Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - Orgenesis Inc. | exhibit32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Orgenesis Inc. | exhibit31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Orgenesis Inc. | exhibit31-1.htm |

| EX-32.2 - EXHIBIT 32.2 - Orgenesis Inc. | exhibit32-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: November 30, 2015

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________________________ to __________________________

Commission file number 000-54329

ORGENESIS INC.

((Exact

name of registrant as specified in its charter)

| Nevada | 98-0583166 |

| State or other jurisdiction | (I.R.S. Employer |

| of incorporation or organization | Identification No.) |

20271 Goldenrod Lane, Germantown, MD 20876

((Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (480) 659-6404

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to section 12(g) of the Act:

Common Stock, par value $0.0001 per share

(Title of class)

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [

] No [X]

Indicate by check mark if the registrant is not required to

file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [

] No [X]

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Yes

[X] No [ ]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files).

Yes

[X] No [ ]

0

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | |

| (Do not check if a smaller reporting company) | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Act).

Yes [ ]

No [X]

The registrant had 108,932,129 shares of common stock outstanding as of February 26, 2016. The aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant as of May 29, 2015 was $16,961,572 as computed by reference to the closing price of such common stock on the OTCQB on such date.

DOCUMENTS INCORPORATED BY REFERENCE

The registrant intends to file a definitive proxy statement pursuant to Regulation 14A in connection with its 2016 Annual Meeting of Stockholders within 120 days after the close of the fiscal year covered by this Form 10-K. Portions of such proxy statement are incorporated by reference into Items 10, 11, 12, 13 and 14 of Part III of this report.

1

ORGENESIS INC.

2015 FORM 10-K ANNUAL REPORT

TABLE OF CONTENTS

2

FORWARD-LOOKING STATEMENTS

CAUTIONARY STATEMENT FOR PURPOSES OF THE "SAFE HARBOR" PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

The following discussion should be read in conjunction with the financial statements and related notes contained elsewhere in this Form 10-K. Certain statements made in this discussion are "forward-looking statements" within the meaning of The Private Securities Litigation Reform Act of 1995. Forward-looking statements are projections in respect of future events or financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. Forward-looking statements made in an annual report on Form 10-K include statements about our:

| • |

ability to obtain sufficient capital or strategic business arrangements to fund our operations and realize our business plan; |

| • |

ability to grow the business of MaSTherCell, which we recently acquired, our Contract Development and Manufacturing Organization (“CDMO”) business; |

| • |

belief as to whether a meaningful and profitable global market can be established for our CDMO business for cell therapy; |

| • |

intention to develop to the clinical stage a new technology to transdifferentiate liver cells into functional insulin-producing cells, thus enabling normal glucose regulated insulin secretion, via cell therapy; |

| • |

belief that our treatment seems to be safer than other options; |

| • |

belief that one of our principal competitive advantages is our cell transdifferentiation technology being developed by our Israeli Subsidiary; |

| • |

expectations regarding our Israeli Subsidiary’s ability to obtain and maintain intellectual property protection for our technology and therapies; |

| • |

ability to commercialize products in light of the intellectual property rights of others; |

| • |

ability to obtain funding for operations, including funding necessary to prepare for clinical trials and to complete such clinical trials; |

| • |

future agreements with third parties in connection with the commercialization of our technologies; |

| • |

size and growth potential of the markets for our product candidates, and our ability to serve those markets; |

| • |

regulatory developments in the United States and foreign countries; |

| • |

ability to contract with third-party suppliers and manufacturers and their ability to perform adequately; |

| • |

plans to integrate and support our manufacturing facilities in Belgium; |

| • |

success as it is compared to competing therapies that are or may become available; |

| • |

ability to attract and retain key scientific or management personnel and to expand our management team; |

| • |

accuracy of estimates regarding expenses, future revenue, capital requirements, profitability, and needs for additional financing; |

| • |

belief that Diabetes Mellitus will be one of the most challenging health problems in the 21st century and will have staggering health, societal and economic impact; |

| • |

need to raise additional funds on an immediate basis which may not be available on acceptable terms or at all; |

| • |

research facility in Israel and the surrounding Middle East political situation which may materially adversely affect our Israeli Subsidiary’s operations and personnel; |

| • |

relationship with with Tel Hashomer - Medical Research, Infrastructure and Services Ltd. (“THM”) and the risk that THM may cancel the License Agreement; |

| • |

expenditures not resulting in commercially successful products; and |

| • |

extensive industry regulation, and how that will continue to have a significant impact on our business, especially our product development, manufacturing and distribution capabilities. |

These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” set forth in this Annual Report on Form 10-K for the year ended November 30, 2015, any of which may cause our company’s or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. These risks may cause the Company’s or its industry’s actual results, levels of activity or performance to be materially different from any future results, levels of activity or performance expressed or implied by these forward looking statements.

3

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, it cannot guarantee future results, levels of activity or performance. Moreover, neither the company nor any other person assumes responsibility for the accuracy and completeness of these forward-looking statements. The company is under no duty to update any forward-looking statements after the date of this report to conform these statements to actual results.

4

PART I

ITEM 1. BUSINESS

As used in this annual report on Form 10-K and unless otherwise indicated, the terms “we,” “us”, "our", “Orgenesis” or the “Company” refer to Orgenesis Inc. and its wholly-owned Subsidiaries, Orgenesis Ltd. (the “Israeli Subsidiary”), Orgenesis SPRL (the “Belgian Subsidiary”), Orgenesis Maryland, Inc. (the “U.S. Subsidiary”) and MaSTherCell SA (“MaSTherCell”), our Belgian-based subsidiary. Unless otherwise specified, all dollar amounts are expressed in United States dollars.

Corporate Overview

We are among the first of a new breed of regenerative therapy companies with expertise and unique experience in cell therapy development and manufacturing. We are building a fully-integrated biopharmaceutical company focused not only on developing our trans-differentiation technologies for diabetes and vertically integrating manufacturing that can optimize our abilities to scale-up our technologies for clinical trials and eventual commercialization, but also do the same for the technologies of other cell therapy markets in such areas as cell-based cancer immunotherapies and neurodegenerative diseases. This integrated approach supports our business philosophy of bringing to market significant life-improving medical treatments.

Our cell therapy technology derives from published work of Prof. Sarah Ferber, our Chief Science Officer and a researcher at Tel Hashomer Medical Center, a leading medical hospital and research center in Israel (“THM”), who established a proof of concept that demonstrates the capacity to induce a shift in the developmental fate of cells from the liver and transdifferentiating (converting) them into “pancreatic beta cell-like” insulin-producing cells. Furthermore, those cells were found to be resistant to autoimmune attack and to produce insulin in a glucose-sensitive manner in relevant animal models. Our development activities with respect to cell-derived and related therapies, which are conducted through the Israeli Subsidiary, have, to date, been limited to laboratory and preclinical testing. Our development plan calls for conducting additional preclinical safety and efficacy studies with respect to diabetes and other potential indications.

