Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PACKAGING CORP OF AMERICA | pkg12312015form8-ker.htm |

| EX-99.1 - EXHIBIT 99.1 - PACKAGING CORP OF AMERICA | pkg12312015exhibit991er.htm |

Fourth Quarter 2015 Supplementary Financial Data January 25, 2016

Certain statements in this supplementary data are forward-looking statements. Forward-looking statements include statements about our future financial condition, our industry and our business strategy. Statements that contain words such as “anticipate”, “believe”, “expect”, “intend”, “estimate”, “hope” or similar expressions, are forward-looking statements. These forward-looking statements are based on the current expectations of PCA. Because forward-looking statements involve inherent risks and uncertainties, the plans, actions and actual results of PCA could differ materially. Among the factors that could cause plans, actions and results to differ materially from PCA’s current expectations are those identified under the caption “Risk Factors” in PCA’s Form 10K filed with the Securities and Exchange Commission and available at the SEC’s website at “www.sec.gov”. We undertake no obligation to publically update any forward-looking statements, whether as a result of new information, future events, or otherwise. Packaging Corporation of America Certain non-U.S. GAAP financial information is presented on these slides. A reconciliation of those numbers to U.S. GAAP financial measures is included in the schedules attached to our press release. Non-GAAP Financial Measures 2

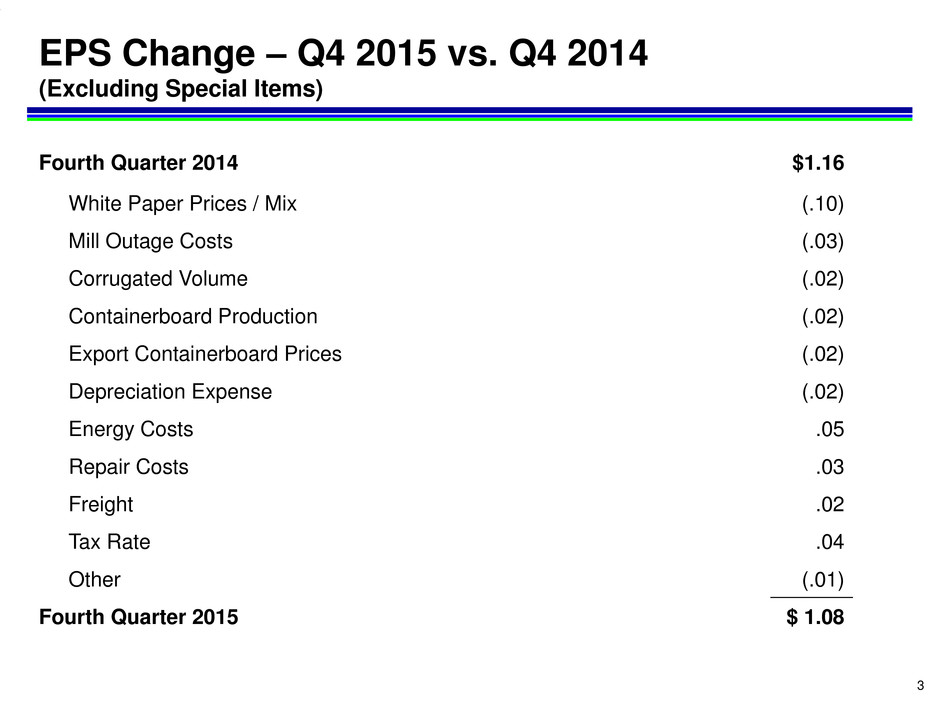

Fourth Quarter 2014 $1.16 White Paper Prices / Mix (.10) Mill Outage Costs (.03) Corrugated Volume (.02) Containerboard Production (.02) Export Containerboard Prices (.02) Depreciation Expense (.02) Energy Costs .05 Repair Costs .03 Freight .02 Tax Rate .04 Other (.01) Fourth Quarter 2015 $ 1.08 EPS Change – Q4 2015 vs. Q4 2014 (Excluding Special Items) 3

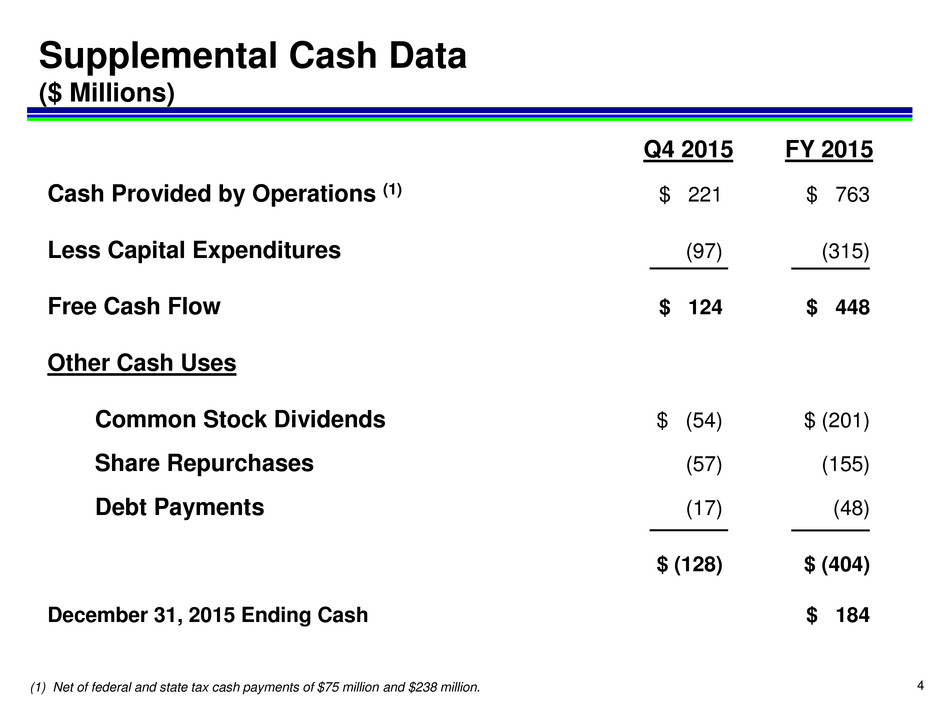

4 Cash Provided by Operations (1) $ 221 $ 763 Less Capital Expenditures (97) (315) Free Cash Flow $ 124 $ 448 Other Cash Uses Common Stock Dividends $ (54) $ (201) Share Repurchases (57) (155) Debt Payments (17) (48) $ (128) $ (404) December 31, 2015 Ending Cash $ 184 Supplemental Cash Data ($ Millions) (1) Net of federal and state tax cash payments of $75 million and $238 million. Q4 2015 FY 2015