Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AAC Holdings, Inc. | d16071d8k.htm |

| EX-99.2 - EX-99.2 - AAC Holdings, Inc. | d16071dex992.htm |

Exhibit 99.1

|

|

RIVER OAKS TAMPA , FLORIDA

INVESTOR UPDATE AUGUST 2015

|

|

IMPORTANT PRESENTATION INFORMATION 2

Notice to Investors

Forward-Looking

Statements

We use market data and industry forecasts and projec ons throughout this presenta on, including data from publicly available informa on and industry publica ons. These sources generally state that the informa on they provide has been obtained from sources believed to be reliable, but that the accuracy and completeness of the informa on are not guaranteed. The forecasts and projec ons are based on industry surveys and the preparers’ experience in the industry, and there can be no assurance that any of the forecasts or projec ons will be achieved. We believe that the surveys and market research others have performed are reliable, but we have not independently inves gated or verified this informa on. Forecasts and other forward-looking informa on obtained from these sources are subject to the same qualifica ons and uncertain es as the other forward-looking statements contained in this presenta on.

Some of the statements made in this presenta on cons tute forward-looking statements within the meaning of federal securi es laws. Forward-looking statements reflect our current views with respect to future events and performance. In some cases you can iden fy forward-looking statements by terminology such as “may,” “might, “will,” “should,” “could” or the nega ve thereof. Generally, the words “an cipate,” “believe,” “con nues,” “expect,” “intend,” “es mate,” “project,” “plan” and similar expressions iden fy forward-looking statements. In par cular, statements about our pipeline, industry growth opportuni es, disclosure of key performance indicators, business growth strategy and pro forma financial results in this presenta on are forward-looking statements.

We have based these forward-looking statements on our current expecta ons, assump ons, es mates and projec ons. While we believe these expecta ons, assump ons, es mates and projec ons are reasonable, such forward-looking statements are only predic ons and involve known and unknown risks, uncertain es and other factors, many of which are outside of our control, which could cause our actual results, performance or achievements to differ materially from any results, performance or achievements expressed or implied by such forward-looking statements. For addi onal discussion of risks, uncertain es and other factors, see the sec on tled “Risk Factors” in our Annual Report on Form 10-K and other filings with the SEC.

Risks, uncertain es and other factors include, without limita on: (i) our inability to operate our facili es; (ii) our reliance on our sales and marke ng program to con nuously a ract and enroll clients; (iii) a reduc on in reimbursement rates by certain third-party payors for inpa ent and outpa ent services and point of care and defini ve lab tes ng; (iv) our failure to successfully achieve growth through acquisi ons and de novo expansions; (v) uncertain es regarding the ming of the closing of pending acquisi ons; (vi) our failure to achieve an cipated financial results from contemplated acquisi ons; (vii) the possibility that a governmental en ty may prohibit, delay or refuse to grant approval for the consumma on of the acquisi ons; (viii) a disrup on in our ability to perform diagnos c drug tes ng services; (ix) maintaining compliance with applicable regulatory authori es, licensure and permits to operate our facili es and lab; (x) a disrup on in our business related to the recent indictment of certain of our subsidiaries and current and former employees; (xi) our inability to integrate newly acquired facili es; and (xii) general economic condi ons, as well as other risks discussed in the “Risk Factors” sec on of the Company’s Annual Report on Form 10-K, and other filings with the Securi es and Exchange Commission.

Given these risks and uncertain es, you are cau oned not to place undue reliance on such forward-looking statements. These risks and uncertain es may cause our actual future results to be materially difierent than those expressed in our forward-looking statements. These forward-looking statements are made only as of the date of this presenta on. We do not undertake and specifically decline any obliga on to update any such statements or to publicly announce the results of any revisions to any such statements to reflect future events or developments.

|

|

PRESENTERS 3

Michael T. Cartwright

Chairman

(since 2011)

Chief Executive Officer

(since 2013)

Kirk R. Manz

Chief Financial Officer

(since 2011)

Founder and CEO of Foundations Recovery Network

At Foundations, opened notable treatment facilities including the Canyon in Malibu, La Paloma in Memphis and Michael’s House in Palm Springs Started Moments of Change & Lifestyle Intervention, two of the leading national industry conferences Author of Believable Hope 20 years industry experience

Founder and Managing Member of Private Capital Securities, a boutique investment banking firm Former Vice President at Piper Jaffray and Fixed Income Specialist with

Stephens Inc.

