Attached files

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2014 | |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period From to | |

Commission file number 1-10235

IDEX CORPORATION

(Exact Name of Registrant as Specified in its Charter)

Delaware | 36-3555336 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

1925 West Field Court, Lake Forest, Illinois | 60045 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number:

(847) 498-7070

Securities Registered Pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock, par value $.01 per share | New York Stock Exchange and Chicago Stock Exchange | |

Securities Registered Pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer þ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

(Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

The aggregate market value, as of the last business day of the registrant's most recently completed second fiscal quarter, of the common stock (based on the June 30, 2014 closing price of $80.74) held by non-affiliates of IDEX Corporation was $6,428,282,555.

The number of shares outstanding of IDEX Corporation’s common stock, par value $.01 per share, as of February 17, 2015 was 78,232,245.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the proxy statement with respect to the IDEX Corporation 2015 annual meeting of stockholders (the “2015 Proxy Statement”) are incorporated by reference into Part III of this Form 10-K.

Table of Contents

PART I. | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

PART II. | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

PART III. | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

PART IV. | ||

Item 15. | ||

PART I

Item 1. | Business. |

IDEX Corporation (“IDEX” or the “Company”) is a Delaware corporation incorporated on September 24, 1987. The Company is an applied solutions business that sells an extensive array of pumps, flow meters and other fluidics systems and components and engineered products to customers in a variety of markets around the world. All of the Company’s business activities are carried out through wholly-owned subsidiaries.

The Company has three reportable business segments: Fluid & Metering Technologies ("FMT"), Health & Science Technologies ("HST") and Fire & Safety/Diversified Products ("FSDP"). Within our three reportable segments, the Company maintains six platforms, where we will invest in organic growth and acquisitions with a strategic view towards a platform with the potential for at least $500 million in revenue, and seven groups, where we will focus on organic growth and strategic acquisitions. The Fluid & Metering Technologies segment contains the Energy, Water (comprised of Water Services & Technology and Diaphragm & Dosing Pump Technology), and Chemical, Food & Process platforms as well as the Agricultural group (comprised of Banjo). The Health & Science Technologies segment contains the IDEX Optics & Photonics, Scientific Fluidics and Material Processing Technologies platforms, as well as the Sealing Solutions and the Industrial (comprised of Micropump and Gast) groups. The Fire & Safety/Diversified Products segment is comprised of the Dispensing, Rescue, Band-It, and Fire Suppression groups. Each platform or group is comprised of one or more of our 15 reporting units: five reporting units within Fluid & Metering Technologies (Energy; Chemical, Food, & Process; Water Services & Technology; Banjo; and Diaphragm & Dosing Pump Technology); six reporting units within Health & Science Technologies (IDEX Optics and Photonics; Scientific Fluidics; Material Processing Technologies; Sealing Solutions; Micropump; and Gast); and four reporting units within Fire & Safety/Diversified Products (Dispensing, Rescue, Band-It, and Fire Suppression).

IDEX believes that each of its reporting units is a leader in its product and service areas. The Company also believes that its strong financial performance has been attributable to its ability to design and engineer specialized quality products, coupled with its ability to identify and successfully consummate and integrate strategic acquisitions.

FLUID & METERING TECHNOLOGIES SEGMENT

The Fluid & Metering Technologies segment designs, produces and distributes positive displacement pumps, flow meters, injectors, and other fluid-handling pump modules and systems and provides flow monitoring and other services for the food, chemical, general industrial, water & wastewater, agricultural and energy industries. Fluid & Metering Technologies application-specific pump and metering solutions serve a diverse range of end markets, including industrial infrastructure (fossil fuels, refined & alternative fuels, and water & wastewater), chemical processing, agricultural, food & beverage, pulp and paper, transportation, plastics and resins, electronics and electrical, construction & mining, pharmaceutical and bio-pharmaceutical, machinery and numerous other specialty niche markets. Fluid & Metering Technologies accounted for 42% of IDEX’s sales and 43% of IDEX’s operating income in 2014, with approximately 45% of its sales to customers outside the U.S.

Banjo. Banjo is a provider of special purpose, severe-duty pumps, valves, fittings and systems used in liquid handling. Banjo is based in Crawfordsville, Indiana and its products are used in agricultural and industrial applications. Approximately 13% of Banjo’s 2014 sales were to customers outside the U.S.

Energy. Energy consists of the Company’s Corken, Faure Herman, Liquid Controls, S.A.M.P.I. and Toptech businesses. Energy is a leading supplier of flow meters, electronic registration and control products, rotary vane and turbine pumps, reciprocating piston compressors, and terminal automation control systems. Headquartered in Lake Bluff, Illinois (Liquid Controls products), Energy has additional facilities in Longwood, Florida and Zwijndrech, Belgium (Toptech products); Oklahoma City, Oklahoma (Corken products); La Ferté Bernard, France (Faure Herman products); and Altopascio, Italy (S.A.M.P.I. products). Applications for Liquid Controls and S.A.M.P.I. positive displacement flow meters, electronic, registration and control products include mobile and stationary metering installations for wholesale and retail distribution of petroleum and liquefied petroleum gas, aviation refueling, and industrial metering and dispensing of liquids and gases. Corken products consist of positive-displacement rotary vane pumps, single and multistage regenerative turbine pumps, and small horsepower reciprocating piston compressors. Toptech supplies terminal automation hardware and software to control and manage inventories, as well as transactional data and invoicing, to customers in the oil, gas and refined-fuels markets. Faure Herman is a leading supplier of ultrasonic and helical turbine flow meters used in the custody transfer and control of high value fluids and gases. Approximately 49% of Energy’s 2014 sales were to customers outside the U.S.

Chemical, Food & Process ("CFP"). CFP consists of the Company’s Richter, Viking and Aegis (acquired in April 2014) businesses. CFP is a producer of fluoroplastic lined corrosion-resistant magnetic drive and mechanical seal pumps, shut-off, control and safety valves for corrosive, hazardous, contaminated, pure and high-purity fluids, as well as rotary internal gear, external gear, vane and rotary lobe pumps, custom-engineered OEM pumps, strainers, gear reducers and engineered pump systems. Richter’s corrosion resistant fluoroplastic lined products offer superior solutions for demanding applications in the

1

process industry. Viking’s products consist of external gear pumps, strainers and reducers, and related controls used for transferring and metering thin and viscous liquids sold under the Viking and Wright Flow brands. Viking products primarily serve the chemical, petroleum, pulp & paper, plastics, paints, inks, tanker trucks, compressor, construction, food & beverage, personal care, pharmaceutical and biotech markets. Aegis is a leader in the design, manufacture and sale of specialty chemical processing valves for use in the chemical, petro-chemical, chlor-alkali, pharmaceutical, semiconductor and pulp/paper industries. CFP maintains operations in Kempen, Germany and Suzhou, China (Richter products); Cedar Falls, Iowa (Richter and Viking products); Eastbourne, England and Shannon, Ireland (Viking products); and Geismar, Louisiana (Aegis products). CFP primarily uses independent distributors to market and sell its products. Approximately 51% of CFP’s 2014 sales were to customers outside the U.S.

Diaphragm & Dosing Pump Technology ("DDPT"). DDPT consists of the Company’s Knight, Pulsafeeder-EPO, Pulsafeeder-SPO, Trebor and Warren Rupp businesses. DDPT is a leading provider of ultra-pure chemical pumps, liquid heating systems, air-operated and natural gas-operated double diaphragm pumps, high-pressure pumps, alloy and non-metallic gear pumps, centrifugal pumps, special purpose rotary pumps, peristaltic pumps, transfer pumps, as well as dispensing equipment for industrial laundries, commercial dishwashing and chemical metering. Knight is a leading manufacturer of pumps and dispensing equipment for industrial laundries, commercial dishwashing and chemical metering. Pulsafeeder products (which also include OBL products) are used to introduce precise amounts of fluids into processes to manage water quality and chemical composition, as well as peristaltic pumps. Its markets include water & wastewater treatment, oil and gas, power generation, pulp and paper, chemical and hydrocarbon processing, and swimming pools. Trebor is a leader in high-purity fluid handling products, including air-operated diaphragm pumps and deionized water-heating systems. Trebor products are used in manufacturing of semiconductors, disk drives and flat panel displays. Warren Rupp products (which also include Pumper Parts and Versa-Matic products) are used for abrasive and semisolid materials as well as for applications where product degradation is a concern or where electricity is not available or should not be used. Warren Rupp products primarily serve the chemical, paint, food processing, electronics, construction, utilities, mining and industrial maintenance markets. DDPT maintains operations in Salt Lake City, Utah (Trebor products); Mansfield, Ohio (Warren Rupp products); Rochester, New York, Punta Gorda, Florida and Milan, Italy (Pulsafeeder products); Lake Forest, California, Mississauga, Ontario, Canada, Eastbourne, England, and Unanderra, Australia (Knight products); and a maquiladora in Ciudad Juarez, Chihuahua, Mexico (Knight products). Approximately 48% of DDPT’s 2014 sales were to customers outside the U.S.

