UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| x | QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED JUNE 30, 2015

Commission file number 333-200344

TRIMAX CONSULTING, INC.

(Exact name of registrant as specified in its charter)

Nevada

(State or other jurisdiction of incorporation or organization)

319 S. Robertson St. 2nd Floor Los Angeles, CA 90211

(Address of principal executive offices, including zip code.)

(855) 777-5666

(Telephone number, including area code)

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the last 90 days. YES x NO o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer, "accelerated filer," "non-accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | o | Accelerated filer | o |

| Non-accelerated filer | o | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES o NO x

State the number of shares outstanding of each of the issuer's classes of common equity, as of the latest practicable date: 5,000,000 shares as of June 30, 2015.

1

ITEM 1. FINANCIAL STATEMENTS

| TRIMAX CONSULTING, INC. | ||||||||

| BALANCE SHEET | ||||||||

| ` | June 30, 2015 | December 31, 2014 | ||||||

| (Unaudited) | (Unaudited) | |||||||

| Assets | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 25,296 | $ | 7,000 | ||||

| Investment in Real Property Tax Liens | 1,231 | 0 | ||||||

| Total Current assets | 26,527 | 7,000 | ||||||

| Total Assets | $ | 26,527 | $ | 7,000 | ||||

| Liabilities and Equity(Deficit) | ||||||||

| Current liabilities | ||||||||

| Accrued Expenses | $ | 4,213 | $ | 4,213 | ||||

| Deferred Revenue | 0 | 1,000 | ||||||

| Related Party Officer Demand Loan | 500 | 4,500 | ||||||

| Total Current Liabilities | 4,713 | 9,713 | ||||||

| Commitments and Contingencies - Note 6 | ||||||||

| TRIMAX CONSULTING, INC. Shareholders' Equity(Deficit) | ||||||||

| Common Stock, $0.0001 par value; 50,000,000 shares authorized, | ||||||||

| 25,957,500 and 25,000,000 issued and outstanding | ||||||||

| at 6/30/2015 & 12/31/2014, respectively. | 2,596 | 2,500 | ||||||

| Additional Paid in Capital | 17,054 | (2,000) | ||||||

| Accumulated deficit | 2,164 | (3,213) | ||||||

| Total Equity | 21,814 | (2,713) | ||||||

| Total Liabilities and Equity(Deficit) | $ | 26,527 | $ | 7,000 | ||||

| "The accompanying notes are an integral part of these financial statements" | ||||||||

2

| TRIMAX CONSULTING, INC. | |||||

| STATEMENT OF OPERATIONS | |||||

| For the Three Months ended June 30, 2015 | For the Six Months ended June 30, 2015 | ||||

| (Unaudited) | (Unaudited) | ||||

| Revenues | 3,500 | 9,000 | |||

| Operating Expenses | 3,073 | 3,623 | |||

| Net Income(Loss) from Operations | 427 | 5,377 | |||

| Other Income(Expenses) | |||||

| Interest Expense | 0 | 0 | |||

| Net Income(Loss) from Operations | |||||

| Before Income Taxes | 427 | 5,377 | |||

| Tax Expense | 0 | 0 | |||

| Net Income(Loss) | 427 | 5,377 | |||

| Basic and Diluted Loss Per Share | 0.0000 | 0.0002 | |||

| Weighted average number | |||||

| of shares outstanding | 25,140,577 | 25,227,472 | |||

| "The accompanying notes are an integral part of these financial statements" | |||||

3

| TRIMAX CONSULTING, INC. | ||||||

| STATEMENT OF CASH FLOWS | ||||||

| For the Six Months Ended June 30, 2015 | ||||||

| (Unaudited) | ||||||

| Cash flows from operating activities: | ||||||

| Net income (loss) | $ | 5,377 | ||||

| (Increase)decrease in tax liens | (1,231) | |||||

| Increase(decrease) in deferred revenue | (1,000) | |||||

| Net cash used in operating activities | 3,146 | |||||

| Cash flows from investing activities: | ||||||

| None | 0 | |||||

| Net cash provided(used) by investing activities | 0 | |||||

| Cash flows from financing activities: | ||||||

| Common stock issued | 19,150 | |||||

| Repayments to related party loans | (4,000) | |||||

| Net cash provided(used) by financing activities | 15,150 | |||||

| Increase in cash and equivalents | 18,296 | |||||

| Cash and cash equivalents at beginning of period | 7,000 | |||||

| Cash and cash equivalents at end of period | $ | 25,296 | ||||

| "The accompanying notes are an integral part of these financial statements" | ||||||

