Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Avangrid, Inc. | d89990d8k.htm |

AVANGRID Update December 22, 2015 Exhibit 99.1

Legal Notice AVANGRID Update FORWARD-LOOKING STATEMENTS Certain communications provided on this website may contain statements related to our future business and financial performance and future events or developments involving us and our subsidiaries that are not purely historical and may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of forward-looking terms such as “may,” “will,” “should,” “can,” “expects,” “believes,” “anticipates,” “intends,” “plans,” “estimates,” “projects,” “assumes,” “guides,” “targets,” “forecasts,” “is confident that” and “seeks” or the negative of such terms or other variations on such terms or comparable terminology. Such forward-looking statements include, but are not limited to, statements about our plans, objectives and intentions, outlooks or expectations for earnings, revenues, expenses or other future financial or business performance, strategies or expectations, or the impact of legal or regulatory matters on our business, results of operations or financial condition. Such statements are based upon the current beliefs and expectations of our management and are subject to significant risks and uncertainties that could cause actual outcomes and results to differ materially. Important factors that could cause actual results to differ materially from those indicated by such forward-looking statements include, without limitation, the risks and uncertainties set forth under the section entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the proxy statement/prospectus included in the Registration Statement on Form S-4, as amended, which is on file with the SEC and available on our investor relations website at www.avangrid.com]and on the SEC website at www.sec.gov. Additional information will also be set forth in filings with the SEC. You should not place undue reliance on these forward-looking statements. We do not undertake any obligation to update or revise any forward-looking statements to reflect events or circumstances after the date of the communication, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. About AVANGRID AVANGRID, Inc. (NYSE:AGR) is a diversified energy and utility company with $30 billion in assets and operations in 23 states, The company operates regulated utilities, electricity generation, and natural gas storage through three primary lines of business. Iberdrola USA Networks includes eight electric and natural gas utilities serving 3.1 million customers in New York and New England. Iberdrola Renewables operates 6.5 gigawatts of electricity capacity, primarily through wind power, in states across the U.S. Iberdrola Energy Holdings operates 120 Bcf of owned or contracted natural gas storage and hub service facilities in the South and West. AVANGRID employs 7,000 people. The company was formed as a business combination between Iberdrola USA and UIL holdings in 2015. AVANGRID remains an affiliate of the Iberdrola Group, a worldwide leader in the energy industry. FORWARD-LOOKING STATEMENTS Certain communications provided on this website may contain statements related to our future business and financial performance and future events or developments involving us and our subsidiaries that are not purely historical and may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of forward-looking terms such as “may,” “will,” “should,” “can,” “expects,” “believes,” “anticipates,” “intends,” “plans,” “estimates,” “projects,” “assumes,” “guides,” “targets,” “forecasts,” “is confident that” and “seeks” or the negative of such terms or other variations on such terms or comparable terminology. Such forward-looking statements include, but are not limited to, statements about our plans, objectives and intentions, outlooks or expectations for earnings, revenues, expenses or other future financial or business performance, strategies or expectations, or the impact of legal or regulatory matters on our business, results of operations or financial condition. Such statements are based upon the current beliefs and expectations of our management and are subject to significant risks and uncertainties that could cause actual outcomes and results to differ materially. Important factors that could cause actual results to differ materially from those indicated by such forward-looking statements include, without limitation, the risks and uncertainties set forth under the section entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the proxy statement/prospectus included in the Registration Statement on Form S-4, as amended, which is on file with the SEC and available on our investor relations website at www.avangrid.com and on the SEC website at www.sec.gov. Additional information will also be set forth in filings with the SEC. You should not place undue reliance on these forward-looking statements. We do not undertake any obligation to update or revise any forward-looking statements to reflect events or circumstances after the date of the communication, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. About AVANGRID AVANGRID, Inc. (NYSE:AGR) is a diversified energy and utility company with $30 billion in assets and operations in 23 states, The company operates regulated utilities, electricity generation, and natural gas storage through three primary lines of business. Iberdrola USA Networks includes eight electric and natural gas utilities serving 3.1 million customers in New York and New England. Iberdrola Renewables operates 6.5 gigawatts of electricity capacity, primarily through wind power, in states across the U.S. Iberdrola Energy Holdings operates 120 Bcf of owned or contracted natural gas storage and hub service facilities in the South and West. AVANGRID employs 7,000 people. The company was formed as a business combination between Iberdrola USA and UIL holdings in 2015. AVANGRID remains an affiliate of the Iberdrola Group, a worldwide leader in the energy industry.

Agenda Introduction to Avangrid Organizational Structure Leadership Team Asset Map Key Highlights Strategic Financial Operational Renewables PPAs Asset map Regulatory Update Appendix Credit Ratings Financial Data Operational Data AVANGRID Update AVANGRID Update

Presenters James P. TorgersonChief Executive Officer Richard J. NicholasChief Financial Officer Robert D. KumpChief Executive Officer of Networks Frank BurkhartsmeyerChief Executive Officer of Renewables AVANGRID Update AVANGRID Update IR Contacts: Patricia Cosgel, Vice President Investor and Shareholder Relations patricia.cosgel@uinet.com Michelle Hanson, Manager Investor Relations michelle.hanson@uinet.com Carlota Lopez Lumbierres, Manager Investor Relations clopezl@iberdrola.es