Water Services & Technology ("WST"). WST consists of the Company’s ADS, IETG and iPEK businesses. WST is a leading provider of metering technology and flow monitoring products and underground surveillance services for wastewater markets. ADS’s products and services provide comprehensive integrated solutions that enable industry, municipalities and government agencies to analyze and measure the capacity, quality and integrity of wastewater collection systems, including the maintenance and construction of such systems. IETG’s products and services enable water companies to effectively manage their water distribution and sewerage networks, while its surveillance service specializes in underground asset detection and mapping for utilities and other private companies. iPEK supplies remote controlled systems used for infrastructure inspection. WST maintains operations in Huntsville, Alabama and various other locations in the United States and Australia (ADS products and services); Leeds, England (IETG products and services); and Hirschegg, Austria, and Sulzberg, Germany (iPEK products). Approximately 44% of WST’s 2014 sales were to customers outside the U.S.

HEALTH & SCIENCE TECHNOLOGIES SEGMENT

The Health & Science Technologies segment designs, produces and distributes a wide range of precision fluidics, rotary lobe pumps, centrifugal and positive displacement pumps, roll compaction and drying systems used in beverage, food processing, pharmaceutical and cosmetics, pneumatic components and sealing solutions, including very high precision, low-flow rate pumping solutions required in analytical instrumentation, clinical diagnostics and drug discovery, high performance molded and extruded, biocompatible medical devices and implantables, air compressors used in medical, dental and industrial applications, optical components and coatings for applications in the fields of scientific research, defense, biotechnology, aerospace, telecommunications and electronics manufacturing, laboratory and commercial equipment used in the production of micro and nano scale materials, precision photonic solutions used in life sciences, research and defense markets, and precision gear and peristaltic pump technologies that meet exacting original equipment manufacturer specifications. The segment accounted for 35% of IDEX’s sales and 31% of IDEX's operating income in 2014, with approximately 54% of its sales to customers outside the U.S.

Scientific Fluidics. Scientific Fluidics consists of the Company's Eastern Plastics, Rheodyne, Ismatec, Sapphire Engineering, Upchurch Scientific and ERC businesses. Scientific Fluidics has facilities in Rohnert Park, California (Rheodyne products); Bristol, Connecticut (Eastern Plastics products); Wertheim-Mondfeld, Germany (Ismatec products); Middleboro, Massachusetts (Sapphire Engineering products); Oak Harbor, Washington (Ismatec and Upchurch Scientific products); and Kawaguchi, Japan (ERC products). Eastern Plastics products, which consist of high-precision integrated fluidics and associated engineered plastics solutions, are used in a broad set of end markets including medical diagnostics, analytical instrumentation,

2

and laboratory automation. Rheodyne products consist of injectors, valves, fittings and accessories for the analytical instrumentation market. These products are used by manufacturers of high pressure liquid chromatography (“HPLC”) equipment servicing the pharmaceutical, biotech, life science, food & beverage, and chemical markets. Ismatec products include peristaltic metering pumps, analytical process controllers, and sample preparation systems. Sapphire Engineering and Upchurch Scientific products consist of fluidic components and systems for the analytical, biotech and diagnostic instrumentation markets, such as fittings, precision-dispensing pumps and valves, tubing and integrated tubing assemblies, filter sensors and other micro-fluidic and nano-fluidic components, as well as advanced column hardware and accessories for the high performance liquid chromatography market. The products produced by Sapphire Engineering and Upchurch Scientific primarily serve the pharmaceutical, drug discovery, chemical, biochemical processing, genomics/proteomics research, environmental labs, food/agriculture, medical lab, personal care, and plastics/polymer/rubber production markets. ERC manufactures gas liquid separations and detection solutions for the life science, analytical instrumentation and clinical chemistry markets. ERC’s products consist of in-line membrane vacuum degassing solutions, refractive index detectors and ozone generation systems. Approximately 56% of Scientific Fluidics' 2014 sales were to customers outside the U.S.

IDEX Optics and Photonics ("IOP"). IOP consists of the Company's CVI Melles Griot (“CVI MG”), Semrock, and AT Films (including Precision Photonics products) businesses. CVI MG is a global leader in the design and manufacture of precision photonic solutions used in the life sciences, research, semiconductor, security and defense markets. CVI MG’s innovative products are focused on the generation, control and productive use of light for a variety of key science and industrial applications. Products consist of specialty lasers and light sources, electro-optical components, specialty shutters, opto-mechanical assemblies and components. In addition, CVI MG produces critical components for life science research, electronics manufacturing, military and other industrial applications including lenses, mirrors, filters and polarizers. These components are utilized in a number of important applications such as spectroscopy, cytometry (cell counting), guidance systems for target designation, remote sensing, menology and optical lithography. CVI MG is headquartered in Albuquerque, New Mexico, with additional manufacturing sites located in Carlsbad, California; Rochester, New York; Leicester, England; Kyongki-Do, Korea; Tokyo, Japan; and Didam, The Netherlands. Semrock is a provider of optical filters for biotech and analytical instrumentation in the life sciences markets. Semrock’s optical filters are produced using state-of-the-art manufacturing processes which enable it to offer its customers significant improvements in instrument performance and reliability. Semrock is located in Rochester, New York. AT Films specializes in optical components and coatings for applications in the fields of scientific research, defense, aerospace, telecommunications and electronics manufacturing. AT Films’ core competence is the design and manufacture of filters, splitters, reflectors and mirrors with the precise physical properties required to support their customers’ most challenging and cutting-edge optical applications. The Precision Photonics portion of its business specializes in optical components and coatings for applications in the fields of scientific research, aerospace, telecommunications and electronics manufacturing. AT Films is headquartered in Boulder, Colorado. Approximately 50% of IOP’s 2014 sales were to customers outside the U.S.

Sealing Solutions. Sealing Solutions consists of the Company's Precision Polymer Engineering (“PPE”) and FTL Sealing Solutions ("FTL") businesses. PPE, which is located in Blackburn, England, is a provider of proprietary high performance seals and advanced sealing solutions for a diverse range of global industries and applications, including hazardous duty, analytical instrumentation, semiconductor/solar, process technologies, pharmaceutical, electronics, and food applications. FTL, located in Leeds, England, specializes in the design and application of high integrity rotary seals, specialty bearings, and other custom products for the oil & gas, mining, power generation, and marine markets. Approximately 80% of Sealing Solutions' 2014 sales were to customers outside the U.S.

Gast. Gast consists of the Company’s Gast and Jun-Air businesses. The Gast business is a leading manufacturer of air-moving products, including air motors, low-range and medium-range vacuum pumps, vacuum generators, regenerative blowers and fractional horsepower compressors. Gast products are used in a variety of long-life applications requiring a quiet, clean source of moderate vacuum or pressure. Gast products primarily serve the medical equipment, environmental equipment, computers and electronics, printing machinery, paint mixing machinery, packaging machinery, graphic arts, and industrial manufacturing markets. The Jun-Air business is a provider of low-decibel, ultra-quiet vacuum compressors suitable for medical, dental and laboratory applications. Based in Benton Harbor, Michigan, Gast also has a logistics and commercial center in Redditch, England. Approximately 28% of Gast’s 2014 sales were to customers outside the U.S.

Micropump. Micropump, headquartered in Vancouver, Washington, is a leader in small, precision-engineered, magnetically and electromagnetically driven rotary gear, piston and centrifugal pumps. Micropump products are used in low-flow abrasive and corrosive applications. Micropump products primarily serve the printing machinery, medical equipment, paints and inks, chemical processing, pharmaceutical, refining, laboratory, electronics, pulp and paper, water treatment, textiles, peristaltic metering pumps, analytical process controllers and sample preparation systems markets. Approximately 72% of Micropump’s 2014 sales were to customers outside the U.S.

