Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Santander Consumer USA Holdings Inc. | scusa8-k123115earningsfinal.htm |

| EX-99.1 - EXHIBIT 99.1 - Santander Consumer USA Holdings Inc. | exhibit991december312015.htm |

01.27.2016 SANTANDER CONSUMER USA HOLDINGS INC. Fourth Quarter 2015

2IMPORTANT INFORMATION Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements about our expectations, beliefs, plans, predictions, forecasts, objectives, assumptions, or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases such as “anticipates,” “believes,” “can,” “could,” “may,” “predicts,” “potential,” “should,” “will,” “estimates,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “intends,” and similar words or phrases. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements are not guarantees of future performance and involve risks and uncertainties which are subject to change based on various important factors, some of which are beyond our control. For additional discussion of these risks, refer to the section entitled “Risk Factors” and elsewhere in our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q filed by us with the SEC. Among the factors that could cause our financial performance to differ materially from that suggested by the forward-looking statements are: (a) we operate in a highly regulated industry and continually changing federal, state, and local laws and regulations could materially adversely affect our business; (b) adverse economic conditions in the United States and worldwide may negatively impact our results; (c) our business could suffer if our access to funding is reduced; (d) we face significant risks implementing our growth strategy, some of which are outside our control; (e) we may incur unexpected costs and delays in connection with exiting our personal lending portfolio; (f) our agreement with FCA US LLC may not result in currently anticipated levels of growth and is subject to certain performance conditions that could result in termination of the agreement; (g) our business could suffer if we are unsuccessful in developing and maintaining relationships with automobile dealerships; (h) our financial condition, liquidity, and results of operations depend on the credit performance of our loans; (i) loss of our key management or other personnel, or an inability to attract such management and personnel, could negatively impact our business; (j) we are subject to certain regulations, including oversight by the Office of the Comptroller of the Currency, the CFPB, the European Central Bank, and the Federal Reserve, which oversight and regulation may limit certain of our activities, including the timing and amount of dividends and other limitations on our business; and (k) future changes in our relationship with Santander could adversely affect our operations. If one or more of the factors affecting our forward-looking information and statements proves incorrect, our actual results, performance or achievements could differ materially from those expressed in, or implied by, forward-looking information and statements. Therefore, we caution not to place undue reliance on any forward-looking information or statements. The effect of these factors is difficult to predict. Factors other than these also could adversely affect our results, and the reader should not consider these factors to be a complete set of all potential risks or uncertainties. New factors emerge from time to time, and management cannot assess the impact of any such factor on our business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. Any forward-looking statements only speak as of the date of this document, and we undertake no obligation to update any forward-looking information or statements, whether written or oral, to reflect any change, except as required by law. All forward-looking statements attributable to us are expressly qualified by these cautionary statements.

BUSINESS AND STRATEGY

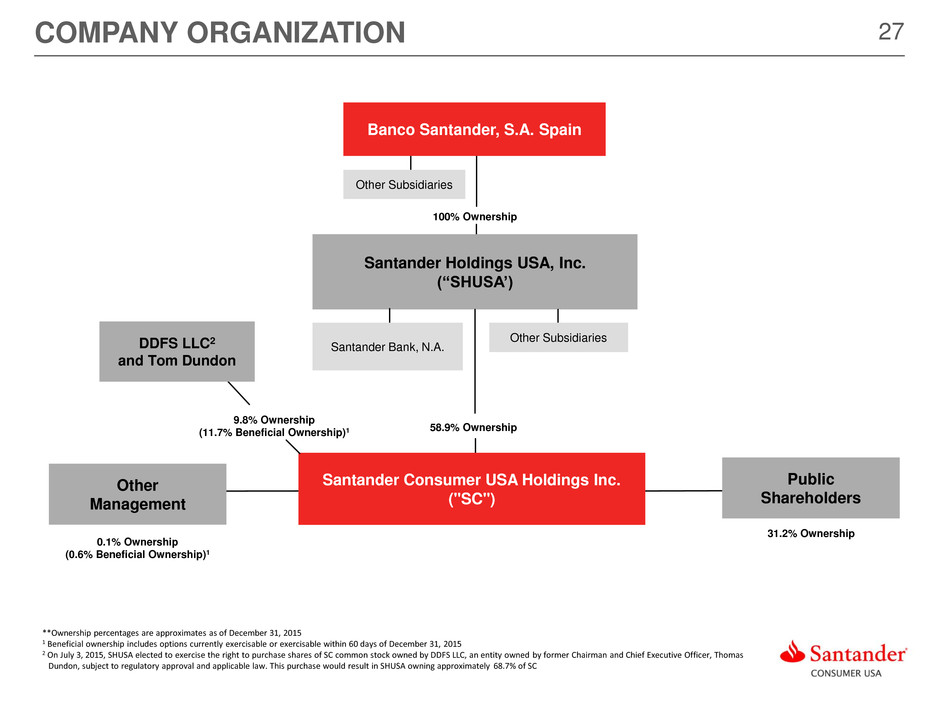

4SANTANDER CONSUMER USA 1 As of December 31, 2015 2 DDFS LLC is an entity owned by former Chairman and Chief Executive Officer, Tom Dundon. This purchase would result in SHUSA owning approximately 68.7% of SC. 3 Chrysler Capital is dba Santander Consumer USA • Santander Consumer USA Holdings Inc. (NYSE:SC) ("SC") is approximately 58.9%1 owned by Santander Holdings USA, Inc. (“SHUSA”), a wholly-owned subsidiary of Banco Santander, S.A. (NYSE:SAN) • On July 3, 2015, SHUSA elected to exercise its right to purchase all of the shares of SC common stock owned by DDFS LLC, subject to regulatory approval and applicable law2 ▪ SC is a full-service, technology-driven consumer finance company focused on vehicle finance, third-party servicing and providing superior customer service • Historically focused on nonprime markets; established presence in prime and lease ▪ Approximately 5,100 full-time, 500 part-time and 900 vendor-based employees across multiple locations in the U.S. and the Caribbean ▪ Our strategy is to leverage our efficient, scalable technology and risk infrastructure and data to underwrite, originate and service profitable assets while treating employees, customers and all stakeholders in a simple, personal and fair manner ▪ Unparalleled compliance and responsible practices focus ▪ Continuously optimizing the mix of assets retained vs. assets sold and serviced for others ▪ Presence in prime markets through Chrysler Capital3 ▪ Efficient funding through key third-party relationships, secondary markets and Santander Overview Strategy

5 » Record income for the year of $866 million, or $2.41 per diluted common share, up 13% » Up 3% over 2014 core net income1 » Net finance and other interest income of $4.9 billion, up 14% » Total auto originations of $28 billion, up 6% » Retail installment contract ("RIC") net charge-off ratio of 7.3%; after adjusting for lower of cost or market (“LOCM”) impairments2, RIC net charge-off ratio of 7.0%, up 10 bps » Total asset sales of $9.2 billion, up 31% » Servicing fee income of $131 million, up 81% » Expense ratio of 2.1%, 40 bp improvement 2015 HIGHLIGHTS SC’s fundamentals remain strong in a shifting environment, and the Company is focused on maintaining disciplined underwriting standards to deliver strong returns, robust profitability and value to its shareholders 1 2014 core net income adjusted for $119.8 million pre-tax ($75.8 million after-tax) non-recurring stock compensation and other IPO-related expenses; reconciliation in appendix 2 Non-GAAP; reconciliation in appendix

6CONSUMER FINANCE ENVIRONMENT Manheim Used Vehicle Index1 1 Manheim, Inc.; Indexed to a basis of 100 at 1995 levels 2 Bureau of Economic Analysis 3 Nasdaq.com Light Auto Vehicle Sales (SAAR)2 In 2015, the Manheim Index average moved to 124.7 compared to 123.2 in 2014 Up 0.8% and 1.2% quarter over quarter and year over year, respectively The industry expects used vehicle values to decrease over time; SC has a lower recovery assumption in provisioning methodology than current actuals 5 10 15 20 25 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Dec-13 Dec-14 Dec-15 90 100 110 120 130 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Dec-13 Dec-14 Dec-15 U.S. auto sales topped a previous record set from 2000, with a final tally of 17.53 million sold in the year 2015 Low gas prices and interest rates increased consumer confidence Low: 98 Low: 9.0 High: 127.8 125.7 High: 18.1 17.2

