Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - UQM TECHNOLOGIES INC | Financial_Report.xls |

| EX-31.2 - EX-31.2 - UQM TECHNOLOGIES INC | uqm-20150331xex312.htm |

| EX-32 - EX-32 - UQM TECHNOLOGIES INC | uqm-20150331xex32.htm |

| EX-23 - EX-23 - UQM TECHNOLOGIES INC | uqm-20150331xex23.htm |

| EX-21.1 - EX-21.1 - UQM TECHNOLOGIES INC | uqm-20150331xex211.htm |

| EX-31.1 - EX-31.1 - UQM TECHNOLOGIES INC | uqm-20150331xex311.htm |

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION |

||||||||||||||

|

WASHINGTON, D.C. 20549 |

||||||||||||||

|

_____________________ |

||||||||||||||

|

FORM 10-K |

||||||||||||||

|

_____________________ |

||||||||||||||

|

[X] |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|||||||||||||

|

|

For the fiscal year ended March 31, 2015 |

|||||||||||||

|

OR |

||||||||||||||

|

[ ] |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|||||||||||||

|

|

For the transition period from to |

|||||||||||||

|

Commission file number 1-10869 |

||||||||||||||

|

|

||||||||||||||

|

UQM TECHNOLOGIES, INC. |

||||||||||||||

|

(Exact name of registrant as specified in its charter) |

||||||||||||||

|

______________________ |

||||||||||||||

|

|

Colorado |

|

84-0579156 |

|

||||||||||

|

|

(State or other jurisdiction |

|

(I.R.S. Employer |

|

||||||||||

|

|

of incorporation or organization) |

|

Identification No.) |

|

||||||||||

|

|

4120 Specialty Place, Longmont, Colorado |

|

80504 |

|

||||||||||

|

|

(Address of principal executive offices) |

|

(Zip Code) |

|

||||||||||

|

Registrant’s telephone number, including area code: (303) 682-4900 |

||||||||||||||

|

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT: |

||||||||||||||

|

|

|

|

|

|

||||||||||

|

|

|

|

Name of each exchange on which registered |

|

||||||||||

|

|

Title of each class |

|

NYSE MKT |

|

||||||||||

|

|

Common Stock |

|

Chicago Stock Exchange |

|

||||||||||

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

||||||||||

|

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: |

||||||||||||||

|

None. |

||||||||||||||

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. |

Yes [ ] No [X] |

|||||||||||||

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. |

Yes [ ] No [X] |

|||||||||||||

|

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), |

||||||||||||||

|

and (2) has been subject to such filing requirements for the past 90 days. |

Yes [X] No [ ] |

|||||||||||||

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every interactive data file required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such |

||||||||||||||

|

shorter period that the registrant was required to submit and post such files). |

Yes [X] No [ ] |

|||||||||||||

|

|

||||||||||||||

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ] |

||||||||||||||

|

|

||||||||||||||

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one): |

||||||||||||||

|

[ ] Large accelerated filer |

[ ] Accelerated filer |

[X] Non-accelerated filer |

[ ] Smaller reporting company |

|||||||||||

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). (Do not check if a smaller reporting company) |

Yes [ ] No [X] |

|||||||||||||

|

The aggregate market value of the registrant’s common stock (“Common Stock”) held by non-affiliates as of September 30, 2014, based on the closing price of the Common Stock as reported by the NYSE MKT on such date was approximately $55,478,927. As of May 26, 2015, there were 40,501,993 shares of the registrant’s Common Stock outstanding. |

||||||||||||||

|

DOCUMENTS INCORPORATED BY REFERENCE |

||||||||||||||

|

Document |

|

Parts Into Which Incorporated |

||||||||||||

|

Portions of the Proxy Statement for the 2015 Annual Meeting of Shareholders. |

|

Part III |

||||||||||||

i

This page intentionally left blank

ii

This Report contains statements that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act. These could be statements regarding our plans, beliefs or current expectations; including those plans, beliefs and expectations of our officers and directors with respect to, among other things, new product developments, future orders to be received from our customers, sales of products from inventory, future financial results, liquidity and the continued growth of the electric-powered vehicle industry. Important Risk Factors that could cause actual results to differ from those contained in the forward-looking statements are listed below in Part I, Item 1A. Risk Factors.

UQM Technologies, Inc., (“UQM”, “Company”, “we”, “our”, or “us”) develops, manufactures and sells power dense, high efficiency electric motors, generators and power electronic controllers for the commercial truck, bus, automobile, marine and military markets. Our primary focus is incorporating our advanced technology as propulsion systems for electric, hybrid electric, plug-in hybrid electric and fuel cell electric vehicles, delivering the heart of the electric vehicle.

We believe our proprietary permanent magnet propulsion motor and motor control technology delivers exceptional performance at a competitive cost. Our principal products include propulsion motors and generators with power ratings from 50 kilowatts to 250 kilowatts, auxiliary motors and electronic controls and DC-to-DC converters. The principal attributes that we believe differentiate our proprietary products are compact size, high torque delivery, high power density (the ratio of power output to weight), design and manufacture of integrated motor/controller systems, and superior energy efficiency with full system ratings as high as 95%.

We have assembled a management team with significant experience in the automotive and electric propulsion market segments with critical experience in state of the art design and high quality production. We are ISO/TS 16949 certified, the highest level of quality certification in the automotive supplier industry, and ISO 14001 certified, the highest environmental standards. We have an approximately 130,000 square foot combined headquarters and manufacturing facility located in Longmont, Colorado. We were incorporated in 1967 as a Colorado corporation.

The Market

The global electrified vehicle market is an emerging market with high growth potential being driven by several factors. In China the market is driven by strong government pressure to deal with the staggering pollution that is choking citizens in its major cities. The government has a number of initiatives to encourage electric vehicle market growth including mandates for purchases of New Energy Vehicles by municipalities, incentives and other tools. We are seeing strong demand for electric buses across several cities and regions. We are also seeing demand for electric delivery vans, and trucks, and taxi fleets. In other global markets, including the United States, the drivers for growth in the commercial truck and bus market include the demand for zero tailpipe emissions from full electric vehicles or during the electric only range for hybrids, improved operating costs due to a more efficient powertrain on a gas equivalent basis and reduced maintenance costs for the powertrain system and other systems, such as improved brake life. Moreover, there is community support for cleaner buses and trucks operating in congested areas, along with government incentives and requirements to purchase electric and hybrid vehicles. In the automotive market, these same growth drivers exist, as well as tremendous consumer acceptance of electric vehicles due to their excellent performance, quiet operation, zero or reduced tailpipe emissions and improved operating cost. In addition, significant Corporate Average Fuel Economy (“CAFE”) standards in the United States are expected to accelerate further electrification of the fleet. The major impediment to electrification of vehicles has been total vehicle cost, of which a substantial part is due to the cost of batteries. Battery cost has decreased considerably and is projected to continue to improve. Government incentives have helped to offset these early additional costs and generate the volume and momentum that should further reduce these incremental costs through scale economies.

