Attached files

| file | filename |

|---|---|

| 8-K - HANCOCK WHITNEY CORP | hbhc4q158-k.htm |

Exhibit 99.1

For Immediate Release

January 21, 2016

For More Information

Trisha Voltz Carlson

SVP, Investor Relations Manager

504.299.5208

trisha.carlson@hancockbank.com

Hancock reports fourth quarter 2015 financial results

Previously announced increase in energy allowance included in quarterly results

Highlights of the company's fourth quarter 2015 results (compared to third quarter 2015):

|

●

|

Increased the allowance for loan losses within the energy portfolio by $43 million

|

|

●

|

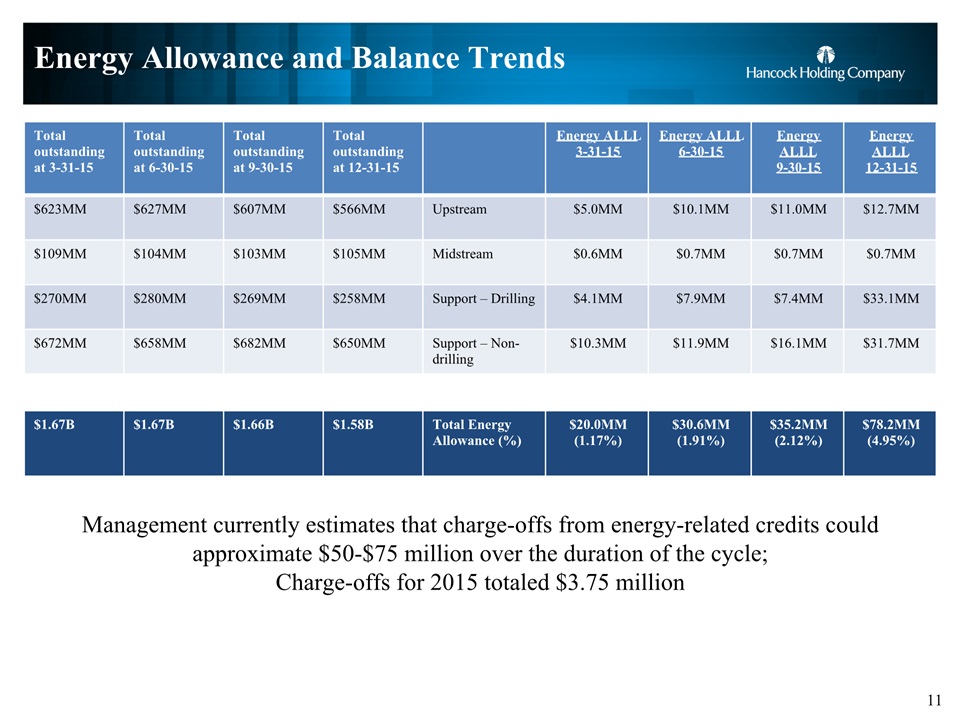

Allowance for energy loans now $78.2 million or 4.95% of energy loans, up from 2.12%

|

|

●

|

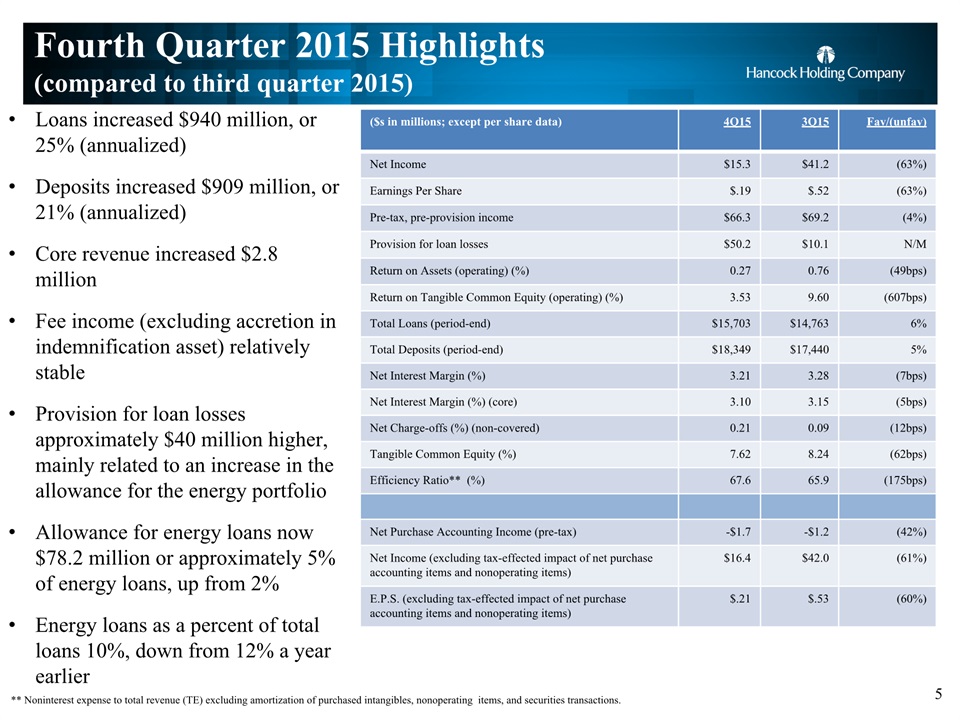

Loans increased $940 million, or 25% (annualized)

|

|

●

|

Deposits increased $909 million, or 21% (annualized)

|

|

●

|

Core revenue increased $2.8 million

|

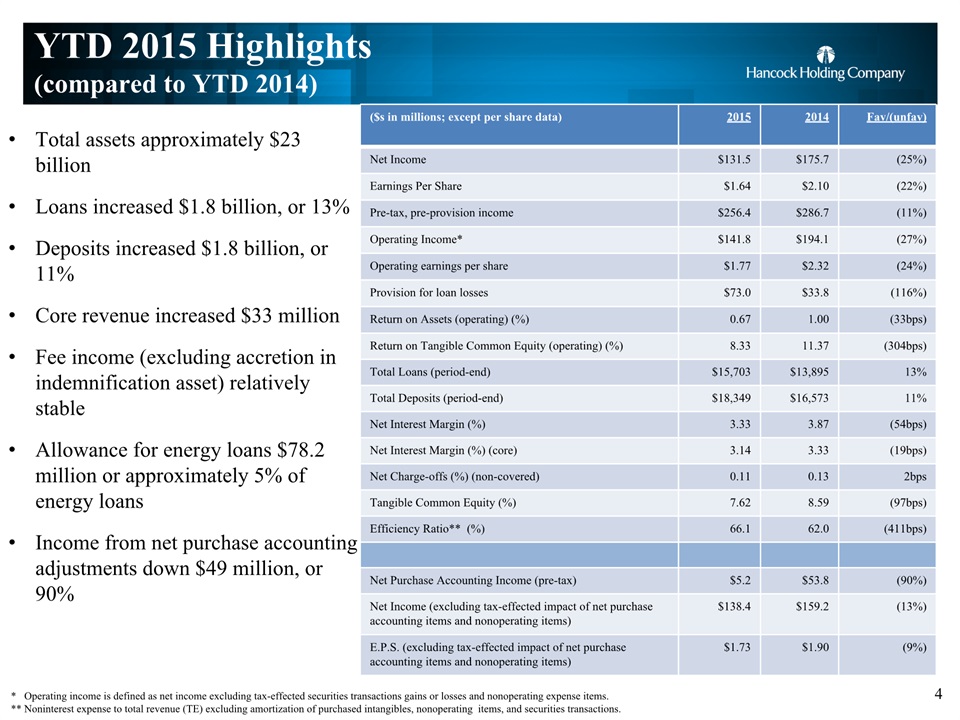

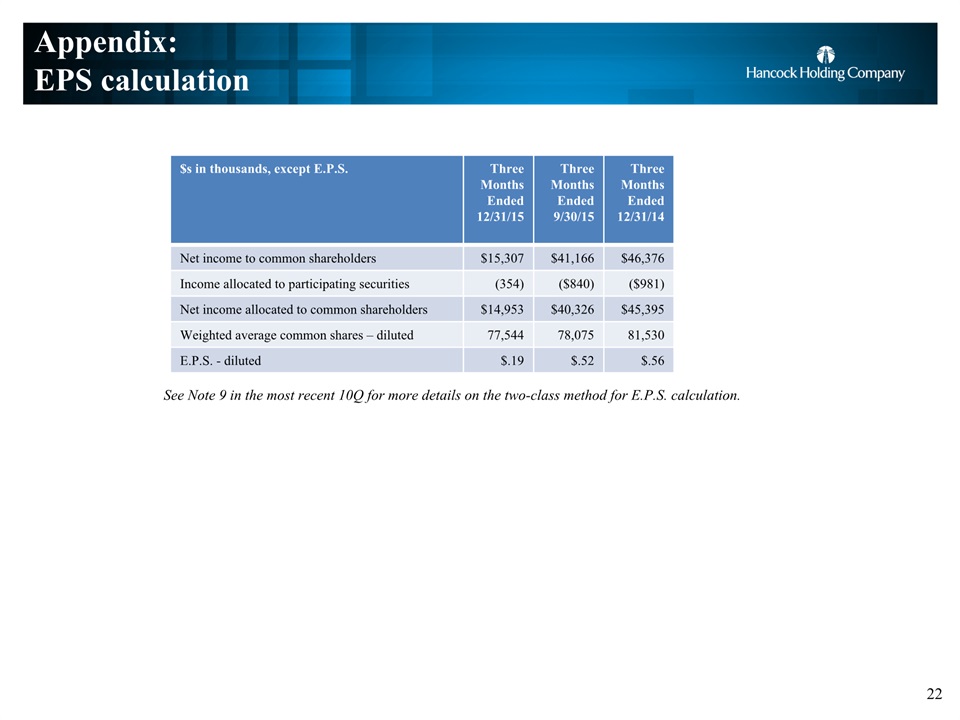

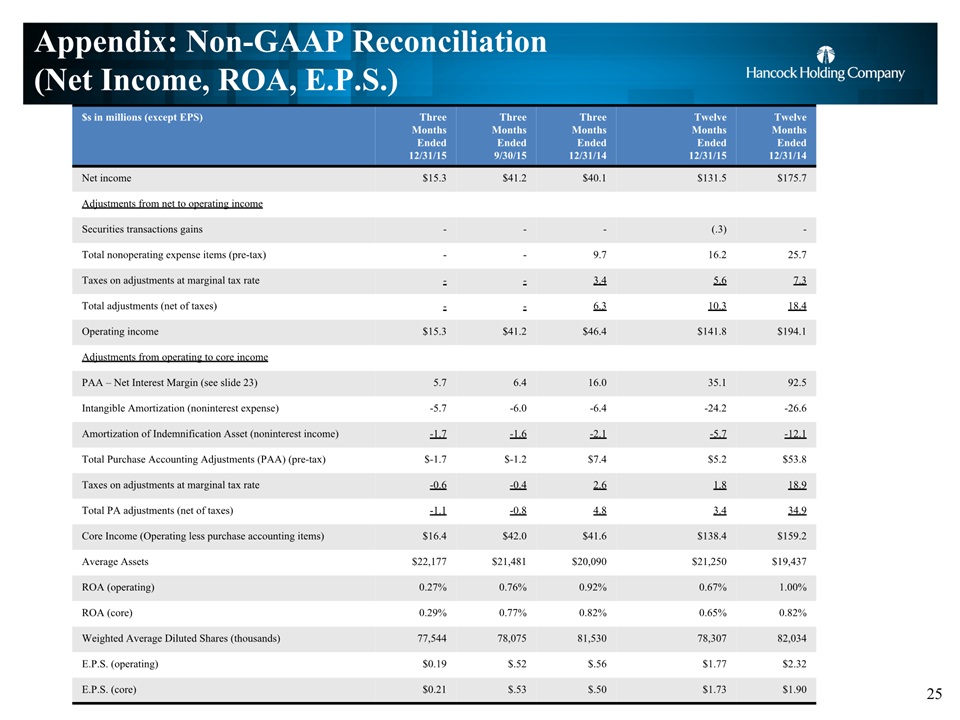

GULFPORT, Miss. (January 21, 2016) — Hancock Holding Company (Nasdaq: HBHC) today announced its financial results for the fourth quarter of 2015. Net income for the fourth quarter of 2015 was $15.3 million, or $.19 per diluted common share, compared to $41.2 million, or $.52 in the third quarter of 2015 and $40.1 million, or $.48, in the fourth quarter of 2014. The linked-quarter decline in earnings was mainly related to the previously announced $43 million (pre-tax), or $.35 per diluted share, increase in the energy allowance. The year-over-year decline in earnings was mainly related to a decrease in purchase accounting income of approximately $9.1 million (pre-tax), and the increase in the energy allowance noted above. Pre-tax, pre-provision earnings were $66.3 million for the fourth quarter of 2015.