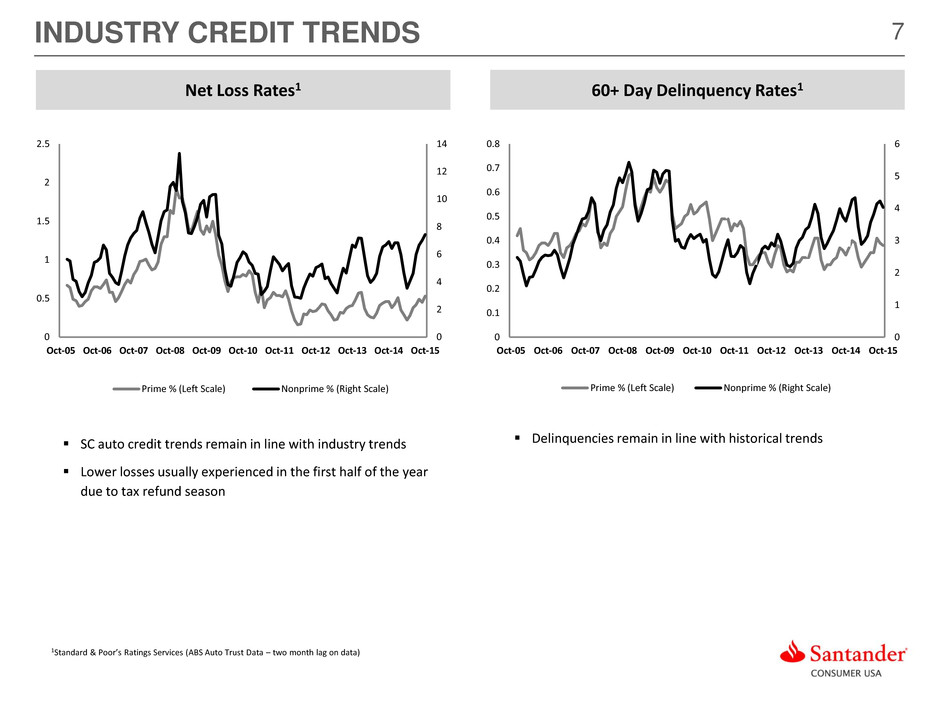

7INDUSTRY CREDIT TRENDS 1Standard & Poor’s Ratings Services (ABS Auto Trust Data – two month lag on data) Net Loss Rates1 60+ Day Delinquency Rates1 0 2 4 6 8 10 12 14 0 0.5 1 1.5 2 2.5 Oct-05 Oct-06 Oct-07 Oct-08 Oct-09 Oct-10 Oct-11 Oct-12 Oct-13 Oct-14 Oct-15 Prime % (Left Scale) Nonprime % (Right Scale) 0 1 2 3 4 5 6 0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 Oct-05 Oct-06 Oct-07 Oct-08 Oct-09 Oct-10 Oct-11 Oct-12 Oct-13 Oct-14 Oct-15 Prime % (Left Scale) Nonprime % (Right Scale) SC auto credit trends remain in line with industry trends Lower losses usually experienced in the first half of the year due to tax refund season Delinquencies remain in line with historical trends

8FOCUSED BUSINESS MODEL Realize full value of Chrysler Capital and other core auto (direct and indirect) Full-spectrum auto lender Substantial dealer network throughout the United States Vehicle Finance Highly scalable and capital-efficient serviced for others platform Opportunity for organic and inorganic growth Originations, acquisitions and/or conversions of more than $130 billion of assets since 2008 Serviced for Others Diverse and stable funding sources Strong and growing capital base Funding and Liquidity

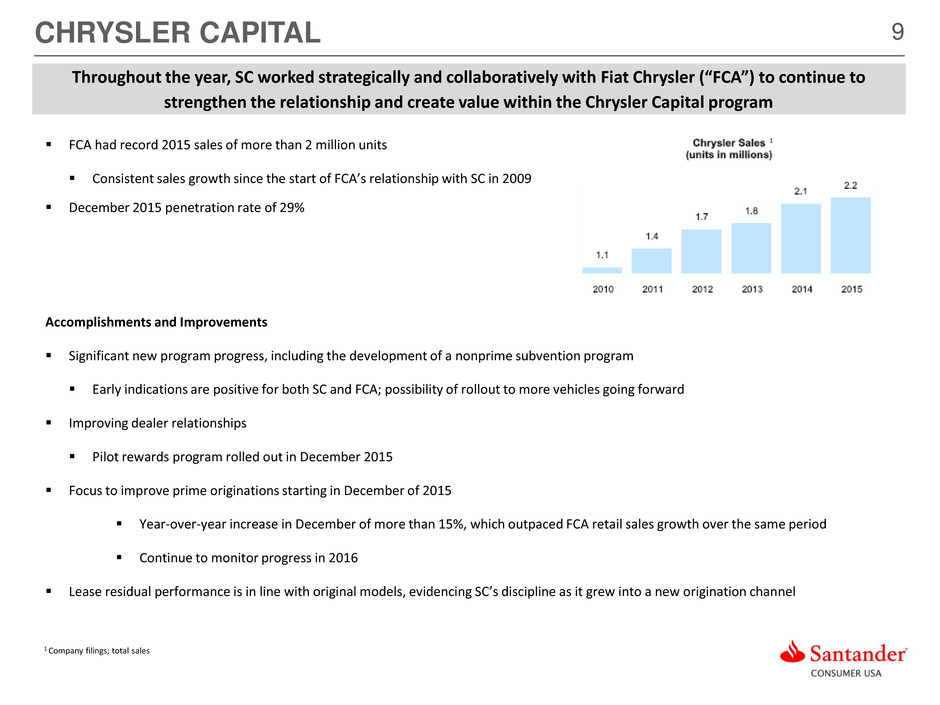

9CHRYSLER CAPITAL FCA had record 2015 sales of more than 2 million units Consistent sales growth since the start of FCA’s relationship with SC in 2009 December 2015 penetration rate of 29% Accomplishments and Improvements Significant new program progress, including the development of a nonprime subvention program Early indications are positive for both SC and FCA; possibility of rollout to more vehicles going forward Improving dealer relationships Pilot rewards program rolled out in December 2015 Focus to improve prime originations starting in December of 2015 Year-over-year increase in December of more than 15%, which outpaced FCA retail sales growth over the same period Continue to monitor progress in 2016 Lease residual performance is in line with original models, evidencing SC’s discipline as it grew into a new origination channel 1 1 Company filings; total sales Throughout the year, SC worked strategically and collaboratively with Fiat Chrysler (“FCA”) to continue to strengthen the relationship and create value within the Chrysler Capital program

