Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Allegiant Travel CO | algt20160208_8k.htm |

Management Presentation February 2016

Forward looking statements 2 This presentation as well as oral statements made by officers or directors of Allegiant Travel Company, its advisors and affiliates (collectively or separately, the "Company“) will contain forward- looking statements that are only predictions and involve risks and uncertainties. Forward-looking statements may include, among others, references to future performance and any comments about our strategic plans. There are many risk factors that could prevent us from achieving our goals and cause the underlying assumptions of these forward-looking statements, and our actual results, to differ materially from those expressed in, or implied by, our forward-looking statements. These risk factors and others are more fully discussed in our filings with the Securities and Exchange Commission. Any forward-looking statements are based on information available to us today and we undertake no obligation to update publicly any forward-looking statements, whether as a result of future events, new information or otherwise. The Company cautions users of this presentation not to place undue reliance on forward looking statements, which may be based on assumptions and anticipated events that do not materialize.

Unique business model and results Highly resilient and profitable – Profitable last 52 quarters (1) – 2015 EBITDA $469.6mm (2) – 2015 Return on Capital 25.6%(2) Strong balance sheet – Rated BB and Ba3(3) – Adjusted debt/ EBITDAR 1.4x(2) – $190mm returned to shareholders in 2015 • $54 mm in share repurchase authority as of 1/27/16 – Recurring quarterly cash dividend of $0.30 per share Management owns >20% 3 (1) Excluding non-cash mark to market hedge adjustments prior to 2008 and 4Q06 one time tax adjustment (2) See GAAP reconciliation and other calculations in Appendix (3) Corporate rating of Ba3 by Moody’s and BB by Standard & Poor’s

Advantages over the typical carrier 4 Leisure customer – Will travel in all economic conditions – Vacations are valued – price dependent Small/medium cities – Filling a large void – Increasing opportunity - industry restructuring – Diversity of network - minimizes competition Flexibility – Adjust rapidly to changing macro (fuel/economy) – Changes in capacity - immediate impact on price – Minimize threat of irrational behavior from others Low cost fleet – Match capacity to demand, highly variable – Low capital needs, higher free cash flow – Can grow and return cash to shareholders Built to be different Leisure customer Underserved markets Little competition Low cost aircraft Low frequency/variable capacity Unbundled pricing Closed distribution Bundled packages Highly profitable

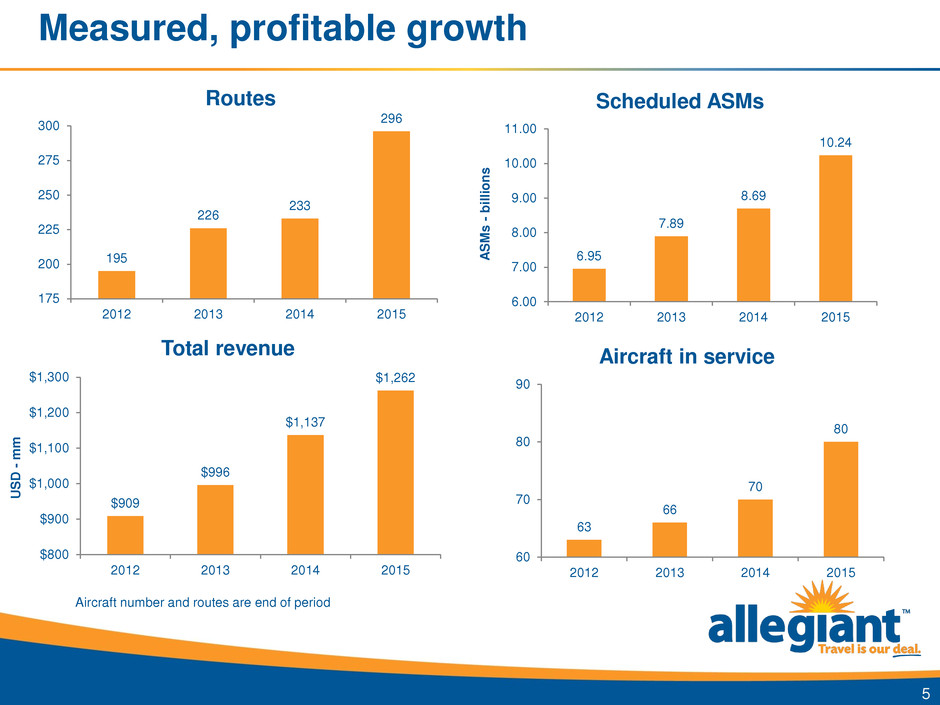

Measured, profitable growth 5 195 226 233 296 175 200 225 250 275 300 2012 2013 2014 2015 Routes 6.95 7.89 8.69 10.24 6.00 7.00 8.00 9.00 10.00 11.00 2012 2013 2014 2015 A S M s - b ill io n s Scheduled ASMs $909 $996 $1,137 $1,262 $800 $900 $1,000 $1,100 $1,200 $1,300 2012 2013 2014 2015 U S D - m m Total revenue 63 66 70 80 60 70 80 90 2012 2013 2014 2015 Aircraft in service Aircraft number and routes are end of period

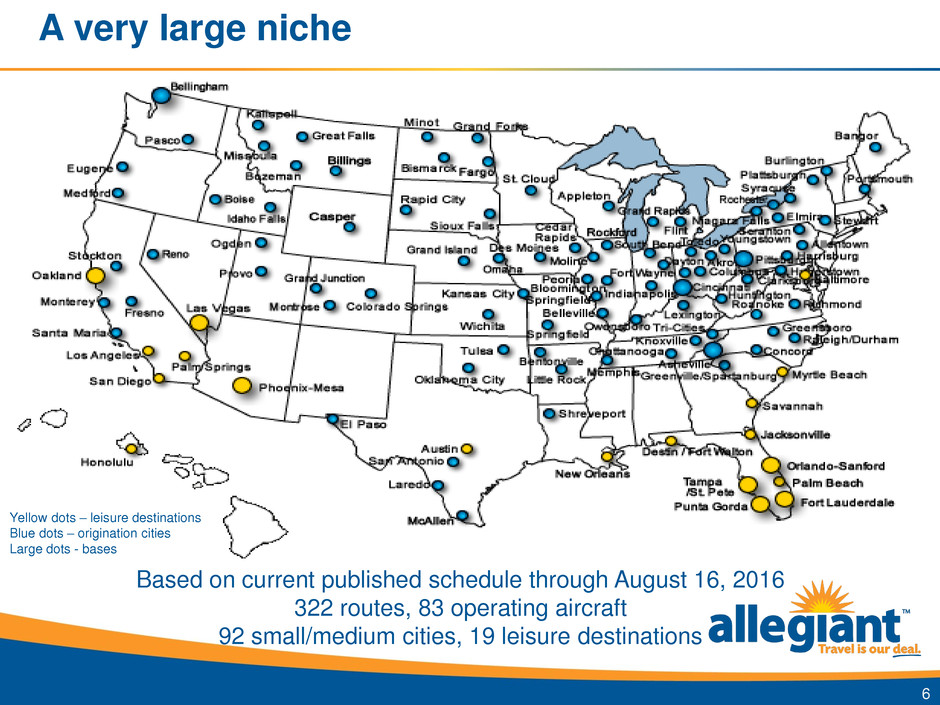

A very large niche Based on current published schedule through August 16, 2016 322 routes, 83 operating aircraft 92 small/medium cities, 19 leisure destinations 6 Yellow dots – leisure destinations Blue dots – origination cities Large dots - bases