"The depth and duration of the current energy cycle continued to deepen and lengthen from original expectations," said President and CEO John M. Hairston. "The action we took in the fourth quarter to increase our allowance for energy was a proactive move on our part to address this change in market conditions. However, while earnings were impacted this quarter, our capital remained solid and we remain focused on achieving our strategic goals. Outside of energy we continued to grow the balance sheet organically and added over $1.2 billion in total assets. While expenses were slightly higher than expected, they were for the most part directed at revenue-generating initiatives as we continue diminishing our concentration in energy-related revenue. As we begin 2016 we are focused on a goal of 25% growth in core pre-tax, pre-provision earnings compared to 2014, and will accomplish this through continued growth in core revenue, controlling expenses and managing through the challenges of today's energy cycle."

1

Hancock reports fourth quarter 2015 financial results

January 21, 2016

Loans

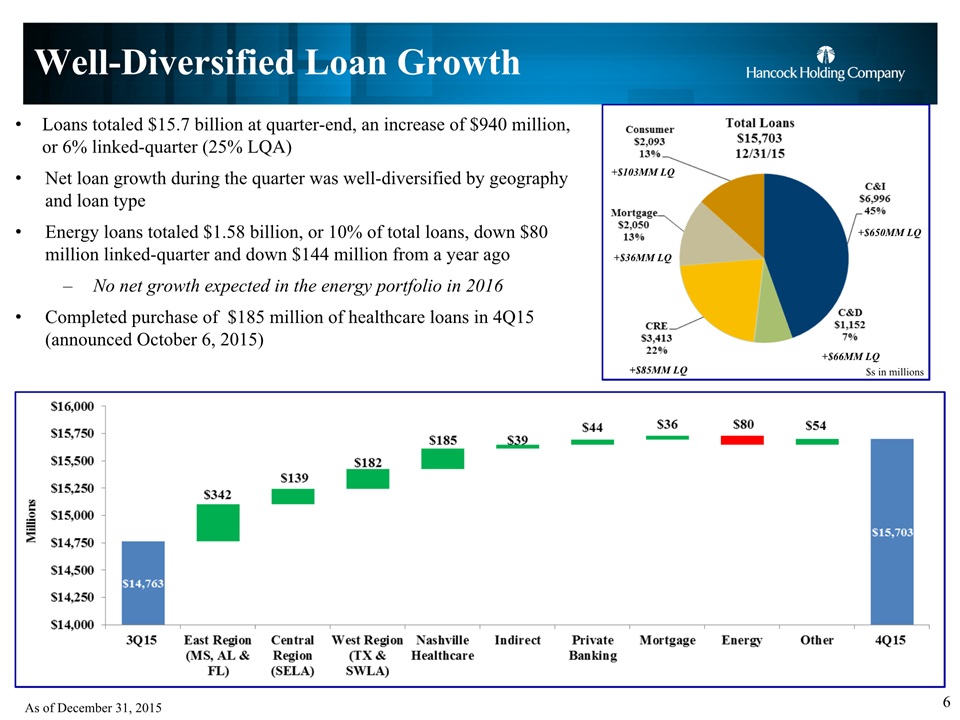

Total loans at December 31, 2015 were $15.7 billion, up $940 million, or 6%, from September 30, 2015. All regions across the footprint reported net loan growth during the quarter, with growth also noted in various business lines such as equipment finance, private banking, indirect, and mortgage.

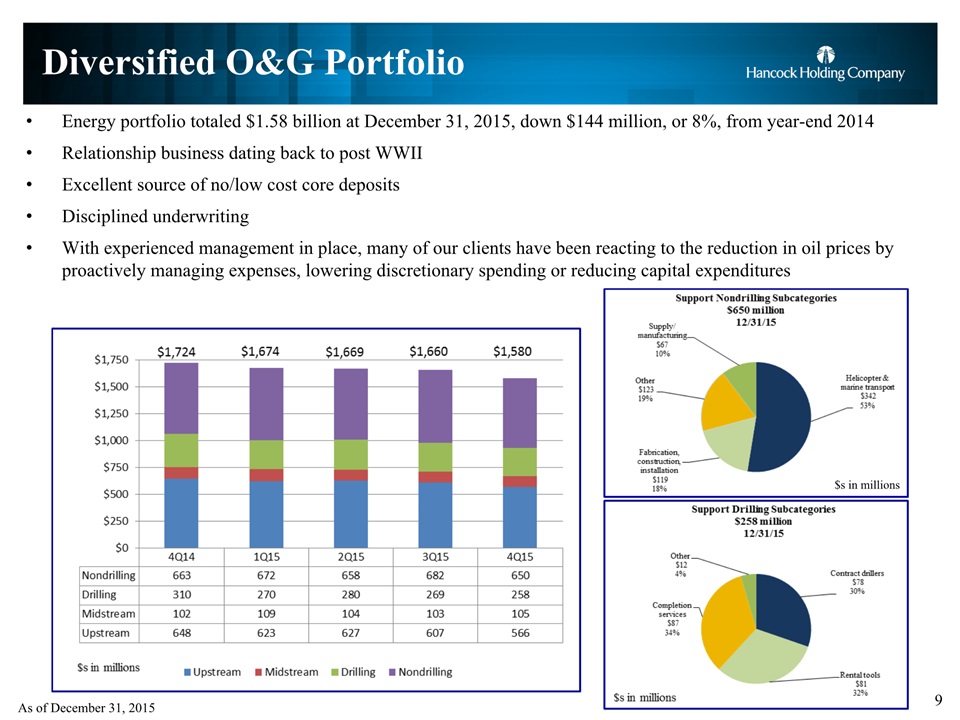

At December 31, 2015, loans in the energy segment totaled $1.58 billion, or 10% of total loans. The energy portfolio declined approximately $80 million linked-quarter and is comprised of credits to both the E&P industry and support industries. Additional details of the energy portfolio are included in the presentation slides posted on our Investor Relations website.

During the fourth quarter of 2015, the company completed the transaction announced on October 6, 2015 to acquire a healthcare portfolio in Nashville, Tennessee, and added $184.6 million in healthcare loans to the balance sheet.

Average loans totaled $15.2 billion for the fourth quarter of 2015, up $687 million, or 5%, linked-quarter.

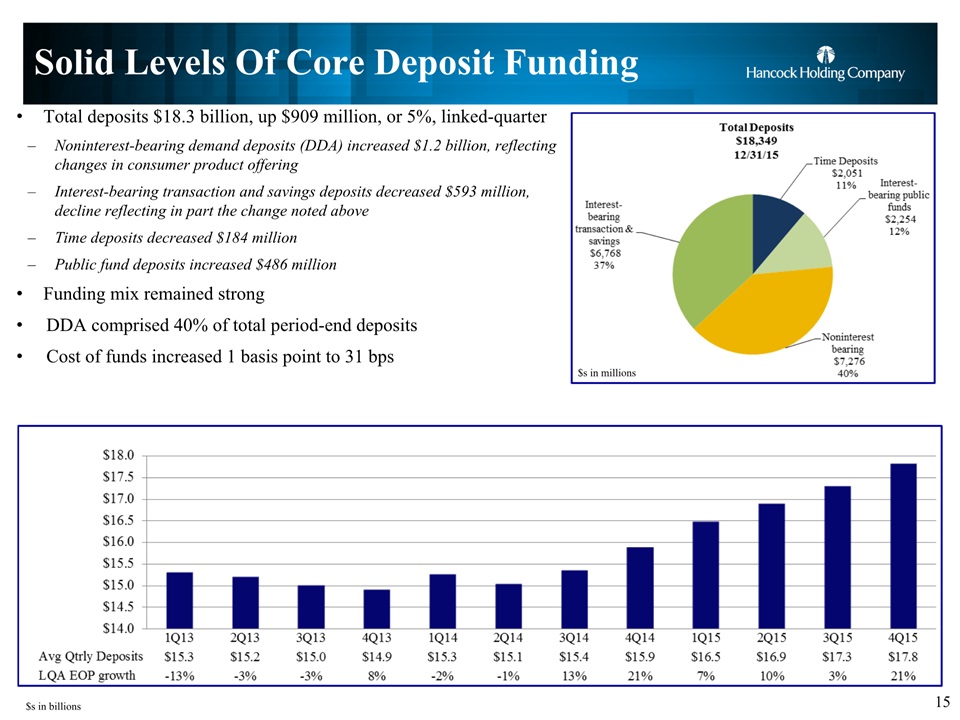

Deposits

Total deposits at December 31, 2015 were $18.3 billion, up $909 million, or 5%, from September 30, 2015. Average deposits for the fourth quarter of 2015 were $17.8 billion, up $508 million, or 3%, linked-quarter.

Noninterest-bearing demand deposits (DDAs) totaled $7.3 billion at December 31, 2015, up $1.2 billion from September 30, 2015. The increase reflects a change in the company's consumer checking product offering. Excluding this activity DDA was relatively stable linked-quarter. DDAs comprised 40% of total period-end deposits at December 31, 2015.

Interest-bearing transaction and savings deposits totaled $6.8 billion at the end of the fourth quarter of 2015, down $593 million, or 8%, from September 30, 2015. The decline reflects, in part, the change in products noted above. Time deposits of $2.1 billion decreased $184 million, or 8%, while interest-bearing public fund deposits increased $486 million, or 28%, to $2.3 billion at December 31, 2015. During the fourth quarter of 2015 the company closed its Cayman branch, reclassifying Eurodollar deposits from the time deposit category to interest-bearing transaction accounts. Excluding these changes, the company did report organic growth in money market deposits.

