Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WORLD ACCEPTANCE CORP | d923254d8k.htm |

| EX-10.1 - EX-10.1 - WORLD ACCEPTANCE CORP | d923254dex101.htm |

| EX-99.2 - EX-99.2 - WORLD ACCEPTANCE CORP | d923254dex992.htm |

Exhibit 99.1

Information Excerpted from

Preliminary Offering Memorandum dated May 8, 2015

This section highlights information that appears elsewhere in or is incorporated by reference into this offering memorandum. Because this section is a summary, it may not contain all the information that may be important to you. You should read this entire offering memorandum and the documents incorporated by reference herein, including the sections entitled “Risk Factors” and the financial statements and related notes, before making an investment decision.

The terms “we,” “our,” “us,” “World Acceptance” and the “Company,” as used in this offering memorandum, refer to World Acceptance Corporation and its consolidated subsidiaries, except where otherwise stated or where it is clear that the terms mean only World Acceptance Corporation.

Our Company

We are one of the nation’s largest small-loan consumer finance companies, providing responsible lending solutions to individuals with limited access to credit in the United States and Mexico. We began offering installment loans in 1962 in South Carolina, and in 1991 we publicly listed on the NASDAQ under the symbol WRLD. Our 50-plus year operating history is reflective of our decentralized approach to originating, underwriting, structuring and servicing consumer loans. Our loans are fully-amortizing, fixed-rate and fixed-term, which we believe is attractive to our customer base. Our underwriting procedures combine an objective credit evaluation with an assessment of the customer’s stability, ability and willingness to pay. In addition to short-term small installment loans, medium-term larger installment loans, related credit insurance, and ancillary products and services to individuals, we also offer income tax return preparation services to customers and other individuals in the United States. We believe significant senior management involvement and a culture of compliance that understands and seeks to anticipate a changing regulatory environment have enabled us to operate successfully in the highly-regulated financial services industry. We believe our experienced management team, combined with a strong balance sheet and continued focus on and adherence to disciplined credit standards, positions us well for future success.

As of December 31, 2014, our Company operated 1,314 branches across Alabama, Georgia, Idaho, Illinois, Indiana, Kentucky, Louisiana, Mississippi, Missouri, New Mexico, Oklahoma, South Carolina, Texas, Tennessee, Wisconsin and Mexico, serving approximately 1 million accounts. As of December 31, 2014, our average U.S. branch served 727 accounts and had $988,000 of gross loan receivables, while our average Mexico branch served 1,056 accounts and had $725,000 of gross loan receivables. For the fiscal year ending March 31, 2014, our U.S. and Mexico branches generated an average of $512,000 and $414,000 in revenue, respectively. We generally serve individuals with limited access to other sources of consumer credit, such as banks, credit unions, other consumer finance businesses and credit card lenders. We offer standardized installment loans generally between $300 and $4,000. All loan applicants are required to have a source of income and complete standardized credit applications in person or by phone at local branches. Our local branches are equipped to perform rapid background, employment and credit checks, and approve loan applications promptly, often while the customer waits. As of November 30, 2014, 73% of our borrowers were employed, 25% received fixed income payments and 2% were unemployed. We verify the applicant’s sources of income and credit history through telephone inquiries with employers, other employment references and through verification with various credit bureaus. As of November 30, 2014, our U.S. borrowers had an average Beacon Score of 583 and net total income (representing the borrower’s individual income after taxes) of $22,188. Our branch network is supported by our wholly-owned, information technology platform, ParaData Financial Systems (“ParaData”), which fully automates all loan account processing and collection reporting. Our employees at local branches directly monitor customer accounts, and senior management receives daily delinquency, loan volume, charge-off, and other statistical reports for each branch. As of December 31, 2014, our network consisted of 4,646 local branch employees. Our branch employees tend to live in the communities they serve. We believe customers value face-to-face interaction and the long-term relationships they have built with our branch staff, and that these

2

interactions enhance our customers’ appreciation of our lending solutions and create more accountable lending relationships. We also believe our long-term financial and operating performance demonstrates that our relationship-based approach to lending is an effective model for serving the needs of our customers, while maintaining acceptable delinquency and default rates for the types of loan products we offer.

As of December 31, 2014, we had $1.3 billion of total gross loans receivable. For the twelve-month period ending December 31, 2014, we generated total revenue and EBITDA of $618.4 million and $192.3 million, respectively. For the fiscal year ending March 31, 2014, we generated total revenue and EBITDA of $617.6 million and $198.8 million, respectively. During the twelve-month period ending December 31, 2014, 88.5% of our revenue was derived from our consumer installment loan business and 91.1% was generated in the United States. For the twelve-month period ending December 31, 2014, we generated net income of $101.3 million, representing a return on average assets of 11.2% and a return on average equity of 33.2%. For the fiscal year ending March 31, 2014, we generated net income of $106.6 million, representing a return on average assets of 12.3% and a return on average equity of 31.2%. EBITDA is a non-GAAP financial measure. For a definition of EBITDA and a reconciliation to our most directly comparable measure calculated and presented in accordance with GAAP, see “Summary Historical Consolidated Financial and Other Data.”

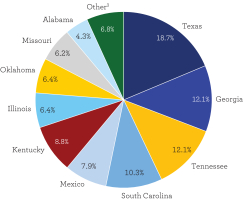

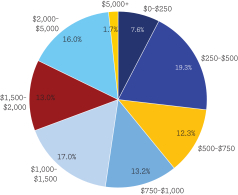

| Portfolio By Geography1

|

U.S. Portfolio by Loan Size Amount2

| |

|

|

| (1) | Based on gross loans receivable as of December 31, 2014 |

| (2) | As of November 30, 2014 |

| (3) | Other states include Louisiana, New Mexico, Colorado, Wisconsin, Indiana, and Mississippi |

Our Strengths

We believe the following competitive strengths contribute to our financial performance and differentiate us from our competitors:

| • | Long Operating History. We began our U.S. operations in South Carolina in 1962 and have subsequently entered 14 additional states and opened our first Mexican branch in 2005. As of December 31, 2014, we had 1,177 branches across 15 U.S. states and 137 branches in Mexico. We have grown organically and through acquisitions in a disciplined manner over our 50-plus year history. Since 1994, we have grown our number of branches by a 9% compounded annual growth rate and originated over $27 billion worth of loans. We believe that the development and continual reinforcement of personal relationships with customers improves our ability to monitor their creditworthiness, reduces credit risk and generates customer loyalty. |

| • | Consistently Profitable Through Multiple Cycles. World Acceptance has remained profitable while maintaining strong gross profit margins in various economic environments. We believe our |

