Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - US ENERGY CORP | Financial_Report.xls |

| EX-32.2 - SOX SDR CERT - US ENERGY CORP | exhibit32_2.htm |

| EX-99.1 - CG&A RESERVE REPORT - US ENERGY CORP | exhibit99_1.htm |

| EX-31.1 - KGL CERT - US ENERGY CORP | exhibit31_1.htm |

| EX-23.1 - CG&A CONSENT - US ENERGY CORP | exhibit23_1.htm |

| EX-23.3 - HEIN CONSENT - US ENERGY CORP | exhibit23_3.htm |

| EX-32.1 - SOX KGL CERT - US ENERGY CORP | exhibit32_1.htm |

| EX-31.2 - SDR CERT - US ENERGY CORP | exhibit31_2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

☑

|

Annual report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended December 31, 2014

|

|

☐

|

Transition report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from ___________ to ___________

|

Commission File Number 000-6814

|

U.S. ENERGY CORP.

|

|

(Exact Name of Company as Specified in its Charter)

|

|

Wyoming

|

83-0205516

|

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

|

incorporation or organization)

|

Identification No.)

|

|

|

877 North 8th West, Riverton, WY

|

82501

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

Registrant's telephone number, including area code:

|

(307) 856-9271

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of exchange on which registered

|

|

|

Common Stock, $0.01 par value

|

NASDAQ Capital Market

|

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ NO ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ☐ NO ☑

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Company was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.YES ☑ NO ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ☑ NO ☐

Indicate by check mark if disclosure of delinquent filers, pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of the Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K ☑

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ Accelerated filer ☑ Non-accelerated filer ☐

Smaller reporting company ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ☑

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and ask price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter (June 30, 2014): $111,157,000.

|

Class

|

Outstanding at March 11, 2015

|

|

|

Common stock, $.01 par value

|

28,388,372

|

Documents incorporated by reference: Certain information required by Items 10, 11, 12, 13, and 14 of Part III is incorporated by reference from portions of the registrant's definitive proxy statement relating to its 2015 annual meeting of stockholders to be filed within 120 days after December 31, 2014.

-2-

TABLE OF CONTENTS

Page

|

Cautionary Statement Regarding Forward-Looking Statements

|

5

|

|

PART I

|

7

|

|

ITEM 1. BUSINESS

|

7

|

|

Overview

|

7

|

|

Industry Segments/Principal Products

|

7

|

|

Office Location and Website

|

8

|

|

Business

|

8

|

|

Oil and Gas

|

8

|

|

Activities other than Oil and Gas

|

13

|

|

ITEM 1 A. RISK FACTORS

|

13

|

|

Risks Involving Our Business

|

13

|

|

Risks Related to Our Stock

|

29

|

|

ITEM 1 B. UNRESOLVED STAFF COMMENTS

|

30

|

|

ITEM 2. PROPERTIES

|

30

|

|

ITEM 3. LEGAL PROCEEDINGS

|

47

|

|

ITEM 4. MINE SAFETY DISCLOSURES

|

48

|

|

PART II

|

49

|

|

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

49

|

|

ITEM 6. SELECTED FINANCIAL DATA

|

51

|

-3-

|

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULT OF OPERATIONS

|

52

|

|

Forward Looking Statement

|

52

|

|

General Overview

|

52

|

|

Results of Operations

|

58

|

|

Overview of Liquidity and Capital Resources

|

66

|

|

Capital Resources

|

67

|

|

Capital Requirements

|

68

|

|

Overview of Cash Flow Activities

|

68

|

|

Critical Accounting Policies and Estimates

|

69

|

|

Future Operations

|

72

|

|

Effects of Changes in Prices

|

72

|

|

Contractual Obligations

|

73

|

|

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

74

|

|

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

75

|

|

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

122

|

|

ITEM 9A. CONTROLS AND PROCEDURES

|

122

|

|

ITEM 9B. OTHER INFORMATION

|

125

|

|

PART III

|

125

|

|

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

|

125

|

|

ITEM 11. EXECUTIVE COMPENSATION

|

125

|

|

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

|

126

|

|

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

|

126

|

|

ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES

|

126

|

|

PART IV

|

129

|

|

ITEM 15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

|

129

|

|

SIGNATURES

|

132

|

-4-

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The information discussed in this Annual Report includes "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 (the "Securities Act") and Section 21E of the Securities Exchange Act of 1934 (the "Exchange Act"). All statements other than statements of historical facts are forward-looking statements.

Examples of forward-looking statements in this Annual Report include:

|

·

|

planned capital expenditures for oil and gas exploration and environmental compliance;

|

|

·

|

potential drilling locations and available spacing units, and possible changes in spacing rules;

|

|

·

|

cash expected to be available for continued work programs;

|

|

·

|

recovered volumes and values of oil and gas approximating third-party estimates;

|

|

·

|

anticipated changes in oil and gas production;

|

|

·

|

drilling and completion activities and opportunities in the Buda, Eagle Ford and other formations in South Texas, the Williston Basin in North Dakota and other areas;

|

|

·

|

timing of drilling additional wells and performing other exploration and development projects;

|

|

·

|

expected spacing and the number of wells to be drilled with our oil and gas industry partners;

|

|

·

|

when payout-based milestones or similar thresholds will be reached for the purposes of our agreements with Statoil, Zavanna and other partners;

|

|

·

|

expected working and net revenue interests, and costs of wells, relating to the drilling programs with our partners;

|

|

·

|

actual decline rates for producing wells in the Buda, Bakken/Three Forks, Eagle Ford and other formations;

|

|

·

|

review, timing and potential approval of the plan of operations by the U.S. Forest Service in connection with the Mt. Emmons molybdenum project ("Mt. Emmons Project"), the receipt of necessary permits relating to the project, and the expected length of time to permit and develop the project;

|

|

·

|

future cash flows, expenses and borrowings;

|

|

·

|

pursuit of potential acquisition opportunities;

|

|

·

|

our expected financial position;

|

|

·

|

other plans and objectives for future operations.

|

These forward-looking statements are identified by their use of terms and phrases such as "may," "expect," "estimate," "project," "plan," "believe," "intend," "achievable," "anticipate," "will," "continue," "potential," "should," "could," "up to," and similar terms and phrases. Though we believe that the expectations reflected in these statements are reasonable, they involve certain assumptions, risks and uncertainties. Results could differ materially from those anticipated in these statements as a result of numerous factors, including, among others:

For oil and gas:

|

·

|

our ability to obtain sufficient cash flow from operations, borrowing and/or other sources to fully develop our undeveloped acreage positions;

|

|

·

|

volatility in oil and natural gas prices, including declines in oil prices and/or natural gas prices, which would have a negative impact on operating cash flow and could require ceiling test write-downs on our oil and gas assets, and which also could adversely impact the borrowing base available under our credit facility with Wells Fargo Bank (sometimes referred to as the "Credit Facility");

|

-5-

|

·

|

the possibility that the oil and gas industry may be subject to new adverse regulatory or legislative actions (including changes to existing tax rules and regulations and changes in environmental regulation);

|

|

·

|

the general risks of exploration and development activities, including the failure to find oil and natural gas in sufficient commercial quantities to provide a reasonable return on investment;

|

|

·

|

future oil and natural gas production rates, and/or the ultimate recoverability of reserves, falling below estimates;

|

|

·

|

the ability to replace oil and natural gas reserves as they deplete from production;

|

|

·

|

environmental risks;

|

|

·

|

risks associated with our plan to develop additional operating capabilities, including the potential inability to recruit and retain personnel with the requisite skills and experience and liabilities we could assume or incur as operator or to acquire operated properties or obtain operatorship of existing properties;

|

|

·

|

availability of pipeline capacity and other means of transporting crude oil and natural gas production, and related midstream infrastructure and services;

|

|

·

|

competition in leasing new acreage and for drilling programs with operating companies, resulting in less favorable terms or fewer opportunities being available;

|

|

·

|

higher drilling and completion costs related to competition for drilling and completion services and shortages of labor and materials;

|

|

·

|

unanticipated weather events resulting in possible delays of drilling and completions and the interruption of anticipated production streams of hydrocarbons, which could impact expenses and revenues; and

|

|

·

|

unanticipated down-hole mechanical problems, which could result in higher than expected drilling and completion expenses and/or the loss of the wellbore or a portion thereof.

