Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - Virgin America Inc. | d878158dex321.htm |

| EX-23.1 - EX-23.1 - Virgin America Inc. | d878158dex231.htm |

| EX-31.2 - EX-31.2 - Virgin America Inc. | d878158dex312.htm |

| EX-31.1 - EX-31.1 - Virgin America Inc. | d878158dex311.htm |

| EX-10.10 - EX-10.10 - Virgin America Inc. | d878158dex1010.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-36718

VIRGIN AMERICA INC.

(Exact name of registrant as specified in its charter)

| Delaware | 20-1585173 | |||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

555 Airport Boulevard

Burlingame, CA 94010

(Address of Principal Executive Offices) (Zip Code)

(650) 762-7000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, $0.01 par value | The NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes ¨ No x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||

| Non-accelerated filer | x | Smaller reporting company | ¨ | |||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The registrant was not a public company as of the last business day of its most recently completed second fiscal quarter and therefore cannot calculate the aggregate market value of its voting and non-voting common equity held by non-affiliates as of such date.

As of March 2, 2015, the registrant had 43,184,652 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement for its 2015 Annual Meeting of Stockholders, which is to be filed subsequent to the date hereof, are incorporated by reference into Part III of this Annual Report on Form 10-K.

Table of Contents

| 1 | ||||||

| 1 | ||||||

| 1 | ||||||

| 10 | ||||||

| 12 | ||||||

| 26 | ||||||

| 27 | ||||||

| 27 | ||||||

| 28 | ||||||

| 28 | ||||||

| PART II |

||||||

| 28 | ||||||

| 32 | ||||||

| Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations |

33 | |||||

| 33 | ||||||

| 36 | ||||||

| 43 | ||||||

| 46 | ||||||

| 47 | ||||||

| 47 | ||||||

| Item 7A. Quantitative and Qualitative Disclosures about Market Risk |

55 | |||||

| 56 | ||||||

| 59 | ||||||

| 59 | ||||||

| 60 | ||||||

| 62 | ||||||

| 63 | ||||||

| Consolidated Statements of Convertible Preferred Stock and Stockholders’ Equity (Deficit) |

64 | |||||

| 65 | ||||||

| 66 | ||||||

| Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

101 | |||||

| 101 | ||||||

| 102 | ||||||

| PART III |

||||||

| Item 10. Directors, Executive Officers and Corporate Governance |

102 | |||||

| 102 | ||||||

| 102 | ||||||

| Item 13. Certain Relationships and Related Transactions, and Director Independence |

102 | |||||

| 102 | ||||||

| PART IV |

||||||

| 103 |

i

Table of Contents

PART I

| ITEM 1. | BUSINESS |

This Annual Report on Form 10-K contains various “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. When used in this Annual Report on Form 10-K, the words “expects,” “estimates,” “plans,” “anticipates,” “indicates,” “believes,” “forecast,” “guidance,” “outlook,” “may,” “will,” “would,” “should,” “seeks,” “targets” and similar expressions are intended to identify forward-looking statements. Forward-looking statements represent the Company’s expectations and beliefs concerning future events, based on information available to the Company on the date of the filing of this Annual Report on Form 10-K, and are subject to various risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of the times at which or by which such performance or results will be achieved. Factors that could cause actual results to differ materially from those referenced in the forward-looking statements include those listed in Part I, Item 1A, Risk Factors and in Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations. The Company disclaims any intent or obligation to update or revise any of the forward-looking statements, whether in response to new information, unforeseen events, changed circumstances or otherwise, except as required by applicable law.

Virgin America is a premium-branded, low-cost airline based in California that provides scheduled air travel in the continental United States and Mexico. We operate primarily from our focus cities of Los Angeles and San Francisco, with a smaller presence at Dallas Love Field (DAL), to other major business and leisure destinations in North America. We provide a distinctive offering for our passengers, whom we call guests, that is centered around our brand and our premium travel experience, while at the same time maintaining a low-cost structure through our point-to-point network and high utilization of our efficient, single fleet type consisting of Airbus A320 - Family aircraft. As of December 31, 2014, we provided service to 21 airports in the United States and Mexico with a fleet of 53 narrow-body aircraft.

Leveraging the reputation of the Virgin brand, a global brand founded by Sir Richard Branson, we target guests who value the experience associated with Virgin and the high-quality product and service that we offer. We have won numerous awards for our product, including Best Domestic Airline in Travel + Leisure Magazine’s World’s Best Awards and Best Domestic Airline in Condé Nast Traveler Magazine’s Readers’ Choice Awards for the past seven consecutive years as well as Best U.S. Business/First Class Airline in Condé Nast Traveler Magazine’s Business Travel Poll for the past six consecutive years.

We were incorporated in the state of Delaware in 2004. Our corporate address is 555 Airport Boulevard, Burlingame, California, and our telephone number is (650) 762-7000. Our internet address is www.virginamerica.com.

The Virgin America Business Model

We believe our business model, which combines a premium product and guest experience with a competitive cost structure, is distinctive within the domestic airline industry. We seek to achieve higher RASM than that of any other low-cost carriers, or “LCCs,” while maintaining a cost structure lower than that of the legacy airlines and competitive with that of other LCCs.

Our Product

We believe that our service is highly differentiated from that of our competitors. Our cabins have a distinctive appearance through innovative design and use of technology. We employ special mood lighting within

1

Table of Contents

our cabins that we designed to create a calming, low-stress environment for our guests. We have installed custom-designed leather seats throughout our cabin that are tailored to provide comfort, especially on our long-haul flights. We were the first airline to offer inflight wireless internet access across our entire fleet, and we also provide electrical power outlets adjacent to every seat. Unlike legacy carriers, which offer certain services on a variety of aircraft types and subcontract some flying to regional airlines, our service is consistent throughout our fleet and on every flight.

All of our guests have access to our Red® inflight entertainment system. The Red system allows each guest to customize his or her inflight experience through a host of entertainment options, including 17 channels of free live television and six pre-recorded channels, on-demand current movies and premium television programs, a free music library with approximately 3,000 MP-3 files from which each guest can create customized playlists, interactive video games and moving map technology that allows guests to track their flights’ progress. A key component of the Red system is our on-demand food and beverage ordering system. Guests can order and pay for high-quality food or beverage items for themselves or for other guests during the flight through the Red system, and our inflight teammates promptly deliver the order. The Red system also features a seat-to-seat chat function which allows guests to message passengers in other seats or send a drink or menu item to another guest. These features provide a distinctive experience for guests to interact during their flight.

Our employees, whom we call teammates, are a key element of our product. We have a highly engaged workforce that strives to provide a high degree of service and friendliness to our guests both at the airport and in flight. We heavily emphasize our service standards with our teammates through training and education programs and monetary incentives related to operational performance and guest surveys.