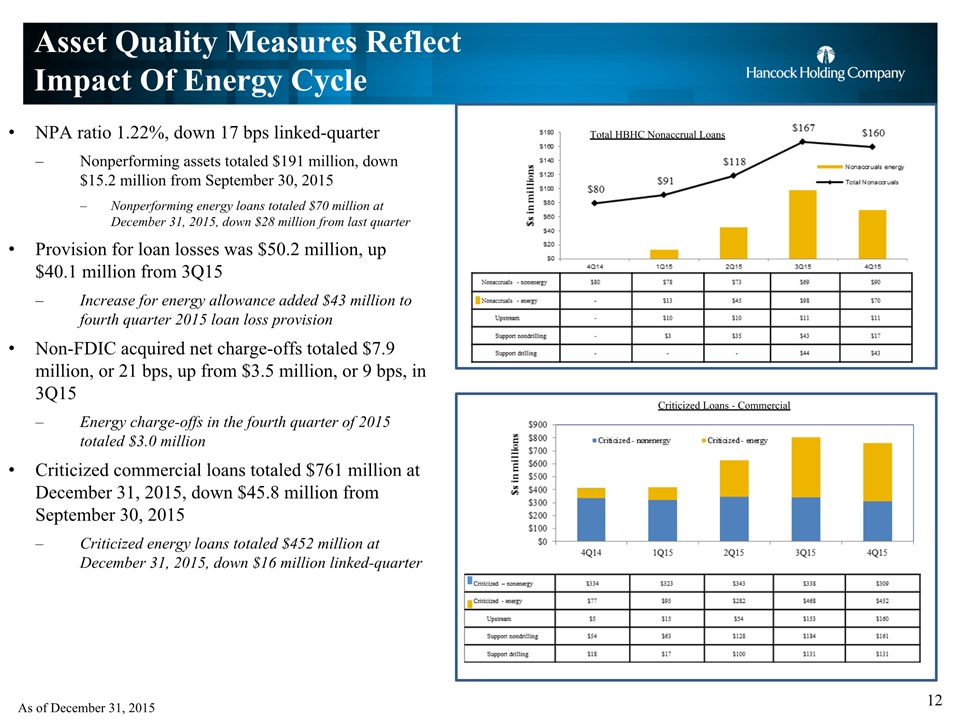

Asset Quality

Nonperforming assets (NPAs) totaled $191 million at December 31, 2015, down $15.2 million from September 30, 2015. During the fourth quarter of 2015, total nonperforming loans decreased approximately $8.7 million while foreclosed and surplus real estate (ORE) and other foreclosed assets decreased approximately $6.5 million. The net decrease in nonperforming loans was mainly related to the payoff of an energy credit during the quarter. Nonperforming

2

Hancock reports fourth quarter 2015 financial results

January 21, 2016

assets as a percent of total loans, ORE and other foreclosed assets was 1.22% at December 31, 2015, down 17 bps from September 30, 2015.

The total allowance for loan losses was $181.2 million at December 31, 2015, up $41.6 million from September 30, 2015. The ratio of the allowance for loan losses to period-end loans was 1.15% at December 31, 2015, up from 0.95% at September 30, 2015. The allowance maintained on the non-FDIC acquired portion of the loan portfolio increased $44.0 million linked-quarter, totaling $158.1 million, while the allowance on the FDIC acquired loan portfolio decreased approximately $2.4 million linked-quarter.

The depth and duration of the current energy cycle continued to deepen and lengthen from what we and many others originally expected. Recent economic and geopolitical events have caused the price of oil to decline even further and there are no indications that there will be a quick recovery. These events, coupled with declining collateral value related to specific credits within the energy portfolio, led us to update our estimated allowance for loan losses. During the fourth quarter the allowance for the energy portfolio was increased $43 million, to $78.2 million, or almost 5% of energy loans. The impact and severity of risk rating migration, associated provision and net charge-offs will depend on overall oil price reduction and the duration of the cycle. While we expect additional charge-offs in the portfolio, we continue to believe the impact of the energy cycle will be manageable and our capital will remain solid. Management currently estimates that charge-offs from energy-related credits could approximate $50-$75 million over the duration of the cycle. Charge-offs for 2015 totaled $3.75 million. Additional details of the energy portfolio are included in the presentation slides posted on our Investor Relations website.

Net charge-offs from the non-FDIC acquired loan portfolio were $7.9 million, or 0.21% of average total loans on an annualized basis in the fourth quarter of 2015, up from $3.5 million, or 0.09% of average total loans in the third quarter of 2015. Included in the fourth quarter total are $3.0 million in charge-offs related to energy credits.

During the fourth quarter of 2015, Hancock recorded a total provision for loan losses of $50.2 million, up $40.1 million from the third quarter of 2015.

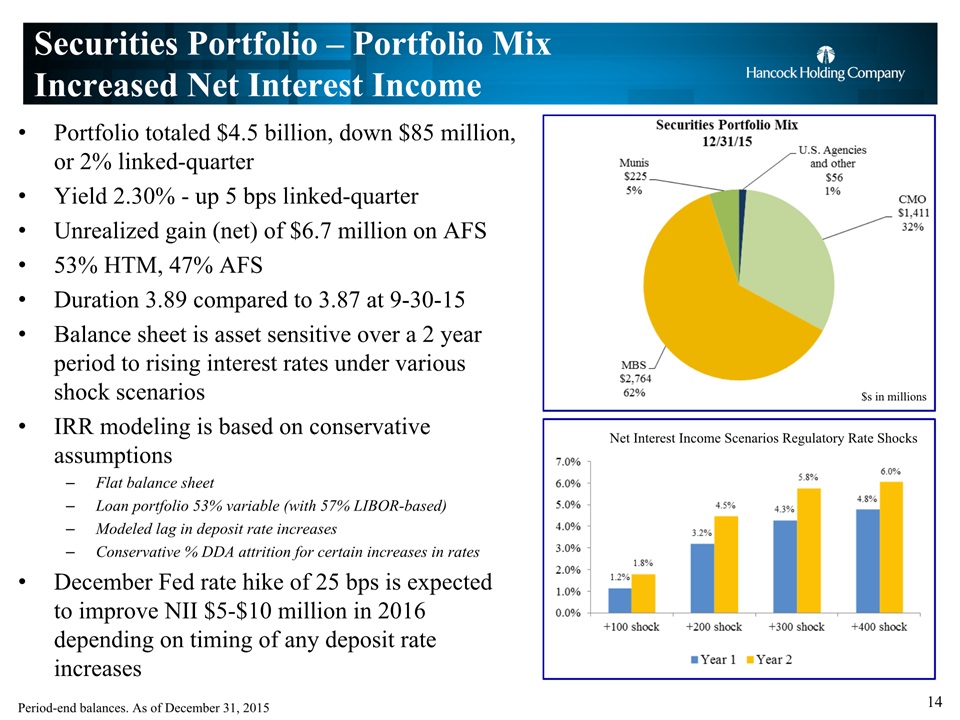

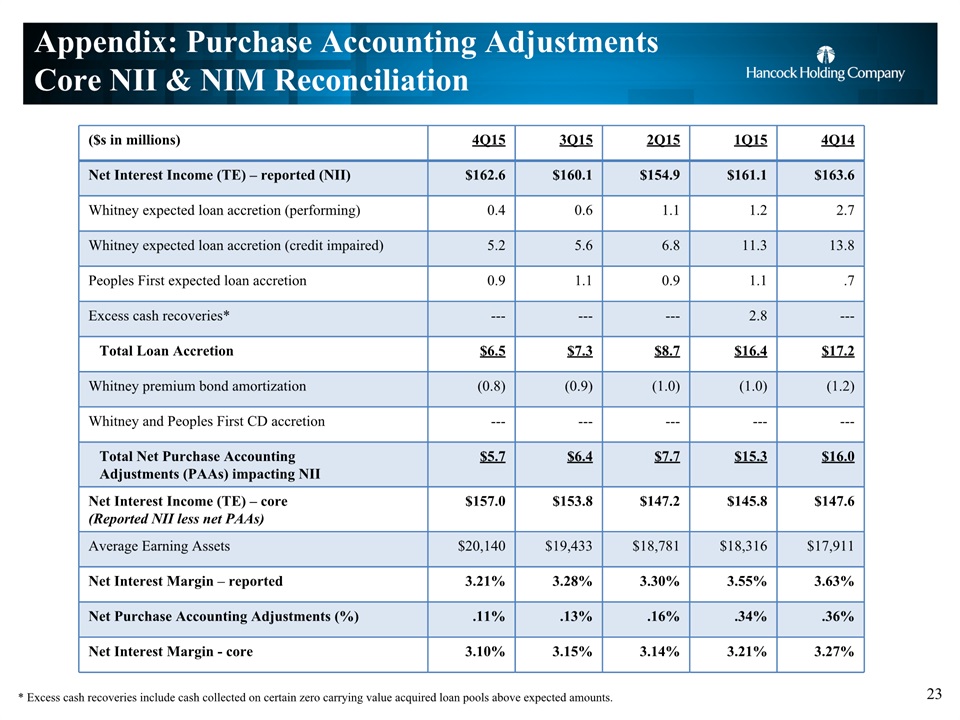

Net Interest Income and Net Interest Margin

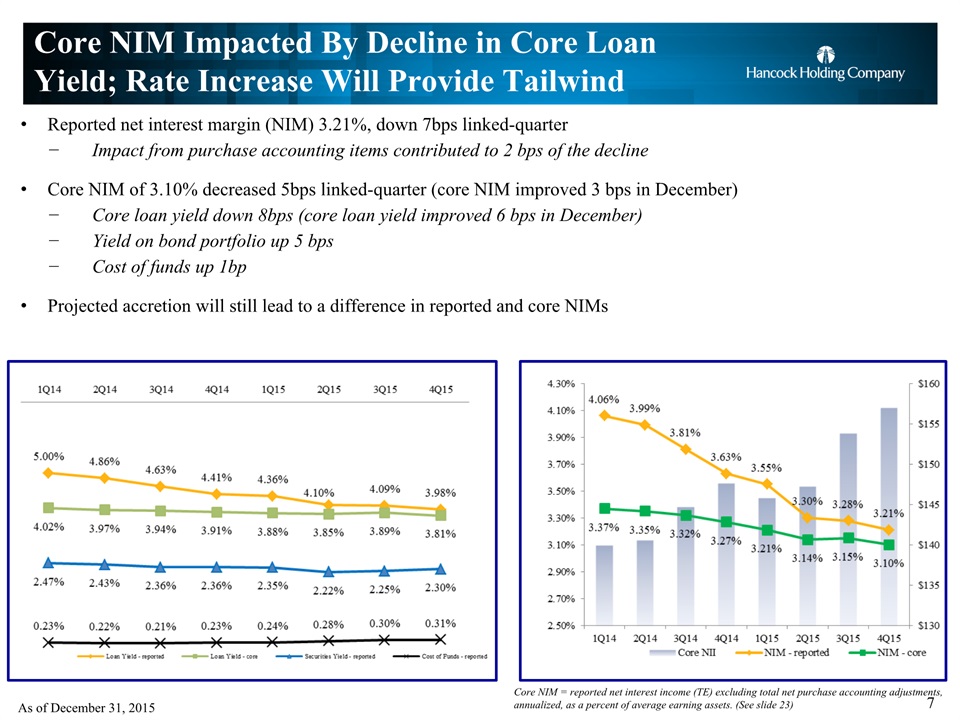

Net interest income (TE) for the fourth quarter of 2015 was $162.6 million, up $2.5 million from the third quarter of 2015. During the fourth quarter, the impact on net interest income from purchase accounting adjustments (PAAs) declined $0.7 million compared to the third quarter of 2015. Excluding the impact from purchase accounting items, core net interest income increased $3.2 million linked-quarter. Average earning assets were $20.1 billion for the fourth quarter of 2015, up $707 million, or 4%, from the third quarter of 2015.

