Attached files

| file | filename |

|---|---|

| EX-32.1 - FIRST COLOMBIA GOLD CORP. | ex32-1.htm |

| EX-31.1 - CERTIFICATIONS - FIRST COLOMBIA GOLD CORP. | ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

¨ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to __________.

Commission file number: 000-51203

First Colombia Gold Corp.

(Exact name of registrant as specified in its charter)

|

Nevada

|

98-0425310

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

Paseo de Bernardez #59 FRACC, Lomas de Bernadez,Guadalupe 98610, Zacatecas,Mexico

|

||

|

(Address of principal executive offices) (Zip Code)

|

||

|

Registrant’s telephone, including area code: 1-888-224-6561

|

||

Securities registered under Section 12(b) of the Exchange Act: None.

Securities registered under Section 12(g) of the Exchange Act:

|

Common Stock, $0.00001 par value

|

Not Applicable

|

|

|

(Title of class)

|

(Name of each exchange on which registered)

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨

Non-accelerated filer ¨ Smaller reporting company ý

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date:

|

Class

|

Outstanding at March 31, 2015

|

|

|

Common Stock, $0.00001 par value

|

2,647,819,214

|

Documents Incorporated by Reference: None.

Table of Contents

FORM 10-K

FIRST COLOMBIA GOLD CORP.

DECEMBER 31, 2014

Table of Contents

|

Page

|

|

|

PART I

|

|

|

Item 1. Business.

|

4

|

|

Item 1A. Risk Factors.

|

7

|

|

Item 1B. Unresolved Staff Comments.

|

17

|

|

Item 2. Properties.

|

17

|

|

Item 3. Legal Proceedings.

|

30

|

|

Item 4. Mine Safety Disclosures.

|

30

|

|

PART II

|

|

|

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

31

|

|

Item 6. Selected Financial Data.

|

33

|

|

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

33

|

|

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

|

38

|

|

Item 8. Financial Statements and Supplementary Data.

|

38

|

|

Item 9. Changes In and Disagreements With Accountants on Accounting and Financial Disclosure.

|

38

|

|

Item 9A. Controls and Procedures.

|

38

|

|

PART III

|

|

|

Item 10. Directors, Executive Officers and Corporate Governance.

|

39

|

|

Item 11. Executive Compensation.

|

41

|

|

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

|

44

|

|

Item 13. Certain Relationships and Related Transactions, and Director Independence.

|

44

|

|

Item 14. Principal Accounting Fees and Services.

|

46

|

|

PART IV

|

|

|

Item 15. Exhibits, Financial Statement Schedules.

|

47

|

1

Table of Contents

Cautionary Note Regarding Forward Looking Statements

This annual report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934.The words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “may,” “should,” “could,” “will,” “plan,” “future,” “continue, ” and other expressions that are predictions of or indicate future events and trends and that do not relate to historical matters identify forward-looking statements. These forward-looking statements are based largely on our expectations or forecasts of future events, can be affected by inaccurate assumptions, and are subject to various business risks and known and unknown uncertainties, a number of which are beyond our control. Therefore, actual results could differ materially from the forward-looking statements contained in this document, and readers are cautioned not to place undue reliance on such forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. A wide variety of factor could cause or contribute to such differences and could adversely impact revenues, profitability, cash flows and capital needs. There can be no assurance that the forward-looking statements contained in this document will, in fact, transpire or prove to be accurate. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by any forward-looking statements.

Important factors that may cause the actual results to differ from the forward-looking statements, projections or other expectations include, but are not limited to, the following:

|

●

|

risk that we will not be able to remediate identified material weaknesses in our internal control over financial reporting and disclosure controls and procedures;

|

|

●

|

risk that we fail to meet the requirements of the agreements under which we acquired our options to acquire mineral property interests, including any cash payments to the optionor or any exploration obligations that we have regarding these properties, which could result in the loss of our right to exercise these options to acquire certain mining and mineral rights underlying these properties;

|

|

●

|

risk that we will be unable to secure additional financing in the near future in order to commence and sustain our planned exploration work and be forced to cease our exploration and development program;

|

|

●

|

risk that we cannot attract, retain and motivate qualified personnel, particularly employees, consultants and contractors for our operations;

|

|

●

|

risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits;

|

|

●

|

results of initial feasibility, pre-feasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with our expectations;

|

|

●

|

mining and development risks, including risks related to accidents, equipment breakdowns, labor disputes or other unanticipated difficulties with or interruptions in production;

|

|

●

|

the potential for delays in exploration or development activities or the completion of feasibility studies;

|

|

●

|

risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses;

|

|

●

|

risks related to commodity price fluctuations;

|

2

Table of Contents

|

●

|

the uncertainty of profitability based upon our history of losses;

|

|

●

|

risks related to failure to obtain adequate financing on a timely basis and on acceptable terms for our planned exploration and development projects;

|

|

●

|

risks related to environmental regulation and liability;

|

|

●

|

risks that the amounts reserved or allocated for environmental compliance, reclamation, post-closure control measures, monitoring and on-going maintenance may not be sufficient to cover such costs;

|

|

●

|

risks related to tax assessments;

|

|

●

|

political and regulatory risks associated with mining development and exploration; and

|

|

●

|

other risks and uncertainties related to our prospects, properties and business strategy.

|

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this report. Except as required by law, we do not undertake to update or revise any of the forward-looking statements to conform these statements to actual results, whether as a result of new information, future events or otherwise.

As used in this annual report, “First Colombia,” the “Company,” “we,” “us,” or “our” refer to First Colombia Gold Corp., unless otherwise indicated.

If you are not familiar with the mineral exploration terms used in this report, please refer to the definitions of these terms under the caption “Glossary” at the end of Item 15 of this report.

PART I

ITEM 1. Business.

Corporate History

We were incorporated in the State of Nevada under the name Gondwana Energy, Ltd. on September 5, 1997, and previously operated under the name Finmetal Mining Ltd. and Amazon Goldsands Ltd. Our operations have historically focused on the acquisition and development of mineral property interests in varying locations, including Finland and Peru. The current focus of our business and operations is on the development of our mineral and oil property interests on properties located in the western United States and we are evaluating mineral and oil property interests and seeking opportunities in other geographical areas.

We no longer have any interest in any properties located in northeastern Peru. For reasons which include our inability to secure sufficient financing to be able to cure our default on notes we used to finance our acquisition of the property interests in Peru, we reached an agreement to relinquish our entire interest in the property interests in Peru in exchange for the cancellation of such notes and related outstanding obligations.

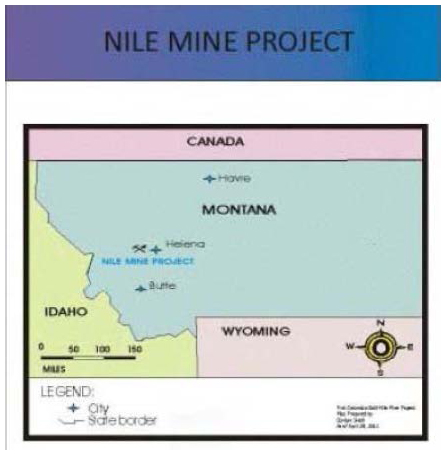

In 2011, we reviewed potential properties for acquisition in Colombia, and expanded our focus to North America which resulted in our acquiring certain mineral property interests in Montana and Idaho in late 2011. Company personnel and consultants are planning our exploration plans, conducting site visits, and reviewing several projects for potential acquisition, and in 2012 we added to our mineral property position through the acquisition of the Skip claims in Montana. We also in 2011 entered into agreements to acquire mineral property interest in the South Idaho Silver and Boulder Hill projects, conducting active due diligence and acquisition work in Croatia, and in 2013 signed a memorandum of understanding on the Nile Mine project in Montana.

