Attached files

| file | filename |

|---|---|

| 8-K - 8-K - VISA INC. | d89014d8k.htm |

| EX-99.1 - EX-99.1 - VISA INC. | d89014dex991.htm |

Visa Inc. Fiscal Fourth Quarter 2015 Financial Results November 2, 2015 Exhibit 99.2

This presentation contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are identified by words such as "estimates," "expectation,“ “outlook,” "will," "continued" and other similar expressions. Examples of forward-looking statements include, but are not limited to, statements we make about our revenue, client incentives, operating margin, tax rate, earnings per share, free cash flow, and the growth of those items. By their nature, forward-looking statements: (i) speak only as of the date they are made; (ii) are not statements of historical fact or guarantees of future performance; and (iii) are subject to risks, uncertainties, assumptions or changes in circumstances that are difficult to predict or quantify. Therefore, actual results could differ materially and adversely from our forward-looking statements due to a variety of factors, including the following: the impact of laws, regulations and marketplace barriers, including: increased regulation of fees, transaction routing, payment card practices or other aspects of the payments industry in the United States, including new or revised regulations issued under the Dodd-Frank Wall Street Reform and Consumer Protection Act; increased regulation in jurisdictions outside of the United States; increased government support of national payments networks outside the United States; and increased regulation of consumer privacy, data use and security; developments in litigation and government enforcement, including those affecting interchange reimbursement fees, antitrust and tax; new lawsuits, investigations or proceedings, or changes to our potential exposure in connection with pending lawsuits, investigations or proceedings; economic factors, such as: economic fragility in the Eurozone, the United States and in other advanced and emerging markets; general economic, political and social conditions in mature and emerging markets globally; general stock market fluctuations, which may impact consumer spending; material changes in cross-border activity, foreign exchange controls and fluctuations in currency exchange rates; and material changes in our financial institution clients' performance compared to our estimates; industry developments, such as competitive pressure, rapid technological developments and disintermediation from our payments network; system developments, such as: disruption of our transaction processing systems or the inability to process transactions efficiently; account data breaches or increased fraudulent or other illegal activities involving Visa-branded cards or payment products; and failure to maintain systems interoperability with Visa Europe; any prospective transaction with Visa Europe may not be agreed to or implemented; costs arising if we become obligated to purchase all of Visa Europe’s outstanding capital stock; the loss of organizational effectiveness or key employees; the failure to integrate acquisitions successfully or to effectively develop new products and businesses; natural disasters, terrorist attacks, military or political conflicts, and public health emergencies; and various other factors, including those more fully described in our filings with the U.S. Securities and Exchange Commission, including our Annual Report on Form 10−K for the year ended September 30, 2014, and our subsequent reports on Forms 10-Q and 8-K. You should not place undue reliance on such statements. Except as required by law, we do not intend to update or revise any forward–looking statements as a result of new information, future developments or otherwise. Forward-Looking Statements

Note: See appendix for reconciliation of adjusted non-GAAP measures to the closest comparable GAAP measures. Solid Fiscal Fourth Quarter Results Solid operating revenues of $3.6 billion, up 11% over prior year Authorized new $5.0 billion share repurchase program Announced quarterly per share dividend increase of 17% Quarterly net income of $1.5 billion and diluted earnings per share of $0.62 reflecting: 41% and 44% increase, respectively, over prior year 12% and 14% increase, respectively, over prior year’s adjusted results

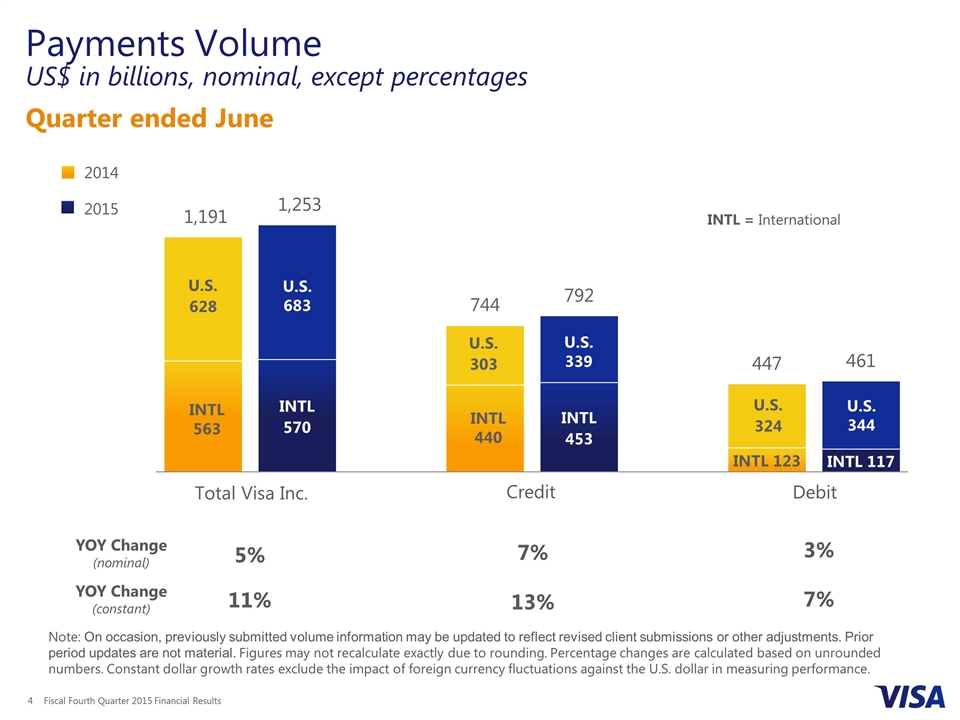

Quarter ended June Payments Volume US$ in billions, nominal, except percentages YOY Change (constant) 11% 13% 7% YOY Change (nominal) 7% 3% 5% Note: On occasion, previously submitted volume information may be updated to reflect revised client submissions or other adjustments. Prior period updates are not material. Figures may not recalculate exactly due to rounding. Percentage changes are calculated based on unrounded numbers. Constant dollar growth rates exclude the impact of foreign currency fluctuations against the U.S. dollar in measuring performance. 2014 2015 U.S.683 INTL563 INTL440 U.S.339 U.S.344