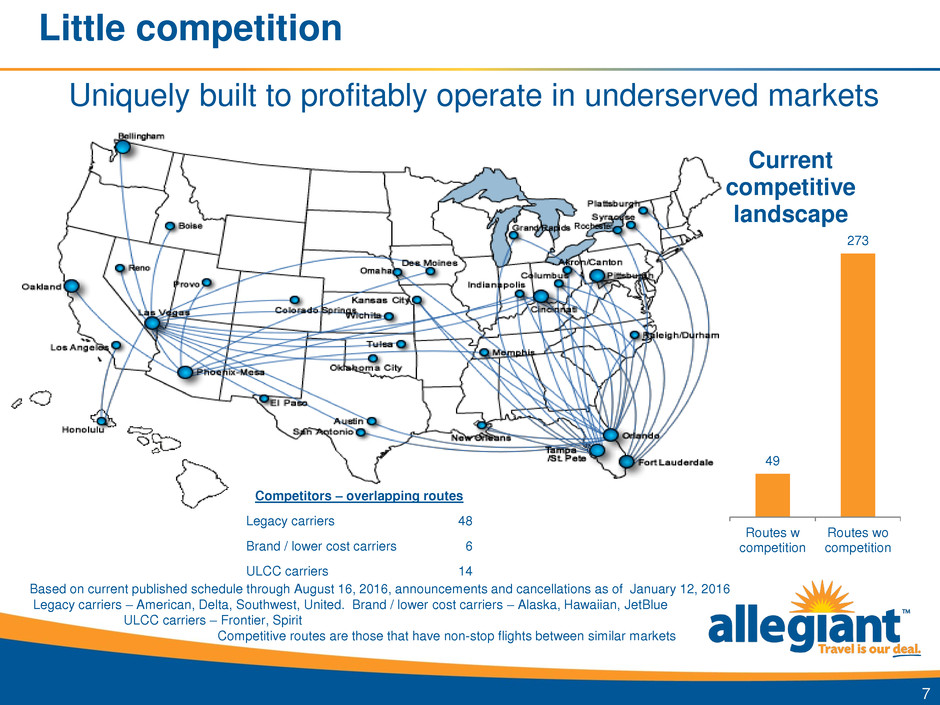

Little competition 49 273 Routes w competition Routes wo competition Current competitive landscape Uniquely built to profitably operate in underserved markets 7 Competitors – overlapping routes Legacy carriers 48 Brand / lower cost carriers 6 ULCC carriers 14 Based on current published schedule through August 16, 2016, announcements and cancellations as of January 12, 2016 Legacy carriers – American, Delta, Southwest, United. Brand / lower cost carriers – Alaska, Hawaiian, JetBlue ULCC carriers – Frontier, Spirit Competitive routes are those that have non-stop flights between similar markets

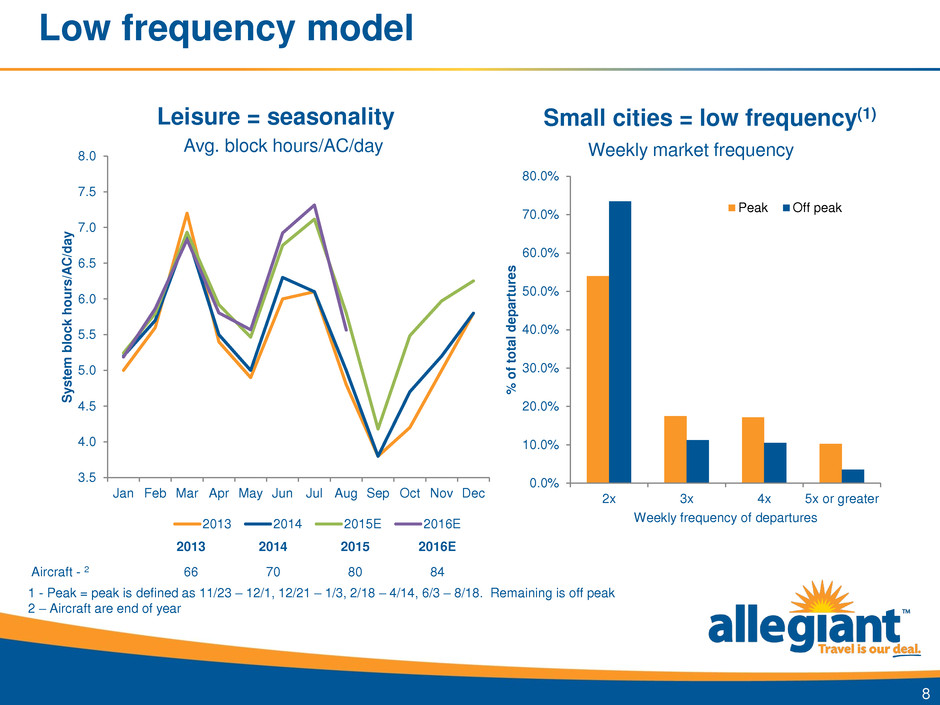

Low frequency model 8 3.5 4.0 4.5 5.0 5.5 6.0 6.5 7.0 7.5 8.0 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec S y ste m b lock h o u rs/ A C/ d a y 2013 2014 2015E 2016E Avg. block hours/AC/day 1 - Peak = peak is defined as 11/23 – 12/1, 12/21 – 1/3, 2/18 – 4/14, 6/3 – 8/18. Remaining is off peak 2 – Aircraft are end of year 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% 2x 3x 4x 5x or greater % o f to tal d epa rt u re s Weekly frequency of departures Weekly market frequency Peak Off peak Leisure = seasonality Small cities = low frequency(1) 2013 2014 2015 2016E Aircraft - 2 66 70 80 84

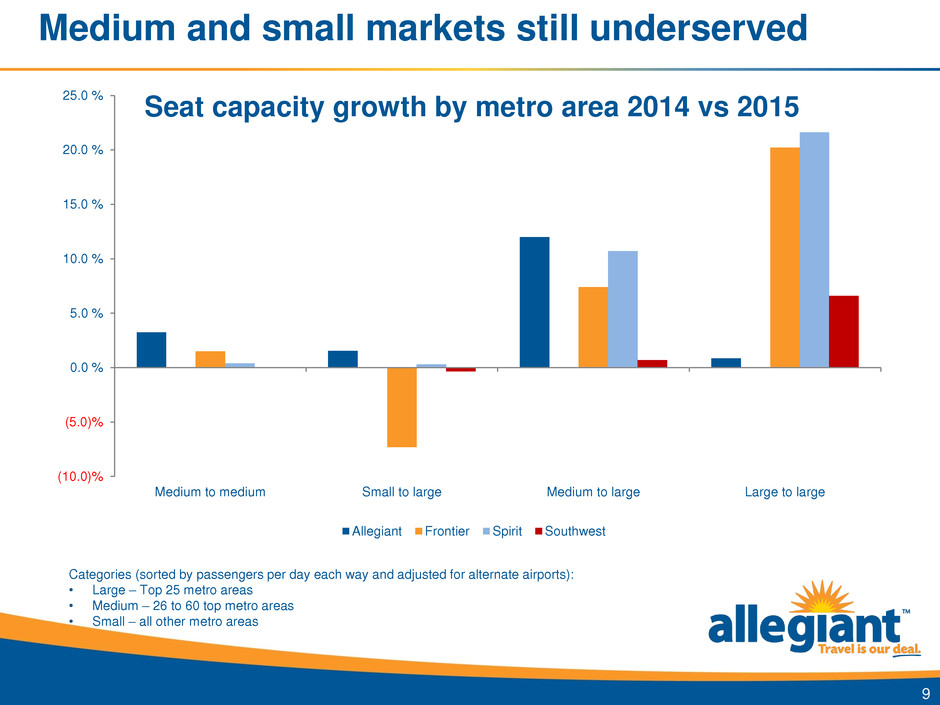

Medium and small markets still underserved 9 Categories (sorted by passengers per day each way and adjusted for alternate airports): • Large – Top 25 metro areas • Medium – 26 to 60 top metro areas • Small – all other metro areas (10.0)% (5.0)% 0.0 % 5.0 % 10.0 % 15.0 % 20.0 % 25.0 % Medium to medium Small to large Medium to large Large to large Seat capacity growth by metro area 2014 vs 2015 Allegiant Frontier Spirit Southwest

