Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - Sanchez Energy Corp | sn-20150930ex321376774.htm |

| EX-10.1 - EX-10.1 - Sanchez Energy Corp | sn-20150930ex101c2a455.htm |

| EX-31.2 - EX-31.2 - Sanchez Energy Corp | sn-20150930ex3124daa4d.htm |

| EX-31.1 - EX-31.1 - Sanchez Energy Corp | sn-20150930ex3113c765c.htm |

| 10-Q - 10-Q - Sanchez Energy Corp | sn-20150930x10q.htm |

| EX-32.2 - EX-32.2 - Sanchez Energy Corp | sn-20150930ex32298c2c3.htm |

EXECUTION

FOURTH AMENDMENT TO SECOND AMENDED

AND RESTATED CREDIT AGREEMENT

This fourth AMENDMENT TO SECOND AMENDED AND RESTATED CREDIT AGREEMENT (this “Fourth Amendment”), dated as of September 29, 2015, is entered into by and among SANCHEZ ENERGY CORPORATION, a Delaware corporation (“Borrower”), each of SEP HOLDINGS III, LLC, a Delaware limited liability company (“SEP”), SN MARQUIS LLC, a Delaware limited liability company (“SN Marquis”), SN COTULLA ASSETS, LLC, a Texas limited liability company (“SN Cotulla”), SN OPERATING, LLC, a Texas limited liability company (“SN Operating”), SN TMS, LLC, a Delaware limited liability company (“SN TMS”), and SN CATARINA, LLC, a Delaware limited liability company (“SN Catarina; together with SEP, SN Marquis, SN Cotulla, SN Operating and SN TMS collectively, the “Guarantors” and each, a “Guarantor”), the Required Lenders party hereto, and ROYAL BANK OF CANADA, as Administrative Agent for the Lenders (in such capacity, together with its successors in such capacity, the “Administrative Agent”) and as Issuing Bank.

RECITALS

A.The Borrower, the Guarantors, the Lenders, RBC, as Issuing Bank, and the Administrative Agent previously entered into that certain Second Amended and Restated Credit Agreement dated as of June 30, 2014 (as amended by that certain First Amendment to Second Amended and Restated Credit Agreement dated as of September 9, 2014, that certain Second Amendment to Second Amended and Restated Credit Agreement dated as of March 31, 2015, that certain Third Amendment to Second Amended and Restated Credit Agreement dated as of July 20, 2015 and as it may be further amended, restated, supplemented or modified from time to time, the “Credit Agreement”) and certain other Loan Documents (as defined in the Credit Agreement) in connection therewith.

B.The Borrower has requested that the Administrative Agent, RBC, as Issuing Bank, and the Lenders amend the Credit Agreement as set forth herein. The Administrative Agent, RBC, as Issuing Bank and the Required Lenders are willing to amend the Credit Agreement on the terms and conditions contained in this Fourth Amendment.

AGREEMENT

NOW, THEREFORE, in consideration of the foregoing and the mutual covenants set forth in this Fourth Amendment and other good and valuable consideration, the receipt and sufficiency of which are acknowledged by the parties hereto, the Borrower, the Guarantors, the Required Lenders, the Issuing Bank and the Administrative Agent agree as follows:

1.Defined Terms. Unless otherwise defined herein, capitalized terms used herein have the meanings assigned to them in the Credit Agreement.

2.Specific Amendments to Credit Agreement. The Credit Agreement is hereby amended as follows:

(i) Recital F of the Credit Agreement is hereby amended by deleting the words “the Issuing Bank” and substituting therefor the words “Royal Bank of Canada, as an Issuing Bank”.

(ii) The following defined terms are hereby added to Section 1.02 of the Credit Agreement in the proper alphabetical order:

“Bee County Gas Processing Property Ownership and Operating Agreement” means the Ownership and Operating Agreement between SN Catarina and the Eagle Ford Midstream JV Counterparty with respect to the ownership and operation of the gas processing facility that is the subject of the Bee County Gas Processing Property.

“Catarina Midstream” means Catarina Midstream, LLC, a Delaware limited liability company, and wholly-owned Subsidiary of SN Catarina to whom the DW Midstream Assets and SPP Units are contributed as part of the DW Midstream Transaction and which is an Unrestricted Subsidiary until such time as the disposition of Equity Interests in Catarina Midstream described in clause (iii) of the definition of DW Midstream Transaction closes.

“Fourth Amendment” means that certain Fourth Amendment to Second Amended and Restated Credit Agreement dated the Fourth Amendment Effective Date among the Borrower, the Guarantors, the Required Lenders, RBC, as Issuing Bank, and the Administrative Agent.

“Fourth Amendment Effective Date” means September 29, 2015.

(iii) The defined term “Agreement” in Section 1.02 of the Credit Agreement is hereby deleted and the following is substituted therefor:

“Agreement” means this Second Amended and Restated Credit Agreement, as amended by the First Amendment, Second Amendment, Third Amendment, Fourth Amendment and as the same may from time to time be amended, modified, supplemented or restated.

(iv) The defined term “Alternate Base Rate” in Section 1.02 of the Credit Agreement is hereby amended to delete “in effect” in clause (c) of the first sentence thereof and substitute therefor “commencing”.

(v) The defined term “Annualized Consolidated EBITDA” in Section 1.02 of the Credit Agreement is amended to delete “and 9.01(c)” from the first sentence thereof.

(vi) The defined term “Bee County Gas Processing Property” in Section 1.02 of the Credit Agreement is hereby deleted and the following is substituted therefor:

“Bee County Gas Processing Property” means a ten percent (10%) undivided interest in that certain gas processing facility in Bee County, Texas and

-2-

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement

includes all permits, licenses, rights and other property received in connection therewith.

(vii)The defined term “DW Midstream Assets” in Section 1.02 of the Credit Agreement is hereby deleted and the following is substituted therefor:

“DW Midstream Assets” means those Eligible Midstream Assets in Dimmit and Webb Counties, Texas used to deliver Hydrocarbons produced by one or more Loan Parties and either contributed to Catarina Midstream or sold to the DW Midstream Counterparty as part of the DW Midstream Transaction.

(viii)The defined term “DW Midstream Counterparty” in Section 1.02 of the Credit Agreement is hereby deleted and the following is substituted therefor:

“DW Midstream Counterparty” means the purchaser or parent entity of the purchaser, as the context requires, of the DW Midstream Assets or the Equity Interests in Catarina Midstream, as applicable, as part of the DW Midstream Transaction.

