Attached files

| file | filename |

|---|---|

| EX-10.G - EXHIBIT 10(G) - DENBURY INC | dnr-20150331xex10g.htm |

| 10-Q - FORM 10-Q - DENBURY INC | dnr-20150331x10q.htm |

| 10-Q - PDF OF FORM 10-Q - DENBURY INC | dnr-20150331x10q.pdf |

| EX-10.A - EXHIBIT 10(A) - DENBURY INC | dnr-20150331xex10a.htm |

| EX-10.B - EXHIBIT 10(B) - DENBURY INC | dnr-20150331xex10b.htm |

| EX-10.C - EXHIBIT 10(C) - DENBURY INC | dnr-20150331xex10c.htm |

| EX-10.D - EXHIBIT 10(D) - DENBURY INC | dnr-20150331xex10d.htm |

| EX-10.E - EXHIBIT 10(E) - DENBURY INC | dnr-20150331xex10e.htm |

| EX-10.H - EXHIBIT 10(H) - DENBURY INC | dnr-20150331xex10h.htm |

| EX-10.I - EXHIBIT 10(I) - DENBURY INC | dnr-20150331xex10i.htm |

| EX-10.J - EXHIBIT 10(J) - DENBURY INC | dnr-20150331xex10j.htm |

| EX-31.A - EXHIBIT 31(A) - DENBURY INC | dnr-20150331xex31a.htm |

| EX-31.B - EXHIBIT 31(B) - DENBURY INC | dnr-20150331xex31b.htm |

| EX-32 - EXHIBIT 32 - DENBURY INC | dnr-20150331xex32.htm |

| EXCEL - IDEA: XBRL DOCUMENT - DENBURY INC | Financial_Report.xls |

Exhibit 10(f)

____________ Maximum Performance Shares Date of Award: ____________

2015 TSR PERFORMANCE AWARD

2004 OMNIBUS STOCK AND INCENTIVE PLAN

DENBURY RESOURCES INC.

This TSR PERFORMANCE AWARD (this “Award”) is made effective on the Date of Award by Denbury Resources Inc. (the “Company”) in favor of ________________________ (“Holder”).

WHEREAS, in accordance with Section 17 of the 2004 Omnibus Stock and Incentive Plan for Denbury Resources Inc., as amended and/or restated (the “Plan”), the Committee may grant performance-based Awards;

WHEREAS, the Committee desires to grant to Holder an Award under which Holder can earn a maximum of ______ Performance Shares based on the Performance Measures set forth in the Plan and this Award, and subject to all of the provisions, including without limitation the Vesting provisions, of the Plan and of this Award;

WHEREAS, no Performance Shares will be issued or outstanding until the Vesting Date or they become Vested Earned Performance Shares;

WHEREAS, the grant and issuance of a certain number Performance Shares (referred to as the “May Performance Shares”) under this Award are expressly conditioned upon the Company’s stockholders approving the Amended and Restated 2004 Omnibus Stock and Incentive Plan at the Company’s May 2015 annual meeting of stockholders (the “Incentive Plan Stockholder Approval”); and

WHEREAS, the Company and Holder understand and agree that this Award is in all respects subject to the terms, definitions and provisions of the Plan, and all of which are incorporated herein by reference, except to the extent otherwise expressly provided in this Award, and all capitalized terms used but not defined herein shall have the meaning given to those terms in the Plan.

NOW THEREFORE, in consideration of the mutual covenants hereinafter set forth and for other good and valuable consideration, the parties agree as follows:

1. Performance Share Grant. The Company hereby grants Holder the right to earn, Vest in, and receive delivery of, on the Delivery Date, up to ________ Reserved Shares (“Performance Shares”) subject to the terms and conditions set forth in the Plan and in this Award, including but not limited to those set forth in Section 4 related to Incentive Plan Stockholder Approval.

