Attached files

| file | filename |

|---|---|

| 8-K - SHENANDOAH TELECOMMUNICATIONS CO 8-K 5-4-2015 - SHENANDOAH TELECOMMUNICATIONS CO/VA/ | form8k.htm |

May 4, 2015 1Q 2015Earnings Conference Call Exhibit 99.1

Exhibit 99.11Q 2015Earnings Conference CallMay 4, 2015

Safe Harbor Statement This presentation includes “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, regarding, among other things, our business strategy, our prospects and our financial position. These statements can be identified by the use of forward-looking terminology such as “believes,” “estimates,” “expects,” “intends,” “may,” “will,” “should,” “could,” or “anticipates” or the negative or other variation of these similar words, or by discussions of strategy or risks and uncertainties. These statements are based on current expectations of future events. If underlying assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results could vary materially from the Company’s expectations and projections. Important factors that could cause actual results to differ materially from such forward-looking statements include, without limitation, risks related to the following: Increasing competition in the communications industry; andA complex and uncertain regulatory environment.A further list and description of these risks, uncertainties and other factors can be found in the Company’s SEC filings which are available online at www.sec.gov, www.shentel.com or on request from the Company. The Company does not undertake to update any forward-looking statements as a result of new information or future events or developments.

Safe Harbor Statement This presentation includes “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, regarding, among other things, our business strategy, our prospects and our financial position. These statements can be identified by the use of forward-looking terminology such as “believes,” “estimates,” “expects,” “intends,” “may,” “will,” “should,” “could,” or “anticipates” or the negative or other variation of these similar words, or by discussions of strategy or risks and uncertainties. These statements are based on current expectations of future events. If underlying assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results could vary materially from the Company’s expectations and projections. Important factors that could cause actual results to differ materially from such forward-looking statements include, without limitation, risks related to the following: Increasing competition in the communications industry; andA complex and uncertain regulatory environment.A further list and description of these risks, uncertainties and other factors can be found in the Company’s SEC filings which are available online at www.sec.gov, www.shentel.com or on request from the Company. The Company does not undertake to update any forward-looking statements as a result of new information or future events or developments.

Use of Non-GAAP Financial Measures Included in this presentation are certain non-GAAP financial measures that are not determined in accordance with US generally accepted accounting principles. These financial performance measures are not indicative of cash provided or used by operating activities and exclude the effects of certain operating, capital and financing costs and may differ from comparable information provided by other companies, and they should not be considered in isolation, as an alternative to, or more meaningful than measures of financial performance determined in accordance with US generally accepted accounting principles. These financial performance measures are commonly used in the industry and are presented because Shentel believes they provide relevant and useful information to investors. Shentel utilizes these financial performance measures to assess its ability to meet future capital expenditure and working capital requirements, to incur indebtedness if necessary, return investment to shareholders and to fund continued growth. Shentel also uses these financial performance measures to evaluate the performance of its businesses and for budget planning purposes.

Use of Non-GAAP Financial Measures Included in this presentation are certain non-GAAP financial measures that are not determined in accordance with US generally accepted accounting principles. These financial performance measures are not indicative of cash provided or used by operating activities and exclude the effects of certain operating, capital and financing costs and may differ from comparable information provided by other companies, and they should not be considered in isolation, as an alternative to, or more meaningful than measures of financial performance determined in accordance with US generally accepted accounting principles. These financial performance measures are commonly used in the industry and are presented because Shentel believes they provide relevant and useful information to investors. Shentel utilizes these financial performance measures to assess its ability to meet future capital expenditure and working capital requirements, to incur indebtedness if necessary, return investment to shareholders and to fund continued growth. Shentel also uses these financial performance measures to evaluate the performance of its businesses and for budget planning purposes

Chris FrenchPresident and CEO

Chris FrenchPresident and CEO

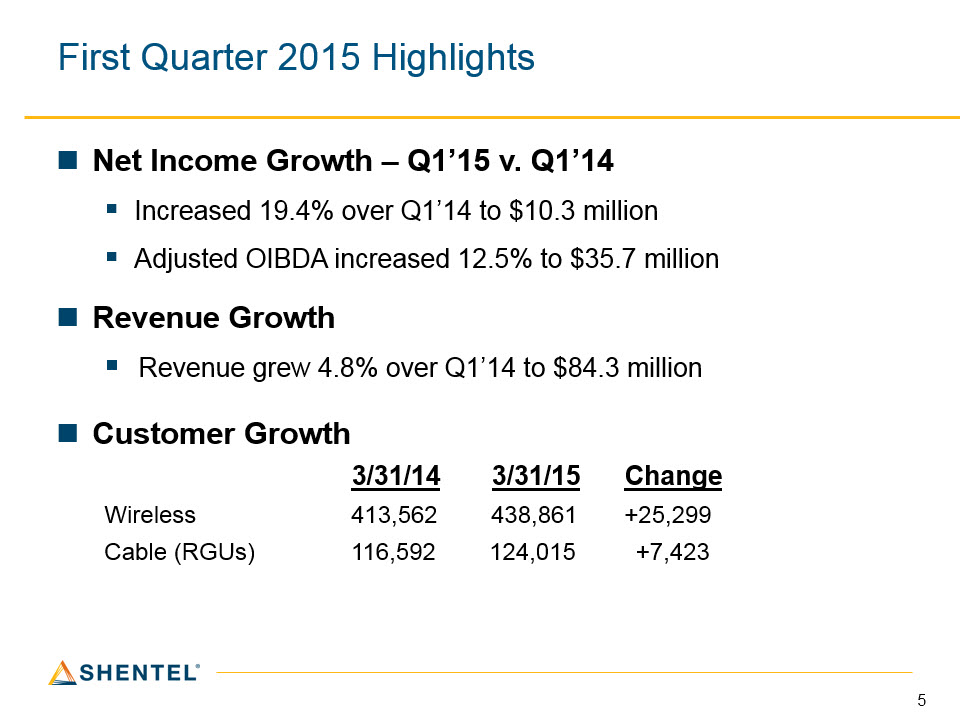

First Quarter 2015 Highlights Net Income Growth – Q1’15 v. Q1’14Increased 19.4% over Q1’14 to $10.3 millionAdjusted OIBDA increased 12.5% to $35.7 millionRevenue Growth Revenue grew 4.8% over Q1’14 to $84.3 millionCustomer Growth 3/31/14 3/31/15 ChangeWireless 413,562 438,861 +25,299Cable (RGUs) 116,592 124,015 +7,423

First Quarter 2015 Highlights Net Income Growth – Q1’15 v. Q1’14 Increased 19.4% over Q1’14 to $10.3 millionAdjusted OIBDA increased 12.5% to $35.7 millionRevenue Growth Revenue grew 4.8% over Q1’14 to $84.3 millionCustomer Growth 3/31/14 3/31/15 ChangeWireless 413,562 438,861 +25,299Cable (RGUs) 116,592 124,015 +7,423

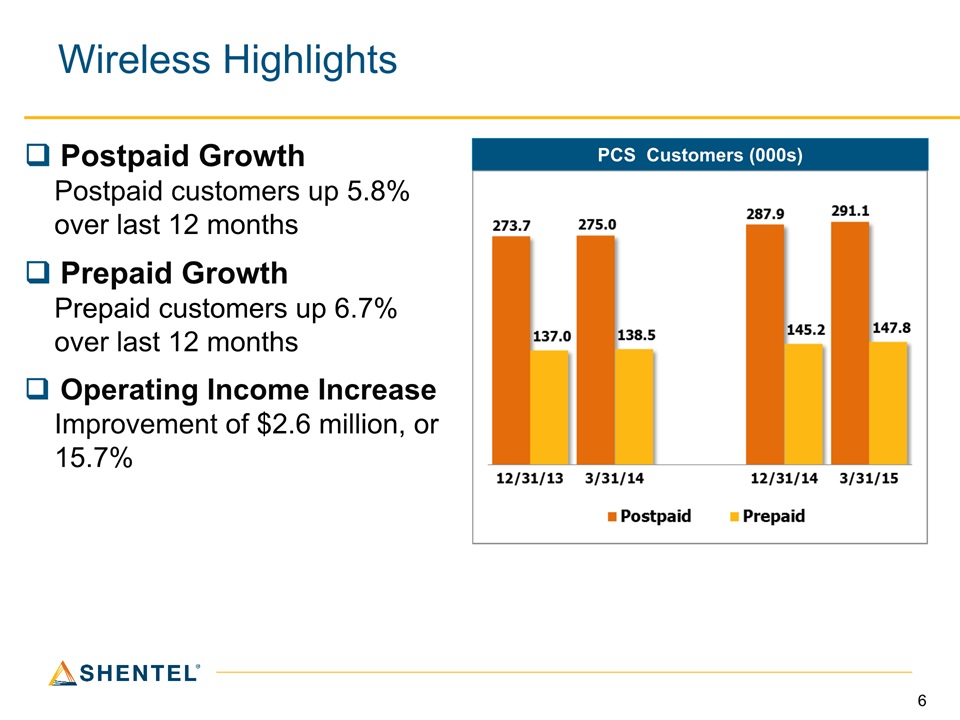

Wireless Highlights PCS Customers (000s) Postpaid Growth Postpaid customers up 5.8% over last 12 monthsPrepaid GrowthPrepaid customers up 6.7% over last 12 monthsOperating Income IncreaseImprovement of $2.6 million, or 15.7%