In 2014 the Company elected to operate through both a Mining and through an Energy division.

The Company announced a Letter of Intent for a Purchase and Sale Agreement which was entered into on July 15, 2014, and subsequently amended on August 27, 2014. This resulted in the Company acquiring various personal property including transportation and drilling equipment, land and buildings, and other assets including interests in oil wells and leases. The Company has established a divisional office in Albany, Kentucky for its energy division in September 2014. The Company’s current activities are primarily focused on initiating and expanding oil production.

3

The Company is in a process of reviewing its mining division strategy and business plan to re-focus on projects with a shorter time frame for development or securing joint-venture partners.

The Company has hired several operations personnel and is expecting more significant production to begin in the fourth quarter of the current fiscal year. The Company’s short term objective is to reach a target monthly production of 1,000 to 2,500 barrels of oil per month, which is subject to working capital availability and the risk factors described herein.

Mining Division

Description of our Mineral Property Interests

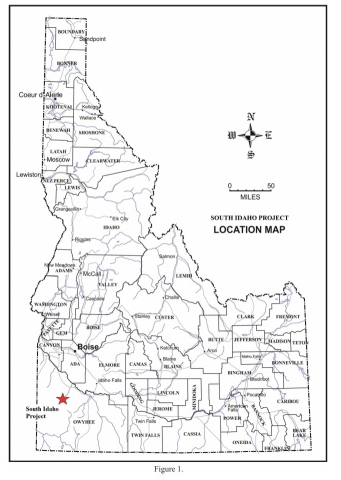

South Idaho Silver Project

On December 7, 2011 (the “Effective Date”), we entered into an Assignment and Assumption Agreement (“Assignment Agreement”) with a private corporation. (“Castle Creek”), an Idaho corporation, and a private individual (‘Ebisch”). Castle Creek and Ebisch are parties to an Option to Purchase and Royalty Agreement dated July 15, 2011 (the “Option Agreement”), for Castle Creek’s option to acquire an undivided 100% of the right, title and interest of Ebisch in and to the PB 7, 9, 11, 12, 23, 25, 27, and 29 lode mining claims (IMC #’s, respectively, 196852, 196854, 196856, 196857, 196866, 196867, 196868, and 196869), situated in Owyhee County, Idaho,. Pursuant to the terms of the Assignment Agreement, Castle Creek transferred and assigned us all of its right, title and interest, in, to and under the Option Agreement and we assumed the assignment of the Option Agreement agreeing to be bound, the same extent as Castle Creek, to the terms and conditions of the Option Agreement.

During 2013, the Company recorded a provision for write-down of mineral property interests of in the amount of $36,650 related to the South Idaho Property.

The Company has elected in 2014 to let this agreement lapse, and to use utilize the database of exploration information developed to target through re-staking a more favorable land position, or to enter into a new agreement with the Ebisch group.

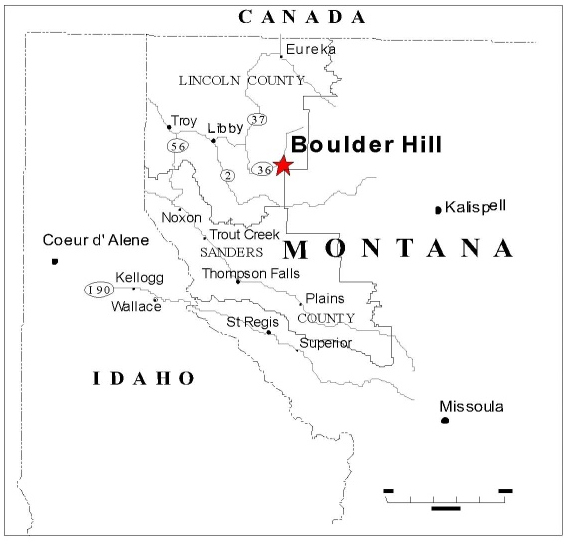

Boulder Hill Project

Purchase and Sale Agreement of Unpatented Mining Claims

On December 16, 2011, we entered into a Purchase and Sale Agreement (“Purchase Agreement”) with Boulder Hill Mines Inc., an Idaho corporation (“Boulder Hill”) relating to the purchase from Boulder Hill of three unpatented mining claims situated in Lincoln County, Montana (the “Boulder Hill Claims”). As consideration for the Boulder Hill Claims, we issued Boulder Hill 1,000 (500,000 pre-reverse )restricted shares of our common stock, are obligated to pay Boulder Hill $25,000 in cash within twelve (12) months of the Effective Date, which is December 16, 2012, and $25,000 in cash within twenty-four (24) months of the Effective Date, which is December 16, 2013.

We received a waiver of the $25,000 cash payment requirement, such payment was due in May 2013, and the Company was unable to make this payment, The Company elected to not continue under the former agreement, nor to explore further in the area after September 30, 2014..

The Purchase Agreement included customary representations and warranties. Under the terms of the Purchase Agreement, Boulder Hill has agreed to indemnify us from claims resulting from any breach or inaccuracy of any representation or warranty made by Boulder Hill in the Purchase Agreement. The Company has been unable to make the required payments, and currently is not planning on re-staking clams in the area in 2014.

Assignment and Assumption of Lease Agreement

On December 16, 2011 (the “Effective Date”), we entered into an Assignment and Assumption Agreement (“Boulder Hill Assignment Agreement”) with Boulder Hill, and a private individual (“Ebisch”). Boulder Hill and Ebisch are parties to an Option to Purchase and Royalty Agreement dated July 15, 2008, as amended on August 1, 2011 (the “ Boulder Hill Option Agreement”) which granted to Boulder Hill an option to acquire an undivided 100% of the right, title and interest of Ebisch in and to that certain Montana State Metal ferrous Gold Lease M-1974-06 dated August 21,2006 he entered into with the State of Montana (the “Montana Gold Lease”) under which Ebisch was granted the exclusive right to prospect, explore, develop and mine for gold, silver and other minerals on property situated in Lincoln County, Montana. The Montana Gold Lease is for a ten (10) year term and is subject to the 5% net smelter return due to the State of Montana. Pursuant to the terms of the Boulder Hill Assignment Agreement, Boulder Hill transferred and assigned us all of its right, title and interest, in, to and under the Option Agreement and we assumed the assignment of the Boulder Hill Option Agreement agreeing to be bound, the same extent as Boulder Hill, to the terms and conditions of the Boulder Hill Option Agreement. As consideration for the Boulder Hill Assignment Agreement, we issued Boulder Hill 1,000 (500,000 pre reverse) restricted shares of our common stock and are obligated to pay Boulder Hill $25,000 in cash within twelve (12) months of the Effective Date, which is December 16, 2012, waived until May 2013, and $25,000 in cash within twenty-four (24) months of the Effective Date, which is December 16, 2013.

