Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - SKY PETROLEUM, INC. | skpi20141231ex311.htm |

| EX-32.1 - EXHIBIT 32.1 - SKY PETROLEUM, INC. | skpi20141231ex321.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 333-99455

SKY PETROLEUM, INC.

(Exact Name of Registrant as Specified in its Charter)

Nevada | 32-0027992 | |

(State of other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

15950 N. Dallas Parkway, Suite 400 | ||

Dallas, Texas | 75248 | |

(Address of Principal Executive Offices) | (Zip Code) | |

(888) 344-9964

(Registrant’s Telephone Number, including Area Code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT: None

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes o No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to the Form 10-K x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

Large Accelerated Filer o | Non-Accelerated Filer o | Accelerated Filer o | Smaller Reporting Company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $1,346,068

The number of shares of the Registrant’s Common Stock outstanding as of August 28, 2015 was 76,533,709.

TABLE OF CONTENTS | |

2

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K and the exhibits attached hereto contain certain statements that constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements concern our anticipated results and developments in our operations in future periods, planned exploration and development of our properties, plans related to our business and matters that may occur in the future. These statements relate to analysis and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management.

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation:

- | risks related to default judgment in Western District of Austin District Court (Federal) related to AKBN litigation; |

- | risks related to our limited operating history: |

- | risks related to our need to raise additional capital to fund working capital requirements; |

- | risks related to the historical losses and expected losses in the future and our ability to continue as a going concern; |

- | risks related to our dependence on our executive officers; |

- | risks related to fluctuations in oil and natural gas prices; |

- | risks related to exploratory activities, drilling for and producing oil and natural gas; |

- | risks related to liability claims from oil and gas operations; |

- | risks related to legal compliance costs and litigation expenditures; |

- | risks related to the unavailability of drilling equipment and supplies; |

- | risks related to competition in the oil and natural gas industry; |

- | risks related to period to period comparison of our financial results; |

- | risks related to our securities, including trading activity, price fluctuation and volatility; |

- | risks related to our ability to raise capital or enter into joint venture or working interest arrangements to complete exploration and development programs on acceptable terms, if at all; and |

- | political, social and cultural risks associated with operations and conducting business in foreign countries. |

This list is not exhaustive of the factors that may affect our forward-looking statements. Some of the important risks and uncertainties that could affect forward-looking statements are described further under the sections titled “Business”, “Risk Factors”, and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Annual Report. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated or expected. Our management has included projections and estimates in this Annual Report, which are based primarily on management’s experience in the industry, assessments of our results of operations, discussions and negotiations with third parties and a review of information filed by our competitors with the Securities and Exchange Commission (which we refer to as the “SEC”) or otherwise publicly available. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events, except as required by law.

We qualify all the forward-looking statements contained in this Annual Report by the foregoing cautionary statements.

3

PART I

ITEM 1. BUSINESS

Overview

Our primary business is to identify opportunities to either make direct property acquisitions or to fund exploration or development of oil and natural gas properties of others under arrangements in which we will finance the costs in exchange for interests in the oil or natural gas revenue generated by the properties. Such arrangements are commonly referred to as farm-ins to us, or farm-outs by the property owners farming out to us.

As used herein, the terms, “Sky Petroleum,” “Sky,” “Company,” “we,” “us,” and “our” refer to Sky Petroleum, Inc. and related subsidiaries.

We were incorporated in the State of Nevada in August 2002 under the corporate name The Flower Valet. In 2004, we began to reassess our business plan and to seek business opportunities in other industries, including the oil and gas industry. On December 20, 2004, at our annual meeting of stockholders, our stockholders approved an amendment to our Articles of Incorporation, changing our name from The Flower Valet to Seaside Exploration, Inc. Subsequently, on March 28, 2005, we changed our name from Seaside Exploration, Inc. to Sky Petroleum, Inc. and began actively identifying opportunities to make direct property acquisitions and to fund exploration and development of oil and natural gas properties.

On October 8, 2010, the Company filed a Certificate of Designation with the Secretary of State for the State of Nevada to designate 5,000,000 shares of the Company’s preferred stock as shares of Series B Preferred Stock (the "Series B Preferred Shares"). The Company issued 3,863,636 Series B Preferred Shares to a consultant (“the Consultant”) under the terms of a consultant agreement related to the final approval of the PSC.

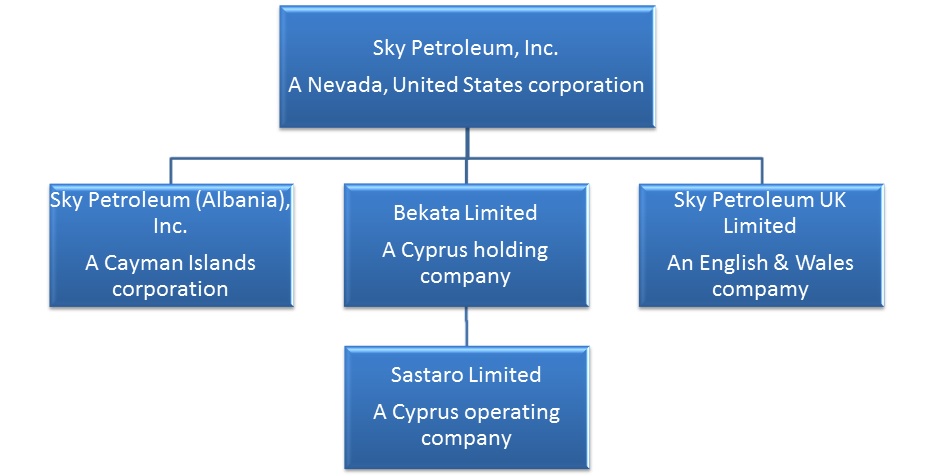

As of December 31, 2014, the Company had four wholly-owned subsidiaries, two incorporated in Cyprus: Sastaro Limited (“Sastaro”) and Bekata Limited ("Bekata”) which owns 100% of Sastaro and a third Sky Petroleum (Albania) Inc., a Cayman Islands corporation and qualified branch in Albania, incorporated for the purposes of holding interests in Albania. On October 31, 2013, the Company entered into a Joint Venture Shareholders agreement, with Hyde Resources Ltd., incorporated in Northern Ireland (the " JV Corporation"). The Company established Sky Petroleum UK Limited, incorporated in England and Wales (the "Sky JV Sub"), a wholly owned subsidiary of the Company. Sky JV Sub owns 75% of the Joint Venture shares.

SKY PETROLEUM, INC.

ORGANIZATION STRUCTURE

Sastaro was incorporated on March 28, 2005. Bekata was incorporated on February 7, 2005. Sky Petroleum (Albania) Inc. was incorporated on February 17, 2011.

Our principal corporate and executive offices are located at 15950 N. Dallas Parkway, Suite 400, Dallas, Texas 75248. Our telephone number is (888) 344-9964. We maintain a website at www.skypetroleum.com. Information contained on our website is not part of this Annual Report.

4

The Company cannot be certain that its existing sources of cash will be adequate to meet our liquidity requirements. However, management has implemented plans to improve liquidity through slowing or stopping certain planned expenditures and improvements to results from operations. Management plans to continue to obtain funding through equity, debt or other securities offerings. There can be no assurance that the capital raising efforts will be successful or that our results of operations will materially improve in either the short-term or long-term and accordingly, we may be unable to meet our obligations as they become due.

