Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended January 29, 2011

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 0-18632

THE WET SEAL, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 33-0415940 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 26972 Burbank, Foothill Ranch, CA | 92610 | |

| (Address of principal executive offices) | (Zip Code) | |

(949) 699-3900

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Class A Common Stock, $0.10 par value per share | NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a nonaccelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “small reporting company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer: ¨ Accelerated filer: þ Nonaccelerated filer: ¨ Smaller reporting company: ¨

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

The aggregate market value of voting stock held by nonaffiliates of the registrant as of July 31, 2010 was approximately $332,138,000 based on the closing sale price of $3.38 per share as reported on the NASDAQ Global Market on July 30, 2010.

The number of shares outstanding of the registrant’s Class A common stock, par value $0.10 per share, at March 25, 2011, was 100,784,547. There were no shares outstanding of the registrant’s Class B common stock, par value $0.10 per share, at March 25, 2011.

DOCUMENTS INCORPORATED BY REFERENCE

PART III of this Annual Report incorporates information by reference to the registrant’s definitive Proxy Statement for its Annual Meeting of Stockholders to be filed with the SEC within 120 days of January 29, 2011.

Table of Contents

THE WET SEAL, INC.

Annual Report on Form 10-K

For the Fiscal Year Ended January 29, 2011

| Page | ||||||

| Part I | ||||||

| Item 1. |

1 | |||||

| Item 1A. |

11 | |||||

| Item 1B. |

18 | |||||

| Item 2. |

18 | |||||

| Item 3. |

20 | |||||

| Part II | ||||||

| Item 4. |

21 | |||||

| Item 5. |

22 | |||||

| Item 6. |

25 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

26 | ||||

| Item 7A. |

50 | |||||

| Item 8. |

50 | |||||

| Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

50 | ||||

| Item 9A. |

50 | |||||

| Item 9B. |

52 | |||||

| Part III | ||||||

| Item 10. |

Directors, Executive Officers, and Corporate Governance of the Registrant |

53 | ||||

| Item 11. |

53 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

53 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

53 | ||||

| Item 14. |

53 | |||||

| Part IV | ||||||

| Item 15. |

54 | |||||

| 58 | ||||||

Table of Contents

PART I

| Item 1. | Business |

Forward-Looking Statements

Certain sections of this Annual Report on Form 10-K (the “Annual Report”), including “Item 1. Business” and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contain various forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), which represent our expectations or beliefs concerning future events.

Forward-looking statements include statements that are predictive in nature, which depend upon or refer to future events or conditions, and/or which include words such as “believes,” “plans,” “intends,” “anticipates,” “estimates,” “expects,” “may,” “will,” or similar expressions. In addition, any statements concerning future financial performance, ongoing strategies or prospects, and possible future actions, which may be provided by our management, are also forward-looking statements. Forward-looking statements are based on current expectations and projections about future events and are subject to risks, uncertainties, and assumptions about our company, economic and market factors, and the industry in which we do business, among other things. These statements are not guarantees of future performance, and we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events, or otherwise.

Actual events and results may differ materially from those expressed or forecasted in forward-looking statements due to a number of factors. Factors that could cause our actual performance, future results, and actions to differ materially from any forward-looking statements include, but are not limited to, those discussed in “Item 1A. Risk Factors” below and elsewhere in this Annual Report.

All references to “we,” “our,” “us,” and “our company” in this Annual Report mean The Wet Seal, Inc. and its wholly owned subsidiaries. All references in this Annual Report to “fiscal 2011,” “fiscal 2010,” “fiscal 2009,” “fiscal 2008,” “fiscal 2007,” “fiscal 2006,” and “fiscal 2005” mean the fiscal year ending January 28, 2012, and the fiscal years ended January 29, 2011, January 30, 2010, February 31, 2009, February 2, 2008, February 3, 2007, and January 28, 2006, respectively.

Available Information

Our Annual Report, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to those reports and the proxy statement for our annual meeting of stockholders are made available, free of charge, on our corporate web site, www.wetsealinc.com, as soon as reasonably practicable after such reports have been electronically filed with or furnished to the Securities and Exchange Commission, or the “SEC.” Our Code of Business Ethics and Conduct and our Code of Ethics Policy for our Chief Executive Officer and Chief Financial Officer are also located within the Corporate Information section of our corporate web site. These documents are also available in print to any stockholder who requests a copy from our Investor Relations department. The public may also read and copy any materials that we have filed with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Members of the general public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, these materials may be obtained at the web site maintained by the SEC at www.sec.gov. The content of our web sites (www.wetsealinc.com, www.wetseal.com, and www.ardenb.com) is not intended to be incorporated by reference in this Annual Report.

General

Incorporated in the State of Delaware in 1990, we are a national specialty retailer operating stores selling fashionable and contemporary apparel and accessory items designed for female customers aged 13 to 35 years old. As of January 29, 2011, we operated 533 retail stores in 47 states and Puerto Rico. Our products can also be purchased online through our web sites.

1

Table of Contents

The names “Wet Seal” and “Arden B” (which are registered in the retail store services and other classes) are trademarks and service marks of our company. Each trademark, trade name, or service mark of any other company appearing in this Annual Report belongs to its respective owner.

Business Segments

We operate two nationwide, primarily mall-based, chains of retail stores under the names “Wet Seal” and “Arden B.” Although the two operating segments have many similarities in their products, production processes, distribution methods, and regulatory environment, there are differences in most of these areas and distinct differences in their economic characteristics. As a result, we consider these segments to be two distinct reportable segments.

Wet Seal. Wet Seal is a junior apparel brand for teenage girls who seek trend-focused and value-competitive clothing, with a target customer age range of 13 to 19 years old. Wet Seal seeks to provide its customer base with a balance of affordably priced, fashionable and basic apparel and accessories.

Arden B. Arden B is a fashion brand at value price points for the feminine contemporary woman. Arden B targets customers aged 25 to 35 years old and seeks to deliver contemporary collections of fashion and basic separates and accessories for various aspects of the customers’ lifestyles.

We maintain a Web-based store located at www.wetseal.com, offering Wet Seal merchandise comparable to that carried in our stores, to customers over the Internet. We also maintain a Web-based store located at www.ardenb.com, offering Arden B merchandise comparable to that carried in our stores, to customers over the Internet. Our online stores are designed to serve as an extension of the in-store experience and offer a wide selection of merchandise, with the goal of expanding in-store sales. Internet operations for both Wet Seal and Arden B are included in their respective operating segments. Since fiscal 2007, we have experienced growth in both visitor traffic and our online sales, and we will continue to develop our Wet Seal and Arden B websites to increase their effectiveness in marketing our brands. We do not consider our Web-based business to be a distinct reportable segment, as the Wet Seal and Arden B reportable segments include, in addition to data from their respective stores, data from their respective Internet operations.

See Note 13 to the consolidated financial statements included in this Annual Report for financial information regarding segment reporting.

Our Stores

Wet Seal stores average approximately 4,000 square feet in size and in fiscal 2010 had average sales per square foot of $267. As of January 29, 2011, we operated 450 Wet Seal stores. Arden B stores average approximately 3,100 square feet in size and in fiscal 2010 had average sales per square foot of $341. As of January 29, 2011, we operated 83 Arden B stores.

During fiscal 2010, we opened 32 and closed six Wet Seal stores and opened nine and closed six Arden B stores.

