Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark one) | |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended March 29, 2015 | |

or | |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period From to | |

Commission File Number 1-10348

PRECISION CASTPARTS CORP.

(Exact name of registrant as specified in its charter)

Oregon | 93-0460598 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

4650 S.W. Macadam Ave., Suite 400 Portland, OR | 97239-4262 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (503) 946-4800 | |

Securities registered pursuant to Section 12(b) of the Act: | |

Title of each class | Name of each exchange on which registered |

Common Stock, without par value | New York Stock Exchange |

Series A Preferred Stock Purchase Rights | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of common equity held by non-affiliates of the Registrant as of September 26, 2014, was $34,132,467,040.

As of the close of business on May 19, 2015, the Registrant had 138,228,926 shares of Common Stock, without par value, outstanding.

Portions of the Registrant’s Proxy Statement to be filed in connection with the 2015 Annual Meeting of Shareholders are incorporated by reference in Part III.

TABLE OF CONTENTS

Page | |

PART I

ITEM 1. | BUSINESS |

Precision Castparts Corp. (“PCC”, “the Company”, or “we”), a worldwide manufacturer of complex metal components and products, provides high-quality investment castings, forgings, fasteners/fastener systems and aerostructures for critical aerospace and power applications. We also provide seamless pipe for coal-fired, industrial gas turbine ("IGT") and nuclear power plants; downhole casing, clad pipe, fittings and various mill forms in a variety of nickel and steel alloys for severe-service oil and gas environments; investment castings and forgings for general industrial, armament, medical and other applications; nickel and titanium alloys in all standard mill forms from large ingots and billets to plate, foil, sheet, strip, tubing, bar, rod, extruded shapes, rod-in-coil, wire and welding consumables, as well as cobalt alloys, for the aerospace, chemical processing, oil and gas, pollution control and other industries; revert management solutions; fasteners for automotive and general industrial markets; specialty alloys for the investment casting and forging industries; heat treating and destructive testing services for the investment cast products and forging industries; refiner plates, screen cylinders and other products for the pulp and paper industry; grinder pumps and affiliated components for low-pressure sewer systems; critical auxiliary equipment and gas monitoring systems for the power generation industry; and metalworking tools for the fastener market and other applications.

Products and Markets

We manufacture complex metal components and products in three principal business segments: Investment Cast Products, Forged Products and Airframe Products. Each of these three business segments is described below.

Investment Cast Products

Our Investment Cast Products segment manufactures investment castings for aircraft engines, IGT engines, airframes, medical implants, armament, unmanned aerial vehicles and other industrial applications. The segment also provides alloys to PCC’s investment casting operations, as well as to other investment casting companies. The Investment Cast Products segment accounted for approximately 25 percent of our sales in fiscal 2015.

We are the market leader in manufacturing large, complex, structural investment castings, and we are the leading manufacturer of airfoil investment castings used in jet aircraft engines. We manufacture investment castings for every jet aircraft engine program in production or under development by our key customers. We are also the market leader in manufacturing structural and airfoil investment castings for IGT and aeroderivative engines used for electric power generation and other applications, and we have expanded into the structural airframe and armament markets. In addition, we make investment castings for use in the medical implant, satellite launch vehicle and general industrial markets.

Investment casting technology involves a multi-step process that uses ceramic molds in the manufacture of metal components with more complex shapes, closer tolerances and finer surface finishes than parts manufactured using other casting methods. The investment casting process begins with the creation of a wax pattern of the part to be cast, along with wax gates and risers to create pathways through which molten metal can flow throughout the ceramic mold. A ceramic shell is then formed around the wax pattern, followed by melting and draining the wax from the shell. Finally, molten metal is poured into the shell, which is removed after the metal cools, and the part undergoes final processing and inspection.

Because of the complexity of the manufacturing process and the application of proprietary technologies, we are currently one of the few manufacturers that can consistently produce the largest, complex, structural investment castings in quantities sufficient to meet our customers’ quality and delivery requirements. Our emphasis on low-cost, high-quality products and timely delivery has enabled us to become the leading supplier of structural and airfoil castings for jet aircraft and IGT engines and to expand into the structural airframe and armament markets.

Large jet aircraft engines are manufactured by a limited number of suppliers, including General Electric (“GE”), Pratt & Whitney (a division of United Technologies Co.), Rolls-Royce and several joint venture partners. With this highly concentrated and sophisticated customer base, we believe customer service and long-term customer relationships will continue to be important to achieving our goals. We have been supplying castings for jet engines to GE, Pratt & Whitney and Rolls-Royce for several decades. As we have been able to cast larger and more complex parts, manufacturers of large jet aircraft engines have increased their use of our structural castings.

Aerospace Structural Castings

Our structural castings business manufactures the largest-diameter, nickel-based superalloy, titanium and stainless steel investment castings in the world, as well as a variety of medium and small structural castings in these same alloys and in aluminum. The nickel, titanium and steel castings are stationary components that form portions of the fan, compressor,

1

combustor and turbine sections of a jet aircraft engine, where strength and structural integrity are critical. Aluminum structural castings are used in such applications as doors and thrust reversers. Structural investment castings are sold primarily as original equipment to jet aircraft engine manufacturers.

We believe that trends in the design of aircraft jet engines will continue to increase our revenue per engine. As the design of new-generation aircraft engines has emphasized increased thrust, higher fuel efficiency and reduction of noise and exhaust emissions, engine operating temperatures and pressures have increased. These conditions require the use of engine parts made of alloys that are able to withstand extreme operating conditions and provide an optimum strength-to-weight ratio. Many of these alloys are particularly suited for use in the investment castings we manufacture. In addition, titanium, a metal with a lower melting temperature than stainless steel or superalloys, is used for structural castings in all but the hottest parts of the engine because of its high mechanical properties and considerable weight savings. Titanium is a challenging metal to cast because of its reaction with other elements. However, we have developed the advanced technology and manufacturing processes to cast large, complex investment castings in a variety of titanium alloys. Many new-generation engines, which are expected to be built through the next decade and beyond, make significantly greater use of our products than did previous engine designs.

We have also expanded into the structural airframes market through the production of components manufactured primarily from titanium and aluminum alloys. Aircraft manufacturers have shown substantial interest in using investment castings for airframe applications such as titanium aileron and flap hinges, pylons (engine mounts), heat shields, wing spars and wing ribs, as well as aluminum alloy nacelle segments (thrust reversers), cascades, aircraft access doors, electronic boxes and pump housings for hydraulic and fuel systems.

Aerospace Airfoil Castings

We manufacture precision cast airfoils, such as the stationary vanes and rotating blades used in the turbine section of jet aircraft engines. This part of the engine is considered the “hot section,” where temperatures may exceed 2,400 degrees Fahrenheit. These conditions require use of special nickel-based superalloys and state-of-the-art casting techniques to manufacture airfoil castings with internal cooling passages that enable the airfoils to operate in an environment with temperatures higher than the melting point of the metal of which they are made.