Within the cabin, we offer three levels of service: First Class, Main Cabin Select, which is our premium economy product, and Main Cabin. Some highlights of our service levels include the following:

First Class:

| • | Exclusive, eight-seat cabin with a dedicated inflight teammate to provide a high level of attention and service; |

| • | Custom-designed 165 degree reclining leather seat with massage functions; |

| • | 55 inches of pitch between rows—one of the most spacious First Class configurations in the U.S. domestic market; |

| • | Complimentary gourmet meals and alcoholic and non-alcoholic beverages with linen table service; |

| • | Individual Red inflight entertainment system; |

| • | Unlimited complimentary on-demand movies and premium television programs; |

| • | Complimentary live television; |

| • | Two free checked bags; and |

| • | Priority boarding and priority security access. |

Main Cabin Select:

| • | 38 inches of pitch, providing generous leg room; |

| • | Individual Red inflight entertainment system at every seatback; |

| • | Complimentary on-demand movies and premium television programs on our Red inflight entertainment system; |

| • | Complimentary live television; |

| • | Complimentary Main Cabin meals, snacks and alcoholic and non-alcoholic beverages; |

2

Table of Contents

| • | One free checked bag; and |

| • | Priority boarding and priority security access. |

Main Cabin:

| • | 32 or 33 inches of pitch—one of the most spacious economy configurations in the U.S. domestic market; |

| • | Individual Red inflight entertainment system at every seatback; |

| • | Complimentary live television; |

| • | Power outlets adjacent to every seat; |

| • | On-demand movies and premium television programs available for purchase; |

| • | A variety of fresh meals, snacks and alcoholic and premium non-alcoholic beverage offerings available for purchase on demand; |

| • | Complimentary non-alcoholic beverages; and |

| • | The ability to purchase reserved seating near the front of the Main Cabin, priority boarding and priority security access with our Express product. |

Our Cost Structure

We employ disciplined strategies to maintain a competitive cost structure. Our CASM was 11.38 cents in 2014. On a stage-length adjusted basis, our CASM was competitive within the industry and below that of legacy airlines. Key components of our low cost structure include the following:

| • | Operating a modern, fuel-efficient single-aircraft fleet type of Airbus A320-family aircraft, with an average age of 5.8 years as of December 31, 2014, resulting in lower maintenance costs and common flight crew training across the entire fleet; |

| • | High aircraft utilization, which averaged 10.8 hours per aircraft day during 2014; |

| • | Point-to-point operations, avoiding the complexities and inefficiencies of a hub-and-spoke system; |

| • | Our productive and engaged workforce; |

| • | The strategic use of outsourcing for non-core activities, such as certain airport ground handling functions, many maintenance functions and call center activities; and |

| • | Lean overhead structure in information technology, finance, human resources and planning that is scalable and can be leveraged as we continue to grow. |

The productivity of our workforce contributes significantly to our competitive cost structure. Our long-haul network provides a naturally efficient environment for crew scheduling. In 2014, our pilots flew an average of 59 block hours per month. Over the same period, our inflight teammates flew an average of 60 block hours per month.

While we maintain our focus on costs, we have chosen to invest in certain areas of our product that we believe support our high RASM strategy. These areas include:

| • | Configuring our First Class and Main Cabin seating capacity with lower density than most airlines. Our Airbus A320 aircraft are configured with 146-149 seats, and our Airbus A319 aircraft are configured with 119 seats. |

| • | Providing a premium travel experience favored by business travelers, including inflight entertainment options, an enhanced cabin with custom leather seats, inflight wireless internet and power outlets adjacent to every seat. |

3

Table of Contents

| • | Focusing on serving primary airports that provide convenience for business travelers but that generally have higher costs than alternative, secondary airports. |

| • | Maintaining a distribution strategy through multiple channels, including global distribution systems, or GDS, and corporate agencies that frequent business travelers value. |

This business model enables us to compete effectively with other low-cost carriers, or LCCs, by generating higher stage-length adjusted RASM but at a stage-length adjusted CASM competitive with that of other LCCs and lower than that of legacy airlines.

Our Competitive Strengths

We believe the following strengths allow us to compete successfully in the U.S. airline industry:

Premium Travel Experience. A key component of our product strength is the consistency across our entire fleet. In contrast to airlines with multiple aircraft types, our product offering is identical on every Airbus 320-family aircraft, allowing for the same enhanced travel experience on every flight. We also provide both First Class and Main Cabin Select products in addition to our Main Cabin economy product. Our First Class cabin has an exclusive feel and a dedicated attendant with just eight seats on every aircraft—fewer than most first class cabins offered on competing airlines, providing a personal level of service. Unlike many other airlines, we do not provide complimentary upgrades to First Class, enhancing the exclusivity of this product. In addition to more leg room, which is a standard feature of most premium economy products, we offer additional features within Main Cabin Select, such as complimentary on-demand current-run movies, premium television programs, premium beverages and Main Cabin meals and snacks.

World-Class Virgin Brand. We believe that the Virgin brand is widely recognized in the United States and is known for being innovative, stylish, entrepreneurial and hip. We believe that the brand is recognized worldwide from the Virgin Group’s offerings in music, air travel, wireless service and a wide variety of other products. We capitalize on the strength of the Virgin brand to target guests who value an enhanced travel experience and association with the Virgin brand. We believe that the Virgin brand has helped us to establish ourselves as a premium airline in the domestic market in a short period of time. When we enter a new market, awareness of the Virgin brand generates interest from new guests. The power of the Virgin brand provides an opportunity for low-cost public relations events that generate extensive media coverage in new markets and has led to other cooperative marketing relationships for us with major companies. In addition to capitalizing on the Virgin brand strength, we are rapidly establishing Virgin America as a distinct and premium brand for air travel in the United States in its own right. We believe our guests associate the Virgin and Virgin America brands with a distinctive high-quality and high-value travel experience.

Low-Cost, Disciplined Operating Structure. A core component of our business model is our disciplined cost structure. Key components of this low cost structure include our modern, fuel-efficient single-aircraft fleet, our high aircraft utilization, our point-to-point operations, our productive and engaged workforce, our outsourcing of non-core activities and our lean, scalable overhead structure. We are committed to maintaining this disciplined cost structure and believe we will continue to improve our competitive cost position in future years as we grow and further leverage our existing infrastructure. In 2014 the average stage-length adjusted domestic CASM of legacy airlines was 25% higher, and the average stage-length adjusted domestic CASM of LCCs was only 13% lower, than our stage-length adjusted CASM. Our lower seating density and three-class cabin configuration, which is a similar configuration to that of many legacy airlines, is the primary reason that our stage-length adjusted CASM was higher than that of other LCCs in 2013. However, our seating configuration with three classes of service was also a primary contributor to our higher stage-length adjusted PRASM when compared to other LCCs in 2013.

Established Presence in Los Angeles and San Francisco. We have built our network around the Los Angeles and San Francisco metropolitan areas, the second- and third-largest domestic air travel markets in the United States in 2014. We believe that these two markets, with a combined population of approximately

4

Table of Contents

27 million people and strong economic bases in the technology, media and entertainment industries, serve as an excellent platform for long-term growth. Los Angeles and San Francisco both have large populations of technologically savvy, entrepreneurial and innovative individuals who we believe value our brand and premium guest experience. We have made significant investments in these key markets since 2010, and as of December 31, 2014, we provide service to 18 destinations from Los Angeles and 20 destinations from San Francisco. These destinations include seven of the top ten domestic destinations served from Los Angeles International Airport (LAX) and nine of the top ten domestic destinations served from San Francisco International Airport (SFO), based on passenger volume. This investment provides greater network coverage across North America for travelers from these two focus markets, and we expect that this investment will allow us to continue to grow by leveraging the loyal guest base that we have established in each market.

