Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - NEXUS BIOPHARMA INC | Financial_Report.xls |

| EX-32.2 - CERTIFICATION - NEXUS BIOPHARMA INC | plata_ex322.htm |

| EX-32.1 - CERTIFICATION - NEXUS BIOPHARMA INC | plata_ex321.htm |

| EX-31.1 - CERTIFICATION - NEXUS BIOPHARMA INC | plata_ex311.htm |

| EX-31.2 - CERTIFICATION - NEXUS BIOPHARMA INC | plata_ex312.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______________to ____________

|

000-53207 |

|

|

(Commission File Number) |

|

PLATA RESOURCES, INC. |

|

|

(Exact name of registrant as specified in its charter) |

|

Nevada |

|

75-3267338 |

|

(I.R.S. Employer Identification No.) |

||

|

2911 Park Avenue, Pasay City, Metro Manilla, Philippines |

|

|

|

(Address of principal executive offices) |

|

(Zip Code) |

|

63-632-886-788 |

|

|

(Registrant’s telephone number, including area code) |

|

|

N/A |

|

|

(Former name, former address and former fiscal year, if changed since last report) |

|

|

Securities registered pursuant to Section 12(b) of the Act: None |

|

|

Title of each class |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ¨ Yes x No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ¨ Yes x No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨ Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. ¨ Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer (Do not check if a smaller reporting company) x Smaller reporting company

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ Yes x No

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter, was $0.

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. March 31, 2015: 63,800,000 common shares.

TABLE OF CONTENTS

| Page | |||||

|

PART I |

|||||

|

Item 1 |

Business |

3 |

|||

|

Item 1A |

Risk Factors |

5 |

|||

|

Item 1B |

Unresolv Staff Comments |

5 |

|||

|

Item 2 |

Properties |

5 |

|||

|

Item 3 |

Legal Proceedings |

11 |

|||

|

Item 4 |

Mine Safety Disclosure |

11 |

|||

|

PART II |

|||||

|

Item 5 |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

12 |

|||

|

Item 6 |

Selected Financial Data |

12 |

|||

|

Item 7 |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

12 |

|||

|

Item 7A |

Quantitative and Qualitative Disclosures About Market Risk |

13 |

|||

|

Item 8 |

Financial Statements and Supplementary Data |

14 |

|||

|

Item 9 |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

24 |

|||

|

Item 9A |

Controls and Procedures |

24 |

|||

|

Item 9B |

Other Information |

25 |

|||

|

PART III |

|||||

|

Item 10 |

Directors, Executive Officers and Corporate Governance |

26 |

|||

|

Item 11 |

Executive Executive Compensation |

29 |

|||

|

Item 12 |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

30 |

|||

|

Item 13 |

Certain Relationships and Related Transactions, and Director Independence |

32 |

|||

|

Item 14 |

Principal Accounting Fees and Services |

33 |

|||

|

PART IV |

|||||

|

Item 15 |

Exhibits, Financial Statement Schedules |

34 |

|||

|

Signatures |

35 |

||||

|

2

|

PART I

Item 1. Business.