A fundamental principle of the preparation of financial statements in accordance with generally accepted accounting principles is the assumption that an entity will continue in existence as a going concern, which contemplates continuity of operations and the realization of assets and settlement of liabilities occurring in the ordinary course of business. However, this principle is applicable to all entities except for entities in liquidation or entities for which liquidation appears imminent. In accordance with this requirement, our policy is to prepare our consolidated financial statements on a going concern basis unless we intend to liquidate or have no other alternative but to liquidate. The Company's consolidated financial statements have been prepared on a going concern basis and do not reflect any adjustments that might specifically result from the outcome of this uncertainty.

History

On June 24, 2010, Sky Petroleum, Inc. (the "Company") entered into a Production Sharing Contract (“PSC”) with the Ministry of Economy, Trade and Energy of Albania, acting through the National Agency of Natural Resources of Albania (“AKBN”). The PSC granted Sky Petroleum exclusive rights to three exploration blocks (Block Four, Block Five and Block Dumre) in the Republic of Albania (the “Concession Area”).

On December 23, 2011, the Company delivered Notice of Arbitration under the Arbitration Rules of the United Nations Commission on Internal Trade Law to National Agency of Natural Resources and to the Ministry of Economy, Trade and Energy of Albania (the "Arbitration") to institute an arbitration proceeding against the Ministry of Economy, Trade and Energy of Albania, acting by and through AKBN, for breach of the PSC in accordance with Article XXI of the PSC. The arbitration proceeding arose out of the termination of the PSC.

On May 7, 2013, the Arbitration Tribunal ruled that (i) AKBN provided proper notice of the termination of the PSC to Sky Petroleum on July 22, 2011, for Sky Petroleum's failure to deliver a conforming bank guarantee to AKBN by July 22, 2011, and

(ii) the PSC was properly terminated on November 17, 2011. The Arbitration Tribunal ruled Sky Petroleum to reimburse AKBN for total fees and expenses in connection with the Arbitration proceeding in the amount of EUR 382,774($501,511). As a result of the ruling, Sky Petroleum impaired its Investment in Oil and Gas Properties, net, related to acquisition and development costs for oil and gas projects in Albania by $10,205,220 to $0. See "Investment in Oil and Gas Properties" in the Notes to Condensed Consolidated Financial Statements for further details. As a result of the ruling Sky Petroleum impaired Investment in Oil and Gas Properties, net, related to acquisition and development costs for oil and gas projects in Albania to $0. The Company had an impairment charge of $10,205,220; and accrued a liability of $501,511 (EUR 382,774) related to liability arising from the obligation to reimburse AKBN for total fees and expenses in connection with the Arbitration proceeding plus interest at the rate of 6% per annum from May 7, 2013 through the end of December 31, 2014.

On May 20, 2015, the Company received a copy of a Notice of Default Judgment issued by the United States District Court for the Western District of Texas Austin Division (the “Court”) in the matter: Ministry of Energy and Industry of the Government of the Republic of Albania, formerly known as the Ministry of Economy, Trade and Energy (acting by and through the National Agency of Natural Resources) vs. Sky Petroleum, Inc. (Case No. 14-cv-0112-SS), issued on February 11, 2015 (the “Judgment”). The complaint was filed with the Court on December 12, 2014, as an application to confirm the foreign arbitration award arising out of the decision by an arbitration tribunal issued under the 1976 UNICITRAL RULES related to the arbitration proceeding between the Company and AKBN arising from the termination of a Production Sharing Contract dated June 24, 2010. The Judgment affirmed AKBN damages as described above in the May 7, 2013 ruling. The Company is currently in settlement discussions with AKBN.

Joint Venture Agreement

On October, 31, 2013, the Company entered into a Joint Venture Shareholders’ Agreement (the “JV Agreement”) with Hyde Resources Ltd., incorporated in Northern Ireland (the “JV Corporation”), Sky Petroleum UK Limited, incorporated in England and Wales ( “Sky JV Sub”), and SO Ventures Ltd., incorporated in Northern Ireland (the “SO Ventures”). Sky JV Sub, is a wholly owned subsidiary of Sky Petroleum. Sky JV Sub owns 300 ordinary shares of the JV Corporation, while the Irish SO Ventures owns 100 ordinary shares of the JV Corporation. Each ordinary share was issued for 1 British Pound.

The purpose of the JV Corporation is to obtain licenses and to conduct technical, environmental and exploration due diligence; raise capital and commence into one or more joint venture projects (each a “JVC Project”) for the purposes of conducting,

5

Exploration, Development and Commercialization of oil and gas in the Area of Interest (as those terms are defined in the JV Agreement). Pursuant to the terms of the JV Agreement, the Parties will jointly use commercially reasonable efforts to jointly identify and secure property, rights and concessions in the Area of Interest. The Parties will also jointly determine the capital requirements of each JVC Project and use commercially reasonable efforts to obtain the required capital.

Sky JV Sub has undertaken to advance funds through loans or use commercially reasonable efforts to identify and secure loans or advancement of funds from bona fide arms’ length third party lenders, on commercially reasonable terms, to fund the reasonable business costs and general and administrative expenses of the JV Corporation and to fund the business from Exploration through to Discovery and onto the Delivery of a Development Plan (as those terms are defined in the JV Agreement). We have guaranteed the due and punctual performance of all obligations of Sky JV Sub under or in connection with the JV Agreement if and when they become performable in accordance with the terms of the JV Agreement (the “Guaranteed Obligations”). We further agreed to indemnify the SO Ventures against any losses, costs and expenses suffered or incurred by the SO Ventures arising out of, or in connection with: (a) any failure of Sky JV Sub to perform or discharge the Guaranteed Obligations; or (b) any of the Guaranteed Obligations being or becoming totally or partially unenforceable; but our obligations or liability under the indemnity shall be no greater than Sky JV Sub’s obligations or liability under the JV Agreement. There has been no activity or operations in the Joint Venture and no property acquired as of December 31, 2014.

The Board of Directors of the JV Corporation has responsibility for the supervision and management of the JV Corporation and its Business. The JV Corporation shall have a minimum of 5 directors, three of whom are appointed by Sky JV Sub and 2 of whom are appointed by SO Ventures. At all times, the Sky JV Sub appointees will make up a majority of the board of directors. The JV Agreement contains other customary terms and agreements between the parties.

The JV Corporation is also governed by the terms of its Articles of Association, which adopt the model articles for private companies limited by shares contained in Schedule 1 of the Companies (Model Articles) Regulations 2008 of Northern Ireland. The foregoing description of the JV Agreement and the Articles of Association is qualified in its entirety by reference to the full-text of the JV Agreement and the Articles of Association, a copies of which are filed on Form 8-K dated October 28, 2013.

Production Sharing Contract with the Ministry of Economy, Trade and Energy of Albania:

On June 24, 2010, Sky entered into a Production Sharing Contract with the Ministry of Economy, Trade and Energy of Albania, acting through the AKBN. The PSC granted Sky Petroleum exclusive rights to three exploration blocks (Block Four, Block Five and Block Dumre) in the Republic of Albania.

The Company's expenditures related to the Albania exploration blocks consisted of acquisition costs totaling $50,000, and $850,000 for fees to consultants for locating and negotiating the Company's investment in the Albania exploration blocks, $850,000 for fees related to evaluations and assessments of the concession area, and $50,000 towards the $100,000 allocation for training and education for the first year exploration period. In addition, 3 million shares of common stock with a fair value of $1,170,000, plus 3,863,636 Preferred Shares Series B with a value of $7,820,000, were issued to a consultant for expertise provided to the Company in acquiring and negotiating the acquisition of oil and gas properties.

