Attached files

| file | filename |

|---|---|

| 8-K - 8-K - VIRTUSA CORP | a15-22348_18k.htm |

| EX-2.1 - EX-2.1 - VIRTUSA CORP | a15-22348_1ex2d1.htm |

| EX-99.1 - EX-99.1 - VIRTUSA CORP | a15-22348_1ex99d1.htm |

Exhibit 99.2

November 5, 2015 Greatly strengthens our position in Banking and Financial Services Virtusa Corporation to acquire controlling interest in Polaris Consulting & Services Limited

Forward Looking Statements This presentation contains forward-looking statements which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. This presentation may make express or implied forward-looking statements relating to, among other things, Virtusa's expectations concerning management's forecast of financial performance, the growth of our business and management's plans, objectives, and strategies, the expected timing of the completion of the acquisition of Polaris described in this press release and the related debt financing; the expected benefits of the transaction, including revenue synergies and an expanded relationship with Citi; Virtusa’s immediate and long-term financial expectations for the combined business, including expected growth, expected pro forma revenue following conversion of Polaris’ historical financial statements into U.S. GAAP, pro forma GAAP and Non-GAAP earnings per share; expectations regarding fiscal 2016, 2017 and 2018 performance of the combined business; and the future operation, direction and success of the combined businesses. Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Virtusa undertakes no obligation to update or revise the information contained in this presentation, whether as a result of new information, future events or circumstances or otherwise. For additional disclosure regarding these and other risks faced by Virtusa, see the disclosure contained in our public filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the fiscal year ending March 31, 2015 as filed with the Securities and Exchange Commission. Virtusa + polaris

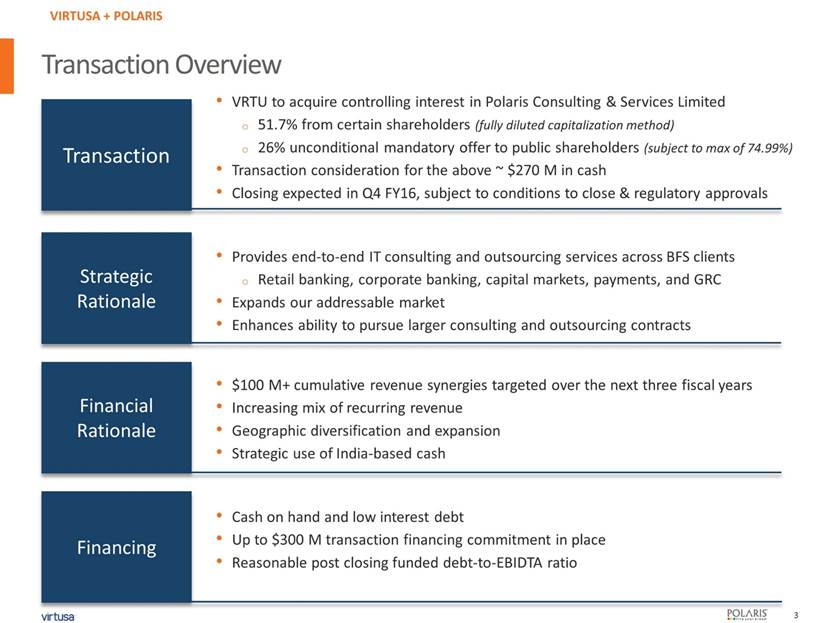

Transaction Overview VRTU to acquire controlling interest in Polaris Consulting & Services Limited 51.7% from certain shareholders (fully diluted capitalization method) 26% unconditional mandatory offer to public shareholders (subject to max of 74.99%) Transaction consideration for the above ~ $270 M in cash Closing expected in Q4 FY16, subject to conditions to close & regulatory approvals $100 M+ cumulative revenue synergies targeted over the next three fiscal years Increasing mix of recurring revenue Geographic diversification and expansion Strategic use of India-based cash Provides end-to-end IT consulting and outsourcing services across BFS clients Retail banking, corporate banking, capital markets, payments, and GRC Expands our addressable market Enhances ability to pursue larger consulting and outsourcing contracts Cash on hand and low interest debt Up to $300 M transaction financing commitment in place Reasonable post closing funded debt-to-EBIDTA ratio Transaction Strategic Rationale Financial Rationale Financing Virtusa + polaris