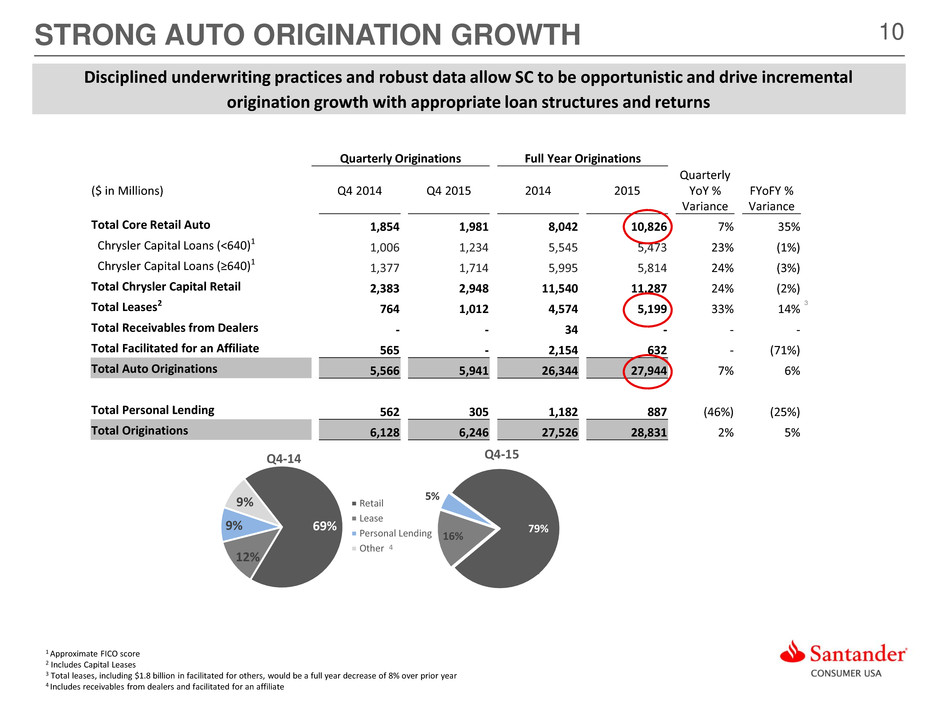

10STRONG AUTO ORIGINATION GROWTH 1 Approximate FICO score 2 Includes Capital Leases 3 Total leases, including $1.8 billion in facilitated for others, would be a full year decrease of 8% over prior year 4 Includes receivables from dealers and facilitated for an affiliate 79% 16% 5% Q4-15 69% 12% 9% 9% Q4-14 Retail Lease Personal Lending Other 4 Quarterly Originations Full Year Originations ($ in Millions) Q4 2014 Q4 2015 2014 2015 Quarterly YoY % Variance FYoFY % Variance Total Core Retail Auto 1,854 1,981 8,042 10,826 7% 35% Chrysler Capital Loans (<640)1 1,006 1,234 5,545 5,473 23% (1%) Chrysler Capital Loans (≥640)1 1,377 1,714 5,995 5,814 24% (3%) Total Chrysler Capital Retail 2,383 2,948 11,540 11,287 24% (2%) Total Leases2 764 1,012 4,574 5,199 33% 14% Total Receivables from Dealers - - 34 - - - Total Facilitated for an Affiliate 565 - 2,154 632 - (71%) Total Auto Originations 5,566 5,941 26,344 27,944 7% 6% Total Personal Lending 562 305 1,182 887 (46%) (25%) Total Originations 6,128 6,246 27,526 28,831 2% 5% Disciplined underwriting practices and robust data allow SC to be opportunistic and drive incremental origination growth with appropriate loan structures and returns 3

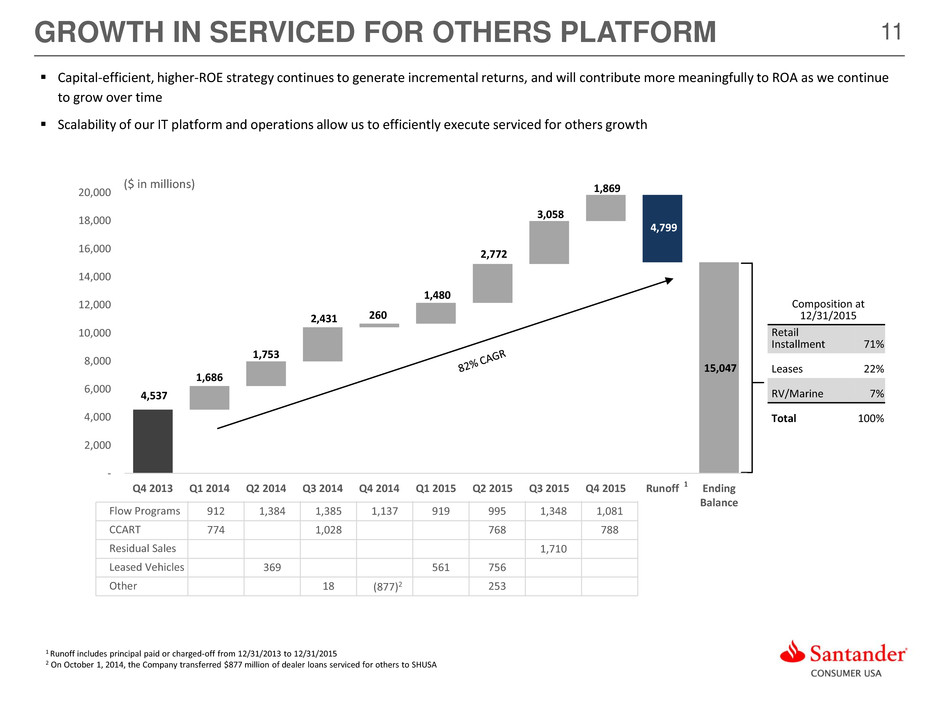

11 Flow Programs 912 1,384 1,385 1,137 919 995 1,348 1,081 CCART 774 1,028 768 788 Residual Sales 1,710 Leased Vehicles 369 561 756 Other 18 253(877)2 Capital-efficient, higher-ROE strategy continues to generate incremental returns, and will contribute more meaningfully to ROA as we continue to grow over time Scalability of our IT platform and operations allow us to efficiently execute serviced for others growth GROWTH IN SERVICED FOR OTHERS PLATFORM Composition at 12/31/2015 Retail Installment 71% Leases 22% RV/Marine 7% Total 100% 1 Runoff includes principal paid or charged-off from 12/31/2013 to 12/31/2015 2 On October 1, 2014, the Company transferred $877 million of dealer loans serviced for others to SHUSA 1 - 4,537 6,223 7,976 10,407 10,667 12,147 14,919 17,977 4,799 4,537 1,686 1,753 2,431 260 1,480 2,772 3,058 1,869 15,047 - 2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 18,000 20,000 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Runoff Ending Balance ($ in millions)

12FUNDING AND LIQUIDITY ▪ Issued and sold $10.8 billion in bonds across three distinct platforms ▪ SDART: $5.9 billion ▪ CCART: $1.5 billion ▪ DRIVE: $3.4 billion ▪ Relaunched DRIVE platform in March 2015 ▪ 122 distinct investors participate in SC’s platforms ▪ SC is the largest issuer of retail auto ABS globally ▪ Deep investor base and tier 1 liquidity in secondary markets Asset-Backed Securitizations Asset Sales and Flow ProgramsIntragroup Third-Party Funding ▪ Approximately $4.3 billion of asset sales through flow programs ▪ $3.1 billion of other loan and lease sales ▪ Demonstrated ability to add incremental liquidity and support growth of serviced for others platform ▪ Fortified liquidity position ▪ Unused capacity at year-end of 46%, increased from 23% at year- end 2014 ▪ 14 financial institution relationships with more than $18 billion in total commitments ($300 million increase from year-end 2014) ▪ $250 million ineligible financing ▪ $300 million personal lending financing ▪ $1 billion inaugural retained lease residuals financing

FOURTH QUARTER 2015

14FINANCIAL HIGHLIGHTS All comparisons are 4Q15 versus 4Q14, unless otherwise noted. Continued balance sheet and serviced for others growth driven by strong originations of $6.2 billion Disciplined auto origination growth of 7% driven by growth in FCA relationship 47% growth in serviced for others portfolio to $15.0 billion Ability to generate earnings and capital while growing assets Common equity tier 1 ratio of 11.2% Net finance and other interest income up 17%, driven by 15% growth in the average portfolio Net charge-offs on individually acquired retail installment contracts (“RICs”) of 9.6%, up 150 bps primarily driven by mix shift Exit of personal lending business drives adjustments to provision for credit losses and net investment gains (losses); further detail on slides 16 & 17 Net income for the quarter down 73% primarily driven by the personal lending adjustments and provision benefits in 4Q14 not seen in this quarter