On December 23, 2011, Sky Petroleum delivered Notice of Arbitration under the Arbitration Rules of the United Nations Commission on Internal Trade Law to National Agency of Natural Resources and to the Ministry of Economy, Trade and Energy of Albania to institute an arbitration proceeding against the Ministry of Economy, Trade and Energy of Albania, acting by and through AKBN, for breach of the PSC in accordance with Article XXI of the PSC. The arbitration proceeding arose out of the termination of the PSC. On May 7, 2013, the Arbitration Tribunal ruled that (i) AKBN provided proper notice of the termination of the PSC to Sky Petroleum on July 22, 2011, for Sky Petroleum's failure to deliver a conforming bank guarantee to AKBN by July 22, 2011, and (ii) the PSC was properly terminated on November 17, 2011.

As a result of the ruling Sky Petroleum impaired Investment in Oil and Gas Properties, net, related to acquisition and development costs for oil and gas projects in Albania to $0. The Company had an impairment charge of $10,205,220; and accrued a liability of $501,511 (EUR 382,774) related to liability arising from the obligation to reimburse AKBN for total fees and expenses in connection with the Arbitration proceeding plus interest at the rate of 6% per annum from May 7, 2013 through the end of December 31, 2014.

On May 20, 2015, the Company received a copy of a Notice of Default Judgment issued by the United States District Court for the Western District of Texas Austin Division in the matter: Ministry of Energy and Industry of the Government of the Republic of Albania, formerly known as the Ministry of Economy, Trade and Energy (acting by and through the National Agency of Natural Resources) vs. Sky Petroleum, Inc. (Case No. 14-cv-0112-SS), issued on February 11, 2015. The complaint was filed with the Court on December 12, 2014, as an application to confirm the foreign arbitration award arising out of the decision by an arbitration

6

tribunal issued under the 1976 UNICITRAL RULES related to the arbitration proceeding between the Company and AKBN arising from the termination of a PSC. The Judgment affirmed AKBN damages as described above in the May 7, 2013 ruling. The Company is currently in settlement discussions with AKBN.

Other Projects:

Komi Republic - Russian Federation

In 2007, we acquired a minority stake in the development of an oilfield in the Komi Republic of the Russian Federation by acquiring a 3.9% interest, subject to dilution, in Pechora Energy through its UK parent company, Concorde Oil & Gas Plc. (“Concorde”). This acquisition was essentially a carried interest. Pechora Energy holds the production license for the Luzskoye field in the Komi Republic. During March 2010, Concorde’s directors noted that Concorde was in the process of disposing its operating assets to one of its majority shareholders - Kuwait Energy Company (“KEC”). The completion of this transaction is subject to a number of conditions, including regulatory consents, bank consent, and approval of KEC shareholders. As a result of these events, and as of December 31, 2010, the investment in this project was impaired to zero. As of December 31, 2014, the Company has not received any proceeds related to the disposition of these assets.

Competition

The oil and natural gas industry is intensely competitive, and we compete with other companies that have greater resources. Many of these companies not only explore for and produce oil and natural gas, but also carry on midstream and refining operations and market petroleum and other products on a regional, national or worldwide basis. These companies may be able to pay more for productive oil and natural gas properties and exploratory prospects or define, evaluate, bid for and purchase a greater number of properties and prospects than our financial or human resources permit. In addition, these companies may have a greater ability to continue exploration activities during periods of low oil and natural gas market prices. Our larger or integrated competitors may be able to absorb the burden of existing, and any changes to, federal, state, local and tribal laws and regulations more easily than we can, which would adversely affect our competitive position. Our ability to acquire additional properties and to discover reserves in the future will be dependent upon our ability to evaluate and select suitable properties and to consummate transactions in a highly competitive environment. In addition, because we have fewer financial and human resources than many companies in our industry, we may be at a disadvantage in bidding for exploratory prospects and producing oil and natural gas properties.

SEC Rules and Regulations

Our oil and gas reporting disclosure obligations with the SEC are regulated under Section 1200 of Regulation S-K and Rule 4-10 of Regulation S-X.

Pursuant to the SEC rules and regulations:

• | Companies must use first-of the month pricing to calculate the 12-month average commodity price unless contractual arrangements designate the price to be used; |

• | Companies that produce oil and natural gas from nontraditional resources (such as oil sands, bitumen and shale) may report such resources as oil and gas reserves instead of mining reserves; |

• | Probable and possible reserves may be disclosed separately on a voluntary basis; |

• | For reserves to be proved, production of the reserves must be reasonably certain, meaning there is a high degree of confidence that the quantities will be recovered and the well from which the reserves are to be recovered is scheduled to be drilled within the next five years, unless the specific circumstances justify a longer time; |

• | Reserves must be estimated through the use of reliable technology in addition to flow tests and production history; |

• | Additional disclosure is required regarding the qualifications of the chief technical person who oversees the reserves estimation process and a general discussion of our internal controls used to assure the objectivity of the reserves estimate; |

• | Disclosure of reserves, production, drilling activity and additional information is required to be given by geographic area; and |

• | Companies must provide disclosure in tabular format of proved developed reserves, proved undeveloped reserves and total proved reserves. |

7

Reserves Reported to Other Agencies

No reserve estimates were filed with a federal authority or agency.

Productive Wells and Acreage

As of December 31, 2014, we had no productive wells or acreage.

Undeveloped Acreage

The Company does not have any undeveloped acreage.

Drilling Activities

The Company had no drilling activities during the years ended December 31, 2014 and 2013.

Present Activities and Delivery Commitments

As of the date of this Annual Report, the Company does not have any wells in the process of drilling, water floods being installed, pressure maintenance operations, or other similar oil and gas related activities which it is conducting.

As of the date of this Annual Report, the Company does not have any delivery commitments for oil and gas quantities in the future.

ITEM 1A. RISK FACTORS

There are many factors that affect our business, prospects, liquidity and the results of operations, some of which are beyond the control of the Company. The following is a discussion of some, but not all, of these and other important risk factors that may cause the actual results of our operations in future periods to differ materially from those currently expected or desired. Additional risks not presently known to management or risks that are currently believed to be immaterial, but which may become material, may also affect our business, prospects, liquidity and results of operations. Our failure to successfully address the risks and uncertainties described below would have a material adverse effect on our business, financial condition and/or results of operations, and the trading price of our common stock may decline and investors may lose all or part of their investment. We cannot assure you that we will successfully address these risks or other unknown risks that may affect our business. Readers should carefully consider the risks and uncertainties described below before deciding whether to invest in shares of our common stock.

Risks related to our company

We may be unable to satisfy the default judgment entered against us in Western District of Texas Austin Division Federal Court.

On May 7, 2013, the Arbitration Tribunal ruled that the PSC was properly terminated on November 17, 2011, and ruled Sky Petroleum to reimburse AKBN for total fees and expenses in connection with the Arbitration proceeding in the amount of EUR 382,774 ($501,511). As a result of the ruling Sky Petroleum impaired Investment in Oil and Gas Properties, net, related to acquisition and development costs for oil and gas projects in Albania to $ 0, and for the year ended December 31, 2013, Sky Petroleum had an impairment charge of $10,205,220; and accrued a liability of $501,511 (EUR 382,774) related to liability arising from the obligation to reimburse AKBN for total fees and expenses in connection with the Arbitration proceeding. We have not had sufficient funds to pay this award and have received demands for payment from the Tribunal.