Polaris at a Glance (1) Globally Diversified Corp Banking/Capital Markets Focus Services With High Visibility Strong industry solutions across banking & financial services Deep domain expertise Over 20 years of banking experience Global client base Blue chip clients across North America, Europe & Asia Preferred relationships ~7,650 (2) Team members globally, including 6,650+ IT professionals Strong financials $150 M revenue (3) Well capitalized with $44.8 M cash, cash equivalents & Investments Virtusa + polaris (1) Financials & metrics as of Sep 30, 2015 (2) Adjusted for potential divestiture of BPO as of Sep 30, 2015 (3) Adj. for BPO & certain pro-forma US GAAP adj. for 6 months ended Sep 30, 2015 Corporate, Treasury & Capital Markets 69% Insurance & Others 15% Retail Banking 16% Americas 52% ROW 27% Europe 21% App Dev 46% App Main 39% Others 1% Testing 14%

Strategic Summary Creates a fully integrated leader in financial services technology and operations Greatly expands our addressable market Minimal Client Overlap > Strong Synergy Potential 10 of Top-20 global banks Enhances ability to pursue larger consulting and outsourcing contracts Consistent with Virtusa’s M&A strategy Strengthen Domain > Add New Capabilities > Expand Geo Reach Virtusa Polaris Locations Virtusa + polaris 1 2 3 4 Consumer banking Corporate banking Global financial services + = Investment banking +

Creates a differentiated, end-to-end service provider delivering next-generation, transformational BFS solutions VIRTUSA CORPORATION Retail and Consumer Banking Consumer experience Governance, Regulatory & Compliance Platform rationalization & business transformation Digital transformation The definitive provider of end-to-end IT services to the BFS Segment Corporate banking Trade finance platform Transaction processing Capital markets Recurring revenue through testing, outsourcing services POLARIS CONSULTING & SERVICES Virtusa + polaris

Expands our addressable market & world-class client-base Banking & Financial Services Clients Virtusa + polaris

Financial impact Virtusa + polaris Expect cumulative revenue synergies of $100 M+ over the next three years Preferred strategic partner status with Citi Good strategic use of India-based cash Enhance revenue base More recurring revenue (app outsourcing, maintenance, testing) Geographic and client diversification Non-GAAP EPS impact: ~($0.08) dilutive in FY '16, slightly dilutive in FY '17, accretive in FY '18 and beyond Virtusa Service offering Combined entity* Service offering Application Outsourcing (recurring) 54% Consulting 46% Application Outsourcing (recurring) 60% Consulting 40% * To be firmed-up post-transaction Virtusa Service offering Combined entity* Service offering

Financing Virtusa + polaris Financed through a combination of cash and debt $300 M of committed debt financing $200 M multi-draw 5-year term loan facility $100 M revolving credit facility (Dependent on MTO participation) Low interest rate: Floating, LIBOR + 2.25% to 2.75% depending on leverage ratio Reasonable leverage ratio of debt to EBIDTA at 2.2x Rapid deleveraging over 5 years with annual amortization and a bullet payment in year 5 Arrangers: JPMorgan and Bank of America, each committed to 50% of the facilities

Summary Virtusa + polaris Virtusa Corporation enters into a definitive agreement to acquire a majority interest in Polaris Consulting & Services Limited; 26% mandatory offer Combination greatly strengthens our position in Banking & Financial Services Industry segment Expands addressable market and synergy opportunities across the combined client base Ability to pursue larger consulting and outsourcing opportunities Low cost debt financing and effective use of offshore cash Transaction is expected to be accretive on a non-GAAP diluted EPS basis in FY18 and beyond Value creation through enhanced client partnerships, diversification, recurring revenue, and $100 M cumulative revenue synergies