We use various casting technologies to manufacture turbine airfoils. A conventional casting process enables us to produce equiaxed airfoil castings, in which the metal grains are oriented randomly throughout the casting. A more advanced process enables us to produce directionally solidified (“DS”) airfoil castings, in which the metal grains are aligned longitudinally. This alignment decreases the internal stress on the weakest portion of a metal part where the various grains adjoin, thereby providing increased strength and improved efficiencies in engine performance over equiaxed parts. An even more advanced process enables us to produce single crystal (“SX”) airfoil castings, which consist of one crystal without grain boundaries. SX castings provide greater strength and performance characteristics than either equiaxed or DS castings, as well as longer engine life. In addition, we have developed a process to cast titanium aluminide blades, the first use of lightweight titanium in the hot section of an aircraft engine. These airfoils are incorporated into the GEnX engine for the Boeing 787.

As engines continue to target increased fuel efficiency and lower emissions, the turbine sections of these engines must burn hotter. As a result, the major aircraft engine manufacturers have increasingly been designing their engines with a greater number of DS and SX blades and vanes. The DS and SX cast airfoils we produce, with their complex cooling passages, have been instrumental in enabling these engines to operate at higher temperatures. SX cast airfoils are used in both new and redesigned engines where performance requirements are higher.

The demand for aerospace airfoil castings is determined primarily by the number and type of engines required for new jet aircraft; the intervals between hot section maintenance, which are driven by engine cycles (takeoffs and landings); and the inventory levels of replacement parts maintained by the principal jet aircraft engine manufacturers, repair centers and airlines. A jet engine’s airfoil components have shorter useful lives than structural investment castings and are replaced periodically during engine maintenance. As a result, our sales of aerospace airfoil castings are less affected by the cyclical patterns of the aerospace industry than are our sales of structural investment castings. The timing for replacement of aerospace airfoil castings principally depends on engine cycles and the expected life of the airfoil casting. We believe that approximately 30 percent of our sales of airfoil castings used in aircraft turbine engines are replacement parts.

IGT Castings

We are the leading supplier of investment castings used in IGT engines. IGTs have been a preferred power source for several decades, and original equipment manufacturers ("OEM") expect that trend to continue due to the availability of natural gas, overall efficiency of operation and relative speed/ease of installation. Most sales growth is anticipated in turbines of 180MW and above, which have higher PCC dollar content. In addition to IGT components, we manufacture structural and

2

airfoil castings for aeroderivative gas turbine engines, which are also used for power generation, as well as for other commercial and military land- and marine-based applications.

IGT manufacturers have significantly improved the efficiency and reduced the emissions profiles of industrial gas turbines, principally by incorporating advanced components in new engines as well as in refurbished and upgraded turbines in the field. We have leveraged our DS and SX airfoil casting knowledge from the aerospace market into the IGT market to produce blades and vanes that are better able to withstand the extreme heat and stresses of new, higher-temperature gas turbines. IGT engines are built with investment castings that are similar, but much larger, than the blades and vanes we manufacture for the aerospace market. Because of their size, IGT airfoils are usually more difficult to cast than smaller aerospace airfoils with the same properties.

Since industrial gas turbines are primarily used in electrical power generation, castings sales for new IGT engines are tied to the growth of global electricity consumption, while spares demand depends on the size and utilization rate of the installed base.

Other Investment Casting Products

Our strategy for profitable growth also includes the pursuit of other opportunities for our existing investment casting technology. We have expanded the application of our investment casting technology in the medical prosthesis, unmanned aerial vehicles (“UAV”) and general industrial markets by manufacturing such products as artificial hips and knees, landing gear struts and engine inlets for UAVs and impellers for pumps and compressors. In addition, we manufacture large titanium components for armament systems.

Internal Alloy-Making Capability

An operation within our Investment Cast Products segment produces alloys used by PCC and other manufacturers of investment castings. Several of these alloys are patented and trademarked, and specifically formulated for the casting of DS and SX airfoils that operate in high-temperature, high-stress engine environments. This operation supplements our other ingot-making furnaces located in Portland, Oregon, and Minerva, Ohio, and our internal supply of nickel-based alloy for investment casting is managed through this group of facilities. The alloys produced also serve such diverse markets as medical, recreational and general industrial.

Forged Products

We are among the leading manufacturers of forged components for the aerospace and power generation markets. Forged Products’ aerospace and IGT sales are primarily derived from the same large engine customers served by the Investment Cast Products segment, with additional aerospace sales to manufacturers of landing gear and airframes. Therefore, the dynamics of the aerospace and IGT markets, as described in the Investment Cast Products section above, are virtually the same for Forged Products, with the exception that Forged Products' IGT sales are mainly for OEM new equipment. We also produce seamless pipe for coal-fired, industrial gas turbine and nuclear power plants, as well as downhole casings and clad pipe for severe service oil and gas environments. In addition, we manufacture high-performance, nickel-based alloys used to produce forged components for aerospace and non-aerospace applications in such markets as oil and gas, chemical processing and pollution control. Our titanium products are used to manufacture components for the commercial and military aerospace, power generation, energy, and industrial end markets. The Forged Products segment accounted for approximately 43 percent of our sales in fiscal 2015.

Forged Components

We manufacture forged components from titanium and nickel-based alloys for commercial and military aircraft engines and IGT power plants, including fan discs, compressor discs, turbine discs, seals, spacers, shafts, hubs and cases. Our airframe structural components are used on both commercial and military aircraft and include landing gear beams, bulkheads, wing structures, engine mounts, struts and tail flaps, and housings. We also produce a variety of mechanical and structural tubular products from steel and nickel alloys, primarily in the form of extruded seamless pipe, for domestic and international energy markets, which include coal, IGT and nuclear power plants and co-generation projects, as well as nickel-alloy casing and tubular products for exploration and production by the oil and gas industry. For naval defense applications, we supply forged components for propulsion systems on nuclear submarines and aircraft carriers, as well as forgings for pumps, valves and structural applications.

Our forged component operations, which employ nine different manufacturing processes, involve heating high-temperature nickel alloys, titanium or steel and then shaping the metal through pressing or extrusion, using hydraulic and

3

mechanical presses with capacities ranging up to 50,000 tons. The process employed is determined based on the raw materials and the product application. The nine manufacturing processes are summarized below:

Open-Die Forging—In this process, the metal is pressed between dies that never completely surround the metal, thus allowing it to be observed during the process. This manufacturing method is used to create relatively simple, preliminary shapes to be processed further by other die forging processes.

Closed-Die Forging—Closed-die forging involves pressing heated metal into shapes and sizes determined by machined impressions in specially prepared dies that completely surround the metal. This process enables the metal to flow more easily within the die cavity and thus produces forgings with superior surface finish, tighter tolerances and unique shapes, with enhanced repeatability of the part shape.

Hammer Forging—This form of closed-die forging uses multiple impact blows to shape a component between specially contoured dies. Forging hammers can be classified into two main types: single action and counterblow. Our counterblow hammers, which couple upper- and lower-ram movement to produce the impact forces required for large components, can offer improved near-net-shape capability compared to conventional press forging. Hammer forging is one of the oldest forging processes; however, computer-controlled technology has enabled the process to meet modern manufacturing requirements.

