Attached files

| file | filename |

|---|---|

| 8-K - 8-K - IDEX CORP /DE/ | iex-20151019x8k.htm |

EX 99.1

For further information: TRADED: NYSE (IEX)

Investor Contact:

Heath Mitts

Senior Vice President and Chief Financial Officer

(847) 498-7070

MONDAY, OCTOBER 19, 2015

IDEX REPORTS THIRD QUARTER ADJUSTED EPS OF 89 CENTS WITH

FULL YEAR ADJUSTED EPS GUIDANCE OF $3.50 -- $3.53

LAKE FOREST, IL, OCTOBER 19 - IDEX Corporation (NYSE: IEX) today announced its financial results for the three month period ended September 30, 2015.

Third Quarter 2015 Highlights

• | Adjusted EPS of 89 cents with adjusted operating margin of 21.5 percent |

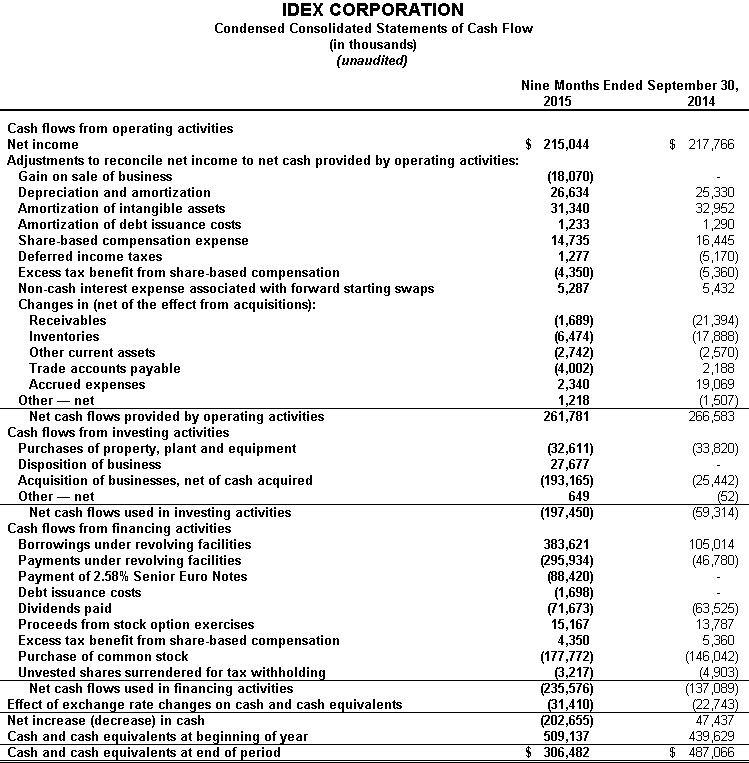

• | Free cash flow of $105 million was 132 percent of net income |

• | Repurchased 911 thousand shares of common stock for $66 million |

• | Restructuring actions resulted in a pre-tax charge of $4.7 million, or 4 cents of EPS |

• | Ismatec business sold for a pre-tax gain of $18.1 million, or 17 cents of EPS |