Co- founder and CEO of four communications companies including Igaea, an international VoIP Company 23 years management experience

|

|

AAC OVERVIEW 4

American Addiction Centers, Inc. (“AAC”) is a leading provider of inpatient drug and alcohol addiction treatment services in the behavioral health sector

Headquartered in Brentwood, Tennessee

Operates 7 residential alcohol and drug addiction treatment facilities in California, Texas, Florida and Nevada

Operates 5 standalone outpatient centers in Nevada, Texas and Rhode Island

1H 2015 revenue of $97 million revenue up 63% from $59 million revenue in 1H 2014

Approx. 90% of reimbursements from commercial payors with no government reimbursement

587 beds currently with over 600 beds in pipeline*

Engaged board of directors with strong healthcare & public company experience

Invested executive management and board—own over 60% of outstanding stock

*

Beds in pipeline reflects management’s current estimates

CUSTOMER

MISSION:

COMBINE

EXCEPTIONAL

CLINICAL

CARE

WITH

PREMIUM

FACILITIES

TO

PROVIDE

EFFECTIVE

TREATMENT

SOLUTIONS

FOR

THOSE

SUFFERING

FROM

ADDICTION

AND

CO-OCCURRING

MENTAL

HEALTH

DISORDERS

|

|

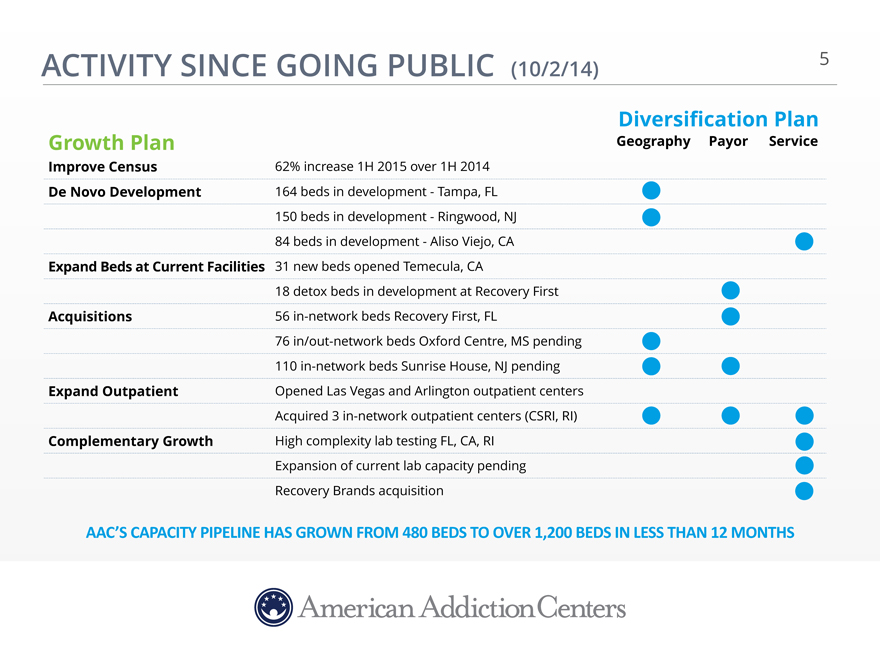

ACTIVITY SINCE GOING PUBLIC (10/2/14) 5

Diversification Plan

Growth Plan Geography Payor Service

Improve Census 62% increase 1H 2015 over 1H 2014

De Novo Development 164 beds in development—Tampa, FL

150 beds in development—Ringwood, NJ

| 84 |

|

beds in development—Aliso Viejo, CA |

Expand Beds at Current Facilities 31 new beds opened Temecula, CA

| 18 |

|

detox beds in development at Recovery First |

Acquisitions 56 in-network beds Recovery First, FL

| 76 |

|

in/out-network beds Oxford Centre, MS pending |

110 in-network beds Sunrise House, NJ pending

Expand Outpatient Opened Las Vegas and Arlington outpatient centers

Acquired 3 in-network outpatient centers (CSRI, RI)

