Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - Trilogy Metals Inc. | exhibit23-1.htm |

| EX-23.3 - EXHIBIT 23.3 - Trilogy Metals Inc. | exhibit23-3.htm |

| EX-23.5 - EXHIBIT 23.5 - Trilogy Metals Inc. | exhibit23-5.htm |

| EX-23.2 - EXHIBIT 23.2 - Trilogy Metals Inc. | exhibit23-2.htm |

| EX-23.4 - EXHIBIT 23.4 - Trilogy Metals Inc. | exhibit23-4.htm |

| EX-23.6 - EXHIBIT 23.6 - Trilogy Metals Inc. | exhibit23-6.htm |

| EX-21.1 - EXHIBIT 21.1 - Trilogy Metals Inc. | exhibit21-1.htm |

| EX-32.2 - EXHIBIT 32.2 - Trilogy Metals Inc. | exhibit32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Trilogy Metals Inc. | exhibit32-1.htm |

| EX-31.1 - EXHIBIT 31.1 - Trilogy Metals Inc. | exhibit31-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Trilogy Metals Inc. | exhibit31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended November 30, 2015

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from to

Commission File Number: 1-35447

NOVACOPPER

INC.

(Exact Name of Registrant as Specified in

Its Charter)

| British Columbia | 98-1006991 |

| (State or Other Jurisdiction of | (I.R.S. Employer |

| Incorporation or Organization) | Identification No.) |

| Suite 1950, 777 Dunsmuir Street | |

| Vancouver, British Columbia | |

| Canada | V7Y 1K4 |

| (Address of Principal Executive Offices) | (Zip Code) |

(604) 638-8088

(Registrant’s Telephone Number,

Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered | |

| Common Shares, no par value | NYSE MKT |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [

] No [X]

Indicate by check mark if the registrant is not required to

file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [

] No [X]

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Yes [X] No [

]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files).

Yes [X] No [

]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer [ ] | Accelerated filer [ ] | Non-accelerated filer [ ] | Smaller reporting company [X] |

| (Do not check if a smaller reporting | |||

| company) |

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Exchange Act).

Yes [

] No [X]

As at May 31, 2015, the aggregate market value of the registrant’s Common Shares held by non-affiliates was approximately $21.3 million. As of February 5, 2016, the registrant had 104,979,820 Common Shares, no par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain portions of the registrant's definitive proxy statement to be filed with the Securities and Exchange Commission pursuant to Regulation 14A not later than March 29, 2016, in connection with the registrant’s 2016 annual meeting of stockholders, are incorporated herein by reference into Part III of this Annual Report on Form 10-K.

2

NOVACOPPER INC.

TABLE OF CONTENTS

1

Unless the context otherwise requires, the words “we,” “us,” “our,” the “Company” and “NovaCopper” refer to NovaCopper Inc., a British Columbia corporation, either alone or together with its subsidiaries as the context requires, as of November 30, 2015.

CURRENCY

All dollar amounts are in United States currency unless otherwise stated. References to C$ or CDN$ refer to Canadian currency, $ or US$ to United States currency, and references to “Colombian pesos” or “COP” are to the currency of the Republic of Colombia. All dollar amounts are expressed in thousands of dollars, except references to per share amounts and unless otherwise stated.

FORWARD-LOOKING STATEMENTS

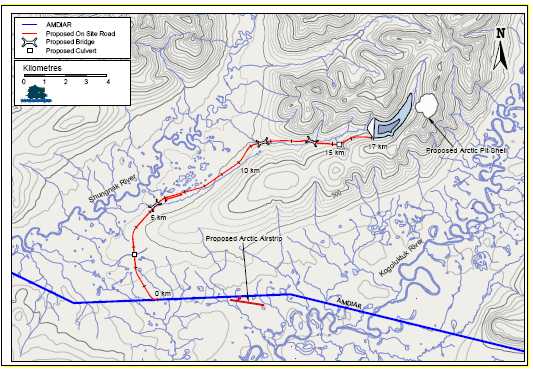

The information discussed in this annual report on Form 10-K includes “forward-looking information” and “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”), and applicable Canadian securities laws. These forward-looking statements may include statements regarding perceived merit of properties, exploration results and budgets, mineral reserves and resource estimates, work programs, capital expenditures, operating costs, cash flow estimates, production estimates and similar statements relating to the economic viability of a project, timelines, strategic plans, statements relating anticipated activity with respect to the Ambler Mining District Industrial Access Road (“AMDIAR”), the Company’s plans and expectations relating to the Upper Kobuk Mineral Projects and Titiribi Project, completion of transactions, market prices for precious and base metals, or other statements that are not statements of fact. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management.

Statements concerning mineral resource estimates may also be deemed to constitute “forward-looking statements” to the extent that they involve estimates of the mineralization that will be encountered if the property is developed. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, identified by words or phrases such as “expects”, “is expected”, “anticipates”, “believes”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategy”, “goals”, “objectives”, “potential”, “possible” or variations thereof or stating that certain actions, events, conditions or results “may”, “could”, “would”, “should”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation:

| • | risks related to inability to define proven and probable reserves; | |

| • | risks related to our ability to finance the development of our mineral properties through external financing, strategic alliances, the sale of property interests or otherwise; | |

| • | none of the Company’s mineral properties are in production or are under development; | |

| • | uncertainties relating to the assumptions underlying our resource estimates, such as metal pricing, metallurgy, mineability, marketability and operating and capital costs; | |

| • | uncertainty as to whether there will ever be production at the Company’s mineral exploration and development properties; | |

| • | uncertainty as to estimates of capital costs, operating costs, production and economic returns; | |

| • | risks related to our ability to commence production and generate material revenues or obtain adequate financing for our planned exploration and development activities; | |

| • | risks related to lack of infrastructure including but not limited to the risk whether or not the AMDIAR will receive the requisite permits and, if it does, whether the Alaska Industrial Development and Export Authority (“AIDEA”) will build the AMDIAR; |

2

| • | risks related to future sales or issuances of equity securities decreasing the value of existing NovaCopper common shares (“Common Shares”), diluting voting power and reducing future earnings per share; | |

| • | risks related to market events and general economic conditions; | |

| • | uncertainty related to inferred mineral resources; | |

| • | uncertainty related to the economic projections contained herein derived from the Preliminary Economic Assessment titled “Preliminary Economic Assessment Report on the Arctic Project, Ambler Mining District, Northwest Alaska” dated effective September 12, 2013 (the “PEA”); | |

| • | risks related to inclement weather which may delay or hinder exploration activities at its mineral properties; | |

| • | risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of our | |

| • | mining and development risks, including risks related to infrastructure, accidents, equipment breakdowns, labor disputes or other unanticipated difficulties with or interruptions in development, construction or production; | |

| • | the risk that permits and governmental approvals necessary to develop and operate mines at the Company’s mineral properties will not be available on a timely basis or at all; | |

| • | commodity price fluctuations; | |

| • | risks related to governmental regulation and permits, including environmental regulation, including the risk that more stringent requirements or standards may be adopted or applied due to circumstances unrelated to the Company and outside of its control; | |

| • | risks related to the need for reclamation activities on our properties and uncertainty of cost estimates related thereto; | |