Net interest income (TE) for the fourth quarter of 2015 was $162.6 million, up $2.5 million from the third quarter of 2015. During the fourth quarter, the impact on net interest income from purchase accounting adjustments (PAAs) declined $0.7 million compared to the third quarter of 2015. Excluding the impact from purchase accounting items, core net interest income increased $3.2 million linked-quarter. Average earning assets were $20.1 billion for the fourth quarter of 2015, up $707 million, or 4%, from the third quarter of 2015.

The reported net interest margin (TE) was 3.21% for the fourth quarter of 2015, down 7 basis points (bps) from the third quarter of 2015. The impact from purchase accounting items contributed to 2 bps of the decline. The core net interest margin (reported net interest income (TE) excluding total net purchase accounting adjustments, annualized, as a percent of average

3

Hancock reports fourth quarter 2015 financial results

January 21, 2016

earning assets) decreased 5 bps to 3.10% during the fourth quarter of 2015. The main driver of the decline was a decrease in the core loan yield of 8 bps. This was slightly offset by an increase in the securities portfolio yield of 5 bps. The cost of funds remained relatively stable (up 1 bp).

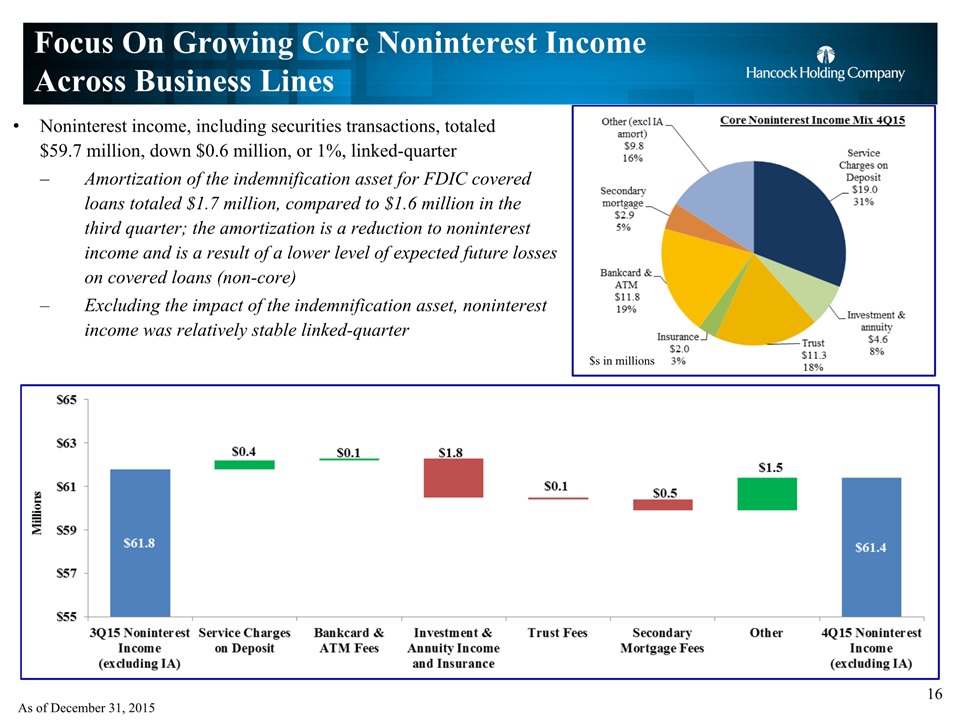

Noninterest Income

Noninterest income, including securities transactions, totaled $59.7 million for the fourth quarter of 2015, down $0.6 million, or 1%, from the third quarter of 2015. Included in the total is a reduction of $1.7 million related to the amortization of the FDIC indemnification asset, compared to a reduction of $1.6 million in the third quarter of 2015. Excluding the impact of this item and securities transactions, core noninterest income totaled $61.4 million, down slightly linked-quarter.

Service charges on deposits totaled $19.0 million for the fourth quarter of 2015, up $0.4 million, or 2%, from the third quarter of 2015. Bank card and ATM fees totaled $11.8 million, up $0.1 million, or 1%, from the third quarter of 2015.

Trust fees totaled $11.3 million, down slightly linked-quarter. Investment and annuity income and insurance fees totaled $6.6 million, down $1.8 million, or 21%, linked-quarter.

Fees from secondary mortgage operations totaled $2.9 million for the fourth quarter of 2015, down $0.5 million, or 16%, linked-quarter.

Other noninterest income (excluding the amortization of the FDIC indemnification asset noted above) totaled $9.8 million, up $1.5 million, or 17%, from the third quarter of 2015.

Noninterest Expense & Taxes

Noninterest expense for the fourth quarter of 2015 totaled $156.0 million, up $4.8 million, or 3%, from the third quarter of 2015. There were no nonoperating expenses in either the third or fourth quarters of 2015.

Noninterest expense for the fourth quarter of 2015 totaled $156.0 million, up $4.8 million, or 3%, from the third quarter of 2015. There were no nonoperating expenses in either the third or fourth quarters of 2015.

Total personnel expense was $85.3 million in the fourth quarter of 2015, up $1.2 million, or 1%, from the third quarter of 2015. The increase primarily reflects salary and incentive expenses related to revenue initiatives.

Occupancy and equipment expense totaled $14.5 million in the fourth quarter of 2015, down $0.3 million, or 2%, from the third quarter of 2015.

ORE expense totaled $1.4 million for the fourth quarter of 2015, up $0.9 million from the third quarter of 2015.

Amortization of intangibles totaled $5.7 million for the fourth quarter of 2015, down $0.3 million, or 6%, linked-quarter. Other operating expense totaled $49.2 million in the fourth quarter of 2015, up $3.4 million, or 7%, from the third quarter of 2015. The change linked-quarter mainly

4

Hancock reports fourth quarter 2015 financial results

January 21, 2016

reflects the impact from $1.25 million in insurance proceeds received in the third quarter and an increase of $1.2 million in revenue-related advertising expense in the fourth quarter.

The effective income tax rate for the full year of 2015 was 23%. The effective rate was 26% in the third quarter of 2015. The lower level of earnings and an increase in tax-exempt income impacted the fourth quarter, causing the effective tax rate to be unusually low. Management expects the effective income tax rate to approximate 26-27% in 2016. The effective income tax rate continues to be less than the statutory rate of 35% due primarily to tax-exempt income and tax credits.

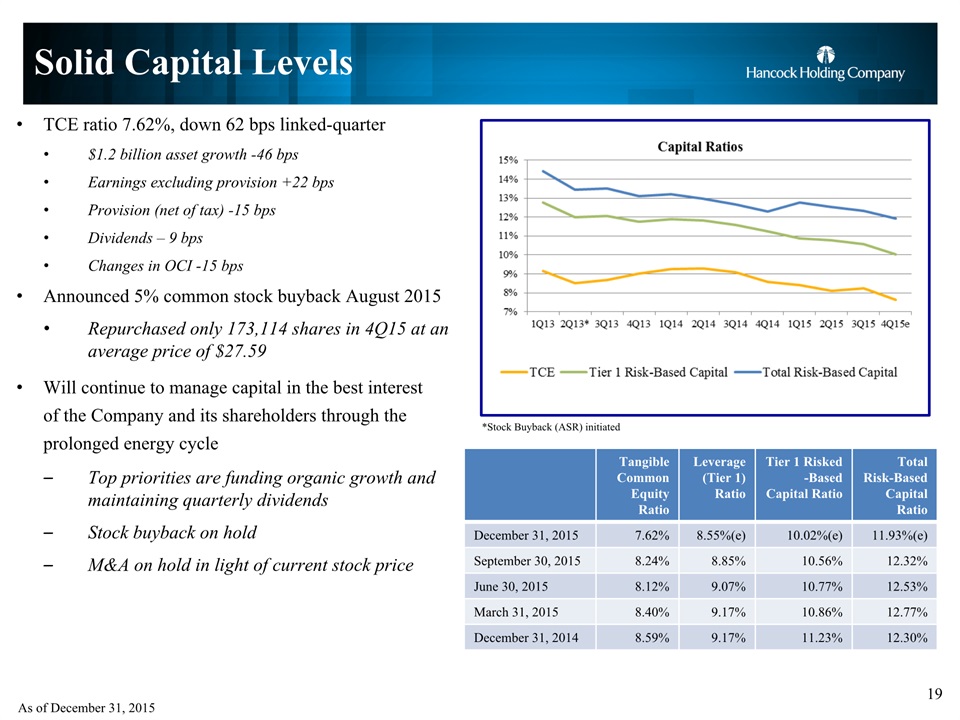

Capital

Common shareholders' equity at December 31, 2015 totaled $2.4 billion. The tangible common equity (TCE) ratio was 7.62%, down 62 bps from September 30, 2015. The decline reflects the $1.2 billion of asset growth in the fourth quarter of 2015, a lower level of earnings in the quarter and a decrease in other comprehensive income (OCI) related to the actuarial losses on retirement plans and the market adjustment on the available for sale (AFS) investment portfolio.

During the fourth quarter the company repurchased 173,114 common shares under the 5% common stock buyback authorization announced in late August 2015. The shares were repurchased at an average price of $27.59. Additional capital ratios are included in the financial tables.

Conference Call and Slide Presentation

Management will host a conference call for analysts and investors at 9:00 a.m. Central Time on Friday, January 22, 2016 to review the results. A live listen-only webcast of the call will be available under the Investor Relations section of Hancock's website at www.hancockbank.com. Additional financial tables and a slide presentation related to fourth quarter results are also posted as part of the webcast link. To participate in the Q&A portion of the call, dial (877) 564-1219 or (973) 638-3429. An audio archive of the conference call will be available under the Investor Relations section of our website. A replay of the call will also be available through January 28, 2016 by dialing (855) 859-2056 or (404) 537-3406, passcode 17108504.

About Hancock Holding Company

Hancock Holding Company is a financial services company with regional business headquarters and locations throughout a growing Gulf South corridor. The company's banking subsidiary provides a comprehensive network of full-service financial choices through Hancock Bank locations in Mississippi, Alabama, and Florida and Whitney Bank offices in Louisiana and Texas, including traditional and online banking; commercial and small business banking; energy banking; private banking; trust and investment services; certain insurance services; mortgage services; and consumer financing. More information and online banking are available at www.hancockbank.com and www.whitneybank.com.

Forward-Looking Statements

This news release contains "forward-looking statements" within the meaning of section 27A of the Securities Act of 1933, as amended, and section 21E of the Securities Exchange Act of 1934, as amended, and we intend such forward-looking statements to

This news release contains "forward-looking statements" within the meaning of section 27A of the Securities Act of 1933, as amended, and section 21E of the Securities Exchange Act of 1934, as amended, and we intend such forward-looking statements to

5

Hancock reports fourth quarter 2015 financial results

January 21, 2016

be covered by the safe harbor provisions therein and are including this statement for purposes of invoking these safe-harbor provisions. Forward-looking statements provide projections of results of operations or of financial condition or state other forward-looking information, such as expectations about future conditions and descriptions of plans and strategies for the future.

