Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HARVEST NATURAL RESOURCES, INC. | d17116d8k.htm |

Exhibit 99.1

HARVEST

The

Oil & Gas Conference Denver

Enercom Oil and Gas Conference

August 19, 2015

Forward Looking Statements HARVEST

Cautionary Statements: Certain statements in this presentation are forward-looking and are based upon Harvest’s current belief as to the outcome and timing of future events.

All statements other than statements of historical facts including planned capital expenditures, increases in oil and gas production, Harvest’s outlook on oil and gas prices, estimates of oil and gas reserves, business strategy and other plans,

estimates, projections, and objectives for future operations, are forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Important factors that could cause

actual results to differ materially from those in the forward-looking statements herein include Harvest’s concentration of assets in Venezuela; timing and extent of changes in commodity prices for oil and gas; political and economic risks

associated with international operations; and other risk factors as described in Harvest’s 2014 Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2015 and June 30, 2015 and other public

filings. Should one or more of these risks or uncertainties occur, or should underlying assumptions prove incorrect, Harvest’s actual results and plans could differ materially from those expressed in the forward-looking statements. Harvest

undertakes no obligation to publicly update or revise any forward-looking statements, which speak as of their respective dates.

Harvest may use certain terms such

as resource base, contingent resources, prospective resources, probable reserves, possible reserves, non-proved reserves or other descriptions of volumes of reserves. These estimates are by their nature more speculative than estimates of proved

reserves and accordingly, are subject to substantially greater risk of being actually realized by the Company. Investors are urged to consider closely the disclosure in our 2014 Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q for the

quarters ended March 31, 2015 and June 30, 2015 and other public filings available from Harvest at 1177 Enclave Parkway, Houston, Texas, 77077 or from the SEC’s website at www.sec.gov.

Contingent resources are resources that are potentially recoverable but not yet considered mature enough for commercial development due to technological or business hurdles.

Prospective resources are those quantities of hydrocarbons which are estimated, as of a given date, to be potentially recoverable from undiscovered accumulations by application of future development projects. They indicate exploration opportunities

and development potential in the event a discovery is made and should not be construed as contingent resources or reserves. The contingent and prospective resources included in this presentation were internally developed by Harvest Natural

Resources.