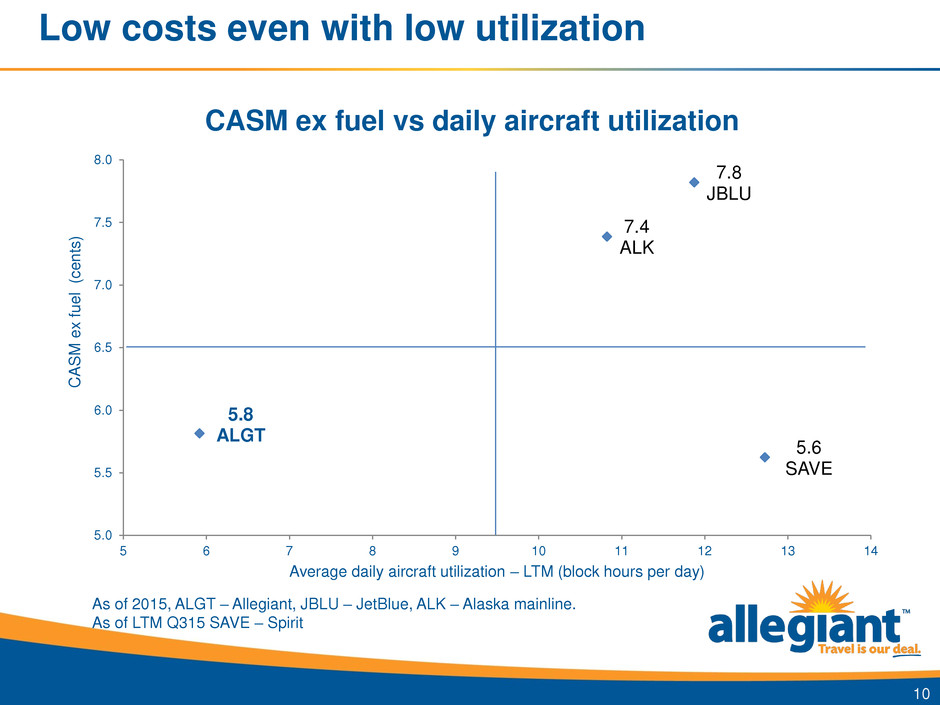

Low costs even with low utilization 7.8 JBLU 5.6 SAVE 7.4 ALK 5.8 ALGT 5.0 5.5 6.0 6.5 7.0 7.5 8.0 5 6 7 8 9 10 11 12 13 14 CA S M e x f u e l (ce n ts ) Average daily aircraft utilization – LTM (block hours per day) CASM ex fuel vs daily aircraft utilization 10 As of 2015, ALGT – Allegiant, JBLU – JetBlue, ALK – Alaska mainline. As of LTM Q315 SAVE – Spirit

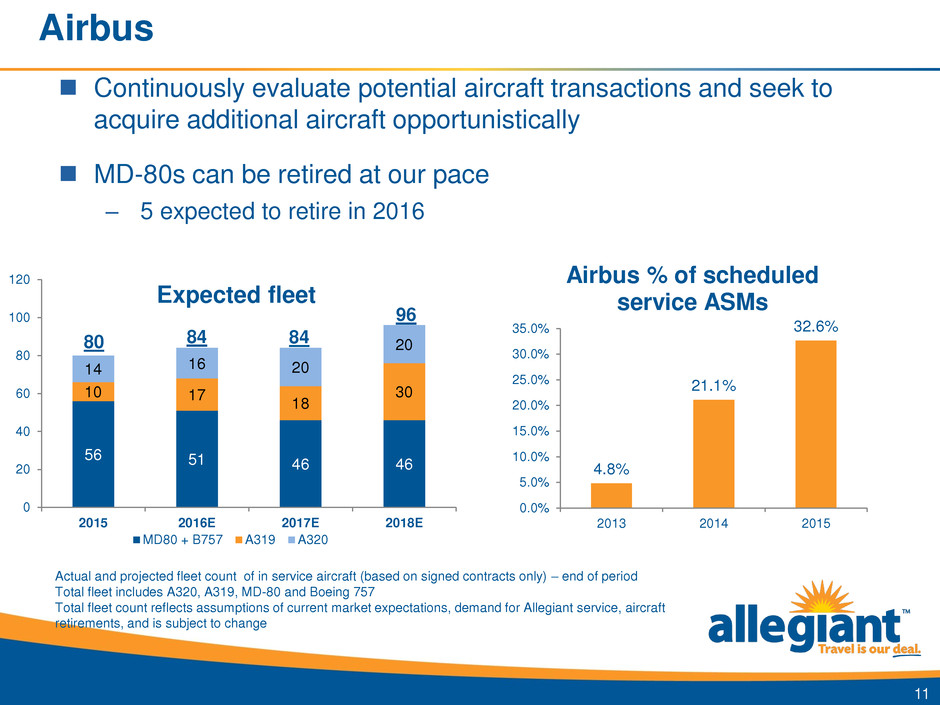

Airbus 11 Actual and projected fleet count of in service aircraft (based on signed contracts only) – end of period Total fleet includes A320, A319, MD-80 and Boeing 757 Total fleet count reflects assumptions of current market expectations, demand for Allegiant service, aircraft retirements, and is subject to change Continuously evaluate potential aircraft transactions and seek to acquire additional aircraft opportunistically MD-80s can be retired at our pace – 5 expected to retire in 2016 56 51 46 46 10 17 18 30 14 16 20 20 0 20 40 60 80 100 120 2015 2016E 2017E 2018E Expected fleet MD80 + B757 A319 A320 80 84 84 96 4.8% 21.1% 32.6% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 2013 2014 2015 Airbus % of scheduled service ASMs

2016 maintenance expense is expected to be between $115 and $125 thousand per aircraft per month – Expect 19 more maintenance events than completed in 2015 Total ownership expense is expected to be between $100 and $110 thousand per aircraft per month Maintenance expense is higher due to a greater number of engine maintenance visits versus 2015 2016 estimated cost highlights 12 Guidance subject to change Total ownership includes both depreciation expense and aircraft lease rental expense Maintenance events include both airframe and engine events

Cumulative return to shareholders $0.6 $17.4 $42.7 $96.5 $98.4 $ 1 0 3 .4 $ 1 8 7 .0 $ 3 2 6 .1 $ 4 5 4 .1 $14.9 $14.9 $53.5 $53.5 $95.3 $ 1 5 7 .8 $0 $100 $200 $300 $400 $500 $600 2007 2008 2009 2010 2011 2012 2013 2014 2015 $ m m Share repurchases Dividends 13 $612m returned to shareholders since 2007 $54m remaining in share repurchase authority* *- As per announcement on January 27, 2016 **-Diluted share count in 2007 was 20.5m, share count for 2015 was 17.0m 2015 includes $44m returned through a special dividend declared in 2014 and paid in January 2015 2014 includes $42m returned through a special dividend declared in 2013 and paid in January 2014 Does not include $28m special dividend declared in 2015 and paid in January 2016 Reduced diluted share count by 17% since 2007** Implemented quarterly cash dividend in Q1 2015 – now $0.30 per share