(ix)The defined term “DW Midstream Transaction” in Section 1.02 of the Credit Agreement is hereby deleted and the following is substituted therefor:

“DW Midstream Transaction” collectively means (i) the contribution of the DW Midstream Assets by a Loan Party to Catarina Midstream; (ii) the contribution of some or all of the SPP Units to Catarina Midstream; (iii) the disposition by a Loan Party of 50% to 100% of the Equity Interests in Catarina Midstream to the DW Midstream Counterparty or the disposition of such DW Midstream Assets to the DW Midstream Counterparty, in exchange for cash, DW Midstream Counterparty Equity Interests or DW Midstream Counterparty Notes; provided that no less than 75% of the aggregate consideration received by the Loan Parties in exchange for such Equity Interests in Catarina Midstream or such DW Midstream Assets, as applicable, is in the form of cash or “cash equivalents” as defined in the indentures governing the Senior Unsecured Notes; (iii) the retention by any Loan Party of any joint and several liability in connection with Eligible Midstream Assets transferred to an Unrestricted Subsidiary, including the DW Midstream Assets, to the extent required under the terms of the HIL Lease and (iv) one or more Loan Parties entering into gathering, transportation, gas processing, and other midstream services agreements with the DW Midstream Counterparty and/or its Affiliates, the terms of which gathering, transportation, gas processing, and other midstream services agreements are acceptable to Administrative Agent, as confirmed by the Administrative Agent in writing when such agreements are or were entered into.

(x)The defined term “Eagle Ford Midstream JV Transaction” in Section 1.02 of the Credit Agreement is hereby deleted and the following is substituted therefor:

-3-

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement

“Eagle Ford Midstream JV Transaction” collectively means (a) the acquisition by SN Catarina of the Bee County Gas Processing Property, (b) direct or indirect Investments by any Loan Party in the Eagle Ford Midstream JV Sanchez Party, any Unrestricted Subsidiary parent entity thereof, and/or the Eagle Ford Midstream JV in an aggregate amount, without duplication, not to exceed $80,000,000, comprised of (i) cash contributions to the Eagle Ford Midstream JV Sanchez Party (including cash contributions made indirectly through the Eagle Ford Midstream JV Sanchez Party’s Unrestricted Subsidiary parent(s), if any), (ii) Eagle Ford Midstream JV Transaction Additional Fees, (iii) net amounts paid pursuant to the Eagle Ford Midstream JV Transaction Netting Agreement to the extent not reimbursed pursuant to the Eagle Ford Midstream JV Transaction Reimbursement Agreement, (iv) amounts paid pursuant to the Eagle Ford Midstream JV Transaction Guaranty to the extent not reimbursed pursuant to the Eagle Ford Midstream JV Transaction Reimbursement Agreement, (v) Letters of Credit issued to support obligations of the Eagle Ford Midstream JV Sanchez Party (less any amounts drawn thereunder and reimbursed pursuant to the Eagle Ford Midstream JV Transaction Reimbursement Agreement) and (vi) amounts realized upon the enforcement, if any, of the Eagle Ford Midstream JV Transaction Pledge Agreement, (c) any Loan Party entering into and performing its obligations under the Eagle Ford Midstream JV Transaction Guaranty, the Eagle Ford Midstream JV Transaction Netting Agreement, the Eagle Ford Midstream JV Transaction Pledge Agreement, the Eagle Ford Midstream JV Transaction Agreements and the Eagle Ford Midstream JV Transaction Reimbursement Agreement, in the case of any such performance which constitutes a direct or indirect Investment by a Loan Party in the Eagle Ford Midstream JV Sanchez Party, any Unrestricted Subsidiary parent entity thereof, and/or the Eagle Ford Midstream JV, to the extent described in clause (b) of this definition, (d) if SN Catarina so elects, the exchange of some or all of the Bee County Gas Processing Property for the Initial Eagle Ford Midstream JV Units and (e) the grant by SN Catarina of a security interest in the Bee County Gas Processing Property, the Bee County Gas Processing Property Ownership and Operating Agreement and in any Eagle Ford Midstream JV Units and rights in the Eagle Ford Midstream JV LLC Agreement so acquired, and certain related property and any proceeds thereof pursuant to the Eagle Ford Midstream JV Transaction Pledge Agreement and, in the case of any Eagle Ford Midstream JV Units and rights in the Eagle Ford Midstream JV LLC Agreement so acquired, the Eagle Ford Midstream JV LLC Agreement. For the sake of clarity, the purchase price of the Bee County Gas Processing Property will count against the $80,000,000 amount in this definition but the value of so much of the Bee County Gas Processing Property as is exchanged for the Initial Eagle Ford Midstream JV Units, and fees and other amounts paid by the Loan Parties under the Eagle Ford Midstream JV Transaction Agreements on arms’ length terms, as determined by the Borrower in good faith, shall not constitute Investments and shall not count against the $80,000,000 amount in this definition.

-4-

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement

(xi)The defined term “Eagle Ford Midstream JV Transaction Additional Fees” in Section 1.02 of the Credit Agreement is hereby deleted and the following is substituted therefor:

“Eagle Ford Midstream JV Transaction Additional Fees” means “Additional Processing Fees” and “Additional Processing True-Up Fees”, each as defined in the Eagle Ford Midstream JV Transaction Agreements.

(xii)The defined term “Eagle Ford Midstream JV Transaction Agreements” in Section 1.02 of the Credit Agreement is hereby deleted and the following is substituted therefor:

“Eagle Ford Midstream JV Transaction Agreements” means the purchase and sale agreement for the Bee County Gas Processing Property, the Bee County Gas Processing Property Ownership and Operating Agreement, natural gas processing agreements, gathering agreements and related agreements, if any, entered into with the Eagle Ford Midstream JV Counterparty in connection with the Eagle Ford Midstream JV Transaction, which purchase and sale agreement, Bee County Gas Processing Property Ownership and Operating Agreement, natural gas processing agreements, gathering agreements and related agreements are acceptable to Administrative Agent, as confirmed by the Administrative Agent in writing when such agreements are or were entered into.

(xiii)The defined term “Eagle Ford Midstream JV Transaction Netting Agreement” in Section 1.02 of the Credit Agreement is hereby deleted and the following is substituted therefor:

“Eagle Ford Midstream JV Transaction Netting Agreement” means an agreement between one or more Loan Parties, the Eagle Ford Midstream JV Sanchez Party and, if applicable, the Eagle Ford Midstream JV (collectively for purposes of this definition, the “Sanchez Parties”) on the one hand and the Eagle Ford Midstream JV Counterparty and, if applicable, the Eagle Ford Midstream JV on the other hand, which agreement is acceptable to Administrative Agent, as confirmed by the Administrative Agent in writing when such agreement is or was entered into and provides for the netting of amounts owed by the Sanchez Parties to the Eagle Ford Midstream JV Counterparty under the Eagle Ford Midstream JV Transaction Agreements against amounts owed by the Eagle Ford Midstream JV Counterparty to the Sanchez Parties under the Eagle Ford Midstream JV Transaction Agreements.

