Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - Contango ORE, Inc. | ctgo-20150630x10kxex312.htm |

| EX-99.10 - EXHIBIT 99.10 - Contango ORE, Inc. | exhibit9910-auditedpeakgol.htm |

| EX-23.1 - EXHIBIT 23.1 UHY LLP CONSENT - Contango ORE, Inc. | uhyconsent-231.htm |

| EX-23.2 - EXHIBIT 23.2 - BDO USA, LLP CONSENT - Contango ORE, Inc. | bdoconsent-232.htm |

| EX-31.1 - EXHIBIT 31.1 - Contango ORE, Inc. | ctgo-20150630x10kxex311.htm |

| EX-32.1 - EXHIBIT 32.1 - Contango ORE, Inc. | ctgo-20150630x10kxex321.htm |

| EX-32.2 - EXHIBIT 32.2 - Contango ORE, Inc. | ctgo-20150630x10kxex322.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2015 | |

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to | |

Commission file number 000-54136

CONTANGO ORE, INC.

(Exact name of registrant as specified in its charter)

Delaware | 27-3431051 | |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | |

3700 BUFFALO SPEEDWAY, SUITE 925

HOUSTON, TEXAS 77098

(Address of principal executive offices)

(713) 877-1311

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, Par Value $0.01 per share | OTCBB | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

Non-accelerated filer | ¨ | Smaller reporting company | ý | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

As of December 31, 2014 the aggregate market value of the registrant's common stock held by non-affiliates (based upon the closing sale price of such common stock as reported on the OTCBB was $17,301,142. As of October 9, 2015, there were 3,904,540 shares of the registrant’s common stock outstanding.

Documents Incorporated by Reference

Items 10, 11, 12, 13 and 14 of Part III have been omitted from this report since registrant will file with the Securities and Exchange Commission, not later than 120 days after the close of its fiscal year, a definitive proxy statement, pursuant to Regulation 14A. The information required by Items 10, 11, 12, 13 and 14 of this report, which will appear in the definitive proxy statement, is incorporated by reference into this Form 10-K.

CONTANGO ORE, INC.

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED JUNE 30, 2015

TABLE OF CONTENTS

Page | |||

SELECTED FINANCIAL DATA | |||

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | |||

Item 9B. | OTHER INFORMATION | 28 | |

i

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements made in this report may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934, as amended. The words and phrases “should be”, “will be”, “believe”, “expect”, “anticipate”, “estimate”, “forecast”, “goal” and similar expressions identify forward-looking statements and express expectations about future events. These include such matters as:

• | The Company's financial position |

• | Business strategy, including outsourcing |

• | Meeting Company forecasts and budgets |

• | Anticipated capital expenditures |

• | Prices of gold and associated minerals |

• | Timing and amount of future discoveries (if any) and production of natural resources on our Tetlin Property |

• | Operating costs and other expenses |

• | Cash flow and anticipated liquidity |

• | Prospect development |

• | New governmental laws and regulations |

Although the Company believes the expectations reflected in such forward-looking statements are reasonable, such expectations may not occur. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company's actual results, performance or achievements to be materially different from future results expressed or implied by the forward-looking statements. These factors include among others:

• | Ability to raise capital to fund capital expenditures |

• | Operational constraints and delays |

• | The risks associated with exploring in the mining industry |

• | The timing and successful discovery of natural resources |

• | Availability of capital |

• | Declines and variations in the price of gold and associated minerals |

• | Price volatility for natural resources |

• | Availability of operating equipment |

• | Operating hazards attendant to the mining industry |

• | Weather |

• | The ability to find and retain skilled personnel |

• | Restrictions on mining activities |

• | Legislation that may regulate mining activities |

• | Impact of new and potential legislative and regulatory changes on mining operating and safety standards |

• | Uncertainties of any estimates and projections relating to any future production, costs and expenses. |

• | Timely and full receipt of sale proceeds from the sale of mined products (if any) |

• | Stock price and interest rate volatility |

• | Federal and state regulatory developments and approvals |

• | Availability and cost of material and equipment |

• | Actions or inactions of third-parties |

• | Potential mechanical failure or under-performance of facilities and equipment |

• | Environmental risks |

• | Strength and financial resources of competitors |

• | Worldwide economic conditions |

• | Expanded rigorous monitoring and testing requirements |

• | Ability to obtain insurance coverage on commercially reasonable terms |

• | Competition generally and the increasing competitive nature of the mining industry |

You should not unduly rely on these forward-looking statements in this report, as they speak only as of the date of this report. Except as required by law, the Company undertakes no obligation to publicly release any revisions to these forward-looking statements to reflect events or circumstances occurring after the date of this report or to reflect the occurrence of unanticipated events. See the information under the heading “Risk Factors” in this Form 10-K for some of the important factors that could affect the Company's financial performance or could cause actual results to differ materially from estimates contained in forward-looking statements.

ii

PART I

Item 1. BUSINESS

Overview

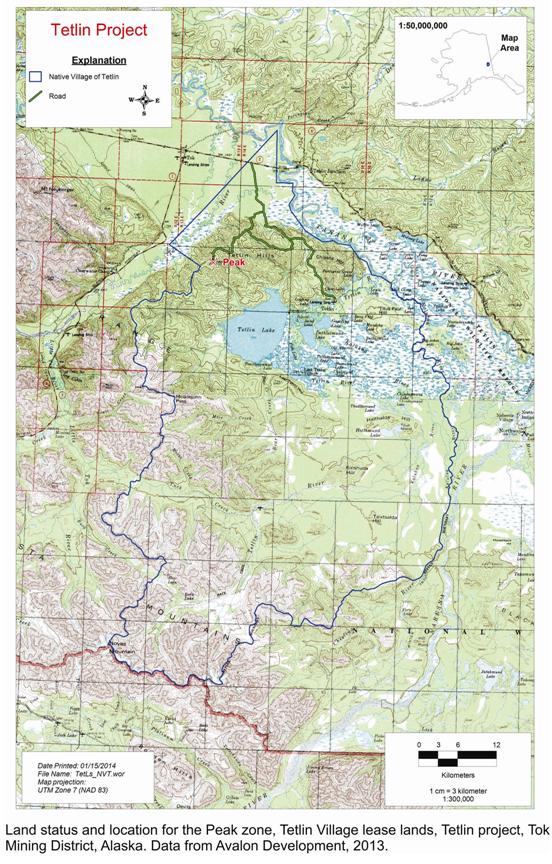

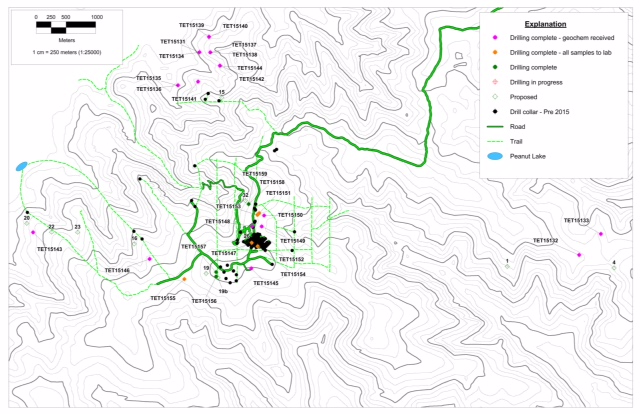

The Company is a Houston-based company, whose primary business is the participation in a joint venture to explore in the State of Alaska for gold ore and associated minerals. On January 8, 2015, the Company and Royal Gold, Inc. (“Royal Gold”), through their wholly-owned subsidiaries, consummated the transactions (the “Transactions”) contemplated under the Master Agreement, dated as of September 29, 2014 (the “Master Agreement”), including the formation of a joint venture, Peak Gold, LLC (the "Joint Venture Company"), to advance exploration of the Company’s Tetlin Property, which is prospective for gold and associated minerals. As of June 30, 2015, the Joint Venture Company had leased or had control over State of Alaska properties totaling approximately 774,356 acres for the exploration of gold ore and associated minerals.

