Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SEAL123 INC | d87984d8k.htm |

Exhibit 99.1

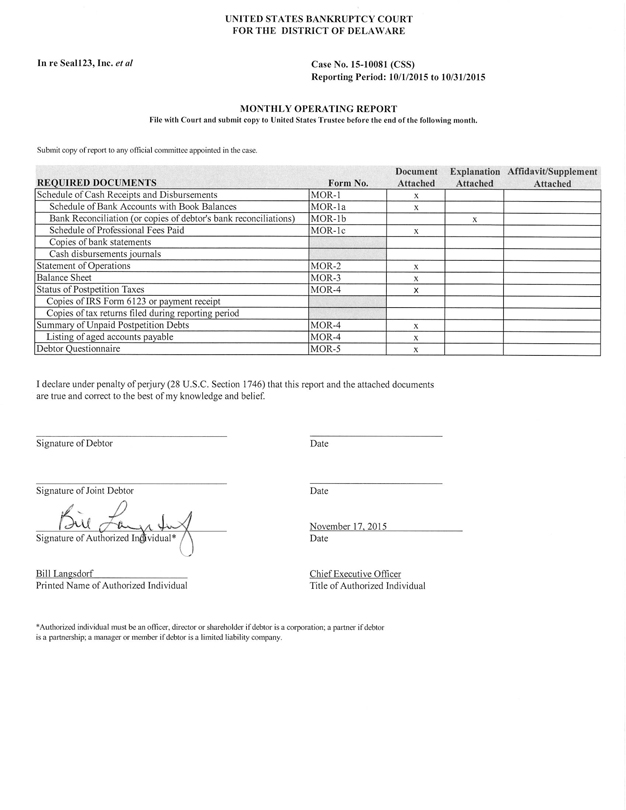

UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE

In re Seal123, Inc. et al Case No. 15-10081 (CSS)

Reporting Period: 10/1/2015 to 10/31/2015

MONTHLY OPERATING REPORT

File with Court and submit copy to United States

Trustee before the end of the following month.

Submit copy of report to any official committee appointed in the case.

REQUIRED DOCUMENTS Form No. Document Attached Explanation Attached Affidavit/Supplement Attached

Schedule of Cash Receipts and Disbursements MOR-1 x

Schedule of Bank Accounts

with Book Balances MOR-1a x

Bank Reconciliation (or copies of debtor’s bank reconciliations) MOR-1b x

Schedule of Professional Fees Paid MOR-1c x

Copies of bank statements

Cash disbursements journals

Statement of Operations MOR-2 x

Balance Sheet MOR-3 x

Status of Postpetition Taxes MOR-4 X

Copies of IRS Form 6123 or payment receipt

Copies of tax returns filed during reporting period

Summary of Unpaid Postpetition Debts MOR-4 x

Listing of aged accounts payable

MOR-4 x

Debtor Questionnaire MOR-5 x

I declare under penalty of perjury (28

U.S.C. Section 1746) that this report and the attached documents are true and correct to the best of my knowledge and belief

Signature of Debtor Date

Signature of Joint Debtor Date

November 17, 2015

Signature of Authorized Individual* Date

Bill Langsdorf Chief Executive Officer

Printed Name of Authorized Individual Title of Authorized Individual

*Authorized individual

must be an officer, director or shareholder if debtor is a corporation; a partner if debtor is a partnership; a manager or member if debtor is a limited liability company.

