Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - PennTex Midstream Partners, LP | fye2015exhibit231.htm |

| EX-31.2 - EXHIBIT 31.2 - PennTex Midstream Partners, LP | fye2015exhibit312.htm |

| EX-10.4 - EXHIBIT 10.4 - PennTex Midstream Partners, LP | fye2015exhibit104.htm |

| EX-31.1 - EXHIBIT 31.1 - PennTex Midstream Partners, LP | fye2015exhibit311.htm |

| EX-32.1 - EXHIBIT 32.1 - PennTex Midstream Partners, LP | fye2015exhibit321.htm |

| EX-21.1 - EXHIBIT 21.1 - PennTex Midstream Partners, LP | fye2015exhibit211.htm |

| EX-10.20 - EXHIBIT 10.20 - PennTex Midstream Partners, LP | fye2015exhibit1020.htm |

| XML - IDEA: XBRL DOCUMENT - PennTex Midstream Partners, LP | R9999.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K | ||||

(Mark One) | ||||

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

For the fiscal year ended | December 31, 2015 | |||

OR | ||||

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

For the transition period | from | to | ||

Commission File Number: 001-37412

PENNTEX MIDSTREAM PARTNERS, LP | ||||

(Exact Name of Registrant as Specified in Its Charter) | ||||

Delaware | 47-1669563 | |||||

(State or Other Jurisdiction of Incorporation or Organization) | (IRS Employer Identification Number) | |||||

11931 Wickchester Lane, Suite 300

Houston, TX 77043

(832) 456-4000

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Exchange on Which Registered |

Common Units Representing Limited Partner Interests | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act | Yes o No x |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. | Yes o No x |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | Yes x No o |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). | Yes x No o |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. | x |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one): | ||

Large accelerated filer | o | Accelerated filer o |

Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). | Yes o No x |

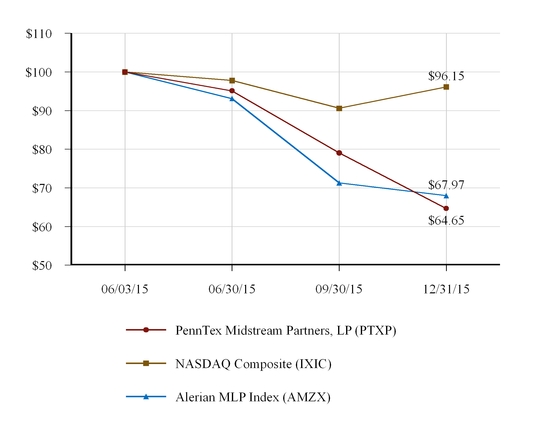

The aggregate market value of the registrant’s common units held by non-affiliates of the registrant on June 30, 2015, the last business day of the registrant’s most recently completed second fiscal quarter, based on the closing price on that date of $19.39, was approximately $326 million. This figure excludes common units beneficially owned by the directors and executive officers of PennTex Midstream GP, LLC, our general partner, and PennTex Midstream Partners, LLC. As of February 26, 2016, the registrant had 20,000,000 common units and 20,000,000 subordinated units outstanding.

Documents incorporated by reference:

None.

Table of Contents | ||

Page | ||

PART I | ||

PART II | ||

PART III | ||

PART IV | ||

SIGNATURES | ||

GLOSSARY OF INDUSTRY AND OTHER COMMONLY-USED TERMS

AMI and Exclusivity Agreement: the Amended & Restated Area of Mutual Interest and Midstream Exclusivity Agreement dated as of April 14, 2015 among PennTex NLA Holdings, LLC, MRD WHR LA Midstream LLC, MRD Operating, LLC and PennTex North Louisiana, LLC, as amended.

Bbl or barrel: One stock tank barrel, or 42 U.S. gallons liquid volume, used in reference to oil, NGLs or other liquid hydrocarbons.

Bbl/d: Bbl per day.

Btu: British thermal units.

Cotton Valley formation: The Cotton Valley formation is a prolific natural gas play spread across East Texas, northern Louisiana and southern Arkansas. This formation, which has been under development since the 1930s, is characterized by thick, multi-zone natural gas and oil reservoirs with well-known geologic characteristics and long-lived, predictable production profiles. The depth of the Cotton Valley formation is roughly 7,800 to 10,000 feet.

EPA: U.S. Environmental Protection Agency.

expansion capital expenditures: Cash expenditures incurred to construct or acquire new midstream infrastructure and to extend the useful lives of our assets, reduce costs, increase revenues or increase system throughput or capacity from current levels.

FERC: U.S. Federal Energy Regulatory Commission.

field: The general area encompassed by one or more oil or gas reservoirs or pools that are located on a single geologic feature, that are otherwise closely related to the same geologic feature (either structural or stratigraphic).

hydrocarbon: An organic compound containing only carbon and hydrogen.

maintenance capital expenditures: Cash expenditures (including expenditures for the construction of new capital assets or the replacement or improvement of existing capital assets) made to maintain, over the long term, our operating capacity, throughput or revenue.

Mcf: One thousand cubic feet of natural gas.

MDth: A dekatherm, which is a unit of energy equal to 10,000 therms or one billion Btus.

MDth/d: MDth per day.

Memorial Resource: Memorial Resource Development Corp. (NASDAQ: MRD), a Delaware corporation, and its wholly-owned subsidiaries, including MRD Operating LLC, a Delaware limited liability company that owns and operates Memorial Resource’s interest in the Terryville Complex.

MMBtu: One million British thermal units.

MMcf: One million cubic feet of natural gas.

MMcfe: One million cubic feet equivalent, determined using a ratio of six Mcf of natural gas to one Bbls of crude oil, condensate or natural gas liquids.

MMcf/d: One million cubic feet per day.

MMcfe/d: One million cubic feet equivalent per day.

natural gas: Hydrocarbon gas found in the earth, composed of methane, ethane, butane, propane and other gases.

NGLs: Natural gas liquids, which consist primarily of ethane, propane, isobutane, normal butane and natural gasoline.

oil: Crude oil and condensate.

rich natural gas: Gas having a heat content of between 1100 BTU to 1200 BTU.

Terryville Complex: The Terryville Complex is a natural gas field located in and around Lincoln Parish, Louisiana within the Cotton Valley formation. This field, which has been producing since 1954, provides multiple zones of highly productive, liquids-rich geology and is one of North America’s most prolific natural gas fields. The Terryville Complex is characterized by high recoveries relative to drilling and completion costs and high initial production rates with high liquid yields.

throughput: The volume of product transported or passing through a pipeline, plant, terminal or other facility.

i

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Some of the information in this report may contain forward-looking statements. Forward-looking statements give our current expectations, contain projections of results of operations or of financial condition, or forecasts of future events. Words such as “may,” “assume,” “forecast,” “position,” “predict,” “strategy,” “expect,” “intend,” “plan,” “estimate,” “anticipate,” “believe,” “project,” “budget,” “potential” or “continue,” and similar expressions are used to identify forward-looking statements. They can be affected by assumptions used or by known or unknown risks or uncertainties. Consequently, no forward-looking statements can be guaranteed. When considering these forward-looking statements, you should keep in mind the risk factors and other cautionary statements in this report. Actual results may vary materially. You are cautioned not to place undue reliance on any forward-looking statements. You should also understand that it is not possible to predict or identify all such factors and should not consider the following list to be a complete statement of all potential risks and uncertainties. Factors that could cause our actual results to differ materially from the results contemplated by such forward-looking statements include:

• | Memorial Resource’s inability to successfully execute its drilling and development plan in northern Louisiana on a timely basis or at all; |

•our ability to successfully implement our business strategy;

•realized natural gas, NGL and oil prices;

•competition and government regulations;

•actions taken by third-party producers, operators, processors and transporters;

•pending legal or environmental matters;

•costs of conducting our midstream operations;

•general economic conditions;

•credit markets;

•operating hazards, natural disasters, weather-related delays, casualty losses and other matters beyond our control;

•uncertainty regarding our future operating results; and

•plans, objectives, expectations and intentions contained in this report that are not historical.