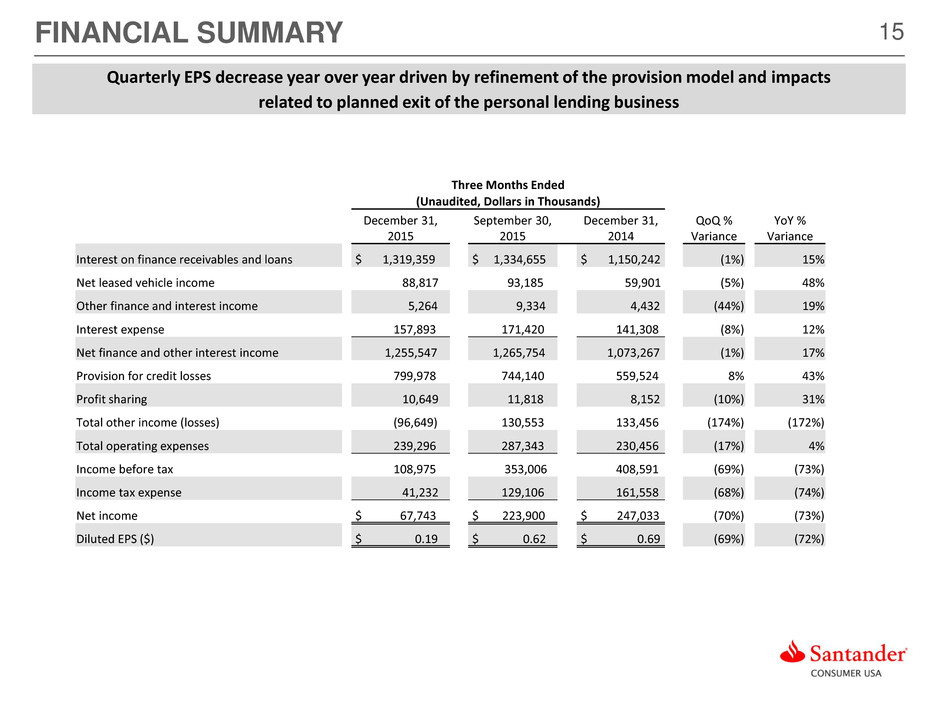

15FINANCIAL SUMMARY Three Months Ended (Unaudited, Dollars in Thousands) December 31, 2015 September 30, 2015 December 31, 2014 QoQ % Variance YoY % Variance Interest on finance receivables and loans $ 1,319,359 $ 1,334,655 $ 1,150,242 (1%) 15% Net leased vehicle income 88,817 93,185 59,901 (5%) 48% Other finance and interest income 5,264 9,334 4,432 (44%) 19% Interest expense 157,893 171,420 141,308 (8%) 12% Net finance and other interest income 1,255,547 1,265,754 1,073,267 (1%) 17% Provision for credit losses 799,978 744,140 559,524 8% 43% Profit sharing 10,649 11,818 8,152 (10%) 31% Total other income (losses) (96,649) 130,553 133,456 (174%) (172%) Total operating expenses 239,296 287,343 230,456 (17%) 4% Income before tax 108,975 353,006 408,591 (69%) (73%) Income tax expense 41,232 129,106 161,558 (68%) (74%) Net income $ 67,743 $ 223,900 $ 247,033 (70%) (73%) Diluted EPS ($) $ 0.19 $ 0.62 $ 0.69 (69%) (72%) Quarterly EPS decrease year over year driven by refinement of the provision model and impacts related to planned exit of the personal lending business

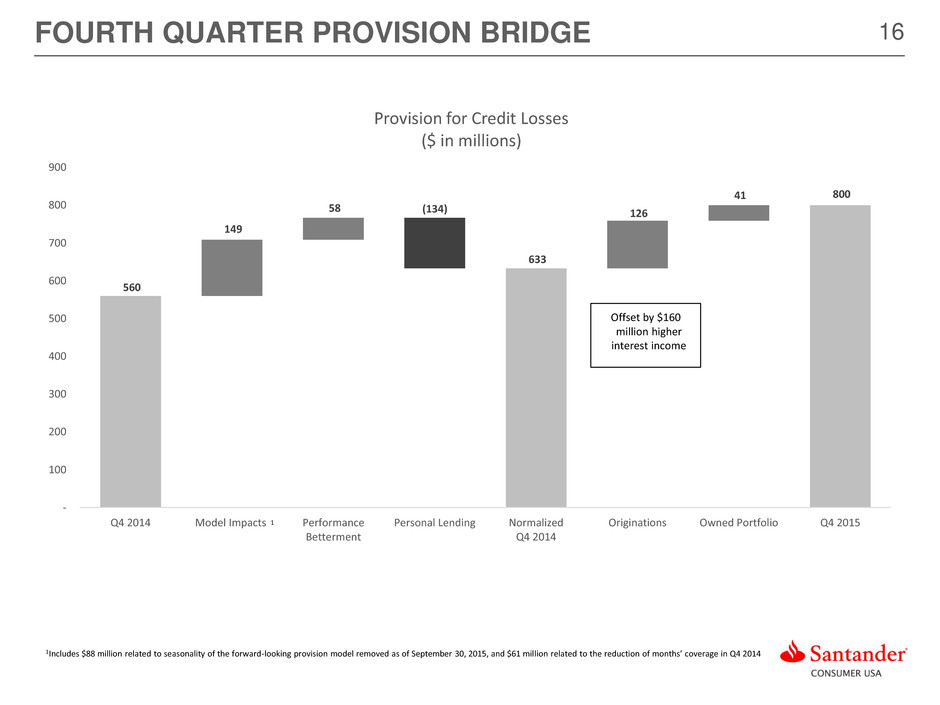

16 560 633 800 149 58 (134) 126 41 - 100 200 300 400 500 600 700 800 900 Q4 2014 Model Impacts Performance Betterment Personal Lending Normalized Q4 2014 Originations Owned Portfolio Q4 2015 Provision for Credit Losses ($ in millions) FOURTH QUARTER PROVISION BRIDGE 1Includes $88 million related to seasonality of the forward-looking provision model removed as of September 30, 2015, and $61 million related to the reduction of months’ coverage in Q4 2014 1 Offset by $160 million higher interest income

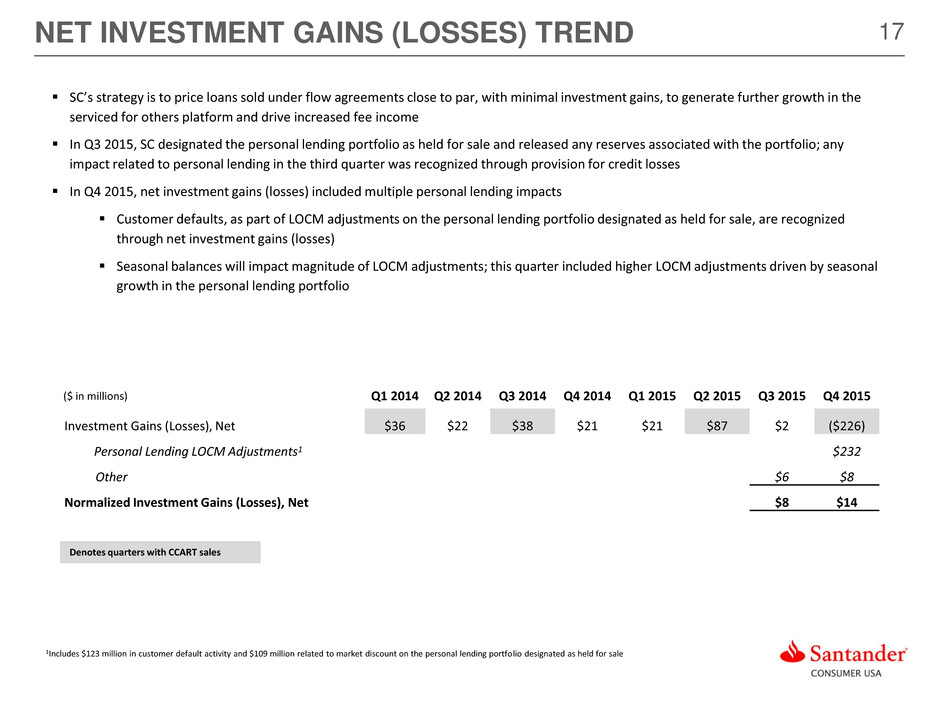

17NET INVESTMENT GAINS (LOSSES) TREND ($ in millions) Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Investment Gains (Losses), Net $36 $22 $38 $21 $21 $87 $2 ($226) Personal Lending LOCM Adjustments1 $232 Other $6 $8 Normalized Investment Gains (Losses), Net $8 $14 SC’s strategy is to price loans sold under flow agreements close to par, with minimal investment gains, to generate further growth in the serviced for others platform and drive increased fee income In Q3 2015, SC designated the personal lending portfolio as held for sale and released any reserves associated with the portfolio; any impact related to personal lending in the third quarter was recognized through provision for credit losses In Q4 2015, net investment gains (losses) included multiple personal lending impacts Customer defaults, as part of LOCM adjustments on the personal lending portfolio designated as held for sale, are recognized through net investment gains (losses) Seasonal balances will impact magnitude of LOCM adjustments; this quarter included higher LOCM adjustments driven by seasonal growth in the personal lending portfolio Denotes quarters with CCART sales 1Includes $123 million in customer default activity and $109 million related to market discount on the personal lending portfolio designated as held for sale