Complementary Growth High complexity lab testing FL, CA, RI

Expansion of current lab capacity pending

Recovery Brands acquisition

AAC’S

CAPACITY

PIPELINE

HAS

GR OWN

FROM

480

BEDS

TO

OVER

1,200

BEDS

IN

LESS

THAN

12

MONTHS

|

|

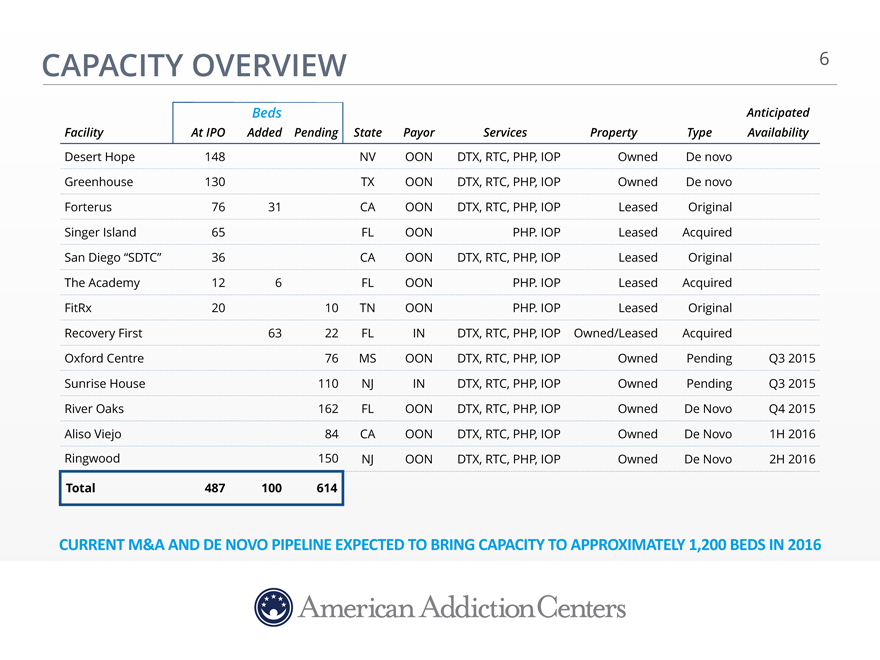

CAPACITY OVERVIEW 6

Beds Anticipated

Facility At IPO Added Pending State Payor Services Property Type Availability

Desert Hope 148 NV OON DTX, RTC, PHP, IOP Owned De novo

Greenhouse 130 TX OON DTX, RTC, PHP, IOP Owned De novo

Forterus 76 31 CA OON DTX, RTC, PHP, IOP Leased Original

Singer Island 65 FL OON PHP. IOP Leased Acquired

San Diego “SDTC” 36 CA OON DTX, RTC, PHP, IOP Leased Original

The Academy 12 6 FL OON PHP. IOP Leased Acquired

FitRx 20 10 TN OON PHP. IOP Leased Original

Recovery First 63 22 FL IN DTX, RTC, PHP, IOP Owned/Leased Acquired