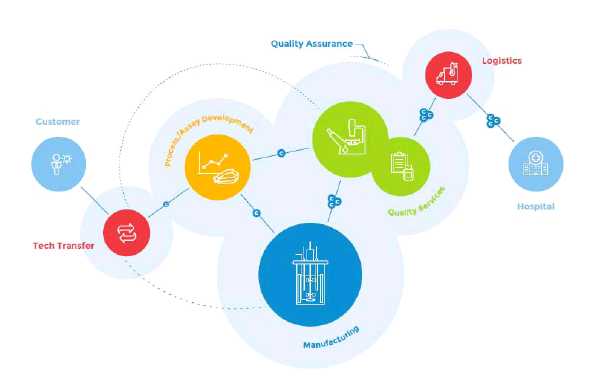

Our Belgian-based subsidiary, MaSTherCell, is a contract development manufacturing organization, or CDMO, specialized in cell therapy development for advanced medicinal products. In the last decade, cell therapy medicinal products have gained significant importance, particularly in the fields of ex-vivo gene therapy, immunotherapy and regenerative medicine. While academic and industrial research has led scientific development in the sector, industrialization and manufacturing expertise remains insufficient. MaSTherCell plans to fill this need by providing two types of services to its customers: (i) process and assay development services and (ii) Good Manufacturing Practices (GMP) contract manufacturing services. These services offer a double advantage to MaSTherCell's customers. First, customers can continue focusing their financial and human resources on their product/therapy, while relying on a trusted source for their process development/production. Second, it allows customers to profit from MaSTherCell's expertise in cell therapy manufacturing and all related aspects.

We intend to leverage the expertise and experience of MaSTherCell, our subsidiary, in cell process development and manufacturing capability, to build a fully integrated bio-pharmaceutical company in the cell therapy development and manufacturing area.

We need to raise significant capital in order to realize our business plan. See “Risk Factors”.

We were incorporated in the state of Nevada on June 5, 2008, under the name Business Outsourcing Services, Inc. Effective August 31, 2011, we completed a merger with our subsidiary, Orgenesis Inc., a Nevada corporation which was incorporated solely to effect a change in our name. As a result, we changed our name from “Business Outsourcing Services, Inc.” to “Orgenesis Inc.” Our common stock is currently listed on the OTC Market, QB tier, under the symbol “ORGS”.

5

Cell Therapy and Regenerative Medicine Field

Regenerative medicine is generally the process of replacing or regenerating human cells, tissues or organs to restore normal function. Our business model is focused on two of these areas. First, through our wholly-owned CDMO subsidiary, MaSTherCell, we are afforded a unique and fundamental base platform of experience and expertise with a multitude of cell types in development. MaSTherCell is strategically positioning us in a way that allows us to participate in the cell therapy field on multiple levels as the cell therapy industry evolves. Our goal is to nurture our reputation as a premier service provider in the regenerative medicine industry by continuing to leverage the experience and expertise of MaSTherCell as a recognized leader of cell therapy manufacturing and development. Second, on our clinical development side, through our Israeli Subsidiary, our goal is to advance a unique product that combines cell-based therapy and regenerative medicine, Autologous Insulin Producing (“AIP”) cells, into clinical development. AIP cells utilize the technology of ‘cellular trans-differentiation’ to transform an autologous adult liver cell into an adult, fully functional and physiologically glucose-responsive pancreatic-like insulin producing cell. Treatment with AIP cells is expected to provide Type 1 Diabetes patients with long-term insulin independence. Because the AIP cells are autologous, this benefit should be achieved and maintained without the need for concomitant immunosuppressive therapy.

All living complex organisms start as a single cell that replicates, differentiates (matures) and perpetuates in an adult organism throughout its lifetime. Cell therapy is the prevention or treatment of human disease by the administration of cells that have been selected, multiplied and pharmacologically treated or altered outside the body (ex vivo). To date, the most common type of cell therapy has been the replacement of mature, functioning cells through blood and platelet transfusions. Since the 1970s, first bone marrow and then blood and umbilical cord-derived stem cells have been used to restore bone marrow, as well as blood and immune system cells damaged by the chemotherapy and radiation that are used to treat many cancers. These types of cell therapies are standard of practice world-wide and are typically reimbursed by insurance.

Within the field of cell therapy, research and development using stem cells to treat a host of diseases and conditions has greatly expanded. Stem cells (in either embryonic or adult forms) are primitive and undifferentiated cells that have the unique ability to transform into or otherwise affect many different cells, such as white blood cells, nerve cells or heart muscle cells. Our cell therapy development efforts do not use stem cells, but rather are focused on the use of fully mature, adult cells; for our purposes in the treatment of diabetes, our cells are derived from the liver or other adult tissue and are transdifferentiated to become adult AIP cells.

There are two general classes of cell therapies: Patient Specific Cell Therapies (PSCTs) and Off-the-Shelf Cell Therapies (OSCTs). In PSCTs, cells collected from a person (donor) are transplanted into, or used to develop a treatment for a patient (recipient) with or without modification. In cases where the donor and the recipient are the same individual, these procedures are referred to as “autologous”. In cases in which the donor and the recipient are not the same individual, these procedures are referred to as “allogeneic.” A notable form of autologous PSCT involves the use of autologous cells to create vaccines directed against tumor cells in the body which has been demonstrated to be effective and safe in clinical trials. Our treatment for diabetes focuses on PSCTs using autologous cells. Autologous cells offer a low likelihood of rejection by the patient and we believe the long-term benefits of these PSCTs can best be achieved with an autologous product.

Various cell therapies are in clinical development for an array of human diseases, including autoimmune, oncologic, neurologic and orthopedic diseases, among other indications. Orgenesis, as well as other companies, are developing cell therapies that are designed to address cancers, ischemic repair and immune modulation. While no assurances can be given regarding future medical developments, we believe that the field of cell therapy holds the promise to better the human experience and minimize or ameliorate the pain and suffering from many common diseases and/or from the process of aging.

6

Diabetes Mellitus (DM), or simply diabetes, is a metabolic disorder usually caused by a combination of hereditary and environmental factors, and results in abnormally high blood sugar levels (hyperglycemia). Diabetes occurs as a result of impaired insulin production by the pancreatic islet cells. The most common types of the disease are Type-1 Diabetes (T1D) and Type-2 Diabetes (T2D). In T1D, the onset of the disease follows an autoimmune attack of β-cells that severely reduces β-cell mass. T1D usually has an early onset and is sometimes also called juvenile diabetes. In T2D, the pathogenesis involves insulin resistance, insulin deficiency and enhanced gluconeogenesis, while late progression stages eventually leads to β-cell failure and a significant reduction in β-cell function and mass. T2D often occurs later in life and is sometimes called adult onset diabetes. Both T1D and late-stage T2D result in marked hypoinsulinemia, reduction in β-cell function and mass and lead to severe secondary complications, such as myocardial infarcts, limb amputations, neuropathies and nephropathies and even death. In both cases, patients become insulin-dependent, requiring either multiple insulin injections per day or reliance on an insulin pump.

We believe that diabetes will be one of the most challenging health problems in the 21st century, and will have a staggering health, societal, and economic impact. Diabetes is currently the fourth or fifth leading cause of death in most developed countries. There also is substantial evidence that it is an epidemic in many developing and newly industrialized nations.

Threats from Pancreas Islet Transplantation and Cell Therapies

For some patients with severe and difficult to control diabetes (hypoglycemic unawareness), islet transplants are considered. Pancreatic islets are the cells in the pancreas that produce insulin. Physicians use enzymes to isolate the islets from the pancreas of a deceased donor. Because the islets are fragile, transplantation must occur soon after they are removed. Typically, a patient receives at least 10,000 islet “equivalents” per kilogram of body weight, extracted from pancreases obtained from different donors. Patients often require two separate transplants to achieve insulin independence.

Transplants are often performed by an interventional radiologist, who uses x-rays and ultrasound to guide placement of a catheter - a small plastic tube - through the upper abdomen and into the portal vein of the liver. The islets are then infused slowly through the catheter into the liver. The patient receives a local anesthetic and a sedative. In some cases, a surgeon may perform the transplant through a small incision, using general anesthesia.