As a result of the ruling Sky Petroleum impaired Investment in Oil and Gas Properties, net, related to acquisition and development costs for oil and gas projects in Albania to $0. The Company had an impairment charge of $10,205,220; and accrued a liability of $501,511 (EUR 382,774) related to liability arising from the obligation to reimburse AKBN for total fees and expenses in connection with the Arbitration proceeding plus interest at the rate of 6% per annum from May 7, 2013 through the end of December 31, 2014.

On May 20, 2015, the Company received a copy of a Notice of Default Judgment issued by the United States District Court for the Western District of Texas Austin Division in the matter: Ministry of Energy and Industry of the Government of the Republic of Albania, formerly known as the Ministry of Economy, Trade and Energy (acting by and through the National Agency of Natural

8

Resources) vs. Sky Petroleum, Inc. (Case No. 14-cv-0112-SS), issued on February 11, 2015. The complaint was filed with the Court on December 12, 2014, as an application to confirm the foreign arbitration award arising out of the decision by an arbitration tribunal issued under the 1976 UNICITRAL RULES related to the arbitration proceeding between the Company and AKBN arising from the termination of a PSC. The Judgment affirmed AKBN damages as described above in the May 7, 2013 ruling. The Company is currently in settlement discussions with AKBN.

We have a history of losses and will require additional financing to fund working capital requirements and ongoing efforts to secure oil and gas properties. Failure to obtain additional financing could have a material adverse effect on our financial condition and could cast uncertainty on our ability to continue as a going concern.

We have limited working capital and we will need to raise additional capital to fund working capital requirements. We will be required to raise additional funds during 2015. We cannot be certain that additional capital or other types of financing will be available if needed or that, if available, the terms of such financing will be favorable or acceptable to us. Our ability to arrange additional financing in the future will depend, in part, on the prevailing capital market conditions as well as our business performance. Our ability to continue on a going concern basis beyond the next twelve months depends on its ability to successfully raise additional financing for the substantial capital expenditures required to achieve planned principal operations.

We do not have sufficient capital to file our periodic reports under Section 13 of the Securities Exchange Act of 1934, and are not current in our reporting obligations. Our inability to file reports on a timely basis may adversely affect our ability to raise capital through the issuance of equity securities and our shareholders’ ability to sell or trade our equity securities.

Because of our historical losses and expected losses in the future, it will be difficult to forecast when we will achieve profitability, if ever.

We have incurred net losses since our inception and expect to incur further losses for the foreseeable future. It is difficult to determine when we will achieve profitability, if ever. If we are unable to generate revenues and achieve profitability, we may be forced to go out of business.

We depend on our executive officers for critical management decisions and industry contacts.

We are dependent upon the continued services of Karim Jobanputra, our principal executive officer and principal accounting officer and chairman of the board who have significant experience in the oil and gas industry. We do not carry key person insurance on their lives. Mr. Jobanputra is an entrepreneur and may not dedicate 100% of their business efforts to the business of Sky. Our executive officer and directors have other business interests, some of which may be in the oil and gas industry, and may serve on the board of directors or provide consulting services for other companies. The loss of the services of our executive officer and board members, through incapacity or otherwise, would be costly to us and would require us to seek and retain other qualified personnel. See “Directors, Executive Officers, and Corporate Governance” below.

A substantial or extended decline in oil and natural gas prices could reduce our future revenue and earnings.

The price we receive for future oil and natural gas production will heavily influence our revenue, profitability, access to capital and rate of growth. Oil and natural gas are commodities and their prices are subject to wide fluctuations in response to relatively minor changes in supply and demand. Historically, the markets for oil and natural gas have been volatile and in the recent past oil and natural gas prices have been significantly above historic levels. These markets will likely continue to be volatile in the future and current prices for oil and natural gas may decline in the future. The prices we may receive for any future production, and the levels of this production, depend on numerous factors beyond our control. These factors include the following:

• | changes in global supply and demand for oil and natural gas |

• | actions by the Organization of Petroleum Exporting Countries, or OPEC; |

• | actions by non OPEC countries; |

• | political conditions, including embargoes, which affect other oil-producing activities; |

• | levels of global oil and natural gas exploration and production activity; |

• | levels of global oil and natural gas inventories; |

• | weather conditions affecting energy consumption; |

• | technological advances affecting energy consumption; and |

• | prices and availability of alternative fuels. |

9

Lower oil and natural gas prices may not only decrease our future revenues but also may reduce the amount of oil and natural gas that we can produce economically. A substantial or extended decline in oil or natural gas prices may reduce our earnings, cash flow and working capital and the ability to obtain funding either through debt or equity.

Drilling for and producing oil and natural gas are high risk activities with many uncertainties that could substantially increase our costs and reduce our profitability.

Oil and natural gas exploration is subject to numerous risks beyond our control; including the risk that drilling will not result in any commercially viable oil or natural gas reserves.

The total cost of drilling, completing and operating wells will be uncertain before drilling commences. Overruns in budgeted expenditures are common risks that can make a particular project uneconomic. Further, many factors may curtail, delay or cancel drilling, including the following:

• | delays imposed by or resulting from compliance with regulatory requirements; |

• | pressure or irregularities in geological formations; |

• | shortages of or delays in obtaining equipment and qualified personnel; |

• | equipment failures or accidents; |

• | adverse weather conditions; |

• | reductions in oil and natural gas prices; and |

• | limitations in the market for oil and natural gas. |

We may incur substantial losses and be subject to substantial liability claims as a result of our oil and natural gas operations.

Our operations will be subject to risks associated with oil and natural gas operations. Losses and liabilities arising from uninsured and under insured events could materially and adversely affect the payment of production revenues to us, if any. Our oil and natural gas exploration activities will be subject to all of the operating risks associated with drilling for and producing oil and natural gas, including the possibility of:

• | environmental hazards, such as uncontrollable flows of oil, natural gas, brine, well fluids, toxic gas or other pollution into the environment, including groundwater contamination; |

• | abnormally pressured formations; |

• | mechanical difficulties, such as stuck oilfield drilling and service tools and casing collapse; |

• | Unexpected failures of key equipment used in the oil and gas production process; |

• | fires and explosions; |

• | personal injuries and death; and |

• | natural disasters. |

Any of these risks could adversely affect our ability to operate or result in substantial losses. These risks may not be insurable or we may elect not to obtain insurance if the cost of available insurance is excessive relative to the risks presented. In addition, pollution and environmental risks generally are not fully insurable. If a significant accident or other event that is not fully covered by insurance occurs, it could adversely affect our operations.

Market conditions or operational impediments may hinder our access to oil and natural gas markets or delay our production.

Market conditions or the unavailability of satisfactory oil and natural gas transportation arrangements may hinder access to oil and natural gas markets or delay production, if any, on our properties. The availability of a ready market for our future oil and natural gas production will depend on a number of factors, including the demand for and supply of oil and natural gas and the proximity of reserves to pipelines and terminal facilities.

We are subject to complex laws that can affect the cost, manner and feasibility of doing business thereby increasing our costs and reducing our profitability.