| • | uncertainty related to title to our mineral properties; | |

| • | our history of losses and expectation of future losses; | |

| • | risks and uncertainties relating to the acquisition of the Titiribi Project, such as the Company's ability to successfully explore and develop the project and realize the anticipated benefits of the acquisition; | |

| • | risks arising from the Company’s acquisition of Sunward including political risk, international operations, changes in laws or policies, foreign taxation, foreign investment regimes, exchange control, corruption risk, labour matters and employee relations, seizure or expropriation of assets, or delays or the inability to obtain necessary governmental permits, licenses and regulatory approvals in foreign jurisdictions; including guerilla and other criminal activity; | |

| • | risks and uncertainties relating to the integration of the acquisition, including the Company’s policies, procedures and controls; | |

| • | risks related to increases in demand for equipment, skilled labor and services needed for exploration and development of mineral properties, and related cost increases; | |

| • | our need to attract and retain qualified management and technical personnel; | |

| • | risks related to conflicts of interests of some of our directors; | |

| • | risks related to potential future litigation; |

3

| • | risks related to the voting power of our major shareholders and the impact that a sale by such shareholders may have on our share price; | |

| • | risks related to global climate change; | |

| • | risks related to adverse publicity from non-governmental organizations; | |

| • | uncertainty as to the volatility in the price of the Company’s shares; | |

| • | the Company’s expectation of not paying cash dividends; | |

| • | adverse federal income tax consequences for U.S. shareholders should the Company be a passive foreign investment company; | |

| • | uncertainty as to our ability to maintain the adequacy of internal control over financial reporting as per the requirements of Section 404 of the Sarbanes-Oxley Act (“SOX”); and | |

| • | increased regulatory compliance costs, associated with rules and regulations promulgated by the SEC, Canadian Securities Administrators, the NYSE MKT, the TSX, and the Financial Accounting Standards Boards, and more specifically, our efforts to comply with the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank”). |

This list is not exhaustive of the factors that may affect any of our forward-looking statements. Forward-looking statements are statements about the future and are inherently uncertain, and our actual achievements or other future events or conditions may differ materially from those reflected in the forward-looking statements due to a variety of risks, uncertainties and other factors, including, without limitation, those referred to in this report under the heading “Risk Factors” and elsewhere.

Our forward-looking statements are based on the beliefs, expectations and opinions of management on the date the statements are made, and we do not assume any obligation to update forward-looking statements if circumstances or management’s beliefs, expectations or opinions should change, except as required by law. For the reasons set forth above, investors should not place undue reliance on forward-looking statements.

CAUTIONARY NOTE TO UNITED STATES INVESTORS

Unless otherwise indicated, all resource estimates, and any future reserve estimates, included or incorporated by reference in this annual report on Form 10-K have been, and will be, prepared in accordance with Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards for Mineral Resources and Mineral Reserves (“CIM Definition Standards”). NI 43-101 is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. NI 43-101 permits the disclosure of an historical estimate made prior to the adoption of NI 43-101 that does not comply with NI 43-101 to be disclosed using the historical terminology if the disclosure: (a) identifies the source and date of the historical estimate; (b) comments on the relevance and reliability of the historical estimate; (c) to the extent known, provides the key assumptions, parameters and methods used to prepare the historical estimate; (d) states whether the historical estimate uses categories other than those prescribed by NI 43-101; and (e) includes any more recent estimates or data available.

4

Canadian standards, including NI 43-101, differ significantly from the requirements of the SEC, and reserve and resource information contained or incorporated by reference into this annual report on Form 10-K may not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, the term “resource” does not equate to the term “reserves”. Under SEC Industry Guide 7, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. SEC Industry Guide 7 does not define and the SEC’s disclosure standards normally do not permit the inclusion of information concerning “measured mineral resources”, “indicated mineral resources” or “inferred mineral resources” or other descriptions of the amount of mineralization in mineral deposits that do not constitute “reserves” by U.S. standards in documents filed with the SEC. U.S. investors should also understand that “inferred mineral resources” have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “inferred mineral resource” will ever be upgraded to a higher category. Under Canadian rules, estimated “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies except in rare cases. Investors are cautioned not to assume that all or any part of an “inferred mineral resource” exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in-place tonnage and grade without reference to unit measures. The requirements of NI 43-101 for identification of “reserves” are also not the same as those of the SEC, and any reserves reported by us in the future in compliance with NI 43-101 may not qualify as “reserves” under SEC standards. Accordingly, information concerning mineral deposits set forth herein may not be comparable to information made public by companies that report in accordance with United States standards.

5

CAUTIONARY NOTE TO ALL INVESTORS CONCERNING ECONOMIC

ASSESSMENTS

THAT INCLUDE INFERRED RESOURCES

Mineral resources that are not mineral reserves have no demonstrated economic viability. The preliminary assessment on the Arctic Project is preliminary in nature and includes “inferred mineral resources” that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the feasibility studies or preliminary assessments at the Arctic Project will ever be realized.

6

GLOSSARY OF TECHNICAL

We estimate and report our resources and we will estimate and report our reserves according to the definitions set forth in NI 43-101. We will modify and reconcile the reserves as appropriate to conform to SEC Industry Guide 7 for reporting in the U.S. The definitions for each reporting standard are presented below with supplementary explanation and descriptions of the parallels and differences.

The following technical terms defined in this section are used throughout this Form 10-K:

“AA” is atomic absorption.

“Ag” is the chemical symbol for silver.

“AMT” is audiomagnetotelluric.

“ARD” is acid rock drainage.

“Au” is the chemical symbol for gold.

“Ba” is barium.

“CIM” is the Canadian Institute of Mining, Metallurgy and Petroleum.

“Co” is the chemical symbol for cobalt.

“CO2” is carbon dioxide.

“CS-AMT” is controlled source audio-frequency magnetotelluric.

“Cu” is the chemical symbol for copper.

“DIGHEM” is a proprietary geophysical survey system.

“dilution” is waste, which is unavoidably mined with ore.

“dip” is the angle of inclination of a geological feature/rock from the horizontal.

“EM” is electromagnetic.

“fault” is the surface of a fracture along which movement has occurred.

“Fe” is the surface of a fracture along which movement has occurred.

“gangue” are non-valuable components of the ore.

“grade” is the measure of concentration of gold within mineralized rock.

“g” is a gram.

“g/t” is grams per metric tonne.

“ha” is a Hectare.

“ICP” is induced couple plasma.

7

“ICP-AES” is inductively coupled plasma atomic emission spectroscopy.

“IRR” is internal rate of return.

“km” is a kilometer.

“m” is a meter.

“masl” is meters above sea level.

“Mg” is the chemical symbol for magnesium.

“micron” or “µm” is 0.000001 meters.

“mm” is a millimeter.

“MS” is massive sulfide.

“MW” is million watts.

“NPV” is net present value

“ounce” or “oz” is a troy ounce.

“Pb” is the chemical symbol for lead.

“ppm” is parts per million.

“QA/QC” is quality assurance and quality control.

“SG” is specific gravity.

“SRM” is standard reference material.

“strike” is the duration of line formed by the intersection of strata surfaces within the horizontal plane, always perpendicular to the dip direction.

“tailings” is the finely ground waste rock from which valuable minerals or metals have been extracted.

“tonne” is a metric tonne: 1,000 kilograms or 2,204.6 pounds.

“t/d” is tonnes per day.