|

For the molybdenum property:

|

·

|

the ability to obtain permits required to initiate mining and processing operations and the risks associated with adverse rulings concerning these permits;

|

|

·

|

completion of a feasibility study based on a comprehensive mine plan, which indicates that the property warrants construction and operation of mine and processing facilities, taking into account projected capital expenditures and operating costs in the context of molybdenum price trends;

|

|

·

|

the ability to fund the capital expenditures required to build the mine and its infrastructure, and the related processing facilities, after all permits and a favorable feasibility study have been received;

|

|

·

|

the ability to find a suitable joint venture partner for the project if necessary;

|

|

·

|

continued compliance with current environmental regulations and the possibility of new legislation, environmental regulations or permit requirements adverse to the mining industry;

|

|

·

|

molybdenum prices and operating costs staying within the parameters established by the feasibility study;

|

|

·

|

successfully managing the substantial operating risks attendant to a large scale mining and processing operation; and

|

|

·

|

compliance and operating costs associated with the wastewater treatment plant and stormwater management system.

|

-6-

Finally, our future results will depend upon various other risks and uncertainties, including, but not limited to, those detailed in the section entitled "Risk Factors" in this Annual Report. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements made above and elsewhere in this Annual Report. We do not assume a duty to update these forward-looking statements, whether as a result of new information, subsequent events or circumstances, changes in expectations, or otherwise.

PART I

Item 1 – Business

Overview

U.S. Energy Corp. ("U.S. Energy", the "Company", "we" or "us"), is a Wyoming corporation organized in 1966. We are an independent energy company focused on the acquisition and development of oil and gas producing properties and other mineral properties in the continental United States. Our business activities are currently focused in South Texas and the Williston Basin in North Dakota. However, we do not intend to limit our focus to these geographic areas. We continue to focus on increasing production, reserves, revenues and cash flow from operations while managing our level of debt.

We have historically explored for and produced oil and gas through a non-operator business model. As a non-operator, we rely on our operating partners to propose, permit, drill, complete and produce oil and gas wells. Before a well is drilled, the operator provides all oil and gas interest owners in the designated well the opportunity to participate in the drilling and completion costs and revenues of the well on a pro-rata basis. Our operating partners also produce, transport, market and account for all oil and gas production. We are currently developing our capability to operate properties, most notably with the appointment of David Veltri as President and Chief Operating Officer in December 2014. Mr. Veltri has over 30 years of oil and gas operating experience.

U.S. Energy believes that additional value for stock holders and for the Company overall is available from having the ability to control drilling and production timing, capital costs and future planning of operations. The Company plans to begin operating its own wells in the near future through acquisition of new assets and/or by consolidating ownership in and around the areas in which the Company currently participates. We believe the current price climate will make opportunities available for us to acquire and/or develop operated properties, and expect over time to operate over 50% of our production.

We are also involved in the exploration for and development of minerals (molybdenum) through our ownership of the Mt. Emmons Project located in west central Colorado, which is a long-term mineral development project. We continue to advance our plans for Mt. Emmons for monetization of the asset, actively mining the minerals or some other use acceptable to local, state and federal governments.

Industry Segments/Principal Products

At December 31, 2014, we have two operating segments: Oil and Gas and Maintenance of Mineral Properties. See Note K to the consolidated financial statements included in this Annual Report for certain financial information by segment.

-7-

Office Location and Website

Our principal executive office is located at 877 North 8th West, Riverton, Wyoming 82501, telephone 307-856-9271.

Our website is www.usnrg.com. We make available on this website, through a direct link to the Securities and Exchange Commission's (the "SEC") website at http://www.sec.gov, free of charge, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and Forms 3, 4 and 5 relating to stock ownership of our directors and executive officers. You may also find information related to our corporate governance, board committees and code of ethics on our website. Our website and the information contained on or connected to our website are not incorporated by reference herein and should not be considered part of this document. In addition, you may read and copy any materials we file with the SEC at the SEC's Public Reference Room, which is located at 100 F Street, NE, Room 1580, Washington, D.C. 20549. Information regarding the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330.

Business

Oil and Gas

We participate in oil and gas projects primarily as a non-operating working interest owner through exploration and development agreements with various oil and gas exploration and production companies. Our working interest varies by project. These projects may result in numerous wells being drilled over the next three to five years depending on, among other things, commodity prices. We are also actively pursuing potential acquisitions of exploration, development and production-stage oil and gas properties or companies. Key attributes of our oil and gas properties include the following:

|

·

|

Estimated proved reserves of 4,654,944 BOE (89% oil and 11% natural gas) at December 31, 2014, with a standardized measure value of $81.9 million and a PV10 of $85.2 million.

|

|

·

|

At March 5, 2015, our oil and gas leases covered 118,188 gross and 11,524 net acres.

|

|

·

|

136 gross (20.02 net) producing wells at December 31, 2014 (138 gross (20.36 net) wells at March 5, 2015).

|

|

·

|

1,275 BOE/d average net production for 2014.

|

PV10 (defined in "Glossary of Oil and Gas Terms") is a non-GAAP measure that is widely used in the oil and gas industry and is considered by institutional investors and professional analysts when comparing companies. However, PV10 data is not an alternative to the standardized measure of discounted future net cash flows, which is calculated under GAAP and includes the effects of income taxes. The following table reconciles PV10 to the standardized measure of discounted future net cash flows as of the dates indicated. See also Note F to our consolidated financial statements.

|

(In thousands)

|

||||||||||||

|

At December 31,

|

||||||||||||

|

2014

|

2013

|

2012

|

||||||||||

|

Standardized measure of discounted net cash flows

|

$

|

81,889

|

$

|

104,853

|

$

|

71,017

|

||||||

|

Future income tax expense (discounted)

|

3,307

|

10,230

|

5,448

|

|||||||||

|

PV-10

|

$

|

85,196

|

$

|

115,083

|

$

|

76,465

|

||||||

-8-

Activities with Operating Partners in Oil and Gas

The Company holds a geographically and geologically diverse portfolio of oil-weighted prospects in varying stages of exploration and development. Prospect stages range from prospect origination, including geologic and geophysical mapping, to leasing, exploration drilling and development. The Company engages in the prospect stages either for its own account or with prospective partners to enlarge its oil and gas lease ownership base.

Each of the operators of our principal prospects has a substantial technical staff. We believe that these arrangements allow us to deliver value to shareholders without having to build the full staff of geologists, engineers and land personnel required to work on diverse projects involving horizontal drilling in North Dakota and South Texas and conventional exploration in Gulf Coast prospects. However, consistent with industry practice with smaller independent oil and gas companies, we also utilize specialized consultants with local expertise as needed. We anticipate that as we establish an operational center in an area, a limited amount of staff will be hired to supply critical aspects of the operations, such as drilling, completions and production.