3

Material Processing Technologies ("MPT"). MPT consists of the Company's Quadro, Fitzpatrick, Microfluidics and Matcon Group Limited (“Matcon”) businesses. Quadro is a leading provider of particle control solutions for the pharmaceutical and bio-pharmaceutical markets. Based in Waterloo, Canada, Quadro’s core capabilities include fine milling, emulsification and special handling of liquid and solid particulates for laboratory, pilot phase and production scale processing. Fitzpatrick is a global leader in the design and manufacture of process technologies for the pharmaceutical, food and personal care markets. Fitzpatrick designs and manufactures customized size reduction, roll compaction and drying systems to support their customers’ product development and manufacturing processes. Fitzpatrick is headquartered in Elmhurst, Illinois. Microfluidics is a global leader in the design and manufacture of laboratory and commercial equipment used in the production of micro and nano scale materials for the pharmaceutical and chemical markets. Microfluidics is the exclusive producer of the Microfluidizer family of high shear fluid processors for uniform particle size reduction, robust cell disruption and nanoparticle creation. Microfluidics has offices in Newton, Massachusetts. Matcon is a global leader in material processing solutions for high value powders used in the manufacture of pharmaceuticals, food, plastics, and fine chemicals. Matcon’s innovative products consist of the original cone valve powder discharge system and filling, mixing and packaging systems, all of which support its customers’ automation and process requirements. These products are critical to its customers’ need to maintain clean, reliable and repeatable formulations of prepackaged foods and pharmaceuticals while helping them achieve lean and agile manufacturing. Matcon is located in Evesham, England. Approximately 60% of MPT’s 2014 sales were to customers outside the U.S.

FIRE & SAFETY/DIVERSIFIED PRODUCTS SEGMENT

The Fire & Safety/Diversified Products segment produces firefighting pumps and controls, rescue tools, lifting bags and other components and systems for the fire and rescue industry, engineered stainless steel banding and clamping devices used in a variety of industrial and commercial applications, and precision equipment for dispensing, metering and mixing colorants and paints used in a variety of retail and commercial businesses around the world. The segment accounted for 23% of IDEX’s sales and 26% of IDEX’s operating income in 2014, with approximately 54% of its sales to customers outside the U.S.

Fire Suppression. Fire Suppression consists of the Company’s Class 1, Hale and Godiva businesses, which produce truck-mounted and portable fire pumps, stainless steel valves, foam and compressed air foam systems, pump modules and pump kits, electronic controls and information systems, conventional and networked electrical systems, and mechanical components for the fire, rescue and specialty vehicle markets. Fire Suppression’s customers are primarily OEMs. Fire Suppression is headquartered in Ocala, Florida (Class 1 and Hale products), with additional facilities located in Warwick, England (Godiva products). Approximately 41% of Fire Suppression’s 2014 sales were to customers outside the U.S.

Rescue. Rescue consists of the Company’s Dinglee, Hurst Jaws of Life, Lukas and Vetter businesses, which produce hydraulic, battery, gas and electric-operated rescue equipment, hydraulic re-railing equipment, hydraulic tools for industrial applications, recycling cutters, pneumatic lifting and sealing bags for vehicle and aircraft rescue, environmental protection and disaster control, and shoring equipment for vehicular or structural collapse. Rescue's customers are primarily public and private fire and rescue organizations. Rescue has facilities in Shelby, North Carolina (Hurst Jaws of Life products); Tianjin, China (Dinglee products); Erlangen, Germany (Lukas products); and Zulpich, Germany (Vetter products). Approximately 80% of Rescue’s 2014 sales were to customers outside the U.S.

Band-It. Band-It is a leading producer of high-quality stainless steel banding, buckles and clamping systems. The BAND-IT brand is highly recognized worldwide. Band-It products are used for securing exhaust system heat and sound shields, industrial hose fittings, traffic signs and signals, electrical cable shielding, identification and bundling, and in numerous other industrial and commercial applications. Band-It products primarily serve the automotive, transportation equipment, oil and gas, general industrial maintenance, electronics, electrical, communications, aerospace, utility, municipal and subsea marine markets. Band-It is based in Denver, Colorado, with additional operations in Staveley, England, and an IDEX shared manufacturing facility in China. Approximately 39% of Band-It’s 2014 sales were to customers outside the U.S.

Dispensing. Dispensing produces precision equipment for dispensing, metering and mixing colorants and paints used in a variety of retail and commercial businesses around the world. Dispensing is a global supplier of precision-designed tinting, mixing, dispensing and measuring equipment for auto refinishing and architectural paints. Dispensing products are used in retail and commercial stores, hardware stores, home centers, department stores, automotive body shops as well as point-of-purchase dispensers. Dispensing is headquartered in Sassenheim, The Netherlands with additional facilities in Wheeling, Illinois; Unanderra, Australia; and Milan, Italy, as well as IDEX shared manufacturing facilities in India and China. Approximately 54% of Dispensing's 2014 sales were to customers outside the U.S.

4

INFORMATION APPLICABLE TO THE COMPANY’S BUSINESS IN GENERAL AND ITS SEGMENTS

Competitors

The Company’s businesses participate in highly competitive markets. IDEX believes that the principal points of competition are product quality, price, design and engineering capabilities, product development, conformity to customer specifications, quality of post-sale support, timeliness of delivery, and effectiveness of our distribution channels.

Principal competitors of the Fluid & Metering Technologies segment are the Pump Solutions Group (Maag, Blackmer and Wilden products) of Dover Corporation (with respect to pumps and small horsepower compressors used in liquified petroleum gas distribution facilities, rotary gear pumps, and air-operated double-diaphragm pumps); Milton Roy LLC (with respect to metering pumps and controls); and Tuthill Corporation (with respect to rotary gear pumps).

Principal competitors of the Health & Science Technologies segment are the Thomas division of Gardner Denver, Inc. (with respect to vacuum pumps and compressors); Thermo Scientific Dionex products (with respect to analytical instrumentation); Parker Hannifin (with respect to sealing devices); Valco Instruments Co., Inc. (with respect to fluid injectors and valves); and Gooch & Housego PLC (with respect to electro-optic and precision photonics solutions used in the life sciences market).

The principal competitors of the Fire & Safety/Diversified Products segment are Waterous Company, a unit of American Cast Iron Pipe Company (with respect to truck-mounted firefighting pumps), Holmatro, Inc. (with respect to rescue tools), CPS Color Group Oy (with respect to dispensing and mixing equipment for the paint industry) and Panduit Corporation (with respect to stainless steel bands, buckles and clamping systems).

Employees

At December 31, 2014, the Company had 6,712 employees. Approximately 7% of employees were represented by labor unions, with various contracts expiring through July 2018. Management believes that the Company’s relationship with its employees is good. The Company historically has been able to renegotiate its collective bargaining agreements satisfactorily, with its last work stoppage in March 1993.

Suppliers

The Company manufactures many of the parts and components used in its products. Substantially all materials, parts and components purchased by the Company are available from multiple sources.

Inventory and Backlog

The Company regularly and systematically adjusts production schedules and quantities based on the flow of incoming orders. Backlogs typically are limited to one to one and a half months of production. While total inventory levels also may be affected by changes in orders, the Company generally tries to maintain relatively stable inventory levels based on its assessment of the requirements of the various industries served.

Raw Materials

The Company uses a wide variety of raw materials which are generally available from a number of sources. As a result, shortages from any single supplier have not had, and are not likely to have a material impact on operations.

Shared Services

The Company has production facilities in Suzhou, China and Vadodara, India that support multiple business units. IDEX also has personnel in China, India, Dubai, Latin America and Singapore that provide sales and marketing, product design and engineering, and sourcing support to its business units, as well as personnel in various locations in Europe, South America, the Middle East and Japan to support sales and marketing efforts of IDEX businesses in those regions.

Segment Information

For segment financial information for the years 2014, 2013 and 2012, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 11 of the Notes to Consolidated Financial Statements in Part II, Item 8, “Financial Statements and Supplementary Data.”

5

Executive Officers of the Registrant

Set forth below are the names of the executive officers of the Company, their ages, years of service, the positions held by them, and their business experience during the past five years.

Name | Age | Years of Service | Position | |||

Andrew K. Silvernail | 44 | 6 | Chairman of the Board and Chief Executive Officer | |||

Heath A. Mitts | 44 | 9 | Senior Vice President and Chief Financial Officer | |||

Frank J. Notaro | 51 | 17 | Senior Vice President-General Counsel and Secretary | |||

Daniel J. Salliotte | 48 | 10 | Senior Vice President-Corporate Strategy, Mergers and Acquisitions and Treasury | |||

Michael J. Yates | 49 | 9 | Vice President and Chief Accounting Officer | |||

Jeffrey D. Bucklew | 44 | 3 | Senior Vice President-Chief Human Resources Officer | |||

Eric D. Ashleman | 47 | 6 | Senior Vice President-Group Executive | |||

Brett E. Finley | 44 | 5 | Senior Vice President-Group Executive | |||

Mr. Silvernail has served as Chief Executive Officer since August 2011 and as Chairman of the Board since January 2012. Prior to that, Mr. Silvernail was Vice President-Group Executive Health & Science Technologies, Global Dispensing and Fire & Safety/Diversified Products from January 2011 to August 2011. From February 2010 to December 2010, Mr. Silvernail was Vice President-Group Executive Health & Sciences Technologies and Global Dispensing. Mr. Silvernail joined IDEX in January 2009 as Vice President-Group Executive Health & Science Technologies.

