Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CenterState Bank Corp | csfl-8k_20150504.htm |

Gulf South Bank Conference New Orleans May 4, 2015 Exhibit 99.1

This presentation contains forward-looking statements, as defined by Federal Securities Laws, relating to present or future trends or factors affecting the operations, markets and products of CenterState Banks, Inc. (CSFL). These statements are provided to assist in the understanding of future financial performance. Any such statements are based on current expectations and involve a number of risks and uncertainties. For a discussion of factors that may cause such forward-looking statements to differ materially from actual results, please refer to CSFL’s most recent Form 10-Q and Form 10-K filed with the Securities Exchange Commission. CSFL undertakes no obligation to release revisions to these forward-looking statements or reflect events or circumstances after the date of this presentation. Forward Looking Statement

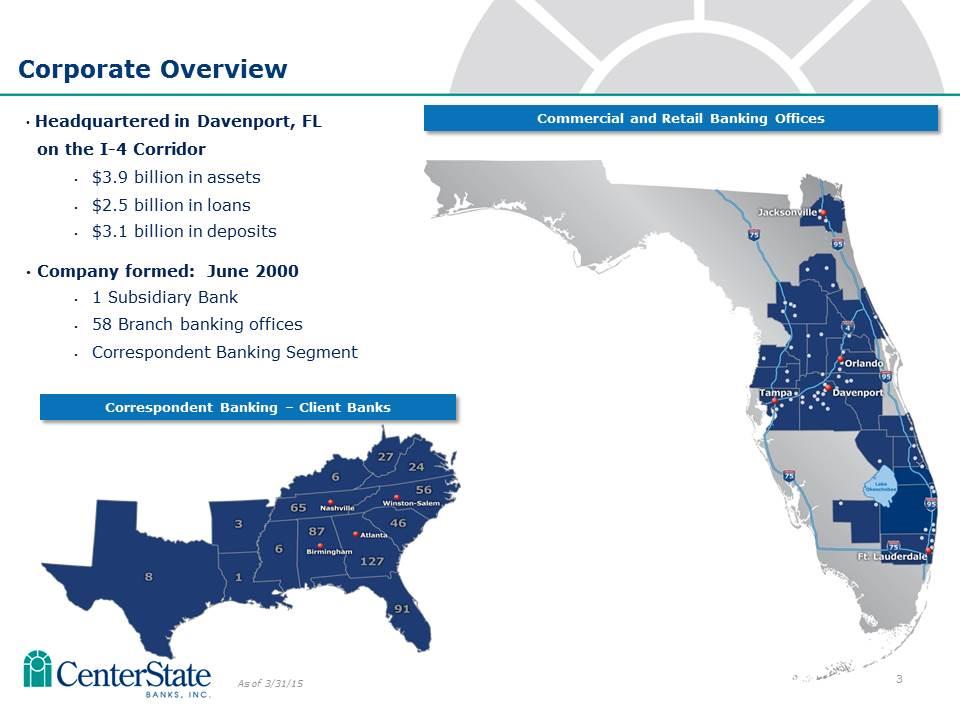

Correspondent Banking – Client Banks As of 3/31/15 Headquartered in Davenport, FL on the I-4 Corridor $3.9 billion in assets $2.5 billion in loans $3.1 billion in deposits Company formed: June 2000 1 Subsidiary Bank 58 Branch banking offices Correspondent Banking Segment Corporate Overview Commercial and Retail Banking Offices

Banking the Sunshine State

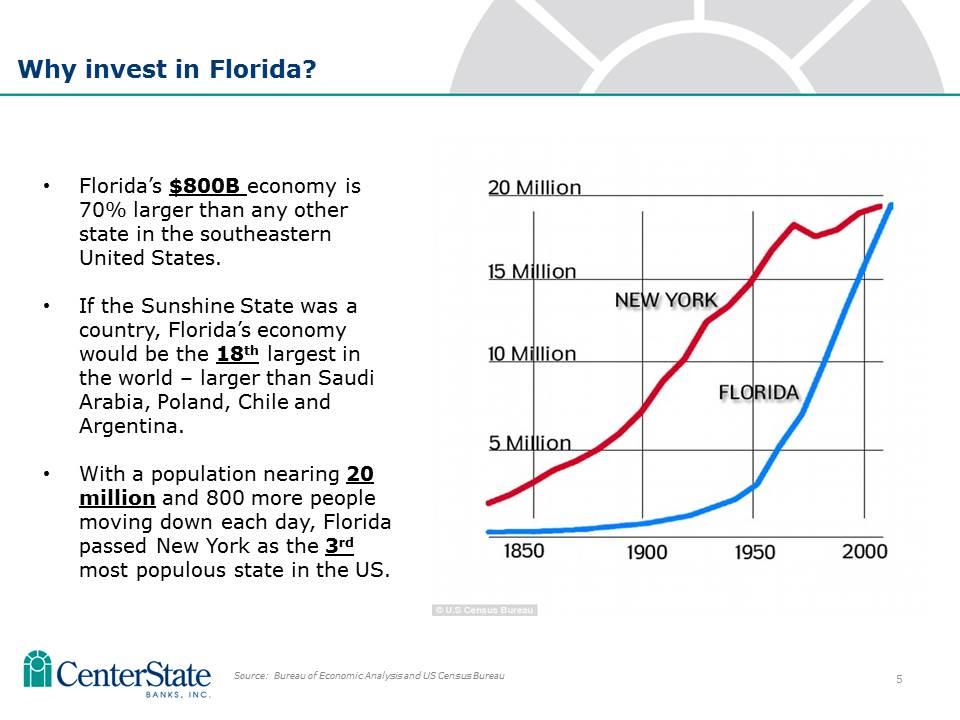

Florida’s $800B economy is 70% larger than any other state in the southeastern United States. If the Sunshine State was a country, Florida’s economy would be the 18th largest in the world – larger than Saudi Arabia, Poland, Chile and Argentina. With a population nearing 20 million and 800 more people moving down each day, Florida passed New York as the 3rd most populous state in the US. Why invest in Florida? Source: Bureau of Economic Analysis and US Census Bureau

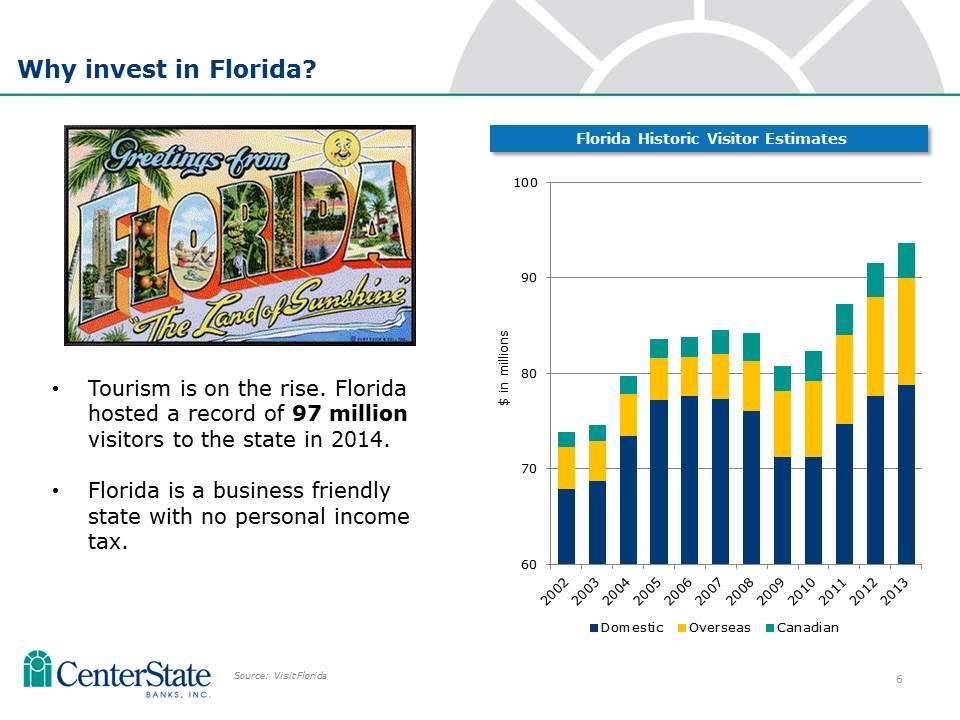

Tourism is on the rise. Florida hosted a record of 97 million visitors to the state in 2014. Florida is a business friendly state with no personal income tax. Why invest in Florida? Source: Visit Florida Florida Historic Visitor Estimates $ in millions