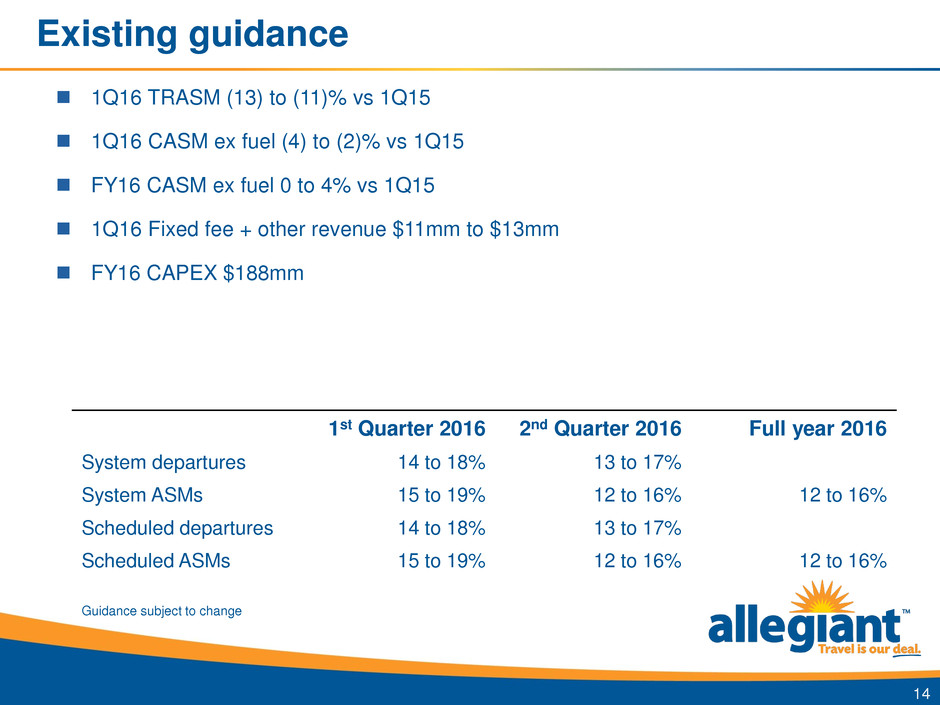

1Q16 TRASM (13) to (11)% vs 1Q15 1Q16 CASM ex fuel (4) to (2)% vs 1Q15 FY16 CASM ex fuel 0 to 4% vs 1Q15 1Q16 Fixed fee + other revenue $11mm to $13mm FY16 CAPEX $188mm 1st Quarter 2016 2nd Quarter 2016 Full year 2016 System departures 14 to 18% 13 to 17% System ASMs 15 to 19% 12 to 16% 12 to 16% Scheduled departures 14 to 18% 13 to 17% Scheduled ASMs 15 to 19% 12 to 16% 12 to 16% Existing guidance 14 Guidance subject to change

Appendix

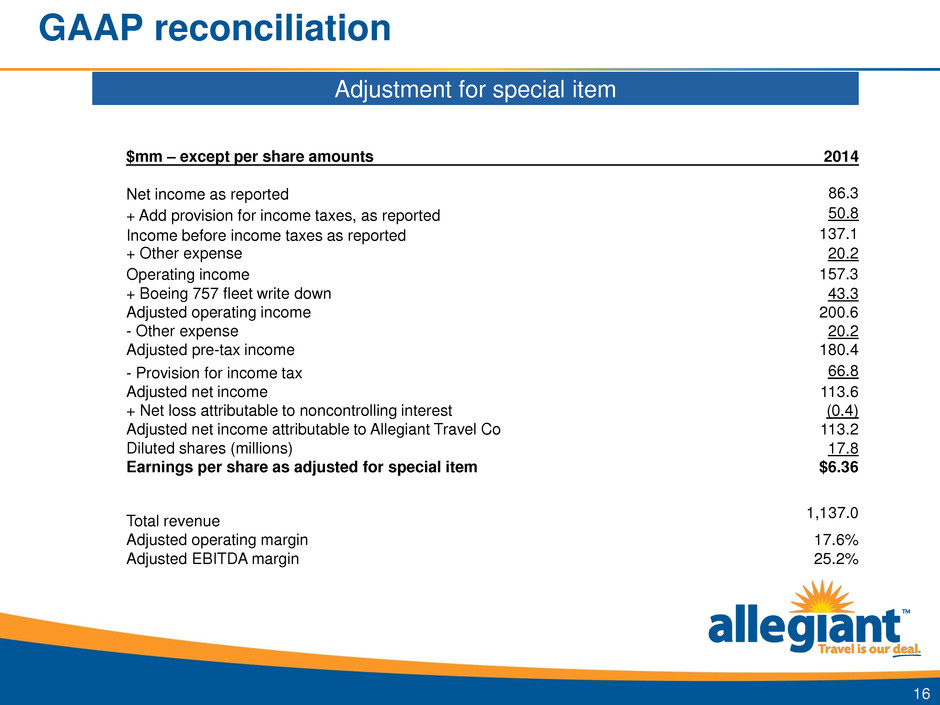

GAAP reconciliation Adjustment for special item 16 2014 $mm – except per share amounts Net income as reported 86.3 + Add provision for income taxes, as reported 50.8 Income before income taxes as reported 137.1 + Other expense 20.2 Operating income 157.3 + Boeing 757 fleet write down 43.3 Adjusted operating income 200.6 - Other expense 20.2 Adjusted pre-tax income 180.4 - Provision for income tax 66.8 Adjusted net income 113.6 + Net loss attributable to noncontrolling interest (0.4) Adjusted net income attributable to Allegiant Travel Co 113.2 Diluted shares (millions) 17.8 Earnings per share as adjusted for special item $6.36 Total revenue 1,137.0 Adjusted operating margin 17.6% Adjusted EBITDA margin 25.2%

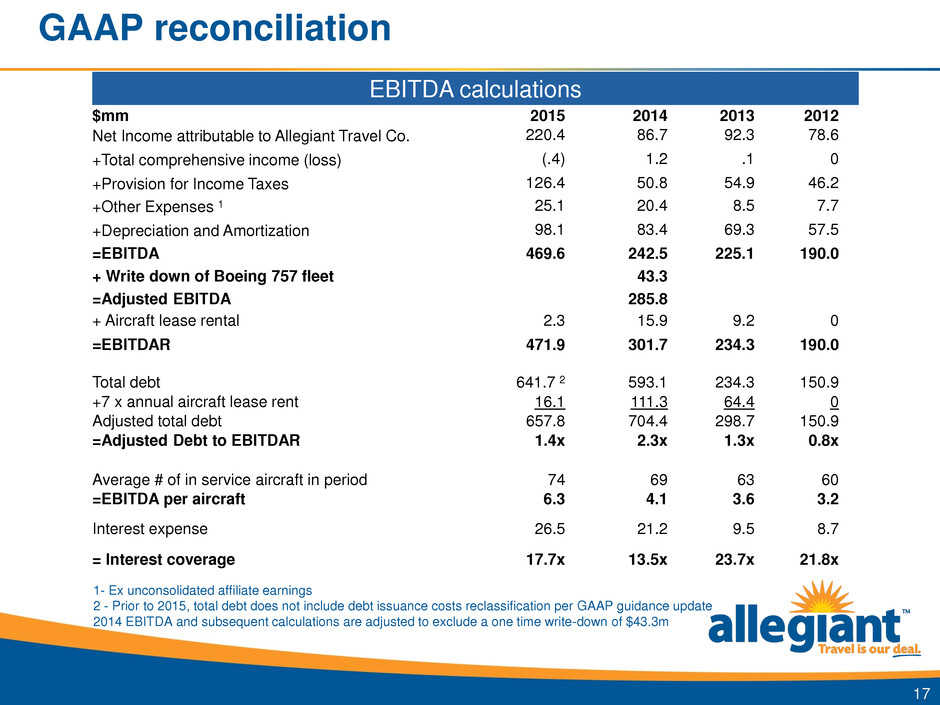

GAAP reconciliation EBITDA calculations 17 $mm 2015 2014 2013 2012 Net Income attributable to Allegiant Travel Co. 220.4 86.7 92.3 78.6 +Total comprehensive income (loss) (.4) 1.2 .1 0 +Provision for Income Taxes 126.4 50.8 54.9 46.2 +Other Expenses 1 25.1 20.4 8.5 7.7 +Depreciation and Amortization 98.1 83.4 69.3 57.5 =EBITDA 469.6 242.5 225.1 190.0 + Write down of Boeing 757 fleet 43.3 =Adjusted EBITDA 285.8 + Aircraft lease rental 2.3 15.9 9.2 0 =EBITDAR 471.9 301.7 234.3 190.0 Total debt 641.7 2 593.1 234.3 150.9 +7 x annual aircraft lease rent 16.1 111.3 64.4 0 Adjusted total debt 657.8 704.4 298.7 150.9 =Adjusted Debt to EBITDAR 1.4x 2.3x 1.3x 0.8x Average # of in service aircraft in period 74 69 63 60 =EBITDA per aircraft 6.3 4.1 3.6 3.2 Interest expense 26.5 21.2 9.5 8.7 = Interest coverage 17.7x 13.5x 23.7x 21.8x 1- Ex unconsolidated affiliate earnings 2 - Prior to 2015, total debt does not include debt issuance costs reclassification per GAAP guidance update 2014 EBITDA and subsequent calculations are adjusted to exclude a one time write-down of $43.3m