3

| customers continue to demand our products throughout different cycles because they have limited access to other traditional sources of credit. While our net charge-offs increased through the most recent economic downturn, from fiscal 2007 through 2010, our Company experienced year-over-year growth in gross loans, revenue and net income, which we believe is a testament to our business model and underwriting methodology. |

| • | Stable Business Model with Low Volatility of Earnings and Losses. We have generated stable returns and maintained loan losses within a range of a few percentage points since 2005. During the last ten years our return on average assets ranged from 10.9% to 14.0% and net charge-offs ranged from 13.3% to 16.7%. Our business model is predicated on relationship lending and our evaluation of our customer’s stability, ability and willingness to repay a loan and make associated interest payments. We believe the annual percentage rates (“APRs”) that we charge our customers adequately compensate us for the relative credit risk and loan administration and collection costs associated with our loan products. Over the last decade, our net charge-offs have averaged 14.6%, while our return on average assets have averaged 12.4%. We believe that the predictability of our business can be attributed to our loyal customer base, operational expertise and disciplined underwriting procedures. |

| • | Strong Balance Sheet with Compelling Cash Flow Characteristics. Our strong operating cash flow profile has allowed us to operate at low leverage levels. Operating cash flow has grown at a 6.2% compounded annual growth rate (“CAGR”) from March 31, 2010 through December 31, 2014. We target a debt-to-equity ratio in the 2.0x to 2.5x range. As of December 31, 2014, which marks the end of our typical seasonal working capital peak, our debt-to-equity ratio was 1.9x, which we believe is below the industry average. We believe our Amended Credit Facility and net proceeds from this offering, in combination with our cash flow generation, will provide sufficient capital to meet our liquidity and growth needs for the foreseeable future. |

| • | High-Touch Business Model Enhances Risk Monitoring. Our Company’s high-touch business model, coupled with strong senior management oversight, enhances relationship lending while reducing risk. We operate our business utilizing a decentralized underwriting model, in which decisions are made locally based on centrally-set guidelines. We believe that we maintain an appropriate level of accounts per employee and receivables per branch and that this provides us with a competitive advantage in underwriting and collecting loans. Our disciplined underwriting process leverages our 50-plus years of lending experience, and we believe our emerging data analytics will complement our relationship-oriented branch staff. |

| • | Attractive Market Supported by Strong Supply/Demand Dynamics. According to the FDIC, approximately 67 million adults, or 28% of American households, are either unbanked or under-banked. Additionally, as of December 31, 2014 the number of U.S. credit inquiries in the last six months — an indicator of consumer credit demand — increased by 4 million from the previous quarter, to 175 million. We believe that recent industry demand dynamics, combined with our reputation and proven business model, will continue to drive our performance going forward. |

| • | Experienced Management Team. We are led by an experienced management team with a proven track record of financial and operational success. Our senior executives and divisional management leaders average 20-plus years of relevant experience. A. Alexander (Sandy) McLean, our Chairman and Chief Executive Officer, has been with World Acceptance in various senior management roles since 1989. Mr. McLean has served as our Chief Executive Officer since 2006 and our Chairman since 2007. Mr. McLean has more than 25 years of experience in consumer finance, and was the 2009-2010 Chair of the American Financial Services Association, the consumer credit industry’s trade organization. |

4

Our Business

Installment Loans

In each state in which we operate, as well as in Mexico, we primarily offer pre-computed consumer installment loans that are standardized by amount and maturity. Our loans are payable in fully-amortizing monthly installments with terms generally of 6 to 36 months, and are prepayable at any time without penalty. For the twelve-month period ending December 31, 2014, the Company’s average originated gross loan size and term were approximately $1,365 and 12 months, respectively. As of December 31, 2014, small loans generated in our U.S. branches averaged $964, ranged in size from $200 to $3,600 and had an average term of 10 months. Large loans originated in the U.S. averaged $3,367, ranged from $1,500 to $13,500 and were outstanding an average of 22 months. State laws regulate various aspects of lending terms, including the maximum loan amounts, the types and maximum amounts of fees and other costs that may be charged, and, in most cases, interest rates. In addition to installment loans, we also offer payroll deduct loans in Mexico. Payroll deduct loans are originated through state unions and exhibit lower loss rates than installment loans. As of December 31, 2014, payroll deduct loans originated in our Mexico branches averaged $1,822, ranged in size from $399 to $8,143 and had an average term of 37 months. Installment loans originated in Mexico averaged $466, ranged from $203 to $1,362 and were outstanding an average of 12 months.

Specific allowable interest, fees and other charges vary by state and, consistent with industry practice, we generally charge at, or close to, the maximum rates allowable under applicable state law in those states that limit loan rates. The finance charge is a combination of origination or acquisition fees, account maintenance fees, monthly account handling fee, interest and other charges permitted by the relevant state laws. As of December 31, 2014, the annual percentage rates on loans we offer in the U.S., including interest, fees and other charges as calculated in accordance with the Federal Truth in Lending Act, ranged from 25% to 199%, depending on the loan size, maturity and the state in which the loan was made.

In evaluating the creditworthiness of a potential customer, we primarily examine the individual’s discretionary income, length of current employment and/or sources of income, duration of residence and prior credit experience. Loans are made to an individual on the basis of their discretionary income and other factors, and are limited to amounts that we believe the customer can reasonably be expected to repay from that income, given our assessment of their stability, ability and willingness to pay. Substantially all new customers are required to submit a listing of personal property that will serve as collateral to secure the loan, but we do not rely on the value of such collateral in the loan approval process and generally do not perfect our security interest in that collateral.

We believe that development and continual reinforcement of personal relationships with customers improve our ability to monitor their creditworthiness, reduce credit risk and generate customer loyalty. It is not unusual for us to have made a number of loans to the same customer over the course of several years, many of which were refinanced with a new loan after the borrower had reduced the existing loan’s outstanding balance by making multiple payments. In determining whether to refinance existing loans, we typically require loans to be current on a recency basis, and repeat customers are generally required to complete a new credit application if they have not completed one within the prior two years.

For the twelve-month period ending December 31, 2014, approximately 82.5% of our loans were generated through the refinancing of outstanding loans and the origination of new loans to previous customers. A refinancing represents a new loan transaction with a present customer in which a portion of the new loan proceeds is used to repay the balance of an existing loan and the remaining portion is advanced to the customer. We actively market the opportunity for qualifying customers to refinance existing loans prior to maturity. In many cases, the existing customer’s past performance and established creditworthiness with World Acceptance qualifies that customer for a larger loan. This, in turn, may increase the fees and other income realized from a particular customer.

5

Other Ancillary Services

As an independent agent for an unaffiliated insurance company, we also market and sell credit insurance in connection with our loans in selected states where the sale of such insurance is permitted by law. Charges for such credit insurance are made at filed authorized rates and are disclosed separately to our customers. We write policies only within limitations established by our agency contracts with the insurer. We do not sell credit insurance to non-borrowers.

We market automobile club memberships to our borrowers in certain states as an agent for an unaffiliated automobile club. Club memberships entitle members to automobile breakdown and towing reimbursement and other related services. We receive a commission on each membership sold, but do not have responsibility for administering the club, paying benefits or providing services to club members. We do not market automobile club memberships to non-borrowers.

We also offer income tax return preparation and electronic filing. This program is provided in all but a few of our U.S. branches. For the fiscal year 2014, we prepared approximately 55,000 returns. We believe that this is a beneficial service for our existing customer base, as well as non-loan customers, and we plan to continue to promote this program.

Data Processing Operations

Our operations employ a proprietary data-processing software package developed by our wholly-owned subsidiary, ParaData Financial Systems. The software enables us to fully automate all of our loan account processing and collection reporting, and provides thorough management information and control capabilities. As of March 31, 2015, ParaData provides data processing systems to 102 separate finance companies, including us. ParaData continues to provide data processing support for our in-house integrated computer system at a substantially reduced cost to us.