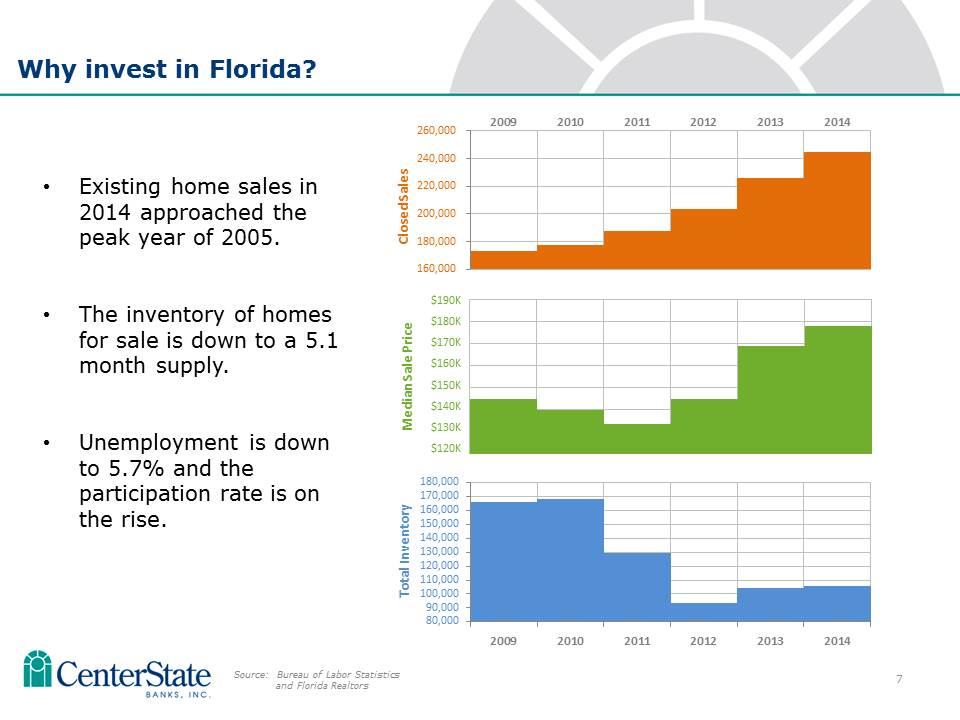

Existing home sales in 2014 approached the peak year of 2005. The inventory of homes for sale is down to a 5.1 month supply. Unemployment is down to 5.7% and the participation rate is on the rise. Why invest in Florida? Source: Bureau of Labor Statistics and Florida Realtors Median Sale Price $190K $180K $170K $160K $150K $140K $130K $120K

Earnings The Catalysts Ahead

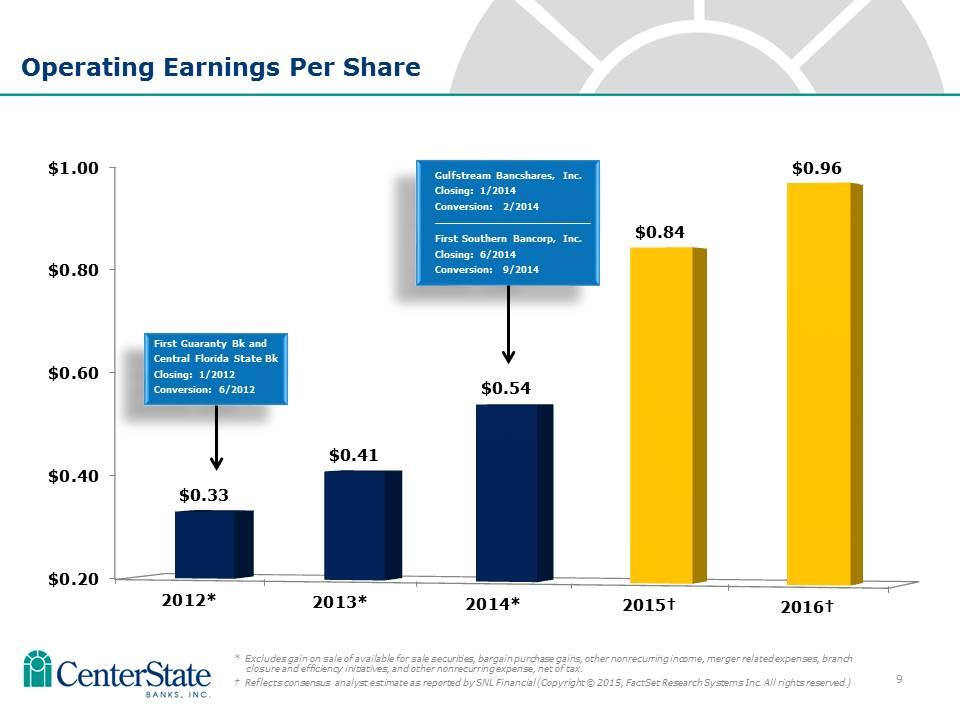

Operating Earnings Per Share First Guaranty Bk and Central Florida State Bk Closing: 1/2012 Conversion: 6/2012 Gulfstream Bancshares, Inc. Closing: 1/2014 Conversion: 2/2014 ____________________ First Southern Bancorp, Inc. Closing: 6/2014 Conversion: 9/2014 * Excludes gain on sale of available for sale securities, bargain purchase gains, other nonrecurring income, merger related expenses, branch closure and efficiency initiatives, and other nonrecurring expense, net of tax. † Reflects consensus analyst estimate as reported by SNL Financial (Copyright © 2015, FactSet Research Systems Inc. All rights reserved.)

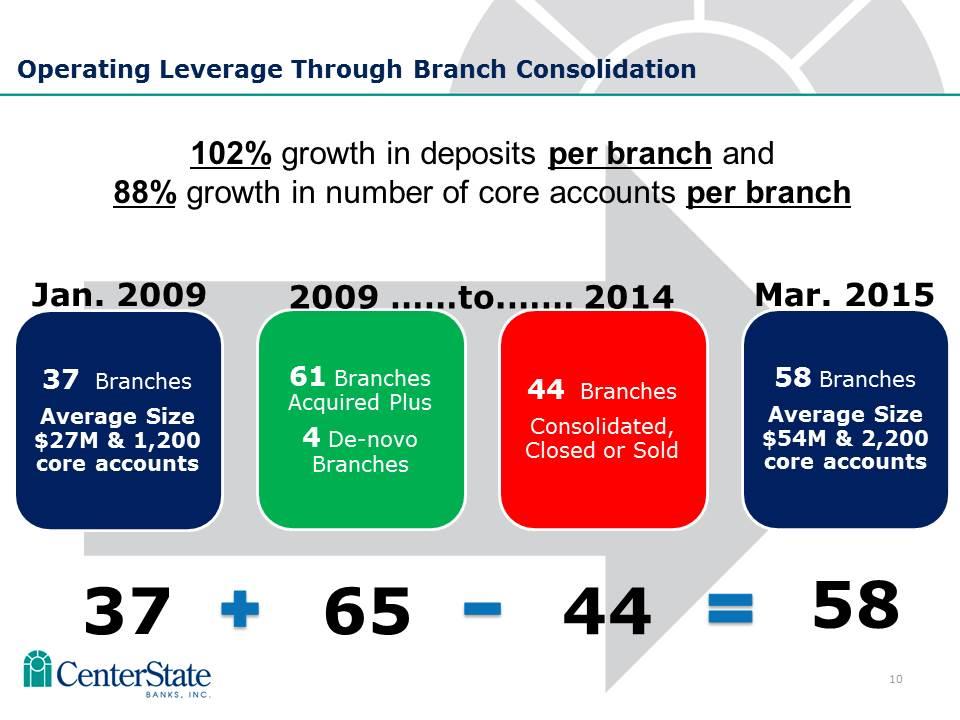

Operating Leverage Through Branch Consolidation 102% growth in deposits per branch and 88% growth in number of core accounts per branch 37 65 44 58 Jan. 2009 2009 ……to.…… 2014 Mar. 2015

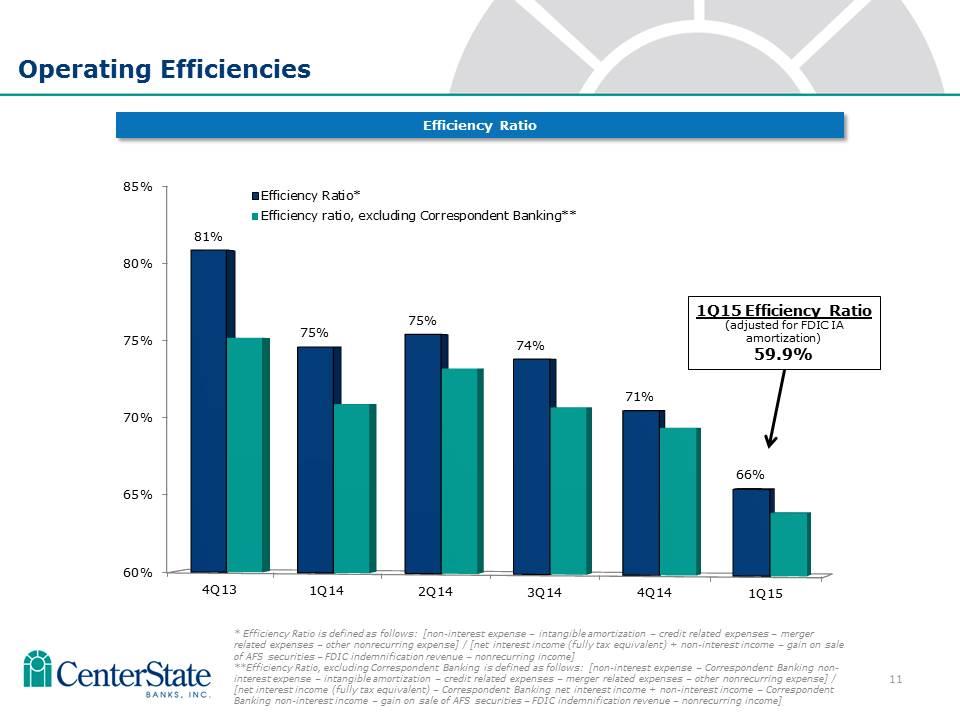

10 Efficiency Ratio Operating Efficiencies * Efficiency Ratio is defined as follows: [non-interest expense – intangible amortization – credit related expenses – merger related expenses – other nonrecurring expense] / [net interest income (fully tax equivalent) + non-interest income – gain on sale of AFS securities – FDIC indemnification revenue – nonrecurring income] **Efficiency Ratio, excluding Correspondent Banking is defined as follows: [non-interest expense – Correspondent Banking non-interest expense – intangible amortization – credit related expenses – merger related expenses – other nonrecurring expense] / [net interest income (fully tax equivalent) – Correspondent Banking net interest income + non-interest income – Correspondent Banking non-interest income – gain on sale of AFS securities – FDIC indemnification revenue – nonrecurring income] 1Q15 Efficiency Ratio (adjusted for FDIC IA amortization) 59.9%