Because the islets are obtained from cadavers that are unrelated to the patient, the patient needs to be treated with drugs that inhibit the immune response so that the patient doesn’t reject the transplant. In the early days of islet transplantation, the drugs were so powerful that they actually were toxic to the islets; improvements in the procedure are widely used and are now referred to as the Edomonton Protocol.

Studies and Reports

Since reporting their findings in the June 2000 issue of the New England Journal of Medicine, researchers at the University of Alberta in Edmonton, Canada, have continued to use and refine Edmonton Protocol to transplant pancreatic islets into selected patients with T1D that is difficult to control.

In 2005, the researchers published 5-year follow-up results for 65 patients who received transplants at their center and reported that about 10 percent of the patients remained free of the need for insulin injections at 5-year follow-up. Most recipients returned to using insulin because the transplanted islets lost their ability to function over time, potentially due to the immune suppression protocol, which prevents the immune rejection of the implanted cells. The researchers noted, however, that many transplant recipients were able to reduce their need for insulin, achieve better glucose stability, and reduce problems with hypoglycemia, also called low blood sugar level.

In its 2006 annual report, the Collaborative Islet Transplant Registry, which is funded by the National Institute of Diabetes and Digestive and Kidney Diseases, presented data from 23 islet transplant programs on 225 patients who received islet transplants between 1999 and 2005. According to the report, nearly two-thirds of recipients achieved “insulin independence” - defined as being able to stop insulin injections for at least 14 days - during the year following transplantation. However, other data from the report showed that insulin independence is difficult to maintain over time. Six months after their last infusion of islets, more than half of recipients were free of the need for insulin injections, but at 2-year follow-up, the proportion dropped to about one-third of recipients. The report described other benefits of islet transplantation, including reduced need for insulin among recipients who still needed insulin, improved blood glucose control, and greatly reduced risk of episodes of severe hypoglycemia.

7

In a 2006 report of the Immune Tolerance Network’s international islet transplantation study, researchers emphasized the value of transplantation in reversing a condition known as hypoglycemia unawareness. People with hypoglycemia unawareness are vulnerable to dangerous episodes of severe hypoglycemia because they are not able to recognize that their blood glucose levels are too low. The study showed that even partial islet function after transplant can eliminate hypoglycemia unawareness.

Pancreatic islet transplantation (cadaver donors) is an allogeneic transplant, and, as in all allogeneic transplantations, there is a risk for graft rejection and patients must receive lifelong immune suppressants. Though this technology has shown good results clinically, there are several setbacks, such as patients being sensitive to recurrent T1D autoimmune attacks and a shortage in tissues available for islet cells transplantation.

Our Cell Therapy Business

We are developing and bringing to the clinical stage a technology that is based on the published work of Prof. Sarah Ferber, our Chief Science Officer and a researcher at THM, who established a proof of concept that demonstrates the capacity to induce a shift in the developmental fate of cells from the liver and differentiating (converting) them into “pancreatic beta cell-like” insulin-producing cells. Furthermore, those cells were found to be resistant to the autoimmune attack and to produce insulin in a glucose-sensitive manner.

We intend to grow our cell therapy business by furthering this technology to the clinical stage. We intend to devote significant resources to process development and manufacturing in order to optimize the safety and efficacy of our future product candidates, as well as our cost of goods and time to market. Our goal is to carefully manage our fixed cost structure, maximize optionality, and drive long-term cost of goods as low as possible. We believe that operating our own manufacturing facility will provide the Company with enhanced control of material supply for both clinical trials and the commercial market, will enable the more rapid implementation of process changes, and will allow for better long-term margins.

The License Agreement

On February 2, 2012, our Israeli Subsidiary entered into a licensing agreement with THM pursuant to which the Israeli Subsidiary was granted a worldwide royalty bearing and exclusive license to certain information regarding a molecular and cellular approach directed at converting liver cells into functional insulin producing cells as a treatment for diabetes (the “License Agreement”). By using therapeutic agents (i.e., PDX-1, and additional pancreatic transcription factors in an adenovirus-vector) that efficiently convert a sub-population of liver cells into pancreatic islets phenotype and function, this approach allows the diabetic patient to be the donor of his own therapeutic tissue. We believe that this provides major competitive advantage the cell transformation technology our Israeli Subsidiary is developing. Based on the licensed knowhow and patents, it is our intention, through the Israeli Subsidiary, to develop to the clinical stage a new technology for regeneration of functional insulin-producing cells, thus enabling normal glucose regulated insulin secretion, via cell therapy. By using therapeutic agents (i.e., PDX-1, and additional pancreatic transcription factors in an adenovirus-vector) that efficiently convert a sub-population of liver cells into pancreatic islets phenotype and function, this approach allows the diabetic patient to be the donor of his own therapeutic tissue.

As consideration for the license under the License Agreement, the Israeli Subsidiary has agreed to pay the following to THM:

| 1) |

A royalty of 3.5% of net sales; | |

| 2) |

16% of all sublicensing fees received; | |

| 3) |

An annual license fee of $15,000, which commenced on January 1, 2012 and is due once every year thereafter (the “Annual Fee”). The Annual Fee is non-refundable, but it shall be credited each year due, against the royalty noted above, to the extent that such are payable, during that year; and | |

| 4) |

Milestone payments as follows: |

8

| a) |

$50,000 on the date of initiation of phase I clinical trials in human subjects; | |

| b) |

$50,000 on the date of initiation of phase II clinical trials in human subjects; | |

| c) |

$150,000 on the date of initiation of phase III clinical trials in human subjects; | |

| d) |

$750,000 on the date of initiation of issuance of an approval for marketing of the first product by the FDA; and | |

| e) |

$2,000,000, when worldwide net sales of products have reached the amount of $150,000,000 for the first time, (The “Sales Milestone”). |

As of November 30, 2015, the Israeli Subsidiary has not reached any of these milestones.

In the event of an acquisition of all of the issued and outstanding share capital of the Israeli Subsidiary or of the Company and/or consolidation of the Israeli Subsidiary or the Company into or with another corporation (“Exit”), under the License Agreement, THM is entitled to elect, at its sole option, whether to receive from the Company a one-time payment based, as applicable, on the value at the time of the Exit of either 5,563,809 shares of common stock of the Company or the value of 1,000 ordinary shares of the Israeli Subsidiary at the time of the Exit. If THM elects to receive the consideration as a result of an Exit, the royalty payments will cease.

If THM elects to not receive any consideration as a result of an Exit, THM is entitled under the License Agreement to continue to receive all the rights and consideration it is entitled to pursuant to the License Agreement (including, without limitation, the exercise of the rights pursuant to future Exit events), and any agreement relating to an Exit event shall be subject to the surviving entity’s and/or the purchaser’s undertaking towards THM to perform all of the Israeli Subsidiary's obligations pursuant to the License Agreement.

The Israeli Subsidiary agreed to submit to THM a commercially reasonable plan which shall include all research and development activities as required for the development and manufacture of the products, including preclinical and clinical activities until an FDA or any other equivalent regulatory authority’s approval for marketing and including all regulatory procedures required to obtain such approval for each product candidate (a “Development Plan”), within 18 months from the date of the License Agreement. Under the License agreement, the Israeli Subsidiary undertook to develop, manufacture, sell and market the products pursuant to the milestones and time-frame schedule specified in the Development Plan. The Israeli Subsidiary submitted the Development Plan in May 2014.