4

The Boulder Hill Option Agreement provided for certain cash payments, some of which were met, however the Company has elected to let the agreement lapse.

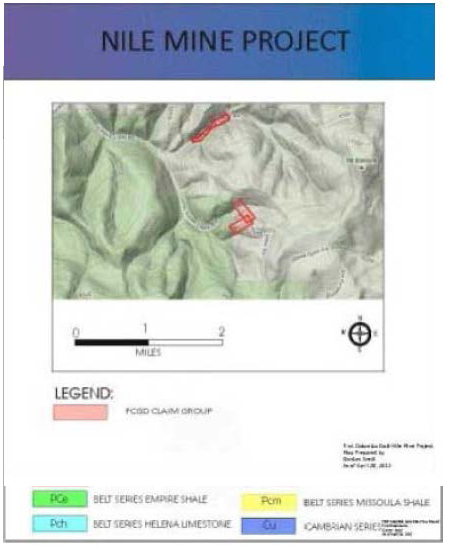

Nile Mine Project

Memorandum of Understanding to Earn-Interest in the Nile Mine Project

On May 1, 2013, the Company with GMRV, a branch of 4uX, LLC, a private Montana company (“GMRV”) entered into a Memorandum of Understanding (“MOU”) to enter into a Definitive Agreement within 180 days for the Company to earn a fifty percent interest in the Nile Mine project. The Company has not entered into a final and definitive agreement at this time. In May 2014 GMRV waived 2013 cash payments in exchange for an agreed upon payments by June and September 30 of 2014, respectively, and provided additional time for preparation and implementation of a definitive agreement. The Company made a payment of the $5,000 due by June 2014 in the form of cash and restricted common shares. The Company is discussing modification and further extensions of the MOU and/or entering into a final definitive agreement, but did not make the required payments as of September 30, 2014. The Memorandum of Understanding therefore is in default.

Land Status

The project is owned/controlled by GMRV and private interests. The Company signed a Memorandum of Understanding (“MOU”) on the project effective May 1, 2013 containing the following terms and conditions for the Company to earn a 50% interest in the project, subsequently amended in May 2014:

Paying within 180 days of the signing of this MOU $2,500 which will be payable in cash or the issuance of restricted shares of the Company at the market bid price, or the equivalent in restricted preferred shares of the Company, subject to an subscription agreement signed by GMRV acceptable to the Company. The Company has agreed to an initial work commitment of $5,000 in 2013, and upon mutual agreement of an exploration plan for 2014, an increased work commitment of at least $10,000 for 2014.As described above this understanding has been extended eliminating cash payments during the extension period and instead the Company may make cash payments or in restricted common stock. The Company during the quarter met the $5,000 commitment through the issuance of restricted stock and prior cash payments.

5

The Company agreed that work commitment will include the consulting services that will be provided by GMRV. The parties in good faith agree to enter into a definitive agreement with duration of 10 years, with a work commitment for this period of $250,000 and annual minimum advance royalty payments of $5,000 per year in cash, common shares, or preferred shares, at First Colombia’s option, for First Colombia to earn a 50% interest in the project. Should a mutually agreed upon definitive agreement not be agreed on and implemented within the effective date of this agreement, the payment referred to above shall be non-refundable. As above this requirement is temporarily waived.

On the effective Date: May 1, 2013, The Company was responsible for all property maintenance fees, estimated not to exceed $500 annually at the current BLM Maintenance Fee rate.

The foregoing description of the MOU does not purport to be complete and is qualified in its entirety by reference to the MOU, previously filed on the Form 8-K and is incorporated herein by reference.

Description of Property

Location

The project is located in Marysville Mining District in the Marysville area, and is comprised of the Nile Mine and nearby Springer II Placer mining claim, comprising approximately fifty-five acres. The Nile Mine Project consists of two unpatented lode claims covering the over 1,000 feet of the unpatented section of Nile and South Nile Veins and the Nile Cross-Cut located in Section 4, T11N, R6W. The Springer_II Placer consists of one unpatented placer claim covering three tailing ponds and nearly 0.3 miles of old dredge piles in Section 32, T12N, R6W. The mill tailings are from the Empire Mill located further up the drainage.

6

History

The placer property contains evidence of production from a former gold-silver mill. Prior sampling identified about 13,000 cubic yards of mill tailings containing gold, silver, and copper values. The Company has not verified prior sampling results. The lead-silver-gold mine reported intermittent production from 1890's through 1940's.

Regional Geology

The Company is currently reviewing regional and project geology.

Project Infrastructure, Access and Power

There is evidence and historical information that indicates some level of production from the Nile Mine but the Company hasn’t completed a thorough review of this data.

Reserves

There are no established reserves on the project.

Permitting

In Montana an Exploration License or POO (Plan of Operation) may be required depending on the extent of planned surface disturbance or water discharge form exploration and development activities, and such permits can typically require bonding.

Exploration Plans

We have been in discussions with GMRV for an initial exploration plan involving surface sampling, road building and other rehabilitation work to improve underground access, and possible bulk sampling. We estimate this plan would cost between $5,000 to $25,000, and provided funding is available, we plan to embark on this plan in the period between January and June 2015... During the quarter surface samples were taken of the property and are awaiting assay. The Company incurred $5,000 related to the implementation of the MOU agreement, in the period ending September 30, 2014. The Company however is in default to the original MOU, thus would need to negotiate a revised agreement to proceed for which there is no assurance a revision could be negotiate under terms the company considers acceptable.

Skip Claims

Land Status

The Skip unpatented mining claims comprise approximately forty acres and are considered a potential silver prospect.

Reserves

There are no established reserves on the property.

Exploration History

The Company has no documented information on prior exploration history. The Company has noticed evidence of trenching on the property.

Exploration Plans

The Company’s next step would be to prepare basic mapping, geologic mapping and taking surface samples. The Company believes that seeking a joint-venture partner would be the preferable approach to advancing the project.

Other Exploration Areas

Our strategy is to advance projects we own, lease or option, and seek joint-venture partners where possible, and to acquire additional projects in different geographical areas though our concentration currently is in Montana and Idaho. There is no assurance this will result in additional projects for the Company, or if they do the Company will meet regulatory and financial requirements to acquire any projects identified.

We are also considering further geographic locations for exploration projects including Mexico and Europe. This activity consists primarily of reviewing historical data to determine potential areas of interest, to be followed by a determination for requirements and potential for acquiring mineral property interest. These activities may not lead to future acquisitions absent future financing under terms deemed acceptable to, if any such financing is available, and determining properties that management believes are properties of merit to add to our portfolio of mineral interests. The Company has retained consulting assistance in south Eastern Europe, and we forecast consulting expenditures of $5,000 to $15,000 in the upcoming six months...

7

Please find attached certain mining terms that may not be familiar.