• | Acquired CiDRA Precision Services |

Third Quarter 2015

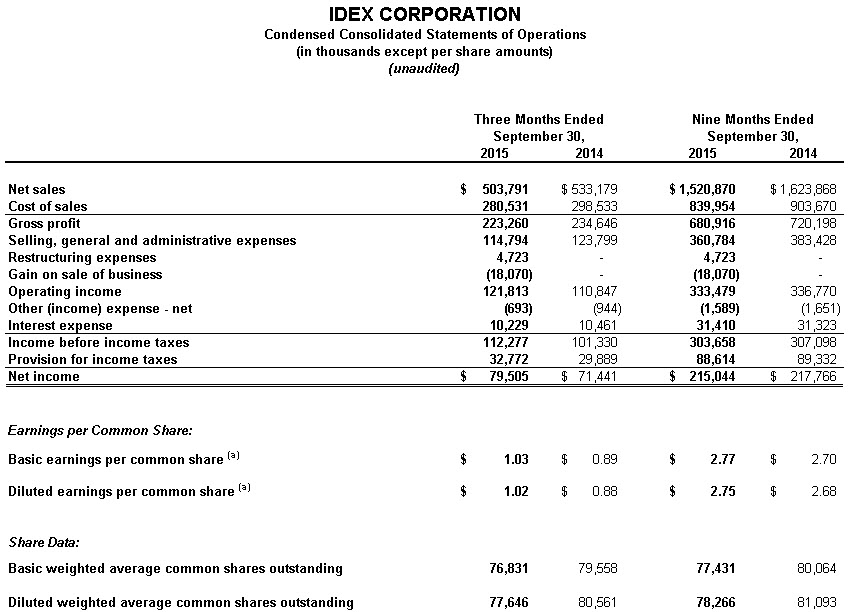

Orders of $485 million were down 4 percent (-2 percent organic, +2 percent acquisitions and -4 percent foreign currency translation) compared with the prior year period. Sales of $504 million were down 6 percent (-4 percent organic, +2 percent acquisitions and -4 percent foreign currency translation) compared with the prior year period.

Gross margin of 44.3 percent was up 30 basis points from the prior year period, while adjusted operating margin of 21.5 percent was up 70 basis points from the prior year.

Adjusted net income of $69 million decreased 3 percent from the prior year period, while adjusted earnings per share of 89 cents increased 1 cent, or 1 percent, from the prior year period. Adjusted EBITDA of $130 million was 26 percent of sales and covered interest expense by almost 13 times, while free cash flow of $105 million was 132 percent of net income.

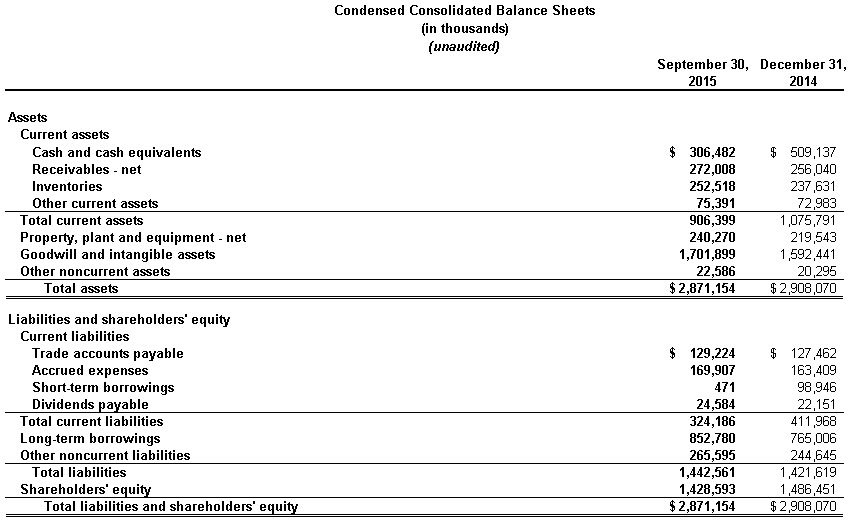

The Company repurchased 911 thousand shares of common stock for $66 million in the third quarter of 2015. Year-to-date, the Company has repurchased 2.4 million shares of common stock for $179 million.

