Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CNO Financial Group, Inc. | form8-k03312015managementd.htm |

Exhibit 99.1 1Q15 Financial and operating results for the period ended March 31, 2015 April 30, 2015 Unless otherwise specified, comparisons in this presentation are between 1Q15 and 1Q14.

Forward-Looking Statements Certain statements made in this presentation should be considered forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. These include statements about future results of operations and capital plans. We caution investors that these forward- looking statements are not guarantees of future performance, and actual results may differ materially. Investors should consider the important risks and uncertainties that may cause actual results to differ, including those included in our press release issued on April 29, 2015, our Quarterly Reports on Form 10-Q, our Annual Report on Form 10-K and th fili k ith th S iti d E h C i i Wo er ngs we ma e w e ecur es an xc ange omm ss on. e assume no obligation to update this presentation, which speaks as of today’s date. CNO Financial Group | 1Q2015 Earnings | April 30, 2015 2

Non-GAAP Measures This presentation contains the following financial measures that differ from the comparable measures under Generally Accepted Accounting Principles (GAAP): operating earnings measures; book value excluding accumulated other comprehensive , income (loss) per share; operating return measures; earnings before the net loss on the sale of CLIC and gain (loss) on reinsurance transactions, the earnings of CLIC prior to being sold, net realized investment gains (losses), fair value changes in embedded derivative liabilities, fair value changes related to the agent deferred compensation plan, loss on extinguishment of debt, other non-operating items, corporate interest expense and taxes; and debt to capital ratios, excluding accumulated other comprehensive income (loss). Reconciliations between those non-GAAP measures and the comparable GAAP measures are included in the Appendix, or on the page such measure is presented. While management believes these measures are useful to enhance understanding and comparability of our financial results, these non-GAAP measures should not be considered substitutes for the most directly comparable GAAP measures. Additional information concerning non-GAAP measures is included in our periodic filings with the Securities and Exchange Commission that are available in the “Investors – SEC Filings” section of CNO’s website, www.CNOinc.com. CNO Financial Group | 1Q2015 Earnings | April 30, 2015 3

CNO Financial Group | 1Q2015 Earnings | April 30, 2015 4

CNO1Q15 Summary (amounts in millions, except per share data) Operating Earnings Per Share Excluding Significant Items*Notable Items 1Q14 $0.28 1Q15 $0.31 Bankers Life recruiting gains have stabilized agent count; positioned for future growth G th i W hi t N ti l row n as ng on a ona sales led by strong PMA results Sales productivity and marketing effectiveness at Colonial Penn Operating Earnings Excl. Significant Items* $61.8 $62.0 driving double digit sales growth Continued strength in key ratios supports return of capital to shareholders Compelling Per Share Growth Story Weighted Average Shares Outstanding 220.3** 202.3 CNO Financial Group | 1Q2015 Earnings | April 30, 2015 5 * A non-GAAP measure. Refer to the Appendix for a reconciliation to the corresponding GAAP measure. ** Equivalent common shares of 5.8mm were not included in the diluted weighted average shares outstanding due to the net loss recognized in 1Q14.

LTC Strategic Focus Short Range (1-3 yrs) Longer Range (4-7 yrs) Continued transparency on• performance and risk • Pursue rate actions if adverse experience develops • Reduce our relative economic exposure to LTC by ~50% through natural run-off and run-on as well as opportunistic reinsurance actions • Actively engaged with the reinsurance community • Continue to maintain pricing • Work with industry groups, legislators and regulators to create a sustainable environment discipline driving new business mix with a better risk profile • Working group focused on defending • Develop alternative products and solutions that address the critical and growing LTC needs of the middle marketand improving the economics of the business - CNO Financial Group | 1Q2015 Earnings | April 30, 2015 6 Remain in the business supporting the middle-market

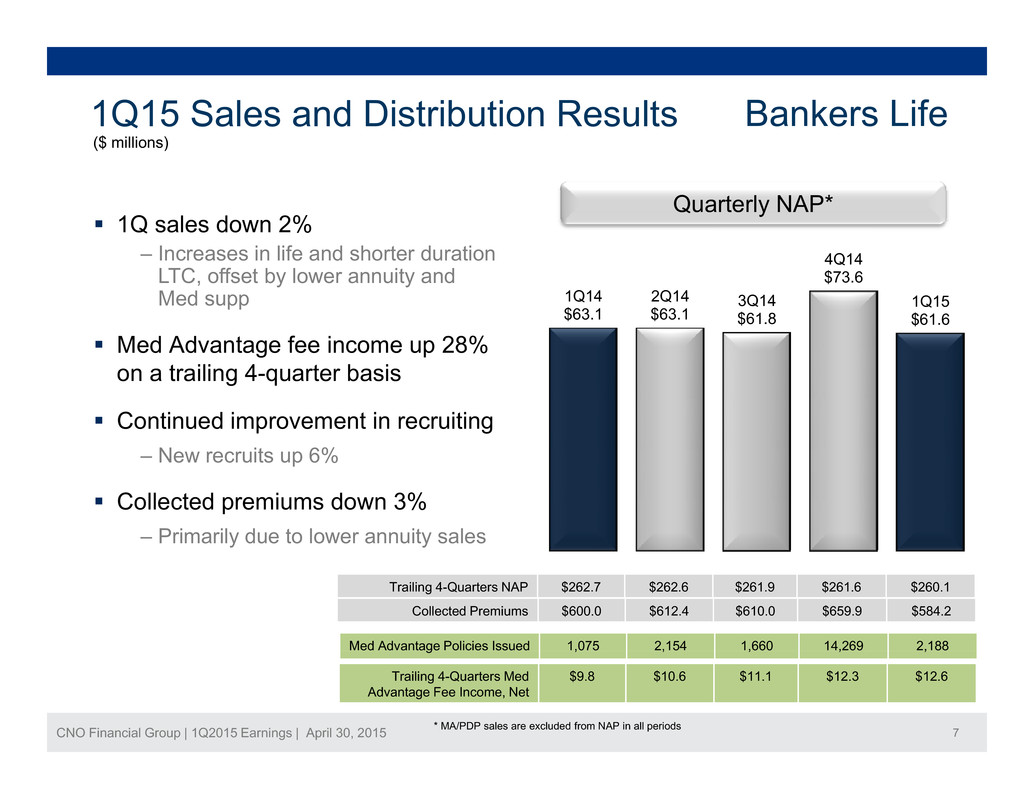

1Q15 Sales and Distribution Results Bankers Life ($ millions) Quarterly NAP* 1Q sales down 2% I i lif d h t d ti 1Q14 $63.1 2Q14 $63.1 3Q14 $61.8 4Q14 $73.6 1Q15 $61.6 ‒ ncreases n e an s or er ura on LTC, offset by lower annuity and Med supp Med Advantage fee income up 28% on a trailing 4-quarter basis Continued improvement in recruiting N it 6%‒ ew recru s up Collected premiums down 3% ‒ Primarily due to lower annuity sales Med Advantage Policies Issued 1,075 2,154 1,660 14,269 2,188 Trailing 4-Quarters NAP $262.7 $262.6 $261.9 $261.6 $260.1 Collected Premiums $600.0 $612.4 $610.0 $659.9 $584.2 CNO Financial Group | 1Q2015 Earnings | April 30, 2015 7* MA/PDP sales are excluded from NAP in all periods Trailing 4-Quarters Med Advantage Fee Income, Net $9.8 $10.6 $11.1 $12.3 $12.6

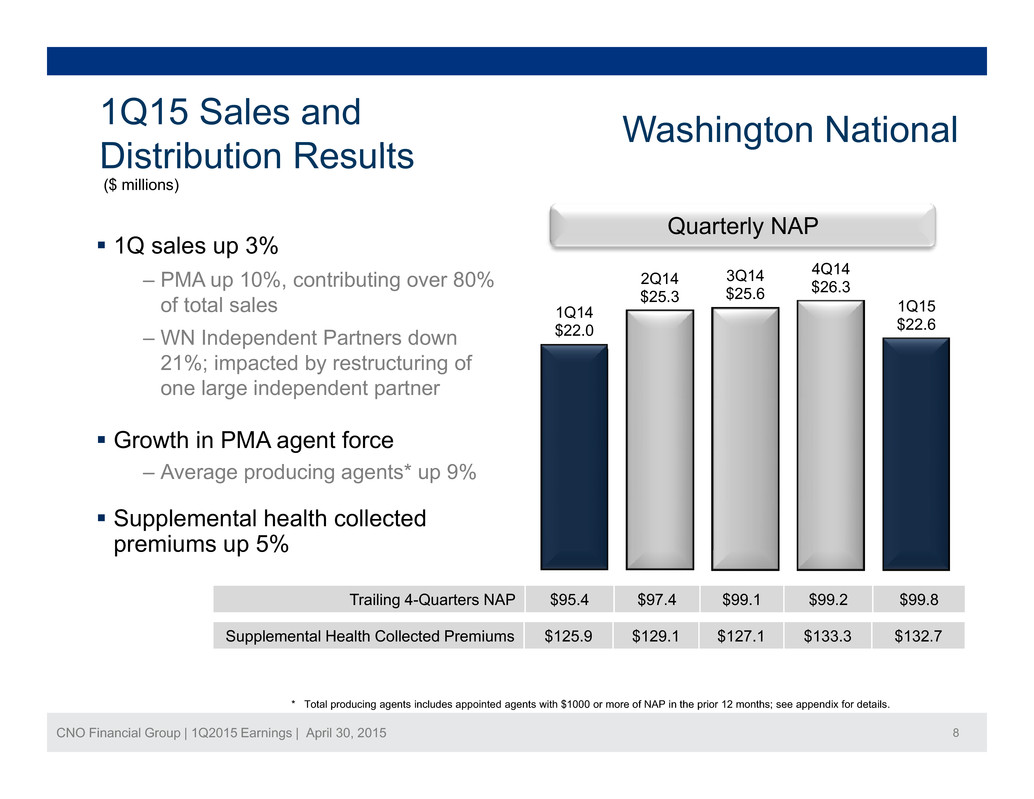

Washington National1Q15 Sales and Di t ib ti R lts r u on esu s ($ millions) Quarterly NAP 1Q sales up 3% 1Q14 $22.0 2Q14 $25.3 3Q14 $25.6 4Q14 $26.3 1Q15 $22.6 ‒ PMA up 10%, contributing over 80% of total sales ‒WN Independent Partners down 21%; impacted by restructuring of one large independent partner Growth in PMA agent force ‒ Average producing agents* up 9% Supplemental health collected premiums up 5% Trailing 4-Quarters NAP $95.4 $97.4 $99.1 $99.2 $99.8 Supplemental Health Collected Premiums $125.9 $129.1 $127.1 $133.3 $132.7 CNO Financial Group | 1Q2015 Earnings | April 30, 2015 8 * Total producing agents includes appointed agents with $1000 or more of NAP in the prior 12 months; see appendix for details.