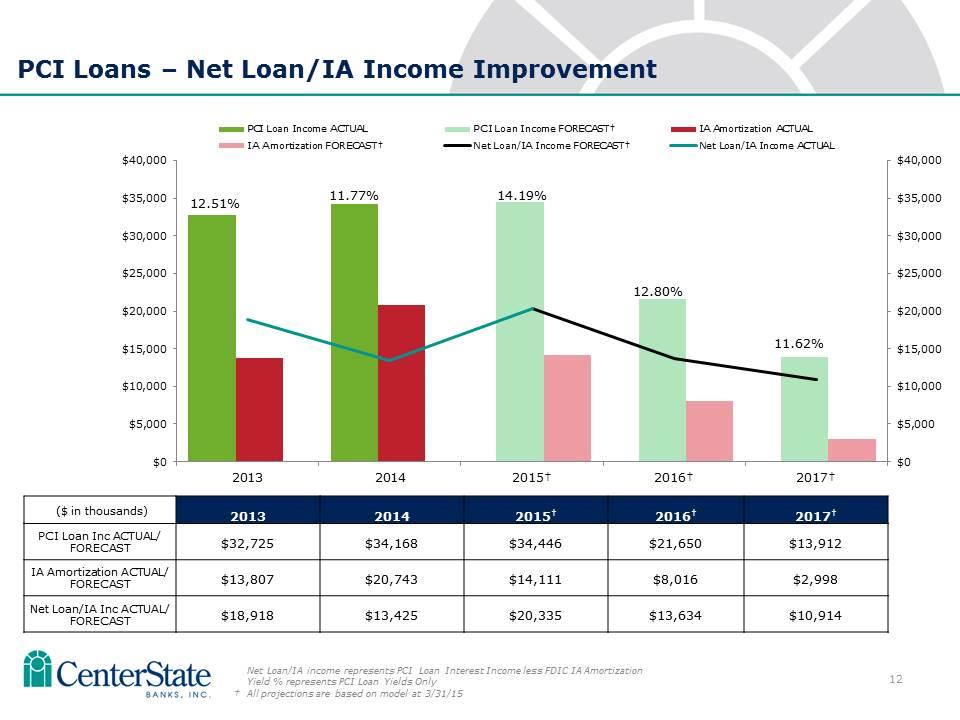

PCI Loans – Net Loan/IA Income Improvement Net Loan/IA income represents PCI Loan Interest Income less FDIC IA Amortization Yield % represents PCI Loan Yields Only † All projections are based on model at 3/31/15 ($ in thousands) 2013 2014 2015† 2016† 2017† PCI Loan Inc ACTUAL/ FORECAST $32,725 $34,168 $34,446 $21,650 $13,912 IA Amortization ACTUAL/ FORECAST $13,807 $20,743 $14,111 $8,016 $2,998 Net Loan/IA Inc ACTUAL/ FORECAST $18,918 $13,425 $20,335 $13,634 $10,914

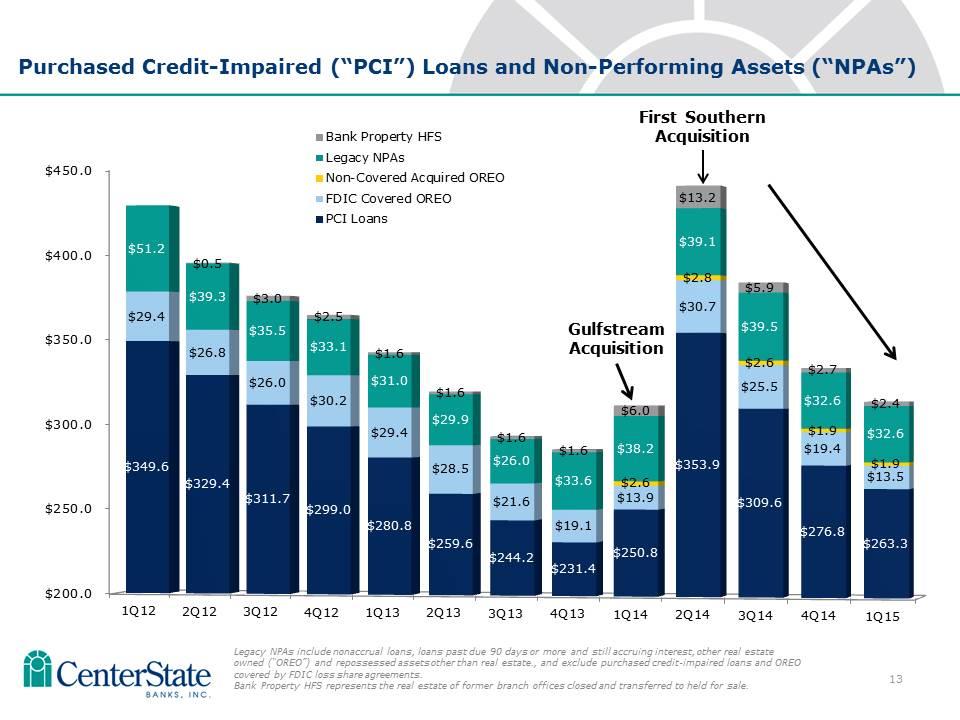

Purchased Credit-Impaired (“PCI”) Loans and Non-Performing Assets (“NPAs”) Gulfstream Acquisition First Southern Acquisition Legacy NPAs include nonaccrual loans, loans past due 90 days or more and still accruing interest, other real estate owned (“OREO”) and repossessed assets other than real estate., and exclude purchased credit-impaired loans and OREO covered by FDIC loss share agreements. Bank Property HFS represents the real estate of former branch offices closed and transferred to held for sale.

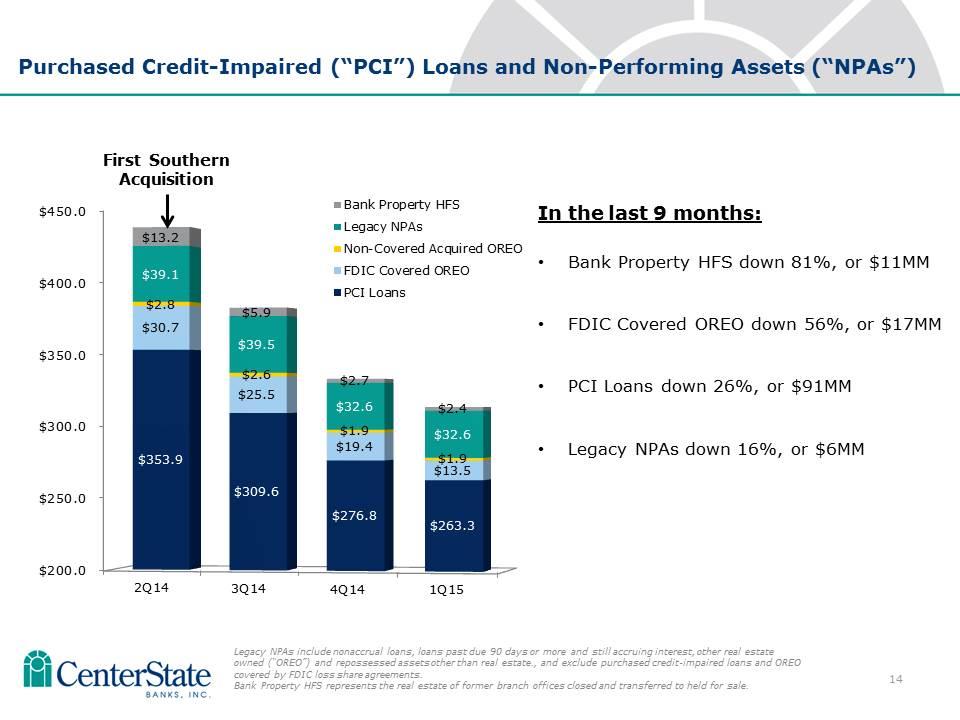

Purchased Credit-Impaired (“PCI”) Loans and Non-Performing Assets (“NPAs”) First Southern Acquisition In the last 9 months: Bank Property HFS down 81%, or $11MM FDIC Covered OREO down 56%, or $17MM PCI Loans down 26%, or $91MM Legacy NPAs down 16%, or $6MM Legacy NPAs include nonaccrual loans, loans past due 90 days or more and still accruing interest, other real estate owned (“OREO”) and repossessed assets other than real estate., and exclude purchased credit-impaired loans and OREO covered by FDIC loss share agreements. Bank Property HFS represents the real estate of former branch offices closed and transferred to held for sale.