Our Team and Entrepreneurial Culture. Our teammates and culture are essential elements of our success because they contribute significantly to our premium travel experience. We start by hiring the right teammates through a rigorous process that includes numerous interviews, as well as pre-employment testing for our frontline teammates and our pilots. Key characteristics of Virgin America teammates include a friendly, personable nature, a willingness to think differently, a passionate approach to his or her work and intense pride in Virgin America and our product. We empower our teammates with a high level of authority to resolve guest issues throughout the travel experience, from making flight reservations to interactions at the airport and in flight. We strive to create an environment for our teammates where open communication is both encouraged and expected and where we celebrate our successes together.

Route Network

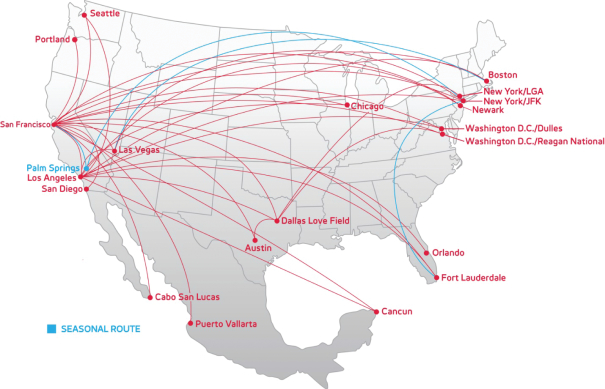

We served 21 airports throughout North America as of December 31, 2014. The majority of our routes operate to and from our focus cities of Los Angeles and San Francisco, with a smaller presence located at Dallas Love Field (DAL). Our current network is a mix of long-haul, transcontinental service combined with short-haul West coast service and select Mexico leisure destinations. Below is a route map of our network.

5

Table of Contents

We use publicly available data related to existing traffic, fares and capacity in domestic markets to identify growth opportunities. To monitor the profitability of each route, we analyze monthly profitability reports as well as near-term forecasting. We routinely make adjustments to capacity and frequency of flights within our network based on the financial performance of our markets, and we discontinue service in markets where we determine that long-term profitability is not likely to meet our expectations.

Our future network plans include growing from our focus cities of Los Angeles and San Francisco to other major markets in North America. By continuing to add destinations in select markets from Los Angeles and San Francisco, we can leverage our existing base of loyal guests and grow our share of revenue within these focus cities while also expanding our customer base as we gain new guests in these markets. In 2014, we added service from DAL to New York LaGuardia Airport (LGA) and Ronald Reagan Washington National Airport (DCA). We believe this DAL opportunity increased the diversity of our route network and will provide growth into strategic airports that are limited by regulation.

Commercial Partnerships

We have codeshare and interline agreements with a number of other high-quality airlines to support our revenue strategy. Our codeshare relationships provide for cross-selling of seamless connecting itineraries from our partners’ international and domestic flights onto our network and, in some instances, also provide for frequent-flyer reciprocity whereby guests can earn and use reward travel on both airlines. Los Angeles and San Francisco are gateways to the U.S. mainland from Asian and trans-Pacific destinations, as well as Hawaii, and our domestic network from these cities provides a natural extension for our codeshare partners.

We currently have codeshare agreements with China Airlines, China Eastern Airlines, Hawaiian Airlines, Singapore Airlines and Virgin Australia, and we plan to add additional codeshare partners in the future, focusing on Asia/Pacific partnership opportunities. We also have interline agreements with 28 additional airlines. Interline agreements allow guests to create itineraries connecting from one airline to another but are more limited in scope than codeshare agreements. Our commercial partnerships contribute to our RASM growth by adding incremental international and domestic guests and revenue and by providing international network opportunities to our existing guests.

Ancillary and Other Revenue

While some of our product features are included in our base pricing, we have unbundled certain ancillary features that our guests separately value. Major ancillary revenue products include checked baggage fees, ticket change fees and our Express product providing reserved seating near the front of the Main Cabin, priority boarding and security access. Guests also pay a reservation fee if they choose to make their reservation through our call center. Additionally, we market certain products from our partners such as travel insurance on our website and recognize revenue in connection with our co-branded credit card program. We also promote and sell products in flight to enhance the guest experience, including meals, snacks, alcoholic and premium non-alcoholic beverages, on-demand current-run movies and premium television programs, headphones and sleep kits. In 2014, other revenue, of which the majority represents the ancillary revenue items noted above, represented 10.8% of our total revenue.

Guest Loyalty Program

We maintain an extensive guest loyalty program called the Elevate® frequent flyer program. Our guests earn points for purchasing travel that are redeemable for travel rewards throughout our network and the networks of our partners. We were the first U.S. airline to adopt a loyalty program based on the value of ticket purchases. The number of points that guests earn is tied directly to the purchase price of the ticket; likewise, guests may redeem Elevate points for any fare within our inventory, without any blackout dates, because our rewards pricing is variable. Elevate members with Gold or Silver status enjoy earning bonus Elevate points on purchases, advance

6

Table of Contents

access to purchase upgrade options, complimentary upgrades to Main Cabin Select on a space-available basis, free checked bags and priority check-in boarding and security access. At the end of 2014, we had approximately 3.5 million Elevate members, which represented a 16.2% increase over the end of 2013.

We maintain partnerships with other companies through our Elevate program. Companies purchase Elevate points from us to reward their own customers. We benefit from the direct sale of Elevate points as well as additional loyalty from guests that earn points through these other channels. Our most significant third-party Elevate relationship is our co-branded consumer credit card issued by Alliance Data Services, or ADS, which replaced our prior co-branded card program in early 2014. The new program provides enhanced features to our Elevate members such as point accumulation, free first checked bag and waived change fees, and various discounts for companion travel and inflight purchases. ADS provides annual guarantees of Elevate points activity significantly greater than our past activity. As a result, we expect this new relationship to result in significant growth in our Elevate program and an increase in revenue for Elevate points sold through this relationship.

Marketing and Distribution

We are focused on direct-to-consumer marketing targeted at our core business and leisure guests. Our principal marketing messages are our association with the Virgin brand, our premium travel experience, popular destinations within our network, our innovative product offerings and competitive fares. Consistent with our business model and our brand, we use edgy and fun marketing messages to engage our key demographic. We are early adopters of technology including social networks, generating significant engagement from our advocates on Facebook, Twitter and other social media channels. We consider these channels important for generating awareness around our product and brand as well as creating a positive connection and communication channel with our guests, teammates and other advocates.

Our primary advertising mediums include online search-and-display advertising, targeted direct email marketing, strategically located outdoor advertisements in our key markets, as well as sponsorships of sports teams, select events and entertainment venues. We are also able to leverage the Virgin brand to create public relations events and low-cost viral marketing campaigns that generate extensive media coverage.

We sell our product through three primary distribution channels: our website, our outsourced call center and third parties such as travel agents who access us through global distribution systems, or GDS (e.g., Amadeus, Sabre and Travelport), and select online travel agents, or OTAs (e.g., Orbitz and Travelocity). We use our website as the primary platform for ticket sales, and approximately 60% of our total tickets sold in 2014 were through direct internet bookings using our website.