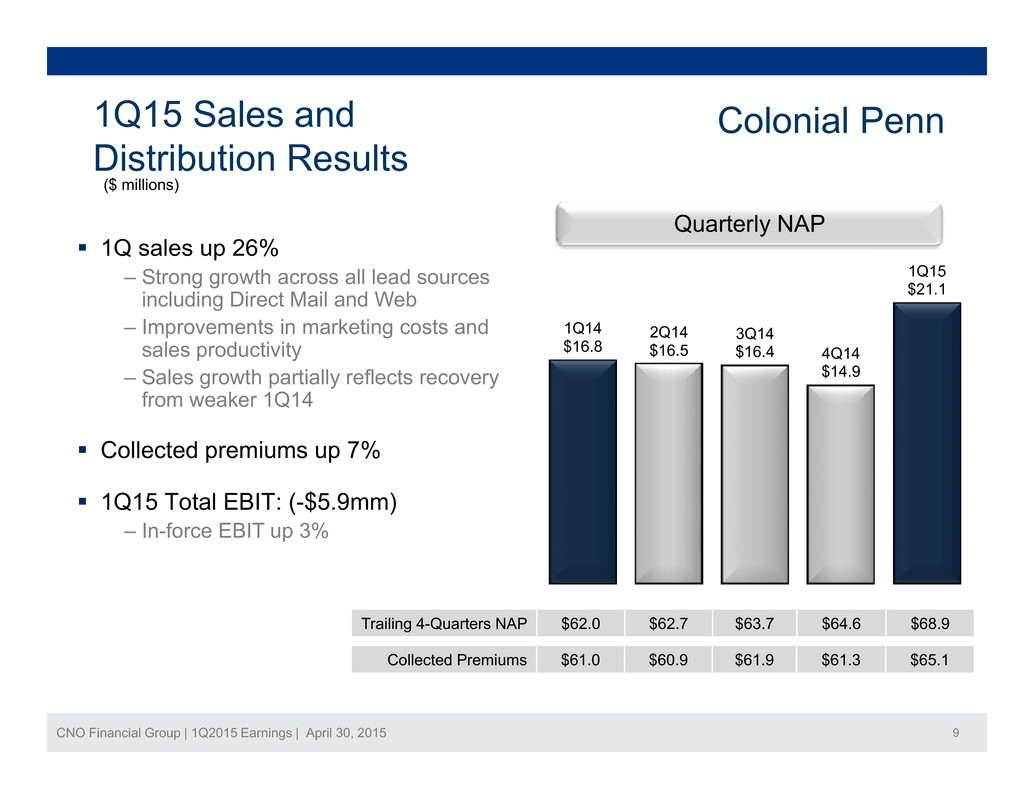

1Q15 Sales and Di t ib ti R lt Colonial Penn s r u on esu s ($ millions) Quarterly NAP 1Q sales up 26% 1Q14 $16 8 2Q14 $16 5 3Q14 $16 4 4Q14 1Q15 $21.1 ‒ Strong growth across all lead sources including Direct Mail and Web ‒ Improvements in marketing costs and sales productivity . . . $14.9 ‒ Sales growth partially reflects recovery from weaker 1Q14 Collected premiums up 7% 1Q15 Total EBIT: (-$5.9mm) ‒ In-force EBIT up 3% Trailing 4-Quarters NAP $62.0 $62.7 $63.7 $64.6 $68.9 CNO Financial Group | 1Q2015 Earnings | April 30, 2015 9 Collected Premiums $61.0 $60.9 $61.9 $61.3 $65.1

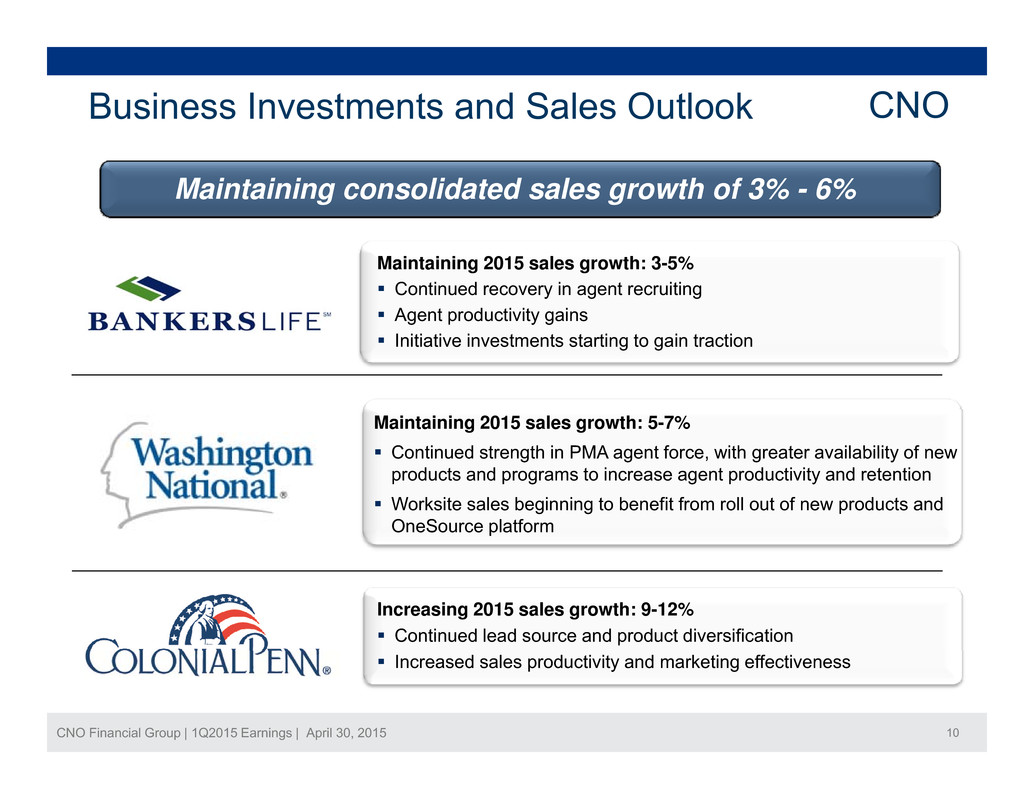

Business Investments and Sales Outlook CNO Maintaining consolidated sales growth of 3% - 6% Maintaining 2015 sales growth: 3-5% Continued recovery in agent recruiting Agent productivity gains Initiative investments starting to gain traction Maintaining 2015 sales growth: 5-7% Continued strength in PMA agent force with greater availability of new , products and programs to increase agent productivity and retention Worksite sales beginning to benefit from roll out of new products and OneSource platform Increasing 2015 sales growth: 9-12% Continued lead source and product diversification CNO Financial Group | 1Q2015 Earnings | April 30, 2015 10 Increased sales productivity and marketing effectiveness

1Q Consolidated Financial Highlights CNO Earnings Remain Strong ‒ Normalized operating EPS up 11% ‒ Health benefit ratios mixed with elevated LTC and supplemental health IABR’s* ‒ Annuity, life and investment results continue to drive favorable results C it l & Li idit ap a qu y ‒ RBC estimated at 428% and holding company leverage at 16.9% ‒ Holding company liquidity and investments of $311 million R t d $98 1 illi i th t t h h ld i l di h b b k d‒ e urne . m on n e quar er o s are o ers, nc u ng s are uy ac s an common stock dividends Updated 2015 Guidance ‒ Production: Colonial Penn NAP growth rate increased to 9-12% ‒ Earnings: LTC IABR* increased to the 84% range, driven by future loss reserve build ‒ Capital: No change to guidance, conditions favorable for recapitalization CNO Financial Group | 1Q2015 Earnings | April 30, 2015 11* Interest-adjusted benefit ratio

($ millions)Segment Earnings CNO 1Q15 Earnings DriversSegment EBIT Excluding Significant Items* $118 7$119.7 Bankers Life strength in annuity $31.1 $32.3 $30.1 $30.2 $31.5 . $106.1 $119.8 $106.5 – spreads, favorable overall health results offset by lower LTC margins Washington National interest-adjusted l t l h lth b fit ti $84.2 $87.4 $98.3 $94.5 $82.2 supp emen a ealt enefi ra os modestly elevated Colonial Penn results outperformed on improved sales productivity and $(3.0) $(3.7) $(9.1) $(8.8) $(1.3) $(6.2) $3.8 $0.4 $2.8 $(5.9) marketing effectiveness Corporate results driven by favorable expenses and investment results S iti h d i 11%1Q14 2Q14 3Q14 4Q14 1Q15 Corporate CP BLC WN * A non-GAAP measure. See the Appendix for a reconciliation to the corresponding GAAP measure1Q14 Weighted Average Diluted Shares Outstanding ecurit es repurc ases r ves a reduction in average diluted shares CNO Financial Group | 1Q2015 Earnings | April 30, 2015 12 . ** Equivalent common shares of 5.8mm were not included in the diluted weighted average shares outstanding due to the net loss recognized in 1Q14.220.3mm** 1Q15 202.3mm

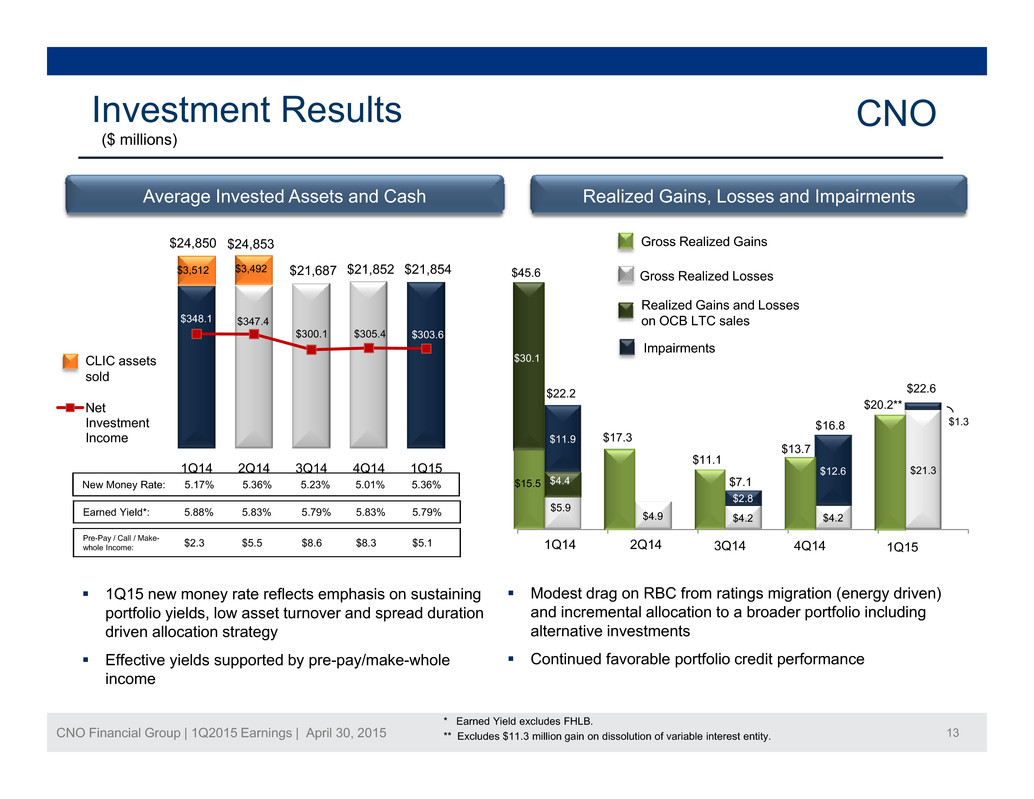

Investment Results CNO ($ millions) $24,850 $24,853 Average Invested Assets and Cash Realized Gains, Losses and Impairments Gross Realized Gains $21,687 $21,852 $21,854 $348.1 $347.4 $300.1 $305.4 $303.6 $3,512 $3,492 Gross Realized Losses Impairments $45.6 Realized Gains and Losses on OCB LTC sales $11.9 $1.3 Net Investment Income CLIC assets sold $22.2 $30.1 $17.3 $16.8 $13 7 $20.2** $22.6 $4.9 $4.2 $4.2 $21.3 $2.8 $12.6 1Q14 2Q14 3Q14 4Q14 1Q15 Earned Yield*: 5.88% 5.83% 5.79% 5.83% 5.79% New Money Rate: 5.17% 5.36% 5.23% 5.01% 5.36% Pre-Pay / Call / Make- whole Income: $2.3 $5.5 $8.6 $8.3 $5.1 $4.4 1Q14 2Q14 3Q14 4Q14 $15.5 $5.9 1Q15 $11.1 $7.1 . 1Q15 new money rate reflects emphasis on sustaining portfolio yields, low asset turnover and spread duration driven allocation strategy Modest drag on RBC from ratings migration (energy driven) and incremental allocation to a broader portfolio including alternative investments CNO Financial Group | 1Q2015 Earnings | April 30, 2015 13 * Earned Yield excludes FHLB. ** Excludes $11.3 million gain on dissolution of variable interest entity. Effective yields supported by pre-pay/make-whole income Continued favorable portfolio credit performance

Capital Targets & Excess Capital Deployment CNO 2014 1Q15 2015 Y.E. Outlook RBC 431% 428% ~ 425% Key Capital Ratios v RBC remains strong on stable statutory Liquidity $345mm $311mm ~ $315mm Leverage* 17.1% 16.9% ~ 16% 2015 C it l Utili ti earnings after $88 million dividends and distributions to the holding company Liquidity position reflects elevated repurchase and debt amortization ap a za on (in millions) Common Stock Dividends Leverage continues to fall due to $20 million of required quarterly amortization v $86mm in common stock repurchased in 1Q15 Securities Repurchase ~$300 $52 Debt Repayment / Financing Costs $79 Securities Repurchases Repurchased ~5.3mm shares at an average cost of $16.32 per share 2015 Outlook: share repurchase range of $250mm to $325mm Holdco Exp & Other $10 Interest $36 CNO Financial Group | 1Q2015 Earnings | April 30, 2015 14 * A non-GAAP measure. Refer to the Appendix for the corresponding GAAP measure.