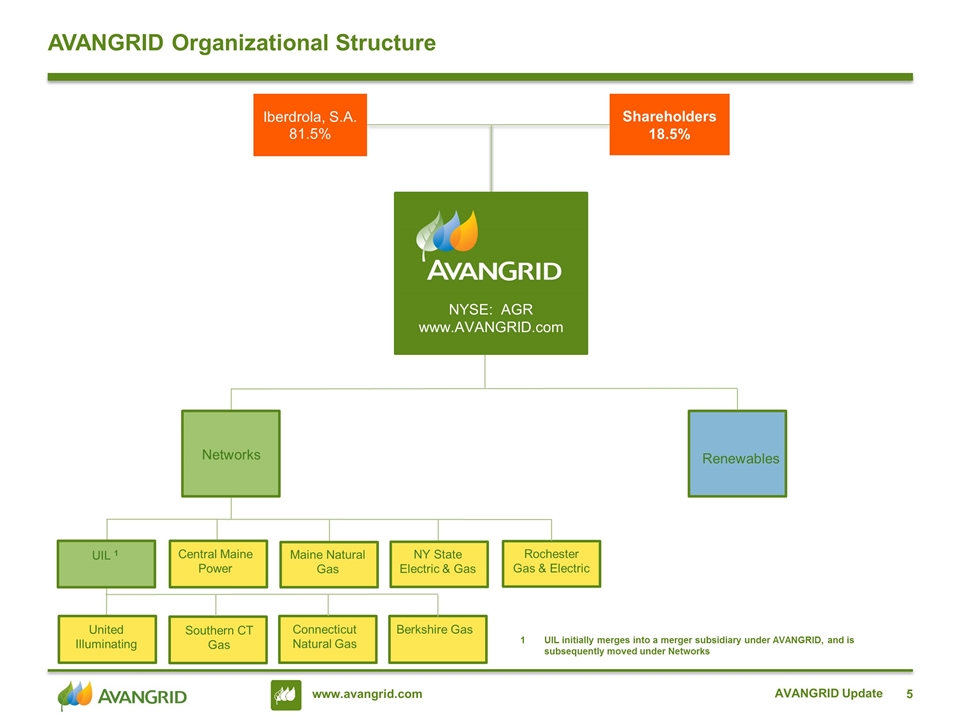

AVANGRID Update AVANGRID Organizational Structure Networks NYSE: AGR www.AVANGRID.com Renewables Iberdrola, S.A. 81.5% Shareholders 18.5% Maine Natural Gas Central Maine Power UIL 1 NY State Electric & Gas Rochester Gas & Electric Southern CT Gas Connecticut Natural Gas Berkshire Gas United Illuminating 1 UIL initially merges into a merger subsidiary under AVANGRID, and is subsequently moved under Networks

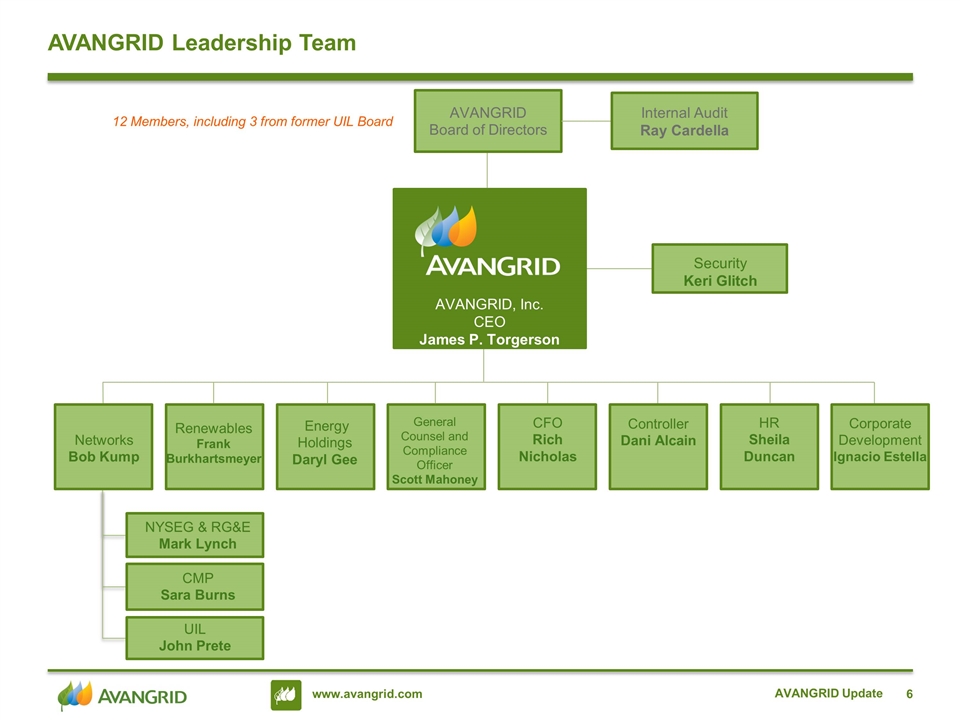

AVANGRID Update AVANGRID Leadership Team Networks Bob Kump AVANGRID, Inc. CEO James P. Torgerson Security Keri Glitch Renewables Frank Burkhartsmeyer Energy Holdings Daryl Gee General Counsel and Compliance Officer Scott Mahoney CFO Rich Nicholas Controller Dani Alcain HR Sheila Duncan Corporate Development Ignacio Estella AVANGRID Board of Directors Internal Audit Ray Cardella 12 Members, including 3 from former UIL Board CMP Sara Burns UIL John Prete NYSEG & RG&E Mark Lynch