History and Organization

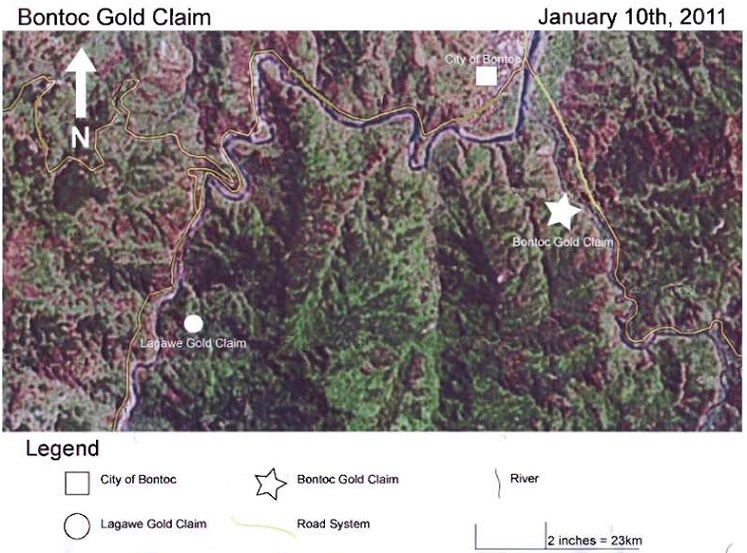

We were incorporated on July 17, 2007 under the laws of the State of Nevada. We are in the very early stages of exploration. Our company is one engaged in the search of mineral deposits or reserves but is not in either the development or production stage. It might take us years before we are able to be in either the development or production stage and the chances are that we might never be in either of these two stages. Our mineral property is called the Bontoc Gold Claim (the “Bontoc Claim”) and is located in the Philippines. We own 100% of the Bontoc Claim. It consists of one – 9 unit claim block containing 102.5 hectares which have been staked and recorded with the Mineral Resources Department of the Ministry of Energy and Mineral Resources of the Government of the Republic of Philippines.

We are an Emerging Growth Company as defined in the Jumpstart Our Business Startups Act.

We shall continue to be deemed an emerging growth company until the earliest of—

(A) the last day of the fiscal year of the issuer during which it had total annual gross revenues of $1,000,000,000 (as such amount is indexed for inflation every 5 years by the Commission to reflect the change in the Consumer Price Index for All Urban Consumers published by the Bureau of Labor Statistics, setting the threshold to the nearest 1,000,000) or more;

(B) the last day of the fiscal year of the issuer following the fifth anniversary of the date of the first sale of common equity securities of the issuer pursuant to an effective registration statement under this title;

(C) the date on which such issuer has, during the previous 3-year period, issued more than $1,000,000,000 in non-convertible debt; or

(D) the date on which such issuer is deemed to be a ‘large accelerated filer’, as defined in section 240.12b-2 of title 17, Code of Federal Regulations, or any successor thereto.

As an emerging growth company we are exempt from Section 404(b) of Sarbanes Oxley. Section 404(a) requires Issuers to publish information in their annual reports concerning the scope and adequacy of the internal control structure and procedures for financial reporting. This statement shall also assess the effectiveness of such internal controls and procedures.

Section 404(b) requires that the registered accounting firm shall, in the same report, attest to and report on the assessment on the effectiveness of the internal control structure and procedures for financial reporting.

As an emerging growth company we are exempt from Section 14A and B of the Securities Exchange Act of 1934 which require the shareholder approval of executive compensation and golden parachutes.

We have irrevocably opted out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the Act.

We have no revenue, have achieved losses since inception, have no operations and have relied upon the sale of our securities and advances from our officers and directors to fund our operations.

Our administrative office is located at 2911 Park Avenue, Pasay City, Metro Manila, Philippines (Tel: 632-886-788) and our registered statutory office is located at the offices of American Corporate Enterprises, Inc., Suite 129, 123 W. Nye Lane, Carson City, Nevada, 89706.

|

3

|

We have no plans to change our business activities or to combine with another business, and are not aware of any events or circumstances that might cause our plans to change.

On August 1, 2007, we purchased the Bontoc Claim for $5,000 from Castillo Explorations LLC, an unrelated company incorporate in the Republic of the Philippines, whereby we obtained a 100% interest in the Bontoc Claim. The Bontoc Claim upon purchase was free and clear of any and all charges, encumbrances, or liens of any nature of kind whatsoever. There is no requirement under Philippine mineral law to spend any money on the Bontoc Claim to maintain our interest therein. Nevertheless, it is the intention of Plata to undertake an exploration program by the end of 2015 as set forth by Geraldo Peralta in his geological report dated August 16, 2007 as more fully mentioned below.

As mentioned above the Bontoc Claim is unencumbered and there are no competitive conditions which affect the property. Further, there is no insurance covering the Bontoc Claim and we believe that no insurance is necessary since it is unimproved and contains no buildings or improvements.

To date we have not performed any work on the property. We are presently exploring for minerals and we cannot guarantee that a commercially viable mineral deposit, a reserve, exists on Bontoc Claim until further exploration is done and a comprehensive evaluation concludes economic and legal feasibility.

