100 $3.70 1,800 $3.40 - - - - Fixed Price Physical Sales 30,426 $2.75 32,893 $3.03 8,010 $3.21 5,840 $3.25 2,928 $3.25 Total 91,986 $3.53 97,243 $3.66 30,160 $3.50 17,240 $3.34 4,928 $3.35 Fiscal 2019 Fiscal 2020 Fiscal 2016 Fiscal 2017 Fiscal 2018 Natural Gas Hedge Positions 55 (Volumes in thousands MMBtu; Prices in $/MMBtu) (1) For the remaining nine months of Fiscal 2016. (2) Fixed price physical sales exclude joint development partner’s share of fixed price contract WDA volumes as specified under the

joint development agreement. (1)

(2) |

Appendix Crude Oil Hedge Positions 56 Fiscal 2016 Fiscal 2017 Fiscal 2018 Volume Avg. Price Volume Avg. Price Volume Avg. Price Brent Swaps 404,000 $94.63 231,000 $92.14 51,000 $91.00 NYMEX Swaps 640,000 $83.33 465,000 $66.77 24,000 $90.52 Total 1,044,000 $87.70 696,000 $75.19 75,000 $90.85 (Volumes & Prices in Bbl) (1) For the remaining nine months of Fiscal 2016. (1) |

Appendix Utica/Point Pleasant: EDA Opportunities 57 PGE Vertical Tests Seneca DCNR Tract 007 IP: 22.7 MMcf/d Lateral Length: 4,640’ Potential locations: ~ 70 Anticipated Development Well Cost: $7-$10 Million (5,500’ Lat.) JKLM Pt Pleasant Test DCNR 595 Potential Future Location Shell:

Gee 11.2 MMcf/d Shell:

Neal 26.5 MMcf/d Travis Peak: Currently Drilling 57 DCNR Tract 001 Potential Future Location |

Appendix Comparable GAAP Financial Measure Slides & Reconciliations 58 This presentation contains certain non-GAAP financial measures. For pages that contain non-GAAP financial measures, pages containing the most directly comparable GAAP financial measures and reconciliations are provided in the slides that follow. The Company believes that its non-GAAP financial measures are useful to investors because they provide an alternative method for assessing the Company’s ongoing operating results, for measuring the Company’s cash flow and liquidity, and for comparing the Company’s financial performance to other companies. The Company’s management uses these non-GAAP financial measures for the same purpose, and for planning and forecasting purposes. The presentation of non-GAAP financial measures is not meant to be a substitute for financial measures prepared in accordance with GAAP. The Company defines Adjusted EBITDA as reported GAAP earnings before the following items: interest expense, depreciation, depletion and amortization, interest and other income, impairments, items impacting comparability and income taxes. |

Appendix National Fuel Gas Company 59 Reconciliation of Adjusted EBITDA to Consolidated Net Income ($ Thousands) FY 2011 FY 2012 Total Adjusted EBITDA Exploration & Production Adjusted EBITDA 377,457 $ 397,129 $ 492,383 $

539,472 $

422,289 $

377,998 Pipeline & Storage Adjusted EBITDA 111,474 136,914 161,226 186,022 188,042 189,890 Gathering Adjusted EBITDA 9,386 14,814 29,777 64,060 68,783 62,478 Utility Adjusted EBITDA 168,540 159,986 171,669 164,643 164,037 156,524 Energy Marketing Adjusted EBITDA 13,178 5,945 6,963 10,335 12,150 9,355 Corporate & All Other Adjusted EBITDA

(12,346) (10,674) (9,920) (11,078) (11,900) (11,391) Total Adjusted EBITDA 667,689 $ 704,114 $ 852,098 $

953,454 $

843,401 $

784,854 $ Total Adjusted EBITDA 667,689 $ 704,114 $ 852,098 $

953,454 $

843,401 $

784,854 $ Minus: Interest Expense (78,121) (86,240) (94,111) (94,277) (99,471) (108,122) Plus: Interest and Other Income 8,863 8,822 9,032 13,631 11,961 13,737 Minus: Income Tax Expense (164,381) (150,554) (172,758) (189,614) 319,136 518,646 Minus: Depreciation, Depletion & Amortization (226,527) (271,530) (326,760) (383,781) (336,158) (303,962) Minus: Impairment of Oil and Gas Properties (E&P) - - - -

(1,126,257) (1,561,708) Plus: Reversal of Stock-Based Compensation - - - -

7,961 7,961 Plus: Gain on Sale of Unconsolidated Subsidiaries (Corp. & All Other)

50,879 - - -

- -

Plus: Elimination of Other

Post-Retirement Regulatory Liability (P&S) -

21,672

-

- -

- Minus: Pennsylvania Impact Fee Related to Prior Fiscal Years (E&P)

- (6,206) - -

- -

Minus: New York Regulatory Adjustment

(Utility) -

-

(7,500)

-

- -

Rounding

- (1) -

- -

- Minus: Joint Development Agreement Professional Fees

- - - -

- (4,682)