Background

Contango Mining Company (“Contango Mining”), a wholly owned subsidiary of Contango Oil & Gas Company (“Contango”), was formed on October 15, 2009 for the purpose of engaging in exploration in the State of Alaska for (i) gold ore and associated minerals and (ii) rare earth elements. Contango Mining initially acquired a 50% interest in properties from Juneau Exploration, L.P., (“JEX”) in exchange for $1 million and a 1.0% overriding royalty interest in the properties under a Joint Exploration Agreement (the “Joint Exploration Agreement”). On September 15, 2010, Contango Mining acquired the remaining 50% interest in the properties by increasing the overriding royalty interest in the properties granted to JEX to 3.0% pursuant to an Amended and Restated Conveyance of Overriding Royalty Interest (the “Amended ORRI Agreement”), and JEX and Contango Mining terminated the Joint Exploration Agreement. JEX assisted the Company in acquiring additional properties in Alaska pursuant to an Advisory Agreement dated September 6, 2012, and the Company granted to JEX a 2% overriding royalty interest in the additional properties acquired. On September 29, 2014, pursuant to a Royalty Purchase Agreement between JEX and Royal Gold (the “Royalty Purchase Agreement”), JEX sold its entire overriding royalty interest in the properties to Royal Gold. On the same date, the Company terminated the Advisory Agreement with JEX.

The Company was formed on September 1, 2010 as a Delaware corporation and on November 29, 2010, Contango Mining assigned all its properties and certain other assets and liabilities to Contango. Contango contributed the properties and $3.5 million of cash to the Company, pursuant to the terms of a Contribution Agreement (the “Contribution Agreement”), in exchange for approximately 1.6 million shares of the Company’s common stock. The transactions occurred between companies under common control. Contango then distributed all of the Company’s common stock to Contango’s stockholders of record as of October 15, 2010, promptly after the effective date of the Company’s Registration Statement Form 10 on the basis of one share of common stock for each ten (10) shares of Contango’s common stock then outstanding.

In connection with the closing of the Transactions with Royal Gold (the “Closing”), the Company formed Peak Gold, LLC and contributed to the Joint Venture Company its Tetlin Property near Tok, Alaska, together with other personal property (the “Contributed Assets”) at an agreed value of $45.7 million (the “Contributed Assets Value”). At the Closing, the Company and Royal Gold, through their wholly-owned subsidiaries, entered into a Limited Liability Company Agreement for the Joint Venture Company (the “Joint Venture Company LLC Agreement”). The audited financial statements of Peak Gold, LLC as of the year ended June 30, 2015 are filed as an exhibit to this Form 10-K.

Upon Closing, Royal Gold initially invested $5 million to fund exploration activity. The initial $5 million did not give Royal Gold an equity stake in the Joint Venture Company. Royal Gold has the option to earn up to a 40% economic interest in the Joint Venture Company by investing up to $30 million (inclusive of the initial $5 million investment) prior to October 2018. On August 31, 2015, the Joint Venture Company approved additional exploration work during the fall of 2015. Royal Gold agreed to make an additional capital contribution of up to approximately $4 million for an aggregate investment of approximately $9 million. Royal Gold may earn up to an approximately 8% economic ownership of the joint venture by contributing the $9 million. The proceeds of Royal Gold’s investment have been and will be used by the Joint Venture Company for additional exploration of the Tetlin Property.

Properties

Since 2009, the Company's primary focus has been the exploration of a mineral lease with the Tetlin Village Council for the exploration of minerals on approximately 675,000 acres near Tok, Alaska (the "Tetlin Lease") and almost all of the Company's resources have been directed to that end. All significant work presently conducted by the Company has been directed at exploration of the Tetlin Lease and increasing understanding of the characteristics of, and economics of, any mineralization. There are no known quantifiable mineral reserves on the Tetlin Lease or any of the Company's other properties as defined by the Securities and Exchange Commission ("SEC") Industry Guide 7.

1

The Tetlin Lease originally had a ten year term beginning July 2008 with an option to renew 50% of the acreage for an additional ten years. In December 2012, the Tetlin Lease was amended, allowing the Company to renew 100% of the acreage in 2018, in exchange for $200,000, which the Company paid to the Tetlin Village Council. If the properties under the Tetlin Lease are placed into commercial production, the Tetlin Lease will be held throughout production and the Company would be obligated to pay a production royalty to the Native Village of Tetlin, which varies from 2.0% to 5.0%, depending on the type of metal produced and the year of production. In June 2011, the Company paid the Tetlin Village Council $75,000 in exchange for reducing the production royalty payable to them by 0.25%. In July 2011, the Company paid the Tetlin Village Council an additional $150,000 in exchange for further reducing the production royalty by 0.50%. These payments lowered the production royalty to a range of 1.25% to 4.25%, depending on the type of metal produced and the year of production. On or before July 15, 2020, the Tetlin Village Council has the option to increase its production royalty by (i) 0.25% by payment to the Joint Venture Company of $150,000, or (ii) 0.50% by payment to the Joint Venture Company of $300,000, or (iii) 0.75% by payment to the Joint Venture Company of $450,000.

The Joint Venture Company also holds certain state of Alaska unpatented mining claims for the exploration of gold ore and associated minerals. The Company believes that the Joint Venture Company holds good title to its properties, in accordance with standards generally accepted in the mineral industry. As is customary in the mineral industry, the Company conducts only a preliminary title examination at the time it acquires a property. The Joint Venture Company conducted a title examination prior to the assignment of the Tetlin Lease to the Joint Venture Company and performed certain curative title work. Before the Joint Venture Company begins any mine development work, however, the Joint Venture Company is expected to again conduct a full title review and perform curative work on any defects that it deems significant. A significant amount of additional work is likely required in the exploration of the properties before any determination as to the economic feasibility of a mining venture can be made. Due to harsh weather conditions in Alaska, the Joint Venture Company's exploration field work will be normally restricted to May through October.

The following table summarizes the Tetlin Lease and unpatented mining claims (the "Tetlin Property") held by the Joint Venture Company as of June 30, 2015:

Property | Location | Commodities | Claims | Acres | Type | |||||

Tetlin-Tok | Eastern Interior | Gold, Copper | 131 | 10,850 | State Mining Claims | |||||

Eagle | Eastern Interior | Gold, Copper | 428 | 65,946 | State Mining Claims | |||||

Bush | Eastern Interior | Gold, Copper | 48 | 7,680 | State Mining Claims | |||||

West Fork | Eastern Interior | Gold, Copper | 48 | 7,680 | State Mining Claims | |||||

Triple Z | Eastern Interior | Gold, Copper | 45 | 7,200 | State Mining Claims | |||||

Tetlin-Village | Eastern Interior | Gold, Copper | - | 675,000 | Lease | |||||

TOTALS: | 700 | 774,356 | ||||||||

Strategy

Partnering with strategic industry participants to expand future exploration work. In connection with an evaluation of the Company’s strategic options conducted by the Board of Directors and its financial advisor, the Company determined to continue its exploration activities on the Tetlin Property through a joint venture with an experienced industry participant. As a result, the Company formed the Joint Venture Company pursuant to a Joint Venture Company's LLC Agreement with Royal Gold. Under the Joint Venture Company's LLC Agreement, Royal Gold is appointed as the manager of the Joint Venture Company (the “Manager”), initially, with overall management responsibility for operations of the Joint Venture Company through October 31, 2018, and, thereafter, provided Royal Gold earns at least a forty percent (40%) percentage interest by October 31, 2018. Royal Gold may resign as Manager and can be removed as Manager for a material breach of the Joint Venture Company LLC Agreement, a material failure to perform its obligations as the Manager, a failure to conduct the Joint Venture Company operations in accordance with industry standards and applicable laws, and other limited circumstances. The Manager will manage, and direct the operation of the Joint Venture Company, and will discharge its duties, in accordance with approved programs and budgets. The Manager will implement the decisions of the Management Committee of the Joint Venture Company (the “Management Committee”) and will carry out the day-to-day operations of the Joint Venture Company. Except as expressly delegated to the Manager, the Joint Venture Company's LLC Agreement provides that the Management Committee has exclusive authority to determine all management matters related to the Company. Initially, the Management Committee consists of one appointee designated by the Company and two appointees designated by Royal Gold. Each designate on the Management Committee will be entitled to one vote. Except for the list of specific actions set forth in the Joint Venture Company's LLC Agreement, the affirmative vote by a majority of designates will be required for action.