The Company currently has oil and gas projects with operating partners in the following areas:

Buda Limestone, Eagle Ford Shale and Austin Chalk Formations, South Texas Properties

Contango Oil & Gas Company. In 2011, we entered into two participation agreements with Contango Oil & Gas Company ("Contango") to acquire working interests in oil prospects and associated leases located in Zavala and Dimmit Counties, Texas (the "Leona River prospect" and "Booth Tortuga prospect") and working interests in 11 gross (2.98 net) wells producing from the Austin Chalk formation. Under the terms of the agreements, the Company has earned a 30% working interest (and approximate 22.5% net revenue interest) in approximately 11,861 gross acres (3,358.5 net acres). All drilling and leasing occurs on a heads up basis with no carry by the Company. Both prospects are believed to be prospective for Buda, Eagle Ford , Austin Chalk, Pearsall and Georgetown formations. Contango is the operator of the prospects.

As a result of subsequent acquisitions, our current total acreage in the Leona River and the Booth Tortuga prospects is approximately 18,878 gross acres (4,915 net acres). Based upon assumed 120 acre spacing units, there is a potential for up to 157 gross and 41.0 net wells in each of the formations should we find commercial quantities of hydrocarbons. Looking forward, the Company continues to seek additional leasing opportunities in this region.

Through the date of this report, we have drilled 15 gross (4.50 net) Buda formation horizontal wells and three gross (0.90 net) Eagle Ford formation horizontal wells. Wells in these prospects produced an average of approximately 303 BOE/d net to the Company (41% oil and 59% natural gas and natural gas liquids) during the fourth quarter of 2014.

U.S. Enercorp. On August 5, 2013, under an area of mutual interest election, the Company acquired a 15% working interest in 4,243 gross (636 net) acres (the "Big Wells prospect") from U.S. Enercorp ("Enercorp"), a private oil and gas company based in San Antonio, Texas. This acreage is contiguous to the southwestern portion of the Booth-Tortuga acreage block held with Contango. Under the terms of the election, the leasehold interest is subject to a 25% back-in upon project payout.

-9-

On May 7, 2014, the Company entered into a Participation Agreement with Enercorp to acquire 33% of Enercorp's interest in approximately 12,100 gross (3,384 net) acres in Dimmit County, Texas. The acreage consists of 4,020 gross (1,181 net) acres of primary leasehold acreage and 8,080 gross (2,203 net) acres of farm-in acreage, to be earned through a continuous drilling program. The farm-in acreage has an initial two well commitment and a 12.5% working interest carry for the leaseholder (the "Farmor") in the first 10 wells. After 100% payout of all costs for the first 10 wells that are drilled under the farm-in program, the Farmor will back in for its 12.5% retained working interest in the prospect. Enercorp also retained a 25% working interest back-in after 115% of project payout has been received by the Company. The Company paid $3.9 million to enter into the transaction, which included leasehold and farm-in acquisition costs as well as our proportionate share of drilling costs for the initial test well in the prospect.

Through the date of this report, we have drilled four gross (0.97 net) Buda formation horizontal wells in these prospects and one gross (0.33 net) Eagle Ford formation horizontal well. One additional gross (0.33 net) well was in progress at December 31, 2014. During the fourth quarter of 2014, the wells in these prospects produced approximately 15 BOE/d net to the Company (99% oil and 1% natural gas).

For further information on the wells drilled in the Buda and Eagle Ford formations in Texas through the date of this Annual Report, see "Item 2 – Properties – Oil and Natural Gas" below.

Williston Basin, North Dakota Properties

Statoil. On August 24, 2009, we entered into a Drilling Participation Agreement (the "DPA") with Brigham Oil & Gas, L.P., now a subsidiary of Statoil ("Statoil"), to jointly explore for oil and gas in up to 19,200 gross acres in a portion of Statoil's Rough Rider prospect in Williams and McKenzie Counties, North Dakota. Under the DPA, we earned working interests, derived from Statoil's initial working interests, in fifteen 1,280-acre spacing units in Statoil's Rough Rider project area by participating in the drilling of one initial well in each spacing unit. Accordingly, we have earned the rights to participate in additional drilling of Bakken and Three Forks formation wells within these units, based on current spacing rules in North Dakota. If the spacing is ultimately increased to four wells per formation per 1,280 acre spacing unit, the potential number of drilling locations could increase to 120 gross wells. In addition, if stacked horizons within the Three Forks formation are determined to be economical, the total gross potential wells could increase further as operators in this region are now drilling multiple wells to multiple zones within single drilling units.

In some areas, our interests under the DPA are depth limited to the Bakken and the upper part of the Three Forks formations under the terms of the leases obtained by Statoil from third parties, while other leases may have rights to all depths. Working interests earned vary according to Statoil's initial working interest, after-payout provisions and the provisions governing each stage of the program. Our working interests (or "WI") in these wells currently range from 3.5% to 48.0% and our net revenue interests (or "NRI") range from 2.8% to 38.2%. Our WIs and NRIs in certain wells will be reduced pursuant to the terms of the DPA as payout-based milestones are achieved. Our earn-in rights were staged in three groups of units and were earned upon paying our proportionate share of all drilling and completion costs, or plugging and abandonment costs (if applicable), for all the initial wells (one for each unit) in each group. Statoil is the operator for all the units covered by the DPA, and is compensated for its services pursuant to an industry standard operating agreement, except that the customary non-consent provisions have been revised as to the drilling of subsequent wells. Under the form of operating agreement which governs operations for each of the 15 units, after the applicable initial well was drilled, we have the right to elect not to participate in the drilling or completion in subsequent wells proposed to be drilled in a unit. If the Company or Statoil should make an election not to participate, the non-participating party will assign all its rights in the proposed well to the participating entity for no consideration. However, our working interest rights in all acreage remaining in the unit would not be affected by the assignment.

-10-

From August 24, 2009 to December 31, 2014, we have drilled and completed 24 gross (6.39 net) Bakken formation wells and two gross (0.22 net) Three Forks formation wells under the DPA. These wells produced an average of approximately 434 BOE/d net to the Company (74% oil and 26% natural gas and natural gas liquids) during the fourth quarter of 2014. At this time, no drilling activity is scheduled for 2015. Statoil's drilling plans beyond 2015 are not known at this time.

Zavanna, LLC. In December 2010, we signed two agreements with Zavanna, a private oil and gas company based in Denver, Colorado, and other parties. The Company paid $11.0 million in cash to acquire 35% of Zavanna's working interests in oil and gas leases covering approximately 6,050 acres net to Zavanna's interest in McKenzie County, North Dakota, which interest was subsequently reduced by the sale to GeoResources, Inc. and Yuma Exploration and Production Company, Inc. in January 2012 as noted below. Approximately 1,225 net acres are currently subject to the agreements.

The acquired acreage is in two prospects – the Yellowstone Prospect and the SE HR Prospect and consists of 28 gross 1,280 acre spacing units. If the spacing is ultimately increased to four wells per formation per 1,280 acre spacing unit, the potential number of drilling locations could increase to 224 gross wells. In addition, if stacked horizons within the Three Forks formation are determined to be economical, the total gross potential wells could increase further as operators in this region are now drilling multiple wells to multiple zones within single drilling units.

Our interests in all the acreage in both prospects is subject to reduction by a 30% reversionary working interest under each prospect upon the achievement of certain payout-based milestones. On January 24, 2012 (but effective as of December 1, 2011), the Company sold an undivided 75% of its undeveloped acreage in the SE HR Prospect and the Yellowstone Prospect to GeoResources, Inc. (56.25%) and Yuma Exploration and Production Company, Inc. (18.75%) for a total of $16.7 million. Under the terms of the agreement, the Company retained the remaining 25% of its interest in the undeveloped acreage and its original working interest in its 10 developed wells in the SE HR and Yellowstone prospects. Our working interest in the remaining locations is approximately 8.75% and net revenue interests in new wells after the sale are in the range of 6.74% to 7.0%, proportionately reduced depending on Zavanna's actual working interest percentages in each unit.