Development, production and sale of oil and natural gas are subject to laws and regulations. Matters subject to regulation include:

• | permits for drilling operations; |

• | reports concerning operations; |

10

• | spacing of wells; |

• | unitization and pooling of properties; and |

• | taxation. |

Failure to comply with these laws may also result in the suspension or termination of operations and liabilities under administrative, civil and criminal penalties. Moreover, these laws could change in ways that substantially increase the costs of doing business. Any such liabilities, penalties, suspensions, terminations or regulatory changes could materially and adversely affect our financial condition and results of operations.

The unavailability or high cost of drilling rigs, equipment, supplies, personnel and oilfield services could adversely affect our ability to execute our plans on a timely basis and within our budget.

Shortages or the high cost of drilling rigs, equipment, supplies or personnel could delay or adversely affect development operations on our properties, which could have a material adverse effect on our business, financial condition or results of operations. Rising or unforeseen costs related to drilling and technical engineering may increase the cost related to drilling and completing the wells, which may either require us to contribute additional capital to drilling of the wells or cause dilution in our right to receive revenue from production, if any.

Competition in the oil and natural gas industry is intense, which may increase our costs and otherwise adversely affect our ability to compete.

We operate in a highly competitive environment for prospects suitable for exploration, marketing of oil and natural gas and securing the services of trained personnel. Many of our competitors possess and employ financial, technical and personnel resources substantially greater than ours, which can be particularly important in the areas in which we operate. Those companies may be able to pay more for prospective oil and natural gas properties and prospects and to evaluate, bid for and purchase a greater number of properties and prospects than our financial or personnel resources permit. In order for us to compete with these companies, we may have to increase the amounts we pay for prospects, thereby reducing our profitability.

We may not be able to compete successfully in acquiring prospective reserves, developing reserves, marketing oil and natural gas, attracting and retaining quality personnel and raising additional capital.

Our ability to acquire additional prospects and to find and develop reserves in the future will depend on our ability to evaluate and select suitable properties and to consummate transactions in a highly competitive environment. In addition, there is substantial competition for capital available for investment in the oil and natural gas industry. Our inability to compete successfully in these areas could have a material adverse effect on our business, financial condition or results of operations.

Recent market events and general economic conditions.

The recent unprecedented events in global financial markets have had a profound impact on the global economy. Many industries, including the oil and gas industry, are impacted by these market conditions. Notwithstanding various actions by the United States. and foreign governments, concerns about the general condition of the capital markets, financial instruments, banks, investment banks, insurers and other financial institutions could cause the broader credit markets to further deteriorate and stock markets to decline substantially. In addition, general economic indicators have deteriorated, including declining consumer sentiment, increased unemployment and declining economic growth and uncertainty about corporate earnings.

These unprecedented disruptions in the current credit and financial markets have had a significant material adverse impact on a number of financial institutions and have limited access to capital and credit for many companies. These disruptions could, among other things, make it more difficult for us to obtain, or increase its cost of obtaining, capital and financing for its operations. A continued or worsened slowdown in the financial markets or other economic conditions, including but not limited to, consumer spending, employment rates, business conditions, inflation, fuel and energy costs, consumer debt levels, lack of available credit, the state of the financial markets, interest rates, and tax rates may adversely affect our growth and profitability. Specifically:

• | the global credit/liquidity crisis could impact the cost and availability of financing and our overall liquidity; |

• | the volatility of oil and gas prices may impact our revenues, profits and cash flow; |

• | volatile energy prices, commodity and consumables prices and currency exchange rates impact potential production costs; and |

• | the devaluation and volatility of global stock markets impacts the valuation of our equity securities |

These factors could have a material adverse effect on our financial condition and results of operations.

11

We have never declared or paid cash dividends on our common stock. We currently intend to retain future earnings to finance the operation, development and expansion of our business.

We do not anticipate paying cash dividends on our common stock in the foreseeable future. Payment of future cash dividends, if any, will be at the discretion of our board of directors and will depend on our financial condition, results of operations, contractual restrictions, capital requirements, business prospects and other factors that our board of directors considers relevant.

Accordingly, investors will only see a return on their investment if the value of our securities appreciates.

The market for our common shares has been volatile in the past, and may be subject to fluctuations in the future.

The market price of our common stock on the OTCBB has ranged from a high of $0.10 and a low of $0.01 during the twelve-month period ended December 31, 2014. As of August 28, 2015, the market price for our common stock closed at $0.02 on the OTCBB. See “Market for Registrant’s Common Equity, and Related Stockholder Matters and Issuer Purchases of Equity Securities”. We cannot assure you that the market price of our common stock will not significantly fluctuate from its current level. The market price of our common stock may be subject to wide fluctuations in response to quarterly variations in operating results, changes in financial estimates by securities analysts, or other events or factors. In addition, the financial markets have experienced significant price and volume fluctuations for a number of reasons, including the failure of the operating results of certain companies to meet market expectations that have particularly affected the market prices of equity securities of many companies that have often been unrelated to the operating performance of such companies. These broad market fluctuations, or any industry-specific market fluctuations, may adversely affect the market price of our common stock. In the past, following periods of volatility in the market price of a company’s securities, class action securities litigation has been instituted against such a company. Such litigation, whether with or without merit, could result in substantial costs and a diversion of management’s attention and resources, which would have a material adverse effect on our business, operating results and financial condition.

Broker-dealers may be discouraged from effecting transactions in our common stock because our common shares are considered a penny stock and are subject to the penny stock rules.

Rules 15g-1 through 15g-9 promulgated under the Securities Exchange Act of 1934 as amended (“Exchange Act”), impose sales practice and disclosure requirements on certain brokers-dealers who engage in certain transactions involving a penny stock. Subject to certain exceptions, a penny stock generally includes any non-NASDAQ equity security that has a market price of less than $5.00 per share. The market price of our common stock on the OTCBB during the period from November 6, 2003 to December 31, 2014 ranged between a high of $3.20 and a low of $0.01 per share, and our common stock is deemed penny stock for the purposes of the Exchange Act. The additional sales practice and disclosure requirements imposed upon brokers-dealers may discourage broker-dealers from effecting transactions in our common stock, which could severely limit the market liquidity of the stock and impede the sale of our stock in the secondary market.

A broker-dealer selling penny stock to anyone other than an established customer or accredited investor, generally, an individual with net worth in excess of $1,000,000 or an annual income exceeding $200,000, or $300,000 together with his or her spouse, must make a special suitability determination for the purchaser and must receive the purchaser’s written consent to the transaction prior to sale, unless the broker-dealer or the transaction is otherwise exempt. In addition, the penny stock regulations require the broker-dealer to deliver, prior to any transaction involving a penny stock, a disclosure schedule prepared by the SEC relating to the penny stock market, unless the broker-dealer or the transaction is otherwise exempt. A broker-dealer is also required to disclose commissions payable to the broker-dealer and the registered representative and current quotations for the securities. Finally, a broker-dealer is required to send monthly statements disclosing recent price information with respect to the penny stock held in a customer’s account and information with respect to the limited market in penny stocks.

There is substantial doubt about our ability to continue our activities as a going concern, which may hinder our ability to obtain future financing.