Under the License Agreement, THM is entitled to terminate the License Agreement in each of the following events:

| • | The Israeli Subsidiary materially changes its business. |

|

• |

The Israeli Subsidiary breaches any of its material obligations under the License Agreement, provided that THM has provided the Israeli Subsidiary with written notice of such material breach and THM’s intention to terminate, and the Israeli Subsidiary has not cured such breach within 180 days of receiving such written notice from THM. The Israeli Subsidiary's failure to comply with sections relating to the following are deemed to be a material breach of the License Agreement: |

| o | granting of sublicenses; | |

| o | confidentiality provisions; | |

| o | performance of payments to the Licensor; or | |

| o | indemnity and insurance. |

| • |

The Israeli Subsidiary breaches any of its obligations thereunder other than material breaches, and such breach remains uncured for 200 days after written notice from THM. |

| • |

The Israeli Subsidiary becomes insolvent; file a petition or have a petition filed against it, under any laws relating to insolvency; enter into any voluntary arrangement for the benefit of our creditors; or appoint or have appointed on our behalf a receiver, liquidator or trustee of any of its property or assets, under any laws relating to insolvency; and such petition, arrangement or appointment is not dismissed or vacated within 90 days. |

| • |

The Israeli Subsidiary has ceased to carry on our business for a period of more than 60 days. |

9

|

• |

The Israeli Subsidiary challenges, or causes any third party to challenge, the intellectual property rights or other rights of THM to the licensed information anywhere in the world. |

The Israeli Subsidiary may terminate the License Agreement and return the licensed information to THM only in the following events:

| • |

the development and/or manufacture of the licensed information is not successful according to the scientific criteria acceptable in the relevant field of the invention; |

| • |

if the registration and/or defense of a patent is not successful, in any country for reasons not dependent upon the Israeli Subsidiary; |

| • |

the development and/or manufacture of the licensed information is not approved by the proper regulation procedures as mandated under the relevant laws for reasons not dependent upon the Israeli Subsidiary; or |

| • |

an external specialist in the field of the product(s) determined in a reasoned and explained written opinion that there is insufficient market demand for the products and such written opinion was provided to THM. |

On March 22, 2012, the Israeli Subsidiary entered into a research service agreement with THM pursuant to which THM is to perform a study at the facilities and use the equipment and personnel of the Chaim Sheba Medical Center (the “Hospital”), for the consideration of approximately $74,000 for a year. On each of May 2013 and 2014, the Israeli Subsidiary renewed the research agreement for an annual consideration of approximately $92,000 and approximately $114,000, respectively.

We intend to advance our cell therapy business by furthering this technology to a clinical stage. We intend to devote significant resources to process development and manufacturing in order to optimize the safety and efficacy of our future product candidates, as well as our cost of goods and time to market. Our goal is to carefully manage our fixed cost structure, maximize optionality, and drive long-term cost of goods as low as possible. We believe that operating our own manufacturing facility will provide the Company with enhanced control of material supply for both clinical trials and the commercial market, will enable the more rapid implementation of process changes, and will allow for better long-term margins.

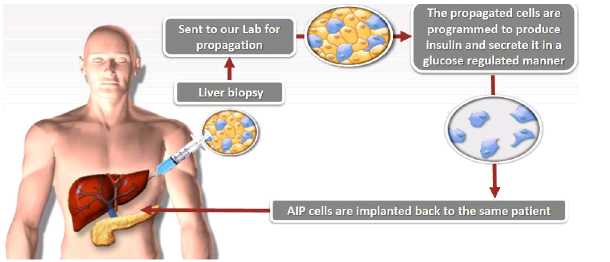

Toward this goal, we are working to advance a unique product that combines cell-based therapy and regenerative medicine, (AIP) cells, into clinical development. AIP cells utilize the technology of ‘cellular trans-differentiation’ to transform an autologous adult liver cell into an adult, fully functional and physiologically glucose-responsive pancreatic-like insulin producing cell. Treatment with AIP cells is expected to provide Diabetes patients with long-term insulin independence. Because the AIP cells are autologous, this benefit should be achieved and maintained without the need for concomitant immunosuppressive therapy. The procedure to generate AIP cells begins with liver tissue accessed via needle biopsy from a patient. The liver tissue is then sent to a central facility where biopsied liver cells are isolated, expanded and trans-differentiated into AIP cells. The final product is a solution of AIP cells, which are packaged in an infusion bag and sent back to the patient’s treating physician where the cells are transplanted back into the patient’s liver via portal vein infusion. The entire process, from biopsy to transplantation, is expected to take 5-6 weeks.

10

Unique benefits of AIP cells

We believe that our singular focus on the acquisition, development, and commercialization of AIP cells may have many and meaningful benefits over other technologies, including:

| • | Physiologically glucose-responsive insulin production within one week of AIP cell transplantation; |

| • | Insulin-independence within one month; |

| • | Single course of therapy (~10-year insulin-independence); |

| • | No need for concomitant immunosuppressive therapy; |

| • | Return to (near) normal quality of life for patients; |

| • | Single liver biopsy supplies unlimited source of therapeutic tissue (bio-banking for future use if needed); |

| • | Highly controlled and tightly closed GMP systems; and |

| • | Quality Control of final product upon release and distribution |

We are aware of no other company focused on development of AIP cells based on transdifferentiatation. The pharmaceutical industry is fragmented and it is a competitive market. We compete with many pharmaceutical companies, both large and small and there may be technologies in development of which we are not aware.

Marketing

Our plan is to market and sell AIP cellular therapy as a stand-alone product, and to provide supporting education and services to treating physicians and the healthcare providers that support them. In addition, we expect to provide appropriate and supportive services to the distribution networks that make our product available to treating physicians and facilities. Once marketing authorization is granted, we plan to market our product in the North American, European and Asian regions.

As part of our long-term strategy, we will consider clinical development and commercialization collaborations and/or partnerships with international companies involved in the diabetes therapeutic area. Currently, leading companies in this field include Novo Nordisk, Takeda Pharmaceutical, Eli Lilly, GlaxoSmithKline, Sanofi Aventis and Merck.

Future Product Candidates

Currently, liver cells are best suited for generating AIP cells. Future products may involve the use of cell types other than liver that are more easily accessible from the diabetic patient or from unrelated donors. Additionally, other adult cells (i.e. fibroblasts) may be studied for trans-differentiation into functional cells in diseases other than insulin-dependent disorders (i.e. neurodegenerative).

11

Competition

Insulin therapy is used for Insulin-Dependent Diabetes Mellitus (IDDM) patients who are not controlled with oral medications, but this therapy has well-known and well-characterized disadvantages. Weight gain is a common side effect of insulin therapy, which is a risk factor for cardiovascular disease. Injection of insulin causes pain and inconvenience for patients. Patient compliance and inconvenience of self-administering multiple daily insulin injections is also considered a disadvantage of this therapy. The most serious adverse effect of insulin therapy is hypoglycemia.

The global diabetes market comprising the insulin, insulin analogues and other anti-diabetic drugs has been evolving rapidly. Today’s overall diabetes market is dominated by a handful of participants such as Novo Nordisk A/S, Eli Lilly and Company, Sanofi-Aventis, Takeda Pharmaceutical Company Limited, Pfizer Inc., Merck KgaA, and Bayer AG.

Collaboration Agreements

We have embarked on a strategy of collaborative arrangements with strategically situated third parties around the world. We believe that these parties have the expertise, experience and strategic location to advance our clinical development business.