Oxford Centre 76 MS OON DTX, RTC, PHP, IOP Owned Pending Q3 2015

Sunrise House 110 NJ IN DTX, RTC, PHP, IOP Owned Pending Q3 2015

River Oaks 162 FL OON DTX, RTC, PHP, IOP Owned De Novo Q4 2015

Aliso Viejo 84 CA OON DTX, RTC, PHP, IOP Owned De Novo 1H 2016

Ringwood 150 NJ OON DTX, RTC, PHP, IOP Owned De Novo 2H 2016

Total 487 100 614

CURRENT

M&A

AND

DE

NOVO

PIPELINE

EXPECTED

TO

BRING

CAPACITY

TO

APPROXIMATELY

1,200

BEDS

IN

2016

|

|

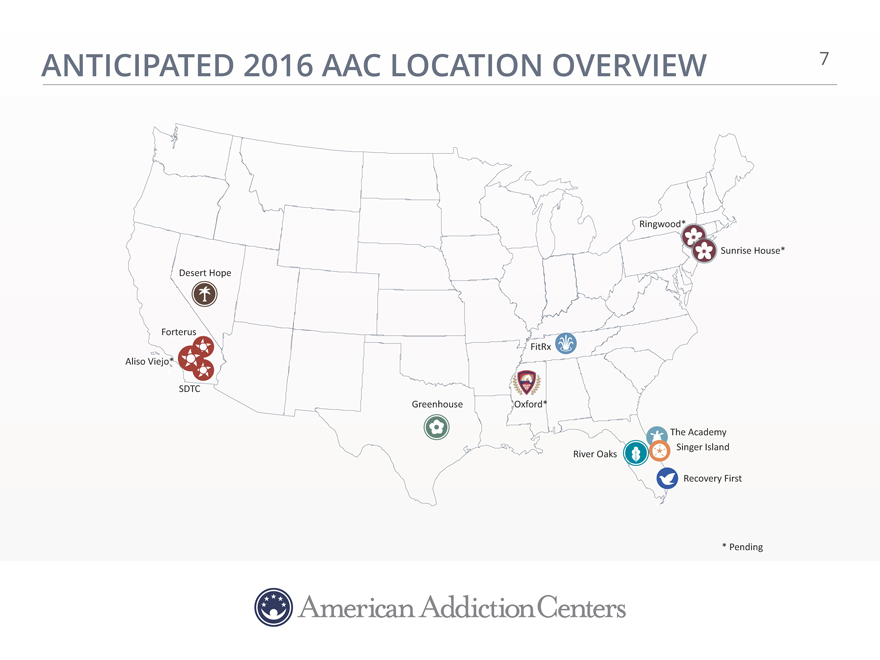

ANTICIPATED 2016 AAC LOCATION OVERVIEW 7

Ringwood*

Sunrise

House*

Desert

Hope

Forterus

FitRx Aliso

Viejo*

SDTC

Greenhouse Oxford*

The

Academy Singer

Island River

Oaks

Recovery

First

*

Pending

|

|

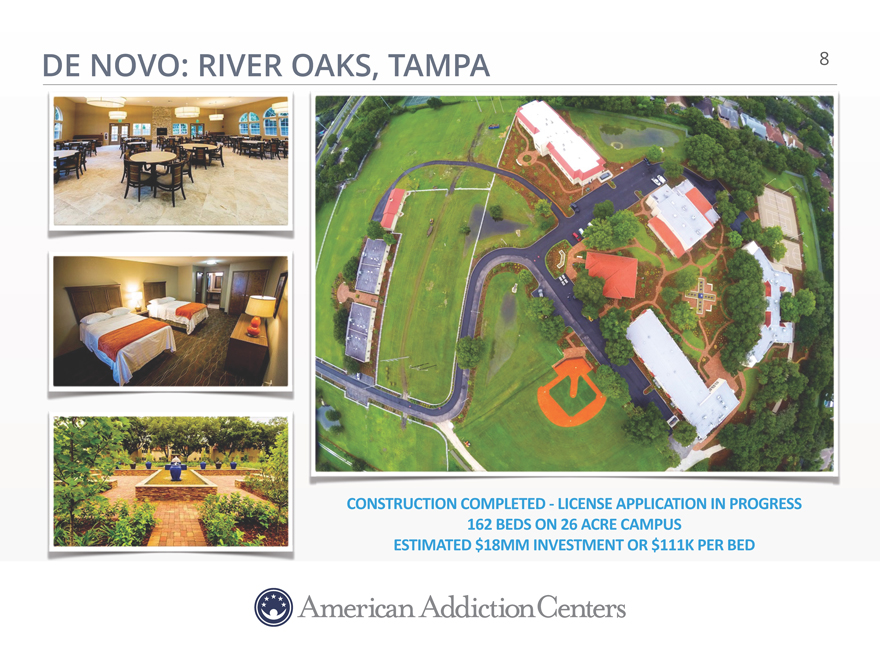

DE NOVO: RIVER OAKS, TAMPA 8

CONSTRUCTION

COMPLETED

--?