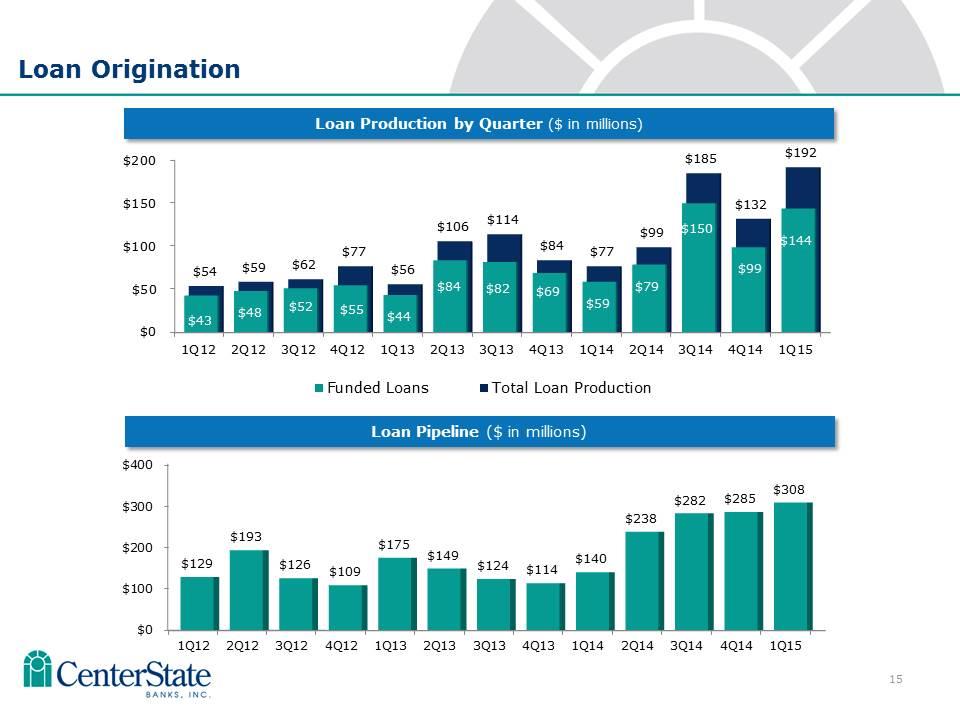

Loan Origination Loan Production by Quarter ($ in millions) Loan Pipeline ($ in millions)

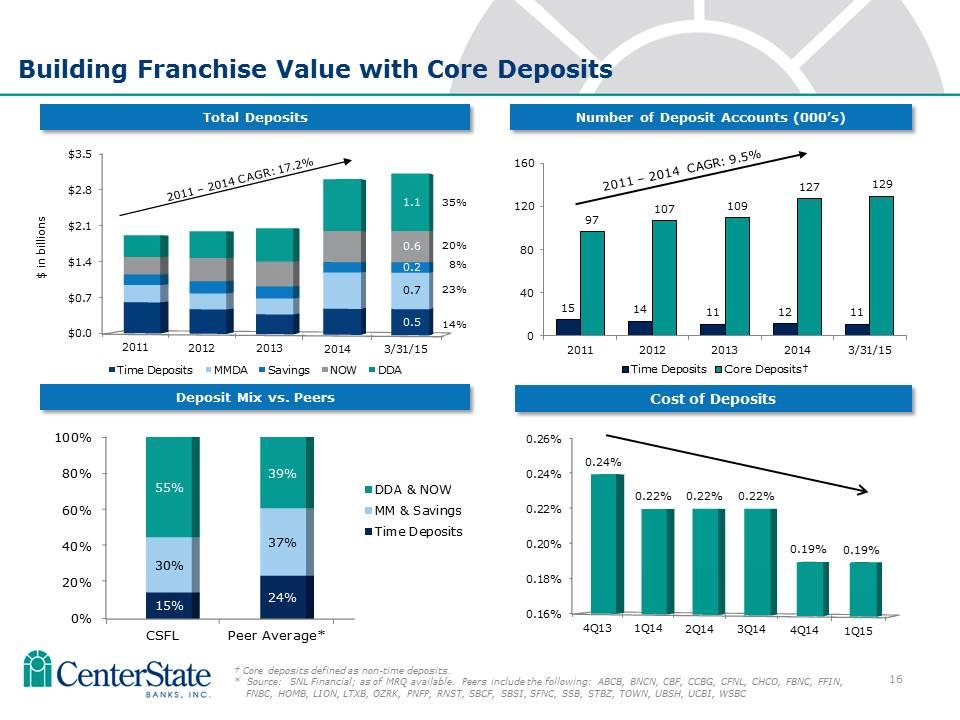

20% 8% 23% 14% 35% Total Deposits Number of Deposit Accounts (000’s) Building Franchise Value with Core Deposits Cost of Deposits 2011 – 2014 CAGR: 9.5% 2011 – 2014 CAGR: 17.2% Deposit Mix vs. Peers † Core deposits defined as non-time deposits. * Source: SNL Financial; as of MRQ available. Peers include the following: ABCB, BNCN, CBF, CCBG, CFNL, CHCO, FBNC, FFIN, FNBC, HOMB, LION, LTXB, OZRK, PNFP, RNST, SBCF, SBSI, SFNC, SSB, STBZ, TOWN, UBSH, UCBI, WSBC

M&A / Capital Allocation

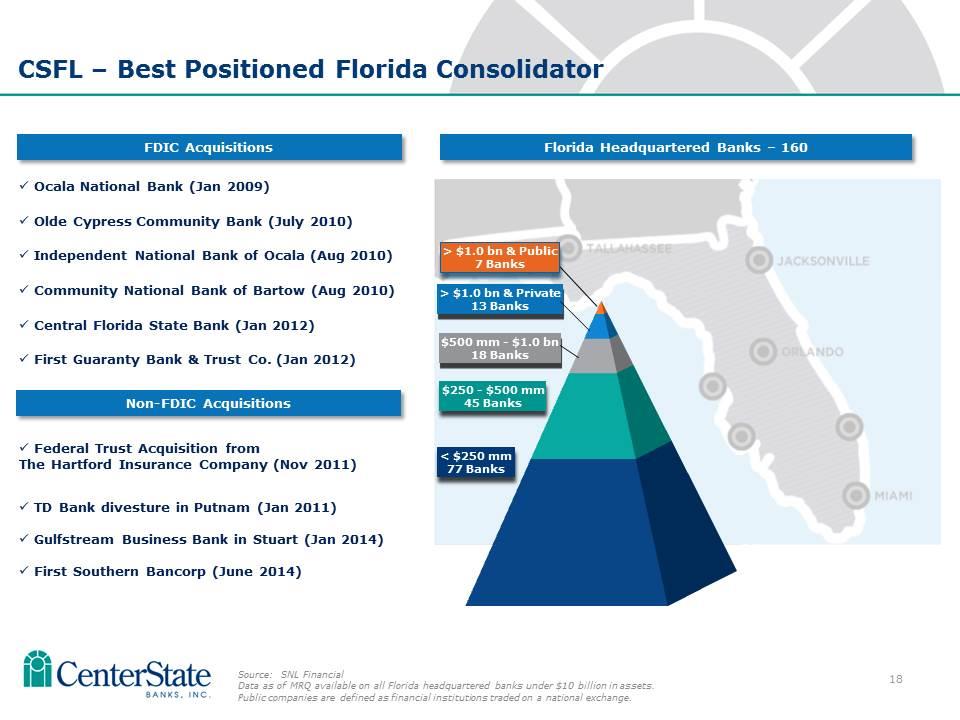

18 CSFL – Best Positioned Florida Consolidator Source: SNL Financial Data as of MRQ available on all Florida headquartered banks under $10 billion in assets. Public companies are defined as financial institutions traded on a national exchange. Ocala National Bank (Jan 2009) Olde Cypress Community Bank (July 2010) Independent National Bank of Ocala (Aug 2010) Community National Bank of Bartow (Aug 2010) Central Florida State Bank (Jan 2012) First Guaranty Bank & Trust Co. (Jan 2012) Federal Trust Acquisition from The Hartford Insurance Company (Nov 2011) TD Bank divesture in Putnam (Jan 2011) Gulfstream Business Bank in Stuart (Jan 2014) First Southern Bancorp (June 2014) FDIC Acquisitions Non-FDIC Acquisitions Florida Headquartered Banks – 160

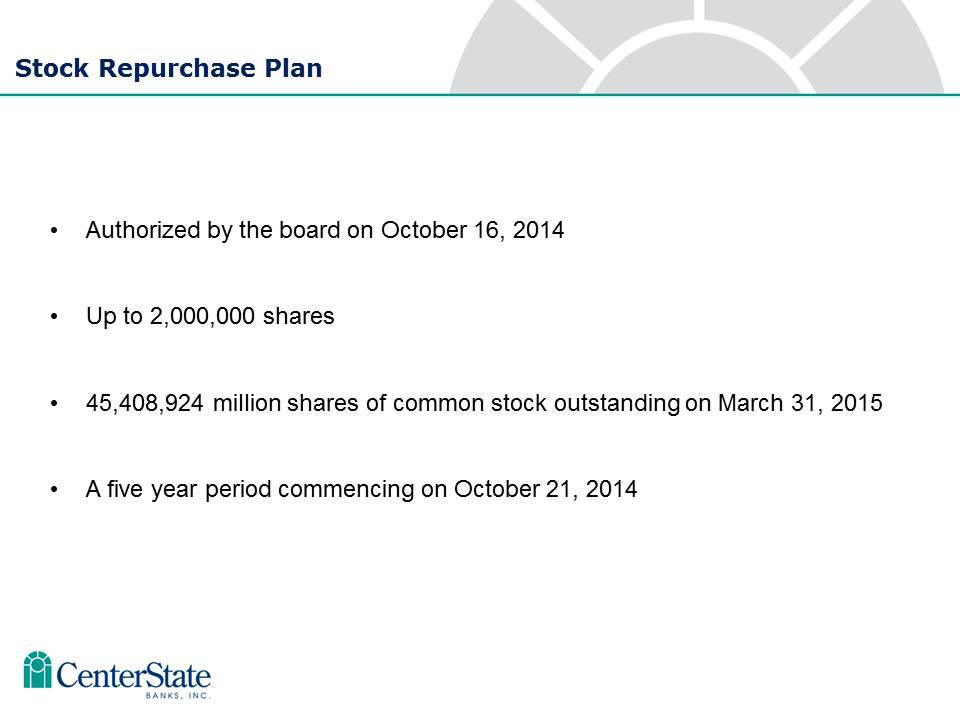

Stock Repurchase Plan Authorized by the board on October 16, 2014 Up to 2,000,000 shares 45,408,924 million shares of common stock outstanding on March 31, 2015 A five year period commencing on October 21, 2014