Glossary of Certain Mining Terms

|

Andesite

|

A gray, fine-grained volcanic rock, chiefly plagioclase and feldspar

|

|

Argentite

|

A valuable silver ore, Ag2S, with a lead-gray color and metallic luster that is often tarnished a dull black

|

|

Arsenic

|

A very poisonous metallic element that has three allotropic forms

|

|

Arsenopyrite

|

A silvery-gray mineral consisting of an arsenide and sulfide of iron

|

|

Basalt

|

An extrusive volcanic rock composed primarily of plagioclase, pyroxene and some olivine

|

|

brecciated tuffs

|

Rocks in which angular fragments are surrounded by a mass of fine grained minerals

|

|

Chalcopyrite

|

A sulphide mineral of copper and iron the most important ore mineral of copper

|

|

Cretaceous

|

Geologic period and system from circa 145.5 ± 4 to 65.5 ± 0.3 million years ago

|

|

Diorite

|

An intrusive igneous rock composed chiefly of sodic plagioclase, hornblende, biotite or pyroxene

|

|

Electrum

|

An alloy of silver and gold

|

|

Eocene

|

the second epoch of the Tertiary Period

|

|

Epithermal

|

Pertaining to mineral veins and ore deposits formed from warm waters at shallow depth

|

|

Fault

|

A break in the Earth’s crust caused by tectonic forces which have moved the rock on one side with respect to the other.

|

|

Galena

|

Lead sulphide, the most common ore mineral of lead

|

|

Granodiorite

|

a phaneritic igneous rock with greater than 20% quartz

|

|

Hornfels

|

A fine-grained metamorphic rock composed of quartz, feldspar, mica, and other minerals

|

|

Humus

|

organic component of soil, formed by the decomposition of leaves and other plant material by soil microorganisms

|

|

Igneous

|

Formed by the solidification

|

|

kaolin-chlorite

|

A fine soft white clay, used for making porcelain and china, as a filler in paper and textiles, and in medicinal absorbents

|

|

Metamorphism

|

The process by which the form and structure of rocks is changed by heat and pressure

|

|

Miocene

|

the fourth epoch of the Tertiary period.

|

|

montmorillonite

|

An aluminum-rich clay mineral of the smectite group, containing sodium and magnesium

|

|

paragenesis

|

A set of minerals that were formed together, esp. in a rock, or with a specified mineral

|

|

Piedrancha

|

A fault line in Colombia

|

|

Reserves

|

That part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination

|

|

Sericite

|

a fine grained mica, either muscovite, illite, or paragonite

|

|

Shale

|

Sedimentary rock formed by the consolidation of mud or silt

|

|

Sphalerite

|

A zinc sulphide metal; the most common ore mineral of zinc

|

|

Tertiary

|

Stones deposited during the Tertiary period lasting from about 65 million to 1.6 million years ago

|

|

Zinc

|

a silvery-white metal that is a constituent of brass and is used for coating (galvanizing)

|

Mine safety issues: As we have no operating mines or mines under development at present we have no disclosures related to mine safety issues.

Energy Division

The Company during the quarter appointed a CEO and Director with experience in the energy sector, and began due diligence on acquiring oil assets in Kentucky with an objective of building assets and cash flow in this sector providing suitable acquisitions are both identified and feasible for the Company to acquire. On July 15, 2014 a Purchase and Sales Agreement was signed, subsequently amended on August 27, 2014, to acquire certain oil interests including equipment, land and buildings (further described below).

The Company’s strategy is to build assets and cash flow through acquiring undervalued energy assets and build value through:

|

·

|

Building economies of scale in exploration , development , production and distribution

|

|

·

|

Adding reserves and increasing production by providing capital for exploration, equipment and well enhancement

|

|

·

|

Conducting exploration on properties and oil interests acquired which prior owners were unable to do due to financial or other constraints

|

|

·

|

Seek to be vertically integrated by building our own oil field services capability for drilling, maintenance and development wherever this is more cost effective

|

The Company expects this business plan to implement our strategy will result in a business model providing three revenue streams:

|

·

|

A revenue, profit or royalty interest in certain oil wells and leases

|

|

·

|

As a contractor providing oil well services ranging from drilling to operating to maintaining

|

|

·

|

Exploring and producing from wells and leases we own outright, which are subject to third-party royalties or working interests

|

8

General Oil and Gas Industry Overview

Our energy division is principally focused on “upstream” activities which include (a) acquiring mineral rights (b)

exploring for oil (c) drilling wells and installing production equipment (d)lifting the oil to surface (e) storing and preparing for transport.

Oil prices are volatile depending on various factors: competing energy sources (coal, natural gas, nuclear, solar, wind, hydroelectric, and others); political turmoil in areas of significant production or reserves; general economic trends, and other actors.

The Company in the third quarter acquired interests in oil wells in Kentucky from a private company. The Company efforts are focused on maintaining production, expanding production and targeted drilling in areas the Company believes are most prospective for new or increased production. We acquired at the same time land, building, and oil field service equipment to support this effort, and hired a local general manger with long experience in the oil industry and Kentucky in particular. We received our first revenue payment during the quarter, and in accordance with our business plan are focused on increasing revenue and cash flow from the oil interests acquired.

Competition

The oil and gas industry is highly competitive. Our competitors and potential competitors include major oil companies and independent producers of varying sizes which are engaged in the acquisition of producing properties and the exploration and development of prospects. Most of our competitors have greater financial, personnel and other resources than we do and therefore have greater leverage in acquiring prospects, hiring personnel and marketing oil and gas.

Government Regulations

The production and sale of oil and gas is subject to regulation by state, federal and local authorities. In most areas there are statutory provisions regulating the production of oil and natural gas under which administrative agencies may set allowable rates of production and promulgate rules in connection with the operation and production of such wells, ascertain and determine the reasonable market demand of oil and gas, and adjust allowable rates with respect thereto.

The sale of liquid hydrocarbons was subject to federal regulation under the Energy Policy and Conservation Act of 1975 which amended various acts, including the Emergency Petroleum Allocation Act of 1973. These regulations and controls included mandatory restrictions upon the prices at which most domestic and crude oil and various petroleum products could be sold. All price controls and restrictions on the sale of crude oil at the wellhead have been withdrawn. It is possible, however, that such controls may be re-imposed in the future but when, if ever, such re-imposition might occur and the effect thereof is unknown.

The sale of certain categories of natural gas in interstate commerce is subject to regulation under the Natural Gas Act and the Natural Gas Policy Act of 1978 (“NGPA”). Under the NGPA, a comprehensive set of statutory ceiling prices applies to all first sales of natural gas unless the gas specifically exempt from regulation (i.e., unless the gas is deregulated). Administration and enforcement of the NGPA ceiling prices are delegated to the Federal Energy Regulatory Commission (“FERC”). In June 1986 the FERC issued Order No. 451, which in general is designed to provide a higher NGPA ceiling price for certain vintages of old gas. It is possible, though unlikely, that we may in the future acquire significant amounts of natural gas subject to NGPA price regulations and/or FERC Order No. 451.

Our operations are subject to extensive and continually changing regulation because of legislation affecting the oil and natural gas industry is under constant review for amendment and expansion. Many departments and agencies, both federal and state, are authorized by statute to issue and have issued rules and regulations binding on the oil and natural gas industry and its individual participants. The failure to comply with such rules and regulations can result in large penalties. The regulatory burden on this industry increases our cost of doing business and, therefore, affects our profitability. However, we do not believe that we are affected in a significantly different way by these regulations than our competitors are affected.