LICENSE

APPLICATION

IN

PROGRESS

162

BEDS

ON

26

ACRE

CAMPUS

ESTIMATED

$18MM

INVESTMENT

OR

$111K

PER

BED

|

|

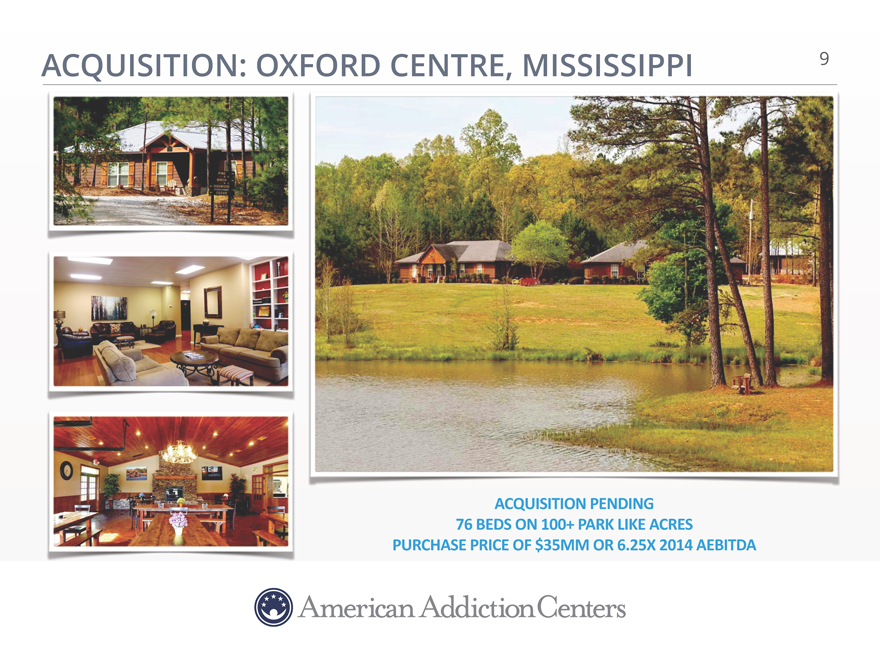

ACQUISITION: OXFORD CENTRE, MISSISSIPPI 9

ACQUISITION

PENDING

76

BEDS

ON

100+

PARK

LIKE

ACRES

PURCHASE

PRICE

OF

$35MM

OR

6.25X2014

AEBITDA

|

|

SENTINEL EVENTS: INDUSTRY DATA 10

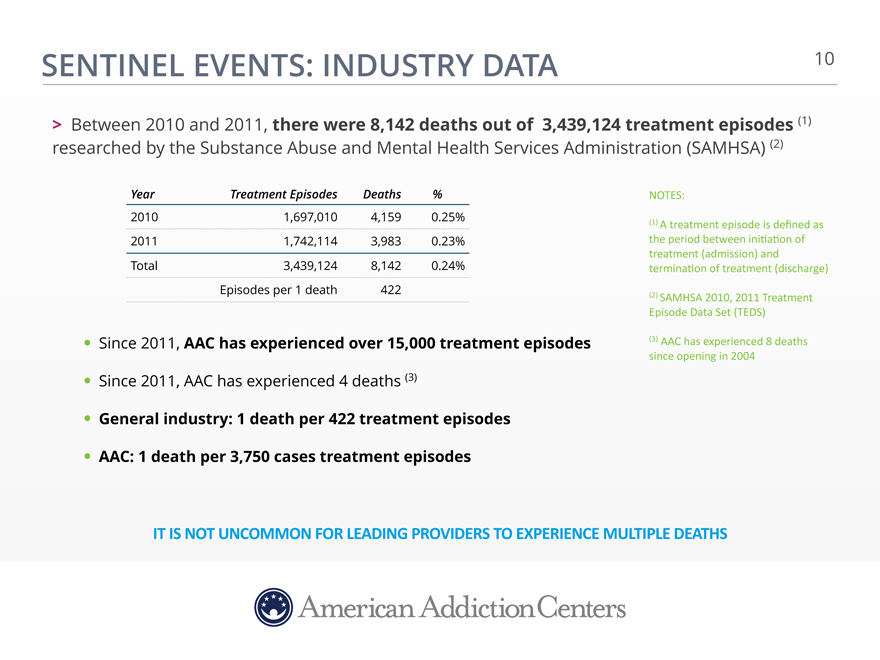

> Between 2010 and 2011, there were 8,142 deaths out of 3,439,124 treatment episodes (1) researched by the Substance Abuse and Mental Health Services Administration (SAMHSA) (2)

Year Treatment Episodes Deaths%

2010 1,697,010 4,159 0.25%

2011 1,742,114 3,983 0.23%

Total 3,439,124 8,142 0.24%

Episodes per 1 death 422

• Since 2011, AAC has experienced over 15,000 treatment episodes

Since 2011, AAC has experienced 4 deaths (3)

General industry: 1 death per 422 treatment episodes

AAC: 1 death per 3,750 cases treatment episodes

NOTES:

(1)

A

treatment

episode

is

de?ned

as

the

period

between

ini a on

of

treatment

(admission)

and

termina on

of

treatment

(discharge)

(2)

SAMHSA

2010,

2011

Treatment

Episode

Data

Set

(TEDS)

(3)

AAC

has

experienced

8

deaths

since

opening

in

2004

IT

IS

NOT

UNCOMMON

FOR

LEADING

PROVIDERS

TO

EXPERIENCE

MULTIPLE

DEATHS

|

|

CALIFORNIA CASE: 7/26/2010 11

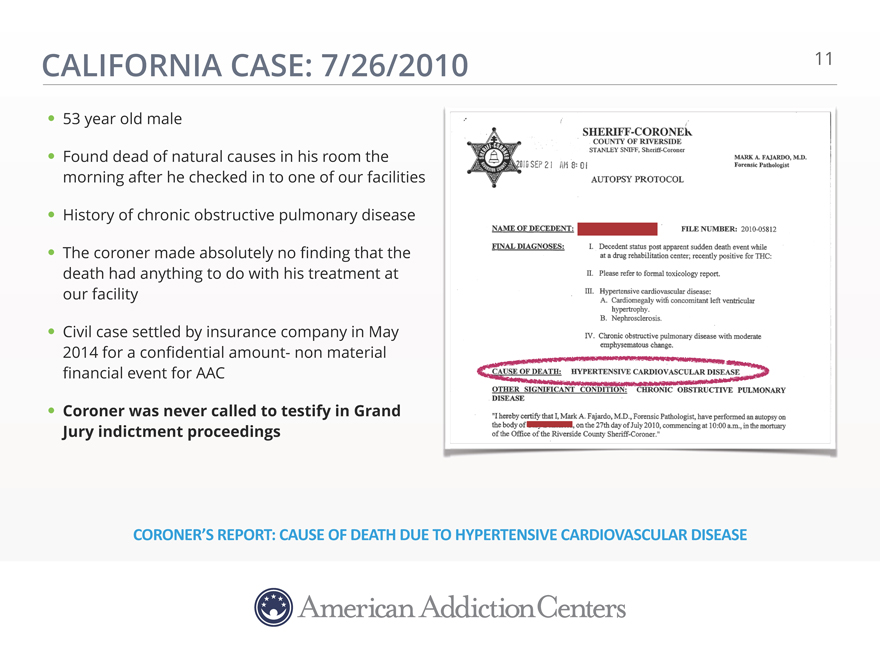

53 year old male

Found dead of natural causes in his room the morning after he checked in to one of our facilities