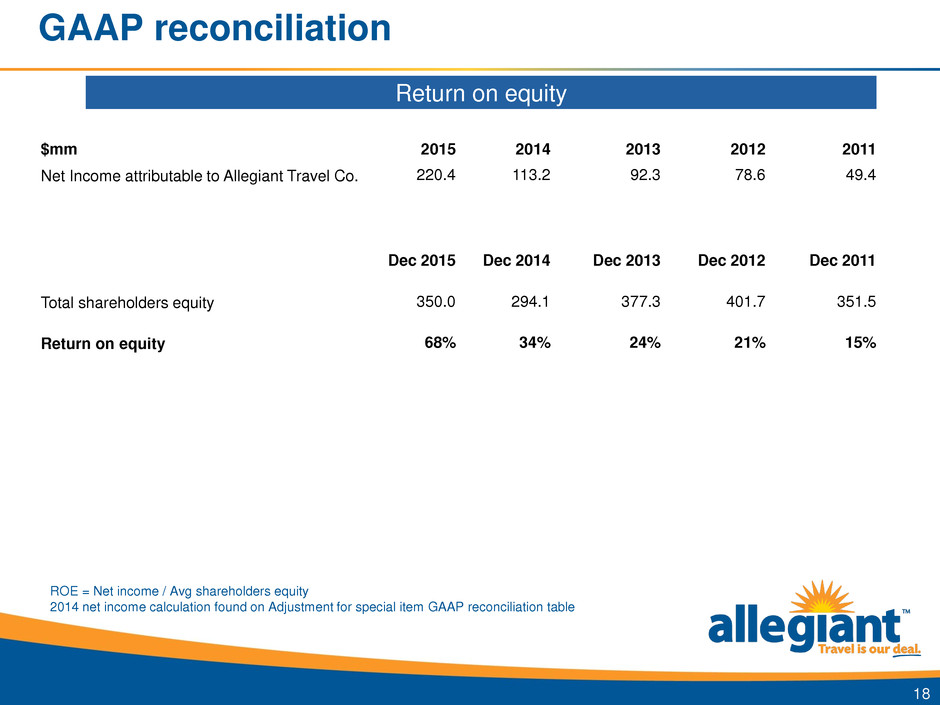

GAAP reconciliation Return on equity 18 $mm 2015 2014 2013 2012 2011 Net Income attributable to Allegiant Travel Co. 220.4 113.2 92.3 78.6 49.4 Dec 2015 Dec 2014 Dec 2013 Dec 2012 Dec 2011 Total shareholders equity 350.0 294.1 377.3 401.7 351.5 Return on equity 68% 34% 24% 21% 15% ROE = Net income / Avg shareholders equity 2014 net income calculation found on Adjustment for special item GAAP reconciliation table

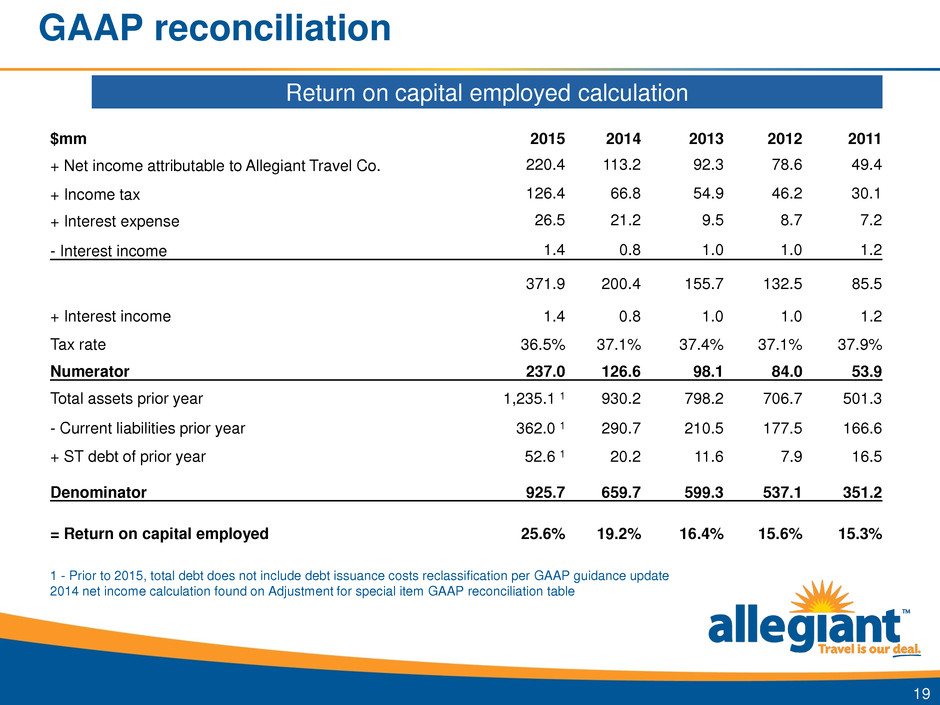

GAAP reconciliation Return on capital employed calculation $mm 2015 2014 2013 2012 2011 + Net income attributable to Allegiant Travel Co. 220.4 113.2 92.3 78.6 49.4 + Income tax 126.4 66.8 54.9 46.2 30.1 + Interest expense 26.5 21.2 9.5 8.7 7.2 - Interest income 1.4 0.8 1.0 1.0 1.2 371.9 200.4 155.7 132.5 85.5 + Interest income 1.4 0.8 1.0 1.0 1.2 Tax rate 36.5% 37.1% 37.4% 37.1% 37.9% Numerator 237.0 126.6 98.1 84.0 53.9 Total assets prior year 1,235.1 1 930.2 798.2 706.7 501.3 - Current liabilities prior year 362.0 1 290.7 210.5 177.5 166.6 + ST debt of prior year 52.6 1 20.2 11.6 7.9 16.5 Denominator 925.7 659.7 599.3 537.1 351.2 = Return on capital employed 25.6% 19.2% 16.4% 15.6% 15.3% 19 1 - Prior to 2015, total debt does not include debt issuance costs reclassification per GAAP guidance update 2014 net income calculation found on Adjustment for special item GAAP reconciliation table

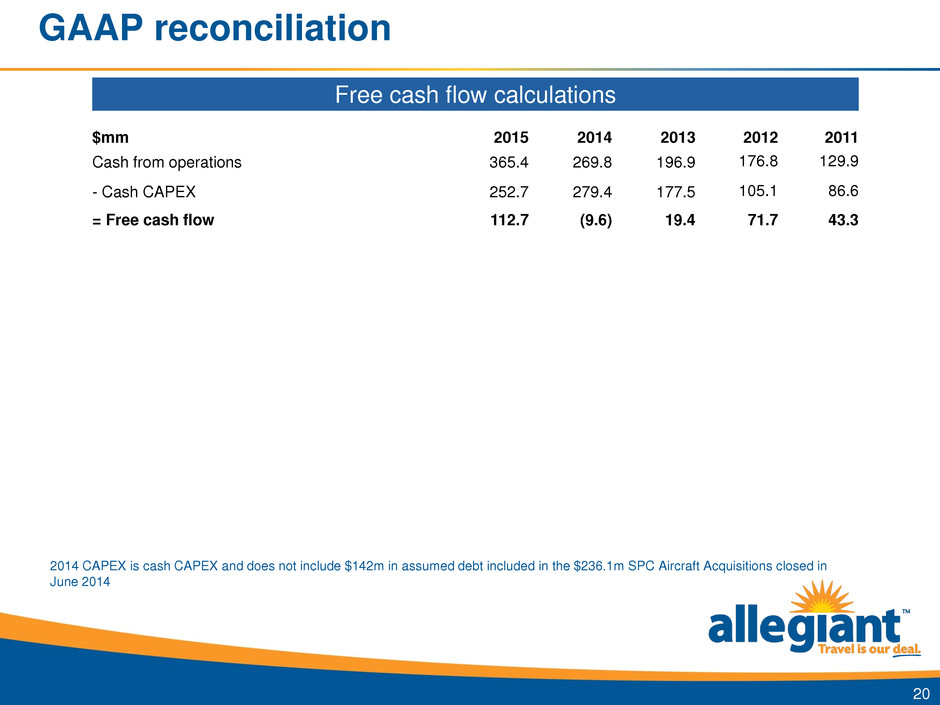

GAAP reconciliation Free cash flow calculations 20 $mm 2015 2014 2013 2012 2011 Cash from operations 365.4 269.8 196.9 176.8 129.9 - Cash CAPEX 252.7 279.4 177.5 105.1 86.6 = Free cash flow 112.7 (9.6) 19.4 71.7 43.3 2014 CAPEX is cash CAPEX and does not include $142m in assumed debt included in the $236.1m SPC Aircraft Acquisitions closed in June 2014