Transportation and Production

Transportation and Sale of Oil and Natural Gas. We can make sales of oil, natural gas and condensate at market prices which are not subject to price controls at this time. The price that we receive from the sale of these products is affected by our ability to transport and the cost of transporting these products to market. Under applicable laws, FERC regulates:

● the construction of natural gas pipeline facilities, and

● the rates for transportation of these products in interstate commerce.

Our possible future sales of natural gas are affected by the availability, terms and cost of pipeline transportation. The price and terms for access to pipeline transportation remain subject to extensive federal and state regulation. Several major regulatory changes have been implemented by Congress and FERC from 1985 to the present. These changes affect the economics of natural gas production, transportation and sales. In addition, FERC is continually proposing and implementing new rules and regulations affecting these segments of the natural gas industry that remain subject to FERC’s jurisdiction. The most notable of these are natural gas transmission companies.

9

FERC’s more recent proposals may affect the availability of interruptible transportation service on interstate pipelines. These initiatives may also affect the intrastate transportation of gas in some cases. The stated purpose of many of these regulatory changes is to promote competition among the various sectors of the natural gas industry. These initiatives generally reflect more light-handed regulation of the natural gas industry. The ultimate impact of the complex rules and regulations issued by FERC since 1985 cannot be predicted. In addition, some aspects of these regulatory developments have not become final but are still pending judicial and FERC final decisions. We cannot predict what further action FERC will take on these matters. However, we do not believe that any action taken will affect us much differently than it will affect other natural gas producers, gatherers and marketers with which we might compete.

Effective as of January 1, 1995, FERC implemented regulations establishing an indexing system for transportation rates for oil. These regulations could increase the cost of transporting oil to the purchaser. We do not believe that these regulations will affect us any differently than other oil producers and marketers with which we compete.

Regulation of Drilling and Production. Our proposed drilling and production operations are subject to regulation under a wide range of state and federal statutes, rules, orders and regulations. Among other matters, these statutes and regulations govern:

|

●

|

the amounts and types of substances and materials that may be released into the environment,

|

|

●

|

the discharge and disposition of waste materials,

|

|

●

|

the reclamation and abandonment of wells and facility sites, and

|

|

●

|

the remediation of contaminated sites,

|

and require:

|

●

|

permits for drilling operations,

|

|

●

|

drilling bonds, and

|

|

●

|

reports concerning operations.

|

Environmental Regulations

General. Our operations are affected by the various state, local and federal environmental laws and regulations, including the:

|

●

|

Clean Air Act,

|

|

●

|

Oil Pollution Act of 1990,

|

|

●

|

Federal Water Pollution Control Act,

|

|

●

|

Resource Conservation and Recovery Act (“RCRA”),

|

|

●

|

Toxic Substances Control Act, and

|

|

●

|

Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”).

|

These laws and regulations govern the discharge of materials into the environment or the disposal of waste materials, or otherwise relate to the protection of the environment. In particular, the following activities are subject to stringent environmental regulations:

|

●

|

drilling,

|

|

●

|

development and production operations,

|

|

●

|

activities in connection with storage and transportation of oil and other liquid hydrocarbons, and

|

|

●

|

use of facilities for treating, processing or otherwise handling hydrocarbons and wastes.

|

10

Violations are subject to reporting requirements, civil penalties and criminal sanctions. As with the industry generally, compliance with existing regulations increases our overall cost of business. The increased costs cannot be easily determined. Such areas affected include:

|

●

|

unit production expenses primarily related to the control and limitation of air emissions and the disposal of produced water,

|

|

●

|

capital costs to drill exploration and development wells resulting from expenses primarily related to the management and disposal of drilling fluids and other oil and natural gas exploration wastes, and

|

|

●

|

capital costs to construct, maintain and upgrade equipment and facilities and remediate, plug and abandon inactive well sites and pits.

|

Environmental regulations historically have been subject to frequent change by regulatory authorities. Therefore, we are unable to predict the ongoing cost of compliance with these laws and regulations or the future impact of such regulations on our operations. However, we do not believe that changes to these regulations will have a significant negative effect on our operations.

A discharge of hydrocarbons or hazardous substances into the environment could subject us to substantial expense, including both the cost to comply with applicable regulations pertaining to the cleanup of releases of hazardous substances into the environment and claims by neighboring landowners and other third parties for personal injury and property damage. We do not maintain insurance for protection against certain types of environmental liabilities.

The Clean Air Act requires or will require most industrial operations in the United States to incur capital expenditures in order to meet air emission control standards developed by the EPA and state environmental agencies. Although no assurances can be given, we believe the Clean Air Act requirements will not have a material adverse effect on our financial condition or results of operations.

RCRA is the principal federal statute governing the treatment, storage and disposal of hazardous wastes. RCRA imposes stringent operating requirements, and liability for failure to meet such requirements, on a person who is either:

|

●

|

a “generator” or “transporter” of hazardous waste, or

|

|

●

|

an “owner” or “operator” of a hazardous waste treatment, storage or disposal facility.

|

At present, RCRA includes a statutory exemption that allows oil and natural gas exploration and production wastes to be classified as non-hazardous waste. As a result, we will not be subject to many of RCRA’s requirements because our operations will probably generate minimal quantities of hazardous wastes.

CERCLA, also known as “Superfund,” imposes liability, without regard to fault or the legality of the original act, on certain classes of persons that contributed to the release of a “hazardous substance” into the environment. These persons include:

|

●

|

the “owner” or “operator” of the site where hazardous substances have been released, and

|

|

●

|

companies that disposed or arranged for the disposal of the hazardous substances found at the site.

|

CERCLA also authorizes the EPA and, in some instances, third parties to act in response to threats to the public health or the environment and to seek to recover from the responsible classes of persons the costs they incur. In the course of our ordinary operations, we could generate waste that may fall within CERCLA’s definition of a “hazardous substance.” As a result, we may be liable under CERCLA or under analogous state laws for all or part of the costs required to clean up sites at which such wastes have been disposed.

Under such law we could be required to:

|

●

|

remove or remediate previously disposed wastes, including wastes disposed of or released by prior owners or operators,

|

|

●

|

clean up contaminated property, including contaminated groundwater, or

|

|

●

|

perform remedial plugging operations to prevent future contamination.

|

We could also be subject to other damage claims by governmental authorities or third parties related to such contamination.

11

Market for oil and gas production

The market for oil and gas production is regulated by both the state and federal governments. The overall market is mature and with the exception of gas, all producers in a producing region will receive the same price. The major oil companies will purchase all crude oil offered for sale at posted field prices. There are price adjustments for quality differences from the Benchmark. Benchmark is Saudi Arabian light crude oil employed as the standard on which OPEC price changes have been based. Quality variances from Benchmark crude results in lower prices being paid for the variant oil. Oil sales are normally contracted with a purchaser or gatherer as it is known in the industry who will pick up the oil at the well site. In some instances there may be deductions for transportation from the well head to the sales point. At this time the majority of crude oil purchasers do not charge transportation fees unless the well is outside their service area. The service area is a geographical area in which the purchaser of crude oil will not charge a fee for picking upon the oil. The purchaser or oil gatherer as it is called within the oil industry, will usually handle all check disbursements to both the working interest and royalty owners. Royalty owners and overriding royalty owners often receive a percentage of gross oil production for the particular lease and are not obligated in any manner whatsoever to pay for the costs of operating the lease.