Wireless Highlights Postpaid Growth Postpaid customers up 5.8% over last 12 monthsPrepaid GrowthPrepaid customers up 6.7% over last 12 monthsOperating Income IncreaseImprovement of $2.6 million, or 15.7%

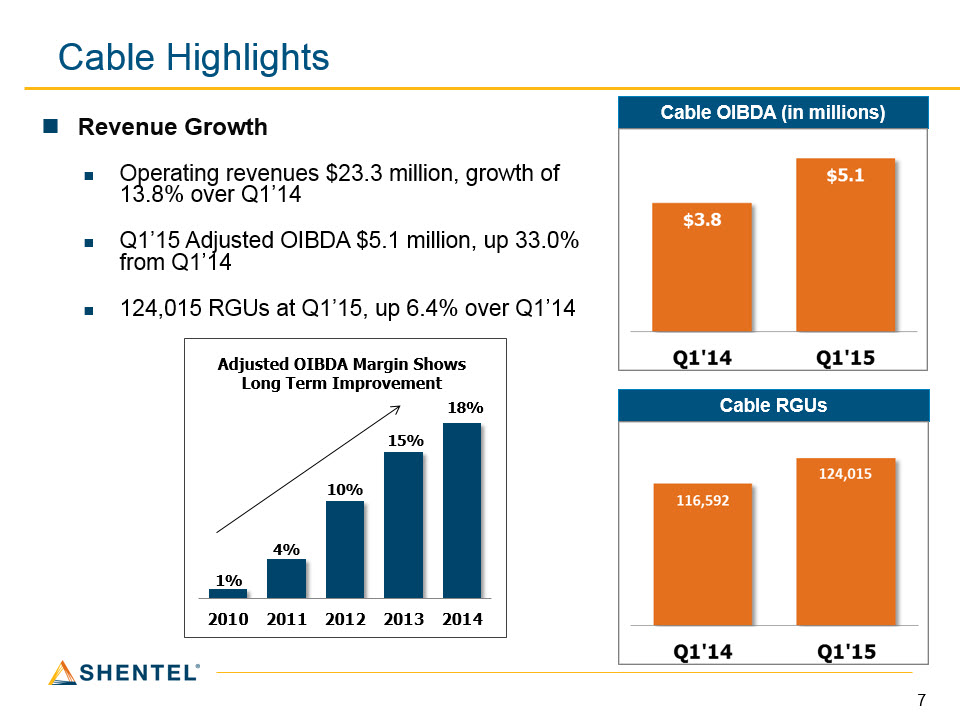

Cable Highlights Revenue GrowthOperating revenues $23.3 million, growth of 13.8% over Q1’14Q1’15 Adjusted OIBDA $5.1 million, up 33.0% from Q1’14124,015 RGUs at Q1’15, up 6.4% over Q1’14 Cable OIBDA (in millions) Cable RGUs

Cable Highlights Revenue Growth Operating revenues $23.3 million, growth of 13.8% over Q1’14 Q1’15 Adjusted OIBDA $5.1 million, up 33.0% from Q1’14 124,015 RGUs at Q1’15, up 6.4% over Q1’14 Adjusted OIBDA Margin Shows Long Term Improvement Cable OIBDA (in millions) Cable RGUs

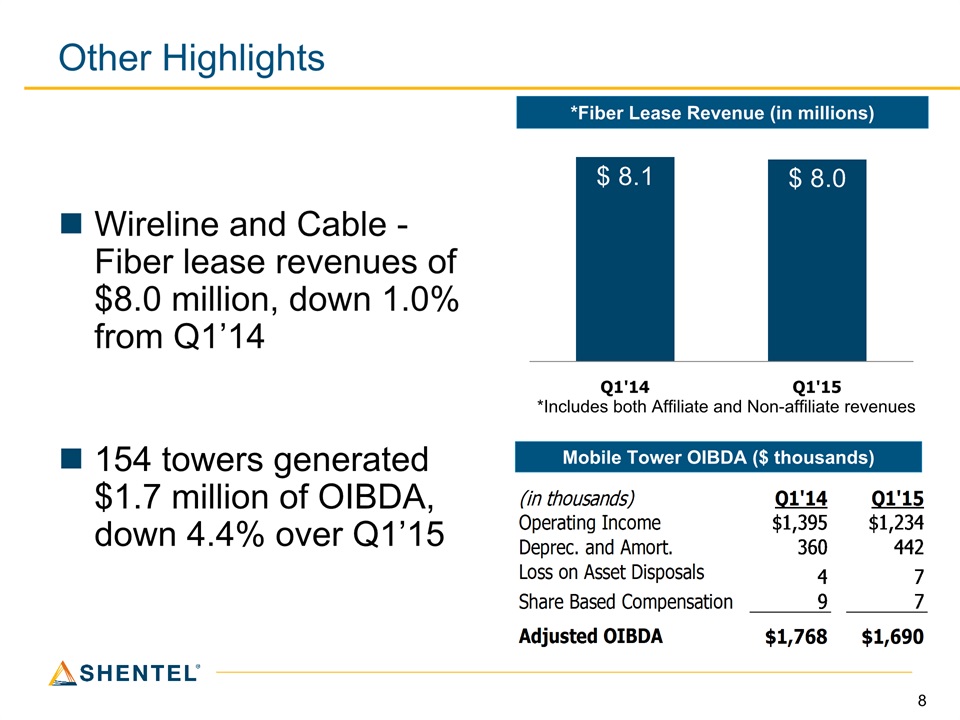

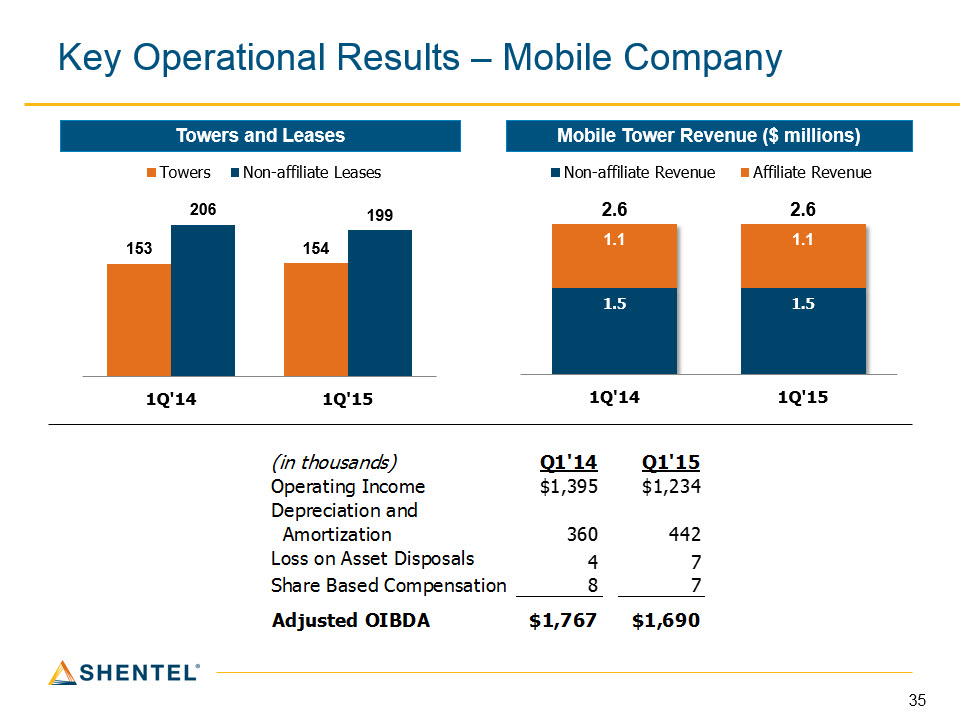

Other Highlights Wireline and Cable -Fiber lease revenues of $8.0 million, down 1.0% from Q1’14154 towers generated $1.7 million of OIBDA, down 4.4% over Q1’15 *Fiber Lease Revenue (in millions) Mobile Tower OIBDA ($ thousands) *Includes both Affiliate and Non-affiliate revenues

Other HighlightsWireline and Cable -Fiber lease revenues of $8.0 million, down 1.0% from Q1’14154 towers generated $1.7 million of OIBDA, down 4.4% over Q1’15*Fiber Lease Revenue (in millions) *Includes both Affiliate and Non-affiliate revenuesMobile Tower OIBDA ($ thousands)