There are no known environmental concerns or parks designated for any area contained within the Bontoc Claim. We have no plans to try and interest other companies in the Bontoc Claim if mineralization is found. If mineralization is found, we will try to develop it ourselves.

Planned Business

The following discussion should be read in conjunction with the information contained in the financial statements of the Company and the notes, which form an integral part of the financial statements, which are attached hereto.

The financial statements mentioned above have been prepared in conformity with accounting principles generally accepted in the United States of America and are stated in United States dollars.

Cautionary Statement Regarding Forward-Looking Statements

Some discussions in this Form 10-K may contain forward-looking statements that involve risks and uncertainties. These statements relate to future events or future financial performance. A number of important factors could cause our actual results to differ materially from those expressed in any forward-looking statements made by us in this prospectus. Forward-looking statements are often identified by words like: “believe”, “expect”, “estimate”, “anticipate”, “intend”, “project” and similar expressions or words which, by their nature, refer to future events.

In some cases, you can also identify forward-looking statements by terminology such as "may", "will", "should", "plans", "predicts", "potential" or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled "Risk Factors" below that may cause our or our industry's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. In addition, you are directed to factors discussed in the "Management's Discussion and Analysis of Financial Condition and Results of Operations" section and as well as those discussed elsewhere in this Form 10-K.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

|

4

|

Item 1A. Risk Factors.

We are a smaller reporting company as defined in Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

Item 1B. Unresolved Staff Comments.

We are a smaller reporting company as defined in Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

Item 2. Properties.

We intend to undertake exploration work on the Bontoc Claim, located in Republic of the Philippines.

We are presently exploring for minerals and there is no assurance that mineralized material with any commercial value exits on our property.

We do not have any ore body and have not generated any revenues from our operations.

Our sole mineral property is:

Bontoc Gold Claim

Upon acquiring the Bontoc Claim, Plata commissioned Geraldo Peralta, Professional Geolgoist, 101 Boni Serrano Avenue, Quezon City, Philippines to prepare a geological report on the Bontoc Claim and recommend an exploration program thereon. Mr. Peralta is a graduate of the University of Western Australia with a Bachelor of Science degree in Geology (1979) and a Masters of Science (1984 from the same University. He is a member of the Geological Society of the Philippines. He has worked for over 30 years as a Geologist. He has worked as a Geological Consultant for companies such as Altai Resources Inc., Mindanao Mining and Abralti Mining Ltd. and has consulted for several other companies around the world writing reports for their use and is therefore qualified to write our report and recommend the proposed exploration program and budget. In preparing the “Summary of Exploration on the Bontoc Property, Philippines” (“Summary”) dated August 16, 2007 Mr. Peralta visited the Bontoc on August 6 and 8 of 2007. At that time, he was able to interview field party personnel who were working near the Bontoc Claim. He has had no prior involvement with the Bontoc Claim and has read Instrument and Form 43-101 F1 prior to preparing the Summary so that it is in compliance with the requirements of Form 43-101 F1 as required by Philippine mining law.

The Summary recommends a two phased mineral exploration program consisting of air photo interpretation, geological mapping, geochemical soil sampling and geophysical surveying will enhance the targets for diamond drilling. This exploration program to evaluate the prospects of the Bontoc Claim, at a cost of $43,964 - PHP 1,953,760 is fully warranted to be spent.

Property

Plata has purchased a 100% interest in Bontoc Claim. Our claim consists of one – 9 unit claim block containing 102.5 hectares which have been staked and recorded with the Mineral Resources Department of the Ministry of Energy and Mineral Resources of the Government of the Republic of Philippines.

The Bontoc Claim was staked to cover gold zones within the claim boundaries. Previous exploration work to investigate the mineral potential of the Bontoc Claim has outlined some favorable areas for continued exploration and development.

|

5

|

Description and Location

Bontoc Claim consists of 1 unpatented mineral claim, located 23 kilometers Southeast of the city of Bontoc at UTM co-ordinates Latitude 17°07’00”N and Longitude 120°58’00”E. The mineral claim was assigned to Plata by Castillo Explorations LLC and the said assignment was filed with the Mineral Resources Department of the Ministry of Energy and Mineral Resources of the Government of the Republic of the Philippines.