Kentucky Oil and Gas Region

In 2011 the Kentucky Geological survey reported 24,364 oil wells in production in Kentucky which produced 790 million barrels of oil form 61 counties. The leading production zones are in Cambrian to Pennsylvanian rocks from more than 1,500 pools; oil is produced from Missippian limestones and sandstone in Eastern and Western Kentucky. Our plan is to acquire properties and oil interests where we believe that are underexplored, or wells that we believe that modern enhanced recovery techniques could initiate or improve oil production.

Oil Leases and Wells

The Company acquired during the quarter ending September 30, 2014 ownership interests of certain oil wells, leases and working interests in the counties of Cumberland (KY), Monroe (KY), Overton (TN) and Clinton (KY). This totaled reportedly 113 wells, (our 8k filing is incorporated by reference and an exhibit to this report). We currently have interests in 96 wells with a gross acreage of 4,302 acres.

Reserves

As of the end of the 2014 fiscal year, the Company had no proven reserves.

As of December 31, 2014 the Company has not completed reserve studies on oil and gas assets acquired in the quarter. The prior operator has reported reserves existing on certain of the wells for which the Company will review as part of its plan to conduct new reserve studies.

Production, Production Prices and Production Costs

Sales of oil during the quarter ending September 30, 2014 amounted to $1,738.99, for 232.31 barrels at an average price of $87.58 per barrel and at an average production cost per barrel of $116.25. All of our oil production has occurred in the United States. The Company had no sales of oil and gas prior to the current quarter.

The Company owns a net retained interest (“NRI”) and net working interest (“NWI”) in 87 oil wells and oil leases, generally ranging from an NRI of 7.8% to 19.5%. This percentage interest is based on initial documentation received as part of the purchase of this interest. Revenue from this interest in the quarter was $1,738.99. The oil and gas operations in which the Company has this interest produced were reported to be 232.31 barrels of oil for a gross revenue of $2,230.46, with revenue costs reported at $26,514.45, for the quarter ended September 30, 2014.

Past and Present Development Activities

We did not drill any exploratory or development wells in the quarter ending September 30, 2014, but have started mobilization of resources for a drilling plan, subject to financing, of over 40 wells in the final quarter of the current fiscal year. It is estimated than an additional $200,000 in working capital will be required expand our current drilling plans. During the 2013 fiscal year we did not drill any exploratory wells in the United States. We did not drill any development wells during the 2013 fiscal year.

Delivery Commitments

As of December 31, 2014, we had no delivery commitments for oil or natural gas under existing contracts or agreements.

As of December 31, 2014, we had no delivery commitments for oil or natural gas under existing contracts or agreements.

Properties, Wells, Operations, Acreage and Current Activities

The following table sets forth our interest in wells and acreage as of December 31, 2014.

|

Number of Productive Wells (1)

|

Developed Acreage (4)

|

Undeveloped Acreage

|

||||

|

Gross (2)

|

Net (3)

|

Gross (2)

|

Net (3)

|

Gross (2)

|

Net (3)

|

|

|

Oil

|

45

|

2.66

|

2610.27

|

154.15

|

1801.24

|

106.68

|

|

Gas

|

0

|

0

|

0

|

0

|

0

|

0

|

12

|

(1)

|

A well which has both oil and gas completions is classified as an oil well.

|

|

(2)

|

A gross well or acre is a well or acre in which we own an interest.

|

|

(3)

|

A net well or acre is deemed to exist when the sum of fractional ownership interests in wells or acres equals 1.

|

|

(4)

|

Developed acreage is acreage assignable to productive wells.

|

During the year ending December 31, 2014, 46 wells were being worked on for a return to production.

Interest in Net Revenues of Oil Wells and Leases

The Company acquired a 19.5% interest in the net revenue interest of a private Company during the quarter ending September 30, 2014. The interest is in 35 leases, containing at present 92 wells. The net interest acquired ranges from 2.0475 to 16.72125% according to the records provided, and is currently being reviewed.

The following table sets forth our interest (of this category) in wells and acreage as of December 31, 2014.

|

Number of Productive Wells (1)

|

Developed Acreage (4)

|

Undeveloped Acreage

|

||||

|

Oil

|

62

|

2610.27

|

1801.24

|

|||

|

Gas

|

0

|

0

|

0

|

|||

|

(1)

|

A well which has both oil and gas completions is classified as an oil well.

|

|

(2)

|

A gross well or acre is a well or acre in which we own an interest.

|

|

(3)

|

A net well or acre is deemed to exist when the sum of fractional ownership interests in wells or acres equals 1.

|

|

(4)

|

Developed acreage is acreage assignable to productive wells.

|

During the year ending December 31, 2014 the operator of these leases and wells reported that 62 wells were being worked on for a return to production, i.e. those with a working interest, out of a total 24 wells being prepared for a return to production.

Oil Field Services and Transportation

The Company in the quarter acquired transportation and oil field service equipment, office furniture and equipment, land and buildings located in Kentucky, and the Company established an operating division in Albany, Kentucky. The Company reported the assets acquired in our 8k filings.

The Company plans to utilize these assets to explore, develop and produce form its own interests in leases and oil wells, and to provide contracting services to local oil field companies including the operator of certain leases and wells in which the company has a revenue interest in as described above. The Company may bill for the use of its equipment or personnel at a fixed fee or at cost plus percentage basis. We expect that up to $150,000 in working capital may be required for providing such services in the fourth quarter of 2014.

The Company expects initial revenue to occur in the fourth quarter, and the equipment acquired can also be used in its internal operations thus reducing reliance and cost on outside contractors.

Results of Operations for the Twelve Months Ended December 31, 2014 and 2013

Revenues

First Colombia Gold had not generated any revenues from operations since our inception through August 2014, however, September due to our recent acquisition of oil interests we received revenue of $2,230.46. In total, we received $22,726 in revenue through December 31, 2014 as a result of our oil acquisition. We had zero revenue in the year ended December 31, 2013,

13

Operating Expenses

We reported operating expenses in the amount of $56,064,409 for the twelve months ending December 31, 2014, an increase of $55,791,099. Of that number, $32,212 was depreciation and amortization and $433,229 was operating expenses related to the oil acquisition. The remaining $55,598,968 was stock compensation related to numerous issuances in conjunction compensation and services booked at a variety of market prices throughout the year ending December 31, 2014. For the year ending December 31, 2013 we had operating expenses of $273,310, which included $182,299 in general and administrative expenses and $41,600 in mining exploration and an impairment charge of $36,650. The majority of the increasing expenses in 2014 was the result of $53,997,637 in stock issued compensation.

Other Income/Expense

The Company recorded net other income of $1,252,681 an increase of $2,104,290 which was mostly the result of gain on derivative liabilities of $3,503,865 for the twelve months ended December 31, 2014. We recorded interest expense of $1,795,289 for the 2014 fiscal year. The derivative ability is premeasured quarterly. For the year ended December 31, 2013 we recorded $851,609 in other expenses including interest expense of $456,156.