NYSE: HNR

www.harvestnr.com

2

About Harvest HARVEST

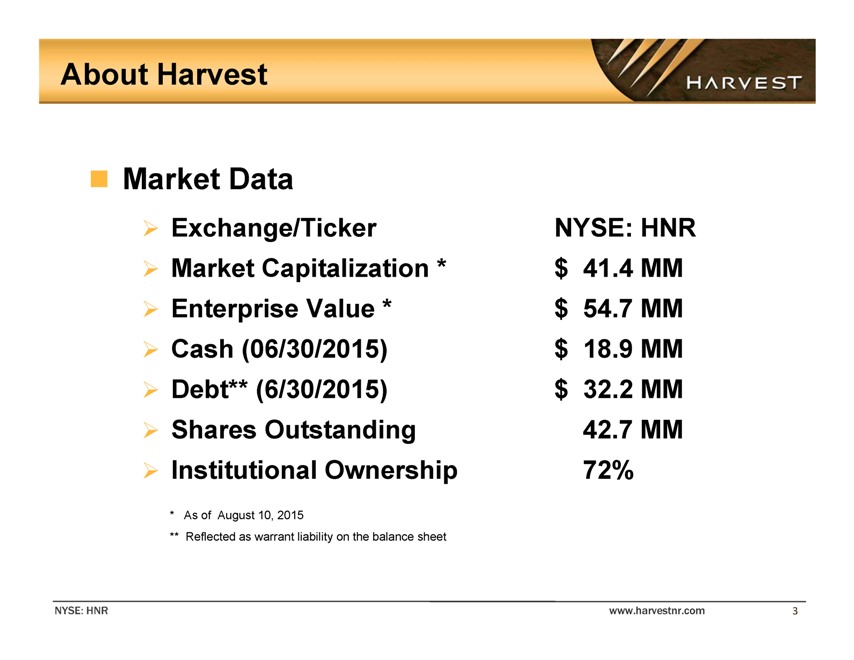

Market Data

Exchange/Ticker NYSE: HNR

Market Capitalization * $ 41.4 MM

Enterprise Value * $ 54.7 MM

Cash (06/30/2015) $ 18.9 MM

Debt** (6/30/2015) $ 32.2 MM

Shares Outstanding 42.7 MM

Institutional Ownership 72%

* As of August 10, 2015

** Reflected as warrant liability on the balance sheet

NYSE: HNR

www.harvestnr.com

3

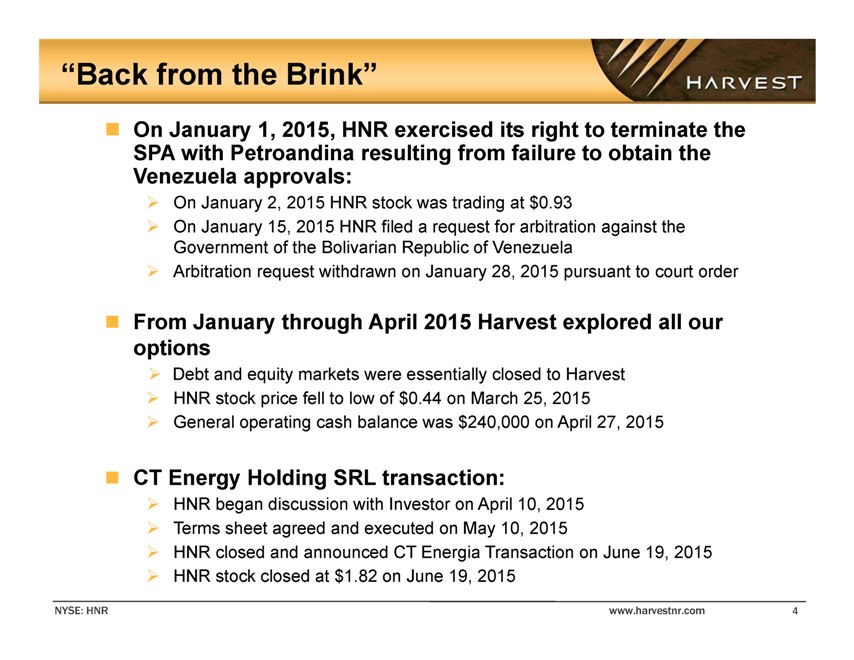

“Back from the Brink” HARVEST

On January 1, 2015, HNR exercised its right to terminate the SPA with Petroandina resulting from failure to obtain the Venezuela approvals:

On January 2, 2015 HNR stock was trading at $0.93

On January 15, 2015 HNR filed a

request for arbitration against the Government of the Bolivarian Republic of Venezuela

Arbitration request withdrawn on January 28, 2015 pursuant to court

order

From January through April 2015 Harvest explored all our options

Debt

and equity markets were essentially closed to Harvest

HNR stock price fell to low of $0.44 on March 25, 2015

General operating cash balance was $240,000 on April 27, 2015

CT Energy Holding SRL

transaction:

HNR began discussion with Investor on April 10, 2015

Terms

sheet agreed and executed on May 10, 2015

HNR closed and announced CT Energia Transaction on June 19, 2015

HNR stock closed at $1.82 on June 19, 2015

NYSE: HNR

www.harvestnr.com

4

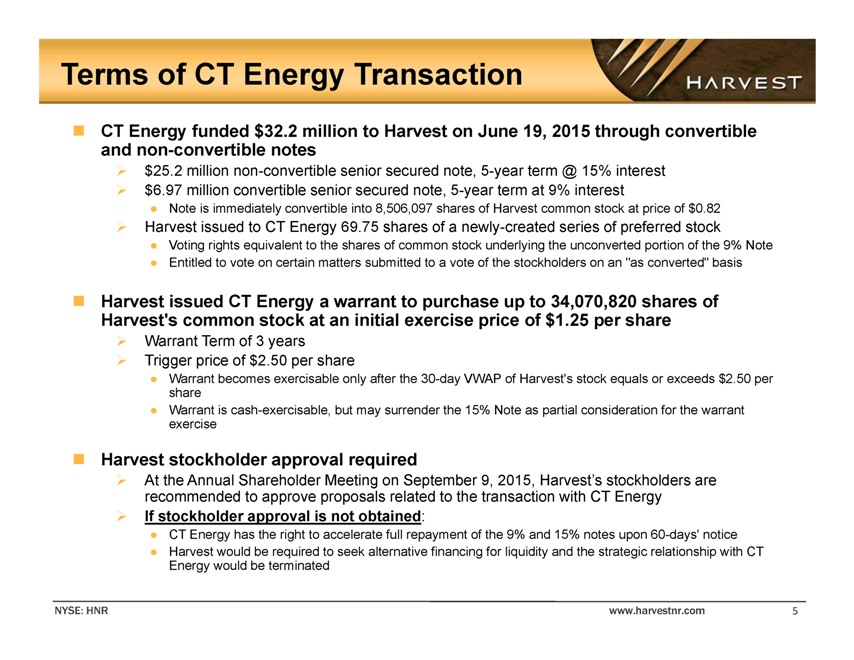

Terms of CT Energy Transaction HARVEST

CT Energy funded $32.2 million to Harvest on June 19, 2015 through convertible and non-convertible notes