Growth Strategy

Our business plan is to expand our operations by opening new branches and by acquiring branches from other consumer finance companies in complementary markets, while continuing to increase revenue and operating profit in our existing branch base.

New Branch Openings

From March 31, 2014 to December 31, 2014, the Company opened 39 new branches in the United States and 4 in Mexico. We plan to continue to open or acquire new branches in the United States and in Mexico by increasing the number of locations in our existing market areas or commencing operations in new states where we believe demographic profiles and state regulations are attractive. Our expansion is also dependent upon our ability to identify attractive locations for new branches and to hire suitable personnel to staff, manage and supervise new branches. In evaluating a particular community, we examine several factors, including the demographic profile of the community, the existence of an established small-loan consumer finance market and the availability of suitable personnel. We generally locate new branches in communities already served by at least one other small-loan consumer finance company.

Acquisitions

The small-loan consumer finance industry is highly fragmented in the 15 states in which we currently operate. We believe that our competitors in these markets are principally independent operators with generally less than 100 offices. We also believe that attractive opportunities to acquire branches from competitors in our existing markets and to acquire branches in communities not currently served by us will become available as conditions in the local economies and the financial circumstances of the operators change.

6

Our Industry

The U.S. consumer finance industry has approximately $3.3 trillion of outstanding borrowings and includes vehicle loans and leases, credit cards, student loans and personal loans. There are approximately 109 million consumers that generally align with our customer base (FICO scores £ 650). Loans to consumers with non-prime credit scores generally have lower collection rates and are subject to higher loss rates than loans to prime borrowers. We believe that most of this population is underserved, which provides an attractive market opportunity for our business.

Small-loan consumer finance companies generally make loans of less than $2,000 with maturities of 18 months or less. These companies approve loans on the basis of the personal creditworthiness of their customers and maintain close contact with borrowers to encourage repayment. By contrast, commercial banks, credit unions and other consumer finance businesses typically make loans of more than $5,000 with maturities of more than one year. Those financial institutions generally approve consumer loans based on the security of qualifying personal property pledged as collateral, or impose more stringent credit requirements than those of small-loan consumer finance companies. As a result of their higher credit standards and specific collateral requirements, commercial banks, savings and loans and other consumer finance businesses typically charge lower interest rates and fees and experience lower delinquency and charge-off rates than do small-loan consumer finance companies. Small-loan consumer finance companies generally charge higher interest rates and fees to compensate for the greater credit risk of delinquencies and charge-offs and increased loan administration and collection costs.

The majority of the participants in the industry are independent operators with generally less than 100 offices. We believe that competition between small-loan consumer finance companies occurs primarily on the basis of the strength of customer relationships, customer service and reputation in the local community, rather than pricing, as participants in this industry generally charge interest rates and fees at, or close to, the maximum permitted by applicable state laws. We believe that our relatively large size affords us a competitive advantage over smaller companies by increasing our access to, and reducing our cost of, capital. In addition, our in-house integrated computer system provides data processing at a substantially reduced cost relative to the majority of our competitors.

Small-loan consumer finance companies are subject to extensive regulation, supervision and licensing under various federal and state statutes, ordinances and regulations. Consumer loan offices are licensed under state laws, which, in many states, establish maximum loan amounts and interest rates and the types and maximum amounts of fees and other charges. In addition, state laws govern other aspects of the operation of small-loan consumer finance companies. Periodically, constituencies within states seek to enact stricter regulations that would affect our business. Furthermore, the industry is subject to numerous federal laws and regulations that affect lending operations. These federal laws require companies to provide complete disclosure of the principal terms of each loan to the borrower in accordance with specified standards prior to the consummation of the loan transaction. Federal laws also prohibit misleading advertising, protect against discriminatory lending practices and proscribe unfair, deceptive or abusive credit practices.

In July 2010 the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) was enacted, and a number of its provisions became effective in July 2011. The Dodd-Frank Act restructured and enhanced the regulation and supervision of the financial services industry and created the Consumer Financial Protection Bureau (the “CFPB”). The CFPB has sweeping regulatory and enforcement authority over consumer financial transactions. As previously disclosed, in March 2014, we received a Civil Investigative Demand (“CID”) from the CFPB with the stated purpose of investigating whether we have been or are engaging in unlawful acts or practices in connection with the marketing, offering, or extension of credit in violation of certain federal consumer financial laws and regulations. We have cooperated and continue to cooperate with the CFPB’s investigation. We have responded to broad requests for production

7

of documents, answers to interrogatories and written reports related to loans made by the Company and other aspects of the Company’s business. Subsequent to the March 2014 CID, the Company has received and responded to, and is actively in the process of responding to, additional broad requests and demands for information from the CFPB and expects that there will continue to be additional requests or demands for information from the CFPB and ongoing interactions between the CFPB, the Company and Company counsel as part of the investigation. We are currently unable to predict the ultimate timing or outcome of the CFPB investigation. In addition, the CFPB continues to actively engage in the announcement and implementation of various plans and initiatives in the area of consumer financial transactions generally, some of which, if implemented, would directly affect certain loan products we currently offer. These CFPB actions could have a material adverse impact on our business. There can be no assurance that the CFPB will not in the future issue additional regulations specifically aimed at the regulation of small-loan consumer finance companies. See “Risk Factors” for further discussion of the Regulatory Risks facing our business and specific risks posed by the CFPB investigation and its regulatory initiatives, including a discussion of proposed rulemaking announced by the CFPB on March 26, 2015.

Recent Developments

Amendment of our existing senior secured revolving credit facility

On May 8, 2015, we entered into an amendment to the credit agreement governing our existing senior secured revolving credit facility (the “Credit Facility Amendment”), which we expect will become effective substantially concurrently with the closing of this offering. We refer to our revolving credit facility as amended by the Credit Facility Amendment as the Amended Credit Facility. The Credit Facility Amendment is expected to, among other things:

| • | permit the issuance of the notes and the guarantees thereof, so long as the closing of the issuance of the notes occurs on or before June 1, 2015; |

| • | reduce the size of our revolving credit facility from $680.0 million to $430.0 million; |

| • | extend the maturity of our revolving credit facility from June 15, 2016 to the third anniversary of the date of closing of the notes; |

| • | restrict our ability to modify the terms of the notes in any manner that would reasonably be expected to be adverse to the agent and the lenders under the facility; and |

| • | require payment of a prepayment fee equal to 1.0% of the total commitments under the facility upon repayment in full of the borrowings under the facility prior to maturity or acceleration of the facility following an event of default. |

The effectiveness of these provisions is conditioned upon our issuance of the notes on or before June 1, 2015 and the use of the net proceeds from this offering to pay down loans outstanding under our revolving credit facility, together with accrued and unpaid interest thereon. See “Use of Proceeds.” As of March 31, 2015, borrowings of approximately $501.2 million were outstanding under our revolving credit facility.

The closing of the offering of the notes is conditioned upon the Credit Facility Amendment described above becoming effective substantially concurrently with the closing of the notes offered hereby.

