Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NEW YORK COMMUNITY BANCORP INC | d129634d8k.htm |

Investor

Presentation February 3, 2016

Growing Earnings, Building Capital, and Creating Value:

The Astoria Financial Merger

Exhibit 99.1 |

New York Community Bancorp, Inc. 2 Cautionary Statements Additional Information and Where to Find It This presentation and certain other related communications are being made in respect of the proposed merger transaction involving the Company and

Astoria Financial Corporation (“Astoria Financial”). The

Company has filed a registration statement on Form S-4 with the SEC, which includes a joint proxy statement of Astoria Financial and the Company and a prospectus of the Company, and each party will file other documents regarding the proposed

transaction

with the SEC. A definitive joint proxy statement/prospectus will also be sent to shareholders of Astoria Financial and of the Company seeking any required stockholder approvals. Before making any voting or investment decision, investors and security holders of Astoria Financial and the Company are urged to carefully read the entire registration statement and joint proxy statement/prospectus, as well as any amendments or supplements to these documents, because they will contain important information about the proposed transaction. The documents filed by the Company and Astoria Financial with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, the documents

filed by the Company

may be obtained free of charge at its website at http://ir.mynycb.com/ and the documents filed by Astoria Financial may be obtained free of charge at its website at http://ir.astoriabank.com/. Alternatively, these documents, when available, can be obtained free of charge from the Company upon written request to New York Community Bancorp, Inc., Attn: Corporate Secretary, 615 Merrick Avenue, Westbury, New York 11590 or by calling (516) 683-4420, or from Astoria Financial upon written request to Astoria Financial Corporation, Attn: Monte N. Redman, President, One Astoria Bank Plaza, Lake Success, New York 11042 or by calling (516) 327-3000. Participants in Solicitation The Company, Astoria Financial, their directors, executive officers, and certain other persons may be deemed to be participants in the

solicitation of proxies from

the Company’s and Astoria Financial’s stockholders in favor of the approval of the merger. Information about the directors and executive officers of the Company and their ownership of its common stock is set forth in the proxy statement for its 2015 annual meeting of stockholders, as previously filed with the SEC on April 24, 2015. Information about the directors and executive officers of Astoria Financial and their ownership of its common stock is set forth in the proxy statement for its 2015 annual meeting of stockholders, as previously filed with the SEC on April 17, 2015. Stockholders may obtain additional information regarding the interests of such participants by reading the registration statement and the proxy statement/prospectus.

|

New York Community Bancorp, Inc. 3 Cautionary Statements Forward-Looking Information This presentation and certain other related communications may contain certain “forward-looking statements” within the meaning of

the Private Securities Litigation Reform Act of 1995. These statements

include, but are not limited to, the expected completion date, financial benefits, and other effects of the proposed merger of the Company and Astoria Financial. Forward-looking statements can be identified by the use of the words “anticipate,” “expect,” “intend,” “estimate,” “target,” and other words of similar import. Forward-looking statements are not historical facts but, instead, express only management’s beliefs regarding future results or

events, many of which, by their nature, are inherently uncertain and

outside of management’s control. It is possible that actual results and outcomes may differ, possibly materially, from the anticipated results or outcomes indicated in these forward-looking statements.

Factors that may cause such a difference include, but are not limited to, the reaction

to the transaction of the companies’ customers, employees, and

counterparties; customer disintermediation; inflation; expected synergies, cost

savings, and other financial benefits of the proposed transaction might

not be realized within the expected time frames or might be less than projected; the

requisite stockholder and regulatory approvals for the proposed

transaction might not be obtained; credit and interest rate risks associated with the

Company’s and Astoria Financial’s respective businesses,

customers, borrowings, repayment, investment, and deposit practices, and general economic conditions, either nationally or in the market areas in which the Company and Astoria Financial operate or anticipate doing business, are less favorable than expected; new regulatory or legal

requirements or obligations;

and other risks and important factors that could affect the Company’s and Astoria Financial’s future results are identified in their Annual Reports on Form 10-K for the year ended December 31, 2014 and other reports filed with the SEC.

Our Use of Non-GAAP Financial Measures

This presentation may contain certain non-GAAP financial measures which management

believes to be useful to investors in understanding the companies’

performance and financial condition, and in comparing their performance and financial condition with those of other banks. Such non-GAAP financial measures are not to be considered in isolation or as a substitute for measures calculated in accordance with GAAP.

Forward-looking statements are made only as of the date of the presentation and neither NYCB nor Astoria Financial undertakes any obligation to update any forward-looking statements contained in the presentation to reflect events or conditions after the date hereof. |

New York Community Bancorp, Inc. 4 (a) Pro forma assets, deposits, and multi-family loans are based on our balances and Astoria’s at 12/31/15.

(b) Data from SNL Financial as of 6/30/15. (c) Our pro forma market cap was calculated by multiplying our closing price at 12/31/15 by the sum of our outstanding shares and Astoria’s at that date. Pro Forma Assets (a) Pro Forma Multi-Family Loan Portfolio (a) Pro Forma Deposits (a) Pro Forma Deposit Market Share (b) Pro Forma Market Cap (c) $65.4 billion $30.0 billion $37.5 billion #2 in the NY MSA $9.6 billion With pro forma assets of $65.4 billion, we expect

to rank 20th

among U.S. bank holding companies. With a pro forma portfolio of $30.0 billion,

we expect to augment our position as a leading multi- family lender in NYC. With pro forma deposits of $37.5 billion and over

350 branches in

Metro NY, NJ, OH, FL, and AZ, we expect to rank 23rd among the nation’s largest depositories. With pro forma deposits of $31.7 billion in the NY MSA, we expect our deposit market share rank among regional banks to rise to #2. With a pro forma market cap of $9.6 billion, we expect

to rank 19th

among the nation’s

publicly traded banks and thrifts. The Astoria merger – like the others we’ve completed – is expected to grow our earnings, build our capital, and create value for our investors. Note: Except as otherwise indicated, all information regarding Astoria in this presentation, include the appendices, was provided by

Astoria; all industry data was provided by SNL Financial as of

12/31/15. |

New York Community Bancorp, Inc. 5 The Astoria merger is expected to significantly increase our earnings and strengthen our balance sheet. Significantly Increases our Earnings ~ 20% pro forma earnings accretion (a) ~ 15.5% return on average tangible common equity (ROATCE) Expected cost saves (~ 50% of Astoria’s non- interest expense) maintain our longstanding record of efficiency Expands our margin Increases our revenue stream Significantly Strengthens our Balance Sheet De-risking strategies greatly enhance our balance sheet profile 6% tangible book value per share (TBVPS) accretion upon closing in 4Q 2016 (a) Boosts deposits by $9 billion and substantially increases our share of deposits in core markets Heightens liquidity while reducing our cost of funds Extends our longstanding record of exceptional asset quality Reduces our interest rate sensitivity Builds capital (a) Including the strategic debt repositioning and capital raise completed in 4Q 2015. |

New York Community Bancorp, Inc. 6 The Astoria merger features substantial upside potential relative to the purchase price. Source: SNL Financial, company disclosure. (a) Time deposits greater than $100k are based on 2Q 2015 regulatory disclosure for Astoria.

(b) Core deposits reflect total deposits less time deposits greater than $100k. (c) Represents the average for U.S. bank-to-bank M&A transactions announced since 2013 with deal values between $1 billion

- $10 billion.

