Attached files

| file | filename |

|---|---|

| 8-K - 8-K - RENASANT CORP | d44252d8k.htm |

| EX-99.1 - EX-99.1 - RENASANT CORP | d44252dex991.htm |

| Exhibit 99.2

|

Merger of Renasant Corporation (RNST) and

KeyWorth Bank

October 20, 2015

|

|

Forward Looking Statement This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Congress passed the Private Securities Litigation Act of 1995 in an effort to encourage companies to provide information about their anticipated future financial performance. This act provides a safe harbor for such disclosure, which protects a company from unwarranted litigation if actual results are different from management expectations. This presentation reflects current views and estimates of the respective management of Renasant Corporation (“Renasant” or “RNST”) and KeyWorth Bank (“KeyWorth”) regarding future economic circumstances, industry conditions, company performance, and financial results. These forward looking statements are subject to a number of factors and uncertainties which could cause Renasant, KeyWorth, or the combined company’s actual results and experience to differ from the anticipated results and expectations expressed in such forward looking statements. Forward looking statements speak only as of the date they are made and neither Renasant nor KeyWorth assumes any duty to update forward looking statements. In addition to factors previously disclosed in Renasant’s reports filed with the SEC and those identified elsewhere in this presentation, these forward-looking statements include, but are not limited to, statements about (i) the expected benefits of the transaction between Renasant and KeyWorth, including future financial and operating results, cost savings, enhanced revenues and the expected market position of the combined company that may be realized from the transaction, and (ii) Renasant and KeyWorth’s plans, objectives, expectations and intentions and other statements contained in this presentation that are not historical facts. Other statements identified by words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “targets,” “projects” or words of similar meaning generally are intended to identify forward-looking statements. These statements are based upon the current beliefs and expectations of Renasant’s and KeyWorth’s management and are inherently subject to significant business, economic and competitive risks and uncertainties, many of which are beyond their respective control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from those indicated or implied in the forward-looking statements.

| 2 |

|

|

|

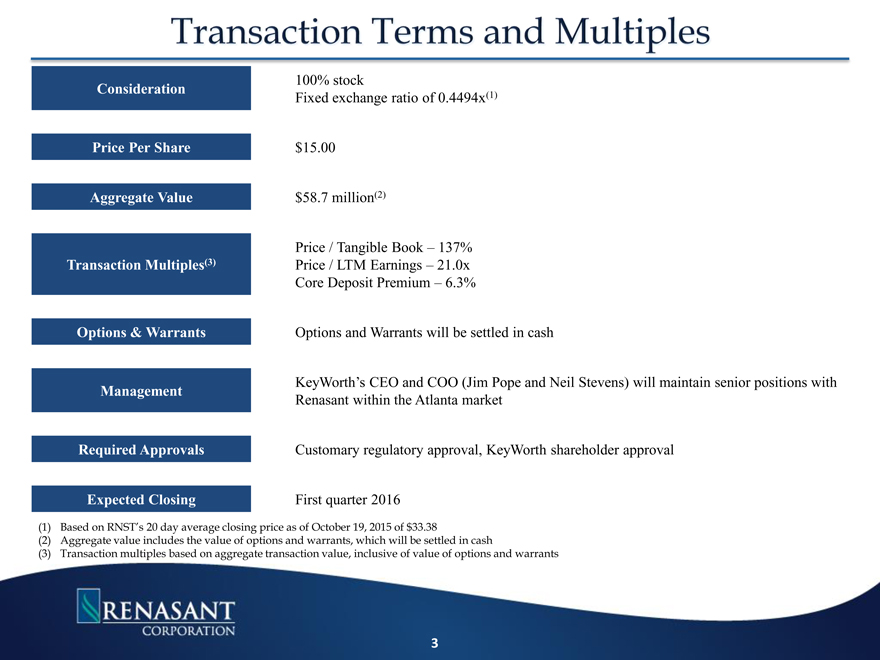

Transaction Terms and Multiples 100% stock

Consideration

Fixed exchange ratio of 0.4494x(1)

Price Per Share $15.00

Aggregate Value $58.7 million(2)

Price / Tangible Book – 137% Transaction Multiples(3) Price / LTM Earnings – 21.0x Core Deposit Premium – 6.3%

Options & Warrants Options and Warrants will be settled in cash

KeyWorth’s CEO and COO (Jim Pope and Neil Stevens) will maintain senior positions with