History of chronic obstructive pulmonary disease

The coroner made absolutely no finding that the death had anything to do with his treatment at our facility

Civil case settled by insurance company in May 2014 for a confidential amount- non material financial event for AAC

Coroner was never called to testify in Grand Jury indictment proceedings

CORONER’S

REPORT:

CAUSE

OF

DEATH

DUE

TO

HYPERTENSIVE

CARDIOVASCULAR

DISEASE

|

|

CALIFORNIA LICENSES 12

> No ABTTC or Forterus licenses have been suspended or revoked

Contrary to media reports, Irongate license was voluntarily surrendered subsequent to lease termination

> 31 new Forterus beds were licensed in January 1, 2015 by California Department of Healthcare Services

> Letter of active licenses and program compliance was provided by California Department of Healthcare Services to State of New Jersey on June 10, 2015

ALL

LICENSES

IN

CALIFORNIA

REMAIN

INTACT

|

|

TODAY’S AAC 13

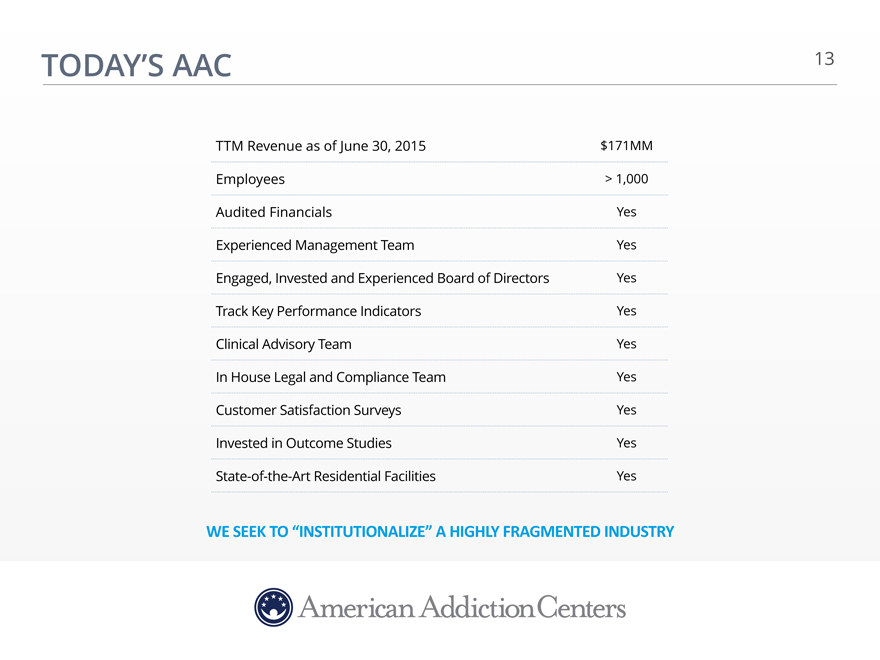

TTM Revenue as of June 30, 2015 $171MM

Employees > 1,000

Audited Financials Yes

Experienced Management Team Yes

Engaged, Invested and Experienced Board of Directors Yes

Track Key Performance Indicators Yes

Clinical Advisory Team Yes

In House Legal and Compliance Team Yes

Customer Satisfaction Surveys Yes

Invested in Outcome Studies Yes

State-of-the-Art Residential Facilities Yes

WE

SEEK

TO

“INSTITUTIONALIZE”

A

HIGHLY

FRAGMENTED

INDUSTRY

|

|

CLINICAL EXCELLENCE 14

> Fully accredited and licensed programs to treat essentially all drug and

alcohol addiction disorders as well as co-occurring disorders regardless of

stage of treatment required

EFFECTIVE

PROGRAM EXPERIENCED

STAFF PREMIUM

FACILITIES EXCEPTIONAL

SERVICE

Research-based Medical Beautiful buildings Delicious, healthy food

Structured curriculum Clinical Amenities Meticulous housekeeping

Tailored treatment Utilization review Desirable locations Courteous interaction

|

|

CLINICAL: RESEARCH INITIATIVES 15

> Centerstone Research Institute (CRI)

• CRI is a not-for-profit organization dedicated to improving healthcare through innovative approaches

to integrating research and technology with clinical practice. They have been awarded over $130

million in research grants and been involved in over 150 groundbreaking studies for behavioral health

> Research & Evaluation

• Analytics—including the development of quality clinical KPIs

• Outcomes Evaluation – including selection, training and implementation of standardized assessment

tools and recovery check-ins (follow-ups) scheduled at 2, 6, 12, 18, and 24 months post client discharge

• Research—plan and design for 4 papers to be published in peer-reviewed addiction treatment journals