(xiv)The defined term “Eagle Ford Midstream JV Transaction Pledge Agreement” in Section 1.02 of the Credit Agreement is hereby deleted and the following is substituted therefor:

“Eagle Ford Midstream JV Transaction Pledge Agreement” means the pledge agreement made by SN Catarina and the Eagle Ford Midstream JV Sanchez Party in favor of the Eagle Ford Midstream JV Counterparty and, if applicable, the Eagle Ford Midstream JV, which pledge agreement is acceptable to Administrative Agent, as confirmed by the Administrative Agent in writing when such pledge agreement is or was entered into.

-5-

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement

(xv) The defined term “Eligible Midstream Assets” in Section 1.02 of the Credit Agreement is hereby amended by inserting the following sentence at the end thereof:

“For the sake of clarity, Eligible Midstream Assets includes permits, licenses, rights and other property (whether granted by a Loan Party or a third party, including any Governmental Authority) used or useful in connection with the operation of Eligible Midstream Assets.”

(xvi) The defined term “First Amendment” in Section 1.02 of the Credit Agreement is hereby deleted and the following is substituted therefor:

“First Amendment” means that certain First Amendment to Second Amended and Restated Credit Agreement dated the First Amendment Effective Date among the Borrower, the Guarantors, the Required Lenders, RBC, as an Issuing Bank and the Administrative Agent.

(xvii) The defined term “Initial Eagle Ford Midstream JV Units” in Section 1.02 of the Credit Agreement is hereby deleted and the following is substituted therefor:

“Initial Eagle Ford Midstream JV Units” means Equity Interests in the Eagle Ford Midstream JV in an amount equal to the lesser of (i) 2% of the issued and outstanding Equity Interests in the Eagle Ford Midstream JV at the time of acquisition by a Loan Party thereof and (ii) such amount of the issued and outstanding Equity Interests in the Eagle Ford Midstream JV at the time of acquisition by a Loan Party thereof as has a value of $5,000,000, as determined by the Borrower in good faith at such time. For the sake of clarity, SN Catarina may receive more than the foregoing amounts; provided that any excess over and above such amounts is distributed by SN Catarina substantially concurrently to Borrower and Borrower substantially concurrently after receipt of such excess amount contributes such excess amount to SN Midstream.

(xviii) The defined term “Issuing Bank” in Section 1.02 of the Credit Agreement is hereby deleted and the following is substituted therefor:

“Issuing Bank” means RBC and any other Lender that agrees with the Borrower and Administrative Agent to act as an Issuing Bank, in each case, in its capacity as an issuer of Letters of Credit hereunder, and its successors in such capacity as provided in Section 2.08(i).

(xix)The defined term “LC Commitment” in Section 1.02 of the Credit Agreement is hereby deleted and the following is substituted therefor:

“LC Commitment” at any time means Eighty Million Dollars ($80,000,000).

(xx)The defined term “Point Comfort Port JV Transaction” in Section 1.02 of the Credit Agreement is hereby deleted and the following is substituted therefor:

-6-

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement

“Point Comfort Port JV Transaction” collectively means (a) direct or indirect Investments by any Loan Party in the Point Comfort Port JV Sanchez Party, any Unrestricted Subsidiary parent entity thereof, and/or the Point Comfort Port JV in an aggregate amount, without duplication, not to exceed $10,000,000 comprised of (i) cash contributions to the Point Comfort Port JV Sanchez Party (including cash contributions made indirectly through the Point Comfort Port JV Sanchez Party’s Unrestricted Subsidiary parent(s), if any) and (ii) amounts paid pursuant to the Point Comfort Port JV Transaction Guaranty to the extent not reimbursed by the Point Comfort Port JV Sanchez Party and (b) any Loan Party entering into and performing its obligations under the Point Comfort Port JV Transaction Guaranty and the Point Comfort Port JV Transaction Agreements, in the case of any such performance which constitutes a direct or indirect Investment by a Loan Party in the Point Comfort Port JV Sanchez Party, to the extent described in clause (a) of this definition.

(xxi)The defined term “Second Amendment” in Section 1.02 of the Credit Agreement is hereby deleted and the following is substituted therefor:

“Second Amendment” means that certain Second Amendment to Second Amended and Restated Credit Agreement dated the Second Amendment Effective Date among the Borrower, the Guarantors, the Required Lenders, RBC, as an Issuing Bank and the Administrative Agent.

(xxii)The defined term “Third Amendment” in Section 1.02 of the Credit Agreement is hereby deleted and the following is substituted therefor:

“Third Amendment” means that certain Third Amendment to Second Amended and Restated Credit Agreement dated the Third Amendment Effective Date among the Borrower, the Guarantors, the Required Lenders, RBC, as an Issuing Bank and the Administrative Agent.

(xxiii) The introductory clause to the defined term “Unrestricted Subsidiary” in Section 1.02 of the Credit Agreement is hereby deleted and the following is substituted therefor:

“Unrestricted Subsidiary” means SN Midstream, SN Services, Catarina Midstream and each other Subsidiary of the Borrower that is designated by the Board of Directors of the Borrower as an Unrestricted Subsidiary pursuant to a resolution of the Board of Directors of Borrower (in each case for so long as such Person remains a Subsidiary), but only to the extent that such Subsidiary:

(xxiv) The second sentence after clause (d) of the defined term “Unrestricted Subsidiary” in Section 1.02 of the Credit Agreement is hereby amended by restating “If at any time any Unrestricted Subsidiary would fail” to read “If at any time any Unrestricted Subsidiary remains a Subsidiary and would fail”.

-7-

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement

(xxv)The following terms defined in Section 1.02 of the Credit Agreement are hereby deleted in their entirety:

“Annualized Consolidated Net Interest Expense”

“DW Midstream Unrestricted Subsidiary”

(xxvi)The first sentence of Section 2.08(a) of the Credit Agreement is hereby deleted and the following is substituted therefor:

“Subject to the terms and conditions set forth herein, the Borrower may request any Issuing Bank to issue Letters of Credit in dollars for its own account or for the account of any of its Restricted Subsidiaries (or, subject to the limitations of Section 9.05(l), any Person that at the time of such issuance is an Unrestricted Subsidiary or JV Entity), in a form reasonably acceptable to the Administrative Agent and such Issuing Bank, at any time and from time to time during the Availability Period.”