We also have a dedicated sales team that focuses on corporate and travel agent accounts. We focus on this segment because corporate accounts and agencies booking through a global distribution system generated average fares 36% higher than those generated through other channels in 2014.

Teammates

We believe maintaining a positive relationship with our teammates is a valuable part of our culture. We believe our relationship with our workforce allows us a highly productive working environment that benefits both the company and our teammates.

At December 31, 2014, our active teammates consisted of 595 pilots, 825 inflight teammates (whom other airlines refer to as flight attendants), 632 guest services teammates, 120 maintenance technicians and 568 management and other personnel. We have a direct working relationship with all of our teammates, other than our inflight teammates, who voted for representation by the Transport Workers Union on August 13, 2014.

Competition

The airline industry is highly competitive. The principal competitive factors in the airline industry are the fare and total price, flight schedules, product and passenger amenities, customer service, number of routes served

7

Table of Contents

from a city, fleet type, safety record and reputation, code-sharing relationships and frequent flier programs. Our competitors and potential competitors include traditional legacy airlines, LCCs and “ultra-low-cost carriers,” or “ULCCs.” We typically compete in markets served by traditional legacy airlines and LCCs and, to a lesser extent, ULCCs.

Our principal competitors on domestic routes are Alaska Airlines, American Airlines, Delta Air Lines, JetBlue Airways, Southwest Airlines and United Airlines. Our principal competitive advantages are our premium product and brand, distinctive culture and low cost structure. We believe our business model enables us to compete effectively with other LCCs by generating higher stage-length adjusted RASM but at a stage-length adjusted CASM competitive within the industry and lower than that of legacy airlines.

The airline industry is particularly susceptible to price discounting because, once a flight is scheduled, airlines incur only nominal incremental costs to provide service to passengers occupying otherwise unsold seats. The expenses of a scheduled aircraft flight do not vary significantly with the number of passengers carried, and as a result, a relatively small change in the number of passengers or in pricing can have a disproportionate effect on an airline’s operating and financial results. Price competition occurs on a market-by-market basis through price discounts, changes in pricing structures, fare matching, target promotions and frequent flier initiatives. Airlines typically use discount fares and other promotions to stimulate traffic during normally slower travel periods to generate cash flow and to maximize RASM. The prevalence of discount fares can be particularly acute when a competitor has excess capacity to sell.

Operational Performance

Operational reliability is paramount to success in the airline industry. We strive to achieve high levels of operational performance through careful planning of our flight schedules, an extensive maintenance reliability program and the use of an operating spare aircraft and spare engines. For both 2014 and 2013, we were the top-ranked airline in the Airline Quality Rating, an annual analysis of airline performance conducted by Wichita State University and Embry-Riddle. The U.S. Department of Transportation, or DOT, publishes statistics regarding measures of customer satisfaction for domestic airlines and can assess civil penalties for failure to comply with certain customer service obligations. Our domestic performance under customer service measures for the years ended December 31, 2014 and 2013 was as follows:

| 2014 | 2013 | |||||||

| On-Time Performance (1) |

81.5 | % | 82.1 | % | ||||

| Completion Factor (2) |

99.4 | % | 99.5 | % | ||||

| Mishandled Baggage (3) |

0.95 | 0.97 | ||||||

| (1) | Percentage of our scheduled flights operated by us on-time (within 15 minutes). |

| (2) | Percentage of our scheduled flights operated by us, whether or not delayed (i.e., not canceled). |

| (3) | Our incidence of delayed, mishandled or lost baggage per 1,000 passengers. |

Aircraft Fuel

Aircraft fuel is our largest expense representing 35.8% of our total operating costs in 2014. The price and availability of jet fuel are volatile due to global economic and geopolitical factors as well as domestic and local supply factors. We use a third-party fuel management vendor to procure most of our fuel. Our historical fuel consumption and costs were as follows:

| Year Ended December 31, | ||||||||||||

| 2014 | 2013 | 2012 | ||||||||||

| Gallons consumed (millions) |

162 | 159 | 161 | |||||||||

| Total cost (millions) |

$ | 499 | $ | 507 | $ | 538 | ||||||

| Average price per gallon |

3.08 | $ | 3.18 | $ | 3.32 | |||||||

| Percent of operating expenses |

35.8 | % | 37.7 | % | 39.4 | % | ||||||

8

Table of Contents

Total cost and average price per gallon each include related fuel fees and taxes as well as effective fuel-hedging gains and losses.

We maintain an active fuel hedging program to reduce our exposure to sudden, sharp increases in fuel prices. We enter into a variety of hedging instruments, such as forward swaps, options and collar contracts on jet fuel and highly correlated commodities such as heating oil and crude oil. We also use fixed forward price contracts, or FFPs, which allow us to lock in the price of jet fuel for specified quantities and at specified locations in future periods.

Maintenance and Repairs

We have a U.S. Federal Aviation Administration, or FAA, mandated and approved maintenance program, which is administered by our technical operations department. Our maintenance technicians undergo extensive initial and ongoing training to ensure the safety of our aircraft.

Aircraft maintenance and repair consist of routine and non-routine maintenance, and work performed is divided into three general categories: line maintenance, major maintenance and component service. Line maintenance consists of routine daily and weekly scheduled maintenance checks on our aircraft, including pre-flight, daily, weekly and overnight checks, diagnostics, routine repairs and any unscheduled items on an as-needed basis. Line maintenance events are currently serviced by our mechanics in Los Angeles, San Francisco, Dallas and New York and are supplemented by contract vendors in other locations. Major airframe maintenance checks consist of a series of more complex tasks that can take from one to four weeks to accomplish and typically are required approximately every 20 months. We outsource our major airframe maintenance to an FAA-certified maintenance provider in the United States. Engine overhauls and engine performance restoration events are quite extensive and can take one to two months. We keep spare engines to maintain continued operations during engine maintenance events. We expect to begin the initial engine maintenance overhauls on our engine fleet approximately eight to ten years after the date of manufacture and introduction into our fleet, with subsequent engine maintenance every four to six years thereafter. We have entered into a long-term flight hour agreement with General Electric for our engine overhaul services. Lufthansa Technik covers our component repair and inventory management services on an hourly basis and also provides all of our aircraft component inventory acquisition, replacement and repairs, thereby eliminating the need to carry expensive spare parts inventory.

Our recent maintenance expenses have been lower than what we expect to incur in the future because of the relatively young age of our aircraft fleet. We expect our maintenance costs to increase as the frequency of repair increases with aircraft age. As our aircraft age, the scheduled scope of work and the frequency of unscheduled maintenance events are likely to increase as with any mature fleet. Our aircraft utilization rate could decrease with the increase in aircraft maintenance. In addition, we account for qualifying major engine maintenance under the deferral method wherein overhaul costs and replacement of engine life limited parts are capitalized and amortized. We expect that the final qualifying major engine maintenance events will be amortized over the remaining lease term rather than until the next estimated major maintenance event, which will result in significantly higher depreciation and amortization expense related to major maintenance in the last few years of the leases as compared to expenses in earlier periods.