4

| TRIMAX CONSULTING, INC. | ||||||||||

| STATEMENT OF CASH FLOWS - CONTINUED | ||||||||||

| For the Six Months Ended June 30, 2015 | ||||||||||

| (Unaudited) | ||||||||||

| SUPPLEMENTAL DISCLOSURE OFCASH FLOW INFORMATION | ||||||||||

| None | $ | 0 | ||||||||

| SUPPLEMENTAL DISCLOSURE OF NON-CASH INVESTING AND FINANCING ACTIVITIES | ||||||||||

| None | $ | 0 | ||||||||

| "The accompanying notes are an integral part of these financial statements" | ||||||||||

5

Note 1. Organization, History and Business

Trimax Consulting, Inc. (“the Company”)

was incorporated in Nevada on May 19, 2014. The Company was established for the purpose of real estate consulting and the purchasing

of Tax Liens.

Note 2. Summary of Significant Accounting Policies

Revenue Recognition

Revenue is derived from sales of products to distributors and consumers. Revenue is recognized in accordance with Staff Accounting Bulletin (“SAB”) No. 101, “Revenue Recognition in Financial Statements,” as revised by SAB No. 104. As such, the Company recognizes revenue when persuasive evidence of an arrangement exists, title transfer has occurred, the price is fixed or readily determinable, and collectability is probable. Sales are recorded net of sales discounts and terms are recorded by contract.

Accounts Receivable

Accounts receivable is reported at the customers’ outstanding balances, less any allowance for doubtful accounts. Interest is not accrued on overdue accounts receivable.

Allowance for Doubtful Accounts

An allowance for doubtful accounts on accounts receivable is charged to operations in amounts sufficient to maintain the allowance for uncollectible accounts at a level management believes is adequate to cover any probable losses. Management determines the adequacy of the allowance based on historical write-off percentages and information collected from individual customers. Accounts receivable are charged off against the allowance when collectability is determined to be permanently impaired.

Stock Based Compensation

When applicable, the Company will account for stock-based payments to employees in accordance with ASC 718, “Stock Compensation” (“ASC 718”). Stock-based payments to employees include grants of stock, grants of stock options and issuance of warrants that are recognized in the consolidated statement of operations based on their fair values at the date of grant.

The Company accounts for stock-based payments to non-employees in accordance with ASC 505-50, “Equity-Based Payments to Non-Employees.” Stock-based payments to non-employees include grants of stock, grants of stock options and issuances of warrants that are recognized in the consolidated statement of operations based on the value of the vested portion of the award over the requisite service period as measured at its then-current fair value as of each financial reporting date.

The Company calculates the fair value of option grants and warrant issuances utilizing the Binomial pricing model. The amount of stock-based compensation recognized during a period is based on the value of the portion of the awards that are ultimately expected to vest. ASC 718 requires forfeitures to be estimated at the time stock options are granted and warrants are issued to employees and non-employees, and revised, if necessary, in subsequent periods if actual forfeitures differ from those estimates. The term “forfeitures” is distinct from “cancellations” or “expirations” and represents only the unvested portion of the surrendered stock option or warrant. The Company estimates forfeiture rates for all unvested awards when calculating the expense for the period. In estimating the forfeiture rate, the Company monitors both stock option and

6

Note 2. Summary of Significant Accounting Policies (continued)

warrant exercises as well as employee termination patterns. The resulting stock-based compensation expense for both employee and non-employee awards is generally recognized on a straight-line basis over the period in which the Company expects to receive the benefit, which is generally the vesting period.