2

Structuring Incentives to Drive Behavior. The Company believes that equity ownership aligns the interests of the Company's executives, employees and directors with those of its stockholders. The Company’s directors, officers and employees do not receive cash compensation for their work for the Company. As of June 30, 2015, the Company's directors, officers, and employees beneficially own approximately 10.7% of the Company's common stock. An additional 21.6% of the Company's common stock is beneficially owned by the Estate of Mr. Kenneth R. Peak, the Company's former Chairman, who passed away on April 19, 2013.

Exploration and Mining Property

Exploration and mining rights in Alaska may be acquired in the following manner: public lands, private fee lands, unpatented Federal or State of Alaska mining claims, patented mining claims, and tribal lands. The primary sources for acquisition of these lands are the United States government, through the Bureau of Land Management and the United States Forest Service, the Alaskan state government, tribal governments, and individuals or entities who currently hold title to or lease government and private lands.

Tribal lands are those lands that are under control by sovereign Native American tribes, such as land constituting the Tetlin Lease or Alaska Native corporations established by the Alaska Native Claims Settlement Act of 1971 (ANSCA). Areas that show promise for exploration and mining can be leased or joint ventured with the tribe controlling the land, including land constituting the Tetlin Lease.

The State of Alaska government owns public lands. Mineral resource exploration, development and production are administered primarily by the State Department of Natural Resources. Ownership of the subsurface mineral estate, including alluvial and lode mineral rights, can be acquired by staking a 40 acre or 160 acre mining claim, which right is granted under Alaska Statute Sec. 38.05.185 to 38.05.275, as amended (the “Alaska Mining Law”). The State government continues to own the surface estate, subject to certain rights of ingress and egress owned by the claimant, even though the subsurface can be controlled by a claimant with a right to extract through claim staking. However, the claimant does not own unfettered title to the minerals or the and the mining claim is subject to annual assessment work requirements, the payment of annual rental fees and royalties due to the State of Alaska after commencement of commercial production. Both private fee-land and unpatented mining claims and related rights, including rights to use the surface, are subject to permitting requirements of Federal, State, Tribal and Local governments.

Consulting Services provided by Avalon Development Corporation

Until January 8, 2015, the Company was a party to a Professional Services Agreement (“PSA”) with Avalon to provide certain geological consulting services and exploration activities with respect to the Tetlin Property. Pursuant to the PSA, Avalon provided geological consulting services and exploration activities, including all field work at the Tetlin Lease. The Company paid Avalon on a per diem basis and reimbursed Avalon for its expenses. As additional compensation, the owner of Avalon received restricted shares of common stock and stock options to purchase shares of common stock of the Company.

Avalon is a Fairbanks, Alaska based mineral exploration consulting firm, which has conducted mineral exploration in Alaska since 1985. The President of Avalon is Curtis J. Freeman who graduated from the College of Wooster, Ohio, with a B.A. degree in Geology (1978) and graduated from the University of Alaska with an M.S. degree in Economic Geology (1980). From 1980 to the present Mr. Freeman has been actively employed in various capacities in the mining industry in numerous locations in North America, Central America, South America, New Zealand and Africa. Avalon's team of engineers and geoscientists combined with its geographic information systems (GIS) database allows Avalon to synthesize existing geological, geochemical and geophysical data and identify specific target areas for ground evaluation and/or acquisition. Avalon’s exploration team has identified or conducted discovery drilling on several gold deposits in Alaska and has completed digital GIS compilations of the Tintina Gold Belt, a regional-scale mineral province stretching from southwest Alaska to the southern Yukon Territory. Avalon also has experience exploring for copper, nickel and platinum group elements (“Cu-Ni-PGE”) deposits and also created a comprehensive GIS compilation of Cu-Ni-PGE prospects in Alaska, an internally-owned database that contains data on over 200 PGE occurrences in Alaska.

In connection with the Transactions, the Company terminated the PSA with Avalon, and Avalon is now providing services to the Joint Venture Company.

Services Provided by Tetlin Village Members

Since the start of the term of the Tetlin Lease, the Company, and the Joint Venture Company have worked closely with the Tetlin Village Council to train and employ Tetlin residents during Tetlin project exploration programs. During the 2013 and 2015 exploration programs, there were more than 15 Tetlin residents working on the Tetlin project exploration program, employed on a seasonal basis through Avalon. Their duties included reconnaissance soil, stream sediment and pan concentrate sampling,

3

diamond drill core processing, drill pad construction and related tasks, expediting services, food services, database management, vehicle transportation and maintenance services, reclamation activities, and project management tasks.

On October 15, 2010, the Company entered into a consulting agreement (as amended, the “Consulting Agreement”), with the Chief of the Tetlin Village (the “Consultant”), which was terminated in January 2015, in connection with the Transactions. Under the terms of the Consulting Agreement, the Consultant assisted the Company in negotiations with other native tribes to lease additional properties and assisted the Company with State of Alaska and Federal governmental affairs issues. The Company paid the Consultant $5,000 per month and certain lodging costs while the Consultant was in Fairbanks, Alaska, in exchange for his services.

Community Affairs

In April 2015, the Joint Venture Company entered into a Community Support Agreement with the Tetlin Village for a one year period, renewable by mutual consent of both parties annually. Under the agreement the Joint Venture Company provides payments to the village three times during the year for an aggregate amount of $100,000. The agreement defines agreed uses for the funds and auditing rights regarding use of funds. In addition, the Joint Venture Company supports the Tetlin Village in maintenance of the village access road, which is used by the Company on a daily basis during the exploration season on an as needed basis. Funding through the end of August 2015 has amounted to $95,000.

The Company's activities have increased road traffic and general activity on the Tetlin lands. During the fiscal years ended June 30, 2015 and 2014, the Company expended approximately $30,000 and $434,000, respectively, on road work, snow plowing, flood relief, winter fuel, village repairs and charitable contributions.

In August 2013, the Company advanced $100,000 to the Tetlin Village Council under a Promissory Note (the "Tetlin Note") for road improvements. The terms of the Tetlin Note required the advance be repaid without interest on the earlier of (i) October 1, 2013 or (ii) a date that was within five days following the date the Tetlin Village Council received funds from the State of Alaska for road improvements. The Tetlin Note was repaid on October 4, 2013.

Adverse Climate Conditions

Weather conditions will affect the Joint Venture Company's ability to conduct exploration activities and mine any ore from the Tetlin Property in Alaska. While exploratory drilling and related activities may only be conducted from May to October on the Tetlin Property, the Company believes development work and any subsequent mining may be conducted year-round.