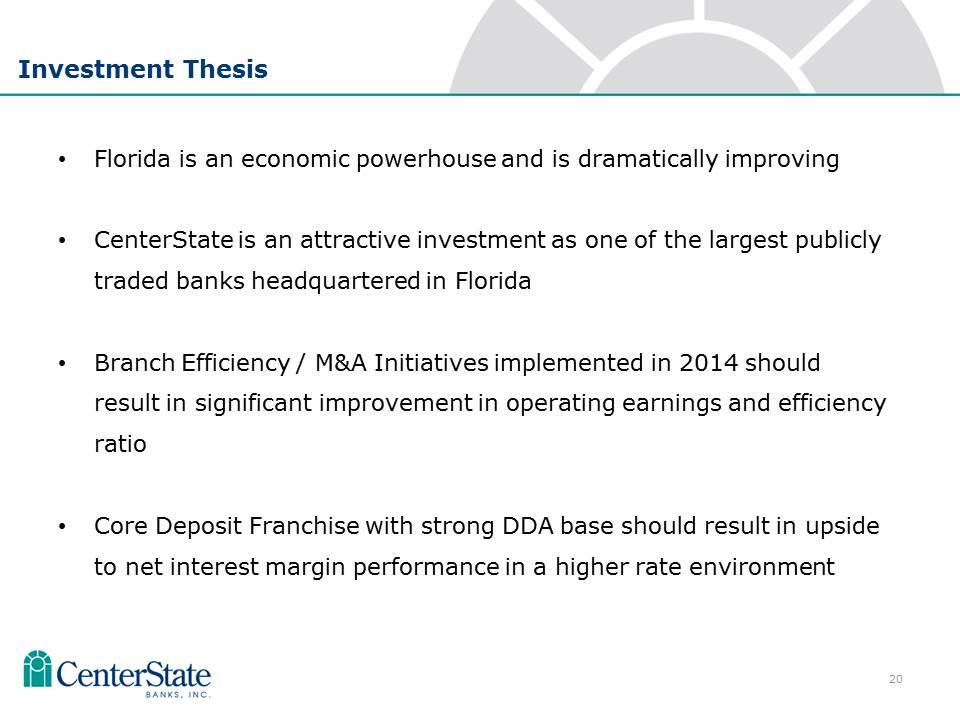

Investment Thesis Florida is an economic powerhouse and is dramatically improving CenterState is an attractive investment as one of the largest publicly traded banks headquartered in Florida Branch Efficiency / M&A Initiatives implemented in 2014 should result in significant improvement in operating earnings and efficiency ratio Core Deposit Franchise with strong DDA base should result in upside to net interest margin performance in a higher rate environment

Analyst Coverage Source: SNL Financial and/or analysts’ reports. Firm Analyst Report Rating Price Target 2015 Date EPS Estimate Wunderlich Securities Inc. Kevin Reynolds, CFA April 22, 2015 Buy $16.00 $0.85 615-567-2085 Sterne Agee & Leach Inc. Peyton Green January 27, 2015 Buy $13.50 $0.85 615-760-1464 Hovde Group LLC Joseph Fenech April 23, 2015 Outperform $14.00 $0.84 312-386-5909 Keefe, Bruyette & Woods Inc. Brady Gailey, CFA April 22, 2015 Outperform $13.50 $0.84 404-231-6546 Macquarie Capital (USA), Inc. Thomas Alonso, CFA April 23, 2015 Neutral $13.00 $0.83 212-231-8047 Fig Partners LLC John Rodis April 24, 2015 Market Perform $13.00 $0.83 314-570-2671 Raymond James Financial Inc. Michael Rose April 22, 2015 Outperform 2 $13.00 $0.82 312-655-2940

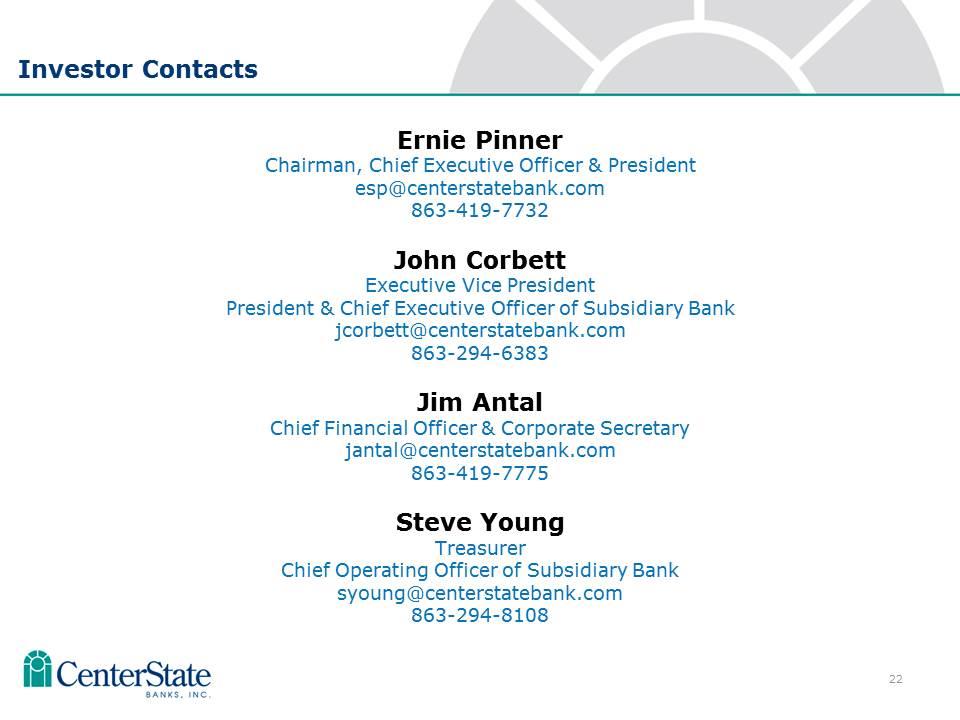

Investor Contacts Ernie Pinner Chairman, Chief Executive Officer & President esp@centerstatebank.com 863-419-7732 John Corbett Executive Vice President President & Chief Executive Officer of Subsidiary Bank jcorbett@centerstatebank.com 863-294-6383 Jim Antal Chief Financial Officer & Corporate Secretary jantal@centerstatebank.com 863-419-7775 Steve Young Treasurer Chief Operating Officer of Subsidiary Bank syoung@centerstatebank.com 863-294-8108

Appendix

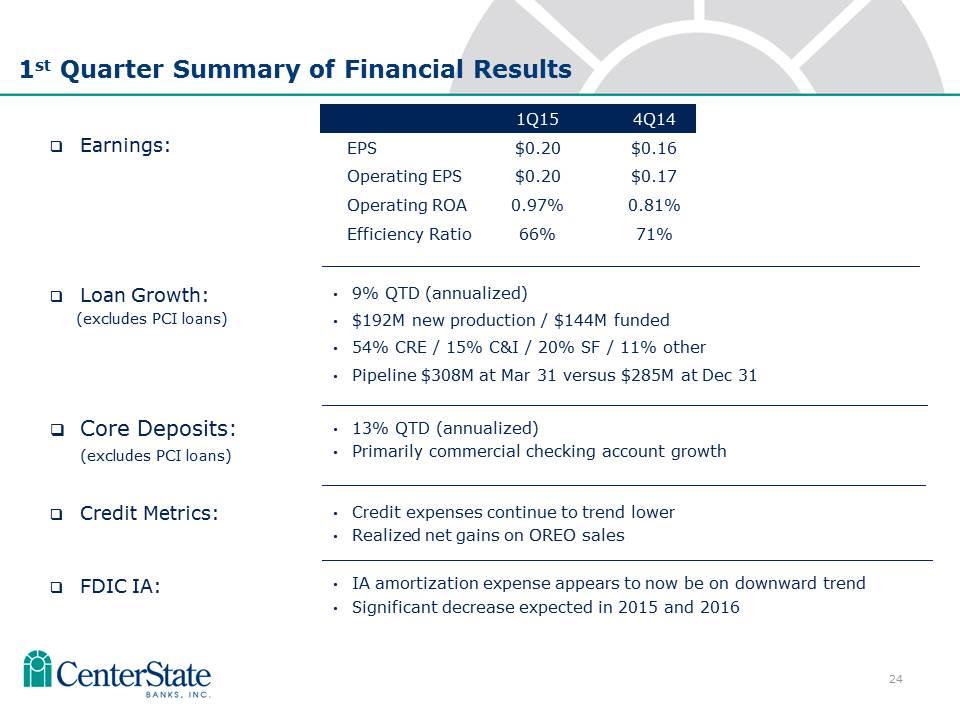

Earnings: Loan Growth: (excludes PCI loans) Core Deposits: (excludes PCI loans) Credit Metrics: FDIC IA: 1st Quarter Summary of Financial Results 1Q15 4Q14 EPS $0.20 $0.16 Operating EPS $0.20 $0.17 Operating ROA 0.97% 0.81% Efficiency Ratio 66% 71% _______________________________________________________________________________________ 9% QTD (annualized) $192M new production / $144M funded 54% CRE / 15% C&I / 20% SF / 11% other Pipeline $308M at Mar 31 versus $285M at Dec 31 _____________________________________________________________________________________________________ 13% QTD (annualized) Primarily commercial checking account growth ________________________________________________________________________________________ Credit expenses continue to trend lower Realized net gains on OREO sales _________________________________________________________________________________________ IA amortization expense appears to now be on downward trend Significant decrease expected in 2015 and 2016