Mr. Mitts has served as Senior Vice President and Chief Financial Officer since March 2011. Mr. Mitts joined IDEX as Vice President-Corporate Finance in September 2005.

Mr. Notaro has served as Senior Vice President-General Counsel and Secretary since March 1998.

Mr. Salliotte has served as Senior Vice President-Mergers, Acquisitions and Treasury since February 2011. Mr. Salliotte joined IDEX in October 2004 as Vice President-Strategy and Business Development.

Mr. Yates has served as Vice President and Chief Accounting Officer since February 2010. Mr. Yates joined IDEX as Vice President-Controller in October 2005.

Mr. Bucklew has served as the Senior Vice President-Chief Human Resources Officer since joining IDEX in March 2012. Prior to joining IDEX, Mr. Bucklew served as the Vice President of Human Resources for Accretive Health from March 2009 to March 2012.

Mr. Ashleman has served as Senior Vice President-Group Executive since August 2011. Mr. Ashleman joined IDEX in 2008 as the President of Gast Manufacturing.

Mr. Finley has served as Senior Vice President-Group Executive since February 2012. Mr. Finley joined IDEX in 2009 as the President of Pulsafeeder.

The Company’s executive officers are elected at a meeting of the Board of Directors immediately following the annual meeting of stockholders, and they serve until the meeting of the Board immediately following the next annual meeting of stockholders, or until their successors are duly elected and qualified or until their death, resignation or removal.

Public Filings

Copies of the Company’s annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports are made available free of charge at www.idexcorp.com as soon as reasonably practicable after being filed electronically with the SEC. Our reports are also available free of charge on the SEC’s website, www.sec.gov. Information on the Company’s website is not incorporated into this Form 10-K.

6

Item 1A. Risk Factors.

For an enterprise as diverse and complex as the Company, a wide range of factors present risks to the Company and could materially affect future developments and performance. In addition to the factors affecting specific business operations identified in connection with the description of our operations and the financial results of our operations elsewhere in this report, the most significant of these factors are as follows:

Changes in U.S. or International Economic Conditions Could Adversely Affect the Sales and Profitability of Our Businesses.

In 2014, 50% of the Company’s sales were derived from domestic operations while 50% were derived from international operations. The Company’s largest end markets include life sciences and medical technologies, fire and rescue, liquefied petroleum gas, paint and coatings, chemical processing, water & wastewater treatment and optical filters and components. A slowdown in the U.S. or global economy and, in particular, any of these specific end markets could reduce the Company’s sales and profitability.

Conditions in Foreign Countries in Which We Operate Could Adversely Affect Our Business.

In 2014, approximately 50% of our total sales were to customers outside the U.S. We expect our international operations and export sales to continue to be significant for the foreseeable future. Our sales from international operations and our sales from export are both subject in varying degrees to risks inherent in doing business outside the United States. These risks include the following:

• | possibility of unfavorable circumstances arising from host country laws or regulations; |

• | risks of economic instability; |

• | currency exchange rate fluctuations and restrictions on currency repatriation; |

• | potential negative consequences from changes to taxation policies; |

• | disruption of operations from labor and political disturbances; |

• | changes in tariff and trade barriers and import or export licensing requirements; and, |

• | insurrection or war. |

Any of these events could have an adverse impact on our business and operations.

Our Inability to Continue to Develop New Products Could Limit Our Sales Growth.

The Company’s sales grew 5% organically in 2014 and 2% in 2013. Approximately 12% of our 2014 sales were derived from new products developed over the past three years. Our ability to continue to grow organically is tied in large part to our ability to continue to develop new products.

Our Growth Strategy Includes Acquisitions and We May Not be Able to Make Acquisitions of Suitable Candidates or Integrate Acquisitions Successfully.

Our historical growth has included, and our future growth is likely to continue to include, acquisitions. We intend to continue to seek acquisition opportunities both to expand into new markets and to enhance our position in existing markets throughout the world. We may not be able to successfully identify suitable candidates, negotiate appropriate acquisition terms, obtain financing needed to consummate those acquisitions, complete proposed acquisitions or successfully integrate acquired businesses into our existing operations. In addition, any acquisition, once successfully integrated, may not perform as planned, be accretive to earnings, or otherwise prove beneficial to us.

Acquisitions involve numerous risks, including the assumption of undisclosed or unindemnified liabilities, difficulties in the assimilation of the operations, technologies, services and products of the acquired companies and the diversion of management’s attention from other business concerns. In addition, prior acquisitions have resulted, and future acquisitions could result, in the incurrence of substantial additional indebtedness and other expenses.

The Markets We Serve are Highly Competitive and this Competition Could Reduce our Sales and Operating Margins.

Most of our products are sold in competitive markets. Maintaining and improving our competitive position will require continued investment by us in manufacturing, engineering, quality standards, marketing, customer service and support, and our distribution networks. We may not be successful in maintaining our competitive position. Our competitors may develop products that are superior to our products, or may develop methods of more efficiently and effectively providing products and

7

services or may adapt more quickly than us to new technologies or evolving customer requirements. Pricing pressures may require us to adjust the prices of our products to stay competitive. We may not be able to compete successfully with our existing competitors or with new competitors. Failure to continue competing successfully could reduce our sales, operating margins and overall financial performance.

We are Dependent on the Availability of Raw Materials, Parts and Components Used in Our Products.

While we manufacture certain parts and components used in our products, we require substantial amounts of raw materials and purchase some parts and components from suppliers. The availability and prices for raw materials, parts and components may be subject to curtailment or change due to, among other things, suppliers’ allocations to other purchasers, interruptions in production by suppliers, changes in exchange rates and prevailing price levels. Any change in the supply of, or price for, these raw materials or parts and components could materially affect our business, financial condition, results of operations and cash flow.

Significant Movements in Foreign Currency Exchange Rates May Harm Our Financial Results.

We are exposed to fluctuations in foreign currency exchange rates, particularly with respect to the Euro, Canadian Dollar, British Pound, Indian Rupee and Chinese Renminbi. Any significant change in the value of the currencies of the countries in which we do business against the U.S. Dollar could affect our ability to sell products competitively and control our cost structure, which could have a material adverse effect on our results of operations. For additional detail related to this risk, see Part II, Item 7A, “Quantitative and Qualitative Disclosure About Market Risk.”

An Unfavorable Outcome of Any of Our Pending Contingencies or Litigation Could Adversely Affect Us.

We currently are involved in legal and regulatory proceedings. Where it is reasonably possible to do so, we accrue estimates of the probable costs for the resolution of these matters. These estimates are developed in consultation with outside counsel and are based upon an analysis of potential results, assuming a combination of litigation and settlement strategies. It is possible, however, that future operating results for any particular quarter or annual period could be materially affected by changes in our assumptions or the effectiveness of our strategies related to these proceedings. For additional detail related to this risk, see Item 3, “Legal Proceedings.”

Our Intangible Assets, Including Goodwill, are a Significant Portion of Our Total Assets and a Write-off of Our Intangible Assets Would Adversely Impact Our Operating Results and Significantly Reduce Our Net Worth.

Our total assets reflect substantial intangible assets, primarily goodwill and identifiable intangible assets. At December 31, 2014, goodwill and intangible assets totaled $1,321.3 million and $271.2 million, respectively. These assets result from our acquisitions, representing the excess of cost over the fair value of the tangible net assets we have acquired. Annually, or when certain events occur that require a more current valuation, we assess whether there has been an impairment in the value of our goodwill and identifiable intangible assets. If future operating performance at one or more of our reporting units were to fall significantly below forecast levels, we could be required to reflect, under current applicable accounting rules, a non-cash charge to operating income for an impairment. Any determination requiring the write-off of a significant portion of our goodwill or identifiable intangible assets would adversely impact our results of operations and net worth. See Note 4 in Part II, Item 8, "Financial Statements and Supplementary Data" for further discussion on goodwill and intangible assets.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

The Company’s principal plants and offices have an aggregate floor space area of approximately 4.2 million square feet, of which 2.7 million square feet (65%) is located in the U.S. and approximately 1.5 million square feet (35%) is located outside the U.S., primarily in the U.K. (9%), Germany (8%), China (4%), India (2%) and The Netherlands (2%). Management considers these facilities suitable and adequate for the Company's operations. Management believes the Company can meet demand increases over the near term with its existing facilities, especially given its operational improvement initiatives that usually increase capacity. The Company’s executive office occupies 36,588 square feet of leased space in Lake Forest, Illinois and 4,420 square feet of leased space in Chicago, Illinois.