$25.2 million non-convertible senior secured note, 5-year term @ 15% interest

$6.97 million

convertible senior secured note, 5-year term at 9% interest

Note is immediately convertible into 8,506,097 shares of Harvest common stock at price of $0.82

Harvest issued to CT Energy 69.75 shares of a newly-created series of preferred stock

Voting rights equivalent to the shares of common stock underlying the unconverted portion of the 9% Note

Entitled to vote on certain matters submitted to a vote of the stockholders on an “as converted” basis

Harvest issued CT Energy a warrant to purchase up to 34,070,820 shares of Harvest’s common stock at an initial exercise price of $1.25 per share

Warrant Term of 3 years

Trigger price of $2.50 per share

Warrant becomes exercisable only after the 30-day VWAP of Harvest’s stock equals or exceeds $2.50 per share

Warrant is cash-exercisable, but may surrender the 15% Note as partial consideration for the warrant exercise

Harvest stockholder approval required

At the Annual Shareholder Meeting on September 9,

2015, Harvest’s stockholders are recommended to approve proposals related to the transaction with CT Energy

If stockholder approval is not obtained:

CT Energy has the right to accelerate full repayment of the 9% and 15% notes upon 60-days’ notice

Harvest would be required to seek alternative financing for liquidity and the strategic relationship with CT Energy would be terminated

NYSE: HNR

www.harvestnr.com

5

Terms of CT Energy Transaction (cont’d) HARVEST

Three new board members

CT Energy appointed three members to the Company’s board of

directors, including one appointee serving as an independent director

Additional draw note provision

Under the five year 15% non-convertible senior secured note CT Energy may elect to provide $2.0 million of additional funds to the Company per month for up to six months following

the one-year anniversary of the closing date of the transaction (up to $12.0 million in aggregate)

Adjustment in interest rate and maturity

If by June 19, 2016, subject to up to six monthly extensions, the volume weighted average price of the Company’s common stock over any consecutive 30-day period has not

equaled or exceeded the trigger price of $2.50 per share, the maturity date of all notes will be extended by two years and the interest rates on the 15% non-convertible note and any additional draw notes will adjust to 8%

Upon conversion of debt and exercising of warrant, CT Energy would own

49.9% of shares

outstanding, subject to shareholders approving related proposals to the transaction at the Annual Meeting

NYSE: HNR www.harvestnr.com 6

Rationale and Benefits Of The Transaction HARVEST

Re-Capitalization of Harvest

Designed to meet Harvest liquidity needs

Repositions Harvest for long-term growth, both in Venezuela and Gabon

Superior to alternative

of funding Chapter 11 reorganization

Strong alignment with current shareholders

The $2.50 warrant trigger price requires substantial appreciation of current shareholder value

CT Energy complements Harvest

Extensive experience in Venezuela

Well-developed relationships in the business and government sectors of Venezuela

Ability to

arrange financial support for future Petrodelta operations

Improved performance of Petrodelta

Expected to facilitate approval of positive changes to the governance of Petrodelta and contractual arrangements between Harvest and the Government of Venezuela

Full distribution of Petrodelta cash flows for operating expenses, capital and dividends