Bankers LTC – Critical Points of Differentiation Target Market • Middle-market and older issue/attained age drives reduced tail risk New Business • Significant claims data on older ages supports reliable studies and estimates • Over 70% of new business is “short duration” (benefit period ≤ 1 year) • Reinsurance with RGA (~25%) reinforces sound pricing & underwriting In-Force Mix • Captive distribution for better control over economics & underwriting • Only 4.6% of policies w/ lifetime benefits and 17% with benefit periods > 3 years • Tight ALM and reduced reinvestment risk with liability duration ~13 years 4 d f f l t i f d h i li i CNO Financial Group | 1Q2015 Earnings | April 30, 2015 15 • roun s o success u ra e ncreases ocuse on compre ens ve po c es

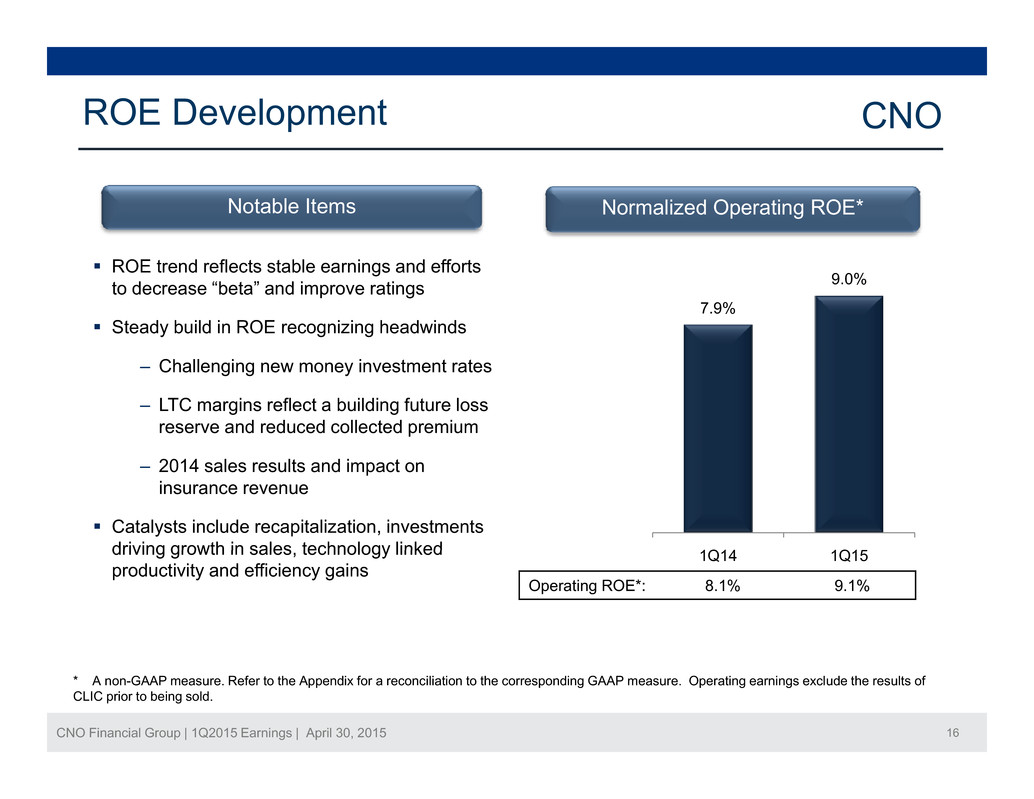

ROE Development CNO Notable Items Normalized Operating ROE* ROE trend reflects stable earnings and efforts to decrease “beta” and improve ratings Steady build in ROE recognizing headwinds 7.9% 9.0% ‒ Challenging new money investment rates ‒ LTC margins reflect a building future loss reserve and reduced collected premium ‒ 2014 sales results and impact on insurance revenue Catalysts include recapitalization, investments driving growth in sales technology linked 1Q14 1Q15 Operating ROE*: 8.1% 9.1% , productivity and efficiency gains CNO Financial Group | 1Q2015 Earnings | April 30, 2015 16 * A non-GAAP measure. Refer to the Appendix for a reconciliation to the corresponding GAAP measure. Operating earnings exclude the results of CLIC prior to being sold.

Wrap-up CNO Regaining momentum on agent recruiting and sales growth Investing in initiatives to increase sales and operating effectiveness Holistic management of our LTC businessHolisti Solid operating performance and favorable markets supports ratings momentum and recapitalization Developing future catalysts and exploring non-organic opportunities to expand and accelerate profitable growth CNO Financial Group | 1Q2015 Earnings | April 30, 2015 17

Questions and Answers CNO Financial Group | 1Q2015 Earnings | April 30, 2015 18

Appendix CNO Financial Group | 1Q2015 Earnings | April 30, 2015 19

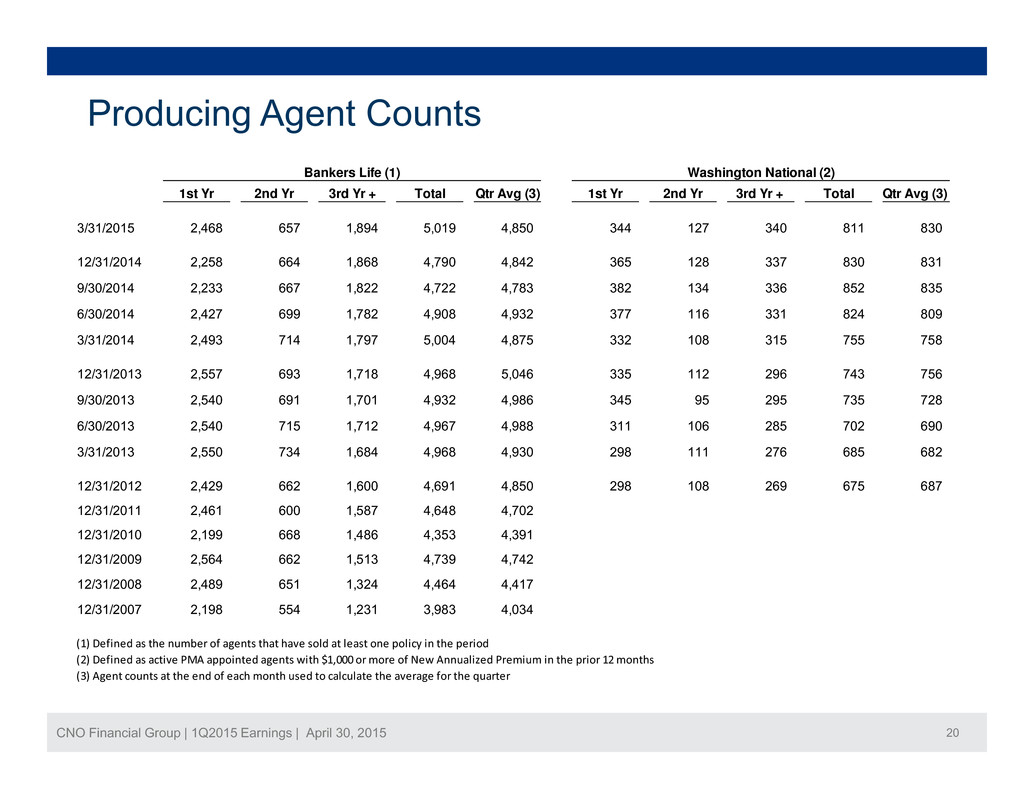

Producing Agent Counts 1st Yr 2nd Yr 3rd Yr + Total Qtr Avg (3) 1st Yr 2nd Yr 3rd Yr + Total Qtr Avg (3) 3/31/2015 2,468 657 1,894 5,019 4,850 344 127 340 811 830 Bankers Life (1) Washington National (2) 12/31/2014 2,258 664 1,868 4,790 4,842 365 128 337 830 831 9/30/2014 2,233 667 1,822 4,722 4,783 382 134 336 852 835 6/30/2014 2,427 699 1,782 4,908 4,932 377 116 331 824 809 3/31/2014 2,493 714 1,797 5,004 4,875 332 108 315 755 758 12/31/2013 2,557 693 1,718 4,968 5,046 335 112 296 743 756 9/30/2013 2,540 691 1,701 4,932 4,986 345 95 295 735 728 6/30/2013 2,540 715 1,712 4,967 4,988 311 106 285 702 690 3/31/2013 2 550 734 1 684 4 968 4 930 298 111 276 685 682, , , , 12/31/2012 2,429 662 1,600 4,691 4,850 298 108 269 675 687 12/31/2011 2,461 600 1,587 4,648 4,702 12/31/2010 2,199 668 1,486 4,353 4,391 12/31/2009 2,564 662 1,513 4,739 4,742 12/31/2008 2,489 651 1,324 4,464 4,417 12/31/2007 2,198 554 1,231 3,983 4,034 (1) Defined as the number of agents that have sold at least one policy in the period CNO Financial Group | 1Q2015 Earnings | April 30, 2015 20 (2) Defined as active PMA appointed agents with $1,000 or more of New Annualized Premium in the prior 12 months (3) Agent counts at the end of each month used to calculate the average for the quarter

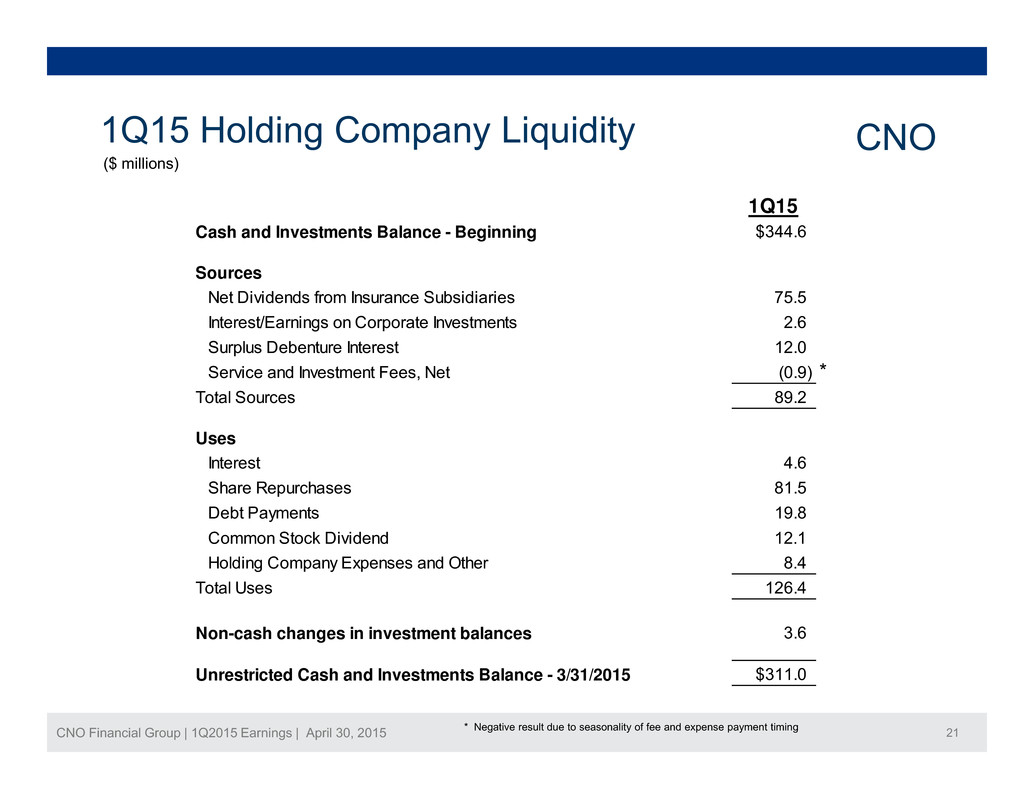

1Q15 Holding Company Liquidity CNO ($ millions) 1Q15 Cash and Investments Balance - Beginning $344.6 Sources Net Dividends from Insurance Subsidiaries 75.5 Interest/Earnings on Corporate Investments 2.6 Surplus Debenture Interest 12 0 . Service and Investment Fees, Net (0.9) * Total Sources 89.2 Uses Interest 4.6 Share Repurchases 81.5 Debt Payments 19.8 Common Stock Dividend 12.1 Holding Company Expenses and Other 8.4 Total Uses 126.4 Non-cash changes in investment balances 3.6 CNO Financial Group | 1Q2015 Earnings | April 30, 2015 21 Unrestricted Cash and Investments Balance - 3/31/2015 $311.0 * Negative result due to seasonality of fee and expense payment timing