We currently plan to open approximately 25 to 30 Wet Seal stores, net of store closings, in fiscal 2011 in mall and off-mall power center locations. We also currently intend to continue growing the Arden B store base moderately, with a plan of approximately four new stores, net of store closings, in fiscal 2011. We believe future closures for at least the next 12 months following the date of this Annual Report will primarily result from lease expirations where we decide not to extend, or are unable to extend, store leases. We may, however, accelerate the closure of underperforming stores prior to their lease expirations in cases where we can obtain favorable early lease terminations with the landlords or exercise certain rights contained in the leases. We have approximately 56 existing store leases scheduled to expire in fiscal 2011. We plan to remodel or relocate approximately 27 Wet Seal and Arden B stores during fiscal 2011 upon lease renewals. These planned remodels/relocations are

2

Table of Contents

primarily inclusive of the 56 store leases scheduled to expire in fiscal 2011. We expect to negotiate new leases that will allow us to remain in a substantial majority of these locations. Our ability to increase the number of Wet Seal and Arden B stores in the future will depend, in part, on satisfactory cash flows from existing operations, the demand for our merchandise, and our ability to find suitable mall or other locations with acceptable sites, satisfactory terms and satisfactory general business conditions. Our management does not believe there are significant geographic constraints within the U.S. on the locations of future stores.

Competitive Strengths

Experienced Management Team. Although we have most recently had changes among our senior management team, the current members have extensive knowledge of our business and operations or our industry, which will be instrumental in managing our company through the current difficult economic environment and driving our company in the next phase of its growth cycle. Ms. Susan P. McGalla, our new chief executive officer, held various leadership roles with American Eagle Outfitter, Inc. from 1994 to 2009, most recently serving as the president and chief merchandising officer of that company. Mr. Ken Seipel, our new president and chief operating officer, most recently served as the president and chief merchandise/marketing officer of Pamida Discount Stores LLC since 2009. Previous to this, Mr. Seipel served as executive vice president of stores, operations and store design for the Old Navy division of Gap, Inc. from 2003 through 2008 and also held various merchandising and operations management roles earlier in his career with Target Corporation, Shopko Stores, Inc. and J. C. Penney Company, Inc. Our Chief Financial Officer, Mr. Steven H. Benrubi, served as our corporate controller for over two years prior to his appointment as chief financial officer in September 2007. Ms. Sharon Hughes, our president and chief merchandise officer for our Arden B division, who served as a consultant to our Arden B merchandising team from 2008 to 2009, was an employee of our company from 1990 through 2002, during which period Ms. Hughes was involved in the formation of the Arden B division and held several different merchant roles, including senior vice president of merchandising. Ms. Kim Bajrech and Ms. Debbie Shinn, vice presidents and divisional merchandise managers for our Wet Seal division, joined the company in 2009 and have extensive experience in the junior apparel business. In addition, Ms. Bajrech was an employee of our company from 1990 to 2002. We are currently evaluating the timing for our need for a chief merchandise officer for our Wet Seal division.

Merchandising Models at Wet Seal and Arden B are Focused on Fashion at Affordable Prices, Speed and Flexibility. At Wet Seal, we have developed considerable expertise in identifying, stocking and selling a broad assortment of fresh and fashionable apparel and accessories at competitive prices to our teenage customers. At Arden B we continue to focus on offering unique and fashionable apparel and accessories for our young contemporary customers and have shifted the merchandising model over recent years to be quicker and more flexible. Our buyers work closely with senior management to evaluate the optimal product selection and promotion and pricing strategies. A significant portion of our merchandise is sourced domestically or from domestic importers. This sourcing strategy is intended to enable us to ship new merchandise to stores with a higher frequency and to react more quickly to changing fashion trends. We also take regular markdowns with the objective of effecting the rapid sale of slow-moving inventory.

In recent years, we have increased our cash and investments position and extinguished our debt. Through fiscal 2010, $56 million in principal amount of our convertible notes and $24.6 million in face amount of our convertible preferred stock had been converted into shares of our Class A common stock. Also, in fiscal 2010, 2009, and 2007, we repurchased 2.3 million, 2.0 million, and 3.6 million shares of our Class A common stock for $8.2 million, $7.3 million, and $20.1 million, respectively. We repurchased no common stock during fiscal 2008. As of January 29, 2011, our cash, cash equivalents and investments were $176.1 million; and stockholders’ equity was $275.7 million.

3

Table of Contents

Strategy

As part of a strategic review of business operations, we have identified what we believe are significant opportunities to improve our business trends and drive sales improvement. The key elements of our opportunities are to:

Continue to Manage Business Conservatively in the Near Term Through the Difficult Economic Environment. We have taken many actions intended to increase our financial strength through a difficult economic environment over the near term and to position ourselves to capitalize on our company’s growth and operating leverage opportunities when such environment improves. In anticipation of a continuing difficult retail environment, our near term goals include preserving a strong balance sheet, continuing growth of our Wet Seal division store base and resuming conservative growth of our Arden B division store base, ensuring our capital expenditure investments made are accretive or provide efficiencies to the business, maintaining clean inventory levels and reducing costs opportunistically, although we cannot assure we will be successful in achieving our goals. As part of our cost-cutting initiatives, in January 2008, January 2009 and January 2010, we eliminated 49, 37 and 19 positions, respectively, in our corporate offices and distribution center, and two, four and two positions, respectively, in our field operations, across numerous functional areas. We plan to open 25 to 30 Wet Seal stores, net of store closings, and four Arden B stores, net of store closings, during fiscal 2011. Additionally, we intend to continue to leverage our recently implemented markdown and size optimization systems, our new distribution center sorter system, and inventory management systems currently being implemented; and plan to continue to closely monitor inventory positions during fiscal 2011 while seeking to have the appropriate inventory mix and levels to obtain new trend opportunities. Lastly, we intend to continue to operate with a more cost-efficient, streamlined management organization by seeking to maintain our past cost reductions and to make conservative re-investments in the business where necessary.

Improve Merchandise Margin. In our Wet Seal division, we identified and began acting upon opportunities to improve our planning and allocation function, merchandise mix, and markdown cadence in response to declining merchandise margin performance over the course of fiscal 2009, resulting in merchandise margin improvement during fiscal 2010. We also intend to continue to improve upon our markdown cadence, promotional strategies and size offerings by further utilizing our markdown and size optimization systems, continue our focus on key merchandise item categories, further develop branded and private label assortments, and further optimize our accessory offerings in the merchandise mix in order to build upon our fiscal 2010 improvement. In our Arden B division, we intend to further improve our inventory management, expand dresses as a percentage of our merchandise mix, and enhance our promotional planning and strategies in order to build upon significant merchandise margin improvement generated in this division during fiscal 2009 and fiscal 2010. We intend to focus on maintaining a merchandise mix balanced with customer needs and to continue to make improvements to our sourcing processes and expand our sourcing base. We also intend to improve our price messaging to gain more recognition from our customers for our value proposition.

Improve Store Operations. Our store operations opportunities include improving customer service through new training and development programs, continuing to obtain customer feedback and acting upon it to improve our business, identifying and implementing opportunities to simplify and/or eliminate non-selling activities, and performing more detailed analysis and monitoring to identify improvements for underperforming stores.

Improve Real Estate. We will continue to seek to improve our new and remodeled store economics to address pressure from rising occupancy and store construction costs. We will re-evaluate our Wet Seal store prototype and enhanced fixturing, first implemented in fiscal 2008, to analyze whether we are providing the most attractive store design and shopper-friendly environment. Additionally, we expect to continue opening a small number of Wet Seal stores in regional “power centers” during fiscal 2011 and will assess the opportunity for off-mall growth. We expect to continue to build the pipeline for store growth and growth of our store base, which we estimate will result in fiscal 2011 openings of approximately 25 to 30 new Wet Seal stores, net of store closings, and will continue to grow the Arden B store base conservatively, with approximately four new stores, net of store closings, in fiscal 2011. Additionally, we plan to remodel or relocate approximately 27 Wet Seal and Arden B stores during fiscal 2011 upon lease renewals.