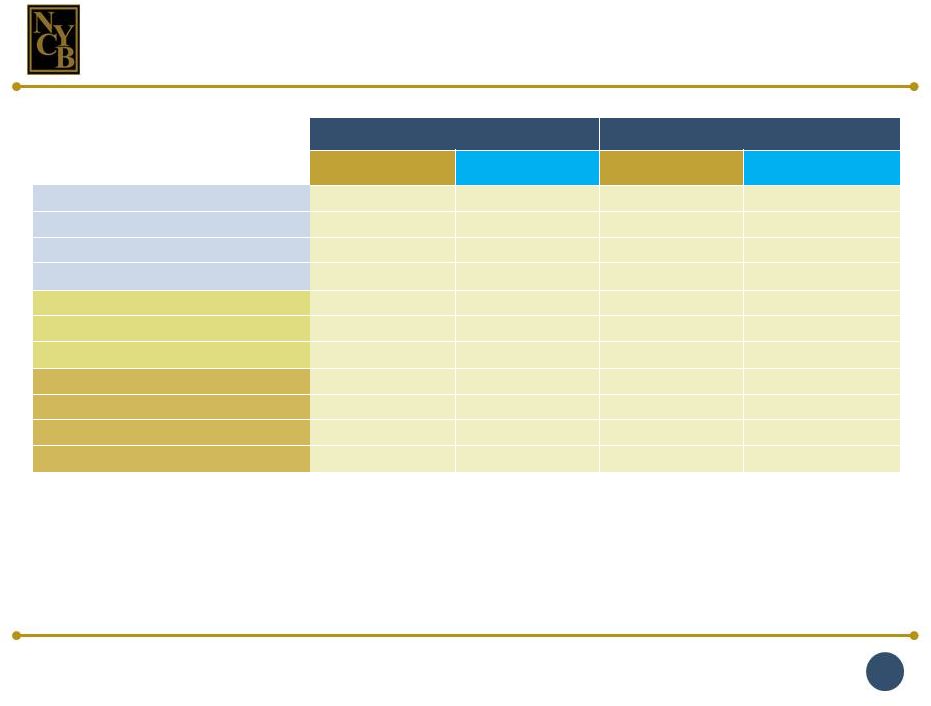

Substantially Higher Financial Returns Attractive Purchase Price Multiples NYCB Bank-to-bank M&A transactions since 2013 (c) 1.49x 1.78x Price / TBVPS 7.7% 12.1% Core Deposit Premium 20.0% 10.1% EPS Accretion 6.0% (5.2%) TBVPS Accretion / (Dilution) (a) (b) |

Note:

Data from SNL Financial as of 6/30/15. Long Island

Brooklyn Queens Westchester 52% 85% 92% Within 1 Mile Within 3 Miles Within 5 Miles Astoria NYCB % of Astoria branches near an NYCB branch The Astoria merger is expected to create New York’s pre- eminent community bank. 7 New York Community Bancorp, Inc. |

New York Community Bancorp, Inc. 8 Increases our rank among regional banks in the NY MSA from #4 to #2 Boosts our market share in four attractive Metro NY markets: Nassau and Suffolk Counties (Long Island), Queens, and Brooklyn Infusion of low-cost core deposits enhances our funding mix Expands our customer base and opportunities to increase non-interest revenues Potential improvement in deposit pricing power due to increased scale We expect the Astoria merger to significantly increase our share of deposits in the NY MSA. 2015 Rank Top Banks in the NY MSA (a) Branches Deposits ($mm) 1 Capital One 302 $55,860 2 NYCB Pro Forma 291 31,703 2 Signature 29 24,444 3 M&T Bank 178 23,149 4 NYCB 204 22,274 5 PNC 237 19,963 6 Valley National 194 12,937 7 Investors 113 11,787 8 Apple Financial 80 10,337 9 Astoria Financial 87 9,429 10 First Republic 9 9,335 Note: Data from SNL Financial as of 6/30/15. (a) Excludes international banks and money centers including: JPMorgan, Bank of New York Mellon, HSBC Holdings, Citigroup, Bank of America, TD, Wells

Fargo, Bank of China, and Banco Santander.

A Stronger Deposit Franchise |

New York Community Bancorp, Inc. 9 The Astoria merger is expected to significantly increase our share of deposits in four highly attractive markets. Nassau 2015 Rank Top Banks Branches Deposits ($000) 1 JPMorgan Chase & Co. 92 $13,964,179 2 Capital One Financial Corp. 49 10,109,533 3 NYCB Pro Forma 65 10,086,758 3 Citigroup Inc. 46 9,455,824 4 NYCB 37 6,534,120 5 Toronto-Dominion Bank 32 4,825,027 6 Bank of America Corp. 41 4,031,542 7 Astoria Financial Corp. 28 3,552,638 8 Signature Bank 5 2,710,436 9 Flushing Financial Corp. 4 2,374,108 10 Apple Financial Holdings 11 1,938,116 Note: Data from SNL Financial as of 6/30/15. Queens 2015 Rank Top Banks Branches Deposits ($000) 1 JPMorgan Chase & Co. 91 $12,396,075 2 Citigroup Inc. 30 7,550,846 3 Capital One Financial Corp. 36 5,773,420 4 NYCB Pro Forma 61 5,641,369 4 NYCB 44 3,406,755 5 Toronto-Dominion Bank 30 3,149,768 6 Astoria Financial Corp. 17 2,234,614 7 HSBC Holdings Plc 17 1,960,130 8 Ridgewood Savings Bank 12 1,866,343 9 Bank of America Corp. 22 1,536,465 10 Maspeth Federal 5 1,080,866 Suffolk 2015 Rank Top Banks Branches Deposits ($000) 1 JPMorgan Chase & Co. 95 $9,911,083 2 Capital One Financial Corp. 52 9,199,284 3 Bank of America Corp. 33 3,796,602 4 Citigroup Inc. 24 3,723,156 5 NYCB Pro Forma 54 3,247,433 5 HSBC Holdings Plc 19 3,113,402 6 Toronto-Dominion Bank 29 2,741,933 7 Bridge Bancorp Inc. 29 2,165,333 8 Astoria Financial Corp. 26 2,062,844 9 Suffolk Bancorp 26 1,699,044 10 People's United 40 1,275,427 12 NYCB 28 1,184,589 Brooklyn 2015 Rank Top Banks Branches Deposits ($000) 1 JPMorgan Chase & Co. 81 $13,084,933 2 Citigroup Inc. 27 5,561,319 3 Banco Santander SA 20 4,674,495 4 Capital One Financial Corp. 31 3,578,731 5 Toronto-Dominion Bank 26 2,906,050 6 HSBC Holdings Plc 20 2,578,225 7 Signature Bank 4 2,209,221 8 NYCB Pro Forma 26 1,974,111 8 Apple Financial Holdings 18 1,792,918 9 Bank of America Corp. 22 1,492,435 10 Dime Community 10 1,263,869 11 Astoria Financial Corp. 12 1,166,054 12 NYCB 14 808,057 |

New York Community Bancorp, Inc. 10 (a) Represents the sum of NYCB’s and Astoria’s balances at 12/31/2015. (b) Tangible stockholders’ equity is a non-GAAP financial measure. Please see page 36 for additional information.