Conventional/Multi-Ram—The closed-die, multi-ram process enables us to produce complex forgings with multiple cavities, such as valve bodies, in a single heating and pressing cycle. Dies may be split on either a vertical or a horizontal plane, and shaped punches may be operated by side rams, piercing rams or both. This process also optimizes grain flow and uniformity of deformation and reduces machining requirements.

Isothermal Forging—Isothermal forging is a closed-die process in which the dies are heated to the same temperature as the metal being forged, typically in excess of 1,900 degrees Fahrenheit. Because the dies may oxidize at these elevated temperatures, this process is performed in a vacuum or inert gas atmosphere. Our isothermal press produces near-net-shape components, requiring less machining by our customers.

Extrusion—The extrusion process is capable of producing thick-wall, seamless pipe, with outside diameters of up to 48 inches and a wall thickness from 0.5 inches to 7 inches for applications in the power generation and oil and gas industries, including main steam lines, hot re-treat lines and other high-stress/high-temperature fluid transmission systems. Our 35,000-ton vertical extrusion press is one of the largest and most advanced in the world. In addition to solid metals, powdered metals can be compacted and extruded into forging billets with this press.

Ring Rolling—The radial ring-rolling process thins the wall thickness and thus enlarges the inside and outside diameter of a rough ring blank, which is generally made by piercing a solid piece of metal in an open or closed-die forging press. In the ring-rolling process, tonnage is applied to the wall of the blank between a mandrel on the inside diameter and a work-roll on the outside diameter. The outer work-roll rotates the ring and progressively reduces the wall thickness. In radial-axial ring rolling, two additional rollers apply tonnage on the end faces of the ring to control the ring height.

Flash Welding Rings—The process involves taking a shaped or rectangular cross-sectional bar and bending it into a hoop to form a ring. The ring is clamped in the flash-welding machine, which heats the ends of the bar to form a molten metal interface and then forges the ends together. After the ends are forged together, the expelled molten metal from the weld joint (flash) is ground down to match the parent material surface. Following the welding process, the rings are finished by rounding and flattening.

Tru-Form Process—Tru-Form is a near-net-shaped, cold-rolling process, which starts with flash-welded or seamless, rolled rings. The high-tonnage rolls of the Tru-Form process apply point contact to thin the wall thickness of a ring and grow the axial height. The rolling tools are programmed to follow profiles unique to the finished product definition. After the rolling process, additional forming operations are performed to transform the rolled ring into a finished near-net-shape contour.

We believe that we are the world leader in producing forged rotating components for use in jet aircraft engines. These parts are forged from billets (ingots converted in our cogging and extrusion presses) and from metal powders (primarily nickel alloys) that are produced, consolidated and extruded into billets entirely in our own facilities. In addition, we purchase billets from outside metal suppliers.

High-Performance Alloys

We believe that we are the world’s largest and most diversified producer of high-performance, nickel-based alloys, supplying more than 5,000 customers. Our alloys, which provide high-temperature strength and corrosion resistance, as well as toughness and strength in certain embrittling environments, are used to manufacture components required in the most technically demanding industries and applications. Power (primarily oil & gas) and commercial and military aerospace represent the largest markets served; other markets served include chemical and petrochemical processing, thermal processing, electrical and heating elements, and marine and welding applications.

Our alloying processes utilize electric arc, air induction and vacuum induction melting furnaces, while a few specialized alloys are made using a mechanical alloying process. Refining facilities include furnaces for argon/oxygen decarburization, vacuum arc remelting and electroslag remelting. Our major hot finishing processes include rotary forging, plate rolling, bar

4

rolling, press forging and extrusion of seamless tubulars and shapes. Cold finishing processes include cold rolled sheet and strip, tube and pipe pilgering, cold drawing of bar and wire, and cold drawing and rolling of pipe and tubulars. We produce nickel alloys in all standard mill forms from large ingots and billets to plate, sheet, strip, tubing, bar and wire, the latter of which includes core and filler wires for welding products. Our alloys are classified into unique families recognized worldwide and are sold under such trademarks as INCONEL®, INCOLOY®, MONEL®, NIMONIC®, UDIMET®, BRIGHTRAY® and NILO®.

Titanium Alloys

We are one of the world's leading producers of titanium melted and mill products. Our titanium products, which have uniquely high strength-to-weight and corrosion-resistance properties, are used to manufacture components for the commercial and military aerospace, power generation, energy and industrial end markets. Commercial aerospace represents our largest market, and new generations of fuel-efficient aircraft, including the Boeing 787 and Airbus A350, are increasing the content of titanium in airframe and engine applications.

As a fully integrated titanium component manufacturer, our breadth of production capabilities enable us to start with titanium-bearing sands and deliver a finished titanium shape to our end customer. Our titanium sponge production employs a vacuum distillation process and combines a titanium-containing feedstock ore with chlorine and petroleum coke to produce titanium tetrachloride, which is then reacted with magnesium to produce sponge. Melted products (ingot, electrode and slab) are produced by melting sponge, titanium scrap and alloying agents to produce various grades of titanium products. Mill products are produced by forging or rolling melt products into smaller gauge materials, including billet, bar, plate, sheet, strip and pipe. Our melting processes employ vacuum arc remelting (VAR) and electron-beam cold-hearth melting (EBCHM) single melt and EBCHM plus VAR; in addition, we have installed and are seeking qualification for plasma cold-hearth melting plus VAR capability. Our mill product processes include open die forging, vacuum annealing, rotary/radial forging, vacuum creep flattening and rolling mills. We also operate a global network of service centers that sell value-added and customized mill products.

Revert Management

We are the market leader in providing nickel superalloy and titanium revert management solutions for the aerospace, oil and gas, and energy markets. Revert includes metal chips, casting gates, bar ends, forging flash and other byproducts from forging, casting, fasteners and aerostructures manufacturing processes that can be re-melted and reused. Our infrastructure and capabilities create a closed loop system for the retention and reuse of internally-generated revert. We also provide metallurgical processing solutions and services worldwide for our use and for other companies that require the melting and processing of specialty alloys. Major markets include specialty alloy producers, foundries and other industries with special metallurgical requirements.

Airframe Products

We are a leading developer and manufacturer of highly engineered fasteners, fastener systems, aerostructures and precision components, primarily for critical aerospace applications. Much of our Airframe Products sales come from the same aerospace customer base served by our Investment Cast Products and Forged Products segments, with the exception that our aerostructures business is primarily driven by original equipment demand. In this regard, Airframe Products is subject to many of the same market forces as these other two segments. The balance of the segment’s sales is derived from construction, automotive, heavy truck and general industrial markets, including farm machinery, mining and construction equipment, shipbuilding, machine tools, medical equipment, appliances and recreation. The Airframe Products segment accounted for approximately 32 percent of our sales in fiscal 2015.

In general, fastener manufacturing begins with metal alloy wire or bar of various diameters, which is cut into fastener blanks of prescribed lengths, formed by highly engineered tools into complex head shapes and dimensional configurations, heat-treated to desired properties and then thread-rolled to meet exacting customer requirements.