2. Definitions. All words capitalized herein that are defined in the Plan shall have the meaning assigned them in the Plan; other capitalized words shall have the following meaning, or shall be defined elsewhere in this Award:

(a) | “Annual TSR” means for the Company and each Peer Company, the result, expressed as a percentage, of the calculation of TSR for each of them set out in Section 5(a) hereof as to a Calendar Year within the Performance Period. |

(b) | “Beginning Common Stock Price” means the average of the Closing Price of the primary common equity security for the Company and each Peer Company for each of the 10 trading days immediately preceding the first day of each Calendar Year, taken separately, within the Performance Period being measured. |

(c) | “Calendar Year” means the 12-month period beginning January 1 and ending December 31 for the Company and each Peer Company. |

(d) | “Change in Control” or “CIC” means, without limitation, the same as it does in the Plan. |

(e) | “Closing Price” means the last reported sales price, regular way, of the primary common equity security of the Company and each Peer Company, as reported by the primary exchange or market upon which such security is traded. |

1

(f) | “Delivery Date” means the date on which Vested Earned Performance Shares are delivered to Holder, which shall be the Vesting Date, or as soon thereafter as practicable, but in no event later than thirty (30) days after the Vesting Date, or the date on which Performance Shares are delivered to Holder at the dates set forth in Section 7(b) or 8(c)(i), (ii) or (iii), if applicable. |

(g) | “Disability” means, without limitation, the same as it does in the Plan. |

(h) | “Earned Performance Shares” means the number of Performance Shares which are earned during the Performance Period as described and calculated in Section 7. |

(i) | “Ending Common Stock Price” equals the average of the Closing Price of the primary common equity security for the Company and each Peer Company for each of the 10 trading days ending on and including the last day of each Calendar Year, taken separately, within the Performance Period. |

(j) | “January Performance Shares” means the number Performance Shares to be issued under this Award that are not expressly conditioned upon the Incentive Plan Stockholder Approval and which are set forth in detail under “Table 1- January Performance Shares” in Section 5(c). |

(k) | “May Performance Shares” means the number Performance Shares to be issued under this Award that are expressly conditioned upon the Incentive Plan Stockholder Approval and which are set forth in detail under “Table 2 - May Performance Shares” in Section 5(c). |

(l) | “Peer Company” means each of the companies listed on Appendix A hereto that has its primary common equity securities listed or traded on a United States national securities exchange, NASDAQ National Market, or Toronto Stock Exchange during each day of each Calendar Year within the Performance Period. |

(m) | “Performance Period” means the three-year period beginning on the first day of the Calendar Year of the Date of Grant and ending on December 31 of the Calendar Year three years thereafter, provided that in the event of a Change in Control, the Performance Period will end on the date that such Change in Control takes effect. |

(n) | “Performance Percentage” means that percentage determined based upon the relative ranking of the Company’s Three-Year Average TSR for the Performance Period compared to the Three-Year Average TSR of each Peer Company for the Performance Period as determined under the provisions of Section 5(c), subject to reduction under Sections 6 and 13, if any. |

(o) | “Post Separation Change in Control” means a Change in Control that follows Holder’s Separation, but results from the Commencement of a Change in Control that occurs prior to Holder’s Separation. For all purposes of this Award, the term “Commencement of a Change in Control” shall mean the date on which any material action, including without limitation through a written offer, open-market bid, corporate action, proxy solicitation or otherwise, is taken by a “person” (as defined in Section 13(d) or Section 14(d)(2) of the 1934 Act), or a “group” (as defined in Section 13(d)(3) of the 1934 Act), or their affiliates, to commence efforts that, within 12 months after the date of such material action, leads to a Change in Control involving such person, group, or their affiliates. |

(p) | “Target Performance Shares” means one-half of the Performance Shares which may be earned under this Award if there are no reductions in the number of Performance Shares under Section 6. |

(q) | “Three-Year Average TSR” means for the Company and each Peer Company, the result, expressed as a percentage, of averaging their respective Annual TSR for each of the Calendar Years in the Performance Period. |

(r) | “Total Shareholder Return” or “TSR” shall mean that percentage which reflects the increase or decrease in the average closing trading price of the Company’s or a Peer Company’s primary common equity security (assuming reinvestment of any dividends) between the last 10 trading days of one Calendar Year and the last 10 trading days of the next Calendar Year, or as applicable, the average of such yearly increases or decreases. |

(s) | “Value of Reinvested Dividends” means a dollar amount derived by (i) calculating an aggregate number of shares (or fractions thereof) of the Company or any Peer Company represented by the sum of each dividend paid on their respective |

2

primary common equity security during a Calendar Year (or portion thereof under Section 5(b) below) within the Performance Period, determined by dividing the per share amount or value paid through each such dividend by the Closing Price of that company’s primary common equity security on each such dividend payment date, and (ii) then multiplying that aggregate number of shares by the Ending Common Stock Price, respectively, of that company for that Calendar Year (or portion thereof in the event of a Change in Control).