Adele SkolitsVP of Finance and CFO

Adele SkolitsVP of Finance and CFO

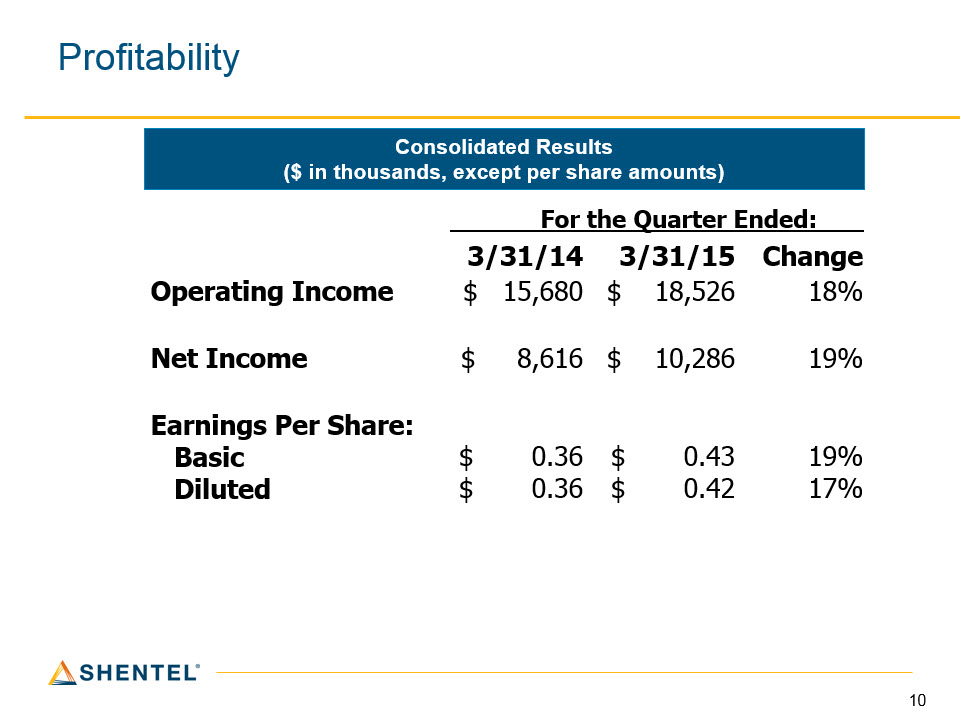

Profitability Consolidated Results($ in thousands, except per share amounts) 3/31/14 3/31/15 Change Operating Income $ 15,680 $ 18,526 18% Net Income $ 8,616 $ 10,286 19% Earnings Per Share: Basic Diluted $ 0.36$ 0.36 $ 0.43 $ 0.42 19%17% For the Quarter Ended:___

Profitability Consolidated Results ($ in thousands, except per share amounts) Operating Income Net Income Earnings Per Share: Basic Diluted For the Quarter Ended:___3/31/14 3/31/15Change $ 15,680 $ 18,52618% $ 8,616 $ 10,286 19%$ 0.36$ 0.36 $ 0.43 $ 0.4219%17%

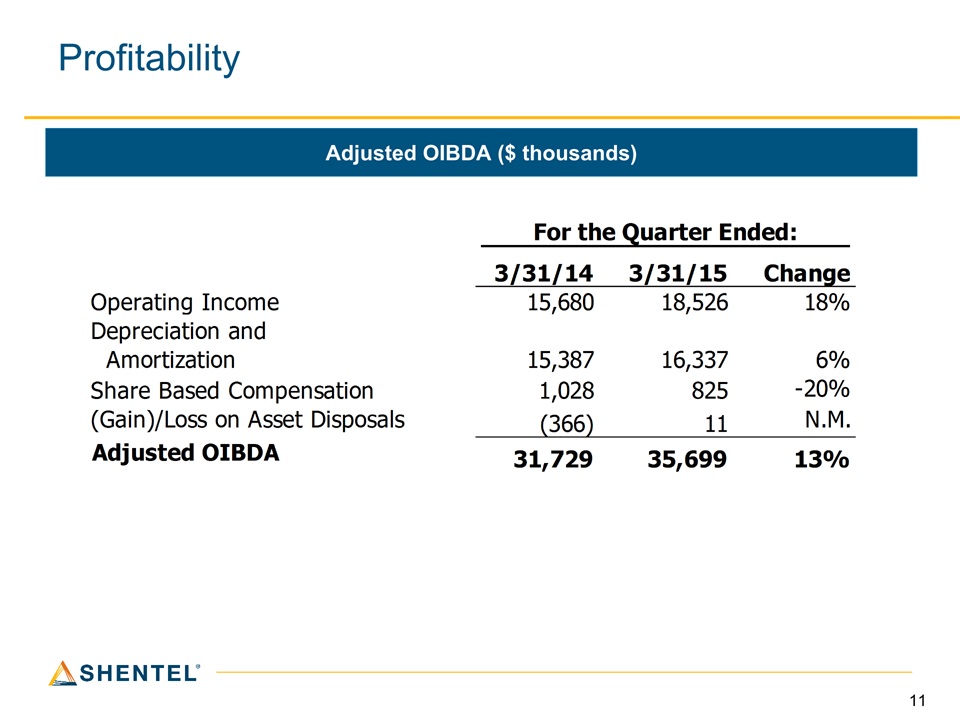

Profitability Adjusted OIBDA ($ thousands)

Profitability Adjusted OIBDA ($ thousands)

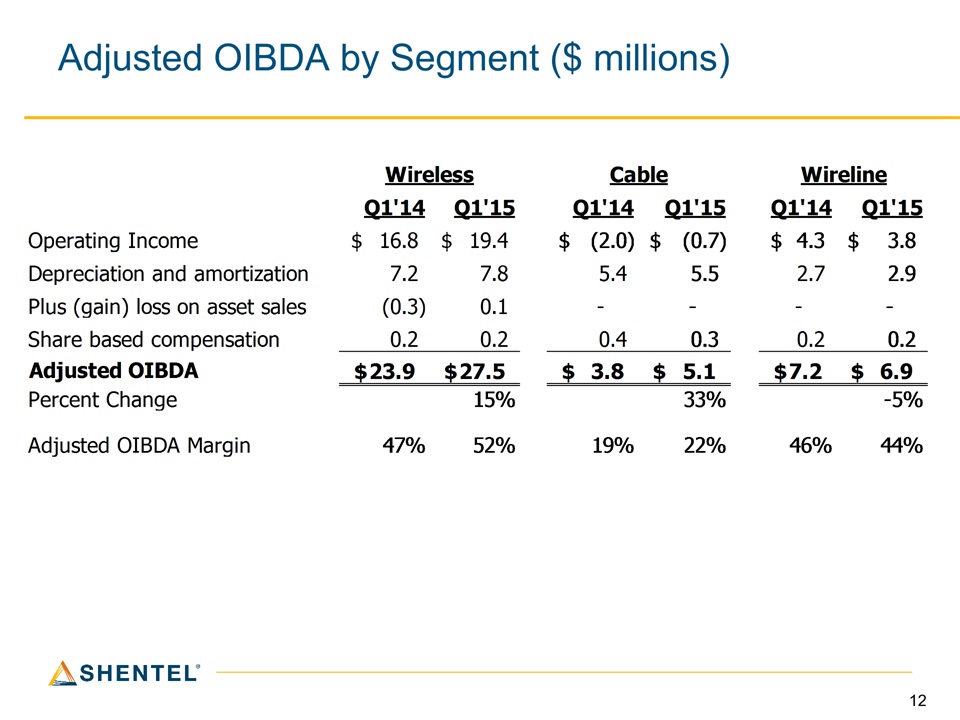

Adjusted OIBDA by Segment ($ millions)

Adjusted OIBDA by Segment ($ millions)

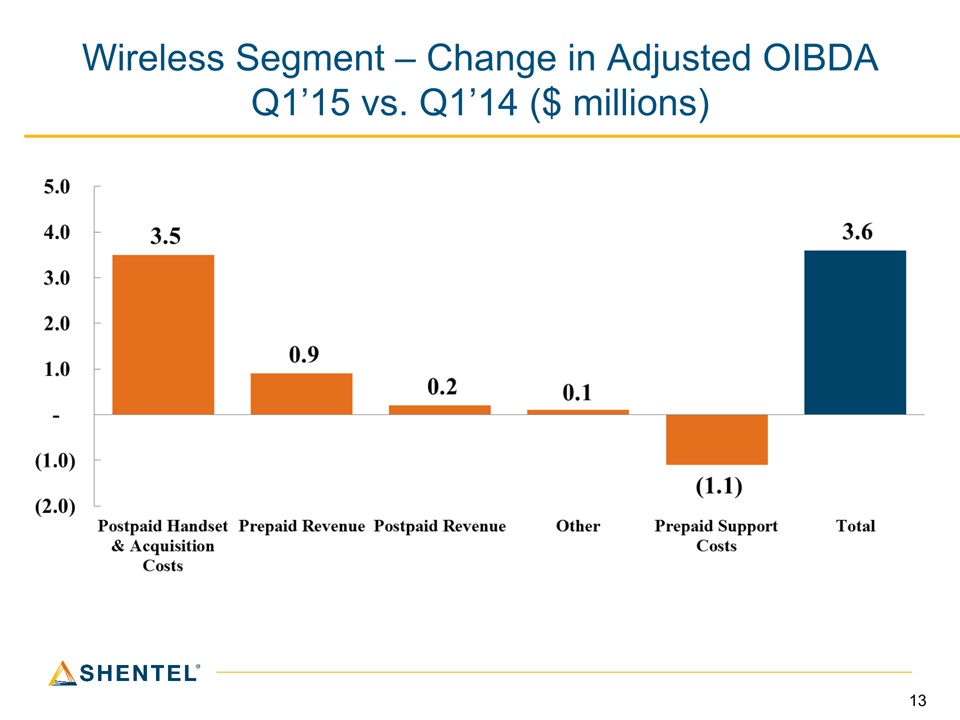

Wireless Segment – Change in Adjusted OIBDA Q1’15 vs. Q1’14 ($ millions)

Wireless Segment – Change in Adjusted OIBDA Q1’15 vs. Q1’14 ($ millions)