8

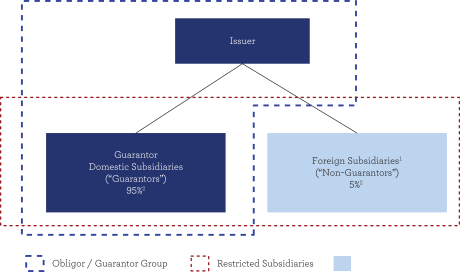

Guarantor Structure

| (1) | For the twelve months ended December 31, 2014, our non-guarantor subsidiaries, which are comprised of all of our foreign subsidiaries, represented approximately 8.6% of total revenue and as of December 31, 2014 represented 7.4% of our total assets. As of December 31, 2014, our non-guarantor subsidiaries had no material third-party liabilities. |

| (2) | Represents percentage of total EBITDA of $192.3 million for the twelve months ended December 31, 2014. |

9

You should carefully consider the risks described below before making an investment decision. The risks described below are not the only ones facing us. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business in the future. Any of the following risks could materially adversely affect our business, financial condition or results of operations. In such case, you may lose all or part of your original investment.

Risks Relating to Our Indebtedness

Our substantial debt could negatively impact our business, prevent us from satisfying our debt obligations and adversely affect our financial condition.

We have a substantial amount of debt. As of December 31, 2014, after giving effect to the offering of the notes and the anticipated use of the net proceeds from the offering of the notes to repay borrowings under our revolving credit facility, we would have had approximately $598.2 million of total debt outstanding and a total debt to shareholders equity ratio of approximately 1.9 to 1. The substantial amount of our debt could have important consequences, including the following:

| • | our ability to obtain additional financing for working capital, debt refinancing, share repurchases or other purposes could be impaired; |

| • | a substantial portion of our cash flows from operations will be dedicated to paying principal and interest on our debt, reducing funds available for other purposes; |

| • | we may be vulnerable to interest rate increases, as some of our borrowings, including those under our revolving credit facility, bear interest at variable rates; |

| • | we could be more vulnerable to adverse developments in our industry or in general economic conditions; |

| • | we may be restricted from taking advantage of business opportunities or making strategic acquisitions; and |

| • | we may be limited in our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate. |

We may incur substantially more debt and other liabilities. This could exacerbate further the risks associated with our current debt levels.

We may be able to incur substantial additional debt in the future. Although the terms of our debt instruments contain restrictions on our ability to incur additional debt, these restrictions are subject to exceptions that could permit us to incur a substantial amount of additional debt. In addition, our debt instruments do not prevent us from incurring liabilities that do not constitute indebtedness as defined for purposes of those debt instruments. If new debt or other liabilities are added to our current debt levels, the risks associated with our having substantial debt could intensify. As of December 31, 2014, after giving effect to the offering of the notes and the anticipated use of the net proceeds from the offering of the notes to repay borrowings under our revolving credit facility, together with related fees and expenses as described in “Use of Proceeds,” we would have had $81.8 million available for borrowing under our Amended Credit Facility, subject to borrowing base limitations and other specified terms and conditions.

We may not be able to generate sufficient cash flows to service our outstanding debt and fund operations and may be forced to take other actions to satisfy our obligations under such debt.

Our ability to make scheduled payments of the principal of, to pay interest on, or to refinance our indebtedness including the notes will depend in part on our cash flows from operations, which are subject to regulatory, economic, financial, competitive and other factors beyond our control. We cannot assure you that we will continue to generate a level of cash flows from operations sufficient to permit us to meet our debt service obligations. If we are unable to generate sufficient cash flows from operations to service our debt, we may be required to sell assets, refinance all or a portion of our existing debt, obtain additional financing or obtain additional equity capital on terms that may be onerous or highly dilutive. There can be no assurance that any refinancing will be possible or that any asset sales or additional financing can be completed on acceptable terms or at all.

The terms of our debt limit how we conduct our business.

The agreements that govern our debt contain covenants that restrict our ability to, among other things:

| • | incur and guarantee debt; |

| • | pay dividends or make other distributions on or redeem or repurchase our stock; |

| • | make investments or acquisitions; |

10

| • | create liens on our assets; |

| • | sell assets; |

| • | merge with or into other companies; |

| • | enter into transactions with shareholders and other affiliates; and |

| • | make capital expenditures. |

Some of our debt agreements also impose requirements that we maintain specified financial measures not in excess of, or not below, specified levels. In particular, the Amended Credit Facility will require, among other things, that we maintain (i) at all times a specified minimum consolidated net worth, (ii) as of the end of each fiscal quarter, a minimum ratio of consolidated net income available for fixed charges for the period of four consecutive fiscal quarters most recently ended to consolidated fixed charges for that period of not less than a specified minimum, (iii) a specified maximum ratio of total debt to consolidated adjusted net worth and (iv) a specified ratio of subordinated debt to consolidated adjusted net worth. These covenants limit the manner in which we can conduct our business and could prevent us from engaging in favorable business activities or financing future operations and capital needs and impair our ability to successfully execute our strategy and operate our business.

A breach of any of the covenants in our debt instruments would result in an event of default thereunder if not promptly cured or waived. Any continuing default would permit the creditors to accelerate the related debt, which could also result in the acceleration of other debt containing a cross-acceleration or cross-default provision. In addition, an event of default under the Amended Credit Facility would permit the lenders thereunder to terminate all commitments to extend further credit under the Amended Credit Facility. Furthermore, if we were unable to repay the amounts due and payable under the Amended Credit Facility or any other secured debt we may incur, the lenders thereunder could cause the collateral agent to proceed against the collateral securing that debt. In the event our creditors accelerate the repayment of our debt, there can be no assurance that we would have sufficient assets to repay that debt, and our financial condition, liquidity and results of operations would suffer. In addition, to the extent creditors exercised such remedies, the claims of holders of the notes would be subordinated to such secured indebtedness (as discussed in greater detail under the heading “The notes and the note guarantees will be effectively subordinated to the existing and future secured obligations of the issuer and the guarantors.”).

The conditions of the U.S. and international capital markets may adversely affect lenders with which we have relationships, causing us to incur additional costs and reducing our sources of liquidity, which may adversely affect our financial position, liquidity and results of operations.

In recent years, there has been turbulence in the global capital markets and the overall economy. Such turbulence can result in disruptions in the financial sector and affect lenders with which we have relationships, including members of the syndicate of banks that are lenders under our revolving credit facility. Disruptions in the financial sector may increase our exposure to credit risk and adversely affect the ability of lenders to perform under the terms of their lending arrangements with us. Failure by our lenders to perform under the terms of our lending arrangements could cause us to incur additional costs that may adversely affect our liquidity, financial condition and results of operations. While overall market conditions have improved, there can be no assurance that future disruptions in the financial sector will not occur that could have similar adverse effects on our business.

Reduction in our credit rating could increase the cost of our funding from, and restrict our access to, the capital markets and adversely affect our liquidity, financial condition and results of operations.

Credit rating agencies evaluate us, and their ratings of our debt and creditworthiness are based on a number of factors. These factors include our financial strength and other factors not entirely within our control, including conditions affecting the financial services industry generally. In light of the difficulties that faced the financial services industry and the financial markets in recent years, there can be no assurance that we will maintain our current ratings. Failure to maintain those ratings could, among other things, adversely limit our access to the capital markets and affect the cost and other terms upon which we are able to obtain financing.

Interest rate fluctuations may adversely affect our borrowing costs, profitability and liquidity.