Approximately 2.6 million square feet (63%) of the principal plant and office floor area is owned by the Company, and the balance is held under lease. Approximately 1.7 million square feet (40%) of the principal plant and office floor area is held by business units in the Fluid & Metering Technologies segment; 1.3 million square feet (31%) is held by business units in the

8

Health & Science Technologies segment; and 1.0 million square feet (23%) is held by business units in the Fire & Safety/Diversified Products segment.

Item 3. Legal Proceedings.

The Company and six of its subsidiaries are presently named as defendants in a number of lawsuits claiming various asbestos-related personal injuries and seeking money damages, allegedly as a result of exposure to products manufactured with components that contained asbestos. These components were acquired from third party suppliers, and were not manufactured by any of the subsidiaries. To date, the majority of the Company’s settlements and legal costs, except for costs of coordination, administration, insurance investigation and a portion of defense costs, have been covered in full by insurance subject to applicable deductibles. However, the Company cannot predict whether and to what extent insurance will be available to continue to cover its settlements and legal costs, or how insurers may respond to claims that are tendered to them. Claims have been filed in jurisdictions throughout the United States. Most of the claims resolved to date have been dismissed without payment. The balance have been settled for various insignificant amounts. Only one case has been tried, resulting in a verdict for the affected business unit. No provision has been made in the financial statements of the Company for these asbestos-related claims, other than for insurance deductibles in the ordinary course, and the Company does not currently believe these claims will have a material adverse effect on it.

The Company is also party to various other legal proceedings arising in the ordinary course of business, none of which is expected to have a material adverse effect on it.

Item 4. Mine Safety Disclosures.

Not applicable.

9

PART II

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

The principal market for the Company’s common stock is the New York Stock Exchange, but the common stock is also listed on the Chicago Stock Exchange. As of February 17, 2015, there were approximately 6,500 shareholders of record of our common stock and there were 78,232,245 shares outstanding.

The high and low sales prices of the common stock per share and the dividends paid per share during the last two years are as follows:

2014 | 2013 | ||||||||||||||||||||||

High | Low | Dividends | High | Low | Dividends | ||||||||||||||||||

First Quarter | $ | 79.27 | $ | 68.58 | $ | 0.23 | $ | 53.84 | $ | 47.43 | $ | 0.20 | |||||||||||

Second Quarter | 80.85 | 69.17 | 0.28 | 57.38 | 49.55 | 0.23 | |||||||||||||||||

Third Quarter | 81.82 | 72.27 | 0.28 | 65.32 | 53.95 | 0.23 | |||||||||||||||||

Fourth Quarter | 78.97 | 65.91 | 0.28 | 74.08 | 63.21 | 0.23 | |||||||||||||||||

Our payment of dividends in the future will be determined by our Board of Directors and will depend on business conditions, our earnings and other factors.

For information pertaining to securities authorized for issuance under equity compensation plans and the related weighted average exercise price, see Part III, Item 12, “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.”

The following table provides information about the Company’s purchases of common stock during the quarter ended December 31, 2014:

Period | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs(1) | Maximum Dollar Value that May Yet be Purchased Under the Plans or Programs(1) | |||||||||

October 1, 2014 to October 31, 2014 | 436,658 | $ | 70.78 | 436,658 | $ | 187,335,900 | |||||||

November 1, 2014 to November 30, 2014 | 292,500 | 76.10 | 292,500 | 565,076,201 | |||||||||

December 1, 2014 to December 31, 2014 | 256,966 | 76.39 | 256,966 | 545,447,449 | |||||||||

Total | 986,124 | $ | 73.82 | 986,124 | $ | 545,447,449 | |||||||

(1) | On November 6, 2014, the Company’s Board of Directors approved an increase of $400.0 million in the authorized level for repurchases of common stock. This followed the prior Board of Directors approved repurchase authorizations of $300.0 million, announced by the Company on November 8, 2013; $200.0 million, announced by the Company on October 22, 2012; $50.0 million, announced by the Company on December 6, 2011; and the original repurchase authorization of $125.0 million announced by the Company on April 21, 2008. |

10

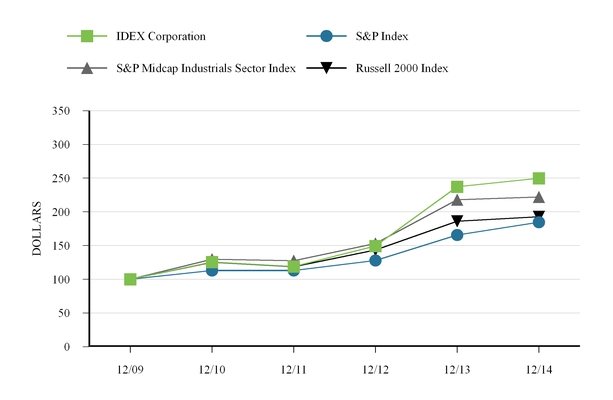

Performance Graph. The following table compares total shareholder returns over the last five years to the Standard & Poor’s (the “S&P”) 500 Index, the S&P Midcap Industrials Sector Index and the Russell 2000 Index assuming the value of the investment in our common stock and each index was $100 on December 31, 2009. Total return values for our common stock, the S&P 500 Index, S&P Midcap Industrials Sector Index and the Russell 2000 Index were calculated on cumulative total return values assuming reinvestment of dividends. The shareholder return shown on the graph below is not necessarily indicative of future performance.

12/09 | 12/10 | 12/11 | 12/12 | 12/13 | 12/14 | |||||||||||||

IDEX Corporation | $ | 100.00 | $ | 125.59 | $ | 119.00 | $ | 149.37 | $ | 237.08 | $ | 249.89 | ||||||

S&P 500 Index | $ | 100.00 | $ | 112.78 | $ | 112.78 | $ | 127.90 | $ | 165.76 | $ | 184.64 | ||||||

S&P Midcap Industrials Sector Index | $ | 100.00 | $ | 129.63 | $ | 127.26 | $ | 152.92 | $ | 217.83 | $ | 221.84 | ||||||

Russell 2000 Index | $ | 100.00 | $ | 125.31 | $ | 118.47 | $ | 143.38 | $ | 186.06 | $ | 192.63 | ||||||

11

Item 6. Selected Financial Data.(1)

(Dollars in thousands, except per share data) | 2014 | 2013 | 2012 (2) | 2011 | 2010 | ||||||||||||||

RESULTS OF OPERATIONS | |||||||||||||||||||

Net sales | $ | 2,147,767 | $ | 2,024,130 | $ | 1,954,258 | $ | 1,838,451 | $ | 1,513,073 | |||||||||

Gross profit | 949,315 | 873,364 | 803,700 | 738,673 | 618,483 | ||||||||||||||

Selling, general and administrative expenses | 504,419 | 477,851 | 444,490 | 421,703 | 358,272 | ||||||||||||||

Asset impairments | — | — | 198,519 | — | — | ||||||||||||||

Restructuring expenses | 13,672 | — | 32,473 | 12,314 | 11,095 | ||||||||||||||

Operating income | 431,224 | 395,513 | 128,218 | 304,656 | 249,116 | ||||||||||||||

Other (income) expense — net | (3,111 | ) | 178 | (236 | ) | 1,443 | 1,092 | ||||||||||||

Interest expense | 41,895 | 42,206 | 42,250 | 29,332 | 16,150 | ||||||||||||||

Provision for income taxes | 113,054 | 97,914 | 48,574 | 80,024 | 74,774 | ||||||||||||||

Net income | 279,386 | 255,215 | 37,630 | 193,857 | 157,100 | ||||||||||||||

Earnings per share (3) | |||||||||||||||||||

— basic | $ | 3.48 | $ | 3.11 | $ | 0.45 | $ | 2.34 | $ | 1.93 | |||||||||

— diluted | $ | 3.45 | $ | 3.09 | $ | 0.45 | $ | 2.32 | $ | 1.90 | |||||||||

Weighted average shares outstanding | |||||||||||||||||||

— basic | 79,715 | 81,517 | 82,689 | 82,145 | 80,466 | ||||||||||||||

— diluted | 80,728 | 82,489 | 83,641 | 83,543 | 81,983 | ||||||||||||||

Year-end shares outstanding | 78,766 | 81,196 | 82,727 | 83,234 | 82,070 | ||||||||||||||