Loss per Share

The Company reports earnings (loss) per share in accordance with ASC Topic 260-10, "Earnings per Share." Basic earnings (loss) per share is computed by dividing income (loss) available to common shareholders by the weighted average number of common shares available. Diluted earnings (loss) per share is computed similar to basic earnings (loss) per share except that the denominator is increased to include the number of additional common shares that would have been outstanding if the potential common shares had been issued and if the additional common shares were dilutive. Diluted earnings (loss) per share has not been presented since there are no dilutive securities.

Cash and Cash Equivalents

For purpose of the statements of cash flows, the Company considers cash and cash equivalents to include all stable, highly liquid investments with maturities of three months or less.

Concentration of Credit Risk

The Company primarily transacts its business with one financial institution. The amount on deposit in that one institution may from time to time exceed the federally-insured limit.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Business segments

ASC 280, “Segment Reporting” requires use of the “management approach” model for segment reporting. The management approach model is based on the way a company’s management organizes segments within the company for making operating decisions and assessing performance. The Company determined it has one operating segment as of June 30, 2015.

Investment in Real Property Tax Liens – The investments in real property tax liens are accounted for as investments in troubled debt and are carried at cost. Collection of interest, penalties and expense reimbursements is not certain and is recognized upon being realized. The Company has evaluated the collectability of the tax liens and believes the investments are realizable over time as the first position liens are secured by the related real property and the estimated fair value of the real property is in excess of the carrying value of the tax liens and the estimated cost to foreclose and sell the real property. Therefore no impairment was recognized on the tax liens as of June 30, 2015.

Income Taxes

The Company accounts for its income taxes under the provisions of ASC Topic 740, “Income Taxes.” The method of accounting for income taxes under ASC 740 is an asset and liability method. The asset and liability method requires the recognition of deferred tax liabilities and assets for the expected future tax

7

Note 2. Summary of Significant Accounting Policies (continued)

consequences of temporary differences between tax bases and financial reporting bases of other assets and liabilities.

Emerging growth Company

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and, as such, may elect to comply with certain reduced public company reporting requirements for future filings.

Recent Accounting Pronouncements

On June 10, 2014, the FASB issued Accounting Standards Update (ASU) No. 2014-10, Development Stage Entities (Topic 915) – Elimination of Certain Financial Reporting Requirements, Including an Amendment to Variable Interest Entities Guidance in Topic 810, Consolidation, which eliminates the concept of a development stage entity (DSE) in its entirety from current accounting guidance. The Company has elected early adoption of this new standard.

The Company has implemented all other new accounting pronouncements that are in effect and that may impact its consolidated financial statements and does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

Note 3. Income Taxes

Deferred income tax assets and liabilities are computed annually for differences between financial statement and tax bases of assets and liabilities that will result in taxable or deductible amounts in the future based on enacted tax laws and rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected to be realized. Income tax expense is the tax payable or refundable for the period plus or minus the change during the period in deferred tax assets and liabilities.

The effective tax rate on the net loss before income taxes differs from the U.S. statutory rate as follows:

| 6/30/2015 | |||||||||

| U.S statutory rate | 34.00% | ||||||||

| Less valuation allowance | -34.00% | ||||||||

| Effective tax rate | 0.00% | ||||||||

The significant components of deferred tax assets and liabilities are as follows:

| 6/30/2015 | |||||||||

| Deferred tax assets | |||||||||

| Net operating losses | $ | 5,377 | |||||||

| Deferred tax liability | |||||||||

| Net deferred tax assets | 1,828 | ||||||||

| Less valuation allowance | (1,828) | ||||||||

| Deferred tax asset - net valuation allowance | $ | 0 | |||||||

8

Note 3. Income Taxes (Continued)

On an interim basis, the Company had no net operating losses and has $0 available to offset future income for income tax reporting purposes, which will expire in various years through 2032, if not previously utilized. However, the Company’s ability to use the carryover net operating loss may be substantially limited or eliminated pursuant to Internal Revenue Code Section 382.The Company adopted the provisions of ASC 740-10-50, formerly FIN 48, and “Accounting for Uncertainty in Income Taxes”. The Company had no material unrecognized income tax assets or liabilities as of June 30, 2015.