Summary Pro Forma Balance Sheet Increases our share of NYC’s multi-family lending market

Leverages our mortgage banking platform and Astoria’s

residential mortgage lending expertise

Extends our longstanding record of credit quality and capital

strength

(dollars in billions)

December 31, 2015 NYCB Pro Forma (a) Change Assets $50.3 $65.4 30.0% Loans, net 38.0 49.1 29.1 Multi-Family Loans 26.0 30.0 15.5 Total Deposits 28.4 37.5 32.0 Wholesale Borrowings 15.4 19.1 24.1 Stockholders’ Equity 5.9 7.6 28.0 Tangible Stockholders’ Equity (b) 3.5 5.0 42.3 Reflecting its in-market nature and our extensive expertise in post-merger

integration and restructuring, the Astoria merger presents maximal

opportunities for revenue enhancement while minimizing risk.

Capitalizes on Complementary Business Models Provides immediate scale to leverage compliance-related costs Expedites our ability to comply with LCR requirements Validates our extensive preparations for SIFI status Facilitates our Transition to SIFI Status Provides Ample Opportunities for Continued Earnings and Capital Growth Post-merger sale of $1+ billion of acquired assets to reduce

credit risk, enhance liquidity, and fund investments in

HQLAs Acquired real estate has embedded value

|

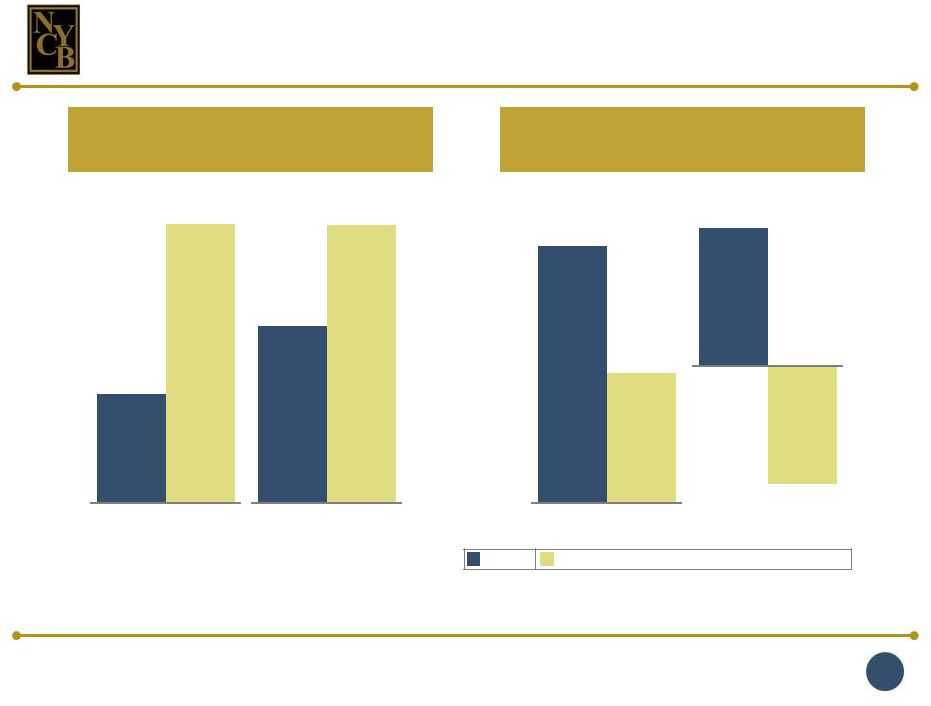

The Astoria merger is expected to enhance our asset and

funding mix. NYCB Astoria Pro Forma (a) Total Loans: $37.8 bn Yield on Loans: 3.97% NYCB Astoria Pro Forma (a) Total Deposits: $28.4 bn Cost of I-B Deposits: 0.62% Total Loans: $11.1 bn Yield on Loans: 3.51% Total Loans: $48.9 bn Yield on Loans: 3.86% Total Deposits: $9.1 bn Cost of I-B Deposits: 0.41% Total Deposits: $37.5 bn Cost of I-B Deposits: 0.58% (a) Pro forma based on the sum of Astoria’s and NYCB’s loans and deposits.

Note: All amounts are as of 12/31/15.

Multi-family 69% CRE 21% ADC 1% C&I 4% 1-4 Family (Non-covered) 0% Covered Loans 5% Other 0% Multi-family 36% CRE 7% C&I 1% 1-4 Family (Non-covered) 54% Other 2% Multi-family 61% CRE 18% ADC 1% C&I 3% 1-4 Family (Non-covered) 13% Covered Loans 4% Other 0% NOW and MMA 46% Savings 26% CDs 19% N-I-B 9% NOW and MMA 45% Savings 26% CDs 20% N-I-B 9% NOW and MMA 44% Savings 23% CDs 22% N-I-B 11% New York Community Bancorp, Inc. 11 |

New York Community Bancorp, Inc. 12 We expect the Astoria merger to provide multiple opportunities to drive profitable, sustainable, long-term asset growth. The Pro Forma Company is Primed for Strong Core Asset Growth Results in greater on-balance sheet capacity to support loan production

Highly liquid residential mortgage loan portfolio provides the

flexibility to manage our asset mix Stronger capital formation and multiple sources of funding and liquidity are available to support growth

Growth Levers More loans to be retained in portfolio once SIFI threshold is exceeded ($2.6 billion of loans sold from 3Q 2014 through 4Q 2015 to manage our assets under $50 billion) Expected sale of acquired (higher-risk) assets to support loan growth going forward Facilitates the continuation of our growth- through-acquisition strategy Results Earnings growth Higher operating leverage Improved risk profile Enhanced returns for investors |

New York Community Bancorp, Inc. 13 De-risking our balance sheet is expected to strengthen our financial performance both before and after the merger. Balance Sheet Repositioning Strategies In 4Q 2015, we prepaid $10.4 billion of primarily puttable wholesale borrowings with an average cost of 3.16% and

replaced them with a like amount of wholesale borrowings with fixed

maturities and an average cost of 1.58%. While the

prepayment of wholesale borrowings resulted in a one-time after-tax debt repositioning charge of $546.8 million in 4Q 2015, it is expected to reduce our annual interest expense by ~ $100 million after-tax beginning in

2016.

Upon completion of the merger, the terms on $1.5 billion of

short-term borrowings will be extended, reducing our

interest rate sensitivity.

We also expect to sell $1.0 billion of Astoria’s

non-performing and higher-risk assets at the close. Benefits of

De-Risking: Eliminates puttable risk

Improves NPV and NII interest rate

sensitivity ratios

Reduces exposure to rising interest rates

Enhances both liquidity and asset quality

Financial Benefits Expected in

FY 16 from 4Q 15 Repositioning:

EPS accretion:

~ 10%

Net Interest Margin:

~ 35 bps

Net Interest Income:

~ $165 million

Net Income:

~ $100 million |

New York Community Bancorp, Inc. 14 Enhancing our capital management strategy has strengthened our capital measures and is expected to facilitate further growth. Completed on 11/4/15, our common stock offering: — Immediately supported our tangible stockholders’ equity and Tier 1 common equity; and — Exceeded by $87.3 million the impact on capital of the one-time after-tax balance sheet repositioning charge incurred in 4Q 2015. Adjusting our quarterly cash dividend to $0.17 per share positioned us for sustainable long-term capital growth while

still providing our investors with an attractive yield.

— Dividend declared on 1/26/16 provided a yield of 4.6%. — Capital retention served to minimize the dilution from our 4Q 2015 capital raise. — Building capital will facilitate the execution of our growth-

through-acquisition strategy going forward, and provide

the flexibility to maximize future value-enhancing

capital deployment strategies.