Opens

path to realization of Petrodelta’s full production potential

NYSE: HNR www.harvestnr.com 7

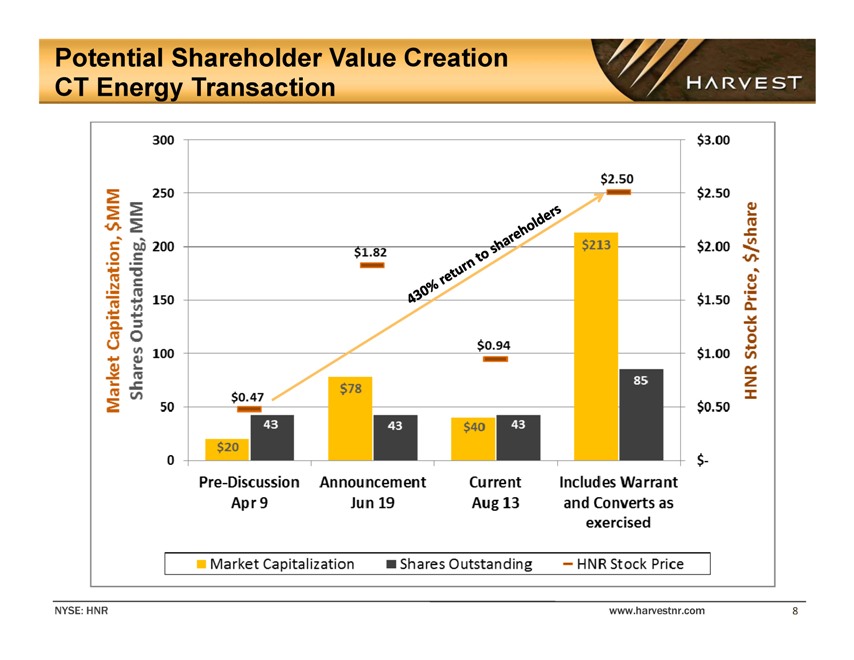

Potential Shareholder Value Creation CT Energy Transaction HARVEST

Market Capitalization, $MM

Shares Outstanding, MM

300

250

200

120

100

50

0

$20 $0.47 43 $78 $1.82 43 $40 $0.94 43 $213 $2.50 85

430% return to

shareholders

$3.00 $2.50 $2.00 $1.50 $1.00 $0.50 $-

HNR Stock Price, $/share

Pre-Discussion Apr 9

Announcement Jun 19

Current Aug 13

Includes Warrant and Converts as exercised

Market Capitalization

Shares Outstanding

HNR Stock Price

NYSE: HNR www.harvestnr.com 8

Progress to Date HARVEST

Key provisions of Petrodelta term sheet

Financing plan for Petrodelta to

ensure funding of its capital requirements

Independent cash management of Petrodelta hydrocarbon sales through an offshore bank, ensuring timely payment of

contractors, lenders, owners and government obligations through a defined waterfall of cash disbursements

Independent procurement and contracting functions

Technical Assistance Agreement under which HNR will provide and be compensated for essential services and technical expertise in drilling, geology, reservoir

engineering and other critical functions

The ability of HNR to appoint its secondees to up to 40% of key management positions in Petrodelta, including finance,

technology, operations, purchasing, contracting, and others

Establishment of a new business plan for Petrodelta

Progress to date

Definitive documents being drafted

Business plan revision at advanced stage with PDVSA and Petrodelta

Next steps

September 9, 2015 Annual Meeting of Stockholders

Conclude definitive agreements and new

business plan

Conclude financing arrangements

NYSE: HNR www.harvestnr.com 9

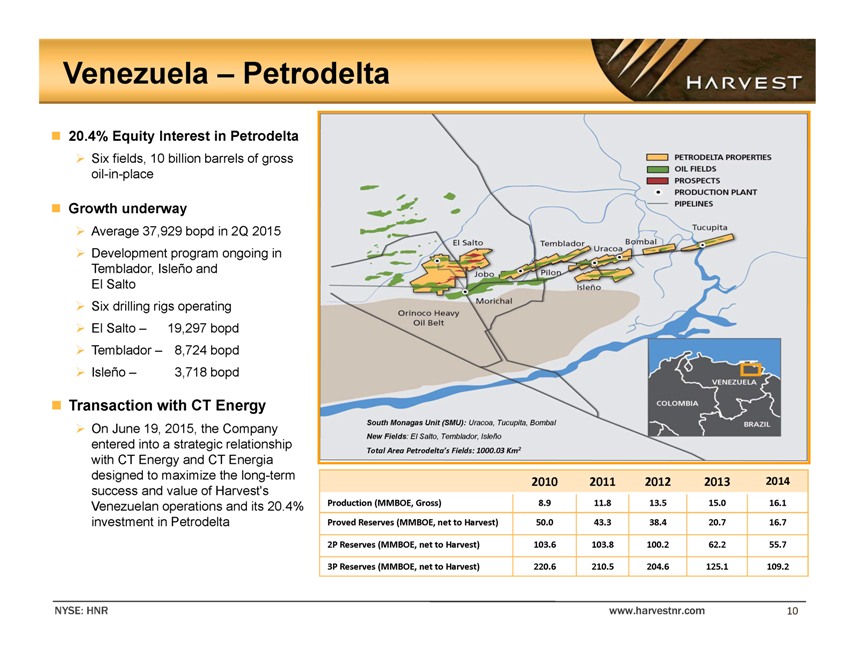

Venezuela – Petrodelta HARVEST

20.4% Equity Interest in Petrodelta

Six fields, 10 billion barrels of gross oil-in-place

Growth underway

Average 37,929 bopd in 2Q 2015

Development program ongoing in Temblador, Isleño and El Salto

Six drilling rigs

operating

El Salto – 19,297 bopd

Temblador – 8,724 bopd

Isleño – 3,718 bopd

Transaction with CT Energy

On June 19, 2015, the Company entered into a strategic relationship with CT Energy and CT Energia designed to maximize the long-term success and value of Harvest’s

