Attached files

| file | filename |

|---|---|

| 8-K - 8-K - US ENERGY CORP | s102628_8k.htm |

| EX-2.1 - EXHIBIT 2.1 - US ENERGY CORP | s102628_ex2-1.htm |

| EX-99.2 - EXHIBIT 99.2 - US ENERGY CORP | s102628_ex99-2.htm |

| EX-10.2 - EXHIBIT 10.2 - US ENERGY CORP | s102628_ex10-2.htm |

| EX-99.1 - EXHIBIT 99.,1. - US ENERGY CORP | s102628_ex99-1.htm |

| EX-10.1 - EXHIBIT 10.1 - US ENERGY CORP | s102628_ex10-1.htm |

Exhibit 3.1

CERTIFICATE OF DESIGNATIONS OF

SERIES A CONVERTIBLE PREFERRED STOCK,

PAR VALUE $0.01 PER SHARE,

OF

U.S. ENERGY CORP.

Pursuant to Section 17-16-602 of the

Wyoming Business Corporation Act

The undersigned DOES HEREBY CERTIFY that the following resolution was duly adopted by the Board of Directors (the “Board”) of U.S. Energy Corp., a Wyoming corporation (hereinafter called the “Corporation”), with the designations, powers, preferences and relative, participating, optional or other special rights, and the qualifications, limitations or restrictions thereof, having been fixed by the Board pursuant to authority granted to it under Article IV of the Corporation’s Restated Articles of Incorporation and in accordance with the provisions of Section 17-16-602 of the Wyoming Business Corporation Act:

RESOLVED: That, pursuant to authority conferred upon the Board by the Corporation’s Restated Articles of Incorporation, the Board hereby authorizes 50,000 shares of Series A Convertible Preferred Stock, par value $0.01 per share, of the Corporation and hereby fixes the designations, powers, preferences and relative, participating, optional or other special rights, and the qualifications, limitations or restrictions thereof, of such shares, in addition to those set forth in the Restated Articles of Incorporation of the Corporation, as follows:

Section 1. Designation . The shares of such Series shall be designated “Series A Convertible Preferred Stock,” and the number of shares constituting such Series shall be 50,000 (the “Series A Preferred Stock”). The number of shares of Series A Preferred Stock may be increased or decreased by resolution of the Board and approval by the holders of a majority of the outstanding shares of the Series A Preferred Stock, voting as a separate voting group; provided that no decrease shall reduce the number of shares of Series A Preferred Stock to a number less than the number of shares of such Series then outstanding.

Section 2. Currency . All Series A Preferred Stock shall be denominated in United States currency, and all payments and distributions thereon or with respect thereto shall be made in United States currency. All references herein to “$” or “dollars” refer to United States currency.

Section 3. Ranking . The Series A Preferred Stock shall, with respect to dividend rights and rights upon liquidation, winding up or dissolution, rank senior to each other class or series of shares of the Corporation that is issued at the time of issuance of the Series A Preferred Stock and that the Corporation may issue thereafter, including, without limitation, the common stock of the Corporation, par value $0.01 per share (the “Common Stock”) (such junior stock, including the Common Stock, being referred to hereinafter collectively as “Junior Stock”).

Section 4. Dividends

(a) The holders of Series A Preferred Stock shall be entitled to receive, in the manner described in Section 4(b), regular quarterly dividends per share of Series A Preferred Stock of an amount equal to 12.250% per annum of the Adjusted Liquidation Preference (as herein defined) then in effect of each share of such Series A Preferred Stock (the “Regular Dividends”), before any dividends shall be declared, set apart for or paid upon Junior Stock. For purposes hereof, the term “Adjusted Liquidation Preference” shall mean $40.00 per share of Series A Preferred Stock as of the Issue Date, which shall be increased as described in Section 4(c).

(b) Regular Dividends shall not be distributed to the holders of Series A Preferred Stock in cash or any other form of shares or property but rather shall be added to the Adjusted Liquidation Preference as provided in Section 4(c). Regular Dividends shall be accrued quarterly in arrears on January 1, April 1, July 1 and October 1 of each year (unless any such day is not a Business Day, in which event such Regular Dividends shall be accrued on the next succeeding Business Day), commencing on April 1, 2016 (each such accrual date being a “Regular Dividend Payment Date,” and the period from the date of issuance of the Series A Preferred Stock to the first Regular Dividend Payment Date and each such quarterly period thereafter being a “Regular Dividend Period”). The amount of Regular Dividends payable on the Series A Preferred Stock for any period shall be computed on the basis of a 360-day year and the actual number of days elapsed.

(c) Regular Dividends, whether or not declared, shall begin to accrue and be cumulative from the Issue Date and shall compound quarterly on each subsequent Regular Dividend Payment Date initially at 3.0625% of the Adjusted Liquidation Preference as of the Issue Date and thereafter at 3.0625% of the Adjusted Liquidation Preference as of the immediately preceding Regular Dividend Payment Date. The amount accrued each Regular Dividend Period shall be added on each Regular Dividend Payment Date to the Adjusted Liquidation Preference as of the immediately preceding Regular Dividend Payment Date (or in the case of the first Regular Dividend Period, to the Adjusted Liquidation Preference as of the Issue Date), and such resulting amount shall become the new Adjusted Liquidation Preference with respect to which the Regular Dividend shall be calculated for the next Regular Dividend Period. The cumulative amount of Regular Dividends accrued pursuant to this Section 4(c) on each Regular Dividend Payment Date are referred to herein as the “Accumulated Regular Dividends”. For the avoidance of doubt, dividends shall accumulate whether or not in any Regular Dividend Period there have been funds of the Corporation legally available for the payment of such dividends.

(d) Except for Permitted Distributions, no dividend or distribution of any kind shall be declared or paid on Junior Stock unless (1) approved by the holders of a majority of the outstanding shares of the Series A Preferred Stock, voting as a separate voting group and (2) the holders of Series A Preferred Stock shall receive dividends or distributions per share of Series A Preferred Stock of an amount equal to the aggregate amount of any dividends or other distributions, whether cash, in kind or other property, paid on outstanding shares of Common Stock on a per share basis based on the number of shares of Common Stock into which such share of Series A Preferred Stock could be converted on the applicable record date for such dividends or other distributions, assuming such shares of Common Stock were outstanding on the applicable record date for such dividend or other distributions (the “Participating Dividends”), unless such right to Participating Dividends is waived by the holders of a majority of the outstanding shares of the Series A Preferred Stock, voting as a separate voting group. “Permitted Distributions” shall mean dividends or distributions of Common Stock or other securities for which anti-dilution adjustments are made as provided in (x) Sections 9(a)(1) and 9(a)(3), and (y) Sections 9(a)(2) and 9(a)(4); provided, however, that with respect to clause (y) no such dividends or distributions shall be Permitted Distributions on or after the time the Conversion Rate equals the Conversion Cap, or if such dividend or distribution would cause the Conversion Rate to equal or exceed the Conversion Cap. For avoidance of doubt, Permitted Distributions shall not include cash, a Spin-Off Transaction, or evidences of indebtedness, assets, or other property.