Insurance

We maintain multiple insurance policies customary in the airline industry and as required by the DOT. The policies principally provide liability coverage for public and passenger injury, damage to property, loss of or damage to flight equipment, third-party war risk (terrorism), fire and extended coverage, directors’ and officers’ liability and workers’ compensation and employer’s liability. Although we currently believe our insurance coverage is adequate, we cannot assure you that the amount of such coverage will not be changed or that we will not be forced to bear substantial losses from any accidents.

9

Table of Contents

Foreign Ownership

Under DOT regulations and federal law, we must be controlled by U.S. citizens. In order to qualify, no more than 24.9% of our voting stock may be voted, directly or indirectly, by persons who are non-U.S. citizens, no more than 49.9% of our outstanding stock may be owned (beneficially or of record) by persons who are not U.S. citizens and our president and at least two-thirds of the members of our board of directors and senior management must be U.S. citizens. We are currently in compliance with these ownership provisions.

Aviation Regulation

The DOT and FAA have regulatory authority over air transportation in the United States. The DOT has authority to issue certificates of public convenience and necessity required for airlines to provide domestic air transportation. International routes and international code-sharing arrangements are regulated by the DOT and by the governments of the foreign countries involved. An airline’s ability to operate flights to international destinations is subject to the aviation agreement in place between the United States and the foreign country and the carrier’s ability to obtain necessary authority from the DOT and the applicable foreign government.

The U.S. government has negotiated “open skies” agreements with many countries, which allow unrestricted access between the United States and foreign markets. Our international flights to Mexico are governed by a bilateral agreement between the United States and Mexico. Changes in U.S. or Mexico aviation policies could result in the alteration or termination of that agreement, diminish the value of our route authorities or otherwise affect our Mexico operations.

The FAA is responsible for regulating and overseeing matters relating to the safety of air carrier flight operations, including the control of navigable air space, the qualification of flight personnel, flight training practices, compliance with FAA airline operating certificate requirements, aircraft certification and maintenance and other matters affecting air safety. The FAA requires each commercial airline to obtain and hold an FAA air carrier certificate. In January 2014, the FAA implemented a rule to amend flight, duty and rest regulations pertaining to pilots. The new rule may reduce our staffing flexibility, and we increased our level of reserve pilots to meet the operational requirements of these rules.

Airport Access

Flights at four major domestic airports are regulated through allocations of “slots” or similar regulatory mechanisms, which limit take-offs and landings at those airports. Each slot represents the authorization to land at or take off from the particular airport during a specified time period.

In the United States, the FAA currently regulates the allocation of slots, slot exemptions, operating authorizations or similar capacity allocation mechanisms at Ronald Reagan Washington National Airport (DCA) in Washington, D.C., Newark Liberty International Airport (EWR) in New Jersey and New York’s LaGuardia Airport (LGA) and John F. Kennedy International Airport (JFK). Our operations at these airports generally require the allocation of slots or analogous regulatory authorizations. We currently have sufficient slots or operating authorizations to operate our existing flights, but there is no assurance that we will be able to do so in the future because, among other reasons, such allocations are subject to changes in governmental policies.

Consumer Protection Regulation

The DOT also has jurisdiction over certain economic issues affecting air transportation and consumer protection matters, including unfair or deceptive practices and unfair methods of competition by air carriers, airline advertising, denied boarding compensation, ticket refunds, baggage liability and disabled passenger transportation. The DOT frequently adopts new consumer protection regulations, such as recent rules to protect

10

Table of Contents

passengers addressing tarmac delays and chronically delayed flights, and is reviewing new guidelines to address the disclosure and sale of ancillary services and related fees. The DOT also has authority to review certain joint venture agreements between major carriers and engages in regulation of economic matters such as slot transactions.

Security Regulation

The U.S. Transportation Security Administration and the U.S. Customs and Border Protection, each a division of the U.S. Department of Homeland Security, are responsible for certain civil aviation security matters, including passenger and baggage screening at U.S. airports and international passenger prescreening prior to entry into or departure from the U.S. International flights are subject to customs, border, immigration and similar requirements of equivalent foreign governmental agencies.

Environmental Regulation

We are subject to various federal, state and local laws and regulations and foreign government requirements relating to the protection of the environment and affecting matters such as aircraft engine emissions, aircraft noise emissions and the discharge or disposal of materials and chemicals.

Emissions. The U.S. Environmental Protection Agency, or EPA, is authorized to regulate aircraft emissions, including air carrier operations, which affect the quality of air in the United States. We believe the aircraft in our fleet meet the emission standards issued by the EPA. Concern about climate change and greenhouse gases may result in additional regulation or taxation of aircraft emissions in the United States and abroad. Cap and trade restrictions have also been proposed in the United States. In addition, other legislative or regulatory action, including by the EPA, to regulate greenhouse gas emissions is possible. In particular, the EPA has found that greenhouse gases threaten the public health and welfare, which could result in regulation of greenhouse gas emissions from aircraft. In the event that legislation or regulation is enacted in the United States or in the event similar legislation or regulation is enacted in jurisdictions where we operate or where we may operate in the future, it could result in significant costs for us and the airline industry. In addition to direct costs, such regulation may have a greater effect on the airline industry through increases in fuel costs that could result from fuel suppliers passing on increased costs that they incur under such a system. We seek to minimize the impact of greenhouse gas emissions from our operations by operating with newer, more fuel-efficient aircraft. In addition, we have implemented fuel saving procedures in our flight and ground support operations as part of our efforts to reduce our emissions and minimize our impact on the environment.

Noise. Federal law recognizes the right of airport operators with special noise problems to implement local noise abatement procedures so long as those procedures do not interfere unreasonably with interstate and foreign commerce and the national air transportation system. These restrictions can include limiting nighttime operations, directing specific aircraft operational procedures during take-off and initial climb and limiting the overall number of flights at an airport. While we have had sufficient scheduling flexibility to accommodate local noise restrictions in the past, our operations could be adversely impacted if locally imposed regulations become more restrictive or widespread.

Other Regulations

Airlines are also subject to various other federal, state, local and foreign laws and regulations. For example, the U.S. Department of Justice has jurisdiction over airline competition matters. Labor relations in the airline industry are generally governed by the Railway Labor Act. The privacy and security of passenger and employee data is regulated by various domestic and foreign laws and regulations.

Future Regulations

The U.S. government and foreign governments may consider and adopt new laws, regulations, interpretations and policies regarding a wide variety of matters that could directly or indirectly affect our results

11

Table of Contents

of operations. We cannot predict what laws, regulations, interpretations and policies might be considered in the future, nor can we judge what impact, if any, the implementation of any of these proposals or changes might have on our business.

| ITEM 1A. | RISK FACTORS |

Our business involves significant risks, some of which are described below. You should carefully consider these risks, as well as the other information in this Annual Report on Form 10-K, including our financial statements and the related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The occurrence of any of the events or developments described below, as well as additional risks and uncertainties not presently known to us or that we currently deem immaterial, could materially adversely affect our business, results of operations, financial condition and growth prospects.

Our business has been and in the future may be materially adversely affected by the price and availability of aircraft fuel. High fuel costs and increases in fuel prices or a shortage or disruption in the supply of aircraft fuel would have a material adverse effect on our business.