"IDEX’s third quarter was highlighted by a solid 89 cents of adjusted EPS and 21.5 percent adjusted operating margins, a 70 basis point operating margin expansion from the third quarter of 2014. Our teams faced continued market headwinds, but executed by delivering strong margin improvement and $105 million of free cash flow. North American industrials slowed during the quarter, contributing to the 2 and 4 percent decreases for organic orders and sales, respectively. | |

The challenging third quarter demand environment means we now expect fourth quarter organic sales to be down 1 to 2 percent, with full year organic sales down 2 to 3 percent. Restructuring actions executed in the third quarter will provide incremental efficiencies going forward. In the third quarter, these actions cost $4.7 million, and the total 2015 cost is now expected to be in the range of $8 to $10 million. These are permanent cost-out actions and the full benefit will be realized in 2016. | |

Continuing to deliver total shareholder returns is critical to our long term success. Year-to-date we have repurchased 2.4 million shares for $179 million, deployed nearly $200 million on three strategic acquisitions across three platforms, retired €81 million of European private placement notes, and, in the third quarter, divested our Ismatec business. This was a non-strategic product line in our Health and Science segment, which sold for $28 million, and resulted in an $18.1 million pre-tax gain. Additionally, the acquisition pipeline is very strong, and our free cash flow and debt capacity allows us to use the strength of our balance sheet for a steady, disciplined pace of acquisitions for the foreseeable future. | |

For the fourth quarter, we expect adjusted EPS in the range 88 to 91 cents and full year 2015 adjusted EPS of $3.50 to $3.53 with adjusted operating margins of 21 percent. This guidance excludes the charges from the restructuring actions in the second half of 2015, and the gain from the Ismatec divestiture.” | |

Andrew K. Silvernail | |

Chairman and Chief Executive Officer | |

Third Quarter 2015 Segment Highlights

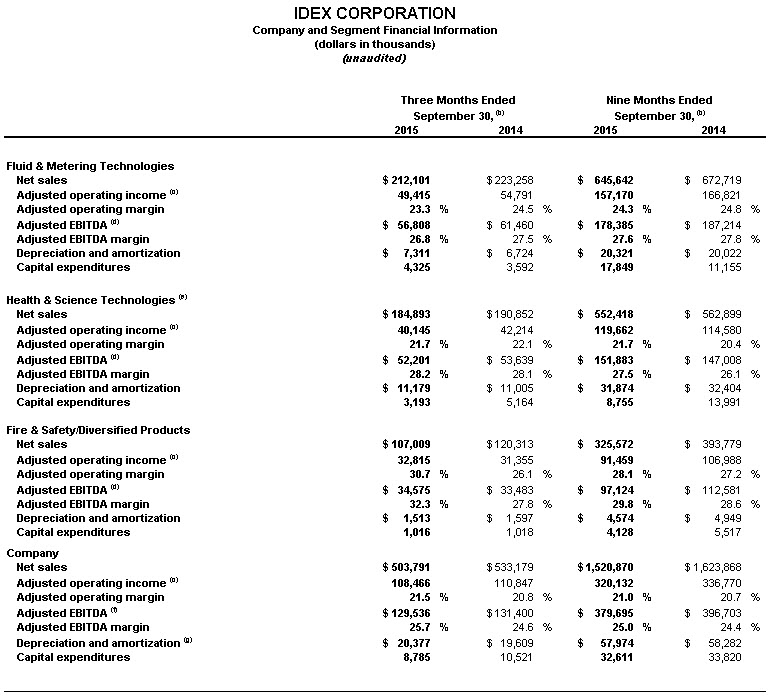

Fluid & Metering Technologies

• | Sales of $212 million reflected a 5 percent decrease compared to the third quarter of 2014 (-4 percent organic, +3 percent acquisition and -4 percent foreign currency translation). |

• | Adjusted operating margin of 23.3 percent represented a 120 basis point decrease compared with the third quarter of 2014 primarily due to non-cash acquisition fair value inventory charges recorded in the quarter as well as lower volume. |