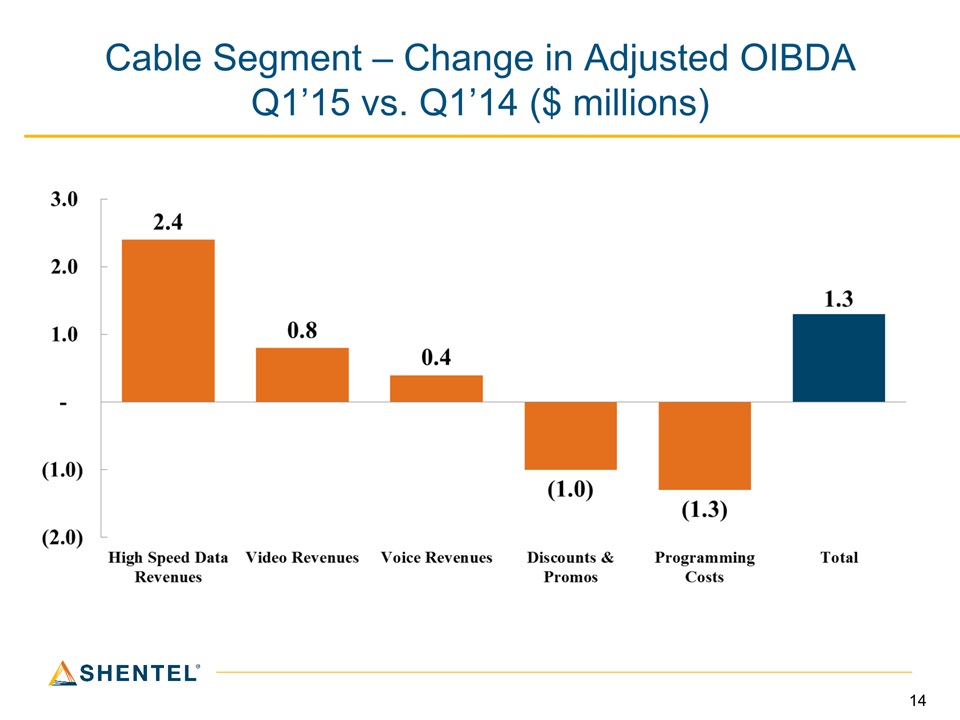

Cable Segment – Change in Adjusted OIBDA Q1’15 vs. Q1’14 ($ millions)

Cable Segment – Change in Adjusted OIBDA Q1’15 vs. Q1’14 ($ millions)

Earle MacKenzieEVP and COO

Earle MacKenzieEVP and COO

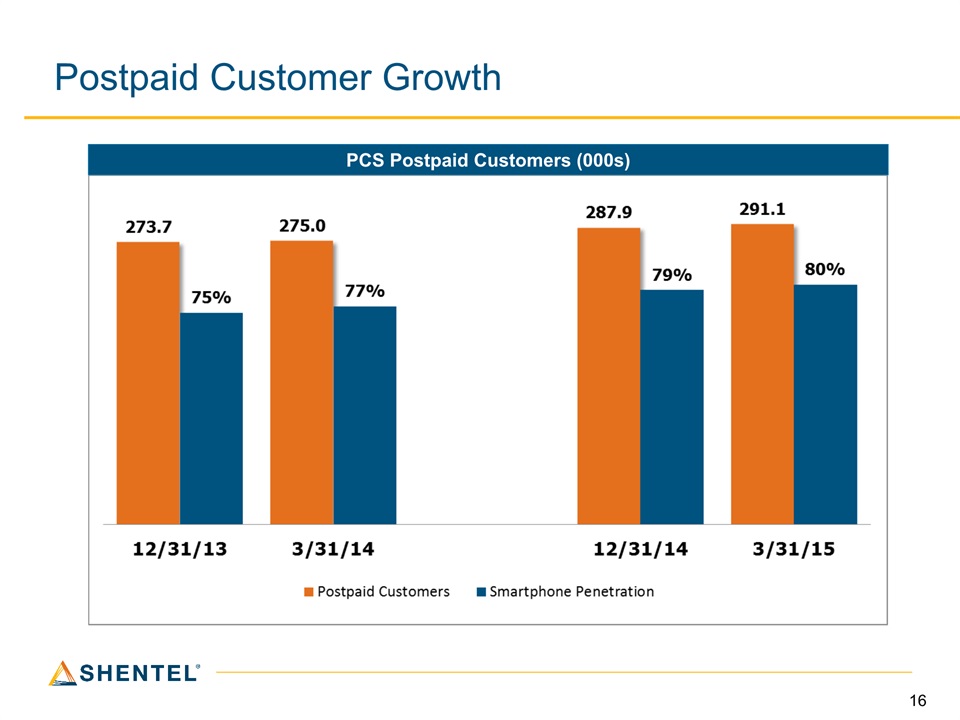

Postpaid Customer Growth PCS Postpaid Customers (000s)

Postpaid Customer Growth PCS Postpaid Customers (000s)

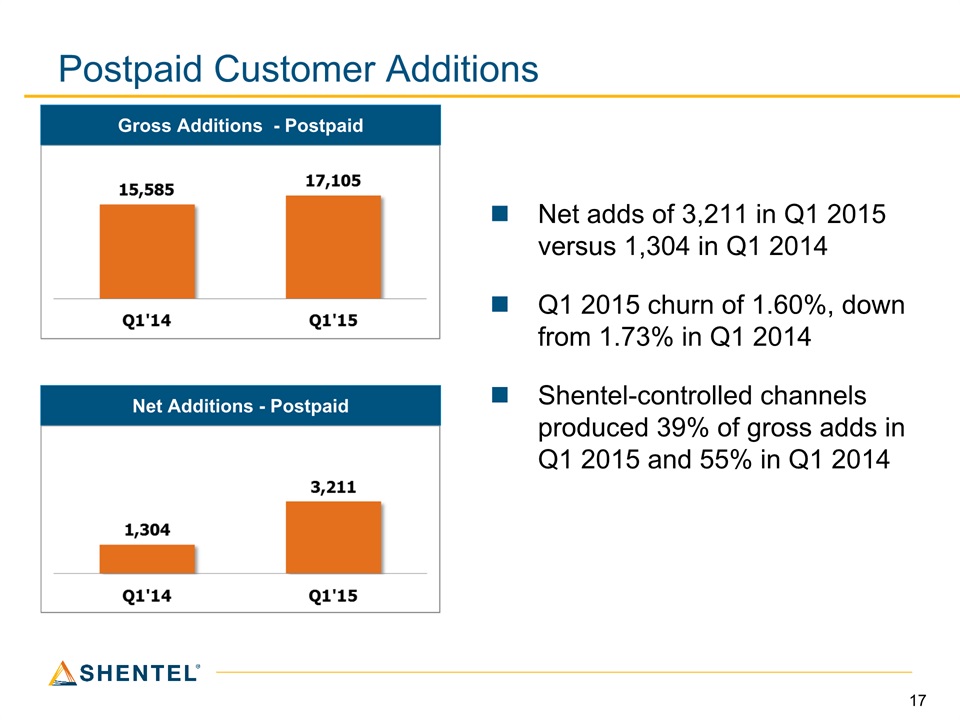

Postpaid Customer Additions Net Additions - Postpaid Gross Additions - Postpaid Net adds of 3,211 in Q1 2015 versus 1,304 in Q1 2014Q1 2015 churn of 1.60%, down from 1.73% in Q1 2014Shentel-controlled channels produced 39% of gross adds in Q1 2015 and 55% in Q1 2014

Postpaid Customer Additions Net Additions - Postpaid Gross Additions - PostpaidNet adds of 3,211 in Q1 2015 versus 1,304 in Q1 2014Q1 2015 churn of 1.60%, down from 1.73% in Q1 2014Shentel-controlled channels produced 39% of gross adds in Q1 2015 and 55% in Q1 2014

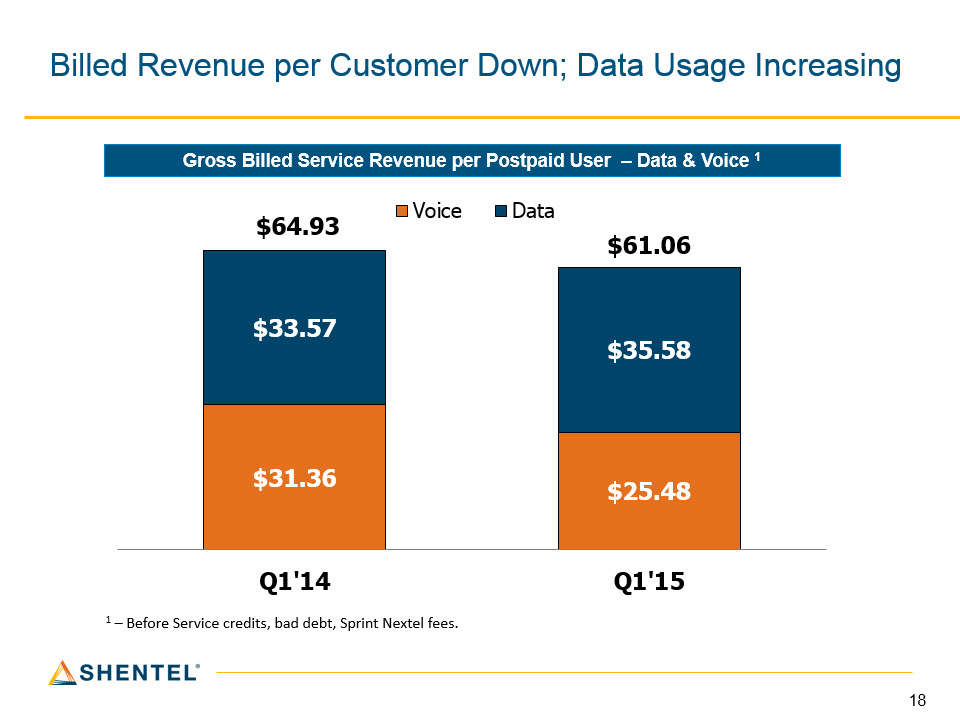

Billed Revenue per Customer Down; Data Usage Increasing Gross Billed Service Revenue per Postpaid User – Data & Voice 1 1 – Before Service credits, bad debt, Sprint Nextel fees.