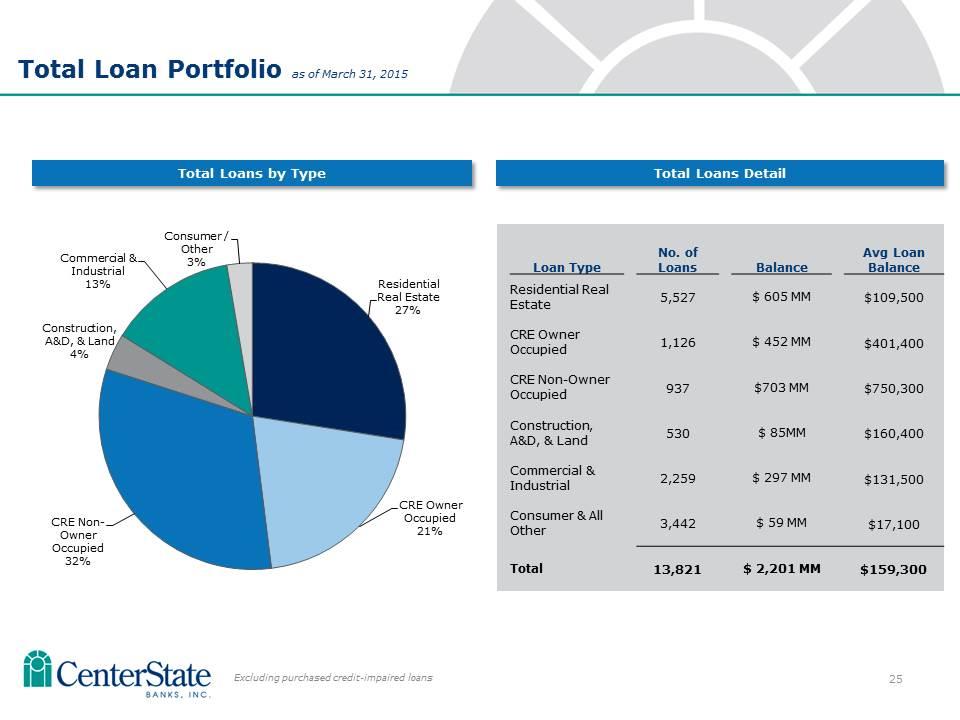

Total Loans by Type Total Loans Detail Loan Type No. of Loans Balance Avg Loan Balance Residential Real Estate 5,527 $ 605 MM $109,500 CRE Owner Occupied 1,126 $ 452 MM $401,400 CRE Non-Owner Occupied 937 $703 MM $750,300 Construction, A&D, & Land 530 $ 85MM $160,400 Commercial & Industrial 2,259 $ 297 MM $131,500 Consumer & All Other 3,442 $ 59 MM $17,100 Total 13,821 $ 2,201 MM $159,300 Total Loan Portfolio as of March 31, 2015 Excluding purchased credit-impaired loans

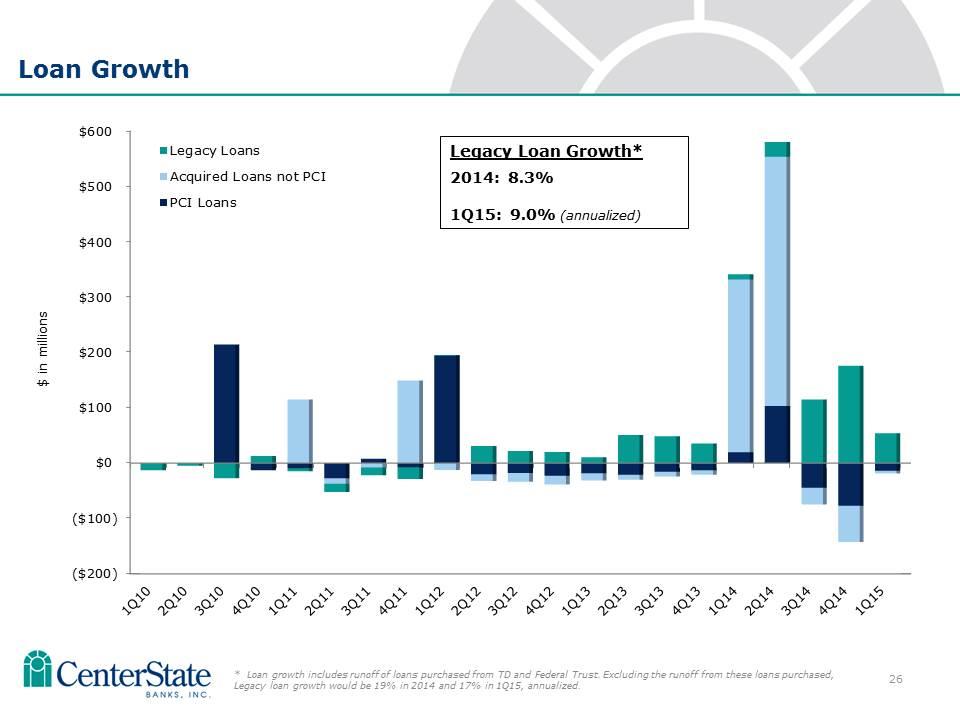

Loan Growth Legacy Loan Growth* 2014: 8.3% 1Q15: 9.0% (annualized) * Loan growth includes runoff of loans purchased from TD and Federal Trust. Excluding the runoff from these loans purchased, Legacy loan growth would be 19% in 2014 and 17% in 1Q15, annualized.

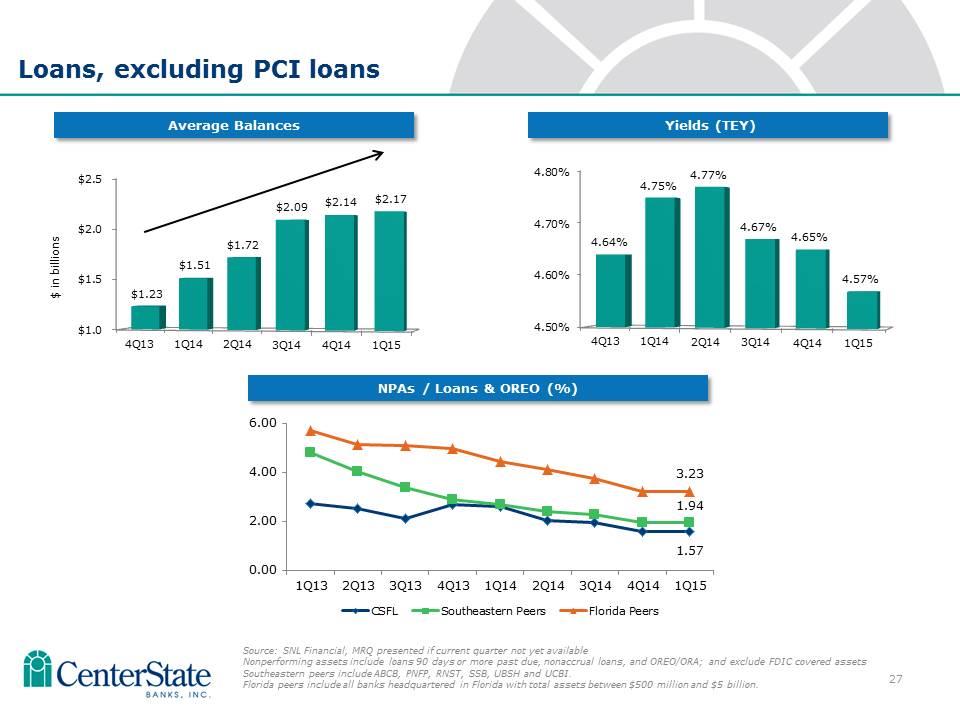

Loans, excluding PCI loans Yields (TEY) Average Balances NPAs / Loans & OREO (%) Source: SNL Financial, MRQ presented if current quarter not yet available Nonperforming assets include loans 90 days or more past due, nonaccrual loans, and OREO/ORA; and exclude FDIC covered assets Southeastern peers include ABCB, PNFP, RNST, SSB, UBSH and UCBI. Florida peers include all banks headquartered in Florida with total assets between $500 million and $5 billion.

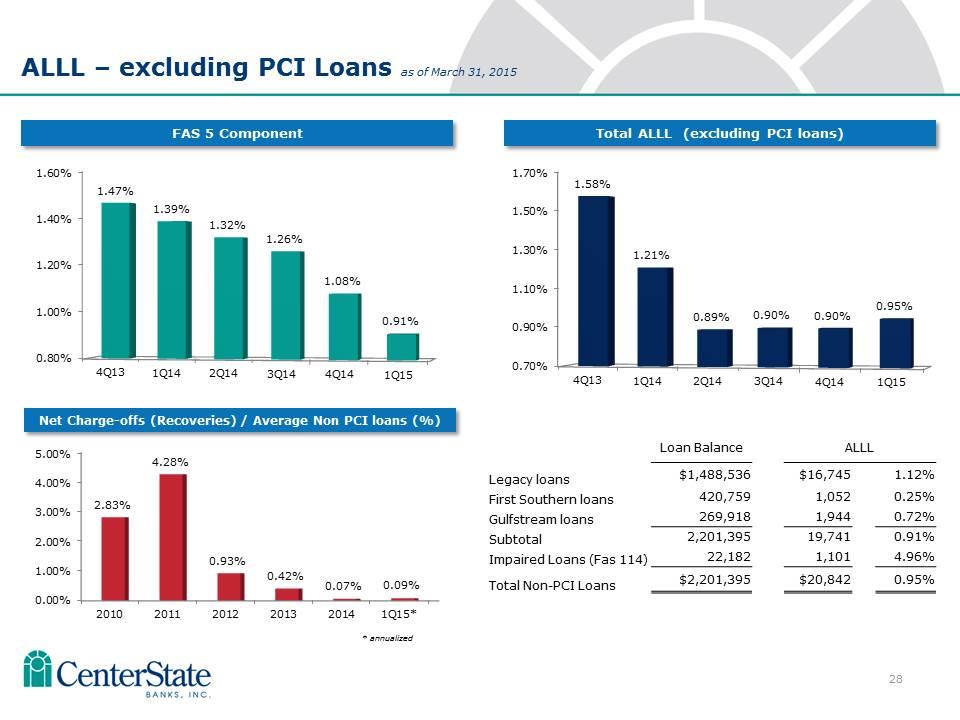

ALLL – excluding PCI Loans as of March 31, 2015 FAS 5 Component Total ALLL (excluding PCI loans) Loan Balance ALLL Legacy loans $1,488,536 $16,745 1.12% First Southern loans 420,759 1,052 0.25% Gulfstream loans 269,918 1,944 0.72% Subtotal 2,201,395 19,741 0.91% Impaired Loans (Fas 114) 22,182 1,101 4.96% Total Non-PCI Loans $2,201,395 $20,842 0.95% Net Charge-offs (Recoveries) / Average Non PCI loans (%) * annualized