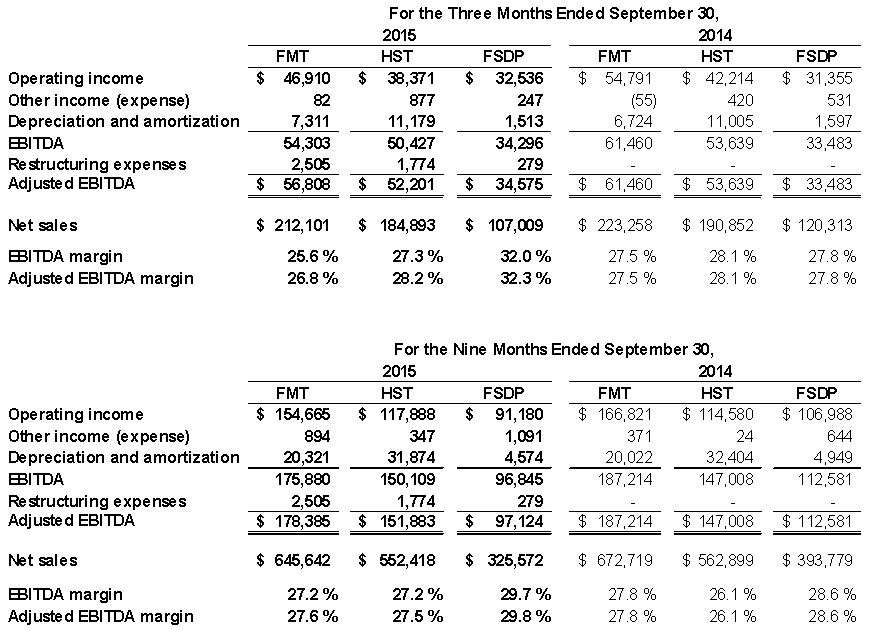

• | Adjusted EBITDA of $56.8 million resulted in an adjusted EBITDA margin of 26.8 percent, down 70 basis points compared with the third quarter of 2014. |

Health & Science Technologies

• | Sales of $185 million reflected a 3 percent decrease compared to the third quarter of 2014 (-3 percent organic, +4 percent acquisitions and -4 percent foreign currency translation). |

• | Adjusted operating margin of 21.7 percent represented a 40 basis point decrease compared with the third quarter of 2014 primarily due to decreased volume. |

• | Adjusted EBITDA of $52.2 million resulted in an adjusted EBITDA margin of 28.2 percent, up 10 basis points compared with the third quarter of 2014. |

Fire & Safety/Diversified Products

• | Sales of $107 million reflected an 11 percent decrease compared to the third quarter of 2014 (-5 percent organic and -6 percent foreign currency translation). |

• | Adjusted operating margin of 30.7 percent represented a 460 basis point increase compared with the third quarter of 2014 primarily due to gross margin improvements at the dispensing and fire suppression platforms driven by favorable mix within these platforms along with productivity improvements across the entire segment. |

• | Adjusted EBITDA of $34.6 million resulted in an adjusted EBITDA margin of 32.3 percent, up 450 basis points compared with the third quarter of 2014. |

For the third quarter of 2015, Fluid & Metering Technologies contributed 42 percent of sales, 40 percent of operating income and 39 percent of EBITDA; Health & Science Technologies accounted for 37 percent of sales, 33 percent of operating income and 36 percent of EBITDA; and Fire & Safety/Diversified Products represented 21 percent of sales, 27 percent of operating income and 25 percent of EBITDA.