Plata has purchased a 100% interest in the property.

Accessibility, Climate, Local Resources, Infrastructure and Topography

Bontoc Gold Claim is accessible from city of Bontoc by traveling on the country’s only highway system which for the most part consists of one lane in each direction and by taking an all weather gravel road. The province is nestled deep in the Cordillera mountain range. Landlocked, it is bounded by the mountains of Benguet on the west and those of the Mountain Province in the north. The terrain is mountainous, sloping into gently rolling hills and plateaus. Its mountain ranges reach an elevation of 2,523 meter above sea level. V-shaped gullies, creeks, streams and U-shaped rivers drain through the valleys. It is the premier mining district. Some 80% of the total Philippine gold production comes from the Cordillera.

|

6

|

The Philippines is situated between 5 and 22 degrees North latitude. This means the country falls within the so-called tropical climate zone, a zone characterized by high temperatures the whole year round, relatively high rainfall and lush vegetation. Rainfall on the city can occur in every month, but the wettest months are October, November and December. Annual rainfall is approximately 1.5 meters. Due to the steep, deforested, mountains on average 60 percent of the rainwater runs off fast to the sea. The remaining 40 percent partly evaporates partly seeps through to the island’s underground water aquifer.

Bontoc has an experienced work force and will provide all the necessary services needed for an exploration and development operation, including police, hospitals, groceries, fuel, helicopter services, hardware and other necessary items. Drilling companies and assay facilities are present in Bontoc.

History

Deposits of shell and eroded sand formed the basis for the limestone, which makes up most of Philippines. This limestone was, over the ages, pushed upwards, making it possible to find today sea fossils high in the country’s mountains. This pushing up continues today. It is caused by the fact that the Philippine Plate, on which most of the country lies, is slowly diving under the Eurasian Plate of the mainland of Asia.

The Philippines is characterized by steep mountains without any substantial forest cover. Highest peaks reach over 1,000 meters. The island is 300 km long and 35 km wide. High, steep mountains, short distances and lack of forest cover mean that rainwater runs fast to the sea, causing substantial erosion.

The island has vast copper, gold and coal reserves which are mined mainly in the central part.

Plata is preparing to conduct preliminary exploration work on its claim.

Regional Geology of the Area

The hilly terrains and the middle level plain contain crystalline hard rocks such as charnockites, granite gneiss, khondalites, leptynites, metamorphic gneisses with detached occurrences of crystalline limestone, iron ore, quartzo-feldspathic veins and basic intrusives such as dolerites and anorthosites. Coastal zones contain sedimentary limestones, clay, laterites, heavy mineral sands and silica sands. The hill ranges are sporadically capped with laterites and bauxites of residual nature. Gypsum and phosphatic nodules occur as sedimentary veins in rocks of the cretaceous age. Gypsum of secondary replacement occurs in some of the areas adjoining the foot hills of the Western Ghats. Lignite occurs as sedimentary beds of tertiary age. The Black Granite and other hard rocks are amenable for high polish. These granites occur in most of the districts except the coastal area.

Stratigraphy

The principal bedded rocks for the area of Bontoc Claim (and for most of the Philippines for that matter) are Precambrian rocks which are exposed along a wide axial zone of a broad complex.

Intrusive

In general the volcanoes culminate with effluents of hydrothermal solutions that carry precious metals in the form of naked elements, oxides or sulphides.

These hydrothermal solutions intrude into the older rocks as quartz veins. These rocks may be broken due to mechanical and chemical weathering into sand size particles and carried by streams and channels. Gold occurs also in these sands as placers.

|

7

|

Recent exploration result for gold occurrence in Bontoc, Mountain Province is highly encouraging. Gold belt in sheared gneissic rocks is found in three subparallel auriferous load zones where some blocks having 250 to 500 metre length and 1.5 to 2 metre width could be identified as most promising ones.