Forward-looking statements that we may make include, but may not be limited to, comments with respect to future levels of economic activity in our markets, including the impact of volatility of oil and gas prices on our energy portfolio and associated loan loss reserves and possible charge-offs, and the downstream impact on businesses that support the energy sector, especially in the Gulf Coast region, loan growth expectations, deposit trends, credit quality trends, net interest margin trends, future expense levels, success of revenue-generating initiatives, projected tax rates, future profitability, improvements in expense to revenue (efficiency) ratio, purchase accounting impacts such as accretion levels, possible repurchases of shares under stock buyback programs, and the financial impact of regulatory requirements. Hancock's ability to accurately project results, predict the effects of future plans or strategies, or predict market or economic developments is inherently limited. Although Hancock believes that the expectations reflected in its forward-looking statements are based on reasonable assumptions, actual results and performance could differ materially from those set forth in the forward-looking statements. Factors that could cause actual results to differ from those expressed in Hancock's forward-looking statements include, but are not limited to, those risk factors included in Hancock's public filings with the Securities and Exchange Commission, which are available at the SEC's internet site (http://www.sec.gov). You are cautioned not to place undue reliance on these forward-looking statements. Hancock does not intend, and undertakes no obligation, to update or revise any forward-looking statements, whether as a result of differences in actual results, changes in assumptions or changes in other factors affecting such statements, except as required by law.

6

|

HANCOCK HOLDING COMPANY

FINANCIAL HIGHLIGHTS

(Unaudited)

|

||||||||||||||||||||

|

|

||||||||||||||||||||

|

Three Months Ended

|

Twelve Months Ended

|

|||||||||||||||||||

|

(amounts in thousands, except per share data)

|

12/31/2015

|

9/30/2015

|

12/31/2014

|

12/31/2015

|

12/31/2014

|

|||||||||||||||

|

INCOME STATEMENT DATA

|

||||||||||||||||||||

|

Net interest income

|

$

|

158,395

|

$

|

156,830

|

$

|

160,813

|

$

|

625,174

|

$

|

654,694

|

||||||||||

|

Net interest income (TE) (a)

|

162,635

|

160,134

|

163,581

|

638,762

|

665,341

|

|||||||||||||||

|

Provision for loan losses

|

50,196

|

10,080

|

9,718

|

73,038

|

33,840

|

|||||||||||||||

|

Noninterest income excluding securities transactions

|

59,655

|

60,207

|

56,961

|

236,949

|

227,999

|

|||||||||||||||

|

Securities transactions (losses) gains

|

(2

|

)

|

4

|

-

|

335

|

-

|

||||||||||||||

|

Noninterest expense (excluding nonoperating items)

|

156,030

|

151,193

|

144,080

|

603,414

|

580,980

|

|||||||||||||||

|

Nonoperating items

|

-

|

-

|

9,667

|

16,241

|

25,686

|

|||||||||||||||

|

Net income

|

15,307

|

41,166

|

40,092

|

131,461

|

175,722

|

|||||||||||||||

|

Operating income (b)

|

15,307

|

41,166

|

46,376

|

141,801

|

194,145

|

|||||||||||||||

|

Pre-tax, pre-provision (PTPP) profit (TE) (a) (c)

|

66,258

|

69,152

|

66,795

|

256,391

|

286,674

|

|||||||||||||||

|

PERIOD-END BALANCE SHEET DATA

|

||||||||||||||||||||

|

Loans

|

$

|

15,703,314

|

$

|

14,763,050

|

$

|

13,895,276

|

$

|

15,703,314

|

$

|

13,895,276

|

||||||||||

|

Securities

|

4,463,792

|

4,548,922

|

3,826,454

|

4,463,792

|

3,826,454

|

|||||||||||||||

|

Earning assets

|

20,753,095

|

19,526,150

|

18,544,930

|

20,753,095

|

18,544,930

|

|||||||||||||||

|

Total assets

|

22,839,459

|

21,608,150

|

20,747,266

|

22,839,459

|

20,747,266

|

|||||||||||||||

|

Noninterest-bearing deposits

|

7,276,127

|

6,075,558

|

5,945,208

|

7,276,127

|

5,945,208

|

|||||||||||||||

|

Total deposits

|

18,348,912

|

17,439,948

|

16,572,831

|

18,348,912

|

16,572,831

|

|||||||||||||||

|

Common shareholders' equity

|

2,413,143

|

2,453,561

|

2,472,402

|

2,413,143

|

2,472,402

|

|||||||||||||||

|

AVERAGE BALANCE SHEET DATA

|

||||||||||||||||||||

|

Loans

|

$

|

15,198,232

|

$

|

14,511,474

|

$

|

13,578,223

|

$

|

14,433,367

|

$

|

12,938,869

|

||||||||||

|

Securities (d)

|

4,480,972

|

4,425,546

|

3,836,123

|

4,208,195

|

3,816,724

|

|||||||||||||||

|

Earning assets

|

20,140,432

|

19,433,337

|

17,911,143

|

19,173,322

|

17,195,492

|

|||||||||||||||

|

Total assets

|

22,176,566

|

21,481,410

|

20,090,372

|

21,249,628

|

19,436,827

|

|||||||||||||||

|

Noninterest-bearing deposits

|

6,709,188

|

6,032,680

|

5,849,356

|

6,195,234

|

5,641,792

|

|||||||||||||||

|

Total deposits

|

17,821,484

|

17,313,433

|

15,892,507

|

17,124,789

|

15,399,993

|

|||||||||||||||

|

Common shareholders' equity

|

2,453,480

|

2,439,068

|

2,509,509

|

2,442,787

|

2,474,948

|

|||||||||||||||

|

COMMON SHARE DATA

|

||||||||||||||||||||

|

Earnings per share - diluted

|

$

|

0.19

|

$

|

0.52

|

$

|

0.48

|

$

|

1.64

|

$

|

2.10

|

||||||||||

|

Operating earnings per share - diluted (b)

|

0.19

|

0.52

|

0.56

|

1.77

|

2.32

|

|||||||||||||||

|

Cash dividends per share

|

$

|

0.24

|

$

|

0.24

|

$

|

0.24

|

$

|

0.96

|

$

|

0.96

|

||||||||||

|

Book value per share (period-end)

|

$

|

31.14

|

$

|

31.65

|

$

|

30.74

|

$

|

31.14

|

$

|

30.74

|

||||||||||

|

Tangible book value per share (period-end)

|

21.74

|

22.18

|

21.37

|

21.74

|

21.37

|

|||||||||||||||

|

Weighted average number of shares - diluted

|

77,544

|

78,075

|

81,530

|

78,307

|

82,034

|

|||||||||||||||

|

Period-end number of shares

|

77,496

|

77,519

|

80,426

|

77,496

|

80,426

|

|||||||||||||||

|

Market data

|

||||||||||||||||||||

|

High sales price

|

$

|

30.96

|

$

|

32.47

|

$

|

35.67

|

$

|

32.98

|

$

|

38.50

|

||||||||||

|

Low sales price

|

23.35

|

25.20

|

28.68

|

23.35

|

28.68

|

|||||||||||||||

|

Period-end closing price

|

25.17

|

27.05

|

30.70

|

25.17

|

30.70

|

|||||||||||||||

|

Trading volume

|

48,789

|

44,705

|

36,396

|

185,523

|

120,635

|

|||||||||||||||

|

PERFORMANCE RATIOS

|

||||||||||||||||||||

|

Return on average assets

|

0.27

|

%

|

0.76

|

%

|

0.79

|

%

|

0.62

|

%

|

0.90

|

%

|

||||||||||

|

Return on average assets - operating (b)

|

0.27

|

%

|

0.76

|

%

|

0.92

|

%

|

0.67

|

%

|

1.00

|

%

|

||||||||||

|

Return on average common equity

|

2.48

|

%

|

6.70

|

%

|

6.34

|

%

|

5.38

|

%

|

7.10

|

%

|

||||||||||

|

Return on average common equity - operating (b)

|

2.48

|

%

|

6.70

|

%

|

7.33

|

%

|

5.80

|

%

|

7.84

|

%

|

||||||||||

|

Return on average tangible common equity

|

3.53

|

%

|

9.60

|

%

|

9.08

|

%

|

7.72

|

%

|

10.30

|

%

|

||||||||||

|

Return on average tangible common equity - operating (b)

|

3.53

|

%

|

9.60

|

%

|

10.50

|

%

|

8.33

|

%

|

11.37

|

%

|

||||||||||

|

Tangible common equity ratio (e)

|

7.62

|

%

|

8.24

|

%

|

8.59

|

%

|

7.62

|

%

|

8.59

|

%

|

||||||||||

|

Net interest margin (TE) (a)

|

3.21

|

%

|

3.28

|

%

|

3.63

|

%

|

3.33

|

%

|

3.87

|

%

|

||||||||||

|

Average loan/deposit ratio

|

85.28

|

%

|

83.82

|

%

|

85.44

|

%

|

84.28

|

%

|

84.02

|

%

|

||||||||||

|

Efficiency ratio (f)

|

67.63

|

%

|

65.88

|

%

|

62.41

|

%

|

66.14

|

%

|

62.03

|

%

|

||||||||||

|

Allowance for loan losses as a percent of period-end loans

|

1.15

|

%

|

0.95

|

%

|

0.93

|

%

|

1.15

|

%

|

0.93

|

%

|

||||||||||

|

Annualized net non-FDIC acquired charge-offs to average loans

|

0.21

|

%

|

0.09

|

%

|

0.08

|

%

|

0.11

|

%

|

0.13

|

%

|

||||||||||

|

Allowance for loan losses to non-performing loans + accruing loans

|

||||||||||||||||||||

|

90 days past due

|

105.54

|

%

|

78.15

|

%

|

137.96

|

%

|

105.54

|

%

|

137.96

|

%

|

||||||||||

|

Noninterest income excluding securities transactions as a percent

|

||||||||||||||||||||

|

of total revenue (TE) (a)

|

26.84

|

%

|

27.32

|

%

|

25.83

|

%

|

27.06

|

%

|

25.52

|

%

|

||||||||||

|

FTE headcount

|

3,921

|

3,863

|

3,794

|

3,921

|

3,794

|

|||||||||||||||

|

(a) Tax-equivalent (TE) amounts are calculated using a federal income tax rate of 35%.

|

||||||||||||||||||||

|

(b) Net income less tax-effected securities transactions and nonoperating items. Management believes that operating income provides a useful measure of financial performance that helps

|

||||||||||||||||||||

|

investors compare the Company's fundamental operations over time.

|

||||||||||||||||||||

|

(c) Net interest income (TE) and noninterest income less noninterest expense. Management believes that PTPP profit is a useful financial measure because it enables investors to assess the Company's ability to generate capital to cover credit losses through a credit cycle.

|

||||||||||||||||||||

|

(d) Average securities does not include unrealized holding gains/losses on available for sale securities.

|

||||||||||||||||||||

|

(e) The tangible common equity ratio is common shareholders' equity less intangible assets divided by total assets less intangible assets.

|

||||||||||||||||||||

|

(f) The efficiency ratio is noninterest expense to total net interest (TE) and noninterest income, excluding amortization of purchased intangibles, nonoperating items, and securities transactions.