Consolidated Net Income

258,402 $ 220,077 $ 260,001 $

299,413 $

(379,427) $ (653,276) $ Consolidated Debt to Total Adjusted EBITDA Long-Term Debt, Net of Current Portion (End of Period) 899,000 $ 1,149,000 $ 1,649,000 $ 1,649,000 $ 2,099,000 $ 2,099,000 $ Current Portion of Long-Term Debt (End of Period) 150,000 250,000 - -

- -

Notes Payable to Banks and Commercial

Paper (End of Period) 40,000

171,000

- 85,600

-

31,400 Total Debt (End of Period) 1,089,000 $ 1,570,000 $ 1,649,000 $ 1,734,600 $ 2,099,000 $ 2,130,400 $ Long-Term Debt, Net of Current Portion (Start of Period) 1,049,000 $ 899,000 1,149,000 1,649,000 1,649,000 1,649,000 Current Portion of Long-Term Debt (Start of Period) 200,000 150,000 250,000 - -

- Notes Payable to Banks and Commercial Paper (Start of Period)

- 40,000 171,000 - 85,600

172,900

Total Debt (Start of Period)

1,249,000 $ 1,089,000 $ 1,570,000 $ 1,649,000 $ 1,734,600 $ 1,821,900 $ Average Total Debt 1,169,000 $ 1,329,500 $ 1,609,500 $ 1,691,800 $ 1,916,800 $ 1,976,150 $ Average Total Debt to Total Adjusted EBITDA 1.75 x 1.89 x 1.89 x 1.77 x 2.27 x 2.52 x FY 2013 12-Months Ended 12/31/15 FY 2014 FY 2015 |

Appendix National Fuel Gas Company 60 (1) FY2016 Exploration and Production capital expenditure guidance reflects the netting of up-front proceeds received from joint

development partner for capital spent on wells drilled and/or

completed prior to the execution date of the joint development agreement.

Reconciliation of Segment Capital Expenditures to

Consolidated Capital Expenditures

($ Thousands) FY 2016 FY 2011 FY 2012 FY 2013 FY 2014 FY 2015 Forecast Capital Expenditures from Continuing Operations Exploration & Production Capital Expenditures 648,815 $ 693,810 $ 533,129 $ 602,705 $ 557,313 $ $150,000-200,000 Pipeline & Storage Capital Expenditures 129,206 144,167 56,144 $ 139,821 $ 230,192 $ $125,000-175,000 Gathering Segment Capital Expenditures 17,021 80,012 54,792 $ 137,799 $ 118,166 $ $85,000-95,000 Utility Capital Expenditures 58,398 58,284 71,970 $ 88,810 $ 94,371 $ $95,000-105,000 Energy Marketing, Corporate & All Other Capital Expenditures 746 1,121 1,062 $ 772 $

467 $

- Total Capital Expenditures

from Continuing Operations 854,186

$

977,394 $ 717,097 $ 969,907 $ 1,000,509 $ $455,000-575,000 Capital Expenditures from Discountinued Operations All Other Capital Expenditures - $

- $

- $

- $

- $

- $

Plus (Minus) Accrued Capital

Expenditures Exploration & Production FY 2015 Accrued Capital

Expenditures -

$

-

$

-

$

-

$

(46,173)

$

Exploration & Production FY 2014 Accrued Capital Expenditures

- - - (80,108) 80,108 Exploration & Production FY 2013 Accrued Capital Expenditures - - (58,478) 58,478 - - Exploration &

Production FY 2012 Accrued Capital Expenditures -

(38,861)

38,861 - - - Exploration &

Production FY 2011 Accrued Capital Expenditures (103,287)

103,287 - - - - Exploration &

Production FY 2010 Accrued Capital Expenditures 78,633

- - - - - Pipeline & Storage FY

2015 Accrued Capital Expenditures -

- - - (33,925) Pipeline & Storage FY 2014 Accrued Capital Expenditures - - - (28,122) 28,122 Pipeline & Storage FY 2013 Accrued Capital Expenditures - - (5,633) 5,633 - - Pipeline & Storage FY

2012 Accrued Capital Expenditures -

(12,699)

12,699 - - - Pipeline & Storage FY

2011 Accrued Capital Expenditures (16,431)

16,431 - - - - Pipeline & Storage FY

2010 Accrued Capital Expenditures 3,681

-

-

-

-

-

Gathering FY 2015 Accrued Capital Expenditures - - - - (22,416) Gathering FY 2014 Accrued Capital Expenditures - - - (20,084) 20,084 Gathering FY 2013 Accrued Capital Expenditures - - (6,700) 6,700 - - Gathering FY 2012 Accrued

Capital Expenditures -

(12,690)

12,690 - - - Gathering FY 2011 Accrued

Capital Expenditures (3,079)

3,079 - - - - Utility FY 2015 Accrued

Capital Expenditures -

-

-

-

(16,445)