Our aerospace fasteners and related components are manufactured from a variety of nickel, titanium, aluminum and steel alloys and are used on airframes, jet engines, aircraft wheels and brakes, landing gear assemblies, floor boards and hydraulic systems. They are found in critical areas of an aircraft, including wing-to-fuselage, stabilizer-to-fuselage and the engine-to-wing joints, as well as airfoil-to-disc and disc-to-shaft connections on a jet engine. These fasteners and related components are not only incorporated in new aircraft builds, but are also integrally involved in the maintenance and replacement cycle, particularly in aircraft engine and wheel and brake applications. The product line includes a variety of bolts, sleeved fastening systems, nuts, nut plates, latches, expandable diameter fasteners, quick release pins, hydraulic fittings, bushings, inserts, collars and other precision components, including but not limited to metallic and composite assemblies, and precision-machined components for airframe applications. While the fasteners and related components are predominantly produced to demanding

5

customer designs, we continue to be active in developing trademarked alloys for applications requiring high strength, elevated temperature, corrosion resistance and/or lighter weight including AEREX®, MULTIPHASE®, MP35N® and MP159® high-temperature, nickel-based alloys.

We have also developed a variety of fasteners, fittings, related components and installation tools for use in aerospace and industrial applications requiring proven strength, close dimensional tolerances and high reliability. These technically-advanced, proprietary products are marketed under the brand names of AVILOK®, BALL-LOK®, CHERRYBUCK®, CHERRYMAX®, CHERRYLOCK®, E-NUT®, FLEXLOC®, FLEXMATE®, FORCEMATE®, FORCETEC®, GROMEX®, HI-LIFE®, MAKE FROM SOLIDTM, MAXIBOLT®, PERMALITE®, PERMASWAGE®, SLEEVbolt®, STA-LOK®, TELLEP® and TUKLOC®. We also hold licenses to use various, well-recognized trademarks and technology in the manufacture of our fasteners and related components. These licensed trademarks include HI-LITE®, HI-LOK®, HI-TIGUE®, TORX®, TORX-PLUS®, TAPTITE®, MORTORQ® and MAThread®.

Our aerostructures facilities manufacture complex components and structural assemblies, including three- to five-axis prismatic and long-bed machined aluminum and titanium components, complex sheet metal fabrications, and composite and metal-bonded components. In addition, we have the capability to machine castings in a range of sizes, provide full-service chemical processing and metal finishing, and to kit, assemble and integrate multiple component parts.

Product applications include wing and fuselage structural parts; engine pylon-related assemblies; engine lock-plates and bracketry; complete passenger and exit doors; major flap support and actuation structures; spars, skins, and bulkheads up to 60 meters; swaged control rods, cables, and actuation and flight control assemblies; and complex latches, quick release BALL-LOK® pins, and specialized fasteners.

The Airframe Products segment also includes businesses that produce refiner plates for use in the pulp and paper industry; grinder pumps and affiliated components for low-pressure sewer systems for residential and commercial applications; critical auxiliary equipment and gas monitoring systems utilized in the power generation industry; critical engineered fasteners and cold-formed parts for the automotive and general industrial market; and a broad range of thread-rolling dies, trimming dies, pins and steel and carbide forging tools for fastener production, principally for aerospace, automotive, and general industrial and other applications.

In fiscal 2015, we acquired two businesses in the Airframe Products segment, including Aerospace Dynamics International ("ADI"). ADI is one of the premier suppliers in the aerospace industry, operating a wide range of high-speed machining centers. ADI has developed particular expertise in large complex components, hard-metal machining, and critical assemblies. ADI is located in Valencia, California, and employs approximately 625 people.

6

Sales and Distribution

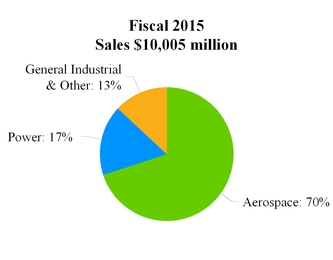

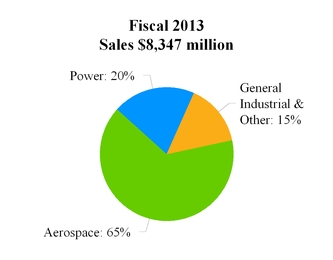

We sell our complex metal components and products into three major market areas: aerospace, power, and general industrial and other. The percentage of sales to these markets is shown below for fiscal 2015, 2014 and 2013.

Our sales to the aerospace market of $6,961 million in fiscal 2015 increased 6 percent from $6,547 million in fiscal 2014. Sales to the aerospace market as a percentage of total net sales increased from 69 percent in fiscal 2014 to 70 percent in fiscal 2015, principally reflecting our strong positions on key growth commercial aerospace platforms, including the Boeing 787, Airbus A350 and the next-generation narrow-bodies. Our sales to the aerospace market of $6,547 million in fiscal 2014 increased 20 percent from $5,472 million in fiscal 2013. Sales to the aerospace market as a percentage of total net sales increased from 65 percent in fiscal 2013 to 69 percent in fiscal 2014, principally reflecting stable aircraft schedules and continued share gains on new airframe and engine development programs, and sales from acquired businesses.

Our sales of investment cast products and forged products are made through direct sales personnel located in each business operation and through field sales representatives located at U.S. and international locations near our major customers, as well as through distributors. Our airframe products and services are sold through a worldwide network of distributors and independent sales representatives and by a direct sales and marketing staff. Industrial metalworking tools and other metal products are sold by both internal sales forces and sales representatives in the U.S., Europe, Asia, Australia and Latin America. Due to the sophisticated nature of our products, our sales efforts require technical personnel to work closely with customers to identify and assist in the development of new and modified products and to provide other services that are necessary to obtain new and repeat orders.

For information on revenue from external customers, profit or loss and total assets for each segment, refer to Part II, Item 8. Financial Statements and Supplementary Data, Note 19—Segment information.

7

Major Customers

Net direct sales to General Electric Company were approximately 13 percent, 13 percent and 15 percent of total sales in fiscal 2015, 2014 and 2013, respectively, as follows:

2015 | 2014 | 2013 | |||||||||

Investment Cast Products | $ | 828 | $ | 736 | $ | 697 | |||||

Forged Products | 435 | 412 | 540 | ||||||||

Airframe Products | 36 | 66 | 39 | ||||||||

$ | 1,299 | $ | 1,214 | $ | 1,276 | ||||||

No other customer directly accounted for more than 10 percent of total sales; however, The Boeing Company, Airbus, Rolls-Royce plc, United Technologies Corporation, and Spirit AeroSystems are also considered key customers, and the loss of their business could have a material adverse effect on our financial results.

Backlog

The backlog of unfilled orders believed to be firm at the end of each of our last three fiscal years was $8.1 billion as of March 29, 2015, $7.3 billion as of March 30, 2014, and $6.8 billion as of March 31, 2013. The majority of the backlog is for sales to aerospace and power market customers in the Investment Cast Products, Forged Products and Airframe Products segments. The increase in backlog during fiscal 2015 reflects sales of machined parts mainly for the commercial aerospace market. The increase in backlog during fiscal 2014 reflects the continued growth in commercial aerospace and power markets, including interconnect pipe. Approximately 72 percent of our backlog is expected to be filled within the 2016 fiscal year.