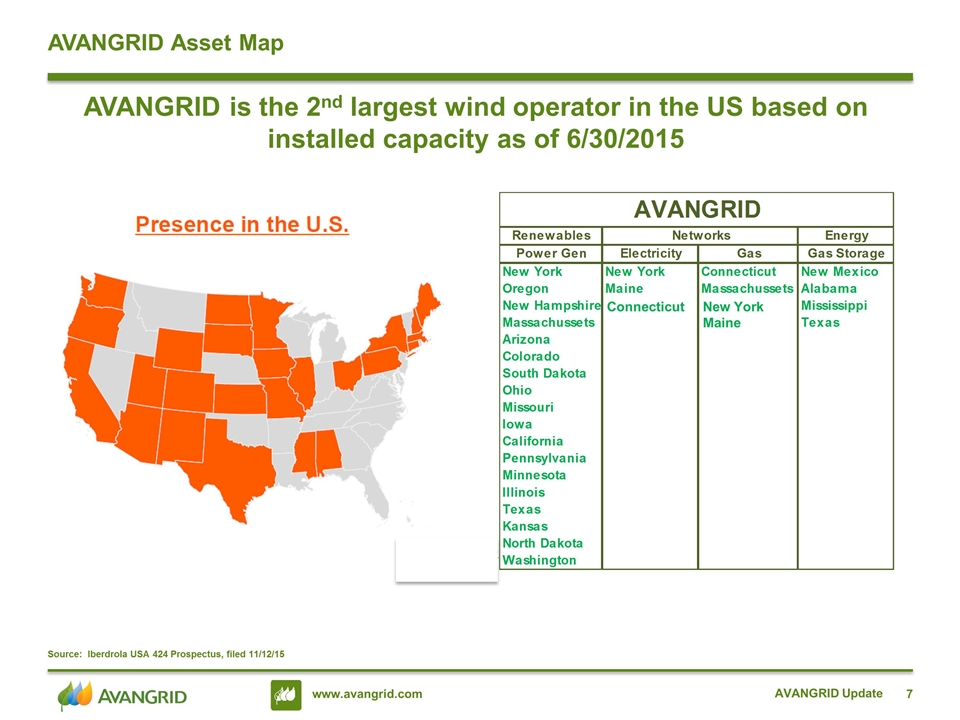

Source: Iberdrola USA 424 Prospectus, filed 11/12/15 AVANGRID Update AVANGRID Asset Map AVANGRID is the 2nd largest wind operator in the US based on installed capacity as of 6/30/2015 Connecticut New York Maine

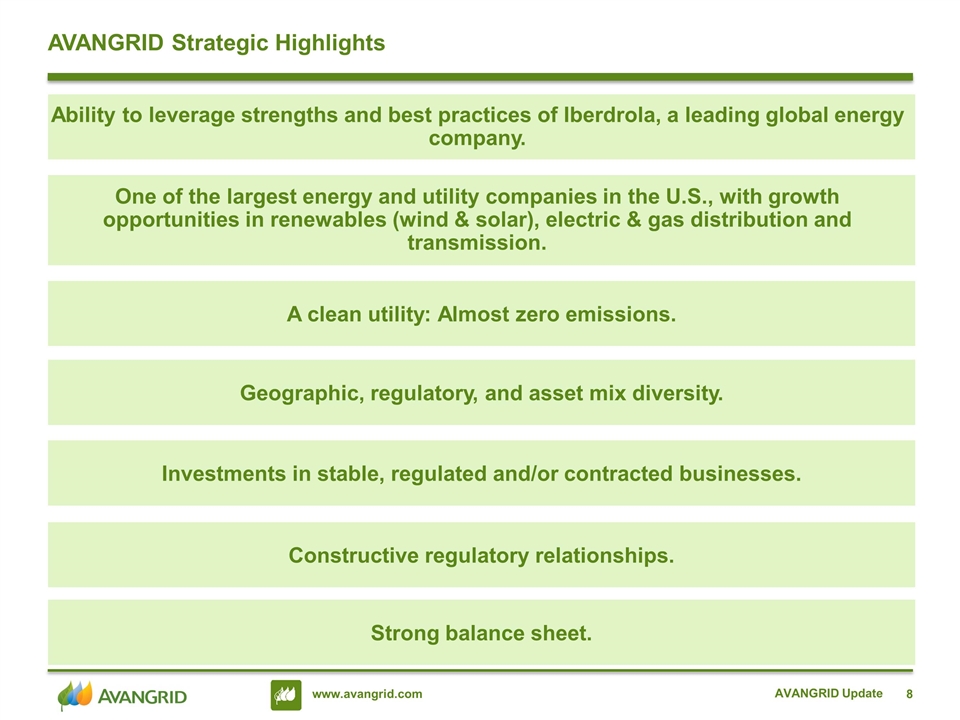

AVANGRID Strategic Highlights Ability to leverage strengths and best practices of Iberdrola, a leading global energy company. Geographic, regulatory, and asset mix diversity. One of the largest energy and utility companies in the U.S., with growth opportunities in renewables (wind & solar), electric & gas distribution and transmission. Investments in stable, regulated and/or contracted businesses. Constructive regulatory relationships. AVANGRID Update A clean utility: Almost zero emissions. Strong balance sheet.