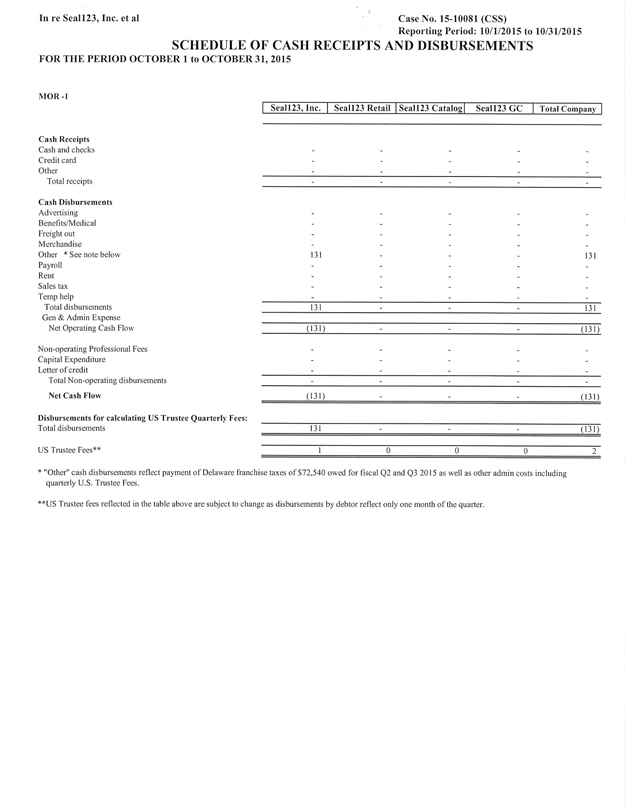

In re Seal123, Inc. et al Case No. 15-10081 (CSS)

Reporting Period: 10/1/2015 to 10/31/2015

SCHEDULE OF CASH RECEIPTS AND

DISBURSEMENTS

FOR THE PERIOD OCTOBER 1 to OCTOBER 31, 2015

MOR-1

Seall23, Inc. Seal123 Retail Seal123 Catalog Seal123 GC Total Company

Cash Receipts

Cash and checks - - - - -

Credit card - - - - -

Other - - - - -

Total receipts - - - - -

Cash Disbursements

Advertising - - - - -

Benefits/Medical - - - - -

Freight out - - - - -

Merchandise - - - - -

Other * See note below 131 - - - 131

Payroll - - - - -

Rent - - - - -

Sales tax - - - - -

Temp help - - - - -

Total disbursements 131 - - - 131

Gen & Admin Expense

Net Operating Cash Flow (131) - - - (131)

Non-operating Professional Fees

Capital Expenditure - - - - -

Letter of credit - - - - -

Total Non-operating disbursements - - - - -

Net Cash Flow (131) - - - (131)

Disbursements for calculating US Trustee Quarterly Fees:

Total disbursements 131 - - - (131)

US Trustee Fees** 1 0 0 0 2

* “Other” cash disbursements reflect

payment of Delaware franchise taxes of $72,540 owed for fiscal Q2 and Q3 2015 as well as other admin costs including quarterly U.S. Trustee Fees.

**US Trustee fees

reflected in the table above are subject to change as disbursements by debtor reflect only one month of the quarter.