The Company’s policy regarding income tax interest and penalties is to expense those items as general and administrative expense but to identify them for tax purposes. During the period May 19, 2014(inception) through June 30, 2015, there were no income tax, or related interest and penalty items in the income statement, or liabilities on the balance sheet. The Company files income tax returns in the U.S. federal jurisdiction and Nevada state jurisdiction. We are not currently involved in any income tax examinations.

Note 4. Related Party Transactions

Oeshadebie Waterford has lent the company a net total of $500 to the company for the period from May 19, 2014 to June 30, 2015. These funds have been used for working capital to date.

Note 5. Stockholders’ Equity

Common Stock

The holders of the Company's common stock are entitled to one vote per share of common stock held. The Company recorded a 5 for 1 forward split on May 18, 2015. All prior periods have been restated to reflect this transaction. As of June 30, 2015 the Company had 25,957,500 shares issued and outstanding.

Note 6. Commitments and Contingencies

Commitments:

The Company currently has no long term commitments as of our balance sheet date.

Contingencies:

None as of our balance sheet date.

Note 7 – Net Income(Loss) Per Share

The following table sets forth the information used to compute basic and diluted net income per share attributable to Carbon Credit International, Inc. for the six months ended June 30, 2015:

| 6/30/2015 | |||||||||||

| Net Income (Loss) | $ | 5,377 | |||||||||

| Weighted-average common shares outstanding basic: | |||||||||||

| Weighted-average common stock | 25,227,472 | ||||||||||

| Equivalents | |||||||||||

| Stock options | 0 | ||||||||||

| Warrants | 0 | ||||||||||

| Convertible Notes | 0 | ||||||||||

| Weighted-average common shares | |||||||||||

| outstanding- Diluted | 25,227,472 | ||||||||||

9

Note 8 - Notes Payable

| Notes payable consist of the following for the periods ended; | 6/30/2015 | |||||||||

| Related party working capital note with no stated interest rate. Note is payable on demand . | ||||||||||

| $ | 500 | |||||||||

| Total Notes Payable | 500 | |||||||||

| Less Current Portion | (500) | |||||||||

| Long Term Notes Payable | $ | 0 | ||||||||

Note 9 - Going Concern

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. Currently, the Company has no operating history and has limited working capital. These factors raise substantial doubt about the Company’s ability to continue as a going concern. Management believes that the Company’s capital requirements will depend on many factors including the success of the Company’s development efforts and its efforts to raise capital. Management also believes the Company needs to raise additional capital for working capital purposes. There is no assurance that such financing will be available in the future. The conditions described above raise substantial doubt about our ability to continue as a going concern. The financial statements of the Company do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts and classifications of liabilities that might be necessary should the Company be unable to continue as a going concern.

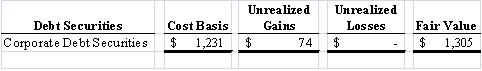

Note 10 - Investments

Investment in Available for Sale Debt Securities

Investment in Real Property Tax Liens – At June 30, 2015, the Company held $1,231 of real property tax liens from various municipalities in the Parrish of Caddo, Louisiana. During the six months ended June 30, 2015, the Company purchased $1,231 of tax lien products. The Louisiana municipal tax liens are receivable from the real property owners and are secured by a first priority lien on the related real property. Upon foreclosure, the Company would obtain ownership of the real property. The tax lien receivables accrue interest up to 1% per month, and accrue penalties at 5%.. The investment in the real property tax liens are accounted for as an investment in troubled debts and are carried at cost. Collection of interest, and penalties is not certain and is recognized upon being realized.

Note 11 - Subsequent Events

There are no subsequent events.

10

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION.

Forward Looking Statements

This section includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like: believe, expect, estimate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements, which apply only as of the date of this report. These forward-looking states are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or out predictions.

Results of Operations

We are still in our development stage and have generated $9,000 in total revenues to date.

We generated revenues of $3,500 for the three month period ended June 30, 2015. Operating expenses for the same three month period were $3,073 all of which were general and administrative.

Since inception we have generated $13,500 in revenues and $8,263 in operating expenses.