(e) For so long as there shall be any shares of Series A Preferred Stock outstanding, without the approval of holders of a majority of the outstanding shares of the Series A Preferred Stock, voting as a separate voting group, no Junior Stock shall be redeemed, purchased or otherwise acquired for any consideration (nor shall any moneys be paid to or made available for a sinking fund for the redemption of any shares of any such Junior Stock) by the Corporation or any Subsidiary; provided, however, that the foregoing limitation shall not apply to:

(1) purchases, redemptions or other acquisitions of shares of Junior Stock from employees or former employees in connection with any employment contract, benefit plan or other similar arrangement with or for the benefit of any one or more employees of the Corporation or any of its Subsidiaries (or from permitted family member transferees pursuant to such arrangements), up to a maximum of an aggregate of 50,000 shares from the Issue Date until such date as no shares of Series A Preferred Stock are issued and outstanding; or

(2) an exchange, redemption, reclassification or conversion of any class or series of Junior Stock exclusively for any class or series of Junior Stock.

(f) If applicable as provided in Section 4(d), Participating Dividends shall be payable as and when paid to the holders of shares of Common Stock. Each Participating Dividend shall be payable to the holders of record of shares of Series A Preferred Stock as they appear on the stock records of the Corporation at the Close of Business on the relevant record date, which with respect to Participating Dividends shall be the same day as the record date for the payment of dividends or distributions to the holders of shares of Common Stock.

2

Section 5. Liquidation, Dissolution or Winding Up

(a) Upon any voluntary or involuntary liquidation, dissolution or winding up of the Corporation, or the Corporation’s sale, lease, exchange or other disposition of assets (other than a disposition described in Section 17-16-1201 of the Wyoming Business Corporation Act) if the disposition would leave the Corporation without a significant continuing business activity (each, a “Liquidation”), after satisfaction (or proper provision made for the satisfaction) of all liabilities and obligations to creditors of the Corporation and before any distribution or payment shall be made to holders of any Junior Stock, each holder of Series A Preferred Stock shall be entitled to receive, out of the assets of the Corporation or proceeds thereof (whether capital or surplus) legally available therefor, an amount per share of Series A Preferred Stock equal to the greater of:

(1) the Adjusted Liquidation Preference per share as of the date of payment of the Liquidation Preference, plus the amount of the Regular Dividend that would be accrued on such share from the Regular Dividend Payment Date immediately preceding the date of payment of the Liquidation Preference through but excluding the date of payment of the Liquidation Preference, plus any declared but unpaid Participating Dividends through the date of payment of the Liquidation Preference; and

(2) the payment such holders would have received had such holders, immediately prior to such Liquidation, converted their shares of Series A Preferred Stock into shares of Common Stock (at the then applicable Conversion Rate) pursuant to Section 7 immediately prior to such Liquidation, plus any declared but unpaid Participating Dividends through the date of Liquidation

(the greater of (1) and (2) is referred to herein as the “Liquidation Preference”). Holders of Series A Preferred Stock will not be entitled to any other amounts from the Corporation after they have received the full amounts provided for in this Section 5(a) and will have no right or claim to any of the Corporation’s remaining assets.

(b) If, in connection with any distribution described in Section 5(a) above, the assets of the Corporation or proceeds thereof are not sufficient to pay in full the Liquidation Preference payable on the Series A Preferred Stock, then such assets, or the proceeds thereof, shall be paid to the holders of Series A Preferred Stock pro rata per share of Series A Preferred Stock in accordance with the full respective amounts that would be payable on such shares if all amounts payable thereon were paid in full.

(c) For purposes of this Section 5, the Corporation’s sale, lease, exchange or other disposition of assets (other than a disposition described in Section 17-16-1201 of the Wyoming Business Corporation Act) if the disposition would leave the Corporation without a significant continuing business activity, shall constitute a Liquidation, such Liquidation shall be deemed to occur as of the closing of such transaction, and payment of the Liquidation Preference shall occur as promptly as practicable after such Liquidation event. For purposes of this Section 5, the merger or consolidation of the Corporation with or into any other corporation or other entity shall not constitute a liquidation, dissolution or winding up of the Corporation.

Section 6. Voting Rights

(a) The holders of the shares of Series A Preferred Stock shall be entitled to notice of all shareholders’ meetings (or any action by written consent) in accordance with the Corporation’s Restated Articles of Incorporation and Bylaws, and applicable law, as if the holders of Series A Preferred Stock were holders of Common Stock (and whether or not the holders of Series A Preferred Stock are entitled to vote at the meeting or on the action taken by written consent).

(b) In addition to the voting rights provided for by law or expressly provided elsewhere herein, for so long as any shares of Series A Preferred Stock remain outstanding, the Corporation shall not and shall not permit any direct or indirect Subsidiary of the Corporation to, without first obtaining the written consent, or affirmative vote at a meeting called for that purpose, of holders of at least a majority of the then outstanding shares of Series A Preferred Stock, voting as a separate voting group, take any of the following actions:

3

(1) Any change, amendment, alteration or repeal (directly or indirectly and including in connection with or as a result of a merger, consolidation, share exchange or other transaction) of any provisions of the Corporation’s Restated Articles of Incorporation or Bylaws that amends, modifies or adversely affects the rights, preferences, privileges or voting powers of the Series A Preferred Stock, or any amendment that would effect any of the actions or changes described in Section 17-16-1004 of the Wyoming Business Corporation Act or any successor provision;

(2) Effect a conversion to a different type of legal entity, effect a transfer of the Corporation to incorporation under the laws of another jurisdiction, or voluntarily change the tax status of the entity;

(3) Any creation, authorization, issuance or reclassification of Capital Stock that would rank equal or senior to the Series A Preferred Stock with respect to redemption, Liquidation rights or with respect to dividend rights or rights on a Change of Control;

(4) The issuance or reclassification of shares of the Corporation’s Series P Preferred Stock;

(5) A sale, lease, exchange or other disposition of assets (other than a disposition described in Section 17-16-1201 of the Wyoming Business Corporation Act) if the disposition would leave the Corporation or Subsidiary without a significant continuing business activity, a merger, consolidation, share exchange, or similar business combination or extraordinary transaction involving the Corporation or any Subsidiary, that (v) converts the shares of Series A Preferred Stock into cash, other securities, interests, obligations, rights to acquire shares, other securities or interests, other property, or any combination of the foregoing; (w) contains one or more provisions that would entitle the holders of Series A Preferred Stock to vote as a separate voting group on such provision or provisions if they were contained in a proposed amendment to the Restated Articles of Incorporation, pursuant to such articles or pursuant to Section 17-16-1004 of the Wyoming Business Corporation Act or any successor provision; (x) if share exchange, if the Series A Preferred Stock is included in the exchange; (y) results in a Change of Control; or (z) impairs in any way other than in a de minimus way, the value or rights of the Series A Preferred Stock;

(6) Any repurchase or redemption of Series A Preferred Stock, other than pro rata or in whole;

(7) Any issuance or sale of capital stock of a Subsidiary, repurchase or redemption of capital stock of a Subsidiary or dividend or distribution with respect to capital stock of a Subsidiary, other than such transactions exclusively involving the Corporation and one or more of its wholly-owned Subsidiaries;

(8) From and after the time that the Conversion Rate equals the Conversion Cap, and including an issuance that would cause the Conversion Rate to equal or exceed the Conversion Cap, the issuance of Common Stock or securities convertible into, exercisable or exchangeable for Common Stock (including by means of a distribution of rights, options or warrants subject to Sections 9(a)(2), or by means of an issuance described in Section 9(a)(4)) at a price per share that is less than ninety percent (90%) of the Closing Price on the Trading Day immediately preceding the Record Date for the issuance of rights, options or warrants, or that is less than ninety percent (90%) of the Closing Price on the Trading Day immediately preceding the earlier of (x) the date on which the sale or issuance is publicly announced and (y) the date on which the price for such sale or issuance is agreed or fixed.