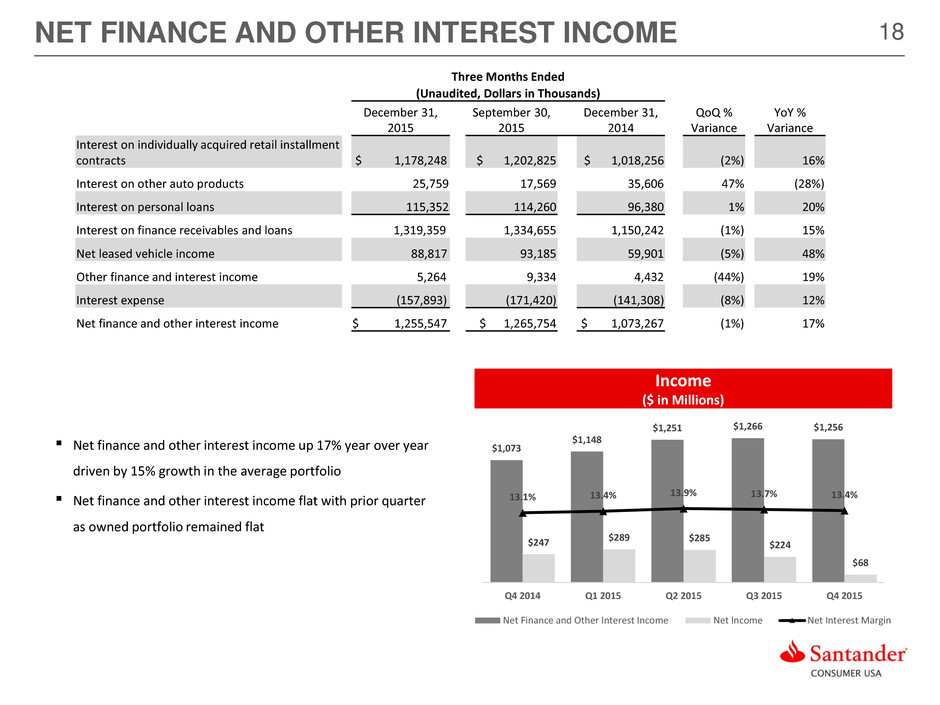

18NET FINANCE AND OTHER INTEREST INCOME Three Months Ended (Unaudited, Dollars in Thousands) December 31, 2015 September 30, 2015 December 31, 2014 QoQ % Variance YoY % Variance Interest on individually acquired retail installment contracts $ 1,178,248 $ 1,202,825 $ 1,018,256 (2%) 16% Interest on other auto products 25,759 17,569 35,606 47% (28%) Interest on personal loans 115,352 114,260 96,380 1% 20% Interest on finance receivables and loans 1,319,359 1,334,655 1,150,242 (1%) 15% Net leased vehicle income 88,817 93,185 59,901 (5%) 48% Other finance and interest income 5,264 9,334 4,432 (44%) 19% Interest expense (157,893) (171,420) (141,308) (8%) 12% Net finance and other interest income $ 1,255,547 $ 1,265,754 $ 1,073,267 (1%) 17% ▪ Net finance and other interest income up 17% year over year driven by 15% growth in the average portfolio ▪ Net finance and other interest income flat with prior quarter as owned portfolio remained flat Income ($ in Millions) $1,073 $1,148 $1,251 $1,266 $1,256 $247 $289 $285 $224 $68 13.1% 13.4% 13.9% 13.7% 13.4% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Net Finance and Other Interest Income Net Income Net Interest Margin

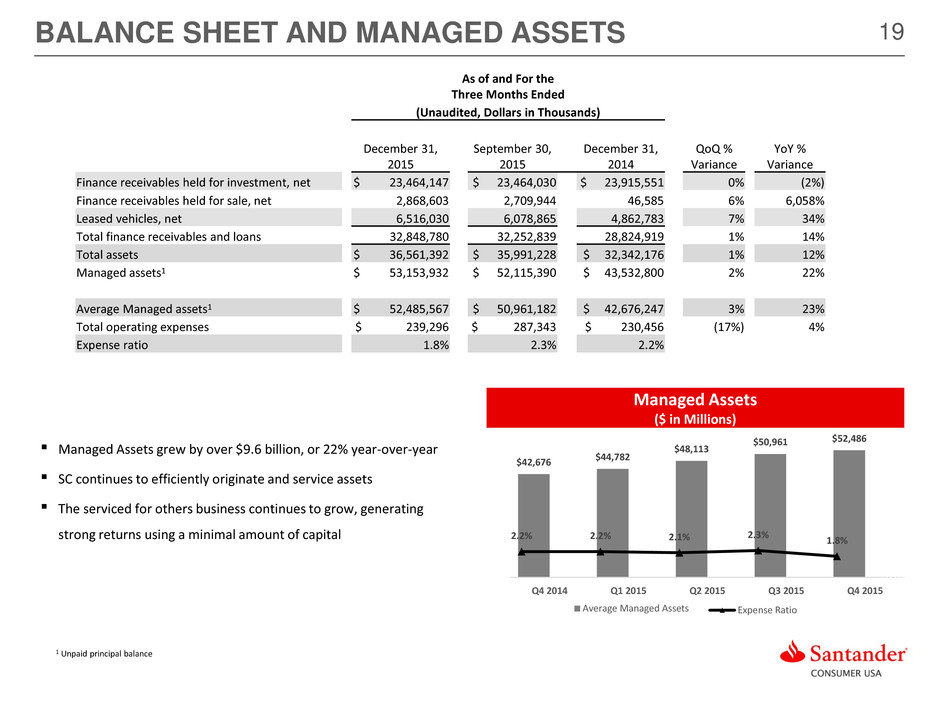

19 $42,676 $44,782 $48,113 $50,961 $52,486 $0 $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Average Managed Assets 2.2% 2.2% 2.1% 2.3% 1.8% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 0 0.2 0.4 0.6 0.8 1 1.2 Expense Ratio BALANCE SHEET AND MANAGED ASSETS Managed Assets ($ in Millions) ▪ Managed Assets grew by over $9.6 billion, or 22% year-over-year ▪ SC continues to efficiently originate and service assets ▪ The serviced for others business continues to grow, generating strong returns using a minimal amount of capital As of and For the Three Months Ended (Unaudited, Dollars in Thousands) December 31, 2015 September 30, 2015 December 31, 2014 QoQ % Variance YoY % Variance Finance receivables held for investment, net $ 23,464,147 $ 23,464,030 $ 23,915,551 0% (2%) Finance receivables held for sale, net 2,868,603 2,709,944 46,585 6% 6,058% Leased vehicles, net 6,516,030 6,078,865 4,862,783 7% 34% Total finance receivables and loans 32,848,780 32,252,839 28,824,919 1% 14% Total assets $ 36,561,392 $ 35,991,228 $ 32,342,176 1% 12% Managed assets1 $ 53,153,932 $ 52,115,390 $ 43,532,800 2% 22% Average Managed assets1 $ 52,485,567 $ 50,961,182 $ 42,676,247 3% 23% Total operating expenses $ 239,296 $ 287,343 $ 230,456 (17%) 4% Expense ratio 1.8% 2.3% 2.2% 1 Unpaid principal balance