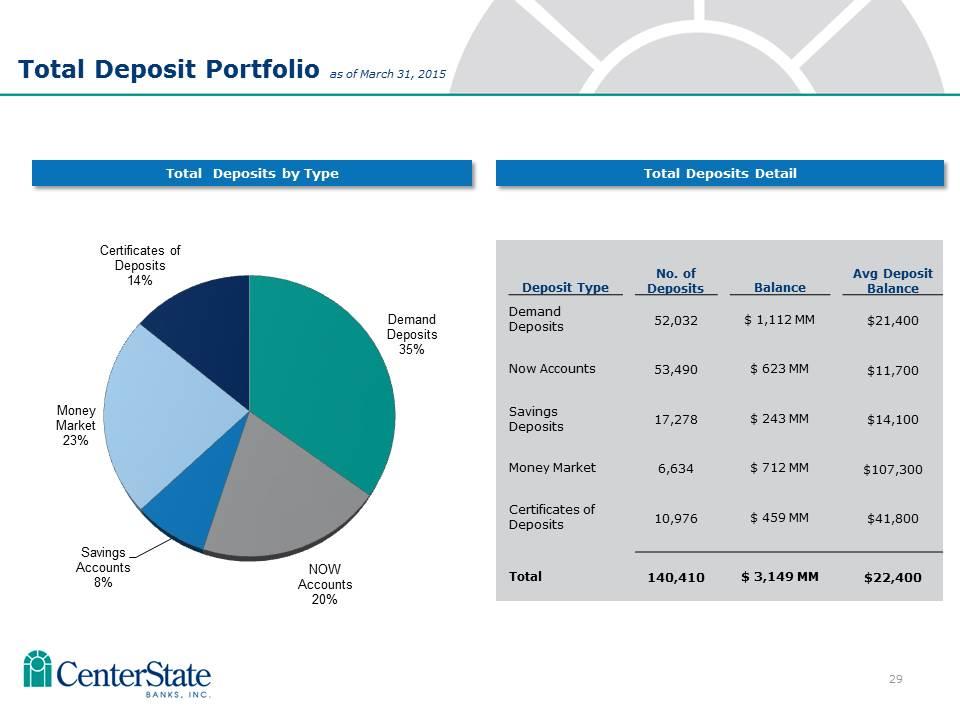

Total Deposits by Type Total Deposits Detail 23 Total Deposit Portfolio as of March 31, 2015 Deposit Type No. of Deposits Balance Avg Deposit Balance Demand Deposits 52,032 $ 1,112 MM $21,400 Now Accounts 53,490 $ 623 MM $11,700 Savings Deposits 17,278 $ 243 MM $14,100 Money Market 6,634 $ 712 MM $107,300 Certificates of Deposits 10,976 $ 459 MM $41,800 Total 140,410 $ 3,149 MM $22,400

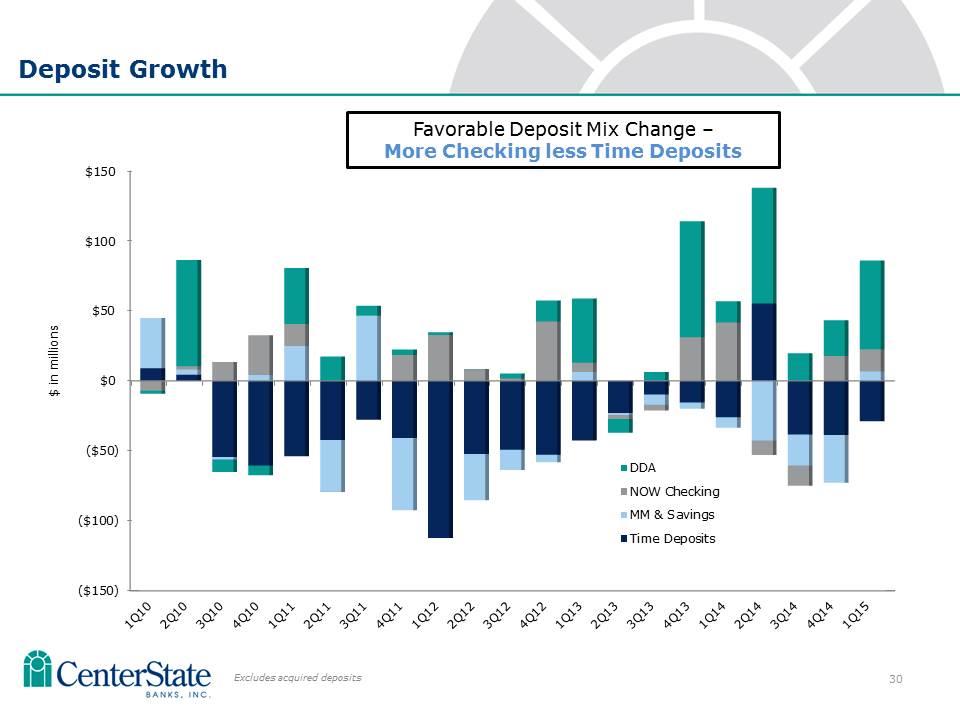

Excludes acquired deposits Deposit Growth Favorable Deposit Mix Change – More Checking less Time Deposits

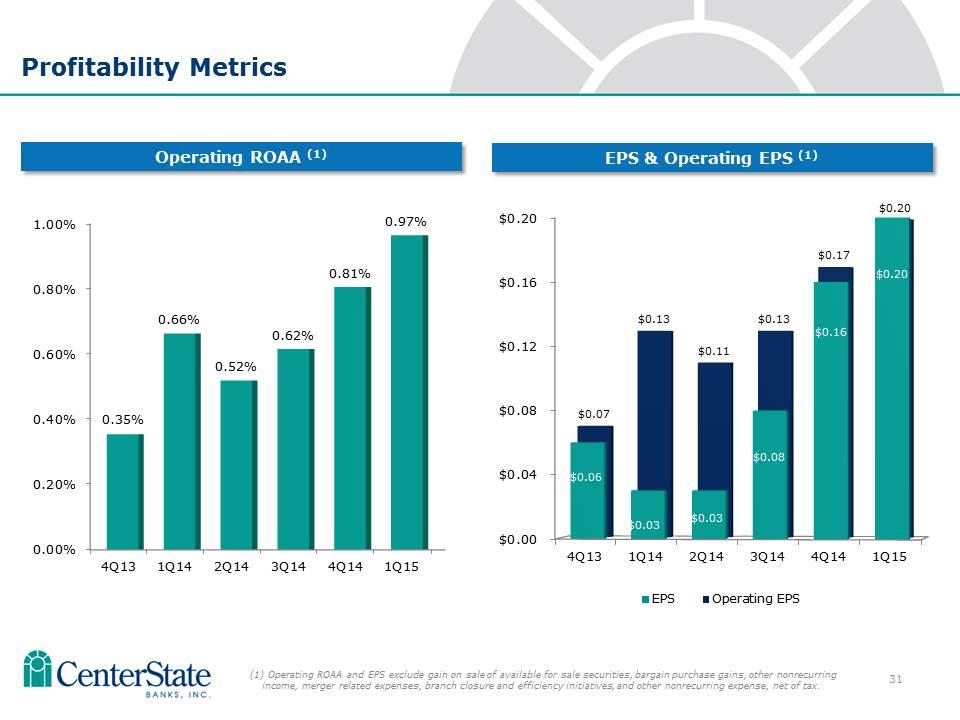

Operating ROAA (1) Profitability Metrics EPS & Operating EPS (1) (1) Operating ROAA and EPS exclude gain on sale of available for sale securities, bargain purchase gains, other nonrecurring income, merger related expenses, branch closure and efficiency initiatives, and other nonrecurring expense, net of tax.