> Status

• Completed longitudinal evaluation plan

• Completed pilot of evaluation instruments and protocol at Singer Island

• Training and implementation of final evaluation protocol scheduled for phased roll out

|

|

THE PREMIUM BRAND WE ARE BUILDING 16

GREENHOUSE,

TEXAS

|

130

BEDS

DESERT

HOPE,

NEVADA

|

148

BEDS

OXFORD

CENTRE,

MISSISSIPPI

|

76

BEDS

OPENED

Q2

2012 OPENED

Q1

2013 ANTICIPATED

Q3

2015

RIVER

OAKS,

FLORIDA

|

162

BEDS

ALISO

VIEJO,

CALIFORNIA

|

84

BEDS

RINGWOOD,

NEW

JERSEY

|

150

BEDS

ANTICIPATED

Q4

2015 ANTICIPATED

1H

2016 ANTICIPATED

2H

2016

|

|

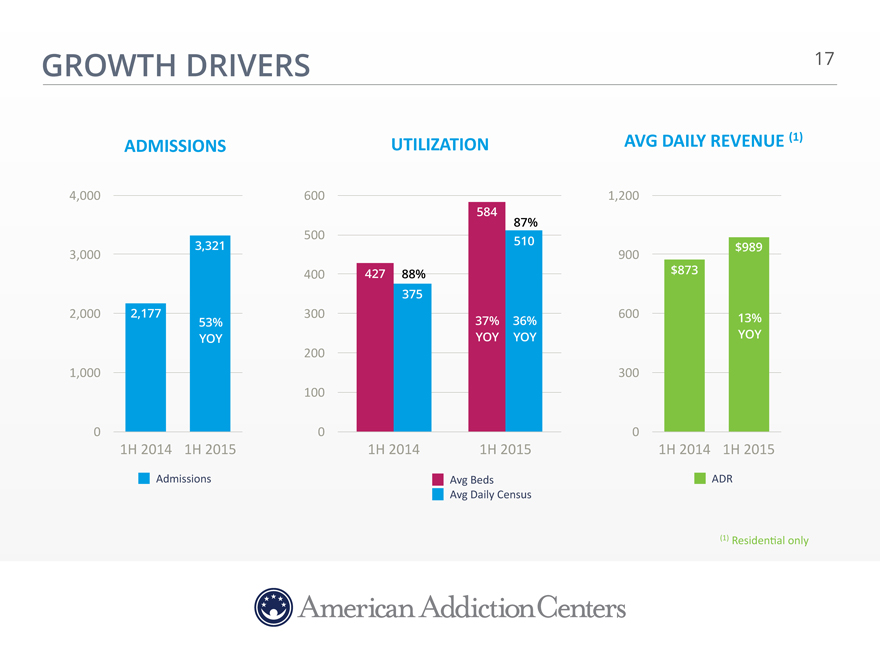

GROWTH DRIVERS 17

ADMISSIONS

4,000

3,321

3,000

2,000 2,177

53% YOY

1,000

0

1H

2014 1H

2015

Admissions

UTILIZATION

600

584 87%

500 510

400 427 88% 375

300

37% 36% YOY YOY

200

100

0

1H

2014 1H

2015

Avg

Beds Avg

Daily

Census

AVG

DAILY

REVENUE

(1)

1,200

$989

900

$873

600 13% YOY

300

0

1H

2014 1H

2015

ADR

(1)