Net Income (Loss)

As a result of the above mentioned items, for the twelve months ended December 31, 2014, we reported a net loss of $54,811,728 for the year ending December 31, 2014.and a net loss for the year ended December 31, 2013 of $1,124,919 which was an increase of $53,686,809 for the factors cited above,

Liquidity and Capital Resources

At December 31, 2014, we had cash and cash equivalents of $33,833, compared to $0 at December 31, 2013.

Our present capital resources are insufficient to commence and sustain all planned acquisition, development and exploration activity. The company elected to re-focus its mining division on exploration in its existing areas of focus to determine acquisitions of more advanced properties, and retain its Skip claims for initial exploration. We estimate that for the next twelve months our mining division will require up to $100,000 in working capital for these plans. For our energy division we estimate that our oil field services division will require up to $200,000 in working capital, and our oil and gas operations require a minimum of $200,000 up to $400,000 for our activities which are geared to steadily establishing and increasing production from existing wells.

In addition to any expenditures related to any exploration activity, our business plan provides for spending of approximately $20,000 in ongoing general and administrative expenses per month for the next twelve months, for a total anticipated expenditure for general and administrative expenses of $240,000 over the next twelve months. The general and administrative expenses for the year will consist primarily of professional fees for the audit and legal work relating to our regulatory filings throughout the year, as well as transfer agent fees and general office expenses. Management compensation is forecast at approximately $144,000 for the next 12 months.

We have only recently generated our first revenue and while we are planning to increase our revenue quarterly there is no assurance we will be successful in doing so, or that any such revenue would be sufficient to meet our working capital needs.

Accordingly, we must obtain additional financing in order to continue our plan of operations during and beyond the next twelve months, which would include being able to sustain any exploration, development and production activity. We believe that traditional debt financing may not be an alternative for funding additional phases of exploration, development or production activities in the current lending environment, but over time if we are successful in our business plan revenue increases may improve our borrowing capability. We anticipate that additional funding will be in the form of equity financing from the sale of our common stock and the issuance of convertible notes. We cannot provide investors with any assurance that we will be able to raise sufficient funding from the sale of our common stock to fund our implement our current business plan, or any acquisition of additional property interests. Any issuance of common stock would dilute the interests of our existing stockholders. In the absence of such financing, we will not be able to pursue our business plan and may not be able to maintain our property interests in good standing. If we are unable to raise additional capital in the near future, we will experience liquidity problems and we would need to curtail operations, liquidate assets, seek additional capital on less favorable terms and/or pursue other remedial measures.

We may consider entering into a joint venture arrangement to provide the required funding to explore and develop the properties underlying our interests. We have not undertaken any efforts to locate a joint venture participant. Even if we determine to pursue a joint venture participant, there is no assurance that any third party would enter into a joint venture agreement with us in order to fund exploration of the properties underlying our mineral property interests. If we enter into a joint venture arrangement, we would likely have to assign a percentage of our interest in property interests to the joint venture participant.

The company has been dependent on convertible note financing which can be highly dilutive to existing shareholders, and there is no assurance the company can continue to receive such financing.

Cash Used in Operating Activities

14

Operating cash flows for the period ending December 31, 2014 were a negative $56,064,409. The increase in negative cash flow from operations is due to increases in debt discount amortization, origination interest, and stock issued for services, offset by gain on derivative liabilities.

Cash Used in Investing Activities

For the year ended December 31, 2014, we used $0 in investing activities, as compared to $4,150 used in investing activities during the twelve months ended December 31, 2013.The Company during the nine month period ending September 30, 2014 acquired oil and gas interests for $261,000, in a non-cash transaction, and certain real property (building, land, transportation equipment, office equipment) for $261,000, in a non-cash transaction.

Cash from Financing Activities

We have financed our operations primarily by using existing capital reserves, notes payable and through private placements of our stock. Net cash flows provided by financing activities for the nine months ended September 30, 2014 was $852,700. Net cash flows provided by financing activities for the nine months ended September 30, 2013 was $60,000, which consisted entirely of proceeds of convertible notes issued to a private party in 2013.

Commitments

Cash Payments and Exploration Expenditures

Our plans to make cash payments for expenses and liabilities, and incur exploration and development expenditures in connection with our mining and energy divisions are described above in Part II of this Annual Report on Form 10-K. We are required to make certain payments as required by regulation for permitting and remediation efforts that at present cannot be quantified for future quarters. We describe in Part II of this Annual Report on Form 10-K the expenditures forecast for the fourth quarter, which include expenditures required to maintain the assets acquired.

Off Balance Sheet Arrangements

We do not have any off-balance sheet debt nor did we have any transactions, arrangements, obligations (including contingent obligations) or other relationships with any unconsolidated entities or other persons that may have material current or future effects on financial conditions, changes in the financial conditions, results of operations, liquidity, capital expenditures, capital resources, or significant components of revenue or expenses.

Going Concern

The continuity of our future operations is dependent on our ability to obtain financing and upon future acquisition, exploration and development of profitable operations from our mineral properties. These conditions raise substantial doubt about our ability to continue as a going concern.

Critical Accounting Policies

Our interim consolidated financial statements have been prepared in conformity with GAAP. For a full discussion of our accounting policies as required by GAAP, refer to our Annual Report on Form 10-K for the year ended December 31, 2014. We consider certain accounting policies to be critical to an understanding of our consolidated financial statements because their application requires significant judgment and reliance on estimations of matters that are inherently uncertain. The specific risks related to these critical accounting policies are unchanged at the date of this report and are described in detail in our Annual Report on Form 10-K.

The Company during the quarter began a second operating division which will operate in the energy field, the Company expects additional critical accounting policies in relation to oil and gas production will be in place during the fourth quarter of the current fiscal year. The Company has adopted “full cost” accounting for its oil and gas activities as further described in notes to our financial statements, which include cost ceiling test analysis and a revision to our asset retirement obligation calculations.

Item 3. Quantitative and Qualitative Disclosures about Market Risk

Not Applicable.

Item 4. Controls and Procedures.

Evaluation of Disclosure Controls and Procedures

15

Management conducted an evaluation of the effectiveness of the Company’s internal control over financial reporting as of December 31, 2014. In making this assessment, management used the criteria established in Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission, or COSO. The COSO framework summarizes each of the components of a company’s internal control system, including (i) the control environment, (ii) risk assessment, (iii) control activities, (iv) information and communication, and (v) monitoring. In management’s assessment of the effectiveness of internal control over financial reporting (as defined in Exchange Act Rule 13a-15(f)) as required by Exchange Act Rule 13a-15(c), our management concluded as of the end of the fiscal period covered by this Yearly Report on Form 10-K that our internal control over financial reporting has not been effective. The company intends, prior to the next fiscal year as the company's finances improve, to hire additional accounting staff and implement additional controls.