“XRF” is x-ray fluorescence spectroscopy.

“Zn” is the chemical symbol for zinc.

8

CIM Definition Standards, adopted by CIM Council on November 27, 2010(1):

“indicated mineral resource” means that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed.

“inferred mineral resource” means that part of a mineral resource for which quantity and grade or quality can be estimated on the basis of geological evidence, limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes.

“measured mineral resource” means that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics are so well-established that they can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for both geological and grade continuity to be reasonably assured.

“mineral reserve” means the economically mineable part of a measured or indicated mineral resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A mineral reserve includes diluting materials and allowances for losses that may occur when the material is mined.

“mineral resource” means a concentration or occurrence of natural solid inorganic material, or natural solid fossilized organic material in or on the earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge.

“probable mineral reserve” means the economically mineable part of an indicated and, in some circumstances, a measured mineral resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified.

“proven mineral reserve” means the economically mineable part of a measured mineral resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified.

SEC Industry Guide 7 Definitions:

“exploration stage” deposit is one which is not in either the development or production stage.

“development stage” project is one which is undergoing preparation of an established commercially mineable deposit for its extraction but which is not yet in production. This stage occurs after completion of a feasibility study.

“mineralized material” refers to material that is not included in the reserve as it does not meet all of the criteria for adequate demonstration for economic or legal extraction.

|

|

(1) |

NI 43-101 refers to CIM Definition Standards with respect to the definitions of “indicated mineral resource”, “inferred mineral resource”, “measured mineral resource”, “mineral reserve”, “mineral resource”, “probable mineral reserve” and “proven mineral reserve.” The CIM Definition Standards, adopted by CIM council on November 27, 2010, were the relevant standards in effect at the time of the preparation of the technical reports referenced herein. |

9

“probable reserve” refers to reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation.

“production stage” project is actively engaged in the process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product.

“proven reserve” refers to reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established.

“reserve” refers to that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Reserves must be supported by a feasibility study done to bankable standards that demonstrates the economic extraction. (“Bankable standards” implies that the confidence attached to the costs and achievements developed in the study is sufficient for the project to be eligible for external debt financing.) A reserve includes adjustments to the in-situ tonnes and grade to include diluting materials and allowances for losses that might occur when the material is mined.

10

PART I

| Item 1. | BUSINESS |

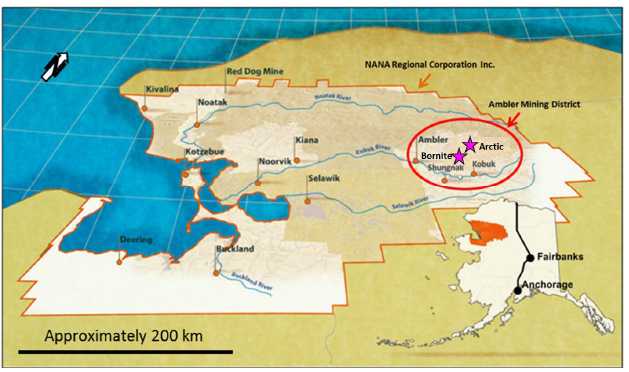

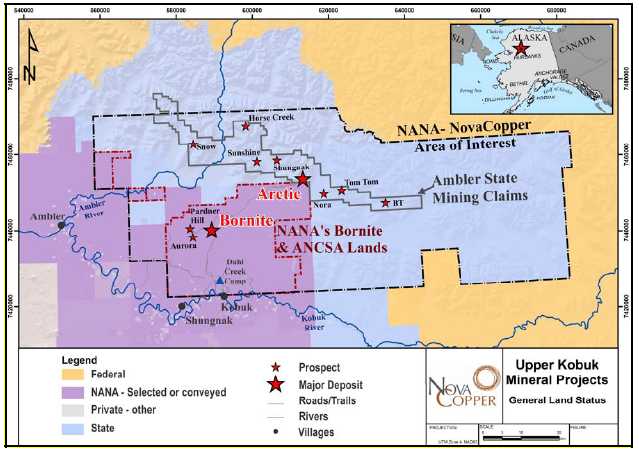

Our principal business is the exploration and development of our Upper Kobuk Mineral Projects (“Upper Kobuk Mineral Projects” or “UKMP Projects”) located in the Ambler mining district in Northwest Alaska, United States, comprising the (i) Arctic Project, which contains a high-grade polymetallic volcanogenic massive sulfide (“VMS”) deposit (“Arctic Project”); and (ii) Bornite Project, which contains a carbonate-hosted copper deposit (“Bornite Project”). Our goals include expanding mineral resources and advancing our projects through technical, engineering and feasibility studies so that production decisions can be made on those projects. We also own a 100% interest in the Titiribi gold-copper exploration project in Colombia.

Name, Address and Incorporation

NovaCopper Inc. was incorporated on April 27, 2011 under the Business Corporations Act (British Columbia) (“BCBCA”). Our registered office is located at Suite 2600, Three Bentall Centre, 595 Burrard Street, Vancouver, British Columbia, Canada, and our executive office is located at Suite 1950, 777 Dunsmuir Street, Vancouver, British Columbia, Canada.

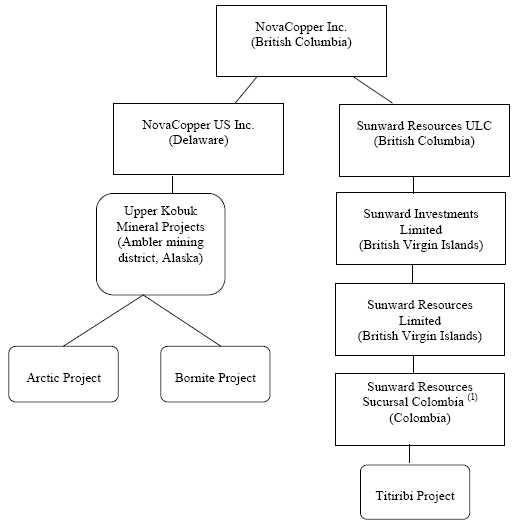

Corporate Organization Chart

The following chart depicts our corporate structure together with the jurisdiction of incorporation of our subsidiary. All ownership is 100%.

| (1) |

A branch of Sunward Resources Limited registered to do business in Colombia |

11

Business Cycle

Our business, at its current exploration phase, is cyclical. Exploration activities are conducted primarily during snow-free months in Alaska. The optimum field season at the Upper Kobuk Mineral Projects is from late May to late September. The length of the snow-free season at the Upper Kobuk Mineral Projects varies from about May through November at lower elevations and from July through September at higher elevations.

NovaCopper’s Strategy

Our business strategy is focused on creating value for stakeholders through our ownership and advancement of the Arctic Project and exploration of the Bornite Project and through the pursuit of similarly attractive mining projects. We plan to:

|

• |

advance the Arctic Project towards development with key activities including increased definition of the mineral resources, technical studies to support completion of a pre-feasibility or feasibility study, and the advancement of baseline environmental studies; | |

|

|

|

|

|

• |

advance exploration in the Ambler mining district and, in particular, at the Bornite Project, pursuant to the NANA Agreement (as more particularly described under “History of NovaCopper – Agreement with NANA Regional Corporation”) through resource development and initial technical studies; and | |

|

|

|

|

|

|

• |

pursue project level or corporate transactions that are value accretive. |

The Arctic Project PEA represents an early stage study and highlights certain opportunities for us to further expand upon. Prior to commencing production, further studies that demonstrate the economic viability of the Arctic Project must be completed including pre-feasibility or feasibility studies, all necessary permits must be obtained, a production decision must be made by our board of directors (the “Board”), financing for construction and development must be arranged and construction must be completed. In addition, we will be required to address certain infrastructure challenges, including a road for access, transportation of supplies and mineral concentrate, and obtain additional rights, including surface use rights and access rights. See “Item 1A. Risk Factors.”