Residen al

only

|

|

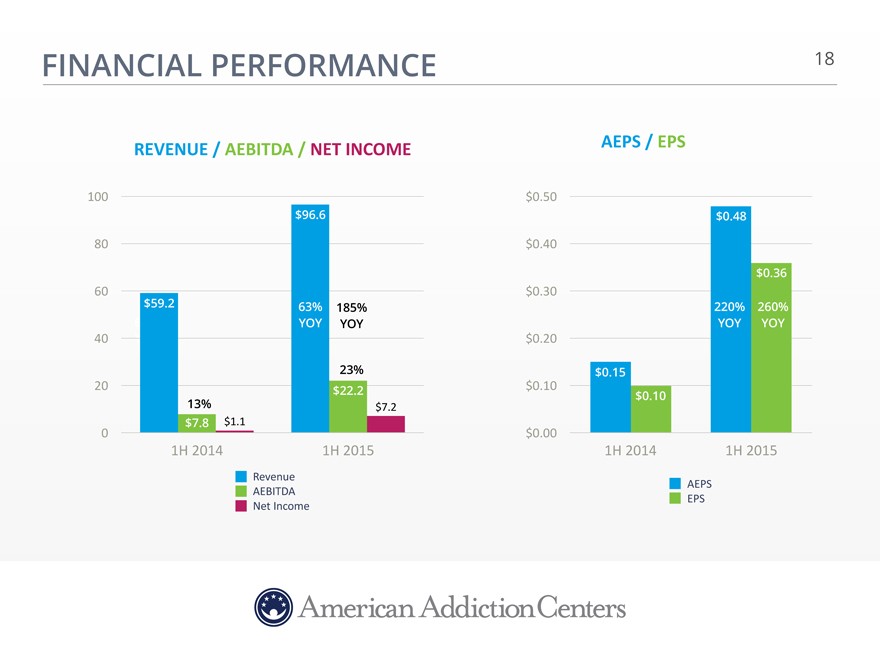

FINANCIAL PERFORMANCE 18

REVENUE

/

AEBITDA

/

NET

INCOME

100

$96.6

80

60

$59.2 63% 185% 62% YOY YOY

40 YOY

23%

20 $22.2 13% $7.2

$7.8 $1.1

0

1H

2014 1H

2015

Revenue AEBITDA Net

Income

AEPS

/

EPS

$0.50

$0.48

$0.40

$0.36

$0.30

220% 260% YOY YOY

$0.20

$0.15

$0.10

$0.10

$0.00

1H

2014 1H

2015

AEPS EPS

|

|

APPENDIX: NON-GAAP FINANCIAL MEASURES 19

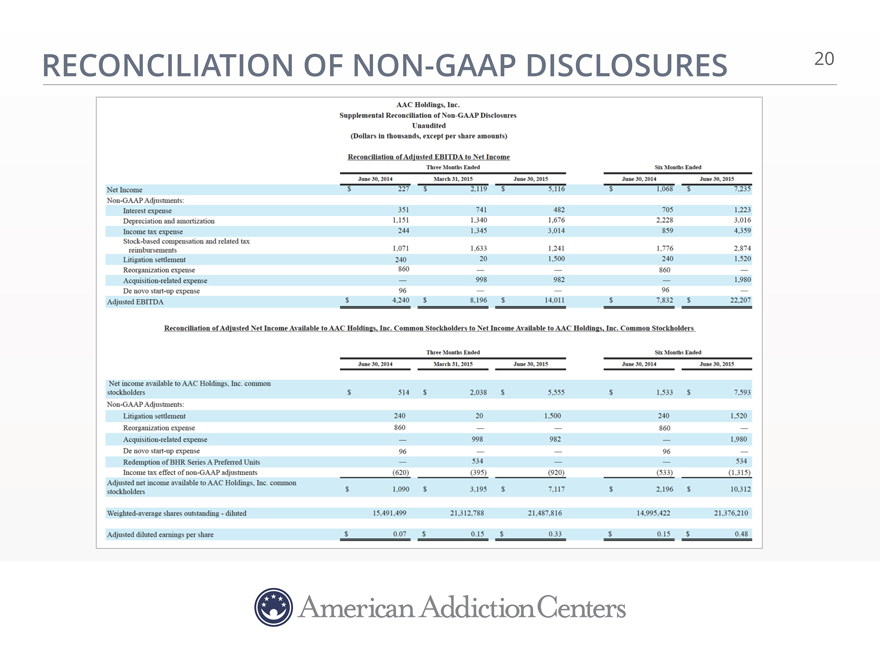

Adjusted EBITDA and Adjusted Earnings Per Share (EPS) are “non--?GAAP financial measures” as defined under the rules and regula ons promulgated by the U.S. Securi es and Exchange Commission. Management defines Adjusted EBITDA as net income adjusted for interest expense, deprecia on and amor za on expense, income tax expense, stock--?based compensa on and related tax reimbursements, li ga on se lement, restructuring charges, reorganiza on expense (which includes certain reorganiza on transac ons in April 2014 and expenses associated with the amendment and restatement of our then--?exis ng credit facility in April 2014), acquisi on--?related expense, and de novo startup expense. Where applicable, these include professional services for accoun ng, legal, valua on services and licensing expenses. Adjusted EBITDA and Adjusted EPS are considered supplemental measures of the Company’s performance and are not required by, or presented in accordance with, generally accepted accoun ng principles, or GAAP. Adjusted EBITDA and Adjusted EPS are not measures of the Company’s financial performance under GAAP and should not be considered as alterna ves to net income or any other performance measures derived in accordance with GAAP. Management has included informa on concerning Adjusted EBITDA and Adjusted EPS because they believe that such informa on is used by certain investors as a measure of a company’s historical performance.

Management believes these measures are frequently used by securi es analysts, investors and other interested par es in the evalua on of issuers of equity securi es, many of which present EBITDA, Adjusted EBITDA and Adjusted EPS when repor ng their results. Because Adjusted EBITDA and Adjusted EPS are not determined in accordance with GAAP, it is subject to varying calcula ons and may not be comparable to the Adjusted EBITDA and Adjusted EPS (or similarly tled measures) of other companies. Management’s presenta on of Adjusted EBITDA and Adjusted EPS should not be construed as an inference that our future results will be una?ected by unusual or nonrecurring items.

|

|

RECONCILIATION OF NON-GAAP DISCLOSURES 20