Korea

On April 7, 2015, we executed a non-binding memorandum of understanding with Global Stem Cell & Regenerative Medicine Acceleration Center of Korea in order to collaborate research in stem cell and regenerative medicine. Both parties will absorb their own expenses related to the memorandum of understanding. The memorandum of understanding is for three years unless one of the parties provides written notice terminating the memorandum of understanding.

On March 25, 2015 the Israeli Subsidiary executed a non-binding memorandum of understanding with CureCell Co., Ltd. of Korea (“CureCell”) as an initial step for finalizing a joint venture to develop and bring to market Orgenesis' AIP cell therapy product in Korea. The parties jointly aim to raise all the available funds from both public and private sectors. The memorandum of understanding is intended to be finalized by a definitive agreement and will be in effect until we sign a formal agreement with CureCell or either party withdraws their collaboration.

Russia

On November 12, 2015, our Israeli Subsidiary entered into a collaboration agreement with Biosequel LLC, a company incorporated and existing under the laws of Russia (“Biosequel”) to collaborate, in carrying out clinical trials and eventually marketing the Company’s products in Russia, Belarus and Kazakhstan. The collaboration is divided into two stages, with the first focused on obtaining the requisite regulatory approvals for conducting clinical trials, as well as performing all clinical and other testing required for market authorization in the defined territory. The second stage will focus on marketing the products in the territory and will be subject to obtaining requisite approvals for such marketing. Biosequel will fund the costs for the first stage, which is expected to last for five or more years, but such stage may terminate earlier if the necessary regulatory approvals for commencement of clinical trials are not obtained by the second anniversary of the agreement or if the malting approvals are not obtained with 48 months following the commencement of the clinical trials. The collaboration agreement is also terminable under certain limited conditions relating to a party’s insolvency or bankruptcy related event or breach of a material term of the agreement and force majeure events or upon the termination of the THM License Agreement.

China, China, Hong Kong SAR and Macau SAR

On February 18, 2016, our Israeli Subsidiary entered into a Collaboration Agreement (the “Collaboration Agreement) with Grand China Energy Group Limited with headquarters in Beijing, China (“Grand China”) to collaborate in carrying out clinical trials and marketing the Company’s autologous insulin producing cell therapy product in the Peoples Republic of China, Hong Kong and Macau, based on achieving certain pre-market development milestones that include Grand China obtaining the requisite regulatory approvals for commercialization of our AIP cells, including performing all clinical and other testing required for market authorization in each jurisdiction in the territory. Upon achieving the pre-market development milestones by Grand China, the parties will collaborate on marketing the products in the territory. Grand China will bear all costs associated with the pre-marketing development efforts in the territory, which is expected to last for approximately four years. Subject to the completion of the pre-marketing development milestones, our Israeli Subsidiary has agreed to grant to Grand China, or a fully owned subsidiary thereof, under a separate sub-license agreement, an exclusive sub-license to the intellectual property underlying the solely for commercialization of the Company’s products in each such jurisdiction in the territory where all of the pre-marketing development required to commercialize the AIP cells have been successfully completed by Grand China. Grand China has agreed to pay annual license fees, ongoing royalties based on net sales generated by Grand China and its sublicensees, milestone payments and sublicense fees.

12

Research and Development Expenditures

We incurred $1,860 thousand in research and development expenditures in the last fiscal year ended November 30, 2015, of which $793 thousand was covered by grant funding (See Item 8). We intend to dedicate most of our capital to research and development with no expectation of revenue from product sales in the foreseeable future.

Contract Development and Manufacturing Businesss

Acquisition of MaSTherCell

We acquired MaSTherCell in November 2014 pursuant to a share purchase agreement with MaSTherCell’s shareholders dated as of November 12, 2014, as subsequently amended (the “SEA”). Under the SEA, as amended in November 2015, we agreed to remit to MaSTherCell, by way of an equity investment, EUR 3.8 million by November 30, 2015 (the “Initial Investment”), to be followed by a subsequent equity investment by December 31, 2015 in MaSTherCell of EUR 1.2 million. By agreement with the MaSTherCell shareholders, we remitted in December 2015, the sum of EUR 3.8 million or $4,103,288, in compliance with our obligations as required under the SEA. The right of the former MaSTherCell shareholders to unwind the merger with our Company terminated upon the such investment. Additionally, in connection with the equity investment, on December 10, 2015 we agreed to invest an additional EUR 2.2 million in MaSTherCell equity in addition to the Initial Investment, which additional amount becomes due upon the request of the MaSTherCell board of directors, of whom Company directors/officers currently represent a majority.

In connection with the above agreements, we granted to certain former MaSTherCell shareholders, who currently hold approximately 12% of the Company’s outstanding common stock, the first right to negotiate the terms of the sale of MaSTherCell, should the Company decide at a future date to sell its shares in MaSTherCell or otherwise sell equity interests in MaSTherCell (the “Sale Event”), on an exclusive basis, for the first thirty days following our delivery to such shareholders of notice of such intention. We agreed to accept the offer of such shareholders resulting from the Sale Event negotiations, unless our board of directors determines that a materially superior offer may be available to us if the Sale Event were open to other parties, in which case we are entitled to negotiate the Sale Event with unrelated third parties.

Our Plans for MaSTherCell

We are conducting our CDMO business thorugh MaSTherCell. Subject to raising additional working capital, we intend to devote significant resources to process development and manufacturing in order to optimize the safety and efficacy of our future product candidates for our customers, as well as our cost of goods and time to market. Our goal is to carefully manage our fixed cost structure, maximize optionality, and drive long-term cost of goods as low as possible. We believe that operating our own manufacturing facility provides us with enhanced control of material supply for both clinical trials and the commercial market, will enable the more rapid implementation of process changes, and will allow for better long-term margins.

MaSTherCell's target customers are primarily cell therapy companies that are in pre- or early-stage clinical trials. This stems from the finding that these companies' processes have to be set up right from start in order for them to obtain approved products that have the simplest possible process and with the lowest possible cost of goods sold (COGS). Therefore, MaSTherCell's strategy is to build long term relationships with its customers in order to help them bring highly potent cell therapy products faster to the market and in cost-effective ways.

13

To provide these services MaSTherCell relies on a team of dedicated experts both from academic and industry backgrounds. It operates through state-of-the-art facilities located just 40 minutes from Brussels, which have received the final cGMP manufacturing authorization from the Belgian Drug Agency (AFMPS) in September 2013.

Competition in the CDMO Field

MaSTherCell competes with a number of companies both directly and indirectly. Key competitors include the following CDMOs: Lonza Group Ltd, Progenitor Cell Therapy (PCT) LLC, Pharmacell BV, WuxiAppTec (WuXi PharmaTech (Cayman) Inc.), Cognate Bioservices Inc., Apceth GmbH & Co. KG, Eufets GmbH, Fraunhofer Gesellschaft, Cellforcure SASU, Cell Therapy Catapult Limited and Molmed S.p.A. MaSTherCell's services differ from these companies in two major aspects:

| • |

Quality and expertise of its services: Clients identify the excellence of its facility, quality system, and people as a major differentiating point compared to competitors; and |

| • |

Flexible and tailored approach: MaSTherCell's philosophy is to build a true partnership with its clients and adapt itself to the clients’ needs, which entails no “off-the-shelf process” nor in-house technology platform, but a dedicated person in plant (of client), joint steering committees on each project and dedicated project managers. |

Neither of these differentiating points results in a price premium compared to other CMO’s as MaSTherCell operates with a lean organization focused solely on cell therapy.