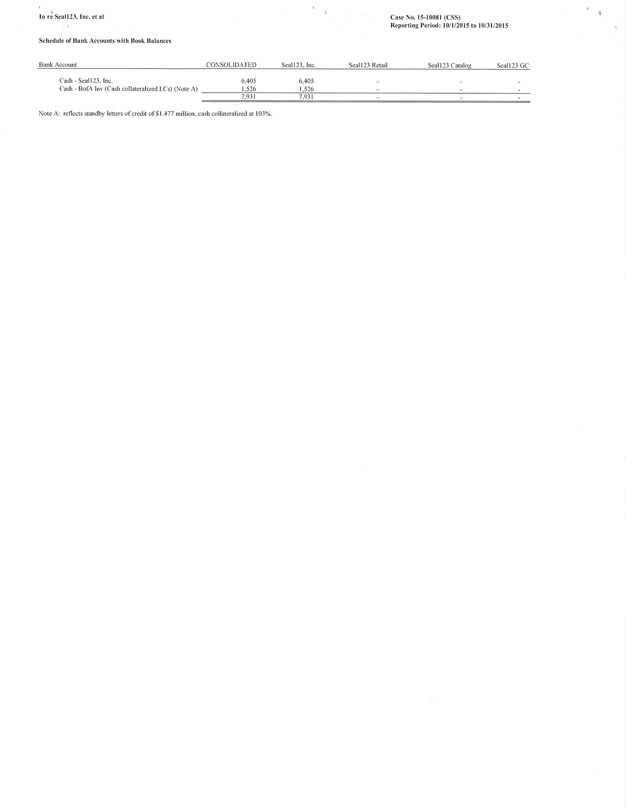

In re Seal123, Inc. et al

Case No. 15-10081 (CSS)

Reporting Period: 10/1/2015 to 10/31/2015

Schedule of Bank Accounts with Book

Balances

Bank Account CONSOLIDATED Seal123, Inc. Seal123 Retail Seal 123 Catalog Seal 123 GC

Cash - Seal 123, Inc. 6,405 6,405 - - -

Cash - BofA Inv (Cash collateralized LCs) (Note A)

1,526 1,526 - - -

7,931 7,931 - - -

Note A: reflects standby letters of

credit of $1.477 million, cash collateralized at 103%.

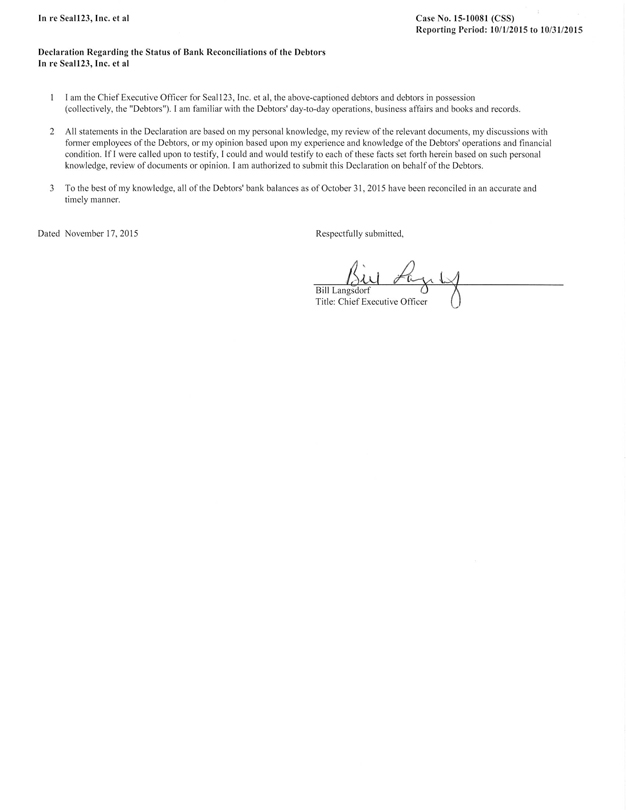

In re Seal123, Inc. et al

Case No. 15-10081 (CSS)

Reporting Period: 10/1/2015 to 10/31/2015

Declaration Regarding the Status of

Bank Reconciliations of the Debtors In re Seal123, Inc. et al

1 I am the Chief Executive Officer for Seal123, Inc. et al, the above-captioned debtors and debtors

in possession (collectively, the “Debtors”). I am familiar with the Debtors’ day-to-day operations, business affairs and books and records.

2 All

statements in the Declaration are based on my personal knowledge, my review of the relevant documents, my discussions with former employees of the Debtors, or my opinion based upon my experience and knowledge of the Debtors’ operations and

financial condition. If I were called upon to testify, I could and would testify to each of these facts set forth herein based on such personal knowledge, review of documents or opinion. I am authorized to submit this Declaration on behalf of the

Debtors.

3 To the best of my knowledge, all of the Debtors’ bank balances as of October 31, 2015 have been reconciled in an accurate and timely manner.