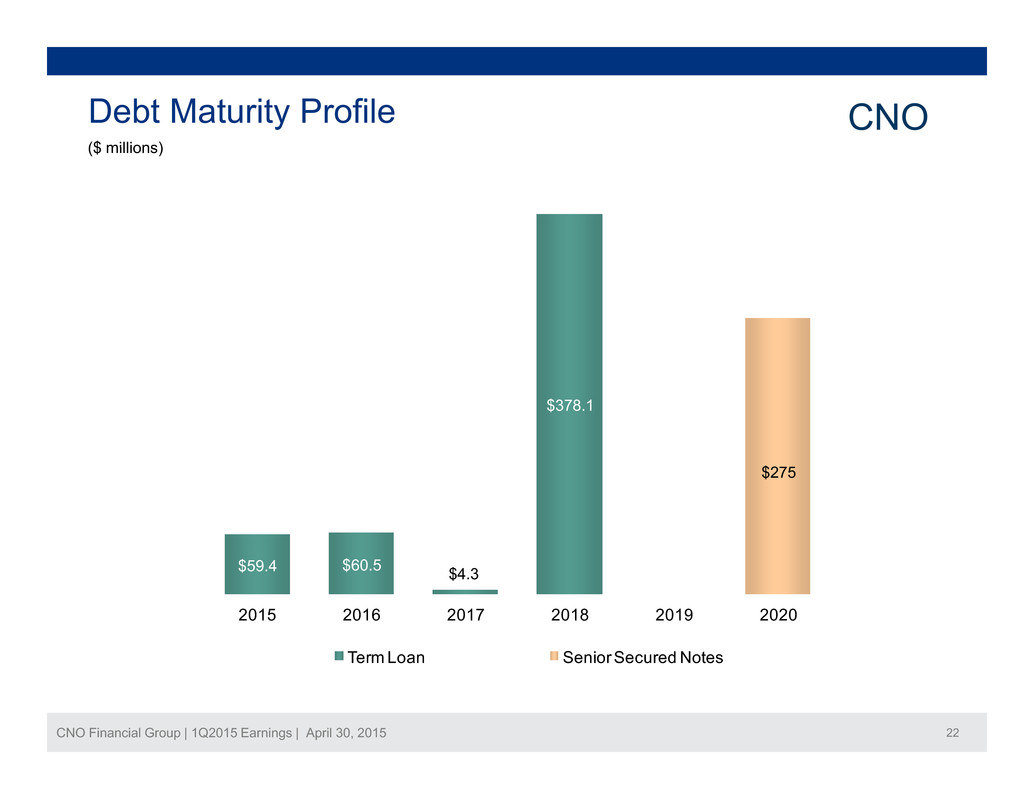

Debt Maturity Profile ($ millions) CNO $378.1 $275 $59.4 $60.5 $4.3 2015 2016 2017 2018 2019 2020 CNO Financial Group | 1Q2015 Earnings | April 30, 2015 22 Term Loan Senior Secured Notes

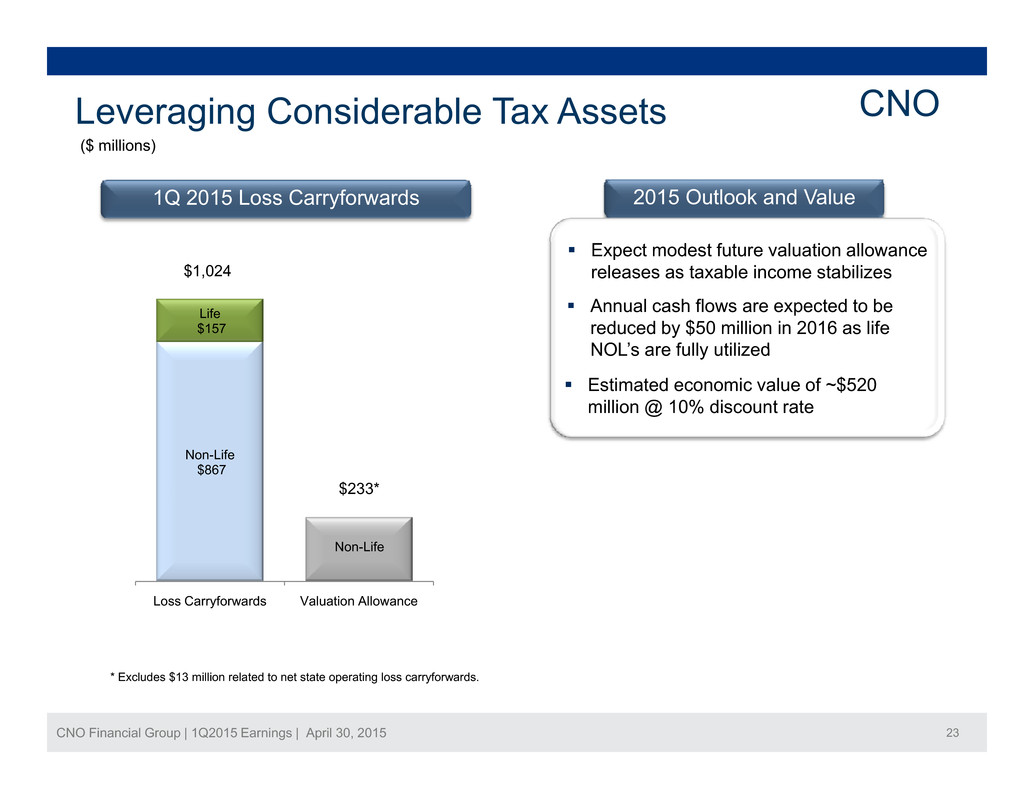

Leveraging Considerable Tax Assets CNO ($ millions) 1Q 2015 Loss Carryforwards 2015 Outlook and Value v Expect modest future valuation allowance Life $157 Annual cash flows are expected to be reduced by $50 million in 2016 as life NOL’s are fully utilized releases as taxable income stabilizes $1,024 Estimated economic value of ~$520 million @ 10% discount rate Non-Life $867 $233* Non-Life Loss Carryforwards Valuation Allowance CNO Financial Group | 1Q2015 Earnings | April 30, 2015 23 * Excludes $13 million related to net state operating loss carryforwards.

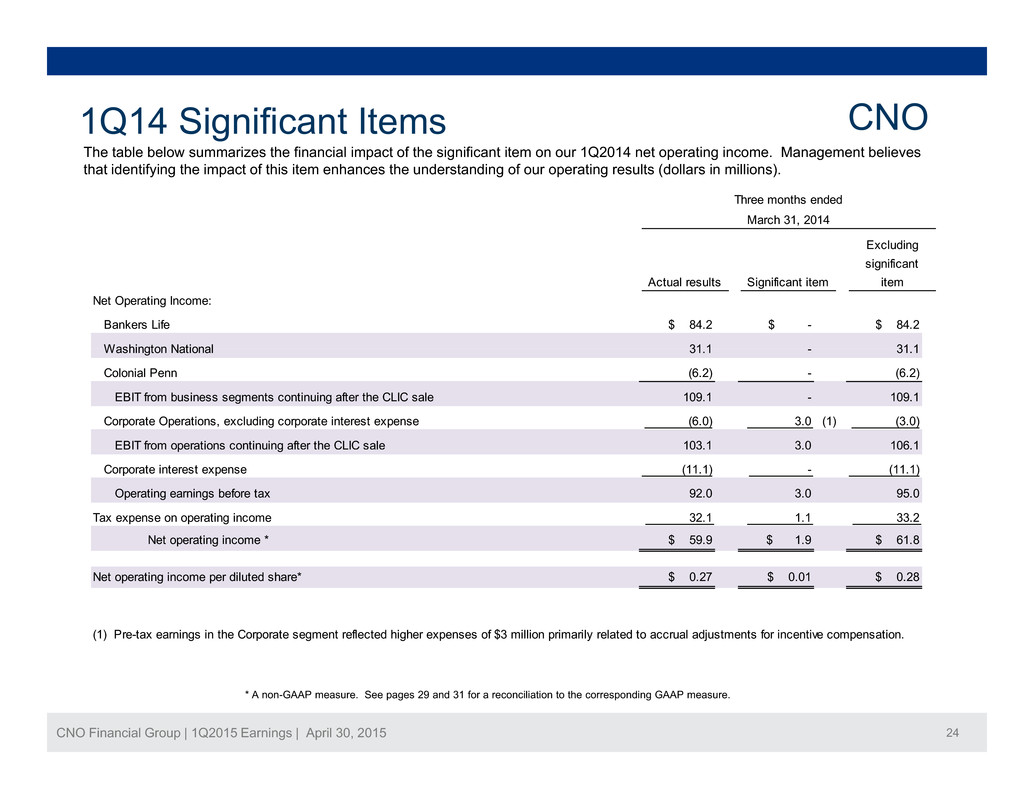

Th t bl b l i th fi i l i t f th i ifi t it 1Q2014 t ti i M t b li 1Q14 Significant Items CNO e a e e ow summar zes e nanc a mpac o e s gn can em on our ne opera ng ncome. anagemen e eves that identifying the impact of this item enhances the understanding of our operating results (dollars in millions). Three months ended March 31, 2014 Excluding Net Operating Income: Bankers Life $ 84.2 $ - $ 84.2 Washington National Actual results Significant item significant item 31 1 31 1 Colonial Penn EBIT from business segments continuing after the CLIC sale Corporate Operations, excluding corporate interest expense (1) EBIT from operations continuing after the CLIC sale . - . (6.2) - (6.2) 109.1 - 109.1 (6.0) 3.0 (3.0) 103.1 3.0 106.1 Corporate interest expense Operating earnings before tax Tax expense on operating income Net operating income * $ 59.9 $ 1.9 $ 61.8 33.2 (11.1) - (11.1) 92.0 3.0 95.0 32.1 1.1 Net operating income per diluted share* $ 0.27 $ 0.01 $ 0.28 (1) Pre-tax earnings in the Corporate segment reflected higher expenses of $3 million primarily related to accrual adjustments for incentive compensation. CNO Financial Group | 1Q2015 Earnings | April 30, 2015 24 * A non-GAAP measure. See pages 29 and 31 for a reconciliation to the corresponding GAAP measure.

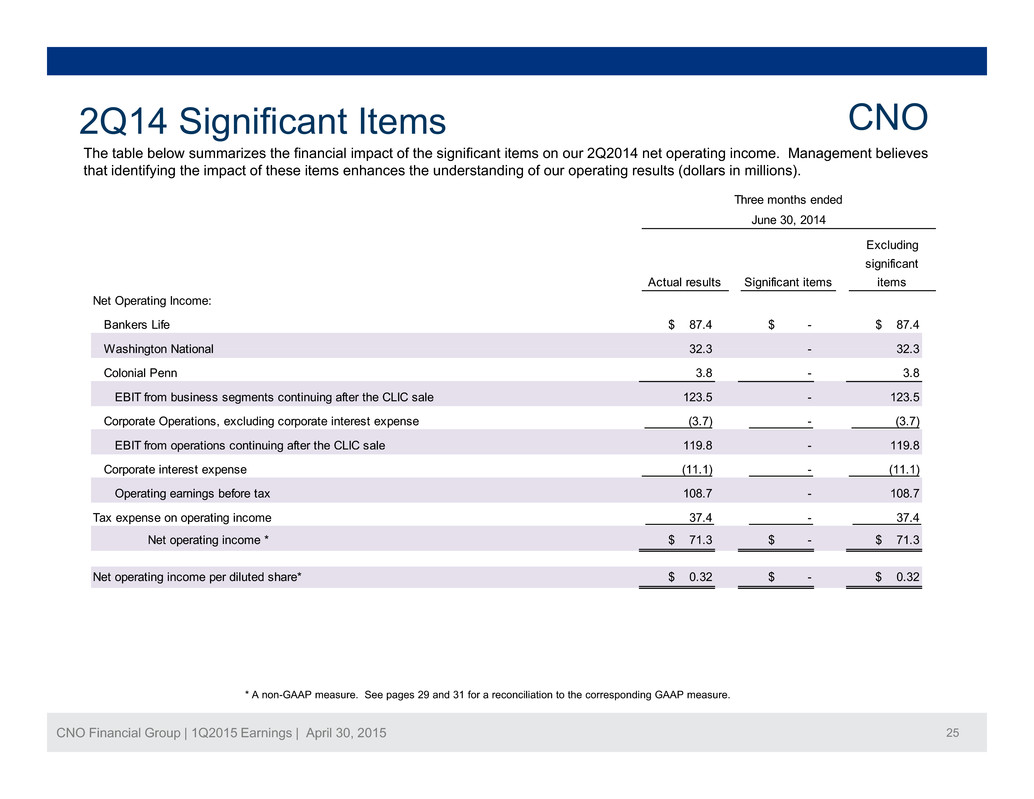

f f f 2Q201 2Q14 Significant Items CNO Three months ended June 30, 2014 Excluding The table below summarizes the inancial impact o the signi icant items on our 4 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results (dollars in millions). Net Operating Income: Bankers Life $ 87.4 $ - $ 87.4 Washington National 32 3 32 3 Actual results Significant items significant items Colonial Penn EBIT from business segments continuing after the CLIC sale Corporate Operations, excluding corporate interest expense EBIT from operations continuing after the CLIC sale (3.7) - (3.7) 119.8 - 119.8 3.8 - 3.8 123.5 - 123.5 . - . Corporate interest expense Operating earnings before tax Tax expense on operating income Net operating income * $ 71.3 $ - $ 71.3 108.7 - 108.7 37.4 - 37.4 (11.1) - (11.1) Net operating income per diluted share* $ 0.32 $ - $ 0.32 CNO Financial Group | 1Q2015 Earnings | April 30, 2015 25 * A non-GAAP measure. See pages 29 and 31 for a reconciliation to the corresponding GAAP measure.

