Attached files

| file | filename |

|---|---|

| 8-K - 8-K - US BANCORP \DE\ | d88155d8k.htm |

| EX-99.1 - EX-99.1 - US BANCORP \DE\ | d88155dex991.htm |

U.S.

Bancorp 2Q15 Earnings Conference Call

Richard K. Davis Chairman, President and CEO Kathy Rogers Vice Chairman and CFO July 15, 2015 Exhibit 99.2 |

2 | 2Q15 Earnings Conference Call Forward-looking Statements and Additional Information The following information appears in accordance with the Private Securities Litigation Reform Act of 1995: This presentation contains forward-looking statements about U.S. Bancorp. Statements that are not historical or current facts,

including statements about beliefs and expectations, are

forward-looking statements and are based on the information available to, and assumptions and estimates made by, management as of the date made. These forward-looking statements cover, among other things, anticipated future

revenue and expenses and the future plans and prospects of U.S.

Bancorp. Forward-looking statements involve inherent risks and uncertainties, and important factors could cause actual results to differ materially from those anticipated. A reversal or slowing of the current economic

recovery or another severe contraction could adversely affect U.S.

Bancorp’s revenues and the values of its assets and liabilities. Global financial markets could experience a recurrence of significant turbulence, which could reduce the availability of funding to certain financial institutions and

lead to a tightening of credit, a reduction of business activity, and

increased market volatility. Stress in the commercial real estate markets, as well as a downturn in the residential real estate markets, could cause credit losses and deterioration in asset values. In addition, U.S.

Bancorp’s business and financial performance is likely to be

negatively impacted by recently enacted and future legislation and regulation. U.S. Bancorp’s results could also be adversely affected by deterioration in general business and economic conditions; changes in interest rates; deterioration in the

credit quality of its loan portfolios or in the value of the collateral

securing those loans; deterioration in the value of securities held in its

investment securities portfolio; legal and regulatory developments; litigation;

increased competition from both banks and non-banks; changes in

customer behavior and preferences; breaches in data security; effects of mergers and

acquisitions and related integration; effects of critical accounting

policies and judgments; and management’s ability to effectively manage credit risk, residual value risk, market risk, operational risk, compliance risk, strategic risk, interest rate risk, liquidity risk and reputational risk. For discussion of these and other risks that may cause actual results to differ from expectations, refer to U.S. Bancorp’s Annual Report

on Form 10-K for the year

ended December 31, 2014, on file with the Securities and Exchange Commission, including the sections entitled “Risk Factors” and “Corporate Risk Profile” contained in Exhibit 13, and all subsequent filings with the Securities and Exchange

Commission under Sections 13(a), 13(c), 14 or 15(d) of the Securities

Exchange Act of 1934. Forward-looking statements speak only as of the date they are made, and U.S. Bancorp undertakes no obligation to update them in light of new information or future events. This presentation includes non-GAAP financial measures to describe U.S. Bancorp’s performance. The calculations of these measures

are provided within or in the appendix of the presentation. These

disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other

companies. |

3 | 2Q15 Earnings Conference Call Net income of $1.5 billion; $0.80 per diluted common share Average loan growth of 4.0% vs. 2Q14 and 0.7% vs. 1Q15 (excluding student loans, which were reclassified to held for sale at the end of 1Q15) Average deposit growth of 8.9% vs. 2Q14 and 2.6% vs. 1Q15 Improving trends in payments-related fee revenue Net charge-offs declined 15.2% vs. 2Q14 and increased 6.1% vs. 1Q15 Nonperforming assets declined 18.8% vs. 2Q14 and 7.0% vs. 1Q15 Capital generation continues to reinforce capital position • Common equity tier 1 capital ratio of 9.2% estimated for the Basel III fully implemented standardized approach Returned 76% of earnings to shareholders in 2Q15 • Repurchased 14 million shares of common stock during the quarter 2Q15 Highlights |