Our profitability may be directly affected by the level of and fluctuations in interest rates, whether caused by changes in economic conditions or other factors, that affect our borrowing costs. Interest rates are highly sensitive to many factors that are beyond our control, including general economic conditions and policies of various governmental and regulatory agencies and, in particular, the Federal Reserve Board. Changes in monetary policy, including changes in interest rates, could influence the amount of interest we pay on the Amended Credit Facility or any other floating interest rate obligations we may incur. Our profitability and liquidity could be materially adversely affected during any period of higher interest rates.

11

Risks Relating to Our Business

Federal legislative or regulatory proposals, initiatives, actions or changes that are adverse to our operations or result in adverse regulatory proceedings, or our failure to comply with existing or future federal laws and regulations, could force us to modify, suspend or cease part or all of our nationwide operations.

We are subject to numerous federal laws and regulations that affect our lending operations. Although these laws and regulations have remained substantially unchanged for many years, the laws and regulations directly affecting our lending activities have been under review and subject to change in recent years as a result of various developments and changes in economic conditions, the make-up of the executive and legislative branches of government, and the political and media focus on issues of consumer and borrower protection. Any changes in such laws and regulations could force us to modify, suspend or cease part, or, in the worst case, all of our existing operations. It is also possible that the scope of federal regulations could change or expand in such a way as to preempt what has traditionally been state law regulation of our business activities.

In July 2010 the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) was enacted. The Dodd-Frank Act restructured and enhanced the regulation and supervision of the financial services industry and created the Consumer Financial Protection Bureau (the “CFPB”), an agency with sweeping regulatory and enforcement authority over consumer financial transactions. Although the Dodd-Frank Act prohibits the CFPB from setting interest rates on consumer loans, efforts to create a federal usury cap, applicable to all consumer credit transactions and substantially below rates at which the Company could create to operate profitably, are still ongoing. Any federal legislative or regulatory action that severely restricts or prohibits the provision of small-loan consumer credit and similar services on terms substantially similar to those we currently provide would, if enacted, have a material adverse impact on our business, prospects, results of operations and financial condition. Any federal law that would impose a 36% or similar annualized credit rate cap on our services would, if enacted, almost certainly eliminate our ability to continue our current operations.

The CFPB’s rulemaking and enforcement authority extends to certain non-depository institutions, including us. The CFPB is specifically authorized, among other things, to take actions to prevent companies providing consumer financial products or services and their service providers from engaging in unfair, deceptive or abusive acts or practices in connection with consumer financial products and services, and to issue rules requiring enhanced disclosures for consumer financial products or services. The CFPB may also issue regulations regarding the use of pre-dispute arbitration clauses in consumer financial markets, but only after conducting a study of the matter as mandated by the Dodd-Frank Act. The CFPB also has authority to interpret, enforce, and issue regulations implementing enumerated consumer laws, including certain laws that apply to our business. Further, the CFPB has authority to designate non-depository “larger participants” in certain markets for consumer financial services and products for purposes of the CFPB’s supervisory authority under the Dodd-Frank Act. Such designated “larger participants” are subject to reporting and on-site compliance examinations by the CFPB, which may result in increased compliance costs and potentially greater enforcement risks based on these supervisory activities. Although the CFPB has not yet developed a “larger participant” rule that directly covers the Company’s installment lending business, in March 2015 in connection with the CFPB’s discussion of a proposed rulemaking initiative described below, the CFPB stated that it expects to conduct separate rulemaking to identify larger participants in the installment lending market for purposes of its supervision program. Though the timing of any such rulemaking is uncertain, the Company believes that the implementation of such rules would likely bring the Company’s business under the CFPB’s direct supervisory authority.

On March 26, 2015, the CFPB announced that it was considering proposing rules under its unfair, deceptive and abusive acts and practices rulemaking authority relating to payday, vehicle title, and similar loans. The proposal would cover short-term loans with a contractual term of 45 days or less, as well as “longer-term loans” with a term of longer than 45 days with an all-in annualized percentage rate of interest (“APR”) in excess of 36% in which the lender has either a non-purchase money security interest in the consumer’s vehicle or the right to collect repayment from the consumer’s bank account or paycheck. Although the Company does not make loans with terms of 45 days or less or obtain access to a customer’s bank account or paycheck for repayment of any of its loans, it does make some vehicle-secured loans with an APR within the scope of the proposal. The Company currently estimates that the amount of such vehicle-secured loans in its loan portfolio as of March 31, 2015 are approximately 13% of its total number of loans and approximately 20% of its portfolio by gross loan volume. The proposals would require a lender, as a condition of making a covered longer-term loan, to first make a good-faith reasonable determination that the consumer has the ability to repay the covered longer-term loan without reborrowing or defaulting. The proposals would require lenders to verify income, “major financial obligations” and borrowing history. Lenders would also be required to determine that a consumer is able to make all projected payments under the covered longer-term loan as those payments are due, while still fulfilling other major financial obligations and meeting living expenses. This ability to repay assessment would apply to both the initial longer-term loan and to any subsequent refinancing. In addition, the proposals would include a rebuttable presumption that customers seeking to refinance a covered longer-term loan lack an “ability to repay” if certain conditions exist at the time of the proposed refinancing. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Regulatory Matters” for more information regarding these proposals. The proposals are subject to several procedural requirements and to possible change before any final rules would be issued and implemented, and we cannot predict what the ultimate rulemaking will provide. Although the Company currently underwrites all its loans (including those secured by a vehicle title that would fall within the scope of these proposals) by reviewing the customer’s ability to repay based on the Company’s standards, there can be no assurance that these proposals, if and when implemented in final rulemaking, would not require changes to the Company’s practices and procedures regarding such loans that could materially and adversely affect the Company’s ability to make

12

such loans, the cost of making such loans, the Company’s ability to, or frequency with which it could, refinance any such covered loans, or the profitability of such loans. Any final rulemaking also could have effects beyond those contemplated in the initial proposal that could further materially and adversely impact our business and operations.

In addition to the specific matters described above, other aspects of our business may be the subject of future CFPB rulemaking. The enactment of one or more of such regulatory changes, or the exercise of broad regulatory authority by regulators, including but not limited to, the CFPB, having jurisdiction over the Company’s business or discretionary consumer financial transactions generically, could materially and adversely affect our business, results of operations and prospects.

In September 2014, the Department of Defense (the “DoD”) proposed an amendment to its existing regulation that implements the Military Lending Act (the “MLA”). Current MLA regulations prohibit creditors from making payday loans, non-purchase money motor vehicle title loans with a term of less than 181 days, and refund anticipation loans to “covered borrowers” (which includes both servicemembers and their dependents) if the APR exceeds 36%. The Company does not make any of the loans covered under the MLA regulations. However, the proposed amendments would expand the MLA and its 36% APR cap to cover all credit offered or extended to a covered borrower primarily for personal, family, or household purposes that is either subject to a finance charge or payable by a written agreement in more than four installments. In addition, creditors must check a database maintained by the DoD before entering into an agreement with a covered borrower, provide both oral and written disclosures, including an all-inclusive APR referred to as the Military Annual Percentage Rate, and must not require arbitration in agreements with covered borrowers. In April 2015, the U.S. House Armed Services Committee narrowly voted to remove a provision in the 2016 National Defense Authorization Act that likely would have delayed implementation of the proposed amendments until 2016. The DoD proposed regulations are subject to possible change or further delay before any final rules would be issued and implemented. However, the Company believes the implementation of these amendments could adversely affect its operations and cost and efficiency of processing loans by requiring it to perform confirming database checks on a much greater number of loans via a database that historically has been prone to technical glitches and outages. These or other consequences of the amendment could materially and adversely affect the Company’s business, results of operations and financial condition.

