Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CTS CORP | form8kinvestorpresentation.htm |

Investor Presentation February 2016

Safe Harbor Statement This presentation contains statements that are, or may be deemed to be, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, any financial or other guidance, statements that reflect our current expectations concerning future results and events, and any other statements that are not based solely on historical fact. Forward-looking statements are based on management's expectations, certain assumptions and currently available information. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof and are based on various assumptions as to future events, the occurrence of which necessarily are subject to uncertainties. These forward-looking statements are made subject to certain risks, uncertainties and other factors, which could cause our actual results, performance or achievements to differ materially from those presented in the forward-looking statements. Examples of factors that may affect future operating results and financial condition include, but are not limited to: changes in the economy generally and in respect to the businesses in which CTS operates; unanticipated issues in integrating acquisitions; the results of actions to reposition our businesses; rapid technological change; general market conditions in the automotive, communications, and computer industries, as well as conditions in the industrial, defense and aerospace, and medical markets; reliance on key customers; unanticipated natural disasters or other events; the ability to protect our intellectual property; pricing pressures and demand for our products; unanticipated developments that could occur with respect to contingencies such as litigation and environmental matters as well as any product liability claims; and risks associated with our international operations, including trade and tariff barriers, exchange rates and political and geopolitical risks. Many of these, and other, risks and uncertainties are discussed in further detail in Item 1A. of the Annual Report on Form 10-K. We undertake no obligation to publicly update our forward- looking statements to reflect new information or events or circumstances that arise after the date hereof, including market or industry changes. 2

Our Company 3 Ticker: CTS (NYSE) Founded: 1896 Business: CTS is a leading designer and manufacturer of sensors, actuators and electronic components. Locations: 11 manufacturing locations throughout North America, Asia and Europe. Number of Employees: ~3,000 Globally 2015 Sales: $382 Million Sales by Market: Transportation – 67% Industrial – 14% Information Technology – 5% Defense / Aerospace – 5% Medical – 3% Communications – 3% Other – 3% Sales by Region: Americas – 55% Asia – 32% Europe – 13% Note: Sales by market and region based on 2015 sales

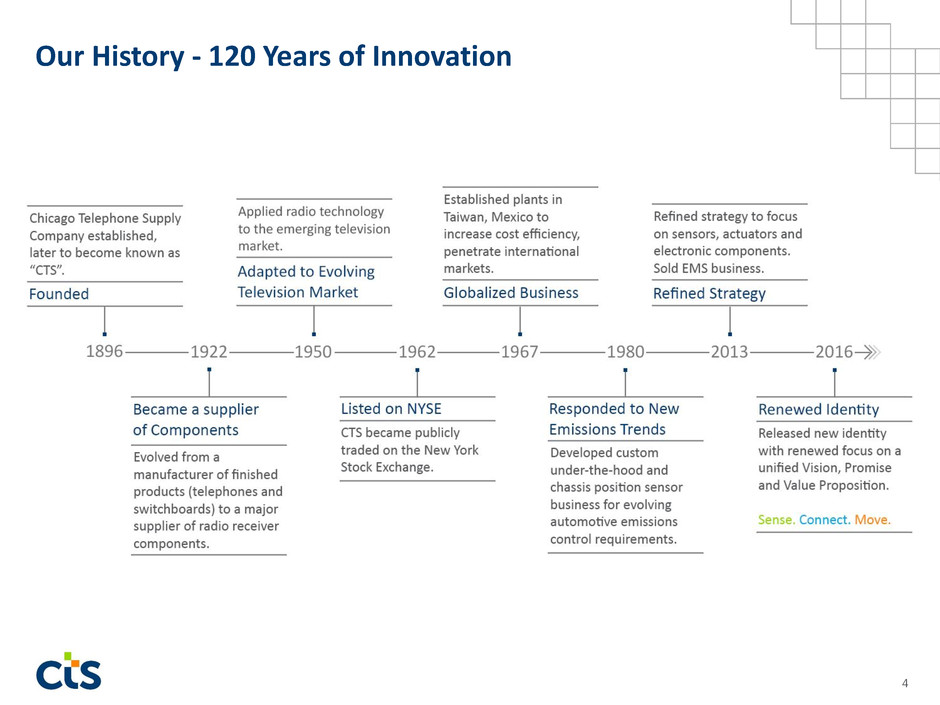

4 Our History - 120 Years of Innovation

Our New Identity 5 CTS has been part of the future for 120 years. As technology has continued to move forward, we’ve been right alongside, engineering intelligent ways to meet people’s ever changing needs. Today is no different and we continue to reinvent ourselves by establishing a new identity. New visuals and graphics are representative of our renewed purpose, vision, promise and value proposition. To learn more, visit www.ctscorp.com Our Purpose: We’re here to enable an intelligent and seamless world. Our Vision: We aim to be a leading provider of sensing and motion devices as well as connectivity components, enabling an intelligent and seamless world. Our Promise: Your Partner in Smart Solutions Our Value Proposition: Sense. Connect. Move.