4

Table of Contents

Improve Marketing. We believe we have an opportunity to improve our marketing and divisional merchandising strategies and are developing specific plans for each division in fiscal 2011. We intend to continue emphasizing Internet marketing, including social networking, and will continue to focus on direct and grass roots marketing programs and in-store visual merchandising. Additionally, we are currently conducting consumer research studies to support and enhance brand marketing programs later in the year and to assess brand positioning opportunities.

Improve Information Systems. We expect to complete implementation of an updated retail merchandising system in fiscal 2011, which are designed to improve merchandising decision support and increase efficiency of inventory management practices. Additionally, we intend to update short-term and long-term information systems strategies to provide further efficiencies and cost controls.

Improve Physical Distribution and Transport. We intend to improve business processes to optimize efficiency of our recently implemented automated sorter system in our distribution center, which we expect will lead to increased merchandise processing speed and further cost savings.

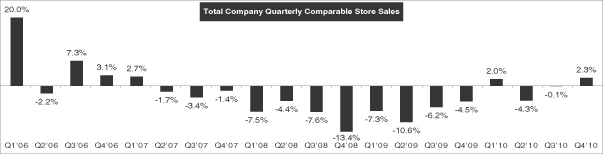

Realize Comparable Store Sales Growth Opportunity. We are focused on regaining sales productivity lost through our comparable stores sales declines experienced in fiscal 2007 through 2009, which represented a 16.7% decline on a cumulative basis, as a result of the challenging economic environment as well as the Arden B sales deterioration under its previous merchandising model. In fiscal 2011, we will seek to achieve comparable store sales improvement through the implementation of strategic initiatives noted above, which, among other things, include continued focus on improving customer service, our store design and fixturing, key merchandise trends, increased efficiencies in our planning and allocation functions from markdown and size optimization systems, improving promotional planning and pricing messaging, ensuring inventory is maintained at sufficient levels to increase business, and implementing an enhanced merchandising system.

| Total Company Monthly Comparable Store Sales | ||||||||||||||||||||||||||||||||||||||||||||

|

Jan-06 |

51.4% | Jan-07 | 3.6% | Jan-08 | -5.7% | Jan-09 | -14.7% | Jan-10 | -3.7% | Jan-11 | 6.2% | |||||||||||||||||||||||||||||||||

| Feb-06 |

29.3% | Feb-07 | 5.0% | Feb-08 | -8.2% | Feb-09 | -6.6% | Feb-10 | 4.7% | |||||||||||||||||||||||||||||||||||

| Mar-06 |

16.2% | Mar-07 | 10.9% | Mar-08 | -10.8% | Mar-09 | -11.4% | Mar-10 | 6.3% | |||||||||||||||||||||||||||||||||||

| Apr-06 |

17.0% | Apr-07 | -9.6% | Apr-08 | -1.9% | Apr-09 | -2.2% | Apr-10 | -6.1% | |||||||||||||||||||||||||||||||||||

| May-06 |

-8.3% | May-07 | 1.9% | May-08 | -2.0% | May-09 | -8.4% | May-10 | -5.3% | |||||||||||||||||||||||||||||||||||

| Jun-06 |

-4.0% | Jun-07 | 0.7% | Jun-08 | -2.9% | Jun-09 | -11.1% | Jun-10 | -3.6% | |||||||||||||||||||||||||||||||||||

| Jul-06 |

6.4% | Jul-07 | -7.2% | Jul-08 | -8.2% | Jul-09 | -12.1% | Jul-10 | -4.3% | |||||||||||||||||||||||||||||||||||

| Aug-06 |

8.7% | Aug-07 | 1.7% | Aug-08 | -8.7% | Aug-09 | -11.2% | Aug-10 | 1.1% | |||||||||||||||||||||||||||||||||||

| Sep-06 |

5.8% | Sep-07 | -7.0% | Sep-08 | -7.5% | Sep-09 | -4.5% | Sep-10 | -0.7% | |||||||||||||||||||||||||||||||||||

| Oct-06 |

7.5% | Oct-07 | -5.4% | Oct-08 | -6.2% | Oct-09 | -1.3% | Oct-10 | -0.7% | |||||||||||||||||||||||||||||||||||

| Nov-06 |

5.5% | Nov-07 | -1.7% | Nov-08 | -13.9% | Nov-09 | -5.0% | Nov-10 | 7.0% | |||||||||||||||||||||||||||||||||||

|

Dec-06 |

1.3% | Dec-07 | 0.6% | Dec-08 | -12.5% | Dec-09 | -4.6% | Dec-10 | -2.1% | |||||||||||||||||||||||||||||||||||

5

Table of Contents

| Wet Seal Monthly Comparable Store Sales | ||||||||||||||||||||||||||||||||||||||||||||

|

Jan-06 |

83.7% | Jan-07 | 5.8% | Jan-08 | -1.1% | Jan-09 | -12.1% | Jan-10 | -6.7% | Jan-11 | 6.6% | |||||||||||||||||||||||||||||||||

| Feb-06 |

47.9% | Feb-07 | 5.2% | Feb-08 | -3.6% | Feb-09 | -5.6% | Feb-10 | 3.4% | |||||||||||||||||||||||||||||||||||

| Mar-06 |

26.0% | Mar-07 | 14.0% | Mar-08 | -7.3% | Mar-09 | -12.5% | Mar-10 | 6.0% | |||||||||||||||||||||||||||||||||||

| Apr-06 |

20.1% | Apr-07 | -10.0% | Apr-08 | 3.1% | Apr-09 | -4.0% | Apr-10 | -6.4% | |||||||||||||||||||||||||||||||||||

| May-06 |

-5.0% | May-07 | 3.1% | May-08 | 1.8% | May-09 | -12.4% | May-10 | -4.6% | |||||||||||||||||||||||||||||||||||

| Jun-06 |

-4.0% | Jun-07 | 2.8% | Jun-08 | -0.8% | Jun-09 | -11.3% | Jun-10 | -3.6% | |||||||||||||||||||||||||||||||||||

| Jul-06 |

8.1% | Jul-07 | -6.0% | Jul-08 | -6.2% | Jul-09 | -12.3% | Jul-10 | -4.7% | |||||||||||||||||||||||||||||||||||

| Aug-06 |

8.6% | Aug-07 | 5.4% | Aug-08 | -5.4% | Aug-09 | -12.6% | Aug-10 | 1.5% | |||||||||||||||||||||||||||||||||||

| Sep-06 |

8.3% | Sep-07 | -4.7% | Sep-08 | -3.1% | Sep-09 | -5.3% | Sep-10 | 0.1% | |||||||||||||||||||||||||||||||||||

| Oct-06 |

8.7% | Oct-07 | -3.7% | Oct-08 | 0.9% | Oct-09 | -3.1% | Oct-10 | -0.7% | |||||||||||||||||||||||||||||||||||

| Nov-06 |

7.3% | Nov-07 | 0.0% | Nov-08 | -9.7% | Nov-09 | -5.8% | Nov-10 | 8.3% | |||||||||||||||||||||||||||||||||||

|

Dec-06 |

2.1% | Dec-07 | 4.8% | Dec-08 | -6.6% | Dec-09 | -7.3% | Dec-10 | -3.7% | |||||||||||||||||||||||||||||||||||

| Arden B Monthly Comparable Store Sales | ||||||||||||||||||||||||||||||||||||||||||||

|

Jan-06 |

5.2% | Jan-07 | -2.7% | Jan-08 | -21.2% | Jan-09 | -27.0% | Jan-10 | 15.7% | Jan-11 | 3.7% | |||||||||||||||||||||||||||||||||

| Feb-06 |

-4.6% | Feb-07 | 4.2% | Feb-08 | -23.9% | Feb-09 | -11.5% | Feb-10 | 12.4% | |||||||||||||||||||||||||||||||||||