(c) The shares of Series A Preferred Stock shall not have voting rights in the election, removal, or replacement of directors, or filling a vacancy in the office of a director, of the Corporation.

4

(d) At a meeting of holders of Series A Preferred Stock, a majority of the outstanding shares of Series A Preferred Stock shall constitute a quorum. The rules and procedures for calling and conducting any meeting of the holders of Series A Preferred Stock (including, without limitation, the fixing of a record date in connection therewith), the solicitation and use of proxies at such a meeting, the obtaining of written consents and any other procedural aspect or matter with regard to such a meeting or such consents shall be governed by any reasonable rules the Board of Directors, in its discretion, may adopt from time to time, which rules and procedures shall conform to the requirements of the Restated Articles of Incorporation and Bylaws of the Corporation; provided, that the Corporation may not restrict or prohibit the use of proxies, or restrict access to shareholder’s lists, by holders of Series A Preferred Stock pursuant to the Wyoming Management Stability Act Sections 17-18-116 and 17-18-118. Any vote of holders of Series A Preferred Stock that may be taken at a meeting of such holders may be taken without a meeting, without prior notice and without a vote if a consent or consents in writing, setting forth the action so taken, shall be signed by the holders of outstanding Series A Preferred Stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted. Each holder of Series A Preferred Stock shall have one vote per share of Series A Preferred Stock.

Section 7. Conversion

(a) Mandatory Conversion by the Corporation. If at any time the Closing Price of the Common Stock equals or exceeds $5.00 per share (adjusted as described in and consistent with the provisions of Section 9 by multiplying such price by the quotient of the Conversion Rate in effect prior to such adjustment divided by the Conversion Rate in effect after such adjustment) for a period of 30 consecutive Trading Days (the Business Day immediately following such 30th Trading Day, the “Mandatory Conversion Date”), at the Corporation’s election effected by written notice to the holders of Series A Preferred Stock within 30 days after the Mandatory Conversion Date, all and not less than all of the shares of Series A Preferred Stock shall be converted such that each share of Series A Preferred Stock is converted into a number of shares of Common Stock (subject to the Conversion Cap) equal to the product of (1) the Adjusted Conversion Value per share divided by the Initial Conversion Value per share, multiplied by (2) the Conversion Rate then in effect, plus cash in lieu of fractional shares as set out in Section 9(h), plus an amount of cash per share of Series A Preferred Stock equal to the amount of the Regular Dividend that would be accrued on such share from and including the immediately preceding Regular Dividend Payment Date to but excluding the Mandatory Conversion Date, out of funds legally available therefor (the “Mandatory Conversion”). This Section 7(a) shall not apply (i.e. there shall be no Mandatory Conversion) if the Common Stock is not traded on a U.S. national securities exchange.

(b) Optional Conversion. At any time, each holder of Series A Preferred Stock shall have the right, at such holder’s option, to convert any or all of such holder’s shares of Series A Preferred Stock, and each share of Series A Preferred Stock to be converted shall be converted into a number of shares of Common Stock (subject to the Conversion Cap) equal to the product of (1) the Adjusted Conversion Value per share divided by the Initial Conversion Value per share, multiplied by (2) the Conversion Rate then in effect, plus cash in lieu of fractional shares as set out in Section 9(h), plus an amount of cash per share of Series A Preferred Stock equal to the amount of the Regular Dividend that would be accrued on such share from and including the immediately preceding Regular Dividend Payment Date to but excluding the applicable Conversion Date, out of funds legally available therefor.

(c) Conversion Definitions.

(1) “Adjusted Conversion Value” per share means the Initial Conversion Value per share plus Accumulated Regular Dividends per share;

(2) “Conversion Rate” means 80 shares, subject to adjustment in accordance with the provisions of Section 9 of this Certificate of Designations;

(3) “Initial Conversion Value” per share means $40 per share of Series A Preferred Stock; and

(4) “Total Conversion Shares” means the aggregate number of shares of Common Stock issuable upon conversion (mandatory or optional) of Series A Preferred Stock.

(d) Conversion Cap. The Total Conversion Shares shall not exceed 4,760,095 shares of Common Stock (i.e. 16.86% of the number of shares of Common Stock outstanding on the Issue Date), and the “Conversion Cap” shall mean 95.20 shares of Common Stock per share of Preferred Stock, adjusted as described in and consistent with the provisions of Section 9, other than Sections 9(a)(2) and 9(a)(4), by multiplying such number by the quotient of the Conversion Rate in effect after such adjustment divided by the Conversion Rate in effect prior to such adjustment).

5

(e) Conversion Procedures. A holder must do each of the following in order to convert its shares of Series A Preferred Stock:

(1) in the case of a conversion pursuant to Section 7(b), give written notice to the Corporation (or any conversion agent appointed pursuant to Section 16) that such holder elects to convert such shares;

(2) deliver to the Corporation or such conversion agent the certificate or certificates representing the shares of Series A Preferred Stock to be converted (or, if such certificate or certificates have been lost, stolen or destroyed, a lost certificate affidavit and indemnity in form and substance reasonably acceptable to the Corporation);

(3) if required, furnish appropriate endorsements and transfer documents in form and substance reasonably acceptable to the Corporation; and

(4) if required, pay any stock transfer, documentary, stamp or similar taxes not payable by the Corporation pursuant to Section 7(i).

If the conversion is in connection with a Reorganization Event, the conversion may, at the option of the holder, be conditioned upon the closing of the Reorganization Event, in which case the Person(s) entitled to receive the Common Stock, cash or other property upon conversion shall not be deemed to have converted the Series A Preferred Stock until immediately prior to the closing of such Reorganization Event. If the conversion is in connection with a tender offer for the Common Stock, the conversion may, at the option of the holder, be conditioned upon the closing of the tender offer and acceptance of tendered shares, in which case the Person(s) entitled to receive the Common Stock, cash or other property upon conversion shall not be deemed to have converted the Series A Preferred Stock until immediately prior to the closing of such tender offer; provided, that in the event less than all of the Common Stock (including the Conversion Shares) tendered is accepted for purchase in the tender offer, the Person(s) entitled to receive the Common Stock, cash or other property upon conversion shall only be deemed to have converted such portion of the Series A Preferred Stock for which the related Conversion Shares were accepted for purchase pursuant to the tender offer. “Conversion Date” means, as applicable, either (x) if the Corporation elects Mandatory Conversion as provided in Section 7(a), the Mandatory Conversion Date; (y) in the case of a conditional conversion, the date such conversion is deemed to occur; or (z) in any other case, the date on which a holder complies in all respects with the procedures set forth in this Section 7(e).