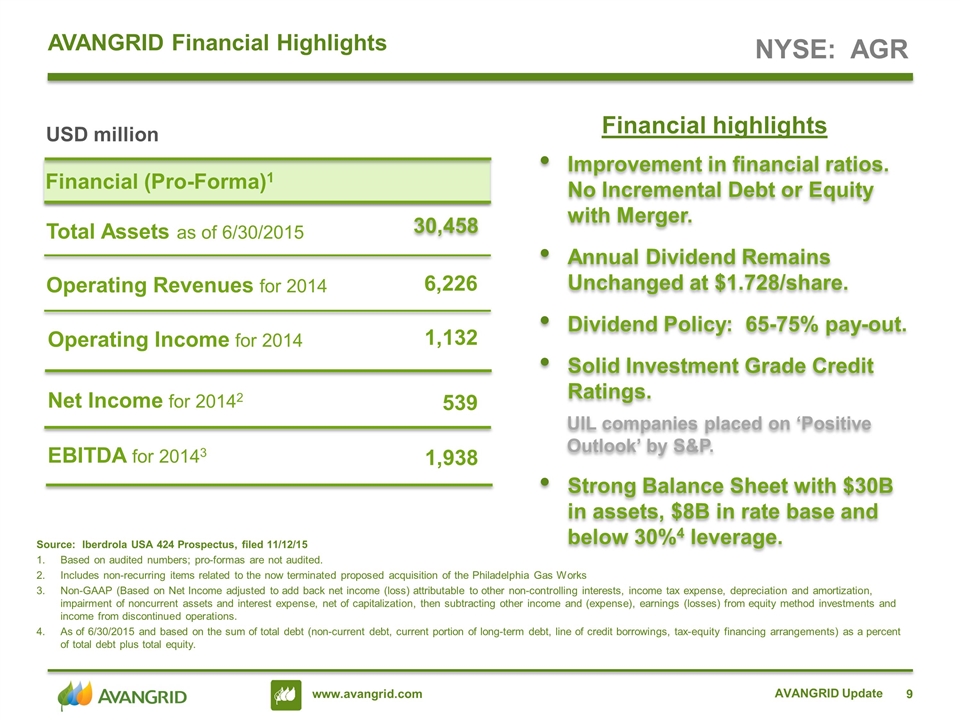

Net Income for 20142 EBITDA for 20143 NYSE: AGR AVANGRID Financial Highlights Source: Iberdrola USA 424 Prospectus, filed 11/12/15 Based on audited numbers; pro-formas are not audited. Includes non-recurring items related to the now terminated proposed acquisition of the Philadelphia Gas Works Non-GAAP (Based on Net Income adjusted to add back net income (loss) attributable to other non-controlling interests, income tax expense, depreciation and amortization, impairment of noncurrent assets and interest expense, net of capitalization, then subtracting other income and (expense), earnings (losses) from equity method investments and income from discontinued operations. As of 6/30/2015 and based on the sum of total debt (non-current debt, current portion of long-term debt, line of credit borrowings, tax-equity financing arrangements) as a percent of total debt plus total equity. Operating Revenues for 2014 Operating Income for 2014 6,226 1,132 539 30,458 Financial (Pro-Forma)1 Total Assets as of 6/30/2015 USD million 1,938 Improvement in financial ratios. No Incremental Debt or Equity with Merger. Annual Dividend Remains Unchanged at $1.728/share. Dividend Policy: 65-75% pay-out. Solid Investment Grade Credit Ratings. UIL companies placed on ‘Positive Outlook’ by S&P. Strong Balance Sheet with $30B in assets, $8B in rate base and below 30%4 leverage. AVANGRID Update Financial highlights

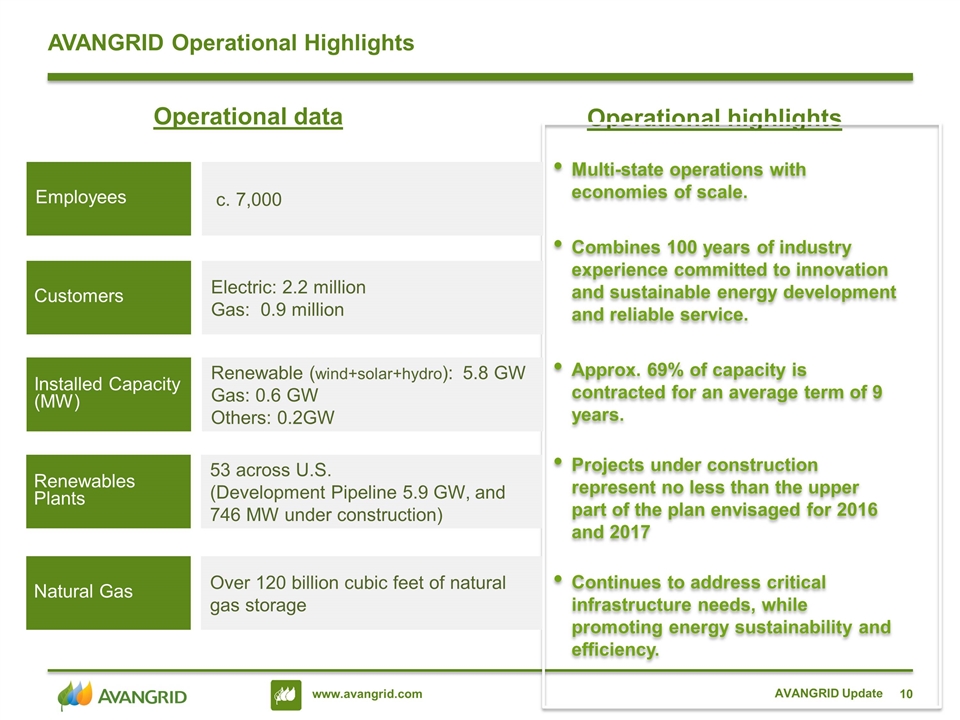

AVANGRID Operational Highlights AVANGRID Update Operational highlights Multi-state operations with economies of scale. Combines 100 years of industry experience committed to innovation and sustainable energy development and reliable service. Approx. 69% of capacity is contracted for an average term of 9 years. Projects under construction represent no less than the upper part of the plan envisaged for 2016 and 2017 Continues to address critical infrastructure needs, while promoting energy sustainability and efficiency. Employees Customers Installed Capacity (MW) c. 7,000 Electric: 2.2 million Gas: 0.9 million Renewable (wind+solar+hydro): 5.8 GW Gas: 0.6 GW Others: 0.2GW Renewables Plants 53 across U.S. (Development Pipeline 5.9 GW, and 746 MW under construction) Natural Gas Over 120 billion cubic feet of natural gas storage Operational data