1

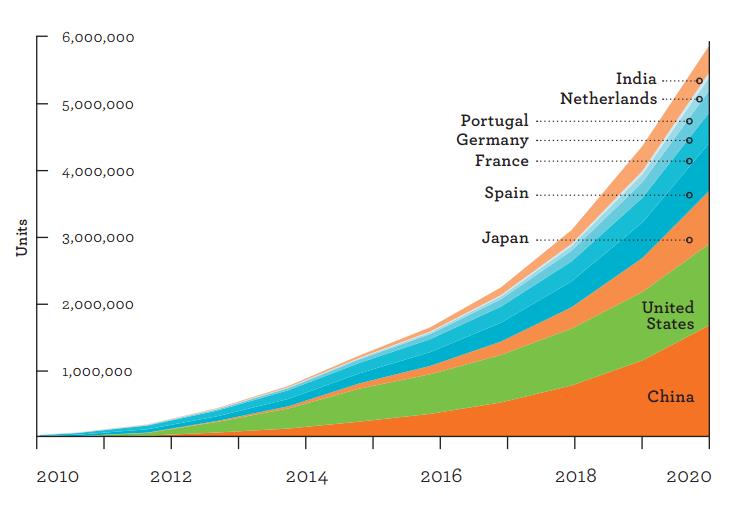

Many studies have been conducted indicating the potential for electric vehicles to capture significant market share over the next several years. For example, in 2015, The International Energy Agency forecasted that 6 million electric vehicles will be on the road by 2020, as shown in the chart below:

Governments around the world have implemented financial incentives to promote the sales of electric vehicles. For example, the U.S. federal government currently offers a $7,500 federal tax credit for the purchase of an electric passenger vehicle, and there are additional tax credits and other benefits such as HOV lane access in various states for purchasers of qualifying vehicles. In China, the country’s National Development and Reform Commission and three other ministries jointly announced in September 2013, a new round of New Energy Vehicle supportive policies for the years 2013 - 2015. Various levels of government subsidies for electric vehicles were announced, including subsidies for pure electric buses of RMB 500,000 each (approximately $80,000), electric trucks of RMB 150,000 each (approximately $24,000) and plug-in electric and fuel cell passenger vehicles of RMB 60,000 each (approximately $9,600). In Europe, a majority of European Union member states provide tax incentives for electrically chargeable passenger vehicles, with Norway providing the most generous package of subsidies totaling almost EUR 17,000 (approximately $19,000).

We believe that the trend toward increasing electrification of vehicles coupled with the government subsidies offered world-wide provide a substantial opportunity for the broad commercial application of our products.

Business Strategy

We are focused primarily on the transportation markets, with a strong emphasis on the commercial truck and bus space, followed by automotive and then marine, military and other. We have developed two basic frame size propulsion systems: the PowerPhase® Pro for passenger car, light commercial applications, light duty marine and other lighter duty applications and the PowerPhase® HD lineup of products for heavier commercial bus and truck applications and heavier duty marine and other HD applications. We also utilize these products, customized versions of these products and all new custom solutions in these markets to meet various customer requirements. We provide motor and controller systems for full-electric, hybrid electric, plug-in hybrid and fuel cell applications. We also provide units for non-automotive markets including the energy management market, auxiliary systems and motor and controller systems for aircraft. We have recently expanded into the fuel cell business by assuming the complete fuel cell air compressor business from Roush Performance Products to address that market directly.

We sell to the following markets:

|

· |

Commercial Trucks, Vans and Shuttles - We supply electric propulsion systems to Electric Vehicles International (“EVI”), a developer and manufacturer of all-electric medium-duty delivery trucks, under a multi-year supply agreement. EVI is also developing a range extended electric vehicle (“REEV”) for PG&E to convert their truck fleet from gasoline engines to electric. We are also the sole supplier of powertrain systems to Zenith Motors, LLC for their electric shuttle vans. |

2

|

· |

Passenger Buses – Electric and hybrid passenger buses can have large positive impacts on the environment and many municipalities around the world are demanding more of these vehicles on the road. For example, we supply electric propulsion systems to Proterra, Inc., a developer and manufacturer of all-electric composite transit buses, under a multi-year supply agreement. We also provide electric propulsion systems for Hino Bus, a subsidiary of Toyota Motor Corporation, for their electric city-buses. PT Sarimas Ahmadi Pratama of Jakarta, Indonesia is using our motors and controllers for their all-electric 17-passenger bus. We have signed a Memorandum of Understanding with one major Chinese company for the development and marketing of UQM electric propulsion systems for New Energy Vehicles in China. In addition, we are in discussions with other potential Chinese customers to supply our products for both all-electric and hybrid-electric vehicles, and we have shipped a small number of electric motor and controller systems into China for prototype testing in buses. |

|

· |

Mining vehicles – In January 2015, we announced a long-term supply agreement with the KESHI Group, a Chinese market leader that manufactures vehicles for the mining industry in China. KESHI will manufacture under license explosion proof electric mining vehicles using UQM’s designs and parts supplied by UQM to Keshi. This first phase is for the vehicles that move the coal from the mines. We are also under discussions for additional usage for the vehicles that move the people in and out of the mines and other potential applications. |

|

· |

Marine – The marine market is a new and growing market for the Company. In January 2014, Research and Markets announced that marine electric vehicles are now a rapidly growing market due to new capability, affordability and legislation banning or restricting internal combustion engines. Their research found that the market for electric water craft, including those on and under water, is expected to increase rapidly from $2.6 billion to $6.3 billion in 2023. In addition, there is a market for electric outboard motors that will more than triple in value as high power pure electric versions become increasingly viable. We are seeing demand for electric solutions for both the clean and quiet operation afforded by full electric and hybrid electric solutions. We supply ReGen Nautic with UQM motors and controllers used in a variety of applications and for a variety of customers. ReGen Nautic has several versions of electric outboard motors utilizing our propulsion systems and also full electric and hybrid inboard solutions utilizing our propulsion systems. We believe the marine market will be a growing segment of electrified vehicles. |

|

· |

Fuel Cell Compressors – In February 2015, we announced that the Company would be expanding into the fuel cell business. This fuel cell compressor is an integral component of hydrogen powered fuel cell vehicles designed for light duty automotive and commercial bus applications for 75kW to 150kW fuel cell stacks. We will commence production in July 2015. |

|

· |

Military - The U.S. military purchases a wide-range of ground vehicles each year, including combat vehicles such as tanks, self-propelled artillery and armored personnel carriers, as well as a variety of light, medium and heavy-duty trucks for convoy and supply operations and for the transport of fuel used on the battlefield. We have in the past worked with a number of military contractors and vehicle makers on prototype hybrid electric vehicles, high export power generators, and electric auxiliaries. There are a number of initiatives to reduce the carbon footprint of military bases that may drive additional efforts in this area. Although this market has not yet emerged, we believe that it may, driven by the availability of electric components in the commercial truck market that operate at similar power levels as those required by many military vehicles. |

|

· |

Automobiles – Government mandates for fuel economy and clean air emissions are accelerating the demand for electric passenger cars. In the United States, for example, CAFE standards will increase the average fuel economy of each manufacturer’s passenger car and light truck model offerings to 35.5 miles per gallon by 2016 and 54.5 miles per gallon by 2025. We have in the past provided electric propulsion systems to many original equipment manufacturers (“OEMs”) for testing and product development. |

|

· |

Other – We supply an automotive qualified DC-to-DC converter which can be used in medium and heavy-duty hybrid trucks. We provide small motors and controllers for aircraft HVAC usage to AirComm. We also supply systems to a customer in the energy management market for a stationary application for electric motors. |

Our business strategy is also comprised of the following:

|

· |

Highly qualified and experienced management – We have a management team with significant experience in the automotive industry and the requirements for high quality production programs and very deep technical knowledge of the motor and controller business. |