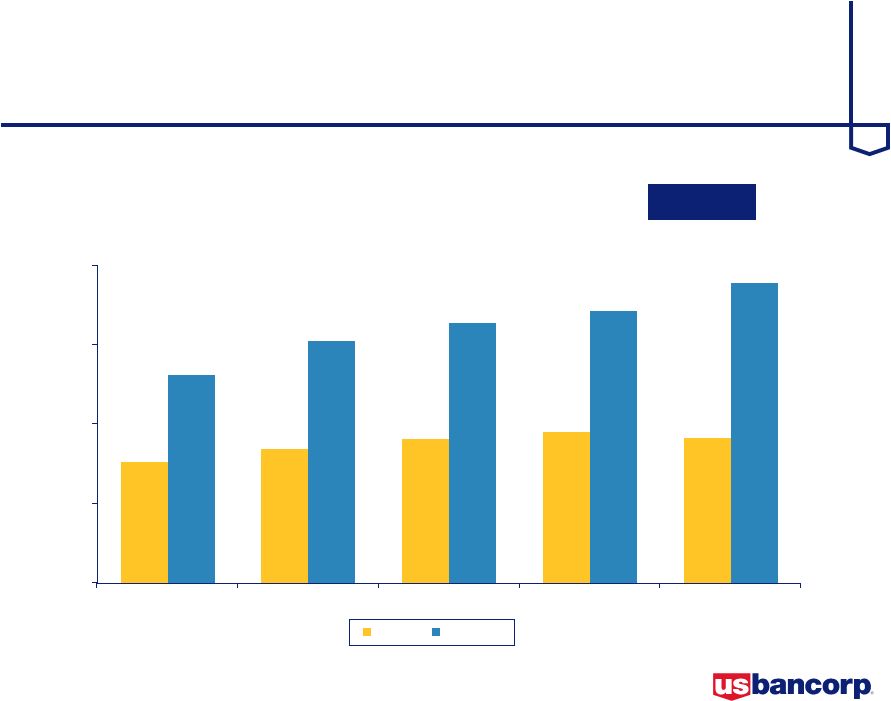

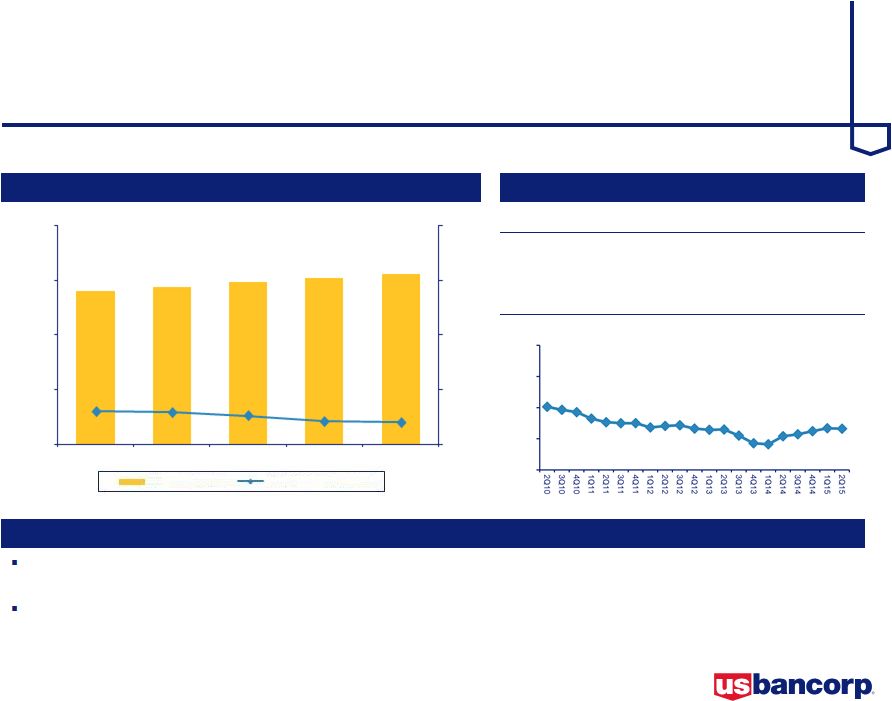

4 | 2Q15 Earnings Conference Call Return on Average Common Equity and Return on Average Assets Efficiency Ratio and Net Interest Margin Return on Avg Common Equity Return on Avg Assets Efficiency Ratio Net Interest Margin Performance Ratios * Excluding $214 million gain on Visa Inc. Class B common stock sale and $200 million FHA DOJ settlement

** Excluding $124 million gain related to an equity interest in Nuveen and $88 million

expense for charitable contributions and legal accruals Efficiency ratio

computed as noninterest expense divided by the sum of net interest income on a taxable-equivalent basis and noninterest income excluding net securities gains (losses) 2Q14 3Q14 4Q14 1Q15 2Q15 2Q14 3Q14 4Q14 1Q15 2Q15 8% 11% 14% 17% 20% 1.0% 1.5% 2.0% 2.5% 3.0% 48% 52% 56% 60% 64% 1.6% 2.2% 2.8% 3.4% 4.0% 1.60% 1.51% 1.50% 1.44% 1.46% 15.1% 14.5% 14.4% 14.1% 14.3% 51.3%* 53.8%** 53.1% 52.4% 54.3% 54.3% 53.2% 3.27% 3.16% 3.14% 3.08% 3.03% |

5 | 2Q15 Earnings Conference Call Notable items: 2Q14 Visa gain $214 million, 4Q14 Nuveen gain $124 million Taxable-equivalent basis Year-Over-Year Change 4.9% 2.0% 5.7% 1.9% (2.8%) $ in millions $4,906 $5,188 $4,990 $5,169 $5,042 $214 $124 3,500 4,000 4,500 5,000 5,500 2Q14 3Q14 4Q14 1Q15 2Q15 Revenue Growth 1.4% excluding 2Q14 notable 3.2% excluding 4Q14 notable 0.5% excluding 2Q14 notable |

6 | 2Q15 Earnings Conference Call Year-Over-Year Growth Average Balances 210 230 250 270 290 2Q14 3Q14 4Q14 1Q15 2Q15 Loans Deposits 5.1% $248.0 2.5% $246.6 6.8% $240.5 6.3% $243.9 5.9% $246.4 8.1% $278.5 8.9% $285.7 6.0% $262.4 7.4% $271.0 7.2% $275.5 Loan and Deposit Growth $ in billions 2Q15 adjusted* loan growth = 4.0% * Excluding the impact of the reclassification of approximately $3 billion of student loans to held for sale at the end of 1Q15

|

7 | 2Q15 Earnings Conference Call Net Charge-offs Nonperforming Assets Net Charge-offs (Left Scale) NCOs to Avg Loans (Right Scale) Nonperforming Assets (Left Scale) NPAs to Loans plus ORE (Right Scale) Credit Quality $ in millions 0.00% 0.75% 1.50% 2.25% 3.00% 0 130 260 390 520 2Q14 3Q14 4Q14 1Q15 2Q15 $349 $336 $308 $279 $296 0.58% 0.55% 0.50% 0.46% 0.48% $1,943 $1,923 $1,808 $1,696 $1,577 0.80% 0.78% 0.73% 0.69% 0.63% 0.00% 0.75% 1.50% 2.25% 3.00% 0 700 1,400 2,100 2,800 2Q14 3Q14 4Q14 1Q15 2Q15 |