(f) Effect of Conversion. Effective immediately prior to the Close of Business on the Conversion Date applicable to any shares of Series A Preferred Stock, dividends shall no longer accrue or be declared on any such shares of Series A Preferred Stock and such shares of Series A Preferred Stock shall cease to be outstanding.

(g) Record Holder of Underlying Securities as of Conversion Date. The Person or Persons entitled to receive the Common Stock and, to the extent applicable, cash or other property, issuable upon conversion of Series A Preferred Stock on a Conversion Date shall be treated for all purposes as the record holder(s) of such shares of Common Stock and/or cash or other property as of the Close of Business on such Conversion Date. As promptly as practicable on or after the Conversion Date and compliance by the applicable holder with the relevant conversion procedures contained in Section 7(e) (and in any event no later than three Trading Days thereafter), the Corporation shall issue the number of whole shares of Common Stock issuable upon conversion (and deliver payment of cash in lieu of fractional shares, and other property due). Upon Mandatory Conversion, the outstanding shares of Series A Preferred Stock shall be converted automatically without further action by the holders and whether or not the certificates representing such shares are surrendered; provided, that the Corporation shall not be obligated to issue certificates evidencing the shares of Common Stock or deliver other securities, cash or property due upon such conversion unless the certificates evidencing the shares of Series A Preferred Stock are delivered to the Corporation or the conversion agent (or, if such certificate or certificates have been lost, stolen or destroyed, a lost certificate affidavit and indemnity in form and substance reasonably acceptable to the Corporation). Such delivery of shares of Common Stock, and if applicable other securities, shall be made, at the option of the applicable holder, in certificated form or by book-entry. Any such certificate or certificates shall be delivered by the Corporation to the appropriate holder on a book-entry basis or by mailing certificates evidencing the shares to the holders at their respective addresses as set forth in the conversion notice. If fewer than all of the shares of Series A Preferred Stock held by any holder are converted pursuant to Section 7(b), then a new certificate representing the unconverted shares of Series A Preferred Stock shall be issued to such holder concurrently with the issuance of the certificates (or book-entry shares) representing the applicable shares of Common Stock. In the event that a holder shall not by written notice designate the name in which shares of Common Stock, and to the extent applicable cash or other property to be delivered upon conversion of shares of Series A Preferred Stock, should be registered or paid, or the manner in which such shares, and if applicable cash or other property, should be delivered, the Corporation shall be entitled to register and deliver such shares, and if applicable cash and other property, in the name of the holder and in the manner shown on the records of the Corporation.

6

(h) Status of Converted or Acquired Shares. Shares of Series A Preferred Stock duly converted in accordance with this Certificate of Designations, or otherwise acquired by the Corporation in any manner whatsoever, shall be retired promptly after the conversion or acquisition thereof. All such shares shall upon their retirement and any filing required by the Wyoming Business Corporation Act become authorized but unissued shares of preferred stock, without designation as to series until such shares are once more designated as part of a particular series by the Board pursuant to the provisions of the Restated Articles of Incorporation.

(i) Taxes. (1) The Corporation and its paying agent shall be entitled to withhold taxes on all payments on the Series A Preferred Stock or Common Stock or other securities issued upon conversion of the Series A Preferred Stock to the extent required by law. Prior to the date of any such payment, each holder of Series A Preferred Stock shall deliver to the Corporation or its paying agent a duly executed, valid, accurate and properly completed Internal Revenue Service Form W-9 or an appropriate Internal Revenue Service Form W-8, as applicable.

(2) Absent a change in law or Internal Revenue Service practice, or a contrary determination (as defined in Section 1313(a) of the United States Internal Revenue Code of 1986, as amended (the “Code”)), each holder of Series A Preferred Stock and the Corporation agree not to treat the Series A Preferred Stock (based on their terms as set forth in this Certificate of Designations) as “preferred stock” within the meaning of Section 305 of the Code, and Treasury Regulation Section 1.305-5 for United States federal income tax and withholding tax purposes and shall not take any position inconsistent with such treatment.

(3) The Corporation shall pay any and all documentary, stamp and similar issue or transfer tax due on (x) the issue of the Series A Preferred Stock and (y) the issue of shares of Common Stock upon conversion of the Series A Preferred Stock. However, in the case of conversion of Series A Preferred Stock, the Corporation shall not be required to pay any tax or duty that may be payable in respect of any transfer involved in the issue and delivery of shares of Common Stock or Series A Preferred Stock in a name other than that of the holder of the shares to be converted, and no such issue or delivery shall be made unless and until the person requesting such issue has paid to the Corporation the amount of any such tax or duty, or has established to the satisfaction of the Corporation that such tax or duty has been paid.

(4) Each holder of Series A Preferred Stock and the Corporation agree to cooperate with each other in connection with any redemption of part of the shares of Series A Preferred Stock and to use good faith efforts to structure such redemption so that such redemption may be treated as a sale or exchange pursuant to Section 302 of the Code; provided that nothing in this Section 7(i) shall require the Corporation to purchase any shares of Series A Preferred Stock, and provided further that the Corporation makes no representation or warranty in this Section 7(i) regarding the tax treatment of any redemption of Series A Preferred Stock.

7

Section 8. Redemption and Repurchase

(a) Repurchase at the Option of the Holders Upon a Change of Control. Upon a Change of Control, the holders of shares of Series A Preferred Stock, by the vote or written consent of holders of a majority of the outstanding shares of the Series A Preferred Stock, voting or acting as a separate voting group, shall have the right to require the Corporation (or its successor) to repurchase, by irrevocable, written notice to the Corporation (or its successor), all and not less than all of the outstanding shares of Series A Preferred Stock, at a purchase price per share equal to the Adjusted Liquidation Preference per share as of the date of payment of the purchase price, plus the amount of the Regular Dividend that would be accrued on such share from the Regular Dividend Payment Date immediately preceding the date of the payment of the purchase price through but excluding the date of the payment of the purchase price, plus any declared but unpaid Participating Dividends through the date of the payment of the purchase price. The shares of Series A Preferred Stock shall be repurchased from the holders thereof no later than 10 Business Days after the Corporation (or its successor) receives notice from the Series A Preferred Shareholders of the election to exercise the repurchase rights under this Section 8.

(b) Procedures for Repurchase Upon a Change of Control. Within 30 days of the occurrence of a Change of Control, the Corporation shall send notice by first class mail, postage prepaid, addressed to the holders of record of the shares of Series A Preferred Stock at their respective last addresses appearing on the books of the Corporation stating (1) that a Change of Control has occurred, describing it in reasonable detail (2) that if the Corporation receives evidence to its reasonable satisfaction no later than 60 days after the Corporation’s notice of the Change of Control that the holders of outstanding shares of Series A Preferred Stock, by the vote or written consent of holders of a majority of the outstanding shares of Series A Preferred Stock voting or acting as a separate voting group, have elected to exercise the repurchase right hereunder, then all shares of Series A Preferred Stock shall be repurchased as provided in this Section 8, and (3) the procedures that holders of the Series A Preferred Stock must follow in order for their shares of Series A Preferred Stock to be repurchased, including the place or places where certificates for such shares are to be surrendered for payment of the repurchase price.