Venezuelan operations and its 20.4% investment in Petrodelta

PETRODELTA PROPERTIES

OIL FIELDS

PROSPECTS

PRODUCTION PLANT

PIPELINES

El Salto

Temblador Uracoa Bombal Tucupita Jobo Pilon Morichal Isleño Orinoco Heavy Oil

Belt

South Monagas Unit (SMU): Uracoa, Tucupita, Bombal

New Fields: El Salto,

Temblador, Isleño

Total Area Petrodelta’s Fields: 1000.03 Km2

2010 2011 2012 2013 2014

Production (MMBOE, Gross) 8.9 11.8 13.5 15.0 16.1

Proved Reserves (MMBOE, net to Harvest) 50.0 43.3 38.4 20.7 16.7

2P Reserves (MMBOE, net to Harvest) 103.6 103.8 100.2 62.2 55.7

3P Reserves (MMBOE, net to Harvest) 220.6 210.5 204.6 125.1 109.2

NYSE: HNR www.harvestnr.com 10

COLOMBIA

VENEZUELA

BRAZIL

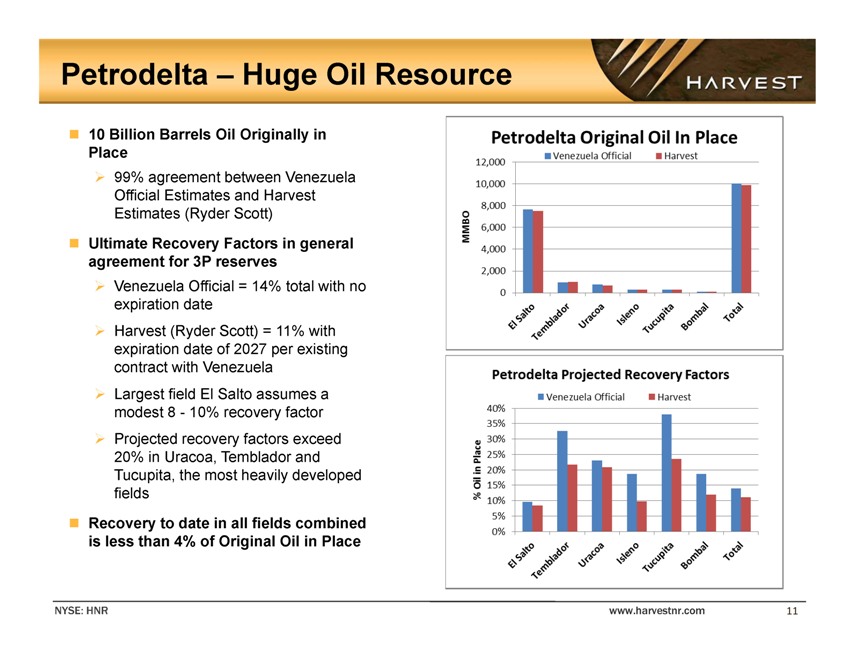

Petrodelta – Huge Oil Resource HARVEST

10 Billion Barrels Oil Originally in Place

99% agreement between Venezuela Official Estimates

and Harvest Estimates (Ryder Scott)

Ultimate Recovery Factors in general agreement for 3P reserves

Venezuela Official = 14% total with no expiration date

Harvest (Ryder Scott) = 11% with

expiration date of 2027 per existing contract with Venezuela

Largest field El Salto assumes a modest 8 - 10% recovery factor

Projected recovery factors exceed 20% in Uracoa, Temblador and Tucupita, the most heavily developed fields