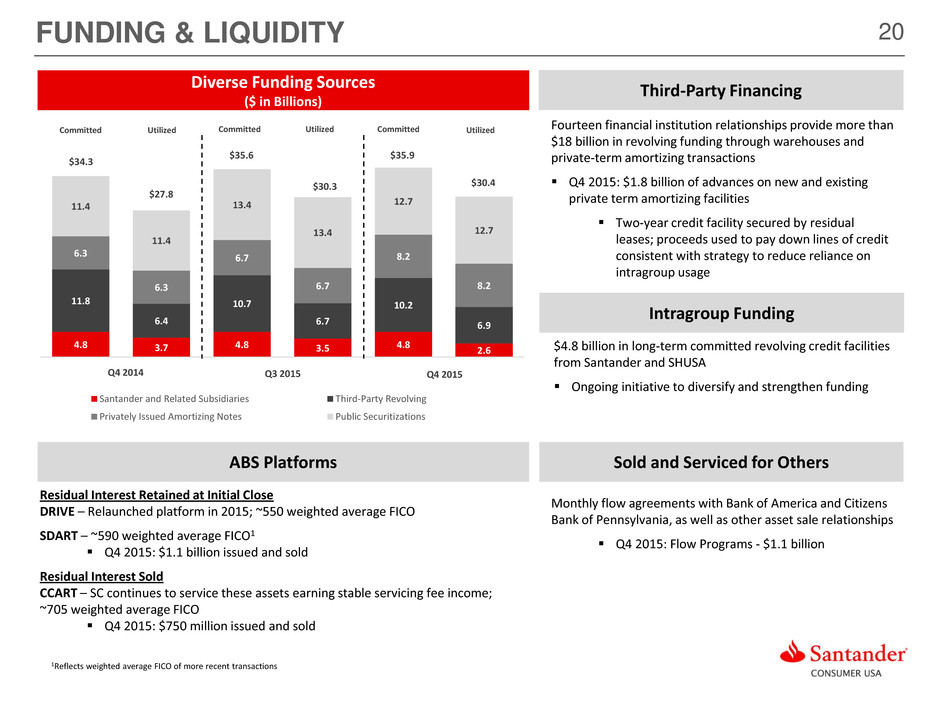

20 Fourteen financial institution relationships provide more than $18 billion in revolving funding through warehouses and private-term amortizing transactions Q4 2015: $1.8 billion of advances on new and existing private term amortizing facilities Two-year credit facility secured by residual leases; proceeds used to pay down lines of credit consistent with strategy to reduce reliance on intragroup usage 4.8 3.7 4.8 3.5 4.8 2.6 11.8 6.4 10.7 6.7 10.2 6.9 6.3 6.3 6.7 6.7 8.2 8.2 11.4 11.4 13.4 13.4 12.7 12.7 Q4 2014 Q3 2015 Q4 2015 Santander and Related Subsidiaries Third-Party Revolving Privately Issued Amortizing Notes Public Securitizations Residual Interest Retained at Initial Close DRIVE – Relaunched platform in 2015; ~550 weighted average FICO SDART – ~590 weighted average FICO1 Q4 2015: $1.1 billion issued and sold Residual Interest Sold CCART – SC continues to service these assets earning stable servicing fee income; ~705 weighted average FICO Q4 2015: $750 million issued and sold 1Reflects weighted average FICO of more recent transactions FUNDING & LIQUIDITY ABS Platforms Diverse Funding Sources ($ in Billions) Third-Party Financing Intragroup Funding Sold and Serviced for Others $4.8 billion in long-term committed revolving credit facilities from Santander and SHUSA Ongoing initiative to diversify and strengthen funding Monthly flow agreements with Bank of America and Citizens Bank of Pennsylvania, as well as other asset sale relationships Q4 2015: Flow Programs - $1.1 billion $34.3 $27.8 $35.6 $30.3 $35.9 $30.4 Committed Committed CommittedUtilized Utilized Utilized Q4 2014 Q3 2015 Q4 2015

CONCLUSION

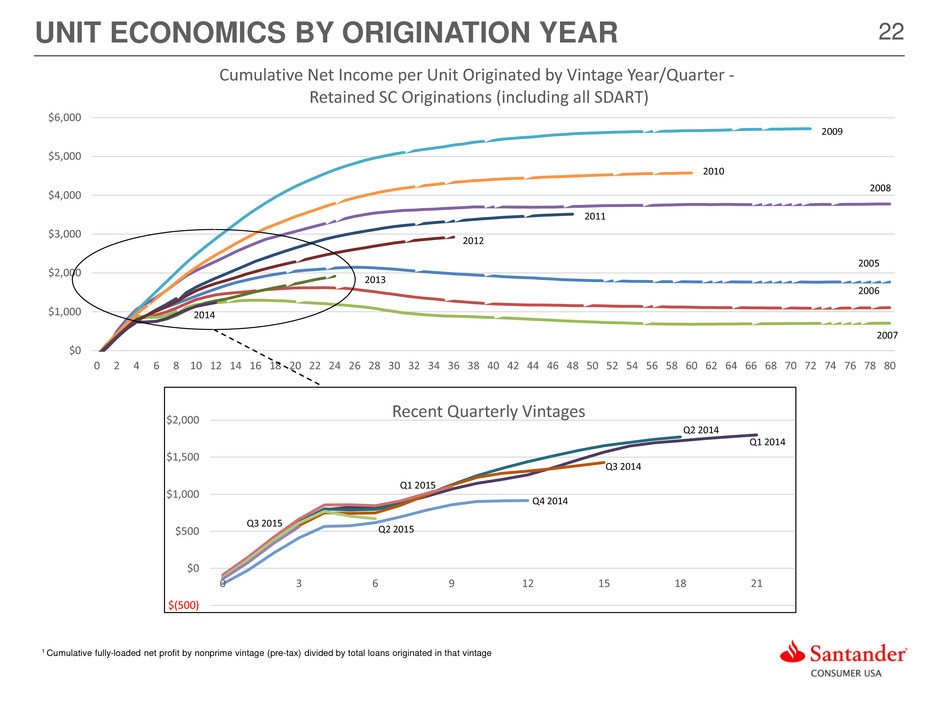

22 $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 0 2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58 60 62 64 66 68 70 72 74 76 78 80 Cumulative Net Income per Unit Originated by Vintage Year/Quarter - Retained SC Originations (including all SDART) 2010 2008 2011 2012 2005 2006 2007 2013 2014 2009 UNIT ECONOMICS BY ORIGINATION YEAR 1 Cumulative fully-loaded net profit by nonprime vintage (pre-tax) divided by total loans originated in that vintage $(500) $0 $500 $1,000 $1,500 $2,000 0 3 6 9 12 15 18 21 Recent Quarterly Vintages Q4 2014 Q3 2014 Q1 2014 Q2 2014 Q2 2015 Q3 2015 Q1 2015

23KEY ACCOMPLISHMENTS AND ENHANCEMENTS OF 2015 Enhanced governance structure Continuity and strengthening of management team Jason Kulas appointed CEO, in line with succession plan Jason Grubb appointed President Kalyan Seshan hired as CRO Izzy Dawood hired as CFO and Jennifer Davis continues as Deputy CFO Eight newly appointed directors, including independent chair, Blythe Masters Leadership Continued strength in FCA relationship Enhancements to prime origination platform Continued development of lease-end process to drive customer retention as lease portfolio matures Strengthened dealer performance management process Pilot reward program started in December 2015 Strategic Development Diversification and expansion of servicing capabilities with new facilities in Mesa, AZ and Puerto Rico Increased automation in quality assurance (“QA”) functions We now score 100% of customer calls for QA through Call-Miner Proactive approach to growth in serviced for others platform Operations and Customer Care

APPENDIX

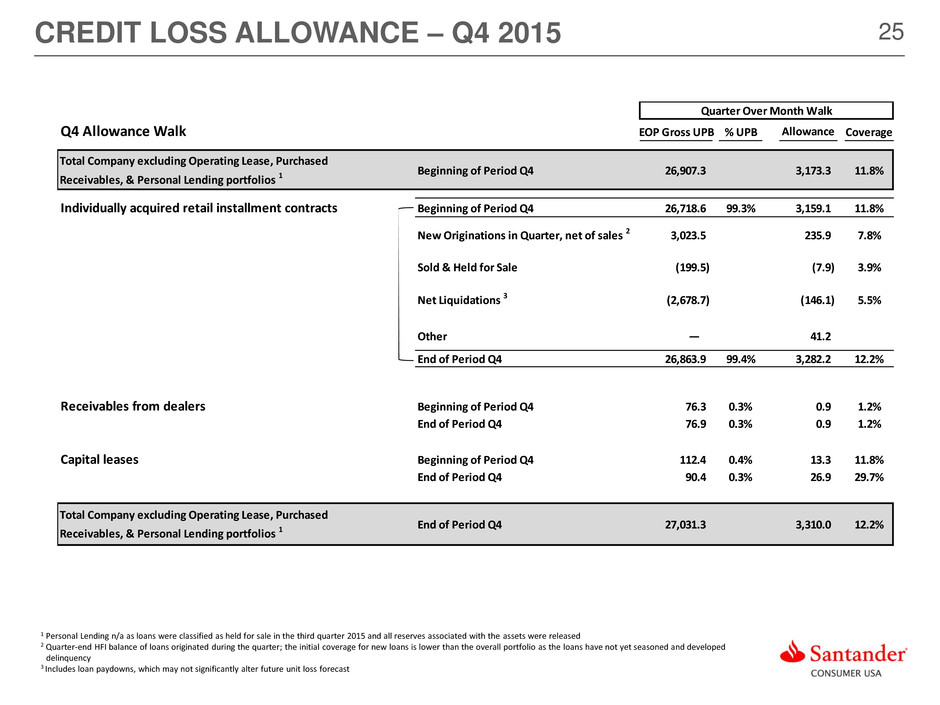

25CREDIT LOSS ALLOWANCE – Q4 2015 1 Personal Lending n/a as loans were classified as held for sale in the third quarter 2015 and all reserves associated with the assets were released 2 Quarter-end HFI balance of loans originated during the quarter; the initial coverage for new loans is lower than the overall portfolio as the loans have not yet seasoned and developed delinquency 3 Includes loan paydowns, which may not significantly alter future unit loss forecast Quarter Over Month Walk Q4 Allowance Walk EOP Gross UPB % UPB Allowance Coverage Beginning of Period Q4 26,907.3 3,173.3 11.8% Individually acquired retail installment contracts Beginning of Period Q4 26,718.6 99.3% 3,159.1 11.8% New Originations in Quarter, net of sales 2 3,023.5 235.9 7.8% Sold & Held for Sale (199.5) (7.9) 3.9% Net Liquidations 3 (2,678.7) (146.1) 5.5% Other — 41.2 End of Period Q4 26,863.9 99.4% 3,282.2 12.2% Receivables from dealers Beginning of Period Q4 76.3 0.3% 0.9 1.2% End of Period Q4 76.9 0.3% 0.9 1.2% Capital leases Beginning of Period Q4 112.4 0.4% 13.3 11.8% End of Period Q4 90.4 0.3% 26.9 29.7% End of Period Q4 27,031.3 3,310.0 12.2% Total Company excluding Operating Lease, Purchased Receivables, & Personal Lending portfolios 1 Total Company excluding Operating Lease, Purchased Receivables, & Personal Lending portfolios 1