(xxvii)The introductory clause of the first sentence of Section 2.08(b) of the Credit Agreement is hereby deleted and the following is substituted therefor:

“To request the issuance of a Letter of Credit (or the amendment, renewal or extension of an outstanding Letter of Credit), the Borrower shall hand deliver or telecopy (or transmit by electronic communication, if arrangements for doing so have been approved by the applicable Issuing Bank) to the Issuing Bank selected by the Borrower and to the Administrative Agent (not less than three (3) Business Days in advance of the requested date of issuance, amendment, renewal or extension) a notice:”

(xxviii)The second sentence of Section 2.08(b) of the Credit Agreement is hereby deleted and the following is substituted therefor:

“If requested by such Issuing Bank, the Borrower shall submit a letter of credit application on such Issuing Bank’s standard form in connection with any request for a Letter of Credit.”

(xxix)The introductory clause of the first sentence of Section 2.08(e) of the Credit Agreement is hereby deleted and the following is substituted therefor:

“If any Issuing Bank shall make any LC Disbursement in respect of a Letter of Credit, the Borrower shall reimburse such LC Disbursement by paying such Issuing Bank, through the Administrative Agent, an amount equal to such LC Disbursement …”

(xxx)The fourth sentence of Section 2.08(e) of the Credit Agreement is hereby deleted and the following is substituted therefor:

-8-

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement

“Promptly following receipt by the Administrative Agent of any payment from the Borrower pursuant to this Section 2.08(e), the Administrative Agent shall distribute such payment to the applicable Issuing Bank or, to the extent that Lenders have made payments pursuant to this Section 2.08(e) to reimburse such Issuing Bank, then to such Lenders and such Issuing Bank as their interests may appear.”

(xxxi)The second sentence of Section 2.08(f) of the Credit Agreement is hereby deleted and the following is substituted therefor:

“Neither the Administrative Agent, the Lenders nor any Issuing Bank, nor any of their Related Parties shall have any liability or responsibility by reason of or in connection with the issuance or transfer of any Letter of Credit or any payment or failure to make any payment thereunder (irrespective of any of the circumstances referred to in the preceding sentence), or any error, omission, interruption, loss or delay in transmission or delivery of any draft, notice or other communication under or relating to any Letter of Credit (including any document required to make a drawing thereunder), any error in interpretation of technical terms or any consequence arising from causes beyond the control of such Issuing Bank; provided that the foregoing shall not be construed to excuse such Issuing Bank from liability to the Borrower to the extent of any direct damages (as opposed to consequential damages, claims in respect of which are hereby waived by the Borrower to the extent permitted by applicable law) suffered by the Borrower that are caused by such Issuing Bank’s failure to exercise care when determining whether drafts and other documents presented under a Letter of Credit comply with the terms thereof.”

(xxxii) Section 2.08(g) of the Credit Agreement is hereby deleted and the following is substituted therefor:

“(g) Disbursement Procedures. Each Issuing Bank shall, promptly following its receipt thereof, examine all documents purporting to represent a demand for payment under a Letter of Credit issued by it. Such Issuing Bank shall promptly notify the Administrative Agent and the Borrower by telephone (confirmed by telecopy) of such demand for payment and whether such Issuing Bank has made or will make an LC Disbursement thereunder; provided that any failure to give or delay in giving such notice shall not relieve the Borrower of its obligation to reimburse such Issuing Bank and the Lenders with respect to any such LC Disbursement.”

(xxxiii)Section 2.08(h) of the Credit Agreement is hereby deleted and the following is substituted therefor:

“(h) Interim Interest. If an Issuing Bank shall make any LC Disbursement, then, until the Borrower shall have reimbursed such Issuing Bank for such LC Disbursement (either with its own funds or a Borrowing under Section 2.08(e)),

-9-

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement

the unpaid amount thereof shall bear interest, for each day from and including the date such LC Disbursement is made to but excluding the date that the Borrower reimburses such LC Disbursement, at the rate per annum then applicable to ABR Loans. Interest accrued pursuant to this Section 2.08(h) shall be for the account of the applicable Issuing Bank, except that interest accrued on and after the date of payment by any Lender pursuant to Section 2.08(d) to reimburse such Issuing Bank shall be for the account of such Lender to the extent of such payment.”

(xxxiv)The first sentence of Section 2.08(i) of the Credit Agreement is hereby deleted and the following is substituted therefor:

“Any Issuing Bank may be replaced or resign at any time by written agreement among the Borrower, the Administrative Agent, such replaced Issuing Bank and a successor Issuing Bank.”

(xxxv)The seventh sentence of Section 2.08(j) of the Credit Agreement is hereby deleted and the following is substituted therefor:

“Moneys in such account shall be applied by the Administrative Agent to reimburse, on a pro rata basis, the Issuing Banks for LC Disbursements for which they have not been reimbursed and, to the extent not so applied, shall be held for the satisfaction of the reimbursement obligations of the Borrower for the LC Exposure at such time or, if the maturity of the Loans has been accelerated, be applied to satisfy other obligations of the Borrower under this Agreement or the other Loan Documents pursuant to Section 10.02(c).”

(xxxvi)Section 5.06(c)(v) of the Credit Agreement is hereby deleted and the following is substituted therefor:

“(v) if any Defaulting Lender’s LC Exposure is neither cash collateralized nor reallocated pursuant to this Section 5.06(c), then, without prejudice to any rights or remedies of any Issuing Bank or any Lender hereunder, all commitment fees that otherwise would have been payable to such Defaulting Lender (solely with respect to the portion of such Defaulting Lender’s Commitment that was utilized by such LC Exposure) and letter of credit fees payable under Section 3.05(b) with respect to such Defaulting Lender’s LC Exposure shall be payable to the applicable Issuing Banks ratably in accordance with their respective shares of the Defaulting Lender’s LC Exposure that is neither cash collateralized or reallocated until such LC Exposure is cash collateralized and/or reallocated;”

(xxxvii)Section 5.06(d) of the Credit Agreement is hereby deleted and the following is substituted therefor:

“(d) so long as any Lender is a Defaulting Lender, no Issuing Bank shall be required to issue, amend or increase any Letter of Credit issued by it, unless it

-10-

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement

is satisfied that the related LC Exposure will be 100% covered by the Commitments of the non-Defaulting Lenders and/or cash collateral will be provided by the Borrower in accordance with Section 5.06(c), and participating interests in any such newly issued or increased Letter of Credit shall be allocated among non-Defaulting Lenders in a manner consistent with Section 5.06(c)(i) (and Defaulting Lenders shall not participate therein); and”

(xxxviii)The second sentence of Section 7.01 of the Credit Agreement is hereby deleted and the following is substituted therefor:

“As of the Fourth Amendment Effective Date, Schedule 7.01 is an accurate corporate organizational chart of Borrower and its Subsidiaries and shows the ownership of all Equity Interests in such Persons.”