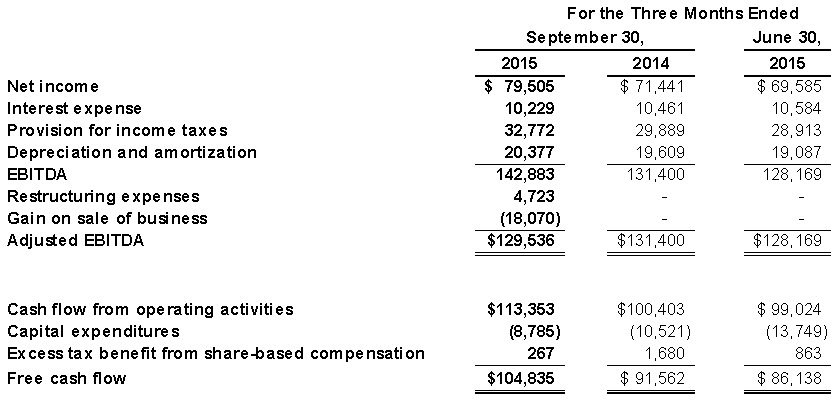

Non-U.S. GAAP Measures of Financial Performance

The Company supplements certain U.S. GAAP financial performance metrics with non-U.S. GAAP financial performance metrics in order to provide investors with better insight and increased transparency while also allowing for a more comprehensive understanding of the financial information used by management in its decision making. Reconciliations of non-U.S. GAAP financial performance metrics to their most comparable U.S. GAAP financial performance metrics are defined and presented below and in no way are considered a substitute for, nor superior to, the financial data prepared in accordance with U.S. GAAP. There were no adjustments to U.S. GAAP financial performance metrics other than the items noted below.

• | Adjusted operating income is calculated as operating income plus restructuring expenses less the gain on sale of a business. |

• | Adjusted operating margin is calculated as adjusted operating income divided by net sales. |

• | Adjusted net income is calculated as net income plus restructuring expenses less the gain on sale of a business, net of the statutory tax expense/benefit. |

• | Consolidated EBITDA is calculated as net income plus interest expense plus provision for income taxes plus depreciation and amortization; while segment EBITDA is calculated as operating income plus or minus other income (expense) plus depreciation and amortization. |

• | Adjusted EBITDA is calculated as EBITDA plus restructuring expenses less the gain on sale of a business. |

• | Free cash flow is calculated as cash flow from operating activities less capital expenditures plus the excess tax benefit from share-based compensation. |

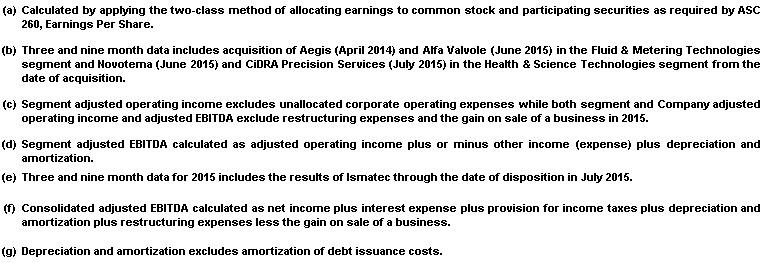

Table 1: Reconciliations of Reported-to-Adjusted Operating Income and Margin (dollars in thousands)

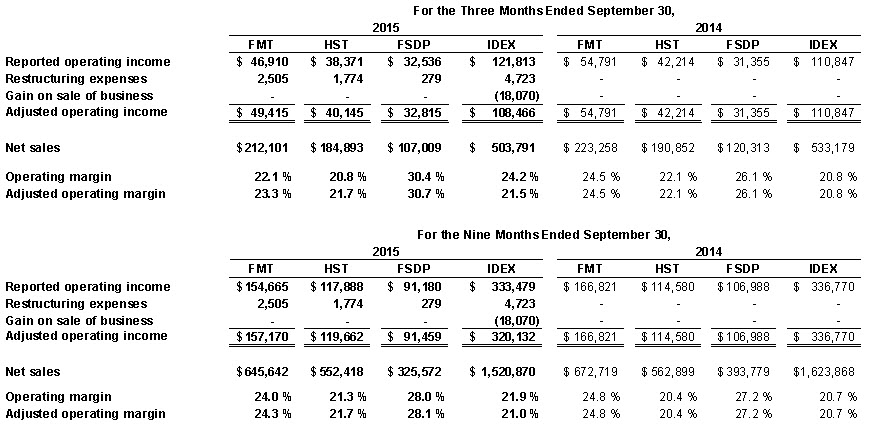

Table 2: Reconciliations of Reported-to-Adjusted Net Income and EPS (dollars in thousands, except EPS)