Structure

(a) Depositional Environment/Geological Settings:

Veins form in high-grade, dynamothermal metamorphic environment where metasedimentary belts are invaded by igneous rocks.

(b) Host/Associated Rock Types:

Hosted by paragneisses, quartzites, clinopyroxenites, wollastonite-rich rocks, pegmatites. Other associated rocks are charnockites, granitic and intermediate intrusive rocks, quartz-mica schists, granulites, aplites, marbles, amphibolites, magnetite-graphite iron formations and anorthosites.

(c) Tectonic Setting(s):

Katazone (relatively deep, high-grade metamorphic environments associated with igneous activity; conditions that are common in the shield areas).

Deposit Types

Deposits are from a few millimetres to over a metre thick in places. Individual veins display a variety of forms, including saddle-, pod- or lens-shaped, tabular or irregular bodies; frequently forming anastomosing or stockwork patterns.

Mineralization is located within a large fractured block created where prominent northwest-striking shears intersect the north striking caldera fault zone. The major lodes cover an area of 2 km and are mostly within 400m of the surface. Lodes occur in three main structural settings:

|

(i) |

steeply dipping northweststriking shears; |

|

|

|

|

(ii) |

flatdipping (1040) fractures (flatmakes); and |

|

|

|

|

(iii) |

shatter blocks between shears. |

Most of the gold occurs in tellurides and there are also significant quantities of gold in pyrite.

Mineralization

No mineralization has been reported for the area of the property but structures and shear zones affiliated with mineralization on adjacent properties pass through it.

Exploration

Previous exploration work on the Bontoc Claim has not been recorded if it was ever done. Governmental records indicate that no detailed exploration has been completed on the property.

|

8

|

Property Geology

To the east of the property is intrusives consisting of rocks such as tonalite, monzonite, and gabbro while the property itself is underlain by sediments and volcanics. The intrusives also consist of a large mass of granodiorite towards the western most point of the property.

The area consists of interlayered chert, argillite and massive andesitic to basaltic volcanics. The volcanics are hornfelsed, commonly contain minor pyrite, pyrrhotite.

Drilling Summary

No drilling is reported on the Bontoc Claim.

Sample Method, Sample Preparation, Data Verification

All the exploration conducted to date has been conducted according to generally accepted exploration procedures with methods and preparation that are consistent with generally accepted exploration practices. No opinion as to the quality of the samples taken can be presented. No other procedures of quality control were employed.

Interpretation and Conclusions

The locale of the Bontoc Claim is underlain by the units of the Precambrian rocks that are found at those mineral occurrence sites.

These rocks consisting of cherts and argillites (sediments) and andesitic to basaltic volcanic have been intruded by granodiorite. Structures and mineralization probably related to this intrusion are found throughout the region and occur on the claim. They are associated with all the major mineral occurrences and deposits in the area.

Mineralization found on the claim is consistent with that found associated with zones of extensive mineralization. Past work however has been limited and sporadic and has not tested the potential of the property.

Potential for significant amounts of mineralization to be found exists on the property and it merits intensive exploration.

Recommendations

A two phased exploration program to further delineate the mineralized system currently recognized on Bontoc Claim is recommended.

The program would consist of air photo interpretation of the structures, geological mapping, both regionally and detailed on the area of the main showings, geophysical survey using both magnetic and electromagnetic instrumentation in detail over the area of the showings and in a regional reconnaissance survey and geochemical soil sample surveying regionally to identify other areas on the claim that are mineralized and in detail on the known areas of mineralization. The effort of this exploration work is to define and enable interpretation of a follow-up diamond drill program, so that the known mineralization and the whole property can be thoroughly evaluated with the most up to date exploration techniques.

|

9

|

The proposed budget for the recommended work in US $43,964 or PHP 1,953,760 is as follows:

|

Phase I |

US Dollars | Philippine Peso | ||||||

|

Geological Mapping |

$ |

8,084 |

359,253 |

|||||

|

Geological Surveying |

7,530 |

334,633 |

||||||

|

Total Phase I |

15,614 |

693,886 |

||||||

|

Phase II |

||||||||

|

Geological surveying and surface sampling (including sample collection an assaying) |