(xxxix) Section 7.14 of the Credit Agreement is hereby deleted and the following is substituted therefor:

“Section 7.14 Subsidiaries. Schedule 7.14 sets forth the name of, and the ownership interest of Borrower in, each Subsidiary of Borrower as of the Fourth Amendment Effective Date. As of the Fourth Amendment Effective Date there are no Unrestricted Subsidiaries other than SN Midstream, SN Services and Catarina Midstream; provided at such time as the disposition of Equity Interests in Catarina Midstream described in clause (iii) of the definition of DW Midstream Transaction closes Catarina Midstream will cease to be an Unrestricted Subsidiary.”

(xl)Section 9.04 of the Credit Agreement is hereby amended by deleting the word “and” before clause (e) and inserting the following new clause (f) immediately before the proviso:

“and (f) repurchases, for aggregate consideration not to exceed $1,000,000, of Equity Interests issued by Borrower;”

(xli) Section 9.05(l) of the Credit Agreement is hereby amended by restating the text therein that reads “Letters of Credit issued hereunder to support Debt or other obligations of any Unrestricted Subsidiary or any JV Entity” to read “Letters of Credit issued hereunder to support Debt or other obligations of any Person that, at the time of issuance of such Letter of Credit, is an Unrestricted Subsidiary or JV Entity”.

(xlii)Section 9.05(m) of the Credit Agreement is hereby deleted and the following is substituted therefor:

“(m)Investments in Unrestricted Subsidiaries (including for the avoidance of doubt Investments in Catarina Midstream, the Eagle Ford Midstream JV Sanchez Party, the Point Comfort Port JV Sanchez Party, SN Midstream and SN Services in excess of amounts otherwise provided in this Agreement)

-11-

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement

(excluding Letters of Credit to support Debt or other obligations of Unrestricted Subsidiaries and JV Entities, which shall be permitted only to the extent permitted under Section 9.05(l) and, in the case of the Eagle Ford Midstream JV Sanchez Party, Section 9.05(n)) comprised of (i) cash in an aggregate amount at any time outstanding not exceeding the remainder of (A) the Unrestricted Subsidiary Maximum Cash Investment Amount minus (B) the aggregate face amount outstanding of Letters of Credit issued pursuant to Section 9.05(l), (ii) Eligible Midstream Assets and (iii) SPP Units;”

(xliii) Clause (ii) in the introductory paragraph of Section 9.11 of the Credit Agreement is hereby amended by inserting “and SPP Units” after “Eligible Midstream Assets”.

(xliv)Section 9.11(f) of the Credit Agreement is hereby deleted and the following is substituted therefor:

“(f)the sale, conveyance, transfer, lease or other disposition of (i) Eligible Midstream Assets, (ii) SPP Units and (iii) cash to an Unrestricted Subsidiary pursuant to Sections 9.05(m) and 9.05(n).”

(xlv) Section 11.09 of the Credit Agreement is hereby amended by inserting the following text at the end thereof:

“Notwithstanding anything to the contrary in this Agreement or any other Loan Document, (i) until such time as the security interests in the right, title and interest of SN Catarina in the Bee County Gas Processing Property, the Bee County Gas Processing Property Ownership and Operating Agreement, the Eagle Ford Midstream JV Units and the Eagle Ford Midstream JV LLC Agreement and any proceeds of any thereof are released in accordance with the Eagle Ford Midstream JV Transaction Pledge Agreement and the Eagle Ford Midstream JV LLC Agreement, none of such right, title and interest shall be subject to any security interest or other Lien to secure the Obligations and (ii) each Lender and each Issuing Bank hereby authorizes the Administrative Agent to execute and deliver to the Borrower, at the Borrower’s sole cost and expense, any and all releases of Liens, termination statements, assignments or other documents reasonably requested by the Borrower in connection therewith. The delivery by the Administrative Agent of all releases of Liens, termination statements, assignments or other documents reasonably requested by the Borrower in connection with the contribution of the DW Midstream Assets by a Loan Party to Catarina Midstream in connection with the DW Midstream Transaction is subject to the condition that the Administrative Agent shall have received evidence reasonably satisfactory to it that the Loan Party contributing such DW Midstream Assets shall receive the purchase price therefor substantially concurrently with the execution and delivery of such releases, terminations statements, assignments or other documents.

-12-

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement

(xlvi) The second proviso in Section 12.02(b) of the Credit Agreement is hereby deleted and the following is substituted therefor:

“provided further that no such agreement shall amend, modify or otherwise affect the rights or duties of the Administrative Agent or any Issuing Bank hereunder or under any other Loan Document without the prior written consent of the Administrative Agent or such Issuing Bank, as the case may be.”

(xlvii) Section 12.03(c) of the Credit Agreement is hereby deleted and the following is substituted therefor:

“(c) To the extent that the Borrower fails to pay any amount required to be paid by it to the Administrative Agent or any Issuing Bank under Section 12.03(a) or Section 12.03(b), each Lender severally agrees to pay to the Administrative Agent or such Issuing Bank, as the case may be, such Lender’s Applicable Percentage (determined as of the time that the applicable unreimbursed expense or indemnity payment is sought) of such unpaid amount; provided that the unreimbursed expense or indemnified loss, claim, damage, liability or related expense, as the case may be, was incurred by or asserted against the Administrative Agent or such Issuing Bank in its capacity as such.”

(xlviii) The second sentence of Section 12.04(a) of the Credit Agreement is hereby deleted and the following is substituted therefor:

“Nothing in this Agreement, expressed or implied, shall be construed to confer upon any Person (other than the parties hereto, their respective successors and assigns permitted hereby (including any Affiliate of an Issuing Bank that issues any Letter of Credit), Participants (to the extent provided in Section 12.04(c)) and, to the extent expressly contemplated hereby, the Related Parties of each of the Administrative Agent, the Issuing Banks and the Lenders) any legal or equitable right, remedy or claim under or by reason of this Agreement.”

(xlix) The first sentence of Section 12.04(c)(i) of the Credit Agreement is hereby deleted and the following is substituted therefor:

“(c)(i) Any Lender may, without the consent of the Borrower, the Administrative Agent or any Issuing Bank, sell participations to one or more banks or other entities (a “Participant”) in all or a portion of such Lender’s rights and obligations under this Agreement (including all or a portion of its Commitment and the Loans owing to it); provided that (1) such Lender’s obligations under this Agreement shall remain unchanged, (2) such Lender shall remain solely responsible to the other parties hereto for the performance of such obligations and (3) the Borrower, the Administrative Agent, the Issuing Banks and the other Lenders shall continue to deal solely and directly with such Lender in connection with such Lender’s rights and obligations under this Agreement.”

