Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MMA Capital Holdings, LLC | v427954_8k.htm |

| EX-10.1 - EXHIBIT 10.1 - MMA Capital Holdings, LLC | v427954_ex10-1.htm |

Exhibit 10.2

MMA Capital Management Investor Presentation December 2015 NASDAQ: MMAC www.MMACapitalManagement.com 621 East Pratt Street, Suite 600, Baltimore, MD 21202 (443 ) 263 - 2900

• This presentation contains forward - looking statements intended to qualify for the safe harbor contained in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward - looking statements often include words such as “may,” “will,” “should,” “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “seek,” “would,” “could,” and similar words or expressions and are made in connection with discussions of future operating or financial performance. • Forward - looking statements reflect our management’s expectations at the date of this Report regarding future conditions, events or results. They are not guarantees of future performance. By their nature, forward - looking statements are subject to risks and uncertainties. Our actual results and financial condition may differ materially from what is anticipated in the forward - looking statements. There are many factors that could cause actual conditions, events or results to differ from those anticipated by the forward - looking statements contained in this presentation. They include the factors discussed in “Item 1A. Risk Factors” in our annual filings with the Securities and Exchange Commission (“SEC”). • Readers are cautioned not to place undue reliance on forward - looking statements in this presentation or that we make from time to time, and to consider carefully the factors discussed in “Item 1A. Risk Factors” in our annual filings with the SEC in evaluating these forward - looking statements. We have not undertaken to update any forward - looking statements included in this presentation. The statements in this presentation are for the convenience of our shareholders, capital partners and other stakeholders and are qualified in their entirety by our periodic reports on Form 10 - K, Form 10 - Q and Form 8 - K . 2 MMA Capital Management, LLC Disclaimer

• Mission, Values and Performance • MMAC Yesterday • MMAC Today • The GE Transaction • MMAC Tomorrow 3 MMA Capital Management, LLC Table of Contents

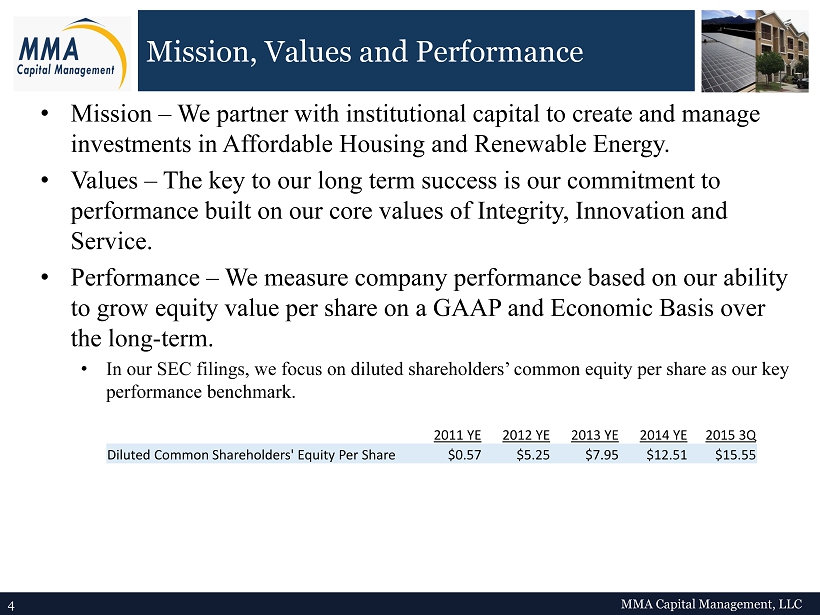

• Mission – We partner with institutional capital to create and manage investments in Affordable Housing and Renewable Energy. • Values – The key to our long term success is our commitment to performance built on our core values of Integrity, Innovation and Service. • Performance – We measure company performance based on our ability to grow equity value per share on a GAAP and Economic Basis over the long - term. • In our SEC filings, we focus on diluted shareholders’ common e quity per share as our key performance benchmark . 4 MMA Capital Management, LLC Mission, Values and Performance 2011 YE 2012 YE 2013 YE 2014 YE 2015 3Q Diluted Common Shareholders' Equity Per Share $0.57 $5.25 $7.95 $12.51 $15.55

• Prior to the Financial Crisis, we managed a full range of investment products focused on multi - family housing, solar facilities and other kinds of real estate and infrastructure investments. • To survive the Financial Crisis, we sold our capital intensive operating businesses at significant losses and focused our business on managing a pool of leveraged tax - exempt bonds as well as assets we could not sell. • The assets we retained included guaranteed tax credit funds , a small fund management business in South Africa, a few operating solar assets, and other non - core assets. • During this period, primarily as a result of operating business sales, we realized substantial net operating losses. • In 2013, we sold our interest in a pool of tax - exempt leveraged bonds for cash to avoid value loss due to rising interest rates . • As part of this transaction, we retained most of the non - performing assets in the pool. • Since 2013, we have focused on: • Creating value in the non - performing assets; • Managing the tax credit funds to minimize our guarantee liability; • Growing our South Africa fund management business while maximizing the promote from its funds; • Selling non - core assets at attractive prices . 5 MMA Capital Management, LLC MMAC Yesterday