3

|

· |

State of the art manufacturing facility – Our headquarters and manufacturing plant are located in an approximately 130,000 square foot facility with fifteen adjacent acres for future expansion. We have designed, installed and qualified volume production lines for our motors and their related electronic controllers. |

|

· |

Manufacturing capacity – We currently have the capacity to build motor/controller systems, in quantities sufficient to meet demands of our current and future customers for the foreseeable future. |

|

· |

Highest production quality standards – Our Company is certified under the ISO/TS 16949 standards, the highest level of automotive quality standards in the industry and ISO 14001, the highest environmental standards. |

|

· |

Leading edge technology – Our technology base includes a number of proprietary technologies and patents related to brushless permanent magnet motors, generators and power electronic controllers, together with software code to intelligently manage the operation of our systems. We continue to launch next generation products to achieve improved performance and efficiency, smaller package sizes and lower production costs. |

Products

We offer a full range motors and controllers for electric, hybrid electric, plug-in hybrid electric and fuel cell electric commercial trucks, vans, buses and automobiles. Our current core electric propulsion products are:

|

· |

PowerPhase HD® 220: Designed for medium and heavy duty trucks and buses. |

|

· |

PowerPhase HD® 950T: A high torque version designed for heavy duty trucks and buses that require additional torque due to higher GVW or more challenging hilly terrain, this product delivers especially high torque performance compared to the PowerPhase HD® 220. |

|

· |

PowerPhase HD® 250: A high voltage version designed for buses and medium and heavy duty trucks . |

|

· |

PowerPhase Pro® 100: Designed for passenger vehicles and light duty truck or van applications. |

|

· |

PowerPhase Pro® 135: The PP 135 offers higher performance for those applications that require it versus our PowerPhase Pro® 100. |

|

· |

Auxiliary Motor Systems: Multiple products are offered for compressor, pump and fan applications, including a family of motor/controller systems for fuel cell air compressors, an integrated motor/controller for aircraft air conditioning compressors, and an integrated motor/controller for aircraft air conditioning condenser fans. |

|

· |

Custom Solutions: We offer variations of the above motors in custom configurations as well as custom hybrid solutions to meet individual customer specifications. |

|

· |

R340 and R410 Fuel Cell Compressor Motor and Controller Assembly: These fuel cell compressors are used in hydrogen powered fuel cell vehicles. |

We also sell four types of DC to DC converters at 1.6 kW and 2.2 kW levels, each available at two different voltage output ranges.

Product Development Activities

We continue to develop new variations of our product lineup to meet expanding customer requirements and work on custom solutions for new prospective customers meeting their precise specifications. We are also developing the next generation of PowerPhase Pro® products designed to be smaller, lighter weight, more energy efficient and producible at lower cost with equal or better performance than our current PowerPhase Pro® systems. This development effort is expected to take more than two years. Development targets include a substantial size reduction of the motor controller. Adopting new generation components and control strategies are also elements of this development. Target applications include automotive and light commercial truck and bus markets.

4

We are also pursuing an advanced motor design technology that eliminates the need for rare-earth elements in the magnets. The technology incorporates permanent magnets of an alternate chemistry, arranged in a unique way that maintains performance benefits. A patent application has been submitted to protect this innovation. We have a $4.0 million program with the Department of Energy (“DOE”) to develop non-rare-earth magnet electric motors for use in electric and hybrid vehicles. The DOE is providing $3.0 million of funding for this program and the Company is providing $1.0 million of cost-share contribution. This award was announced in August 2011 and is a multi-year technology development program.

Competition

All of the markets in which we operate are highly competitive and are characterized by rapid changes due to technological advances that could render existing technologies and products obsolete, although we are not currently aware of any such advances that could render our current product portfolio obsolete. We believe our competitors are large automotive OEMs, Tier 1 suppliers to OEMs, Chinese electric motor manufacturers offering lower cost options, and numerous other competitors in nearly every region of the world

As a result, additional vehicle makers in both on-road and off-road markets are expected to develop and introduce a variety of hybrid electric and all-electric vehicles as market acceptance of these vehicles continues to grow. We cannot assure that we will be able to compete successfully in this market or any other market that now exists or may develop in the future. There are numerous companies developing products that do or soon will compete with our systems. Some of these companies possess significantly greater financial, personnel and other resources than we do, including established supply arrangements, volume manufacturing operations and access to governmental incentive programs.

Customers and Suppliers

We derive our revenue from two principal sources: 1) the sale of products designed, engineered and manufactured by us primarily to OEMs, Tier 1 suppliers of OEMs, and vehicle integrators; and 2) funded contract research and development services performed for strategic partners, customers and the U.S. government directed toward either the advancement of our proprietary technology portfolio or the application of our proprietary technology to customers’ products.

Our business is subject to revenue fluctuation based on the buying cycles of our customers. Specific customers that reach 10% or more of revenues in any given fiscal quarter or year will also vary depending on these buying cycles. In fiscal year ending March 31, 2015, three customers individually comprised 10% or more of our total revenues. Any loss of business with these customers could have a material adverse effect on our business, financial condition and results of operation.

Principal raw materials and components purchased by us include iron, steel, electronic components, rare-earth magnets and copper wire. Most of these items are available from several suppliers. Certain components used by us are custom designs and if our current supplier no longer made them available to us, we could experience production delays.

We can experience significant price fluctuation in the cost of magnets used in our motors, which contain the rare-earth elements neodymium and dysprosium and are primarily sourced from China. We have not experienced any disruption in supply of magnets and magnet prices may continue to be volatile until mining operations outside of China increase or restart.

5

Financial Information about Geographic Areas

The following summarizes total revenue by geographic area:

|

Fiscal Year Ended March 31, |

||||||||

|

2015 |

2014 |

2013 |

||||||

|

United States |

$ |

3,442,050 |

$ |

5,694,144 |

$ |

5,695,623 | ||

|

Foreign Countries |

573,694 | 1,352,056 | 1,483,086 | |||||

|

$ |

4,015,744 |

$ |

7,046,200 |

$ |

7,178,709 | |||

Classification of geographic area is determined based upon the country where the purchase transaction originated.

U.S. Government Contracts

We had a Grant from the DOE under the American Recovery and Reinvestment Act. The Grant provided funds to facilitate the manufacture and deployment of electric drive vehicles, batteries and electric drive vehicle components in the United States. Under the terms of our Grant Agreement, the DOE reimbursed us 50 percent of qualifying costs incurred for the purchase of facilities, tooling and manufacturing equipment, and for engineering expenditures related to product qualification and testing of our electric propulsion systems and other products. The Grant ended on January 12, 2015.

As of March 31, 2015, we had received cumulative reimbursements from the DOE of $27.1 million and had no funds receivable.

We also have a $4.0 million program with the DOE to develop non-rare-earth magnet electric motors for use in electric and hybrid vehicles. The DOE is providing $3.0 million of funding for this three-year program and the Company is providing $1.0 million of cost-share contribution. The objective of the program is to identify and evaluate magnet materials and technology that can deliver performance comparable to our rare-earth magnet motors, broaden our product portfolio, potentially lower magnet costs and limit our exposure to price and supply concerns associated with rare-earth magnets. At March 31, 2015, we had received reimbursements from the DOE under this program of $1.9 million. In January 2015, we announced that we were granted a U.S. patent for our electric and hybrid electric vehicle motor design using non-rare earth magnets.

Backlog

Our order backlog for products at April 30, 2015 was approximately $1.8 million versus $2.3 million at April 30, 2014. Certain orders are blanket purchase orders which are subject to the issuance of subsequent release orders directing the number and timing of actual deliveries. We had backlog of service contracts from customers, which will provide future revenue upon completion, totaling approximately $1.2 million at April 30, 2015 versus $0.4 million at April 30, 2014. Substantially all of the backlog amounts at April 30, 2015 and 2014 are subject to amendment, modification or cancellation. We expect to ship motor and controller backlog products over the next twelve months and complete all service contracts in backlog over the next thirteen months.