-13-

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement

(l) The first sentence of Section 12.13 of the Credit Agreement is hereby deleted and the following is substituted therefor:

“This Agreement, the other Loan Documents, and the agreement of the Lenders to make Loans and the Issuing Banks to issue, amend, renew or extend Letters of Credit hereunder are solely for the benefit of the Borrower, and no other Person (including, without limitation, any Subsidiary of the Borrower, any obligor, contractor, subcontractor, supplier or materialmen) shall have any rights, claims, remedies or privileges hereunder or under any other Loan Document against the Administrative Agent, any Issuing Bank or any Lender for any reason whatsoever.”

(li)The words “the Issuing Bank” are deleted and the words “any Issuing Bank” are substituted therefor in the following:

(a)the defined terms “Change in Law,” “Excluded Taxes,” “Governmental Authority, “LC Disbursement,” “Letter of Credit Agreements,” “Material Adverse Effect,” “Obligations”; and

(b)the third sentence of Section 2.08(j), the first sentence of Section 4.02, Section 5.01(b), the first sentence of Section 5.01(c), Section 5.01(d), Section 6.02(e), the first sentence of Section 12.02(a), the fourth sentence of Section 12.02(a), Section 12.03(a)(iv), the third sentence of Section 12.04(b)(iv), Section 12.05(a), Section 12.11(h)(ii), and the second sentence of Section 12.11.

(lii)The words “the Issuing Bank” are deleted and the words “an Issuing Bank” are substituted therefor in the following:

(a)the defined term “Defaulting Lender”; and

(b)the fifth sentence of Section 2.08(e), the first sentence of Section 2.08(f), the second, fourth and fifth sentences of Section 2.08(i), Section 4.01(a), Section 4.03, the second sentence of Section 5.03(c) and the first sentence of Section 12.04(a).

(liii)The words “the Issuing Bank” are deleted and the words “the Issuing Banks” are substituted therefor in the following:

(a)Section 2.07(b)(i), Section 2.07(b)(iii), Section 2.07(d), the second sentence of Section 2.08(j), Section 5.06(e), the introductory clause to Section 6.02, Section 11.06, the second sentence of Section 12.02(a), Section 12.03(a)(iii), the second and fourth sentences of Section 12.04(b)(iv), and the introductory clause of Section 12.11.

(liv)The words “the Issuing Bank” are deleted and the words “such Issuing Bank” are substituted therefor in the following:

(a)Section 2.08(d), and the third sentence of Section 2.08(f).

-14-

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement

(lv) The words “the Issuing Bank” are deleted and the words “each Issuing Bank” are substituted therefor in the following:

(a)Section 3.05(b), the first sentence of Section 5.03(c), Section 11.01, Section 11.04, Section 11.09, the third sentence of Section 2.08(f) and Section 12.03(b).

(lvi) The words “the Issuing Bank” are deleted and the words “the applicable Issuing Bank” are substituted therefor in the following:

(a)the third sentence of Section 2.08(e), and the fourth sentence of Section 2.08(f).

(lvii)A new Schedule 7.01 to the Credit Agreement, “Corporate Organizational Chart” in the form attached as Schedule 7.01 to this Fourth Amendment is hereby added to the Credit Agreement in substitution for the prior Schedule 7.01.

(lviii)A new Schedule 7.14 to the Credit Agreement, “Subsidiaries” in the form attached as Schedule 7.14 to this Fourth Amendment is hereby added to the Credit Agreement in substitution for the prior Schedule 7.14.

3.Loan Parties’ Ratification. Subject to the conditions set out in Section 5, Borrower (and each Loan Party by its execution in the space provided below under “ACKNOWLEDGED for purposes of Sections 3 and 4”) hereby ratifies all of its Obligations under the Credit Agreement and each of the Loan Documents to which it is a party (other than the Guaranty which is specifically addressed in Section 4), and agree and acknowledge that the Credit Agreement and each of the Loan Documents to which it is a party (other than the Guaranty which is specifically addressed in Section 4) are and shall continue to be in full force and effect. Nothing in this Fourth Amendment extinguishes, novates or releases any right, claim, Lien, security interest or entitlement of any of the Lenders, any Issuing Bank or the Administrative Agent created by or contained in any of such documents nor is any Loan Party released from any covenant, warranty or obligation created by or contained herein or therein. Each Loan Party (other than the Borrower) agrees that its execution and delivery of this Fourth Amendment does not indicate or establish an approval or consent requirement by any such Loan Party under the Credit Agreement in connection with the execution and delivery of amendments to the Credit Agreement, the Notes or any of the other Loan Documents (other than any Loan Document to which such a Loan Party is a party).

4.Guarantors’ Ratification. Each Guarantor by its execution in the space provided below under “ACKNOWLEDGED for purposes of Sections 3 and 4” hereby ratifies, confirms, acknowledges and agrees that its obligations under the Guaranty are in full force and effect and that such Guarantor continues to unconditionally and irrevocably guarantee the full and punctual payment, when due, whether at stated maturity or earlier by acceleration or otherwise, of the Obligations, and its execution and delivery of this Fourth Amendment does not indicate or establish an approval or consent requirement by any Guarantor under the Guaranty in connection with the execution and delivery of amendments to the Credit Agreement, the Notes or any of the

-15-

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement

other Loan Documents (other than the Guaranty or any other Loan Document to which a Guarantor is a party).

5.Conditions to Effectiveness of Fourth Amendment. This Fourth Amendment shall be effective upon the satisfaction, in the Administrative Agent’s sole discretion, of the following conditions precedent:

(i)The Administrative Agent shall have executed, and shall have received from the Borrower, RBC, as Issuing Bank, and the Required Lenders duly executed signature pages to, this Fourth Amendment, and shall have received a duly executed acknowledgement of Section 4 of this Fourth Amendment from each Guarantor; and

(ii)the Administrative Agent shall have received such other documents as the Administrative Agent or its counsel may reasonably request.

6.No Implied Amendment, Waiver or Consent. This Fourth Amendment shall not constitute an amendment or waiver of any provision not expressly referred to herein and shall not be construed as a consent to any action on the part of the Borrower that would require a waiver or consent of the Lenders or Required Lenders, as applicable, or an amendment or modification to any term of the Loan Documents except as expressly stated herein.