Management

Renasant within the Atlanta market

Required Approvals Customary regulatory approval, KeyWorth shareholder approval

Expected Closing First quarter 2016

(1) Based on RNST’s 20 day average closing price as of October 19, 2015 of $33.38

(2) Aggregate value includes the value of options and warrants, which will be settled in cash

(3) Transaction multiples based on aggregate transaction value, inclusive of value of options and warrants

3

|

|

Transaction Rationale

Strategically Advantageous

Provides additional scale in the Atlanta MSA with $389 million in assets and a strong core deposit base

Branch footprint provides an increased presence in the attractive northern suburbs of Atlanta

Complementary cultures and business model consistent with Renasant

Ability to leverage KeyWorth’s management experience in market

Ability to expand KeyWorth’s current relationships with more comprehensive services

Financially Attractive

Accretive to first full year earnings per share (excluding transaction costs)

Immediately accretive to tangible book value per share

Estimated IRR of approximately 19%

Conservative cost saving assumptions (25% of non-interest expense)

Pro forma regulatory ratios remain above “well capitalized” guidelines

Lower risk opportunity

Key management of KeyWorth to remain with Renasant

Extensive due diligence process completed

Conservative credit culture with solid asset quality

Manageable asset size and branch network

Non-complex business lines that are easily integrated

4

|

|

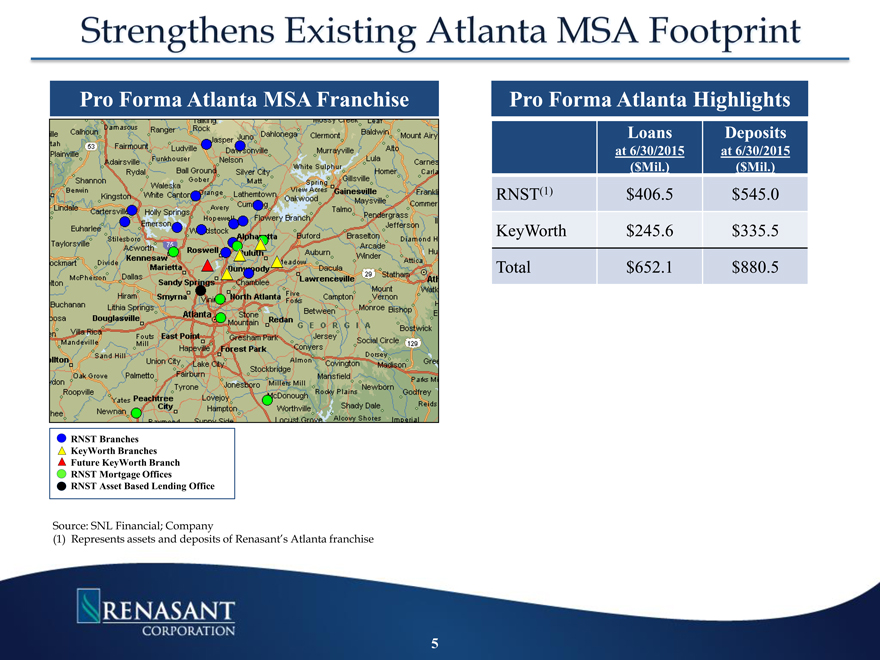

Strengthens Existing Atlanta MSA Footprint Pro Forma Atlanta MSA Franchise Pro Forma Atlanta Highlights

Loans Deposits

at 6/30/2015 at 6/30/2015

($Mil.) ($Mil.)