Th t bl b l i th fi i l i t f i ifi t it 3Q2014 t ti i M t b li th t 3Q14 Significant Items CNO e a e e ow summar zes e nanc a mpac o s gn can ems on our ne opera ng ncome. anagemen e eves a identifying the impact of these items enhances the understanding of our operating results (dollars in millions). Three months ended September 30, 2014 Excluding Net Operating Income: Bankers Life $ 111.8 $ (13.5) (1) $ 98.3 Washington National (2) 30 1 Actual results Significant items significant items 27 6 2 5 Colonial Penn EBIT from business segments continuing after the CLIC sale Corporate Operations, excluding corporate interest expense EBIT from operations continuing after the CLIC sale (11.0) 119.7130.7 139.8 (11.0) 128.8 (9.1) - (9.1) . 0.4 - 0.4 . . Corporate interest expense Operating earnings before tax Tax expense on operating income Net operating income * $ 76.6 $ (7.1) $ 69.5 (10.9) (11.0) 108.8 43.2 (3.9) 39.3 119.8 (10.9) - Net operating income per diluted share* $ 0.35 $ (0.03) $ 0.32 (1) Pre-tax earnings in the Bankers Life segment included $11.0 million of favorable reserve developments in Bankers Life's long-term care block (including $2.8 million of favorable one-time catch-up reserve releases related to the use of a new process to identify changes in the status of our insureds in a more timely manner) and $2.5 million of favorable reserve developments in the Medicare supplement block. CNO Financial Group | 1Q2015 Earnings | April 30, 2015 26 (2) Pre-tax earnings in the Washington National segment included $2.5 million of unfavorable premium refunds in the supplemental health block (related to the same process used on Bankers Life's long-term care block to identify changes in the status of our insureds in a more timely manner). * A non-GAAP measure. See pages 29 and 31 for a reconciliation to the corresponding GAAP measure.

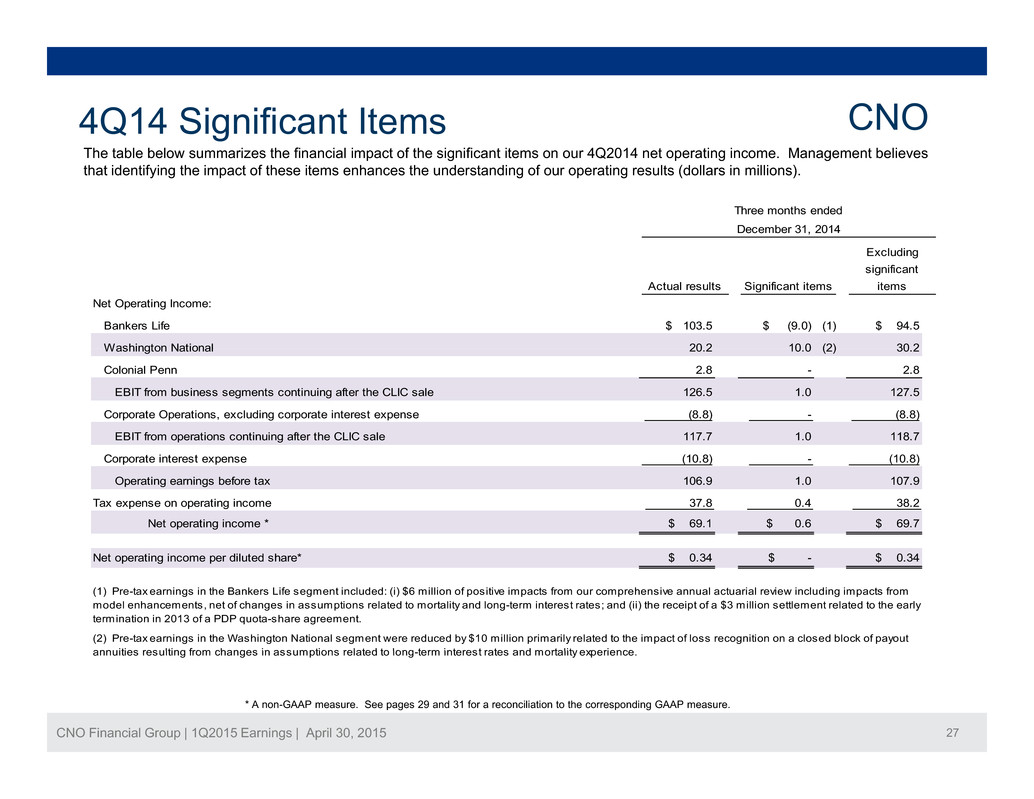

f f f Q201 4Q14 Significant Items CNO Three months ended December 31, 2014 E l di The table below summarizes the inancial impact o the signi icant items on our 4 4 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results (dollars in millions). Net Operating Income: Bankers Life $ 103.5 $ (9.0) (1) $ 94.5 Washington National (2) Actual results Significant items xc u ng significant items 20 2 10 0 30 2 Colonial Penn EBIT from business segments continuing after the CLIC sale Corporate Operations, excluding corporate interest expense EBIT from operations continuing after the CLIC sale 127.5 . . . 1.0 118.7 2.8 - 2.8 126.5 1.0 (8.8) - (8.8) 117.7 Corporate interest expense Operating earnings before tax Tax expense on operating income Net operating income * $ 69.1 $ 0.6 $ 69.7 (10.8) - (10.8) 106.9 1.0 107.9 37.8 0.4 38.2 Net operating income per diluted share* $ 0.34 $ - $ 0.34 (2) Pre-tax earnings in the Washington National segment were reduced by $10 million primarily related to the impact of loss recognition on a closed block of payout annuities resulting from changes in assumptions related to long term interest rates and mortality experience (1) Pre-tax earnings in the Bankers Life segment included: (i) $6 million of positive impacts from our comprehensive annual actuarial review including impacts from model enhancements, net of changes in assumptions related to mortality and long-term interest rates; and (ii) the receipt of a $3 million settlement related to the early termination in 2013 of a PDP quota-share agreement. CNO Financial Group | 1Q2015 Earnings | April 30, 2015 27 - . * A non-GAAP measure. See pages 29 and 31 for a reconciliation to the corresponding GAAP measure.

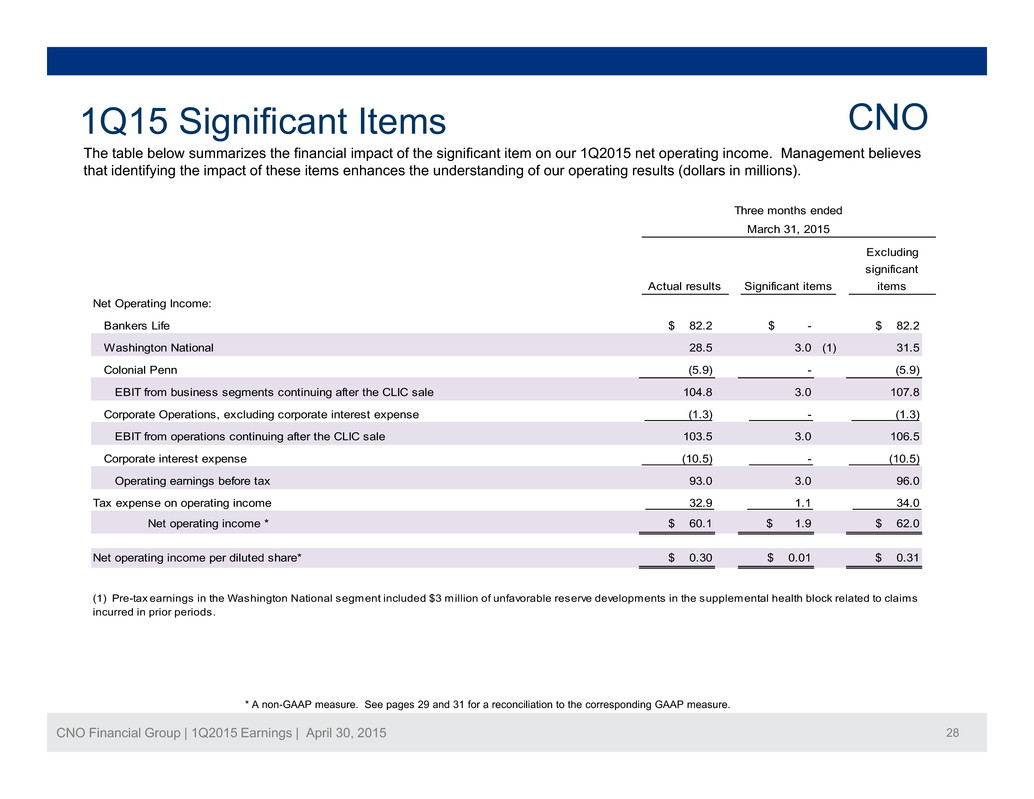

f f f 1Q201 1Q15 Significant Items CNO The table below summarizes the inancial impact o the signi icant item on our 5 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results (dollars in millions). Three months ended March 31, 2015 E l di Net Operating Income: Bankers Life $ 82.2 $ - $ 82.2 Washington National (1) Actual results Significant items xc u ng significant items 28 5 3 0 31 5 Colonial Penn EBIT from business segments continuing after the CLIC sale Corporate Operations, excluding corporate interest expense EBIT from operations continuing after the CLIC sale 107.8 . . . 3.0 106.5 (5.9) - (5.9) 104.8 3.0 (1.3) - (1.3) 103.5 Corporate interest expense Operating earnings before tax Tax expense on operating income Net operating income * $ 60.1 $ 1.9 $ 62.0 (10.5) - (10.5) 93.0 3.0 96.0 32.9 1.1 34.0 Net operating income per diluted share* $ 0.30 $ 0.01 $ 0.31 (1) Pre-tax earnings in the Washington National segment included $3 million of unfavorable reserve developments in the supplemental health block related to claims incurred in prior periods. CNO Financial Group | 1Q2015 Earnings | April 30, 2015 28 * A non-GAAP measure. See pages 29 and 31 for a reconciliation to the corresponding GAAP measure.