Competition

The Joint Venture Company currently faces strong competition for the acquisition of exploration-stage properties as well as extraction of any minerals in Alaska. Numerous larger mining companies actively seek out and bid for mining prospects as well as for the services of third party providers and supplies, such as mining equipment and transportation equipment. The Joint Venture Company's competitors in the exploration, development, acquisition and mining business include major integrated mining companies as well as numerous smaller mining companies, almost all of which have significantly greater financial resources and in-house technical expertise. In addition, the Joint Venture Company will compete with others in efforts to obtain financing to further explore and develop its mineral properties.

Government Regulation

The Joint Venture Company's mineral exploration activities are generally affected by various laws and regulations, including environmental, conservation, tax and other laws and regulations relating to the exploration of minerals. Various Federal and Alaskan laws and regulations often require permits for exploration activities and also cover extraction of minerals. In addition, the Tetlin Lease is located on land leased from the Tetlin Village Council. Federally recognized Native American tribes are independent governments, with sovereign powers, except as those powers may have been limited by treaty or by the United States Congress. Such tribes maintain their own governmental systems and often their own judicial systems and have the right to tax, and to require licenses and to impose other forms of regulation and regulatory fees, on persons and businesses operating on their lands. As sovereign nations, federally recognized Native American tribes are generally subject only to federal regulation. States do not have the authority to regulate them, unless such authority has been specifically granted by Congress, and state laws generally do not directly apply to them and to activities taking place on their lands, unless they have a specific agreement or compact with the state or federal government allowing for the application of state law. The Joint Venture Company will continue to use its best efforts to ensure that it is in compliance with all applicable laws and regulations but the denial of permits required to explore for or mine ore may prevent it from realizing any revenues arising from the presence of minerals on its properties.

4

Environmental Regulation

The Joint Venture Company believes that it is currently operating in compliance with all environmental regulations. While the Alaska Department of Natural Resources, Office of Project Management and Permitting coordinates the permitting of mine projects on state lands, it has no jurisdiction on Native American land such as the Tetlin Lease. However, the Joint Venture Company has voluntarily elected, with the concurrence of the Chief of Tetlin Village and the Tetlin Village Council, to conduct its mineral exploration activities under the same terms and conditions as required on State of Alaska mining claims.

The Joint Venture Company has been issued Hard Rock Exploration permits and Temporary Water Use Permits covering past and planned activities on the Tetlin Property. These permits were issued to the Company by the Alaska Department of Natural Resources in 2012 and 2013 and assigned to the Joint Venture Company and consist of the following multi-year permits:

1. | Alaska Hard Rock Exploration and Reclamation Permit #2626 covering exploration drilling activities on the Tetlin Lease. This permit extends through December 31, 2015. Each year during the term of the permit, the Company will submit a reclamation statement detailing reclamation actions taken and a letter of intent to do reclamation for the following year. |

2. | Alaska Temporary Water Use Permits F2011-51 and F2012-157, each allowing a seasonal average water use of 21,600 gallons per day during the period May 20 to October 15 during calendar years 2011 through 2016. These water use authorizations are specific to Alaska Hard Rock Exploration permit #2626; |

The above referenced State of Alaska permits were issued to the Company and assigned to the Joint Venture Company to cover its access road, drill pad and core drilling impacts. The Joint Venture Company does not anticipate requiring additional permits from the State of Alaska for the remainder of 2015. Reclamation of surface disturbance, if any, associated with our exploration activities is conducted concurrently where required.

The Joint Venture Company also has received a Nationwide Permit #6, Permit #POA-2013-286, from the U.S. Department of the Army Corps of Engineers with respect to the Joint Venture Company’s intended drilling and access-related disturbances on wetlands within the Tetlin Lease, which is valid through March 18, 2017. However, such lands were classified as wetlands more than 20 years ago and much of the land covered by such permit has since been burned by natural wildfires. As a consequence of the wildfires and natural habitat changes that have taken place since the wildfires, the Tetlin Property may no longer be considered wetlands according to Corps of Engineers guidelines.

The Company began collecting baseline environmental data in 2012 and the Joint Venture Company has continued this process. The Joint Venture Company has not developed a comprehensive environmental permitting strategy as the Company remains in an exploration stage. If and when its exploration work is significantly advanced that additional baseline environmental studies and prefeasibility studies are desirable, the Company will be required to expend considerable funds and resources for an environmental impact statement and related studies to advance any mining project.

Any future mining operations are subject to local, state and federal regulation governing environmental quality and pollution control, including air quality standards, greenhouse gas, waste management, reclamation and restoration of properties, plant and wildlife protection, handling and disposal of radioactive substances, and employee health and safety. Extraction of mineral ore is subject to stringent environmental regulation by state and federal authorities, including the Environmental Protection Agency. Such regulation can increase the cost of planning, designing, installing and operating mining facilities or otherwise delay, limit or prohibit planned operations.

Significant fines and penalties may be imposed for failure to comply with environmental laws. Some environmental laws provide for joint and several strict liability for remediation of releases of hazardous substances. In addition, the Joint Venture Company may be subject to claims alleging personal injury or property damages as a result of alleged exposure to hazardous substances.

The Federal Mine Safety and Health Act of 1977 and regulations promulgated thereunder, as well as, the State of Alaska Department of Labor and Workforce Development impose a variety of health and safety standards on numerous aspects of employee working conditions related to mineral extraction and processing operations, including the training of personnel, operating procedures and operating equipment. In addition, the Joint Venture Company may be subject to additional state and local mining standards. The Company believes that the Joint Venture Company currently is in compliance with applicable mining standards; however, the Company cannot predict whether changes in standards or the interpretation or enforcement thereof will have a material adverse effect on the Joint Venture Company's business, financial condition or otherwise impose restrictions on its ability to conduct mining operations.

A typical time frame for baseline environmental studies and permitting for a gold mine in Alaska may consume a decade or more. There are numerous state and federal permits and authorizations required from many different state and federal agencies.

5

Federal legislation and regulations adopted and administered by the U.S. Environmental Protection Agency, Forest Service, Bureau of Land Management, Fish and Wildlife Service, Mine Safety and Health Administration, and other federal agencies, legislation such as the Federal Clean Water Act, Clean Air Act, National Environmental Policy Act, Endangered Species Act, and Comprehensive Environmental Response, Compensation, and Liability Act (“CERCLA”) and various laws and regulations administered by the State of Alaska including the Alaska Department of Fish and Game, the Alaska Department of Environmental Conservation, Alaska Department of Transportation and Public Facilities and the Alaska Department of Natural Resources, have a direct bearing on exploration and mining operations conducted in Alaska. These regulations will make the process for preparing and obtaining approval of a plan of operations much more time-consuming, expensive, and uncertain. The Alaska Department of Natural Resources coordinates the permitting of mining operations in the State of Alaska and has developed a process to integrate federal, state and local government requirements to obtain mine permits, and also provides an opportunity for public comment. Plans of operation will be required to include detailed baseline environmental information and address how detailed reclamation performance standards will be met. In addition, all activities for which plans of operation are required will be subject to a new standard of review by the U.S. Bureau of Land Management, which must make a finding that the conditions, practices or activities do not cause substantial irreparable harm to significant scientific, cultural, or environmental resource values that cannot be effectively mitigated.

CERCLA generally imposes joint and several strict liability for costs of investigation and remediation and for natural resource damages, with respect to the release of hazardous substances (as designated under CERCLA) into the environment. CERCLA also authorizes the EPA, and in some cases, third parties, to take action in response to threats to the public health or the environment and to seek to recover from the potentially responsible parties the costs of such action. The Joint Venture Company's mining operations may generate wastes that fall within CERCLA’s definition of Hazardous Substances.