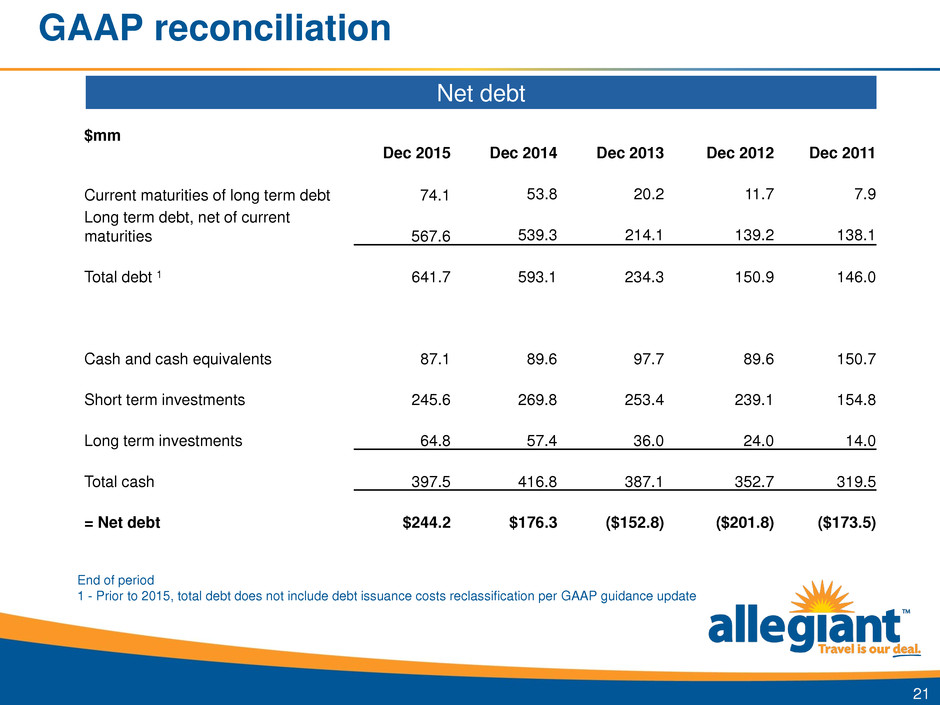

GAAP reconciliation Net debt 21 $mm Dec 2015 Dec 2014 Dec 2013 Dec 2012 Dec 2011 Current maturities of long term debt 74.1 53.8 20.2 11.7 7.9 Long term debt, net of current maturities 567.6 539.3 214.1 139.2 138.1 Total debt 1 641.7 593.1 234.3 150.9 146.0 Cash and cash equivalents 87.1 89.6 97.7 89.6 150.7 Short term investments 245.6 269.8 253.4 239.1 154.8 Long term investments 64.8 57.4 36.0 24.0 14.0 Total cash 397.5 416.8 387.1 352.7 319.5 = Net debt $244.2 $176.3 ($152.8) ($201.8) ($173.5) End of period 1 - Prior to 2015, total debt does not include debt issuance costs reclassification per GAAP guidance update

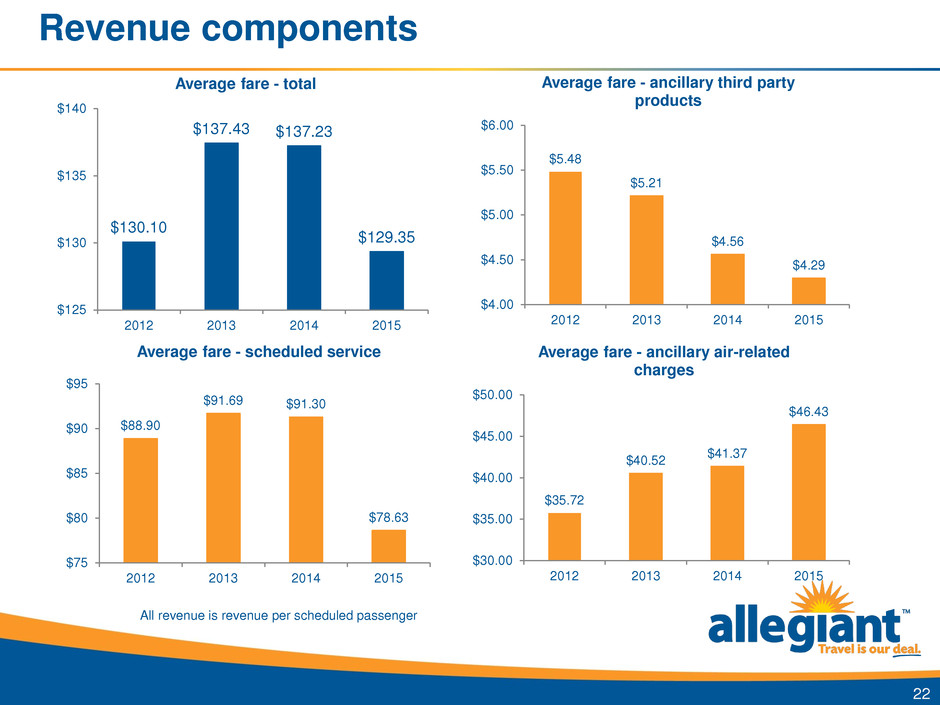

Revenue components 22 $88.90 $91.69 $91.30 $78.63 $75 $80 $85 $90 $95 2012 2013 2014 2015 Average fare - scheduled service $5.48 $5.21 $4.56 $4.29 $4.00 $4.50 $5.00 $5.50 $6.00 2012 2013 2014 2015 Average fare - ancillary third party products $35.72 $40.52 $41.37 $46.43 $30.00 $35.00 $40.00 $45.00 $50.00 2012 2013 2014 2015 Average fare - ancillary air-related charges $130.10 $137.43 $137.23 $129.35 $125 $130 $135 $140 2012 2013 2014 2015 Average fare - total All revenue is revenue per scheduled passenger

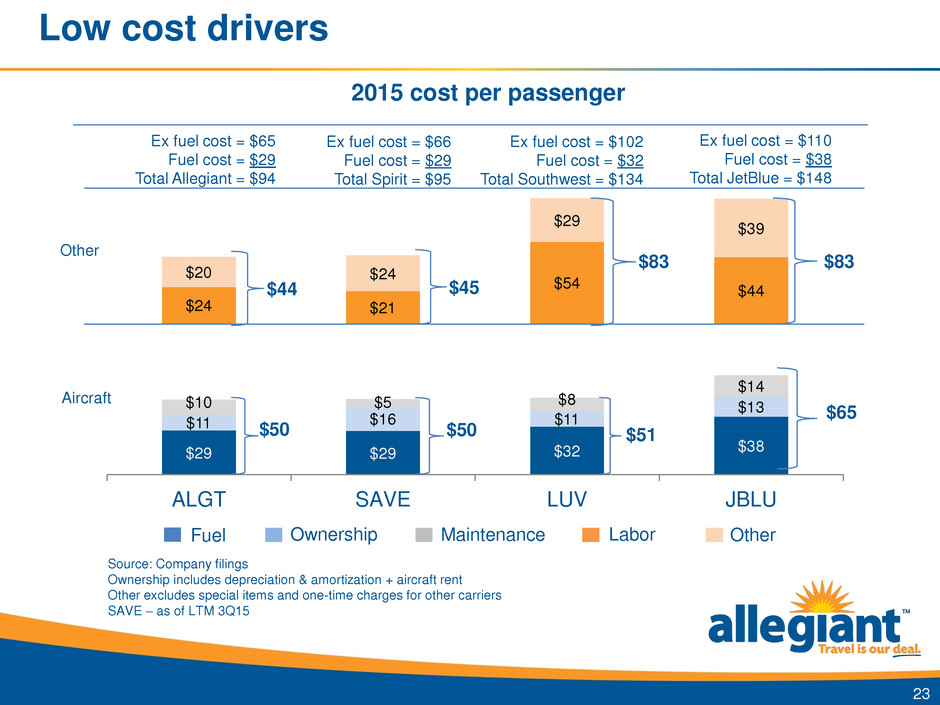

2015 cost per passenger Low cost drivers $29 $29 $32 $38 $11 $16 $11 $13 $10 $5 $8 $14 $24 $21 $54 $44 $20 $24 $29 $39 ALGT SAVE LUV JBLU 23 Source: Company filings Ownership includes depreciation & amortization + aircraft rent Other excludes special items and one-time charges for other carriers SAVE – as of LTM 3Q15 Other Aircraft $50 $51 $65 $44 $83 $83 Ex fuel cost = $65 Fuel cost = $29 Total Allegiant = $94 Ex fuel cost = $102 Fuel cost = $32 Total Southwest = $134 Ex fuel cost = $110 Fuel cost = $38 Total JetBlue = $148 $50 $45 Ex fuel cost = $66 Fuel cost = $29 Total Spirit = $95 Fuel Ownership Maintenance Other Labor