| Mar-06 |

-4.8% | Mar-07 | 1.8% | Mar-08 | -23.0% | Mar-09 | -6.3% | Mar-10 | 7.8% | |||||||||||||||||||||||||||||||||||

| Apr-06 |

8.7% | Apr-07 | -8.3% | Apr-08 | -17.2% | Apr-09 | 6.0% | Apr-10 | -4.5% | |||||||||||||||||||||||||||||||||||

| May-06 |

-16.9% | May-07 | -1.7% | May-08 | -15.1% | May-09 | 11.0% | May-10 | -7.8% | |||||||||||||||||||||||||||||||||||

| Jun-06 |

-4.1% | Jun-07 | -6.0% | Jun-08 | -10.7% | Jun-09 | -10.3% | Jun-10 | -3.2% | |||||||||||||||||||||||||||||||||||

| Jul-06 |

0.8% | Jul-07 | -11.4% | Jul-08 | -16.2% | Jul-09 | -11.2% | Jul-10 | -1.9% | |||||||||||||||||||||||||||||||||||

| Aug-06 |

9.1% | Aug-07 | -12.0% | Aug-08 | -24.7% | Aug-09 | -1.8% | Aug-10 | -1.8% | |||||||||||||||||||||||||||||||||||

| Sep-06 |

-0.7% | Sep-07 | -13.6% | Sep-08 | -21.7% | Sep-09 | -1.1% | Sep-10 | -5.5% | |||||||||||||||||||||||||||||||||||

| Oct-06 |

4.5% | Oct-07 | -10.3% | Oct-08 | -29.4% | Oct-09 | 8.2% | Oct-10 | -0.9% | |||||||||||||||||||||||||||||||||||

| Nov-06 |

0.8% | Nov-07 | -6.7% | Nov-08 | -27.9% | Nov-09 | -1.5% | Nov-10 | -0.3% | |||||||||||||||||||||||||||||||||||

|

Dec-06 |

-0.7% | Dec-07 | -12.7% | Dec-08 | -36.9% | Dec-09 | 14.1% | Dec-10 | 8.5% | |||||||||||||||||||||||||||||||||||

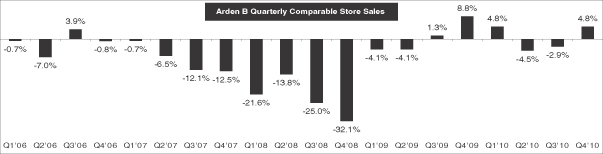

Continue Arden B Improvement. Since fiscal 2008, we have significantly reduced the size and cost of the Arden B merchandising organization, refined the product development and sourcing processes to include more partnering with merchandise suppliers, and adjusted our merchandise mix and pricing and promotional strategies. Our new pricing and promotional strategies at Arden B included significant reductions in price points across all categories. As a result, during the last half of fiscal 2009 and the first and fourth quarters of fiscal 2010, Arden B experienced positive comparable store sales results, and throughout fiscal 2009 and fiscal 2010 we generated significantly improved merchandise margins versus such results for fiscal 2007 and fiscal 2008. However, we

6

Table of Contents

believe Arden B has yet to achieve its full potential with its target young contemporary customers. We aim to drive further sales and profitability improvement at Arden B through our distinctive, quality merchandise, unified apparel and accessory assortments, higher penetration of dresses, our value-pricing strategy, new fixturing to increase store capacity, and a continually improving in-store customer experience.

Expand our Online Business. We plan to continue to grow our Internet business through several initiatives, including expanding our style offerings and significantly growing our customer contact channels through social network investments and more targeted Internet marketing programs, including Facebook® and mobile phone marketing. We experienced substantial growth in fiscal 2010, with an increase of 20% in Internet sales over fiscal 2009. We believe our focus on expanding our style offering, introducing new channels to capture customers, continuing to increase Internet marketing, maintaining consistent brand messages across both channels, and being more focused with targeted marketing will allow us to continue to grow our online business and also increase traffic to our stores. We are optimizing inventory allocated to the Internet business to better meet the demand of our Internet customers and have strengthened our buying and planning staff to meet the anticipated sales growth in this area. We also plan to continue to grow our Internet business through continued improvements to inventory planning, fulfillment, and customer service. Prior to the 2007 holiday season, we launched new website platforms for both divisions, which supports advanced merchandising capabilities, personalization based on browsing behavior and past purchase history, and testing tools to measure and determine the most effective content and promotional strategies. In fiscal 2008 Wet Seal launched industry leading social media features for the website and a cross channel mobile phone application which allow our customers to design, rate, and buy outfits using the majority of Wet Seal products. In fiscal 2009, we launched website features that allow for selling to countries outside the U.S., customers to search for and reserve denim at stores near them, customers to invite friends to shop with them online whereby each person can control and see the same screen, customers to shop online from their mobile devices and other features that continue to enhance our website and customer experience. In fiscal 2010, we launched additional mobile initiatives in the areas of location based marketing and virtual gift cards. We also added additional methods to tender payment online. Our social media marketing reach has increased substantially, adding over one million Facebook® fans in 2010.

Buying

Our buying teams are responsible for identifying evolving fashion trends and developing themes to guide our merchandising strategy. Each retail division has a separate buying team. The merchandising teams for each division develop fashion themes and strategies by assessing customer responses to current trends, shopping appropriate domestic and international markets, using fashion services, and gathering references from industry publications. After selecting fashion themes, the buying teams work closely with vendors to use colors, materials, and designs that create images consistent with the themes for our product offerings.

Since fiscal 2004 for our Wet Seal division, and beginning in fiscal 2008 for our Arden B division, we no longer internally design merchandise. This allows us more flexibility to respond to the changing fashion trends of our target customers, to buy in smaller lots, and to reduce sourcing lead times. See also “Allocation and Distribution” below.

Marketing, Advertising, and Promotion

We believe that our brands are among our most important assets. Our ability to successfully increase brand awareness is dependent upon our ability to address the changing needs and priorities of each brand’s target customers. To that end, we have embarked on thorough customer market research intended to keep us in touch with our customers and their needs and direct our marketing efforts to them. We will also continue our emphasis on visual merchandising and direct and grass roots marketing. As discussed further in Note 1 to the consolidated financial statements included elsewhere in this Annual Report, we also offer a frequent buyer program in our Wet Seal stores in order to build loyalty to the brand, increase the frequency of visits, promote multiple item purchases, and gain direct access to the customer. As part of this program, we send e-mails to participants to

7

Table of Contents

notify them of special in- store promotions. Our Arden B division also offers a loyalty program, “B Rewarded,” designed for the same purposes as that of our Wet Seal division. We intend to implement marketing strategies to build upon the past successes of these loyalty programs and to accelerate their growth. We also plan to more aggressively pursue customer acquisitions and to increase our use of Internet marketing to drive increased store traffic.

During fiscal 2010, 2009, and 2008, we spent 0.6%, 0.4%, and 0.5%, respectively, of net sales on advertising. In fiscal 2010, our primary marketing focus was on in-store promotion programs and events and Internet marketing, including Facebook®, for both Wet Seal and Arden B stores. We expect to increase marketing and advertising spending modestly in fiscal 2011 in support of our business strategies.

Sourcing and Vendor Relationships

We purchase our merchandise primarily from domestic vendors. For fiscal 2010, approximately 14% of our retail merchandising receipts were directly imported from foreign vendors. Although in fiscal 2010 no single vendor provided more than 10% of our merchandise, management believes we are one of the largest customers of many of our smaller vendors. Quality control is monitored at the distribution points of our largest vendors and manufacturers, and merchandise is inspected upon arrival at our Foothill Ranch, California facility.

We do not maintain any long-term or exclusive commitments or arrangements to purchase merchandise from any single supplier, and there are many vendors who could supply our merchandise.