8 | 2Q15 Earnings Conference Call Taxable-equivalent basis Earnings Summary $ and shares in millions, except per-share data YTD YTD 2Q15 1Q15 2Q14 vs 1Q15 vs 2Q14 2015 2014 %B/(W) Net Interest Income 2,770 $ 2,752 $ 2,744 $ 0.7 0.9 5,522 $ 5,450 $ 1.3 Noninterest Income 2,272 2,154 2,444 5.5 (7.0) 4,426 4,552 (2.8) Net Revenue 5,042 4,906 5,188 2.8 (2.8) 9,948 10,002 (0.5) Noninterest Expense 2,682 2,665 2,753 (0.6) 2.6 5,347 5,297 (0.9) Operating Income 2,360 2,241 2,435 5.3 (3.1) 4,601 4,705 (2.2) Net Charge-offs 296 279 349 (6.1) 15.2 575 690 16.7 Excess Provision (15) (15) (25) - (40.0) (30) (60) (50.0) Income before Taxes 2,079 1,977 2,111 5.2 (1.5) 4,056 4,075 (0.5) Applicable Income Taxes 582 533 602 (9.2) 3.3 1,115 1,154 3.4 Noncontrolling Interests (14) (13) (14) (7.7) - (27) (29) 6.9 Net Income 1,483 1,431 1,495 3.6 (0.8) 2,914 2,892 0.8 Preferred Dividends/Other 66 66 68 - 2.9 132 134 1.5 NI to Common 1,417 $ 1,365 $ 1,427 $ 3.8 (0.7) 2,782 $ 2,758 $ 0.9 Diluted EPS 0.80 $ 0.76 $ 0.78 $ 5.3 2.6 1.56 $ 1.51 $ 3.3 Average Diluted Shares 1,779 1,789 1,821 0.6 2.3 1,784 1,825 2.2 % B/(W) |

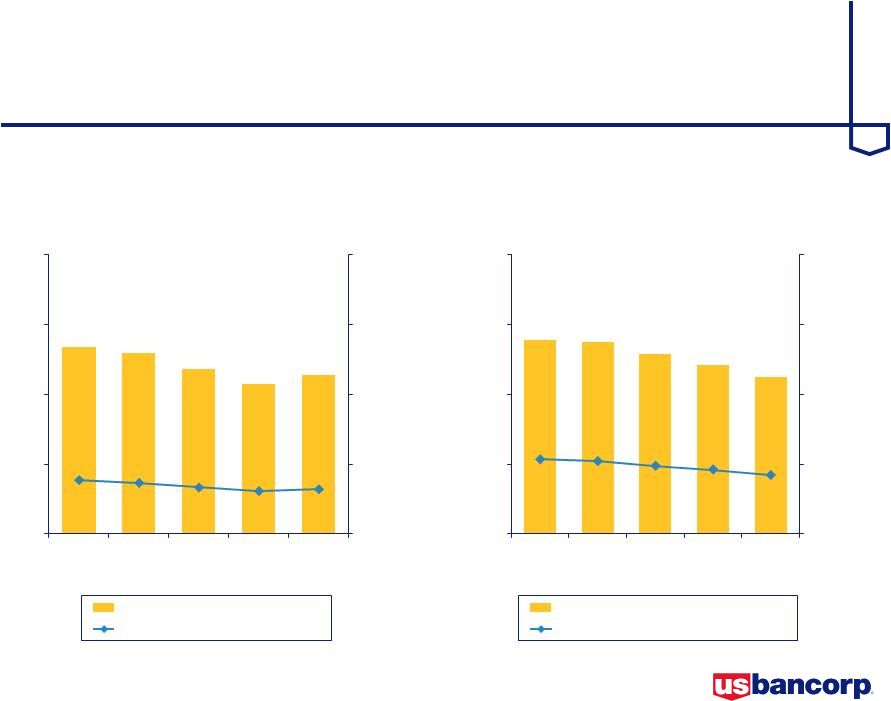

9 | 2Q15 Earnings Conference Call Net Interest Income Key Points vs. 2Q14 Average earning assets grew $30.4 billion, or 9.1% Net interest margin lower 24 bps (3.03% vs. 3.27%) Growth in the investment portfolio at lower average rates as well as lower reinvestment rates on investment securities, lower loan fees due to the Checking Account Advance product wind down, lower rates on new loans and a change in loan portfolio mix Partially offset by lower funding costs vs. 1Q15 Average earning assets grew $5.6 billion, or 1.5% Net interest margin lower 5 bps (3.03% vs. 3.08%) Continued change in loan portfolio mix, the impact of higher cash balances at the Federal Reserve as a result of continued deposit growth, along with growth in lower rate investment securities and lower investment portfolio reinvestment rates Year-Over-Year Change 2.7% 1.3% 2.4% 1.7% 0.9% Net Interest Income $ in millions Taxable-equivalent basis $2,744 $2,748 $2,799 $2,752 $2,770 0.0% 2.0% 4.0% 6.0% 8.0% 0 1,000 2,000 3,000 4,000 2Q14 3Q14 4Q14 1Q15 2Q15 Net Interest Income Net Interest Margin 3.27% 3.16% 3.14% 3.08% 3.03% 9 | 2Q15 Earnings Conference Call |