28,350 |

1,259,874 |

||||||

|

Total Phase II |

28,350 |

1,259,874 |

||||||

|

Total of Phases I and II |

$ |

43,964 |

1,953,760 |

|||||

Competitive Factors

The gold mining industry is fragmented, that is there are many, many gold prospectors and producers, small and large. We do not compete with anyone. That is because there is no competition for the exploration or removal of minerals from the Bontoc Claim. Plata will either find gold on its claim or not. If we do not, we will cease or suspend operations. We are an infinitely small participant in the gold mining market. Readily available gold markets exist in Philippines and around the world for the sale of gold. Therefore, we believe we will be able to sell any gold that we are able to recover.

Regulations

Our mineral exploration program is subject to the Philippine mineral requirements. The type of mining permit required in the Philippines by the Company is a MGB Form 50-1. During the exploration stage, the Company will engage the services of an exploration company who will be responsible for any fees and bonding requirements needed. The exact amount of the fees and bonding requirements will be known upon application for a mining permit. The Company, in conjunction with the exploration company, will make application to the Department of Environment and Natural Resources (DENR) Mines and Geosciences of the Philippines for its mining permit. The time frame for obtaining a mining permit is anywhere from 21 to 90 business days. .

Subcontractors

We intend to use the services of subcontractors for manual labor exploration work on the Bontoc Claim. It is the directors’ intention to engage the services of Geraldo Peralta, Professional Engineer, if he is available when needed, to supervise Phase I of our exploration program. If Mr. Peralta is not available the directors will attempt to locate another geologist to supervise the exploration program.

|

10

|

Employees and Employment Agreements

At present, we have no full-time employees. Our officers and directors do not have employment agreements with us. We presently do not have pension, health, annuity, insurance, stock options, profit sharing or similar benefit plans; however, we may adopt plans in the future. There are presently no personal benefits available to our officers and directors. Our officers and directors will handle our administrative duties. They engage a geologist to supervise the surveying and exploration work on the Bontoc claim.

Item 3. Legal Proceedings.

There are no legal proceedings to which the Company is a party or to which the Bontoc Gold Claim is subject, nor to the best of management’s knowledge are any material legal proceedings contemplated.

Item 4. Mine Safety Disclosures.

None

|

11

|

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Since inception, there has been no trading in the Company’s shares although it is currently listed on the OTCBB and the Company has not paid any dividends on its common stock, and it does not anticipate that it will pay dividends in the foreseeable future. As of December 31, 2014, the Company had 11 shareholders; two of these shareholders are an officers and director of the Company.

Option Grants and Warrants outstanding since Inception.

No stock options have been granted since the Company’s inception.

There are no outstanding warrants or conversion privileges for the Company’s shares.

Item 6. Selected Financial Data.

We are a smaller reporting company as defined in Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Results of Operations

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our financial statements and related notes included elsewhere in this report.

This annual report contains forward looking statements relating to our Company's future economic performance, plans and objectives of management for future operations, projections of revenue mix and other financial items that are based on the beliefs of, as well as assumptions made by and information currently known to, our management. The words "expects”, “intends”, “believes”, “anticipates”, “may”, “could”, “should" and similar expressions and variations thereof are intended to identify forward-looking statements. The cautionary statements set forth in this section are intended to emphasize that actual results may differ materially from those contained in any forward looking statement.

Our auditor’s report on our December 31, 2014 financial statements expresses an opinion that substantial doubt exists as to whether we can continue as an ongoing business. We believe that if we do not raise additional capital over the next 12 months, we may be required to suspend or cease the implementation of our business plans. See “December 31, 2014 Audited Financial Statements - Report of Independent Registered Accounting Firm.”