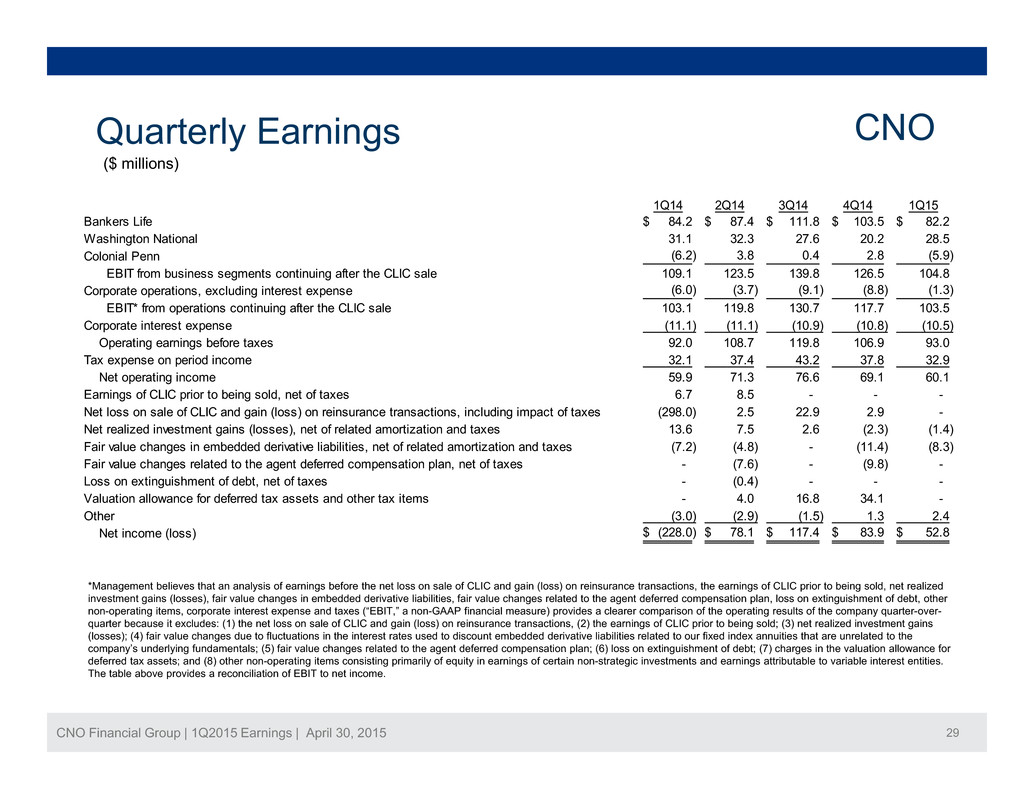

Quarterly Earnings CNO 1Q14 2Q14 3Q14 4Q14 1Q15 Bankers Life 84.2$ 87.4$ 111.8$ 103.5$ 82.2$ Washington National 31.1 32.3 27.6 20.2 28.5 ($ millions) Colonial Penn (6.2) 3.8 0.4 2.8 (5.9) EBIT from business segments continuing after the CLIC sale 109.1 123.5 139.8 126.5 104.8 Corporate operations, excluding interest expense (6.0) (3.7) (9.1) (8.8) (1.3) EBIT* from operations continuing after the CLIC sale 103.1 119.8 130.7 117.7 103.5 Corporate interest expense (11.1) (11.1) (10.9) (10.8) (10.5) Operating earnings before taxes 92.0 108.7 119.8 106.9 93.0 Tax expense on period income 32.1 37.4 43.2 37.8 32.9 Net operating income 59.9 71.3 76.6 69.1 60.1 Earnings of CLIC prior to being sold, net of taxes 6.7 8.5 - - - Net loss on sale of CLIC and gain (loss) on reinsurance transactions, including impact of taxes (298.0) 2.5 22.9 2.9 - Net realized investment gains (losses), net of related amortization and taxes 13.6 7.5 2.6 (2.3) (1.4) Fair value changes in embedded derivative liabilities net of related amortization and taxes (7 2) (4 8) - (11 4) (8 3) , . . . . Fair value changes related to the agent deferred compensation plan, net of taxes - (7.6) - (9.8) - Loss on extinguishment of debt, net of taxes - (0.4) - - - Valuation allowance for deferred tax assets and other tax items - 4.0 16.8 34.1 - Other (3.0) (2.9) (1.5) 1.3 2.4 Net income (loss) (228.0)$ 78.1$ 117.4$ 83.9$ 52.8$ *Management believes that an analysis of earnings before the net loss on sale of CLIC and gain (loss) on reinsurance transactions, the earnings of CLIC prior to being sold, net realized investment gains (losses), fair value changes in embedded derivative liabilities, fair value changes related to the agent deferred compensation plan, loss on extinguishment of debt, other non-operating items, corporate interest expense and taxes (“EBIT,” a non-GAAP financial measure) provides a clearer comparison of the operating results of the company quarter-over- quarter because it excludes: (1) the net loss on sale of CLIC and gain (loss) on reinsurance transactions, (2) the earnings of CLIC prior to being sold; (3) net realized investment gains (losses); (4) fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities that are unrelated to the company’s underlying fundamentals; (5) fair value changes related to the agent deferred compensation plan; (6) loss on extinguishment of debt; (7) charges in the valuation allowance for CNO Financial Group | 1Q2015 Earnings | April 30, 2015 29 deferred tax assets; and (8) other non-operating items consisting primarily of equity in earnings of certain non-strategic investments and earnings attributable to variable interest entities. The table above provides a reconciliation of EBIT to net income.

Information Related to Certain Non-GAAP Financial Measures The following provides additional information regarding certain non-GAAP measures used in this presentation. A non-GAAP measure is a numerical measure of a company’s performance, financial position, or cash flows that excludes or includes amounts that are normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. While management believes these measures are useful to enhance understanding and comparability of our financial results these non-GAAP measures , should not be considered as substitutes for the most directly comparable GAAP measures. Additional information concerning non-GAAP measures is included in our periodic filings with the Securities and Exchange Commission that are available in the “Investors – SEC Filings” section of CNO’s website, www.CNOinc.com. Operating earnings measures Management believes that an analysis of net income applicable to common stock before net loss on sale of CLIC and gain (loss) on reinsurance transactions, the earnings of CLIC prior to being sold, net realized gains or losses, fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities, fair value changes related to the agent deferred compensation plan loss on extinguishment of debt changes in our valuation allowance for deferred tax assets and other, , non-operating items consisting primarily of equity in earnings of certain non-strategic investments and earnings attributable to variable interest entities (“net operating income,” a non-GAAP financial measure) is important to evaluate the performance of the Company and is a key measure commonly used in the life insurance industry. Management uses this measure to evaluate performance because these items are unrelated to the Company’s continuing operations. CNO Financial Group | 1Q2015 Earnings | April 30, 2015 30

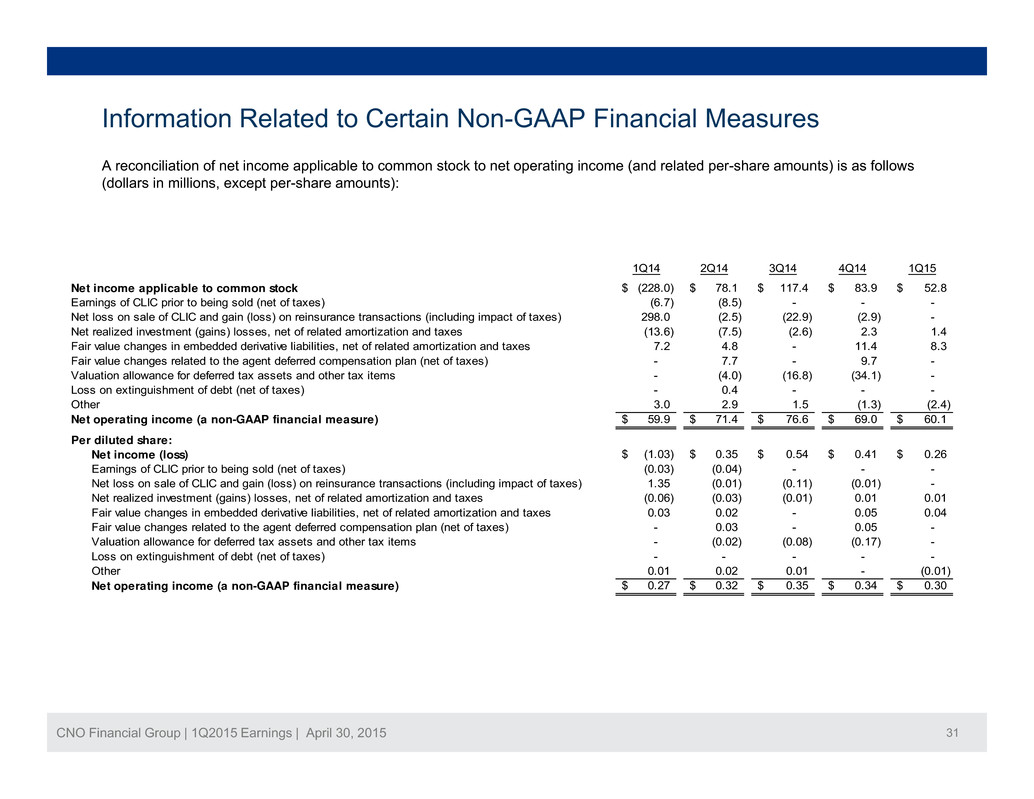

Information Related to Certain Non-GAAP Financial Measures A reconciliation of net income applicable to common stock to net operating income (and related per-share amounts) is as follows (dollars in millions, except per-share amounts): 1Q14 2Q14 3Q14 4Q14 1Q15 Net income applicable to common stock (228.0)$ 78.1$ 117.4$ 83.9$ 52.8$ Earnings of CLIC prior to being sold (net of taxes) (6.7) (8.5) - - - Net loss on sale of CLIC and gain (loss) on reinsurance transactions (including impact of taxes) 298.0 (2.5) (22.9) (2.9) - Net realized investment (gains) losses, net of related amortization and taxes (13.6) (7.5) (2.6) 2.3 1.4 Fair value changes in embedded derivative liabilities, net of related amortization and taxes 7.2 4.8 - 11.4 8.3 Fair value changes related to the agent deferred compensation plan (net of taxes) - 7.7 - 9.7 - Valuation allowance for deferred tax assets and other tax items - (4.0) (16.8) (34.1) - Loss on extinguishment of debt (net of taxes) - 0.4 - - - Other 3.0 2.9 1.5 (1.3) (2.4) Net operating income (a non-GAAP financial measure) 59.9$ 71.4$ 76.6$ 69.0$ 60.1$ Per diluted share: $ $ $ $ $Net income (loss) (1.03) 0.35 0.54 0.41 0.26 Earnings of CLIC prior to being sold (net of taxes) (0.03) (0.04) - - - Net loss on sale of CLIC and gain (loss) on reinsurance transactions (including impact of taxes) 1.35 (0.01) (0.11) (0.01) - Net realized investment (gains) losses, net of related amortization and taxes (0.06) (0.03) (0.01) 0.01 0.01 Fair value changes in embedded derivative liabilities, net of related amortization and taxes 0.03 0.02 - 0.05 0.04 Fair value changes related to the agent deferred compensation plan (net of taxes) - 0.03 - 0.05 - Valuation allowance for deferred tax assets and other tax items - (0.02) (0.08) (0.17) - Loss on extinguishment of debt (net of taxes) - - - - - Other 0.01 0.02 0.01 - (0.01) Net operating income (a non-GAAP financial measure) 0.27$ 0.32$ 0.35$ 0.34$ 0.30$ CNO Financial Group | 1Q2015 Earnings | April 30, 2015 31

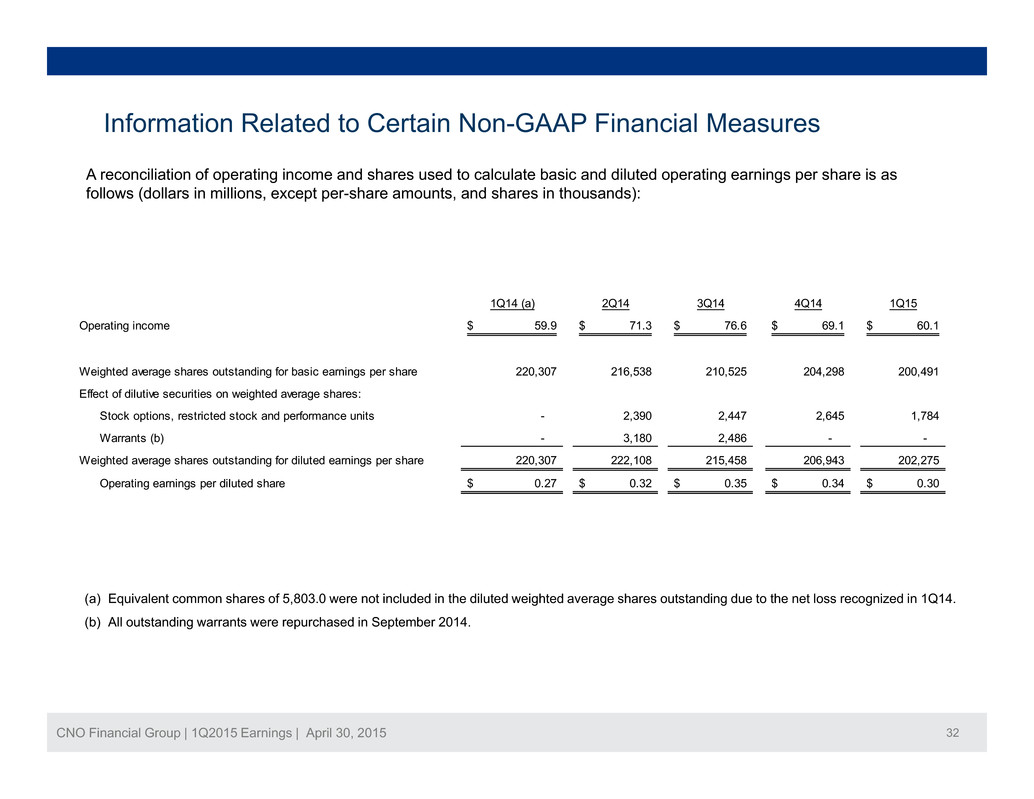

Information Related to Certain Non-GAAP Financial Measures A reconciliation of operating income and shares used to calculate basic and diluted operating earnings per share is as follows (dollars in millions, except per-share amounts, and shares in thousands): 1Q14 (a) 2Q14 3Q14 4Q14 1Q15 Operating income 59.9$ 71.3$ 76.6$ 69.1$ 60.1$ Weighted average shares outstanding for basic earnings per share 220,307 216,538 210,525 204,298 200,491 Effect of dilutive securities on weighted average shares: Stock options, restricted stock and performance units - 2,390 2,447 2,645 1,784 Warrants (b) - 3,180 2,486 - - Weighted average shares outstanding for diluted earnings per share 220,307 222,108 215,458 206,943 202,275 Operating earnings per diluted share 0.27$ 0.32$ 0.35$ 0.34$ 0.30$ (a) Equivalent common shares of 5,803.0 were not included in the diluted weighted average shares outstanding due to the net loss recognized in 1Q14. (b) All outstanding warrants were repurchased in September 2014. CNO Financial Group | 1Q2015 Earnings | April 30, 2015 32