We caution you that these forward-looking statements are subject to all of the risks and uncertainties incident to our midstream business, most of which are difficult to predict and many of which are beyond our control. These risks include, but are not limited to, commodity price volatility, inflation, environmental risks, drilling and completion and other operating risks, regulatory changes, the uncertainty inherent in projecting future rates of production, cash flow and access to capital, the timing of development expenditures and the other risks referenced in Item 1A. of this annual report.

Should one or more of the risks or uncertainties described in this report occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements.

All forward-looking statements, expressed or implied, included in this report are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue.

Except as otherwise required by applicable law, we disclaim any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this annual report.

ii

PART I

As used in this annual report, unless the context otherwise requires, “we,” “us,” “our,” the “Partnership,” “PennTex” and similar terms refer to PennTex Midstream Partners, LP, together with its consolidated subsidiaries. The term “general partner” refers to PennTex Midstream GP, LLC, the Partnership’s general partner. References to “PennTex Development” or our “parent” refer to PennTex Midstream Partners, LLC, which owns a controlling 92.5% interest in our general partner. References to “NGP” are to Natural Gas Partners and its affiliated investment funds and, as the context may require, other entities under its control.

A reference to a “Note” herein refers to the accompanying “Notes to the Consolidated Financial Statements” contained in “Financial Statements and Supplementary Data” in Item 8 of this annual report. In addition, please read “Cautionary Statement Regarding Forward-Looking Statements” on page ii and “Risk Factors” in Item 1A for information regarding certain risks inherent in our business.

ITEM 1. BUSINESS

Overview

We are a growth-oriented limited partnership focused on owning, operating, acquiring and developing midstream energy infrastructure assets in North America. We completed our initial public offering in June 2015. Our general partner is controlled by PennTex Development, which was formed by NGP and members of our management team to develop a multi-basin midstream growth platform with an initial focus on organic growth projects in partnership with oil and natural gas producers affiliated with NGP. We intend to leverage our management team’s significant industry relationships to become a leading midstream energy company serving attractive oil and natural gas basins throughout North America.

We currently provide natural gas gathering and processing and residue gas and NGL transportation services to producers in northern Louisiana primarily focused in the Terryville Complex of the Cotton Valley formation. Our assets were completed in 2015 and consist of a rich natural gas gathering system, two 200 MMcf/d design-capacity cryogenic natural gas processing plants and residue gas and NGL transportation pipelines. Our primary customer is Memorial Resource, an NGP-affiliated exploration and production company focused on the development of liquids-rich natural gas opportunities in northern Louisiana. In addition to providing midstream services to our primary customer with our existing assets, we are pursuing other opportunities for organic development and growth as producers in our region continue to develop their acreage.

Our assets are supported by long term, fee-based commercial agreements with Memorial Resource, including gathering and processing agreements that contain escalating minimum volume commitments. Our gathering agreement also provides for firm capacity reservation payments based on available gathering system capacity. The minimum volume commitments under our gathering and processing agreements are currently 345,000 MMBtu/d, or 75% of the combined design capacity of our processing plants. For a ten-year period beginning on July 1, 2016, the minimum volume commitments will further increase to 460,000 MMBtu/d, or 100% of the combined design capacity of our processing plants. In addition, our assets are supported by long term, fee-based residue gas and NGL transportation agreements pursuant to which we transport all residue gas and NGLs produced on behalf of Memorial Resource at our processing plants. Under the AMI and Exclusivity Agreement, we also have the exclusive right to develop, own and operate midstream assets and to provide midstream services to support Memorial Resource’s growing production in northern Louisiana (other than production subject to existing third-party commitments or other arrangements to which we consent).

Our Assets

We operate and manage our business as a single reportable segment. Our assets, which are primarily located in Lincoln Parish, Louisiana, consist of the following:

• | the Lincoln Parish plant, a 200 MMcf/d design-capacity cryogenic natural gas processing plant located near Arcadia, Louisiana; |

• | the Mt. Olive plant, a 200 MMcf/d design-capacity cryogenic natural gas processing plant located near Ruston, Louisiana with on-site liquids handling facilities for inlet gas; |

• | a 35-mile rich natural gas gathering system that provides producers with access to our processing plants and third-party processing capacity; |

• | a 15-mile residue natural gas pipeline that provides market access for natural gas from our processing plants, including connections with pipelines that provide access to the Perryville Hub and other markets in the Gulf Coast region; and |

• | a 40-mile NGL pipeline that provides connections to the Mont Belvieu market for NGLs produced from our processing plants. |

1

The following map shows our assets:

Our Contractual Arrangements with Memorial Resource

Memorial Resource is an independent natural gas and oil company engaged in the acquisition, development and exploration of natural gas and oil properties in northern Louisiana. Substantially all of Memorial Resource’s developed acreage is in northern Louisiana, where Memorial Resource targets over-pressured, liquids-rich natural gas opportunities in multiple zones in the Cotton Valley formation.

Our long-term gathering and processing agreements with Memorial Resource contain escalating minimum volume commitments, and our gathering agreement also provides for firm capacity reservation payments based on available gathering system capacity. In addition, under our long-term, fee-based residue gas and NGL transportation agreements, we transport all of the residue gas and NGLs produced on behalf of Memorial Resource at our processing plants.

Natural Gas Processing. Our 15-year gas processing agreement with Memorial Resource contains minimum volume commitments that are measured on a cumulative basis and based on specified daily minimum volume thresholds. The daily minimum volume threshold is currently 345,000 MMBtu/d and increases to 460,000 MMBtu/d effective July 1, 2016 through June 30, 2026, then decreases to 345,000 MMBtu/d until June 1, 2030, then decreases to 115,000 MMBtu/d until the initial term of the processing agreement ends on September 30, 2030. Any volumes of gas delivered up to the then-applicable daily minimum volume threshold are considered firm reserved gas and are charged the firm fixed-commitment fee, and any volumes delivered in excess of such threshold are considered interruptible volumes and are charged the interruptible-service fixed fee, in each case subject to CPI-based adjustments. Memorial Resource must pay a quarterly deficiency payment based on the firm-commitment fixed fee if the cumulative minimum volume commitment as of the end of such quarter exceeds the sum of (i) the cumulative volumes processed (or credited with respect to plant interruptions) under the processing agreement as of the end of such quarter plus (ii) volumes corresponding to deficiency payments incurred prior to such quarter. Deficiency payments are credited towards any fees owed by Memorial Resource only to the extent it has delivered the total minimum volume commitment under the processing agreement within the initial 15-year term of the agreement. Deficiency payments are recorded as deferred revenue because Memorial Resource may utilize these deficiency payments as credit for fees owed if it has delivered the total minimum volume commitment under the processing agreement within the initial term of the agreement.

Rich Natural Gas Gathering. Our 15-year natural gas gathering agreement with Memorial Resource commenced on December 20, 2014 and will remain in effect until June 1, 2030. The gathering agreement includes a firm capacity reservation payment and a usage fee component that is subject to a minimum volume commitment. For the period from June 1, 2015 through November 30, 2019, (i) the firm capacity reservation payment is payable for a daily capacity of 460,000 MMBtu/d (subject to certain credits relating to the availability of gathering capacity), calculated monthly, and (ii) the usage fee component is payable for volumes delivered into the gathering system, subject to a deficiency fee based on a specified minimum volume commitment that is calculated and paid on an annual basis. The deficiency fee calculation is based on Memorial Resource’s then applicable daily minimum volume commitment under the processing agreement. Accordingly, the

2

amount of such specified minimum gathering volume commitment varies between 115,000 MMBtu/d and 460,000 MMBtu/d, and is currently 345,000 MMBtu/d. Beginning December 1, 2019, no firm capacity reservation payment will be payable, and the usage fee component will increase, subject to the deficiency fee and specified minimum volume commitment described above.