Intellectual Property

We have numerous patents in the United States and in other countries to protect our intellectual property.

We determine if our intellectual property should be handled as a trade secret or submitted to the patent application process by deciding whether a technology successfully passes through three evaluation gates. The first gate is an assessment of whether the expected breadth of the patent would offer a high level of protection or whether it will serve as an educational tool for competitors. Based upon a patent and literature search, if the expected coverage is broad, the evaluation moves to the second gate, which is an assessment of infringement detection. This is a review of whether or not it will be possible to detect patent infringement if a competitor were to adopt the technology. Difficulty in detection reduces the value of a patent and will lead us to handle the technology as a trade secret rather than a patent. The last gate is an assessment of whether the technology will have value for many years or whether the technology is a stepping stone to a different technology. The patent process is a multi-year endeavor from

6

the initial disclosure to the granted patent, which leads to the importance of this gate. A technology that is expected to have value for five or more years will pass the final gate and the patent application process will then commence.

We also implement measures to protect our intellectual property, including the guarding of source code, nondisclosure of control techniques, and protection of product design details, drawings and documentation.

Trademarks

We have registered the letters "UQM" in the U.S. Patent and Trademark Office. Counterpart applications have been filed in numerous countries throughout the world, most of which have granted registrations or indicated them to be allowable. We own three U.S. Trademark Registrations for "UQM" (International Class 7 for power transducers, Class 12 for utility land vehicles, and Class 16 for publications). The foreign trademark registrations and applications include major markets where we are doing business or establishing business contacts.

We have also registered the trademark "POWERPHASE" which we use in conjunction with certain of our propulsion systems. The trademark is registered in the European Community and several other foreign countries.

As of April 30, 2015, we had 58 total employees, of whom 56 are full-time employees. We have entered into employment agreements with our executive officers. The employment agreements expire on August 31, 2015. We believe our relationship with employees has been generally satisfactory.

In addition to our full-time staff, we from time to time engage the services of outside consultants and contract employees to meet peak workload or specialized program requirements. We do not anticipate any difficulty in locating additional qualified engineers, technicians and production workers, if so required, to meet expanded research and development or manufacturing operations.

Available Information

We file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission (“SEC”). Anyone seeking information about our business can receive copies of our Fiscal Year 2015 Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, all amendments to those reports and other documents, filed with the SEC at the public reference section of the SEC at 100 F Street, NE, Room 1580, Washington, D.C. 20549. These documents also may be obtained, free of charge, by: contacting our Investor Relations office by e-mail at investor@uqm.com; by phone at (303) 682-4900; writing to UQM Technologies, Inc., Investor Relations, 4120 Specialty Place, Longmont, CO 80504-5400; or accessing our website at www.uqm.com. We make our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, available on our website as soon as reasonably practicable after we file or furnish the materials electronically with the SEC. To obtain any of this information, go to www.uqm.com, select “Investor Relations” and select the form you would like to access. Our website also includes our Audit Committee Charter and Code of Business Conduct and Ethics as well as the procedures for reporting a violation of business ethics. Information on our website does not constitute part of this Annual Report.

7

ITEM 1A.RISK FACTORS

We operate in a challenging and changing environment that involves numerous known and unknown risks and uncertainties that could materially affect our operations. The risks, uncertainties and other factors set forth below may cause our actual results, performances or achievements to be materially different from those expressed or implied by our forward-looking statements. If any of these risks or events occur, our business, financial condition or results of operations may be adversely affected.

We have incurred significant losses and may continue to do so.

We have incurred significant net losses as shown in the following tables:

|

Fiscal Year Ended March 31, |

||||||||

|

2015 |

2014 |

2013 |

||||||

|

Net loss |

$ |

5,988,530 |

$ |

2,773,244 |

$ |

10,688,312 | ||

As of March 31, 2015, we had an accumulated deficit of $99,937,075.

In the future, we plan to make additional investments in product development, facilities and equipment and other costs related to the commercialization of our products. As a result, we expect to continue to incur net losses for the foreseeable future.

Our operating losses, anticipated capital expenditures and working capital requirements in the longer term may exceed our current cash balances.

Our net loss for the fiscal year ended March 31, 2015 was $5,988,530 versus a net loss for the fiscal years ended March 31, 2014 and 2013 of $2,773,244 and $10,688,312, respectively. At March 31, 2015, our cash and short-term investments totaled $6,585,703. We expect our losses to continue for the foreseeable future. Our existing cash resources, together with cash generated from reductions in our inventories of PowerPhase Pro propulsion systems, are expected to be sufficient to complete our business plan for at least the next twelve months. Should those resources be insufficient, we may need to secure additional debt or equity funding, which may not be available on terms acceptable to us, if at all.

Our business depends, in part, on the expansion of the market for all-electric and hybrid electric vehicles.

Although our electric propulsion systems may be used in a wide variety of products, the market for electric and hybrid vehicles is fairly new. At the present time, batteries used to power electric motors have limited life and require several hours to charge, and charging stations for electric motors are not widely available. Electric and hybrid vehicles also tend to be priced higher than comparable gasoline-powered vehicles. As a result, consumers may experience concerns about driving range limitations, battery charging time and higher purchase costs of electric or hybrid vehicles. If consumer preferences shift to vehicles powered by other alternative methods, or if concerns about the availability of charging stations cannot be overcome, the market for all-electric vehicles, and therefore our electric propulsion systems, may be limited. In addition, our electric propulsion systems are incorporated in buses used for mass transit in several U.S. cities. If passenger traffic in these mass transit systems declines or government funding to transportation districts declines from current levels, demand for our products may also decrease.

The popularity of alternative fuel based vehicles and “green energy” initiatives are highly dependent on macro-economic conditions, including oil prices and the overall health of the economy. When oil prices fall, interest in and resources allocated to the development of advanced technology vehicles and propulsion systems may diminish. We cannot predict how and the extent to which the recent substantial decrease of oil prices will affect the domestic interest in electric and hybrid vehicles. Downturns in the world economy may also have a severe impact on the automotive industry, slowing the demand for vehicles generally and reducing consumers' willingness to pay more for environmentally friendly technology.

8

If our products do not achieve market acceptance, our business may not grow.

Although we believe our proprietary systems are suited for a wide-range of vehicle electrification applications, our business and financial plan relies heavily on our introduction of new products that have limited testing in the marketplace. We have made substantial investments in manufacturing facilities and equipment, production and application engineering, among other things, to increase our production capacity in order to capitalize on the anticipated expansion in demand for electric propulsion systems and generators in the commercial truck, bus and automobile markets. We are not certain that our existing products will achieve broad market acceptance, or that we will be able to develop new products or product enhancements that will achieve broad market acceptance.

Our sales cycle is inherently long.

We must go through lengthy processes to achieve supply contracts with our customers. Our products must conform to the technical specifications of the customer and meet design requirements of the electric vehicle. Typically prototype testing is required to ensure consistent system performance on an ongoing basis. These steps can often take many months to multiple years until decisions are made on whether or not to take a vehicle to production. We may spend considerable financial and human resources over an extended period of time and not end up with a completed supply contract. Failure to secure volume production levels within a reasonable period of time could have an adverse effect on our results of operations and our liquidity.