The continuation of the Company as a going concern is dependent upon the Company attaining and maintaining profitable operations, and raising additional capital. The financial statements do not include any adjustment relating to the recovery and classification of recorded asset amounts or the amount and classification of liabilities that might be necessary should our company discontinue operations. Due to the uncertainty of our ability to meet our current operating expenses, in their report on the annual financial statements for the years ended December 31, 2014, our independent auditors included an explanatory paragraph regarding the doubt about our ability to continue as a going concern. Our financial statements contain additional note disclosures describing the status of the Company. The continuation of our business is dependent upon us raising additional financial support, and maintaining profitable operations. The issuance of additional equity securities by us could result in a substantial dilution in the

12

equity interests of our current stockholders. Obtaining commercial loans, assuming those loans would be available, will increase our liabilities and future cash commitments. If the Company should fail to continue as a going concern, you may lose the value of your investment in the Company.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not Applicable

ITEM 2. PROPERTIES

Our principal corporate and executive offices are located at 15950 N. Dallas Parkway, Suite 400, Dallas, Texas 75248. Our telephone number is (888) 344-9964. We rent our corporate office space on a month-to-month basis. We do not currently maintain any investments in real estate, real estate mortgages or securities of persons primarily engaged in real estate activities, nor do we expect to do so in the foreseeable future.

ITEM 3. LEGAL PROCEEDINGS

We are not aware of any material pending or threatened litigation or of any proceedings known to be contemplated by governmental authorities which are, or would be, likely to have a material adverse effect upon us or our operations, taken as a whole other than stated below. There are no material proceedings pursuant to which any of our directors, officers or affiliates or any owner of record or beneficial owner of more than 5% of our securities or any associate of any such director, officer or security holder is a party adverse to us or has a material interest adverse to us.

On December 23, 2011, Sky Petroleum delivered Notice of Arbitration under the Arbitration Rules of the United Nations Commission on Internal Trade Law to National Agency of Natural Resources and to the Ministry of Economy, Trade and Energy of Albania to institute an arbitration proceeding against the Ministry of Economy, Trade and Energy of Albania, acting by and through AKBN, for breach of the PSC in accordance with Article XXI of the PSC. The arbitration proceeding arose out of the termination of the PSC.

On May 7, 2013, the Arbitration Tribunal ruled that the PSC was properly terminated on November 17, 2011, and ruled Sky Petroleum to reimburse AKBN for total fees and expenses in connection with the Arbitration proceeding in the amount of EUR 382,774 ($501,511). As a result of the ruling Sky Petroleum impaired Investment in Oil and Gas Properties, net, related to acquisition and development costs for oil and gas projects in Albania to $ 0, and for the year ended December 31, 2014, Sky Petroleum had an impairment charge of $10,205,220; and accrued a liability of $501,511 (EUR 382,774) related to liability arising from the obligation to reimburse AKBN for total fees and expenses in connection with the Arbitration proceeding. As a result of the ruling Sky Petroleum impaired Investment in Oil and Gas Properties, net, related to acquisition and development costs for oil and gas projects in Albania to $0. The Company had an impairment charge of $10,205,220; and accrued a liability of $501,511 (EUR 382,774) related to liability arising from the obligation to reimburse AKBN for total fees and expenses in connection with the Arbitration proceeding plus interest at the rate of 6% per annum from May 7, 2013 through the end of December 31, 2014.

On May 20, 2015, the Company received a copy of a Notice of Default Judgment issued by the United States District Court for the Western District of Texas Austin Division in the matter: Ministry of Energy and Industry of the Government of the Republic of Albania, formerly known as the Ministry of Economy, Trade and Energy (acting by and through the National Agency of Natural Resources) vs. Sky Petroleum, Inc. (Case No. 14-cv-0112-SS), issued on February 11, 2015. The complaint was filed with the Court on December 12, 2014, as an application to confirm the foreign arbitration award arising out of the decision by an arbitration tribunal issued under the 1976 UNICITRAL RULES related to the arbitration proceeding between the Company and AKBN arising from the termination of a PSC.

The Company’s registered agent, Paracorp Incorporated (the “Registered Agent”), in Nevada was served the complaint and summons on December 22, 2014, notice of default judgment on February 12, 2015, and a request for production of documents on March 27, 2015. The Registered Agent failed to deliver the documents served on the Company to the Company. The Company contacted the Registered Agent on April 24, 2015, regarding an inquiry about the Judgment and was informed that no service had been made on the Company. After receipt of a demand letter from AKBN counsel dated May 20, 2015, the Registered Agent confirmed it had received prior service and indicated that it was unable to provide notice of the service to the Company. On May 21, 2015, the Company received copies of the documents served on the Registered Agent.

13

The Judgment affirmed AKBN damages as described above in the May 7, 2013 ruling. The Company is currently in settlement discussions with AKBN.

ITEM 4. MINE SAFETY DISCLOSURE

Not applicable.

14

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Our common stock is quoted as “SKPI” on the Over the Counter Bulletin Board ( “OTCBB”), which is sponsored by the Financial Industry Regulatory Authority ( “FINRA”). The OTCBB is a network of security dealers who buy and sell stock. The dealers are connected by a computer network, which provides information on current “bids” and “asks” as well as volume information. The OTCBB is not considered a “national exchange.” Our common stock commenced trading on the OTCBB on November 3, 2003.

The high and low bid quotations of our common stock on the OTCBB as reported by the FINRA were as follows:

Period | High | Low | ||||||

2014 | ||||||||

First Quarter | $ | 0.09 | $ | 0.04 | ||||

Second Quarter | $ | 0.08 | $ | 0.04 | ||||

Third Quarter | $ | 0.06 | $ | 0.03 | ||||

Fourth Quarter | $ | 0.10 | $ | 0.01 | ||||

2013 | ||||||||

First Quarter | $ | 0.17 | $ | 0.09 | ||||

Second Quarter | $ | 0.18 | $ | 0.05 | ||||

Third Quarter | $ | 0.12 | $ | 0.07 | ||||

Fourth Quarter | $ | 0.12 | $ | 0.06 | ||||

The above quotations reflect inter-dealer prices, without retail mark-up, markdown or commission and may not necessarily represent actual transactions.

As of December 31, 2014, the closing bid quotation for our common stock was $0.03 per share as quoted by the OTCBB. On August 28, 2015, the closing bid quotation on our common stock was $0.02 as quoted by the OTCBB.

Holders

As of August 28, 2015, we had 76,533,709 shares of common stock outstanding, held by 36 registered stockholders.

Dividends

The declaration of dividends on our common shares is within the discretion of our board of directors and will depend upon the assessment of, among other factors, results of operations, capital requirements and the operating and financial condition of the Company. The Board has never declared a dividend on the common shares. At the present time, we anticipate that all available funds will be invested to finance the growth of our business.