Thank You Questions ? Please e-mail William Maina from ICR at William.Maina@icrinc.com

APPENDIX Virtusa + polaris

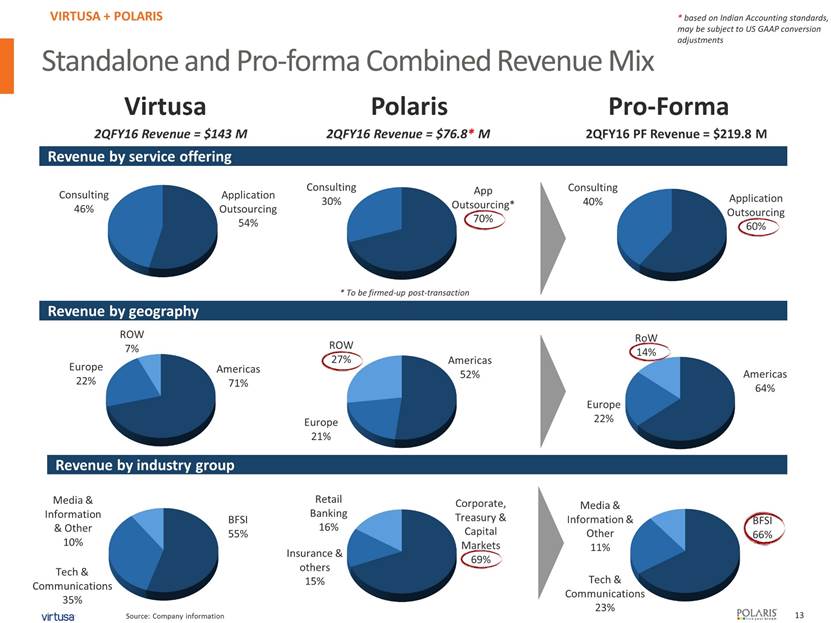

Standalone and Pro-forma Combined Revenue Mix Pro-Forma Revenue by geography Revenue by industry group Revenue by service offering 2QFY16 Revenue = $143 M 2QFY16 Revenue = $76.8* M 2QFY16 PF Revenue = $219.8 M Source: Company information * To be firmed-up post-transaction Virtusa + Polaris Polaris Virtusa * based on Indian Accounting standards, may be subject to US GAAP conversion adjustments Application Outsourcing 54% Consulting 46% App Outsourcing* 70% Consulting 30% Application Outsourcing 60% Consulting 40% Americas 52% Europe 21% ROW 27% Americas 64% Europe 22% RoW 14% BFSI 55% Tech & Communications 35% Media & Information & Other 10% Corporate, Treasury & Capital Markets 69% Insurance & others 15% Retail Banking 16% BFSI 66% Tech & Communications 23% Media & Information & Other 11% Americas 71% Europe 22% ROW 7%

Financial impact of the transaction Virtusa + polaris Fiscal Year 2016: Polaris expected to contribute revenue of ~$70 M, in Q4 (ending March 31, 2016)* ~($0.08) dilutive to non-GAAP EPS, ~($0.55) dilutive to GAAP EPS including ~ ($0.23) from transaction and integration expenses GAAP and non-GAAP include ($0.07) of dilution from debt to finance the transaction Fiscal Year 2017: Polaris combination expected to be to be slightly dilutive to non-GAAP EPS Revenue synergies including preferred vendor status at Citi, offset by: 2-year Citi productivity savings commitments; if not achieved, provide minimum discounts Additional Investments in Polaris in support of revenue growth Higher interest expense from deal-related financing Fiscal Year 2018 and beyond: Accretive to non-GAAP EPS in FY18 and beyond, based on: Acceleration of revenue synergies Margin accretion from roll out of Delivery & Shared Services best practices Tax benefits related to interest expense Balance sheet deleveraging Anticipated additional equity investments * Assuming an early January 2016 Close