CODA Automotive filed for bankruptcy protection on May 1, 2013 and it is unlikely we will be able to recover more than insignificant amounts due to us under our Supply Agreement, including substantial amounts due for accounts receivable, inventory purchases and guaranteed minimum payments.

We executed a ten-year Supply Agreement with CODA in July, 2009 which provided a framework for CODA, or its manufacturing partner, to purchase from us electric propulsion systems for use in automobiles to be manufactured by CODA. On May 1, 2013, CODA filed for bankruptcy protection. Amounts due from CODA at March 31, 2015 totaled $3,838,092, all of which had been written off as uncollectible. In addition, CODA was obligated under the Supply Agreement for inventory purchases totaling approximately $8.2 million and for a guaranteed minimum payment of $2 million due to their failure to purchase at least 15,000 units. It is likely that we will recover only an insignificant amount of the balance owed to us under the Supply Agreement, if any.

We carry a large inventory balance originally acquired for CODA and may not be able to sell this inventory.

At March 31, 2015, we had aged inventory of $7.7 million of PowerPhase Pro® systems on our books originally acquired for now-bankrupt CODA. We believe the PowerPhase Pro® system is right sized for many medium-duty truck, marine, passenger vehicle and stationary power applications, and this inventory is now for sale to other customers. While we believe that there continues to be a strong market for these products, a change in market conditions or technology advancements could make this inventory obsolete, causing a material adverse effect on our results of operations.

We entered into purchase contracts with our supply base to support the CODA program, some of which are non-cancellable by their terms. Our actual liability under these contracts may vary from our current estimates.

We have recorded a liability as of March 31, 2015 of $774,974 representing the amount we expect to pay to settle non-cancellable contracts with certain suppliers to the CODA program that will not be fulfilled due to the bankruptcy filing by CODA. This liability is lower than the original amount we recorded of $1,050,000 as of March 31, 2013 as a result of negotiations and settlements we reached with some vendors during fiscal year 2014. The amount of this liability represents management’s current estimate and may be subject to further adjustment based on future negotiations or litigation. Settlements in excess of our estimates or any upward revision in our settlement estimate could result in a material change in our results of operations and financial condition.

All funding from our DOE Grant ended as of January 12, 2015 when the Grant expired.

Funds from the DOE Grant were very useful in supporting our growth initiatives and reducing our losses over the past several years. We believe that we have adequate cash resources for at least the next twelve months. However, if anticipated revenues are not realized and other cash resources are unavailable, the end of the DOE Grant funding could significantly impact our ability to sustain operations.

9

The reduction or elimination of government subsidies and economic incentives for alternative energy technologies, including our electric vehicle motor technology, could reduce demand for our products and services, lead to a reduction in our revenues and adversely impact our operating results.

We believe that the near-term growth of alternative energy technologies, including our electric vehicle motor technology, relies on the availability and size of government and economic incentives both in the United States and in other countries. Many of these government incentives expire, phase out over time, exhaust the allocated funding, require renewal by the applicable authority, and/or could be reduced or discontinued for other reasons. The reduction, elimination, or expiration of government subsidies and economic incentives may result in the diminished demand from our customers and could materially and adversely affect our future operating results.

We are subject to risks inherent in international operations.

Since we market our products both inside and outside the United States, our success depends in part, on our ability to secure international customers and our ability to manufacture products that meet foreign regulatory and commercial requirements in target markets. In addition, we are subject to tariff regulations and requirements for export licenses. We can face numerous challenges in our international growth plans, including unexpected changes in regulatory requirements, potential conflicts or disputes that countries may have to deal with, fluctuations in currency exchange rates, longer accounts receivable requirements and collections, difficulties in managing international operations, potentially adverse tax consequences, restrictions on repatriation of earnings and the burdens of complying with a wide variety of international laws. Any of these factors could adversely affect our results of operations and financial condition.

Our revenue is highly concentrated among a small number of customers.

A large percentage of our revenue is typically derived from a small number of customers, and we expect this trend to continue.

Our customer arrangements generally are non-exclusive, have no long-term volume commitments and are often done on a purchase order basis. We cannot be certain that customers that have accounted for significant revenue in past periods will continue to purchase our products. Accordingly, our revenue and results of operations may vary substantially from period to period. We are also subject to credit risk associated with the concentration of our accounts receivable from our customers. If one or more of our significant customers were to cease doing business with us, significantly reduce or delay its purchases from us or fail to pay us on a timely basis, our business, financial condition and results of operations could be materially adversely affected.

Our business relies on third parties, whose success we cannot predict.

As a manufacturer of motors, generators, and other component parts, our business model depends on the ability of third parties in our industry to develop, produce and market products that include or are compatible with our technology and then to sell these products into the marketplace. Our ability to generate revenue depends significantly on the commercial success of our customers and partners. Failure of these third parties to achieve significant sales of products incorporating our products and fluctuations in the timing and volume of such sales could have a material adverse effect on our business, financial condition and results of operations.

Our electric propulsion systems use rare-earth minerals and unavailability or limited supply of these minerals could prevent us from manufacturing our products in production quantities or increase our costs.

Neodymium and dysprosium, rare-earth minerals, are key elements used in the production of magnets that are components of our electric propulsion systems. We currently source our magnets from China, and China has indicated its intent to retain more of this mineral for China use, rather than exporting it. During calendar year 2011, for example, we experienced significant price escalation in the cost of magnets used in our motors. This price escalation was primarily due to rare-earth government policy in China. Rare-earth prices have decreased substantially since peaking in the summer of 2011, and are now approaching the baseline prices (defined as the beginning of calendar year 2011). We have implemented a magnet surcharge process to recover these additional costs in the event of another price escalation. Although rare-earth magnets are available from other sources, these alternative sources are currently more costly. Reduced availability of neodymium and dysprosium from China could adversely affect our ability to obtain magnets in sufficient quantities, in a timely manner, or at a commercially reasonable cost. In the event that China's actions cause us to seek alternate sources of supply for magnets, it could cause an increase in our product costs, thereby reducing or eliminating our profit margin on electric propulsion systems if we are unable to pass the increase

10

on to our customers. Increasing prices to our customers due to escalating magnet costs may reduce demand for our motors and make it difficult or impossible to compete with other motor manufacturers whose motors do not use rare-earth minerals.

Some of our contracts can be cancelled with little or no notice and could restrict our ability to commercialize our technology.

Our contracts with government agencies are subject to the risk of termination at the convenience of the contracting agency and in some cases grant "march-in" rights to the government. March-in rights are the right of the United States government or the applicable government agency, under limited circumstances, to exercise a non-exclusive, royalty-free, irrevocable worldwide license to any technology developed under contracts funded by the government to facilitate commercialization of technology developed with government funding. March-in rights can be exercised if we fail to commercialize the developed technology. The exercise of march-in rights by the government or an agency of the government could restrict our ability to commercialize our technology.

Some of our orders for the future delivery of products are placed under blanket purchase orders which may be cancelled by our customers at any time. The amount payable to us, if any, upon cancellation by the customer varies by customer. Accordingly, we may not recognize as revenue all or any portion of the amount of outstanding order backlog we have reported.

We face intense competition and may be unable to compete successfully.

In developing electric motors for use in vehicles and other applications, we face competition from very large domestic and international companies, including the world's largest automobile manufacturers. Many of our competitors have far greater resources to apply to research and development efforts than we have, and they may independently develop motors that are technologically more advanced than ours. These competitors also have much greater experience in and resources for marketing their products. For these reasons, potential customers may choose to purchase electric motors from our competitors rather than from us.