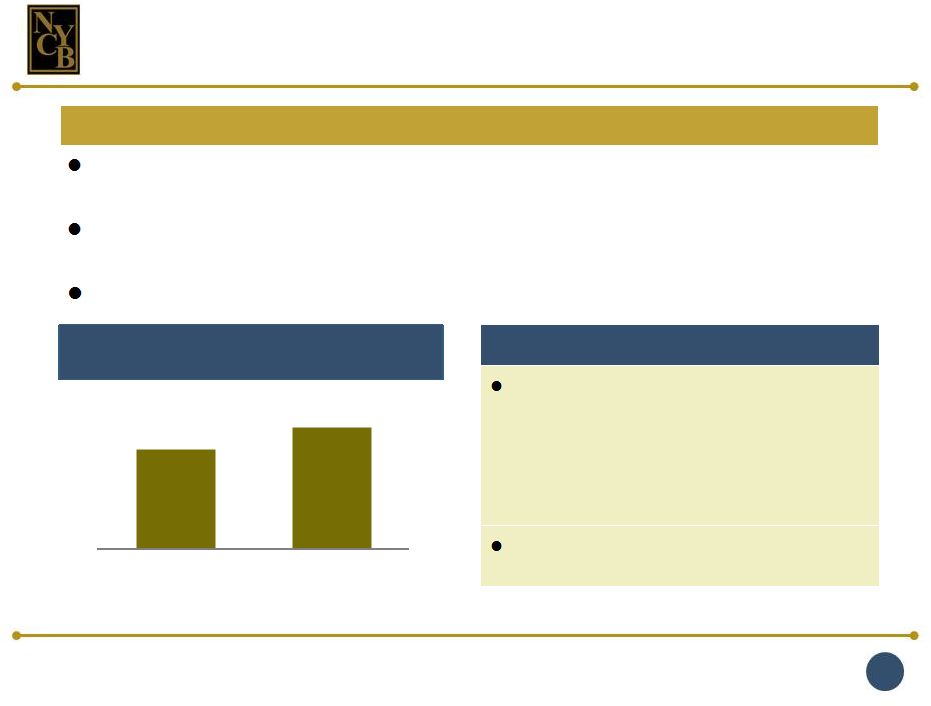

Enhancements to Our Capital Management Strategy Increased Capital Generation ~ 55 bps ~ 90 bps NYCB Stand-Alone Pro Forma w/ Astoria 4Q 2016 12-month bps of Capital Generation |

New York Community Bancorp, Inc. 15 36% 44% (a) 2010 2015 Following enactment of the Dodd-Frank Act, we began allocating significant resources towards SIFI

preparedness.

The degree to which we have already leveraged the cost of SIFI

compliance is reflected in the ~ 800-basis point

increase in our efficiency ratio since the enactment of Dodd-Frank. The merger will provide the additional scale to leverage the remaining SIFI compliance costs.

While we expect the merger to bring us well beyond the current

SIFI threshold, we plan to cross it organically in 2Q 2016.

Preparing for SIFI Status

NYCB Efficiency Ratio

Prior to and Since Dodd-Frank

SIFI Compliance Key infrastructure investments to date include: — Enhanced ERM and corporate governance frameworks — Bottom-up capital planning and stress testing capabilities — Substantial expansion of regulatory compliance staff Remaining costs of SIFI compliance include LCR, CCAR reporting, and Living Will (a) Excludes the impact of the debt repositioning charge recorded in net interest income and the debt repositioning charge and merger-related

expenses recorded in non-interest expense. Please see the

reconciliation of our GAAP and non-GAAP efficiency ratios on page 37. |

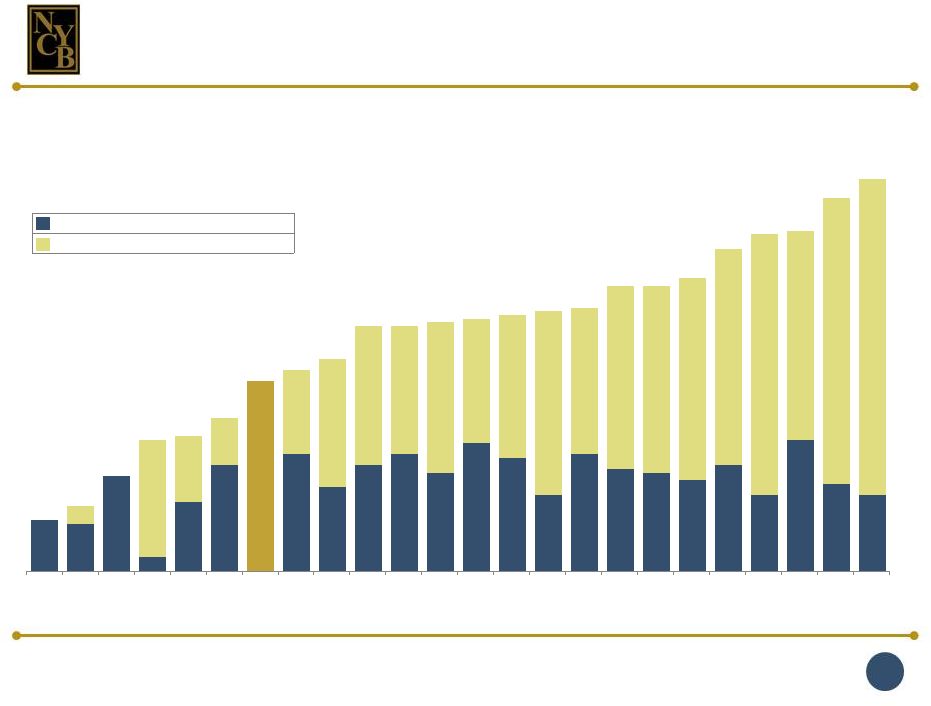

New York Community Bancorp, Inc. 16 14 % 13 % 26 % 4 % 19 % 29 % 52 % 32 % 23 % 29 % 32 % 27 % 35 % 31 % 21 % 32 % 28 % 27 % 25 % 29 % 21 % 36 % 24 % 21 % 5 % 32 % 18 % 13 % 23 % 35 % 38 % 35 % 41 % 34 % 39 % 50 % 40 % 50 % 51 % 55 % 59 % 71 % 57 % 78 % 86 % 14 % 18 % 26 % 36 % 37 % 42 % 55 % 58 % 67 % 67 % 68 % 69 % 70 % 71 % 72 % 78 % 78 % 80 % 88 % 92 % 93 % 102 % 107 % ZION BAC MTB C MS JPM NYCB PF 2017 BBT CFG STI HBAN CMA WFC USB COF FITB PNC KEY STT RF DFS NTRS BK AXP As we continue to grow, we would expect our total payout ratio to be more consistent with the total payout ratio for our SIFI peers. Dividends Approved in 2015 Share Repurchases Approved in 2015 |