Section 9. Anti-Dilution Provisions

(a) Adjustments. The Conversion Rate will be subject to adjustment, without duplication, under the following circumstances:

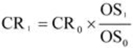

(1) the issuance of Common Stock as a dividend or distribution to all or substantially all holders of Common Stock, or a subdivision or combination of Common Stock or a reclassification of Common Stock into a greater or lesser number of shares of Common Stock, in which event the Conversion Rate will be adjusted based on the following formula:

where,

CR0 = the Conversion Rate in effect immediately prior to the Close of Business on (i) the Record Date for such dividend or distribution, or (ii) the effective date of such subdivision, combination or reclassification;

CR1 = the new Conversion Rate in effect immediately after the Close of Business on (i) the Record Date for such dividend or distribution, or (ii) the effective date of such subdivision, combination or reclassification;

OS0 = the number of shares of Common Stock outstanding immediately prior to the Close of Business on (i) the Record Date for such dividend or distribution or (ii) the effective date of such subdivision, combination or reclassification; and

OS1 = the number of shares of Common Stock that would be outstanding immediately after, and solely as a result of, the completion of such event.

8

Any adjustment made pursuant to this clause (1) shall be effective immediately prior to the Open of Business on the Trading Day immediately following the Record Date, in the case of a dividend or distribution, or the effective date in the case of a subdivision, combination or reclassification. If any such event is declared but does not occur, the Conversion Rate shall be readjusted, effective as of the date the Board announces that such event shall not occur, to the Conversion Rate that would then be in effect if such event had not been declared.

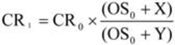

(2) the dividend, distribution or other issuance to all or substantially all holders of Common Stock of rights (other than a distribution of rights issued pursuant to a shareholders rights plan, to the extent such rights are attached to shares of Common Stock (in which event the provisions of Section 9(a)(3) shall apply)), options or warrants entitling them to subscribe for or purchase shares of Common Stock for a period expiring 60 days or less from the date of issuance thereof, at a price per share that is less than the Closing Price on the Trading Day immediately preceding the Record Date for such issuance, in which event the Conversion Rate will be increased based on the following formula:

where,

CR0 = the Conversion Rate in effect immediately prior to the Close of Business on the Record Date for such dividend, distribution or issuance;

CR1 = the new Conversion Rate in effect immediately following the Close of Business on the Record Date for such dividend, distribution or issuance;

OS0 = the number of shares of Common Stock outstanding immediately prior to the Close of Business on the Record Date for such dividend, distribution or issuance;

X = the total number of shares of Common Stock issuable pursuant to such rights, options or warrants; and

Y = the number of shares of Common Stock equal to the aggregate price payable to exercise such rights, options or warrants divided by the Closing Price on the Trading Day immediately preceding the Record Date for such dividend, distribution or issuance.

For purposes of this clause (2), in determining whether any rights, options or warrants entitle the holders to purchase the Common Stock at a price per share that is less than the Closing Price on the Trading Day immediately preceding the Record Date for such dividend, distribution or issuance, there shall be taken into account any consideration the Corporation receives for such rights, options or warrants, and any amount payable on exercise thereof, with the value of such consideration, if other than cash, to be the fair market value thereof as determined in good faith by the Board of Directors.

Any adjustment made pursuant to this clause (2) shall become effective immediately prior to the Open of Business on the Trading Day immediately following the Record Date for such dividend, distribution or issuance. In the event that such rights, options or warrants are not so issued, the Conversion Rate shall be readjusted, effective as of the date the Board publicly announces its decision not to issue such rights, options or warrants, to the Conversion Rate that would then be in effect if such dividend, distribution or issuance had not been declared. To the extent that such rights, options or warrants are not exercised prior to their expiration or shares of Common Stock are otherwise not delivered pursuant to such rights, options or warrants upon the exercise of such rights, options or warrants, the Conversion Rate shall be readjusted to the Conversion Rate that would then be in effect had the adjustments made upon the dividend, distribution or issuance of such rights, options or warrants been made on the basis of the delivery of only the number of shares of Common Stock actually delivered.

9

(3) If the Corporation has a shareholder rights plan in effect with respect to the Common Stock on the Conversion Date, upon conversion of any shares of the Series A Preferred Stock, holders of such shares will receive, in addition to the shares of Common Stock, the rights under such rights plan relating to such Common Stock, unless, prior to the Conversion Date, the rights have (i) become exercisable or (ii) separated from the shares of Common Stock (the first of such events to occur being the “Trigger Event”), in either of which cases the Conversion Rate will be adjusted, effective automatically at the time of such Trigger Event, as if the Corporation had made a distribution of such rights to all holders of the Common Stock as described in Section 9(a)(2) (without giving effect to the 60-day limit on the exercisability of rights, options and warrants ordinarily subject to such Section 9(a)(2)), subject to appropriate readjustment in the event of the expiration, termination or redemption of such rights prior to the exercise, deemed exercise or exchange thereof. Notwithstanding the foregoing, to the extent any such shareholder rights are exchanged by the Corporation for shares of Common Stock, the Conversion Rate shall be appropriately readjusted as if such shareholder rights had not been issued, but the Corporation had instead issued the shares of Common Stock issued upon such exchange as a dividend or distribution of shares of Common Stock subject to Section 9(a)(1). Notwithstanding the preceding provisions of this paragraph, no adjustment shall be required to be made to the Conversion Rate with respect to any holder of Series A Preferred Stock which is, or is an “affiliate” or “associate” of, an “acquiring person” under such shareholder rights plan or with respect to any direct or indirect transferee of such holder who receives Series A Preferred Stock in such transfer after the time such holder becomes, or its affiliate or associate becomes, an “acquiring person.” The Corporation shall not adopt a shareholder rights plan pursuant to which the holders of the Series A Preferred Stock on the Issue Date or their affiliates could be deemed an “acquiring person” or an “affiliate” or “associate” of an “acquiring person.”

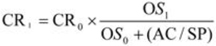

(4) If the Corporation, at any time or from time to time while any of the Series A Preferred Stock is outstanding, shall issue shares of Common Stock or any other security convertible into, exercisable or exchangeable for Common Stock (such Common Stock or other security, “Equity-Linked Securities”) (other than (i) an Excluded Issuance, (ii) Common Stock issued upon conversion of the Series A Preferred Stock and (iii) rights, options, warrants or other distributions referred to in Section 9(a)(2)), the Conversion Rate shall be increased based on the following formula:

where,

CR0 = the Conversion Rate in effect immediately prior to the issuance of such Equity-Linked Securities;

CR1 = the new Conversion Rate in effect immediately after the issuance of such Equity-Linked Securities;

AC = the aggregate consideration paid or payable for such Equity-Linked Securities;

OS0 = the number of shares of Common Stock outstanding immediately before the issuance of Equity-Linked Securities;

OS1 = the number of shares of Common Stock outstanding immediately after the issuance of Equity-Linked Securities and giving effect to any shares of Common Stock issuable upon conversion, exercise or exchange of such Equity-Linked Securities; and

SP = the Closing Price on the date of issuance of such Equity-Linked Securities.