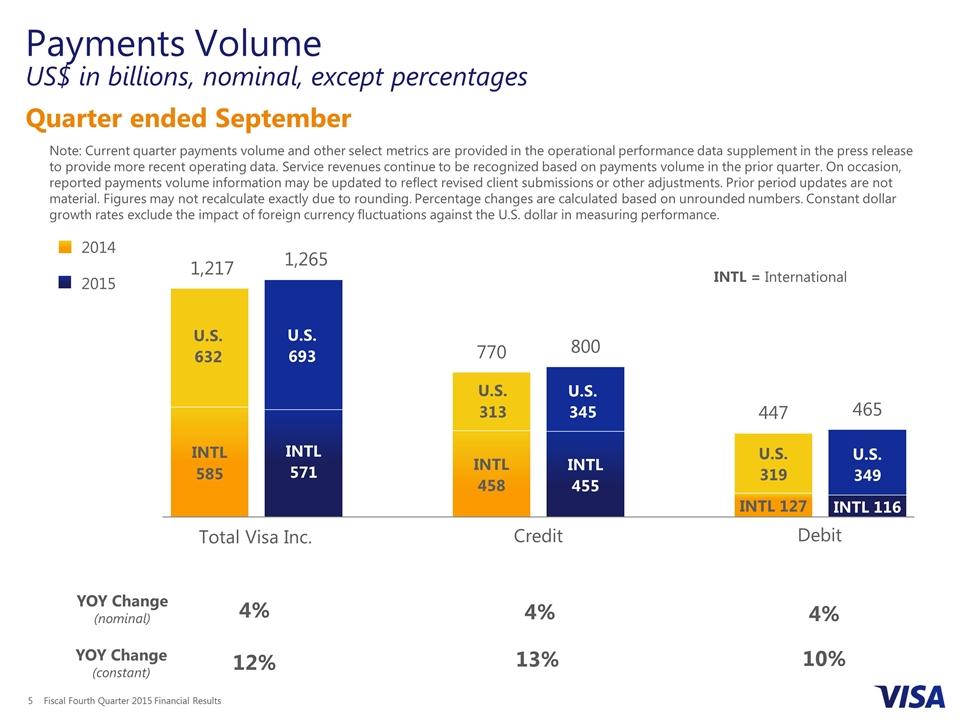

Quarter ended September Payments Volume US$ in billions, nominal, except percentages YOY Change (constant) 12% 13% 10% YOY Change (nominal) 4% 4% 4% Note: Current quarter payments volume and other select metrics are provided in the operational performance data supplement in the press release to provide more recent operating data. Service revenues continue to be recognized based on payments volume in the prior quarter. On occasion, reported payments volume information may be updated to reflect revised client submissions or other adjustments. Prior period updates are not material. Figures may not recalculate exactly due to rounding. Percentage changes are calculated based on unrounded numbers. Constant dollar growth rates exclude the impact of foreign currency fluctuations against the U.S. dollar in measuring performance. INTL 420 INTL 457 INTL 109 INTL 127 U.S. 575 U.S. 631 U.S. 277 U.S. 313 U.S. 298 U.S. 319 2014 2015

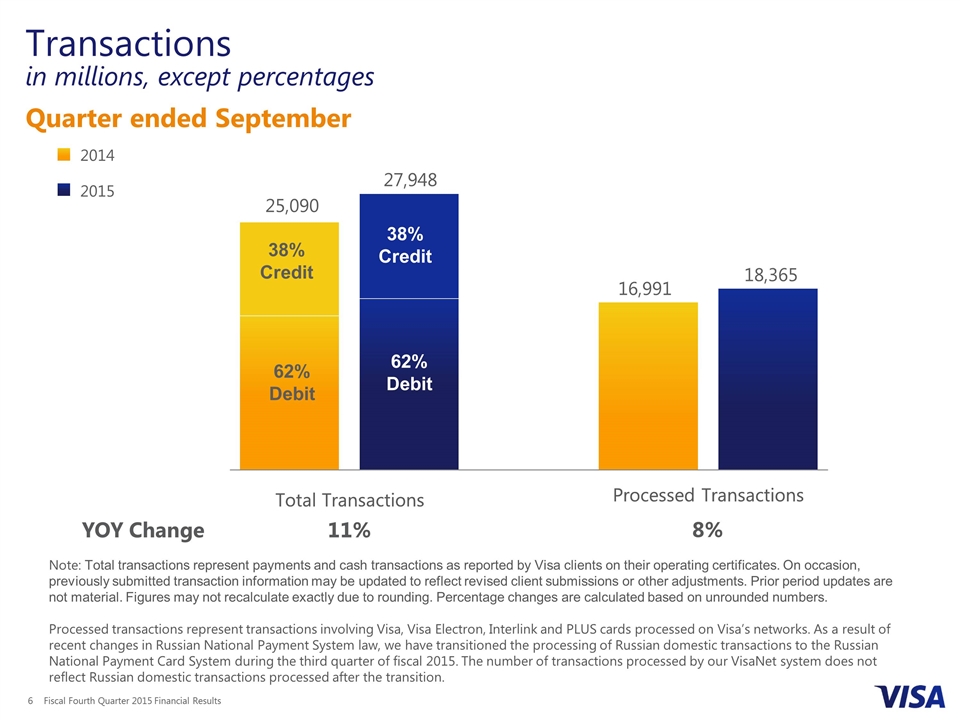

Quarter ended September Transactions in millions, except percentages Note: Total transactions represent payments and cash transactions as reported by Visa clients on their operating certificates. On occasion, previously submitted transaction information may be updated to reflect revised client submissions or other adjustments. Prior period updates are not material. Figures may not recalculate exactly due to rounding. Percentage changes are calculated based on unrounded numbers. Processed transactions represent transactions involving Visa, Visa Electron, Interlink and PLUS cards processed on Visa’s networks. As a result of recent changes in Russian National Payment System law, we have transitioned the processing of Russian domestic transactions to the Russian National Payment Card System during the third quarter of fiscal 2015. The number of transactions processed by our VisaNet system does not reflect Russian domestic transactions processed after the transition. Credit 38% YOY Change 11% 8% Debit 62% Credit 38% 2014 2015 62% Debit 38% Credit 38% Credit 62% Debit