Recovery to date in all fields combined is less than 4% of Original Oil in Place

Petrodelta

Original Oil In Place

Venezuela Official Harvest

MMBO

12,000 10,000 8,000 6,000 4,000 2,000 0

El Salto Temblador Uracoa Isleno Tucupita Bombal Total

Petrodelta Projected Recovery Factors

% Oil in Place

Venezuela Official Harvest

40% 35% 30% 25% 20% 15% 10% 5% 0%

El Salto Temblador Uracoa Isleno Tucupita Bombal Total

NYSE: HNR www.harvestnr.com 11

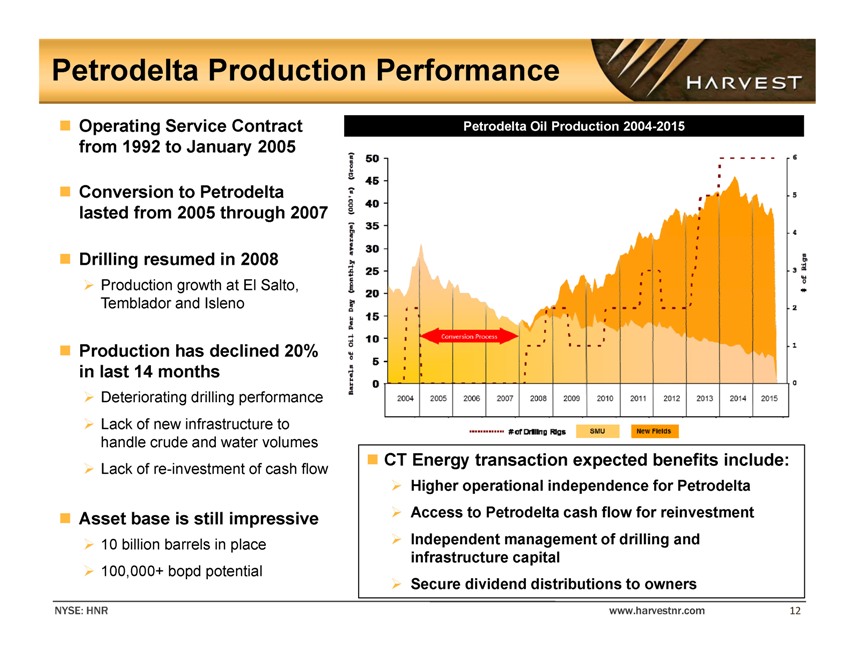

Petrodelta Production Performance HARVEST

Operating Service Contract from 1992 to January 2005

Conversion to Petrodelta lasted from 2005

through 2007

Drilling resumed in 2008

Production growth at El Salto,

Temblador and Isleno

Production has declined 20% in last 14 months

Deteriorating drilling performance

Lack of new infrastructure to handle crude

and water volumes

Lack of re-investment of cash flow

Asset base is still

impressive

10 billion barrels in place 100,000+ bopd potential

Petrodelta Oil

Production 2004-2015

Barrels of Oil Per Day (monthly average) (000’s) (Gross)

50 45 40 35 30 25 20 15 10 5 0

Conversion Process

0 1 2 3 4 5 6 # of Rigs

2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

# of Drilling Rigs SMU New Fields

CT Energy transaction expected benefits

include:

Higher operational independence for Petrodelta

Access to Petrodelta

cash flow for reinvestment

Independent management of drilling and

infrastructure capital

Secure dividend distributions to owners

NYSE: HNR www.harvestnr.com 12

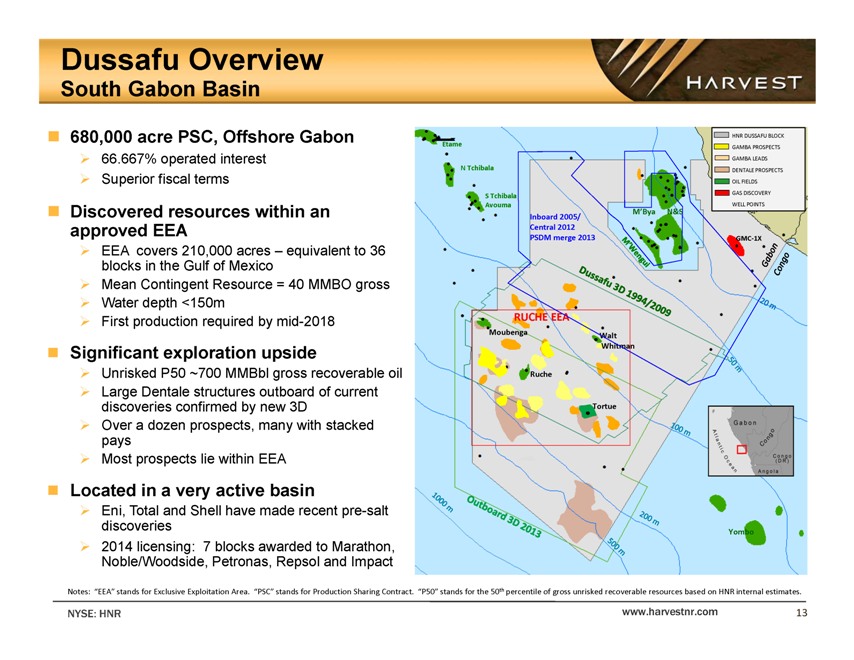

Dussafu Overview

South

Gabon Basin

HARVEST

n 680,000

acre PSC, Offshore Gabon

Ø 66.667% operated interest

Ø Superior fiscal terms

n Discovered resources within an approved EEA

Ø EEA covers 210,000 acres

– equivalent to 36 blocks in the Gulf of Mexico

Ø Mean Contingent Resource = 40 MMBO gross

Ø Water depth <150m

Ø First production required by mid-2018

n Significant exploration upside

Ø Unrisked P50 ~700 MMBbl gross recoverable oil

Ø Large Dentale structures outboard of current discoveries confirmed by new 3D

Ø Over a dozen prospects, many with stacked pays

Ø Most prospects lie within EEA

n Located in a very active basin

Ø Eni, Total and Shell have made recent pre-salt discoveries

Ø 2014 licensing: 7 blocks awarded to Marathon, Noble/Woodside, Petronas, Repsol and Impact