Changes in environmental policies could hurt the market for our products.

The market for electric and other alternative fuel vehicles and equipment and the demand for our products are influenced, to a degree, by federal, state and local regulations relating to air quality, greenhouse gases and pollutants. These laws and regulations may change, which could result in transportation or equipment manufacturers abandoning or delaying their interest in electric or hybrid electric vehicles or equipment. In addition, a failure by authorities to enforce current laws and regulations or to adopt additional environmental laws or regulations could limit the demand for our products.

Although many governments have identified as a significant priority the development of alternative energy sources, governments may change their priorities, and any change they make could materially affect our revenue or the development of our products.

If we are unable to protect our patents and other proprietary technology, we will be unable to prevent third parties from using our technology, which would impair our competitiveness and ability to commercialize our products. In addition, the cost of enforcing our proprietary rights may be expensive and result in increased losses.

Our ability to compete effectively against other companies in our industry will depend, in part, on our ability to protect our proprietary technology. Although we have attempted to safeguard and maintain our proprietary rights, we do not know whether we have been or will be successful in doing so. We have historically pursued patent protection in the United States and a limited number of foreign countries where we believe significant markets for our products exist or where potentially significant competitors have operations. It is possible that a substantial market could develop in a country where we have not received patent protection and under such circumstances our proprietary products would not be afforded legal protection in these markets. Further, our competitors may independently develop or patent technologies that are substantially equivalent or superior to ours. We cannot assure that additional patents will be issued to us or, if they are issued, as to the scope of their protection. Patents granted may not provide meaningful protection from competitors. Even if a competitor's products were to infringe patents owned by us, it would be costly for us to pursue our rights in an enforcement action, it would divert funds and resources which otherwise could be used in our operations and we may not be successful in enforcing our intellectual property rights. In addition, effective patent, trademark, service mark, copyright and trade secret protection may not be available in

11

every country where we may operate or sell our products in the future. If third parties assert technology infringement claims against us, the defense of the claims could involve significant legal costs and require our management to divert time and attention from our business operations. If we are unsuccessful in defending any claims of infringement, we may be forced to obtain licenses or to pay royalties to continue to use our technology. We may not be able to obtain any necessary licenses on commercially reasonable terms or at all. If we fail to obtain necessary licenses or other rights, or if these licenses are costly, our results of operations may suffer either from reductions in revenues through our inability to serve customers or from increases in costs to license third-party technologies. Finally, patents may not deter third parties from attempting to reverse engineer our products and discovering our intellectual property.

We rely, in part, on contractual provisions to protect our trade secrets and proprietary knowledge, the adequacy of which may not be sufficient.

Confidentiality agreements to which we are party may be breached, and we may not have adequate remedies for any breach. Our trade secrets may also be known without breach of such agreements or may be independently developed by competitors. Our inability to maintain the proprietary nature of our technology and processes could allow our competitors to limit or eliminate any competitive advantages we may have.

Use of our motors in vehicles could subject us to product liability claims or product recalls, and product liability insurance claims could cause an increase in our insurance rates or could exceed our insurance limits, which could impair our financial condition, results of operations and liquidity.

The automotive industry experiences significant product liability claims. As a supplier of electric propulsion systems or other products to vehicle OEMs, we face an inherent business risk of exposure to product liability claims in the event that our products, or the equipment into which our products are incorporated, malfunction and result in personal injury or death. We may be named in product liability claims even if there is no evidence that our systems or components caused an accident. Product liability claims could result in significant losses as a result of expenses incurred in defending claims or the award of damages. The sale of systems and components for the transportation industry entails a high risk of these claims, which may increase as our production and sales increase. In addition, we may be required to participate in recalls involving these systems if any of our systems prove to be defective, or we may voluntarily initiate a recall or make payments related to such claims as a result of various industry or business practices or the need to maintain good customer relationships.

We carry product liability insurance of $10 million covering most of our products. If we were to experience a large insured loss, it might exceed our coverage limits, or our insurance carriers could decline to further cover us or raise our insurance rates to unacceptable levels, any of which could impair our financial position and results of operations. Any product liability claim brought against us also could have a material adverse effect on our reputation.

We may be subject to warranty claims, and our provision for warranty costs may not be sufficient.

We may be subject to warranty claims for defects or alleged defects in our products, and the risk of such claims arising will increase as our production and sales increase. In addition, in response to consumer demand, vehicle manufacturers have been providing, and may continue to provide, increasingly longer warranty periods for their products. As a consequence, these manufacturers may require their suppliers, such as us, to provide correspondingly longer product warranties. As a result, we could incur substantially greater warranty claims in the future.

Our future success will depend on our ability to attract and retain qualified management and technical personnel.

Our future success is substantially dependent on the continued services and on the performance of our executive officers and other key management, engineering, manufacturing and operating personnel. The loss of the services of any executive officer, or other key management, engineering, manufacturing and operating personnel, could materially adversely affect our business. Our ability to achieve our growth plans will also depend on our ability to attract and retain additional qualified management and technical personnel, and we do not know whether we will be able to be successful in these regards. Our inability to attract and retain additional qualified management and technical personnel, or the departure of key employees, could materially and adversely affect our growth plans and, therefore, our business prospects, results of operations and financial condition.

Our stock price has been and could remain volatile.

12

The market price for our common stock has been and may continue to be volatile and subject to extreme price and volume fluctuations in response to market and other factors, including the following, some of which are beyond our control:

|

· |

failure to meet growth expectations; |

|

· |

variations in our quarterly operating results from the expectations of investors; |

|

· |

downward changes in general market conditions; |

|

· |

announcements of new products or services by our competitors; |

|

· |

announcements by our competitors of significant acquisitions, strategic partnerships, joint ventures or capital commitments; |

|

· |

additions or departures of key personnel; |

|

· |

investor perception of our industry or our prospects; |

|

· |

insider selling or buying; |

|

· |

demand for our common stock; and |

|

· |

general technological or economic trends. |

In the past, following periods of volatility in the market price of their stock, many companies have been the subjects of securities class action litigation. If we became involved in securities class action litigation in the future, it could result in substantial costs and diversion of management’s attention and resources and could harm our stock price, business prospects, results of operations and financial condition.

The maintenance and security of our information systems are critical to our operations.

We rely on our information systems to be functioning at all times, and that the data in those systems is protected and secure from viruses, illegal access and any other form of unauthorized use. Should our information systems be compromised in any way, our business operations could be severely impacted.

13

ITEM 1B.UNRESOLVED STAFF COMMENTS

None.

We own our offices and manufacturing facility and believe the facility to be well maintained, adequately insured and suitable for its present and intended uses. Information concerning our facility as of March 31, 2015 is set forth in the table below:

|

Ownership or |

|||

|

Location |

Square Feet |

Expiration Date of Lease |

Use |

|

Longmont, Colorado |

129,304 |

Own |

Manufacturing, laboratories and offices |

Litigation

We are involved in various claims and legal actions arising in the ordinary course of business. In the opinion of management, and based on current available information, the ultimate disposition of these matters is not expected to have a material adverse effect on our financial position, results of operations or cash flow.

ITEM 4.MINE SAFETY DISCLOSURES

Not applicable.