(t) | “Vesting Date” means March 31, 2018 or the effective date of any earlier (i) Change in Control pursuant to Section 7(b) or (ii) death, disability or Post Separation Change in Control pursuant to Sections 8(c)(i), (ii) or (iii), as appropriate. |

3. Performance Shares as Contractual Right. Each Performance Share represents a contractual right to receive one share of Common Stock of the Company, subject to the terms and conditions of this Award; provided that, based on relative Total Shareholder Return as detailed below, the number of shares of Common Stock of the Company that may be deliverable hereunder in respect of the Performance Shares may range from 0% to 200% of the number of Target Performance Shares, and Holder’s right to receive Common Stock of the Company in respect of Performance Shares is generally contingent.

4. Performance Shares Subject to Shareholder Approval. Notwithstanding the other terms and conditions of this Award Agreement, the grant and issuance of the May Performance Shares, are expressly conditioned upon Incentive Plan Stockholder Approval. Holder has no rights or privileges to the May Performance Shares, and cannot vest in or otherwise earn any May Performance Shares, until the Incentive Plan Stockholder Approval (if any). For the avoidance of doubt, nothing contained in this Section 4 affects the rights granted to Holder with respect to January Performance Shares and such Performance Shares are not conditioned upon Incentive Plan Stockholder Approval.

5. Total Shareholder Return Calculations. Total Shareholder Return shall be calculated for the periods specified below as follows:

(a) | Annual TSR for the Company and each Peer Company for each Calendar Year within the Performance Period shall equal the result of the following calculation for each such company: |

Ending Common Stock Price + Value of Reinvested Dividends | - 1 |

Beginning Common Stock Price | |

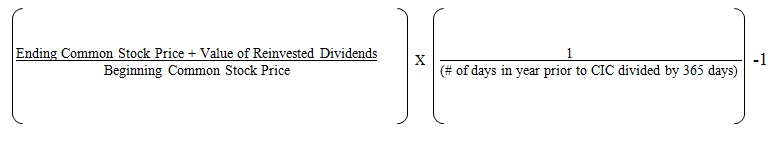

(b) | For any Calendar Year in which a Change in Control of the Company occurs, Annual TSR for the Company and each Peer Company for that Calendar Year shall equal the result of the following calculation for each such company: |

(c) | The Three-Year Average TSR of the Company and each Peer Company is to be calculated as soon as practical after the end of the Performance Period. A ranking is to be made of the Three-Year Average TSR for each Peer Company and the Company, and they are to be listed in Column 1 of Table 1 and Table 2 below in descending order of their respective Three-Year Average TSR from the highest percentage to the lowest percentage, and reflecting in Column 2 of each table the exact percentage of each company’s respective Three-Year Average TSR. |

The Company’s Performance Percentage will be that percentage shown in Column 4 (subject to adjustment, if any, provided in Sections 6 or 13) opposite the ranking of the Company in Column 1 of each table (for example, in the following tables for 17 Companies, being ranked as fifth would equal a Performance Percentage of 86.932% for the January Performance Shares and 63.068% for the May Performance Shares, or 150% for the combined Performance Shares).

3

Table 1 - January Performance Shares

Three-Year Average TSR Rank of the Company and Peer Companies 1 | Actual Three-Year Average TSR (expressed as a %) 2 | Scale of Three-Year Average TSR for 17 Companies (expressed as a %) 3 | Performance Percentage Scale (subject to interpolation) 4 |

1 | 100.0% | 86.932% | |

2 | 93.8% | 86.932% | |

3 | 87.5% | 86.932% | |

4 | 81.3% | 86.932% | |

5 | 75.0% | 86.932% | |

6 | 68.8% | 86.932% | |

7 | 62.5% | 86.932% | |

8 | 56.3% | 86.932% | |

9 | 50.0% | 86.932% | |

10 | 43.8% | 86.932% | |

11 | 37.5% | 75.00% | |

12 | 31.3% | 63.00% | |

13 | 25.0% | 50.00% | |

14 | 18.8% | 38.00% | |

15 | 12.5% | 25.00% | |

16 | 6.3% | 13.00% | |

17 | 0.0% | 0.00% | |

4

Table 2 - May Performance Shares

Three-Year Average TSR Rank of the Company and Peer Companies 1 | Actual Three-Year Average TSR (expressed as a %) 2 | Scale of Three-Year Average TSR for 17 Companies (expressed as a %) 3 | Performance Percentage Scale (subject to interpolation) 4 |