Employees

The Company has three part-time employees. Of these, two are officers of the Company. Brad Juneau is the Chairman, President and Chief Executive Officer of the Company and is responsible for the management of the Company. Leah Gaines is the Vice President, Chief Financial Officer, Chief Accounting Officer, Treasurer and Secretary of the Company and is responsible for the financial and accounting affairs of the Company. Mr. Juneau and Ms. Gaines each devote approximately 10% of their time to the Company’s business. The Company also uses the services of independent consultants and contractors to perform various professional services, including land acquisition, legal, environmental and tax services. In addition, the Joint Venture Company utilizes the services of Avalon to perform geological, exploration and drilling operation services and independent third party engineering firms to evaluate any mineral resources identified.

Directors and Executive Officers

The following table sets forth the names, ages and positions of the Company's directors and executive officers:

Name | Age | Position | ||

Brad Juneau | 55 | Chairman, President, and Chief Executive Officer | ||

Leah Gaines | 39 | Vice President, Chief Financial Officer, Chief Accounting Officer, Treasurer and Secretary | ||

Joseph Compofelice | 66 | Director | ||

Joseph G. Greenberg | 54 | Director | ||

Brad Juneau. Mr. Juneau, the Company's co-founder, was elected President and Chief Executive Officer in December 2012. Mr. Juneau was first appointed President, Acting Chief Executive Officer and director in August 2012 when the Company's Co-founder, Mr. Kenneth R. Peak received a medical leave of absence. Mr. Juneau was appointed Chairman of the Board in April 2013. Mr. Juneau is the sole manager of the general partner of JEX, an oil and gas exploration and production company. Prior to forming JEX in 1998, Mr. Juneau served as Senior Vice President of Exploration for Zilkha Energy Company from 1987 to 1998. Prior to joining Zilkha Energy Company, Mr. Juneau served as Staff Petroleum Engineer with Texas International Company for three years, where his principal responsibilities included reservoir engineering, as well as acquisitions and evaluations. Prior to that, he was a production engineer with Enserch Corporation in Oklahoma City. Mr. Juneau holds a Bachelor of Science degree in Petroleum Engineering from Louisiana State University. Mr. Juneau previously served as a Director of Contango from April 2012 to March 2014.

Leah Gaines. Ms. Gaines was appointed as the Company’s Vice President, Chief Financial Officer, Chief Accounting Officer, Treasurer and Secretary on October 1, 2013. Ms. Gaines has also served as Vice President and Chief Financial Officer of JEX since October 2010. Prior to joining JEX, she served as the Controller for Beryl Oil and Gas, LP and Beryl Resources LP from July 2007 to December 2009. From April 2006 to July 2007, Ms. Gaines held the position of Financial Reporting Manager at SPN Resources, a division of Superior Energy Services. From 2003 to 2006, Ms. Gaines was the Senior Financial Reporting

6

Accountant at Hilcorp Energy. Ms. Gaines was a Principal Accountant at El Paso Corporation in its Power Asset division from 2001 to 2003. Prior to that, Ms. Gaines worked at Deloitte and Touche, LLP for three years as a Senior Auditor. Ms. Gaines graduated Magna Cum Laude from Angelo State University with a Bachelor of Business Administration in Accounting and is a Certified Public Accountant with over seventeen years of experience.

Joseph Compofelice. Mr. Compofelice has been a Director of the Company since its inception. Since January 1, 2014, Mr. Compofelice has been an Operating Partner at White Deer Energy, a private equity firm that targets investments in the energy business. Mr. Compofelice served as Managing Director of Houston Capital Advisors, a boutique financial advisory, mergers and acquisitions investment service from January 2004 to December 2013. Mr. Compofelice served as Chairman of the Board of Trico Marine Service, a provider of marine support vessels serving the international natural gas and oil industry, from 2004 to 2010 and as its Chief Executive Officer from 2007 to 2010. Mr. Compofelice was President and Chief Executive Officer of Aquilex Services Corp., a service and equipment provider to the power generation industry, from October 2001 to October 2003. From February 1998 to October 2000 he was Chairman and CEO of CompX International Inc., a provider of components to the office furniture, computer and transportation industries. From March 1994 to May 1998 he was Chief Financial Officer of NL Industries, a chemical producer, Titanium Metals Corporation, a metal producer and Tremont Corp. Mr. Compofelice received his Bachelor of Science from California State University at Los Angeles and his Masters of Business Administration from Pepperdine University.

Joseph G. Greenberg. Mr. Greenberg has been a Director of the Company since its inception. Mr. Greenberg is Founder and President and CEO of Alta Resources, L.L.C., an oil and gas exploration and production company. Prior to founding Alta Resources in 1999, Mr. Greenberg worked as an exploration geologist for Shell Oil Company and Edge Petroleum Company. Mr. Greenberg received a Bachelor of Science in Geology and Geophysics from Yale University in 1983, and a Masters in Geological Sciences from the University of Texas at Austin in 1986. He has over twenty-eight years of diversified experience in oil and gas exploration and production.

The Board of Directors is responsible for managing the Company, in accordance with the provisions of the Company’s Bylaws and Certificate of Incorporation and applicable law. The number of directors which constitutes the Board of Directors is established by the Board, subject to a minimum of three and a maximum of seven directors. Except, as otherwise provided by the Bylaws for filling vacancies on the Company’s Board of Directors, the Company’s directors are elected at the Company’s annual meeting of stockholders and hold office until their respective successors are elected, or until their earlier resignation or removal. The Company's executive officers are elected annually by the Board and serve until their successors are duly elected and qualified or until their earlier resignation or removal. There are no family relationships between the Company's directors or executive officers.

The Board of Directors elected Mr. Juneau as Chairman of the Board and Chief Executive Officer for a number of reasons. Mr. Juneau is the co-founder of the Company and beneficially owns approximately 9.8% of the Company’s common stock, making him one of the largest shareholders. Mr. Juneau has been an active entrepreneur who founded JEX and built the business into a successful exploration and production company.

Corporate Offices

The Company currently subleases office space from JEX at 3700 Buffalo Speedway, Ste 925, Houston, TX 77098 for approximately $11,000 per quarter.

Code of Ethics

The Company adopted a Code of Ethics for senior management in September 2010. A copy of our Code of Ethics is filed as an Exhibit to this Form 10-K and is also available on the Company's website at www.contangoore.com.

Available Information

You may read and copy all or any portion of this annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, as well as any amendments and exhibits to those reports, without charge at the office of the Securities and Exchange Commission (the “SEC”) in Public Reference Room, 100 F Street NE, Washington, DC, 20549. Information regarding the operation of the public reference rooms may be obtained by calling the SEC at 1-800-SEC-0330. In addition, filings made with the SEC electronically are publicly available through the SEC’s website at http://www.sec.gov, and at the Company's website at http://www.contangoore.com. This annual report on Form 10-K, including all exhibits and amendments, has been filed electronically with the SEC.

7

Item 1A. RISK FACTORS

In addition to other information set forth elsewhere in this Form 10-K, you should carefully consider the following factors when evaluating the Company. An investment in the Company is subject to risks inherent in the mining business as an exploration stage company. The value of an investment in the Company may decrease, resulting in a complete loss of your investment. The risk factors below are not all inclusive.

Royal Gold will have discretion regarding the use and allocation of funds for further exploration of the Contributed Assets.

Royal Gold is the Manager of the Joint Venture Company and has appointed two designates to the Management Committee of the Joint Venture Company (the “Management Committee”). The Company has appointed one designate to the Management Committee. If, after October 31, 2018, Royal Gold has earned at least a 40% membership interest in the Joint Venture by making the full $30 million investment, Royal Gold will continue to have the right to appoint two designates to the Management Committee and the Company will continue to have the right to appoint one designate, The affirmative vote of a majority of designates will determine most decisions of the Management Committee, including the approval of programs and budgets and the expenditure of Royal Gold’s investments.

The Company must depend upon Royal Gold's management of the Joint Venture Company following termination of the Company's third party consulting agreements.

On September 29, 2014, the Company terminated its advisory agreement with JEX. In addition, the Company terminated its services agreements with Avalon Development Corporation and the Chief of the Tetlin Village in January 2015. Because the Company has historically had part-time employees, none of whom are mineral geoscientists or have experience in the mining industry, the Company has previously depended upon consultants, Avalon Development Corporation and the Chief of the Tetlin Village, for the success of its exploration projects. The Company must depend upon Royal Gold for its expertise in planning work programs, conducting field work, evaluating drilling results and preparing development programs.

There can be no assurance that Royal Gold will continue to fund the Joint Venture Company to continue exploration work.

The Joint Venture Company's LLC Agreement contains earn-in periods where Royal Gold has the option to fund up to $25 million on or before October 31, 2018 after its initial $5 million investment at the Closing of the Master Agreement. There is no requirement that Royal Gold contribute any future amounts to the Joint Venture Company to continue exploration work, and the Company will have limited funds to continue exploration of its Tetlin Property, if Royal Gold fails to contribute additional amounts to the Joint Venture Company.

The Company may retain only a 60% interest in the Joint Venture Company and its interest could be diluted further.

The Company’s only significant asset is its interest in the Joint Venture Company. If Royal Gold makes the full $30 million capital contribution, it will receive a 40% interest in the Joint Venture Company, and the Company will retain a 60% interest in the Joint Venture Company. In addition, once Royal Gold has earned a 40% interest in the Joint Venture Company, it has the option to require the Company to sell an additional 20% of the Company’s interest in the Joint Venture Company in a sale by Royal Gold of its entire 40% interest to a bona fide third party purchaser. Furthermore, if the Company were unable to fund its contributions to the approved programs and budgets for the Joint Venture Company, its interest in the Joint Venture Company would be diluted further.

There can be no assurance that the Company will be capable of raising additional funding required to continue development of the Tetlin Property and meet its funding obligations under the Joint Venture Company's LLC Agreement.

Upon the later of the investment by Royal Gold of $30 million into the Joint Venture Company or October 31, 2018, the Company and Royal Gold will jointly fund the joint venture operations in proportion to their interests in the Joint Venture Company. The capital costs of developing a large gold mining facility could exceed $1 billion. The Company has limited financial resources and the ability of the Company to arrange additional financing in the future will depend, in part, on the prevailing capital market conditions, the exploration results achieved at the Tetlin Property, as well as the market price of metals. There is no assurance that sources of financing will be available to the Company on acceptable terms, if at all. Failure to obtain additional financing on a timely basis will cause the Company’s interest in the Joint Venture Company to be diluted.

Further financing by the Company may include issuances of equity, instruments convertible into equity (such as warrants) or various forms of debt. The Company has issued common stock and other instruments convertible into equity in the past and

8

cannot predict the size or price of any future issuances of common stock or other instruments convertible into equity, and the effect, if any, that such future issuances and sales will have on the market price of the Company’s securities. Any additional issuances of common stock or securities convertible into, or exercisable or exchangeable for, common stock may ultimately result in dilution to the holders of common stock, dilution in any future earnings per share of the Company and may have a material adverse effect upon the market price of the common stock of the Company.

Royal Gold has far greater technical and financial resources than the Company.

Royal Gold is an international precious metals royalty and streaming company with interests in approximately 198 properties on six continents and a market capitalization of approximately $4 billion on June 30, 2015. Because of its vastly superior technical and financial resources, Royal Gold may adopt budgets and work programs for the Joint Venture Company that the Company will be unable to fund in the time frame required, and its interest in the Joint Venture Company may be substantially diluted.

The Joint Venture Company's LLC Agreement restricts the Company’s right to transfer or encumber its interests in the Joint Venture Company.

The Joint Venture Company's LLC Agreement contains certain limitations on transferring or encumbering interests in the Joint Venture Company including any transfer that would cause termination of the Joint Venture Company as a partnership for Federal income tax purposes except none of the restrictions limit the transfer of any capital stock of the Company.

The formation of the Joint Venture Company and appointment of Royal Gold as Manager do not provide assurance that further exploration efforts will be successful.

The formation of the Joint Venture Company and appointment of Royal Gold as Manager do not provide assurance that further exploration of the Tetlin Property will be successful, any additional resource will be discovered or a commercial deposit of gold ore and associated minerals may be located. The results of any further exploration work will be assayed and analyzed to determine if additional work should be performed and additional funds expended.

The probability that an individual prospect will contain commercial grade reserves is extremely remote.

The probability of finding economic mineral reserves on the Tetlin Property is extremely small. It is common to spend millions of dollars on an exploration prospect and complete many phases of exploration and still not obtain mineral reserves that can be economically exploited. Therefore, the possibility that the Tetlin Property will contain commercial mineral reserves and that the Company will recover funds spent on exploration is extremely remote.

The price of gold and the gold mining industry have suffered dramatic declines in the past several years.

With the price of gold declining over the past several years, many large mining companies have announced the closure of existing gold mines and a moratorium on new gold mine development.

The Company's ability to successfully execute its business plan is dependent on its ability to obtain adequate financing.

The Company's business plan, which includes the drilling of the Joint Venture Company’s exploration prospects, will require substantial capital expenditures. The Company's ability to raise capital will depend on many factors, including the status of various capital and industry markets at the time it seeks such capital. Accordingly, the Company cannot be certain that financing will be available to us on acceptable terms, if at all. In the event additional capital resources are unavailable, the Company may be required to cease our exploration and development activities or be forced to sell all or some portion of its interest in the Joint Venture Company in an untimely fashion or on less than favorable terms.

The Company has no revenue to date from the Tetlin Property, which may negatively impact the Company's ability to achieve its business objectives.

Since the acquisition of the Tetlin Property, the Company and the Joint Venture Company have conducted only limited exploration activities and to date have not discovered any commercially viable mineral deposits. The Company's ability to become profitable will be dependent on the receipt of revenues from the extraction of minerals greater than operational expenses. The Company and the Joint Venture Company have carried on their business of exploring the Tetlin Property at a loss since inception and expect that the Company and the Joint Venture Company will continue to incur losses unless and until such time as one of the properties enters into commercial production and generates sufficient revenues to fund its continuing operations. The amounts

9

and timing of expenditures will depend on the progress of ongoing exploration, the results of consultants’ analysis and recommendations, the rate at which operating losses are incurred, and other factors, many of which are beyond control. Whether any mineral deposits discovered would be commercially viable depends on a number of factors, which include, without limitation, the particular attributes of the deposit, market prices for the minerals, and governmental regulations. If the Joint Venture Company cannot discover commercially viable deposits or commence actual mining operations, the Company and the Joint Venture Company may never generate revenues and will never become profitable.

The Company's continued viability depends on the exploration, permitting, development and operation of the Tetlin Lease, which is the only material property of the Joint Venture Company.

The Joint Venture Company's only material project at this time is the Tetlin Lease, which is in the exploration stage. The Company's continued viability is based on successfully implementing its strategy, which will require the Joint Venture Company to perform appropriate exploratory and engineering work and evaluate such work, and the permitting and construction of a mine and processing facilities in a reasonable time frame.

The Tetlin Property does not have any proven or probable reserves and the Joint Venture Company may never identify any commercially exploitable mineralization.

None of the Joint Venture Company’s properties have any proven or probable reserves as defined by SEC Industry Guide 7. To date, the Company and the Joint Venture Company have only engaged in material exploration activities on the Tetlin Lease. Accordingly, the Company does not have sufficient information upon which to assess the ultimate success of their exploration efforts. There is no assurance that the Joint Venture Company may ever locate any mineral reserves on the Tetlin Property that may be in economic quantities. Additionally, even if the Joint Venture Company finds minerals in sufficient quantities to warrant recovery, such recovery may not be economically profitable. Mineral exploration is highly speculative in nature, involves many risks and is frequently non-productive. Unusual or unexpected geologic formations and the inability to obtain suitable or adequate machinery, equipment or labor are risks involved in the conduct of exploration programs. If the Joint Venture Company does not establish reserves, it will be required to curtail or suspend our operations, in which case the market value of the Company's common stock will decline, and you may lose all of your investment.

The Tetlin Property is located in the remote regions of Alaska and exploration activities may be limited by weather and limited access and existing infrastructure.

The Joint Venture Company is focused on the exploration of its properties in the State of Alaska. The arctic climate limits most exploration activities to the period from May to October. In addition, the remote location of the properties may limit access and increase exploration expense. Higher costs associated with exploration activities and limitation on the annual periods in which the Joint Venture Company can carry on exploration activities will increase the costs and time associated with our planned exploration activities and could negatively affect the value of the Tetlin Property and the Company's securities.

Concentrating capital investment in the Tetlin Properties in the State of Alaska increases exposure to risk.

The Company and the Joint Venture Company have focused their capital investments in exploring for gold and associated mineral prospects on the Tetlin Property in the State of Alaska. However, the exploration prospects in Alaska may not lead to any revenues or the Joint Venture Company may not be able to drill for mineral deposits at anticipated finding and development costs due to financing, environmental or operating uncertainties. Should the Joint Venture Company be able to make an economic discovery on the Tetlin Property, it would then be solely dependent upon a single mining operation for its revenue and profits.

The Company will rely on the accuracy of the estimates in reports provided to the Company by Royal Gold and the Joint Venture Company’s outside consultants and engineers.

The Company has no in-house mineral engineering capability, and therefore will rely on the accuracy of reports provided to us by Royal Gold, and the Joint Venture Company’s independent third party consultants. If those reports prove to be inaccurate, the Company's financial reports could have material misstatements. Further, the Company will use the reports of Royal Gold and such independent consultants in its financial planning. If the reports prove to be inaccurate, we may also make misjudgments in its financial planning.

10

Exploration activities involve a high degree of risk, and the Joint Venture Company’s exploratory drilling activities may not be successful.

The Company future success will largely depend on the success of the exploration drilling programs of the Joint Venture Company. Participation in exploration drilling activities involves numerous risks, including the significant risk that no commercially marketable minerals will be discovered. The mining of minerals and the manufacture of mineral products involves numerous hazards, including:

• | Ground or slope failures; |

• | Pressure or irregularities in formations affecting ore or wall rock characteristics; |

• | Equipment failures or accidents; |

• | Adverse weather conditions; |

• | Compliance with governmental requirements and laws, present and future; |

• | Shortages or delays in the availability and delivery of equipment; and |

• | Lack of adequate infrastructure, including access to roads, electricity and available housing. |

Poor results from the Joint Venture Company’s drilling activities would materially and adversely affect the Company's future cash flows and results of operations.

The Joint Venture Company has no assurance of title to its properties.

The Joint Venture Company holds 99,356 acres in the form of State of Alaska unpatented mining claims, for gold ore exploration. Unpatented mining claims are unique property interests, in that they are subject to the paramount title of, the State of Alaska and rights of third parties to uses of the surface within their boundaries, and are generally considered to be subject to greater title risk than other real property interests. The rights to deposits of minerals lying within the boundaries of the unpatented state claims are subject to Alaska Statues 38.05.185 - 38.05.280, and are governed by Alaska Administrative Code 11 AAC 86.100 - 86.600. The validity of all State of Alaska unpatented mining claims is dependent upon inherent uncertainties and conditions.

With respect to the Tetlin Lease, the Company retained title lawyers to conduct a preliminary examination of title to the mineral interest prior to executing the Tetlin Lease. The Joint Venture Company conducted a title examination prior to the assignment of the Tetlin Lease to the Joint Venture Company and performed certain curative title work. Prior to conducting any mining activity, however, the Joint Venture Company is expected to again obtain a full title review of the Tetlin Lease to identify more fully any deficiencies in title to the lease and, if there are deficiencies, to identify measures necessary to cure those defects to the extent reasonably possible. However, such deficiencies may not be cured. It does happen, from time to time, that the examination made by title lawyers reveals that the title to properties is defective, having been obtained in error from a person who is not the rightful owner of the mineral interest desired. In these circumstances, the Joint Venture Company may not be able to proceed with exploration of the lease site or may incur costs to remedy a defect. It may also happen, from time to time, that the Joint Venture Company may elect to proceed with mining work despite defects to the title identified in a title opinion.

The Tetlin Lease was executed with a Native American tribe for the exploration of gold ore and associated minerals. The enforcement of contractual rights against Native American tribes with sovereign powers may be difficult.

Federally recognized Native American tribes are independent governments with sovereign powers, except as those powers may have been limited by treaty or the United States Congress. Such tribes maintain their own governmental systems and often their own judicial systems and have the right to tax, and to require licenses and to impose other forms of regulation and regulatory fees, on persons and businesses operating on their lands. As sovereign nations, federally recognized Native American tribes are generally subject only to federal regulation. States do not have the authority to regulate them, unless such authority has been specifically granted by Congress, and state laws generally do not directly apply to them and to activities taking place on their lands, unless they have a specific agreement or compact with the state or Federal government allowing for the application of state law. The Tetlin Lease provides that it will be governed by applicable federal law and the law of the State of Alaska. The Company and the Tetlin Village Council entered into a Stability Agreement, dated October 2, 2014, that was assigned by the Company to the Joint Venture Company. However, no assurance may be given that the choice of law clause in the Tetlin Lease or the agreements with the Tetlin Village Council in the Stability Agreement will be enforceable.

Federally recognized Native American tribes also generally enjoy sovereign immunity from lawsuit similar to that of the states and the United States federal government. In order to sue a Native American tribe (or an agency or instrumentality of a Native American tribe), the Native American tribe must have effectively waived its sovereign immunity with respect to the matter in dispute. Moreover, even if a Native American tribe effectively waives its sovereign immunity, there exists an issue as to the forum in which a lawsuit can be brought against the tribe. Federal courts are courts of limited jurisdiction and generally do not

11

have jurisdiction to hear civil cases relating to matters concerning Native American lands or the internal affairs of Native American governments. Federal courts may have jurisdiction if a federal question is raised by the lawsuit, which is unlikely in a typical contract dispute. Diversity of citizenship, another common basis for federal court jurisdiction, is not generally present in a suit against a tribe because a Native American tribe is not considered a citizen of any state. Accordingly, in most commercial disputes with tribes, the jurisdiction of the federal courts, may be difficult or impossible to obtain. The Tetlin Lease contains a provision in which the Tetlin Village Council expressly waives its sovereign immunity to the limited extent necessary to permit judicial review in the courts in Alaska of certain issues affecting the Tetlin Lease and the Stability Agreement contains, among other things, agreement that any disputes under the Tetlin Lease will be submitted to the jurisdiction of the federal and state courts.

Competition in the mineral exploration industry is intense, and the Joint Venture Company is smaller and has a much more limited operating history than most of its competitors.