The adjustment shall become effective immediately after such issuance.

(b) Calculation of Adjustments. All adjustments to the Conversion Rate shall be calculated by the Corporation to the nearest 1/10,000th of one share of Common Stock (or if there is not a nearest 1/10,000th of a share, to the next lower 1/10,000th of a share). No adjustment to the Conversion Rate will be required unless such adjustment would require an increase or decrease of at least one percent of the Conversion Rate; provided, however, that any such adjustment that is not required to be made will be carried forward and taken into account in any subsequent adjustment; provided, further that any such adjustment of less than one percent that has not been made will be made upon any Conversion Date.

10

(c) When No Adjustment Required. Notwithstanding the foregoing, no adjustment to the Conversion Rate shall be made upon the issuance of any shares of Common Stock pursuant to any option, warrant, right, or exercisable, exchangeable or convertible security outstanding as of the Issue Date.

(d) Successive and Multiple Adjustments. After an adjustment to the Conversion Rate under this Section 9, any subsequent event requiring an adjustment under this Section 9 shall cause an adjustment to each such Conversion Rate as so adjusted. For the avoidance of doubt, if an event occurs that would trigger an adjustment to the Conversion Rate pursuant to this Section 9 under more than one subsection hereof (other than where holders of Series A Preferred Stock are entitled to elect the applicable adjustment, in which case such election shall control), such event, to the extent fully taken into account in a single adjustment, shall not result in multiple adjustments hereunder; provided, however, that if more than one subsection of this Section 9 is applicable to a single event, the subsection shall be applied that produces the largest adjustment.

(e) Other Adjustments.

(1) The Corporation will not, by amendment of its Restated Articles of Incorporation, Bylaws or through any reorganization, recapitalization, transfer of assets, consolidation, merger, share exchange, dissolution, issue or sale of securities or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms to be observed or performed under this Section 9 by the Corporation, but will at all times in good faith assist in the carrying out of all the provisions of this Section 9 and in the taking of all such action as may be necessary or appropriate in order to protect the conversion rights of the holders of the Series A Preferred Stock against impairment; and

(2) The Corporation may, but shall not be required to, make such increases in the Conversion Rate, in addition to those required by this Section 9, as the Board considers to be advisable in order to avoid or diminish any income tax to any holders of shares of Common Stock resulting from any dividend or distribution of stock or issuance of rights or warrants to purchase or subscribe for stock or from any event treated as such for income tax purposes or for any other reason.

(f) Notice of Adjustments. Whenever the Conversion Rate is adjusted as provided under this Section 9, the Corporation shall as soon as reasonably practicable following the occurrence of an event that requires such adjustment (or if the Corporation is not aware of such occurrence, as soon as reasonably practicable after becoming so aware) or the date the Corporation makes an adjustment pursuant to Section 9(e)(2):

(1) compute the adjusted applicable Conversion Rate in accordance with this Section 9 and prepare and transmit to the conversion agent (if other than the Corporation) an officer’s certificate setting forth the applicable Conversion Rate, the method of calculation thereof in reasonable detail, and the facts requiring such adjustment and upon which such adjustment is based; and

(2) provide a written notice to the holders of the Series A Preferred Stock of the occurrence of such event and a statement in reasonable detail setting forth the method by which the adjustment to the applicable Conversion Rate was determined and setting forth the adjusted applicable Conversion Rate.

(g) Conversion Agent other than the Corporation. A conversion agent other than the Corporation shall not at any time be under any duty or responsibility to any holder of Series A Preferred Stock to determine whether any facts exist that may require any adjustment of the applicable Conversion Rate or with respect to the nature or extent or calculation of any such adjustment when made, or with respect to the method employed in making the same. Such conversion agent shall be fully authorized and protected in relying on any officer’s certificate delivered pursuant to Section 9(f) and any adjustment contained therein and such conversion agent shall not be deemed to have knowledge of any adjustment unless and until it has received such certificate. Such conversion agent shall not be accountable with respect to the validity or value (or the kind or amount) of any shares of Common Stock, or of any securities or property, that may at the time be issued or delivered with respect to any Series A Preferred Stock; and such conversion agent makes no representation with respect thereto. The Conversion Agent, if other than the Corporation, shall not be responsible for any failure of the Corporation to issue, transfer or deliver any shares of Common Stock pursuant to the conversion of Series A Preferred Stock or to comply with any of the duties, responsibilities or covenants of the Corporation contained in this Section 9.

11

(h) Fractional Shares. No fractional shares of Common Stock will be delivered to the holders of Series A Preferred Stock upon conversion. In lieu of fractional shares otherwise issuable, holders of Series A Preferred Stock will be entitled to receive an amount in cash equal to the fraction of a share of Common Stock, multiplied by the Closing Price of the Common Stock on the Trading Day immediately preceding the applicable Conversion Date. In order to determine whether the number of shares of Common Stock to be delivered to a holder of Series A Preferred Stock upon the conversion of such holder’s shares of Series A Preferred Stock will include a fractional share (in lieu of which cash would be paid hereunder), such determination shall be based on the aggregate number of shares of Series A Preferred Stock of such holder that are being converted on any single Conversion Date.

(i) Reorganization Events. In the event of (each, a “Reorganization Event”):

(1) any recapitalization, reclassification or change of the Common Stock (other than a change in par value or from par value to no par value or from no par value to par value, or as a result of a subdivision or a combination);

(2) consolidation, merger or other similar business combination of the Corporation with or into another Person;

(3) the Corporation’s sale, lease, exchange or other disposition of assets (other than a disposition described in Section 17-16-1201 of the Wyoming Business Corporation Act) if the disposition would leave the Corporation without a significant continuing business activity; or

(4) any statutory share exchange of securities of the Corporation with another Person,

in each case as a result of which holders of Common Stock are entitled to receive stock, other securities, other property or assets (including cash or any combination thereof) with respect to or in exchange for Common Stock, each share of Series A Preferred Stock outstanding immediately prior to such Reorganization Event shall become convertible into the number, kind and amount of stock, securities, other property or assets (including cash or any combination thereof) (the “Exchange Property”) that the holder of such share of Series A Preferred Stock would have received in such Reorganization Event had such holder converted its share of Series A Preferred Stock into the applicable number of shares of Common Stock immediately prior to the effective date of the Reorganization Event.

(j) Exchange Property Election. In the event that the holders of the shares of Common Stock have the opportunity to elect the form of consideration to be received in such transaction, the Exchange Property that the holders of Series A Preferred Stock shall be entitled to receive shall be determined by the holders of a majority of the outstanding shares of Series A Preferred Stock on or before the earlier of (1) the deadline for elections by holders of Common Stock and (2) two Business Days before the anticipated effective date of such Reorganization Event; provided, if no such election is made, they shall receive upon conversion the weighted average of the types and amounts of consideration received by the holders of Common Stock that affirmatively make such an election. The number of units of Exchange Property for each share of Series A Preferred Stock converted following the effective date of such Reorganization Event shall be determined from among the choices made available to the holders of the Common Stock and based on the per share amount as of the effective date of the Reorganization Event, determined as if the references to “share of Common Stock” in this Certificate of Designations were to “units of Exchange Property.”