15

Securities Authorized for Issuance under Equity Compensation Plans

EQUITY COMPENSATION PLAN INFORMATION

Number of securities to be issued upon exercise of outstanding options, warrants, and rights | Weighted-average exercise price of outstanding options, warrants, and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | ||||||||

(a) | (b) | (c) | ||||||||

Equity compensation plans approved by security holders (1) | 2,400,000 | $ | 0.49 | 4,200,959 | ||||||

Equity compensation plans not approved by security holders | N/A | N/A | N/A | |||||||

(1) | We have two stock option plans: a stock incentive plan for non-U.S. residents and a stock incentive plan for U.S. residents. Our stock incentive plan for non-U.S. residents authorizes the issuance of stock options to acquire up to 10% of our issued and outstanding shares of common stock (currently 7,653,371 shares, based on 76,533,709 issued shares of common stock at December 31, 2014) , and our stock incentive plan for U.S. residents authorizes the issuance of stock options to acquire up to a maximum of 3,321,600 shares of common stock (less the number of shares issuable upon exercise of options granted by us under all other stock incentive plans on the date of any grant under the U.S. plan). As of December 31, 2014, 1,150,000 options were granted under the U.S. plan and 1,250,000 options were granted under the non-U.S. plan. A total of 6,403,371 options are available for grant under the Non-U.S. Plan and a total of 2,171,600 are available for grant under the U.S. Plan. |

Adoption of Non-U.S. Stock Option Plan

On July 26, 2005, we adopted, and on July 31, 2006, our stockholders approved, the Sky Petroleum, Inc. Non-U.S. Stock Option Plan, effective as of April 1, 2005. The Non-U.S. Plan authorizes the issuance of stock options to acquire up to 10% of our issued and outstanding shares of common stock. The purpose of the Non-U.S. Plan is to aid us in retaining and attracting Non-U.S. residents that are capable of enhancing our prospects for future success, to offer such personnel additional incentives to exert maximum efforts for the success of our business, and to afford such personnel an opportunity to acquire a proprietary interest in the Company through stock options. Our Compensation Committee administers the Non-U.S. Plan and determines the terms and conditions under which options to purchase shares of our common stock may be awarded. The term of an option granted under the Non-U.S. Plan cannot exceed seven years and the exercise price for options granted under the Non-U.S. Plan cannot be less than the fair market value of our common stock on the date of grant.

Adoption of 2005 U.S. Stock Incentive Plan

On August 25, 2005, we adopted, and on July 31, 2006 our stockholders approved, the Sky Petroleum, Inc. 2005 U.S. Stock Incentive Plan for U.S. residents. The U.S. Plan authorizes the issuance of stock options and other awards to acquire up to a maximum of 3,321,600 shares of our common stock (less the number of shares issuable upon exercise of options granted by us under all other stock incentive plans on the date of any grant under the plan). The purpose of the U.S. Plan is to aid the Company in retaining and attracting U.S. personnel capable of enhancing our prospects for future success, to offer such personnel additional incentives to exert maximum efforts for the success of our business, and to afford such personnel an opportunity to acquire a proprietary interest in the Company through stock options and other awards. The U.S. Plan provides for the grant of incentive stock options (within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended), options that are not incentive stock options, stock appreciation rights and various other stock-based grants. Our Compensation Committee administers the U.S. Plan and determines the terms and conditions under which options to purchase shares of our common stock or other awards may be granted to eligible participants. The term of an incentive stock option granted under the U.S. Plan cannot exceed ten years and the exercise price for options granted under the U.S. Plan cannot be less than the fair market value of our common stock on the date of grant.

16

Repurchase of Securities

During the period covered by this Annual Report, neither us nor any of our affiliates repurchased common shares of the Company registered under Section 12 of the Exchange Act of 1934, as amended.

ITEM 6. SELECTED FINANCIAL DATA

Not applicable.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

You should read the following discussion and analysis of our financial condition and results of operations together with our consolidated financial statements and related notes appearing elsewhere in this Annual Report. This discussion and analysis contains forward-looking statements that involve risks, uncertainties and assumptions. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of many factors, including, but not limited to, those set forth under “Risk Factors” above and elsewhere in this Annual Report. See section” Cautionary Note Regarding Forward-Looking Statements” above.

This discussion and analysis should be read in conjunction with the accompanying consolidated financial statements of the Company and related notes. The discussion and analysis of the financial condition and results of operations are based upon the consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires the Company to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of any contingent liabilities at the financial statement date and reported amounts of revenue and expenses during the reporting period. On an on-going basis the Company reviews its estimates and assumptions. The estimates were based on historical experience and other assumptions that the Company believes to be reasonable under the circumstances. Actual results are likely to differ from those estimates under different assumptions or conditions, but the Company does not believe such differences will materially affect our financial position or results of operations. Critical accounting policies, the policies the Company believes are most important to the presentation of its financial statements and require the most difficult, subjective and complex judgments, are outlined below in the sub-section "Management’s Discussion and Analysis of Financial Condition and Results of Operations - Critical Accounting Policies,” and have not changed significantly.

Overview and Plan of Operations

Our primary business is to identify opportunities to either make direct property acquisitions or to fund exploration or development of oil and natural gas properties of others under arrangements in which we will finance the costs in exchange for interests in the oil or natural gas revenue generated by the properties. Such arrangements are commonly referred to as farm-ins to us, or farm-outs by the property owners farming out to us. There can be no assurance that we will successfully implement our business strategy or meet our goals during the next twelve months.

Comparison of 2014 Statement of Operations to 2013 Statement of Operations

Net Income/Loss:

During the year ended December 31, 2014 we had net income of $66,014 as compared to a net loss of $12,918,008 during the year ended December 31, 2013.

We did not generate any revenue from operations in 2014 or 2013.

We do not expect to generate any operating revenue until we complete exploration and development on our properties.

Operating expenses:

Total operating income in 2014 of $134,675 as compared to total operating expenses of $12,906,438 for 2013, a decrease of $13,041,113. The operating income in 2014 primarily attributable to the Company negotiating a settlement reducing legal costs owed of $760,202 and a one-time impairment of Albanian assets in 2013 for the Albania oil and gas property of $10,205,220 and related arbitration expenses of $941,314. Additionally, a reduction in travel expenses for 2014 of $224,519 ($44,068 in 2014;

17

$268,587 in 2013) and decreases in other general and administrative expenses of $175,144 ($310,122 in 2014; $485,266 in 2013); decreases in consulting fees of $173,661 ($54,727 in 2014; $228,388 in 2013), and legal and accounting expenses decreased by $556,849 related to the Arbitration matter ($210,613 in 2014; $767,462 in 2013). We expect operating expenses to decrease in 2015 as our arbitration dispute was decided.

Liquidity and Capital Resources

A component of our operating plan is the ability to obtain additional capital through additional equity and/or debt financing to fund new projects. We had cash on hand of approximately $13,534 at December 31, 2014.

The current market conditions could make it difficult or impossible for us to raise necessary funds to meet our capital requirements. If we are unable to obtain financing through equity investments, we will seek alternative financing solutions including, but not limited to, credit facilities, debenture issuances or third party funding of our arbitration.

Net cash used in operating activities during the year ended December 31, 2014 was $458,461 as compared to net cash used in operating activities of $1,418,063 for the comparable period in 2013, a decrease of $959,602. This decrease in cash used in operations is primarily due to decreased operating results including reduced legal and consulting expenses. Cash provided by investing activities in 2014 of $0 as compared to $1,500,000 in 2013 from a maturing CD released. Cash from financing activities was $194,000 for issuance of shares in 2014 reduced by debt payments compared to $150,000 in 2013 for issuance of shares from the private placement proceeds of convertible debt.

Total assets as of December 31, 2014 were $33,041 compared to total assets of $303,499 as of December 31, 2013. Stockholder’s deficit as of December 31, 2014 was $1,759,074 compared to $2,101,261 as of December 31, 2013. The decrease in assets was related to cash outflows for operating expenses.