Residue Gas Transportation. Our 15-year natural gas transportation agreement with Memorial Resource commenced June 1, 2015 and will remain in effect until June 1, 2030. The agreement provides for the transportation of residue gas through our residue gas pipeline from our processing plants to interconnections with third-party natural gas transportation pipelines providing access to Gulf Coast markets. Memorial Resource pays a usage fee for all volumes transported under the agreement. Memorial Resource pays an additional fee for priority firm service for the first 100,000 MMBtu/d of residue gas delivered to us for transportation by Memorial Resource. The agreement includes a plant tailgate dedication pursuant to which all of Memorial Resource’s residue gas delivered from our processing plants is transported on the residue gas pipeline.

NGL Transportation. Our 15-year NGL transportation agreement with Memorial Resource commenced October 1, 2015 and will remain in effect until October 1, 2030. The agreement provides for the transportation of NGLs through our NGL pipeline from our processing plants to an interconnect with DCP Midstream’s Black Lake pipeline near Ada, Louisiana. Memorial Resource pays a usage fee for all volumes transported under the agreement. The agreement includes a plant tailgate dedication pursuant to which all of Memorial Resource’s NGLs delivered from our processing plants are transported on the NGL pipeline. The NGL transportation agreement is subject to the terms of our tariff, which is filed with FERC.

AMI and Exclusivity Agreement. Pursuant to the AMI and Exclusivity Agreement, we have the exclusive right to build all of the midstream infrastructure for Memorial Resource in northern Louisiana and to provide midstream services to support Memorial Resource’s current and future production on its operated acreage within such area (other than production subject to existing third-party commitments or other arrangements to which we consent) through September 30, 2030. The area of mutual interest under the AMI and Exclusivity Agreement is depicted below:

Our Relationship with PennTex Development

Our parent, PennTex Development, was formed in January 2014 by NGP and members of our management team to pursue midstream growth opportunities and develop midstream energy assets. PennTex Development owns 3,262,019 common units and 12,500,000 subordinated units, collectively representing a 39.4% limited partner interest in us, 92.5% of our incentive distribution rights and a 92.5% controlling interest in our general partner. Additionally, our parent owns PennTex Permian, which operates a gathering and processing system in the Delaware sub-basin of the Permian Basin in Reeves County, Texas that consists of a 60 MMcf/d design capacity cryogenic natural gas processing plant and approximately 82 miles of low- and intermediate-pressure gathering pipelines and associated compression assets. We have a right of first offer with respect to our parent’s equity interest in PennTex Permian to the extent our parent elects to sell such equity interest. Additionally, PennTex Development intends to acquire, construct and develop midstream operations for, or in partnership with, oil and natural gas producers, and has business relationships that we believe will provide us with future acquisition opportunities.

3

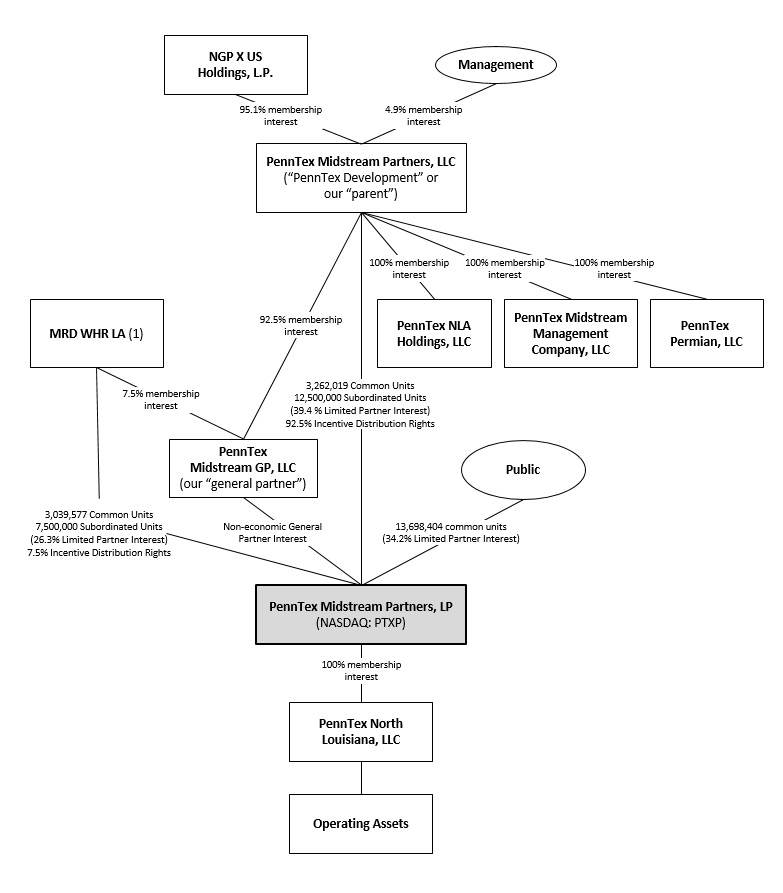

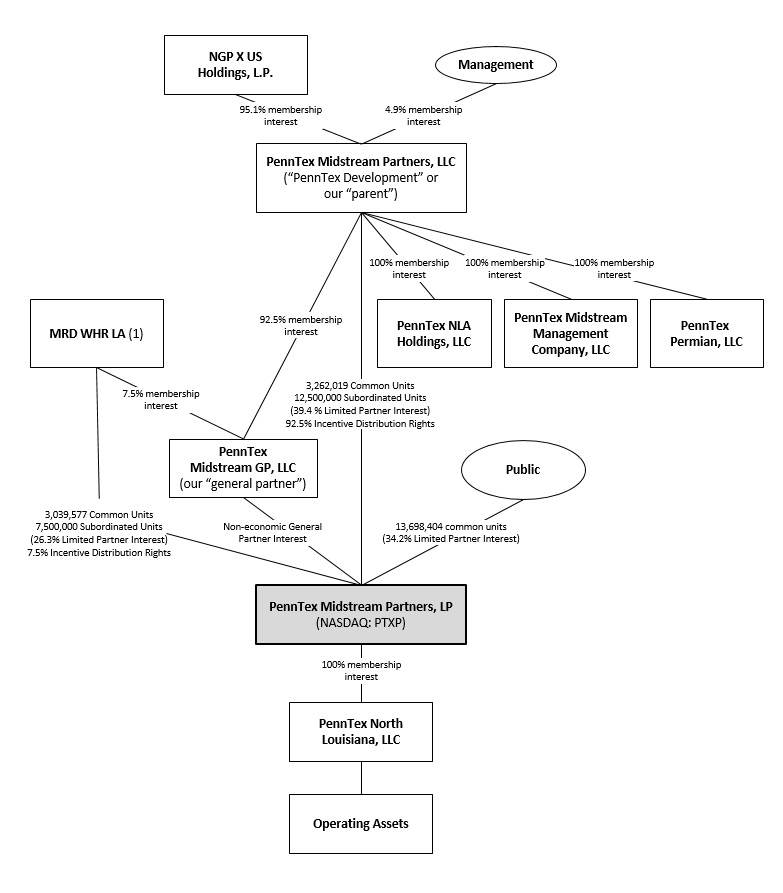

The following simplified diagram depicts our organizational structure and ownership as of December 31, 2015:

(1) Represents aggregate ownership by MRD WHR LA Midstream LLC (“MRD WHR LA”), its members and their members, consisting of 2,127,704 common units and 5,250,000 subordinated units owned by MRD Midstream LLC and 911,873 common units and 2,250,000 subordinated units owned in the aggregate by the members of WHR Midstream LLC. MRD Midstream LLC and WHR Midstream LLC own a 5.25% and 2.25% membership interest in our general partner, respectively, and collectively own a 100% ownership interest in MRD WHR LA. MRD WHR LA owns 7.5% of our incentive distribution rights.