The majority of sales to customers are made on individual purchase orders generated from long-term agreements. Most of our orders are subject to termination by the customer upon payment of the cost of work in process, plus a related profit factor. We typically do not experience significant order cancellations, although we periodically receive requests for delays in delivery schedules.

Competition

We are subject to substantial competition in all of the markets we serve. Components and products similar to those we make can be produced by competitors using either the same types of manufacturing processes or other forms of manufacturing. Although we believe our manufacturing processes, technology and experience provide advantages to our customers, such as high quality, competitive prices and physical properties that often meet more stringent demands, alternative forms of manufacturing can be used to produce many of the components and products we make. Despite intense competition, we believe we are the number one or two supplier in most of our principal markets. Several factors, including long-standing customer relationships, technical expertise, state-of-the-art facilities and dedicated employees, aid us in maintaining our competitive advantages.

In the Investment Cast Products segment, our principal competitor is Alcoa Inc. ("Alcoa"). Alcoa produces superalloy, titanium, stainless steel and aluminum investment castings principally for the aerospace and IGT markets. We believe that Alcoa is capable of producing investment castings comparable to all but the largest and most complex of our structural investment castings. We also believe Alcoa has the financial and technical resources to produce structural castings as large and complex as those produced by us, should they decide to do so. In addition, Allegheny Technologies, Inc. ("ATI"), manufactures large titanium investment castings for jet engine and airframe applications. Many other companies throughout the world also produce superalloy, titanium, stainless steel and aluminum investment castings, and some of these companies currently compete with us in the aerospace and other markets. Others are capable of competing with us if they choose to do so.

In the Forged Products segment, our largest competitors are ATI, Aubert & Duval SAS, and Otto Fuchs KG for aerospace turbine products, Alcoa for aerospace structural products, Vallourec SA and Nippon Steel Sumitomo Metal Corporation for energy products and ATI, Carpenter Technology Corporation, and ThyssenKrupp AG for nickel-based alloys and superalloys. We also face increased competition from international companies as customers seek lower cost sources of supply.

Our principal competitors in the aerospace titanium market are ATI and RTI International Metals, Inc. ("RTI"), both based in the U.S., and Verkhnaya Salda Metallurgical Production Organization ("VSMPO"), based in Russia. UNITI (a joint venture between ATI and VSMPO), RTI and certain Japanese producers are our principal competitors in the industrial and emerging markets.

8

International competition in the forging and casting processes may also increase in the future as a result of strategic alliances among aircraft prime contractors and overseas companies, particularly where “offset” or “local content” requirements create purchase obligations with respect to products manufactured in or directed to a particular country. Competition is often intense among the companies currently involved in the industry. We continue to strive to maintain competitive advantages with high-quality products, low-cost manufacturing, excellent customer service and expertise in engineering and production.

Our Airframe Products operations compete with a large number of companies based primarily on technology, price, service, product quality, product performance and delivery performance. Of these companies, our largest competitors are Alcoa, LISI, and TransDigm Group, Inc., in fastener products, and GKN PLC, Triumph Group, Inc., Mitsubishi Heavy Industries, Ltd., Kawasaki Heavy Industries, Ltd., and the internal machining operations of certain of our OEM customers in aerostructures products. We believe that we maintain our strong market position through our high-quality product performance, service to our customers and competitive synergies with other PCC business units.

Research and Development

We have departments involved in research and development in all three of our reportable segments. The research and development effort at these operations is primarily directed at the technical aspects of developing new and improved manufacturing processes. In addition, a substantial amount of our technological capability is the result of engineering work and experimentation performed on the shop floor in connection with process development and production of new parts. This engineering work and experimentation are charged to the cost of production.

Employees

At March 29, 2015, we had approximately 30,100 employees, including nearly 7,750 employees in the Investment Cast Products segment, approximately 9,450 employees in the Forged Products segment, approximately 12,550 employees in the Airframe Products segment, approximately 150 employees in corporate functions, and approximately 200 employees in discontinued operations. Approximately 22 percent of our employees are affiliated with unions or covered by collective bargaining agreements. We expect to negotiate 13 collective bargaining agreements affecting approximately 7 percent of the workforce during fiscal 2016. Management believes that labor relations in the Company have generally been satisfactory.

Patents and Trademarks

From time to time, we seek U.S. and foreign patent protection on certain of our processes and products. We have also federally registered several of our trademarks in the U.S. and foreign countries. We do not view patents or trademarks as materially important to our business as a whole. We also have rights and obligations under various license agreements. We receive no significant royalty income from patents.

Materials & Supplies

We use a number of raw materials in our products, including certain metals such as nickel, titanium, cobalt, tantalum and molybdenum, which are found in only a few parts of the world. These metals are required for the alloys used or manufactured in our Investment Cast, Forged and Airframe Product segments. The availability and costs of these metals may be influenced by private or governmental cartels, changes in world politics, labor relations between the metal producers and their work forces, and/or unstable governments in exporting nations and inflation. Supplies of the tool-grade steel we use may similarly be subject to variations in availability and cost. We have escalation clauses for nickel and other metals in certain of our long-term contracts with major customers, and we employ “price-in-effect” metal pricing in our alloy production businesses to lock in the current cost of metal at the time of production or shipment. We also enter into long-term supply agreements to fix the purchase price of strategic raw materials. Shortages of and price increases for certain raw materials we use have occurred in the past and may occur in the future. Future shortages or price fluctuations in raw materials could have a material adverse effect on us.

Government Regulations

Certain of our products are manufactured and sold under U.S. government contracts or subcontracts. Consequently, we are directly and indirectly subject to various federal rules, regulations and orders applicable to government contractors. Violation of applicable government rules and regulations could result in civil liability, in cancellation or suspension of existing contracts or in ineligibility for future contracts or subcontracts funded in whole or in part with federal funds.

9

International Operations

We purchase products from and supply products to businesses located outside the U.S. We have also been expanding our international activities during the past several years, primarily through acquisitions and the development of overseas subsidiaries. This expansion is part of our strategy to acquire and develop businesses that complement our core competencies, provide low-cost manufacturing, have strong growth prospects and maintain leading positions in their respective market niches. Certain risks are inherent in international operations, including the risk of government-financed competition, changes in trade policies, tariff regulations, the relative stability of certain foreign currencies and difficulties in obtaining U.S. export and import licenses. Information with respect to sales and assets by geographic location is included in Part II, Item 8. Financial Statements and Supplementary Data, Note 19—Segment information.

Environmental Compliance

We are subject to various federal, state and foreign environmental laws concerning, among other things, water discharges, air emissions, waste management, toxic use reduction and environmental cleanup. Environmental laws and regulations continue to evolve, and it is likely we will be subject to increasingly stringent environmental standards in the future, particularly under air quality and water quality laws and standards related to climate change issues, such as reporting of greenhouse gas emissions. It is also likely that we will be required to make additional expenditures, which could be significant, relating to environmental matters on an ongoing basis. We also own properties, or conduct or have conducted operations at properties, where hazardous materials have been used for many years, including during periods before careful management of these materials was required or generally believed to be necessary. Consequently, we are subject to environmental laws that impose liability for historical releases of hazardous substances.