We are currently under investigation by the CFPB, and any adverse finding, allegation, or exercise of enforcement or regulatory discretion by the CFPB could materially and adversely affect our business, financial condition, results of operations or ability to operate our business as we currently do.

As previously disclosed, on March 12, 2014, we received a Civil Investigative Demand (“CID”) from the Consumer Financial Protection Bureau (the “CFPB”). The stated purpose of the CID is to determine whether the Company has been or is “engaging in unlawful acts or practices in connection with the marketing, offering, or extension of credit in violation of Sections 1031 and 1036 of the Consumer Financial Protection Act, 12 U.S.C. §§ 5531, 5536, the Truth in Lending Act, 15 U.S.C. §§ 1601, et seq., Regulation Z, 12 C.F.R. pt. 1026, or any other Federal consumer financial law” and “also to determine whether Bureau action to obtain legal or equitable relief would be in the public interest.” The Company responded, within the deadlines specified in the CID, to broad requests for production of documents, answers to interrogatories to and written reports related to loans made by the Company and numerous other aspects of the Company’s business. Subsequent to the March 2014 CID, the Company has received and responded to, and is actively in the process of responding to, additional broad requests and demands for information from the CFPB and expects that there will continue to be additional requests or demands for information from the CFPB and ongoing interactions between the CFPB, the Company and Company counsel as part of the investigation. We are currently unable to predict the ultimate timing or outcome of the CFPB investigation. While the Company believes its marketing and lending practices are lawful, there can be no assurance that the CFPB’s ongoing investigation or future exercise of its enforcement, regulatory, discretionary or other powers will not result in findings or alleged violations of federal consumer financial protection laws that could lead to enforcement actions, proceedings or litigation and the imposition of damages, fines, penalties, restitution, other monetary liabilities, sanctions, settlements or changes to the Company’s business practices or operations that could have a material adverse effect on the Company’s business, financial condition or results of operations or eliminate altogether the Company’s ability to operate its business profitably or on terms substantially similar to those on which it currently operates.

Litigation and regulatory actions, including challenges to the arbitration clauses in our customer agreements, could subject us to significant class actions, fines, penalties, judgments and requirements resulting in increased expenses and potential material adverse effects on our business, results of operations and financial condition.

In the normal course of business, from time to time, we have been named as a defendant in various legal actions, including arbitrations, class actions and other litigation, arising in connection with our business activities. Certain of the legal actions include claims for substantial compensatory and punitive damages, or claims for indeterminate amounts of damages. While the arbitration provisions in our customer agreements historically have limited our exposure to consumer class action litigation, there can be no assurance that we will be successful in enforcing our arbitration clause in the future. There may also be legislative, administrative or regulatory efforts to directly or indirectly prohibit the use of pre-dispute arbitration clauses, including by the CFPB, or we may be compelled as a result of competitive pressure or reputational concerns to voluntarily eliminate pre-dispute arbitration clauses.

13

Unfavorable state legislative or regulatory actions or changes, adverse outcomes in litigation or regulatory proceedings or failure to comply with existing laws and regulations could force us to cease, suspend or modify our operations in a state, potentially resulting in a material adverse effect on our business, results of operations and financial condition.

In addition to federal laws and regulations, we are subject to numerous state laws and regulations that affect our lending activities. Many of these regulations impose detailed and complex constraints on the terms of our loans, lending forms and operations. Failure to comply with applicable laws and regulations could subject us to regulatory enforcement action that could result in the assessment against us of civil, monetary or other penalties, including the suspension or revocation of our licenses to lend in one or more jurisdictions.

Changes in the state laws under which we currently operate or the enactment of new laws governing our operations resulting from state political activities and legislative or regulatory initiatives could have a material adverse effect on all aspects of our business in a particular state. For example, proponents of rate cap legislation in New Mexico have recently attempted to advance bills that would place a 36% rate cap on all financial lending products. In February 2015, these measures were tabled by The New Mexico Regulatory and public affairs subcommittee.

The Company, through state and federal trade associations of which it is a member, is working in opposition to this pending legislation; however, it is uncertain whether these efforts will be successful in preventing the passage of the legislation. Passage of such proposed legislation or similar initiatives in other states could have a material adverse effect on the Company’s business, results of operations, prospects or ability to continue operations in the jurisdictions affected by such changes. We can give no assurance that the laws and regulations that govern our business, or the interpretation or administration of those laws and regulations, will remain unchanged or that any such future changes will not materially and adversely affect or in the worst case, eliminate the Company’s lending practices, operations, profitability or prospects.

In addition, any adverse change in existing laws or regulations, or any adverse interpretation or litigation relating to existing laws and regulations in any state in which we operate, could subject us to liability for prior operating activities or could lower or eliminate the profitability of our operations going forward by, among other things, reducing the amount of interest and fees we can charge in connection with our loans. If these or other factors lead us to close our branches in a state, then in addition to the loss of net revenues attributable to that closing, we would also incur closing costs such as lease cancellation payments and we would have to write off assets that we could no longer use. If we were to suspend rather than permanently cease our operations in a state, we may also have continuing costs associated with maintaining our branches and our employees in that state, with little or no revenues to offset those costs.

Media and public perception of consumer installment loans as being predatory or abusive could have a material adverse effect on our business, prospects, results of operations and financial condition.

Consumer activist groups and various other media sources continue to advocate for governmental and regulatory action to prohibit or severely restrict our products and services. These critics frequently characterize our products and services as predatory or abusive toward consumers. If this negative characterization of the consumer installment loans we make and/or ancillary services we provide becomes widely accepted by government policy makers or is embodied in legislative, regulatory, policy or litigation developments that adversely affect our ability to continue offering our products and services or the profitability of these products and services, our business, results of operations and financial condition would be materially and adversely affected.

Employee misconduct or misconduct by third parties acting on our behalf could harm us by subjecting us to monetary loss, significant legal liability, regulatory scrutiny and reputational harm.

Our reputation is critical to maintaining and developing relationships with our existing and potential customers and third parties with whom we do business. There is a risk that our employees or third-party contractors could engage in misconduct that adversely affects our business. For example, if an employee or a third-party contractor were to engage in, or be accused or engaging in, illegal or suspicious activities including fraud or theft, we could suffer direct losses from the activity and, in addition, we could be subject to regulatory sanctions and suffer serious harm to our reputation, financial condition, customer relationships and ability to attract future customers. Employee or third-party misconduct could prompt regulators to allege or to determine based upon such misconduct that we have not established adequate supervisory systems and procedures to inform employees of applicable rules or to detect violations of such rules. Our branches have experienced employee fraud from time to time, and it is not always possible to deter employee or third-party misconduct. The precautions that we take to detect and prevent misconduct may not be effective in all cases. Misconduct by our employees or third-party contractors, or even unsubstantiated allegations of misconduct, could result in a material adverse effect on our reputation and our business.