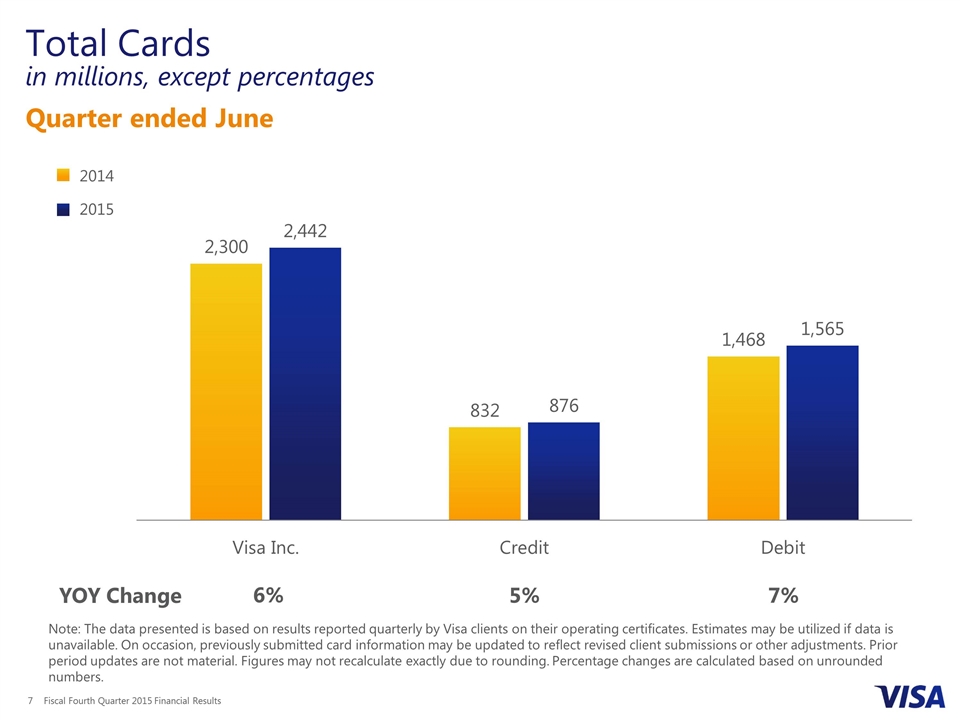

Quarter ended June Total Cards in millions, except percentages Note: The data presented is based on results reported quarterly by Visa clients on their operating certificates. Estimates may be utilized if data is unavailable. On occasion, previously submitted card information may be updated to reflect revised client submissions or other adjustments. Prior period updates are not material. Figures may not recalculate exactly due to rounding. Percentage changes are calculated based on unrounded numbers. YOY Change 5% 7% 6% 2014 2015

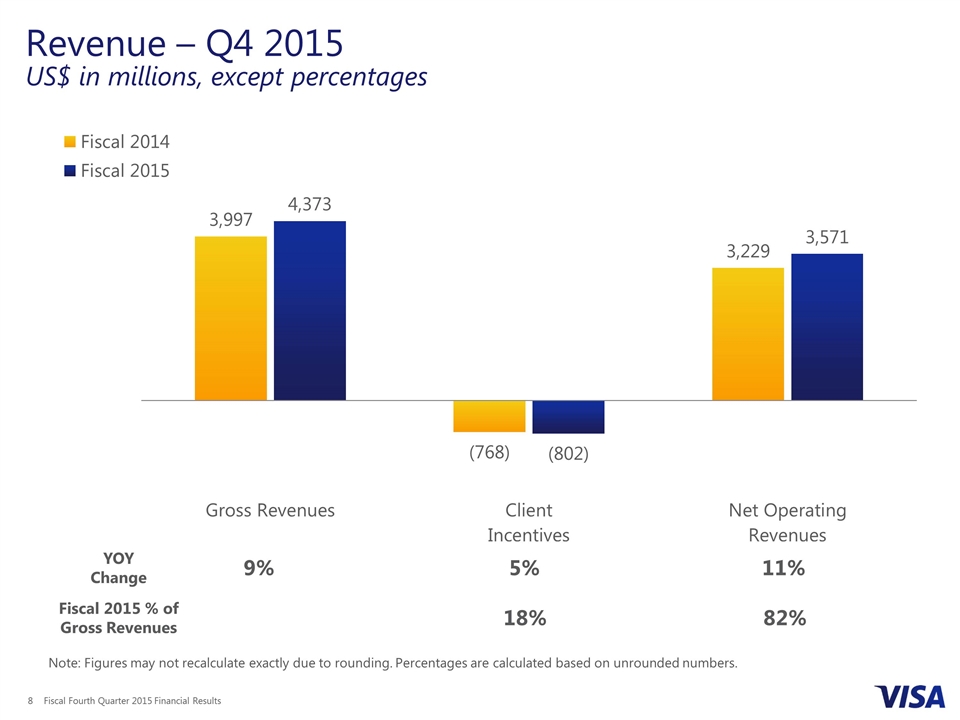

Revenue – Q4 2015 US$ in millions, except percentages Note: Figures may not recalculate exactly due to rounding. Percentages are calculated based on unrounded numbers. YOY Change 5% 11% 9% Fiscal 2015 % of Gross Revenues 18% 82%

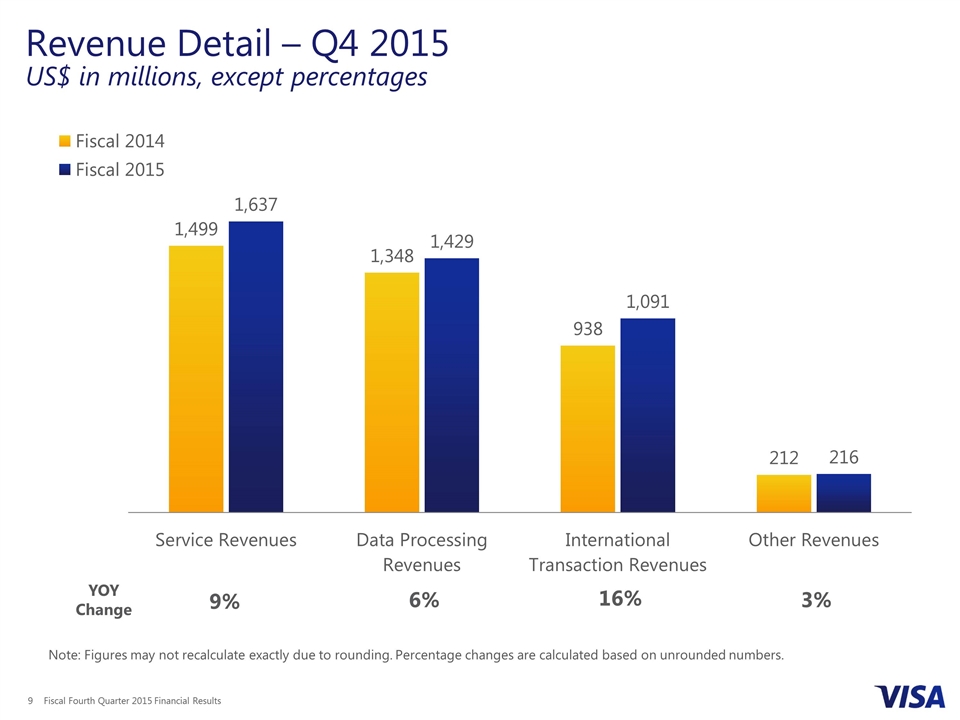

Revenue Detail – Q4 2015 US$ in millions, except percentages Note: Figures may not recalculate exactly due to rounding. Percentage changes are calculated based on unrounded numbers. YOY Change 6% 16% 9% 3%