Finally, MaSTherCell is the only CDMO located in Belgium which logistically offers an ideal location given the high concentration of companies active in cell therapy (potential clients and companies with complementary know-how, products and services).

Subsidiaries and Grant Funding

Subsidiaries

14

In addition to our Israeli Subsidiary and MaSTherCell, we have the following subsidiaries:

On July 31, 2013, we incorporated a wholly-owned subsidiary in Maryland, Orgenesis Maryland Inc., or the U.S. Subsidiary, which was formed as the U.S. center for research and development and manufacturing scale-up for our technology. The U.S. Subsidiary received a grant from TEDCO which is being used for pre-clinical research and will oversee initiation and conduct of our Phase 1 clinical trial program. The TEDCO grant is further discussed below.

On October 11, 2013, Orgenesis Ltd. incorporated a wholly-owned subsidiary in Belgium, Orgenesis SPRL, our Belgian Subsidiary, which is engaged in development and manufacturing activities together with clinical development studies in Europe. The incorporation of Orgenesis SPRL followed a strategic decision in May 2013 to work with Pall Life Science Belgium BVBA (formerly ATMI BVBA), a Belgian company, to supply disposable bioreactors as the major component in our product manufacturing. In addition, we made another strategic decision in September 2013 to work with Masthercell SPRL, which we subsequently acquired, in order to develop a manufacturing process and to manufacture our product. Both companies are located in Belgium.

A breakdown of our various subsidiaries is as follows:

| Entity | Percentage of | Location |

| Ownership | ||

| Orgenesis Ltd. | 100% | Israel |

| Orgenesis Maryland Inc. | 100% | United States of America |

| Orgenesis SPRL (1) | 95% | Belgium |

| Cell Therapy Holding SA(2) | 100% | Belgium |

| MaSTherCell SA | 100% | Belgium |

| (1) |

Orgenesis Ltd. Owns 5% of Orgenesis SPRL. |

| (2) |

Cell Therapy Holding SA is a financial holding company of MaSTherCell SA, but has no operations. |

Grant Funding

Maryland Technology Development Corporation (“TEDCO”).

On June 30, 2014, the Company’s U.S. Subsidiary entered into a grant agreement with Maryland Technology Development Corporation (“TEDCO”). TEDCO was created by the Maryland State Legislature in 1998 to facilitate the transfer and commercialization of technology from Maryland’s research universities and federal labs into the marketplace and to assist in the creation and growth of technology based businesses in all regions of the State. TEDCO is an independent organization that strives to be Maryland’s lead source for entrepreneurial business assistance and seed funding for the development of startup companies in Maryland’s innovation economy. TEDCO administers the Maryland Stem Cell Research Fund to promote State funded stem cell research and cures through financial assistance to public and private entities within the State. Under the agreement, TEDCO has agreed to give the U.S Subsidiary an amount not to exceed $406,431 (the “Grant”). The Grant will be used solely to finance the costs to conduct the research project entitled “Autologous Insulin Producing (AIP) Cells for Diabetes” during a period of two years. On July 22, 2014, the U.S Subsidiary received an advance payment of $203,000 under the grant. Through November 30, 2015, the company spent the full amount of the grant. On September 21, 2015 the U.S Subsidiary received the second advance payment in amount of $203,000.

Department De La Gestion Financiere Direction De L’analyse Financiere (“DGO6”)

On November 17, 2014, our Belgian Subsidiary received the formal approval from the Walloon Region, Belgium (Service Public of Wallonia, DGO6) for a €2.015 million ($2.4 million) support program for the research and development of a potential cure for Type 1 Diabetes. The financial support is composed of a €1,085 thousand (70% of budgeted costs) grant for the industrial research part of the research program and a further recoverable advance of €930 thousand (60% of budgeted costs) of the experimental development part of the research program. The grants will be paid to the Company over a period of approximately 3 years. The grants are subject to certain conditions with respect to our work in the Walloon Region.

15

In addition, the DGO6 is also entitled to a royalty upon revenue being generated from any commercial application of the technology. On December 9 and 16, 2014, the Belgian Subsidiary received €651 thousand and €558 thousand under the grant, respectively. Up through November 30, 2015, an amount of $1.4 million (€1.1 million) was recorded as deduction of research and development expenses and an amount of $114 thousand was recorded as advance payments on account of grant. On March 20, 2012, MaSTherCell had been granted an investment grant from the DGO6 for an amount of €1,421 thousand. This grant is related to the investment in the production facility with a coverage of 32% of the investment planned. A first payment of €568 thousand was received in August 2013. The remaining part is expected to be paid by the end of fiscal 2016.

Israel-U.S. Binational Industrial Research and Development Foundation (“BIRD”)

On September 9, 2015, the Israeli Subsidiary entered into a pharma Cooperation and Project Funding Agreement (CPFA) with BIRD and Pall Corporation, a U.S. company. BIRD will give a conditional grant of $400 thousand each (according to terms defined in the agreement), for a joint research and development project for the use Autologous Insulin Producing (AIP) Cells for the Treatment of Diabetes (the “Project”). The Project started on March 1, 2015. Upon the conclusion of product development, the grant shall be repaid at the rate of 5% of gross sales. The grant will be used solely to finance the costs to conduct the research of the project during a period of 18 months starting on March 1, 2015.

Up through November 30, 2015, an amount of $153 thousand was recorded as deduction of research and development expenses and receivable on account of grant. On September 21, 2015, the Israeli Subsidiary received $100 thousand under the grant.

Intellectual Property

We will be able to protect our technology and products from unauthorized use by third parties only to the extent it is covered by valid and enforceable patents or is effectively maintained as trade secrets. Patents and other proprietary rights are thus an essential element of our business.

Our success will depend in part on our ability to obtain and maintain proprietary protection for our product candidates, technology, and know-how, to operate without infringing on the proprietary rights of others, and to prevent others from infringing it proprietary rights. Our policy is to seek to protect our proprietary position by, among other methods, filing U.S. and foreign patent applications related to our proprietary technology, inventions, and improvements that are important to the development of our business. We also rely on trade secrets, know-how, continuing technological innovation, and in-licensing opportunities to develop and maintain our proprietary position.

We own or have exclusive rights to three (3) United States and seven (7) foreign issued patents and allowed patent applications, three (3) pending applications in the United States, twelve (12) pending applications in foreign jurisdictions: Europe, Australia, Brazil, Canada, China, Columbia, Eurasia, Israel, Japan, South Korea, Mexico, and Singapore, and one (1) international PCT patent application, relating to the transdifferentiation of cells (including hepatic cells) to cells having pancreatic β-cell phenotype and function, and their use in the treatment of degenerative pancreatic disorders including diabetes, pancreatic cancer, and pancreatitis.

Granted United States patents which are directed to methods of making transdifferentiated cells will expire between 2021 and 2023, excluding any patent term extensions that might be available following the grant of marketing authorizations. Granted patents outside of the United States directed to making transdifferentiated cells and their uses will expire between 2020 and 2024. We have pending patent applications for methods of making our product, the product itself, and methods of using the product that, if issued, would expire in the United States and in countries outside of the United States between 2034 and 2035, excluding any patent term adjustment that might be available following the grant of the patent and any patent term extensions that might be available following the grant of marketing authorizations. These pending patent applications are directed to the following specific compositions and methods: a method of producing a transdifferentiated population of cells, a population of transdifferentiated cells, a method of treating a degenerative pancreatic disorder in a subject in need, a method of isolating a population of cells that have an enriched capacity for transcription factor induced transdifferentiation, an isolated population of cells having enriched transdifferentiation capacity, a method of increasing transdifferentiation efficiency in a population of cells, a population of liver cells enriched for cells predisposed to transdifferentiation, and a method of manufacturing a population of human insulin producing cells and the population of cells produced by the recited manufacturing method.