Dated November 17, 2015

Respectfully submitted,

Bill Langsdorf

Title: Chief Executive Officer

In re Seal123, Inc. et al

Case No. 15-10081 (CSS)

Reporting Period: 10/1/2015 to 10/31/2015

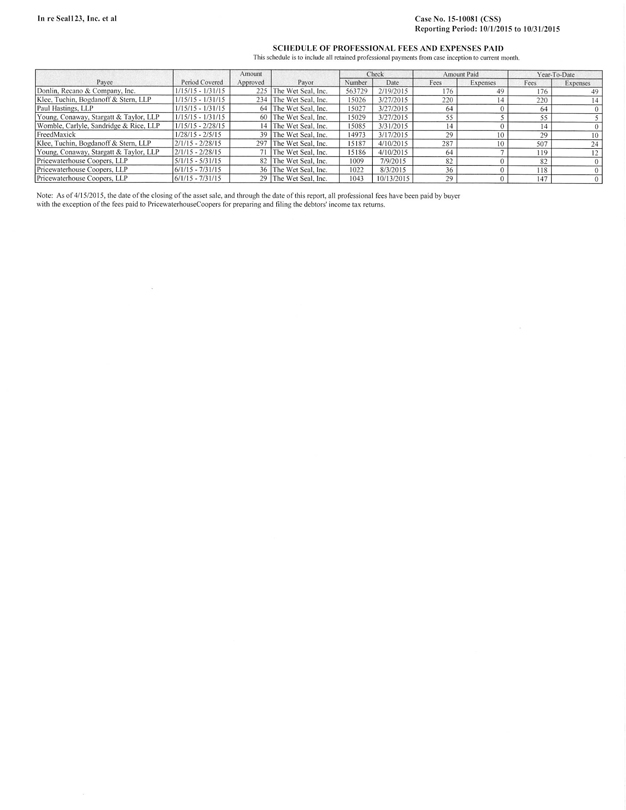

SCHEDULE OF PROFESSIONAL FEES AND

EXPENSES PAID

This schedule is to include all retained professional payments from case inception to current month.

Payee

Period Covered

Amount Approved

Payor

Check

Number

Date

Amount Paid

Fees

Expenses

Year-To-Date

Fees

Expenses

Donlin, Recano & Company, Inc. 1/15/15 - 1/31/15 225 The Wet Seal, Inc.

563729 2/19/2015 176 49 176 49

Klee, Tuchin, Bogdanoff & Stern, LLP 1/15/15 - 1/31/15 234 The Wet Seal, Inc. 15026 3/27/2015 220 14 220 14

Paul Hastings, LLP 1/15/15 - 1/31/15 64 The Wet Seal, Inc. 15027 3/27/2015 64 0 64 0

Young,

Conaway, Stargatt & Taylor, LLP 1/15/15 - 1/31/15 60 The Wet Seal, Inc. 15029 3/27/2015 55 5 55 5

Womble, Carlyle, Sandridge & Rice, LLP 1/15/15 - 2/28/15

14 The Wet Seal, Inc. 15085 3/31/2015 14 0 14 0

FreedMaxick 1/28/15 - 2/5/15 39 The Wet Seal, Inc. 14973 3/17/2015 29 10 29 10

Klee, Tuchin, Bogdanoff & Stem, LLP 2/1/15 - 2/28/15 297 The Wet Seal, Inc. 15187 4/10/2015 287 10 507 24

Young, Conaway, Stargatt & Taylor, LLP 2/1/15 - 2/28/15 71 The Wet Seal, Inc. 15186 4/10/2015 64 7 119 12

Pricewaterhouse Coopers, LLP 5/1/15 - 5/31/15 82 The Wet Seal, Inc. 1009 7/9/2015 82 0 82 0

Pricewaterhouse Coopers, LLP 6/1/15 - 7/31/15 36 The Wet Seal, Inc. 1022 8/3/2015 36 0 118 0

Pricewaterhouse Coopers, LLP 6/1/15 - 7/31/15 29 The Wet Seal, Inc. 1043 10/13/2015 29 0 147 0

Note: As of 4/15/2015, the date of the closing of the asset sale, and through the date of this report, all professional fees have been paid by buyer with the

exception of the fees paid to PricewaterhouseCoopers for preparing and filing the debtors’ income tax returns.