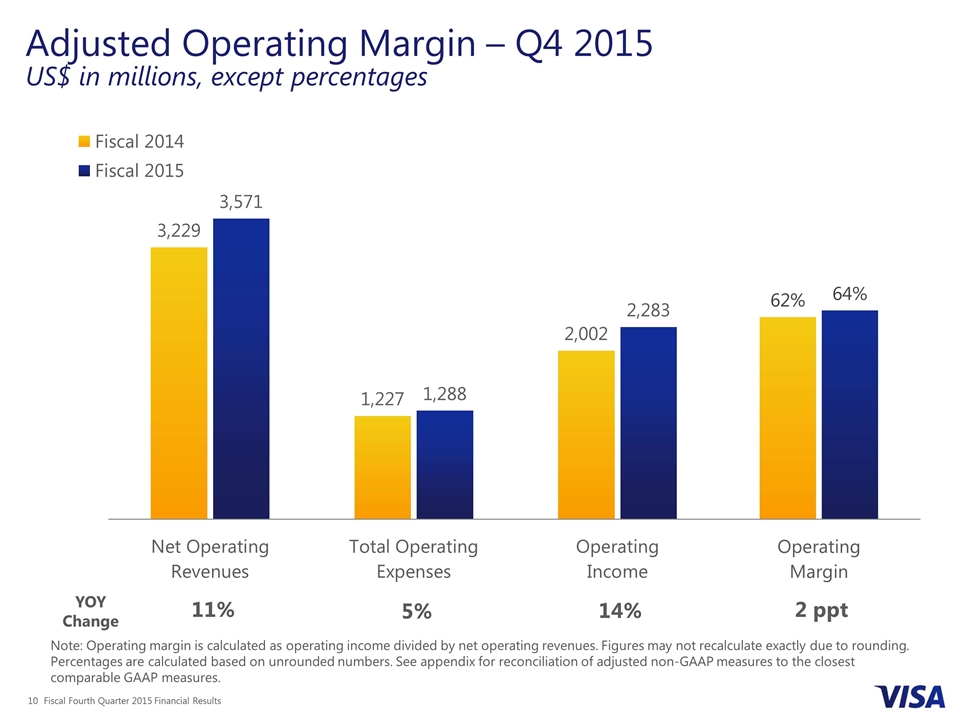

Adjusted Operating Margin – Q4 2015 US$ in millions, except percentages Note: Operating margin is calculated as operating income divided by net operating revenues. Figures may not recalculate exactly due to rounding. Percentages are calculated based on unrounded numbers. See appendix for reconciliation of adjusted non-GAAP measures to the closest comparable GAAP measures. YOY Change 5% 14% 11% 2 ppt

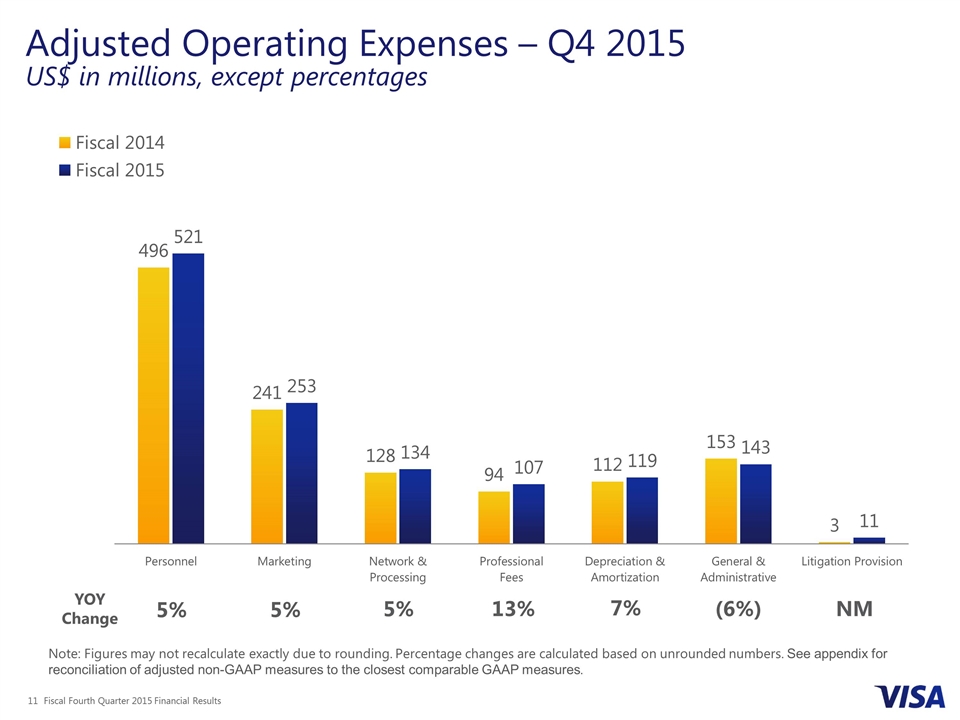

Adjusted Operating Expenses – Q4 2015 US$ in millions, except percentages Note: Figures may not recalculate exactly due to rounding. Percentage changes are calculated based on unrounded numbers. See appendix for reconciliation of adjusted non-GAAP measures to the closest comparable GAAP measures. YOY Change 5% 13% 5% (6%) 7% 5% NM

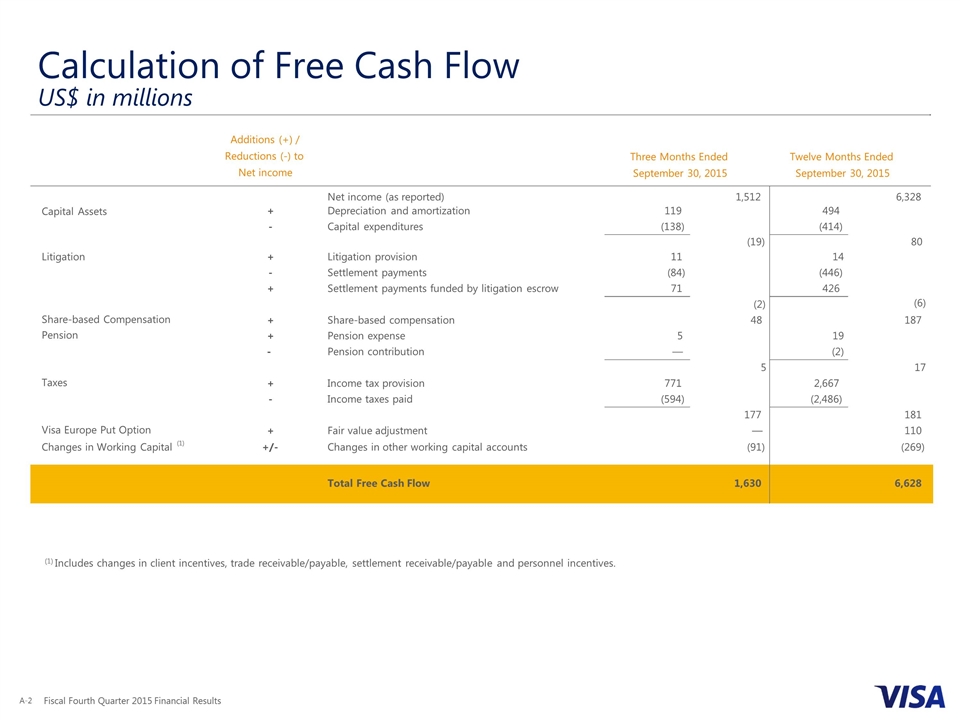

Other Financial Results Cash, cash equivalents and available-for-sale investment securities of $9.3 billion at the end of the fiscal fourth quarter Free cash flow of $1.6 billion for the fiscal fourth quarter Capital expenditures of $138 million during the fiscal fourth quarter