1 | 100.0% | 113.068% | |

2 | 93.8% | 101.068% | |

3 | 87.5% | 88.068% | |

4 | 81.3% | 76.068% | |

5 | 75.0% | 63.068% | |

6 | 68.8% | 51.068% | |

7 | 62.5% | 38.068% | |

8 | 56.3% | 26.068% | |

9 | 50.0% | 13.068% | |

10 | 43.8% | 1.068% | |

11 | 37.5% | 0.000% | |

12 | 31.3% | 0.000% | |

13 | 25.0% | 0.000% | |

14 | 18.8% | 0.000% | |

15 | 12.5% | 0.000% | |

16 | 6.3% | 0.000% | |

17 | 0.0% | 0.000% | |

The percentages in Column 3 of each table above are based upon increments derived by dividing 100% by 16 Peer Companies, which percentage increments will be adjusted, if necessary, on a pro rata basis to reflect a reduction in the number of Peer Companies.

6. Committee’s Reduction of Performance Percentage. Notwithstanding any provision hereof to the contrary, the Committee, in its sole discretion, by written notice to Holder prior to the Vesting Date, may reduce Holder’s otherwise total earned Performance Percentage (measured by adding the Performance Percentage earned in Table 1 plus Table 2) in an amount (if any) based upon the Committee’s subjective evaluation. Any reduction of Holder’s Performance Percentage by the Committee for the Performance Period shall be determined after the end of the Performance Period, and shall not exceed twenty-five percent (25%) of Holder’s Performance Percentage earned during the Performance Period. The Committee does not have discretion to increase a Holder’s Performance Percentage.

7. Earned Performance Shares.

(a) Earned Performance Shares. The number of Earned Performance Shares shall be equal to the product of (i) the Target Performance Shares, multiplied by (ii) the Performance Percentage in Table 1 and Table 2, as such number shall be reduced by the Company to satisfy all minimum applicable federal, state, and local income tax withholding requirements and employment tax withholding requirements. Only whole shares will be issued to the Holder. The Performance Percentage shall be determined by the Committee and the Holder will be advised as soon as administratively practicable following the end of the Performance Period (but in no case later than 90 days after the end of the Performance Period), and the Committee shall certify whether and to the extent that the Performance Percentage has been achieved, subject to the Change in Control provisions of Section 7(b) below.

(b) Change in Control. Notwithstanding the foregoing and any other provision hereof to the contrary, if a Change in Control of the Company occurs during the Performance Period then, regardless of the Performance Percentage at the date of the Change in Control, the Performance Period will end on the date of the Change in Control and the performance for the partial year will be annualized as set out in Section 5(b) above and averaged with the Annual TSR calculated for any prior completed Calendar Year to determine Earned Performance Shares, which Holder will be entitled to receive on the date of the Change in Control, but in no

5

event later than the 15th day of the third month after the end of the Calendar Year in which such Change in Control occurs, and Holder permanently shall forfeit the right to receive any other Performance Shares.

8. | Vesting (and Forfeiture) of Earned Performance Shares. |

(a) | No Separation Prior to the Vesting Date. If Holder does not Separate prior to the Vesting Date (other than a Separation after Holder’s Retirement Vesting Date), Holder will be 100% Vested in the Earned Performance Shares. |

(b) | Retirement Vesting Date. In the event Holder reaches his Retirement Vesting Date prior to the Vesting Date, Holder will be entitled to receive Performance Shares in an amount equal to the number of Earned Performance Shares on the Vesting Date (which Performance Shares will be delivered to the employee on the Delivery Date), without any right to receive any additional Performance Shares, and without any proration of the number of Performance Shares earned in such circumstances. Notwithstanding the foregoing, in the event Holder Separates after Holder’s Retirement Vesting Date but within 12 months of the Date of Grant, all rights to receive Performance Shares under this Award will be forfeited. |

(c) | Forfeiture. Except to the extent expressly provided in Sections 8(b) and 8(c) (i), (ii) or (iii), Holder permanently will forfeit all rights with respect to all Performance Shares upon the date of his Separation, if such Separation occurs prior to the Vesting Date. |

(i) Death. If Holder Separates by reason of death prior to the last day of the Performance Period, Holder’s Beneficiary will be entitled to receive Performance Shares in an amount equal to the number of Target Performance Shares (without any right to receive any other Performance Shares) as soon as reasonably possible, but in no event more than 90 days after Holder’s death. If Holder Separates by reason of death prior to the Vesting Date but on or after the last day of the Performance Period, Holder’s Beneficiary will be entitled to receive the number of Performance Shares based on the calculation in Section 7 herein (and does not have any right to receive any other Performance Shares) as soon as reasonably possible, but in no event more than 90 days after Holder’s death.