• In 2014, we took an important step to create a scalable Affordable Housing asset management business by selling our tax credit funds to another tax credit asset manager, Morrison Grove Management (“MGM”), and getting the option to buy the combined business in the future. • In late 2014, we also took steps to re - enter the Renewable Energy finance space and throughout 2015 have grown the team and assets under management in that space. • In 2014 and 2015, we have grown the South Africa fund management business to include three investment vehicles and a property management company focused on rental housing. • Throughout 2015, we have taken the opportunity to dispose of non - performing assets at what we believe are attractive values . • As a result of these initiatives, our balance sheet has evolved as follows: 6 MMA Capital Management, LLC MMAC Yesterday, cont. (amounts in thousands except per share data) 2011 YE 2012 YE 2013 YE 2014 YE 2015 3Q Assets $1,843,663 $1,801,752 $1,015,358 $671,692 $624,536 Liabilities $1,138,613 $1,090,027 $476,499 $350,494 $331,328 Preferred Equity in a Subsidiary $155,033 $155,033 $0 $0 $0 Noncontrolling Interests $545,185 $511,791 $473,513 $229,714 $188,328 Common Equity $4,832 $44,901 $65,346 $91,484 $104,880 Diluted Common Shareholders' Equity Per Share $0.57 $5.25 $7.95 $12.51 $15.55

• With the General Electric Capital Corporation (“GE”) transaction, our commitment to managing investments in affordable housing is greatly expanded. • MMAC partnered with affiliates of Bank of America Corporation (collectively , “Bank of America”) to acquire the GE Low Income Housing Tax Credit (“LIHTC”) portfolio. • MMAC and Bank of America are now partners in a joint venture which indirectly owns interests in over 650 properties. • Bank of America will be allocated essentially all of the annual tax credits and net cash flow (after - fees) and will share in the residual value generated from the portfolio. • MMAC is guaranteeing the majority of the tax credits Bank of America is expecting to receive . • When combined with the approximately 300 properties in MGM funds which we have the option to purchase in the future, we have investments in over 950 affordable housing properties around the U.S. • We expect to create value for MMAC shareholders through fee and residual value generated from these portfolios . • Also as part of the GE transaction, we acquired financial instruments with a notional amount of approximately $23 million secured by loans associated with assets from the GE LIHTC portfolio. • Finally, as a result of the transaction we will own directly or have 99% LP interests in five properties for which we have paid $9 million. 7 MMA Capital Management, LLC MMAC Today

• The GE LIHTC Portfolio and Associated Debt • The GE LIHTC portfolio includes interests in: ▪ 28 multi - investor funds with 446 properties; ▪ 30 proprietary funds with 165 properties; and ▪ 44 direct property investments. • There is also $23.4 million of loans secured by properties associated with the GE LIHTC portfolio. • The total purchase price was $244 million. • The Joint Venture • We formed a Joint Venture with Bank of America to acquire interests in all but five properties from the GE LIHTC portfolio. ▪ The Joint Venture will not be consolidated by MMAC for financial reporting purposes. • Bank of America made a $211 million investment in the JV and will be allocated 99.99% of both the tax credits and the annual net cash flows from the Joint Venture. • MMAC will receive an annual Asset Management fee equal to 2% of the Bank of America investment. • After payment of guarantee and asset management fees, MMAC will be allocated 70% of residuals, with the balance of 30% to Bank of America. 8 MMA Capital Management, LLC MMAC Today – GE Transaction

• The Guarantee • MMAC will guarantee the majority of the tax credits projected to be earned by Bank of America through 2020, with Bank of America retaining the risk on the balance of the tax credits. • MMAC will provide support for its guarantee to Bank of America by expanding an existing facility with an additional collateral pledge of $10 million. • MMAC will receive a guarantee fee of 2% of the initial Bank of America investment amount. • Bank of America will receive an upfront fee equal to 2% of their initial investment and will also receive a fee equal to 20% of the realized residual value of the portfolio. • The Associated Debt • We acquired financial instruments with a notional amount of approximately $23 million, secured by loans associated with the GE LIHTC portfolio. • This debt is senior mortgage debt associated with properties in the GE LIHTC portfolio. ▪ The debt has a weighted average rate of 8%. • We expect these financial instruments to be outstanding for less than a year as the underlying debt is expected to pay off in 2016. We expect to earn approximately 4% on the notional amount while the financial instruments are outstanding. 9 MMA Capital Management, LLC MMAC Today – GE Transaction, cont.

• The Directly Owned Properties • We will own directly or have 99% limited partner interests in five properties from the GE LIHTC portfolio outside the JV. • On our balance sheet we will reflect one property as real - estate owned and the balance as investments in partnership. • We purchased our interest in this portfolio for $9 million. • We will seek to maximize the residual values of these properties, which we anticipate to occur over the next 24 months . • Four of the properties are located in Houston, TX, one in St. Louis, MO and one in Honolulu, HI . ▪ The six properties have a total of 787 units. • MMAC will retain all of the residuals from the properties, net of fees. 10 MMA Capital Management, LLC MMAC Today – GE Transaction, cont.

Moving forward we expect to grow our diluted common equity per share by: • Staying true to our Mission and Values. • Collecting interest income on bonds, loans and total return swaps primarily backed by affordable housing and renewable energy. • Earning fee and promote income on our funds in the United States and South Africa. • Managing, buying and selling balance sheet and fund assets to maximize returns and minimize loss. • E xploring opportunities in related spaces. • Maximizing after - tax earnings by taking advantage of our net operating loss carry forwards. • Managing our overhead at a scale so that we are not compelled to transact if market conditions are not favorable. • Aggressively purchasing our shares in the marketplace when we think they are undervalued. 11 MMA Capital Management, LLC MMAC Tomorrow

We believe all businesses are a work in progress and need constant innovation to succeed. Those innovations often come as a result of asking important questions about the business. These are some of the important questions we are asking ourselves: • How do we get the most value out of our current investments? • Can we create additional funds in our areas of expertise? • Given recent tax law changes, what is next for our renewable finance business? • Can we develop scale in South and Sub - Saharan Africa ? • Is there a solar opportunity for us in South and Sub - Saharan Africa ? • What are the opportunities that we can pursue based on our organization’s skill set and capital structure? 12 MMA Capital Management, LLC MMAC Tomorrow – Important Questions