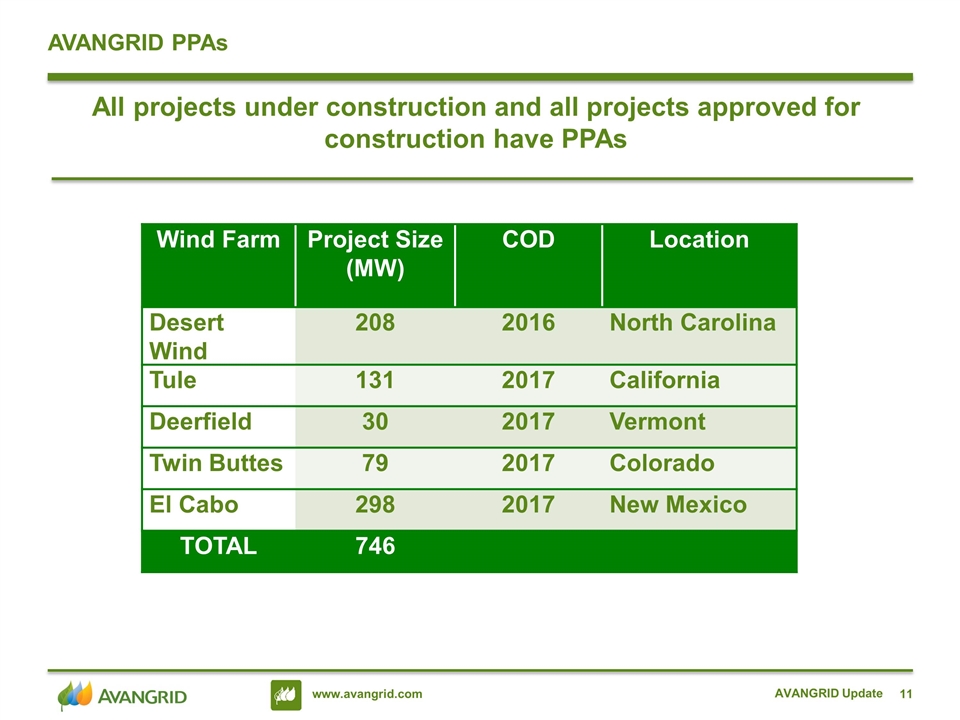

AVANGRID PPAs AVANGRID Update All projects under construction and all projects approved for construction have PPAs Wind Farm Project Size (MW) COD Location Desert Wind 208 2016 North Carolina Tule 131 2017 California Deerfield 30 2017 Vermont Twin Buttes 79 2017 Colorado El Cabo 298 2017 New Mexico TOTAL 746