Significant Developments in 2015

|

• |

On June 19, 2015, we announced the completion of a Plan of Arrangement (the “Arrangement”) with Sunward Resources Ltd. (“Sunward”), a publicly listed company on the TSX, resulting in the acquisition of Sunward by NovaCopper. Under the terms of the Arrangement, Sunward shareholders received 0.3 of a NovaCopper Common Share for each Sunward Common Share held resulting in the Company issuing approximately 43.1 million Common Shares to Sunward shareholders and Sunward directors holding Sunward deferred share units. Each Sunward stock option outstanding was exchanged for a fully-vested option to purchase NovaCopper Common Shares (a “Sunward Arrangement Option”) for a period of 90 days, with the number of shares issuable and exercise price adjusted based on an exchange ratio of 0.3. A total of 2,505,000 Sunward Arrangement Options were issued to holders of Sunward stock options at closing. | |

|

|

|

|

|

• |

On October 21, 2015, we announced the drill results from our 2015 summer field program for the Arctic Project. In total, fourteen diamond drill holes were completed amounting to a total of 3,056 meters drilled. In addition to the twelve resource estimation drill holes, two drill holes, representing 631 meters drilled, were completed to support preliminary rock mechanics and geotechnical studies and a hydrogeological assessment of the proposed Arctic open-pit. All fourteen drill holes encountered mineralized intervals, defined as a minimum of 1.0 meter copper interval with average grade >0.7% copper. | |

|

|

|

|

|

• |

On October 22, 2015, we announced that Alaska’s Governor has authorized AIDEA to begin the environmental impact statement (“EIS”) process on AMDIAR. |

Significant Developments in 2014

| • | On March 18, 2014, NovaCopper reported an updated NI 43-101 resource estimate for the Bornite Project in a report entitled “NI 43-101 Technical Report on the Bornite Project, Northwest Alaska, USA”, dated effective April 1, 2014, which updated the resource estimate previously released on February 5, 2013. At the base case 0.5% copper cut-off grade, the Bornite Project is estimated to contain in-pit Indicated Resources of 14.1 million tonnes of 1.08% Cu or 334 million pounds of contained copper. At the base case 0.5% copper cut-off grade, the Bornite Project is estimated to contain in-pit Inferred Resources of 109.6 million tonnes of 0.94% Cu or 2,259 million pounds of contained copper. Resources are stated as potentially being economically viable in an open-pit mining scenario based on a projected metal price of $3.00 per pound copper, total site operating costs of $18.00 per tonne, 87% metallurgical recoveries and an average pit slope of 43 degrees. At the base case 1.5% copper cut-off grade, the Bornite Project is estimated to contain below-pit Inferred Resources of 55.6 million tonnes of 2.81% Cu or 3,437 million pounds of contained copper. Inferred resources are stated as potentially being economically viable in an underground mining scenario based on a projected metal price of $3.00 per pound copper, total site operating costs of $66.00 per tonne and an average metallurgical recovery of 87%. Inferred resources have a great amount of uncertainty as to their existence and whether they can be mined legally or economically. It cannot be assumed that all or any part of the Inferred resources will ever be upgraded to a higher category. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. See “Cautionary Note to United States Investors.” |

12

|

• |

On July 7, 2014, we announced the completion of a non-brokered private placement of approximately $7.5 million in units to existing shareholders. Each unit was priced at $1.15 per unit and consisted of one common share and one common share purchase warrant. Each common share purchase warrant entitles the holders to purchase one common share at a price of $1.60 per share for a period of five years from the closing date. Net proceeds from the private placement were $7.2 million. The gross proceeds raised were allocated for the 12 months following closing to fund $2.7 million on program expenditures, $4.0 million on general and administrative expenses including costs associated with the offering, and $0.8 million on one-time expenses incurred in reducing annual general and administrative expenses. | |

|

|

|

|

|

• |

On August 15, 2014, we announced the departure of Senior VP Exploration, Joseph Piekenbrock, VP Human Resources and Workforce Development, Sacha Iley, and VP Corporate Communications, Patrick Donnelly, from our senior management team to reduce our general and administrative expenses. | |

|

|

|

|

|

• |

On October 28, 2014, we announced the results of our 2014 re-logging and re-sampling program at the Bornite Project. During the 2014 field season, we re-logged the geology and re-sampled approximately 13,000 meters in 37 historical drill holes, originally drilled by Kennecott on the Bornite Project between 1959 and 1976, and submitted the samples for a complete 42 element Induced Coupled Plasma analysis. Of the 37 historic drill holes sampled, 5 holes had intervals of copper grading more than 0.5% copper, and 21 holes contained mineralization grading more than 0.2% copper. |

Significant Developments in 2013

|

• |

On March 28, 2012, the securityholders of NovaGold Resources Inc. (“NovaGold”) voted in favor of the special resolution approving the spin-out of NovaCopper Inc. and its wholly-owned subsidiary NovaCopper US Inc. (“NovaCopper US”) (“Plan of Arrangement” or “Arrangement”). Under the Plan of Arrangement, each holder of NovaGold warrants on record as of April 30, 2012 received the right to receive one NovaCopper Share for every six common shares of NovaGold represented by the warrant. On January 2, 2013, we announced that our largest shareholder, Electrum Strategic Resources L.P. (“Electrum”), added an additional 5.2 million NovaCopper Shares to its holdings through the exercise of NovaGold warrants. We received no proceeds from the exercise of the NovaGold warrants. Between January 10, 2013 to January 18, 2013, we issued an additional 0.9 million NovaCopper Shares to various holders upon their exercise of NovaGold warrants. | |

|

|

|

|

|

• |

On February 5, 2013, NovaCopper released an updated NI 43-101 resource estimate for the Bornite Project in a report entitled “NI 43-101 Technical Report Resource Estimation – South Reef and Ruby Creek zones, Bornite deposit, Upper Kobuk Mineral Projects, Northwest Alaska”, further to the resource estimate previously released on July 18, 2012 with respect to the Ruby Creek zone. At the base case 1.0% copper cut-off grade, the South Reef zone at the Bornite Project, which lies roughly 400 to 600 meters southeast of the Ruby Creek zone, is estimated to contain Inferred Resources of 43.1 million tonnes of 2.54% Cu or 2,409 million pounds of contained copper. Inferred resources are stated as potentially being economically viable in an underground mining scenario based on a projected metal price of $2.75 per pound copper and total site operating costs of $60.00 per tonne. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. See “Cautionary Note to United States Investors.” |