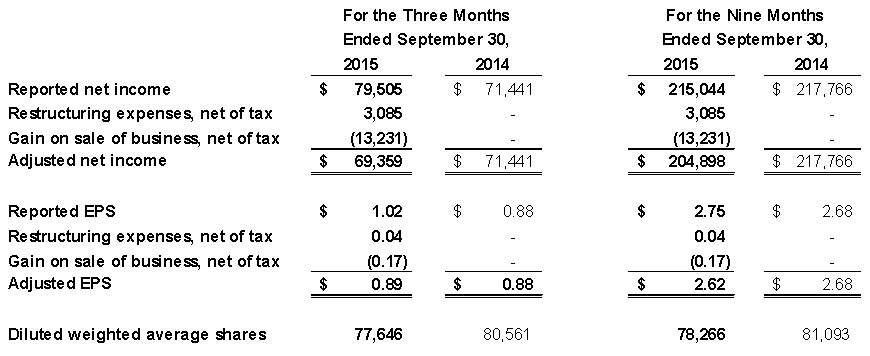

Table 3: Reconciliations of Consolidated EBITDA and Free Cash Flow (dollars in thousands)

Table 4: Reconciliations of Segment EBITDA (dollars in thousands)

Conference Call to be Broadcast over the Internet

IDEX will broadcast its third quarter earnings conference call over the Internet on Tuesday, October 20, 2015 at 9:30 a.m. CT. Chairman and Chief Executive Officer Andy Silvernail and Senior Vice President and Chief Financial Officer Heath Mitts will discuss the Company’s recent financial performance and respond to questions from the financial analyst community. IDEX invites interested investors to listen to the call and view the accompanying slide presentation, which will be carried live on its website at www.idexcorp.com. Those who wish to participate should log on several minutes before the discussion begins. After clicking on the presentation icon, investors should follow the instructions to ensure their systems are set up to hear the event and view the presentation slides, or download the correct applications at no charge. Investors will also be able to hear a replay of the call by dialing 877.660.6853 (or 201.612.7415 for international participants) using the ID # 13604137.

Forward-Looking Statements

This news release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act of 1934, as amended. These statements may relate to, among other things, capital expenditures, cost reductions, cash flow, and operating improvements and are indicated by words or phrases such as “anticipate,” “estimate,” “plans,” “expects,” “projects,” “should,” “will,” “management believes,” “the company believes,” “the company intends,” and similar words or phrases. These statements are subject to inherent uncertainties and risks that could cause actual results to differ materially from those anticipated at the date of this news release. The risks and uncertainties include, but are not limited to, the following: economic and political consequences resulting from terrorist attacks and wars; levels of industrial activity and economic conditions in the U.S. and other countries around the world; pricing pressures and other competitive factors, and levels of capital spending in certain industries - all of which could have a material impact on order rates and IDEX’s results, particularly in light of the low levels of order backlogs it typically maintains; its ability to make acquisitions and to integrate and operate acquired businesses on a profitable basis; the relationship of the U.S. dollar to other currencies and its impact on pricing and cost competitiveness; political and economic conditions in foreign countries in which the company operates; interest rates; capacity utilization and the effect this has on costs; labor markets; market conditions and material costs; and developments with respect to contingencies, such as litigation and environmental matters. The forward-looking statements included here are only made as of the date of this news release, and management undertakes no obligation to publicly update them to reflect subsequent events or circumstances. Investors are cautioned not to rely unduly on forward-looking statements when evaluating the information presented here.

About IDEX

IDEX Corporation is an applied solutions company specializing in fluid and metering technologies, health and science technologies, and fire, safety and other diversified products built to its customers’ exacting specifications. Its products are sold in niche markets to a wide range of industries throughout the world. IDEX shares are traded on the New York Stock Exchange and Chicago Stock Exchange under the symbol “IEX”.

For further information on IDEX Corporation and its business units, visit the company’s website at www.idexcorp.com.

(Financial reports follow)