7.Miscellaneous. This Fourth Amendment is a Loan Document. Except as affected by this Fourth Amendment, the Loan Documents are unchanged and continue in full force and effect. However, in the event of any inconsistency between the terms of the Credit Agreement, as amended by this Fourth Amendment, and any other Loan Document, the terms of the Credit Agreement will control and the other document will be deemed to be amended to conform to the terms of the Credit Agreement. All references to the Credit Agreement will refer to the Credit Agreement as amended by this Fourth Amendment and any other amendments properly executed among the parties. Borrower agrees that all Loan Documents to which it is a party (whether as an original signatory or by assumption of the Obligations) remain in full force and effect and continue to evidence its legal, valid and binding obligations enforceable in accordance with their terms (as the same are affected by this Fourth Amendment or are amended in connection with this Fourth Amendment). AS A MATERIAL INDUCEMENT TO THE ADMINISTRATIVE AGENT AND LENDERS PARTY HERETO TO ENTER INTO THIS FOURTH AMENDMENT, BORROWER RELEASES THE ADMINISTRATIVE AGENT, THE ISSUING BANKS, THE LENDERS AND THEIR RESPECTIVE PREDECESSORS, SUCCESSORS, ASSIGNS, DIRECTORS, OFFICERS, EMPLOYEES, TRUSTEES, AGENTS AND ATTORNEYS FROM ANY LIABILITY FOR ACTIONS OR FAILURES TO ACT IN CONNECTION WITH THE LOAN DOCUMENTS PRIOR TO THE FOURTH AMENDMENT EFFECTIVE DATE. NO COURSE OF DEALING BETWEEN BORROWER OR ANY OTHER PERSON, ON THE ONE HAND, AND THE ADMINISTRATIVE AGENT, ISSUING BANKS AND THE LENDERS, ON THE OTHER, WILL BE DEEMED TO HAVE ALTERED OR AMENDED THE CREDIT AGREEMENT OR AFFECTED BORROWER’S, THE ADMINISTRATIVE AGENT’S, THE ISSUING BANKS’ OR THE LENDERS’ RIGHT TO ENFORCE THE CREDIT AGREEMENT AS WRITTEN. This Fourth Amendment will be

-16-

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement

binding upon and inure to the benefit of each of the undersigned and their respective successors and permitted assigns.

8.Form. Each agreement, document, instrument or other writing to be furnished to the Administrative Agent and/or the Lenders under any provision of this instrument must be in form and substance satisfactory to the Administrative Agent and its counsel.

9.Headings. The headings and captions used in this Fourth Amendment are for convenience only and will not be deemed to limit, amplify or modify the terms of this Fourth Amendment, the Credit Agreement, or the other Loan Documents.

10.Interpretation. Wherever possible each provision of this Fourth Amendment shall be interpreted in such manner as to be effective and valid under applicable law, but if any provision of this Fourth Amendment shall be prohibited by or invalid under such law, such provision shall be ineffective to the extent of such prohibition or invalidity, without invalidating the remainder of such provision or the remaining provisions of this Fourth Amendment.

11.Multiple Counterparts. This Fourth Amendment may be separately executed in any number of counterparts and by different parties hereto in separate counterparts, each of which when so executed shall be deemed to constitute one and the same agreement. This Fourth Amendment may be transmitted and/or signed by facsimile, telecopy or electronic mail. The effectiveness of any such documents and signatures shall, subject to applicable law, have the same force and effect as manually‑signed originals and shall be binding on all Loan Parties, all Lenders, the Administrative Agent and the Issuing Banks. The Administrative Agent may also require that any such documents and signatures be confirmed by a manually‑signed original thereof; provided, however, that the failure to request or deliver the same shall not limit the effectiveness of any facsimile document or signature.

12.Governing Law. This FOURTH AMENDMENT shall be governed by, and construed in accordance with the laws of the State of NEW YORK without regard to any choice-of-law provisions that would require the application of the law of another jurisdiction. EACH PARTY HEREBY IRREVOCABLY AND UNCONDITIONALLY WAIVES, TO THE FULLEST EXTENT PERMITTED BY LAW, TRIAL BY JURY IN ANY LEGAL ACTION OR PROCEEDING RELATING TO THIS FOURTH AMENDMENT OR ANY OTHER LOAN DOCUMENT AND FOR ANY COUNTERCLAIM THEREIN.

[Signature Pages Follow]

-17-

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement

IN WITNESS WHEREOF, the parties hereto have caused this Fourth Amendment to be executed by their respective officers thereunto duly authorized as of the date first above written.