Business Strategies

Our principal business objective is to increase the quarterly cash distributions that we pay to our unitholders over time

4

while maintaining the ongoing stability of our business. We expect to achieve this objective by pursuing the following business strategies:

• | Maintain and grow stable cash flows supported by long-term, fee-based contracts. Our cash flows and distributions to unitholders are supported by escalating minimum volume commitments under our gathering and processing agreements with Memorial Resource. We also benefit from firm capacity reservation payments under our gathering agreement and plant tailgate dedications under our residue gas and NGL transportation agreements. We seek to generate the majority of our cash flows pursuant to multi-year, firm contracts with creditworthy customers. We will continue to pursue opportunities to increase the fee-based component of our contract portfolio to minimize our direct commodity price exposure. |

• | Capitalize on organic growth to support growing production in northern Louisiana. Our primary customer has a deep and growing inventory of drilling locations in northern Louisiana and we currently provide gathering and processing services to other producers with significant acreage in the area. We believe that the superior economics of Terryville Complex drilling programs, which are attributable to the combination of prolific horizontal well results and the strategic location of the Terryville Complex, will continue to support significant drilling activity in the region, even in a low-commodity price environment. As production continues to increase in the region, we expect to capitalize on opportunities to expand our initial asset base to support increasing midstream service needs in northern Louisiana. |

• | Maintain a conservative and flexible capital structure in order to support our access to capital. We intend to maintain a conservative and balanced capital structure which, when combined with our stable, fee-based cash flows, will afford us efficient access to the capital markets at a competitive cost of capital. As of December 31, 2015, our total indebtedness consisted of approximately $156.0 million of borrowings outstanding under our $275 million revolving credit facility and we had additional available borrowing capacity of $98.5 million. |

• | Grow our business by pursuing accretive acquisitions from, or development opportunities with, PennTex Development and third parties. We intend to pursue opportunities to grow our business through accretive acquisitions from, or development opportunities with, our parent. For example, we have a right of first offer to acquire our parent’s equity interest in PennTex Permian if our parent elects to sell such interests. Additionally, we expect that our parent will make strategic acquisitions from time to time that may create additional expansion opportunities for us in the future. We also review attractive acquisition opportunities with third parties as they become available, both as bolt-on opportunities for our existing assets in northern Louisiana and as strategic acquisitions in other economic basins. |

• | Leverage our relationships to identify and execute growth opportunities. Our senior management team has significant industry experience and has built, grown and managed large, successful midstream organizations, including public and private companies. We believe our management’s experience and expertise across the midstream spectrum provides us with access to strong commercial relationships throughout the energy industry. Through our management’s interest in our parent, our management team is highly incentivized to grow our business. Additionally, through our relationship with NGP and its affiliates, we have access to NGP’s significant pool of management talent and industry relationships, which we believe provides us with a competitive advantage in pursuing potential acquisition opportunities. |

Competition

Our principal competitors in northern Louisiana are Regency Energy Partners LP, a wholly-owned subsidiary of Energy Transfer Partners, L.P., which we refer to as Regency, and DCP Midstream Partners, LP, which we refer to as DCP Midstream, each of which owns and operates significant legacy gathering, processing and transportation assets in the region. In addition, producers in the region own, and may in the future construct additional, localized gathering pipelines to transport production from the wellhead to processing facilities or residue gas outlets. We compete directly with Regency and DCP Midstream and, to a lesser extent, producer-owned gathering systems, for undedicated, expiring dedicated and future production of producers in northern Louisiana. Pursuant to the AMI and Exclusivity Agreement, we have the exclusive right to provide midstream services to support Memorial Resource’s current and future production on its operated acreage in northern Louisiana (other than production subject to existing third-party commitments or other arrangements to which we consent). Our ability to attract third-party volumes to our gathering, processing and transportation system depends on our ability to evaluate and select suitable projects and to consummate transactions in a highly competitive environment. Also, there is substantial competition for capital available for investment in the oil and natural gas industry. Many of our competitors possess and employ financial, technical and personnel resources substantially greater than ours. In addition, as a provider of midstream services to the natural gas and crude oil industries, we generally compete with other forms of energy available to consumers, including electricity, coal, propane and fuel oils. Several factors influence the demand for natural gas, NGLs and crude oil, including price changes, the

5

availability of natural gas, NGLs and crude oil and other forms of energy, the level of business activity, conservation, legislation and governmental regulations, weather, and the ability to convert to alternative fuels.

Title to Properties

Other than the Mt. Olive plant site, which we own in fee, our interest in the real property on which our processing plants, pipelines and related facilities are located derives from leases, easements, rights-of-way, permits or licenses from landowners or governmental authorities permitting the use of such land for our operations. We have leased or acquired easements, rights-of-way, permits or licenses in these lands without any material challenge known to us relating to the title to the land upon which the assets will be located, and we believe that we have satisfactory interests in such lands.

Regulation of Operations

Our operations are subject to significant regulations at the federal, state and local levels.

Natural Gas Gathering Pipeline Regulation

Section 1(b) of the Natural Gas Act of 1938 exempts natural gas gathering facilities from regulation by FERC under the NGA. Although the FERC has not made any formal determinations with respect to any of our facilities we consider to be gathering facilities, we believe that our natural gas pipelines meet the traditional tests FERC has used to establish whether a pipeline is a gathering pipeline not subject to FERC jurisdiction. The distinction between FERC-regulated transmission services and federally unregulated gathering services, however, has been the subject of substantial litigation, and the FERC determines whether facilities are gathering facilities on a case-by-case basis, so the classification and regulation of some our gathering facilities and intrastate transportation pipelines may be subject to change based on future determinations by FERC, the courts, or Congress. If the FERC were to consider the status of an individual facility and determine that the facility is not a gathering pipeline and the pipeline provides interstate service, the rates for, and terms and conditions of, services provided by such facility would be subject to regulation by the FERC under the NGA or the NGPA. Such regulation could decrease revenue, increase operating costs, and, depending upon the facility in question, could adversely affect our results of operations and cash flows. In addition, if any of our facilities were found to have provided services or otherwise operated in violation of the NGA or NGPA, this could result in the imposition of civil penalties as well as a requirement to disgorge charges collected for such service in excess of the rate established by the FERC.

State regulation of gathering facilities generally includes various safety, environmental and, in some circumstances, nondiscriminatory take requirements and complaint-based rate regulation. Our natural gas gathering operations will be subject to ratable take and common purchaser statutes in the states in which we operate. These statutes generally require our gathering pipelines to take natural gas without undue discrimination in favor of one producer over another producer or one source of supply over another similarly situated source of supply. The regulations under these statutes can have the effect of imposing some restrictions on our ability as an owner of gathering facilities to decide with whom we contract to gather natural gas. States in which we operate have also adopted a complaint-based regulation of natural gas gathering activities, which allows natural gas producers and shippers to file complaints with state regulators in an effort to resolve grievances relating to gathering access and rate discrimination. We cannot predict whether such a complaint will be filed against us in the future. Failure to comply with state regulations can result in the imposition of administrative, civil and criminal remedies. To date, there has been no adverse effect to our system due to state regulations.