Billed Revenue per Customer Down; Data Usage Increasing Gross Billed Service Revenue per Postpaid User – Data & Voice 1 1 – Before Service credits, bad debt, Sprint Nextel fees

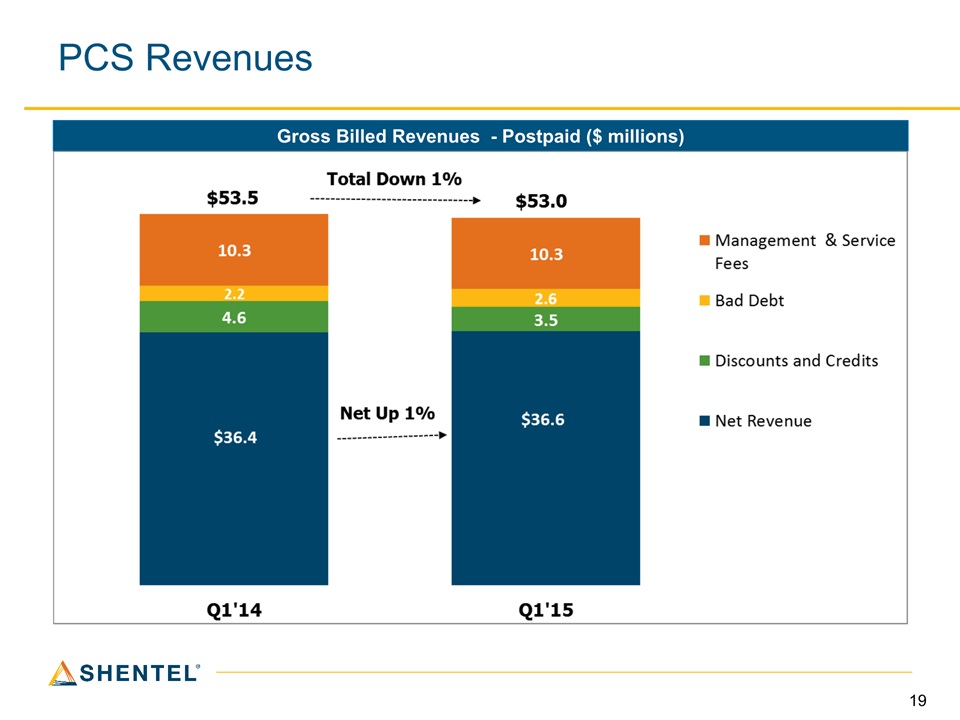

PCS Revenues Gross Billed Revenues - Postpaid ($ millions) *

PCS Revenues Gross Billed Revenues - Postpaid ($ millions)

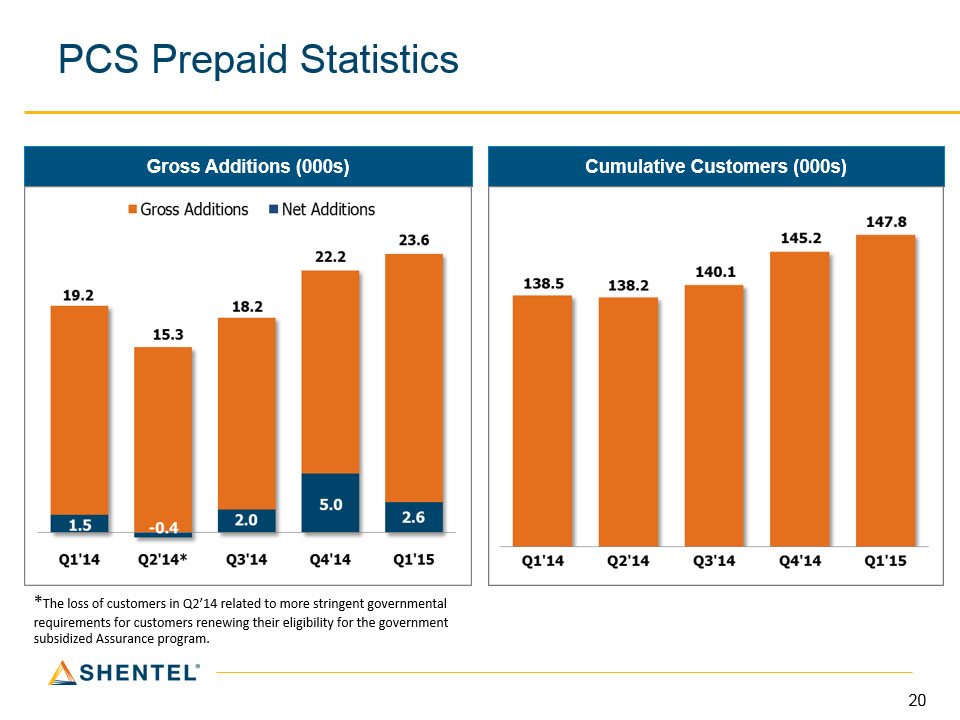

PCS Prepaid Statistics Gross Additions (000s) Cumulative Customers (000s) *The loss of customers in Q2’14 related to more stringent governmental requirements for customers renewing their eligibility for the government subsidized Assurance program.

PCS Prepaid Statistics Gross Additions (000s) Cumulative Customers (000s) *The loss of customers in Q2’14 related to more stringent governmental requirements for customers renewing their eligibility for the government subsidized Assurance program.

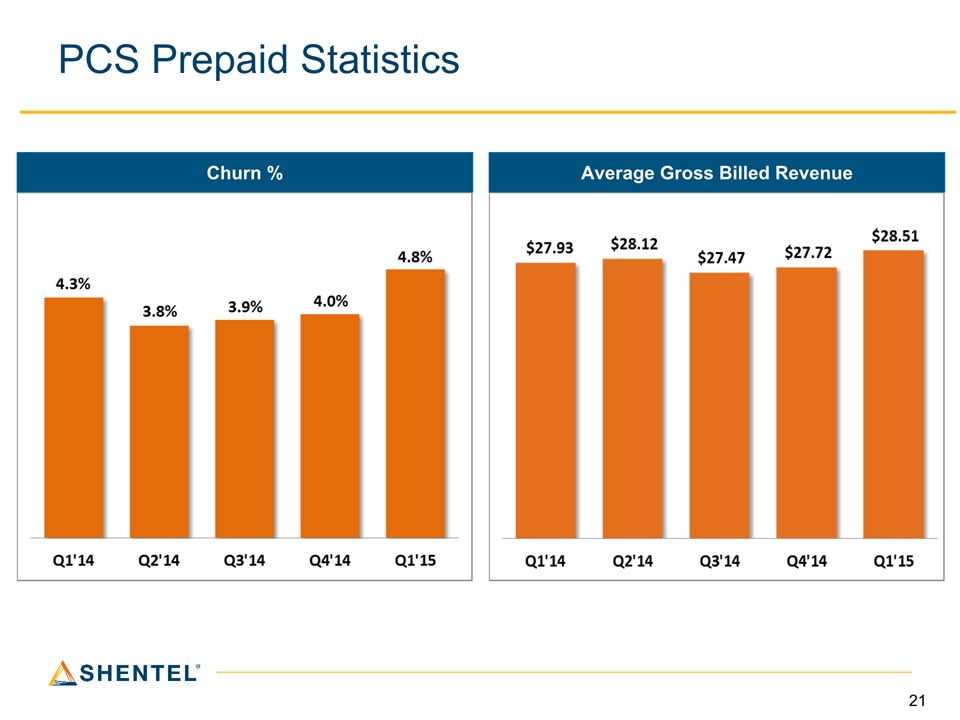

PCS Prepaid Statistics Churn % Average Gross Billed Revenue

PCS Prepaid Statistics Churn % Average Gross Billed Revenue

Network Statistics at 3/31/15 542 Cell Sites95% have a second LTE carrier at 800 MHz126 sites have three carriers, including a second carrier at 1900 MHzTraffic 84% of data traffic is on LTE, with 35% on 800 MHzData usage grew 15% in Q1’15Average speeds of approximately 5 MbpsAverage customer uses approximately 3.8 GB per monthDropped calls - 0.6%Blocked calls - 0.4%

Network Statistics at 3/31/15 542 Cell Sites95% have a second LTE carrier at 800 MHz126 sites have three carriers, including a second carrier at 1900 MHzTraffic 84% of data traffic is on LTE, with 35% on 800 MHzData usage grew 15% in Q1’15Average speeds of approximately 5 MbpsAverage customer uses approximately 3.8 GB per monthDropped calls - 0.6%Blocked calls - 0.4%