Our Customers 6 Ind. / Defense New European OEM Transportation Medical Communications Industrial / IT Distribution Transportation Industrial / IT Other

Our Products 7 Accelerator Pedals Switches & Controls Timing Components RF Filters EMI/RFI Filters Smart Actuators Micro Actuators Torque Motor Actuator Sensors

LV I M CV C/IT AD [CATE GORY NAME ] I C AD M IT/O LV I M CV C/IT AD 30-50% 20-30% 10-20% 10-20% 10-20% 5-15% Targeted End Markets Light Vehicles Industrial Medical Commercial Vehicles Comm./IT Aviation/Defense EMS Divestiture Front End Refocus New Customers Regional Expansion Organic Projects M&A Legend: AD: Aviation/Defense C: Communications CV: Commercial Vehicles I: Industrial IT: Information Technology LV: Light Vehicles M: Medical O: Others Organic Growth Innovation M&A Diversify End Markets 8 LV/CV I C DA M O

New Products, New Applications, New Customers Develop next generation sensor products Expanded pedal applications Expanded switch and control product line Expanded piezo-ceramic applications and new technologies: Naval sonar buoys Naval hydrophones Miniature medical ultrasound Organic Growth - Focusing on Our Value Proposition 9 Low power OCXO RF monoblock modules and ClearPlex Waveguide technology for telecom and military markets Broaden portfolio of distribution products Leverage current competencies to expand actuator portfolio Expanded piezo-ceramic applications and new technologies: Naval sonar buoys Industrial ultrasonic welding

Inorganic Growth - Targeted Acquisitions 10 Disciplined approach to acquisitions: Returns in excess of cost of capital Accretive to earnings Maintain balance sheet strength Synergy opportunities Strengthen Customer Relationships Expand Product Range Broaden Geographic Reach Enhance Technology Portfolio

FST Overview Start-up founded by two MIT Ph. D. graduates located in the Boston area Innovative sensing technology that uses a low power RF signal to measure soot and ash loading on Diesel Particulate Filters (DPF) or Gasoline Particulate Filters (GPF) Suitable for aftertreatment systems in Passenger or Commercial Vehicles, diesel or gasoline. Filter Sensing Technologies (FST) Acquisition 11 RF Sensing – DPF/GPF Benefits Highly accurate direct measurement of both soot and ash in DPF/GPF Optimize DPF/GPF to improve efficiency and reduce ash maintenance Reduce fuel consumption by optimizing particulate filter regeneration Enable aftertreatment system cost reduction Potential to integrate on-board diagnostics function while providing significant value add Extended filter component life and reduce warranty claims Acquisition Rationale Disruptive sensing technology with potential to become a sensing platform Entry point into aftertreatment applications in Transportation applications Potential applications outside transportation Leverages CTS core capabilities

$305 $409 $404 $382 2012 2013 2014 2015 2016E Sales $0.64 $0.82 $0.97 $0.93 2012 2013 2014 2015 2016E Adjusted Earnings Per Share $400 $390 $1.05 $0.95 +2% to 13% 12 Note 1: Sales are from continuing operations. Adjusted EPS is as reported. +2% to 5% Note 2: 2016E represents guidance provided on February 8, 2016. Annual Financial Performance Trend ($ Millions except Adjusted Earnings Per Share)

New Business Awards 13 $299 2Q-4Q $484 $560 2012 2013 2014 2015 Not Reported 1Q Not Reported ($ Millions) 16% Growth

Improved Cost Structure Manufacturing locations Reduced from 15 to 11 Utilization of best cost manufacturing locations up from ~50% in 2013 to >80% by 2017 – ~70% at the end of 2015 Shift SG&A spend – Increase Sales & Marketing, Optimize G&A Improve presence in Europe and Asia Increase customer intimacy Lean corporate office G&A best cost optimization Continue to fund R&D for growth Closer to customer Best cost optimization 14