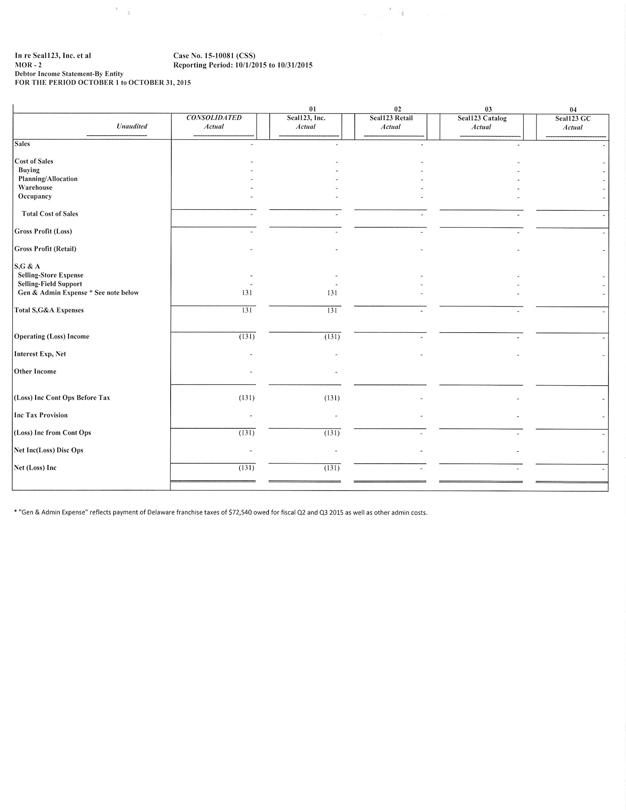

In re Seal123, Inc. et al

Case No. 15-10081 (CSS)

MOR - 2

Reporting Period: 10/1/2015 to 10/31/2015

Debtor Income Statement-By Entity

FOR THE PERIOD OCTOBER 1 to OCTOBER 31, 2015

01 02 03 04

Unaudited

CONSOLIDATED Actual

Seall23, Inc. Actual

Seal 123 Retail Actual

Seal123 Catalog Actual

Seal123 GC Actual

Sales - - - - -

Cost of Sales - - - - -

Buying - - - - -

Planning/Allocation - - - - -

Warehouse - - - - -

Occupancy - - - - -

Total Cost of Sales - - - - -

Gross Profit (Loss) - - - - -

Gross Profit (Retail) - - - - -

S,G & A

Selling-Store Expense - - - - -

Selling-Field Support - - - - -

Gen & Admin Expense * See note below 131 131 - - -

Total S,G&A Expenses 131 131 - - -

Operating (Loss) Income (131) (131) -

- -

Interest Exp, Net - - - - -

Other Income - -

(Loss) Inc Cont Ops Before Tax (131) (131) - - -

Inc Tax Provision - - - - -

(Loss) Inc from Cont Ops (131) (131) - - -

Net Inc(Loss) Disc Ops - - - - -

Net (Loss) Inc (131) (131) - - -

* “Gen & Admin Expense” reflects payment of

Delaware franchise taxes of $72,540 owed for fiscal Q2 and Q3 2015 as well as other admin costs.