13

|

• |

On April 30, 2013, we announced the signing of a Memorandum of Understanding (“MOU”) with AIDEA to investigate the viability of permitting and constructing an industrial access road to the Ambler mining district and the UKMP Projects. The MOU formalizes the roles of each party as they relate to advancing the AMDIAR, which AIDEA is expected to commence permitting in 2014. The MOU also allows AIDEA to investigate various ways to fund the construction and maintenance of the AMDIAR. Although no specific terms have yet been discussed on payment for usage of the AMDIAR, the arrangement that AIDEA entered into with Cominco Ltd. (now Teck Resources Ltd.) in 1986 for construction of the Red Dog Road and Port Facility may serve as a general template for a final financing agreement. This MOU is non-exclusive, meaning that other mining and exploration companies or other industrial users may also work in cooperation with AIDEA to support development of the AMDIAR by signing their own MOUs. | |

|

• |

On July 30, 2013, we reported a new Preliminary Economic Assessment (“PEA”) prepared under NI 43- 101 for the Arctic project in a report entitled “Preliminary Economic Assessment Report on the Arctic Project, Ambler Mining District, Northwest Alaska.” The PEA outlines an open-pit scenario of a 12-year mine life supporting a 10,000 tonne-per-day conventional grinding mill-and-flotation circuit at the Arctic deposit with a pre-tax net present value (“NPV”) of $927.7 million or 22.8% internal rate of return (“IRR”) and after-tax NPV of $537.2 million or 17.9% IRR at an 8% discount rate. Initial capital expenditures are estimated at $717.7 million with sustaining capital expenditures of $164.4 million. The base case scenario assumes long-term metal prices of $2.90/lb for copper, $0.85/lb for zinc, $0.90/lb for lead, $22.70/oz for silver and $1,300/oz for gold. The total average operating cost for the proposed mine is estimated at $63.93 per tonne milled. The PEA is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the PEA will be realized. See “Cautionary Note to United States Investors.” | |

|

• |

On October 9, 2013, we announced the completion of our 2013 exploration field season program at our UKMP Projects which accomplished approximately 8,142 meters or 109% of planned drilling of which 4,684 meters was drilled at the Ruby Creek zone and 3,458 meters at the South Reef zone of the Bornite Project. Results from the drilling campaign were released throughout the fall of 2013. The 2013 exploration program was focused on expansion and further characterization of the resources identified in the 2013 Bornite resource technical report released in February 2013. | |

|

• |

On December 18, 2013, we announced results from our re-logging and re-sampling program of 33 historical drill holes at the Bornite Project. These holes were previously drilled and only selectively sampled by Kennecott within the Ruby Creek zone of the Bornite deposit. Of the 33 historic drill holes sampled, 26 holes had intervals of copper greater than 0.5% copper, and 29 holes contained mineralization greater than 0.2% copper. The objectives of the re-logging/re-sampling program were twofold: 1) to confirm and conduct a Quality Assurance/Quality Control (“QA/QC”) program on the historical sample results; and 2) to identify additional lower-grade (0.2-0.5% copper) shallow material, which was not previously sampled. The re-logging and re-sampling program has confirmed previously known high-grade mineralization. It is also expected to add additional lower-grade mineralization to the Company’s mineral inventory. |

History of NovaCopper

Spin-Out

We were formerly a wholly-owned subsidiary of NovaGold. At a special meeting of securityholders of NovaGold held on March 28, 2012, the securityholders voted in favour of a special resolution approving the distribution of Common Shares of NovaCopper to the shareholders of NovaGold as a return of capital through a statutory Plan of Arrangement under the Companies Act (Nova Scotia).

On April 30, 2012, all of the outstanding NovaCopper Common Shares were distributed to shareholders of NovaGold such that each NovaGold shareholder of record at the close of business on April 27, 2012 received one NovaCopper Common Share for every six common shares in the capital of NovaGold held at that time. The NovaCopper Common Shares were listed and posted for trading on the TSX and on the NYSE-MKT under the symbol NCQ on April 25, 2012.

14

Agreement with NANA Regional Corporation

On October 19, 2011, NANA Regional Corporation, Inc. (“NANA”), an Alaska Native Corporation headquartered in Kotzebue, Alaska, and NovaCopper US entered an Exploration Agreement and Option Agreement, as amended (the “NANA Agreement”) for the cooperative development of NANA’s respective resource interests in the Ambler mining district of Northwest Alaska. The NANA Agreement consolidates our and NANA’s land holdings into an approximately 142,831-hectare land package and provides a framework for the exploration and any future development of this high-grade and prospective poly-metallic belt.

The NANA Agreement grants NovaCopper US the nonexclusive right to enter on, and the exclusive right to explore, the Bornite lands and the Alaska Native Claims Settlement Act (“ANCSA”) lands (each as defined in the NANA Agreement) and in connection therewith, to construct and utilize temporary access roads, camps, airstrips and other incidental works. In consideration for this right, NovaCopper US paid to NANA $4 million in cash. NovaCopper US will also be required to make payments to NANA for scholarship purposes in accordance with the terms of the NANA Agreement. NovaCopper US has further agreed to use reasonable commercial efforts to train and employ NANA shareholders to perform work for NovaCopper US in connection with its operations on the Bornite lands, ANCSA lands and Ambler lands (as defined in the NANA Agreement) (collectively, the “Lands”). Under the NANA Agreement, NANA also has the right to appoint a board member to NovaCopper’s Board within a five year period following our public listing on a stock exchange.

The NANA Agreement has a term of 20 years, with an option in favour of NovaCopper US to extend the term for an additional 10 years. The NANA Agreement may be terminated by mutual agreement of the parties or by NANA if NovaCopper US does not meet certain expenditure requirements on the Bornite lands and ANCSA lands.

If, following receipt of a feasibility study and the release for public comment of a related draft environmental impact statement, we decide to proceed with construction of a mine on the Lands, NovaCopper US will notify NANA in writing and NANA will have 120 days to elect to either (a) exercise a non-transferrable back-in-right to acquire an undivided ownership interest between 16% and 25% (as specified by NANA) of that specific project; or (b) not exercise its back-in-right, and instead receive a net proceeds royalty equal to 15% of the net proceeds realized by NovaCopper US from such project (following the recoupment by NovaCopper of all costs incurred, including operating, capital and carrying costs). The cost to exercise such back-in-right is equal to the percentage interest in the project multiplied by the difference between (i) all costs incurred by NovaCopper US or its affiliates on the project, including historical costs incurred prior to the date of the NANA Agreement together with interest on the costs; and (ii) $40 million (subject to exceptions). This amount will be payable by NANA to NovaCopper US in cash at the time the parties enter into a joint venture agreement and in no event will the amount be less than zero.

In the event that NANA elects to exercise its back-in-right, the parties will as soon as reasonably practicable form a joint venture, with NANA’s interest being between 16% to 25% and NovaCopper US owning the balance of the interest in the joint venture. Upon formation of the joint venture, the joint venture will assume all of the obligations of NovaCopper US and be entitled to all the benefits of NovaCopper US under the NANA Agreement in connection with the mine to be developed and the related Lands. A party’s failure to pay its proportionate share of costs in connection with the joint venture will result in dilution of its interest. Each party will have a right of first refusal over any proposed transfer of the other party’s interest in the joint venture other than to an affiliate or for the purposes of granting security. A transfer by either party of any net proceeds royalty interest in a project other than for financing purposes will also be subject to a first right of refusal. A transfer of NANA’s net smelter return on the Lands is subject to a first right of refusal by NovaCopper.