B k l dil t d h Information Related to Certain Non-GAAP Financial Measures oo va ue per u e s are Book value per diluted share reflects the potential dilution that could occur if outstanding stock options and warrants were exercised, restricted stock and performance units were vested and convertible securities were converted. The dilution from options, warrants, restricted shares and performance units is calculated using the treasury stock method. Under this method, we assume the proceeds from the exercise of the options and warrants (or the unrecognized compensation expense with respect to restricted stock and performance units) will be used to purchase shares of our common stock at the closing market price on the last day of the period. In addition, the calculation of this non-GAAP measure differs from the corresponding GAAP measure because accumulated other comprehensive income (loss) has been excluded from the value of capital used to determine this measure. Management believes this non-GAAP measure is useful because it removes the volatility that arises from changes in the unrealized appreciation (depreciation) of our investments . A reconciliation from book value per share to book value per diluted share, excluding accumulated other comprehensive income (loss) is as follows (dollars in millions, except per share amounts): 1Q14 2Q14 3Q14 4Q14 1Q15 Total shareholders' equity 4,710.2$ 4,844.3$ 4,722.0$ 4,688.2$ 4,753.6$ Shares outstanding for the period 219,266,947 213,755,190 207,640,050 203,324,458 198,631,949 Book value per share 21.48$ 22.66$ 22.74$ 23.06$ 23.93$ Total shareholders' equity 4,710.2$ 4,844.3$ 4,722.0$ 4,688.2$ 4,753.6$ Less accumulated other comprehensive income (766.2) (926.1) (859.3) (825.3) (934.2) Adjusted shareholders' equity excluding AOCI 3,944.0$ 3,918.2$ 3,862.7$ 3,862.9$ 3,819.4$ Shares outstanding for the period 219,266,947 213,755,190 207,640,050 203,324,458 198,631,949 Dilutive common stock equivalents related to: Warrants, stock options, restricted stock and performance units 5,839,726 5,780,892 2,406,402 2,645,322 1,857,139 Diluted shares outstanding 225,106,673 219,536,082 210,046,452 205,969,780 200,489,088 Book value per diluted share (a non-GAAP financial measure) 17.52$ 17.85$ 18.39$ 18.75$ 19.05$ CNO Financial Group | 1Q2015 Earnings | April 30, 2015 33

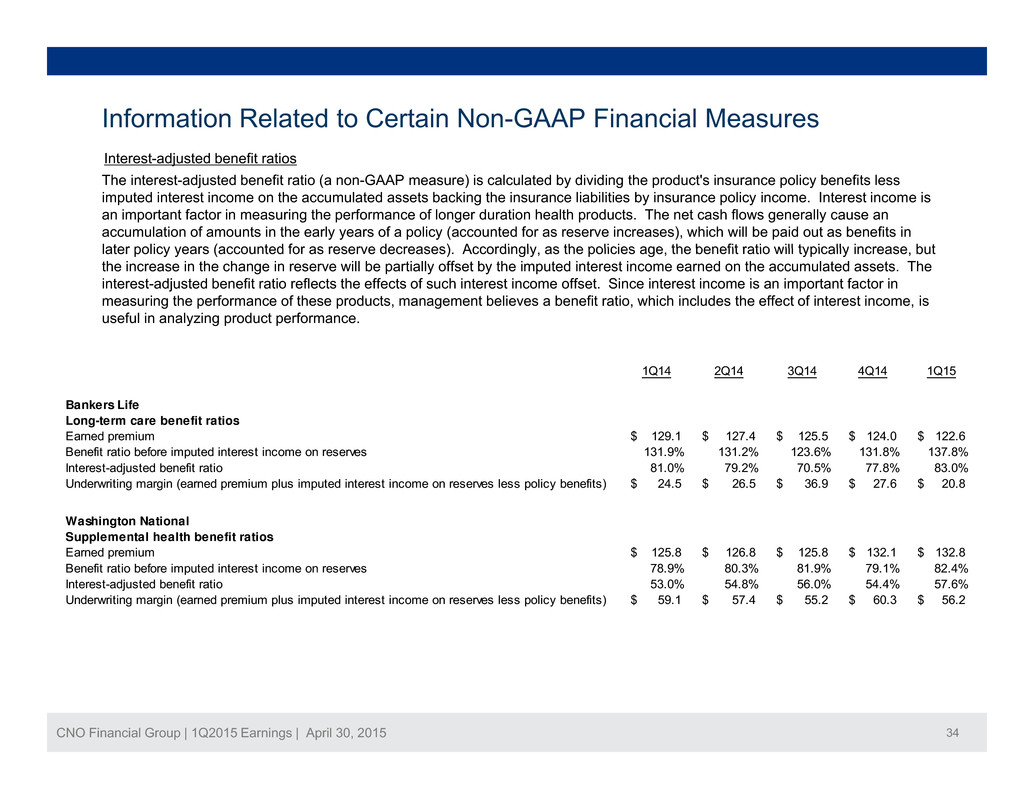

Information Related to Certain Non-GAAP Financial Measures The interest-adjusted benefit ratio (a non-GAAP measure) is calculated by dividing the product's insurance policy benefits less imputed interest income on the accumulated assets backing the insurance liabilities by insurance policy income. Interest income is an important factor in measuring the performance of longer duration health products. The net cash flows generally cause an accumulation of amounts in the early years of a policy (accounted for as reserve increases), which will be paid out as benefits in later policy years (accounted for as reserve decreases) Accordingly as the policies age the benefit ratio will typically increase but Interest-adjusted benefit ratios year . , , , the increase in the change in reserve will be partially offset by the imputed interest income earned on the accumulated assets. The interest-adjusted benefit ratio reflects the effects of such interest income offset. Since interest income is an important factor in measuring the performance of these products, management believes a benefit ratio, which includes the effect of interest income, is useful in analyzing product performance. 1Q14 2Q14 3Q14 4Q14 1Q15 Bankers Life Long-term care benefit ratios Earned premium 129.1$ 127.4$ 125.5$ 124.0$ 122.6$ B fit ti b f i t d i t t i 131 9% 131 2% 123 6% 131 8% 137 8%ene ra o e ore mpu e n eres ncome on reserves . . . . . Interest-adjusted benefit ratio 81.0% 79.2% 70.5% 77.8% 83.0% Underwriting margin (earned premium plus imputed interest income on reserves less policy benefits) 24.5$ 26.5$ 36.9$ 27.6$ 20.8$ Washington National Supplemental health benefit ratios Earned premium 125 8$ 126 8$ 125 8$ 132 1$ 132 8$ . . . . . Benefit ratio before imputed interest income on reserves 78.9% 80.3% 81.9% 79.1% 82.4% Interest-adjusted benefit ratio 53.0% 54.8% 56.0% 54.4% 57.6% Underwriting margin (earned premium plus imputed interest income on reserves less policy benefits) 59.1$ 57.4$ 55.2$ 60.3$ 56.2$ CNO Financial Group | 1Q2015 Earnings | April 30, 2015 34

Information Related to Certain Non-GAAP Financial Measures Operating return measures Management believes that an analysis of net income applicable to common stock before the net loss on sale of CLIC and gain (loss) on reinsurance transactions, the earnings of CLIC prior to being sold, net realized gains or losses, fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities, fair value changes related to the agent deferred compensation plan, loss on extinguishment of d bt h i l ti ll f d f d t t d th ti it i ti i il fe , c anges n our va ua on a owance or e erre ax asse s an o er non-opera ng ems cons s ng pr mar y o equity in earnings of certain non-strategic investments and earnings attributable to variable interest entities (“net operating income,” a non-GAAP financial measure) is important to evaluate the performance of the Company and is a key measure commonly used in the life insurance industry. Management uses this measure to evaluate performance because these items are unrelated to the Company’s continuing operations. Management also believes that an operating return, excluding significant items, is important as the impact of these items enhances the understanding of our operating results. This non-GAAP financial measure also differs from return on equity because accumulated other comprehensive income (loss) has been excluded from the value of equity used to determine this ratio. Management believes this non-GAAP financial measure is useful because it removes the volatility that arises from changes in accumulated other comprehensive income (loss). Such volatility is often caused by changes in the estimated fair value of our investment portfolio resulting from changes in general market interest rates rather than the business decisions made by management. In addition our equity includes the value of significant net operating loss carryforwards (included in income tax assets) , assets . In accordance with GAAP, these assets are not discounted, and accordingly will not provide a return to shareholders (until after it is realized as a reduction to taxes that would otherwise be paid). Management believes that excluding this value from the equity component of this measure enhances the understanding of the effect these non-discounted assets have on operating returns and the comparability of these measures from period-to-period. Operating return measures are used in measuring the performance of our business units and are used as a basis for incentive CNO Financial Group | 1Q2015 Earnings | April 30, 2015 35 unit compensation.

Information Related to Certain Non-GAAP Financial Measures Th l l ti f (i) ti t it l di l t d th h i i (l ) d te ca cu a ons o : (i opera ng re urn on equ y, exc u ng accumu a e o er compre ens ve ncome oss an ne operating loss carryforwards (a non-GAAP financial measure); (ii) operating return, excluding significant items, on equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non- GAAP financial measure); and (iii) return on equity are as follows (dollars in millions): Trailing twelve months ended 1Q14 2Q14 3Q14 4Q14 1Q15 Operating income 252.5$ 263.8$ 274.0$ 276.9$ 277.1$ Operating income, excluding significant items 246.2$ 260.1$ 266.8$ 272.3$ 272.5$ Net Income 238.1$ 239.1$ 73.5$ 51.4$ 332.2$ Average common equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) 3,126.8$ 3,121.5$ 3,097.9$ 3,052.1$ 3,029.2$ Average common shareholders' equity 4,798.2$ 4,791.2$ 4,816.0$ 4,774.6$ 4,746.6$ Operating return on equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) 8.1% 8.5% 8.8% 9.1% 9.1% Operating return, excluding significant items, on equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) 7.9% 8.3% 8.6% 8.9% 9.0% Return on equity 5.0% 5.0% 1.5% 1.1% 7.0% CNO Financial Group | 1Q2015 Earnings | April 30, 2015 36 (Continued on next page)