As of December 31, 2014, we have interests in twenty-eight gross 1,280 acre spacing units in the Yellowstone and SEHR prospects with Zavanna. We have drilled and completed 42 gross (3.10 net) Bakken formation wells and eight gross (0.33 net) Three Forks formation wells in these prospects. The wells are operated by Zavanna (18 gross, 2.91 net), Emerald Oil, Inc. (27 gross, 0.34 net), Murex Petroleum (2 gross, 0.13 net), Kodiak Oil & Gas Corp. (2 gross, 0.04 net) and Slawson Exploration Company, Inc. (1 gross, 0.01 net). These wells produced an average of approximately 235 BOE/d net to the Company (91% oil and 9% natural gas and natural gas liquids) during the fourth quarter of 2014.

Bakken/Three Forks Asset Package Acquisition. On September 21, 2012, but effective July 1, 2012, we acquired interests in 27 producing Bakken and Three Forks formation wells and related acreage in McKenzie, Williams and Mountrail Counties of North Dakota for $2.3 million after adjusting for related revenue and operating expenses from the effective date through September 21, 2012. Under the terms of the agreement, we acquired working interests in 23 drilling units ranging from less than 1% to approximately 5%, with an average working interest of 1.67%.

-11-

On May 27, 2014, the Company entered into a Purchase and Sale Agreement to sell its interest in approximately 285.70 net acres and 16 gross (0.62 net) producing wells in this acreage package for $12.2 million. The transaction closed in June 2014 with an effective date of January 1, 2014. All remaining acreage is held by production and produced approximately 12 BOE/d net to the Company (84% oil and 16% natural gas and natural gas liquids) during the fourth quarter of 2014.

For further information on the wells drilled in North Dakota through the date of this Annual Report, see "Item 2 – Properties – Oil and Natural Gas" below.

Louisiana Properties

PetroQuest Energy, L.L.C. The Company has an interest in one producing well with PetroQuest Energy, L.L.C. in coastal Louisiana, with a working interest of 17.0% (12.75% NRI). During the fourth quarter of 2014, average daily production from this well was approximately 75 BOE/d net to the Company (100% natural gas).

Texas Petroleum Investment Company. The Company has an interest in one producing well with Texas Petroleum Investment Company with a 25% WI (17.63% NRI). During the fourth quarter of 2014, average daily production from this well was approximately one BOE/d net to the Company (100% oil).

Other Texas Properties

Southern Resources Company. Our agreement with Southern Resources Company covers a 13.5% working interest (9.86% NRI) in 1,282 gross (173 net) acres in Hardin County, Texas. The Company earned a working interest in all the acreage by participating in the initial test well and paying $135,000 in seismic, land acquisition and legal costs. The Company agreed to carry the seller in an 18.75% working interest to the casing point decision ("CPD") in the initial test well, and a 12.5% carried working interest in the second test well to the CPD. Subsequent wells will be paid for proportionally to all parties' working interests. Mueller Exploration, Inc. ("Mueller") operates all of the wells. As of December 31, 2014 we had one gross (0.14 net) producing well in this project. No drilling is currently scheduled on these properties in 2015. During 2014, average daily net production from this well was less than one BOE/d (20% oil and 80% natural gas and natural gas liquids).

For further information on the wells drilled in Texas and Louisiana through the date of this Annual Report, see "Item 2 – Properties – Oil and Natural Gas" below.

Daniels County, Montana Acreage

In 2010 through 2012, the Company acquired a working interest in approximately 30,332 gross (18,939 net) mineral acres of undeveloped leasehold interests in Daniels County, Montana for approximately $1.2 million. This acreage is believed to have conventional and horizontal Bakken and Three Forks resource potential.

On June 8, 2012, we sold an undivided 87.5% of this acreage to Greehey & Company Ltd. ("Greehey") for $3.7 million. Under the terms of the agreement, we retained a 12.5% working interest in the acreage and reserved overriding royalty interests ("ORRI") in leases with an excess of 81% NRI. Greehey also committed to drill a vertical test well to depths sufficient to core the Bakken and Three Forks formations on or before December 31, 2015. We delivered an 80% NRI to the purchaser and a 1% ORRI to Energy Investments, Inc. ("EII"), a land broker, in connection with the sale. We also paid EEI a commission equal to 10% of the cash consideration paid by Greehey.

-12-

Forward Plan

In 2015 and beyond, the Company intends to seek additional opportunities in the oil and natural gas sector, including but not limited to further acquisition of assets, participation with current and new industry partners in their exploration and development projects, acquisition of operating companies, and the purchase and exploration of new acreage positions.