In connection with possible development of a mine on the Bornite lands or ANCSA lands, NovaCopper US and NANA will execute a mining lease to allow NovaCopper US or the joint venture to construct and operate a mine on the Bornite lands or ANCSA lands. These leases will provide NANA a 2% net smelter royalty as to production from the Bornite lands and a 2.5% net smelter royalty as to production from the ANCSA lands. If NovaCopper US decides to proceed with construction of a mine on the Ambler lands, NANA will enter into a surface use agreement with NovaCopper US which will afford NovaCopper US access to the Ambler lands along routes approved by NANA on the Bornite lands or ANCSA lands. In consideration for the grant of such surface use rights, NovaCopper US will grant NANA a 1% net smelter royalty on production and an annual payment of $755 per acre (as adjusted for inflation each year beginning with the second anniversary of the effective date of the NANA Agreement and for each of the first 400 acres (and $100 for each additional acre) of the lands owned by NANA and used for access which are disturbed and not reclaimed.

15

We have formed an oversight committee with NANA, which consists of four representatives from each of NovaCopper and NANA (the “Oversight Committee”). The Oversight Committee is responsible for certain planning and oversight matters carried out by us under the NANA Agreement. The planning and oversight matters that are the subject of the NANA Agreement will be determined by majority vote. The representatives of each of NovaCopper and NANA attending a meeting will have one vote in the aggregate and in the event of a tie, the NovaCopper representatives jointly shall have a deciding vote on all matters other than Subsistence Matters, as that term is defined in the NANA Agreement. There shall be no deciding vote on Subsistence Matters and we may not proceed with such matters unless approved by majority vote of the Oversight Committee or with the consent of NANA, such consent not to be unreasonably withheld or delayed.

Principal Markets

We do not currently have a principal market. Our principal objective is to become a producer of copper.

Specialized Skill and Knowledge

All aspects of our business require specialized skills and knowledge. Such skills and knowledge include the areas of geology, mining and accounting. See “Executive Officers of NovaCopper” for details as to the specific skills and knowledge of our directors and management.

Environmental Protection

Mining is an extractive industry that impacts the environment. Our goal is to evaluate ways to minimize that impact and to develop safe, responsible and profitable operations by developing natural resources for the benefit of our employees, shareholders and communities and maintain high standards for environmental performance at our Upper Kobuk Mineral Projects and Titiribi Project. We strive to meet or exceed environmental standards at our Upper Kobuk Mineral Projects and Titiribi Project. One way we do this is through collaborations with local communities in Colombia and Alaska, including Native Alaskan groups. Our environmental performance will be overseen at the Board level and environmental performance is the responsibility of the project manager.

|

• |

All new activities and operations will be managed for compliance with applicable laws and regulations. In the absence of regulation, best management practices will be applied to manage environmental risk. | |

|

|

|

|

|

• |

We will strive to limit releases to the air, land or water and appropriately treat and dispose of waste. |

See “Arctic Project – Environmental Considerations.”

Employees

As of November 30, 2015, we had 14 full-time employees, 7 of whom were employed at our executive office in Vancouver, BC, and 7 of whom were employed at our Colombia branch. The number of individuals employed by us fluctuates throughout the year depending on the season; however, during 2015, we had, on average, 18 employees working for us. We have entered into executive employment agreements with two individuals, the CEO and CFO.

We believe our success is dependent on the performance of our management and key employees, many of whom have specialized skills in exploration in Alaska and Colombia and the base metals industry. Substantially all of our exploration site employees have been active either in the Ambler mining district or Titiribi for the last five years and are knowledgeable as to the geology, metallurgy and infrastructure related to mining development.

Segment Information

The Company’s reportable segments are based on geographic region for the Company’s operations. Segment information relating to our assets is provided under the section heading “Item 8. Financial Statements and Supplementary Data” below.

16

Competitive Conditions

The mineral exploration and development industry is competitive in all phases of exploration, development and production. There is a high degree of competition faced by us in Alaska and elsewhere for skilled management employees, suitable contractors for drilling operations, technical and engineering resources, and necessary exploration and mining equipment, and many of these competitor companies have greater financial resources, operational expertise, and/or more advanced properties than us. Additionally, our operations are in a remote location where skilled resources and support services are limited. We have in place experienced management personnel and continue to evaluate the required expertise and skills to carry out our operations. As a result of this competition, we may be unable to achieve our exploration and development in the future on terms we consider acceptable or at all. See “Item 1A. Risk Factors.”

Available Information

We make available, free of charge, on or through our website, at www.novacopper.com our annual report on Form 10-K which includes our audited financial statements, our quarterly reports on Form 10-Q and our current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act. You may read and copy any materials filed with the SEC free of charge at the SEC’s Public Reference Room, 100 F Street, N.E., Washington, D.C. 20549 and you may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains a website that contains reports, proxy and information statements, and other information at http://www.sec.gov. Our website and the information contained therein or connected thereto are not intended to be, and are not incorporated into this annual report on Form 10-K.

| Item 1A. | RISK FACTORS |

Investing in our securities is speculative and involves a high degree of risk due to the nature of our business and the present stage of exploration of our mineral properties. The following risk factors, as well as risks currently unknown to us, could materially adversely affect our future business, operations and financial condition and could cause them to differ materially from the estimates described in forward-looking information relating to NovaCopper, or our business, property or financial results, each of which could cause purchasers of securities to lose all or part of their investments.

We have not defined any proven or probable reserves and none of our mineral properties are in production or under development.

We have no history of commercially producing precious or base metals and all of our properties are in the exploration stage. We have not defined or delineated any measured mineral resources or proven or probable reserves on our Upper Kobuk Mineral Projects and Titiribi Project. Mineral exploration involves significant risk, since few properties that are explored contain bodies of ore that would be commercially economic to develop into producing mines. We cannot assure you that we will establish the presence of any measured resources, or proven or probable reserves at the Upper Kobuk Mineral Projects, Titiribi Project or any other properties. The failure to establish measured mineral resources, or proven or probable reserves, would severely restrict our ability to implement our strategies for long-term growth.

We may not have sufficient funds to develop our mineral projects or to complete further exploration programs.

We have limited financial resources. We currently generate no mining operating revenue, and must primarily finance exploration activity and the development of mineral projects by other means. In the future, our ability to continue exploration, development and production activities, if any, will depend on our ability to obtain additional external financing. Any unexpected costs, problems or delays could severely impact our ability to continue exploration and development activities. The failure to meet ongoing obligations on a timely basis could result in a loss or a substantial dilution of our interests in projects.

The sources of external financing that we may use for these purposes include project or bank financing or public or private offerings of equity and debt. In addition, we may enter into one or more strategic alliances or joint ventures, decide to sell certain property interests, or utilize one or a combination of all of these alternatives. The financing alternative we choose may not be available on acceptable terms, or at all. If additional financing is not available, we may have to postpone further exploration or development of, or sell, one or more of our principal properties.

17

Even if one of our mineral projects is determined to be economically viable to develop into a mine, such development may not be successful.