The price of aircraft fuel may be high or volatile. The cost of aircraft fuel is highly volatile and is our largest individual operating expense, accounting for 35.8%, 37.7%, and 39.4% of our operating expenses for 2014, 2013, and 2012. High fuel costs or increases in fuel costs (or in the price of crude oil) could materially adversely affect our business. Since August 2014, the price of jet fuel has fallen by approximately fifty percent, which benefits us by lowering our expenses. However, because fuel prices are highly volatile, the price of jet fuel may increase significantly at any time. We may be more susceptible to fuel-price volatility than most of our competitors since fuel represents a larger proportion of our total costs due to the longer average stage length of our flights.

Availability of aircraft fuel may be low. Our business is also dependent on the availability of aircraft fuel (or crude oil), which is not predictable. Weather-related events, natural disasters, terrorism, wars, political disruption or instability involving oil-producing countries, changes in governmental or cartel policy concerning crude oil or aircraft fuel production, labor strikes or other events affecting refinery production, transportation, taxes or marketing, environmental concerns, market manipulation, price speculation and other unpredictable events may drive actual or perceived fuel supply shortages. Shortages in the availability of, or increases in demand for, crude oil in general, other crude-oil-based fuel derivatives and aircraft fuel in particular could result in increased fuel prices and could materially adversely affect our business.

Fare increases may not cover increased fuel costs. We may not be able to increase ticket prices sufficiently to cover increased fuel costs, particularly when fuel prices rise quickly. We sell a significant number of tickets to passengers well in advance of travel, and, as a result, fares sold for future travel may not reflect increased fuel costs. In addition, our ability to increase ticket prices to offset an increase in fuel costs is limited by the competitive nature of the airline industry and the price sensitivity associated with air travel, particularly leisure travel, and any increases in fares may reduce the general demand for air travel.

Our fuel hedging program may not be effective. We cannot assure you our fuel hedging program, including our forward fixed price contracts, or FFPs, which we use as part of our hedging strategy, will be effective or that we will maintain a fuel hedging program. Even if we are able to hedge portions of our future fuel requirements, we cannot guarantee that our hedge contracts will provide an adequate level of protection against increased fuel costs or that the counterparties to our hedge contracts will be able to perform. Certain of our fuel hedge contracts may contain margin funding requirements that could require us to post collateral to counterparties in the event of a significant drop in fuel prices. For example, the recent decrease in the price of jet fuel has triggered unrealized losses on certain hedge positions of $27.1 million at December 31, 2014. Additionally, our ability to realize the benefit of declining fuel prices will be delayed by the impact of fuel hedges in place, and we may record significant losses on fuel hedges during periods of declining prices. A failure of our fuel hedging strategy,

12

Table of Contents

significant margin funding requirements, overpaying for fuel through the use of FFPs or our failure to maintain a fuel hedging program could prevent us from adequately mitigating the risk of fuel price increases and could materially adversely affect our business.

The airline industry is exceedingly competitive, and we compete against both legacy airlines and low-cost carriers; if we are not able to compete successfully in the domestic airline industry, our business will be materially adversely affected.

The domestic airline industry is characterized by significant competition from both large legacy airlines and low-cost carriers, or LCCs. Airlines compete for passengers with a variety of fares, discounts, route networks, flight schedules, flight frequencies, frequent flyer programs and other products and services, including seating, food, entertainment and other on-board amenities. Airlines also compete on the basis of customer-service performance statistics, such as on-time arrivals, customer complaints and mishandled baggage reports. We face significant competition from both large legacy airlines and LCCs on the routes we operate, and if we are unable to compete effectively, our business will be materially adversely affected.

Large legacy airlines have numerous competitive advantages in competing for airline passengers, particularly following the consolidation in the domestic airline industry that occurred between 2008 and 2013, which resulted in the creation of four dominant domestic airlines with significant breadth of network coverage and financial resources. We face competition from one or more of these legacy carriers with respect to nearly all of the routes we serve. The legacy carriers have a number of competitive advantages relative to us that may enable them to attain higher average fares, more passenger traffic and a greater percentage of business passengers than we attain. These advantages include a much larger route network with domestic and international connections, more flights and convenient flight schedules in routes that overlap with ours. These carriers also offer frequent flyer programs and lounge access benefits that reward and create loyalty with travelers, particularly business travelers. Moreover, several legacy carriers have corporate travel contracts that direct employees to fly with a preferred carrier. The enormous route networks operated by these airlines, combined with their marketing and partnership relationships with regional airlines and international alliance partner carriers, allow them to generate increased passenger traffic from domestic and international cities. Our smaller, point-to-point route network and lack of connecting traffic and marketing alliances puts us at a competitive disadvantage to legacy carriers, particularly with respect to our appeal to higher-fare business travelers.

Each of the legacy carriers operates a much larger fleet of aircraft and has greater financial resources than we do, which permits them to add service in response to our entry into new markets. For example, United Airlines operates a hub at San Francisco International Airport (SFO) and has engaged in aggressive competitive practices, such as increasing seat capacity by introducing larger-gauge aircraft or adding incremental flights in response to our entry into new markets served from SFO. Due to our relatively small size, we are more susceptible to a fare war or other competitive activities in one or more of the markets we serve, which could prevent us from attaining the level of passenger traffic or maintaining the level of ticket sales required to sustain profitable operations in new or existing markets.

LCCs also have numerous competitive advantages in competing for airline passengers. LCCs generally offer a more basic service to travelers and therefore have lower cost structures than other airlines. The lower cost structure of LCCs permits them to offer flights to and from many of the same markets as most major airlines, which are defined by the U.S. Department of Transportation, or DOT, as U.S.-based air carriers with annual operating revenues in excess of one billion dollars during a fiscal year, but at lower prices. LCCs also typically fly direct, point-to-point flights, which tends to improve aircraft and crew scheduling efficiency. Many LCCs also provide only a single class of service, thereby avoiding the incremental cost of offering premium-class services like those that we offer.

In addition, some LCCs have a relentless focus on lowering costs and provide only a very basic level of service to passengers. These carriers configure their aircraft with high-density seating configurations and offer

13

Table of Contents

minimal amenities during the flight, and as a result, they incur lower unit costs than we do. Some LCCs also charge ancillary fees for basic services that we provide free of charge, such as making a reservation, printing boarding passes at the airport and carrying bags onboard the cabin for stowage in the overhead bins. In general, LCCs have lower unit costs and therefore are able to offer lower base fares.

If we fail to implement our business strategy successfully, our business will be materially adversely affected.

Our business strategy is to target business and leisure travelers who are willing to pay a premium for our newer aircraft, more comfortable seating, better customer service and the latest on-board amenities while maintaining a cost structure that is lower than that of the legacy airlines that these business and premium travelers have historically favored. We may not be successful in attracting enough passengers willing to pay a premium over the fares offered by the LCCs, which we require to offset the additional costs embedded within our premium service model. In addition, American Airlines, Delta Air Lines, United Airlines and JetBlue Airways are increasing the quality of their seating and on-board amenities in some of the routes where they compete with us, making it more challenging to attract passengers who are loyal to those airlines. Continuing to grow our business profitably is also critical to our business strategy. Growth poses various operational and financial challenges, including securing additional financing for aircraft acquisition, obtaining airport gates and facilities at congested airports that serve business and premium travelers and hiring qualified personnel while maintaining our culture, which we believe is vital to the continued success of our airline. We cannot assure you that we will be able to successfully and profitably expand our fleet, enter new markets or grow existing markets in order to achieve additional economies of scale and maintain or increase our profitability. If we are unsuccessful in deploying our strategy, or if our strategy is unsustainable, our business will be materially adversely affected.