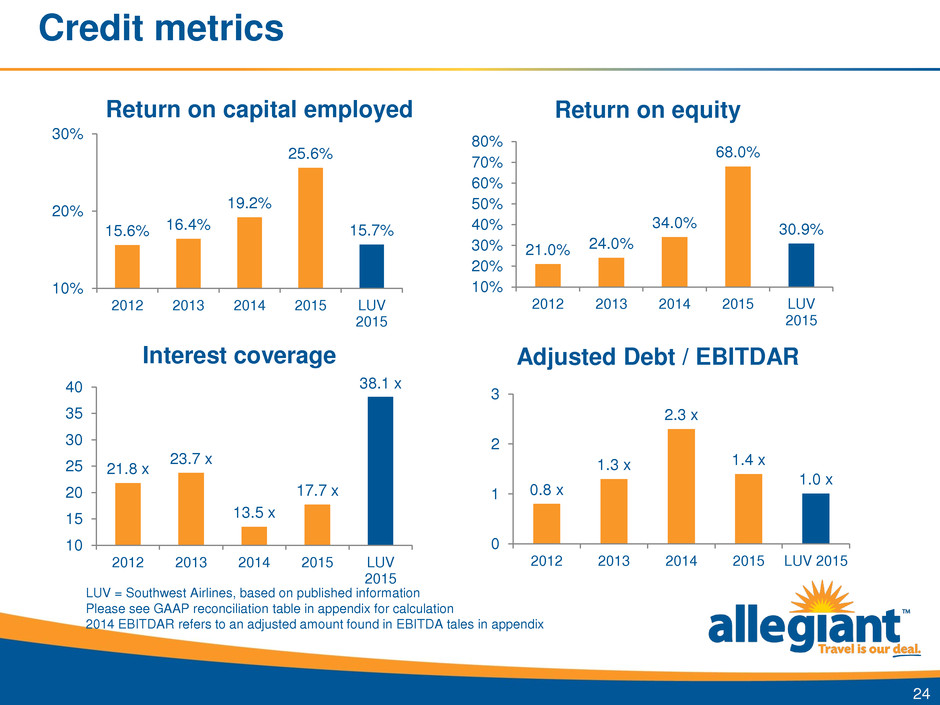

Credit metrics 15.6% 16.4% 19.2% 25.6% 15.7% 10% 20% 30% 2012 2013 2014 2015 LUV 2015 24 Return on capital employed 21.0% 24.0% 34.0% 68.0% 30.9% 10% 20% 30% 40% 50% 60% 70% 80% 2012 2013 2014 2015 LUV 2015 Return on equity 21.8 x 23.7 x 13.5 x 17.7 x 38.1 x 10 15 20 25 30 35 40 2012 2013 2014 2015 LUV 2015 Interest coverage 0.8 x 1.3 x 2.3 x 1.4 x 1.0 x 0 1 2 3 2012 2013 2014 2015 LUV 2015 Adjusted Debt / EBITDAR LUV = Southwest Airlines, based on published information Please see GAAP reconciliation table in appendix for calculation 2014 EBITDAR refers to an adjusted amount found in EBITDA tales in appendix

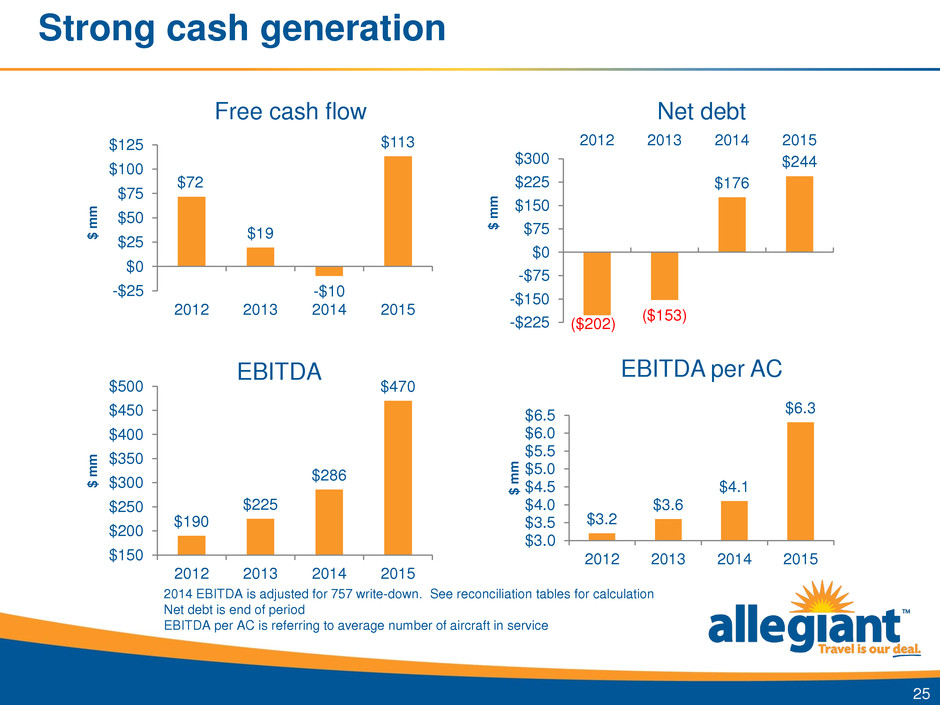

Strong cash generation $190 $225 $286 $470 $150 $200 $250 $300 $350 $400 $450 $500 2012 2013 2014 2015 $ m m 25 EBITDA $3.2 $3.6 $4.1 $6.3 $3.0 $3.5 $4.0 $4.5 $5.0 $5.5 $6.0 $6.5 2012 2013 2014 2015 $ m m EBITDA per AC Free cash flow $72 $19 -$10 $113 -$25 $0 $25 $50 $75 $100 $125 2012 2013 2014 2015 $ m m ($202) ($153) $176 $244 -$225 -$150 -$75 $0 $75 $150 $225 $300 2012 2013 2014 2015 $ m m Net debt 2014 EBITDA is adjusted for 757 write-down. See reconciliation tables for calculation Net debt is end of period EBITDA per AC is referring to average number of aircraft in service