If the development of one of our projects is found to be economically feasible and approved by our Board, such development will require obtaining permits and financing, the construction and operation of mines, processing plants and related infrastructure, including road access. As a result, we are and will continue to be subject to all of the risks associated with establishing new mining operations, including:

| • | the timing and cost, which can be considerable, of the construction of mining and processing facilities and related infrastructure; | |

| • | the availability and cost of skilled labour and mining equipment; | |

| • | the availability and cost of appropriate smelting and refining arrangements; | |

| • | the need to obtain necessary environmental and other governmental approvals and permits and the timing of the receipt of those approvals and permits; | |

| • | the availability of funds to finance construction and development activities; | |

| • | potential opposition from non-governmental organizations, environmental groups or local groups which may delay or prevent development activities; and | |

| • | potential increases in construction and operating costs due to changes in the cost of fuel, power, materials and supplies. |

The costs, timing and complexities of developing our projects may be greater than anticipated because our property interests are not located in developed areas, and, as a result, our property interests are not currently served by appropriate road access, water and power supply and other support infrastructure. Cost estimates may increase significantly as more detailed engineering work is completed on a project. It is common in new mining operations to experience unexpected costs, problems and delays during construction, development and mine start-up. In addition, delays in the early stages of mineral production often occur. Accordingly, we cannot provide assurance that we will ever achieve, or that our activities will result in, profitable mining operations at our mineral properties.

In addition, there can be no assurance that our mineral exploration activities will result in any discoveries of new mineralization. If further mineralization is discovered there is also no assurance that the mineralization would be economical for commercial production. Discovery of mineral deposits is dependent upon a number of factors and significantly influenced by the technical skill of the exploration personnel involved. The commercial viability of a mineral deposit is also dependent upon a number of factors which are beyond our control, including the attributes of the deposit, commodity prices, government policies and regulation and environmental protection.

The Upper Kobuk Mineral Projects are located in a remote area of Alaska, and access to them is limited. Exploration and any future development or production activities may be limited and delayed by infrastructure challenges, inclement weather and a shortened exploration season.

The Upper Kobuk Mineral Projects are located in a remote area of Alaska. Access to the Upper Kobuk Mineral Projects is limited and there is currently no infrastructure in the area.

We cannot provide assurances that the proposed AMDIAR that would provide access to the Ambler mining district will be permitted or built, that it will be built in a timely manner, that the cost of accessing the proposed road will be reasonable, that it will be built in the manner contemplated, or that it will sufficiently satisfy the requirements of the Upper Kobuk Mineral Projects. In addition, successful development of the Upper Kobuk Mineral Projects will require the development of the necessary infrastructure. If adequate infrastructure is not available in a timely manner, there can be no assurance that:

| • | the development of the Upper Kobuk Mineral Projects will be commenced or completed on a timely basis, if at all; |

18

| • | the resulting operations will achieve the anticipated production volume; or | |

| • | the construction costs and operating costs associated with the development of the Upper Kobuk Mineral Projects will not be higher than anticipated. |

As the Upper Kobuk Mineral Projects are located in a remote area, exploration, development and production activities may be limited and delayed by inclement weather and a shortened exploration season.

We have no history of production and no revenue from mining operations.

We have a very limited history of operations and to date have generated no revenue from mining operations. As such, we are subject to many risks common to such enterprises, including under-capitalization, cash shortages, limitations with respect to personnel, financial and other resources and lack of significant revenues. There is no assurance that the Upper Kobuk Mineral Projects, Titiribi Project, or any other future projects will be commercially mineable, and we may never generate revenues from our mining operations.

Future sales or issuances of equity securities could decrease the value of any existing Common Shares, dilute investors’ voting power and reduce our earnings per share.

We may sell additional equity securities (including through the sale of securities convertible into Common Shares) and may issue additional equity securities to finance our operations, exploration, development, acquisitions or other projects. We are authorized to issue an unlimited number of Common Shares. We cannot predict the size of future sales and issuances of equity securities or the effect, if any, that future sales and issuances of equity securities will have on the market price of the Common Shares. Sales or issuances of a substantial number of equity securities, or the perception that such sales could occur, may adversely affect prevailing market prices for the Common Shares. With any additional sale or issuance of equity securities, investors will suffer dilution of their voting power and may experience dilution in our earnings per share.

Changes in the market price of copper, gold and other metals, which in the past have fluctuated widely, will affect our ability to finance continued exploration and development of our projects and affect our operations and financial condition.

Our long-term viability will depend, in large part, on the market price of copper, gold and other metals. The market prices for these metals are volatile and are affected by numerous factors beyond our control, including:

| • | global or regional consumption patterns; | |

| • | the supply of, and demand for, these metals; | |

| • | speculative activities; | |

| • | the availability and costs of metal substitutes; | |

| • | expectations for inflation; and | |

| • | political and economic conditions, including interest rates and currency values. |

We cannot predict the effect of these factors on metal prices. A decrease in the market price of copper, gold and other metals could affect our ability to raise funds to finance the exploration and development of any of our mineral projects, which would have a material adverse effect on our financial condition and results of operations. The market price of copper, gold and other metals may not remain at current levels. In particular, an increase in worldwide supply, and consequent downward pressure on prices, may result over the longer term from increased copper production from mines developed or expanded as a result of current metal price levels. There is no assurance that a profitable market may exist or continue to exist.

19

Actual capital costs, operating costs, production and economic returns may differ significantly from those described in the PEA.

The PEA technical report for the Arctic Project is an early stage study that is preliminary in nature. There can be no assurance that the results described in the PEA will be realized. The capital costs to take our projects into production may be significantly higher than anticipated.

None of our mineral properties have an operating history upon which we can base estimates of future operating costs. Decisions about the development of the Arctic Project (or the Titiribi Project or the Bornite Project) will ultimately be based upon feasibility studies. Feasibility studies derive estimates of cash operating costs based upon, among other things:

| • | anticipated tonnage, grades and metallurgical characteristics of the ore to be mined and processed; | |

| • | anticipated recovery rates of metals from the ore; | |

| • | cash operating costs of comparable facilities and equipment; and | |

| • | anticipated climatic conditions. |

Cash operating costs, production and economic returns, and other estimates contained in studies or estimates prepared by or for us may differ significantly from those anticipated by the PEA and there can be no assurance that our actual operating costs will not be higher than currently anticipated.

We will incur losses for the foreseeable future.

We expect to incur losses unless and until such time as our mineral projects generate sufficient revenues to fund continuing operations. The exploration and development of our mineral properties will require the commitment of substantial financial resources that may not be available.

The amount and timing of expenditures will depend on a number of factors, including the progress of ongoing exploration and development, the results of consultants’ analyses and recommendations, the rate at which operating losses are incurred, the execution of any joint venture agreements with strategic partners and the acquisition of additional property interests, some of which are beyond our control. We cannot provide assurance that we will ever achieve profitability.

Mineral resource and reserve calculations are only estimates.

Any figures presented for mineral resources in this Form 10-K and in our other filings with securities regulatory authorities and those which may be presented in the future or any figures for mineral reserves that may be presented by us in the future are and will only be estimates. There is a degree of uncertainty attributable to the calculation of mineral reserves and mineral resources. Until mineral reserves or mineral resources are actually mined and processed, the quantity of metal and grades must be considered as estimates only and no assurances can be given that the indicated levels of metals will be produced. In making determinations about whether to advance any of our projects to development, we must rely upon estimated calculations as to the mineral resources and grades of mineralization on our properties.