Threatened or actual terrorist attacks or security concerns involving airlines could materially adversely affect our business.

Past terrorist attacks against airlines have caused substantial revenue losses and increased security costs. As a result, any actual or threatened terrorist attack or security breach, even if not directly against an airline, could materially adversely affect our business by weakening the demand for air travel and resulting in increased safety and security costs for us and the airline industry generally. Terrorist attacks made directly on a domestic airline, or the fear of such attacks or other hostilities (including elevated national threat warnings or selective cancellation or redirection of flights due to terror threats), would have a negative impact on the airline industry and materially adversely affect our business.

We rely heavily on technology and automated systems to operate our business, and any failure of these technologies or systems could materially adversely affect our business.

We are highly dependent on technology and computer systems and networks to operate our business. These technologies and systems include our computerized airline reservation system, flight operations systems, telecommunications systems, airline website, maintenance systems and check-in kiosks.

In order for our operations to work efficiently, our website and reservation system must be able to accommodate a high volume of traffic, maintain secure information and deliver flight information. We depend on our reservation system, which is hosted and maintained under a long-term contract by a third-party service provider, to issue, track and accept electronic tickets, conduct check-in, board and manage our passengers through the airports we serve and provide us with access to global distribution systems, which enlarge our pool of potential passengers. In May 2011, we experienced significant reservations system outages, which resulted in lost ticket sales on our website which materially adversely affected our business and goodwill. If our reservation system fails or experiences interruptions again, and we are unable to book seats for any period of time, we could lose a significant amount of revenue as customers book seats on other airlines, and our reputation could be harmed.

14

Table of Contents

We also rely on third-party service providers to maintain our flight operations systems, and if those systems are not functioning, we could experience service disruptions, which could result in the loss of important data, increase our expenses, decrease our operational performance and temporarily stall our operations. Replacement services may not be readily available on a timely basis, at competitive rates or at all, and any transition time to a new system may be significant. In the event that one or more of our primary technology or systems vendors fails to perform and a replacement system is not available, our business could be materially adversely affected.

Our business could be materially adversely affected from an accident or safety incident involving our aircraft.

An accident or safety incident involving one of our aircraft could expose us to significant liability and a public perception that our airline is unsafe or unreliable. In the event of a major accident, we could be subject to significant personal injury and property claims. While we maintain liability insurance in amounts and of the type generally consistent with industry practice, the amount of such coverage may not be adequate to cover fully all claims, and we may be forced to bear substantial losses from an accident. In addition, any accident or incident involving one of our aircraft (or an accident involving another Virgin-branded airline), even if fully insured, could harm our reputation and result in a loss of future passenger demand if it creates a public perception that our operation is unsafe or unreliable as compared to other airlines or means of transportation. As a result, any accident or safety incident involving our aircraft could materially adversely affect our business.

The demand for airline services is sensitive to changes in economic conditions, and another recession would weaken demand for our services and materially adversely affect our business.

The demand for business and leisure travel is affected by U.S. and global economic conditions. Unfavorable economic conditions have historically reduced airline travel spending. For most leisure consumers, travel is a discretionary expense, and during unfavorable economic conditions, travelers have often replaced air travel with car travel or other forms of ground transportation or have opted not to travel at all. Likewise, during unfavorable economic conditions, businesses have foregone or deferred air travel. Travelers have also reduced spending by purchasing less expensive tickets, which can result in a decrease in average revenue per seat. Because we have relatively high fixed costs, much of which cannot be mitigated during periods of lower demand for air travel, our business is particularly sensitive to changes in U.S. economic conditions. A reduction in the demand for air travel due to unfavorable economic conditions also limits our ability to raise fares to counteract increased fuel, labor and other costs. If U.S. or global economic conditions are unfavorable or uncertain for an extended period of time, it would materially adversely affect our business.

We have a limited operating history and have only recorded two years of profit, and we may not sustain or increase profitability in the future.

We have a history of losses and only a limited operating history upon which you can evaluate our business and prospects. While we recorded an annual profit in 2013 and 2014, we cannot assure you that we will be able to sustain or increase profitability on a quarterly or an annual basis. In turn, this may cause the trading price of our common stock to decline and may materially adversely affect our business.

Airlines are subject to extensive regulation and taxation by governmental authorities, and compliance with new regulations and any new or higher taxes will increase our operating costs and may materially adversely affect our business.

We are subject to extensive regulatory and legal compliance requirements. Congress regularly passes laws that affect the airline industry, and the DOT, the Federal Aviation Administration, or FAA, and the Transportation Security Administration, or TSA, continually issue regulations, orders, rulings and guidance relating to the operation, safety and security of airlines that require significant expenditures and investment by us. For example, the DOT has broad authority over airlines to prevent unfair and deceptive practices and has used this authority to impose numerous airline regulations, including rules and fines relating to airline advertising,

15

Table of Contents

pricing, baggage compensation, denied boarding compensation and tarmac delayed flights. The DOT frequently considers the adoption of new regulations, such as rules relating to congestion-based landing fees at airports and limits or disclosures concerning ancillary passenger fees. For example, in June 2014, the DOT issued a notice of proposed rulemaking to further enhance passenger protections that addresses several areas of regulation, including post-purchase ticket increases, ancillary fee disclosures and code-share data reporting and disclosure. Compliance with existing requirements drives administrative, legal and operational costs and subjects us to potential fines, and any new regulatory requirements issued by the DOT may increase our compliance costs, reduce our revenues and materially adversely affect our business.

The FAA has broad authority to address airline safety issues, including inspection authority over our flight, technical and safety operations, and has the ability to issue mandatory orders relating to, among other things, the grounding of aircraft, installation of mandatory equipment and removal and replacement of aircraft parts that have failed or may fail in the future. Any decision by the FAA to require aircraft inspections, complete aircraft maintenance or ground aircraft types operated by us could materially adversely affect our business. For example, on January 4, 2014, the FAA’s new and more stringent pilot flight and duty time requirements under Part 117 of the Federal Aviation Regulations took effect, which has increased costs and could further increase our costs in the future.

The FAA also has extensive authority to address airspace/airport congestion issues and has imposed limitations on take-off and landing slots at four airports: Ronald Reagan Washington National Airport (DCA), LaGuardia Airport (LGA), John F. Kennedy International Airport (JFK) and Newark Liberty International Airport (EWR). The FAA could reduce the number of slots allocated at these airports or impose new slot restrictions at other airports.