Allocation and Distribution of Merchandise

Our merchandising strategies depend on maintaining a regular flow of fresh, fashionable merchandise into our stores. Successful execution depends largely on our integrated buying, planning, allocation, and distribution functions. By working closely with store operations management and merchandise buyers, our teams of planners and allocators manage inventory levels and coordinate allocation of merchandise to each of our stores based on sales volume and store size, demographics, climate, and other factors that may influence an individual store’s product mix. We utilize merchandise planning software that assists us in streamlining the planning process. In fiscal 2009, we implemented size optimization software that we believe has begun to improve our allocation of sizes to better align with each store’s needs.

All merchandise is received from vendors at our Foothill Ranch, California distribution center, where items are inspected and prepared for shipping to our stores. We ship all of our merchandise to our stores by common carrier. Consistent with our goal of maintaining the freshness of our product offerings, we frequently ship new merchandise to stores, and markdowns are taken regularly to effect the rapid sale of slow-moving inventory. In fiscal 2009, we implemented markdown optimization at our Wet Seal division to improve the speed of selling through slow product and improve merchandise margins. Marked-down merchandise that remains unsold is either sent to select stores for deep discounting and sale, sent to our Internet store for selling, sold to an outside clearance company, or given to charity. The fulfillment process and distribution of merchandise for our online business is performed at our Foothill Ranch, California distribution center.

Information and Control Systems

Our merchandise, financial, and store computer systems are integrated and operate using primarily Oracle® technology. We have invested in a large data warehouse that provides management, buyers, and planners comprehensive data that helps us identify emerging trends and manage inventories. The core merchandise system is frequently enhanced to support strategic business initiatives.

Through an installation completed in fiscal 2010, all of our stores have a point-of-sale system operating on software provided by Oracle®. This system facilitates bar-coded ticket scanning, automatic price lookups, and

8

Table of Contents

centralized credit authorizations. All stores are networked to the corporate office via a centrally managed virtual private network. We utilize a store portal/intranet that is integrated with the corporate merchandise ERP system to provide the stores and corporate staff with current information regarding sales, promotions, inventory, and shipments, and enables more efficient communications with the corporate office. We utilize wide area networking hardware at all stores, which guards against security breaches to our stores point-of-sale system. We also recently upgraded our merchandising system, and launched new website platforms for the online businesses. In fiscal 2009, in order to further improve gross margin through the use of technology, we completed implementation of Oracle® Markdown Optimization for our Wet Seal stores, and we completed the implementation of the SAS® Size Optimization system. In 2010, to maximize the benefits of size optimization, we completed installation of a new distribution center automated sorter system to allow automated picking of customized size ranges for each store. In addition, a major upgrade to the Oracle® Retail Merchandising system began in fiscal 2010 and will be completed in early fiscal 2011.

Seasonality and Inflation

Our business is seasonal in nature, with the Christmas season, beginning the week of Thanksgiving and ending the first Saturday after Christmas, and the back-to-school season, beginning the last week of July and ending during September, historically accounting for a large percentage of our sales volume. For the past three fiscal years, the Christmas and back-to-school seasons together accounted for an average of slightly less than 30% of our annual sales.

We do not believe that inflation has had a material effect on our results of operations during the past three years. However, we began to experience merchandise cost pressures in the fourth quarter of fiscal 2010 as a result of rising commodity prices, primarily for cotton, and increased labor costs, due to labor shortages in China, from which a majority of our merchandise is sourced. In addition, the rising value of the currency in China relative to the U.S. dollar is expected to have a further impact on future product costs. Although our initial mark-ups have remained fairly stable to date, we experienced some deterioration in mark-up rates in fourth quarter 2010 merchandise receipts and are experiencing further cost increases for merchandise on order for the first half of fiscal 2011. In response to the costs increases, we have evaluated and modestly adjusted our pricing in certain categories and are assessing ongoing promotional strategies in efforts to help maintain or improve upon historical merchandise margin levels. We will continue to diligently monitor our costs as well as the competitive pricing environment in order to mitigate potential margin erosion. However, we cannot be certain that our business will not be affected by inflation in the future.

Trademarks

We own numerous trademarks, several of which are important to our business. Our primary and most significant trademarks and service marks are WET SEAL and ARDEN B, which are registered in the United States Patent and Trademark Office. We also have registered, or have applications pending for, a number of other trademarks including, but not limited to, ACCOMPLICE, B. REWARDED, BLINK by WET SEAL, BLUE ASPHALT, CHIC BOUTIQUE, CONTEMPO CASUALS, ENR EVOLUTION NOT REVOLUTION, FASHION INSIDER, FIT IN. STAND OUT., GET IT. WEAR IT. FLAUNT IT., iRUNWAY, LOVE THE TREND-HATE TO SPEND, SEAL STASH, TREND SPOT, STYLIZER, REBELLIOUS, and URBAN VIBE. In general, the registrations for these trademarks and service marks are renewable indefinitely as long as the marks are used as required under applicable regulations. We are not aware of any significant adverse claims or infringement actions relating to our trademarks or service marks.

Competition

The women’s retail apparel industry is highly competitive, with fashion, quality, price, location, and service being the principal competitive factors. Our Wet Seal and Arden B stores compete with specialty apparel retailers, department stores, and other apparel retailers, including Abercrombie & Fitch, Aeropostale, American

9

Table of Contents

Eagle, Anthropologie, Banana Republic, BCBG, bebe, Charlotte Russe, Express, Forever 21, Gap, Guess?, H&M, J.C. Penney, Nordstrom, Old Navy, Pacific Sunwear, Rue 21, Target, Urban Outfitters, Zara, and other regional retailers. Many of our competitors are large national chains that have substantially greater financial, marketing, and other resources than we do. While we believe we compete effectively for favorable site locations and lease terms, competition for prime locations within malls and power centers is intense, and we cannot ensure that we will be able to obtain new locations on terms favorable to us, if at all.

Customers

Our company’s business is not dependent upon a single customer or small group of customers.

Environmental Matters

We are not aware of any federal, state, or local environmental laws or regulations that will materially affect our earnings or competitive position, or result in material capital expenditures. However, we cannot predict the effect on our operations of possible future environmental legislation or regulations. During fiscal 2010, we did not make any material capital expenditures for environmental control facilities and no such material expenditures are anticipated for fiscal 2011.

Government Regulation

Our company is subject to various federal, state, and local laws affecting our business. Each of our company’s stores must comply with licensing and regulation by a number of governmental authorities in jurisdictions in which the store is located. To date, our company has not been significantly affected by any difficulty, delay, or failure to obtain required licenses or approvals.

Our company is also subject to federal and state laws governing such matters as employment and pay practices, overtime, and working conditions. The bulk of our company’s employees are paid on an hourly basis at rates related to the federal and state minimum wages. In the past, we have been assessed penalties or paid settlements to gain dismissal of lawsuits for noncompliance with certain of these laws, and future noncompliance could result in a material adverse effect on our company’s operations. In July 2006, May 2007, and September 2008, we were served with class action complaints alleging violations under certain State of California labor laws. In November 2006, we reached an agreement to settle the July 2006 class action complaint for approximately $0.3 million, and we have accrued within accrued liabilities in our consolidated balance sheet an amount equal to this settlement amount, awaiting final approval. On September 27, 2010, the Superior Court granted final approval of the settlement agreement; however, an appeal was subsequently filed on January 26, 2011. On December 17, 2010, the Court denied Plaintiffs’ Motion for Class Certification in its entirety on the May 2007 class action complaint and denied Plaintiffs’ Motion For Leave to File An Amended Complaint. Plaintiffs have appealed both orders but have not yet filed their opening appellate briefs. We are vigorously defending the May 2007 and September 2008 complaints and are unable to predict the likely outcomes and whether such outcomes may have a material adverse effect on our results of operations or financial condition. Accordingly, no provisions for loss contingencies for the May 2007 and September 2008 complaints have been accrued as of January 29, 2011.