(k) Successive Reorganization Events. The above provisions of Section 9(i) and Section 9(j) shall similarly apply to successive Reorganization Events and the provisions of Section 9 shall apply to any shares of Capital Stock (or capital stock of any other issuer) received by the holders of the Common Stock in any such Reorganization Event.

12

(l) Reorganization Event Notice. The Corporation (or any successor) shall, no less than 20 Business Days prior to the occurrence of any Reorganization Event, provide written notice to the holders of Series A Preferred Stock of such occurrence of such event and of the kind and amount of the cash, securities or other property that constitutes the Exchange Property. Failure to deliver such notice shall not affect the operation of this Section 9.

(m) Reorganization Requirements. The Corporation shall not enter into any agreement for a transaction constituting a Reorganization Event unless (1) such agreement provides for or does not interfere with or prevent (as applicable) conversion of the Series A Preferred Stock into the Exchange Property in a manner that is consistent with and gives effect to this Section 9, and (2) to the extent that the Corporation is not the surviving corporation in such Reorganization Event or will be dissolved in connection with such Reorganization Event, proper provision shall be made in the agreements governing such Reorganization Event for the conversion of the Series A Preferred Stock into stock of the Person surviving such Reorganization Event or such other continuing entity in such Reorganization Event, or in the case of a Reorganization Event described in Section 9(i)(3), an exchange of Series A Preferred Stock for the stock of the Person to whom the Corporation’s assets are conveyed or transferred, having voting powers, preferences, and relative, participating, optional or other special rights as nearly equal as possible to those provided in this Certificate of Designations.

Section 10. Reservation of Shares . The Corporation shall at all times when the Series A Preferred Stock shall be outstanding reserve and keep available, free from preemptive rights, for issuance upon the conversion of Series A Preferred Stock, such number of its authorized but unissued Common Stock as will from time to time be sufficient to permit the conversion of all outstanding Series A Preferred Stock. Prior to the delivery of any securities which the Corporation shall be obligated to deliver upon conversion of the Series A Preferred Stock, the Corporation shall comply with all applicable laws and regulations which require action to be taken by the Corporation.

Section 11. Certain Definitions . As used in this Certificate of Designations, the following terms shall have the following meanings, unless the context otherwise requires:

“Accumulated Regular Dividends” shall have the meaning ascribed to it in Section 4(c).

“Adjusted Conversion Value” shall have the meaning ascribed to it in Section 7(c).

“Adjusted Liquidation Preference” shall have the meaning ascribed to it in Section 4(a).

“Beneficially Own” shall mean “beneficially own” as defined in Rule 13d-3 of the Securities Exchange Act of 1934, as amended, or any successor provision thereto.

“Board” shall have the meaning ascribed to it in the recitals.

“Business Day” shall mean a day that is a Monday, Tuesday, Wednesday, Thursday or Friday and is not a day on which banking institutions in New York, New York generally are authorized or obligated by law, regulation or executive order to close.

“Capital Stock” shall mean any and all shares, interests, rights to purchase, warrants, options, participations or other equivalents of or interests in (however designated) stock issued by the Corporation.

“Certificate of Designations” shall mean this Certificate of Designations relating to the Series A Preferred Stock, as it may be amended from time to time.

“Change of Control” shall mean the occurrence of any of the following:

13

(1) any Person acquires after the date hereof Beneficial Ownership, directly or indirectly, through a purchase, merger, share exchange, or other acquisition transaction or series of transactions, of shares of the Corporation’s Capital Stock entitling such Person to exercise more than 50% of the total voting power of all classes of Voting Stock of the Corporation, other than an acquisition by the Corporation, any of the Corporation’s Subsidiaries or any of the Corporation’s employee benefit plans (for purposes of this clause (1), “Person” shall include any syndicate or group that would be deemed to be a “person” under Section 13(d)(3) of the Securities Exchange Act of 1934, as amended); or

(2) the Corporation’s consummation of a reorganization, share exchange, merger or consolidation, or of the Corporation’s sale, lease, exchange or other disposition of assets (other than a disposition described in Section 17-16-1201 of the Wyoming Business Corporation Act) if the disposition would leave the Corporation without a significant continuing business activity, unless immediately following such transaction (x) the Voting Stock of the Corporation outstanding immediately prior to such transaction is converted into or exchanged for Voting Stock of the surviving or transferee Person constituting a majority of the outstanding shares of such Voting Stock of such surviving or transferee Person (immediately after giving effect to such issuance) or (y) the transaction does not result in a reclassification, conversion, exchange or cancellation of any of the Corporation’s outstanding Common Stock.

“Close of Business” shall mean 5:00 p.m., New York City time, on any Business Day.

“Closing Price” shall mean the price per share of the final trade of the Common Stock on the applicable Trading Day on the principal U.S. national securities exchange on which the Common Stock is listed or admitted to trading. If the Common Stock is not traded on a U.S. national securities exchange, Closing Price shall mean the fair market value per share of the Common Stock on the applicable Business Day, as determined by the Corporation’s Board of Directors in good faith, with written notice of such determination and supporting analysis in reasonable detail to be provided by the Corporation to the holders of Series A Preferred Stock.

“Code” shall have the meaning ascribed to it in Section 7(i).

“Common Stock” shall have the meaning ascribed to it in Section 3.

“Conversion Cap” shall have the meaning ascribed to it in Section 7(d).

“Conversion Date” shall have the meaning ascribed to it in Section 7(e).

“Conversion Rate” shall have the meaning ascribed to it in Section 7(c).

“Corporation” shall have the meaning ascribed to it in the recitals.

“Equity-Linked Securities” shall have the meaning ascribed to it in Section 9(a)(4).

“Exchange Property” shall have the meaning ascribed to it in Section 9(i).

“Excluded Issuance” shall mean, any issuances of (1) Capital Stock or options to purchase shares of Capital Stock to employees, directors, managers, officers or consultants of or to the Corporation or any of its Subsidiaries pursuant to a stock option or incentive compensation or similar plan outstanding as of the Issue Date or, subsequent to the Issue Date, approved by the Board or a duly authorized committee of the Board, (2) securities pursuant to any bona fide merger, joint venture, partnership, consolidation, share exchange, business combination or any other direct or indirect acquisition by the Corporation, whereby the Corporation’s securities comprise, in whole or in part, the consideration paid by the Corporation in such transaction, (3) shares of Common Stock issued at a price equal to or greater than ninety percent (90%) of the Closing Price on the Trading Day immediately preceding the earlier of (x) the date on which the sale or issuance is publicly announced and (y) the date on which the price for such sale or issuance is agreed or fixed, and (4) securities convertible into, exercisable or exchangeable for shares of Common Stock issued with an exercise or conversion price equal to or greater than ninety percent (90%) of the Closing Price on the Trading Day immediately preceding the earlier of (x) the date on which the sale or issuance is publicly announced and (y) the date on which the price for such sale or issuance is agreed or fixed.