Cash dividends per share | $ | 1.12 | $ | 0.89 | $ | 0.80 | $ | 0.68 | $ | 0.60 | |||||||||

FINANCIAL POSITION | |||||||||||||||||||

Current assets | $ | 1,075,791 | $ | 990,953 | $ | 881,865 | $ | 789,161 | $ | 692,758 | |||||||||

Current liabilities | 411,968 | 304,609 | 291,427 | 258,278 | 353,668 | ||||||||||||||

Current ratio | 2.6 | 3.3 | 3.0 | 3.1 | 2.0 | ||||||||||||||

Operating working capital (4) | 366,209 | 350,881 | 373,704 | 396,126 | 306,044 | ||||||||||||||

Total assets | $ | 2,908,070 | $ | 2,887,577 | $ | 2,785,390 | $ | 2,836,107 | $ | 2,381,695 | |||||||||

Total borrowings | 863,952 | 773,876 | 786,576 | 808,810 | 527,895 | ||||||||||||||

Shareholders’ equity | 1,486,451 | 1,572,989 | 1,464,998 | 1,513,135 | 1,375,660 | ||||||||||||||

PERFORMANCE MEASURES AND OTHER DATA | |||||||||||||||||||

Percent of net sales: | |||||||||||||||||||

Gross profit | 44.2 | % | 43.1 | % | 41.1 | % | 40.2 | % | 40.9 | % | |||||||||

SG&A expenses | 23.5 | % | 23.6 | % | 22.7 | % | 22.9 | % | 23.7 | % | |||||||||

Operating income | 20.1 | % | 19.5 | % | 6.6 | % | 16.6 | % | 16.5 | % | |||||||||

Income before income taxes | 18.3 | % | 17.4 | % | 4.4 | % | 14.9 | % | 15.3 | % | |||||||||

Net income | 13.0 | % | 12.6 | % | 1.9 | % | 10.5 | % | 10.4 | % | |||||||||

Capital expenditures | $ | 47,997 | $ | 31,536 | $ | 35,520 | $ | 34,548 | $ | 32,769 | |||||||||

Depreciation and amortization | 76,907 | 79,334 | 78,312 | 72,386 | 58,108 | ||||||||||||||

Return on average assets | 9.6 | % | 9.0 | % | 1.3 | % | 7.4 | % | 7.0 | % | |||||||||

Borrowings as a percent of capitalization | 36.8 | % | 33.0 | % | 34.9 | % | 34.8 | % | 27.7 | % | |||||||||

Return on average shareholders' equity | 18.3 | % | 16.8 | % | 2.5 | % | 13.4 | % | 11.9 | % | |||||||||

Employees at year end | 6,712 | 6,787 | 6,717 | 6,814 | 5,966 | ||||||||||||||

Shareholders at year end | 6,500 | 6,500 | 6,700 | 7,000 | 7,000 | ||||||||||||||

NON-GAAP MEASURES (5) | |||||||||||||||||||

EBITDA | $ | 511,242 | $ | 474,669 | $ | 206,766 | $ | 375,599 | $ | 306,132 | |||||||||

EBITDA margin | 23.8 | % | 23.5 | % | 10.6 | % | 20.4 | % | 20.2 | % | |||||||||

Adjusted EBITDA | $ | 524,914 | $ | 474,669 | $ | 437,758 | $ | 387,913 | $ | 317,227 | |||||||||

Adjusted EBITDA margin | 24.4 | % | 23.5 | % | 22.4 | % | 21.1 | % | 21.0 | % | |||||||||

Adjusted operating income | $ | 444,896 | $ | 395,513 | $ | 359,210 | $ | 332,772 | $ | 260,211 | |||||||||

Adjusted operating margin | 20.7 | % | 19.5 | % | 18.4 | % | 18.1 | % | 17.2 | % | |||||||||

Adjusted net income | $ | 288,823 | $ | 255,215 | $ | 224,067 | $ | 213,758 | $ | 164,617 | |||||||||

Adjusted earnings per share | $ | 3.57 | $ | 3.09 | $ | 2.68 | $ | 2.56 | $ | 1.99 | |||||||||

(1) | For additional detail, see Notes to Consolidated Financial Statements in Part II, Item 8, “Financial Statements and Supplementary Data.” |

(2) | Fiscal year 2012 includes an impairment charge for goodwill and intangible assets within the IOP platform and an impairment charge for goodwill and long-lived assets within the WST group. |

(3) | Calculated by applying the two-class method of allocating earnings to common stock and participating securities as required by ASC 260, Earnings Per Share. |

(4) | Operating working capital is defined as inventory plus accounts receivable minus accounts payable. |

(5) | Set forth below are reconciliations of Adjusted operating income, Adjusted net income, Adjusted EPS, EBITDA and Adjusted EBITDA to the comparable measures of net income and operating income, as determined in accordance with U.S. GAAP. We have reconciled Adjusted operating income to Operating income; Adjusted net income to Net income; Adjusted EPS to EPS; consolidated EBITDA to net income; and segment EBITDA to segment operating income. |

Management uses Adjusted operating income, Adjusted net income, and Adjusted EPS as metrics by which to measure performance of the Company since they exclude items that are not reflective of ongoing operations, such as asset impairments and restructuring expenses. Management also supplements its U.S. GAAP financial statements with adjusted information to provide investors with greater insight, transparency, and a more comprehensive understanding of the information used by management in its financial and operational decision making.

EBITDA means earnings before interest, income taxes, depreciation and amortization. Given the acquisitive nature of the Company which results in a higher level of amortization expense at recently acquired businesses, management uses EBITDA as an internal operating metric to provide management with another representation of performance of businesses across our three segments and for enterprise valuation purposes. EBITDA is also used to calculate certain financial covenants, as discussed in Note 5 of the Notes to Consolidated Financial Statements in Part II, Item 8, “Financial Statements and Supplementary Data.” In addition, EBITDA has been adjusted for items that are not reflective of ongoing operations, such as asset impairments and restructuring expenses to arrive at Adjusted EBITDA. Management believes that Adjusted EBITDA is useful as a performance indicator on ongoing operations. We believe that Adjusted EBITDA is also useful to some investors as an indicator of the strength and performance of the Company's and its segments ongoing business operations and a way to evaluate and compare operating performance and value companies within our industry. The definition of Adjusted EBITDA used here may differ from that used by other companies.

The non-GAAP financial measures disclosed by the Company should not be considered a substitute for, or superior to, financial measures prepared in accordance with U.S. GAAP, and the financial results prepared in accordance with U.S. GAAP and the reconciliations from these results should be carefully evaluated.

Reconciliations of Consolidated EBITDA | ||||||||||||||||||||

For the Years Ended December 31, | ||||||||||||||||||||

2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

(In thousands) | ||||||||||||||||||||

Net income | $ | 279,386 | $ | 255,215 | $ | 37,630 | $ | 193,857 | $ | 157,100 | ||||||||||

+ Provision for income taxes | 113,054 | 97,914 | 48,574 | 80,024 | 74,774 | |||||||||||||||

+ Interest expense | 41,895 | 42,206 | 42,250 | 29,332 | 16,150 | |||||||||||||||

+ Depreciation and amortization | 76,907 | 79,334 | 78,312 | 72,386 | 58,108 | |||||||||||||||

EBITDA | 511,242 | 474,669 | 206,766 | 375,599 | 306,132 | |||||||||||||||

+ Restructuring expenses | 13,672 | — | 32,473 | 12,314 | 11,095 | |||||||||||||||

+ Asset impairments | — | — | 198,519 | — | — | |||||||||||||||

Adjusted EBITDA | $ | 524,914 | $ | 474,669 | $ | 437,758 | $ | 387,913 | $ | 317,227 | ||||||||||

Net sales | $ | 2,147,767 | $ | 2,024,130 | $ | 1,954,258 | $ | 1,838,451 | $ | 1,513,073 | ||||||||||

EBITDA margin | 23.8 | % | 23.5 | % | 10.6 | % | 20.4 | % | 20.2 | % | ||||||||||

Adjusted EBITDA margin | 24.4 | % | 23.5 | % | 22.4 | % | 21.1 | % | 21.0 | % | ||||||||||

Reconciliations of Segment EBITDA | ||||||||||||||||||||||||||||||||||||

For the Years Ended December 31, | ||||||||||||||||||||||||||||||||||||

2014 | 2013 | 2012 | ||||||||||||||||||||||||||||||||||

FMT | HST | FSDP | FMT | HST | FSDP | FMT | HST | FSDP | ||||||||||||||||||||||||||||

(In thousands) | ||||||||||||||||||||||||||||||||||||

Operating income (loss) | $ | 216,886 | $ | 152,999 | $ | 130,494 | $ | 211,256 | $ | 136,707 | $ | 102,730 | $ | 146,650 | $ | (62,835 | ) | $ | 96,120 | |||||||||||||||||