RNST(1) $406.5 $545.0 KeyWorth $245.6 $335.5 Total $652.1 $880.5

RNST Branches KeyWorth Branches Future KeyWorth Branch RNST Mortgage Offices

RNST Asset Based Lending Office

Source: SNL Financial; Company

(1) Represents assets and deposits of Renasant’s Atlanta franchise

5

|

|

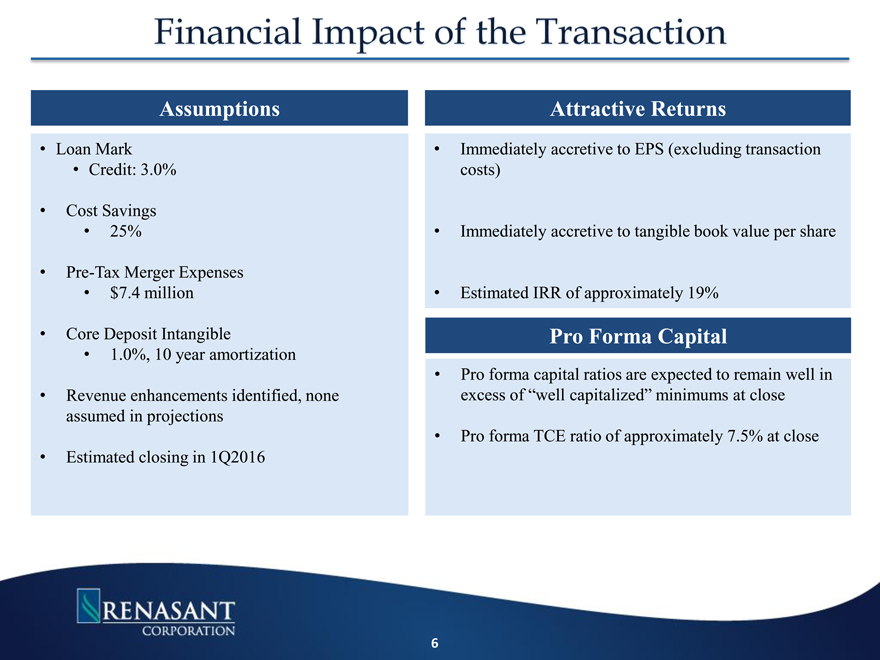

Financial Impact of the Transaction Assumptions Attractive Returns

Loan Mark Immediately accretive to EPS (excluding transaction

Credit: 3.0% costs)

Cost Savings

25% Immediately accretive to tangible book value per share

Pre-Tax Merger Expenses

$7.4 million Estimated IRR of approximately 19%

Core Deposit Intangible Pro Forma Capital

1.0%, 10 year amortization

• Pro forma capital ratios are expected to remain well in

Revenue enhancements identified, none excess of “well capitalized” minimums at close assumed in projections

• Pro forma TCE ratio of approximately 7.5% at close

Estimated closing in 1Q2016

6

|

|

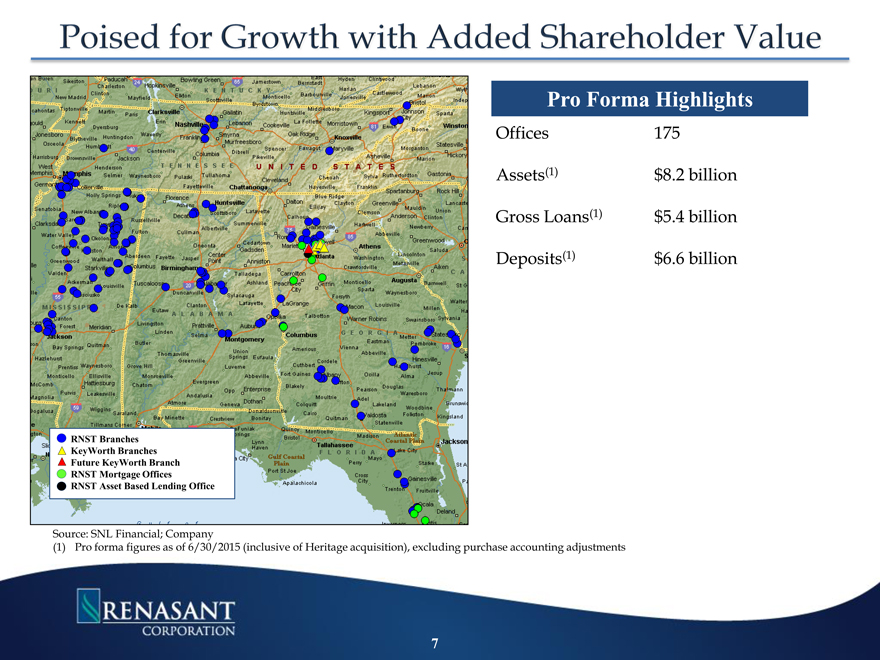

Poised Growth with Added Shareholder ValuePro Forma Highlights

Offices 175

Assets(1) $8.2 billion Gross Loans(1) $5.4 billion Deposits(1) $6.6 billion

RNST Branches KeyWorth Branches Future KeyWorth Branch RNST Mortgage Offices

RNST Asset Based Lending Office

Source: SNL Financial; Company

(1) Pro forma figures as of 6/30/2015 (inclusive of Heritage acquisition), excluding purchase accounting adjustments