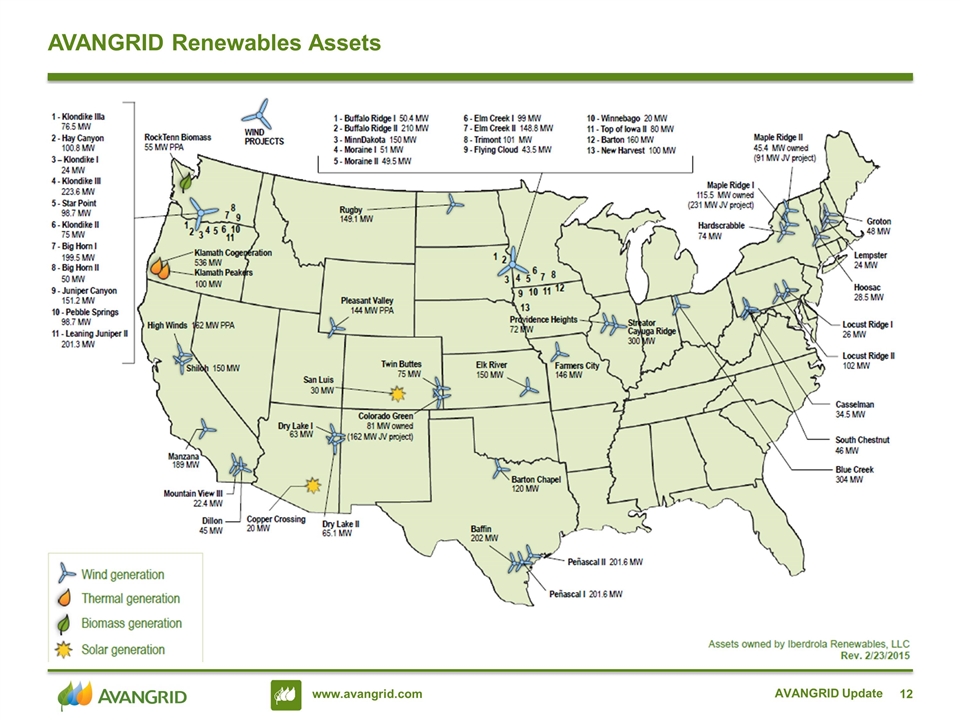

AVANGRID Renewables Assets AVANGRID Update

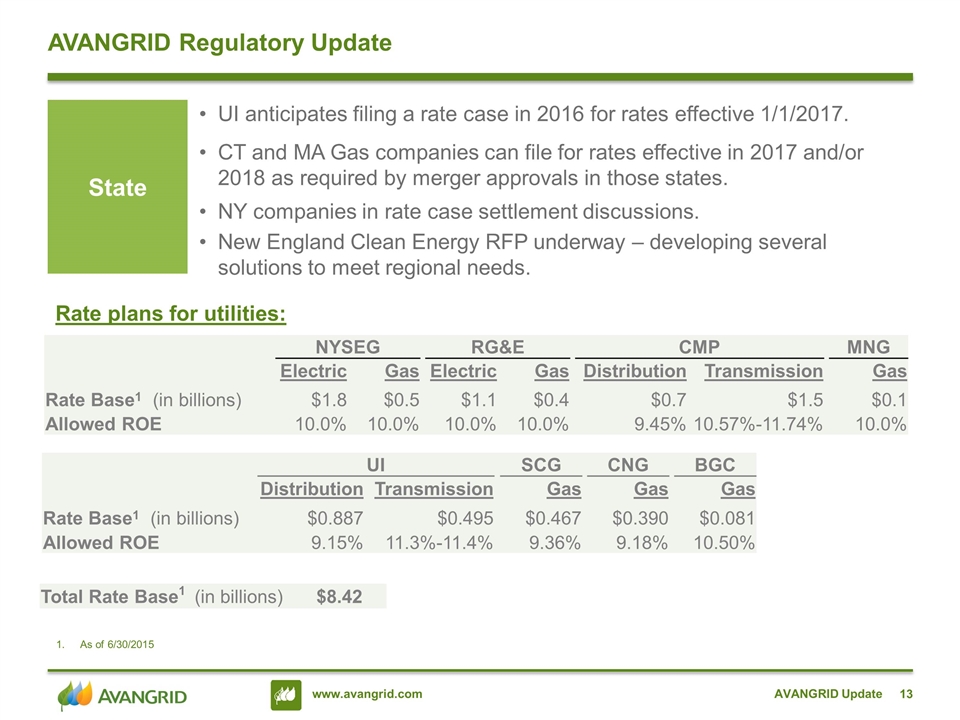

State UI anticipates filing a rate case in 2016 for rates effective 1/1/2017. CT and MA Gas companies can file for rates effective in 2017 and/or 2018 as required by merger approvals in those states. NY companies in rate case settlement discussions. New England Clean Energy RFP underway – developing several solutions to meet regional needs. AVANGRID Update AVANGRID Regulatory Update Rate plans for utilities: As of 6/30/2015 NYSEG RG&E CMP MNG Electric Gas Electric Gas Distribution Transmission Gas Rate Base1 (in billions) $1.8 $0.5 $1.1 $0.4 $0.7 $1.5 $0.1 Allowed ROE 10.0% 10.0% 10.0% 10.0% 9.45% 10.57%-11.74% 10.0% UI SCG CNG BGC Distribution Transmission Gas Gas Gas Rate Base1 (in billions) $0.887 $0.495 $0.467 $0.390 $0.081 Allowed ROE 9.15% 11.3%-11.4% 9.36% 9.18% 10.50% Total Rate Base1 (in billions) $8.42