10 | 2Q15 Earnings Conference Call Noninterest Income Noninterest Income Key Points vs. 2Q14 Noninterest income decreased $172 million, or 7.0% (1.9% increase excluding notable item in 2Q14) • Higher trust and investment management fees (7.4% increase) • Higher merchant processing revenue (2.9% increase, 7.6% increase adjusted for the impact of foreign currency rate changes) • Higher credit and debit card revenue (2.7% increase) on volume increase of 6.6% • Lower mortgage revenue primarily due to an unfavorable change in the valuation of mortgage servicing rights net of hedging activities vs. 1Q15 Noninterest income increased $118 million, or 5.5% • Seasonally higher credit and debit card revenue (10.4% increase), merchant processing services revenue (10.0% increase), and deposit service charges (8.1% increase) • Higher trust and investment management fees (3.7% increase) • Partially offset by lower mortgage banking revenue Year-Over-Year Change 7.4% 3.0% 9.9% 2.2% (7.0%) $2,444 $2,242 $2,370 $2,154 $2,272 All Other Mortgage Service Charges Trust and Inv Mgmt Payments Notable items: 2Q14 Visa gain $214 million, 4Q14 Nuveen gain $124 million Payments = credit and debit card, corporate payment products and merchant processing

Service charges = deposit service charges, treasury management and ATM

processing $ in millions

$637 $432 $587 $446 $472 $278 $260 $235 $240 $231 $393 $402 $396 $376 $396 $311 $315 $322 $322 $334 $825 $833 $830 $770 $839 0 700 1,400 2,100 2,800 2Q14 3Q14 4Q14 1Q15 2Q15 10 | 2Q15 Earnings Conference Call |

11 | 2Q15 Earnings Conference Call Noninterest Expense $643 $503 $594 $479 $459 $214 $219 $219 $214 $221 $273 $261 $347 $229 $266 $241 $249 $248 $247 $247 $1,382 $1,382 $1,396 $1,496 $1,489 0 800 1,600 2,400 3,200 2Q14 3Q14 4Q14 1Q15 2Q15 Noninterest Expense Key Points vs. 2Q14 Noninterest expense decreased $71 million, or 2.6% (5.1% increase excluding notable item in 2Q14) • Higher compensation (6.3% increase) reflecting the impact of merit increases, acquisitions, and higher staffing for risk and compliance activities • Higher employee benefits expense (14.0% increase) primarily due to higher pension costs • Lower postage, printing and supplies expense (20.0% decrease) vs. 1Q15 Noninterest expense increased $17 million, or 0.6% • Higher professional services expense (37.7% increase) due to mortgage servicing and compliance related matters • Higher marketing and business development expense (37.1% increase) due to the timing of various marketing programs • Partially offset by lower employee benefit expense (7.6% decrease) primarily resulting from seasonally lower payroll taxes Year-Over-Year Change 7.7% 1.9% 4.5% 4.8% (2.6%) $2,753 $2,614 $2,804 $2,665 $2,682 All Other Tech and Communications Prof Svcs, Marketing and PPS Occupancy and Equipment Compensation and Benefits Notable items: 2Q14 FHA DOJ settlement $200 million, 4Q14 charitable contributions and accruals for legal matters $88 million

$ in millions 11 | 2Q15 Earnings Conference Call |

12 | 2Q15 Earnings Conference Call Capital Position *RWA = risk-weighted assets $ in billions 2Q15 1Q15 4Q14 3Q14 2Q14 Total U.S. Bancorp shareholders' equity 44.5 $ 44.3 $ 43.5 $ 43.1 $ 42.7 $ Standardized Approach Basel III transitional standardized approach Common equity tier 1 capital ratio 9.5% 9.6% 9.7% 9.7% 9.6% Tier 1 capital ratio 11.0% 11.1% 11.3% 11.3% 11.3% Total risk-based capital ratio 13.1% 13.3% 13.6% 13.6% 13.2% Leverage ratio 9.2% 9.3% 9.3% 9.4% 9.6% Common equity tier 1 capital to RWA* estimated for the Basel III fully implemented standardized approach 9.2% 9.2% 9.0% 9.0% 8.9% Advanced Approaches Common equity tier 1 capital to RWA for the Basel III transitional advanced approaches 12.9% 12.3% 12.4% 12.4% 12.3% Common equity tier 1 capital to RWA estimated for the Basel III fully implemented advanced approaches 12.4% 11.8% 11.8% 11.8% 11.7% Tangible common equity ratio 7.5% 7.6% 7.5% 7.6% 7.5% Tangible common equity as a % of RWA 9.2% 9.3% 9.3% 9.3% 9.2% |