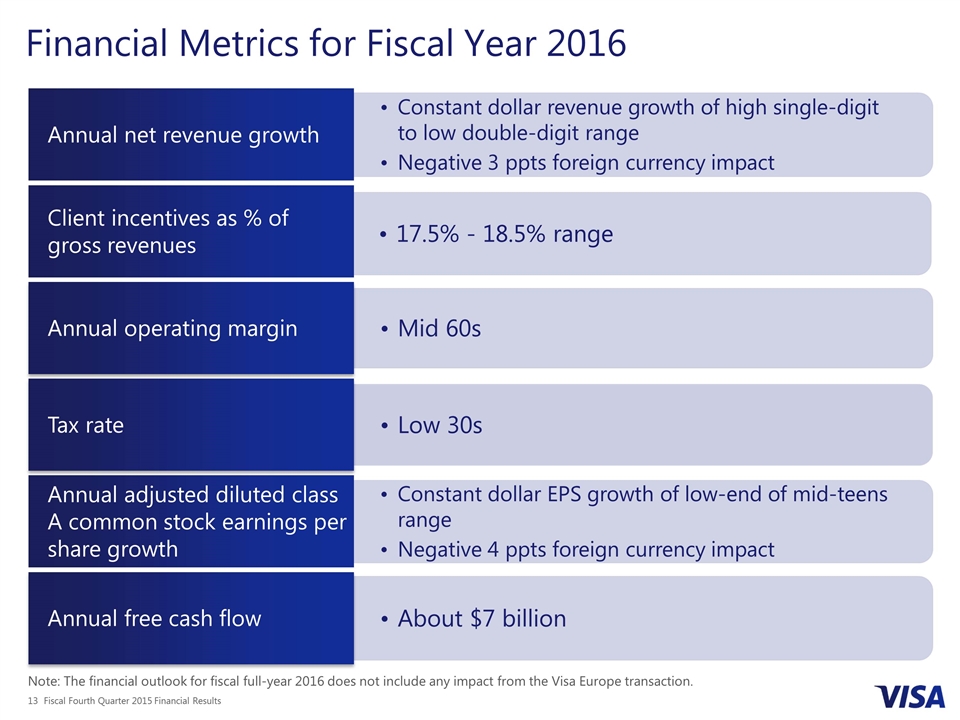

Financial Metrics for Fiscal Year 2016 Note: The financial outlook for fiscal full-year 2016 does not include any impact from the Visa Europe transaction. Annual net revenue growth Client incentives as % of gross revenues Constant dollar revenue growth of high single-digit to low double-digit range Mid 60s Annual adjusted diluted class A common stock earnings per share growth Constant dollar EPS growth of low-end of mid-teens range About $7 billion Annual free cash flow Annual operating margin 17.5% - 18.5% range Tax rate Low 30s Negative 3 ppts foreign currency impact Negative 4 ppts foreign currency impact