We continue to monitor our facilities for compliance with the Americans with Disabilities Act, or the ADA, in order to conform to its requirements. Under the ADA, we could be required to expend funds to modify stores to better provide service to, or make reasonable accommodation for the employment of, disabled persons. We believe that expenditures, if required, would not have a material adverse effect on our company’s operations.

Employees

As of January 29, 2011, we had 6,982 employees, consisting of 2,047 full-time employees and 4,935 part-time employees. Full-time personnel consisted of 649 salaried employees and 1,398 hourly employees. All

10

Table of Contents

part-time personnel are hourly employees. Of all employees, 6,575 were sales personnel and 407 were administrative and distribution center personnel. Personnel at all levels of store operations are provided various opportunities for cash and/or other incentives based upon various individual store sales and other performance targets. All of our employees are nonunion, and, in management’s opinion, are paid competitively at current industry standards. We believe that our relationship with our employees is good.

| Item 1A. | Risk Factors |

Risks Related to our Business

General economic conditions, perceptions of such conditions by our customers and the impact on consumer confidence and consumer spending have adversely impacted our results of operations and may continue to do so.

Our performance is subject to general economic conditions and their impact on levels of consumer confidence and consumer spending. Consumer purchases of discretionary items, including our merchandise, generally decline during periods when disposable income is adversely affected or there is economic uncertainty. As a result of the continued difficult economic conditions, we may face risks that will impact many facets of our operations, including, among other things, the ability of one or more of our vendors to deliver their merchandise in a timely manner or otherwise meet their obligations to us. If continued poor economic conditions in the U.S. and world economic markets become more volatile, or if they deteriorate further, our business, financial condition, and results of operations may be adversely affected.

We may experience declines in comparable store sales in our Wet Seal division.

Although we had flat comparable store sales in our Wet Seal division in fiscal 2010, we did experience declines in fiscal 2009 and 2008, and we cannot assure that we will improve our comparable store sales in the future. In order to improve comparable store sales results, we will need to focus on a variety of factors, including fashion trends, our merchandise mix, holiday periods, actions of competitors, weather conditions and general economic conditions. There can be no guarantee that financial results of our Wet Seal division will improve and if they do, there can be no guarantee as to the timing, duration or significance of the improvement.

Our continued improvements in comparable store sales and improved operating results of our Arden B division may not be indicative of our future performance trends, and we cannot assure that we will be able to sustain such improvement in the future.

In fiscal 2007 and 2008, we experienced poor financial performance in our Arden B division. However, comparable store sales and operating results of our Arden B division have improved as a result of efforts by our senior management team, the closing or rebranding of underperforming stores, and changes to promotional and pricing strategies. There can be no guarantee that this improvement of our Arden B division will continue.

Our success depends to a significant extent on the performance of our senior management.

In general, our success depends to a significant extent on the performance of our senior management, particularly personnel engaged in merchandising and store operations, and on our ability to identify, hire and retain additional key management personnel. We have had significant changes in management recently and these changes may impact our ability to execute our business strategy.

Effective January 18, 2011, we appointed Ms. Susan P. McGalla as our new chief executive officer. As we noted in our announcement of her appointment, Ms. McGalla will not be based in our executive offices until August 2011. Additionally, effective March 28, 2011, we appointed Mr. Ken Seipel as our new president and chief operating officer. While Ms. McGalla and Mr. Seipel have immediately become involved in the day-to-day activities of our company, we expect that we will experience a transition period until they are fully integrated organizationally and until Ms. McGalla is fully integrated geographically. We cannot provide any assurance that

11

Table of Contents

there will not be any disruption that adversely impacts our customer relationships, employee morale and/or our business during such transition period. Further, in their roles as our chief executive officer and chief operating officer, Ms. McGalla and Mr. Seipel, respectively, may implement new strategic initiatives for our company. Because these strategic initiatives have not been formulated yet, we cannot predict how these initiatives will impact us. If they are ineffective, this would adversely affect our financial condition, results of operations and cash flow.

Our company’s ability to attract customers to our stores depends heavily on the success of the shopping centers in which many of our stores are located.

Substantially all of our stores are located in regional mall shopping centers. Factors beyond our control impact mall traffic, such as general economic conditions and consumer spending levels. Accordingly, consumer spending and mall traffic remain depressed due to the continued difficult economic conditions. As a result, mall operators have been facing increasing operational and financial difficulties. The increasing inability of mall “anchor” tenants and other area attractions to generate consumer traffic around our stores, the increasing inability of mall operators to attract “anchor” tenants and maintain viable operations and the increasing departures of existing “anchor” and other mall tenants due to declines in the sales volume and in the popularity of malls as shopping destinations, have reduced and may continue to reduce our sales volume and, consequently, adversely affect our financial condition, results of operations and/or cash flows.

Our ability to procure merchandise could be adversely affected by changes in our vendors’ factoring arrangements.

Changes in our vendors’ factoring arrangements may threaten the factors’ financial viability and ability to provide factoring services to its customers. Although we do not have a direct relationship with factors, a portion of our vendors who supply our company with merchandise have direct factoring arrangements. Vendors who engage in factoring transactions will typically sell their accounts receivable to a factor at a discount in exchange for cash payments, which can be used to finance the business and operations of the vendors.

If the financial condition of our vendors’ factors were to deteriorate and certain of our vendors were unable to procure alternative factoring arrangements from competitors of their factor on the same or substantially similar terms, our ability to timely procure merchandise for our stores could be adversely affected. This could require the devotion of significant time and attention by our management to adequately resolve such matters. In turn, our results of operations and financial condition could suffer.

Our ability to use net operating loss carryforwards to offset future taxable income for U.S. federal or state income tax purposes is subject to limitation.

We believe that our net operating losses (“NOLs”) are a valuable asset and we intend to take actions to protect the value of our NOLs. However, Section 382 of the Internal Revenue Code, or Section 382, contains provisions that may limit the availability of federal net operating loss carryforwards, or NOLs, to be used to offset taxable income in any given year upon the occurrence of certain events, including significant changes in our stockholders’ ownership interests in our company. Under Section 382, potential limitations on NOLs are triggered when there has been an “ownership change” (generally defined as a greater than 50% change (by value) in our stock ownership over a three-year period).

We incurred ownership changes in April 2005 and December 2006, which resulted in Section 382 limitations applying to NOLs generated prior to those dates, which were approximately $172.1 million. As a result of these ownership changes, of our $93.5 million NOLs as of January 29, 2011, we may utilize up to $58.3 million to offset taxable income in fiscal 2011 and 2012. Future transactions involving the sale or other transfer of our stock may result in additional ownership changes for purposes of Section 382. The occurrence of such additional ownership changes could limit our ability to utilize our remaining NOLs and possibly other tax attributes. Limitations imposed on our ability to use NOLs and other tax attributes to offset future taxable income

12

Table of Contents

could cause us to pay U.S. federal income taxes earlier than we otherwise would if such limitations were not in effect. Any further ownership change also could cause such NOLs and other tax attributes to expire unused, thereby reducing or eliminating the benefit of such NOLs and other tax attributes to us and adversely affecting our future cash flows.

In addition, we may determine that varying state laws with respect to NOL utilization may result in lower limits, or an inability to utilize NOLs in some states altogether, which could result in us incurring additional state income taxes. During fiscal 2008, the State of California passed legislation that suspended our ability to utilize NOLs to offset taxable income in fiscal 2008 and 2009. In late 2010, the State of California extended such legislation that further suspended use of NOLs to fiscal 2011. As a result, we incurred additional state income taxes in California, which increased our effective tax rate in fiscal 2008 through 2010. We may also generate income in future periods on a federal alternative minimum tax basis, which would result in alternative minimum taxes payable on a portion of such income. In the event that state law results in lower limits, or an inability to utilize loss carryforwards, or we become subject to federal alternative minimum tax, this could adversely affect our future cash flows.