The Port Authority of New York & New Jersey maintains a so-called “perimeter rule” that prohibits weekday non-stop flights longer than 1,500 miles from LGA, a restriction that does not exist at JFK and EWR. We currently have a limited number of take-off and landing slots at LGA, compared to certain of our competitors. If the LGA perimeter rule were relaxed or eliminated, it could increase competition at LGA for high-revenue longer haul routes favored by business travelers and higher revenue passengers. If New York business travelers and higher revenue passengers elect to travel out of LGA rather than JFK and EWR, airports that farther from Manhattan, we may not have sufficient slots to compete, which could materially adversely affect our business.

We are also subject to restrictions imposed by federal law that require that no more than 24.9% of our stock be voted, directly or indirectly, by persons who are not U.S. citizens, that no more than 49.9% of our outstanding stock be owned by persons who are not U.S. citizens and that our president and at least two-thirds of the members of our board of directors and senior management be U.S. citizens. For more information on these requirements, see “—Our corporate charter and bylaws include provisions limiting voting and ownership by non-U.S. citizens and specifying an exclusive forum for stockholder disputes.” We are currently in compliance with these ownership restrictions. Our high level of foreign ownership may limit our opportunity to participate in U.S. government travel contracts and the Civilian Reserve Air Fleet program, however, if we are unable to satisfy policies and procedures of the U.S. Department of Defense for the mitigation of foreign ownership, control or influence required of cleared U.S. contractors.

Domestic airlines are also subject to significant taxation, including taxes on jet fuel, passenger tickets and security fees to compensate the federal government for its role in regulating airlines, providing air traffic controls and implementing security measures related to airlines and airports. In July 2014, the TSA implemented an increased passenger security fee at a flat rate of $5.60 per passenger. Any significant increase in ticket taxes or security fees could weaken the demand for air travel, increase our costs and materially adversely affect our business.

Many aspects of airlines’ operations are also subject to increasingly stringent environmental regulations, and growing concerns about climate change may result in the imposition of additional regulation. Since the domestic

16

Table of Contents

airline industry is highly price sensitive, we may not be able to recover from our passengers the cost of compliance with new or more stringent environmental laws and regulations, which could materially adversely affect our business. Although we do not expect the costs of complying with current environmental regulations will have a material adverse effect on our business, we cannot assure you that the costs of complying with environmental regulations would not materially adversely affect us in the future.

Almost all commercial service airports are owned and/or operated by units of local or state governments. Airlines are largely dependent on these governmental entities to provide adequate airport facilities and capacity at an affordable cost. Many airports have increased their rates and charges to air carriers because of higher security costs, increased costs related to updated infrastructures and other costs. Additional laws, regulations, taxes and airport rates and charges have been proposed from time to time that could significantly increase the cost of airline operations or reduce the demand for air travel. Although lawmakers may impose these additional fees and consider them “pass-through” costs, we believe that a higher total ticket price will influence consumer purchase and travel decisions and may result in an overall decline in passenger traffic, which could materially adversely affect our business.

Our ability to obtain financing or access capital markets may be limited.

We have significant obligations to purchase aircraft and spare engines that we have on order from Airbus and CFM International, or CFM, and we have historically relied solely on lessors to provide financing for our aircraft acquisition needs. As of December 31, 2014, committed expenditures for these aircraft and spare engines, including estimated amounts for contractual price escalations and $94.3 million of pre-delivery payment commitments, were approximately $396.1 million. Because we may not have sufficient liquidity or creditworthiness to fund the purchase of aircraft and engines, including payment of pre-delivery payments, we expect to seek external financing for these expenses. There are a number of factors that may affect our ability to raise financing or access the capital markets, including our liquidity and credit status, our operating cash flows, market conditions in the airline industry, U.S. and global economic conditions, the general state of the capital markets and the financial position of the major providers of commercial aircraft financing. We cannot assure you that we will be able to source external financing for our planned aircraft acquisitions or for other significant capital needs, and if we are unable to source financing on acceptable terms, or unable to source financing at all, our business could be materially adversely affected. To the extent we finance our activities with additional debt, we may become subject to financial and other covenants that may restrict our ability to pursue our strategy or otherwise constrain our growth and operations.

In addition, we may be unable to fully finance future aircraft acquisitions if the aircraft are perceived to be less valuable for any reason. We presently have ten Airbus A320-family, current technology aircraft on order for delivery between July 2015 and June 2016. If Airbus’s newer A320neo-family aircraft provide expected improvements in the fuel consumption and an increase in nautical mile range, the Airbus A320-family current-technology aircraft may be perceived to be less valuable. If we are unable to fully finance our acquisition of these aircraft, our business may be materially adversely affected.

The “Virgin” brand is not under our control, and negative publicity related to the Virgin brand name could materially adversely affect our business.

We believe the “Virgin” brand, which is integral to our corporate identity, represents quality, innovation, creativity, fun, a sense of competitive challenge and employee-friendliness. We license rights to the Virgin brand from certain entities affiliated with the Virgin Group on a non-exclusive basis. The Virgin brand is also licensed to and used by a number of other companies, including two airlines, Virgin Atlantic Airways and Virgin Australia Airlines, operating in other geographies. We rely on the general goodwill of consumers and our employees, whom we call teammates, towards the Virgin brand as part of our internal corporate culture and external marketing strategy. Consequently, any adverse publicity in relation to the Virgin brand name or its principals, particularly Sir Richard Branson who is closely associated with the brand, or in relation to another

17

Table of Contents

Virgin-branded company over which we have no control or influence, could have a material adverse effect on our business.

We obtain our rights to use the Virgin brand under agreements with certain entities affiliated with the Virgin Group, and we would lose those rights if these agreements are terminated or not renewed.

We are party to license agreements with certain entities affiliated with the Virgin Group pursuant to which we obtain rights to use the Virgin brand. The licensor may terminate the agreements upon the occurrence of a number of specified events including if we commit a material breach of our obligations under the agreements that is uncured for more than 10 business days or if we materially damage the Virgin brand. If we lose our rights to use the Virgin brand, we would lose the goodwill associated with our brand name and be forced to develop a new brand name, which would likely require substantial expenditures, and our business would likely be materially adversely affected.

We are subject to labor-related disruptions that could materially adversely affect our business.

On August 13, 2014, our inflight teammates (whom other airlines refer to as flight attendants), representing approximately 32% of our workforce at the time, voted for representation by the Transport Workers Union, or TWU. As a result, the TWU has been certified as the representative of our inflight teammates, and we will be engaged with the TWU in a collective bargaining process for a first contract for those teammates in accordance with the requirements of the Railway Labor Act. Although we currently have a direct relationship with our remaining teammates, airline workers are one of the most heavily unionized private-sector employee groups, and any of our other non-management teammates could also seek to unionize. If we are not able to reach agreement with the TWU on the terms of the collective bargaining agreement for our inflight teammates, or if one or more of our other teammate groups elects a union to represent them, it could create a risk of work stoppages which could materially adversely affect our business.

We depend on the Los Angeles and San Francisco markets to be successful.

Most of our current flights operate from our two focus cities of Los Angeles and San Francisco. In 2014, passengers to and from Los Angeles International Airport (LAX) and to and from SFO accounted for 43.2% and 54.1% of our total passengers. We believe that concentrating our service offerings in this way allows us to maximize our investment in personnel, aircraft and ground facilities and to leverage sales and marketing efforts in those regions. As a result, we are highly dependent on the LAX and SFO markets.