We Expect the Core Components

of our Business Model to Be Enhanced

by the Astoria Financial Merger |

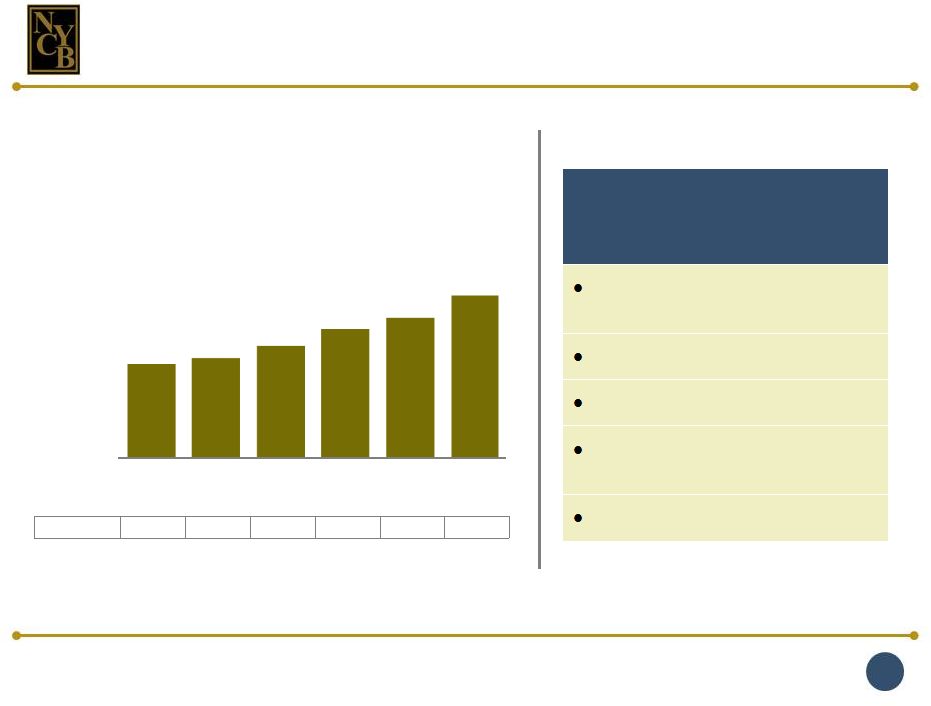

New York Community Bancorp, Inc. 18 $17,433 $18,605 $20,714 $23,849 $25,989 $30,013 12/31/11 12/31/12 12/31/13 12/31/14 12/31/15 12/31/15 Pro Forma NYCB Portfolio Statistics at or for the 12 Mos. Ended 12/31/15 % of non-covered loans held for investment = 72.7% Average principal balance = $5.3 million Weighted average life = 2.8 years % of our multi-family loans located in Metro New York = 80.6% % of HFI loan originations = 72.7% Multi-Family Loan Portfolio (in millions) The merger is expected to increase our share of NYC’s highly attractive multi-family lending niche. Originations: $5,761 $5,791 $7,417 $7,584 $9,214 $9,998 (b) (a) Includes Astoria’s balance of multi-family loans at 12/31/15. (b) Includes Astoria’s multi-family loan originations in the twelve months ended 12/31/15.

(a) |

New York Community Bancorp, Inc. 19 0.68% 1.63% 2.83% 2.89% 0.00% 0.03% 0.13% 0.21% 2007 2008 2009 2010 0.54% 1.28% 1.50% 1.17% 0.91% 0.00% 0.00% 0.04% 0.07% 0.06% 1989 1990 1991 1992 1993 S & L Crisis Net Charge-Offs/ Average Loans 5-Year Total NYCB: 17 bp SNL U.S. Bank and Thrift Index: 540 bp 4-Year Total NYCB: 37 bp SNL U.S. Bank and Thrift Index: 803 bp SNL U.S. Bank and Thrift Index NYCB Great Recession Current Credit Cycle 5-Year Total NYCB: 52 bp SNL U.S. Bank and Thrift Index: 476 bp 1.77% 1.24% 0.76% 0.53% 0.43% 0.35% 0.13% 0.05% 0.01% 2011 2012 2013 2014 2015 (0.02)% We have been distinguished by our low level of net charge- offs in downward credit cycles. |

New York Community Bancorp, Inc. 20 2.91% 4.00% 4.05% 3.41% 2.35% 1.46% 2.48% 2.10% 2.83% 1.51% 12/31/89 12/31/90 12/31/91 12/31/92 12/31/93 S & L Crisis Great Recession Current Credit Cycle Non-Performing Loans (a)(b) / Total Loans (a) (a) Non-performing loans and total loans exclude covered loans and non-covered purchased credit-impaired loans.

(b) Non-performing loans are defined as non-accrual loans and loans 90 days or more past due but still accruing interest.

1.11%

2.71%

4.17%

3.56%

0.11%

0.51%

2.47%

2.63%

12/31/07

12/31/08

12/31/09

12/31/10

2.60%

2.22%

1.66%

1.26%

0.78%

1.28%

0.96%

0.35%

0.23%

0.13%

12/31/11

12/31/12

12/31/13

12/31/14

12/31/15

Average NPLs/Total Loans

NYCB: 2.08% SNL U.S. Bank and Thrift Index: 3.34% Average NPLs/Total Loans NYCB: 1.43% SNL U.S. Bank and Thrift Index: 2.89% SNL U.S. Bank and Thrift Index NYCB Average NPLs/Total Loans NYCB: 0.59% SNL U.S. Bank and Thrift Index: 1.70% The sale of Astoria’s non-performing and higher-risk loans upon completion of the

merger is expected to enable us to maintain our superior record of asset

quality. |

New York Community Bancorp, Inc. 21 SNL U.S. Bank and Thrift Index NYCB Astoria The Astoria merger also is expected to maintain our record of superior efficiency. 67.12% 66.59% 65.93% 65.41% 65.84% 40.03% 40.75% 42.71% 43.16% 43.81% (a) 2011 2012 2013 2014 2015 2015 Efficiency Ratio Benefits of the Astoria Merger In-market nature of the merger underscores the potential for significant cost savings Estimated cost saves = ~

50% of Astoria’s

non-interest expense

Opportunity to leverage our mortgage

platform and

Astoria’s retail origination model

Provides immediate scale to absorb higher

SIFI compliance-related

costs

Expanded

customer

base represents an opportunity for revenue growth (e.g., through sales of third-party investment products and other financial services) 73.21% (a) Excludes the impact of the debt repositioning charge recorded in net interest income and the debt repositioning charge and merger-related

expenses recorded in non-interest expense. Please see the

reconciliation of our GAAP and non-GAAP efficiency ratios on page 37. |

New York Community Bancorp, Inc. 22 Features Loans can be originated/purchased in all 50 states and the District of Columbia.

Loan production is driven by our proprietary real time, web-accessible mortgage

banking

technology platform, which securely controls the lending process while mitigating business and regulatory risks. We have over 900 approved clients including community banks, credit unions, mortgage companies, and mortgage brokers. 100% of loans funded are full documentation, prime credit loans. Credit Quality As of December 31, 2015, 99.8% of all funded loans were current. Limited Repurchase Risk Of the eight loans that were repurchased in 2015, five were subsequently resolved and three were placed back into the portfolio. Benefits Since January 2010, our mortgage banking business has originated 1-4 family loans

of $42.7 billion and generated mortgage banking income of $638.5 million.

Our proprietary mortgage banking platform has enabled us to expand our revenues,

market share, and product line.