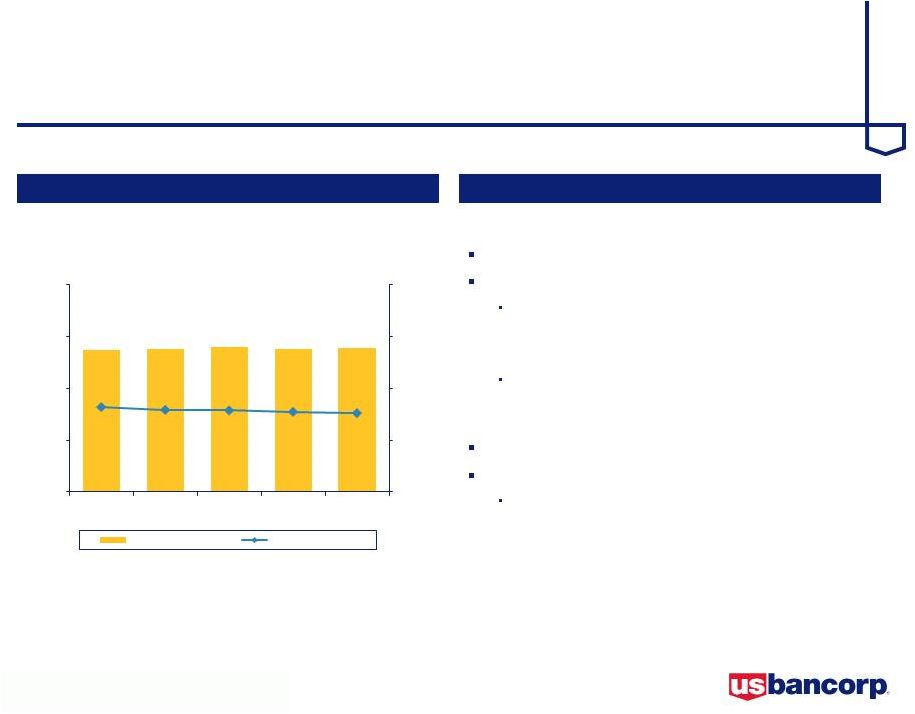

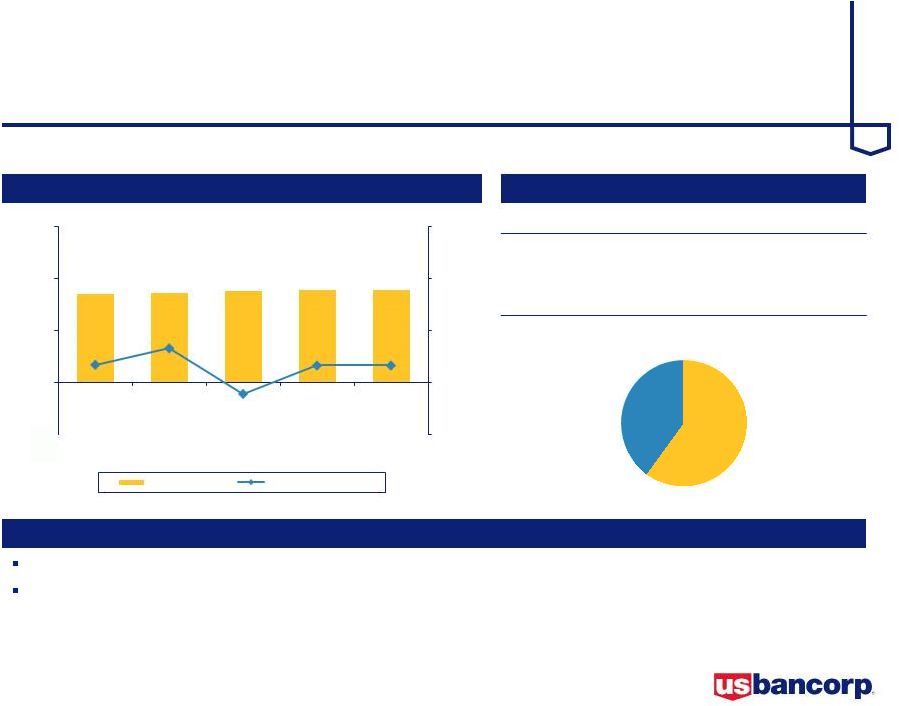

13 | 2Q15 Earnings Conference Call 76% Reinvest and Acquisitions Dividends Share Repurchases Capital Actions 27% 29% 31% 32% 32% 35% 42% 41% 38% 44% 0% 25% 50% 75% 100% 2012 2013 2014 1Q15 2Q15 Dividends Share Repurchases 62% 70% Payout Ratio 71% 72% Dividend increase announced June 16 • Annual dividend increased from $0.98 to $1.02 per share, a 4.1% increase One year authorization to repurchase up to $3.0 billion of outstanding common stock effective April 1, 2015 Returned 76% of earnings to shareholders during 2Q15 Earnings Distribution Target 32% 24% 44% 2Q15 Actual 20 - 40% 30 - 40% 30 - 40% |