Appendix

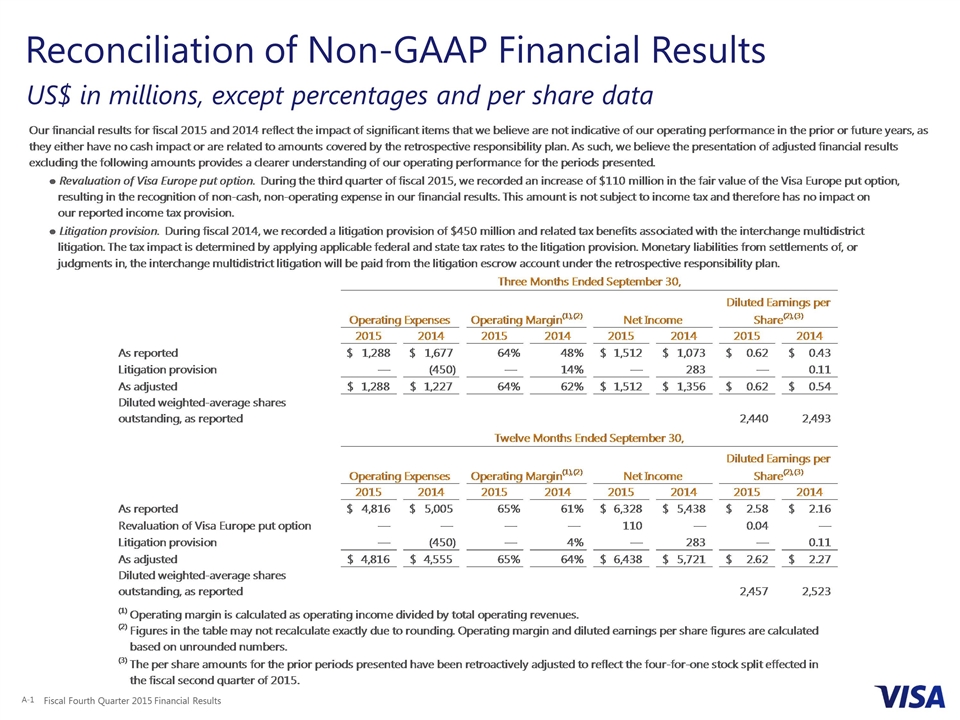

Reconciliation of Non-GAAP Financial Results US$ in millions, except percentages and per share data A-1 VISA INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) For the Years Ended September 30, 2014 2013 2012 (in millions) Operating Activities Net income $5,438 $4,980 $2,142 Adjustments to reconcile net income to net cash provided by (used in) operating activities: Amortization of client incentives 2,592 2,321 2155 Share-based compensation 172 179 147 Excess tax benefit for share-based compensation -90 -74 -71 Depreciation and amortization of property, equipment, technology and intangible assets 435 397 333 Deferred income taxes -,580 1,527 -1,690 Litigation provision 453 3 4,101 Other 37 50 -8 Change in operating assets and liabilities: Income tax receivable 51 37 -67 Settlement receivable 13 -,345 -42 Accounts receivable -53 -38 -161 Client incentives -2,395 -2,336 -1757 Other assets -,430 -,543 41 Accounts payable -56 40 -17 Settlement payable 107 506 270 Accrued and other liabilities 513 702 -,227 Accrued litigation 998 -4,384 -140 Net cash provided by operating activities 7205 3022 5009 Investing Activities Purchases of property, equipment, technology and intangible assets -,553 -,471 -,376 Proceeds from disposal of property, equipment and technology 0 0 2 Investment securities, available-for-sale: Purchases -2,572 -3,164 -4,140 Proceeds from maturities and sales 2,342 2,440 2,093 Acquisitions, net of cash received -,149 0 -3 Purchases of / contributions to other investments -9 -3 -12 Proceeds / distributions from other investments 0 34 22 Net cash used in investing activities -,941 -1,164 -2,414 Financing Activities Repurchase of class A common stock -4,118 -5,365 -,710 Dividends paid -1,006 -,864 -,595 Deposits into litigation escrow account—retrospective responsibility plan -,450 0 -1,715 (Return to) payments from litigation escrow account—retrospective responsibility plan -,999 4,383 140 Cash proceeds from exercise of stock options 91 108 174 Restricted stock and performance-based shares settled in cash for taxes -86 -64 0 Excess tax benefit for share-based compensation 90 74 71 Payments for earn-out related to PlaySpan acquisition 0 -12 -14 Principal payments on capital lease obligations 0 -6 -6 Net cash used in financing activities -6,478 -1,746 -2,655 Effect of exchange rate changes on cash and cash equivalents -1 0 0 7 (Decrease) increase in cash and cash equivalents -,215 112 -53 Cash and cash equivalents at beginning of year 2,186 2,074 2,127 Cash and cash equivalents at end of period $1,971 $2,186 $2,074 Supplemental Disclosures Income taxes paid, net of refunds $2,656 $595 $2,057 Non-cash accruals related to purchases of property, equipment, technology and intangible assets $62 $46 $67 VISA INC. CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED) Three Months Ended September 30, Twelve Months Ended September 30, 2014 2013 2014 2013 (in millions, except per share data) Operating Revenues Service revenues $1,499 $1,385 $5,797 $5,352 Data processing revenues 1,348 1,186 5,167 4,642 International transaction revenues 938 899 3,560 3,389 Other revenues 212 183 770 716 Client incentives -,768 -,680 -2,592 -2,321 Total operating revenues 3,229 2,973 12,702 11,778 Operating Expenses Personnel 496 499 1,875 1,932 Marketing 241 236 900 876 Network and processing 128 122 507 468 Professional fees 94 130 328 412 Depreciation and amortization 112 106 435 397 General and administrative 153 129 507 451 Litigation provision 453 0 453 3 Total operating expenses 1,677 1,222 5,005 4,539 Operating income 1,552 1,751 7,697 7,239 Non-operating (expense) income -2 15 27 18 Income before income taxes 1,550 1,766 7,724 7,257 Income tax provision 477 574 2,286 2,277 Net income $1,073 $1,192 $5,438 $4,980 Basic earnings per share Class A common stock $1.73 $1.86 $8.65 $7.61 Class B common stock $0.73 $0.78 $3.63 $3.2 Class C common stock $1.73 $1.86 $8.65 $7.61 Basic weighted-average shares outstanding Class A common stock 492 509 498 520 Class B common stock 245 245 245 245 Class C common stock 24 27 26 28 Diluted earnings per share Class A common stock $1.72 $1.85 $8.6199999999999992 $7.59 Class B common stock $0.72 $0.78 $3.62 $3.19 Class C common stock $1.72 $1.85 $8.6199999999999992 $7.59 Diluted weighted-average shares outstanding Class A common stock 623 644 631 656 Class B common stock 245 245 245 245 Class C common stock 24 27 26 28 VISA INC. CONSOLIDATED BALANCE SHEETS (UNAUDITED) September 30,2014 September 30,2013 (in millions, except par value data) Assets Cash and cash equivalents $1,971 $2,186 Restricted cash—litigation escrow 1,498 49 Investment securities: Trading 69 75 Available-for-sale 1,910 1,994 Income tax receivable 91 142 Settlement receivable 786 799 Accounts receivable 822 761 Customer collateral 961 866 Current portion of client incentives 210 282 Current portion of deferred tax assets 1,028 481 Prepaid expenses and other current assets 216 187 Total current assets 9,562 7,822 Investment securities, available-for-sale 3,015 2,760 Client incentives 81 89 Property, equipment and technology, net 1,892 1,732 Deferred tax assets 8 0 Other assets 847 521 Intangible assets, net 11,411 11,351 Goodwill 11,753 11,681 Total assets $38,569 $35,956 Liabilities Accounts payable $147 $184 Settlement payable 1,332 1,225 Customer collateral 961 866 Accrued compensation and benefits 450 523 Client incentives 1,036 919 Accrued liabilities 624 613 Accrued litigation 1,456 5 Total current liabilities 6,006 4,335 Deferred tax liabilities 4,145 4,149 Other liabilities 1,005 602 Total liabilities 11,156 9,086 Equity Preferred stock, $0.0001 par value, 25 shares authorized and none issued 0 0 Class A common stock, $0.0001 par value, 2,001,622 shares authorized, 495 and 508 shares issued and outstanding at September 30, 2014 and 2013, respectively 0 0 Class B common stock, $0.0001 par value, 622 shares authorized, 245 shares issued and outstanding at September 30, 2014 and 2013 0 0 Class C common stock, $0.0001 par value, 1,097 shares authorized, 22 and 27 shares issued and outstanding at September 30, 2014 and 2013, respectively 0 0 Additional paid-in capital 18,299 18,875 Accumulated income 9,131 7,974 Accumulated other comprehensive (loss) income, net: Investment securities, available-for-sale 31 59 Defined benefit pension and other postretirement plans -84 -60 Derivative instruments classified as cash flow hedges 38 23 Foreign currency translation adjustments -2 -1 Total accumulated other comprehensive (loss) income, net -17 21 Total equity 27,413 26,870 Total liabilities and equity $38,569 $35,956 Our financial results for fiscal 2015 and 2014 reflect the impact of significant items that we believe are not indicative of our operating performance in the prior or future years, as they either have no cash impact or are related to amounts covered by the retrospective responsibility plan. As such, we believe the presentation of adjusted financial results excluding the following amounts provides a clearer understanding of our operating performance for the periods presented. ● Revaluation of Visa Europe put option. During the third quarter