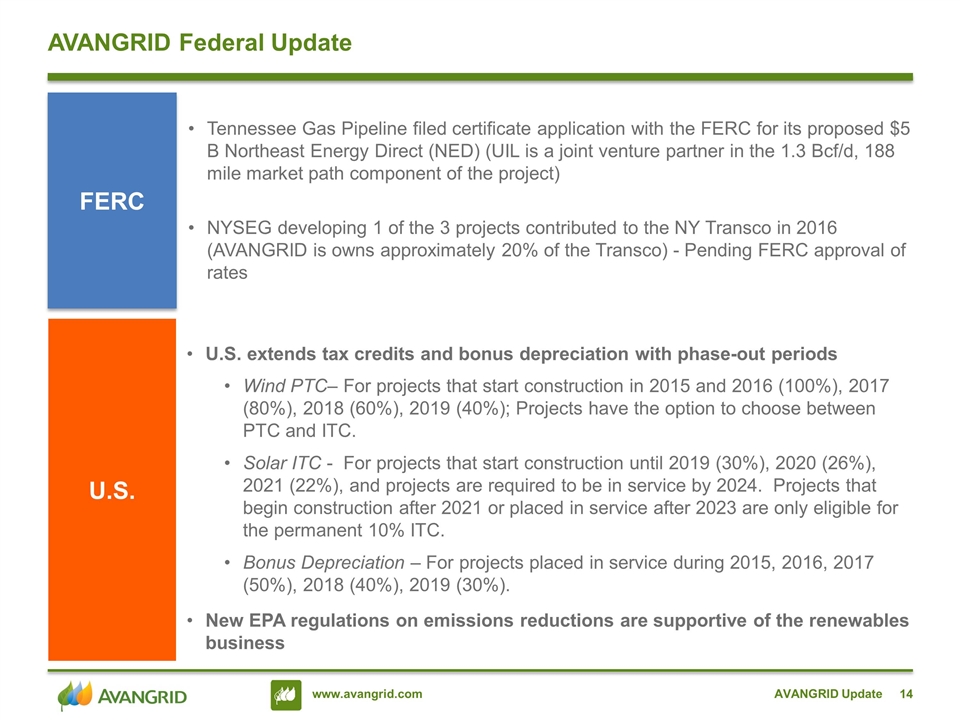

U.S. U.S. extends tax credits and bonus depreciation with phase-out periods Wind PTC– For projects that start construction in 2015 and 2016 (100%), 2017 (80%), 2018 (60%), 2019 (40%); Projects have the option to choose between PTC and ITC. Solar ITC - For projects that start construction until 2019 (30%), 2020 (26%), 2021 (22%), and projects are required to be in service by 2024. Projects that begin construction after 2021 or placed in service after 2023 are only eligible for the permanent 10% ITC. Bonus Depreciation – For projects placed in service during 2015, 2016, 2017 (50%), 2018 (40%), 2019 (30%). New EPA regulations on emissions reductions are supportive of the renewables business AVANGRID Update AVANGRID Federal Update FERC Tennessee Gas Pipeline filed certificate application with the FERC for its proposed $5 B Northeast Energy Direct (NED) (UIL is a joint venture partner in the 1.3 Bcf/d, 188 mile market path component of the project) NYSEG developing 1 of the 3 projects contributed to the NY Transco in 2016 (AVANGRID is owns approximately 20% of the Transco) - Pending FERC approval of rates

AVANGRID Summary Leverages strengths and best practices of Iberdrola, a leading global energy company. Geographic, regulatory, and asset mix diversity. One of the largest energy and utility companies in the U.S., with growth opportunities in renewables (wind & solar), electric & gas distribution and transmission. Investments in stable, regulated and/or contracted businesses. Constructive regulatory relationships. AVANGRID Update A clean utility: Almost zero emissions. Strong balance sheet.

Appendix AVANGRID Update

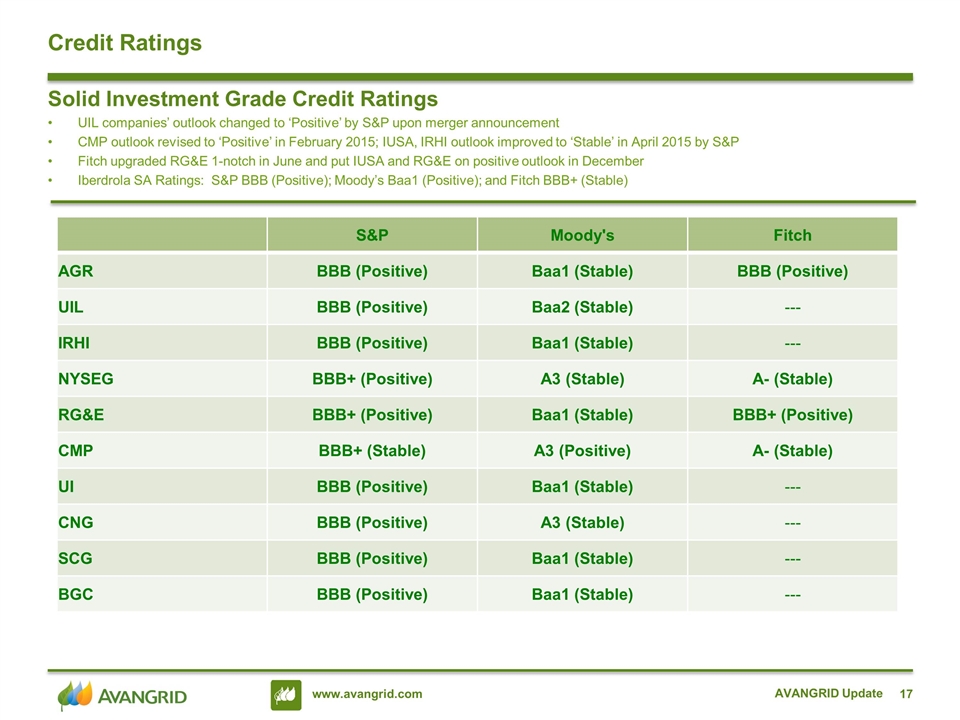

Solid Investment Grade Credit Ratings UIL companies’ outlook changed to ‘Positive’ by S&P upon merger announcement CMP outlook revised to ‘Positive’ in February 2015; IUSA, IRHI outlook improved to ‘Stable’ in April 2015 by S&P Fitch upgraded RG&E 1-notch in June and put IUSA and RG&E on positive outlook in December Iberdrola SA Ratings: S&P BBB (Positive); Moody’s Baa1 (Positive); and Fitch BBB+ (Stable) S&P Moody's Fitch AGR BBB (Positive) Baa1 (Stable) BBB (Positive) UIL BBB (Positive) Baa2 (Stable) --- IRHI BBB (Positive) Baa1 (Stable) --- NYSEG BBB+ (Positive) A3 (Stable) A- (Stable) RG&E BBB+ (Positive) Baa1 (Stable) BBB+ (Positive) CMP BBB+ (Stable) A3 (Positive) A- (Stable) UI BBB (Positive) Baa1 (Stable) --- CNG BBB (Positive) A3 (Stable) --- SCG BBB (Positive) Baa1 (Stable) --- BGC BBB (Positive) Baa1 (Stable) --- AVANGRID Update Credit Ratings