14

Part II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock trades on the NYSE MKT and Chicago Stock Exchange under the symbol UQM. The high and low trade prices, by fiscal quarter, as reported by the NYSE MKT Stock Exchange for the last two fiscal years are as follows:

|

2015 |

High |

Low |

||

|

Fourth Quarter |

$ 1.32 |

$ 0.71 |

||

|

Third Quarter |

$ 1.44 |

$ 0.76 |

||

|

Second Quarter |

$ 2.30 |

$ 1.18 |

||

|

First Quarter |

$ 2.96 |

$ 1.72 |

||

|

2014 |

High |

Low |

||

|

Fourth Quarter |

$ 3.45 |

$ 1.56 |

||

|

Third Quarter |

$ 2.49 |

$ 1.40 |

||

|

Second Quarter |

$ 2.20 |

$ 1.00 |

||

|

First Quarter |

$ 1.55 |

$ 0.68 |

On May 26, 2015 the closing price of our common stock, as reported on the NYSE MKT, was $1.00 per share and there were 559 holders of record of our common stock.

We have not paid any cash dividends on our common stock since inception and we intend for the foreseeable future to retain any earnings to finance the growth of our business. Future dividend policy will be determined by our Board of Directors based upon consideration of our earnings, capital needs and other factors then relevant.

15

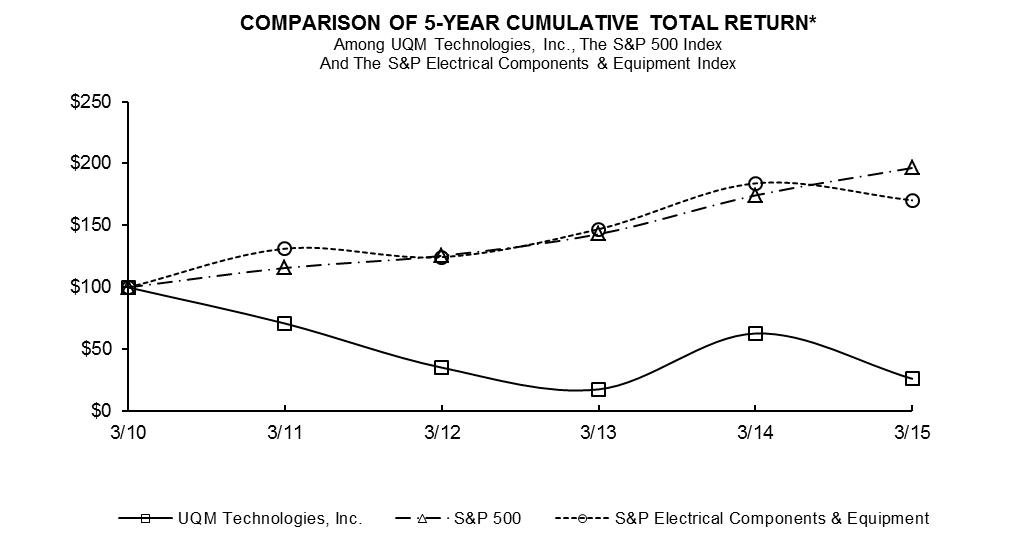

PERFORMANCE GRAPH 1

The following graph represents the yearly percentage change in the cumulative total return on the common stock of UQM Technologies, Inc., the group of companies comprising the S&P Electrical Equipment Index, and those companies comprising the S&P 500 Index for the five year period from March 31, 2010 through March 31, 2015:

|

3/10 |

3/11 |

3/12 |

3/13 |

3/14 |

3/15 |

|

|

UQM Technologies, Inc. |

100.00 | 70.78 | 35.15 | 17.58 | 62.71 | 26.13 |

|

S&P 500 |

100.00 | 115.65 | 125.52 | 143.05 | 174.31 | 196.51 |

|

S&P Electrical Components & Equipment |

100.00 | 131.26 | 124.37 | 147.03 | 184.03 | 170.31 |

|

*$100 invested on 3/31/10 in stock or index, including reinvestment of dividends |

||||||

|

Fiscal year ending March 31. |

||||||

1 The stock price performance graph depicted is not “soliciting material,” is not deemed "filed" with the SEC, and is not to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation contained in such filing.

16

ITEM 6.SELECTED FINANCIAL DATA

The selected consolidated financial data presented below should be read in conjunction with our consolidated financial statements and related notes included elsewhere in this document.

|

UQM Technologies, Inc. |

||||||||||||||

|

Selected Consolidated Financial Data |

||||||||||||||

|

Years Ended March 31, |

||||||||||||||

|

2015 |

2014 |

2013 |

2012 |

2011 |

||||||||||

|

Product sales |

$ |

3,218,616 |

$ |

6,136,305 |

$ |

5,910,153 |

$ |

9,358,388 |

$ |

8,413,098 | ||||

|

Contract services revenue |

$ |

797,128 |

$ |

909,895 |

$ |

1,268,556 |

$ |

785,068 |

$ |

608,204 | ||||

|

Loss before other income |

||||||||||||||

|

(expense) |

$ |

(6,859,891) |

$ |

(2,782,503) |

$ |

(10,707,432) |

$ |

(4,953,336) |

$ |

(2,349,174) | ||||

|

Net loss |

$ |

(5,988,530) |

$ |

(2,773,244) |

$ |

(10,688,312) |

$ |

(4,928,520) |

$ |

(1,992,358) | ||||

|

Net loss per common share - |

||||||||||||||

|

basic and diluted |

$ |

(0.15) |

$ |

(0.07) |

$ |

(0.29) |

$ |

(0.14) |

$ |

(0.06) | ||||

|

Total assets |

$ |

24,801,993 |

$ |

29,835,133 |

$ |

28,608,715 |

$ |

39,655,601 |

$ |

41,803,920 | ||||

|

Long-term obligations (1) |

$ |

445,024 |

$ |

182,100 |

$ |

627,412 |

$ |

715,107 |

$ |

1,316,372 | ||||

|

Cash dividend declared per |

||||||||||||||

|

common share |

- |

- |

- |

- |

- |

|||||||||

|

(1) Includes current portion of long-term obligations. |

||||||||||||||

17

ITEM 7.MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

This Report contains statements that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act. These could be statements regarding our plans, beliefs or current expectations; including those plans, beliefs and expectations of our officers and directors with respect to, among other things, new product developments, future orders to be received from our customers, sales of products from inventory, future financial results, liquidity and the continued growth of the electric-powered vehicle industry. Important Risk Factors that could cause actual results to differ from those contained in the forward-looking statements are listed above in Part I, Item 1A. Risk Factors.

UQM is a developer and manufacturer of power dense, high efficiency electric motors, generators and power electronic controllers for the commercial truck, bus, automotive, marine and military markets. We generate revenue from two principal activities: 1) the sale of motors, generators and electronic controls; and 2) research, development and application engineering contract services. Our product sales consist of annually recurring volume production, prototype low volume sales, and revenues derived from the sale of refurbished and serviced products. The sources of engineering revenue typically vary from year to year and individual projects may vary substantially in their periods of performance and aggregate dollar value.

We have invested considerable financial and human resources into the development of our technology and manufacturing operations. We have developed and production-validated a full range of products for use in full-electric, hybrid electric, plug-in-hybrid and fuel cell applications for the commercial bus and truck, automotive, marine and military markets. These products are all highly efficient permanent magnet designs and feature outstanding performance, package size and weight valued by our customers. Our production capabilities and capacity are sufficient to meet the demands of our current and future customers for the foreseeable future. We are certified as an ISO/TS 16949 quality supplier, which is the highest level of quality standards in the automotive industry, and we are ISO 14001 certified, meeting the highest environmental standards. We have a management team with significant experience in the automotive industry and the requirements for high quality production programs and very deep technical knowledge of the motor and controller business. This team has the ability and background to grow the business to significantly higher levels, and we believe we have adequate cash balances to fund our operations for at least the next twelve months.