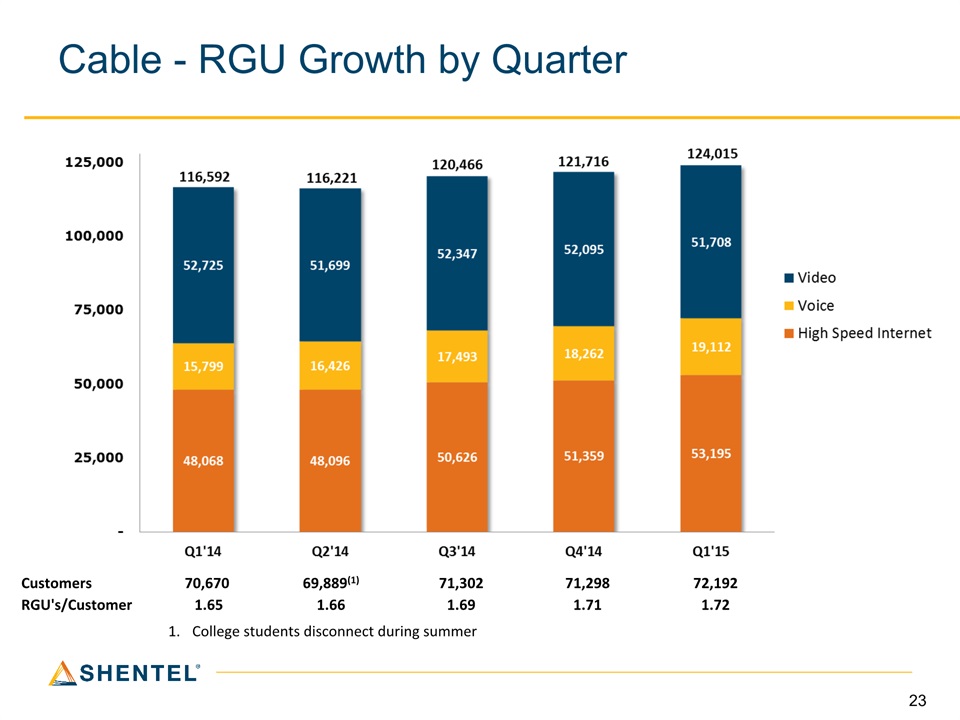

Cable - RGU Growth by Quarter Customers 70,670 69,889(1) 71,302 71,298 72,192 RGU's/Customer 1.65 1.66 1.69 1.71 1.72 College students disconnect during summer

Cable - RGU Growth by QuarterCustomers 70,670 69,889(1)71,30271,29872,192RGU's/Customer 1.65 1.661.691.711.72 College students disconnect during summer

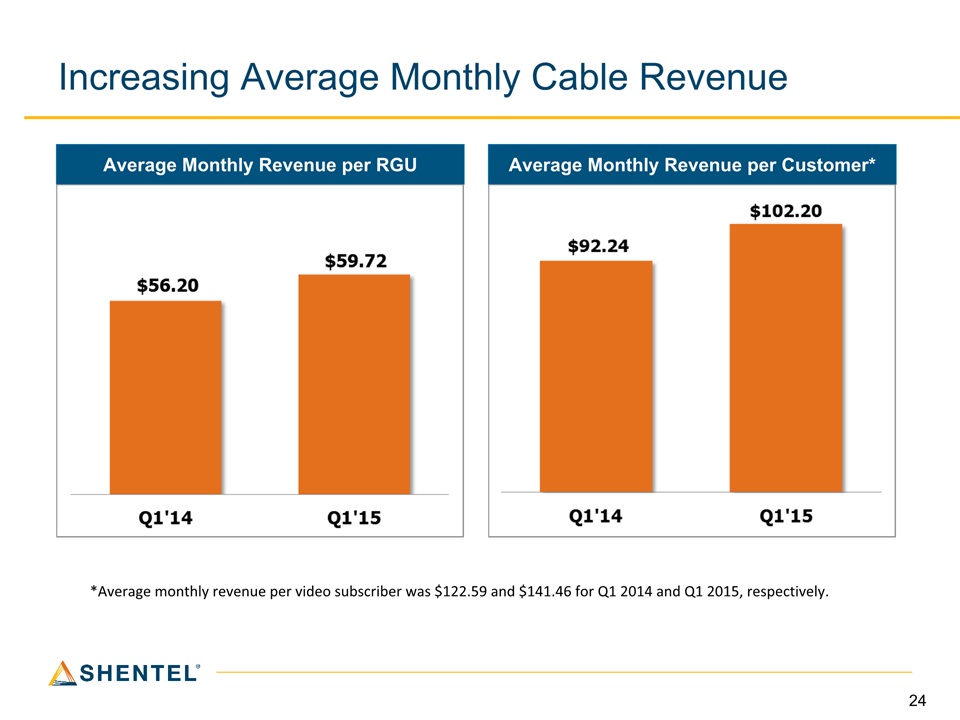

Increasing Average Monthly Cable Revenue Average Monthly Revenue per RGU Average Monthly Revenue per Customer* *Average monthly revenue per video subscriber was $122.59 and $141.46 for Q1 2014 and Q1 2015, respectively.

Increasing Average Monthly Cable Revenue Average Monthly Revenue per RGU Average Monthly Revenue per Customer* *Average monthly revenue per video subscriber was $122.59 and $141.46 for Q1 2014 and Q1 2015, respectively.

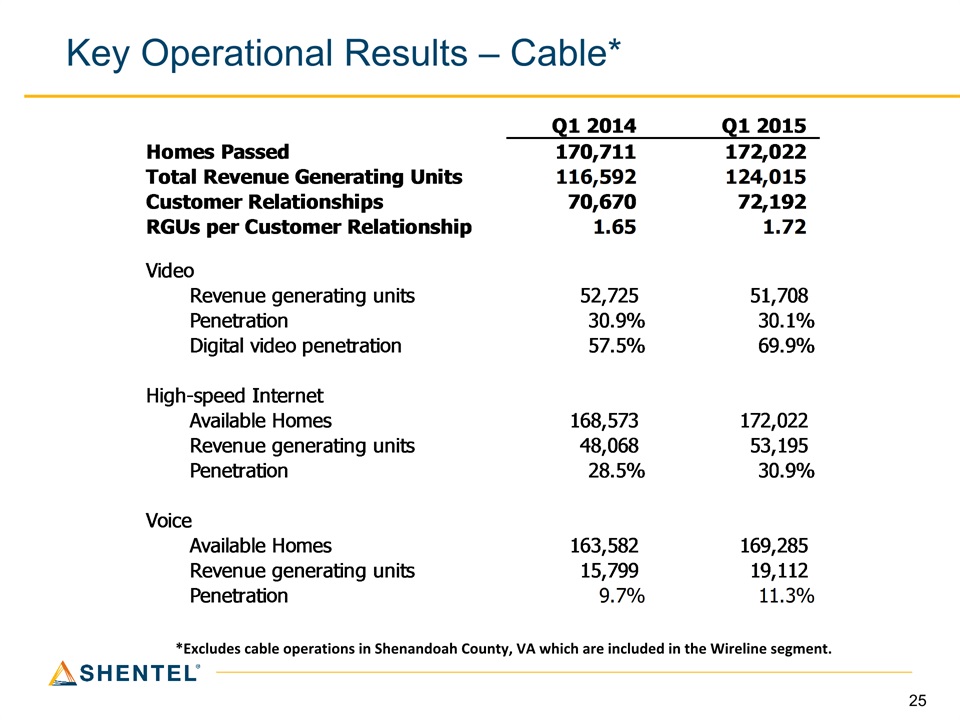

Key Operational Results – Cable* *Excludes cable operations in Shenandoah County, VA which are included in the Wireline segment.

Key Operational Results – Cable* *Excludes cable operations in Shenandoah County, VA which are included in the Wireline segment.

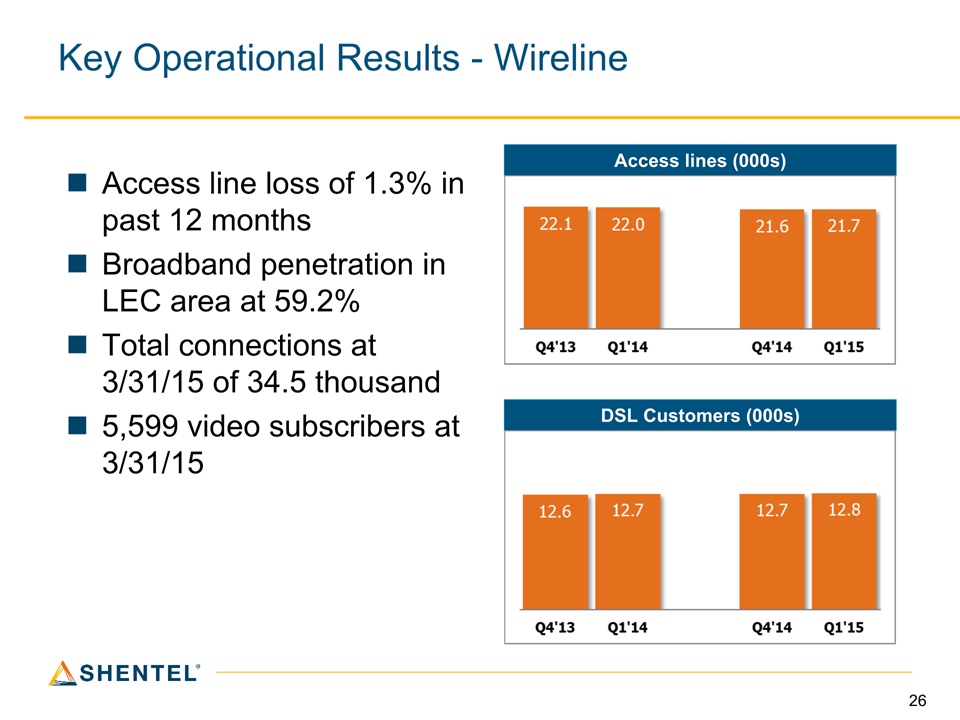

Key Operational Results - Wireline Access line loss of 1.3% in past 12 monthsBroadband penetration in LEC area at 59.2%Total connections at 3/31/15 of 34.5 thousand5,599 video subscribers at 3/31/15 Access lines (000s) DSL Customers (000s)