|

BORROWER: |

||

|

SANCHEZ ENERGY CORPORATION, |

||

|

a Delaware corporation |

||

|

By: |

/s/ G. Gleeson Van Riet |

|

|

G. Gleeson Van Riet |

||

|

Senior Vice President – Chief Financial |

||

|

Officer |

||

Signature Page 1

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement

|

|

ACKNOWLEDGED for the purposes stated in Sections 3 and 4: |

|

|

|

|

|

|

|

|

|

|

|

GUARANTORS: |

|

|

|

|

|

|

|

|

|

|

|

SEP HOLDINGS III, LLC, |

|

|

|

a Delaware limited liability company |

|

|

|

|

|

|

|

SN MARQUIS LLC, |

|

|

|

a Delaware limited liability company |

|

|

|

|

|

|

|

SN COTULLA ASSETS, LLC, |

|

|

|

a Texas limited liability company |

|

|

|

|

|

|

|

SN OPERATING, LLC, |

|

|

|

a Texas limited liability company |

|

|

|

|

|

|

|

SN TMS, LLC, |

|

|

|

a Delaware limited liability company |

|

|

|

|

|

|

|

SN CATARINA, LLC, |

|

|

|

a Delaware limited liability company |

|

|

By: |

/s/ G. Gleeson Van Riet |

|

|

G. Gleeson Van Riet |

||

|

Senior Vice President – Chief Financial Officer |

||

Signature Page 2

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement

|

ADMINISTRATIVE AGENT: |

||

|

ROYAL BANK OF CANADA, as Administrative Agent |

||

|

By: |

/s/ Yvonne Brazier |

|

|

Name: |

Yvonne Brazie |

|

|

Title: |

Manager, Agency |

|

Signature Page 3

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement

|

LENDERS: |

||

|

ISSUING BANK AND LENDER: |

||

|

ROYAL BANK OF CANADA |

||

|

By: |

/s/ Evans Swann, Jr. |

|

|

Name: |

Evans Swann, Jr. |

|

|

Title: |

Authorized Signatory |

|

Signature Page 4

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement

|

|

CAPITAL ONE, NATIONAL ASSOCIATION |

|

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Michael Higgins |

|

|

Name: |

Michael Higgins |

|

|

Title: |

Director |

Signature Page 5

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement

|

|

CREDIT SUISSE AG, CAYMAN ISLANDS BRANCH |

|

|

|

|

|

|

|

By: |

/s/ Doreen Barr |

|

|

Name: |

Doreen Barr |

|

|

Title: |

Authorized Signatory |

|

|

|

|

|

|

By: |

/s/ Warren Van Heyst |

|

|

Name: |

Warren Van Heyest |

|

|

Title: |

Authorized Signatory |

Signature Page 6

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement

|

|

COMPASS BANK |

|

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Umar Hassan |

|

|

Name: |

Umar Hassan |

|

|

Title: |

Senior Vice President |

Signature Page 7

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement

|

|

SUNTRUST BANK |

|

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Chulley Bogle |

|

|

Name: |

Chulley Bogle |

|

|

Title: |

Vice President |

Signature Page 8

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement

|

|

ING CAPITAL LLC |

|

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Josh Strong |

|

|

Name: |

Josh Strong |

|

|

Title: |

Director |

|

|

|

|

|

|

By: |

/s/ Charles Hall |

|

|

Name: |

Charles Hall |

|

|

Title: |

Managing Director |

Signature Page 9

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement

|

|

BRANCH BANKING AND TRUST COMPANY |

|

|

|

|

|

|

|

By: |

/s/ Kelly Graham |

|

|

Name: |

Kelly Graham |

|

|

Title: |

Vice President |

Signature Page 10

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement

|

|

IBERIABANK |

|

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Stacy Goldstein |

|

|

Name: |

Stacy Goldstein |

|

|

Title: |

Senior Vice President |

Signature Page 11

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement

|

|

MUFG UNION BANK, N.A., f/k/a Union Bank, N.A. |

|

|

|

|

|

|

|

By: |

/s/ Tina M. Snouffer |

|

|

Name: |

Tina M. Snouffer |

|

|

Title: |

Managing Director |

Signature Page 12

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement

|

|

SOCIÉTÉ GENÉRALÉ |

|

|

|

|

|

|

|

|

|

|

|

By: |

/s/ David M. Bornstein |

|

|

Name: |

David M. Bornstein |

|

|

Title: |

Director |

Signature Page 13

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement

|

|

BMO HARRIS BANK, N.A. |

|

|

|

|

|

|

|

|

|

|

|

By: |

/s/ James V. Ducote |

|

|

Name: |

James V. Ducote |

|

|

Title: |

Managing Director |

Signature Page 14

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement

|

|

CREDIT AGRICOLE CORPORATE AND INVESTMENT BANK |

|

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Mark Roche |

|

|

Name: |

Mark Roche |

|

|

Title: |

Managing Director |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Michael Willis |

|

|

Name: |

Michael Willis |

|

|

Title: |

Managing Director |

Signature Page 15

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement

|

|

SUMITOMO MITSUI BANKING CORPORATION |

|

|

|

|

|

|

|

|

|

|

|

By: |

/s/ David W. Kee |

|

|

Name: |

David W. Kee |

|

|

Title: |

Managing Director |

Signature Page 16

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement

|

|

U.S. BANK NATIONAL ASSOCIATION |

|

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Ben Leonard |

|

|

Name: |

Ben Leonard |

|

|

Title: |

Vice President |

Signature Page 17

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement

|

|

COMERICA BANK |

|

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Jeffery Treadway |

|

|

Name: |

Jeffery Treadway |

|

|

Title: |

Senior Vice President |

Signature Page 18

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement

|

|

FIFTH THIRD BANK |

|

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Justin Bellamy |

|

|

Name: |

Justin Bellamy |

|

|

Title: |

Director |

Signature Page 19

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement

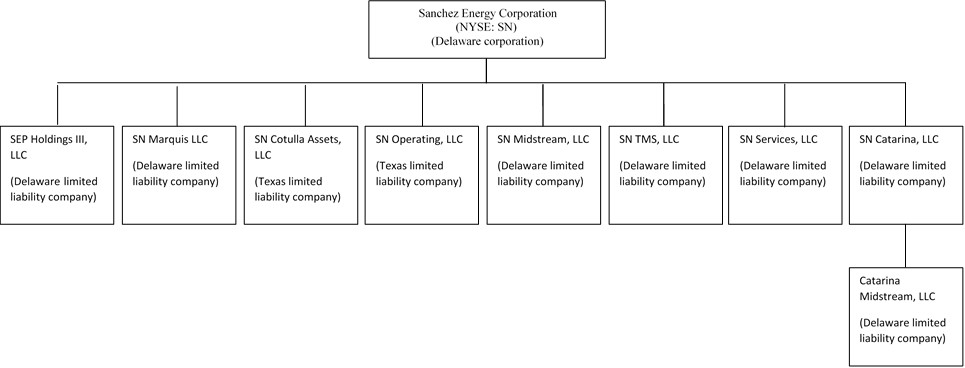

SCHEDULE 7.01

CORPORATE ORGANIZATIONAL CHART

All of the membership interests in each of SEP Holdings III, LLC, SN Marquis LLC, SN Cotulla Assets, LLC, SN Operating, LLC, SN Midstream, LLC, SN TMS, LLC, SN Services, LLC, and SN Catarina, LLC are owned by Sanchez Energy Corporation.

Schedule 7.01

SCHEDULE 7.14

SUBSIDIARIES

|

Name of Subsidiary |

Jurisdiction of Organization |

Federal Taxpayer ID |

Ownership Interest |

|

Catarina Midstream, LLC |

Delaware |

Pending |

100% Membership Interest held by SN Catarina, LLC |

|

SEP Holdings III, LLC |

Delaware |

45-3193696 |

100% Membership Interest held by Borrower |

|

SN Marquis LLC |

Delaware |

45-3090102 |

100% Membership Interest held by Borrower |

|

SN Cotulla Assets, LLC |

Texas |

45-3090102 |

100% Membership Interest held by Borrower |

|

SN Operating, LLC |

Texas |

38-3902143 |

100% Membership Interest held by Borrower |

|

SN Midstream, LLC |

Delaware |

45-3090102 |

100% Membership Interest held by Borrower |

|

SN TMS, LLC |

Delaware |

45-3090102 |

100% Membership Interest held by Borrower |

|

SN Catarina, LLC |

Delaware |

45-3090102 |

100% Membership Interest held by Borrower |

|

SN Services, LLC |

Delaware |

45-3090102 |

100% Membership Interest held by Borrower |

Schedule 7.14

Fourth Amendment to Sanchez

Second Amended and Restated Credit Agreement