If we are unable to anticipate and react to new fashion trends, our financial condition and results of operations could be adversely affected.

We rely on a limited demographic customer base for a large percentage of our sales. Our brand image is dependent upon our ability to anticipate, identify and provide fresh inventory reflecting current fashion trends.

Furthermore, the continued difficult economic conditions make it increasingly difficult for us to accurately predict product demand trends. If we fail to anticipate, identify or react appropriately or in a timely manner to these fashion trends, we could experience reduced consumer acceptance of our products, a diminished brand image and higher markdowns. These factors could adversely affect our financial condition and results of operations.

If we decrease the price that we charge for our products or offer extensive, continued promotions on our products, we may earn lower gross margins and our revenues and profitability may be adversely affected.

The prices that we are able to charge for our products depend on, among other things, the type of product offered, the consumer response to the product and the prices charged by our competitors. To the extent that we are forced to lower our prices, our gross margins will be lower and our revenues and profitability may be adversely affected.

If we are unable to pass through increases in raw material, labor and energy costs to our customers through price increases, our financial condition and results of operations could be adversely affected.

Our product costs are rising due to increasing commodity prices, primarily for cotton, as well as due to higher production labor and energy costs. We may not be able to, or may elect not to, pass these increases on to our customers through price increases, which may adversely affect our financial condition and results of operations.

We depend upon a single center for our corporate offices and distribution activities, and any significant disruption in the operation of this center could harm our business, financial condition, results of operations and/or cash flows.

Our corporate offices and the distribution functions for all of our stores and Internet business are handled from a single, leased facility in Foothill Ranch, California. In general, this area of California is subject to earthquakes and wildfires. Any significant interruption in the operation of this facility due to a natural disaster, arson, accident, system failure or other unforeseen event could delay or impair our ability to distribute merchandise to our stores and, consequently, lead to a decrease in sales. Furthermore, we have little experience operating essential functions away from our main corporate offices and are uncertain what effect operating satellite facilities might have on our business, personnel and results of operations. The financial losses incurred may exceed our insurance for earthquake damages and business interruption costs related to any such disruption. As a result, our business, financial condition, results of operations and/or cash flows could be adversely affected.

13

Table of Contents

Fluctuations in our revenues for the third fiscal quarter and the fourth fiscal quarter have a disproportionate effect on our overall financial condition, results of operations and/or cash flows.

We experience seasonal fluctuations in revenues, with a disproportionate amount of our revenues being generated in the third fiscal quarter “back-to-school” season, which begins the last week of July and ends during September, and the fourth fiscal quarter “holiday” season. Our revenues are generally lower during the first and second fiscal quarters. In addition, any factors that harm our third and fourth fiscal quarter operating results, including adverse weather or unfavorable economic conditions, could have a disproportionate effect on our results of operations for the entire fiscal year.

In order to prepare for our peak shopping seasons, we must order and keep in stock significantly more merchandise than we would carry at other times of the year. An unanticipated decrease in demand for our products during our peak shopping seasons could require us to sell excess inventory at a substantial markdown, which could reduce our net sales and gross profit. Alternatively, an unanticipated increase in demand for certain of our products could leave us unable to fulfill customer demand and result in lost sales and customer dissatisfaction.

Our quarterly results of operations may also fluctuate significantly as a result of a variety of other factors, including the merchandise mix and the timing and level of inventory markdowns. As a result, historical period-to-period comparisons of our revenues and operating results are not necessarily indicative of future period-to-period results. Reliance should not be placed on the results of a single fiscal quarter, particularly the third fiscal quarter “back-to-school” season or fourth fiscal quarter “holiday” season, as an indication of our annual results or our future performance.

Our failure to effectively compete with other retailers for sales and locations could have a material adverse effect on our financial condition, results of operations and/or cash flows.

The women’s retail apparel industry is highly competitive, with fashion, quality, price, location and service being the principal competitive factors. Our Wet Seal and Arden B stores compete with specialty apparel retailers, department stores and certain other apparel retailers, including Abercrombie & Fitch, Aeropostale, American Eagle, Anthropologie, Banana Republic, BCBG, bebe, Charlotte Russe, Express, Forever 21, Gap, Guess?, H&M, J.C. Penney, Nordstrom, Old Navy, Pacific Sunwear, Rue 21, Target, Urban Outfitters, Zara, and other regional retailers. Many of our competitors are large national chains that have substantially greater financial, marketing and other resources than we do. We face a variety of competitive challenges, including:

| • | anticipating and quickly responding to changing consumer demands; |

| • | maintaining favorable brand recognition and effectively marketing our products to consumers in narrowly-defined market segments; |

| • | developing innovative, high-quality products in sizes, colors and styles that appeal to consumers in our target markets and maintaining a sufficient quantity of these items for which there is the greatest demand; |

| • | obtaining favorable site locations within malls on reasonable terms; |

| • | sourcing merchandise efficiently; |

| • | pricing our products competitively and achieving customer perception of value; |

| • | offering attractive promotional incentives while maintaining profit margins; and |

| • | withstanding periodic downturns in the apparel industry. |

Our industry has low barriers to entry that allow the introduction of new products or new competitors at a fast pace. Any of these factors could result in reductions in sales or the prices of our products which, in turn, could have a material adverse effect on our financial condition, results of operations and/or cash flows.

14

Table of Contents

We expect to open between 25 and 30 Wet Seal stores, net of store closures, in fiscal 2011. At this time, we plan to conservatively grow our Arden B store base in fiscal 2011, with approximately four stores, net of store closures. While we believe we compete effectively for favorable site locations and lease terms, competition for prime locations within malls, in particular, and within other locations is intense and we cannot assure that we will be able to obtain new locations on terms favorable to us, if at all.

In addition, actions of our competitors, particularly increased promotional activity, can negatively impact our business. In light of the continued difficult economic conditions, pricing is a significant driver of consumer choice in our industry and we regularly engage in price competition, particularly through our promotional programs. To the extent that our competitors lower prices, through increased promotional activity or otherwise, our ability to maintain gross profit margins and sales levels may be negatively impacted. There can be no assurance that our competitors’ increased promotional activity will not negatively impact our business.

The upcoming expiration of leases for approximately 56 of our existing stores could lead to increased costs associated with renegotiating our leases and/or relocating our stores.

We have approximately 56 existing store leases scheduled to expire in fiscal 2011. In connection with the expiration of these leases, we will have to renegotiate new leases, which could result in higher rental amounts for each store and landlord requirements to remodel existing locations as a condition for renewal. We may not be able to obtain new lease terms that are favorable to us. In addition, as a result of renewal negotiations, we may be required by the landlord to remodel, which could result in significant capital expenditures. In addition, some landlords may refuse to renew our leases due to our lower sales per square foot as compared with other prospective tenants. If we are unable to agree to new terms with our landlords, we will have to close or relocate these stores, which could result in a significant expenditure and could lead to an interruption in the operation of our business at the affected stores, and we could be required to relocate to less desirable locations or may not be able to find viable locations at all.

Our hardware and software systems are vital to the efficient operation of our retail and Web-based stores, and damage to these systems could harm our business.

We rely on our computer hardware and software systems for the efficient operation of our retail and Web-based stores. Our information systems provide our management with real-time inventory, sales and cost information that is essential to the operation of our business. Due to our number of stores, geographic diversity and other factors, we would be unable to generate this information in a timely and accurate manner in the event our hardware or software systems were unavailable. These systems are vulnerable to damage or interruption from a number of factors, including earthquake, fire, flood and other natural disasters and power loss, computer systems failure, or security breaches, Internet and telecommunications or data network failure.