Our gathering operations could be adversely affected should they be subject in the future to more stringent application of state regulation of rates and services. Our gathering operations also may be or become subject to additional safety and operational regulations relating to the design, installation, testing, construction, operation, replacement and management of gathering facilities. Additional rules and legislation pertaining to these matters are considered or adopted from time to time. We cannot predict what effect, if any, such changes might have on our operations, but the industry could be required to incur additional capital expenditures and increased costs depending on future legislative and regulatory changes.

NGL Pipeline Regulation

Our NGL pipeline is a common carrier of NGLs subject to regulation by various federal and state agencies. The FERC regulates interstate pipeline transportation of crude oil, petroleum products and other liquids, such as NGLs (collectively, “petroleum pipelines”), under the Interstate Commerce Act, or the ICA, and the Energy Policy Act of 1992, or EPAct 1992, and the rules and regulations promulgated under those laws. The ICA and its implementing regulations require that tariff rates for interstate service on petroleum pipelines be just and reasonable and must not be unduly discriminatory or confer any undue preference upon any shipper. In accordance with FERC regulations, transportation rates and terms and conditions of service must be filed with the FERC prior to placing the pipeline into service. Under the ICA, interested persons may challenge new or changed rates or services. The FERC is authorized to investigate such charges and may suspend the effectiveness of a challenged rate for up to seven months. A successful rate challenge could result in a petroleum pipeline paying refunds together with interest for the period that the rate was in effect. The FERC may also investigate, upon complaint or on its own motion, existing rates and related rules and may order a pipeline to change them prospectively. A shipper may obtain

6

reparations for damages sustained for a period up to two years prior to the filing of a complaint.

If our rate levels were investigated by FERC on its own initiative or in response to a protest or complaint filed by an interested person, the inquiry could result in a comparison of our rates to those charged by others or to an investigation of costs, including the overall cost of service, including operating costs and overhead; the allocation of overhead and other administrative and general expenses to the regulated entity; the appropriate capital structure to be utilized in calculating rates; the appropriate rate of return on equity and interest rates on debt; the rate base, including the proper starting rate base; the throughput underlying the rate and the proper allowance for federal and state income taxes.

Pipeline Safety Regulation

Our natural gas pipelines are subject to regulation by the Pipeline and Hazardous Materials Safety Administration, or PHMSA, pursuant to the Natural Gas Pipeline Safety Act of 1968, or NGPSA, and the Pipeline Safety Improvement Act of 2002, or PSIA, as reauthorized and amended by the Pipeline Inspection, Protection, Enforcement and Safety Act of 2006, or the PIPES Act. The NGPSA regulates safety requirements in the design, construction, operation and maintenance of gas pipeline facilities, while the PSIA establishes mandatory inspections for all U.S. oil and natural gas transmission pipelines in high-consequence areas, or HCAs. Our NGL pipeline is subject to regulation by PHMSA under the Hazardous Liquid Pipeline Safety Act of 1979, or the HLPSA, which requires PHMSA to develop, prescribe and enforce minimum federal safety standards for the transportation of hazardous liquids by pipeline, and the Pipeline Safety Act of 1992, or the PSA, which added the environment to the list of statutory factors that must be considered in establishing safety standards for hazardous liquid pipelines, established safety standards for certain “regulated gathering lines,” and mandated that regulations be issued to establish criteria for operators to use in identifying and inspecting pipelines located in HCAs, defined as those areas that are unusually sensitive to environmental damage, that cross a navigable waterway, or that have a high population density. In 1996, Congress enacted the Accountable Pipeline Safety and Partnership Act of 1996, or the APSA, which limited the operator identification requirement to operators of pipelines that cross a waterway where a substantial likelihood of commercial navigation exists, required that certain areas where a pipeline rupture would likely cause permanent or long-term environmental damage be considered in determining whether an area is unusually sensitive to environmental damage, and mandated that regulations be issued for the qualification and testing of certain pipeline personnel. In the PIPES Act, Congress required mandatory inspections for certain U.S. crude oil and natural gas transmission pipelines in HCAs and mandated that regulations be issued for low-stress hazardous liquid pipelines and pipeline control room management.

PHMSA has developed regulations that require pipeline operators to implement integrity management programs, including more frequent inspections and other measures to ensure pipeline safety in HCAs. The regulations require operators, including us, to:

• | perform ongoing assessments of pipeline integrity; |

• | identify and characterize applicable threats to pipeline segments that could impact a HCA; |

• | improve data collection, integration and analysis; |

• | repair and remediate pipelines as necessary; and |

• | implement preventive and mitigating actions. |

The Pipeline Safety, Regulatory Certainty and Job Creation Act of 2011, or the 2011 Pipeline Safety Act, reauthorizes funding for federal pipeline safety programs, increases penalties for safety violations, establishes additional safety requirements for newly constructed pipelines and requires studies of certain safety issues that could result in the adoption of new regulatory requirements for existing pipelines. The 2011 Pipeline Safety Act, among other things, increases the maximum civil penalty for pipeline safety violations and directs the Secretary of Transportation to promulgate rules or standards relating to expanded integrity management requirements, automatic or remote-controlled valve use, excess flow valve use, leak detection system installation and testing to confirm the material strength of pipe operating above 30% of specified minimum yield strength in high consequence areas. Effective October 25, 2013, PHMSA adopted new rules increasing the maximum administrative civil penalties for violation of the pipeline safety laws and regulations after January 3, 2012 to $200,000 per violation per day, with a maximum of $2,000,000 for a series of violations. In addition, in October 2015, PHMSA proposed changes to its hazardous liquid pipeline safety regulations that would significantly extend the integrity management requirements to previously exempt hazardous liquid pipelines and would impose additional obligations on hazardous liquid pipeline operators that are already subject to the integrity management requirements. PHMSA’s proposed rule would also require annual reporting of safety-related conditions and incident reports for all hazardous liquid gathering lines and gravity lines, including pipelines that are currently exempt from PHMSA regulations. PHMSA issued a separate regulatory proposal in July 2015 that would impose pipeline incident prevention and response measures on pipeline operators. PHMSA also recently issued an advisory bulletin providing guidance on verification of records related to pipeline maximum allowable operating pressure and maximum operating pressure. The advisory bulletin advised pipeline operators of anticipated changes in annual reporting requirements and explained that to the extent pipeline operators are relying on design, construction,

7

inspection, testing, or other data to determine the pressures at which their pipelines should operate, the records of that data must be traceable, verifiable and complete. Locating such records and, in the absence of any such records, verifying maximum pressures through physical testing (including hydrotesting) or modifying or replacing facilities to meet the demands of such pressures, could significantly increase our costs on a going forward basis.

The National Transportation Safety Board has recommended that PHMSA make a number of changes to its rules, including removing an exemption from most safety inspections for natural gas pipelines installed before 1970. While we cannot predict the outcome of legislative or regulatory initiatives, such legislative and regulatory changes could have a material effect on our operations, particularly by extending more stringent and comprehensive safety regulations (such as integrity management requirements) to pipelines and gathering lines not previously subject to such requirements. While we expect any legislative or regulatory changes to allow us time to become compliant with new requirements, costs associated with compliance may have a material effect on our operations. There can be no assurance as to the amount or timing of future expenditures for pipeline integrity regulation, and actual future expenditures may be different from the amounts we currently anticipate.

Regulations, changes to regulations or an increase in public expectations for pipeline safety may require additional reporting, the replacement of some of our pipeline segments, the addition of monitoring equipment and more frequent inspection or testing of our pipeline facilities. Any repair, remediation, preventative or mitigating actions may require significant capital and operating expenditures.