14

Our continued expansion into Mexico may increase the risks inherent in conducting operations internationally and in Mexico, contribute materially to increased costs and negatively affect our business, prospects, results of operations and financial condition.

Although our operations in Mexico accounted for only 8.9% of our revenues during the nine months ended December 31, 2014 and 7.9% of our gross loans receivable at December 31, 2014, we intend to continue opening branches and expanding our presence in Mexico. In addition, if and to the extent that the state and federal regulatory climate in the U.S. changes in ways that adversely affect our ability to continue profitable operations in one or more U.S. states, we could become increasingly dependent on our operations in Mexico as our only viable expansion or growth strategy. In pursuing such an expansion or growth strategy, we may expose an increasing portion of our business to risks inherent in conducting international operations, including currency fluctuations and devaluations, unsettled political and social conditions, communication and translation errors due to language barriers, compliance with differing legal and regulatory regimes and differing cultural attitudes toward regulation and compliance. In particular, political and social unrest in Mexico, coupled with a unionized labor structure that effectively gives labor unions control over repayment of funds remitted from our customers who borrow under our payroll deduction loan product in Mexico, create risks of non-payment or delinquent payment of these funds collected through the labor unions. We recently experienced such a situation in the third quarter of fiscal 2015 in which a union refused to make payments of $2.6 million related to such loans. If we are unable to resolve these issues and persuade the unions to remit these payments, our revenues, delinquencies and charge-off rates from our Mexican operations could be materially and adversely affected.

We depend to a substantial extent on borrowings under our Amended Credit Facility to fund our liquidity needs.

Concurrently with the closing of the offering of the notes, we will replace our existing revolving credit facility. We have an Amended Credit Facility committed through the third anniversary of the date of the closing of the notes offered hereby that allows us to borrow up to $430.0 million, assuming we are in compliance with a number of covenants and conditions, including a minimum borrowing base calculation. If our existing sources of liquidity become insufficient to satisfy our financial needs or our access to these sources becomes unexpectedly restricted, we may need to try to raise additional debt or equity in the future. If such an event were to occur, we can give no assurance that such alternate sources of liquidity would be available to us at all or on favorable terms. Additional information regarding our liquidity risk is included in “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources.”

We are exposed to credit risk in our lending activities.

Our ability to collect on loans to individuals, our single largest asset group, depends on the ability and willingness of our borrowers to repay such loans. Any material adverse change in the ability or willingness of a significant portion of our borrowers to meet their obligations to us, whether due to changes in economic conditions, unemployment rates, the cost of consumer goods (particularly, but not limited to, food and energy costs), disposable income, interest rates, natural disasters, acts of war or terrorism, or other causes over which we have no control, would have a material adverse impact on our earnings and financial condition. Although new customers are required to submit a listing of personal property that will serve as collateral to secure their loans, the Company does not rely on the value of such collateral in the loan approval process and generally does not perfect its security interest in that collateral. Additional information regarding our credit risk is included in “Management’s Discussion and Analysis of Financial Condition and Results of Operation — Credit Quality.”

If our estimates of loan losses are not adequate to absorb actual losses, our provision for loan losses would increase. This would result in a decline in our future revenues and earnings.

We maintain an allowance for loan losses for loans we make directly to consumers. This allowance is an estimate. If our actual loan losses exceed the assumption used to establish the allowance, our provision for loan losses would increase, which would result in a decline in our future earnings. Additional information regarding our allowance for loan losses is included in “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Credit Quality.”

The concentration of our revenues in certain states could adversely affect us.

We currently operate consumer installment loan branches in fifteen states in the United States. Any adverse legislative or regulatory change in any one of our states, but particularly in any of our larger states could have a material adverse effect on our business, prospects, and results of operation or financial condition. For information regarding the size of our business in the various states in which we operate, see “Business.”

We have goodwill, which is subject to periodic review and testing for impairment.

A portion of our total assets is comprised of goodwill. Under generally accepted accounting principles, goodwill is subject to periodic review and testing to determine if it is impaired. Unfavorable trends in our industry and unfavorable events or disruptions to our operations resulting from adverse legislative or regulatory actions or from other unpredictable causes could result in significant goodwill impairment charges.

15

Controls and procedures may fail or be circumvented.

Controls and procedures are particularly important for small-loan consumer finance companies. Any system of controls, however well designed and operated, is based in part on certain assumptions and can provide only reasonable, not absolute, assurance that the objectives of the system are met. In the second quarter of fiscal 2014, we reported a loss of $1.2 million as the result of a fraud at one of our branches where certain of our controls and procedures were circumvented. Any failure or circumvention of our controls and procedures or failure to comply with regulations related to controls and procedures could have a material adverse effect on our business, results of operations and financial condition.

The loss, replacement or transition of key management personnel, could cause our business to suffer.

Our future success significantly depends on the continued services and performance of our key management personnel. Competition for these employees is intense. Additionally, during fiscal 2014, the Company experienced the departure and replacement of its Chief Financial Officer and Chief Operating Officer. The loss of, or inability to successfully replace and transition, the services of members of our senior management or key team members or the inability to attract additional qualified personnel as needed could materially harm our business.

Regular turnover among our managers and other employees at our branches makes it more difficult for us to operate our branches and increases our costs of operations, which could have an adverse effect on our business, results of operations and financial condition.

The annual turnover as of March 31, 2014 among our office employees was approximately 30.8%. This turnover increases our cost of operations and makes it more difficult to operate our branches. If we are unable to keep our employee turnover rates consistent with historical levels or if unanticipated problems arise from our high employee turnover, our business, results of operations and financial condition could be adversely affected.

Our ability to manage our growth may deteriorate, and our ability to execute our growth strategy may be adversely affected.

Our growth strategy, which is based on opening and acquiring branches in existing and new markets, is subject to significant risks, some of which are beyond our control, including:

| • | the prevailing laws and regulatory environment of each state in which we operate or seek to operate, and, to the extent applicable, federal laws and regulations, which are subject to change at any time; |

| • | our ability to obtain and maintain any regulatory approvals, government permits or licenses that may be required; |

| • | the degree of competition in new markets and its effect on our ability to attract new customers; |

| • | our ability to obtain adequate financing for our expansion plans; and |

| • | our ability to attract, train and retain qualified personnel to staff our new operations. |

We currently lack product and business diversification; as a result, our revenues and earnings may be disproportionately negatively impacted by external factors and may be more susceptible to fluctuations than more diversified companies.

Our primary business activity is offering small consumer installment loans together with, in some states in which we operate, related ancillary products. Thus, any developments, whether regulatory, economic or otherwise, that would hinder, reduce the profitability of or limit our ability to operate our small consumer installment loan business on the terms currently conducted would have a direct and adverse impact on our business, profitability and perhaps even our viability. Our current lack of product and business diversification could inhibit our opportunities for growth, reduce our revenues and profits and make us more susceptible to earnings fluctuations than many other financial institutions whose operations are more diversified.

Interruption of, or a breach in security relating to, our information systems could adversely affect us.