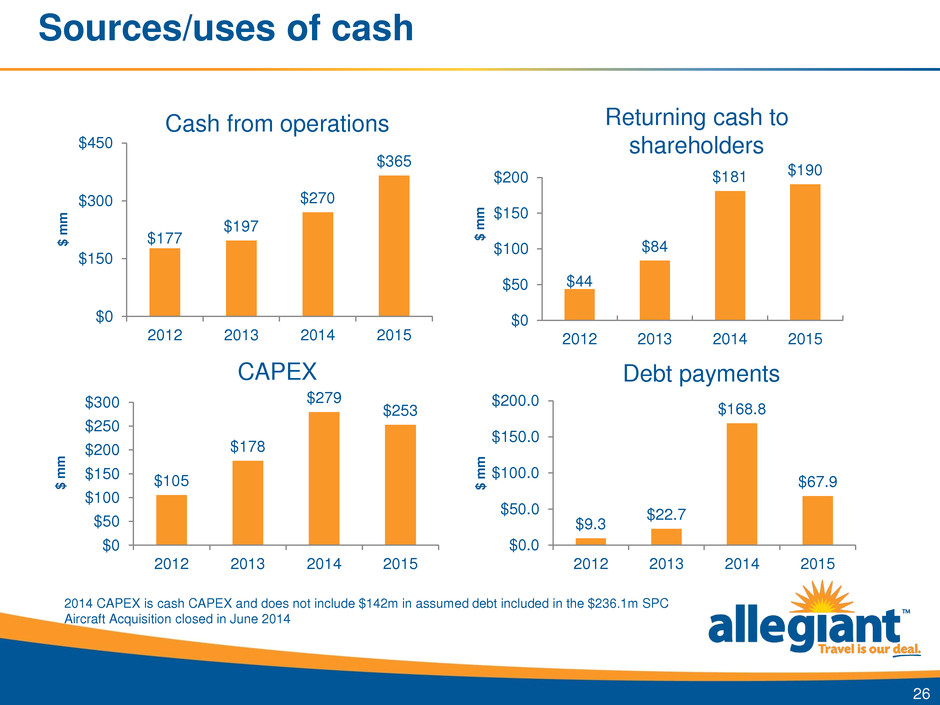

Sources/uses of cash $105 $178 $279 $253 $0 $50 $100 $150 $200 $250 $300 2012 2013 2014 2015 $ m m 26 CAPEX $9.3 $22.7 $168.8 $67.9 $0.0 $50.0 $100.0 $150.0 $200.0 2012 2013 2014 2015 $ m m Debt payments Cash from operations $177 $197 $270 $365 $0 $150 $300 $450 2012 2013 2014 2015 $ m m $44 $84 $181 $190 $0 $50 $100 $150 $200 2012 2013 2014 2015 $ m m Returning cash to shareholders 2014 CAPEX is cash CAPEX and does not include $142m in assumed debt included in the $236.1m SPC Aircraft Acquisition closed in June 2014

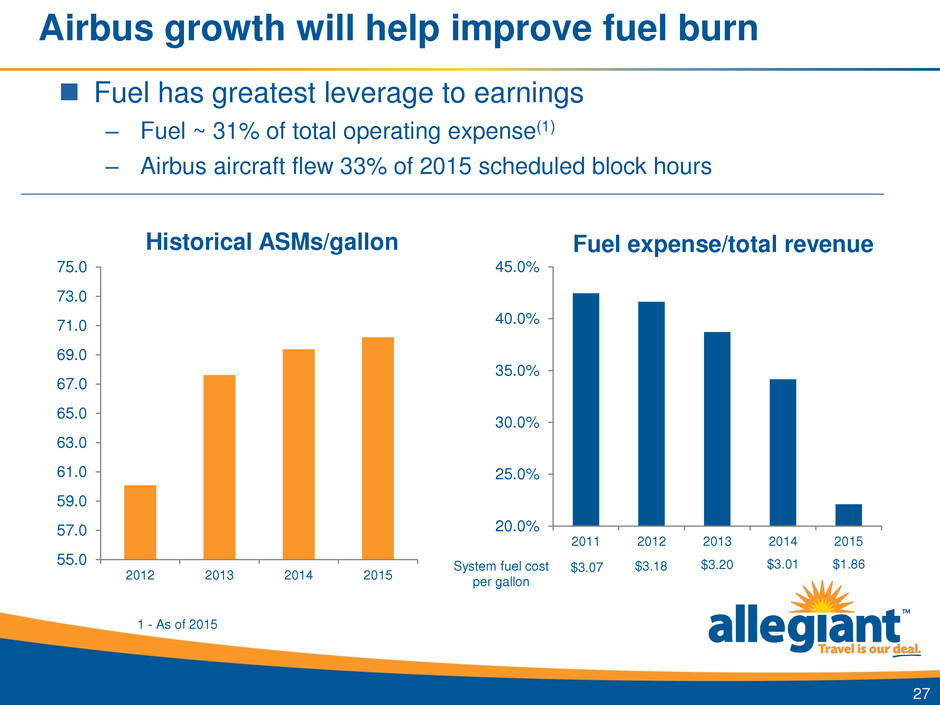

Airbus growth will help improve fuel burn 27 20.0% 25.0% 30.0% 35.0% 40.0% 45.0% 2011 2012 2013 2014 2015 Fuel expense/total revenue 1 - As of 2015 Fuel has greatest leverage to earnings – Fuel ~ 31% of total operating expense(1) – Airbus aircraft flew 33% of 2015 scheduled block hours 55.0 57.0 59.0 61.0 63.0 65.0 67.0 69.0 71.0 73.0 75.0 2012 2013 2014 2015 Historical ASMs/gallon System fuel cost per gallon $3.07 $3.18 $3.20 $3.01 $1.86

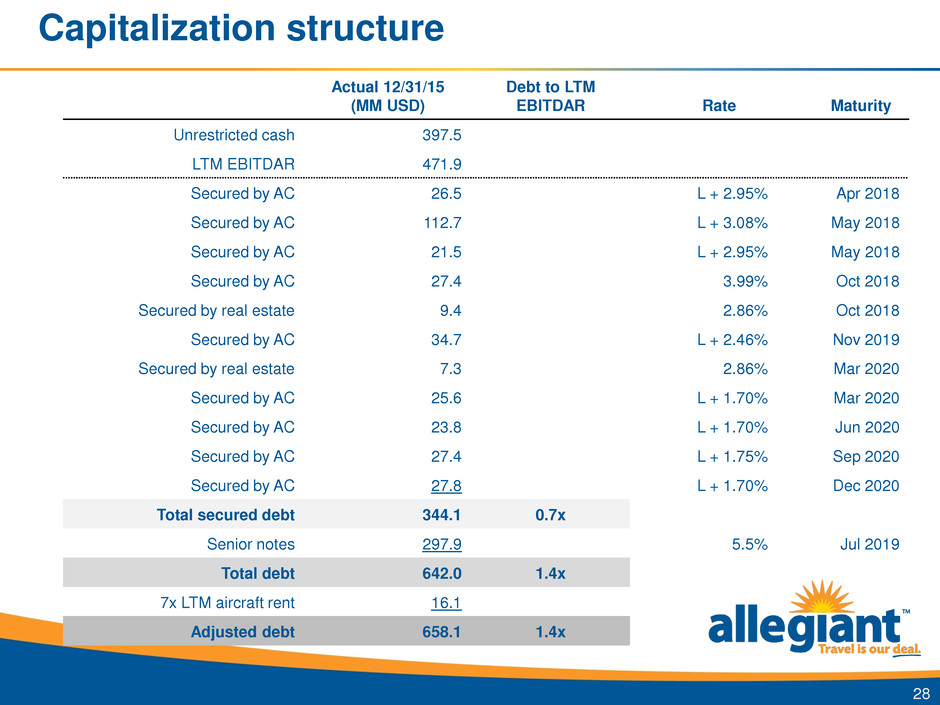

Capitalization structure Actual 12/31/15 (MM USD) Debt to LTM EBITDAR Rate Maturity Unrestricted cash 397.5 LTM EBITDAR 471.9 Secured by AC 26.5 L + 2.95% Apr 2018 Secured by AC 112.7 L + 3.08% May 2018 Secured by AC 21.5 L + 2.95% May 2018 Secured by AC 27.4 3.99% Oct 2018 Secured by real estate 9.4 2.86% Oct 2018 Secured by AC 34.7 L + 2.46% Nov 2019 Secured by real estate 7.3 2.86% Mar 2020 Secured by AC 25.6 L + 1.70% Mar 2020 Secured by AC 23.8 L + 1.70% Jun 2020 Secured by AC 27.4 L + 1.75% Sep 2020 Secured by AC 27.8 L + 1.70% Dec 2020 Total secured debt 344.1 0.7x Senior notes 297.9 5.5% Jul 2019 Total debt 642.0 1.4x 7x LTM aircraft rent 16.1 Adjusted debt 658.1 1.4x 28