Net Interest Margin tax equivalent

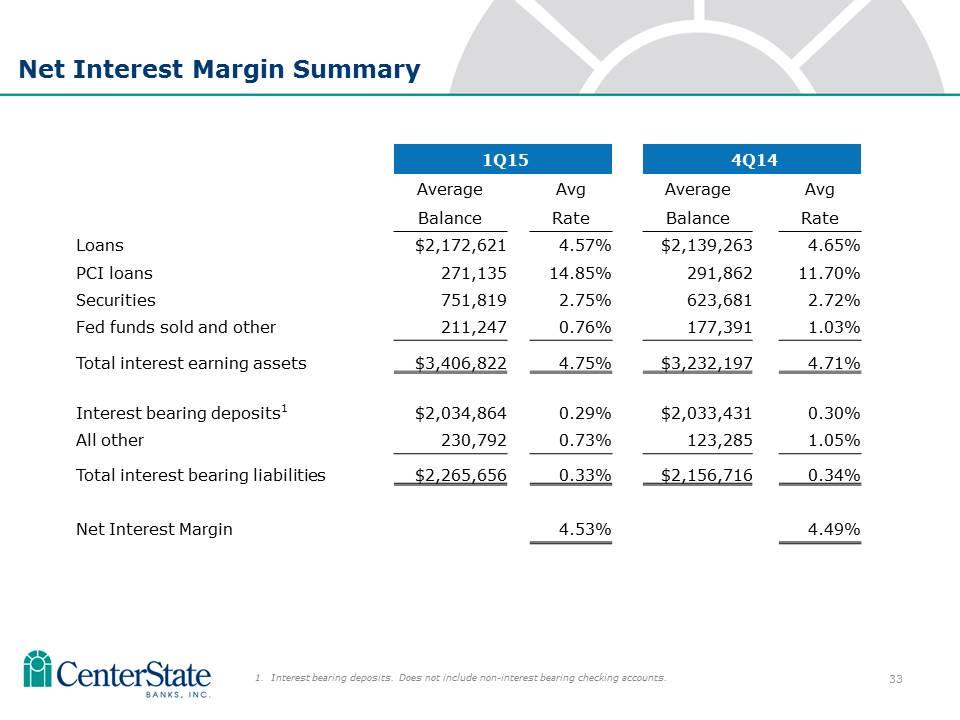

Net Interest Margin Summary 1. Interest bearing deposits. Does not include non-interest bearing checking accounts. 1Q15 4Q14 Average Avg Average Avg Balance Rate Balance Rate Loans $2,172,621 4.57% $2,139,263 4.65% PCI loans 271,135 14.85% 291,862 11.70% Securities 751,819 2.75% 623,681 2.72% Fed funds sold and other 211,247 0.76% 177,391 1.03% Total interest earning assets $3,406,822 4.75% $3,232,197 4.71% Interest bearing deposits1 $2,034,864 0.29% $2,033,431 0.30% All other 230,792 0.73% 123,285 1.05% Total interest bearing liabilities $2,265,656 0.33% $2,156,716 0.34% Net Interest Margin 4.53% 4.49%

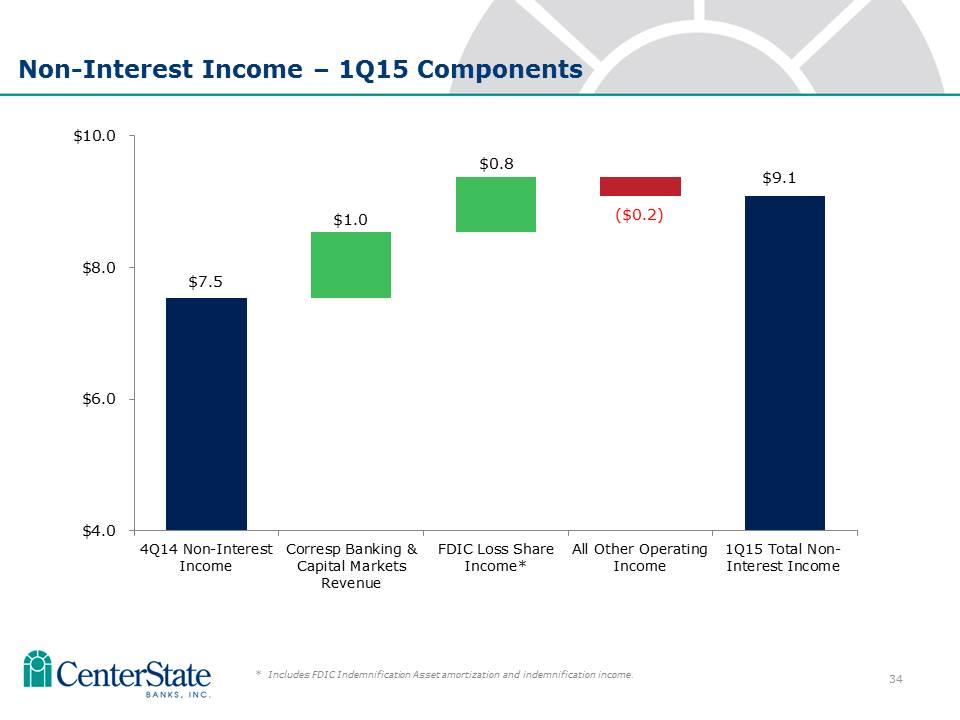

Non-Interest Income – 1Q15 Components * Includes FDIC Indemnification Asset amortization and indemnification income. ($0.2)

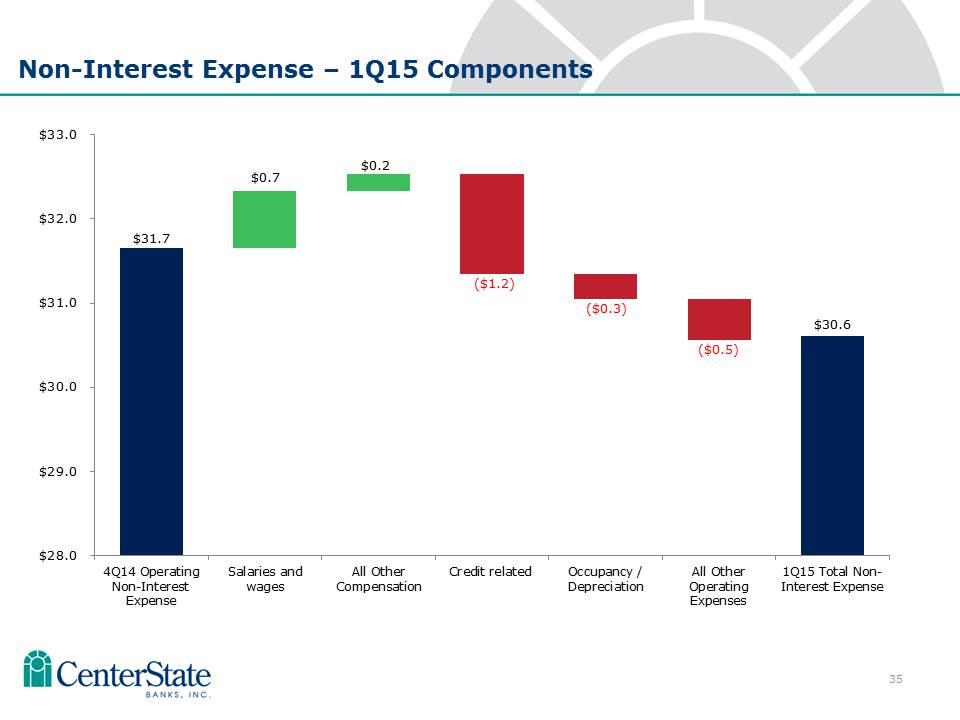

Non-Interest Expense – 1Q15 Components ($1.2) ($0.3) ($0.5)

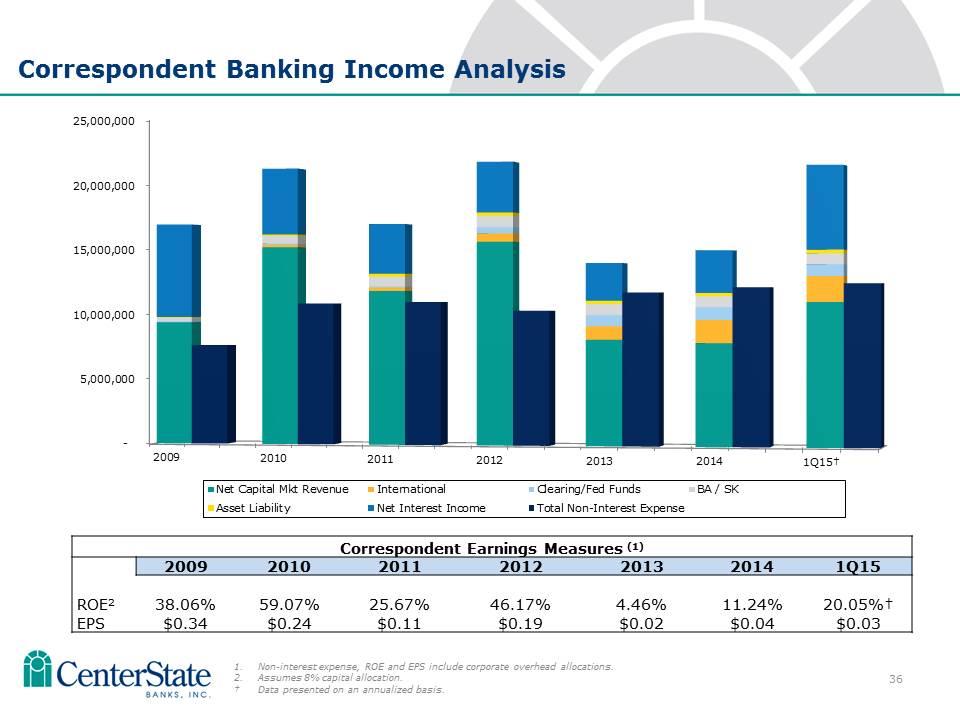

Non-interest expense, ROE and EPS include corporate overhead allocations. Assumes 8% capital allocation. †Data presented on an annualized basis. Correspondent Banking Income Analysis Correspondent Earnings Measures (1) 2009 2010 2011 2012 2013 2014 1Q15 ROE2 38.06% 59.07% 25.67% 46.17% 4.46% 11.24% 20.05%† EPS $0.34 $0.24 $0.11 $0.19 $0.02 $0.04 $0.03