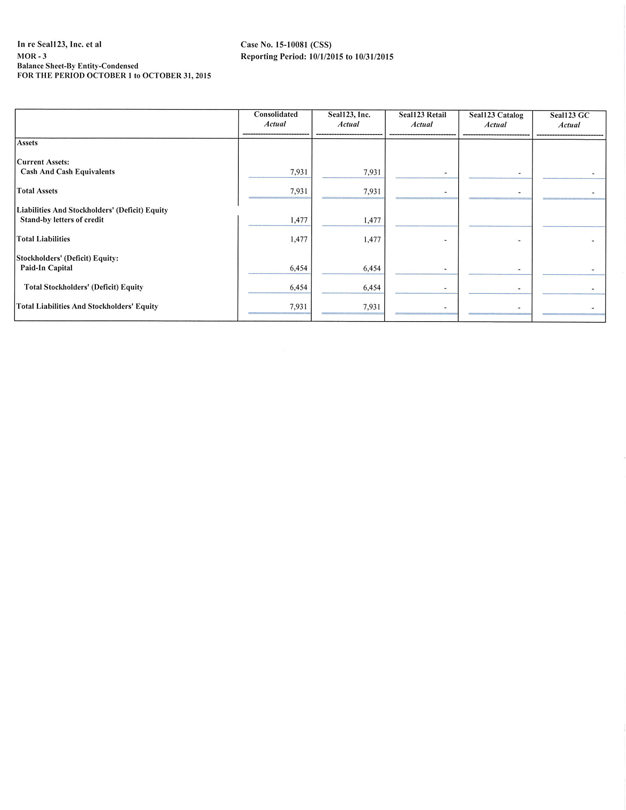

In re Seall23, Inc. et al Case No. 15-10081 (CSS)

MOR-3 Reporting Period: 10/1/2015 to 10/31/2015

Balance Sheet-By

Entity-Condensed

FOR THE PERIOD OCTOBER 1 to OCTOBER 31, 2015

Consolidated

Actual Seal123, Inc. Actual Seal123 Retail Actual Seal123 Catalog Actual Seal123 GC Actual

Assets

Current Assets:

Cash And Cash Equivalents

Total Assets

Liabilities And Stockholders’ (Deficit) Equity Stand-by letters of credit

Total Liabilities

Stockholders’ (Deficit) Equity:

Paid-In Capital

Total Stockholders’ (Deficit) Equity Total Liabilities And

Stockholders’ Equity 7,931 7,931 1,477 7,931 7,931 1,477 - - - - - -- - -

1,477 6,454 1,477 6,454 - - -

6,454 6,454 - - -

7,931 7,931 - - -

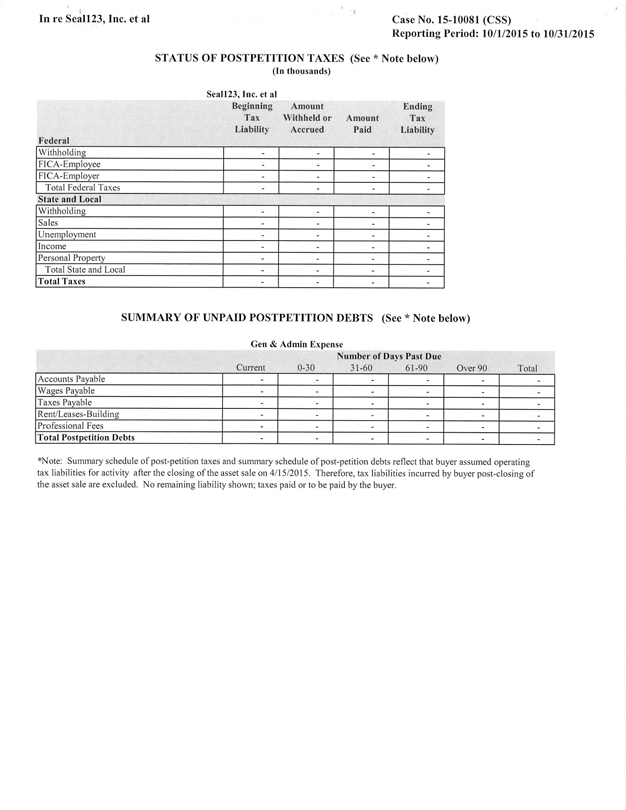

In re Seal123, Inc. et al Case No. 15-10081 (CSS)