|

||||||||||||||||||||

7

|

HANCOCK HOLDING COMPANY

QUARTERLY HIGHLIGHTS

(Unaudited) |

||||||||||||||||||||

|

Three Months Ended

|

||||||||||||||||||||

|

(amounts in thousands, except per share data)

|

12/31/2015

|

9/30/2015

|

6/30/2015

|

3/31/2015

|

12/31/2014

|

|||||||||||||||

|

INCOME STATEMENT DATA

|

||||||||||||||||||||

|

Net interest income

|

$

|

158,395

|

$

|

156,830

|

$

|

151,791

|

$

|

158,158

|

$

|

160,813

|

||||||||||

|

Net interest income (TE) (a)

|

162,635

|

160,134

|

154,879

|

161,114

|

163,581

|

|||||||||||||||

|

Provision for loan losses

|

50,196

|

10,080

|

6,608

|

6,154

|

9,718

|

|||||||||||||||

|

Noninterest income excluding securities transactions

|

59,655

|

60,207

|

60,874

|

56,213

|

56,961

|

|||||||||||||||

|

Securities transactions (losses) gains

|

(2

|

)

|

4

|

-

|

333

|

-

|

||||||||||||||

|

Noninterest expense (excluding nonoperating items)

|

156,030

|

151,193

|

149,990

|

146,201

|

144,080

|

|||||||||||||||

|

Nonoperating items

|

-

|

-

|

8,927

|

7,314

|

9,667

|

|||||||||||||||

|

Net income

|

15,307

|

41,166

|

34,829

|

40,159

|

40,092

|

|||||||||||||||

|

Operating income (b)

|

15,307

|

41,166

|

40,631

|

44,697

|

46,376

|

|||||||||||||||

|

Pre-tax, pre-provision (PTPP) profit (TE) (a) (c)

|

66,258

|

69,152

|

56,836

|

64,145

|

66,795

|

|||||||||||||||

|

PERIOD-END BALANCE SHEET DATA

|

||||||||||||||||||||

|

Loans

|

$

|

15,703,314

|

$

|

14,763,050

|

$

|

14,344,752

|

$

|

13,924,386

|

$

|

13,895,276

|

||||||||||

|

Securities

|

4,463,792

|

4,548,922

|

4,445,452

|

4,107,904

|

3,826,454

|

|||||||||||||||

|

Earning assets

|

20,753,095

|

19,526,150

|

19,409,963

|

18,568,037

|

18,544,930

|

|||||||||||||||

|

Total assets

|

22,839,459

|

21,608,150

|

21,538,405

|

20,724,511

|

20,747,266

|

|||||||||||||||

|

Noninterest-bearing deposits

|

7,276,127

|

6,075,558

|

6,180,814

|

6,201,403

|

5,945,208

|

|||||||||||||||

|

Total deposits

|

18,348,912

|

17,439,948

|

17,301,788

|

16,860,485

|

16,572,831

|

|||||||||||||||

|

Common shareholders' equity

|

2,413,143

|

2,453,561

|

2,430,040

|

2,425,098

|

2,472,402

|

|||||||||||||||

|

AVERAGE BALANCE SHEET DATA

|

||||||||||||||||||||

|

Loans

|

$

|

15,198,232

|

$

|

14,511,474

|

$

|

14,138,904

|

$

|

13,869,397

|

$

|

13,578,223

|

||||||||||

|

Securities (d)

|

4,480,972

|

4,425,546

|

4,143,097

|

3,772,997

|

3,836,123

|

|||||||||||||||

|

Earning assets

|

20,140,432

|

19,433,337

|

18,780,771

|

18,315,839

|

17,911,143

|

|||||||||||||||

|

Total assets

|

22,176,566

|

21,481,410

|

20,875,090

|

20,443,859

|

20,090,372

|

|||||||||||||||

|

Noninterest-bearing deposits

|

6,709,188

|

6,032,680

|

6,107,900

|

5,924,196

|

5,849,356

|

|||||||||||||||

|

Total deposits

|

17,821,484

|

17,313,433

|

16,862,088

|

16,485,259

|

15,892,507

|

|||||||||||||||

|

Common shareholders' equity

|

2,453,480

|

2,439,068

|

2,430,710

|

2,447,870

|

2,509,509

|

|||||||||||||||

|

COMMON SHARE DATA

|

||||||||||||||||||||

|

Earnings per share - diluted

|

$

|

0.19

|

$

|

0.52

|

$

|

0.44

|

$

|

0.49

|

$

|

0.48

|

||||||||||

|

Operating earnings per share - diluted (b)

|

0.19

|

0.52

|

0.51

|

0.55

|

0.56

|

|||||||||||||||

|

Cash dividends per share

|

$

|

0.24

|

$

|

0.24

|

$

|

0.24

|

$

|

0.24

|

$

|

0.24

|

||||||||||

|

Book value per share (period-end)

|

$

|

31.14

|

$

|

31.65

|

$

|

31.12

|

$

|

31.14

|

$

|

30.74

|

||||||||||

|

Tangible book value per share (period-end)

|

21.74

|

22.18

|

21.63

|

21.55

|

21.37

|

|||||||||||||||

|

Weighted average number of shares - diluted

|

77,544

|

78,075

|

78,115

|

79,661

|

81,530

|

|||||||||||||||

|

Period-end number of shares

|

77,496

|

77,519

|

78,094

|

77,886

|

80,426

|

|||||||||||||||

|

Market data

|

||||||||||||||||||||

|

High sales price

|

$

|

30.96

|

$

|

32.47

|

$

|

32.98

|

$

|

31.13

|

$

|

35.67

|

||||||||||

|

Low sales price

|

23.35

|

25.20

|

28.02

|

24.96

|

28.68

|

|||||||||||||||

|

Period-end closing price

|

25.17

|

27.05

|

31.91

|

29.86

|

30.70

|

|||||||||||||||

|

Trading volume

|

48,789

|

44,705

|

40,162

|

51,866

|

36,396

|

|||||||||||||||

|

PERFORMANCE RATIOS

|

||||||||||||||||||||

|

Return on average assets

|

0.27

|

%

|

0.76

|

%

|

0.67

|

%

|

0.80

|

%

|

0.79

|

%

|

||||||||||

|

Return on average assets - operating (b)

|

0.27

|

%

|

0.76

|

%

|

0.78

|

%

|

0.89

|

%

|

0.92

|

%

|

||||||||||

|

Return on average common equity

|

2.48

|

%

|

6.70

|

%

|

5.75

|

%

|

6.65

|

%

|

6.34

|

%

|

||||||||||

|

Return on average common equity - operating (b)

|

2.48

|

%

|

6.70

|

%

|

6.70

|

%

|

7.41

|

%

|

7.33

|

%

|

||||||||||

|

Return on average tangible common equity

|

3.53

|

%

|

9.60

|

%

|

8.28

|

%

|

9.60

|

%

|

9.08

|

%

|

||||||||||

|

Return on average tangible common equity - operating (b)

|

3.53

|

%

|

9.60

|

%

|

9.66

|

%

|

10.68

|

%

|

10.50

|

%

|

||||||||||

|

Tangible common equity ratio (e)

|

7.62

|

%

|

8.24

|

%

|

8.12

|

%

|

8.40

|

%

|

8.59

|

%

|

||||||||||

|

Net interest margin (TE) (a)

|

3.21

|

%

|

3.28

|

%

|

3.30

|

%

|

3.55

|

%

|

3.63

|

%

|

||||||||||

|

Average loan/deposit ratio

|

85.28

|

%

|

83.82

|

%

|

83.85

|

%

|

84.13

|

%

|

85.44

|

%

|

||||||||||

|

Efficiency ratio (f)

|

67.63

|

%

|

65.88

|

%

|

66.67

|

%

|

64.36

|

%

|

62.41

|

%

|

||||||||||

|

Allowance for loan losses as a percent of period-end loans

|

1.15

|

%

|

0.95

|

%

|

0.91

|

%

|

0.92

|

%

|

0.93

|

%

|

||||||||||

|

Annualized net non-FDIC acquired charge-offs to average loans

|

0.21

|

%

|

0.09

|

%

|

0.03

|

%

|

0.11

|

%

|

0.08

|

%

|

||||||||||

|

Allowance for loan losses to non-performing loans + accruing loans

|

||||||||||||||||||||

|

90 days past due

|

105.54

|

%

|

78.15

|

%

|

100.92

|

%

|

123.14

|

%

|

137.96

|

%

|

||||||||||

|

Noninterest income excluding securities transactions as a percent

|

||||||||||||||||||||

|

of total revenue (TE) (a)

|

26.84

|

%

|

27.32

|

%

|

28.21

|

%

|

25.87

|

%

|

25.83

|

%

|

||||||||||

|

FTE headcount

|

3,921

|

3,863

|

3,825

|

3,785

|

3,794

|

|||||||||||||||

|

(a) Tax-equivalent (TE) amounts are calculated using a federal income tax rate of 35%.

|

||||||||||||||||||||

|

(b) Net income less tax-effected securities transactions and nonoperating items. Management believes that operating income provides a useful measure of financial

|

||||||||||||||||||||

|

performance that helps investors compare the Company's fundamental operations over time.

|

||||||||||||||||||||

|

(c) Net interest income (TE) and noninterest income less noninterest expense. Management believes that PTPP profit is a useful financial measure because it enables investors to assess the Company's ability to generate capital to cover credit losses through a credit cycle.

|

||||||||||||||||||||

|

(d) Average securities does not include unrealized holding gains/losses on available for sale securities.

|

||||||||||||||||||||

|

(e) The tangible common equity ratio is common shareholders' equity less intangible assets divided by total assets less intangible assets.

|

||||||||||||||||||||

|

(f) The efficiency ratio is noninterest expense to total net interest (TE) and noninterest income, excluding amortization of purchased intangibles, nonoperating items, and

|

||||||||||||||||||||

|

securities transactions.