Over time, mortgage banking income has supported the stability of our return on

average tangible assets, even in times of interest rate

volatility. The Astoria merger is expected to leverage our mortgage

banking platform and its residential mortgage lending

expertise. |

Total Return on Investment |

New York Community Bancorp, Inc. 24 244% 213% 209% 245% 168% 260% 393% 450% 461% 717% 2,059% 2,754% 3,843% 2,670% 3,069% 4,265% 4,319% 11/23/93 12/31/99 12/31/08 12/31/09 12/31/10 12/31/11 12/31/12 12/31/13 12/31/14 12/31/15 CAGR since IPO: 26.2% (a) Bloomberg Total Return on Investment As a result of nine stock splits between 1994 and 2004, our charter shareholders have 2,700 shares of NYCB stock for each 100 shares originally purchased. SNL U.S. Bank and Thrift Index NYCB (a) Our commitment to building value for our investors is reflected in our total returns over the course of our public life. 4,682%

|

New York Community Bancorp, Inc. 25 2/3/16 Visit our website: ir.myNYCB.com E-mail requests to: ir@myNYCB.com Call Investor Relations at: (516) 683-4420 Write to: Investor Relations New York Community Bancorp, Inc. 615 Merrick Avenue Westbury, NY 11590 For More Information |

Appendix A: Additional Information about the Proposed Astoria Financial Merger |

New York Community Bancorp, Inc. 27 Transaction Features The Merger Astoria Financial will merge with and into NYCB and Astoria Bank will merge with and into NYCB’s primary bank subsidiary, New York Community Bank. Consideration One-for-one fixed exchange ratio plus $0.50 per share cash payment Cost Savings Approximately 50% of Astoria’s non-interest expense Merger & Integration Costs Approximately $180 million pre-tax Credit Mark Approximately 1% of current portfolio less net charge-offs at the close Closing Conditions Contingent on the approval of NYCB’s and Astoria’s regulators and

shareholders Other customary closing conditions Expected Closing 4Q 2016, subject to the conditions noted above |

New York Community Bancorp, Inc. 28 NYCB Features Astoria Financial 1859 Established 1888 1993 Year Converted 1993 Westbury, NY Headquarters Lake Success, NY Largest US Thrift Rank by Assets 4th Largest US Thrift NYSE Exchange NYSE 484,943,308 Shares Outstanding at 12/31/15 100,721,358 $7.91 Billion Market Cap at 12/31/15 $1.60 Billion Nassau, Suffolk, Queens, Brooklyn, Manhattan, Westchester, Staten Island, The Bronx Metro NY Markets Nassau, Suffolk, Queens, Brooklyn, Manhattan, Westchester 143 (a) Number of Branches in Metro NY 88 (a) 258 (a)(b) Total Number of Branches 88 (a) 3,448 FTE Number of Employees 1,551 FTE (a) At 12/31/15 (b) Includes 46 branches in NJ, 28 in OH, 27 in FL, and 14 in AZ. NYCB and Astoria Financial at a Glance |

New York Community Bancorp, Inc. 29 NYCB and Astoria Financial: Earnings Summary For the 3 months ended 12/31/15 For the 12 months ended 12/31/15 (in thousands, except share data) NYCB Astoria Financial NYCB Astoria Financial Net interest income $324,554 (a) $84,684 $1,181,831 (a) $340,289 Recovery of losses on loans (6,317) (4,323) (15,004) (12,072) Non-interest income 59,041 13,469 210,763 54,596 Non-interest expense 159,430 (a) 74,506 615,504 (a) 289,083 Income tax expense 85,292 (a) 9,539 289,253 (a) 41,203 (b) Net income 145,190 (a) 18,431 502,841 (a) 76,671 (b) Diluted earnings per common share 0.31 (a) 0.16 1.11 (a) 0.67 (b) Dividend per common share 0.25 0.04 1.00 0.16 (a) Presented on a non-GAAP basis. Please see pages 38 and 40 – 42 for reconciliations of NYCB’s GAAP and non-GAAP amounts and measures.

(b) Presented on a non-GAAP basis. Please see pages 39 and 42 for reconciliations of Astoria’s GAAP and non-GAAP amounts and

measures. |

New York Community Bancorp, Inc. 30 At or for the 3 months ended 12/31/15 At or for the 12 months ended 12/31/15 NYCB (a) Astoria Financial NYCB (a) Astoria Financial (b) ROATE 17.26 % 4.85% 15.01% 5.19% ROATA 1.24 0.49 1.09 0.51 Net Interest Margin (c) 2.95 2.39 2.71 2.36 Efficiency Ratio (d) 41.27 75.91 43.81 73.21 NPAs (e) /Total Assets (e) 0.13 1.05 0.13 1.05 NPLs (f) /Total Loans (f) 0.13 1.24 0.13 1.24 Net (Recoveries) Provisions/ Average Loans (0.00) 0.04 (0.02) 0.01 Equity/Total Assets 11.79 11.03 11.79 11.03 Tangible Equity/Tangible Assets (a) 7.30 9.06 7.30 9.06 Common Equity Tier 1 Ratio 10.48 16.00 10.48 16.00 Leverage Capital Ratio 7.76 10.21 7.76 10.21 NYCB and Astoria Financial: Profitability, Asset Quality, and Capital Measures (a) ROATE and ROATA are presented on a non-GAAP basis. Please see page 42 for a reconciliation of NYCB’s GAAP and non-GAAP

measures. (b)

ROATE and ROATA are presented on a non-GAAP basis. Please see page 42

for a reconciliation of Astoria’s GAAP and non-GAAP measures.

(c) NYCB’s margin has been adjusted to exclude the debt repositioning charge recorded in its 4Q and full-year 2015 net interest income, and

is therefore a non- GAAP measure. Please see page 41 for a

reconciliation of NYCB’s GAAP and non-GAAP margin.

(d) NYCB’s efficiency ratio excludes the impact of the debt repositioning charge recorded in net interest income and the debt repositioning

charge and merger- related expenses recorded in non-interest

expense. Please see the reconciliation of NYCB’s GAAP and non-GAAP efficiency ratios on page 37. (e) Non-performing assets and total assets exclude covered loans, non-covered purchased credit-impaired loans, and covered other real

estate owned. (f)

Non-performing loans and total loans, which exclude covered loans and

non-covered purchased credit-impaired loans, are defined as

non-accrual loans and loans 90 days or more past due but still

accruing interest. |

Appendix B: Historical Information about Our Merger Transactions |

New York Community Bancorp, Inc. 32 * The Astoria merger was announced in October 2015. All other mergers on this page were completed in the months and years indicated.

The number of branches indicated for our previous transactions is the number of

branches in our current franchise that stemmed from each. Transaction

Type: Savings Bank

Commercial Bank Branch FDIC Deposit The Astoria merger leverages our expertise in executing accretive transactions and managing post-merger integrations. 1. Nov. 2000 Haven Bancorp (HAVN) Assets: $2.7 billion Deposits: $2.1 billion Branches: 28 2. July 2001 Richmond County Financial Corp. (RCBK) Assets: $3.7 billion Deposits: $2.5 billion Branches: 24

3. Oct. 2003

Roslyn Bancorp, Inc. (RSLN) Assets: $10.4 billion Deposits: $5.9 billion Branches: 38

4. Dec. 2005

Long Island Financial Corp. (LICB) Assets: $562 million Deposits: $434 million Branches: 9

5. April 2006

Atlantic Bank of New York (ABNY) Assets: $2.8 billion Deposits: $1.8 billion Branches: 14 6. April 2007 PennFed Financial Services, Inc. (PFSB) Assets: $2.3 billion Deposits: $1.6 billion Branches: 22 7. July 2007 NYC branch network of Doral Bank, FSB (Doral- NYC) Assets: $485 million Deposits: $370 million Branches: 11