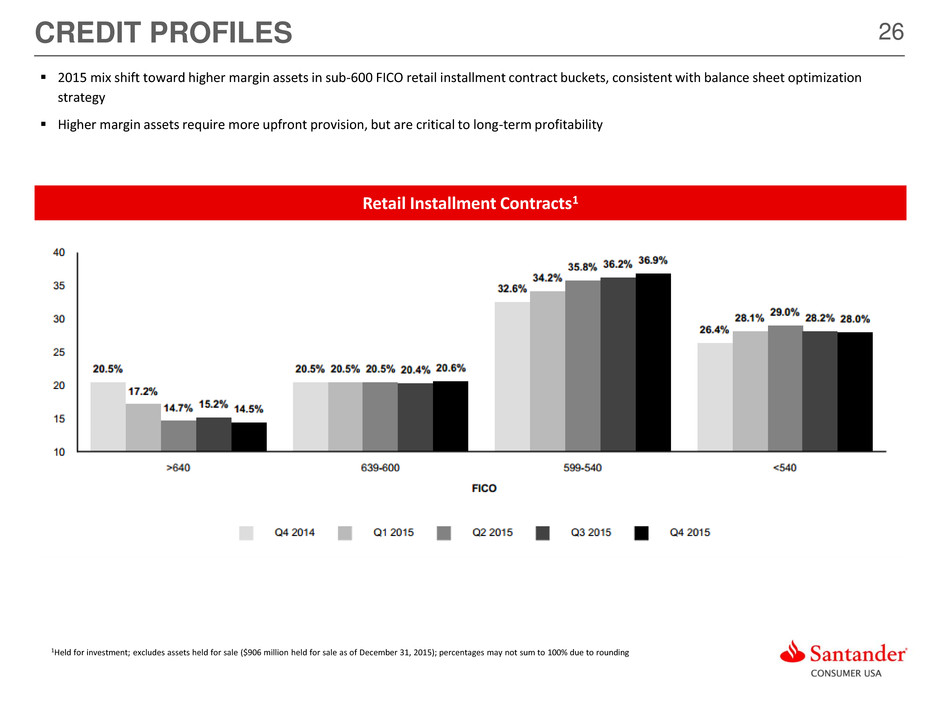

26CREDIT PROFILES Retail Installment Contracts1 2015 mix shift toward higher margin assets in sub-600 FICO retail installment contract buckets, consistent with balance sheet optimization strategy Higher margin assets require more upfront provision, but are critical to long-term profitability 1Held for investment; excludes assets held for sale ($906 million held for sale as of December 31, 2015); percentages may not sum to 100% due to rounding

27COMPANY ORGANIZATION Other Subsidiaries 100% Ownership Santander Holdings USA, Inc. (“SHUSA’) 58.9% Ownership Santander Consumer USA Holdings Inc. ("SC") Santander Bank, N.A. Other Subsidiaries 9.8% Ownership (11.7% Beneficial Ownership)1 DDFS LLC2 and Tom Dundon 0.1% Ownership (0.6% Beneficial Ownership)1 31.2% Ownership Other Management Public Shareholders Banco Santander, S.A. Spain **Ownership percentages are approximates as of December 31, 2015 1 Beneficial ownership includes options currently exercisable or exercisable within 60 days of December 31, 2015 2 On July 3, 2015, SHUSA elected to exercise the right to purchase shares of SC common stock owned by DDFS LLC, an entity owned by former Chairman and Chief Executive Officer, Thomas Dundon, subject to regulatory approval and applicable law. This purchase would result in SHUSA owning approximately 68.7% of SC

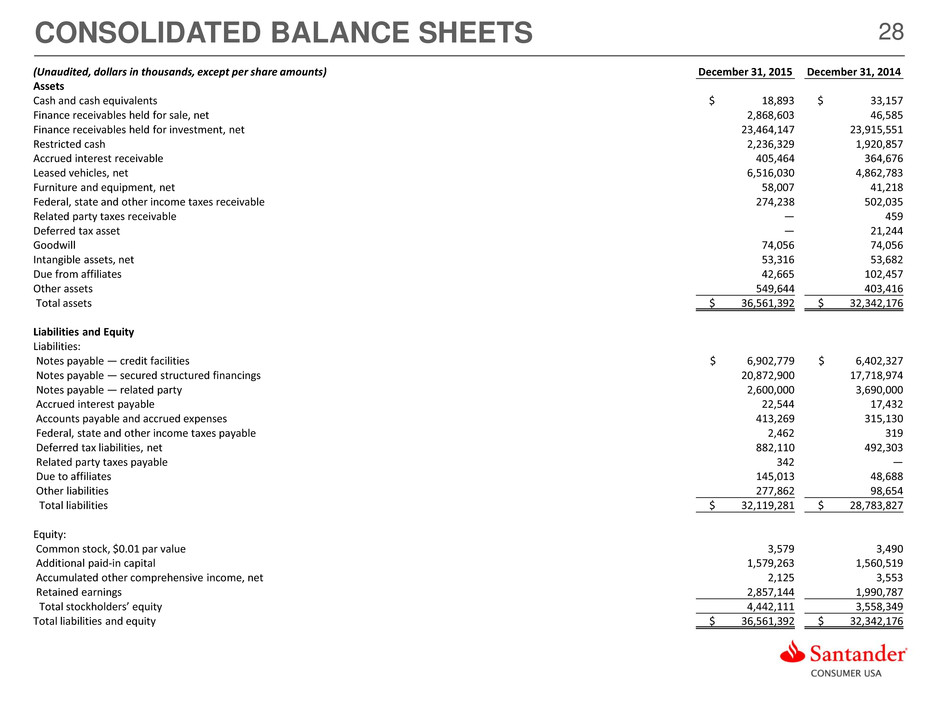

28CONSOLIDATED BALANCE SHEETS (Unaudited, dollars in thousands, except per share amounts) December 31, 2015 December 31, 2014 Assets Cash and cash equivalents $ 18,893 $ 33,157 Finance receivables held for sale, net 2,868,603 46,585 Finance receivables held for investment, net 23,464,147 23,915,551 Restricted cash 2,236,329 1,920,857 Accrued interest receivable 405,464 364,676 Leased vehicles, net 6,516,030 4,862,783 Furniture and equipment, net 58,007 41,218 Federal, state and other income taxes receivable 274,238 502,035 Related party taxes receivable — 459 Deferred tax asset — 21,244 Goodwill 74,056 74,056 Intangible assets, net 53,316 53,682 Due from affiliates 42,665 102,457 Other assets 549,644 403,416 Total assets $ 36,561,392 $ 32,342,176 Liabilities and Equity Liabilities: Notes payable — credit facilities $ 6,902,779 $ 6,402,327 Notes payable — secured structured financings 20,872,900 17,718,974 Notes payable — related party 2,600,000 3,690,000 Accrued interest payable 22,544 17,432 Accounts payable and accrued expenses 413,269 315,130 Federal, state and other income taxes payable 2,462 319 Deferred tax liabilities, net 882,110 492,303 Related party taxes payable 342 — Due to affiliates 145,013 48,688 Other liabilities 277,862 98,654 Total liabilities $ 32,119,281 $ 28,783,827 Equity: Common stock, $0.01 par value 3,579 3,490 Additional paid-in capital 1,579,263 1,560,519 Accumulated other comprehensive income, net 2,125 3,553 Retained earnings 2,857,144 1,990,787 Total stockholders’ equity 4,442,111 3,558,349 Total liabilities and equity $ 36,561,392 $ 32,342,176