Utility FY 2014 Accrued Capital Expenditures

- - - (8,315) 8,315 Utility FY 2013 Accrued Capital Expenditures

- - (10,328) 10,328 - - Utility FY 2012 Accrued

Capital Expenditures -

(3,253)

3,253 - - - Utility FY 2011 Accrued

Capital Expenditures (2,319)

2,319 - - - - Utility FY 2010 Accrued

Capital Expenditures 2,894

-

-

-

-

-

Total Accrued Capital Expenditures (39,908) $ 57,613 $ (13,636) $ (55,490) $ 17,670 $ - $

Eliminations

- $

- $

- $

- $

- $

- $

Total Capital Expenditures per

Statement of Cash Flows 814,278

$

1,035,007 $ 703,461 $ 914,417 $ 1,018,179 $ $455,000-575,000 (1) |

Appendix National Fuel Gas Company 61 Reconciliation of Exploration & Production Adjusted EBITDA for Appalachia and West Coast divisions

to Exploration & Production Segment Net Income

($ Thousands) Appalachia West Coast Total E&P Appalachia West Coast Total E&P Reported GAAP Earnings (215,558) $ (21,528) $ (237,086) $ (604,945) $ (215,835) $ (820,780) $ Depreciation, Depletion and Amortization 36,565 7,468 44,033 160,431 43,353 203,784 Interest and Other Income - (667) (667) - (2,711) (2,711) Interest Expense 13,772 810 14,582 48,585 2,415 51,000 Income Taxes (154,357) (15,498) (169,855) (457,237) (159,681) (616,918) Impairment of Oil and Gas Producing Properties 378,887 56,564 435,451 1,109,002 452,706 1,561,708 Joint Development Agreement Professional Fees 4,682 - 4,682 4,682 - 4,682 Reversal of Stock Based Compensation - - - (825) (1,942) (2,767) Adjusted EBITDA 63,991 $ 27,149 $ 91,140 $ 259,693 $ 118,305 $ 377,998 $ Appalachia West Coast Total E&P Appalachia West Coast Total E&P Production: Gas Production (MMcf) 32,788 783 33,571 126,394 3,169 129,563 Oil Production (MBbl) 6 742 748 27 2,984 3,011 Total Production (Mmcfe) 32,824 5,235 38,059 126,556 21,073 147,629 Adjusted EBITDA Margin per Mcfe 1.95 $ 5.19 $ 2.39 $ 2.05 $ 5.61 $ 2.56 $ Total Production (Mboe) NM 873 NM NM 3,512 NM Adjusted EBITDA Margin per Boe NM 31.10 $ NM NM 33.69 $ NM Note: Seneca West Coast division includes Seneca corporate and eliminations. Three Months Ended December 31, 2015 Twelve Months Ended December 31, 2014 |

Appendix National Fuel Gas Company 62 Reconciliation of Exploration & Production Segment Operating Expenses by Division

($000s unless noted otherwise)

Appalachia West Coast Total E&P Appalachia West Coast Total E&P Appalachia West Coast Total E&P Appalachia West Coast Total E&P $/ Mcfe $ / Boe $ / Mcfe $/ Mcfe $ / Boe $ / Mcfe Operating Expenses: Lease Operating & Transportation Expense - Gathering $76,709 $0 $76,709 $0.56 $0.00 $0.49 $69,937 $0 $69,937 $0.50 $0.00 $0.44 Lease Operating Expense - Other $34,013 $57,078 $91,091 $0.25 $16.17 $0.57 $32,811 $62,786 $95,597 $0.24 $17.74 $0.59 Total Lease Operating Expense $110,722 $57,078 $167,800 $0.81 $16.17 $1.06 $102,748 $62,786 $165,534 $0.74 $17.74 $1.03 General & Administrative Expense $47,445 $18,669 $66,114 $0.35 $5.29 $0.42 $45,987 $17,817 $63,804 $0.33 $5.03 $0.40 All Other Operating and Maintenance Expense $5,296 $9,008 $14,304 $0.04 $2.55 $0.09 $6,779 $7,742 $14,521 $0.05 $2.19 $0.09 Property, Franchise and Other Taxes $9,046 $11,121 $20,167 $0.07 $3.15 $0.13 $10,114 $10,651 $20,765 $0.07 $3.01 $0.13 Total Taxes & Other $14,342 $20,129 $34,471 $0.11 $5.70 $0.22 $16,893 $18,393 $35,286 $0.12 $5.20 $0.22 Depreciation, Depletaion & Amortization $239,818 $1.52 $296,210 $1.85 Production: Gas Production (MMcf) 136,404 3,159 139,563 139,097 3,210 142,307 Oil Production (MBbl) 30 3,004 3,034 31 3,005 3,036 Total Production (Mmcfe) 136,584 21,183 157,767 139,283 21,240 160,523 Total Production (Mboe) 22,764 3,531 26,295 23,214 3,540 26,754 Note: Seneca West Coast division includes Seneca corporate and eliminations. Twelve Months Ended September 30, 2015 Twelve Months Ended September 30, 2014 |