of fiscal 2015, we recorded an increase of $110 million in the fair value of the Visa Europe put option, resulting in the recognition of non-cash, non-operating expense in our financial results. This amount is not subject to income tax and therefore has no impact on our reported income tax provision. ● Litigation provision. During fiscal 2014, we recorded a litigation provision of $450 million and related tax benefits associated with the interchange multidistrict litigation. The tax impact is determined by applying applicable federal and state tax rates to the litigation provision. Monetary liabilities from settlements of, or judgments in, the interchange multidistrict litigation will be paid from the litigation escrow account under the retrospective responsibility plan. Three Months Ended September 30, Operating Expenses Operating Margin(1),(2) Net Income Diluted Earnings per Share(2),(3) 2015 2014 2015 2014 2015 2014 2015 2014 As reported $1,288 $1,677 0.64 0.48 $1,512 $1,073 $0.62 $0.43 Litigation provision 0 -,450 0 0.14000000000000001 0 283 0 0.11 As adjusted $1,288 $1,227 0.64 0.62 $1,512 $1,356 $0.62 $0.54 Diluted weighted-average shares outstanding, as reported 2,440 2,493 Twelve Months Ended September 30, Operating Expenses Operating Margin(1),(2) Net Income Diluted Earnings per Share(2),(3) 2015 2014 2015 2014 2015 2014 2015 2014 As reported $4,816 $5,005 0.65 0.61 $6,328 $5,438 $2.58 $2.16 Revaluation of Visa Europe put option 0 0 0 0 110 0 0.04 0 Litigation provision 0 -,450 0 0.04 0 283 0 0.11 As adjusted $4,816 $4,555 0.65 0.64 $6,438 $5,721 $2.62 $2.27 Diluted weighted-average shares outstanding, as reported 2,457 2,523 (1) Operating margin is calculated as operating income divided by total operating revenues. (2) Figures in the table may not recalculate exactly due to rounding. Operating margin and diluted earnings per share figures are calculated based on unrounded numbers. (3) The per share amounts for the prior periods presented have been retroactively adjusted to reflect the four-for-one stock split effected in the fiscal second quarter of 2015. VISA INC. FISCAL 2014 AND 2013 QUARTERLY RESULTS OF OPERATIONS (UNAUDITED) Fiscal 2014 Quarter Ended Fiscal 2013 Quarter Ended September 30,2014 June 30,2014 March 31,2014 December 31,2013 September 30,2013 (in millions) Operating Revenues Service revenues $1,499 $1,417 $1,462 $1,419 $1,385 Data processing revenues 1,348 1,321 1,234 1,264 1,186 International transaction revenues 938 860 871 891 899 Other revenues 212 195 183 180 183 Client incentives -,768 -,638 -,587 -,599 -,680 Total operating revenues 3,229 3,155 3,163 3,155 2,973 Operating Expenses Personnel 496 463 446 470 499 Marketing 241 228 245 186 236 Network and processing 128 127 120 132 122 Professional fees 94 82 77 75 130 Depreciation and amortization 112 109 107 107 106 General and administrative 153 126 120 108 129 Litigation provision 453 0 — 0 0 Total operating expenses 1,677 1,135 1,115 1,078 1,222 Operating income 1,552 2,020 2,048 2,077 1,751 Non-operating (expense) income -2 10 13 6 15 Income before income taxes 1,550 2,030 2,061 2,083 1,766 Income tax provision 477 670 463 676 574 Net income $1,073 $1,360 $1,598 $1,407 $1,192 VISA INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) For the Years Ended September 30, 2014 2013 2012 (in millions) Operating Activities Net income $5,438 $4,980 $2,142 Adjustments to reconcile net income to net cash provided by (used in) operating activities: Amortization of client incentives 2,592 2,321 2155 Share-based compensation 172 179 147 Excess tax benefit for share-based compensation -90 -74 -71 Depreciation and amortization of property, equipment, technology and intangible assets 435 397 333 Deferred income taxes -,580 1,527 -1,690 Litigation provision 453 3 4,101 Other 37 50 -8 Change in operating assets and liabilities: Income tax receivable 51 37 -67 Settlement receivable 13 -,345 -42 Accounts receivable -53 -38 -161 Client incentives -2,395 -2,336 -1757 Other assets -,430 -,543 41 Accounts payable -56 40 -17 Settlement payable 107 506 270 Accrued and other liabilities 513 702 -,227 Accrued litigation 998 -4,384 -140 Net cash provided by operating activities 7205 3022 5009 Investing Activities Purchases of property, equipment, technology and intangible assets -,553 -,471 -,376 Proceeds from disposal of property, equipment and technology 0 0 2 Investment securities, available-for-sale: Purchases -2,572 -3,164 -4,140 Proceeds from maturities and sales 2,342 2,440 2,093 Acquisitions, net of cash received -,149 0 -3 Purchases of / contributions to other investments -9 -3 -12 Proceeds / distributions from other investments 0 34 22 Net cash used in investing activities -,941 -1,164 -2,414 Financing Activities Repurchase of class A common stock -4,118 -5,365 -,710 Dividends paid -1,006 -,864 -,595 Deposits into litigation escrow account—retrospective responsibility plan -,450 0 -1,715 (Return to) payments from litigation escrow account—retrospective responsibility plan -,999 4,383 140 Cash proceeds from exercise of stock options 91 108 174 Restricted stock and performance-based shares settled in cash for taxes -86 -64 0 Excess tax benefit for share-based compensation 90 74 71 Payments for earn-out related to PlaySpan acquisition 0 -12 -14 Principal payments on capital lease obligations 0 -6 -6 Net cash used in financing activities -6,478 -1,746 -2,655 Effect of exchange rate changes on cash and cash equivalents -1 0 0 7 (Decrease) increase in cash and cash equivalents -,215 112 -53 Cash and cash equivalents at beginning of year 2,186 2,074 2,127 Cash and cash equivalents at end of period $1,971 $2,186 $2,074 Supplemental Disclosures Income taxes paid, net of refunds $2,656 $595 $2,057 Non-cash accruals related to purchases of property, equipment, technology and intangible assets $62 $46 $67 VISA INC. CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED) Three Months Ended September 30, Twelve Months Ended September 30, 2014 2013 2014 2013 (in millions, except per share data) Operating Revenues Service revenues $1,499 $1,385 $5,797 $5,352 Data processing revenues 1,348 1,186 5,167 4,642 International transaction revenues 938 899 3,560 3,389 Other revenues 212 183 770 716 Client incentives -,768 -,680 -2,592 -2,321 Total operating revenues 3,229 2,973 12,702 11,778 Operating Expenses Personnel 496 499 1,875 1,932 Marketing 241 236 900 876 Network and processing 128 122 507 468 Professional fees 94 130 328 412 Depreciation and amortization 112 106 435 397 General and administrative 153 129 507 451 Litigation provision 453 0 453 3 Total operating expenses 1,677 1,222 5,005 4,539 Operating income 1,552 1,751 7,697 7,239 Non-operating (expense) income -2 15 27 18 Income before income taxes 1,550 1,766 7,724 7,257 Income tax provision 477 574 2,286 2,277 Net income $1,073 $1,192 $5,438 $4,980 Basic earnings per share Class A common stock $1.73 $1.86 $8.65 $7.61 Class B common stock $0.73 $0.78 $3.63 $3.2 Class C common stock $1.73 $1.86 $8.65 $7.61 Basic weighted-average shares outstanding Class A common stock 492 509 498 520 Class B common stock 245 245 245 245 Class C common stock 24 27 26 28 Diluted earnings per share Class