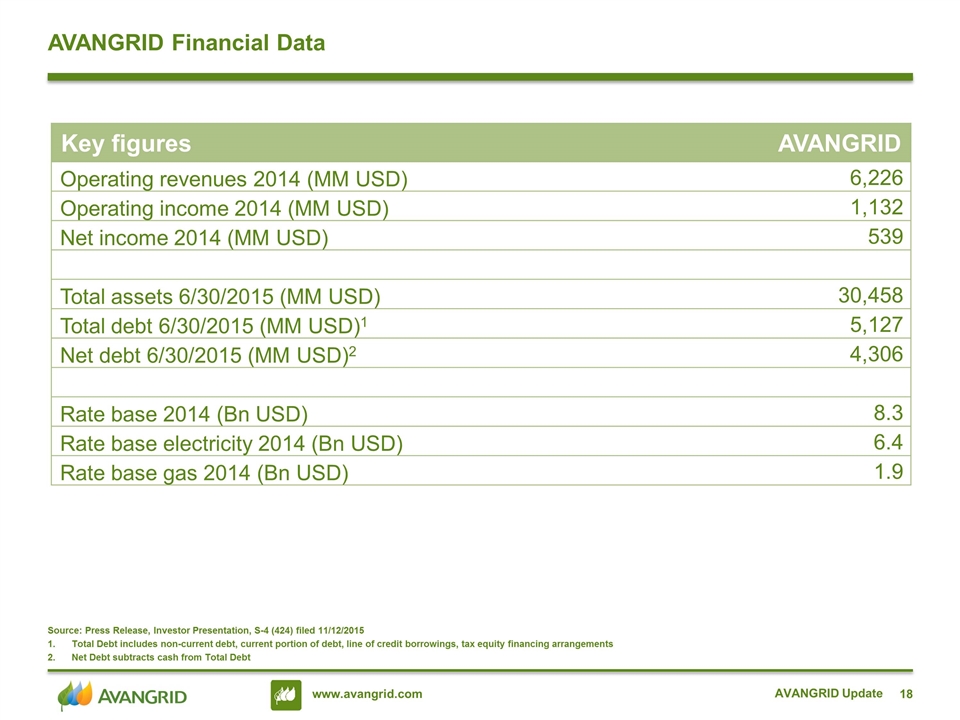

AVANGRID Update AVANGRID Financial Data Key figures AVANGRID Operating revenues 2014 (MM USD) 6,226 Operating income 2014 (MM USD) 1,132 Net income 2014 (MM USD) 539 Total assets 6/30/2015 (MM USD) 30,458 Total debt 6/30/2015 (MM USD)1 5,127 Net debt 6/30/2015 (MM USD)2 4,306 Rate base 2014 (Bn USD) 8.3 Rate base electricity 2014 (Bn USD) 6.4 Rate base gas 2014 (Bn USD) 1.9 Source: Press Release, Investor Presentation, S-4 (424) filed 11/12/2015 Total Debt includes non-current debt, current portion of debt, line of credit borrowings, tax equity financing arrangements Net Debt subtracts cash from Total Debt

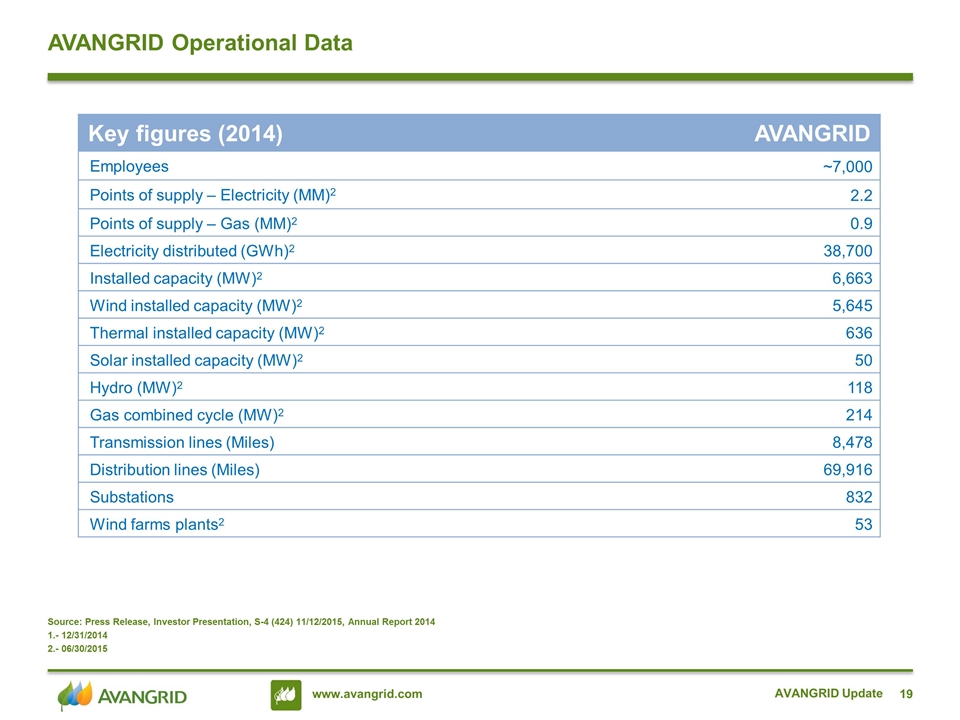

AVANGRID Update AVANGRID Operational Data Key figures (2014) AVANGRID Employees ~7,000 Points of supply – Electricity (MM)2 2.2 Points of supply – Gas (MM)2 0.9 Electricity distributed (GWh)2 38,700 Installed capacity (MW)2 6,663 Wind installed capacity (MW)2 5,645 Thermal installed capacity (MW)2 636 Solar installed capacity (MW)2 50 Hydro (MW)2 118 Gas combined cycle (MW)2 214 Transmission lines (Miles) 8,478 Distribution lines (Miles) 69,916 Substations 832 Wind farms plants2 53 Source: Press Release, Investor Presentation, S-4 (424) 11/12/2015, Annual Report 2014 1.- 12/31/2014 2.- 06/30/2015