We rely heavily on communications and information systems to conduct our business. Each office is part of an information network that is designed to permit us to maintain adequate cash inventory, reconcile cash balances on a daily basis and report revenues and expenses to our headquarters. Any failure, interruption or breach in security of these systems, including any failure of our back-up systems, cyber attacks, data theft, computer viruses or similar problems could result in failures or disruptions in our customer relationship management, general ledger, loan and other systems, loss of confidential Company, customer or vendor information and could result in a loss of customer confidence and business, subject us to additional regulatory scrutiny or negative publicity, or expose us to civil litigation, financial liability, and increased costs to remediate such problems, any of which could have a material adverse effect on our financial condition and results of operations.

16

Our centralized headquarters functions are susceptible to disruption by catastrophic events, which could have a material adverse effect on our business, results of operations and financial condition.

Our headquarters building is located in Greenville, South Carolina. Our information systems and administrative and management processes are primarily provided to our branches from this centralized location, and they could be disrupted if a catastrophic event, such as severe weather, natural disaster, power outage, act of terror or similar event, destroyed or severely damaged our headquarters. Any such catastrophic event or other unexpected disruption of our headquarters functions could have a material adverse effect on our business, results of operations and financial condition.

Absence of dividends could reduce our attractiveness to investors.

Since 1989, we have not declared or paid cash dividends on our common stock and may not pay cash dividends in the foreseeable future. As a result, our common stock may be less attractive to certain investors than the stock of dividend-paying companies.

Various provisions of our charter documents and applicable laws could delay or prevent a change of control that shareholders may favor.

Provisions of our articles of incorporation, South Carolina law, and the laws in several of the states in which our operating subsidiaries are incorporated could delay or prevent a change of control that the holders of our common stock may favor or may impede the ability of our shareholders to change our management. In particular, our articles of incorporation and South Carolina law, among other things, authorize our board of directors to issue preferred stock in one or more series, without shareholder approval, and will require the affirmative vote of holders of two-thirds of our outstanding shares of voting stock, to approve our merger or consolidation with another corporation. Additional information regarding the similar effect of laws in certain states in which we operate is described in Part 1, “Business — Government Regulation.”

Overall stock market volatility may materially and adversely affect the market price of our common stock.

The Company’s common stock price has been and is likely to continue to be subject to significant volatility. A variety of factors could cause the price of the common stock to fluctuate, perhaps substantially, including: general market fluctuations resulting from factors not directly related to the Company’s operations or the inherent value of its common stock; state or federal legislative or regulatory proposals, initiatives, actions or changes that are, or are perceived to be, adverse to our operations or the broader consumer finance industry in general; announcements of developments related to our business; fluctuations in our operating results and the provision for loan losses; low trading volume in our common stock; decreased availability of our common stock resulting from stock repurchases and concentrations of ownership by large or institutional investors; general conditions in the financial service industry, the domestic or global economy or the domestic or global credit or capital markets; changes in financial estimates by securities analysts; our failure to meet the expectations of securities analysts or investors; negative commentary regarding our Company and corresponding short-selling market behavior; adverse developments in our relationships with our customers; investigations or legal proceedings brought against the Company or its officers; or significant changes in our senior management team.

Our use of derivatives exposes us to credit and market risk.

From time to time we may use derivatives to manage our exposure to interest rate risk and foreign currency fluctuations. By using derivative instruments, the Company is exposed to credit and market risk. We can provide no assurance that these strategies will mitigate the impact of increases in interest rates or foreign currency fluctuations.

Changes to accounting rules, regulations or interpretations could significantly affect our financial results.

New accounting rules or regulations, changes to existing accounting rules or regulations and changing interpretations of existing rules and regulations have and may continue to be issued or occur in the future. Any such changes to accounting rules, regulations or interpretations could negatively affect our reported results of operations and could negatively affect our financial condition through increased cost of compliance.

A small number of our shareholders have the ability to significantly influence matters requiring shareholder approval and such shareholders have interests which may conflict with the interests of our other security holders.

As of March 31, 2015, based on filings made with the SEC and other information made available to us, Prescott General Partners, LLC and its affiliates beneficially owned approximately 27.6% of our common stock. As a result, these few shareholders are able to significantly influence matters presented to shareholders, including the election and removal of directors, the approval of significant corporate transactions, such as any reclassification, reorganization, merger, consolidation or sale of all or substantially all of our assets, and the control of our management and affairs, including executive compensation arrangements. Their interests may conflict with the interests of our other security holders. See “Management and Board of Directors — Common Stock Ownership of Certain Beneficial Owners and Management” for additional information.

17

The following table sets forth our cash and cash equivalents and our capitalization as of December 31, 2014:

| • | on an actual basis; |

| • | on an as adjusted basis, giving effect to the offering of the notes and the anticipated use of proceeds of approximately $243.8 million from the offering of the notes to repay borrowings under our revolving credit facility and pay related fees and expenses as described under “Use of Proceeds.” |

You should read this table in conjunction with “Risk Factors,” “Summary — Summary Historical Consolidated Financial and Other Data,” “Use of Proceeds,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our historical consolidated financial statements and related notes included in this offering memorandum.

| As of December 31, 2014 | ||||||||

| Actual | As Adjusted | |||||||

| (Unaudited) | ||||||||

| Cash and cash equivalents |

$ | 16.8 | $ | 16.8 | ||||

|

|

|

|

|

|||||

| Long-term debt, including current portion: |

||||||||

| Revolving credit facility(1) |

$ | 592.0 | (3) | $ | 348.2 | |||

| Notes offered hereby(2) |

— | 250.0 | ||||||

|

|

|

|

|

|||||

| Total long-term debt, including current portion |

592.0 | 598.2 | ||||||

|

|

|

|

|

|||||

| Shareholders’ equity: |

||||||||

| Total shareholders’ equity |

313.1 | 313.1 | ||||||

|

|

|

|

|

|||||

| Total capitalization |

$ | 905.1 | $ | 911.3 | ||||

|

|

|

|

|

|||||

| (1) | The Amended Credit Facility will provide for up to $430.0 million of borrowings, subject to borrowing base limitations and other specified terms and conditions, and will have a maturity date of the third anniversary of the date of the closing of the notes offered hereby. As of December 31, 2014, total commitments under our revolving credit facility were $680.0 million, total borrowings under our revolving credit facility were $592.0 million, and the effective interest rate on those borrowings, including the commitment fee, was 4.3%. The as adjusted amount assumes that all of the net proceeds of this offering will be used to repay borrowings under our revolving credit facility. See “Use of Proceeds.” For a description of the Amended Credit Facility, see “Description of Certain Other Indebtedness.” |

| (2) | The as adjusted amount represents the aggregate principal amount of the notes. |

| (3) | As of March 31, 2015, total borrowings under our revolving credit facility were $501.2 million. |

SELECTED HISTORICAL CONSOLIDATED FINANCIAL AND OTHER DATA

The following table presents our selected historical consolidated financial and certain other data as of and for the periods presented.

Our selected historical consolidated statement of operations, statement of cash flows and other data for the nine months ended December 31, 2014 and 2013, and our selected historical consolidated balance sheet data as of December 31, 2014 and 2013, are derived from our unaudited consolidated financial statements included in this offering memorandum. However, in the opinion of management, all adjustments (consisting only of items of a normal recurring nature) necessary for a fair presentation of the financial position at December 31, 2014 and 2013, and the results of operations and cash flows for the periods ended December 31, 2014 and 2013, have been included. The results for the interim periods are not necessarily indicative of the results that may be expected for the full year or any other interim period.