HNR DUSSAFU BLOCK

Etame

GAMBA PROSPECTS

GAMBA LEADS N Tchibala DENTALE PROSPECTS

OIL FIELDS

S Tchibala Avouma GAS DISCOVERY WELL POINTS

M’Bya N&S Inboard 2005/Central 2012

PSDM merge 2013 GMC-1X

RUCHE EEA

Moubenga

Walt Whitman

Ruche

Tortue

Yombo

M’Wengui

Dussfu 3D 1994/2009

Outboard 3D 2013

Notes: “EEA” stands for Exclusive Exploitation Area. “PSC” stands for Production

Sharing Contract. “P50” stands for the 50th percentile of gross unrisked recoverable resources based on HNR internal estimates.

NYSE: HNR

www.harvestnr.com

13

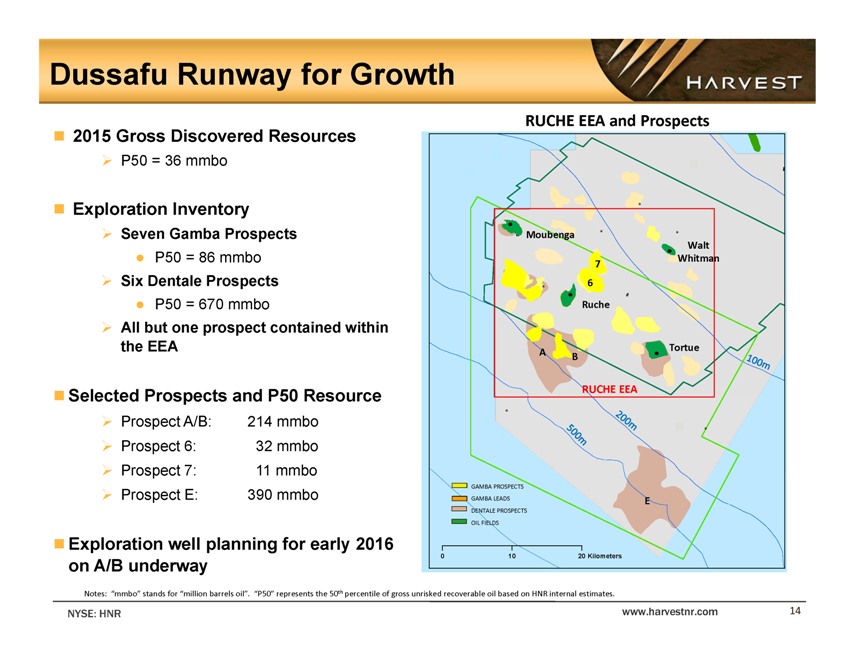

Dussafu Runway for Growth

HARVEST

2015 Gross Discovered Resources

P50 = 36 mmbo

Exploration Inventory

Seven Gamba Prospects

P50 = 86 mmbo

Six Dentale Prospects

P50 = 670 mmbo

All but one prospect contained within the EEA

Selected Prospects and P50 Resource

Prospect A/B: 214 mmbo

Prospect 6: 32 mmbo

Prospect 7: 11 mmbo

Prospect E: 390 mmbo

Exploration well planning for early 2016 on A/B underway

RUCHE EEA and Prospects

Moubenga a a

Walt

a

Whitman

7

6

a

)Q a

a

Ruche

Tortue

A

B

100m

200m

500m

RUCHE EEA

GAMBA PROSPECTS

GAMBA LEADS E

DENTALE PROSPECTS

OIL FIELDS

0 10 20 Kilometers

Notes: “mmbo” stands for “million barrels oil”. “P50” represents the 50th percentile of gross unrisked recoverable oil based on HNR internal

estimates.