Our financial statements include estimated liabilities for future costs arising from environmental issues relating to our properties and operations. At March 29, 2015, we had accrued environmental liabilities of approximately $448 million. We believe these liabilities are adequate to cover the cost of remedial measures that may eventually be required by environmental authorities with respect to known environmental matters. Our liabilities represent our best estimate of probable future obligations for the investigation and remediation of known contaminated sites. The liabilities include potential costs associated with asserted and unasserted claims. Our actual future expenditures, however, relating to compliance and cleanup of environmental conditions at our properties cannot be conclusively determined. The estimate of our environmental costs is based on currently available facts, present laws and regulations, and current technology and take into consideration our prior experience in site investigation and remediation, the data available for each site and the professional judgment of our environmental specialists and consultants. Although recorded liabilities include our best estimate of all probable costs, our total costs for the final settlement of each site cannot be predicted with certainty due to the variety of factors that make potential costs associated with contaminated sites inherently uncertain, such as the nature and extent of site contamination, available remediation alternatives, the extent to which remedial actions will be required, the time period over which costs will be incurred, the number and economic viability of other responsible parties and whether we have any opportunity of contribution from third parties, including recovery from insurance policies. Further, sites that are in the early stages of investigation are subject to greater uncertainties than mature sites that are close to completion. Although the sites we have identified vary across the spectrum, many of our sites could be considered at an early stage of the investigation and remediation process. Therefore, our cost estimates, and our accruals associated with those sites, are subject to greater uncertainties. Environmental contingent liabilities are often resolved over a long period of time, and the timing of expenditures depends on a number of factors that vary by site. We expect that we will expend present accruals over many years, and that remediation of all currently known sites will be completed within an estimated 41 years.

We have been named as a potentially responsible party (“PRP”) at sites identified by the Environmental Protection Agency (“EPA”) and state regulatory agencies for investigation and remediation under the Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”) and similar state statutes. In the environmental remediation context, PRPs may be subject to an allocation process to assess liability, and therefore the Company may be potentially liable to the government or third parties for an allocated portion or full cost of remediating contamination at our facilities or former facilities or at third-party sites where we have been designated a PRP. In estimating our current liabilities for environmental matters, we have assumed that we will not bear the entire cost of remediation of every site to the exclusion of other PRPs who may also be liable for contributing to the cost of cleanup. We are a party to various cost-sharing arrangements with other PRPs at certain sites. Our estimates of current liabilities factor in these cost-sharing arrangements and an assessment of the likelihood that such parties will fulfill their obligations at such sites. In the unlikely event that we are required to fully fund the remediation of a site, the statutory framework would allow us to pursue rights of contribution from other PRPs. We are identified as a PRP at the following federally designated Superfund sites: Boarhead Farms, Bridgeton, Pennsylvania; Operating Industries, Monterey Park, California; Casmalia Resources Site, Casmalia, California; Pasco Sanitary Landfill, Pasco, Washington; Quanta Resources Corp., Edgewater, New Jersey; and Peterson-Puritan Site, Cumberland, Rhode Island. Generally, these Superfund sites are mature, and almost all of the sites are in the remedial implementation phase and, as a consequence, are subject to less

10

uncertainty than newly discovered sites. These Superfund sites constitute approximately $2 million, or less than 1 percent, of our estimated environmental liabilities.

We have notified our insurers of potential environmental cleanup liabilities at various facilities, including the Superfund sites identified above, and have asserted that we are entitled to recover the defense and indemnity costs incurred, and to be incurred, under certain historic insurance policies. Our accruals include our best estimate of all probable costs, without reduction for anticipated recovery from insurance or third parties unless collection is probable. We have also asserted indemnity claims against third-parties for certain sites, and we expect to recover a portion of our losses with respect to these sites.

The Financial Accounting Standards Board (“FASB”) issued guidance on asset retirement and environmental obligations that clarifies the term "conditional asset retirement obligation" and requires a liability to be recorded if the fair value of the obligation can be reasonably estimated. Asset retirement obligations covered by this guidance include those for which an entity has an obligation to perform an asset retirement activity. However, the timing or method of settling the obligation are conditional on a future event that may not be within the control of the entity. This guidance also clarifies when an entity would have sufficient information to reasonably estimate the fair value of an asset retirement obligation.

In accordance with the asset retirement and environmental obligations guidance, we record all known asset retirement obligations for which the liability can be reasonably estimated. Currently, we have identified known asset retirement obligations associated with environmental contamination at several of our manufacturing facilities and have accrued approximately $5 million to satisfy these asset retirement obligations. However, we have not recognized a liability for an asset retirement obligation at two of our manufacturing facilities, because the fair value of the retirement obligation at these sites cannot be reasonably estimated since the settlement date is unknown at this time. The settlement date is unknown because the retirement obligation (remediation of contamination) of these sites is not required until production ceases, and we have no current or future plans to cease production. These asset retirement obligations, when estimable, are not expected to have a material adverse effect on our consolidated financial position, results of operations, cash flows or business.

Forward-looking Statements

Information included within this Form 10-K describing the projected growth and future results and events constitutes forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995. Actual results in future periods may differ materially from the forward-looking statements because of a number of risks and uncertainties, including but not limited to fluctuations in the aerospace, power generation, and general industrial cycles; the relative success of our entry into new markets; competitive pricing; the financial viability of our significant customers; the concentration of a substantial portion of our business with a relatively small number of key customers; the impact on the Company of customer or supplier labor disputes; demand, timing, and market acceptance of new commercial and military programs, and our ability to accelerate production levels to meet order increases on new or existing programs in a timely fashion; the availability and cost of energy, raw materials, supplies, and insurance; the cost of pension and postretirement medical benefits; equipment failures; product liability claims; changes in inventory valuations; cybersecurity threats; relations with our employees; our ability to manage our operating costs and to integrate acquired businesses in an effective manner, including the ability to realize expected synergies; the timing of new acquisitions; misappropriation of our intellectual property rights; governmental regulations and environmental matters; risks associated with international operations and world economies; the relative stability of certain foreign currencies; fluctuations in oil & gas prices and production; the impact of adverse weather conditions or natural disasters; the availability and cost of financing; and the implementation of new technologies and process improvements. Any forward-looking statements should be considered in light of these factors. We undertake no obligation to update any forward-looking information to reflect anticipated or unanticipated events or circumstances after the date of this document.

Available Information

Our Annual Report on Form 10-K, quarterly reports on Form 10-Q, proxy statement, current reports on Form 8-K and amendments to these reports filed with the Securities and Exchange Commission, as well as the annual report to shareholders, quarterly earnings releases, the Audit Committee Charter, the Nominating and Corporate Governance Committee Charter, the Compensation Committee Charter, Corporate Governance Guidelines and the Code of Conduct may be received free of charge by calling Investor Relations at (503) 946-4850 or sending an email to info@precastcorp.com. This information may also be downloaded from the PCC Corporate Center at www.precast.com.