|

||||||||||||||||||||

8

|

HANCOCK HOLDING COMPANY

INCOME STATEMENT

(Unaudited) |

||||||||||||||||||||

|

|

||||||||||||||||||||

|

Three Months Ended

|

Twelve Months Ended

|

|||||||||||||||||||

|

(dollars in thousands, except per share data)

|

12/31/2015

|

9/30/2015

|

12/31/2014

|

12/31/2015

|

12/31/2014

|

|||||||||||||||

|

NET INCOME

|

||||||||||||||||||||

|

Interest income

|

$

|

174,310

|

$

|

171,329

|

$

|

170,971

|

$

|

679,646

|

$

|

692,813

|

||||||||||

|

Interest income (TE)

|

178,550

|

174,633

|

173,739

|

693,234

|

703,460

|

|||||||||||||||

|

Interest expense

|

15,915

|

14,499

|

10,158

|

54,472

|

38,119

|

|||||||||||||||

|

Net interest income (TE)

|

162,635

|

160,134

|

163,581

|

638,762

|

665,341

|

|||||||||||||||

|

Provision for loan losses

|

50,196

|

10,080

|

9,718

|

73,038

|

33,840

|

|||||||||||||||

|

Noninterest income excluding securities transactions

|

59,655

|

60,207

|

56,961

|

236,949

|

227,999

|

|||||||||||||||

|

Securities transactions (losses) gains

|

(2

|

)

|

4

|

-

|

335

|

-

|

||||||||||||||

|

Noninterest expense

|

156,030

|

151,193

|

153,747

|

619,655

|

606,666

|

|||||||||||||||

|

Income before income taxes

|

11,822

|

55,768

|

54,309

|

169,765

|

242,187

|

|||||||||||||||

|

Income tax expense

|

(3,485

|

)

|

14,602

|

14,217

|

38,304

|

66,465

|

||||||||||||||

|

Net income

|

$

|

15,307

|

$

|

41,166

|

$

|

40,092

|

$

|

131,461

|

$

|

175,722

|

||||||||||

|

ADJUSTMENTS FROM NET INCOME TO OPERATING INCOME

|

||||||||||||||||||||

|

Securities transactions gains

|

-

|

-

|

-

|

(333

|

)

|

-

|

||||||||||||||

|

Nonoperating items

|

||||||||||||||||||||

|

Impact of insurance business lines divestiture

|

-

|

-

|

-

|

-

|

(9,101

|

)

|

||||||||||||||

|

FDIC resolution of denied claims

|

-

|

-

|

-

|

1,854

|

10,268

|

|||||||||||||||

|

Nonoperating expense items

|

-

|

-

|

9,667

|

14,387

|

21,058

|

|||||||||||||||

|

Early debt redemption

|

-

|

-

|

-

|

-

|

3,461

|

|||||||||||||||

|

Total nonoperating items

|

-

|

-

|

9,667

|

16,241

|

25,686

|

|||||||||||||||

|

Taxes on adjustments at marginal tax rate

|

-

|

-

|

3,383

|

5,568

|

7,263

|

|||||||||||||||

|

Total adjustments (net of taxes)

|

-

|

-

|

6,284

|

10,340

|

18,423

|

|||||||||||||||

|

Operating income (g)

|

$

|

15,307

|

$

|

41,166

|

$

|

46,376

|

$

|

141,801

|

$

|

194,145

|

||||||||||

|

ADJUSTMENTS FROM NET INCOME TO PTPP PROFIT

|

||||||||||||||||||||

|

Difference between interest income and interest income (TE)

|

4,240

|

3,304

|

2,768

|

13,588

|

10,647

|

|||||||||||||||

|

Provision for loan losses

|

50,196

|

10,080

|

9,718

|

73,038

|

33,840

|

|||||||||||||||

|

Income tax expense

|

(3,485

|

)

|

14,602

|

14,217

|

38,304

|

66,465

|

||||||||||||||

|

Pre-tax, pre-provision (PTPP) profit (TE) (h)

|

$

|

66,258

|

$

|

69,152

|

$

|

66,795

|

$

|

256,391

|

$

|

286,674

|

||||||||||

|

NONINTEREST INCOME AND NONINTEREST EXPENSE

|

||||||||||||||||||||

|

Service charges on deposit accounts

|

$

|

18,971

|

$

|

18,619

|

$

|

19,025

|

$

|

72,813

|

$

|

77,006

|

||||||||||

|

Trust fees

|

11,287

|

11,345

|

11,559

|

45,627

|

44,826

|

|||||||||||||||

|

Bank card and ATM fees

|

11,792

|

11,637

|

11,225

|

46,480

|

45,031

|

|||||||||||||||

|

Investment & annuity fees

|

4,632

|

6,149

|

4,736

|

20,669

|

20,291

|

|||||||||||||||

|

Secondary mortgage market operations

|

2,884

|

3,413

|

2,000

|

12,579

|

8,036

|

|||||||||||||||

|

Insurance commissions and fees

|

1,980

|

2,238

|

1,862

|

8,567

|

9,473

|

|||||||||||||||

|

Amortization of FDIC loss share receivable

|

(1,713

|

)

|

(1,564

|

)

|

(2,113

|

)

|

(5,747

|

)

|

(12,102

|

)

|

||||||||||

|

Other income

|

9,822

|

8,370

|

8,667

|

35,961

|

35,438

|

|||||||||||||||

|

Noninterest income excluding securities transactions

|

59,655

|

60,207

|

56,961

|

236,949

|

227,999

|

|||||||||||||||

|

Securities transactions (losses) gains

|

(2

|

)

|

4

|

-

|

335

|

-

|

||||||||||||||

|

Total noninterest income including securities transactions

|

$

|

59,653

|

$

|

60,211

|

$

|

56,961

|

$

|

237,284

|

$

|

227,999

|

||||||||||

|

Personnel expense

|

$

|

85,315

|

$

|

84,155

|

$

|

79,522

|

$

|

332,120

|

$

|

320,502

|

||||||||||

|

Net occupancy expense

|

10,639

|

11,222

|

10,571

|

44,788

|

43,476

|

|||||||||||||||

|

Equipment expense

|

3,871

|

3,598

|

3,986

|

15,481

|

16,861

|

|||||||||||||||

|

Other real estate expense, net

|

1,361

|

422

|

1,001

|

2,740

|

2,758

|

|||||||||||||||

|

Other operating expense

|

49,153

|

45,769

|

42,555

|

184,101

|

170,586

|

|||||||||||||||

|

Amortization of intangibles

|

5,691

|

6,027

|

6,445

|

24,184

|

26,797

|

|||||||||||||||

|

Total operating expense

|

156,030

|

151,193

|

144,080

|

603,414

|

580,980

|

|||||||||||||||

|

Nonoperating expense items

|

-

|

-

|

9,667

|

16,241

|

25,686

|

|||||||||||||||

|

Total noninterest expense

|

$

|

156,030

|

$

|

151,193

|

$

|

153,747

|

$

|

619,655

|

$

|

606,666

|

||||||||||

|

COMMON SHARE DATA

|

||||||||||||||||||||

|

Earnings per share:

|

||||||||||||||||||||

|

Basic

|

$

|

0.19

|

$

|

0.52

|

$

|

0.48

|

$

|

1.64

|

$

|

2.10

|

||||||||||

|

Diluted

|

0.19

|

0.52

|

0.48

|

1.64

|

2.10

|

|||||||||||||||

|

Operating earnings per share: (g)

|

||||||||||||||||||||

|

Basic

|

$

|

0.19

|

$

|

0.52

|

$

|

0.56

|

$

|

1.77

|

$

|

2.32

|

||||||||||

|

Diluted

|

0.19

|

0.52

|

0.56

|

1.77

|

2.32

|

|||||||||||||||

|

(g) Net income less tax-effected securities transactions and nonoperating items. Management believes that

|

||||||||||||||||||||

|

operating income provides a useful measure of financial performance that helps investors compare the Company's fundamental operations over time.

|

||||||||||||||||||||

|

(h) Net interest income (TE) and noninterest income less noninterest expense. Management believes that PTPP profit is a useful financial measure because it enables investors to assess the Company's ability to generate capital to cover credit losses through a credit cycle.

|

||||||||||||||||||||

9

|

HANCOCK HOLDING COMPANY

INCOME STATEMENT

(Unaudited)

|

||||||||||||||||||||

|

|

||||||||||||||||||||

|

Three months ended

|

||||||||||||||||||||

|

(dollars in thousands)

|

12/31/2015

|

9/30/2015

|

6/30/2015

|

3/31/2015

|

12/31/2014

|

|||||||||||||||

|

Interest income

|

$

|

174,310

|

$

|

171,329

|

$

|

164,920

|

$

|

169,087

|

$

|

170,971

|

||||||||||

|

Interest income (TE)

|

178,550

|

174,633

|

168,008

|

172,043

|

173,739

|

|||||||||||||||

|

Interest expense

|

15,915

|

14,499

|

13,129

|

10,929

|

10,158

|

|||||||||||||||

|

Net interest income (TE)

|

162,635

|

160,134

|

154,879

|

161,114

|

163,581

|

|||||||||||||||

|

Provision for loan losses

|

50,196

|

10,080

|

6,608

|

6,154

|

9,718

|

|||||||||||||||

|

Noninterest income excluding securities transactions

|

59,655

|

60,207

|

60,874

|

56,213

|

56,961

|

|||||||||||||||

|

Securities transactions (losses) gains

|

(2

|

)

|

4

|

-

|

333

|

-

|

||||||||||||||

|

Noninterest expense

|

156,030

|

151,193

|

158,917

|

153,515

|

153,747

|

|||||||||||||||

|

Income before income taxes

|

11,822

|

55,768

|

47,140

|

55,035

|

54,309

|

|||||||||||||||

|

Income tax expense

|

(3,485

|

)

|

14,602

|

12,311

|

14,876

|

14,217

|

||||||||||||||

|

Net income

|

$

|

15,307

|

$

|

41,166

|

$

|

34,829

|

$

|

40,159

|

$

|

40,092

|

||||||||||

|

ADJUSTMENTS FROM NET INCOME TO OPERATING INCOME

|

||||||||||||||||||||

|

Securities transactions gains

|

-

|

-

|

-

|

(333

|

)

|

-

|

||||||||||||||

|

Nonoperating expense

|

-

|

-

|

8,927

|

7,314

|

9,667

|

|||||||||||||||

|

Total nonoperating items

|

-

|

-

|

8,927

|

6,981

|

9,667

|

|||||||||||||||

|

Taxes on adjustments at marginal tax rate

|

-

|

-

|

3,125

|

2,443

|

3,383

|

|||||||||||||||

|

Adjustments (net of taxes)

|

-

|

-

|

5,802

|

4,538

|

6,284

|

|||||||||||||||

|

Operating income (g)

|

$

|

15,307

|

$

|

41,166

|

$

|

40,631

|

$

|

44,697

|

$

|

46,376

|

||||||||||

|

Pre-tax, pre-provision (PTPP) profit (TE) (h)

|

$

|

66,258

|

$

|

69,152

|

$

|

56,836

|

$

|

64,145

|

$

|

66,795

|

||||||||||

|

NONINTEREST INCOME AND NONINTEREST EXPENSE

|

||||||||||||||||||||

|

Service charges on deposit accounts

|

$

|

18,971

|

$

|

18,619

|

$

|

17,908

|

$

|

17,315

|

$

|

19,025

|

||||||||||

|

Trust fees

|

11,287

|

11,345

|

11,795

|

11,200

|

11,559

|

|||||||||||||||

|

Bank card and ATM fees

|

11,792

|

11,637

|

11,868

|

11,183

|

11,225

|

|||||||||||||||

|

Investment & annuity fees

|

4,632

|

6,149

|

4,838

|

5,050

|

4,736

|

|||||||||||||||

|

Secondary mortgage market operations

|

2,884

|

3,413

|

3,618

|

2,664

|

2,000

|

|||||||||||||||

|

Insurance commissions and fees

|

1,980

|

2,238

|

2,595

|

1,754

|

1,862

|

|||||||||||||||

|

Amortization of FDIC loss share receivable

|

(1,713

|

)

|

(1,564

|

)

|

(1,273

|

)

|

(1,197

|

)

|

(2,113

|

)

|

||||||||||

|

Other income

|

9,822

|

8,370

|

9,525

|

8,244

|

8,667

|

|||||||||||||||

|

Noninterest income excluding securities transactions

|

59,655

|

60,207

|

60,874

|

56,213

|

56,961

|

|||||||||||||||

|

Securities transactions (losses) gains

|

(2

|

)

|

4

|

-

|

333

|

-

|

||||||||||||||

|

Total noninterest income including securities transactions

|

$

|

59,653

|

$

|

60,211

|

$

|

60,874

|

$

|

56,546

|

$

|

56,961

|

||||||||||

|

Personnel expense

|

$

|

85,315

|

$

|

84,155

|

$

|

82,533

|

$

|

80,117

|

$

|

79,522

|

||||||||||

|

Net occupancy expense

|

10,639

|

11,222

|

11,765

|

11,162

|

10,571

|

|||||||||||||||

|

Equipment expense

|

3,871

|

3,598

|

4,079

|

3,933

|

3,986

|

|||||||||||||||

|

Other real estate expense, net

|

1,361

|

422

|

501

|

456

|

1,001

|

|||||||||||||||

|

Other operating expense

|

49,153

|

45,769

|

44,964

|

44,215

|

42,555

|

|||||||||||||||

|

Amortization of intangibles

|

5,691

|

6,027

|

6,148

|

6,318

|

6,445

|

|||||||||||||||

|

Total operating expense

|

156,030

|

151,193

|

149,990

|

146,201

|

144,080

|

|||||||||||||||

|

Nonoperating expense items

|

-

|

-

|

8,927

|

7,314

|

9,667

|

|||||||||||||||

|

Total noninterest expense

|

$

|

156,030

|

$

|

151,193

|

$

|

158,917

|

$

|

153,515

|

$

|

153,747

|

||||||||||

|

(g) Net income less tax-effected securities transactions and nonoperating items. Management believes that operating income provides a useful measure of financial performance that helps

|

||||||||||||||||||||

|

investors compare the Company's fundamental operations over time.