8. Oct. 2007

Synergy Financial Group, Inc. (SYNF) Assets: $892 million Deposits: $564 million Branches: 16 9. Dec. 2009 AmTrust Bank Assets: $11.0 billion Deposits: $8.2 billion Branches: 64

10. March 2010

Desert Hills Bank Assets: $452 million Deposits: $375 million Branches: 3

11. June 2012

Aurora Bank FSB Assets: None Deposits: $2.2 billion Branches: 0

Payment Received: $24.0 million 12. Oct. 2015* Astoria Financial Corporation (AF) Assets: $15.1 billion Deposits: $9.0 billion Branches:

88 |

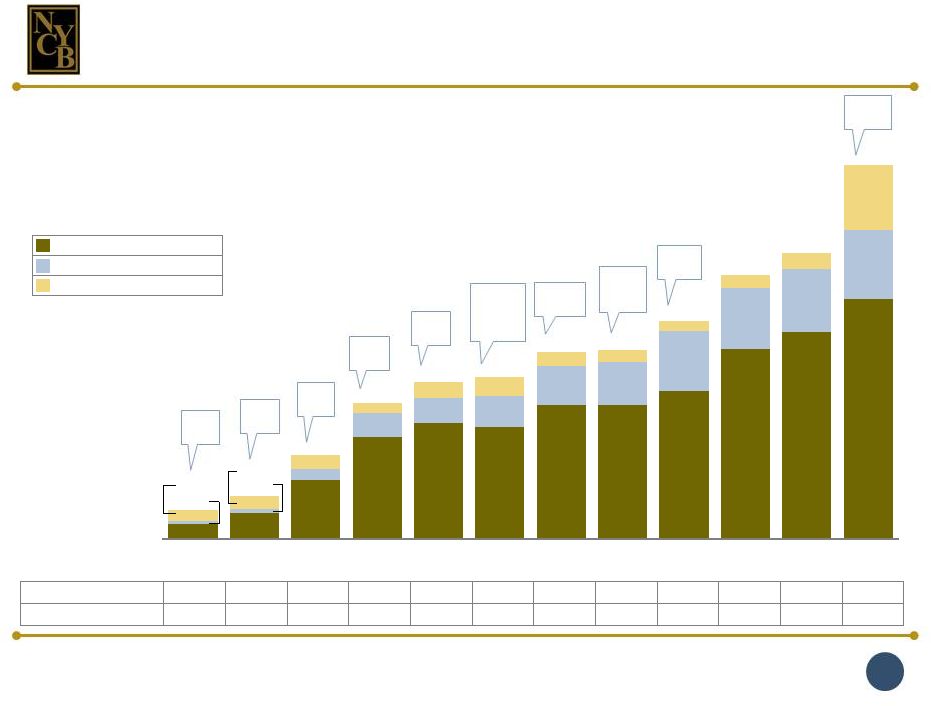

New York Community Bancorp, Inc. 33 (in millions) Deposits w/ HAVN w/ RCBK w/ RSLN w/ LICB w/ ABNY w/ PFSB, Doral, & SYNF w/ AmTrust w/ Desert Hills w/ Astoria Total Deposits: $3,268 $5,472 $10,360 $12,168 $12,764 $13,311 $22,418 $21,890 $24,878 $28,329 $28,426 $37,533 Total Branches: 86 120 139 152 166 217 276 276 275 272 258 345 The Astoria merger, like every other, is expected to enhance our liquidity, reduce our funding costs, and boost our deposit market share. w/ Aurora $1,874 $2,408 $4,362 $5,247 $5,945 $6,913 $9,054 $7,835 $9,121 $6,421 $5,312 $7,307 $1,223 $2,609 $5,278 $6,015 $5,554 $4,975 $11,494 $12,122 $12,998 $19,601 $20,610 $26,724 $171 $455 $720 $906 $1,265 $1,423 $1,870 $1,933 $2,759 $2,307 $2,504 $3,502 12/31/00 12/31/01 12/31/03 12/31/05 12/31/06 12/31/07 12/31/09 12/31/10 12/31/12 12/31/14 12/31/15 CDs NOW, MMAs, and Savings Demand deposits 12/31/15 Pro Forma |

New York Community Bancorp, Inc. 34 $1,946 $3,255 $7,368 $12,854 $14,529 $14,055 $16,736 $16,802 $18,605 $23,849 $25,989 $30,013 $324 $566 $1,445 $2,888 $3,114 $3,826 $4,987 $5,438 $7,437 $7,637 $7,860 $8,680 $1,366 $1,584 $1,686 $1,287 $2,010 $2,482 $1,654 $1,467 $1,243 $1,539 $1,914 $8,182 12/31/00 12/31/01 12/31/03 12/31/05 12/31/06 12/31/07 12/31/09 12/31/10 12/31/12 12/31/14 12/31/15 12/31/15 Pro Forma Held-for-Investment Loan Portfolio After HAVN After RCBK After RSLN After LICB After ABNY After PFSB, Doral, & SYNF After AmTrust After Desert Hills HFI Loans Outstanding: $3,636 $5,405 $10,499 $17,029 $19,653 $20,363 $23,377 $23,707 $27,285 $33,025 $35,763 $46,875 HFI Originations: $616 $1,150 $4,330 $6,332 $4,971 $4,853 $3,392 $4,329 $8,969 $11,015 $12,673 $14,308 After Aurora Multi-family CRE All other HFI loans (in millions) The Astoria merger, like every other, is expected to provide funding for the growth of our high-yielding loan portfolio. After Astoria |

Appendix C: Reconciliations of GAAP and Non-GAAP Financial Measures |

New York Community Bancorp, Inc. 36 December 31, 2015 (dollars in thousands) NYCB Astoria Total stockholders’ equity $ 5,934,696 $1,663,448 Less: Goodwill (2,436,131) (185,151) Core deposit intangibles (2,599) -- Preferred stock -- (129,796) Tangible stockholders’ equity $ 3,495,966 $1,348,501 Total assets $50,317,796 $15,076,211 Less: Goodwill (2,436,131) (185,151) Core deposit intangibles (2,599) -- Tangible assets $47,879,066 $14,891,060 Stockholders’ equity to total assets 11.79% 11.03% Tangible stockholders’ equity to tangible assets 7.30% 9.06% Tangible stockholders’ equity and tangible assets are non-GAAP financial measures. The following table presents reconciliations of these

non-GAAP measures with the related GAAP measures for NYCB and for

Astoria at December 31, 2015. Reconciliations of GAAP and

Non-GAAP Financial Measures |

New York Community Bancorp, Inc. 37 For the Three Months Ended December 31, 2015 For the Twelve Months Ended December 31, 2015 (dollars in thousands) GAAP Non-GAAP GAAP Non-GAAP Total net interest income and non-interest income $(390,161) $(390,161) $618,838 $618,838 Adjustment: Debt repositioning charge -- 773,756 -- 773,756 Adjusted total net interest income and non-interest income $(390,161) $383,595 $618,838 $1,392,594 Operating expenses $163,735 $163,735 $615,600 $615,600 Adjustment: State and local non-income taxes resulting from the loss on debt repositioning and recorded in G&A expense -- (5,440) -- (5,440) Adjusted operating expenses $163,735 $158,295 $615,600 $610,160 Efficiency ratio (41.97)% 41.27% 99.48% 43.81% The following table presents reconciliations of NYCB’s GAAP and non-GAAP efficiency ratios for the three and twelve months ended December 31, 2015. Reconciliations of NYCB’s GAAP and Non-GAAP Efficiency Ratios |

New York Community Bancorp, Inc. 38 Reconciliations of NYCB’s GAAP Loss and Non-GAAP Earnings For the Three Months Ended December 31, 2015 For the Twelve Months Ended December 31, 2015 $(404,807) $ (47,156 Debt repositioning charge 914,965 914,965 State and local non-income taxes resulting from the loss on debt repositioning and recorded in G&A expense 5,440 5,440 Merger-related expenses 3,702 3,702 Income tax effect (374,110) (374,110) $ 145,190 $ 502,841 $(0.87) $(0.11) Debt repositioning charge 1.17 1.22 Merger-related expenses 0.01 0.01 $ 0.31 $ 1.11 The following table presents reconciliations of NYCB’s GAAP loss and non-GAAP earnings for the three and twelve months ended December

31, 2015. (a)

Footing differences are due to rounding.