16

Government Regulation

We have not sought approval from the FDA for the AIP cells. Among all forms of cell therapy modalities, we believe that autologous cell replacement therapy seems to be of the highest benefit. We believe that it seems to be safer than other options as it does not alter the host genome but only alters the set of expressed epigenetic information that seems to be highly specific to the reprogramming protocol. It provides an abundant source of therapeutic tissue, which is not rejected by the patient and does not have to be treated by immune suppressants. It is highly ethical since no human organ donations or embryo-derived cells are needed. The proposed therapeutic approach does not require cell bio-banking at birth, which is both expensive and cannot be used for patients born prior to 2000.

Within the last decade, many studies published in leading scientific journal confirmed the capacity of reprogramming adult cells from many of our mature organs to either alternate organs or to “stem like cells”. The most widely used autologous cell replacement protocol is the one used for autologous implantation of bone marrow stem cells. This protocol is widely used in patients undergoing a massive chemotherapy session that destroys their bone marrow cells. However, the stem cells used for cancer patients delineated above do not require extensive manipulation and is regarded by FDA as “minimally manipulated”.

An additional autologous cell therapy approach already used in man is autologous chondrocyte implantation (ACI). In the United States, Genzyme Corporation provides the only FDA approved ACI treatment: Carticel. The Carticel treatment is designated for young, healthy patients with medium to large sized damage to cartilage. During an initial procedure, the patient’s own chondrocytes are removed arthroscopically from a non-load-bearing area from either the intercondylar notch or the superior ridge of the medial or lateral femoral condyles.

To aid us in our efforts to achieve the highest level of compliance with FDA requirements, we have looked to hire experts in the field of pharmaceutical compliance.

Regulatory Process in the United States

Our product is subject to regulation as a biological product under the Public Health Service Act and the Food, Drug and Cosmetic Act. FDA generally requires the following steps for pre-market approval or licensure of a new biological product:

| • |

Pre-clinical laboratory and animal tests conducted in compliance with the Good Laboratory Practice, or GLP, requirements to assess a drug’s biological activity and to identify potential safety problems, and to characterize and document the product’s chemistry, manufacturing controls, formulation, and stability; |

| • |

Submission to FDA of an Investigational New Drug, or IND application, which must become effective before clinical testing in humans can begin; |

| • |

Obtaining approval of Institutional Review Boards, or IRBs, of research institutions or other clinical sites to introduce the biologic drug candidate into humans in clinical trials; |

| • |

Conducting adequate and well-controlled human clinical trials to establish the safety and efficacy of the product for its intended indication conducted in compliance with Good Clinical Practice, or GCP requirements; |

| • |

Compliance with current Good Manufacturing Practices, or cGMP regulations and standards; |

| • |

Submission to FDA of a Biologics License Application, or BLA, for marketing that includes adequate results of pre-clinical testing and clinical trials; |

| • |

FDA reviews the marketing application in order to determine, among other things, whether the product is safe, effective and potent for its intended uses; and |

| • |

Obtaining FDA approval of the BLA, including inspection and approval of the product manufacturing facility as compliant with cGMP requirements, prior to any commercial sale or shipment of the pharmaceutical agent. FDA may also require post marketing testing and surveillance of approved products, or place other conditions on the approvals. |

17

Regulatory Process in Europe

The European Union (“EU”) has approved a regulation specific to cell and tissue therapy product, the Advanced Therapy Medicinal Product (ATMP) regulation. For products such as our AIP that are regulated as an ATMP, the EU Directive requires:

| • |

Compliance with current Good Manufacturing Practices, or cGMP regulations and standards, pre-clinical laboratory and animal testing; |

| • |

Filing a Clinical Trial Application (CTA) with the various member states or a centralized procedure; Voluntary Harmonization Procedure (VHP), a procedure which makes it possible to obtain a coordinated assessment of an application for a clinical trial that is to take place in several European countries; |

| • |

Obtaining approval of Ethic Committees of research institutions or other clinical sites to introduce the AIP into humans in clinical trials; |

| • |

Adequate and well-controlled clinical trials to establish the safety and efficacy of the product for its intended use; and |

| • |

Submission to EMEA for a Marketing Authorization (MA); Review and approval of the MAA (Marketing Authorization Application). |

Clinical trials

Typically, both in the U.S. and the European Union, clinical testing involves a three-phase process, although the phases may overlap. In Phase I, clinical trials are conducted with a small number of healthy volunteers or patients and are designed to provide information about product safety and to evaluate the pattern of drug distribution and metabolism within the body. In Phase II, clinical trials are conducted with groups of patients afflicted with a specific disease in order to determine preliminary efficacy, optimal dosages and expanded evidence of safety. In some cases, an initial trial is conducted in diseased patients to assess both preliminary efficacy and preliminary safety and patterns of drug metabolism and distribution, in which case it is referred to as a Phase I/II trial. Phase III clinical trials are generally large-scale, multi-center, comparative trials conducted with patients afflicted with a target disease in order to provide statistically valid proof of efficacy, as well as safety and potency. In some circumstances, FDA or EMA may require Phase IV or post-marketing trials if it feels that additional information needs to be collected about the drug after it is on the market. During all phases of clinical development, regulatory agencies require extensive monitoring and auditing of all clinical activities, clinical data and clinical trial investigators. An agency may, at its discretion, re-evaluate, alter, suspend, or terminate the testing based upon the data that have been accumulated to that point and its assessment of the risk/benefit ratio to the patient. Monitoring all aspects of the study to minimize risks is a continuing process. All adverse events must be reported to the FDA or EMA.

Employees

As of November 30, 2015, we had 41 full-time employees, including the employees of our subsidiaries. Most of our senior management and professional employees have had prior experience in pharmaceutical or biotechnology companies. None of our employees is covered by collective bargaining agreements. We believe that our relations with our employees are good.

Corporate and Available Information

Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports are made available free of charge though our Internet website (http://www.orgenesis.com) as soon as practicable after such material is electronically filed with, or furnished to, the Securities and Exchange Commission. Except as otherwise stated in these documents, the information contained on our website or available by hyperlink from our website is not incorporated by reference into this report or any other documents we file, with or furnish to, the Securities and Exchange Commission.

18

ITEM 1A. RISK FACTORS

An investment in our common stock involves a number of very significant risks. You should carefully consider the following risks and uncertainties in addition to other information in this report in evaluating our company and its business before purchasing shares of our common stock. Our business, operating results and financial condition could be seriously harmed due to any of the following risks. You could lose all or part of your investment due to any of these risks.

Risks Related to Our Financial Condition and Liquidity

We are at an early stage of development, making our future viability, going concern, and success uncertain.

Our business is at an early stage of development. We are subject to all of the business risks associated with an early stage enterprise. We are still in the process of conducting laboratory research to determine potential product candidates for our cell therapy technology, and have not yet identified a lead product candidate or begun clinical trials with respect to any product candidates. The success of our business will depend on many factors including, without limitation, our ability to obtain additional capital as and when needed, identify a viable, lead product candidate, successfully complete preclinical testing and clinical trials, obtain marketing approvals and establish sales and marketing capacity. We may not be able to develop any products, initiate or complete clinical trials for any product candidates, obtain requisite regulatory approvals or commercialize any products. Any potential products may prove to have undesirable and unintended side effects or other characteristics adversely affecting their safety, efficacy or cost-effectiveness that could prevent or limit their use. Any potential product incorporating our technology may fail to provide the intended therapeutic benefits or to achieve therapeutic benefits equal to or better than the standard of treatment at the time of testing or production. As a result of our early stage of development, the future viability, going concern, and success of our company is uncertain.