- Other (income) expense | (560 | ) | (542 | ) | (990 | ) | 1,789 | (508 | ) | (342 | ) | (25 | ) | 511 | (143 | ) | ||||||||||||||||||||

+ Depreciation and amortization | 26,453 | 42,478 | 6,583 | 27,633 | 43,496 | 6,852 | 29,637 | 39,981 | 7,107 | |||||||||||||||||||||||||||

EBITDA | 243,899 | 196,019 | 138,067 | 237,100 | 180,711 | 109,924 | 176,312 | (23,365 | ) | 103,370 | ||||||||||||||||||||||||||

+ Restructuring expenses | 6,413 | 4,912 | 1,034 | — | — | — | 6,262 | 14,744 | 8,340 | |||||||||||||||||||||||||||

+ Asset impairments | — | — | — | — | — | — | 27,721 | 170,798 | — | |||||||||||||||||||||||||||

Adjusted EBITDA | $ | 250,312 | $ | 200,931 | $ | 139,101 | $ | 237,100 | $ | 180,711 | $ | 109,924 | $ | 210,295 | $ | 162,177 | $ | 111,710 | ||||||||||||||||||

Net sales | $ | 899,588 | $ | 752,021 | $ | 502,749 | $ | 871,814 | $ | 714,650 | $ | 445,049 | $ | 833,288 | $ | 695,235 | $ | 437,053 | ||||||||||||||||||

EBITDA margin | 27.1 | % | 26.1 | % | 27.5 | % | 27.2 | % | 25.3 | % | 24.7 | % | 21.2 | % | (3.4 | )% | 23.7 | % | ||||||||||||||||||

Adjusted EBITDA margin | 27.8 | % | 26.7 | % | 27.7 | % | 27.2 | % | 25.3 | % | 24.7 | % | 25.2 | % | 23.3 | % | 25.6 | % | ||||||||||||||||||

Reconciliations of Consolidated Reported-to-Adjusted Operating Income and Margin | ||||||||||||||||||||

For the Years Ended December 31, | ||||||||||||||||||||

2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

(In thousands) | ||||||||||||||||||||

Operating income | $ | 431,224 | $ | 395,513 | $ | 128,218 | $ | 304,656 | $ | 249,116 | ||||||||||

+ Restructuring expenses | 13,672 | — | 32,473 | 12,314 | 11,095 | |||||||||||||||

+ Asset impairments | — | — | 198,519 | — | — | |||||||||||||||

+ CVI fair value inventory charge | — | — | — | 15,802 | — | |||||||||||||||

Adjusted operating income | $ | 444,896 | $ | 395,513 | $ | 359,210 | $ | 332,772 | $ | 260,211 | ||||||||||

Net sales | $ | 2,147,767 | $ | 2,024,130 | $ | 1,954,258 | $ | 1,838,451 | $ | 1,513,073 | ||||||||||

Operating margin | 20.1 | % | 19.5 | % | 6.6 | % | 16.6 | % | 16.5 | % | ||||||||||

Adjusted operating margin | 20.7 | % | 19.5 | % | 18.4 | % | 18.1 | % | 17.2 | % | ||||||||||

Reconciliations of Segment Reported-to-Adjusted Operating Income and Margin | ||||||||||||||||||||||||||||||||||||

For the Years Ended December 31, | ||||||||||||||||||||||||||||||||||||

2014 | 2013 | 2012 | ||||||||||||||||||||||||||||||||||

FMT | HST | FSDP | FMT | HST | FSDP | FMT | HST | FSDP | ||||||||||||||||||||||||||||

(In thousands) | ||||||||||||||||||||||||||||||||||||

Operating income (loss) | $ | 216,886 | $ | 152,999 | $ | 130,494 | $ | 211,256 | $ | 136,707 | $ | 102,730 | $ | 146,650 | $ | (62,835 | ) | $ | 96,120 | |||||||||||||||||

+ Restructuring expenses | 6,413 | 4,912 | 1,034 | — | — | — | 6,262 | 14,744 | 8,340 | |||||||||||||||||||||||||||

+ Asset impairments | — | — | — | — | — | — | 27,721 | 170,798 | — | |||||||||||||||||||||||||||

Adjusted operating income | $ | 223,299 | $ | 157,911 | $ | 131,528 | $ | 211,256 | $ | 136,707 | $ | 102,730 | $ | 180,633 | $ | 122,707 | $ | 104,460 | ||||||||||||||||||

Net sales | $ | 899,588 | $ | 752,021 | $ | 502,749 | $ | 871,814 | $ | 714,650 | $ | 445,049 | $ | 833,288 | $ | 695,235 | $ | 437,053 | ||||||||||||||||||

Operating margin | 24.1 | % | 20.3 | % | 26.0 | % | 24.2 | % | 19.1 | % | 23.1 | % | 17.6 | % | (9.0 | )% | 22.0 | % | ||||||||||||||||||

Adjusted operating margin | 24.8 | % | 21.0 | % | 26.2 | % | 24.2 | % | 19.1 | % | 23.1 | % | 21.7 | % | 17.6 | % | 23.9 | % | ||||||||||||||||||

Reconciliations of Reported-to-Adjusted Net Income and EPS | ||||||||||||||||||||

For the Years Ended December 31, | ||||||||||||||||||||

2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

(In thousands) | ||||||||||||||||||||

Net income | $ | 279,386 | $ | 255,215 | $ | 37,630 | $ | 193,857 | $ | 157,100 | ||||||||||

+ Restructuring expenses, net of tax | 9,437 | — | 22,926 | 8,716 | 7,517 | |||||||||||||||

+ Asset impairments, net of tax | — | — | 163,511 | — | — | |||||||||||||||

+ CVI fair value inventory charge, net of tax | — | — | — | 11,185 | — | |||||||||||||||

Adjusted net income | $ | 288,823 | $ | 255,215 | $ | 224,067 | $ | 213,758 | $ | 164,617 | ||||||||||

EPS | $ | 3.45 | $ | 3.09 | $ | 0.45 | $ | 2.32 | $ | 1.90 | ||||||||||

+ Restructuring expenses, net of tax | 0.12 | — | 0.27 | 0.10 | 0.09 | |||||||||||||||

+ Asset impairments, net of tax | — | — | 1.96 | — | — | |||||||||||||||

+ CVI fair value inventory charge | — | — | — | 0.14 | — | |||||||||||||||

Adjusted EPS | $ | 3.57 | $ | 3.09 | $ | 2.68 | $ | 2.56 | $ | 1.99 | ||||||||||

Diluted weighted average shares | 80,728 | 82,489 | 83,641 | 83,543 | 81,983 | |||||||||||||||

12

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Cautionary Statement Under the Private Securities Litigation Reform Act

This management’s discussion and analysis, including, but not limited to, the section entitled “2014 Overview and Outlook”, and other portions of this report, contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act of 1934, as amended. These statements may relate to, among other things, capital expenditures, cost reductions, cash flow, and operating improvements and are indicated by words or phrases such as “anticipate,” “estimate,” “plans,” “expects,” “projects,” “should,” “will,” “management believes,” “the Company believes,” “we believe,” “the Company intends” and similar words or phrases. These statements are subject to inherent uncertainties and risks that could cause actual results to differ materially from the results described in those statements. These risks and uncertainties include, but are not limited to, the risks described in Item 1A, "Risk Factors" of this report, economic and political consequences resulting from terrorist attacks and wars; levels of industrial activity and economic conditions in the U.S. and other countries around the world; pricing pressures and other competitive factors, and levels of capital spending in certain industries — all of which could have a material impact on our order rates and results, particularly in light of the low levels of order backlogs we typically maintain; our ability to make acquisitions and to integrate and operate acquired businesses on a profitable basis; the relationship of the U.S. dollar to other currencies and its impact on pricing and cost competitiveness; political and economic conditions in foreign countries in which we operate; interest rates; capacity utilization and its effect on costs; labor markets; market conditions and material costs; and developments with respect to contingencies, such as litigation and environmental matters. The forward-looking statements included in this report are only made as of the date of this report, and we undertake no obligation to update them to reflect subsequent events or circumstances. Investors are cautioned not to rely unduly on forward-looking statements when evaluating the information presented here.