(ii) Disability. If Holder Separates by reason of Disability prior to the last day of the Performance Period, Holder or Holder’s Beneficiary, as applicable, will be entitled to receive Performance Shares in an amount equal to the number of Target Performance Shares (without any right to receive any other Performance Shares) as soon as reasonably possible, but in no event later than the 15th day of the third month after the end of the Calendar Year following the date on which the Committee determines that Holder is Disabled. If Holder Separates by reason of Disability prior to the Vesting Date but on or after the last day of the Performance Period, Holder or Holder’s Beneficiary, as applicable, will be entitled to receive the number of Performance Shares based on the calculation in Section 7 herein (without any right to receive any other Performance Shares) as soon as reasonably possible, but in no event later than the 15th day of the third month after the end of the Calendar Year following the date on which the Committee determines that Holder is Disabled.

(iii) Post Separation Change in Control. If there is a Post Separation Change in Control, Holder will be entitled to receive Performance Shares in an amount equal to the number of Target Performance Shares (without any right to receive any additional Performance Shares) as soon as reasonably possible after the date of the Change in Control, but in no event later than the 15th day of the third month after the end of the Calendar Year in which such Change in Control occurs.

9. Withholding. On the Vesting Date, the minimum statutory tax withholding required to be made by the Company, or other withholding rate as determined by the Committee in its discretion if determined not to be detrimental to the Company or Participant, shall be paid by Holder (or Holder’s Beneficiary) to the Administrator in cash, by delivery of Company Common Stock, or by authorizing the Company to retain Performance Shares, or a combination thereof; provided, further, that where Company Common Stock or Performance Shares are delivered or retained, the satisfaction of Holder’s obligation hereunder will be based on the Fair Market Value on the Vesting Date of such delivered or retained Shares.

10. Issuance of Shares. Without limitation, Holder shall not have any of the rights and privileges of an owner of the Company’s Common Stock (including voting rights and dividend rights, except as set forth in Section 13 below), until the Vesting Date or such Performance Shares otherwise become Vested Earned Performance Shares. The Administrator shall deliver the Vested Shares (reduced by the number of Vested Shares delivered to the Administrator to pay required withholding under Section 9 above) to the Holder as soon as reasonably possible following Vesting. The Holder agrees that the delivery of Vested Shares is subject to the Company’s stock ownership guidelines, as potentially modified from time to time.

6

11. Administration. Without limiting the generality of the Committee’s rights, duties and obligations under the Plan, the Committee shall have the following specific rights, duties and obligations with respect to this Award. Without limitation, the Committee shall interpret conclusively the provisions of the Award, adopt such rules and regulations for carrying out the Award as it may deem advisable, decide conclusively all questions of fact arising in the application of the Award, certify the extent to which Performance Measures have been satisfied and the Performance Percentage earned, exercise its right to reduce the Performance Percentage, and make all other determinations and take all other actions necessary or desirable for the administration of the Award. The Committee is authorized to change any of the terms or conditions of the Award in order to take into account any material unanticipated change in the Company’s operations, corporate structure, assets, or similar change, but only to the extent such action carries out the original purpose, intent and objectives of the Award. All decisions and acts of the Committee shall be final and binding upon Holder and all other affected parties. The Committee, without limitation, may delegate all of what, in its sole discretion, it determines to be ministerial duties to the Administrator; provided, further, that the determinations under, and the interpretations of, any provision of the Award by the Committee shall, in all cases, be in its sole discretion, and shall be final and conclusive.

12. Beneficiary. Holder’s rights hereunder shall be exercisable during Holder’s lifetime only by Holder or Holder’s legal representative. Holder may file with the Administrator a written designation of beneficiary (such person(s) being the Holder’s “Beneficiary”), on such form as may be prescribed by the Administrator. Holder may, from time to time, amend or revoke a designation of Beneficiary. If no designated Beneficiary survives Holder, the Holder’s estate shall be deemed to be Holder’s Beneficiary.