If we fail to obtain the capital necessary to fund our operations, our financial results, financial condition and ability to continue as a going concern will be adversely affected and we will have to delay, reduce the scope of or terminate some or all of our research and development programs and may be forced to cease operations.

Our consolidated financial statements for the year ended November 30, 2015 have been prepared assuming that we will continue as a going concern. Our recurring losses from operations and our stockholders’ deficit raise substantial doubt about our ability to continue as a going concern. As a result, our independent registered public accounting firm included an explanatory paragraph in its report on our consolidated financial statements for the year ended November 30, 2015 with respect to this uncertainty. We do not anticipate generating meaningful revenue in the foreseeable future and we will need to raise additional capital to fund our operating requirements and continue as a going concern. In addition, the perception that we may not be able to continue as a going concern may cause others to choose not to deal with us due to concerns about our ability to meet our contractual obligations and may adversely affect our ability to raise additional capital.

Based upon our current plan of operations, and assuming we raise capital as and when needed, we anticipate spending approximately $5.7 million on manufacturing and scale-up activities during the 12 months ending November 30, 2016. Our capital requirements will depend on many factors, including:

| • |

The number and type of product candidates that we pursue; |

| • |

The progress, timing, scope, number and complexity of preclinical studies and clinical trials that we undertake; |

| • |

The timing and cost involved in obtaining FDA and other regulatory approvals; |

| • |

Costs related to maintaining, expanding and enforcing our intellectual property portfolio; |

| • |

Whether we enter into joint venture, licensing, collaboration or other strategic transactions involving funding or otherwise relating to research and development, manufacturing or marketing activities, and the scope and terms of any such arrangements; and |

| • |

The time and cost necessary to launch and successfully commercialize our product candidates, if approved. |

These factors raise substantial doubt about the Company’s ability to continue as a going concern.

19

We need to raise additional capital through equity or debt financing and collaborative arrangements, or some combination thereof. Substantially all of our operating capital requirements since inception have been provided by existing investors, on an as needed basis. Additional capital may not be available on acceptable terms, or at all. If we raise capital through the sale of equity-based securities, dilution to our then-existing equity investors would result. If we obtain capital through the incurrence of debt, we would likely become subject to covenants restricting our business activities, and holders of debt instruments would have rights and privileges senior to those of our equity investors. In addition, servicing the interest and repayment obligations under borrowings would divert funds that would otherwise be available to support research and development, clinical or commercialization activities. If we obtain capital through collaborative arrangements, these arrangements could require us to relinquish some rights to our technologies or product candidates and we may become dependent on third parties.

If we are unable to obtain adequate financing on a timely basis, we may be required to delay, reduce the scope of or eliminate one or more of our planned research and development programs and otherwise limit or cease our operations.

We have incurred losses since inception and may never achieve or sustain profitability.

We have incurred significant operating losses. We expect to incur operating losses for the foreseeable future. We had an accumulated deficit of $20.6 million as of November 30, 2015. Currently, our revenues are not substantial enough to cover our operating expenses. The extent of future operating losses is highly uncertain, and we may never achieve or sustain profitability

Risk Related to our CDMO Business

We need additional financing to grow our CDMO operations; if we are unable to raise additional capital, as and when needed, or on acceptable terms, we may be forced to delay, reduce or eliminate the expansion of our contract development and manufacturing operations.

The current operating plan of our subsidiary, MaSTherCell, requires additional capital to fund, among other things, the operation, enhancement and expansion of its operations to support its customers. The amount and timing of our future capital requirements also will likely depend on many other factors, including:

| • |

the cost of expansion of our contract development and manufacturing operations, including but not limited to, the costs of expanded facilities, equipment costs, engineering and innovation initiatives and personnel; and |

| • |

the opportunity to produce therapies in commercial phases for a customer which will require large production units. |

We have committed to remit to MaSTherCell, as an equity investment, an additional EUR 2.2 milllion, as needed by MaSTherCell. We will need to raise additional capital in order to fund MaSTherCell. Currently, we have no commitments for our working capital needs and we may ultimately be unable to raise capital on terms that are acceptable to us, if at all. Our inability to obtain necessary capital or financing to fund our future operating needs could adversely affect our business, results of operations and financial condition.

MaSTherCell has incurred substantial losses and negative cash flow from operations in the past, and expects to continue to incur losses and negative cash flow for the foreseeable future.

MaSTherCell has a limited operating history, limited capital, and limited sources of revenue. Since its inception in 2011 through November 30, 2015, the revenues generated have not been sufficient to cover costs attributable to that business. Based upon current plans, it is expected that MaSTherCell will reach a positive EBITDA in 2016, although our we will incur operating losses in future periods. This will happen because there are expenses associated with the development, marketing, and sales of our services. As a result, we may not generate significant revenues in the future. Failure to generate significant revenues in near future may cause us to suspend or cease activities. Our ability to achieve and maintain profitability and positive cash flow is dependent upon our ability to generate revenues, manage expenses, and compete successfully with our direct and indirect competitors.

A significant global market for our third party manufacturing services at MaSTherCell may never emerge.

20

At MaSTherCell, the current market and our existing contracts principally consist of providing consulting and manufacturing of cell and tissue-based therapeutic products in clinical trials. The number of people who may use cell or tissue-based therapies and thus the demand for stem cell processing services is difficult to forecast. If cell therapies under development by our customers to treat disease are not proven effective, demonstrate unacceptable risks or side effects or, where required, fail to receive regulatory approval, our business will be significantly impaired. While the therapeutic application of cells to treat serious diseases is currently being explored by a number of companies, to date there are only a handful of approved products in the United States, Asia and in Europe. Ultimately, our success in developing our contract development and manufacturing business depends on the development and growth of a broad and profitable global market for cell- and tissue-based therapies and services and our ability to capture a share of this market through MaSTherCell.

MaSTherCell's revenues may vary dramatically from period to period making it difficult to forecast future results.

MaSTherCell recorded revenues of $2.9 million for the year ended November 30, 2015. The nature and duration of MaSTherCell's contracts with customers often involve regular renegotiation of the scope, level and price of the services we are providing. If our customers reduce the level of their spending on research and development or marketing or are unsuccessful in attaining or retaining product sales due to market conditions, reimbursement issues or other factors, our results of operations may be materially impacted. In addition, other factors, including the rate of enrollment for clinical studies, will directly impact the level and timing of the products and services we deliver. As such, the levels of our revenues and profitability can fluctuate significantly from one period to another and it can be difficult to forecast the level of future revenues with any certainty.

The loss of one or more of MaSTherCell’s major clients or a decline in demand from one or more of these clients could harm MaSTherCell’s business.

MaSTherCell has a limited number of major clients that together account for a large percentage of the total revenues earned. There can be no assurance that such clients will continue to use MaSTherCell’s services at the same level or at all. A reduction or delay in the use of MaSTherCell’s services, including reductions or delays due to market, economic or competitive conditions, could have a material adverse effect on MaSTherCell’s business, operating results and financial condition.

MaSTherCell has a finite manufacturing capacity, which could inhibit the long-term growth prospects of this business.