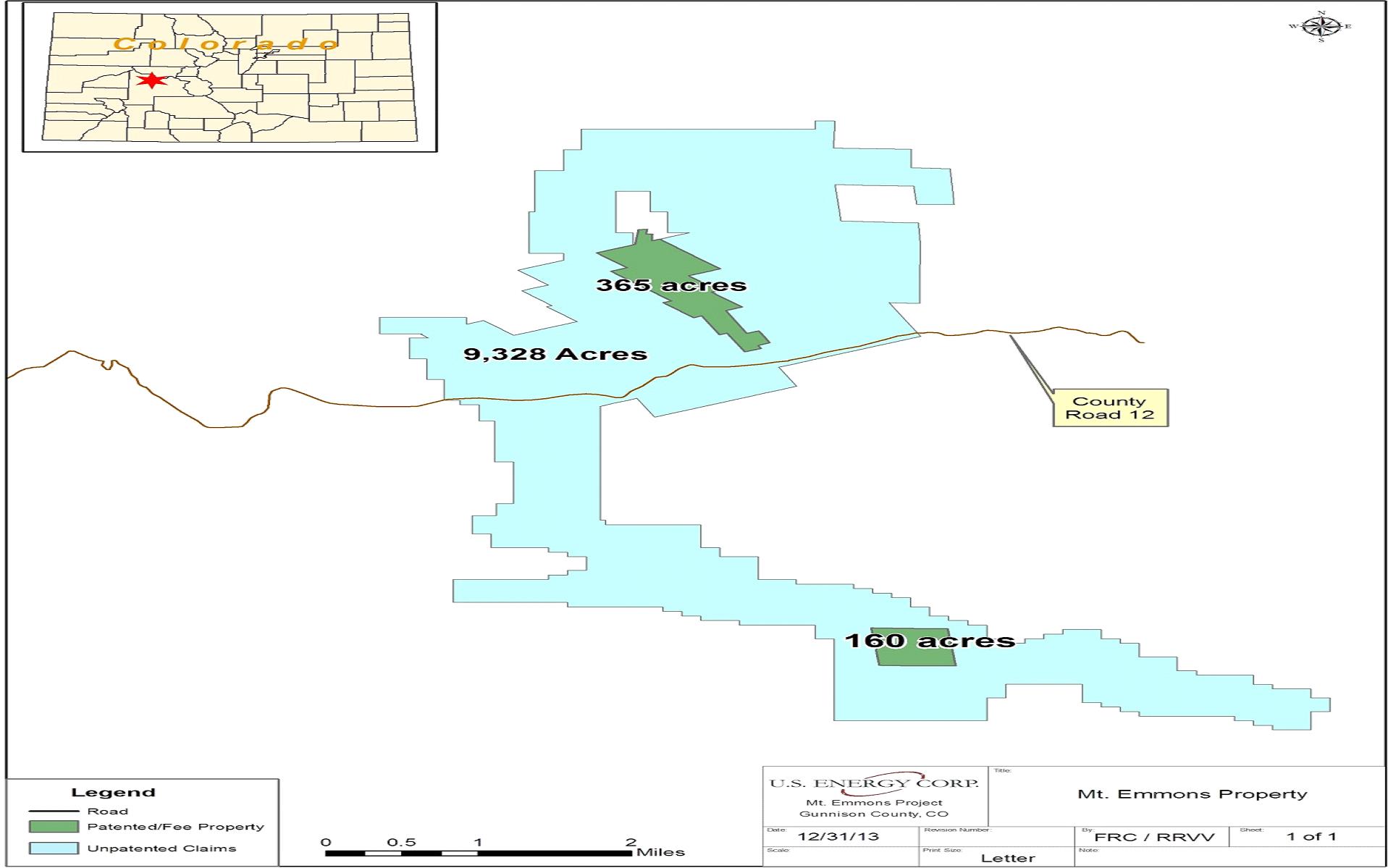

Activities other than Oil and Gas

Molybdenum

The Company re-acquired the Mt. Emmons Project located near Crested Butte, Colorado on February 28, 2006. The Mt. Emmons Project includes a total of 160 fee acres, 25 patented and approximately 1,345 unpatented mining and mill site claims, which together approximate 9,853 acres, or over 15 square miles of claims and fee lands. For further information, see "Item 2 – Properties – Molybdenum - Mt. Emmons Project" below.

Renewable Energy — Geothermal

At December 31, 2014 we owned a 19.54% interest in Standard Steam Trust ("SST"), a geothermal limited liability company. Our investment in SST does not obligate us to fund any future cash calls, but if we elect not to fund cash calls, we will suffer dilution. We did not participate in any cash calls in 2011, 2012, 2013 or 2014, which diluted our ownership. In December 2013, we recorded an impairment charge of $2.2 million to write off the carrying amount of the investment in SST at December 31, 2013 to zero.

Item 1A - Risk Factors

The following risk factors should be carefully considered in evaluating the information in this Annual Report.

Risks Involving Our Business

The development of oil and gas properties involves substantial risks that may result in a total loss of investment.

The business of exploring for and developing natural gas and oil properties involves a high degree of business and financial risk, and thus a significant risk of loss of initial investment that even a combination of experience, knowledge and careful evaluation may not be able to overcome. The cost and timing of drilling, completing and operating wells is often uncertain. Factors which can delay or prevent drilling or production, or otherwise impact expected results, include but are not limited to:

|

·

|

unexpected drilling conditions;

|

|

·

|

inability to obtain required permits from State and Federal agencies;

|

|

·

|

inability to obtain, or limitations on, easements from land owners;

|

|

·

|

uncertainty regarding our operating partners' drilling schedules;

|

|

·

|

high pressure or irregularities in geologic formations;

|

|

·

|

equipment failures;

|

|

·

|

title problems;

|

|

·

|

fires, explosions, blowouts, cratering, pollution, spills and other environmental risks or accidents;

|

|

·

|

changes in government regulations and issuance of local drilling restrictions or moratoria;

|

-13-

|

·

|

adverse weather;

|

|

·

|

reductions in commodity prices;

|

|

·

|

pipeline ruptures; and

|

|

·

|

unavailability or high cost of equipment and field services and labor.

|

A productive well may become uneconomic in the event that unusual quantities of water or other non-commercial substances are encountered in the well bore that impair or prevent production. We may participate in wells that are or become unproductive or, though productive, do not produce in economic quantities. In addition, even commercial wells can produce less, or have higher costs, than we projected.

In addition, initial 24-hour or other limited-duration production rates announced regarding our oil and gas properties are not necessarily indicative of future production rates.

Dry holes and other unsuccessful or uneconomic exploration, exploitation and development activities can adversely affect our cash flow, profitability and financial condition, and can adversely affect our reserves. To the extent we act as a non-operator, we have limited ability to control the manner in which drilling and other exploration and development activities on our properties are conducted, which may increase these risks. Conversely, our anticipated transition to an operated business model entails risks as well. For example, the benefits of this transition may be less, or the costs may be greater, than we currently anticipate. In addition, we may be subject to a greater risk of drilling dry holes or encountering other operational problems until our operating capabilities are more fully developed. Similarly, we may incur liabilities as an operator that we have historically avoided through a non-operated business model.

Our business may be impacted by adverse commodity prices.

In the three years ended December 31, 2014, oil prices have ranged from a high of $110.62 per barrel during September 2013 to a low of $53.45 per barrel during December 2014. Global markets, in reaction to general economic conditions and perceived impacts of future global supply, have caused large fluctuations in price, including an almost 50% decline in the price of oil that occurred over the second half of 2014. Significant future price swings are likely. Natural gas prices have also been volatile, reaching a ten year high during December 2005 on the Henry Hub of $15.39 per MMbtu, and a ten year low during April 2012 of $1.82 per MMbtu. Declines in the prices we receive for our oil and natural gas production can adversely affect many aspects of our business, including our financial condition, revenues, results of operations, cash flows, liquidity, reserves, rate of growth and the carrying value of our oil and natural gas properties, all of which depend primarily or in part upon those prices. For example, due to recent significant decreases in the price of oil, we have reduced our capital expenditure budget for 2015 to $8.2 million from $30.2 million in 2014. The reduction in drilling activity will likely result in lower production and, together with lower realized oil prices, lower revenue and EBITDAX. Declines in the prices we receive for our oil and natural gas can also adversely affect our ability to finance capital expenditures, make acquisitions, raise capital and satisfy our financial obligations. In addition, declines in prices can reduce the amount of oil and natural gas that we can produce economically and the estimated future cash flow from that production and, as a result, adversely affect the quantity and present value of our proved reserves. Among other things, a reduction in the amount or present value of our reserves can limit the capital available to us, as the maximum amount of available borrowing under our Credit Facility is, and the availability of other sources of capital likely will be, based to a significant degree on the estimated quantity and value of the reserves.

-14-

Mineral prices also change significantly over time. Molybdenum prices have fluctuated significantly, with a ten-year high of $38.00 per pound in June 2005 to a ten-year low average price of $8.03 per pound in April 2009. The average price at December 31, 2014 was $9.31 per pound, compared to $9.75 per pound at year end 2013. Price improvement in 2015 will be dependent on continued demand, but demand could weaken if industrial consumption sags due to economic constraints in key global markets. Lower molybdenum prices would adversely affect the feasibility of developing the Mt. Emmons Project.

The Williston Basin oil price differential could have adverse impacts on our revenues.

Generally, crude oil produced from the Bakken formation in North Dakota is high quality (36 to 44 degrees API, which is comparable to West Texas Intermediate Crude). However, due to takeaway constraints, our realized oil prices in the Williston Basin generally have been from $13.00 to $21.00 less per barrel than prices for other areas in the United States, and averaged approximately $17.00 less per barrel during the fourth quarter of 2014. This discount, or differential, may widen in the future, which would reduce the price we receive for our production. We may also be adversely affected by widening differentials in other areas of operation.

Drilling and completion costs for the wells we drill in the Williston Basin are comparable to or higher than other areas where there is no price differential. This makes it more likely that a downturn in oil prices will result in a ceiling limitation write-down of our Williston Basin oil and gas properties. A widening of the differential would reduce the cash flow from our Williston Basin properties and adversely impact our ability to participate fully in drilling with Statoil, Zavanna and other operators and to effect our strategy of transitioning to an operated business model. Our production in other areas could also be affected by adverse changes in differentials. In addition, changes in differentials could make it more difficult for us to effectively hedge our exposure to changes in commodity prices.

We may require funding in addition to working capital during 2015.

We were able to maintain adequate working capital in 2014 primarily through borrowing under our Credit Facility and cash flow from operations. Working capital at December 31, 2014 was negative $466,000, an amount insufficient to continue substantial exploration and development work on our oil and gas properties without additional borrowing under our Credit Facility or other funding. In 2015, we have budgeted $8.2 million for work on existing oil and gas programs.

Our exploration and development agreements contain customary industry non-consent provisions. Pursuant to these provisions, if a well is proposed to be drilled or completed but a working interest owner elects not to participate, the resulting revenues (which otherwise would go to the non-participant) flow to the participants until they receive from 150% to 300% of the capital they provided to cover the non-participant's share. In order to be in position to avoid non-consent penalties and to make opportunistic investments in new assets, we will continue to evaluate various options to obtain additional capital, including borrowings under our Credit Facility, sales of one or more producing or non-producing oil and gas assets and/or the issuance of equity.

The oil and gas and minerals businesses present the opportunity for significant returns on investment, but achievement of such returns is subject to high risk. As examples:

|

·

|

Initial results from one or more of the oil and gas programs could be marginal but warrant investing in more wells. Dry holes, over-budget exploration costs, low commodity prices, or any combination of these or other adverse factors, could result in production revenues below projections, thus adversely impacting cash expected to be available for continued work in a program, and a reduction in cash available for investment in other programs.

|

-15-

|

·

|

We are paying the annual costs (approximately $1.7 million) to operate and maintain the water treatment plant and stormwater management system at the Mt. Emmons Project, and these costs could increase in the future.

|

These types of events could require a reassessment of priorities and therefore potential re-allocations of existing capital and could also mandate obtaining new capital. There can be no assurance that we will be able to complete any financing transaction on acceptable terms. For example, our ability to borrow under our Credit Facility may be limited if we are unable, or run a significant risk of becoming unable, to comply with the financial covenants that we are required to satisfy under the agreement. In addition, the borrowing base under the agreement is subject to redetermination periodically and from time to time at the lenders' discretion. Borrowing base reductions may occur as a result of unfavorable changes in commodity prices, asset sales, performance issues or other events. In addition to reducing the capital available to finance our operations, a reduction in the borrowing base could cause us to be required to repay amounts outstanding under the Credit Facility in excess of the reduced borrowing base, and the funds necessary to do so may not be available at that time. Other sources of external debt or equity financing may not be available when needed on acceptable terms or at all, especially during periods in which financial market conditions are unfavorable. Also, the issuance of equity would be dilutive to existing shareholders.

Competition may limit our opportunities in the oil and gas business.

The oil and natural gas business is very competitive. We compete with many public and private exploration and development companies in finding investment opportunities. We also compete with oil and gas operators in acquiring acreage positions. Our principal competitors are small to mid-size companies with in-house petroleum exploration and drilling expertise. Many of our competitors possess and employ financial, technical and personnel resources substantially greater than ours. They also may be willing and able to pay more for oil and natural gas properties than our financial resources permit, and may be able to define, evaluate, bid for and purchase a greater number of properties. In addition, there is substantial competition in the oil and natural gas industry for investment capital, and we may not be able to compete successfully in raising additional capital if needed.

Successful exploitation of the Buda formation, the Williston Basin (Bakken and Three Forks shales) and the Eagle Ford shale is subject to risks related to horizontal drilling and completion techniques.

Operations in the Buda formation and the Bakken, Three Forks and Eagle Ford shales in many cases involve utilizing the latest drilling and completion techniques in an effort to generate the highest possible cumulative recoveries and therefore generate the highest possible returns. Risks that are encountered while drilling include, but are not limited to, landing the well bore in the desired drilling zone, staying in the zone while drilling horizontally through the shale formation, running casing the entire length of the well bore (as applicable to the formation) and being able to run tools and other equipment consistently through the horizontal well bore.

-16-

For wells that are hydraulically fractured, completion risks include, but are not limited to, being able to fracture stimulate the planned number of frac stages, and successfully cleaning out the well bore after completion of the final fracture stimulation stage. Ultimately, the success of these latest drilling and completion techniques can only be evaluated over time as more wells are drilled and production profiles are established over a sufficient period of time.

Currently, the typical cost for drilling and completing a horizontal well is estimated at approximately $3.0 million to $4.0 million for wells targeting the Buda formation, $8.1 million to $10.1 million for wells in the Williston Basin, and $7.5 million for wells in the Eagle Ford, in each case on a gross basis. Costs for any individual well will vary due to a variety of factors. These wells are significantly more expensive than a typical onshore shallow conventional well. Accordingly, unsuccessful exploration or development activity affecting even a small number of wells could have a significant impact on our results of operations. Costs other than drilling and completion costs can also be significant for Williston Basin, Eagle Ford and other wells. For example, we incurred approximately $3.1 million in workover costs relating to a single Williston Basin well in 2011, and these costs substantially exceeded our estimates.

If our access to oil and gas markets is restricted, it could negatively impact our production and revenues. Securing access to takeaway capacity may be particularly difficult in less developed areas of the Williston Basin.

Market conditions or limited availability of satisfactory oil and natural gas transportation arrangements may hinder our access to oil and natural gas markets or delay our production. The availability of a ready market for our oil and natural gas production depends on a number of factors, including the demand for and supply of oil and natural gas and the proximity of reserves to pipelines and other midstream facilities. Our ability to market our production depends in substantial part on the availability and capacity of gathering systems, pipelines, rail transportation and processing facilities owned and operated by third parties. In particular, access to adequate gathering systems or pipeline or rail takeaway capacity is limited in the Williston Basin. In order to secure takeaway capacity and related services, we or our operating partners may be forced to enter into arrangements that are not as favorable to operators as those in other areas.

As of the date of this report, all of the wells we have drilled in the Williston Basin have produced oil and natural gas (generally at an initial ratio of about 85% oil and 15% gas). Oil sales generally commence immediately after completion work is finished, but natural gas is flared (burned off) until the well can be hooked up to a transmission line. Installation of a gathering system can take from 90 to 120 days, or longer, depending on well location, weather conditions, and availability of service providers. As of the date of this report, all but one of our Williston Basin wells is selling gas.

Continued drilling in the Williston Basin and South Texas has placed additional demands on the capacity of the various gathering and intrastate or interstate transportation pipelines or rail tankers and other midstream facilities available in these areas, and increased production from us and others could exceed available capacity in some areas from time to time. If this occurs, it will be necessary for new rail takeaway lines, pipelines, gathering systems and/or other types of infrastructure to be built. The availability of new or existing infrastructure or services depends on many factors outside of our control. For example, well-publicized accidents involving trains carrying crude oil may lead to new regulations that limit the number of rail cars available to transport our production. In addition, certain pipeline or rail projects that are planned for the Williston Basin and other areas may not occur. In such event, we might have to sell our production for significantly lower prices or shut in our wells until a pipeline connection or rail capacity is available. In the case of natural gas, we may have to flare the gas we produce or shut the well in.

-17-

We may not be able to drill wells on a substantial portion of our acreage.

We may not be able to participate in all or even a substantial portion of the many locations we have potentially available through our agreements with our partners. The extent of our participation will depend on drilling and completion results, commodity prices, the availability and cost of capital relative to ongoing revenues from completed wells, applicable spacing rules and other factors. Significant recent declines in the price of oil may reduce the number of potential locations that we will ultimately drill.

Lower oil and natural gas prices may cause us to record ceiling test write-downs, which would reduce stockholders' equity.