Appendix |

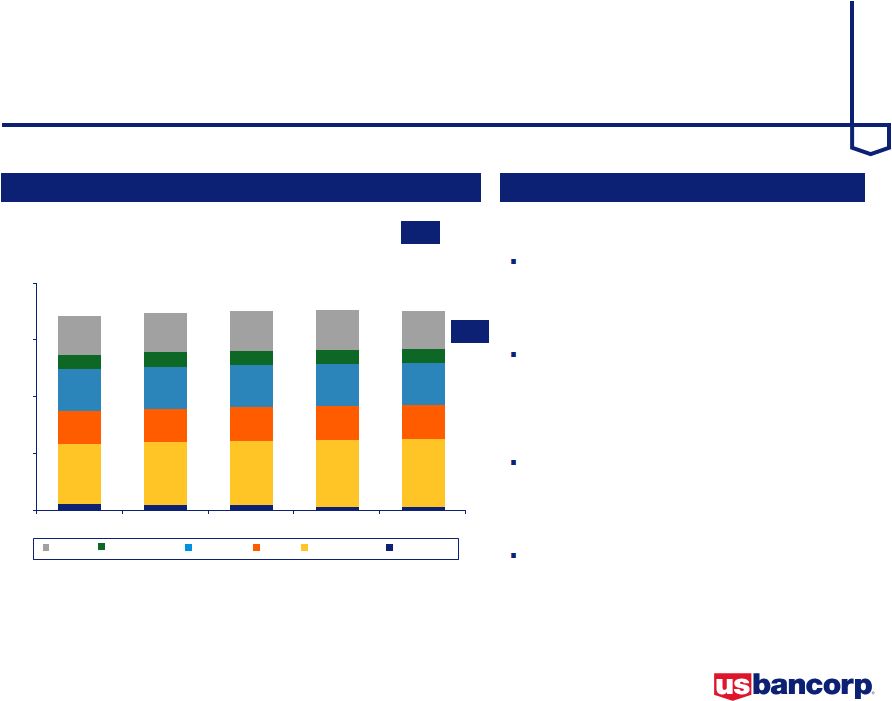

15 | 2Q15 Earnings Conference Call 12.4% 13.6% 15.5% 15.1% 11.0% 6.9% 6.1% 4.2% 6.5% 4.8% 10.5% 5.8% 2.2% (0.3%) (1.4%) 5.9% 4.9% 3.6% 2.4% 1.3% 2.3% 3.6% 3.6% 3.5% (1.8%) 0 70 140 210 280 2Q14 3Q14 4Q14 1Q15 2Q15 Average Loans Key Points vs. 2Q14 Average total loans increased by $6.1 billion, or 2.5% ($9.5 billion, or 4.0% increase excluding student loans, which were reclassified to held for sale at the end of 1Q15) Average total commercial loans increased $8.2 billion, or 11.0%; average commercial real estate loans increased $2.0 billion, or 4.8% vs. 1Q15 Average total loans declined by $1.4 billion, or 0.6% (0.7% increase excluding student loans, which were reclassified to held for sale at the end of 1Q15) Average total commercial loans increased $1.7 billion, or 2.1%; average commercial real estate loans decreased $0.2 billion, or 0.5% Year-Over-Year Growth 6.8% 6.3% 5.9% 5.1% 2.5% Covered Commercial CRE Res Mtg Retail Credit Card $246.6 $240.5 $243.9 $246.4 $248.0 Average Loans 4.0%* $ in billions 5.7%* * Excluding the impact of the reclassification of approximately $3 billion of student loans to held for sale at the end of 1Q15

|

16 | 2Q15 Earnings Conference Call (5.9%) (13.1%) (4.9%) (8.2%) (14.1%) 10.8% 18.3% 19.7% 24.7% 30.2% 8.3% 10.9% 8.3% 7.3% 6.1% 7.4% 8.6% 3.3% 5.2% 7.7% 0 80 160 240 320 2Q14 3Q14 4Q14 1Q15 2Q15 Average Deposits Key Points vs. 2Q14 Average total deposits increased by $23.3 billion, or 8.9% Average low-cost deposits (NIB, interest checking, money market and savings) increased by $29.3 billion, or 13.3% vs. 1Q15 Average total deposits increased by $7.3 billion, or 2.6% Average low-cost deposits increased by $10.4 billion, or 4.4% Year-Over-Year Growth 6.0% 7.4% 7.2% 8.1% 8.9% Time Money Market Checking and Savings Noninterest-bearing $262.4 $271.0 $275.5 $278.5 $285.7 Average Deposits $ in billions 16 | 2Q15 Earnings Conference Call |

17 | 2Q15 Earnings Conference Call Average Loans and Net Charge-offs Ratios Key Statistics Key Points Average quarter-over-quarter loan growth of 2.3% and year-over-year loan growth of 11.5% is supported by strong

credit quality Net charge-offs, nonperforming loans and delinquencies remained at historically low levels

2Q14 1Q15 2Q15 Average Loans $69,920 $76,183 $77,932 30-89 Delinquencies 0.23% 0.19% 0.19% 90+ Delinquencies 0.06% 0.06% 0.05% Nonperforming Loans 0.24% 0.10% 0.10% Credit Quality – Commercial Loans $ in millions 0.0% 0.5% 1.0% 1.5% 2.0% 0 25,000 50,000 75,000 100,000 2Q14 3Q14 4Q14 1Q15 2Q15 20% 24% 28% 32% 36% Revolving Line Utilization Trend $69,920 $72,190 $74,333 $76,183 $77,932 0.30% 0.29% 0.26% 0.21% 0.20% Average Loans Net Charge-offs Ratio |

18 | 2Q15 Earnings Conference Call Average Loans and Net Charge-offs Ratios Key Statistics Key Points Year-over-year average leases increased 4.3% Net charge-offs, nonperforming loans and delinquencies continued at modest levels

2Q14 1Q15 2Q15 Average Loans $5,100 $5,325 $5,321 30-89 Delinquencies 0.75% 0.84% 0.81% 90+ Delinquencies 0.00% 0.00% 0.00% Nonperforming Loans 0.31% 0.24% 0.23% Credit Quality – Commercial Leases $ in millions Small Ticket $3,197 Equipment Finance $2,124 Commercial Leases 18 | 2Q15 Earnings Conference Call $5,100 $5,155 $5,292 $5,325 $5,321 0.7% 0.0% 0.7% 1.4% 2.1% 0 3,000 6,000 9,000 2Q14 3Q14 4Q14 1Q15 2Q15 0.24% 0.46% 0.23% 0.23% Average Loans Net Charge -offs Ratio -0.15% |

19 | 2Q15 Earnings Conference Call Average Loans and Net Charge-offs Ratios Key Statistics Key Points Year-over-year average loans increased 4.8% Historically low delinquency and nonperforming loan levels improved both on a quarter-over-quarter and year-over-

year basis The net charge-off ratio of 0.01% continued a two-year trend of minimal CRE net charge-offs