11

ITEM 1A. | RISK FACTORS |

Our growth strategy includes business and capital equipment acquisitions with associated risks.

Our growth strategy includes the acquisition of strategic operations and capital equipment. We have completed a number of acquisition transactions in recent years. We expect that we will continue to seek acquisitions of complementary businesses, products, capital equipment and technologies to add products and services for our core customer base and for related markets, and will also continue to expand each of our businesses geographically. The success of the completed transactions will depend on our ability to integrate assets and personnel and to apply our manufacturing processes and controls to the acquired businesses. Although our acquisition strategy generally emphasizes the retention of key management of the acquired businesses and an ability of the acquired business to continue to operate independently, various changes may be required to integrate the acquired businesses into our operations, to assimilate new employees and to implement reporting, monitoring and forecasting procedures. Business and capital equipment acquisitions entail a number of other risks, including as applicable:

• | inaccurate assessment of liabilities; |

• | entry into markets in which we may have limited or no experience; |

• | diversion of management's attention from our existing businesses; |

• | difficulties in realizing projected efficiencies, synergies, installation schedules and cost savings; |

• | decrease in our cash or an increase in our indebtedness and a limitation in our ability to access additional capital |

when needed; and |

• | risks associated with investments where we do not have full operational control. |

Our failure to adequately address these acquisition risks could cause us to incur increased expenses or to fail to realize the benefits we anticipated from the transactions.

We operate in cyclical markets.

A significant portion of our revenues are derived from the highly cyclical aerospace and power generation markets. Our sales to the aerospace industry constituted 70 percent of our total sales in fiscal 2015. Our sales to the power market constituted 17 percent of our total sales in fiscal 2015.

The commercial aerospace industry is historically driven by the demand from commercial airlines for new aircraft. The U.S. and international commercial aviation industries continue to face challenges arising from competitive pressures and fuel costs. Demand for commercial aircraft is influenced by airline industry profitability, trends in airline passenger traffic, the state of U.S. and world economies, the ability of aircraft purchasers to obtain required financing and numerous other factors including the effects of terrorism, health and safety concerns and environmental constraints imposed upon aircraft operators. The military aerospace cycle is highly dependent on U.S. and foreign government funding; however, it is also driven by the effects of terrorism, a changing global political environment, U.S. foreign policy, the retirement of older aircraft and technological improvements to new engines. Accordingly, the timing, duration and severity of cyclical upturns and downturns cannot be forecast with certainty. Downturns or reductions in demand could have a material adverse effect on our business.

The power generation market is also cyclical in nature. Demand for power generation products is global and is affected by the state of the U.S. and world economies, the availability of financing to power generation project sponsors, the political environments of numerous countries and environmental constraints imposed upon power project operators. The availability of fuels and related prices also have a large impact on demand. Reductions in demand for our power generation products could have a material adverse effect on our business.

We also sell products and services to customers in the oil and gas, automotive, chemical and petrochemical, medical, industrial process, and other general industrial markets. Each of these markets is cyclical in nature, and the market for oil and gas products can be particularly volatile. Customer demand for our products or services in these markets may fluctuate widely depending upon U.S. and world economic conditions, the availability of financing and industry-specific factors, which for the oil and gas market include the levels of exploration, development, and production activity of oil and natural gas companies and the trends in oil and natural gas prices. Cyclical declines or sustained weakness in any of these markets could have a material adverse effect on our business.

Our business is dependent on a small number of direct and indirect customers.

A substantial portion of our business is conducted with a relatively small number of large direct and indirect customers, including General Electric Company, United Technologies Corporation, Rolls Royce plc, Airbus, Spirit AeroSystems, and The Boeing Company. General Electric accounted for approximately 13 percent of our total sales for fiscal 2015. No other customer directly accounted for more than 10 percent of total sales; however, Boeing, Airbus, Rolls Royce, Spirit AeroSystems, and United Technologies are also considered key customers. A financial hardship experienced by any one of these key customers,

12

the loss of any of them or a reduction in or substantial delay of orders from any of them could have a material adverse effect on our business.

In addition, a significant portion of our aerospace products are ultimately used in the production of new commercial aircraft. There are only two primary manufacturers of large commercial aircraft in the world, Boeing and Airbus. A significant portion of our aerospace sales are dependent on the number of new aircraft built by these two manufacturers, which is in turn dependent on a number of factors over which we have little or no control. Those factors include the demand for new aircraft from airlines around the globe and factors that impact manufacturing capabilities, such as the availability of raw materials and manufactured components, changes in the regulatory environment and labor relations between the aircraft manufacturers and their work forces. A significant interruption or slowdown in the number of new aircraft built by aircraft manufacturers could have a material adverse effect on our business.

Sales to the military sector constituted approximately 10 percent of our fiscal 2015 sales. Defense spending is subject to appropriations and to political pressures that influence which programs are funded and which are canceled. Reductions in domestic or foreign defense budgets or military aircraft procurement, delays in funding or reprioritization of government spending away from defense programs in which we participate could adversely affect our business.

Our business depends, in part, on the success of new commercial and military aircraft programs.

The success of our business will depend, in part, on the success of new commercial and military aircraft programs including the Boeing 787, Boeing 737Max, Boeing 777X, Airbus A350, Airbus A320neo, Airbus A330neo and F-35 programs. We are currently under contract to supply components for a number of new commercial, general aviation and military aircraft programs. These new programs as well as certain existing aircraft programs are scheduled to have production increases over the next several years. Our failure to accelerate production levels to timely match these order increases could have a material adverse effect on our business. Cancellation, reductions or delays of orders or contracts by our customers on any of these programs, or regulatory or certification-related groundings or other delays to any new aircraft programs or to the scheduled production increases for existing aircraft programs, could also have a material adverse effect on our business.

The competitive nature of our business results in pressure for price concessions to our customers and increased pressure to reduce our costs.

We are subject to substantial competition in all of the markets we serve, and we expect this competition to continue. As a result, we have made significant long-term price concessions to our customers in the aerospace and power generation markets from time to time, and we expect customer pressure for further long-term price concessions to continue. Maintenance of our market share will depend, in part, on our ability to sustain a cost structure that enables us to be cost-competitive. If we are unable to adjust our costs relative to our pricing, our profitability will suffer. Our effectiveness in managing our cost structure will be a key determinant of future profitability and competitiveness.

Our business is dependent on a number of raw materials that are subject to volatility in price and availability.

We use a number of raw materials in our products, including certain metals such as nickel, titanium, cobalt, tantalum and molybdenum, various rare earth elements, and titanium-containing feedstock ore (natural rutile and upgraded ilmenite), which are found in only a few parts of the world, are available from a limited number of suppliers and, in some cases, are considered conflict minerals for U.S. regulatory purposes if originating in certain countries. The availability and costs of these metals and elements may be influenced by private or government cartels, changes in world politics or regulatory requirements, labor relations between the producers and their work forces, unstable governments in exporting nations, export quotas imposed by governments in countries with rare earth element supplies, market forces of supply and demand, and inflation. These raw materials are required for the alloys or processes used or manufactured in our investment cast products, forged products and airframe products segments. We have escalation clauses for nickel, titanium and other metals in a number of our long-term contracts with major customers, but we are not usually able to fully offset the effects of changes in raw material costs. We also employ “price-in-effect” metal pricing in our alloy production businesses to lock-in the current cost of metal at the time of production or time of shipment. The ability of key metal suppliers to meet quality and delivery requirements can also impact our ability to meet commitments to customers. Future shortages (either to us or our customers) or price fluctuations in raw materials could result in decreased sales or margins or otherwise adversely affect our business. The enactment of new or increased import duties on raw materials imported by us could also increase the costs to us of obtaining the raw materials and might adversely affect our business.