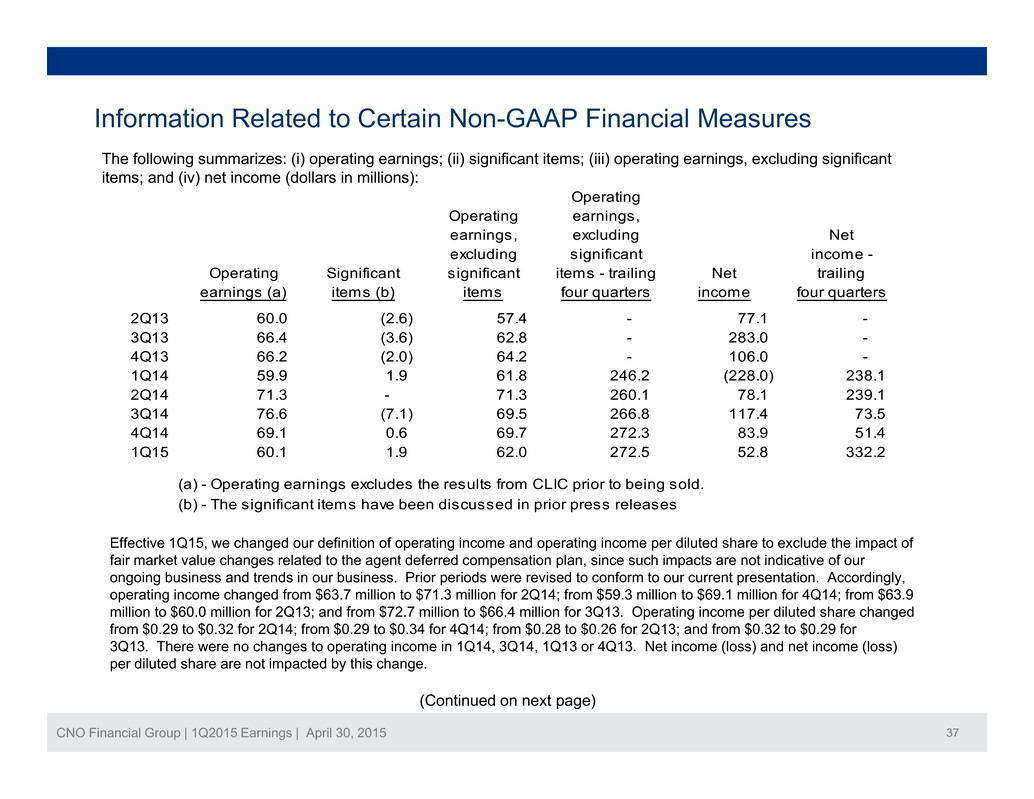

Information Related to Certain Non-GAAP Financial Measures The following summarizes: (i) operating earnings; (ii) significant items; (iii) operating earnings, excluding significant items; and (iv) net income (dollars in millions): Operating Operating earnings, earnings, excluding Net excluding significant income - Operating Significant significant items - trailing Net trailing earnings (a) items (b) items four quarters income four quarters 2Q13 60.0 (2.6) 57.4 - 77.1 - 3Q13 66.4 (3.6) 62.8 - 283.0 - 4Q13 66.2 (2.0) 64.2 - 106.0 - 1Q14 59.9 1.9 61.8 246.2 (228.0) 238.1 2Q14 71.3 - 71.3 260.1 78.1 239.1 3Q14 76.6 (7.1) 69.5 266.8 117.4 73.5 4Q14 69.1 0.6 69.7 272.3 83.9 51.4 1Q15 60 1 1 9 62 0 272 5 52 8 332 2 Effective 1Q15, we changed our definition of operating income and operating income per diluted share to exclude the impact of . . . . . . (a) - Operating earnings excludes the results from CLIC prior to being sold. (b) - The significant items have been discussed in prior press releases fair market value changes related to the agent deferred compensation plan, since such impacts are not indicative of our ongoing business and trends in our business. Prior periods were revised to conform to our current presentation. Accordingly, operating income changed from $63.7 million to $71.3 million for 2Q14; from $59.3 million to $69.1 million for 4Q14; from $63.9 million to $60.0 million for 2Q13; and from $72.7 million to $66.4 million for 3Q13. Operating income per diluted share changed from $0.29 to $0.32 for 2Q14; from $0.29 to $0.34 for 4Q14; from $0.28 to $0.26 for 2Q13; and from $0.32 to $0.29 for 3Q13. There were no changes to operating income in 1Q14, 3Q14, 1Q13 or 4Q13. Net income (loss) and net income (loss) CNO Financial Group | 1Q2015 Earnings | April 30, 2015 37 per diluted share are not impacted by this change. (Continued on next page)

Information Related to Certain Non-GAAP Financial Measures A reconciliation of pretax operating earnings (a non-GAAP financial measure) to net income is as follows (dollars in millions): 1Q14 2Q14 3Q14 4Q14 1Q15 Twelve months ended Pretax operating earnings (a non-GAAP financial measure) 383.2$ 399.7$ 422.2$ 427.4$ 428.4$ Income tax (expense) benefit (130.7) (135.9) (148.2) (150.5) (151.3) Operating return 252.5 263.8 274.0 276.9 277.1 Earnings of CLIC prior to being sold, net of taxes 26.7 30.4 24.9 15.2 8.5 Net loss on sale of CLIC and gain (loss) on reinsurance transactions, inculding impact of taxes (361.3) (358.8) (335.9) (269.7) 28.3 Net realized investment gains, net of related amortization and taxes 22.4 29.1 32.8 21.4 6.4 Fair value changes in embedded derivative liabilities, net of related amortization and taxes 14.5 (2.4) (4.6) (23.4) (24.5) Fair value changes related to the agent deferred compensation plan, net of taxes 10.2 (1.3) (7.6) (17.4) (17.4) Loss on extinguishment or modification of debt (net of taxes) (6.8) (0.4) (0.4) (0.4) (0.4) Valuation allowance for deferred tax assets and other tax items 291.0 290.0 100.1 54.9 54.9 Other (11.1) (11.3) (9.8) (6.1) (0.7) CNO Financial Group | 1Q2015 Earnings | April 30, 2015 38 Net income 238.1$ 239.1$ 73.5$ 51.4$ 332.2$ (Continued on next page)

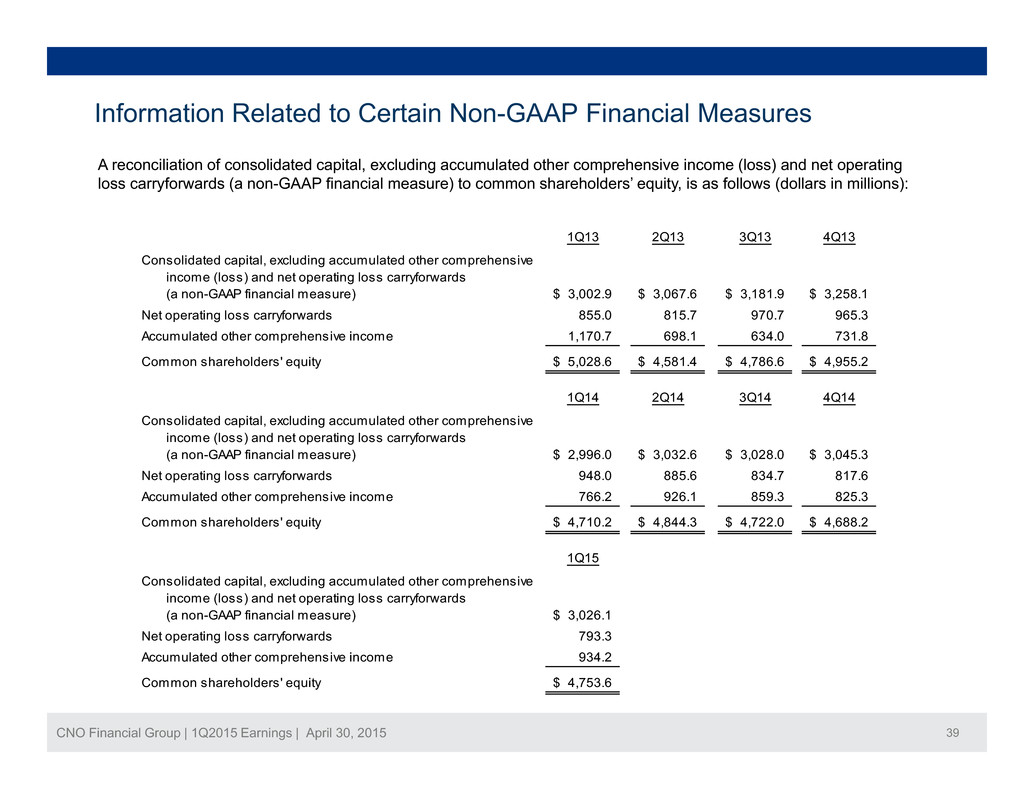

Information Related to Certain Non-GAAP Financial Measures A reconciliation of consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) to common shareholders’ equity, is as follows (dollars in millions): 1Q13 2Q13 3Q13 4Q13 Consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) 3,002.9$ 3,067.6$ 3,181.9$ 3,258.1$ Net operating loss carryforwards 855.0 815.7 970.7 965.3 Accumulated other comprehensive income 1,170.7 698.1 634.0 731.8 Common shareholders' equity 5,028.6$ 4,581.4$ 4,786.6$ 4,955.2$ 1Q14 2Q14 3Q14 4Q14 Consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards $ $ $ $(a non-GAAP financial measure) 2,996.0 3,032.6 3,028.0 3,045.3 Net operating loss carryforwards 948.0 885.6 834.7 817.6 Accumulated other comprehensive income 766.2 926.1 859.3 825.3 Common shareholders' equity 4,710.2$ 4,844.3$ 4,722.0$ 4,688.2$ 1Q15 Consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) 3,026.1$ Net operating loss carryforwards 793.3 CNO Financial Group | 1Q2015 Earnings | April 30, 2015 39 Accumulated other comprehensive income 934.2 Common shareholders' equity 4,753.6$

Information Related to Certain Non-GAAP Financial Measures A reconciliation of consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) to common shareholders’ equity, is as follows (dollars in millions): 1Q14 2Q14 3Q14 4Q14 1Q15 Trailing Four Quarter Average Consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) 3,126.8$ 3,121.5$ 3,097.9$ 3,052.1$ 3,029.3$ Net operating loss carryforwards 913.3 933.7 925.4 890.0 852.1 Accumulated other comprehensive income 758.1 736.0 792.7 832.5 865.2 Common shareholders' equity 4,798.2$ 4,791.2$ 4,816.0$ 4,774.6$ 4,746.6$ CNO Financial Group | 1Q2015 Earnings | April 30, 2015 40

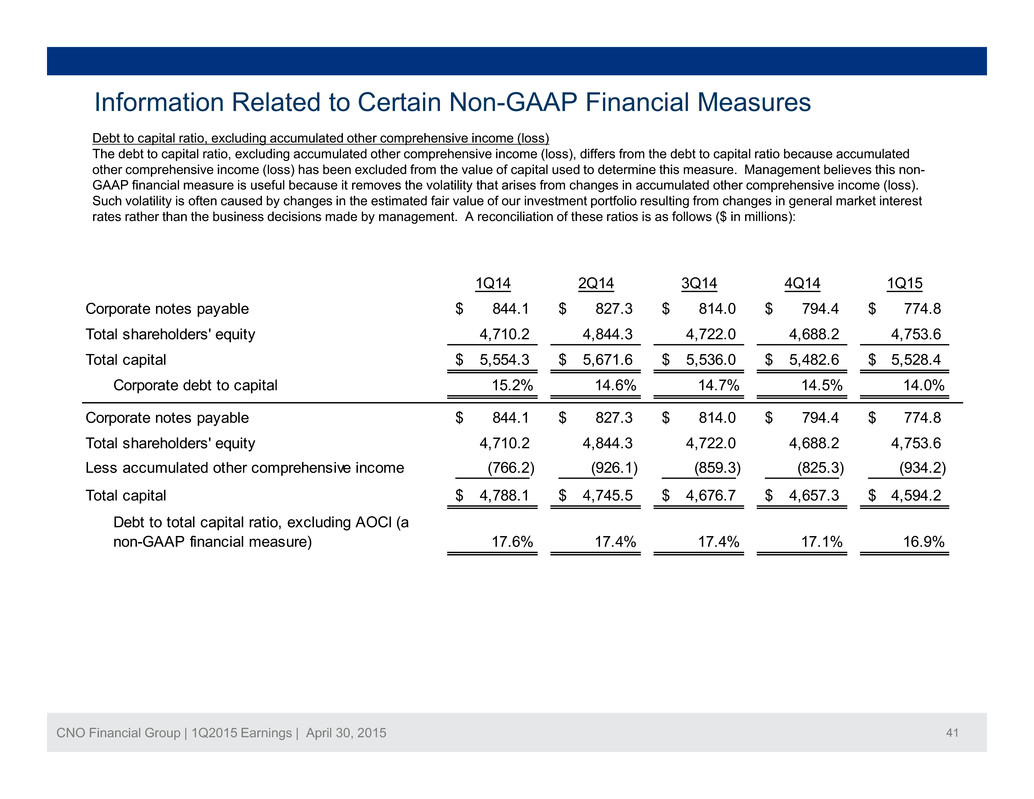

Information Related to Certain Non-GAAP Financial Measures Debt to capital ratio, excluding accumulated other comprehensive income (loss) The debt to capital ratio, excluding accumulated other comprehensive income (loss), differs from the debt to capital ratio because accumulated other comprehensive income (loss) has been excluded from the value of capital used to determine this measure. Management believes this non- GAAP financial measure is useful because it removes the volatility that arises from changes in accumulated other comprehensive income (loss). Such volatility is often caused by changes in the estimated fair value of our investment portfolio resulting from changes in general market interest rates rather than the business decisions made by management. A reconciliation of these ratios is as follows ($ in millions): 1Q14 2Q14 3Q14 4Q14 1Q15 Corporate notes payable 844.1$ 827.3$ 814.0$ 794.4$ 774.8$ Total shareholders' equity 4,710.2 4,844.3 4,722.0 4,688.2 4,753.6 Total capital 5,554.3$ 5,671.6$ 5,536.0$ 5,482.6$ 5,528.4$ Corporate debt to capital 15.2% 14.6% 14.7% 14.5% 14.0% Corporate notes payable 844.1$ 827.3$ 814.0$ 794.4$ 774.8$ Total shareholders' equity 4,710.2 4,844.3 4,722.0 4,688.2 4,753.6 Less accumulated other comprehensive income (766.2) (926.1) (859.3) (825.3) (934.2) Total capital 4,788.1$ 4,745.5$ 4,676.7$ 4,657.3$ 4,594.2$ Debt to total capital ratio, excluding AOCI (a non-GAAP financial measure) 17.6% 17.4% 17.4% 17.1% 16.9% CNO Financial Group | 1Q2015 Earnings | April 30, 2015 41