Liquidity and Capital Resources

We had $25,296 in cash at June 30, 2015, and there were outstanding liabilities of $4,713. The Company hopes to meet its operating expenses by raising additional funds from its registered offering on Form S-1

There is very little historical financial information about us upon which to base an evaluation of our performance. We are a development stage corporation and have only begun to generate revenues from operations. We cannot guarantee we will be successful in our business operations. Our business is subject to risks inherent in the establishment of a new business enterprise, including limited capital resources and possible cost overruns due to price and cost increases in products.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

ITEM 4. CONTROLS AND PROCEDURES.

Evaluation of Disclosure Controls and Procedures

Management maintains “disclosure controls and procedures,” as such term is defined in Rule 13a-15(e) under the Securities Exchange Act of 1934 (the “Exchange Act”), that are designed to ensure that information required to be disclosed in our Exchange Act reports is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission rules and forms, and that such information is accumulated and communicated to management, including our Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure.

11

In connection with the preparation of this quarterly report on Form 10-Q, an evaluation was carried out by management, with the participation of the Chief Executive Officer and the Chief Financial Officer, of the effectiveness of our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act) as of June 30, 2015.

Based on that evaluation, management concluded, as of the end of the period covered by this report, that our disclosure controls and procedures were effective in recording, processing, summarizing, and reporting information required to be disclosed, within the time periods specified in the Securities and Exchange Commission’s rules and forms.

Changes in Internal Controls over Financial Reporting

As of the end of the period covered by this report, there have been no changes in the internal controls over financial reporting during the quarter ended June 30, 2015, that materially affected, or are reasonably likely to materially affect, our internal control over financial reporting subsequent to the date of management’s last evaluation.

PART II. OTHER INFORMATION

ITEM 6. EXHIBITS.

The following exhibits are included with this quarterly filing. Those marked with an asterisk and required to be filed hereunder, are incorporated by reference and can be found in their entirety in our original Registration Statement on Form S-1, filed under SEC File Number 333-199720, at the SEC website at www.sec.gov :

| Exhibit No. | Description | |

| 3.1 | Articles of Incorporation* | |

| 3.2 | Bylaws* | |

| 31.1 | Sec. 302 Certification of Principal Executive Officer & Chief Financial Officer | |

| 32.1 | Sec. 906 Certification of Principal Executive Officer & Chief Financial Officer | |

| 101 | Interactive data files pursuant to Rule 405 of Regulation S-T |

| *previously filed with the Commission |

12

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this amended report to be signed on its behalf by the undersigned thereunto duly authorized.

|

TRIMAX CONSULTING, INC. Registrant |

|||

| Date: August 18, 2015 | By: |

/s/ Oeshadebie Waterford |

|

|

Name: Title: |

Oeshadebie Waterford Chief Executive Officer, President and Treasurer |

||

13

I, Oeshadebie Waterford, certify that:

| 1. | I have reviewed this Form 10-Q for the quarter ended June 30, 2015 of Trimax Consulting Inc.; |

| 2. | Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

| 3. | Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; |

| 4. | The registrant's other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have: |

| a. | Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

| b. | Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| c. | Evaluated the effectiveness of the registrant's disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| d. | Disclosed in this report any change in the registrant's internal control over financial reporting that occurred during the registrant's most recent fiscal quarter (the registrant's fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial reporting; and |

| 5. | The registrant's other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant's auditors and the audit committee of the registrant's board of directors (or persons performing the equivalent functions): |

| a. | All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant's ability to record, process, summarize and report financial information; and |

| b. | Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. |

August 18, 2015

/s/ Oeshadebie Waterford

Oeshadebie Waterford

Chief Executive Officer, Chief Financial Officer

EXHIBIT 32.1

CERTIFICATION OF CHIEF EXECUTIVE OFFICER AND CHIEF FINANCIAL OFFICER

PURSUANT TO

18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

I, Oeshadebie Waterford, certify, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that the Quarterly Report of Trimax Consulting, Inc. on Form 10-Q for the quarterly period ended June 30, 2015 fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934 and that information contained in such Report on Form 10-Q fairly presents in all material respects the financial condition and results of operations of Trimax Consulting, Inc.

| By: | /s/ Oeshadebie Waterford | |

| Oeshadebie Waterford | ||

|

Chief Executive Officer, Chief Financial Officer (Authorized Officer) August 18, 2015 |