2Q14 1Q15 2Q15 Average Loans $40,497 $42,671 $42,446 30-89 Delinquencies 0.14% 0.24% 0.12% 90+ Delinquencies 0.06% 0.07% 0.05% Nonperforming Loans 0.55% 0.51% 0.41% Performing TDRs* $330 $259 $240 Credit Quality – Commercial Real Estate (CRE) $ in millions Investor $21,028 Owner Occupied $11,471 Multi-family $3,075 Retail $773 Residential Construction $2,103 A&D Construction $666 Office $1,203 Other $2,127 * TDR = troubled debt restructuring CRE Mortgage CRE Construction $40,497 $40,839 $40,966 $42,671 $42,446 -0.04% 0.04% -0.10% -0.17% 0.01% -0.5% 0.0% 0.5% 1.0% 1.5% 0 20,000 40,000 60,000 2Q14 3Q14 4Q14 1Q15 2Q15 Average Loans Net Charge -offs Ratio |

20 | 2Q15 Earnings Conference Call Average Loans and Net Charge-offs Ratios Key Statistics Key Points Originations are of high credit quality (weighted average FICO 757, weighted average LTV 70%)

83% of the balances have been originated since the beginning of 2009; the origination

quality metrics and performance to date have significantly outperformed

prior vintages with similar seasoning Credit Quality –

Residential Mortgage $ in millions 2Q14 1Q15 2Q15 Average Loans $51,815 $51,426 $51,114 30-89 Delinquencies 0.48% 0.38% 0.38% 90+ Delinquencies 0.49% 0.33% 0.30% Nonperforming Loans 1.57% 1.61% 1.50% *Excludes GNMA loans, whose repayments are insured by the FHA or guaranteed by the Department of VA ($2,080 million in 2Q15)

$51,815 $51,994 $51,872 $51,426 $51,114 0.44% 0.32% 0.30% 0.28% 0.26% 0.0% 0.5% 1.0% 1.5% 2.0% 0 15,000 30,000 45,000 60,000 2Q14 3Q14 4Q14 1Q15 2Q15 Average Loans Net Charge -offs Ratio $1,922 $1,899 $1,866 $1,851 $1,931 0 1,000 2,000 3,000 4,000 2Q14 3Q14 4Q14 1Q15 2Q15 Residential Mortgage Performing TDRs* |

21 | 2Q15 Earnings Conference Call Average Loans and Net Charge-offs Ratios Key Statistics Key Points Average loans increased 1.3% year-over-year driven by high quality originations (weighted average FICO 756)

Delinquencies and losses remain historically low, reflecting stability in both

underwriting and credit quality Nonperforming loans continued to

decline $17,384

$17,753 $17,990 $17,823 $17,613 3.92% 3.53% 3.53% 3.71% 3.85% 0.0% 3.0% 6.0% 9.0% 12.0% 0 6,000 12,000 18,000 24,000 2Q14 3Q14 4Q14 1Q15 2Q15 Average Loans Net Charge-offs Ratio Credit Quality – Credit Card $ in millions 2Q14 1Q15 2Q15 Average Loans $17,384 $17,823 $17,613 30-89 Delinquencies 1.13% 1.16% 1.16% 90+ Delinquencies 1.06% 1.19% 1.03% Nonperforming Loans 0.29% 0.13% 0.09% $52 $40 $30 $22 $16 0.29% 0.22% 0.16% 0.13% 0.09% 0.0% 0.5% 1.0% 1.5% 2.0% 0 20 40 60 80 2Q14 3Q14 4Q14 1Q15 2Q15 Credit Card Nonperforming Loans |

22 | 2Q15 Earnings Conference Call Average Loans and Net Charge-offs Ratios Key Statistics Key Points High-quality originations (weighted average FICO on commitments was 768, weighted average CLTV 71%)

originated primarily through the retail branch network to existing bank customers on

their primary residences Net charge-offs ratio declined on a linked

quarter and year-over-year basis Credit Quality –

Home Equity $ in millions 2Q14 1Q15 2Q15 Average Loans $15,327 $15,897 $15,958 30-89 Delinquencies 0.50% 0.41% 0.36% 90+ Delinquencies 0.26% 0.25% 0.25% Nonperforming Loans 1.11% 1.07% 0.98% Subprime: 1% Wtd Avg LTV*: 90% NCO: 1.83% Prime: 96% Wtd Avg LTV*: 72% NCO: 0.24% Other: 3% Wtd Avg LTV*: 71% NCO: 0.84% *LTV at origination $15,327 $15,704 $15,853 $15,897 $15,958 0.0% 1.0% 2.0% 3.0% 4.0% 0 5,000 10,000 15,000 20,000 2Q14 3Q14 4Q14 1Q15 2Q15 0.60% 0.61% 0.43% 0.36% 0.28% Average Loans Net Charge-offs Ratio 22 | 2Q15 Earnings Conference Call Home Equity |

23 | 2Q15 Earnings Conference Call Average Loans and Net Charge-offs Ratios Key Statistics Key Points Continued high-quality originations (weighted average FICO 790) support the portfolio’s stable credit profile

Delinquencies remained relatively stable at very low levels

Strong used auto values continued to contribute to historically low net

charge-offs Credit Quality –

Retail Leasing $ in millions 2Q14 1Q15 2Q15 Average Loans $6,014 $5,819 $5,696 30-89 Delinquencies 0.16% 0.12% 0.17% 90+ Delinquencies 0.00% 0.00% 0.00% Nonperforming Loans 0.02% 0.02% 0.04% * Manheim Used Vehicle Value Index source: www.manheimconsulting.com, January 1995 = 100, quarter value = average monthly ending

values Average Loans

Net Charge-offs Ratio

$6,014 $5,991 $5,939 $5,819 $5,696 0.0% 0.2% 0.4% 0.6% 0.8% 0 2,000 4,000 6,000 8,000 2Q14 3Q14 4Q14 1Q15 2Q15 100 110 120 130 140 ManheimUsed Vehicle Index* 0.07% 0.00% 0.07% 0.07% 0.07% |