13. Adjustments in Respect of Performance Shares. In addition to any adjustments under Section 6 herein, in the event of any dividend or split of the primary common equity security of the Company or any Peer Company, or recapitalization (including, but not limited to, the payment of an extraordinary dividend), merger, consolidation, combination, spin-off, distribution of assets to stockholders (other than cash dividends), exchange of such shares, or other similar corporate change, with regard to the Company or any Peer Company, appropriate adjustments may be made to the number of Target Performance Shares in a manner deemed equitable by the Committee.

14. Holder’s Access to Information. As soon as reasonably possible after the close of the preceding Calendar Year, the Committee (and the Administrator to the extent it shall have been directed by the Committee) shall make all relevant annually determined calculations and determinations hereunder, and shall communicate such information to the Administrator. The Administrator will furnish all such relevant information to Holder as soon as reasonably possible following the date on which all, or a substantial majority, of the information is available.

15. No Transfers Permitted. The rights under this Award are not transferable by the Holder other than by will or the laws of descent and distribution, and so long as Holder lives, only Holder or his or her guardian or legal representative shall have the right to receive and retain Vested Earned Performance Shares.

16. No Right To Continued Employment. Neither the Plan nor this Award shall confer upon Holder any right with respect to continuation of employment by the Company, or any right to provide services to the Company, nor shall they interfere in any way with Holder’s right to terminate employment, or the Company’s right to terminate Holder’s employment, at any time.

17. Governing Law. Without limitation, this Award shall be construed and enforced in accordance with, and be governed by, the laws of Delaware.

18. Binding Effect. This Award shall inure to the benefit of and be binding upon the heirs, executors, administrators, permitted successors and assigns of the parties hereto.

19. Waivers. Any waiver of any right granted pursuant to this Award shall not be valid unless it is in writing and signed by the party waiving the right. Any such waiver shall not be deemed to be a waiver of any other rights.

20. Severability. If any provision of this Award is declared or found to be illegal, unenforceable or void, in whole or in part, the remainder of this Award will not be affected by such declaration or finding and each such provision not so affected will be enforced to the fullest extent permitted by law.

7

IN WITNESS WHEREOF, the Company has caused this Award to be executed on its behalf by its duly authorized representatives on the Date of Grant.

DENBURY RESOURCES INC. | |||

By: | |||

Phil Rykhoek Chief Executive Officer | Mark C. Allen Senior Vice President and Chief Financial Officer | ||

8

ACKNOWLEDGMENT

The undersigned hereby acknowledges (i) receipt of this Award, (ii) the opportunity to review the Plan, (iii) the opportunity to discuss this Award with a representative of the Company, and the undersigned’s personal advisors, to the extent the undersigned deems necessary or appropriate, (iv) the understanding of the terms and provisions of the Award and the Plan, and (v) the understanding that, by the undersigned’s signature below, the undersigned is agreeing to be bound by all of the terms and provisions of this Award and the Plan.

Without limitation, the undersigned agrees to accept as binding, conclusive and final all decisions, factual determinations, and/or interpretations (including, without limitation, all interpretations of the meaning of provisions of the Plan, or this Award, or both) of the Committee regarding any questions arising under the Plan, or this Award, or both.

Dated as of the effective date.

Holder's Signature | ||

9

Appendix A

Peer Companies

Canadian Oil Sands Limited (COS.TO)

Concho Resources, Inc. (CXO)

ConocoPhillips (COP)

Continental Resources, Inc. (CLR)

Crescent Point Energy Corp. (CPG)

Devon Energy Corporation (DVN)

Marathon Oil Corporation (MRO)

MEG Energy Corporation (MEG.TO)

Murphy Oil Corporation (MUR)

Oasis Petroleum, Inc. (OAS)

Occidental Petroleum Corporation (OXY)

Pioneer Natural Resources Company (PXD)

Sandridge Energy, Inc. (SD)

SM Energy Company (SM)

Vermilion Energy (VET)

Whiting Petroleum Corporation (WLL)

In the event that any company within the Peer Group is acquired or ceases to have its primary common equity security listed or traded on a U.S. national securities exchange, the Toronto Stock Exchange, or the NASDAQ National Market (or any successors thereto) during the Performance Period, such company will be removed from the Peer Group for the purposes of calculating achievement of the Performance Percentage.

10