Reporting Period: 10/1/2015 to 10/31/2015

STATUS OF POSTPETITION TAXES (See *

Note below)

(In thousands)

Seal123, Inc. et al

Federal Beginning Tax Liability Amount Withheld or Accrued Amount Paid Ending Tax Liability

Withholding - - - -

FICA-Employee - - - -

FICA-Employer - - - -

Total Federal Taxes - - - -

State and Local

Withholding - - - -

Sales - - - -

Unemployment - - - -

Income - - - -

Personal Property - - - -

Total State and Local - - - -

Total Taxes - - - -

SUMMARY OF UNPAID POSTPETITION DEBTS (See * Note below)

Gen & Admin Expense

Number of Days Past Due

Current 0-30 31-60 61-90 Over 90 Total

Accounts Payable - - - - - -

Wages Payable - - - - - -

Taxes Payable - - - - - -

Rent/Leases-Building - - - - - -

Professional Fees - - - - - -

Total Postpetition Debts - - - - - -

*Note: Summary schedule of post-petition taxes and summary schedule of post-petition debts reflect that buyer assumed operating tax liabilities for activity after the closing of

the asset sale on 4/15/2015. Therefore, tax liabilities incurred by buyer post-closing of the asset sale are excluded. No remaining liability shown; taxes paid or to be paid by the buyer.

In re Seal123, Inc. et al Case No. 15-10081 (CSS)

Reporting Period: 10/1/2015 to 10/31/2015

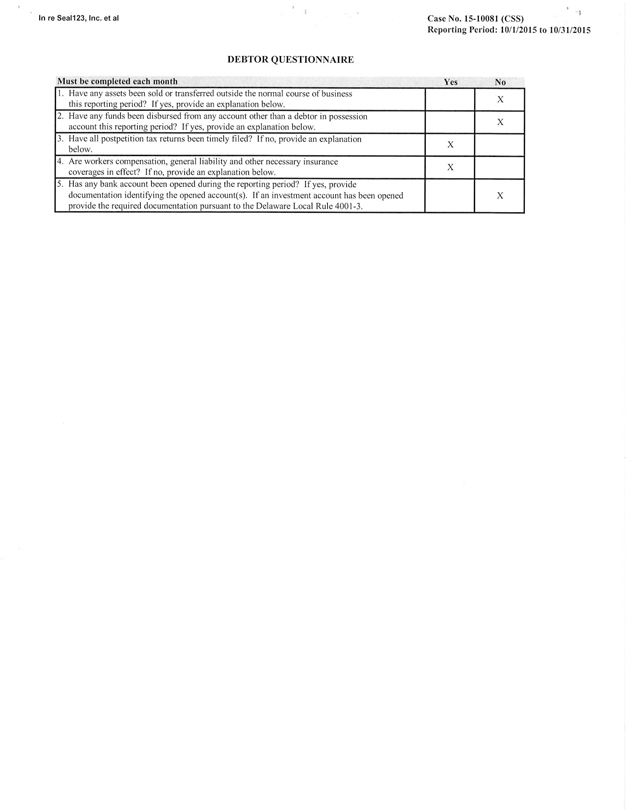

DEBTOR QUESTIONNAIRE

Must be completed each month Yes No

1. Have any assets been sold or transferred outside the

normal course of business this reporting period? If yes, provide an explanation below. X

2. Have any funds been disbursed from any account other than a debtor in

possession account this reporting period? If yes, provide an explanation below. X

3. Have all postpetition tax returns been timely filed? If no, provide an

explanation below. X

4. Are workers compensation, general liability and other necessary insurance coverages in effect? If no, provide an explanation below. X

5. Has any bank account been opened during the reporting period? If yes, provide

documentation identifying the opened account(s). If an investment account has been opened provide the required documentation pursuant to the Delaware Local Rule 4001-3. X