States are largely preempted by federal law from regulating pipeline safety for interstate lines but most are certified by the DOT to assume responsibility for enforcing federal intrastate pipeline regulations and inspection of intrastate pipelines. States may adopt stricter standards for intrastate pipelines than those imposed by the federal government for interstate lines; however, states vary considerably in their authority and capacity to address pipeline safety. State standards may include requirements for facility design and management in addition to requirements for pipelines. We do not anticipate any significant difficulty in complying with applicable state laws and regulations. Our natural gas pipelines and NGL pipeline have continuous inspection and compliance programs designed to keep the facilities in compliance with pipeline safety and pollution control requirements.

We expect to incorporate all existing requirements into our programs by the required regulatory deadlines, and will continually incorporate the new requirements into procedures and budgets. We expect to incur increasing regulatory compliance costs, based on the intensification of the regulatory environment and upcoming changes to regulations as outlined above. In addition to regulatory changes, costs may be incurred when there is an accidental release of a commodity transported by our system, or a regulatory inspection identifies a deficiency in our required programs.

Regulation of Environmental and Occupational Safety and Health Matters

Our natural gas gathering, processing and transportation activities are subject to stringent and complex federal, state and local laws and regulations relating to the protection of the environment. As an owner or operator of these facilities, we must comply with these laws and regulations at the federal, state and local levels. These laws and regulations can restrict or impact our business activities in many ways, such as:

• | requiring the installation of pollution-control equipment, imposing emission or discharge limits or otherwise restricting the way we operate resulting in additional costs to our operations; |

• | limiting or prohibiting construction activities in areas, such as air quality nonattainment areas, wetlands, coastal regions or areas inhabited by endangered or threatened species; |

• | delaying system modification or upgrades during review of permit applications and revisions; |

• | requiring investigatory and remedial actions to mitigate discharges, releases or pollution conditions associated with our operations or attributable to former operations; and |

• | enjoining the operations of facilities deemed to be in non-compliance with permits issued pursuant to or regulatory requirements imposed by such environmental laws and regulations. |

Failure to comply with these laws and regulations may trigger a variety of administrative, civil and criminal enforcement measures, including the assessment of monetary penalties and natural resource damages. Certain environmental statutes impose strict joint and several liability for costs required to clean up and restore sites where hazardous substances, hydrocarbons or solid wastes have been disposed or otherwise released. Moreover, neighboring landowners and other third parties may file common law claims for personal injury and property damage allegedly caused by the release of hazardous substances, hydrocarbons or solid waste into the environment.

The trend in environmental regulation is to place more restrictions and limitations on activities that may affect the environment and thus there can be no assurance as to the amount or timing of future expenditures for environmental

8

compliance or remediation and actual future expenditures may be different from the amounts we currently anticipate. As with the midstream industry in general, complying with current and anticipated environmental laws and regulations can increase our capital costs to construct, maintain and operate equipment and facilities. While we expect these laws and regulations will affect our maintenance capital expenditures and net income, we do not believe they will have a material adverse effect on our business, financial position or results of operations or cash flows. In addition, we believe that the various activities in which we are engaged that are subject to environmental laws and regulations are not expected to materially interrupt or diminish our operational ability to gather natural gas. We cannot assure you, however, that future events, such as changes in existing laws or enforcement policies, the promulgation of new laws or regulations, or the development or discovery of new facts or conditions will not cause us to incur significant costs. Below is a discussion of the material environmental laws and regulations that relate to our business.

Hazardous Waste and Site Remediation

Our operations generate solid wastes, including some hazardous wastes, that are subject to the federal Resource Conservation and Recovery Act, or RCRA, and comparable state laws, which impose requirements for the handling, storage, treatment and disposal of hazardous waste. RCRA currently exempts many natural gas gathering and field processing wastes from classification as hazardous waste. Specifically, RCRA excludes from the definition of hazardous waste produced waters and other wastes intrinsically associated with the exploration, development or production of crude oil and natural gas. However, these oil and gas exploration and production wastes may still be regulated under state solid waste laws and regulations, and it is possible that certain oil and natural gas exploration and production wastes now classified as non-hazardous could be classified as hazardous waste in the future.

The Comprehensive Environmental Response, Compensation and Liability Act, or CERCLA, also known as the Superfund law, and comparable state laws impose liability without regard to fault or the legality of the original conduct, on certain classes of persons responsible for the release of hazardous substances into the environment. Such classes of persons include the current and past owners or operators of sites where a hazardous substance was released, and companies that disposed or arranged for disposal of hazardous substances at offsite locations, such as landfills. We expect that, in the course of our ordinary operations, our operations will generate wastes that may be designated as hazardous substances. CERCLA authorizes the EPA, states and, in some cases, third parties to take actions in response to releases or threatened releases of hazardous substances into the environment and to seek to recover from the classes of responsible persons the costs they incur to address the release. Under CERCLA, we could be subject to strict joint and several liability for the costs of cleaning up and restoring sites where hazardous substances have been released into the environment and for damages to natural resources.

Hydrocarbons or wastes may be disposed of or released on or under the properties owned or leased by us or on or under other locations where such substances have been taken for disposal. Such hydrocarbons or wastes may migrate to property adjacent to our owned and leased sites or the disposal sites. In addition, some of the properties may be operated by third parties or by previous owners whose treatment and disposal or release of hydrocarbons or wastes was not under our control. These properties and the substances disposed or released on them may be subject to CERCLA, RCRA and analogous state laws. Under such laws, we could be required to remove previously disposed wastes, including waste disposed of by prior owners or operators; remediate contaminated property, including groundwater contamination, whether from prior owners or operators or other historic activities or spills; or perform remedial operations to prevent future contamination. We are not currently a potentially responsible party in any federal or state site remediation and there are no current, pending or anticipated response or remedial activities at or implicating our business and the business of our customers.

Air Emissions

The federal Clean Air Act, and comparable state laws, regulate emissions of air pollutants from various industrial sources, including natural gas processing plants and compressor stations, and also impose various emission limits, operational limits and monitoring, reporting and record keeping requirements on air emission sources. Failure to comply with these requirements could result in monetary penalties, injunctions, conditions or restrictions on operations, and potentially criminal enforcement actions. Such laws and regulations require pre-construction permits for the construction or modification of certain projects or facilities with the potential to emit air emissions above certain thresholds. These pre-construction permits generally require use of best available control technology, or BACT, to limit air emissions. We expect that several new and recently proposed EPA new source performance standards, or NSPS, and national emission standards for hazardous air pollutants, or NESHAP, will also apply to our facilities and operations. These NSPS and NESHAP standards impose emission limits and operational limits as well as detailed testing, record keeping and reporting requirements on the “affected facilities” covered by these regulations. We may incur capital expenditures in the future for air pollution control equipment in connection with complying with existing and recently proposed rules, or with obtaining or maintaining operating permits and complying with federal, state and local regulations related to air emissions. However, we do not believe that such requirements will have a material adverse effect on our operations.

9

Water Discharges

The Federal Water Pollution Control Act, or the Clean Water Act, and analogous state laws impose restrictions and strict controls with respect to the discharge of pollutants, including spills and leaks of oil and other substances, into waters of the United States, including wetlands. The discharge of pollutants into jurisdictional waters is prohibited, except in accordance with the terms of a permit issued by the EPA, U.S. Army Corps of Engineers if wetlands are impacted, or a delegated state agency. Federal and state regulatory agencies can impose administrative, civil and criminal penalties for non-compliance with discharge permits or other requirements of the Clean Water Act and analogous state laws and regulations. Any unpermitted release of petroleum or other pollutants from our operations could result in government penalties and civil liability.

Endangered Species

The Endangered Species Act, or ESA, and analogous state laws restrict activities that may affect endangered or threatened species or their habitats. Some of our pipelines may be located in areas that are or may be designated as habitats for endangered or threatened species, and previously unprotected species may later be designated as threatened or endangered in areas where underlying property operations are conducted. Future construction and expansion activities could also be impacted by the presence of endangered or threatened species. This could cause us to incur increased costs arising from species protection measures, delay the completion of projects, or result in limitations on our operating activities that could have an adverse impact on our results of operations.