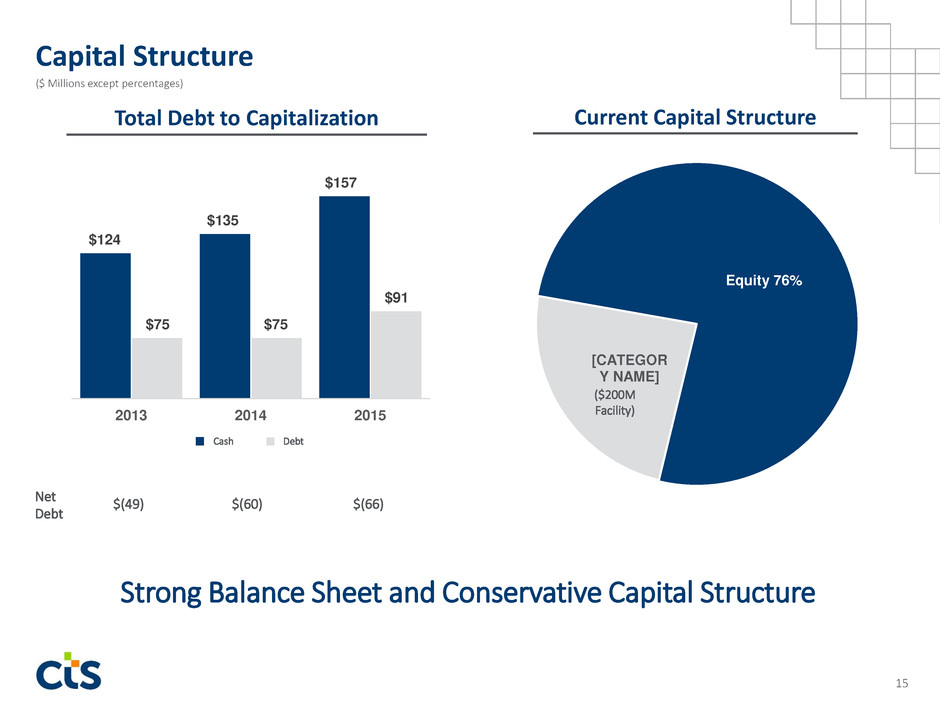

Equity 76% [CATEGOR Y NAME] $124 $135 $157 $75 $75 $91 2013 2014 2015 Strong Balance Sheet and Conservative Capital Structure Capital Structure 15 Total Debt to Capitalization Net Debt $(49) $(60) Current Capital Structure ($200M Facility) Debt Cash $(66) ($ Millions except percentages)

Capital Structure Leverage = 1.0x - 2.5x EBITDA Operating Cash Flow Return Capital to Shareholders ~4% of Sales 20-40% of Free Cash Flow 12-14% of Sales 60-80% of Free Cash Flow Target Capital Deployment – Disciplined Approach 16 Growth Acquisitions Investment Dividends & Buybacks

Appendix

Financial Summary Note 1: Adjusted data excludes restructuring and related charges, certain asset impairments, income tax and other adjustments. Note 2: All figures are from continuing operations except for Adjusted EPS (As Reported), Free Cash Flow, Total Debt / Capitalization and Controllable Working Capital - % of Sales. 18 ($ Millions, except percentages and adjusted EPS) Net Sales Adjusted Operating Earnings Adjusted Operating Earnings % of Sales Adjusted Net Earnings Adjusted Net Earnings % of Sales Adjusted Diluted EPS (As Reported) Free Cash Flow Total Debt / Capitalization Depreciation and Amortization Adjusted EBITDA Adjusted EBITDA % of Sales Controllable Working Capital - % of Sales Capex Capex - % of Sales 2015 $382.3 $47.8 12.5% $31.2 8.2% $0.93 $28.9 24.4% $16.3 $60.9 15.9% 10.4% $9.7 2.5% 2014 $404.0 $50.2 12.4% $33.2 8.2% $0.97 $19.5 20.6% $17.0 $66.5 16.5% 10.3% $12.9 3.2% 2013 $409.5 $33.6 8.2% $25.5 6.2% $0.82 $23.6 20.2% $17.3 $54.5 13.3% 11.7% $12.4 3.0% 2012 $304.5 $13.2 4.3% $12.1 4.0% $0.64 $27.6 36.4% $13.5 $28.7 9.4% 16.8% $8.0 2.6% 2011 $279.9 $15.7 5.6% $13.4 4.8% $0.67 $8.7 22.0% $12.1 $29.5 10.5% 17.4% $12.1 4.3%

19 Switches & Controls Resistor Networks EMI/RFI Filters RF Filters Piezoelectric Frequency Mechatronics Sensors Accelerator Pedals Bosch, Denso, Hella, KSR Alps, Bourns, Bosch, Continental, Delphi, Sensata, Stoneridge, TT (AB), Tyco Electronics (TE) Borg Warner, Continental, Delphi, Denso, Johnson Electric, Minebea, Mitsuba, Mitsubishi Electric, Valeo Epson, Mtron, NDK, Rakon, Si Labs, Tai Tien, TEW, Vectron Channel Technology Group, Exelis, Morgan, Murata, NGK/Sumitomo, TDK Partron, Shangshin Elecom, UBE API Technologies, AVX, Corry Micronics, Ferroperm, Spectrum Conrols, Stelco BI Tech, Bourns, KOA Alps, BI Tech, Bourns, C&K, Diptronics, ECE, Elma, Grayhill, Tocos CTS Competitors

CTS Core Values 20