Key Operational Results - Wireline Access line loss of 1.3% in past 12 monthsBroadband penetration in LEC area at 59.2%Total connections at 3/31/15 of 34.5 thousand5,599 video subscribers at 3/31/15 Access lines (000s) DSL Customers (000s)

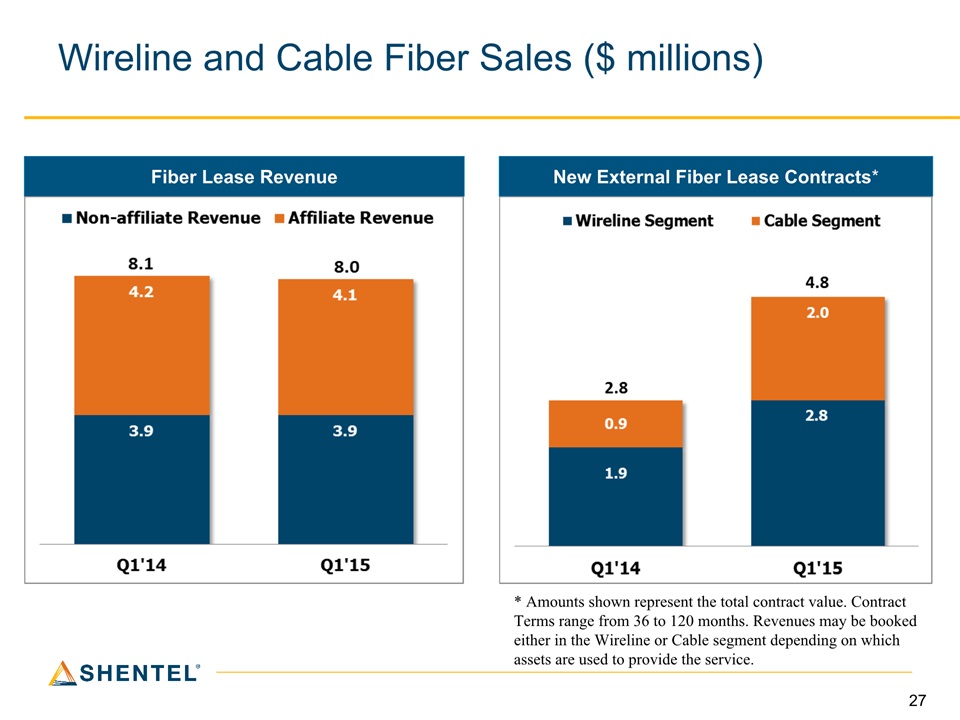

Wireline and Cable Fiber Sales ($ millions) Fiber Lease Revenue New External Fiber Lease Contracts* * Amounts shown represent the total contract value. Contract Terms range from 36 to 120 months. Revenues may be booked either in the Wireline or Cable segment depending on which assets are used to provide the service.

Wireline and Cable Fiber Sales ($ millions) Fiber Lease Revenue New External Fiber Lease Contracts* * Amounts shown represent the total contract value. Contract Terms range from 36 to 120 months. Revenues may be booked either in the Wireline or Cable segment depending on which assets are used to provide the service.

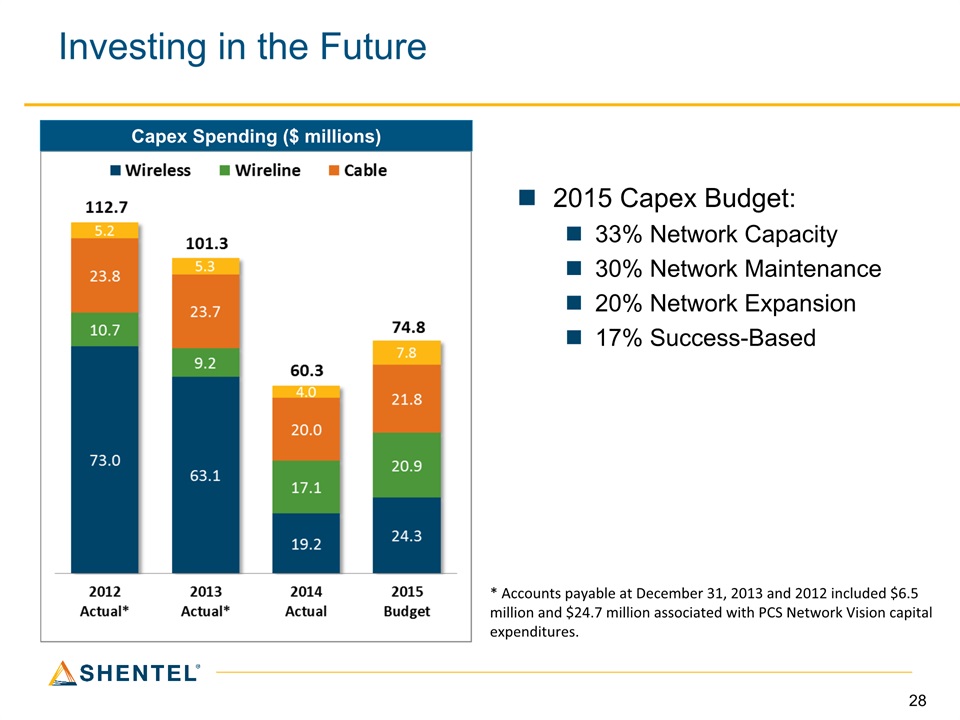

Investing in the Future Capex Spending ($ millions) * Accounts payable at December 31, 2013 and 2012 included $6.5 million and $24.7 million associated with PCS Network Vision capital expenditures. 2015 Capex Budget:33% Network Capacity30% Network Maintenance20% Network Expansion17% Success-Based

Investing in the Future Capex Spending ($ millions) 2015 Capex Budget:33% Network Capacity30% Network Maintenance20% Network Expansion17% Success-Based * Accounts payable at December 31, 2013 and 2012 included $6.5 million and $24.7 million associated with PCS Network Vision capital expenditures.

Q&A

Q&A

Appendix

Appendix

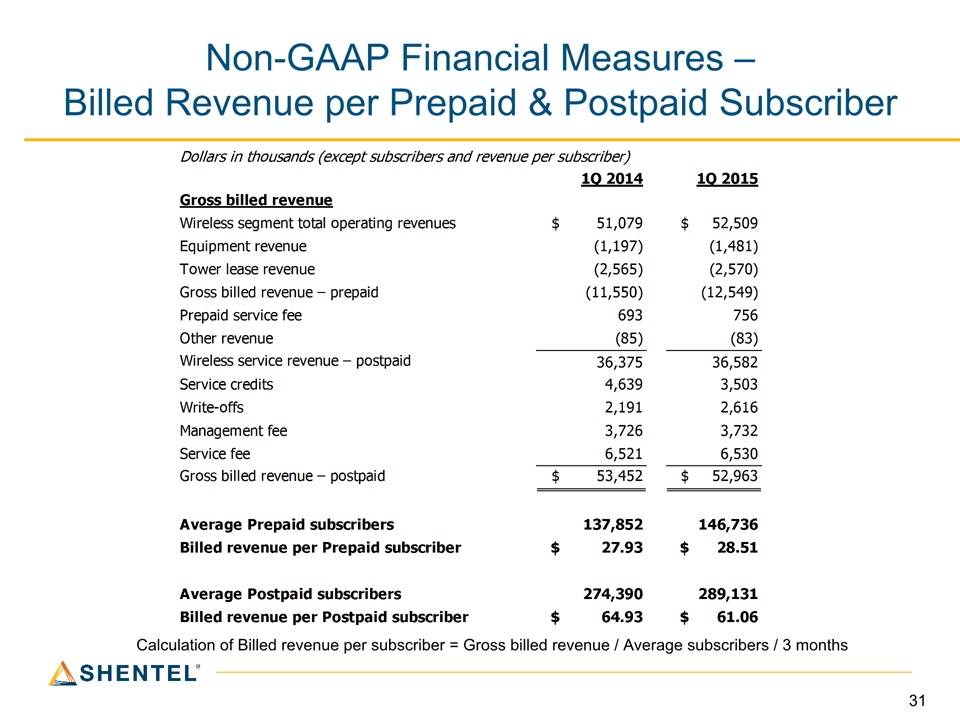

Non-GAAP Financial Measures – Billed Revenue per Prepaid & Postpaid Subscriber Calculation of Billed revenue per subscriber = Gross billed revenue / Average subscribers / 3 months