|

||||||||||||||||||||

|

(h) Net interest income (TE) and noninterest income less noninterest expense. Management believes that PTPP profit is a useful financial measure because it enables investors to assess the Company's ability to generate capital to cover credit losses through a credit cycle.

|

||||||||||||||||||||

10

|

HANCOCK HOLDING COMPANY

PERIOD-END BALANCE SHEET

(Unaudited)

|

||||||||||||||||||||

|

|

||||||||||||||||||||

|

Three Months Ended

|

||||||||||||||||||||

|

(dollars in thousands)

|

12/31/2015

|

9/30/2015

|

6/30/2015

|

3/31/2015

|

12/31/2014

|

|||||||||||||||

|

ASSETS

|

||||||||||||||||||||

|

Commercial non-real estate loans

|

$

|

6,995,824

|

$

|

6,345,994

|

$

|

6,185,684

|

$

|

5,987,084

|

$

|

6,044,060

|

||||||||||

|

Construction and land development loans

|

1,151,950

|

1,085,585

|

1,120,947

|

1,113,510

|

1,106,761

|

|||||||||||||||

|

Commercial real estate loans

|

3,412,551

|

3,327,386

|

3,212,833

|

3,150,103

|

3,144,048

|

|||||||||||||||

|

Residential mortgage loans

|

2,049,524

|

2,013,789

|

1,955,837

|

1,913,885

|

1,894,181

|

|||||||||||||||

|

Consumer loans

|

2,093,465

|

1,990,296

|

1,869,451

|

1,759,804

|

1,706,226

|

|||||||||||||||

|

Total loans

|

15,703,314

|

14,763,050

|

14,344,752

|

13,924,386

|

13,895,276

|

|||||||||||||||

|

Loans held for sale

|

20,434

|

19,764

|

21,304

|

19,950

|

20,252

|

|||||||||||||||

|

Securities

|

4,463,792

|

4,548,922

|

4,445,452

|

4,107,904

|

3,826,454

|

|||||||||||||||

|

Short-term investments

|

565,555

|

194,414

|

598,455

|

515,797

|

802,948

|

|||||||||||||||

|

Earning assets

|

20,753,095

|

19,526,150

|

19,409,963

|

18,568,037

|

18,544,930

|

|||||||||||||||

|

Allowance for loan losses

|

(181,179

|

)

|

(139,576

|

)

|

(131,087

|

)

|

(128,386

|

)

|

(128,762

|

)

|

||||||||||

|

Goodwill

|

621,193

|

621,193

|

621,193

|

621,193

|

621,193

|

|||||||||||||||

|

Other intangible assets, net

|

107,538

|

113,229

|

119,256

|

125,404

|

132,810

|

|||||||||||||||

|

Other assets

|

1,538,812

|

1,487,154

|

1,519,080

|

1,538,263

|

1,577,095

|

|||||||||||||||

|

Total assets

|

$

|

22,839,459

|

$

|

21,608,150

|

$

|

21,538,405

|

$

|

20,724,511

|

$

|

20,747,266

|

||||||||||

|

LIABILITIES

|

||||||||||||||||||||

|

Noninterest-bearing deposits

|

$

|

7,276,127

|

$

|

6,075,558

|

$

|

6,180,814

|

$

|

6,201,403

|

$

|

5,945,208

|

||||||||||

|

Interest-bearing transaction and savings deposits

|

6,767,881

|

7,360,677

|

6,994,603

|

6,576,658

|

6,531,628

|

|||||||||||||||

|

Interest-bearing public fund deposits

|

2,253,645

|

1,768,133

|

1,962,589

|

1,828,559

|

1,982,616

|

|||||||||||||||

|

Time deposits

|

2,051,259

|

2,235,580

|

2,163,782

|

2,253,865

|

2,113,379

|

|||||||||||||||

|

Total interest-bearing deposits

|

11,072,785

|

11,364,390

|

11,120,974

|

10,659,082

|

10,627,623

|

|||||||||||||||

|

Total deposits

|

18,348,912

|

17,439,948

|

17,301,788

|

16,860,485

|

16,572,831

|

|||||||||||||||

|

Short-term borrowings

|

1,423,644

|

1,049,182

|

1,079,193

|

755,250

|

1,151,573

|

|||||||||||||||

|

Long-term debt

|

495,999

|

497,177

|

507,341

|

516,007

|

374,371

|

|||||||||||||||

|

Other liabilities

|

157,761

|

168,282

|

220,043

|

167,671

|

176,089

|

|||||||||||||||

|

Total liabilities

|

20,426,316

|

19,154,589

|

19,108,365

|

18,299,413

|

18,274,864

|

|||||||||||||||

|

COMMON SHAREHOLDERS' EQUITY

|

||||||||||||||||||||

|

Common stock net of treasury and capital surplus

|

1,715,794

|

1,717,959

|

1,730,344

|

1,726,736

|

1,798,980

|

|||||||||||||||

|

Retained earnings

|

777,944

|

781,769

|

759,780

|

744,131

|

723,497

|

|||||||||||||||

|

Accumulated other comprehensive income

|

(80,595

|

)

|

(46,167

|

)

|

(60,084

|

)

|

(45,769

|

)

|

(50,075

|

)

|

||||||||||

|

Total common shareholders' equity

|

2,413,143

|

2,453,561

|

2,430,040

|

2,425,098

|

2,472,402

|

|||||||||||||||

|

Total liabilities & shareholders' equity

|

$

|

22,839,459

|

$

|

21,608,150

|

$

|

21,538,405

|

$

|

20,724,511

|

$

|

20,747,266

|

||||||||||

|

CAPITAL RATIOS

|

||||||||||||||||||||

|

Tangible common equity

|

$

|

1,684,388

|

$

|

1,719,108

|

$

|

1,689,550

|

$

|

1,678,453

|

$

|

1,718,343

|

||||||||||

|

Tier 1 capital (i)

|

1,844,705

|

1,848,418

|

1,837,369

|

1,812,010

|

1,777,348

|

|||||||||||||||

|

Common equity (period-end) as a percent of total assets (period-end)

|

10.57

|

%

|

11.35

|

%

|

11.28

|

%

|

11.70

|

%

|

11.92

|

%

|

||||||||||

|

Tangible common equity ratio

|

7.62

|

%

|

8.24

|

%

|

8.12

|

%

|

8.40

|

%

|

8.59

|

%

|

||||||||||

|

Leverage (Tier 1) ratio (i)

|

8.55

|

%

|

8.85

|

%

|

9.07

|

%

|

9.17

|

%

|

9.17

|

%

|

||||||||||

|

Tier 1 risk-based capital ratio (i)

|

10.02

|

%

|

10.56

|

%

|

10.77

|

%

|

10.86

|

%

|

11.23

|

%

|

||||||||||

|

Total risk-based capital ratio (i)

|

11.93

|

%

|

12.32

|

%

|

12.53

|

%

|

12.77

|

%

|

12.30

|

%

|

||||||||||

|

(i) Estimated for most recent period-end. Regulatory ratios reflect the impact of Basel III capital requirements effective January 1, 2015.

|

||||||||||||||||||||

11

|

HANCOCK HOLDING COMPANY

AVERAGE BALANCE SHEET

(Unaudited)

|

||||||||||||||||||||

|

|

||||||||||||||||||||

|

Three Months Ended

|

Twelve Months Ended

|

|||||||||||||||||||

|

(dollars in thousands)

|

12/31/2015

|

9/30/2015

|

12/31/2014

|

12/31/2015

|

12/31/2014

|

|||||||||||||||

|

ASSETS

|

||||||||||||||||||||

|

Commercial non-real estate loans

|

$

|

6,643,961

|

$

|

6,261,241

|

$

|

5,727,003

|

$

|

6,250,796

|

$

|

5,401,992

|

||||||||||

|

Construction and land development loans

|

1,100,502

|

1,115,406

|

1,159,378

|

1,105,348

|

1,047,753

|

|||||||||||||||

|

Commercial real estate loans

|

3,384,409

|

3,231,597

|

3,057,022

|

3,239,070

|

3,058,355

|

|||||||||||||||

|

Residential mortgage loans

|

2,028,688

|

1,977,990

|

1,886,230

|

1,960,420

|

1,791,859

|

|||||||||||||||

|

Consumer loans

|

2,040,672

|

1,925,240

|

1,748,590

|

1,877,733

|

1,638,910

|

|||||||||||||||

|

Total loans

|

15,198,232

|

14,511,474

|

13,578,223

|

14,433,367

|

12,938,869

|

|||||||||||||||

|

Loans held for sale

|

16,717

|

17,233

|

15,424

|

18,101

|

16,540

|

|||||||||||||||

|

Securities (j)

|

4,480,972

|

4,425,546

|

3,836,123

|

4,208,195

|

3,816,724

|

|||||||||||||||

|

Short-term investments

|

444,511

|

479,084

|

481,373

|

513,659

|

423,359

|

|||||||||||||||

|

Earning assets

|

20,140,432

|

19,433,337

|

17,911,143

|

19,173,322

|

17,195,492

|

|||||||||||||||

|

Allowance for loan losses

|

(140,798

|

)

|

(132,634

|

)

|

(127,356

|

)

|

(133,470

|

)

|

(129,642

|

)

|

||||||||||

|

Goodwill and other intangible assets

|

731,414

|

737,361

|

757,123

|

740,666

|

768,047

|

|||||||||||||||

|

Other assets

|

1,445,518

|

1,443,346

|

1,549,462

|

1,469,110

|

1,602,930

|

|||||||||||||||

|

Total assets

|

$

|

22,176,566

|

$

|

21,481,410

|

$

|

20,090,372

|

$

|

21,249,628

|

$

|

19,436,827

|

||||||||||

|

LIABILITIES AND SHAREHOLDERS' EQUITY

|

||||||||||||||||||||

|

Noninterest-bearing deposits

|

$

|