Average

Loans and Net Charge-offs Ratios Key Statistics

Key Points Student loans were moved to held for sale at the end of the first quarter of 2015

Growth in auto and installment loans partially offset the reclassification of student

loans Net charge-offs and delinquencies remained low on a linked

quarter and year-over-year basis Credit Quality –

Other Retail $ in millions 2Q14 1Q15 2Q15 Average Loans $26,587 $27,604 $25,415 30-89 Delinquencies 0.47% 0.44% 0.48% 90+ Delinquencies 0.11% 0.11% 0.10% Nonperforming Loans 0.06% 0.06% 0.07% Installment $6,529 Auto Loans $15,609 Revolving Credit $3,277 $26,587 $27,003 $27,317 $27,604 $25,415 0.68% 0.72% 0.76% 0.60% 0.62% 0.0% 0.5% 1.0% 1.5% 2.0% 0 10,000 20,000 30,000 40,000 2Q14 3Q14 4Q14 1Q15 2Q15 Average Loans Net Charge -offs Ratio 24 | 2Q15 Earnings Conference Call Other Retail |

25 | 2Q15 Earnings Conference Call Average Loans and Net Charge-offs Ratios Key Statistics Key Points Continued growth (10.6% year-over-year) in auto loans driven by high-quality originations in the indirect channel

(weighted average FICO 768)

Net charge-offs seasonally improved on a linked quarter basis and, as expected,

increased slightly year-over-year as growth initiatives continued

to mature Credit Quality –

Auto Loans $ in millions 2Q14 1Q15 2Q15 Average Loans $14,108 $15,013 $15,609 30-89 Delinquencies 0.38% 0.30% 0.35% 90+ Delinquencies 0.03% 0.01% 0.02% Nonperforming Loans 0.01% 0.03% 0.04% Direct: 6% Wtd Avg FICO: 748 NCO: 0.11% Indirect: 94% Wtd Avg FICO: 764 NCO: 0.16% Auto Loans are included in Other Retail category $14,108 $14,404 $14,644 $15,013 $15,609 0.0% 0.5% 1.0% 1.5% 2.0% 0 5,000 10,000 15,000 20,000 2Q14 3Q14 4Q14 1Q15 2Q15 0.11% 0.25% 0.33% 0.19% 0.15% Average Loans Net Charge -offs Ratio 25 | 2Q15 Earnings Conference Call Indirect and Direct Channel |

| 2Q15

Earnings Conference Call 26

26 | 2Q15 Earnings Conference Call Non-GAAP Financial Measures June 30, March 31, December 31, September 30, June 30, (Dollars in Millions, Unaudited) 2015 2015 2014 2014 2014 Total equity $45,231 $44,965 $44,168 $43,829 $43,386 Preferred stock (4,756) (4,756) (4,756) (4,756) (4,756) Noncontrolling interests (694) (688) (689) (688) (686) Goodwill (net of deferred tax liability) (1) (8,350) (8,360) (8,403) (8,503) (8,548) Intangible assets, other than mortgage servicing rights (744) (783) (824) (877) (925) Tangible common equity (a) 30,687 30,378 29,496 29,005 28,471 Tangible common equity (as calculated above) 30,687 30,378 29,496 29,005 28,471 Adjustments (2) 125 158 172 187 224 Common equity tier 1 capital estimated for the Basel III fully implemented standardized and advanced approaches (b) 30,812 30,536 29,668 29,192 28,695 Total assets 419,075 410,233 402,529 391,284 389,065 Goodwill (net of deferred tax liability) (1) (8,350) (8,360) (8,403) (8,503) (8,548) Intangible assets, other than mortgage servicing rights (744) (783) (824) (877) (925) Tangible assets (c) 409,981 401,090 393,302 381,904 379,592 Risk-weighted assets, determined in accordance with prescribed regulatory requirements (d) 333,177 * 327,709 317,398 311,914 309,929 Adjustments (3) 3,532 * 3,153 11,110 12,837 12,753 Risk-weighted assets estimated for the Basel III fully implemented

standardized approach (e)

336,709 * 330,862 328,508 324,751 322,682 Risk-weighted assets, determined in accordance with prescribed transitional advanced approaches regulatory requirements 245,038 * 254,892 248,596 243,909 241,929 Adjustments (4) 3,721 * 3,321 3,270 3,443 3,383 Risk-weighted assets estimated for the Basel III fully implemented

advanced approaches (f)

248,759 * 258,213 251,866 247,352 245,312 Ratios * Tangible common equity to tangible assets (a)/(c) 7.5 % 7.6 % 7.5 % 7.6 % 7.5 % Tangible common equity to risk-weighted assets (a)/(d) 9.2 9.3 9.3 9.3 9.2 Common equity tier 1 capital to risk-weighted assets estimated for the

Basel III fully implemented standardized approach (b)/(e)

9.2 9.2 9.0 9.0 8.9 Common equity tier 1 capital to risk-weighted assets estimated for the Basel III fully implemented advanced approaches (b)/(f) 12.4 11.8 11.8 11.8 11.7 * Preliminary data. Subject to change prior to filings with applicable regulatory agencies.

(1) Includes goodwill related to certain investments in unconsolidated financial

institutions per prescribed regulatory requirements. (2) Includes net

losses on cash flow hedges included in accumulated other comprehensive income and other adjustments. (3) Includes higher risk-weighting for unfunded loan commitments, investment securities, residential mortgages, mortgage servicing rights and

other adjustments. (4)

Primarily reflects higher risk-weighting for mortgage servicing

rights. |

U.S.

Bancorp 2Q15 Earnings Conference Call

July 15, 2015 |