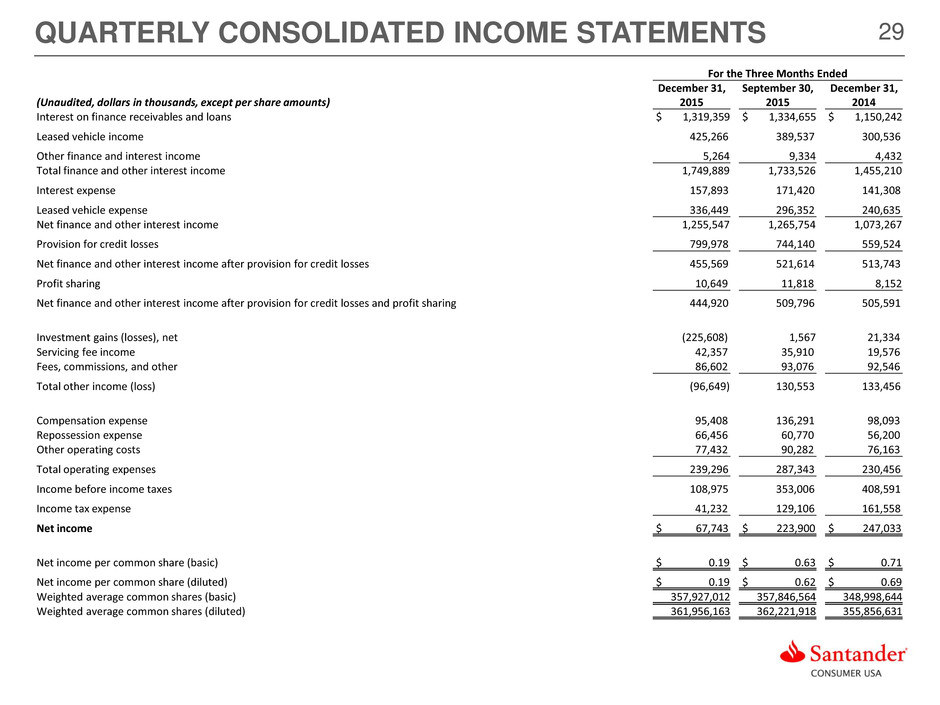

29QUARTERLY CONSOLIDATED INCOME STATEMENTS For the Three Months Ended (Unaudited, dollars in thousands, except per share amounts) December 31, 2015 September 30, 2015 December 31, 2014 Interest on finance receivables and loans $ 1,319,359 $ 1,334,655 $ 1,150,242 Leased vehicle income 425,266 389,537 300,536 Other finance and interest income 5,264 9,334 4,432 Total finance and other interest income 1,749,889 1,733,526 1,455,210 Interest expense 157,893 171,420 141,308 Leased vehicle expense 336,449 296,352 240,635 Net finance and other interest income 1,255,547 1,265,754 1,073,267 Provision for credit losses 799,978 744,140 559,524 Net finance and other interest income after provision for credit losses 455,569 521,614 513,743 Profit sharing 10,649 11,818 8,152 Net finance and other interest income after provision for credit losses and profit sharing 444,920 509,796 505,591 Investment gains (losses), net (225,608) 1,567 21,334 Servicing fee income 42,357 35,910 19,576 Fees, commissions, and other 86,602 93,076 92,546 Total other income (loss) (96,649) 130,553 133,456 Compensation expense 95,408 136,291 98,093 Repossession expense 66,456 60,770 56,200 Other operating costs 77,432 90,282 76,163 Total operating expenses 239,296 287,343 230,456 Income before income taxes 108,975 353,006 408,591 Income tax expense 41,232 129,106 161,558 Net income $ 67,743 $ 223,900 $ 247,033 Net income per common share (basic) $ 0.19 $ 0.63 $ 0.71 Net income per common share (diluted) $ 0.19 $ 0.62 $ 0.69 Weighted average common shares (basic) 357,927,012 357,846,564 348,998,644 Weighted average common shares (diluted) 361,956,163 362,221,918 355,856,631

30 For the Year Ended December 31, (Unaudited, dollars in thousands, except per share amounts) 2015 2014 Interest on finance receivables and loans $ 5,205,261 $ 4,631,847 Leased vehicle income 1,502,886 929,745 Other finance and interest income 28,677 8,068 Total finance and other interest income 6,736,824 5,569,660 Interest expense 628,791 523,203 Leased vehicle expense 1,186,983 740,236 Net finance and other interest income 4,921,050 4,306,221 Provision for credit losses 2,888,834 2,616,943 Net finance and other interest income after provision for credit losses 2,032,216 1,689,278 Profit sharing 57,484 74,925 Net finance and other interest income after provision for credit losses and profit sharing 1,974,732 1,614,353 Investment gains (losses), net (116,127) 116,765 Servicing fee income 131,113 72,627 Fees, commissions, and other 375,079 368,279 Total other income 390,065 557,671 Compensation expense 443,212 482,637 Repossession expense 241,522 201,017 Other operating costs 340,712 278,382 Total operating expenses 1,025,446 962,036 Income before income taxes 1,339,351 1,209,988 Income tax expense 472,994 443,639 Net income $ 866,357 $ 766,349 Net income per common share (basic) $2.44 $2.20 Net income per common share (diluted) $2.41 $2.15 Weighted average common shares (basic) 355,102,742 348,723,472 Weighted average common shares (diluted) 358,883,643 355,722,363 FULL YEAR CONSOLIDATED INCOME STATEMENTS

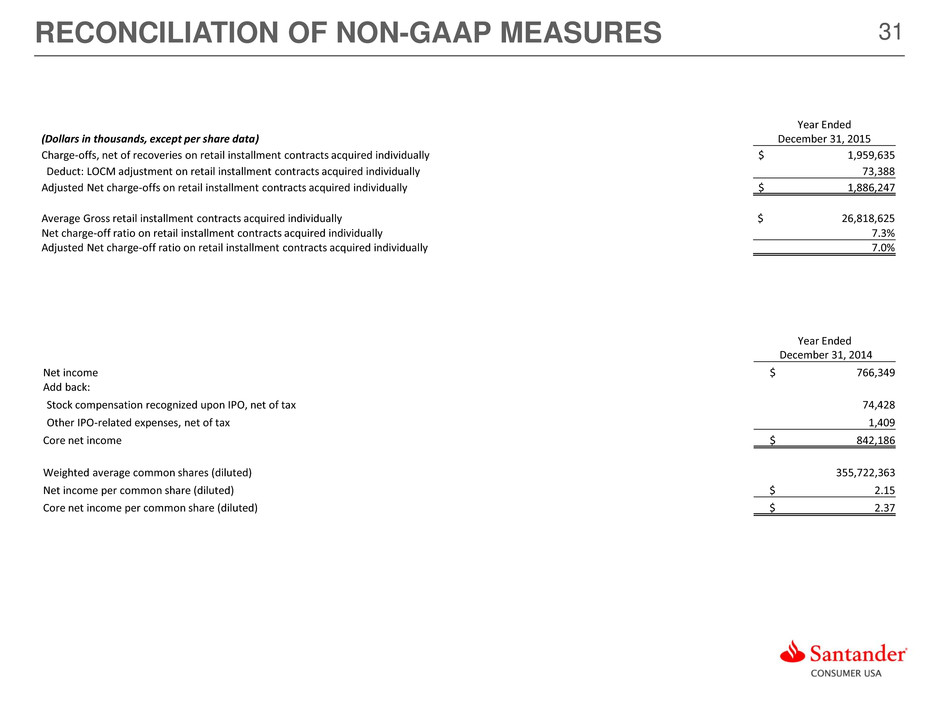

31RECONCILIATION OF NON-GAAP MEASURES (Dollars in thousands, except per share data) Year Ended December 31, 2015 Charge-offs, net of recoveries on retail installment contracts acquired individually $ 1,959,635 Deduct: LOCM adjustment on retail installment contracts acquired individually 73,388 Adjusted Net charge-offs on retail installment contracts acquired individually $ 1,886,247 Average Gross retail installment contracts acquired individually $ 26,818,625 Net charge-off ratio on retail installment contracts acquired individually 7.3% Adjusted Net charge-off ratio on retail installment contracts acquired individually 7.0% Year Ended December 31, 2014 Net income $ 766,349 Add back: Stock compensation recognized upon IPO, net of tax 74,428 Other IPO-related expenses, net of tax 1,409 Core net income $ 842,186 Weighted average common shares (diluted) 355,722,363 Net income per common share (diluted) $ 2.15 Core net income per common share (diluted) $ 2.37