The estimating of mineral reserves and mineral resources is a subjective process that relies on the judgment of the persons preparing the estimates. The process relies on the quantity and quality of available data and is based on knowledge, mining experience, analysis of drilling results and industry practices. Valid estimates made at a given time may significantly change when new information becomes available. While we believe that the mineral resource estimates included in this Form 10-K for the Upper Kobuk Mineral Projects are well-established and reflect management’s best estimates, by their nature mineral resource estimates are imprecise and depend, to a certain extent, upon analysis of drilling results and statistical inferences that may ultimately prove to be inaccurate. There can be no assurances that actual results will meet the estimates contained in feasibility studies. As well, further studies are required.

Estimated mineral reserves or mineral resources may have to be recalculated based on changes in metal prices, further exploration or development activity or actual production experience. This could materially and adversely affect estimates of the volume or grade of mineralization, estimated recovery rates or other important factors that influence mineral reserve or mineral resource estimates. The extent to which mineral resources may ultimately be reclassified as mineral reserves is dependent upon the demonstration of their profitable recovery. Any material changes in mineral resource estimates and grades of mineralization will affect the economic viability of placing a property into production and a property’s return on capital. We cannot provide assurance that mineralization can be mined or processed profitably.

20

Our mineral resource estimates have been determined and valued based on assumed future metal prices, cut-off grades and operating costs that may prove to be inaccurate. Extended declines in market prices for copper, zinc, lead, gold and silver may render portions of our mineralization uneconomic and result in reduced reported mineral resources, which in turn could have a material adverse effect on our results of operations or financial condition. We cannot provide assurance that mineral recovery rates achieved in small scale tests will be duplicated in large scale tests under on-site conditions or in production scale.

A reduction in any mineral reserves that may be estimated by us in the future could have an adverse impact on our future cash flows, earnings, results of operations and financial condition. No assurances can be given that any mineral resource estimates for the Upper Kobuk Mineral Projects will ultimately be reclassified as mineral reserves. See “Cautionary Note to United States Investors.”

Significant uncertainty exists related to inferred mineral resources.

There is a risk that inferred mineral resources referred to in this Form 10-K cannot be converted into measured or indicated mineral resources as there may be limited ability to assess geological continuity. Due to the uncertainty that may attach to inferred mineral resources, there is no assurance that inferred mineral resources will be upgraded to resources with sufficient geological continuity to constitute proven and probable mineral reserves as a result of continued exploration. See “Cautionary Note to United States Investors.”

Mining is inherently risky and subject to conditions or events beyond our control.

The development and operation of a mine is inherently dangerous and involves many risks that even a combination of experience, knowledge and careful evaluation may not be able to overcome, including:

| • | unusual or unexpected geological formations; | |

| • | metallurgical and other processing problems; | |

| • | metal losses; | |

| • | environmental hazards; | |

| • | power outages; | |

| • | labour disruptions; | |

| • | industrial accidents; | |

| • | periodic interruptions due to inclement or hazardous weather conditions; | |

| • | flooding, explosions, fire, rockbursts, cave-ins and landslides; | |

| • | mechanical equipment and facility performance problems; and | |

| • | the availability of materials and equipment. |

These risks could result in damage to, or destruction of, mineral properties, production facilities or other properties, personal injury or death, including to our employees, environmental damage, delays in mining, increased production costs, asset write downs, monetary losses and possible legal liability. We may not be able to obtain insurance to cover these risks at economically feasible premiums, or at all. Insurance against certain environmental risks, including potential liability for pollution and other hazards associated with mineral exploration and production, is not generally available to companies within the mining industry. We may suffer a material adverse effect on our business if we incur losses related to any significant events that are not covered by our insurance policies.

21

General economic conditions may adversely affect our growth, future profitability and ability to finance.

The unprecedented events in global financial markets in the past several years have had a profound impact on the global economy. Many industries, including the copper mining industry, are impacted by these market conditions. Some of the key impacts of the current financial market turmoil include contraction in credit markets resulting in a widening of credit risk, devaluations, high volatility in global equity, commodity, foreign exchange and precious metal markets and a lack of market liquidity. A worsening or slowdown in the financial markets or other economic conditions, including but not limited to, consumer spending, employment rates, business conditions, inflation, fuel and energy costs, consumer debt levels, lack of available credit, the state of the financial markets, interest rates and tax rates, may adversely affect our growth and ability to finance. Specifically:

| • |

the volatility of copper, gold and other metal prices would impact our estimates of mineral resources, revenues, profits, losses and cash flow, and the feasibility of our projects; | |

|

| ||

| • |

negative economic pressures could adversely impact demand for our future production, if any; | |

|

| ||

| • |

construction related costs could increase and adversely affect the economics of any project; | |

|

| ||

| • |

volatile energy, commodity and consumables prices and currency exchange rates would impact our estimated production costs; and | |

|

| ||

| • |

the devaluation and volatility of global stock markets would impact the valuation of our equity and other securities. |

We cannot provide assurance that we will successfully acquire commercially mineable mineral rights.

Exploration for and development of copper and gold properties involves significant financial risks which even a combination of careful evaluation, experience and knowledge may not eliminate. While the discovery of an ore body may result in substantial rewards, few properties which are explored are ultimately developed into producing mines. Major expenses may be required to establish reserves by drilling, constructing mining and processing facilities at a site, developing metallurgical processes and extracting metals from ore. We cannot ensure that our current exploration and development programs will result in profitable commercial mining operations.

The economic feasibility of development projects is based upon many factors, including the accuracy of mineral resource estimates; metallurgical recoveries; capital and operating costs; government regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting and environmental protection; and metal prices, which are highly volatile. Development projects are also subject to the successful completion of feasibility studies, issuance of necessary governmental permits and availability of adequate financing.

Most exploration projects do not result in the discovery of commercially mineable ore deposits, and no assurance can be given that any anticipated level of recovery of ore reserves, if any, will be realized or that any identified mineral deposit will ever qualify as a commercially mineable (or viable) ore body which can be legally and economically exploited. Estimates of mineral reserves, mineral resources, mineral deposits and production costs can also be affected by such factors as environmental permitting regulations and requirements, weather, environmental factors, unforeseen technical difficulties, the metallurgy of the mineralization forming the mineral deposit, unusual or unexpected geological formations and work interruptions. If current exploration programs do not result in the discovery of commercial ore, we may need to write-off part or all of our investment in our existing exploration stage properties, and may need to acquire additional properties.

Material changes in mineral reserves, if any, grades, stripping ratios or recovery rates may affect the economic viability of any project. Our future growth and productivity will depend, in part, on our ability to develop commercially mineable mineral rights at our existing properties or identify and acquire other commercially mineable mineral rights, and on the costs and results of continued exploration and potential development programs. Mineral exploration is highly speculative in nature and is frequently non-productive. Substantial expenditures are required to:

22

| • | establish mineral reserves through drilling and metallurgical and other testing techniques; | |

| • | determine metal content and metallurgical recovery processes to extract metal from the ore; and | |

| • | construct, renovate or expand mining and processing facilities. |

In addition, if we discover ore, it would take several years from the initial phases of exploration until production is possible. During this time, the economic feasibility of production may change. As a result of these uncertainties, there can be no assurance that we will successfully acquire commercially mineable (or viable) mineral rights.

We are subject to significant governmental regulations.

Our exploration activities are subject to extensive federal, state, provincial and local laws and regulations governing various matters, including: