Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Virgin America Inc. | d77340d8k.htm |

Exhibit 99.1

|

|

Virgin America

September 2015

|

|

Disclaimer

This presentation includes forward-looking statements that are subject to many risks and uncertainties. These forward-looking statements, such as our statements about our short-term and long-term growth strategies, can sometimes be identified by our use of terms such as “intend,” “expect,” “plan,” “estimate,” “future,” “strive” and similar words. Although we believe that the expectations reflected in our forward-looking statements are reasonable, those statements involve many risks and uncertainties that may cause our actual results to differ from what may be expressed or implied in our statements. Those risks are discussed in our quarterly report on Form 10-Q, which is on file with the Securities and Exchange Commission (the “SEC), particularly in the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” No forward-looking statement is a guarantee of future results, and you should not place undue reliance on our forward-looking statements, which reflect our views as of the date of this presentation. We assume no obligation to update any forward-looking statement contained in this presentation, except as may be required by law.

This presentation contains certain information that has not been presented in accordance with generally accepted accounting principles (“GAAP”). Reconciliations of such information to the most directly comparable GAAP financial measures are included in the Appendix to these slides and in our quarterly report on Form 10-Q. This information should not be considered a substitute for any GAAP financial measures.

|

|

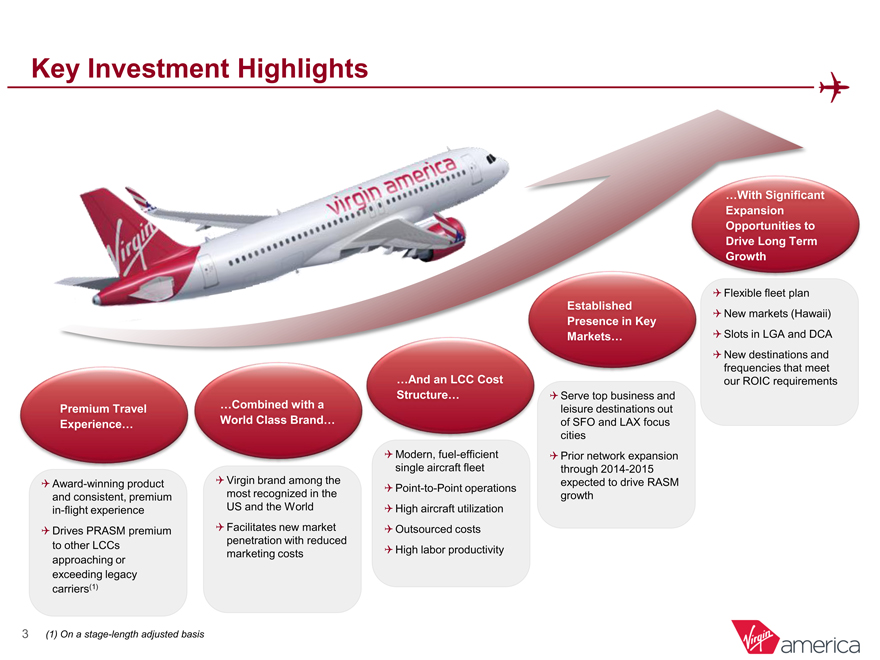

Key Investment Highlights

Premium Travel

Experience…

…Combined with a World Class Brand…

…And an LCC Cost Structure…

Established presence in key markets…

…with significant expansion opportunities to drive long term growth

Award-winning product and consistent, premium in-flight experience Drives PRASM premium to other LCCs approaching or exceeding legacy carriers(1)

Virgin brand among the most recognized in the US and the World Facilitates new market penetration with reduced marketing costs

Modern, fuel-efficient single aircraft fleet Point-to-Point operations High aircraft utilization Outsourced costs High labor productivity

Serve top business and leisure destinations out of SFO and LAX focus cities Prior network expansion through 2014-2015 expected to drive RASM growth

Flexible fleet plan New markets (Hawaii) Slots in LGA and DCA New destinations and frequencies that meet our ROIC requirements

3 (1) On a stage-length adjusted basis

|

|

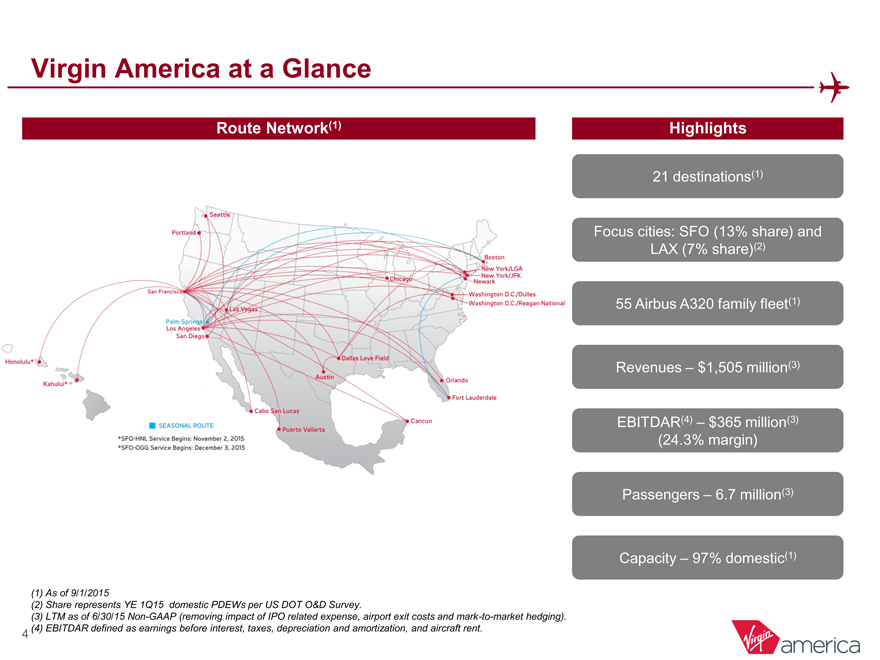

Virgin America at a Glance

Route Network(1)

Highlights

21 destinations(1)

Focus cities: SFO (13% share) and

LAX (7% share)(2)

55 Airbus A320 family fleet(1)

Revenues – $1,505 million(3)

EBITDAR(4) – $365 million(3)

(24.3% margin)

Passengers – 6.7 million(3)

Capacity – 97% domestic(1)

(1) As of 9/1/2015

(2) Share represents YE 1Q15 domestic PDEWs per US DOT O&D Survey.

(3) LTM as of 6/30/15 Non-GAAP (removing impact of IPO related expense, airport exit costs and mark-to-market hedging). (4) EBITDAR defined as earnings before interest, taxes, depreciation and amortization, and aircraft rent.

4

|

|

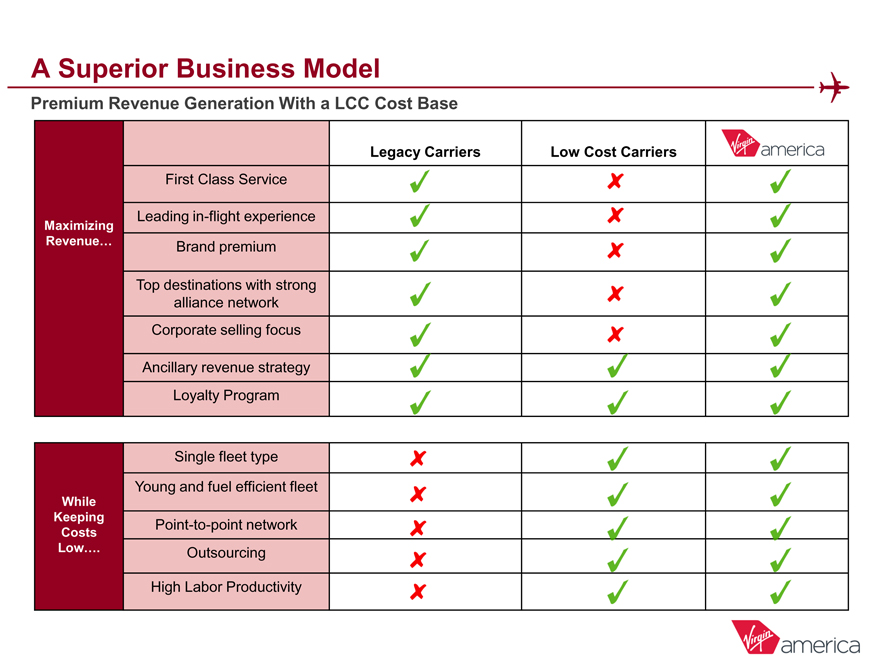

A Superior Business Model

Premium Revenue Generation With a LCC Cost Base

Legacy Carriers Low Cost Carriers

First Class Service

Leading in-flight experience

Maximizing

Revenue… Brand premium

Top destinations with strong

alliance network

Corporate selling focus

Ancillary revenue strategy

Loyalty Program

Single fleet type

Young and fuel efficient fleet

While

Keeping Point-to-point network

Costs

Low…. Outsourcing

High Labor Productivity

|

|

Premium In-Flight Experience

A premium travel experience that is consistent across the entire fleet for all destinations

First Class Main Cabin Select Main Cabin

55” pitch, 165 degree recline

Massaging chairs Distinctive meal service Spacious cabin

Dedicated flight attendant and lavatory for 8 seats Free movies + premium TV Free live television In-seat power Access to paid wi-fi

Extra leg room with 38” pitch

Free food and beverage Free movies + premium TV Priority boarding/security Free live television In-seat power Access to paid wi-fi

Custom-designed Recaro seats

32” – 33” pitch

Full in-flight entertainment Food and beverage on demand via seatback screen Free live television In-seat power Access to paid wi-fi

|

|

Award Winning Product

The quality of our product has been consistently recognized by our guests

Travel + Leisure World’s

Best Awards

Best Domestic Airline: 2008, 2009, 2010, 2011, 2012, 2013, 2014 & 2015 Best Domestic Airline for Food: 2009 & 2014

Fortune & Travel + Leisure

Best in Business Travel

Top U.S. Airline, 2014

SkyTrax 4-Star Airline, 2015

Only the Second U.S. Carrier to Receive a 4-Star Rating

Best in Consumer Reports

2013 & 2014 U.S. Airline Rankings

Condé Nast Traveler Reader’s Choice Awards

Best Domestic Airline: 2008, 2009, 2010, 2011, 2012, 2013 & 2014

Condé Nast Traveler Business Travel Poll

Best Business/First Class: 2008, 2009, 2010, 2011, 2012, 2013 & 2014

|

|

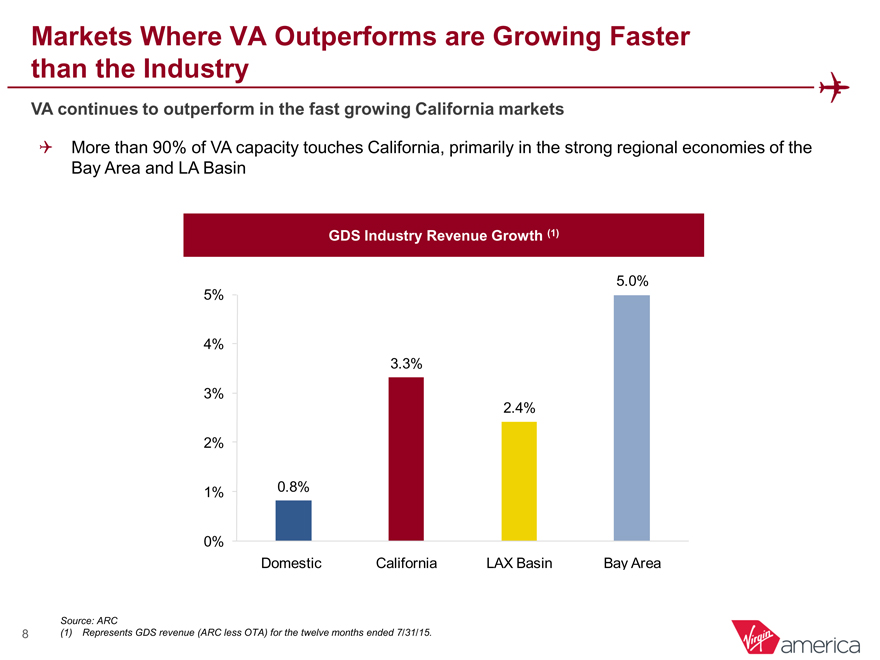

Markets Where VA Outperforms are Growing Faster than the Industry

VA continues to outperform in the fast growing California markets

More than 90% of VA capacity touches California, primarily in the strong regional economies of the Bay Area and LA Basin

GDS Industry Revenue Growth (1)

5.0%

5%

4%

3.3%

3%

2.4%

2%

1% 0.8%

0%

Domestic California LAX Basin Bay Area

Source: ARC

8 (1) Represents GDS revenue (ARC less OTA) for the twelve months ended 7/31/15.

|

|

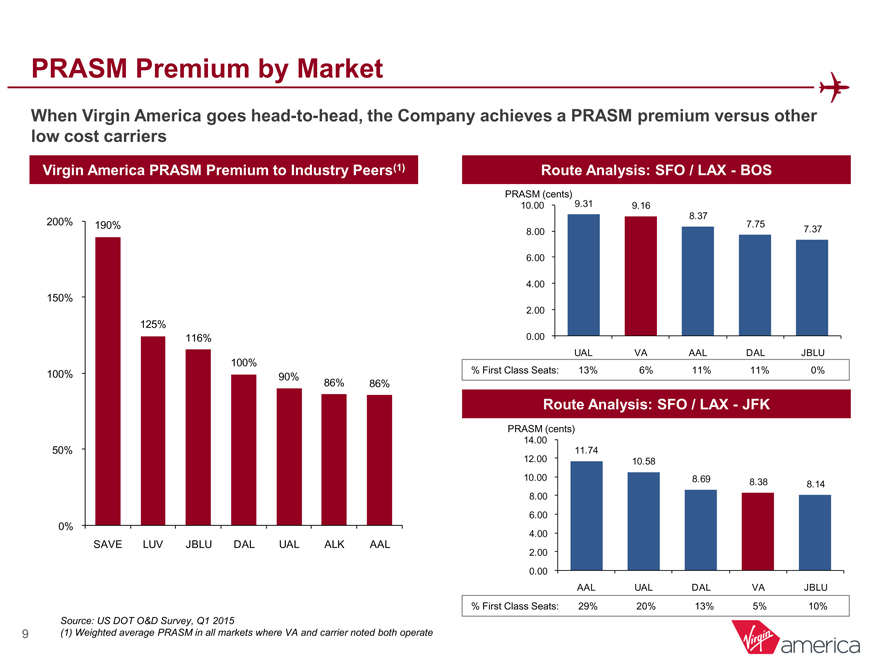

PRASM Premium by Market

When Virgin America goes head-to-head, the Company achieves a PRASM premium versus other low cost carriers

Virgin America PRASM Premium to Industry Peers(1)

Route Analysis: SFO / LAX—BOS

200% 190%

150%

125%

116%

100%

100% 90% 86% 86%

50%

0%

SAVE LUV JBLU DAL UAL ALK AAL

PRASM (cents)

10.00 9.31 9.16

8.37

7.75

8.00 7.37

6.00

4.00

2.00

0.00

UAL VA AAL DAL JBLU

% First Class Seats: 13% 6% 11% 11% 0%

Route Analysis: SFO / LAX—JFK

PRASM (cents)

14.00

11.74

12.00 10.58

10.00 8.69 8.38 8.14

8.00

6.00

4.00

2.00

0.00

AAL UAL DAL VA JBLU

% First Class Seats: 29% 20% 13% 5% 10%

Source: US DOT O&D Survey, Q1 2015

9 (1) Weighted average PRASM in all markets where VA and carrier noted both operate

|

|

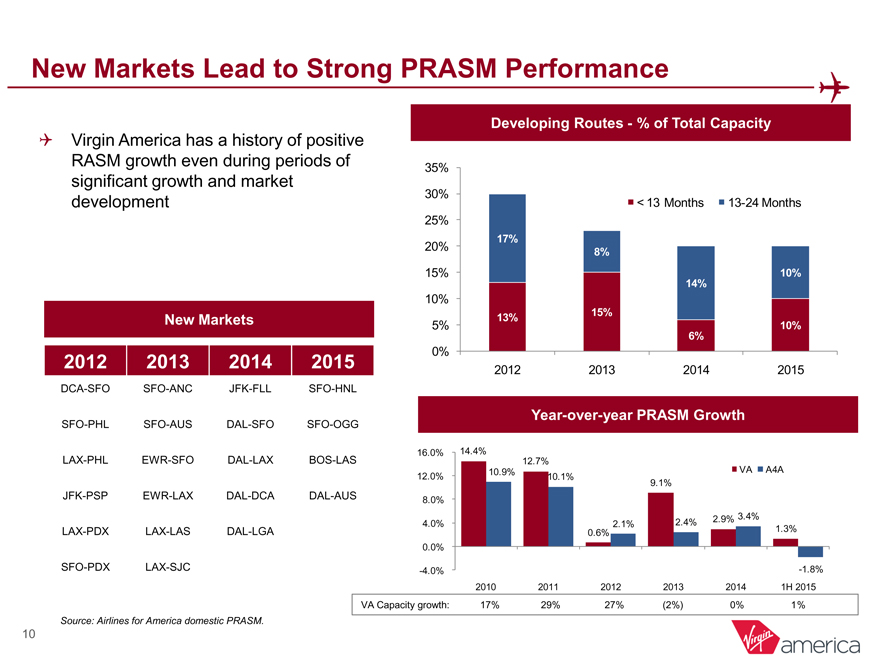

New Markets Lead to Strong PRASM Performance

Virgin America has a history of positive RASM growth even during periods of significant growth and market development

Developing Routes—% of Total Capacity

35%

30%

< 13 Months 13-24 Months 25%

17%

20%

8%

15% 10% 14%

10%

15% 13%

5% 10% 6%

0%

2012 2013 2014 2015

New Markets

2012 2013 2014 2015

DCA-SFO SFO-ANC JFK-FLL SFO-HNL

SFO-PHL SFO-AUS DAL-SFO SFO-OGG

LAX-PHL EWR-SFO DAL-LAX BOS-LAS

JFK-PSP EWR-LAX DAL-DCA DAL-AUS

LAX-PDX LAX-LAS DAL-LGA

SFO-PDX LAX-SJC

Year-over-year PRASM Growth

16.0% 14.4%

12.7%

10.9% VA A4A

12.0% 10.1% 9.1%

8.0%

4.0% 2.1% 2.4% 2.9% 3.4%

0.6% 1.3%

0.0%

-4.0% -1.8%

2010 2011 2012 2013 2014 1H 2015

Source: Airlines for America domestic PRASM.

10

VA Capacity growth: 17% 29% 27% (2%) 0% 1%

|

|

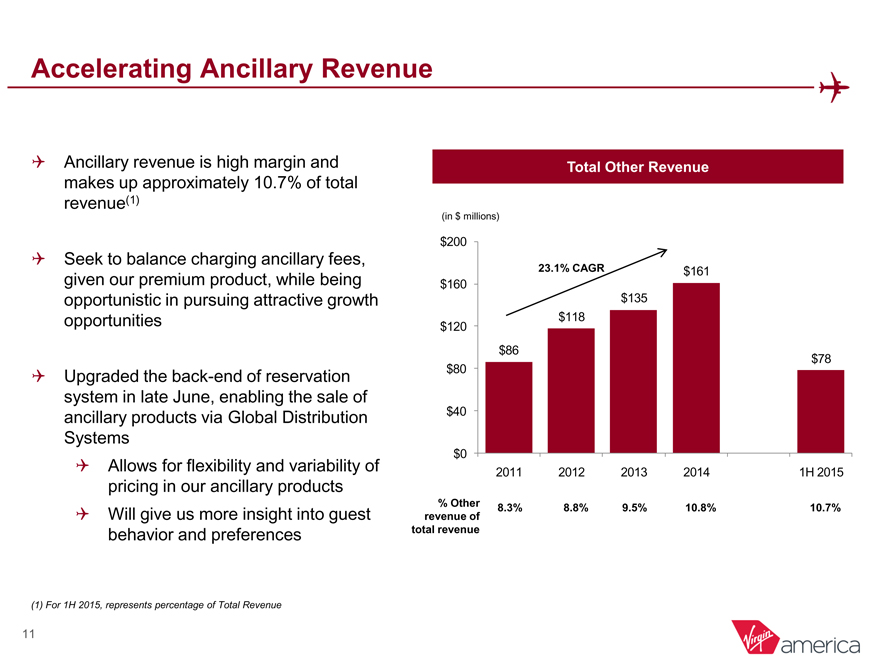

Accelerating Ancillary Revenue

Ancillary revenue is high margin and makes up approximately 10.7% of total revenue(1)

Seek to balance charging ancillary fees, given our premium product, while being opportunistic in pursuing attractive growth opportunities

Upgraded the back-end of reservation system in late June, enabling the sale of ancillary products via Global Distribution Systems

Allows for flexibility and variability of pricing in our ancillary products Will give us more insight into guest behavior and preferences

Total Other Revenue

(in $ millions)

$200

23.1% CAGR $161

$160

$135

$118

$120

$86

$78

$80

$40

$0

2011 2012 2013 2014 1H 2015

% Other 8.3% 8.8% 9.5% 10.8% 10.7%

revenue of

total revenue

(1) For 1H 2015, represents percentage of Total Revenue

11

|

|

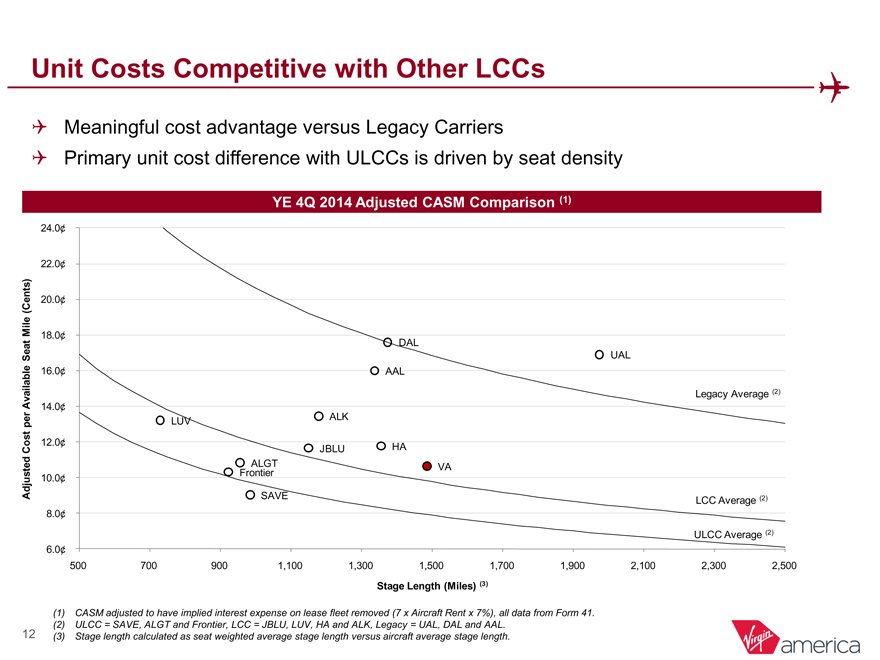

Unit Costs Competitive with Other LCCs

Meaningful cost advantage versus Legacy Carriers

Primary unit cost difference with ULCCs is driven by seat density

YE 4Q 2014 Adjusted CASM Comparison (1)

24.0¢

22.0¢

20.0¢

18.0¢

DAL

UAL

16.0¢ AAL

Legacy Average (2)

14.0¢

LUV ALK

12.0¢ JBLU HA

ALGT VA

Frontier

10.0¢

SAVE LCC Average (2)

8.0¢

ULCC Average (2)

6.0¢

500 700 900 1,100 1,300 1,500 1,700 1,900 2,100 2,300 2,500

Stage Length (Miles) (3)

Adjusted Cost per Available Seat Mile (Cents)

(1) CASM adjusted to have implied interest expense on lease fleet removed (7 x Aircraft Rent x 7%), all data from Form 41.

(2) ULCC = SAVE, ALGT and Frontier, LCC = JBLU, LUV, HA and ALK, Legacy = UAL, DAL and AAL.

12 (3) Stage length calculated as seat weighted average stage length versus aircraft average stage length.

|

|

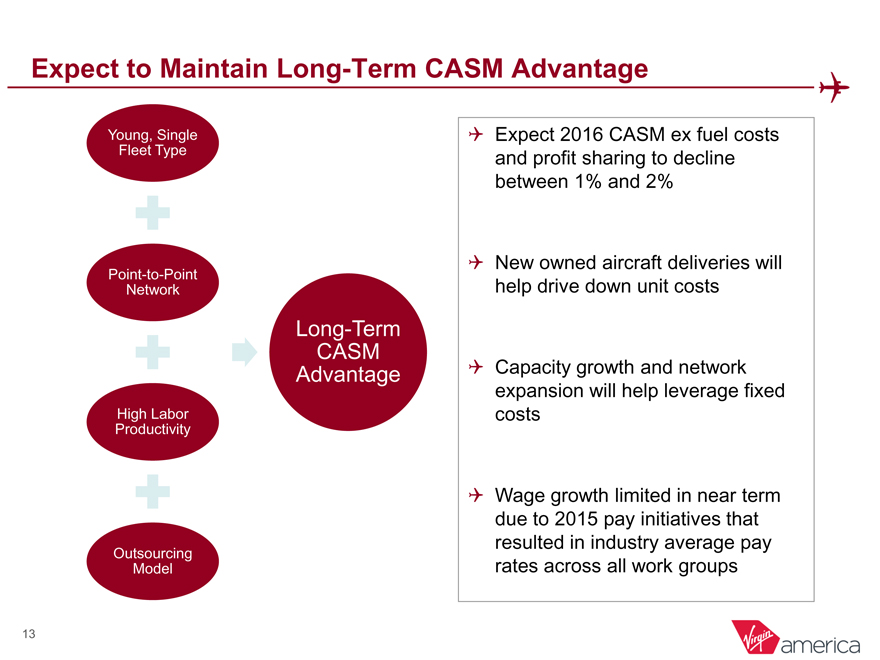

Expect to Maintain Long-Term CASM Advantage

Expect 2016 CASM ex fuel costs and profit sharing to decline between 1% and 2%

New owned aircraft deliveries will help drive down unit costs

Capacity growth and network expansion will help leverage fixed costs

Wage growth limited in near term due to 2015 pay initiatives that resulted in industry average pay rates across all work groups

Young, Single Fleet Type

Point-to-Point Network

Long-Term CASM Advantage

High Labor Productivity

Outsourcing Model

13

|

|

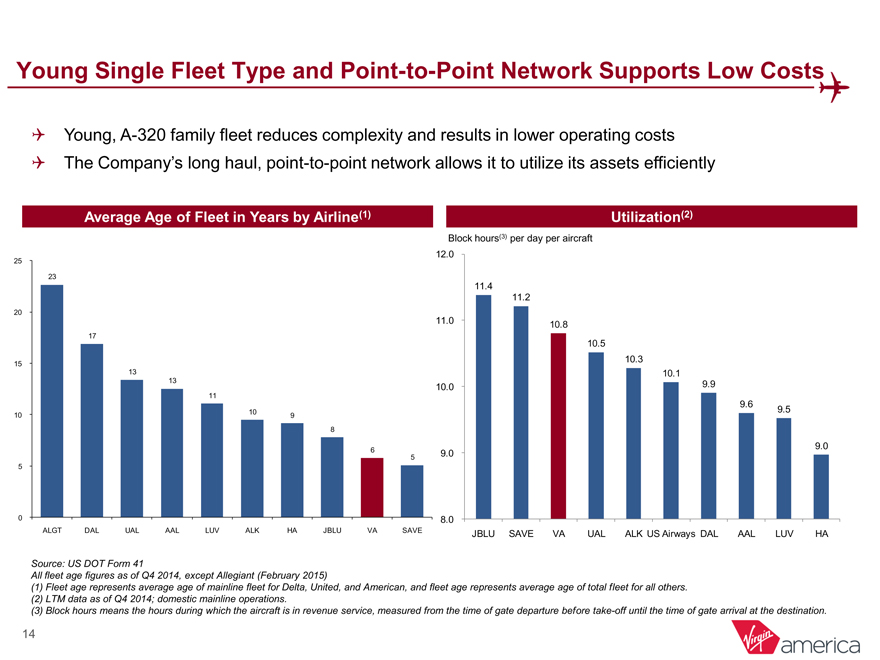

Young Single Fleet Type and Point-to-Point Network Supports Low Costs

Young, A-320 family fleet reduces complexity and results in lower operating costs The Company’s long haul, point-to-point network allows it to utilize its assets efficiently

Average Age of Fleet in Years by Airline(1)

Utilization(2)

25

23

20

17

15

13

13

11

10 10 9

8

6

5

5

0

ALGT DAL UAL AAL LUV ALK HA JBLU VA SAVE

Block hours(3) per day per aircraft

12.0

11.4

11.2

11.0 10.8

10.5

10.3

10.1

10.0 9.9

9.6 9.5

9.0

9.0

8.0

JBLU SAVE VA UAL ALK US Airways DAL AAL LUV HA

Source: US DOT Form 41

All fleet age figures as of Q4 2014, except Allegiant (February 2015)

(1) Fleet age represents average age of mainline fleet for Delta, United, and American, and fleet age represents average age of total fleet for all others. (2) LTM data as of Q4 2014; domestic mainline operations.

(3) Block hours means the hours during which the aircraft is in revenue service, measured from the time of gate departure before take-off until the time of gate arrival at the destination.

14

|

|

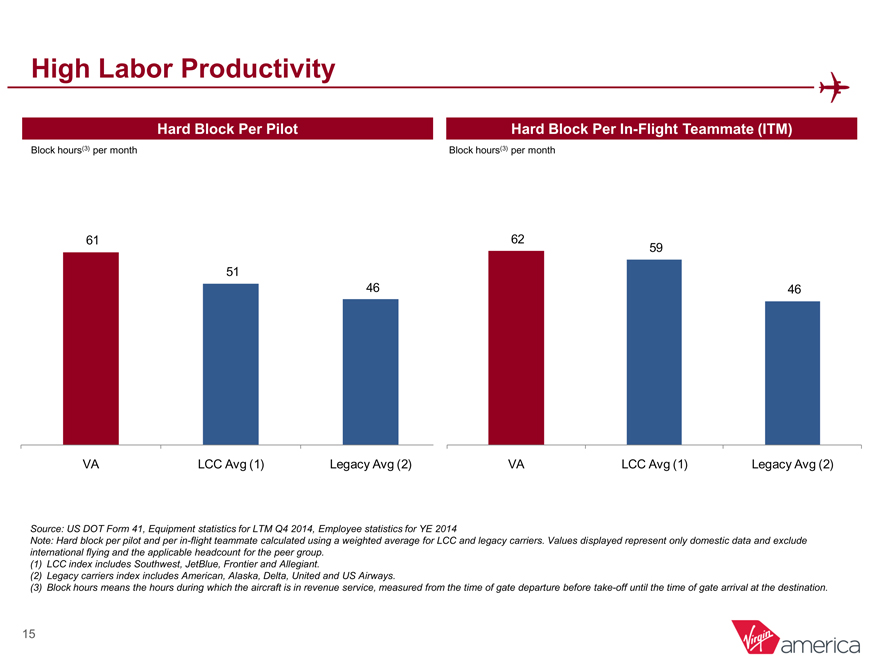

High Labor Productivity

Hard Block Per Pilot

Hard Block Per In-Flight Teammate (ITM)

Block hours(3) per month

Block hours(3) per month

61 62 59

51

46 46

VA LCC Avg (1) Legacy Avg (2) VA LCC Avg (1) Legacy Avg (2)

Source: US DOT Form 41, Equipment statistics for LTM Q4 2014, Employee statistics for YE 2014

Note: Hard block per pilot and per in-flight teammate calculated using a weighted average for LCC and legacy carriers. Values displayed represent only domestic data and exclude international flying and the applicable headcount for the peer group.

(1) LCC index includes Southwest, JetBlue, Frontier and Allegiant.

(2) Legacy carriers index includes American, Alaska, Delta, United and US Airways.

(3) Block hours means the hours during which the aircraft is in revenue service, measured from the time of gate departure before take-off until the time of gate arrival at the destination.

15

|

|

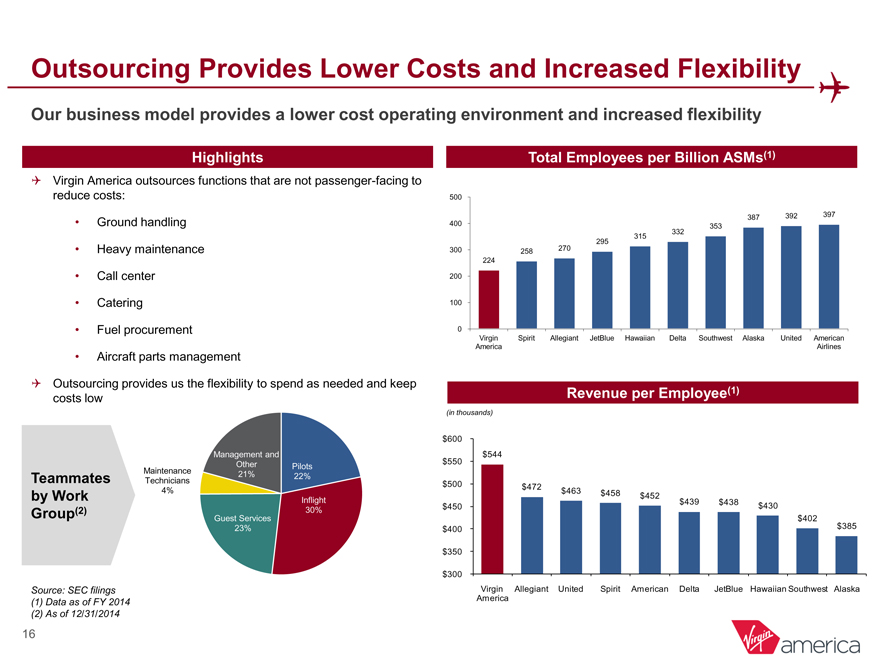

Outsourcing Provides Lower Costs and Increased Flexibility

Our business model provides a lower cost operating environment and increased flexibility

Highlights

Total Employees per Billion ASMs(1)

Virgin America outsources functions that are not passenger-facing to reduce costs:

Ground handling

Heavy maintenance

Call center Catering Fuel procurement

Aircraft parts management

Outsourcing provides us the flexibility to spend as needed and keep costs low

500

387 392 397

400 353

315 332

295

300 258 270

224

200

100

0

Virgin Spirit Allegiant JetBlue Hawaiian Delta Southwest Alaska United American

America Airlines

Management and

Maintenance Other Pilots

Teammates Technicians 21% 22%

by Work 4% Inflight

Group(2) Guest Services 30%

23%

Revenue per Employee(1)

(in thousands)

$ 600

$ 544

$ 550

$ 500 $ 472

$ 463 $ 458 $ 452

$ 439 $ 438

$ 450 $ 430

$ 402

$ 400 $ 385

$ 350

$ 300

Virgin Allegiant United Spirit American Delta JetBlue Hawaiian Southwest Alaska

America

Source: SEC filings (1) Data as of FY 2014 (2) As of 12/31/2014

16

|

|

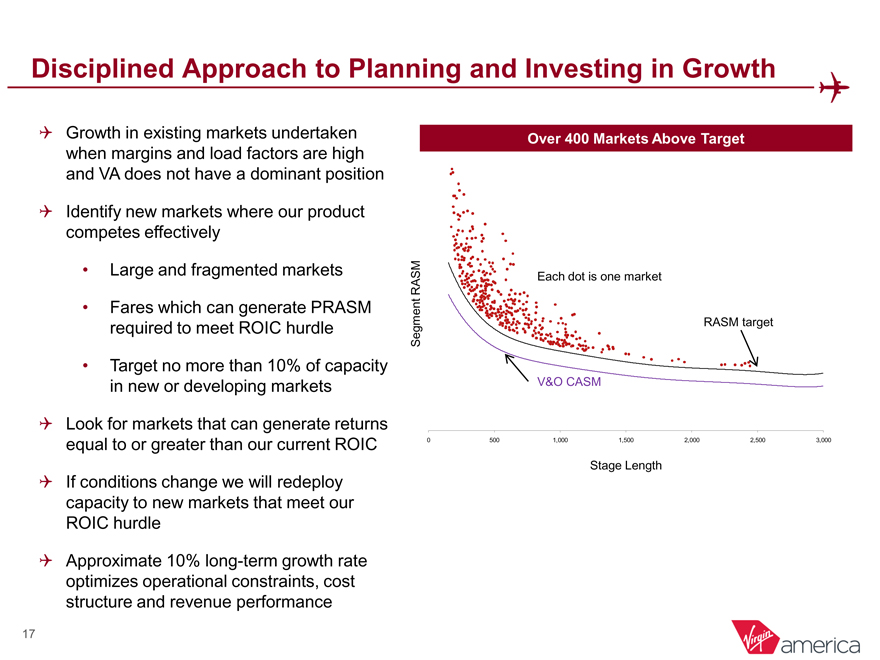

Disciplined Approach to Planning and Investing in Growth

Growth in existing markets undertaken when margins and load factors are high and VA does not have a dominant position

Identify new markets where our product competes effectively

Large and fragmented markets

Fares which can generate PRASM required to meet ROIC hurdle

Target no more than 10% of capacity in new or developing markets

Look for markets that can generate returns equal to or greater than our current ROIC

If conditions change we will redeploy capacity to new markets that meet our ROIC hurdle

Approximate 10% long-term growth rate optimizes operational constraints, cost structure and revenue performance

Over 400 Markets Above Target

Segment RASM

Each dot is one market

RASM target

V&O CASM

0 500 1,000 1,500 2,000 2,500 3,000

Stage Length

17

|

|

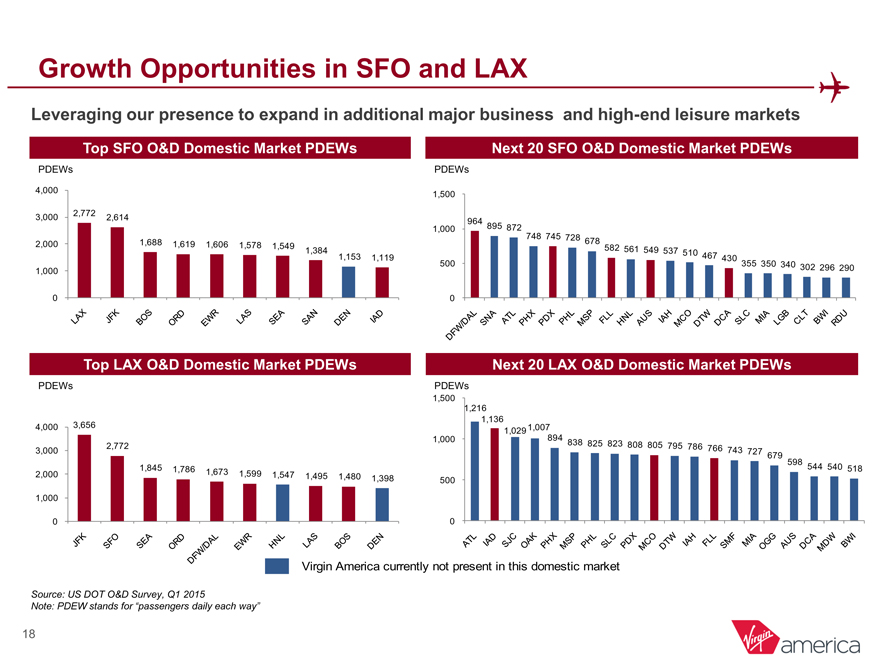

Growth Opportunities in SFO and LAX

Leveraging our presence to expand in additional major business and high-end leisure markets

Top SFO O&D Domestic Market PDEWs

PDEWs

4,000

2,772

3,000 2,614

2,000 1,688 1,619 1,606 1,578 1,549 1,384

1,153 1,119

1,000

0

Next 20 SFO O&D Domestic Market PDEWs

PDEWs

1,500

1,000 964 895 872

748 745 728 678

582 561 549 537 510 467 430

500 355 350 340 302 296 290

0

Top LAX O&D Domestic Market PDEWs

PDEWs

4,000 3,656

3,000 2,772

2,000 1,845 1,786 1,673 1,599 1,547 1,495 1,480 1,398

1,000

0

Next 20 LAX O&D Domestic Market PDEWs

PDEWs

1,500

1,216

1,136

1,029 1,007

1,000 894

838 825 823 808 805 795 786 766 743 727 679

598 544 540 518

500

0

Virgin America currently not present in this domestic market

Source: US DOT O&D Survey, Q1 2015

Note: PDEW stands for “passengers daily each way”

18

|

|

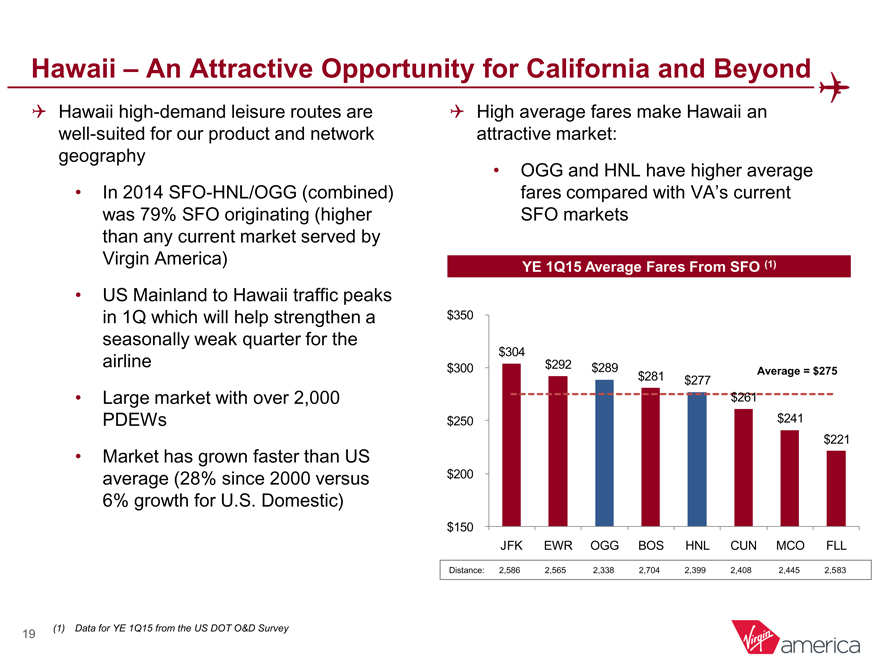

Hawaii – An Attractive Opportunity for California and Beyond

Hawaii high-demand leisure routes are well-suited for our product and network geography

High average fares make Hawaii an attractive market:

In 2014 SFO-HNL/OGG (combined) was 79% SFO originating (higher than any current market served by Virgin America)

US Mainland to Hawaii traffic peaks in 1Q which will help strengthen a seasonally weak quarter for the airline

Large market with over 2,000 PDEWs

Market has grown faster than US average (28% since 2000 versus

6% growth for U.S. Domestic)

OGG and HNL have higher average fares compared with VA’s current

SFO markets

YE 1Q15 Average Fares From SFO (1)

$ 350

$ 304

$ 300 $ 292 $ 289 Average = $275

$ 281 $277

$261

$ 250 $241

$221

$ 200

$ 150

JFK EWR OGG BOS HNL CUN MCO FLL

Distance: 2,586 2,565 2,338 2,704 2,399 2,408 2,445 2,583

(1) Data for YE 1Q15 from the US DOT O&D Survey

19

|

|

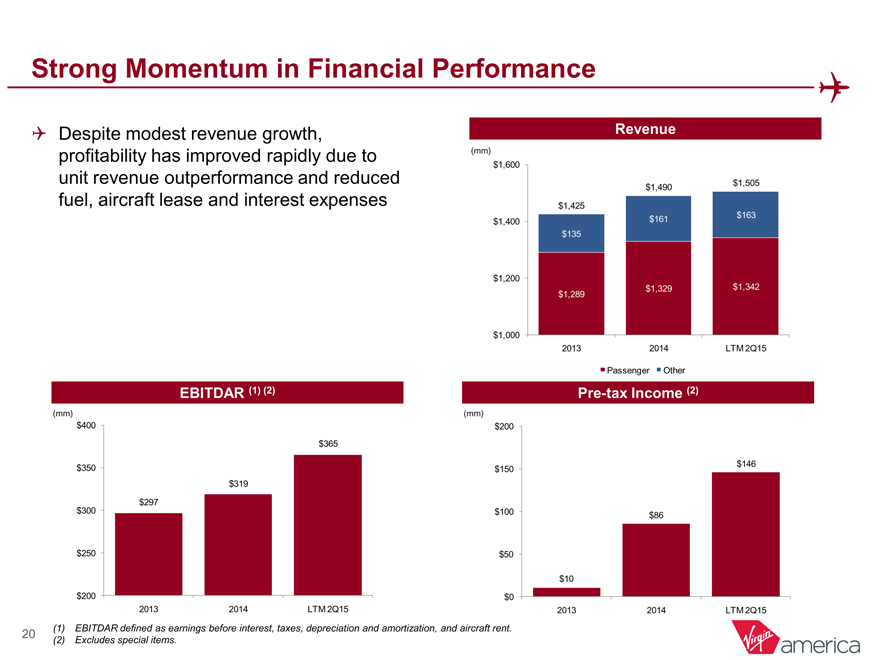

Strong Momentum in Financial Performance

Despite modest revenue growth, profitability has improved rapidly due to unit revenue outperformance and reduced fuel, aircraft lease and interest expenses

Revenue

(mm)

$1,600

$1,490 $1,505

$1,425

$1,400 $161 $163

$135

$1,200

$1,289 $1,329 $1,342

$1,000

2013 2014 LTM 2Q15

EBITDAR (1) (2)

(mm)

$ 400

$ 365

$ 350

$ 319

$ 297

$ 300

$ 250

$ 200

2013 2014 LTM 2Q15

Passenger Other

Pre-tax Income (2)

(mm)

$200

$150 $146

$100 $86

$50

$10

$0

2013 2014 LTM 2Q15

(1) EBITDAR defined as earnings before interest, taxes, depreciation and amortization, and aircraft rent. (2) Excludes special items.

|

|

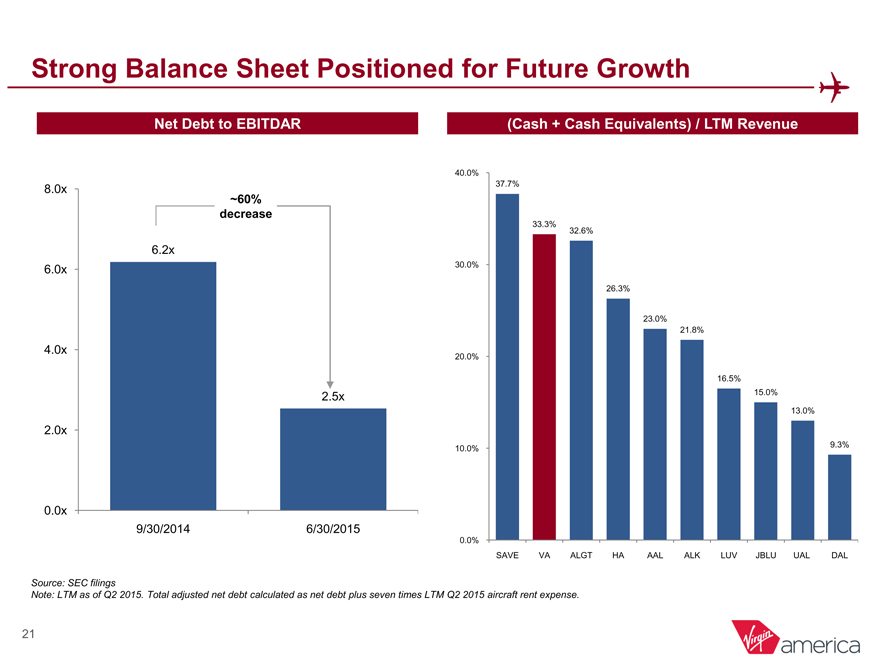

Strong Balance Sheet Positioned for Future Growth

Net Debt to EBITDAR

(Cash + Cash Equivalents) / LTM Revenue

8.0x

~60%

decrease

6.2x

6.0x

4.0x

2.5x

2.0x

0.0x

9/30/2014 6/30/2015

40.0%

37.7%

33.3%

32.6%

30.0%

26.3%

23.0%

21.8%

20.0%

16.5%

15.0%

13.0%

10.0% 9.3%

0.0%

SAVE VA ALGT HA AAL ALK LUV JBLU UAL DAL

Source: SEC filings

Note: LTM as of Q2 2015. Total adjusted net debt calculated as net debt plus seven times LTM Q2 2015 aircraft rent expense.

21

|

|

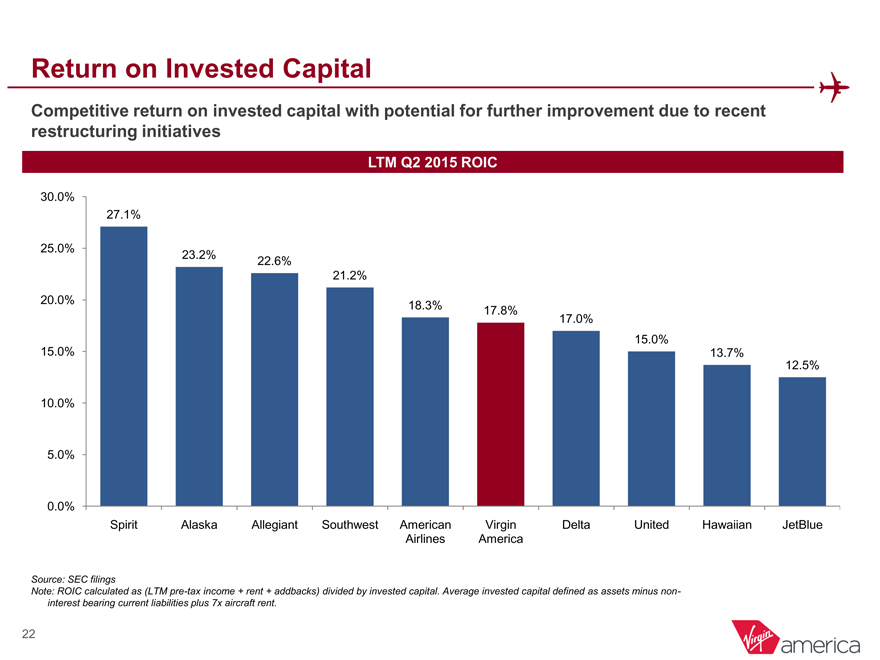

Return on Invested Capital

Competitive return on invested capital with potential for further improvement due to recent restructuring initiatives

LTM Q2 2015 ROIC

30.0%

27.1%

25.0%

23.2% 22.6%

21.2%

20.0%

18.3% 17.8%

17.0%

15.0%

15.0% 13.7%

12.5%

10.0%

5.0%

0.0%

Spirit Alaska Allegiant Southwest American Virgin Delta United Hawaiian JetBlue

Airlines America

Source: SEC filings

Note: ROIC calculated as (LTM pre-tax income + rent + addbacks) divided by invested capital. Average invested capital defined as assets minus non-interest bearing current liabilities plus 7x aircraft rent.

22

|

|

Key Investment Highlights

Premium Travel

Experience…

…Combined with a World Class Brand…

…And an LCC Cost Structure…

Established presence in key markets…

…with significant expansion opportunities to drive long term growth

23

|

|

Appendix

|

|

CONFIDENTIAL

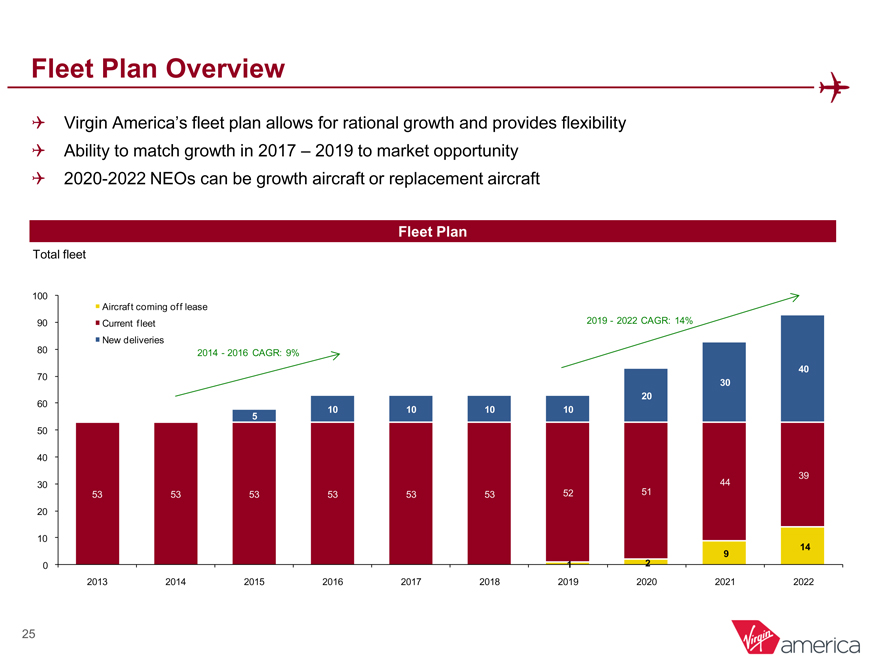

Fleet Plan Overview

Virgin America’s fleet plan allows for rational growth and provides flexibility

Ability to match growth in 2017 – 2019 to market opportunity 2020-2022 NEOs can be growth aircraft or replacement aircraft

Fleet Plan

Total fleet

100

Aircraft coming off lease

90 Current fleet 2019—2022 CAGR: 14%

New deliveries

80 2014—2016 CAGR: 9%

40

70 30

20

60 10 10 10 10

5

50

40

39

30 44

53 53 53 53 53 53 52 51

20

10

14

9

0 1 2

2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

25

|

|

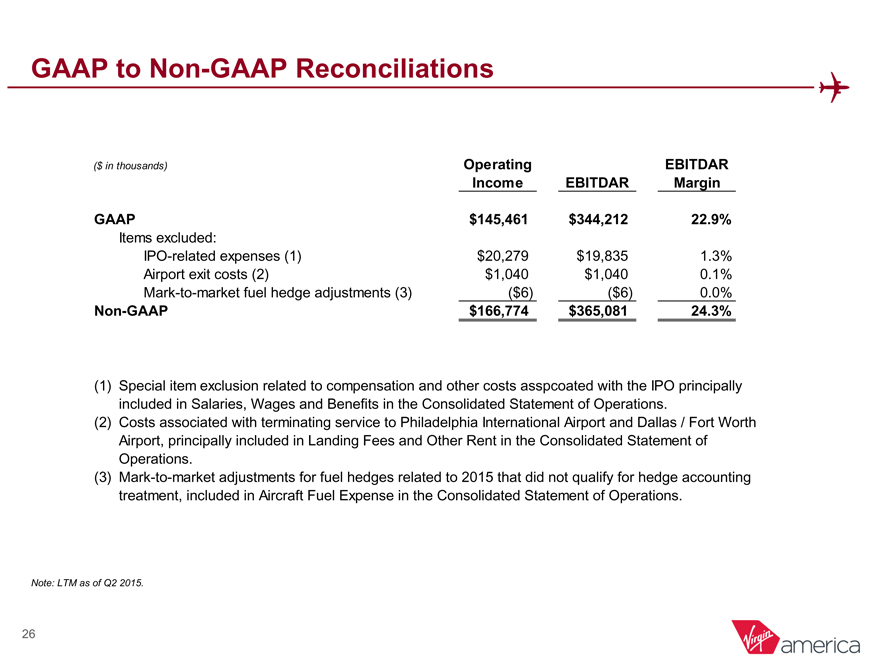

GAAP to Non-GAAP Reconciliations

($ in thousands) Operating EBITDAR

Income EBITDAR Margin

GAAP $145,461 $344,212 22.9%

Items excluded:

IPO-related expenses (1) $20,279 $19,835 1.3%

Airport exit costs (2) $1,040 $1,040 0.1%

Mark-to-market fuel hedge adjustments (3) ($6) ($6) 0.0%

Non-GAAP $166,774 $365,081 24.3%

(1) Special item exclusion related to compensation and other costs asspcoated with the IPO principally included in Salaries, Wages and Benefits in the Consolidated Statement of Operations.

(2) Costs associated with terminating service to Philadelphia International Airport and Dallas / Fort Worth Airport, principally included in Landing Fees and Other Rent in the Consolidated Statement of Operations.

(3) Mark-to-market adjustments for fuel hedges related to 2015 that did not qualify for hedge accounting treatment, included in Aircraft Fuel Expense in the Consolidated Statement of Operations.

Note: LTM as of Q2 2015.

26