2014 Overview and Outlook

IDEX is an applied solutions company specializing in fluid and metering technologies, health and science technologies, and fire, safety and other diversified products built to customer specifications. IDEX’s products are sold in niche markets to a wide range of industries throughout the world. Accordingly, our businesses are affected by levels of industrial activity and economic conditions in the U.S. and in other countries where we do business and by the relationship of the U.S. dollar to other currencies. Levels of capacity utilization and capital spending in the industries that use our products and overall industrial activity are important factors that influence the demand for our products.

The Company has three reportable business segments: Fluid & Metering Technologies, Health & Science Technologies and Fire & Safety/Diversified Products. Within our three reportable segments, the Company maintains six platforms, where we will invest in organic growth and acquisitions with a strategic view towards a platform with the potential for at least $500 million in revenue, and seven groups, where we will focus on organic growth and strategic acquisitions. The Fluid & Metering Technologies segment contains the Energy, Water (comprised of Water Services & Technology and Diaphragm & Dosing Pump Technology), and Chemical, Food & Process platforms as well as the Agricultural group (comprised of Banjo.) The Health & Science Technologies segment contains the IDEX Optics & Photonics, Scientific Fluidics and Material Processing Technologies platforms, as well as the Sealing Solutions and the Industrial (comprised of Micropump and Gast) groups. The Fire & Safety/Diversified Products segment is comprised of the Dispensing, Rescue, Band-It, and Fire Suppression groups. Each platform or group is comprised of one or more of our 15 reporting units: five reporting units within Fluid & Metering Technologies (Energy; Chemical, Food, & Process; Water Services & Technology; Banjo; Diaphragm & Dosing Pump Technology); six reporting units within Health & Science Technologies (IDEX Optics and Photonics; Scientific Fluidics; Material Processing Technologies; Sealing Solutions; Micropump; and Gast); and four reporting units within Fire & Safety/Diversified Products (Dispensing, Rescue, Band-It, and Fire Suppression).

The Fluid & Metering Technologies segment designs, produces and distributes positive displacement pumps, flow meters, valves, injectors, and other fluid-handling pump modules and systems and provides flow monitoring and other services for the food, chemical, general industrial, water and wastewater, agricultural and energy industries. The Health & Science Technologies segment designs, produces and distributes a wide range of precision fluidics, rotary lobe pumps, centrifugal and positive displacement pumps, roll compaction and drying systems used in beverage, food processing, pharmaceutical and cosmetics, pneumatic components and sealing solutions, including very high precision, low-flow rate pumping solutions required in analytical instrumentation, clinical diagnostics and drug discovery, high performance molded and extruded, biocompatible medical devices and implantables, air compressors used in medical, dental and industrial applications, optical components and coatings for applications in the fields of scientific research, defense, biotechnology, life sciences, aerospace, telecommunications and electronics manufacturing, laboratory and commercial equipment used in the production of micro and nano scale materials, precision photonic solutions used in life sciences, research and defense markets, and precision gear and peristaltic pump technologies that meet exacting original equipment manufacturer specifications. The Fire & Safety/Diversified Products segment produces firefighting pumps and controls, rescue tools, lifting bags and other components and systems for the

13

fire and rescue industry, and engineered stainless steel banding and clamping devices used in a variety of industrial and commercial applications, precision equipment for dispensing, metering and mixing colorants and paints used in a variety of retail and commercial businesses around the world.

Our 2014 financial results are as follows:

• | Sales of $2.1 billion increased 6%; organic sales — excluding acquisitions and foreign currency translation — were up 5%. |

• | Operating income of $431.2 million increased 9% and operating margin of 20.1% was up 60 basis points from the prior year. |

• | Net income increased 9% to $279.4 million. |

• | Diluted EPS of $3.45 increased $0.36 or 12% compared to 2013. |

Our 2014 financial results, adjusted for $13.7 million of restructuring costs, are as follows (These non-GAAP measures have been reconciled to U.S. GAAP measures in Item 6, "Selected Financial Data"):

• | Adjusted operating income of $444.9 million increased 12% and adjusted operating margin of 20.7% was up 120 basis points from the prior year. |

• | Adjusted net income of $288.8 million is 13% higher than the prior year of $255.2 million. |

• | Adjusted EPS of $3.57 was 16% higher than the prior year EPS of $3.09. |

Overall, we believe we are operating in a challenging market environment, which will continue throughout 2015. On a regional basis, we anticipate North American demand will be solid, the European market will remain soft throughout 2015, and Asia will be volatile. For 2015, based on the Company’s current outlook, we anticipate 1 to 2 percent organic revenue growth and EPS of $3.65 to $3.75.

Results of Operations

The following is a discussion and analysis of our results of operations for each of the three years in the period ended December 31, 2014. For purposes of this Item, reference is made to the Consolidated Statements of Operations in Part II, Item 8, “Financial Statements and Supplementary Data.” Segment operating income excludes unallocated corporate operating expenses. Management's primary measurements of segment performance are sales, operating income, and operating margin.

In the following discussion, and throughout this report, references to organic sales, a non-GAAP measure, refers to sales from continuing operations calculated according to generally accepted accounting principles in the United States but excludes (1) the impact of foreign currency translation and (2) sales from acquired businesses during the first twelve months of ownership. The portion of sales attributable to foreign currency translation is calculated as the difference between (a) the period-to-period change in organic sales and (b) the period-to-period change in organic sales after applying prior period foreign exchange rates to the current year period. Management believes that reporting organic sales provides useful information to investors by helping identify underlying growth trends in our business and facilitating easier comparisons of our revenue performance with prior and future periods and to our peers. The Company excludes the effect of foreign currency translation from organic sales because foreign currency translation is not under management’s control, is subject to volatility and can obscure underlying business trends. The Company excludes the effect of acquisitions because the nature, size, and number of acquisitions can vary dramatically from period to period and between the Company and its peers and can also obscure underlying business trends and make comparisons of long-term performance difficult.

Performance in 2014 Compared with 2013

(In thousands) | 2014 | 2013 | Change | ||||||||

Net sales | $ | 2,147,767 | $ | 2,024,130 | 6 | % | |||||

Operating income | 431,224 | 395,513 | 9 | % | |||||||

Operating margin | 20.1 | % | 19.5 | % | 60 | bps | |||||

Sales in 2014 were $2.1 billion, a 6% increase from the comparable period last year. This increase reflects a 5% increase in organic sales and 1% from acquisitions (Aegis — April 2014 and FTL — March 2013). Organic sales to customers outside the U.S. represented approximately 50% of total sales in 2014 compared with 51% in 2013.

14

In 2014, Fluid & Metering Technologies contributed 42% of sales and 43% of operating income; Health & Science Technologies contributed 35% of sales and 31% of operating income; and Fire & Safety/Diversified Products contributed 23% of sales and 26% of operating income.

Gross profit of $949.3 million in 2014 increased $76.0 million, or 9%, from 2013, while gross margins were 44.2% in 2014 and 43.1% in 2013. The increases are mainly attributable to increased sales volume, favorable net material costs as well as benefits from productivity initiatives.

SG&A expenses increased to $504.4 million in 2014 from $477.9 million in 2013. The $26.6 million increase reflects approximately $4.0 million of incremental costs from new acquisitions and $22.6 million of volume-related expenses. As a percentage of sales, SG&A expenses were 23.5% for 2014 and 23.6% for 2013.

During 2014, the Company recorded pre-tax restructuring expenses totaling $13.7 million. No restructuring expenses were recorded in 2013. The 2014 restructuring expenses were mainly attributable to employee severance related to head count reductions across all three segments and corporate.

Operating income of $431.2 million in 2014 increased from the $395.5 million recorded in 2013, primarily reflecting an increase in volume, improved productivity partially offset by the $13.7 million of restructuring-related charges recorded in 2014. Operating margin of 20.1% in 2014 was up from 19.5% in 2013 primarily due to volume leverage and productivity partially offset by the restructuring-related charges in 2014.

Other (income) expense increased $3.3 million from other expense of $0.2 million in 2013 to $3.1 million of income in 2014 mainly due to a favorable impact from foreign currency transactions and an increase in interest income.

Interest expense decreased slightly to $41.9 million in 2014 from $42.2 million in 2013. The decrease was principally due to lower interest rates.

The provision for income taxes is based upon estimated annual tax rates for the year applied to federal, state and foreign income. The provision for income taxes increased to $113.1 million in 2014 compared to $97.9 million in 2013. The effective tax rate increased to 28.8% in 2014 compared to 27.7% in 2013, due to a mix of global pre-tax income among jurisdictions and the 2012 U.S. R&D credit in 2013, which was retroactively reinstated to January 1, 2012 as a result of the the enactment of the American Taxpayer Relief Act of 2012 on January 2, 2013.