NYSE: HNR

www.harvestnr.com

14

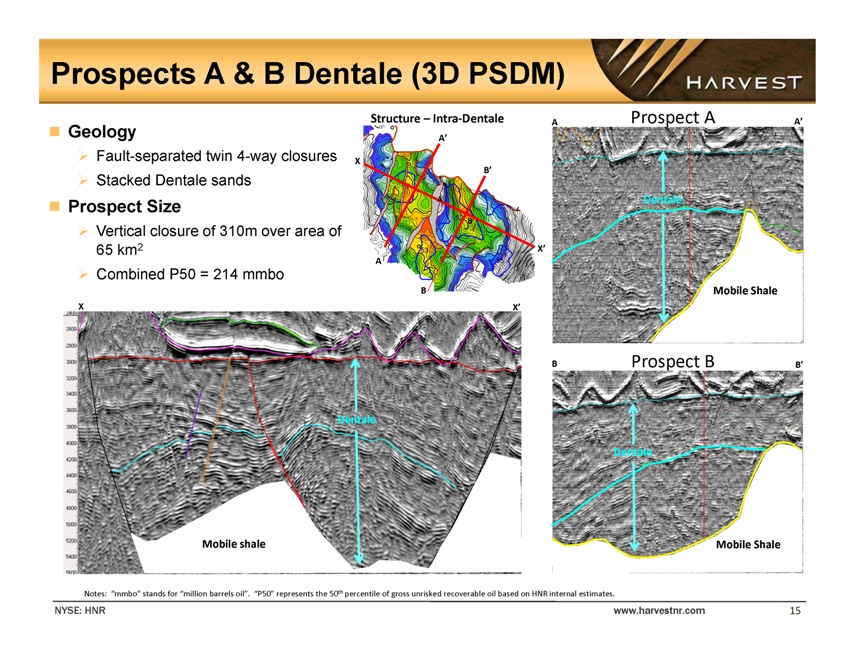

Prospects A & B Dentale (3D PSDM)

HARVEST

Geology

Fault-separated twin 4-way closures

Stacked Dentale sands

Prospect Size

Vertical closure of 310m over area of 65 km2

Combined P50 = 214 mmbo

Structure – Intra-Dentale

A’

B’

A

B

X’

A

B

X X’

Dentale

Mobile shale

A Prospect A A’

Dentale

Mobile Shale

B Prospect B B’

Dentale

Mobile Shale

Notes: “mmbo” stands for “million barrels oil”. “P50” represents the 50th percentile of gross unrisked recoverable oil based on HNR internal

estimates.

NYSE: HNR

www.harvestnr.com

15

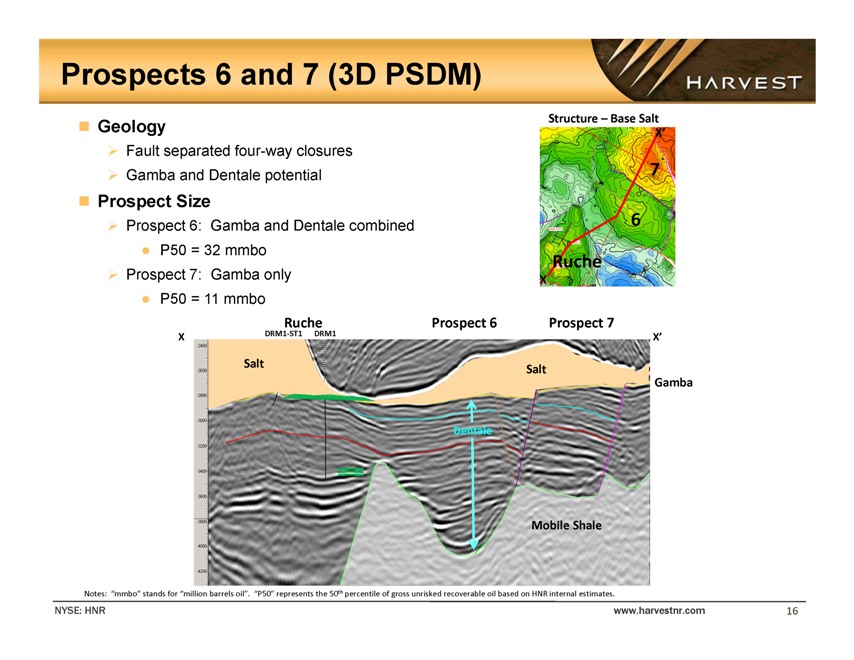

Prospects 6 and 7 (3D PSDM)

HARVEST

Geology

Fault separated four-way closures

Gamba and Dentale potential

Prospect Size

Prospect 6: Gamba and Dentale combined

P50 = 32 mmbo

Prospect 7: Gamba only

P50 = 11 mmbo

Structure – Base Salt

X’

7

6

Ruche

X

Ruche

Prospect 6

Prospect 7

X DRM1-ST1 DRM1 X’

Salt

Salt

Gamba

Dentale

Mobile Shale

Notes: “mmbo” stands for “million barrels oil”. “P50” represents the 50th percentile of gross unrisked recoverable oil based on HNR internal

estimates.

NYSE: HNR

www.harvestnr.com

16

Summary

HARVEST

September 9, 2015 Annual Meeting of Stockholders to vote on proposals related to the strategic transaction with CT Energy

Very strong alignment with current shareholder interest

Provides significant upside for

shareholders

Progress being made

Petrodelta term sheet executed

Work toward definitive agreements and financing in progress

Balance sheet strength sufficient

to support strategic plan

Gabon continues to provide substantial option value

Compelling exploration and development portfolio

NYSE: HNR

www.harvestnr.com

17