7

|

|

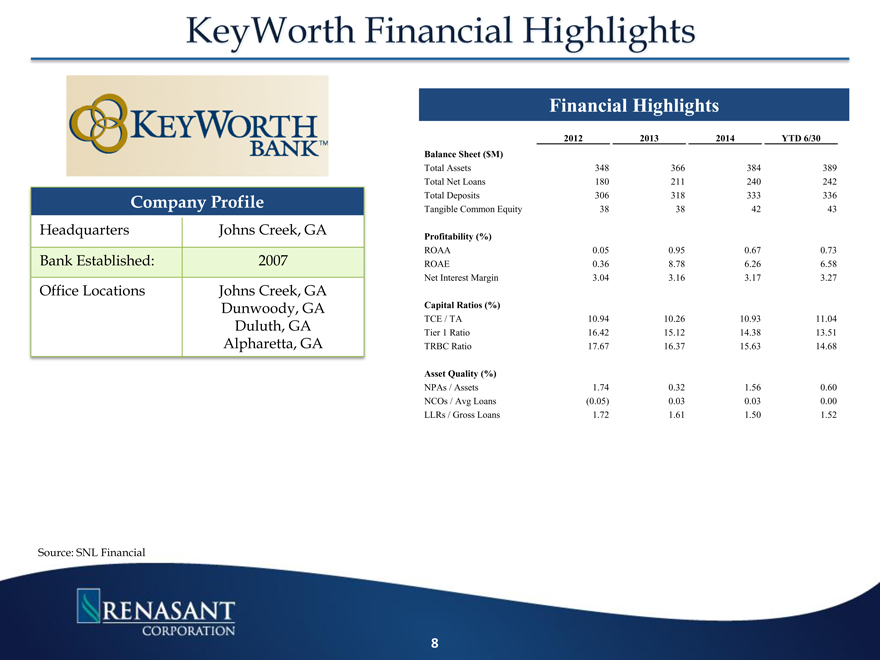

Keyworth Financial Highlights Financial Highlights

2012 2013 2014 YTD 6/30 Balance Sheet ($M)’

Total Assets 348 366 384 389 Total Net Loans 180 211 240 242 Company Profile Total Deposits 306 318 333 336 Tangible Common Equity 38 38 42 43

Headquarters Johns Creek, GA

Profitability (%)’

ROAA 0.05 0.95 0.67 0.73

Bank Established: 2007 ROAE 0.36 8.78 6.26 6.58

Net Interest Margin 3.04 3.16 3.17 3.27

Office Locations Johns Creek, GA

Dunwoody, GA Capital Ratios (%)

Duluth, GA TCE / TA 10.94 10.26 10.93 11.04 Tier 1 Ratio 16.42 15.12 14.38 13.51 Alpharetta, GA TRBC Ratio 17.67 16.37 15.63 14.68

Asset Quality (%)’

NPAs / Assets 1.74 0.32 1.56 0.60 NCOs / Avg Loans (0.05) 0.03 0.03 0.00 LLRs / Gross Loans 1.72 1.61 1.50 1.52

Source: SNL Financial

8

|

|

Additional information Renasant and KeyWorth will be filing a joint proxy statement/prospectus, and other relevant documents concerning the

merger with the Securities and Exchange Commission (the “SEC”). This presentation does not constitute an offer to sell or

the solicitation of an offer to buy any securities. KEYWORTH INVESTORS ARE URGED TO READ THE JOINT PROXY

STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH

THE MERGER OR INCORPORATED BY REFERENCE IN THE JOINT PROXY STATEMENT/PROSPECTUS BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT RENASANT, KEYWORTH AND THE PROPOSED

MERGER. When available, the joint proxy statement/prospectus will be mailed to shareholders of KeyWorth. Investors will

also be able to obtain copies of the joint proxy statement/prospectus and other relevant documents (when they become available)

free of charge at the SEC’s Web site (www.sec.gov). In addition, documents filed with the SEC by Renasant will be available

free of charge from Kevin Chapman, Chief Financial Officer, Renasant Corporation, 209 Troy Street, Tupelo, Mississippi

38804-4827, telephone: (662) 680-1450.

9

|

|

Investor Inquires E. Robinson McGraw

Chairman

209 TROY STREET President and Chief Executive Officer

TUPELO, MS 38804-4827 PHONE: 1-800-680-1001

F0ACSIMILE: 1-662-680-1234 Kevin D. Chapman

WWW.RENASANT.COM Senior Executive Vice President and WWW.RENASANTBANK.COM Chief Financial Officer

10