Climate Change

In December 2009, the EPA determined that emissions of greenhouse gases, or GHGs, present an endangerment to public health and the environment because emissions of such gases are contributing to the warming of the Earth’s atmosphere and other climatic changes. Based on these findings, EPA has adopted regulations under existing provisions of the federal Clean Air Act, that require certain large stationary sources to obtain Prevention of Significant Deterioration, or PSD, pre-construction permits and Title V operating permits for GHG emissions. Under these regulations, facilities required to obtain PSD permits must meet BACT standards for their GHG emissions. The EPA has also adopted rules requiring the monitoring and reporting of GHG emissions from specified sources in the United States, including, among others, certain onshore oil and natural gas processing and fractionating facilities, which was expanded in October 2015 to include onshore petroleum and natural gas gathering and boosting activities and natural gas transmission pipelines. Requiring reductions in greenhouse gas emissions could result in increased costs to operate and maintain our facilities. Additionally, while Congress has from time to time considered legislation to reduce emissions of GHGs, the prospect for adoption of significant legislation at the federal level to reduce GHG emissions is perceived to be low at this time. Nevertheless, the Obama administration has announced it intends to adopt additional regulations to reduce emissions of GHGs and to encourage greater use of low carbon technologies. Although it is not possible at this time to predict how legislation or new regulations that may be adopted to address GHG emissions would impact our business, any such future laws and regulations that limit emissions of GHGs could adversely affect demand for the oil and natural gas that exploration and production operators produce, including our current or future customers, which could thereby reduce demand for our midstream services. In addition, in December 2015, over 190 countries, including the United States, reached an agreement to reduce greenhouse gas emissions. To the extent the United States and other countries implement this agreement or impose other climate change regulations on the oil and gas industry, it could have an adverse direct or indirect effect on our business.

Finally, increasing concentrations of GHGs in the earth’s atmosphere may produce climate changes that have significant physical effects, such as increased frequency and severity of storms, droughts and floods and other climatic events; if any such effects were to occur, it is uncertain if they would have an adverse effect on our financial condition and operations.

Occupational Safety and Health Act

We are also subject to the requirements of the federal Occupational Safety and Health Act, or OSHA, and comparable state laws that regulate the protection of the health and safety of employees. In addition, OSHA’s hazard communication standard, the Emergency Planning and Community Right to Know Act and implementing regulations and similar state statutes and regulations require that information be maintained about hazardous materials used or produced in our operations and that this information be provided to employees, state and local government authorities and citizens.

Employees

We do not have any employees. All of the employees required to conduct and support our operations are employed by PennTex Midstream Management Company, LLC, a wholly-owned subsidiary of PennTex Development, which we refer to as PennTex Management, and seconded to our general partner pursuant to the services and secondment agreement described under Item 13 of this annual report. The officers of our general partner, all of whom are also officers of PennTex Development, manage our operations and activities. As of December 31, 2015, PennTex Management employed

10

approximately 70 people who provide direct, full-time support to our operations. PennTex Management considers its relations with such employees to be satisfactory.

Insurance

We generally share insurance coverage with PennTex Development, and we reimburse PennTex Development for the portion of its insurance costs allocated to our assets and business pursuant to the terms of the services and secondment agreement. The PennTex Development insurance program includes general and excess liability insurance, auto liability insurance, workers’ compensation insurance and property insurance. We maintain through our general partner director and officer liability insurance for which we reimburse our general partner pursuant to our partnership agreement. Management believes that our insurance coverage is reasonable and appropriate.

Available Information

Our website is available at www.penntex.com. Information contained on or connected to our website is not incorporated by reference into this annual report and should not be considered part of this annual report or any other filing we make with the U.S. Securities Exchange Commission, which we refer to as the SEC. We make available, free of charge, on our website, the annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports, as soon as reasonably practicable after filing such reports with the SEC. Other information such as presentations, our Governance Guidelines, the charter of the Audit Committee and the Code of Business Conduct and Ethics are available on our website and in print to any unitholder who provides a written request to the Secretary at 11931 Wickchester Lane, Suite 300, Houston, Texas 77043. Our Code of Business Conduct and Ethics applies to all directors, officers and employees, including the Chief Executive Officer and Chief Financial Officer.

The public may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Also, the SEC maintains a website that contains reports and information statements, and other information regarding issuers that file electronically with the SEC. The public can obtain any document that we file with the SEC at www.sec.gov.

ITEM 1A. RISK FACTORS

Limited partner interests are inherently different from the capital stock of a corporation, although many of the business risks to which we are subject are similar to those that would be faced by a corporation engaged in a similar business. If any of the following risks were to materialize, our business, financial condition, results of operations and cash available for distribution could be materially adversely affected.

Risks Related to Our Business

We generate a substantial majority of our revenue from gathering, processing and transportation services provided to Memorial Resource. Accordingly, any development that materially and adversely affects Memorial Resource’s operations, financial condition or market reputation could have a material and adverse impact on us.

We currently generate a substantial majority of our revenue from gathering, processing and transportation services that support Memorial Resource’s natural gas exploration and production activities in northern Louisiana. As a result, we are substantially dependent on Memorial Resource and any event, whether in our area of operations or otherwise, that adversely affects Memorial Resource’s production, drilling and completion schedule, financial condition, leverage, market reputation, liquidity, results of operations or cash flows may adversely affect our revenues and cash available for distribution. Accordingly, we are indirectly subject to the business risks of Memorial Resource, including, among others:

• | a reduction in or slowing of Memorial Resource’s drilling and development program, which would directly and adversely impact demand for our midstream services; |

• | the volatility of natural gas, NGL and oil prices, especially in light of recent declines, which could have a negative effect on the value of Memorial Resource’s properties, its drilling programs or its ability to finance its operations; |

• | the availability of capital to Memorial Resource on an economic basis to fund its exploration and development activities; |

• | Memorial Resource’s ability to replace its reserves; |

• | drilling and operating risks, including potential environmental liabilities; |

• | transportation capacity constraints and interruptions; |

• | adverse effects on Memorial Resource of governmental and environmental regulation; and |

• | losses to Memorial Resource from pending or future litigation. |

11

Further, we are subject to the risk of non-payment or non-performance by Memorial Resource. We cannot predict the extent to which Memorial Resource’s business would be impacted if conditions in the energy industry were to further deteriorate, nor can we estimate the impact such conditions would have on Memorial Resource’s ability to execute its drilling and development program. In addition, lower natural gas, NGL and oil prices could lead Memorial Resource to seek to renegotiate its agreements with us for various reasons. Any material non-payment or non-performance by Memorial Resource would reduce our ability to make distributions to our unitholders.

We may not generate sufficient cash from operations following the establishment of cash reserves and payment of fees and expenses, including cost reimbursements to our general partner, to enable us to pay the minimum quarterly distribution to our unitholders.

In order to make our minimum quarterly distribution of $0.2750 per common unit and subordinated unit per quarter, or $1.10 per unit per year, we will require available cash of $11.0 million per quarter, or $44.0 million per year, based on the common units and subordinated units outstanding as of December 31, 2015. We may not generate sufficient cash flow each quarter to support the payment of the minimum quarterly distribution or to increase our quarterly distributions in the future. Additionally, we funded a portion of the quarterly distributions that we made to our unitholders with respect to the second and third quarters of 2015 with borrowings under our revolving credit facility.