We use the full cost method of accounting to account for our oil and natural gas investments. Accordingly, we capitalize the cost to acquire, explore for and develop these properties. Under full cost accounting rules, the net capitalized cost of oil and gas properties may not exceed a "ceiling limit" that is based upon the present value of estimated future net revenues from proved reserves, discounted at 10%, plus the lower of the cost or fair market value of unproved properties. If net capitalized costs exceed the ceiling limit, we must charge the amount of the excess to earnings (a charge often referred to as a "ceiling test write-down"). The risk of a ceiling test write-down increases when oil and gas prices are depressed, if we have substantial downward revisions in estimated proved reserves or if we drill unproductive wells.

Under the full cost method, all costs associated with the acquisition, exploration and development of oil and gas properties are capitalized and accumulated in a country-wide cost center. This includes any internal costs that are directly related to development and exploration activities, but does not include any costs related to production, general corporate overhead or similar activities. Proceeds received from disposals are credited against accumulated cost, except when the sale represents a significant disposal of reserves, in which case a gain or loss is recognized. The sum of net capitalized costs and estimated future development and dismantlement costs for each cost center is depleted on the equivalent unit-of-production method, based on proved oil and gas reserves. Excluded from amounts subject to depletion are costs associated with unevaluated properties.

Under the full cost method, net capitalized costs are limited to the lower of unamortized cost reduced by the related net deferred tax liability and asset retirement obligations or the cost center ceiling. The cost center ceiling is defined as the sum of (i) estimated future net revenue, discounted at 10% per annum, from proved reserves, based on unescalated costs, adjusted for contract provisions, any financial derivatives that hedge our oil and gas revenue and asset retirement obligations, and unescalated oil and gas prices during the period, (ii) the cost of properties not being amortized, and (iii) the lower of cost or market value of unproved properties included in the cost being amortized, less (iv) income tax effects related to tax assets directly attributable to the natural gas and crude oil properties. If the net book value reduced by the related net deferred income tax liability and asset retirement obligations exceeds the cost center ceiling limitation, a non-cash impairment charge is required in the period in which the impairment occurs.

Full cost pool capitalized costs are amortized over the life of production of proven properties. Capitalized costs at December 31, 2014, 2013 and 2012, which were not included in the amortized cost pool, were $12.5 million, $7.5 million and $9.2 million, respectively. These costs consist of wells in progress, costs for seismic analysis of potential drilling locations, and land costs, all related to unproved properties.

-18-

We perform a quarterly and annual ceiling test for each of our oil and gas cost centers. At December 31, 2014 and 2013, there was one such cost center (the United States). The ceiling test incorporates assumptions regarding pricing and discount rates over which we have no influence in the determination of present value. In arriving at the ceiling test for the year ended December 31, 2014, we used $94.99 per barrel for oil and $4.35 per MMbtu for natural gas to compute the future cash flows of each of the producing properties at that date. The discount factor used was 10%.

During the first quarter of 2013, capital costs for oil and gas properties exceeded the ceiling test limit and we recorded a ceiling test write-down of $5.8 million primarily due to a decline in the price of oil, additional capitalized well costs and changes in production. We recorded a similar write-down of $5.2 million in 2012. We may be required to recognize additional ceiling test write-downs in future reporting periods depending on the results of oil and gas operations and/or market prices for oil, and to a lesser extent natural gas.

Recent declines in the price of oil have significantly increased the risk of a ceiling test write-down. For example, we expect to use $82.72 per barrel for oil and $3.84 per MMbtu for natural gas to compute the ceiling test limit as of March 31, 2015. Had these prices been used to compute the ceiling test limit as of December 31, 2014 and all other variables (including applicable differentials) remained unchanged, we would have incurred a ceiling test write-down of approximately $14 million. Further, if we assume that the oil price is $50 per barrel for the remainder of 2015, the oil prices used in the ceiling test limit calculation would be approximately $70.06, $57.63 and $50.11 at June 30, 2015, September 30, 2015 and December 31, 2015, respectively. Had these oil prices been used to compute the ceiling test limit as of December 31, 2014, we would have incurred ceiling test write-downs of approximately $31 million, $44 million and $51 million, respectively.

We do not currently operate our drilling locations. Therefore, we will not be able to control the timing of exploration or development efforts, associated costs, or the rate of production of these non-operated assets.

We do not currently operate any of the prospects we hold with industry partners. As a non-operator, our ability to exercise influence over the operations of the drilling programs is limited. In the usual case in the oil and gas industry, new work is proposed by the operator and often is approved by most of the non-operating parties. If the work is approved by the holders of a majority of the working interests, but we disagree with the proposal and do not (or are unable to) participate, we will forfeit our share of revenues from the well until the participants receive 150% to 300% of their investment. In some cases, we could lose all of our interest in the well. We would avoid a penalty of this kind only if a majority of the working interest owners agree with us and the proposal does not proceed.

The success and timing of our drilling and development activities on properties operated by others depend upon a number of factors outside of our control, including:

|

·

|

the nature and timing of the operator's drilling and other activities;

|

|

·

|

the timing and amount of required capital expenditures;

|

|

·

|

the operator's geological and engineering expertise and financial resources;

|

|

·

|

the approval of other participants in drilling wells; and

|

|

·

|

the operator's selection of suitable technology.

|

-19-

The fact that we do not operate our prospects with industry partners makes it more difficult for us to predict future production, cash flows and liquidity needs. Our ability to grow our production and reserves depends on decisions by our partners to drill wells in which we have an interest, and they may elect to reduce or suspend the drilling of those wells.

Our estimated reserves are based on many assumptions that may turn out to be inaccurate. Any material inaccuracies in these reserve estimates or the relevant underlying assumptions will materially affect the quantity and present value of our reserves.

Oil and gas reserve reports are prepared by independent consultants to provide estimates of the quantities of hydrocarbons that can be economically recovered from proved properties, utilizing current commodity prices and taking into account expected capital and other expenditures. These reports also provide estimates of the future net present value of the reserves, which we use for internal planning purposes and for testing the carrying value of the properties on our balance sheet.

The reserve data included in this report represent estimates only. Estimating quantities of, and future cash flows from, proved oil and natural gas reserves is a complex process. It requires interpretations of available technical data and various estimates, including estimates based upon assumptions relating to economic factors, such as future commodity prices, production costs, severance and excise taxes, availability of capital, estimates of required capital expenditures and workover and remedial costs, and the assumed effect of governmental regulation. The assumptions underlying our estimates of our proved reserves could prove to be inaccurate, and any significant inaccuracy could materially affect, among other things, future estimates of the reserves, the economically recoverable quantities of oil and natural gas attributable to the properties, the classifications of reserves based on risk of recovery, and estimates of our future net cash flows.

At December 31, 2014, 43% of our estimated proved reserves were producing, 1% were proved developed non-producing and 56% were proved undeveloped. Estimation of proved undeveloped reserves and proved developed non-producing reserves is almost always based on analogy to existing wells, volumetric analysis or probabilistic methods, in contrast to the performance data used to estimate producing reserves. Recovery of proved undeveloped reserves requires significant capital expenditures and successful drilling operations. Revenues from estimated proved developed non-producing and proved undeveloped reserves will not be realized until sometime in the future, if at all.

You should not assume that the present values referred to in this report represent the current market value of our estimated oil and natural gas reserves. The timing and success of the production and the expenses related to the development of oil and natural gas properties, each of which is subject to numerous risks and uncertainties, will affect the timing and amount of actual future net cash flows from our proved reserves and their present value. In addition, our PV10 and standardized measure estimates are based on costs as of the date of the estimates and assume fixed commodity prices. Actual future prices and costs may be materially higher or lower than the prices and costs used in the estimate. If prices as of December 31, 2014 were used to derive the estimated quantity and present value of our reserves, those estimates would have been significantly lower than those included in this report, which are based on a 12-month average price under applicable SEC rules.