Our most important strategic initiative going forward is to develop customer relationships that lead to longer-term supply contracts. Volume production is the key to our ongoing operations. We are driving business development in the following ways:

|

· |

We have created a well-defined, structured process to target potential customers of vehicle electric motor technology in the commercial truck/van and shuttles, passenger buses, automotive, marine, military and other targeted markets both domestically and internationally. |

|

· |

We have developed a customer pipeline where identified potential customers are synergistic and strategic in nature for longer-term growth potential. |

|

· |

We are building long term quantifiable and sustainable relationships within the identified target markets. |

|

· |

We provide service and support to our customers from pilot and test activities through commissioning processes and then ultimately to volume production operations. |

|

· |

We improve our purchasing and manufacturing processes to develop competitive costs to ensure that our pricing to customers is market competitive. |

|

· |

We provide customized solutions to meet specification requirements that some customers require. |

|

· |

We participate in trade show events globally to demonstrate our products and engage with users of electric motor technology. |

18

|

· |

We actively involve all functional groups within the Company to support the requests of our customers. |

We believe that the successful execution of these activities will lead us to secure volume production commitments from customers, so that our operations will become cash flow positive and ultimately profitable.

In February 2015, we announced the signing of a ten-year cooperative production and supply agreement with the KESHI GROUP in Changzhou, China. KESHI is a major manufacturer of vehicles used in the mining industry in China. Under the supply agreement, UQM will supply the core component parts and KESHI will source the unique explosion-proof components and perform final assembly and test in Changzhou under a license agreement with UQM. The relationship between the two companies is exclusive for explosion proof systems in China. Production is expected to begin in fiscal year 2015 and will ramp over the next few years. We worked with KESHI for more than one year to develop their explosion-proof component requirement which lead to the signing of the long-term agreement.

In February 2015, we announced that we had achieved China Certification on our PowerPhase HD® 250 electric propulsion system that meets the Chinese General Specifications for electrical machines and controllers for electric vehicles. The PowerPhase HD 250 is optimized for transit bus and commercial vehicle applications, and the certification enables us to supply this system to vehicle manufacturers throughout China. The testing, conducted over a three month period at the China Automotive Technology & Research Center in Tianjin, included extensive system performance analysis for power and torque, environmental examinations including vibration, salt spray and sealing performance and electrical testing.

In February 2015, we announced a business relationship with Power Plaza Co. Ltd., a South Korean electric vehicle manufacturer, to provide PowerPhase Pro® 100 electric motor and controller systems for the rapidly growing Korean 1-ton truck EV market. Power Plaza is working with the Seoul city government and other key partners on a program to convert 1-ton diesel trucks – which are the primary commercial truck used in Seoul – to electric vehicles. One of the key partners in the program is the South Korean conglomerate CJ which has a total fleet of 18,000 1-ton vehicles used for short-haul delivery, and is evaluating electrifying a portion of their fleet.

In February 2015, we also announced expansion into the fuel cell business by taking over the fuel cell compressor module business from another company. These compressor modules are an integral component of hydrogen powered fuel cell vehicles. We previously provided motor/controller components to customers who manufactured fuel cell compressors. We believe that our expertise in manufacturing electric motor and controller systems makes this a natural extension of our existing product lines. We further believe that our revenue and gross profits will be improved over time as a result of this addition to our business.

In November 2014, we signed a long-term supply agreement to provide electric power systems for industrial and commercial applications to an energy management company. UQM PowerPhase® electric motors and controllers will be incorporated with this partner’s proprietary technology to create new solutions to address the needs of its global customer base in a wide range of large industrial and commercial facilities. Pilot shipments are expected to begin in calendar 2015, followed by a second purchase order for 500 units once certification is complete and follow-on customer orders are received. These initial production units are expected to available to start shipping in late calendar year 2015.

The Department of Energy grant that was awarded to us in 2010 expired on January 12, 2015. Since the beginning of the grant program, we were reimbursed a total of $27.1 million through March 31, 2015. These cumulative reimbursements have allowed us to achieve many milestones to support our business development efforts that we believe will lead to volume production opportunities. First, we were able to relocate our headquarters and production operations to an approximate 130,000 square foot facility with fifteen adjacent acres of land for future expansion. Within this modern facility, we were able to develop and install manufacturing capacity and infrastructure to build and test our state-of-the-art traction motors and controllers. We have installed a flexible manufacturing footprint that allows us to build both the large and smaller frame size motors and controllers at production capacity levels consistent with the growth targets of our current and potential customers. Throughout the program, the DOE grant supported product validation and release activities for both passenger vehicle and heavy duty truck and bus platforms. In addition, the grant assisted us in implementing all of the required processes and systems to certify our facility to the ISO/TS 16949 quality standard that is a requirement to be a supplier to the automotive industry.

With the expiration of the Grant, we launched and re-deployed resources from production engineering activities to several new internally funded projects aimed at developing and significantly improving our product portfolio. This led to a significant increase in research and development expenditures in the fourth quarter of fiscal year 2015, and we expect those resources to continue to be deployed on similar research and development activities in the future.

19

The funding from the DOE grant brought us to a position of strength with regards to product validation and manufacturing capabilities. This, in addition to the business development activities in place and the cash reserves we have to fund the operations for at least the next twelve months, makes us optimistic about the future of the Company.

Financial Condition

Cash and cash equivalents and short-term investments at March 31, 2015 were $6,585,703 and working capital was $15,605,555 compared with $10,310,141 and $20,052,187, respectively, at March 31, 2014. The decrease in cash and short-term investments and working capital is primarily attributable to operating losses.

Accounts receivable decreased $438,002 to $522,417 at March 31, 2015 from $960,419 at March 31, 2014. The decrease is primarily due to a reduction in billings outstanding under our DOE Grant. Our sales are conducted through acceptance of customer purchase orders or in some cases through supply agreements. For credit qualified customers, our standard terms are net 30 days. For international customers and customers without an adequate credit rating or history, our typical terms are irrevocable letter of credit or cash payment in advance of delivery. At March 31, 2015 and 2014, we had an allowance for uncollectible accounts of zero, respectively.

Other receivable increased to $855,000 at March 31, 2015 from zero at March 31, 2014 resulting from insurance proceeds due and recorded under a key-man life insurance policy following the death of one of our executives in the fourth quarter of fiscal year 2015.

Costs and estimated earnings on uncompleted contracts decreased to $49,917 at March 31, 2015 versus $341,255 at March 31, 2014. The decrease is due to timing of billings on certain contracts in process at March 31, 2015 versus March 31, 2014.

Inventories decreased $700,369 to $9,354,053 at March 31, 2015 compared to $10,054,422 at March 31, 2014, reflecting shipments of PowerPhase Pro® and PowerPhase HD® propulsion systems.

Prepaid expenses and other current assets increased to $266,448 at March 31, 2015 from $263,988 at March 31, 2014, primarily due to higher levels of prepayments on software licenses outstanding at the end of the current fiscal year versus the prior fiscal year end.

We invested $558,755 for the acquisition of property and equipment during the fiscal year ended March 31, 2015 before reimbursements from the DOE Grant versus $377,224 during the fiscal year ended March 31, 2014. The increase in capital expenditures is primarily attributable to increased levels of investments in production equipment during the current fiscal year. Cash reimbursements for capital assets under the Grant during the fiscal years ended March 31, 2015 and March 31, 2014 were $371,140 and $215,754, respectively.