A significant information systems failure could reduce the quality or quantity of operating data available to our management. If this information were unavailable for any extended period of time, our management would be unable to efficiently run our business, which would result in a reduction in our net sales.

Because of the importance of our brand names, we may lose market share to our competitors if we fail to adequately protect our intellectual property rights.

We believe that our trademarks and other proprietary rights are important to our success and our competitive position. We have registered trademarks for Wet Seal and Arden B (which are registered in the retail store services and other classes). We take actions to establish and protect our intellectual property. However, others may infringe on our intellectual property rights or seek to block the sale of our products as violative of their intellectual property rights. If we are required to stop using any of our registered or nonregistered trademarks, our sales could decline and, consequently, our business and results of operations could be adversely affected.

15

Table of Contents

Covenants contained in agreements governing our senior credit facility restrict the manner in which we conduct our business, under certain circumstances, and our failure to comply with these covenants could result in a default under these agreements, which would have a material adverse effect on our business, financial condition, growth prospects and ability to procure merchandise for our stores.

Our senior revolving credit facility contains covenants that restrict the manner in which we conduct our business under certain circumstances. Subject to certain exceptions, these covenants restrict or limit our ability to, among other things:

| • | incur or guarantee additional indebtedness or refinance our existing indebtedness; |

| • | make certain investments or acquisitions; |

| • | merge, consolidate, dissolve or liquidate; |

| • | engage in certain asset sales (including the sale of stock); |

| • | repurchase stock; |

| • | grant liens on assets; |

| • | pay dividends; and |

| • | close stores. |

A breach of any of these covenants could result in a default under the agreements governing our existing indebtedness, acceleration of any amounts then outstanding, the foreclosure upon collateral securing the debt obligations, or the unavailability of the line of credit.

We do not authenticate the license rights of our suppliers.

We purchase merchandise from a number of vendors who purport to hold manufacturing and distribution rights under the terms of license agreements or that assert that their products are not subject to any restrictions as to distribution. We generally rely upon each vendor’s representation concerning those manufacturing and distribution rights and do not independently verify whether each vendor legally holds adequate rights to the licensed properties they are manufacturing or distributing. If we acquire unlicensed merchandise or merchandise violating a registered trademark, we could be obligated to remove it from our stores, incur costs associated with destruction of the merchandise if the vendor is unwilling or unable to reimburse us and be subject to civil and criminal liability. The occurrence of any of these events could adversely affect our financial condition, results of operations and/or cash flows.

We are subject to risks associated with our procurement of products from non-U.S. based vendors and U.S. vendors that purchase products internationally, any of which could have a material adverse effect on our business, financial condition, results of operations and/or cash flows.

The majority of our products are manufactured outside the U.S. and is primarily bought by us within the U.S. from domestic importers. As a result, we are susceptible to greater losses as a result of a number of risks inherent in doing business in international markets and from a number of factors beyond our control, any of which could have a material adverse effect on our business, financial condition, results of operations and/or cash flows.

These factors include:

| • | import or trade restrictions (including increased tariffs, customs duties, taxes or quotas) imposed by the U.S. government in respect of the foreign countries in which our products are currently manufactured or any of the countries in which our products may be manufactured in the future; |

16

Table of Contents

| • | political instability or acts of terrorism, significant fluctuations in the value of the U.S. dollar against foreign currencies, restrictions on the transfer of funds between the U.S. and foreign jurisdictions, and/or potential disruption of imports due to labor disputes at U.S. ports, any of which could adversely affect our merchandise flow and, consequently, cause our sales to decline; and |

| • | local business practices that do not conform to our legal or ethical guidelines. |

The U.S. and the countries in which our products are produced or sold may also, from time to time, impose new quotas, duties, tariffs or other restrictions, or adversely adjust prevailing quota, duty or tariff levels. In addition, none of our international suppliers or international manufacturers supplies or manufactures our products exclusively. As a result, we compete with other companies for the production capacity of independent manufacturers and import quota capacity. If we were unable to obtain our raw materials and finished apparel from the countries where we wish to purchase them, either because room under the necessary quotas was unavailable or for any other reason, or if the cost of doing so should increase, it could have a material adverse effect on our business, financial condition, results of operations and/or cash flows.

Violation of labor laws and practices by our suppliers could harm our business and results of operations.

Our company’s policy is to use only those sourcing agents and independent manufacturers who operate in material compliance with applicable laws and regulations. The violation of laws, particularly labor laws, by an independent manufacturer, or by one of the sourcing agents, or the divergence of an independent manufacturer’s or sourcing agent’s labor practices from those generally accepted as ethical in the U.S. or in the country in which the manufacturing facility is located, and the public revelation of those illegal or unethical practices, could cause significant damage to our company’s reputation. Although our manufacturer operating guidelines promote ethical business practices, we do not control the business and operations of the manufacturers and cannot guarantee their legal and regulatory compliance.

We are exposed to business risks as a result of our Internet operations.

We operate online stores at www.wetseal.com and www.ardenb.com. Our Internet operations are subject to numerous risks, including unanticipated operating problems, reliance on third-party computer hardware and software providers, system failures and the need to invest in additional computer systems. Specific risks include: (i) diversion of sales from our stores; (ii) rapid technological change; (iii) liability for online content; and (iv) risks related to the failure of the computer systems that operate the websites and their related support systems, including computer viruses, telecommunication failures and electronic break-ins and similar disruptions. In addition, Internet operations involve risks which are beyond our control that could have a direct material adverse effect on our operational results, including: (i) price competition involving the items we intend to sell; (ii) the entry of our vendors into the Internet business in direct competition with us; (iii) the level of merchandise returns experienced by us; (iv) governmental regulation; (v) online security breaches involving unauthorized access to our and/or customer information; (vi) credit card fraud; and (vii) competition and general economic conditions specific to the Internet, online commerce and the apparel industry. Our inability to effectively address these risks and any other risks that we face in connection with our Internet operations could materially adversely affect our business, financial condition, results of operations and/or cash flows.

Risks Related to our Common Stock

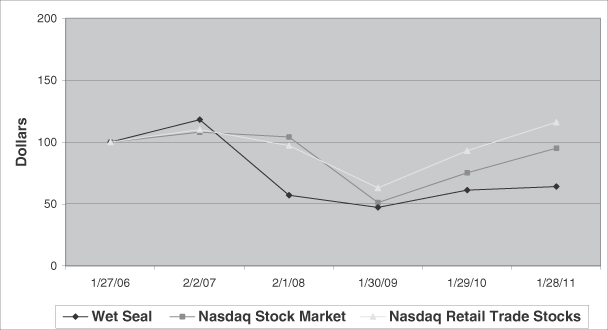

The price of our Class A common stock has fluctuated significantly during the past few years and may fluctuate significantly in the future.

Our Class A common stock, which is traded on the NASDAQ Global Market, has experienced and may continue to experience significant price and volume fluctuations that could adversely affect the market price of our Class A common stock. The market price of our Class A common stock is likely to fluctuate, both because of

17

Table of Contents

actual and perceived changes in our operating results and prospects and because of general volatility in the stock market. The market price of our Class A common stock could continue to fluctuate widely in response to factors such as:

| • | actual or anticipated variations in our results of operations, including comparable store sales; |

| • | the addition or loss of suppliers, customers and other business relationships; |

| • | changes in financial estimates of, and recommendations by, securities analysts; |

| • | conditions or trends in the apparel and consumer products industries; |

| • | additions or departures of key personnel; |

| • | sales of our Class A common stock; |

| • | general market and economic conditions; and |

| • | other events or factors, including the realization of any of the risks described in this risk factors section, many of which are beyond our control. |

Fluctuations in the price and trading volume of our Class A common stock in response to factors such as those set forth above could be unrelated or disproportionate to our actual operating performance.