Further, the use of a 10% discount factor to calculate PV10 and standardized measure values may not necessarily represent the most appropriate discount factor given actual interest rates and risks to which our business or the oil and natural gas industry in general are subject.

-20-

The use of hedging arrangements in oil and gas production could result in financial losses or reduce income.

From time to time, we use derivative instruments, typically fixed-rate swaps and costless collars, to manage price risk underlying our oil production. The fair value of our derivative instruments will be marked to market at the end of each quarter and the resulting unrealized gains or losses due to changes in the fair value of our derivative instruments will be recognized in current earnings. Accordingly, our earnings may fluctuate significantly as a result of changes in the fair value of our derivative instruments.

Our actual future production may be significantly higher or lower than we estimate at the time we enter into derivative contracts for the relevant period. If the actual amount of production is higher than we estimated, we will have greater commodity price exposure than we intended. If the actual amount of production is lower than the notional amount that is subject to our derivative instruments, we might be forced to satisfy all or a portion of our derivative transactions without the benefit of the cash flow from our sale of the underlying physical commodity, resulting in a substantial diminution of our liquidity. As a result of these factors, our hedging activities may not be as effective as we intend in reducing the volatility of our cash flows, and in certain circumstances may actually increase the volatility of our cash flows.

Derivative instruments also expose us to the risk of financial loss in some circumstances, including when:

|

·

|

the counter-party to the derivative instrument defaults on its contract obligations;

|

|

·

|

there is an increase in the differential between the underlying price in the derivative instrument and actual prices received; or

|

|

·

|

the steps we take to monitor our derivative financial instruments do not detect and prevent transactions that are inconsistent with our risk management strategies.

|

In addition, depending on the type of derivative arrangements we enter into, the agreements could limit the benefit we would receive from increases in oil prices. It cannot be assumed that the hedging transactions we have entered into, or will enter into, will adequately protect us from fluctuations in commodity prices.

Additionally, the Dodd-Frank Wall Street Reform and Consumer Protection Act, or the Dodd-Frank Act, among other things, imposes restrictions on the use and trading of certain derivatives, including energy derivatives. The nature and scope of those restrictions will be determined in significant part through regulations that are in the process of being implemented by the SEC, the Commodities Futures Trading Commission and other regulators. If, as a result of the Dodd-Frank Act or its implementing regulations, capital or margin requirements or other limitations relating to our commodity derivative activities are imposed, this could have an adverse effect on our ability to implement our hedging strategy. In particular, a requirement to post cash collateral in connection with our derivative positions, which are currently collateralized on a non-cash basis by our oil and natural gas properties and other assets, would likely make it impracticable to implement our current hedging strategy. In addition, requirements and limitations imposed on our derivative counterparties could increase the costs of pursuing our hedging strategy.

-21-

Our acreage must be drilled before lease expiration, generally within three to five years, in order to hold the acreage by production. In the highly competitive market for acreage, failure to drill sufficient wells in order to hold acreage will result in a substantial lease renewal cost, or if renewal is not feasible, the loss of our lease and prospective drilling opportunities.

Unless production is established within the spacing units covering the undeveloped acres on which some of our potential drilling locations are identified, the leases for such acreage will expire. The cost to renew such leases may increase significantly, and we may not be able to renew such leases on commercially reasonable terms or at all. The risk that our leases may expire will generally increase when commodity prices fall, as lower prices may cause our operating partners to reduce the number of wells they drill. In addition, on certain portions of our acreage, third-party leases could become immediately effective if our leases expire. As such, our actual drilling activities may materially differ from our current expectations, which could adversely affect our business.

Our producing properties are primarily located in the Williston Basin and South Texas, making us vulnerable to risks associated with having operations concentrated in these geographic areas.

Because our operations are geographically concentrated in the Williston Basin and South Texas (94% of our production in the fourth quarter of 2014 was from these areas), the success and profitability of our operations may be disproportionally exposed to the effect of regional events. These include, among others, regulatory issues, natural disasters and fluctuations in the prices of crude oil and natural gas produced from wells in the region and other regional supply and demand factors, including gathering, pipeline and other transportation capacity constraints, available rigs, equipment, oil field services, supplies, labor and infrastructure capacity. Any of these events has the potential to cause producing wells to be shut-in, delay operations and growth plans, decrease cash flows, increase operating and capital costs and prevent development of lease inventory before expiration. In addition, our operations in the Williston Basin may be adversely affected by seasonal weather and lease stipulations designed to protect wildlife, which can intensify competition for services, infrastructure and equipment during months when drilling is possible and may result in periodic shortages. Any of these risks could have a material adverse effect on our financial condition and results of operations.

Our acquisition activities may not be successful.

As part of our growth strategy, we have made and may continue to make acquisitions. However, suitable acquisition candidates may not continue to be available on terms and conditions we find acceptable, and acquisitions pose substantial risks to our business, financial condition and results of operations. In pursuing acquisitions, we compete with other companies, many of which have greater financial and other resources than we do. The following are some of the risks associated with acquisitions, including any completed or future acquisitions:

|

·

|

acquired properties may not produce revenues, reserves, earnings or cash flow at anticipated levels, or at all;

|

|

·

|

we may assume liabilities that were not disclosed to us or that exceed our estimates;

|

|

·

|

we may be unable to integrate acquisitions successfully and realize anticipated economic, operational and other benefits in a timely manner, which could result in substantial costs and delays or other operational, technical or financial problems; and

|

|

·

|

acquisitions could disrupt our ongoing business, distract management, divert resources and make it difficult to maintain our current business standards, controls and procedures.

|

-22-

We may incur losses as a result of title deficiencies in oil and gas leases.

Typically, operators obtain a preliminary title opinion prior to drilling. We rely on our operating partners to provide us with ownership of the interests we pay for. To date, our operators have generally provided preliminary title opinions prior to drilling. However, from time to time, our operators may not retain attorneys to examine title, even on a preliminary basis, before starting drilling operations. If curative title work is recommended to provide marketability of title (and assurance of payment from production), but is not successfully completed, a loss may be incurred from drilling a productive well because the operator (and therefore the Company) would not own the interest.

Insurance may be insufficient to cover future liabilities.

Our business is focused in two areas, each of which presents potential liability exposure: oil and gas exploration and development and permitting and limited exploration of the Mt. Emmons molybdenum property. We also have potential exposure to general liability and property damage associated with the ownership of other corporate assets. In the past, we relied primarily on the operators of our oil and gas properties to obtain and maintain liability insurance for our working interest in our oil and gas properties. In some cases, we may continue to rely on those operators' insurance coverage policies depending on the coverage. However, since June 2011, we have established our own insurance policies for our oil and gas operations that are broader in scope and coverage and are in our control. We also maintain insurance policies for liabilities associated with and damage to general corporate assets.

We also have separate policies for the Mt. Emmons properties and liability and environmental exposures for the water treatment plant operations at the Mt. Emmons project. These policies provide coverage for bodily injury and property damage as well as costs to remediate events adversely impacting the environment. See "Insurance" below.

We would be liable for claims in excess of coverage and for any deductible provided for in the relevant policy. If uncovered liabilities are substantial, payment could adversely impact the Company's cash on hand, resulting in possible curtailment of operations. Moreover, some liabilities are not insurable at a reasonable cost or at all.

Oil and gas and mineral operations are subject to environmental and other regulations that can materially adversely affect the timing and cost of operations.