Non-GAAP Financial Measures – Billed Revenue per Prepaid & Postpaid Subscriber Calculation of Billed revenue per subscriber = Gross billed revenue / Average subscribers / 3 months

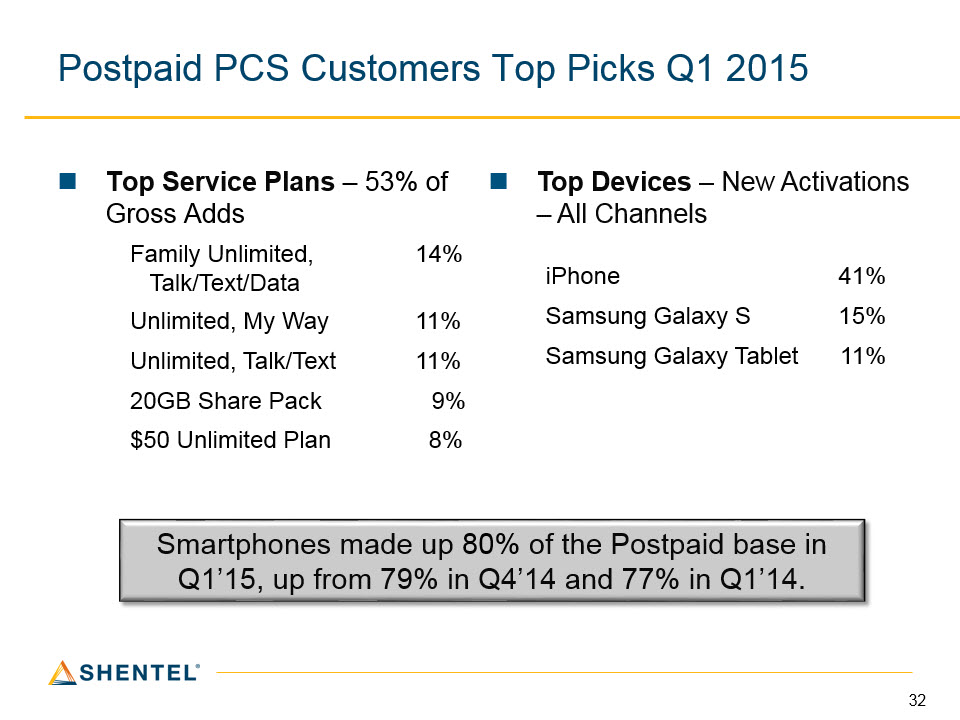

Postpaid PCS Customers Top Picks Q1 2015 Top Service Plans – 53% of Gross Adds Top Devices – New Activations – All Channels Family Unlimited, Talk/Text/Data 14% Unlimited, My Way 11% Unlimited, Talk/Text 11% 20GB Share Pack 9% $50 Unlimited Plan 8% iPhone 41% Samsung Galaxy S 15% Samsung Galaxy Tablet 11% Smartphones made up 80% of the Postpaid base in Q1’15, up from 79% in Q4’14 and 77% in Q1’14.

Postpaid PCS Customers Top Picks Q1 2015Top Service Plans – 53% of Gross AddsFamily Unlimited, Talk/Text/Data 14%Unlimited, My Way 11%Unlimited, Talk/Text11%20GB Share Pack 9%$50 Unlimited Plan 8%Top Devices – New Activations – All ChannelsiPhone 41%Samsung Galaxy S15%Samsung Galaxy Tablet11% Smartphones made up 80% of the Postpaid base in Q1’15, up from 79% in Q4’14 and 77% in Q1’14.

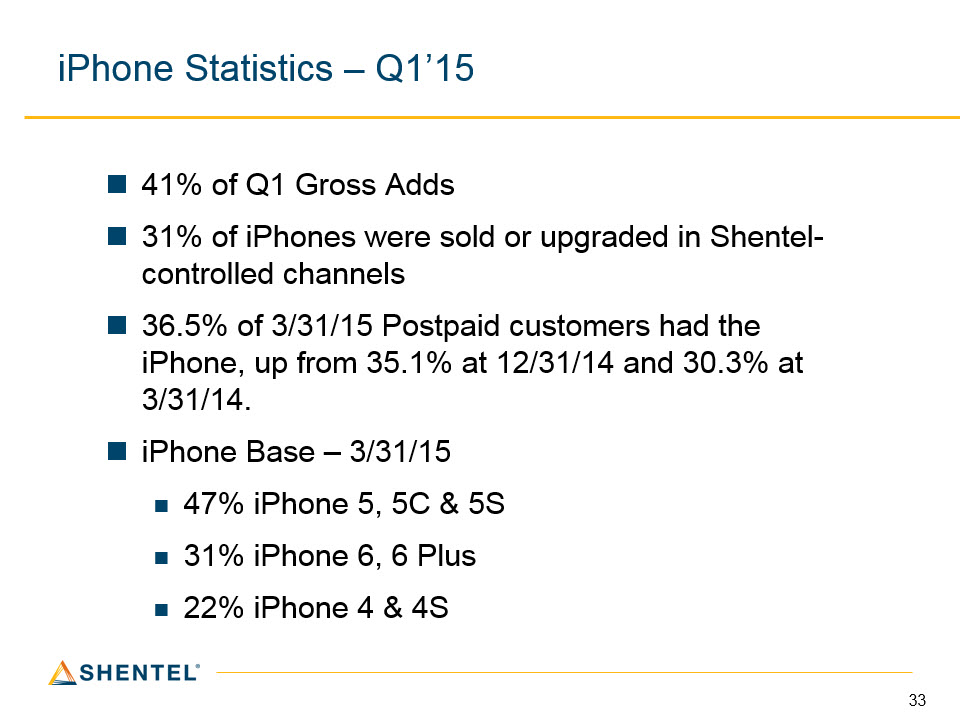

iPhone Statistics – Q1’15 41% of Q1 Gross Adds31% of iPhones were sold or upgraded in Shentel-controlled channels36.5% of 3/31/15 Postpaid customers had the iPhone, up from 35.1% at 12/31/14 and 30.3% at 3/31/14.iPhone Base – 3/31/1547% iPhone 5, 5C & 5S31% iPhone 6, 6 Plus22% iPhone 4 & 4S

iPhone Statistics – Q1’15 41% of Q1 Gross Adds31% of iPhones were sold or upgraded in Shentel-controlled channels36.5% of 3/31/15 Postpaid customers had the iPhone, up from 35.1% at 12/31/14 and 30.3% at 3/31/14.iPhone Base – 3/31/1547% iPhone 5, 5C & 5S31% iPhone 6, 6 Plus22% iPhone 4 & 4S

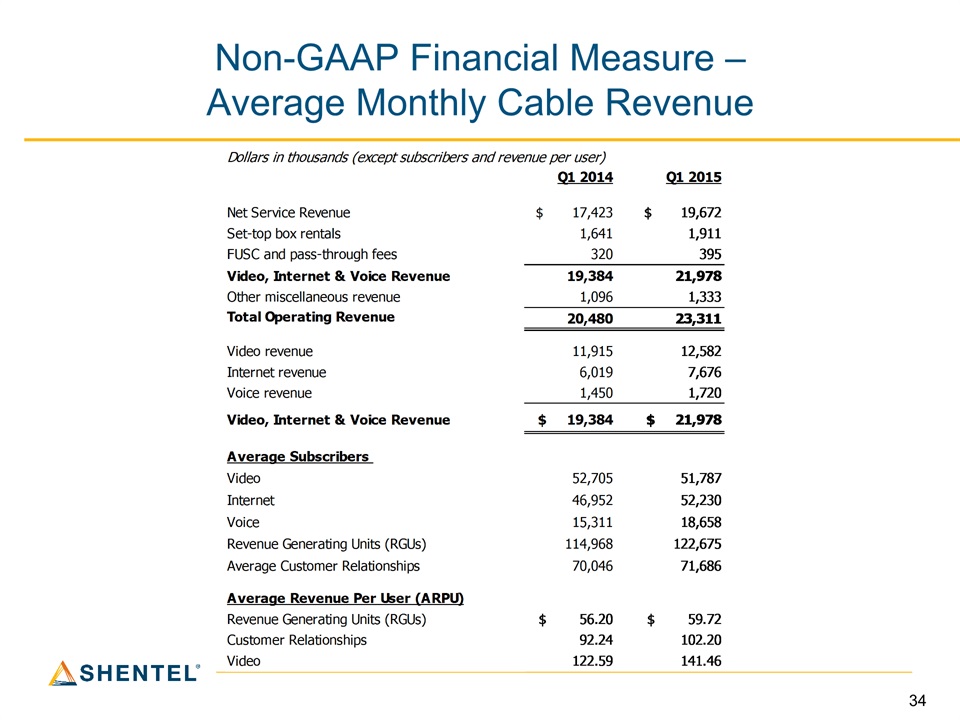

Non-GAAP Financial Measure – Average Monthly Cable Revenue

Non-GAAP Financial Measure – Average Monthly Cable Revenue

Key Operational Results – Mobile Company Mobile Tower Revenue ($ millions) Towers and Leases

Key Operational Results – Mobile Company Towers and Leases Mobile Tower Revenue ($ millions)