14

“Initial Conversion Value” shall have the meaning ascribed to it in Section 7(c).

“Issue Date” shall mean February 11, 2016.

“Junior Stock” shall have the meaning ascribed to it in Section 3.

“Liquidation” shall have the meaning ascribed to it in Section 5(a).

“Liquidation Preference” shall have the meaning ascribed to it in Section 5(a).

“Mandatory Conversion” shall have the meaning ascribed to it in Section 7(a).

“Mandatory Conversion Date” shall have the meaning ascribed to it in Section 7(a).

“Open of Business” shall mean 9:00 a.m., New York City time, on any Business Day.

“Participating Dividends” shall have the meaning ascribed to it in Section 4(d).

“Permitted Distributions” shall have the meaning ascribed to it in Section 4(d).

“Person” shall mean any individual, company, partnership, limited liability company, joint venture, association, joint stock company, trust, unincorporated organization, government or agency or political subdivision thereof or any other entity.

“Record Date” shall mean, with respect to any dividend, distribution or other transaction or event in which the holders of Common Stock have the right to receive any cash, securities or other property or in which the Common Stock (or other applicable security) is exchanged for or converted into any combination of cash, securities or other property, the date fixed for determination of shareholders entitled to receive such cash, securities or other property (whether such date is fixed by the Board or by statute, contract, this Certificate of Designations or otherwise).

“Regular Dividend” shall have the meaning ascribed to it in Section 4(a).

“Regular Dividend Payment Date” shall have the meaning ascribed to it in Section 4(b).

“Regular Dividend Period” shall have the meaning ascribed to it in Section 4(b).

“Reorganization Event” shall have the meaning ascribed to it in Section 9(i).

“Series A Preferred Stock” shall have the meaning ascribed to it in Section 1.

“Spin-Off Transaction” means any transaction by which a Subsidiary of the Corporation ceases to be a Subsidiary of the Corporation by reason of the distribution of such Subsidiary’s equity securities to holders of Common Stock, whether by means of a spin-off, split-off, redemption, reclassification, exchange, stock dividend, share distribution, rights offering or similar transaction.

“Subsidiary” means any company or corporate entity for which the Corporation owns, directly or indirectly, an amount of the voting securities, other voting rights or voting partnership interests of which is sufficient to elect at least a majority of its board of directors or other governing body (or, if there are no such voting interests, more than 50% of the equity interests of such company or corporate entity).

“Total Conversion Shares” shall have the meaning ascribed to it in Section 7(c).

“Trading Day” shall mean any Business Day on which the Common Stock is traded, or able to be traded, on the principal national securities exchange on which the Common Stock is listed or admitted to trading. If the Common Stock is not traded on a U.S. national securities exchange, Trading Day shall mean the relevant Business Day.

15

“Trigger Event” shall have the meaning ascribed to it in Section 9(a)(3).

“Voting Stock” shall mean Capital Stock of the class or classes pursuant to which the holders thereof have the general voting power under ordinary circumstances (determined without regard to any classification of directors) to elect one or more members of the Board of Directors of the Corporation (without regard to whether or not, at the relevant time, Capital Stock of any other class or classes (other than Common Stock) shall have or might have voting power by reason of the happening of any contingency).

Section 12. Headings . The headings of the paragraphs of this Certificate of Designations are for convenience of reference only and shall not define, limit or affect any of the provisions hereof.

Section 13. Record Holders . To the fullest extent permitted by applicable law, the Corporation may deem and treat the record holder of any share of the Series A Preferred Stock as the true and lawful owner thereof for all purposes, and the Corporation shall not be affected by any notice to the contrary.

Section 14. Notices . All notices or communications in respect of the Series A Preferred Stock shall be sufficiently given if given in writing and delivered in person or by first class mail, postage prepaid, or if given in such other manner as may be permitted in this Certificate of Designations, in the Restated Articles of Incorporation or Bylaws or by applicable law or regulation. Notwithstanding the foregoing, if the Series A Preferred Stock is issued in book-entry form through The Depository Trust Corporation or any similar facility, such notices may be given to the holders of the Series A Preferred Stock in any manner permitted by such facility.

Section 15. Replacement Certificates . The Corporation shall replace any mutilated certificate at the holder’s expense upon surrender of that certificate to the Corporation. The Corporation shall replace certificates that become destroyed, stolen or lost at the holder’s expense upon delivery to the Corporation of reasonably satisfactory evidence that the certificate has been destroyed, stolen or lost, together with any indemnity that may be required by the Corporation.

Section 16. Transfer Agent, Conversion Agent, Registrar and Paying Agent . The duly appointed transfer agent, conversion agent, registrar and paying agent for the Series A Preferred Stock shall be the Corporation. The Corporation may, in its sole discretion, resign from such positions or remove such agents or registrar in accordance with the agreement between the Corporation and such agent or registrar; provided that the Corporation shall appoint a successor who shall accept such appointment prior to the effectiveness of such resignation or removal. Upon any such resignation, removal or appointment, the Corporation shall send notice thereof by first-class mail, postage prepaid, to the holders of the Series A Preferred Stock.

Section 17. Severability . If any term of the Series A Preferred Stock set forth herein is invalid, unlawful or incapable of being enforced by reason of any rule of law or public policy, all other terms set forth herein which can be given effect without the invalid, unlawful or unenforceable term will, nevertheless, remain in full force and effect, and no term herein set forth will be deemed dependent upon any other such term unless so expressed herein.

16

Section 18. Information Rights . In addition to reports required by law, regulation, or the rules of any national securities exchange on which the Common Stock is listed or admitted to trading, the Corporation shall furnish to each of the holders of Series A Preferred Stock (1) within 45 days after the end of the first, second and third quarterly accounting periods in each fiscal year of the Corporation, a consolidated balance sheet of the Corporation and its subsidiaries as of the end of each such quarterly period, and consolidated statements of income and cash flows of the Corporation and its subsidiaries for such period and for the current fiscal year to date, prepared in accordance with United States generally accepted accounting principles consistently applied and setting forth in comparative form the figures for the corresponding periods of the prior fiscal year (subject to changes resulting from normal year-end audit adjustments and except that such financial statements need not contain the notes required by generally accepted accounting principles), and (2) within 120 days after the end of each fiscal year of the Corporation, an audited consolidated balance sheet of the Corporation and its subsidiaries as at the end of such fiscal year, and audited consolidated statements of income and cash flows of the Corporation and its subsidiaries for such year, prepared in accordance with United States generally accepted accounting principles consistently applied and setting forth in each case in comparative form the figures for the previous fiscal year and certified by independent public accountants of recognized national or regional standing selected by the Corporation (in each case in clauses (1) and (2), whether or not such financial statements are then required to be filed with or furnished to the United States Securities and Exchange Commission).

[Remainder of Page Left Intentionally Blank.]

17

IN WITNESS WHEREOF, U.S. Energy Corp. has caused this Certificate of Designations to be duly executed by its authorized corporate officer this 11th day of February, 2016.

| U.S. ENERGY CORP. | ||

| By: | /s/ David Veltri | |

| Name: | David Veltri | |

| Title: | Chief Executive Officer and President | |