As of December 31, 2014 we had current assets of $13,534 which consists of cash and cash equivalents. We had current liabilities of $1,760,811 resulting in a working capital deficit of $1,747,277 for the twelve months ended December 31, 2014 as compared to $2,126,765 for the same period ended 2013. Total liabilities were $1,792,115 and $2,404,760 at December 31, 2014 and 2013, respectively.

In May 2014, the Company initiated subscriptions agreements for a non-brokered private placement to raise $400,000. Upon receipt of proceeds the Company will issue up to 8,000,000 Class D Units at $0.05 per unit to investors. Each Class D Unit consists of one share of common stock of the Company, par value US$0.001 (a “Common Share”) and one Class D Warrant (each, a “Class D Warrant”). Each Class D Warrant is exercisable to acquire one Common Share of the Company, par value US$0.001 at an exercise price of US$0.10 per Class D Warrant Share until May 29, 2016 (the two (2) year anniversary of the Closing Date). A related party entity invested $325,000 in units and paid in multiple transactions. The first payment was on June 23, 2014 for $55,000. The second payment was on June 25, 2014 for $45,000. A third payment was received on July 7, 2014 for $69,000 leaving a balance of $156,000 receivable from shareholder as of the date of this filing. Another accredited investor invested $75,000 worth in units and paid on June 12, 2014. On, September 9, 2014, the 8,000,000 Common Shares were issued to the investors as restricted stock.

On January 8, 2013 the Company obtained loans through the offer of 8% Convertible Promissory Notes due May 8, 2014 (the “Notes”) in the aggregate amount of $150,000 (the “Offering”). The Notes are convertible into shares of Common Shares of the Company (“Common Shares”) at a conversion price of $0.25 per share (the “Conversion Price”) and interest on the Notes is payable in cash or, at the option of the Company, in-kind in Common Shares at the Conversion Price. The note was extended to May 8, 2016.

Subsequent to December 31, 2014, effective May 5, 2015, the Company entered into a Note Purchase Agreement (“Note Purchase Agreement”) with an accredited investor (as defined under Rule 501(a) of Regulation D under the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”) outside the United States, in connection with the sale of a Convertible Promissory Note, due May 5, 2017 (the “Note”), in the principal amount of US$500,000. The Note is convertible into shares of common stock of the Company at a conversion price of US$0.08 per share. The Note Purchase Agreement contained customary representations and warranties. Under the terms of the Note Purchase Agreement, the Company issued a Note, due May 5, 2017, in the principal amount of US$500,000. The Note is convertible into Common Shares at the Conversion Price. Interest on the Note shall accrue at a rate equal to three percent (3%) per annum and interest on the Note is payable on the Maturity Date in cash or, at the option of the Company, in-kind in shares of common stock of the Company at the Conversion Price.

18

Default Interest shall increase to six percent (6%) per annum commencing immediately upon an Event of Default. Default Interest shall be paid in cash. An “Event of Default” is deemed to occur upon:

(a) | failure to pay principal and interest on any of the Notes when due; |

(b) | proceedings are commenced for the winding-up, liquidation or dissolution of the Company, unless the Company in good faith actively and diligently contests such proceedings, decree, order or approval, resulting in a dismissal or stay thereof within 60 days of commencement; |

(c) | a decree or order of a court of competent jurisdiction is entered adjudging the Company to be bankrupt or insolvent, or a petition seeking reorganization, arrangement or adjustment of or in respect of the Company is approved under applicable law relating to bankruptcy, insolvency or relief of debtors; |

(d) | the Company makes an assignment for the benefit of its creditors, or petitions or applies to any court or tribunal for the appointment of a receiver or trustee for itself or any substantial part of its property, or commences for itself or acquiesces in any proceeding under any bankruptcy, insolvency, reorganization, arrangement or readjustment of debt law or statute or any proceeding for the appointment of a receiver or trustee for itself or any substantial part of its property, or suffers any such receivership or trusteeship; or |

(e) | a resolution is passed for the winding-up or liquidation of the Company. |

The Holder shall have the right, at its sole option, to declare this Note immediately due and payable, irrespective of the stated Maturity Date, upon an Event of Default.

Our lack of operating history makes predictions of future operating results difficult to ascertain. Our prospects must be considered in light of the risks, expenses and difficulties frequently encountered by companies in their early stage of development, particularly companies searching for opportunities in the oil and gas industry. Such risks include, but are not limited to, our ability to secure a drilling rig, our ability to successfully drill for hydrocarbons, commodity price fluctuations, delays in drilling or bringing production, if any, on line, an evolving business model and unpredictable availability of qualified oil and gas exploration prospects and the management of growth. To address these risks we must, among other things, implement and successfully execute our business and development plan, successfully identify future drilling locations, continue to rely on qualified independent consultants, respond to competitive developments, and attract, retain and motivate qualified personnel. There can be no assurance that we will be successful in addressing such risks, and the failure to do so can have a material adverse effect on our business prospects, financial condition and results of operations.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements.

Inflation

We do not believe that inflation has had a significant impact on our consolidated results of operations or financial condition.

Critical Accounting Policies

Use of estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ significantly from those estimates.

Investment in oil and gas properties

The Company follows the full cost method of accounting for oil and gas operations whereby exploration and development expenditures are capitalized. Such costs may include geological and geophysical, drilling, equipment and technical consulting directly related to exploration and development activities. The aggregate of net capitalized costs and estimated future development costs is amortized using the units of production method based on estimated proved oil and gas reserves.

Advances for oil and gas interests are transferred to oil and gas properties as actual exploration and development expenditures are incurred.

19

Costs related to unproved properties and major development projects may be excluded from costs subject to depletion until proved reserves have been determined or their value is impaired. These properties are assessed periodically and any impairment is transferred to costs subject to depletion.

Under the full cost method of accounting, the net book value of oil and natural gas properties, less related deferred income taxes, may not exceed a calculated "ceiling”. The ceiling limitation is the discounted estimated after-tax future net cash flows from proved oil and natural gas properties. In calculating future net cash flows, current prices and costs are generally held constant indefinitely. The net book value of oil and natural gas properties, less related deferred income taxes is compared to the ceiling on a quarterly and annual basis. Any excess of the net book value, less related deferred income taxes, is generally written off as an expense. Under rules and regulations of the SEC, all or a portion of the excess above the ceiling may not be written off if, subsequent to the end of the quarter or year but prior to the release of the financial results, prices have increased sufficiently that all or a portion of such excess above the ceiling would not have existed if the increased prices were used in the calculations.

Revenue is recognized in the period in which title to the petroleum or natural gas transfers to the purchaser.

Income taxes

We follow U.S. GAAP, for recording the provision for income taxes. Deferred tax assets and liabilities are computed based upon the difference between the financial statement and income tax basis of assets and liabilities using the enacted marginal tax rate applicable when the related asset or liability is expected to be realized or settled. Deferred income tax expenses or benefits are based on the changes in the asset or liability each period. If available evidence suggests that it is more likely than not that some portion or all of the deferred tax assets will not be realized, a valuation allowance is required to reduce the deferred tax assets to the amount that is more likely than not to be realized. Future changes in such valuation allowance are included in the provision for deferred income taxes in the period of change. Deferred income taxes may arise from temporary differences resulting from income and expense items reported for financial accounting and tax purposes in different periods. Deferred taxes are classified as current or non-current, depending on the classification of assets and liabilities to which they relate. Deferred taxes arising from temporary differences that are not related to an asset or liability are classified as current or non-current depending on the periods in which the temporary differences are expected to reverse.