Our business is affected by federal rules, regulations and orders applicable to government contractors.

A number of our products are manufactured and sold under U.S. government contracts or subcontracts. Consequently, we are directly and indirectly subject to various federal rules, regulations and orders applicable to government contractors. From time to time, we are also subject to government inquiries and investigations of our business practices due to our participation in

13

government programs. These inquiries and investigations are costly and consuming of internal resources. Violation of applicable government rules and regulations could result in civil liability, in cancellation or suspension of existing contracts or in ineligibility for future contracts or subcontracts funded in whole or in part with federal funds, any of which could have a material adverse effect on our business.

Our business is subject to environmental regulations and related liabilities and liabilities associated with chemicals and substances in the workplace.

We are subject to various federal, state and foreign environmental laws and regulations concerning, among other things, water discharges, air emissions, hazardous material and waste management and environmental cleanup. Environmental laws and regulations continue to evolve and we may become subject to increasingly stringent environmental standards in the future, particularly under air quality and water quality laws and standards related to climate change issues, such as reporting of greenhouse gas emissions. We are required to comply with environmental laws and the terms and conditions of environmental permits required for our operations. Failure to comply with these laws or permits could result in fines and penalties, interruption of manufacturing operations or the need to install pollution control equipment that could be costly. We also may be required to make additional expenditures, which could be significant, relating to environmental matters on an ongoing basis. We also own properties, or conduct or have conducted operations at properties, where hazardous materials have been used for many years, including during periods before careful management of these materials was required or generally believed to be necessary. Consequently, we will continue to be subject to environmental laws that impose liability for historical releases of hazardous substances.

Our financial statements include estimated liabilities for future costs arising from environmental issues relating to our properties and operations. Our accruals for known environmental liabilities represent our best estimate of our probable future obligations for the investigation and remediation of known contaminated sites. Our accruals include asserted and unasserted claims. The estimates of our environmental costs are based on currently available facts, present laws and regulations and current technology and take into consideration our prior experience in site investigation and remediation, the data available for each site and the professional judgment of our environmental specialists and consultants. Although recorded liabilities include our best estimate of all probable costs, our total costs for the final settlement of each site cannot be predicted with certainty due to the variety of factors that make potential costs associated with contaminated sites inherently uncertain, such as the nature and extent of site contamination, available remediation alternatives, the extent to which remedial actions will be required, the time period over which costs will be incurred, the number and economic viability of other responsible parties and whether we have any opportunity of contribution from third parties, including recovery from insurance policies. In addition, sites that are in the early stages of investigation are subject to greater uncertainties than mature sites that are close to completion. Although the sites we identify vary across the spectrum, a majority of our sites could be considered at an early stage of the investigation and remediation process. Therefore, our cost estimates and the accruals associated with those sites are subject to greater uncertainties. Environmental contingent liabilities are often resolved over a long period of time, and the timing of expenditures depends on a number of factors that vary by site. We expect that we will expend present accruals over many years, and that remediation of all currently known sites will be completed within an estimated 41 years. We cannot ensure that our estimated liabilities are adequate to cover the total cost of remedial measures that may eventually be required by environmental authorities with respect to known environmental matters or the cost of claims that may be asserted in the future with respect to environmental matters about which we are not yet aware. Accordingly, the costs of environmental remediation or claims may exceed the amounts accrued.

We have been named as a PRP at sites identified by the EPA and state regulatory agencies for investigation and remediation under CERCLA and similar state statutes. In the environmental remediation context, potentially responsible parties may be subject to an allocation process to determine liability, and therefore we may be potentially liable to the government or third parties for an allocated portion or full cost of remediating contamination at our facilities or former facilities or at third-party sites where we have been designated a PRP. In estimating our current liabilities for environmental matters, we have assumed that we will not bear the entire cost of remediation of every site to the exclusion of other PRPs who may also be liable. It is also possible that we will be designated a PRP at additional sites in the future.

Like many other industrial companies in recent years, we are defendants in lawsuits alleging personal injury as a result of exposure to chemicals and substances in the workplace, including asbestos. To date, we have been dismissed from a number of these suits and have settled a number of others. The outcome of litigation such as this is difficult to predict, and a judicial decision unfavorable to us could be rendered, possibly having a material adverse effect on our business.

Our business is subject to risks associated with international operations.

We purchase products from and supply products to businesses located outside of the U.S. We also have significant operations located outside the U.S. In fiscal 2015, approximately 17 percent of our total sales were attributable to our non-U.S.

14

subsidiaries. A number of risks inherent in international operations could have a material adverse effect on our results of operations, including:

• | fluctuations in U.S. dollar value arising from transactions denominated in foreign currencies and the translation of certain foreign currency subsidiary balances; |

• | difficulties in staffing and managing multi-national operations; |

• | general economic and political uncertainties and potential for social unrest in countries in which we or our customers operate; |

• | limitations on our ability to enforce legal rights and remedies; |

• | restrictions on the repatriation of funds; |

• | changes in trade policies; |

• | tariff regulations; |

• | difficulties in obtaining export and import licenses; |

• | the risk of government financed competition; and |

• | compliance with a variety of international laws as well as U.S. and other laws affecting the activities of companies abroad. |

A majority of our sales of extruded pipe for the power generation market have been exported to power generation customers in China. These sales are subject to the risks associated with international sales generally. In addition, changes in demand could result from a reduction of power plant build rates in China due to economic conditions or otherwise, or increased competition from local manufacturers who have cost advantages or who may be preferred suppliers, or effects of anti-dumping or other import duties. Also, Chinese commercial laws, regulations and interpretations applicable to non-Chinese market participants such as us are rapidly changing. These laws, regulations and interpretations could impose restrictions on our ownership or operations of our interests in China and have a material adverse effect on our business.

Any lower-than-expected rating of our bank debt and debt securities could adversely affect our business.

Two rating agencies, Moody's and Standard & Poor's, rate our debt securities. If the rating agencies were to reduce their current ratings, our interest expense may increase, our access to short-term commercial paper markets may be restricted, and the terms of future borrowing arrangements may become more stringent or require additional credit support. Our ability to comply with covenants contained in the instruments governing our existing and future indebtedness may be affected by events and circumstances beyond our control. If we breach any of these covenants, one or more events of default, including cross-defaults between multiple components of our indebtedness, could result. These events of default could permit our creditors to declare all amounts owing to be immediately due and payable and terminate any commitments to make further extensions of credit, or could otherwise have a material adverse effect on our business.

Our production may be interrupted due to equipment failures or other events affecting our factories.