The Joint Venture Company will compete with a broad range of mining companies with far greater resources in its exploration activities. Several mining companies concentrate drilling efforts on one type of mineral and thus may enjoy economies of scale and other efficiencies. However, the Joint Venture Company’s drilling strategies currently include exploring for gold ore and associated minerals. As a result, the Joint Venture Company may not be able to compete effectively with such companies. The Joint Venture Company will also compete for the equipment and labor required to operate and to develop its Properties if its exploration activities are successful. Most competitors have substantially greater financial resources than the Joint Venture Company. These competitors may be able to evaluate, bid for and purchase a greater number of properties and prospects than the Joint Venture Company can. In addition, most competitors have been operating for a much longer time than the Joint Venture Company has and have substantially larger staffs. Processing of gold and associated minerals requires complex and sophisticated processing technologies. The Company has no experience in the minerals processing industry.

The Company and the Joint Venture Company have only owned the Tetlin Property since the acquisition by its predecessors of the properties in 2009 and 2010. Furthermore, no member of the Company's management has any technical training or experience in minerals exploration or mining. Because of the Company's limited operating history, the Company has limited insight into trends that may emerge and affect its business. The Company may make errors in predicting and reacting to relevant business trends and will be subject to the risks, uncertainties and difficulties frequently encountered by early-stage companies. Neither the Company nor the Joint Venture Company may be able to compete effectively with more experienced companies or in such a highly competitive environment.

The mining industry is historically a cyclical industry and market fluctuations in the prices of minerals could adversely affect the Company's and Joint Venture Company's business.

Prices for minerals tend to fluctuate significantly in response to factors beyond the Company's control. These factors include:

• | Global economic conditions; |

• | Domestic and foreign tax policy; |

• | The price of gold; |

• | The cost of exploring for, producing and processing gold; |

• | Available transportation capacity; and |

• | The overall supply and demand for gold. |

Changes in gold prices would directly affect revenues and may reduce the amount of funds available to reinvest in exploration activities. Reductions in gold prices not only reduce revenues and profits, but could also reduce the quantities of resources that are commercially recoverable. Declining metal prices may also impact the operations of the Joint Venture Company by requiring a reassessment of the commercial feasibility of any of its mining work.

Because the Company's and Joint Venture Company's sole source of revenue, if its exploration efforts are successful, will be the sale of gold and associated minerals, changes in demand for, and the market price of, gold and associated minerals could significantly affect the Company's Joint Venture Company's profitability. The value and price of the Company's common stock may be significantly affected by declines in the prices of gold minerals and products.

Gold prices fluctuate widely and are affected by numerous factors beyond the Company's control such as interest rates, exchange rates, inflation or deflation, fluctuation in the relative value of the United States dollar against foreign currencies on the world market, global and regional supply and demand for gold, and the political and economic conditions of gold producing countries throughout the world.

12

An increase in the global supply of gold and associated minerals may adversely affect the Company's and Joint Venture Company's business.

The pricing and demand for gold and associated minerals is affected by a number of factors beyond the Joint Venture Company's control, including global economic conditions and the global supply and demand for gold and associated minerals and products. Increases in the amount of gold and associated minerals sold by competitors of the Joint Venture Company may result in price reductions, reduced margins and the Joint Venture Company may not be able to compete effectively against current and future competitors.

The Joint Venture Company is subject to complex laws and regulations, including environmental regulations that can adversely affect the cost, manner or feasibility of doing business.

The Joint Venture Company's exploratory mining operations are subject to numerous laws and regulations governing its operations and the discharge of materials into the environment, including the Federal Clean Water Act, Clean Air Act, Endangered Species Act, and the Comprehensive Environmental Response, Compensation, and Liability Act. Federal initiatives are often also administered and enforced through state agencies operating under parallel state statutes and regulations. Failure to comply with such rules and regulations could result in substantial penalties and have an adverse effect on the Joint Venture Company. These laws and regulations may:

• | Require that the Joint Venture Company obtain permits before commencing mining work; |

• | Restrict the substances that can be released into the environment in connection with mining work; |

• | Impose obligations to reclaim land in order to minimize long term effects of land disturbance; |

• | Limit or prohibit mining work on protected areas. |

Under these laws and regulations, the Joint Venture Company could be liable for personal injury and clean-up costs and other environmental and property damages, as well as administrative, civil and criminal penalties. The Company and the Joint Venture Company maintain only limited insurance coverage for sudden and accidental environmental damages. Accordingly, the Joint Venture Company may be subject to liability, or it may be required to cease production from properties in the event of environmental damages. Compliance with environmental laws and regulations and future changes in these laws and regulations may require significant capital outlays, cause material changes or delays in the Joint Venture Company’s current and planned operations and future activities and reduce the profitability of operations. It is possible that future changes in these laws or regulations could increase operating costs or require capital expenditures in order to remain in compliance. Any such, changes could have an adverse effect on the Joint Venture Company’s business, financial condition and results of operations.

The Joint Venture Company is subject to the Federal Mine Safety and Health Act of 1977 and regulations promulgated thereto, which impose stringent health and safety standards on numerous aspects of its operations.

The Joint Venture Company’s exploration and mining work in Alaska is subject to the Federal Mine Safety and Health Act of 1977, which impose stringent health and safety standards on numerous aspects of mineral extraction and processing operations, including the training of personnel, operating procedures, operating equipment and other matters. The Joint Venture Company’s failure to comply with these standards could have a material adverse effect on its business, financial condition or otherwise impose significant restrictions on its ability to conduct mining work.

The Joint Venture Company may be unable to obtain, maintain or renew permits necessary for the exploration, development or operation of any mining activities, which could have a material adverse effect on its business, financial condition or results of operation.

The Joint Venture Company must obtain a number of permits that impose strict conditions, requirements and obligations relating to various environmental and health and safety matters in connection with its current and future operations. To obtain certain permits, the Joint Venture Company may be required to conduct environmental studies, collect and present data to governmental authorities and the general public pertaining to the potential impact of its current and future operations upon the environment and take steps to avoid or mitigate the impact. The permitting rules are complex and have tended to become more stringent over time. Accordingly, permits required for mining work may not be issued, maintained or renewed in a timely fashion or at all, or may be conditioned upon restrictions which may impede its ability to operate efficiently. The failure to obtain certain permits or the adoption of more stringent permitting requirements could have a material adverse effect on its business, its plans of operation, and properties in that the Joint Venture Company may not be able to proceed with its exploration, development or mining programs.

13

Anti-takeover provisions of the Company's certificate of incorporation, bylaws and Delaware law could adversely affect a potential acquisition by third parties.

In December 2012, the Board of Directors adopted a shareholder rights plan, which was amended on March 21, 2013, September 29, 2014 and December 18, 2014 (as amended, the "Rights Plan"), pursuant to which one preferred stock purchase right was distributed as a dividend on each share of the Company's common stock held of record. The Rights Plan is scheduled to expire in December 20, 2016. The Rights Plan is designed to deter coercive takeover tactics and to prevent an acquirer from gaining control of the Company without offering a fair price to all of the Company's stockholders. The existence of the Rights Plan, however, could have the effect of making it more difficult for a third party to acquire a majority of Company's outstanding common stock, and thereby adversely affect the market price of the Company's common stock.

In addition, the Company's certificate of incorporation, bylaws and the Delaware General Corporation Law contain provisions that may discourage unsolicited takeover proposals. These provisions could have the effect of inhibiting fluctuations in the market price of the Company's common stock that could result from actual or rumored takeover attempts, preventing changes in the Company's management or limiting the price that investors may be willing to pay for shares of common stock. Among other things, these provisions:

• | Limit the personal liability of directors; |

• | Limit the persons who may call special meetings of stockholders; |

• | Prohibit stockholder action by written consent; |

• | Establish advance notice requirements for nominations for election of the board of directors and for proposing matters to be acted on by stockholders at stockholder meetings; |

• | Require us to indemnify directors and officers to the fullest extent permitted by applicable law; |

• | Impose restrictions on business combinations with some interested parties. |

The Company's common stock is thinly traded.