As defined by Auditing Standard No. 5, “An Audit of Internal Control Over Financial Reporting that is Integrated with an Audit of Financial Statements and Related Independence Rule and Conforming Amendments,” established by the Public Company Accounting Oversight Board ("PCAOB"), a material weakness is a deficiency or combination of deficiencies that results more than a remote likelihood that a material misstatement of annual or interim financial statements will not be prevented or detected. In connection with the assessment described above, management identified the following control deficiencies that represent material weaknesses as of December 31, 2014:

|

i)

|

Lack of segregation of duties. At this time, our resources and size prevent us from being able to employ sufficient resources to enable us to have adequate segregation of duties within our internal control system. Management will periodically reevaluate this situation.

|

|

ii)

|

Lack of an independent audit committee. Although the Board of Directors serves an audit committee it is not comprised solely of independent directors. We may establish an audit committee comprised solely of independent directors when we have sufficient capital resources and working capital to attract qualified independent directors and to maintain such a committee.

|

|

iii)

|

Insufficient number of independent directors. At the present time, our Board of Directors does not consist of a majority of independent directors, a factor that is counter to corporate governance practices as set forth by the rules of various stock exchanges.

|

Our management determined that these deficiencies constituted material weaknesses. Due to a lack of financial resources, we are not able to, and do not intend to, immediately take any action to remediate these material weaknesses. We will not be able to do so until we acquire sufficient financing to do so. We will implement further controls as circumstances, cash flow, and working capital permit. Notwithstanding the assessment that our ICFR was not effective and that there were material weaknesses as identified in this report, we believe that our financial statements fairly present our financial position, results of operations and cash flows for the years covered thereby in all material respects.

Disclosure controls and procedures are controls and other procedures that are designed to ensure that information required to be disclosed in our reports filed or submitted under the Exchange Act are recorded, processed, summarized and reported, within the time periods specified in the SEC's rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed in our reports filed under the Exchange Act is accumulated and communicated to management, including our Chief Executive Officer, to allow timely decisions regarding required disclosure.

Limitations on the Effectiveness of Internal Controls

Our management does not expect that our disclosure controls and procedures or our internal control over financial reporting will necessarily prevent all fraud and material error. Our disclosure controls and procedures are designed to provide reasonable assurance of achieving our objectives and our Chief Executive Officer concluded that our disclosure controls and procedures are effective at that reasonable assurance level. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within our company have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty, and that breakdowns can occur because of simple error or mistake. Additionally, controls can be circumvented by the individual acts of some persons, by collusion of two or more people, or by management override of the internal control. The design of any system of controls also is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions. Over time, control may become inadequate because of changes in conditions, or the degree of compliance with the policies or procedures may deteriorate.

Changes in Internal Control over Financial Reporting

There have been no changes in our internal controls over financial reporting during the year ended December 31, 2014 that have materially affected or are reasonably likely to materially affect such controls.

Subsidiaries

During 2010, we acquired a fifty percent interest in the issued and outstanding stock of Beardmore Holdings, Inc. (“Beardmore”), a corporation incorporated under the laws of Panama. Beardmore indirectly owns the mineral rights to certain properties located in Peru held by its subsidiary, Rio Santiago Minerales S.A.C. On September 21, 2011, we entered into a Settlement and Mutual Release Agreement, which resulted in us relinquishing our fifty percent interest in the outstanding capital stock of Beardmore and as a result, we no longer have any ownership interest in any subsidiary entities.

16

ITEM 1A. Risk Factors.

You should carefully consider the following risk factors in evaluating our business and us. The factors listed below represent certain important factors that we believe could cause our business results to differ. These factors are not intended to represent a complete list of the general or specific risks that may affect us. It should be recognized that other risks may be significant, presently or in the future, and the risks set forth below may affect us to a greater extent than indicated. If any of the following risks occur, our business, financial condition or results of operations could be materially and adversely affected. You should also consider the other information included in this Annual Report and subsequent quarterly reports filed with the SEC.

Risk Factors

Risks Associated With Our Business

Our accountants have raised substantial doubt with respect to our ability to continue as a going concern.

As noted in our consolidated financial statements, we have incurred an accumulated net loss of $75,024,417 for the period from inception on September 5, 1997 to December 31, 2014 and have presently no source of revenue. At December 31, 2013, we had a working capital deficit of $963,352. As of December 31, 2013, we had cash and cash equivalents in the amount of $-0-. We will have to raise additional funds to meet our currently budgeted operating requirements for the next twelve months.

The audit report of Scrudato & Co., PA for the year ended December 31, 2014 contained a paragraph that emphasizes the substantial doubt as to our continuance as a going concern. This is a significant risk that we may not be able to generate or raise enough capital to remain operational for an indefinite period of time.

The audit report of Sadler Gibb and Associates for the year ended December 31, 2013 contained a paragraph that emphasizes the substantial doubt as to our continuance as a going concern. This is a significant risk that we may not be able to generate or raise enough capital to remain operational for an indefinite period of time.

In preparing our consolidated financial statements for the year ended December 31, 2014, our management identified material weaknesses in our internal control over financial reporting and our failure to remediate these material weaknesses could result in material misstatements in our consolidated financial statements and the loss of investor confidence in our reported financial information. Such weakness has neither been cured nor resolved during the year ended December 31, 2014.

Our management is responsible for establishing and maintaining adequate internal control over our financial reporting, as defined in Rule 13a-15(f) under the Exchange Act. Our management identified material weaknesses in our internal control over financial reporting as of December 31, 2014. Such weakness was not cured or resolved during the year ended December 31, 2014. A material weakness is defined as a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim consolidated financial statements will not be prevented or detected on a timely basis. The material weaknesses identified by management as of December 31, 2014 were attributable to the size of the Company and the fact that we have only one financial expert on our management team and no audit committee. Although management believes that the material weakness set forth above has not had an effect on our financial statements, there can be no assurance that this will continue to be the case going forward.

If remedial measures are not taken or are insufficient to address this material weaknesses, or if additional material weaknesses or significant deficiencies in our internal control over our financial reporting are discovered or occur in the future, our consolidated financial statements may contain material misstatements and we could be required to restate our financial results. Any future restatement of consolidated financial statements could place a significant strain on our internal resources and harm our operating results. Further, any additional or un-remedied material weakness may preclude us from meeting our reporting obligations on a timely basis and cause investors to lose confidence in our reported financial information.

We may own options to acquire certain mining and mineral rights underlying certain properties and if we fail to perform the obligations necessary to exercise these options, we will lose our options and cease operations.

We have held and/or are re-negotiating renewals of options to acquire certain mining and mineral rights underlying properties located in Owyhee County, Idaho and Lincoln County, Montana, subject to certain conditions, and have a pending memorandum of understanding on the Nile Mine project. If we fail to meet the requirements of the agreement under which we acquired such options, including any cash payments to the option nor or any exploration obligations that we have regarding these properties, we may lose our right to exercise the options to acquire certain mining and mineral rights underlying these properties. If we do not fulfill these conditions, then our ability to commence or continue operations could be materially limited. Accordingly, any adverse circumstances that affect the areas covered by these options and our rights thereto would affect us and your entire investment in shares of our common stock. If any of these situations were to arise, we would need to consider alternatives, both in terms of our prospective operations and for the financing of our activities. Management cannot provide assurance that we will ultimately achieve profitable operations or become cash-flow positive, or raise additional debt and/or equity capital. If we are unable to raise additional capital in the near future, we will experience liquidity problems and management expects that we will need to curtail operations, liquidate assets, seek additional capital on less favorable terms and/or pursue other remedial measures, including ceasing operations. Our existing agreements are in default and while we hope to re-negotiate, we may not be successful.

17

We have a history of losses that we expect to continue into the future.