A common stock $1.72 $1.85 $8.6199999999999992 $7.59 Class B common stock $0.72 $0.78 $3.62 $3.19 Class C common stock $1.72 $1.85 $8.6199999999999992 $7.59 Diluted weighted-average shares outstanding Class A common stock 623 644 631 656 Class B common stock 245 245 245 245 Class C common stock 24 27 26 28 VISA INC. CONSOLIDATED BALANCE SHEETS (UNAUDITED) September 30,2014 September 30,2013 (in millions, except par value data) Assets Cash and cash equivalents $1,971 $2,186 Restricted cash—litigation escrow 1,498 49 Investment securities: Trading 69 75 Available-for-sale 1,910 1,994 Income tax receivable 91 142 Settlement receivable 786 799 Accounts receivable 822 761 Customer collateral 961 866 Current portion of client incentives 210 282 Current portion of deferred tax assets 1,028 481 Prepaid expenses and other current assets 216 187 Total current assets 9,562 7,822 Investment securities, available-for-sale 3,015 2,760 Client incentives 81 89 Property, equipment and technology, net 1,892 1,732 Deferred tax assets 8 0 Other assets 847 521 Intangible assets, net 11,411 11,351 Goodwill 11,753 11,681 Total assets $38,569 $35,956 Liabilities Accounts payable $147 $184 Settlement payable 1,332 1,225 Customer collateral 961 866 Accrued compensation and benefits 450 523 Client incentives 1,036 919 Accrued liabilities 624 613 Accrued litigation 1,456 5 Total current liabilities 6,006 4,335 Deferred tax liabilities 4,145 4,149 Other liabilities 1,005 602 Total liabilities 11,156 9,086 Equity Preferred stock, $0.0001 par value, 25 shares authorized and none issued 0 0 Class A common stock, $0.0001 par value, 2,001,622 shares authorized, 495 and 508 shares issued and outstanding at September 30, 2014 and 2013, respectively 0 0 Class B common stock, $0.0001 par value, 622 shares authorized, 245 shares issued and outstanding at September 30, 2014 and 2013 0 0 Class C common stock, $0.0001 par value, 1,097 shares authorized, 22 and 27 shares issued and outstanding at September 30, 2014 and 2013, respectively 0 0 Additional paid-in capital 18,299 18,875 Accumulated income 9,131 7,974 Accumulated other comprehensive (loss) income, net: Investment securities, available-for-sale 31 59 Defined benefit pension and other postretirement plans -84 -60 Derivative instruments classified as cash flow hedges 38 23 Foreign currency translation adjustments -2 -1 Total accumulated other comprehensive (loss) income, net -17 21 Total equity 27,413 26,870 Total liabilities and equity $38,569 $35,956 Our financial results for fiscal 2015 and 2014 reflect the impact of significant items that we believe are not indicative of our operating performance in the prior or future years, as they either have no cash impact or are related to amounts covered by the retrospective responsibility plan. As such, we believe the presentation of adjusted financial results excluding the following amounts provides a clearer understanding of our operating performance for the periods presented. ● Revaluation of Visa Europe put option. During the third quarter of fiscal 2015, we recorded an increase of $110 million in the fair value of the Visa Europe put option, resulting in the recognition of non-cash, non-operating expense in our financial results. This amount is not subject to income tax and therefore has no impact on our reported income tax provision. ● Litigation provision. During fiscal 2014, we recorded a litigation provision of $450 million and related tax benefits associated with the interchange multidistrict litigation. The tax impact is determined by applying applicable federal and state tax rates to the litigation provision. Monetary liabilities from settlements of, or judgments in, the interchange multidistrict litigation will be paid from the litigation escrow account under the retrospective responsibility plan. Three Months Ended September 30, Operating Expenses Operating Margin(1),(2) Net Income Diluted Earnings per Share(2),(3) 2015 2014 2015 2014 2015 2014 2015 2014 As reported $1,288 $1,677 0.64 0.48 $1,512 $1,073 $0.62 $0.43 Litigation provision 0 -,450 0 0.14000000000000001 0 283 0 0.11 As adjusted $1,288 $1,227 0.64 0.62 $1,512 $1,356 $0.62 $0.54 Diluted weighted-average shares outstanding, as reported 2,440 2,493 Twelve Months Ended September 30, Operating Expenses Operating Margin(1),(2) Net Income Diluted Earnings per Share(2),(3) 2015 2014 2015 2014 2015 2014 2015 2014 As reported $4,816 $5,005 0.65 0.61 $6,328 $5,438 $2.58 $2.16 Revaluation of Visa Europe put option 0 0 0 0 110 0 0.04 0 Litigation provision 0 -,450 0 0.04 0 283 0 0.11 As adjusted $4,816 $4,555 0.65 0.64 $6,438 $5,721 $2.62 $2.27 Diluted weighted-average shares outstanding, as reported 2,457 2,523 (1) Operating margin is calculated as operating income divided by total operating revenues. (2) Figures in the table may not recalculate exactly due to rounding. Operating margin and diluted earnings per share figures are calculated based on unrounded numbers. (3) The per share amounts for the prior periods presented have been retroactively adjusted to reflect the four-for-one stock split effected in the fiscal second quarter of 2015. VISA INC. FISCAL 2014 AND 2013 QUARTERLY RESULTS OF OPERATIONS (UNAUDITED) Fiscal 2014 Quarter Ended Fiscal 2013 Quarter Ended September 30,2014 June 30,2014 March 31,2014 December 31,2013 September 30,2013 (in millions) Operating Revenues Service revenues $1,499 $1,417 $1,462 $1,419 $1,385 Data processing revenues 1,348 1,321 1,234 1,264 1,186 International transaction revenues 938 860 871 891 899 Other revenues 212 195 183 180 183 Client incentives -,768 -,638 -,587 -,599 -,680 Total operating revenues 3,229 3,155 3,163 3,155 2,973 Operating Expenses Personnel 496 463 446 470 499 Marketing 241 228 245 186 236 Network and processing 128 127 120 132 122 Professional fees 94 82 77 75 130 Depreciation and amortization 112 109 107 107 106 General and administrative 153 126 120 108 129 Litigation provision 453 0 — 0 0 Total operating expenses 1,677 1,135 1,115 1,078 1,222 Operating income 1,552 2,020 2,048 2,077 1,751 Non-operating (expense) income -2 10 13 6 15 Income before income taxes 1,550 2,030 2,061 2,083 1,766 Income tax provision 477 670 463 676 574 Net income $1,073 $1,360 $1,598 $1,407 $1,192

Calculation of Free Cash Flow US$ in millions A-2 (1) Includes changes in client incentives, trade receivable/payable, settlement receivable/payable and personnel incentives. Additions (+) / Reductions (-) to Net income Net income (as reported) 1,512 6,328 Capital Assets + Depreciation and amortization 119 494 - Capital expenditures (138) (414) (19) 80 Litigation + Litigation provision 11 14 - Settlement payments (84) (446) + Settlement payments funded by litigation escrow 71 426 (2) (6) Share-based Compensation + Share-based compensation 48 187 Pension + Pension expense 5 19 - Pension contribution — (2) 5 17 Taxes + Income tax provision 771 2,667 - Income taxes paid (594) (2,486) 177 181 Visa Europe Put Option + Fair value adjustment — 110 Changes in Working Capital (1) +/- Changes in other working capital accounts (91) (269) Total Free Cash Flow 1,630 6,628 Three Months Ended September 30, 2015 Twelve Months Ended September 30, 2015