(in thousands, except per share data)

GAAP Loss Adjustments to GAAP Loss: Non-GAAP earnings Diluted GAAP Loss per Share Adjustments to diluted GAAP loss per share: Diluted non-GAAP earnings per share (a) ) |

New York Community Bancorp, Inc. 39 Reconciliations of Astoria’s GAAP and Non-GAAP Net Income and Diluted

Earnings per Common Share and its GAAP and Non-GAAP Income Tax

Expense The following table presents a reconciliation of Astoria's GAAP and non-GAAP net income and diluted earnings per common share for the twelve

months ended December 31, 2015.

The following table presents a reconciliation of Astoria's GAAP and non-GAAP income

tax expense for the twelve months ended December 31, 2015. (in thousands,

except per share data) For the Twelve Months Ended

December 31, 2015 GAAP Net Income $ 88,075 Adjustment to GAAP earnings: Income tax expense adjustment (11,404) Non-GAAP net income $ 76,671 Diluted GAAP earnings per common share $ 0.79 Adjustment to diluted GAAP earnings per common share: Income tax expense adjustment (0.12) Diluted non-GAAP earnings per common share $ 0.67 (in thousands) For the Twelve Months Ended December 31, 2015 GAAP Income Tax Expense $ 29,799 Adjustment to diluted GAAP income tax expense: Income tax expense adjustment 11,404 Non-GAAP income tax expense $ 41,203 |

New York Community Bancorp, Inc. 40 Reconciliations of NYCB’s GAAP and Non-GAAP Net Interest (Loss) Income and GAAP and Non-GAAP Non-Interest Expense For the Three Months Ended December 31, 2015 For the Twelve Months Ended December 31, 2015 $(449,202) $ 408,075 Debt repositioning charge 773,756 773,756 $ 324,554 $1,181,831 The following table presents reconciliations of NYCB’s GAAP net interest (loss) income and non-GAAP net interest income for the three

and twelve months ended December 31, 2015.

For the Three Months Ended

December 31, 2015 For the Twelve Months Ended December 31, 2015 $ 309,781 $ 765,855 Debt repositioning charge (141,209) (141,209) Merger-related expenses (3,702) (3,702) State and local non-income taxes resulting from the loss on debt repositioning and recorded in G&A expense (5,440) (5,440) $ 159,430 $ 615,504 The following table presents reconciliations of NYCB’s GAAP non-interest expense and non-GAAP non-interest expense for the three

and twelve months ended December 31, 2015.

Adjustments to non-interest expense:

Non-interest expense

(in thousands) (in thousands) Net interest (loss) income Adjustment to net interest (loss) income: Non-GAAP net interest income Non-GAAP non-interest expense |

New York Community Bancorp, Inc. 41 For the Three Months Ended December 31, 2015 GAAP Non-GAAP Average Average Average Yield/ Average Yield/ Balance Interest Cost Balance Interest Cost -earning assets $44,111,768 $424,501 3.85% $44,111,768 $ 424,501 3.85 % -bearing deposits 25,866,830 39,219 0.60 25,866,830 39,219 0.60 14,813,371 834,484 22.35 14,813,371 60,728 1.63 -bearing liabilities 40,680,201 873,703 8.52 40,680,201 99,947 0.98 interest (loss) income $(449,202) $324,554 (4.01)% 2.95% For the Twelve Months Ended December 31, 2015 GAAP Non-GAAP Average Average Average Yield/ Average Yield/ Balance Interest Cost Balance Interest Cost -earning assets $43,621,969 $1,691,584 3.88 $43,621,969 $1,691,584 3.88 % -bearing deposits 25,919,090 160,149 0.62 25,919,090 160,149 0.62 14,275,818 1,123,360 7.87 14,275,818 349,604 2.45 -bearing liabilities 40,194,908 1,283,509 3.19 40,194,908 509,753 1.27 interest income $ 408,075 $ 1,181,831 0.94 2.71% The following tables present reconciliations of NYCB’s GAAP and non-GAAP net interest margins for the three and twelve months ended

December 31, 2015.

Reconciliations of GAAP and Non-GAAP Net Interest Margins

|

New York Community Bancorp, Inc. 42 Average tangible common stockholders’ equity and average tangible assets are non-GAAP financial measures. The following table presents

reconciliations of these non-GAAP measures with the related GAAP

measures for the three and twelve months ended December 31, 2015.

Reconciliations of GAAP and Non-GAAP Profitability

Measures For the Three Months Ended December 31, 2015 For the Twelve Months Ended December 31, 2015 (dollars in thousands) NYCB Astoria NYCB Astoria Average common stockholders’ equity $ 5,819,461 $1,522,952 $ 5,813,636 $1,492,325 Less: Average goodwill (2,436,131) (185,151) (2,436,131) (185,151) Average core deposit intangibles (3,302) -- (5,275) -- Average tangible common stockholders’ equity $ 3,380,028 $1,337,801 $ 3,372,230 $1,307,174 Average assets $49,403,650 $15,104,261 $48,870,205 $15,319,981 Less: Average goodwill (2,436,131) (185,151) (2,436,131) (185,151) Average core deposit intangibles (3,302) -- (5,275) -- Average tangible assets $46,964,217 $14,919,110 $46,428,799 $15,134,830 Net (loss) income $(404,807) $18,431 $(47,156) $88,075 Add back: Amortization of core deposit intangibles, net of tax 681 -- 3,206 -- Less: Preferred stock dividends -- (2,193) -- (8,775) Adjusted net (loss) income $(404,126) $16,238 $(43,950) $79,300 Non-GAAP earnings (a) $145,190 n.a. $502,841 $76,671 GAAP (Loss) Income: Return on average assets (3.28)% 0.49% (0.10)% 0.57% Return on average tangible assets (3.44) 0.49 (0.09) 0.58 Return on average common stockholders’ equity (27.82) 4.26 (0.81) 5.31 Return on average tangible common stockholders’ equity (47.83) 4.86 (1.30) 6.07 Non-GAAP Earnings: Return on average assets 1.18 % n.a. 1.03 % 0.50% Return on average tangible assets 1.24 n.a. 1.09 0.51 Return on average common stockholders’ equity 9.98 n.a. 8.65 4.55 Return on average tangible common stockholders’ equity 17.26 n.a. 15.01 5.19 (a) Please see the reconciliations of NYCB’s GAAP loss and non-GAAP earnings on page 38 and of Astoria’s GAAP and non-GAAP earnings

on page 39. Non-GAAP earnings available to common shareholders

(a) $67,896 |