The amount of cash we can distribute on our units principally depends upon the amount of cash we generate from our operations, which will fluctuate from quarter to quarter based on, among other things:

• | the volume of natural gas we gather, process and transport; |

• | the rates we charge for our services; |

• | volumes received in excess of Memorial Resource’s minimum volume commitments in prior quarters, which may reduce deficiency payments we receive from Memorial Resource with respect to a given period even if Memorial Resource delivers volumes below its minimum volume commitment; |

• | market prices of natural gas, NGLs and oil and their effect on the drilling schedules and production of our customers; |

• | our customers’ ability to fund their drilling and development programs; |

• | adverse weather conditions; |

• | the level of our operating, maintenance and general and administrative costs; |

• | regional, domestic and foreign supply and perceptions of supply of natural gas; |

• | the level of demand and perceptions of demand in our end-user markets, and actual and anticipated future prices of natural gas and other commodities (and the volatility thereof), which may impact our ability to renew and replace our gathering, processing and transportation agreements; |

• | the relationship between natural gas and NGL prices and resulting effect on processing margins; |

• | the realized pricing impacts on revenues and expenses that are directly related to commodity prices; |

• | the level of competition from other midstream energy companies in northern Louisiana; |

• | the creditworthiness of our customers; |

• | damages to pipelines and plants, related equipment and surrounding properties caused by hurricanes, tornadoes, floods, fires and other natural disasters and acts of terrorism and acts of third parties; |

• | outages at our processing plants; |

• | leaks or accidental releases of hazardous materials into the environment, whether as a result of human error or otherwise; |

• | regulatory action affecting the supply of, or demand for, natural gas, the rates we can charge for our services, how we contract for services, our existing contracts, our operating costs or our operating flexibility; and |

• | prevailing economic conditions. |

In addition, the actual amount of cash we will have available for distribution will depend on other factors, including:

• | the level and timing of capital expenditures we make; |

• | our debt service requirements and other liabilities; |

• | our ability to borrow under our debt agreements to pay distributions; |

12

• | fluctuations in our working capital needs; |

• | restrictions on distributions contained in any of our debt agreements; |

• | the cost of acquisitions, if any; |

• | fees and expenses of our general partner and its affiliates we are required to reimburse; |

• | the amount of cash reserves established by our general partner; and |

• | other business risks affecting our cash levels. |

Because of the natural decline in production from existing wells, our success depends, in part, on the ability of our customers to replace declining production and our ability to secure new sources of natural gas from existing customers or other producers.

The natural gas volumes that support our assets depend on the level of production from our customers’ natural gas wells in northern Louisiana. This production may be less than expected and will naturally decline over time. To the extent our customers reduce or delay their drilling and completion activities, including in response to decreased commodity prices and lower drilling economics, revenues for our midstream services will be directly and adversely affected. For example, Memorial Resource has publicly announced its expectation of a four-rig drilling program for 2016, as compared to eight rigs at the end of 2015. In addition, natural gas volumes from completed wells, and our cash flows associated with these wells, will naturally decline over time. In order to maintain or increase throughput levels on our assets, we must obtain new sources of natural gas from our existing customers or other producers. The primary factors affecting our ability to obtain additional sources of natural gas include (i) the overall level of successful drilling activity in northern Louisiana, (ii) Memorial Resource’s acquisition of additional acreage and (iii) our ability to enter into commercial agreements with other producers.

We have no control over development and completion activity in northern Louisiana, the lateral lengths of wells drilled, the amount of reserves associated with wells drilled within such region or the rate at which production from a well declines. We have no control over Memorial Resource or other producers or their development plan decisions, which are affected by, among other things:

• | the availability and cost of capital; |

• | prevailing and projected natural gas, NGL and oil prices, which have significantly declined in recent periods; |

• | demand for natural gas, NGLs and oil; |

• | levels of reserves; |

• | geologic considerations; |

• | environmental or other governmental regulations, including the availability of drilling permits and the regulation of hydraulic fracturing; and |

• | the costs of producing the gas and the availability and costs of drilling rigs and other equipment. |

These factors and the volatility of the energy markets make it extremely difficult to predict future oil, natural gas and NGL price movements with any certainty and can greatly affect the development of reserves. For example, for the five years ended December 31, 2015, the WTI oil spot price at Cushing, Oklahoma ranged from a high of $113.93 per Bbl on April 29, 2011 to a low of $34.73 per Bbl on December 18, 2015, while the Henry Hub natural gas spot price ranged from a high of $7.92 per MMBtu on March 4, 2014 to a low of $1.53 per MMBtu on December 24, 2015. Recently, oil and natural gas prices have declined significantly. Through February 24, 2016, the WTI spot price at Cushing, Oklahoma declined to a low of $26.21 per Bbl on February 11, 2016, and was $30.40 per Bbl on February 24, 2016. In addition, the Henry Hub spot price declined to a low of $1.53 per MMbtu on December 18, 2015, and was $1.79 per MMBtu on February 24, 2016. Memorial Resource or other producers could elect to reduce development and production activity when commodity prices are declining and any sustained declines could lead to a material decrease in such activity. Sustained reductions in development or production activity in northern Louisiana could lead to reduced utilization of our services.

Due to these and other factors, even if reserves are known to exist in areas served by our assets, producers may choose not to develop those reserves. If reductions in development activity result in our inability to maintain the current levels of throughput on our systems, those reductions could reduce our revenue and cash flow and adversely affect our ability to make cash distributions to our unitholders.

13

Memorial Resource may not require additional midstream infrastructure in northern Louisiana or it may be uneconomic for us to provide such infrastructure, which could limit our ability to expand our asset base in northern Louisiana.

Our long-term growth strategy includes expanding our asset base and increasing our revenues by providing additional midstream services within our area of mutual interest to support Memorial Resource’s production in northern Louisiana. If Memorial Resource’s drilling activities and resulting natural gas production do not require additional midstream services in northern Louisiana, our ability to expand our asset base may be limited. In addition, Memorial Resource may require additional midstream services from time to time that are uneconomic or otherwise not suitable for us to provide. As a result, we may consent to Memorial Resource contracting for specified third party midstream services that we would otherwise have the right to provide under the AMI and Exclusivity Agreement. For example, we recently consented to Memorial Resource’s entry into a firm transportation agreement with Regency to transport specified volumes of Memorial Resource’s residue gas, including residue gas transportation within our area of mutual interest, in part because it would be uneconomic for us to construct duplicative midstream infrastructure in an area served by existing, underutilized residue gas transportation facilities. As a result, we may not expand our asset base in northern Louisiana as much or as rapidly as expected or at all.

We may not be able to attract third-party volumes, which could limit our ability to grow and prolong our dependence on Memorial Resource.

Our long-term growth strategy includes diversifying our customer base by identifying opportunities to offer services to additional producers in northern Louisiana. We earn a substantial majority of our revenues from Memorial Resource. Our ability to increase our assets’ throughput and any related revenue from third parties is subject to numerous factors beyond our control, including competition from third parties and the extent to which we have available capacity when requested by third parties. To the extent our assets lack available capacity for third-party volumes, we may not be able to compete effectively with third-party systems for additional natural gas production and completions in our area of operation. In addition, some of our natural gas and NGL marketing competitors for third-party volumes have greater financial resources and access to larger supplies of natural gas than those available to us, which could allow those competitors to price their services more aggressively than we do.

Our efforts to attract additional customers may be adversely affected by (i) our relationship with Memorial Resource and the fact that a substantial majority of the capacity of our assets are expected to support Memorial Resource’s production and (ii) our desire to provide services pursuant to fee-based contracts. As a result, we may not have the capacity to provide services to third parties and/or potential third-party customers may prefer to obtain services pursuant to other forms of contractual arrangements under which we would assume direct commodity exposure.

We may be required to make substantial capital expenditures to expand our asset base. If we are unable to obtain needed capital or financing on satisfactory terms, our ability to make cash distributions may be diminished or our financial leverage could increase.