As of December 31, 2014, Plata Resources had prepaid expense of $5,000, as compared to $0 prepaid expense as of December 31, 2013. As of December 31, 2014, total liabilities were $48,571 comprised of Accounts payable of $16,230 and Advances from related parties of $32,341 as compared to total liabilities of $42,171 comprised of Accounts payable of $21,506 and Advances from related parties of $20,665 for the period ended December 31, 2013. Having no cash at the present will not allow us to pay any of our creditors. We plan to satisfy our future cash requirements by additional equity financing. This will likely be in the form of private placements of common stock.

If Plata Resources is unsuccessful in raising the additional proceeds through a private placement offering it will then have to seek additional funds through debt financing, which would be very difficult for a new development stage company to secure. Therefore, the company is highly dependent upon the success of the anticipated private placement offering and failure thereof would result in Plata Resources having to seek capital from other sources such as debt financing, which may not even be available to the company. However, if such financing were available, because Plata Resources is a development stage company with minimal operations to date, it would likely have to pay additional costs associated with high risk loans and be subject to an above market interest rate. At such time these funds are required, management would evaluate the terms of such debt financing and determine whether the business could sustain operations and growth and manage the debt load.

|

12

|

The Company did not generate any revenue during the fiscal year ended December 31, 2014 and has not generated revenue since inception.

Total operating expenses for the fiscal year ended December 31, 2014 were $1,400 resulting in a net loss of $1,400, as compared to total operating expenses of $15,261 resulting in a net loss of $15,261, for the period ended December 31, 2013.

The Company’s two directors have acquired 56% of the common stock issued and outstanding. During the years ended December 31, 2014 and 2013, the Company’s two directors paid expenses on behalf of the Company of $11,676 and 3,500, respectively (reported as advances from related parties on the balance sheet). Total advances from related parties at December 31, 2014 and 2013, were $32,341 and $20,665, respectively. Advances from related parties are non-interest bearing and payable on demand.

We anticipate that our current cash and cash equivalents and cash generated from financing activities will be insufficient to satisfy our liquidity requirements for the next 12 months. We expect to incur product development, marketing and professional and administrative expenses as well expenses associated with maintaining our SEC filings. We will require additional funds during this time and will seek to raise the necessary additional capital. If we are unable to obtain additional financing, we may be required to reduce the scope of our business development activities, which could harm our business plans, financial condition and operating results. Additional funding may not be available on favorable terms, if at all.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

We are a smaller reporting company as defined in Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

|

13

|

Item 8. Financial Statements and Supplementary Data.

The following financial statements are included in this report:

|

Title of Document |

Page | |||

|

Report of Independent Registered Public Accounting Firm |

15 |

|||

|

Balance Sheets as of December 31, 2014 and 2013 |

16 |

|||

|

Statements of Operations for the years ended December 31, 2014 and 2013 |

17 |

|||

|

Statement of Stockholders’ Deficiency for the years ended December 31, 2014 and 2013 |

18 |

|||

|

Statements of Cash Flows for the years ended December 31, 2014 and 2013 |

19 |

|||

|

Notes to the Financial Statements |

20 |

|||

|

14

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and shareholders

Plata Resources, Inc.

We have audited the accompanying balance sheets of Plata Resources, Inc. (“the Company”) as of December 31, 2014 and 2013 and the related statements of operations, stockholders’ deficiency and cash flows for the years then ended. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion the financial statements referred to above present fairly, in all material respects, the financial position of Plata Resources, Inc. as of December 31, 2014 and 2013, and the results of its operations and cash flows for the years then ended, in conformity with U.S. generally accepted accounting principles.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. The Company has generated no revenues from its business operations, has incurred operating losses since inception and will need additional working capital to service its debt and for its planned activity, which raises substantial doubt about its ability to continue as a going concern. Management’s plans in regard to these matters are described in Note 2 to the financial statements. These financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Sadler, Gibb & Associates, LLC

Salt Lake City, UT

April 17, 2015

|

15

|

PLATA RESOURCES, INC.

BALANCE SHEETS

| December 31, 2014 |

December 31, 2013 |

|||||||

|

ASSETS |

||||||||

|

CURRENT ASSETS |

||||||||

|

Cash |

$ |

- |

$ |

- |

||||

|

Prepaid expense |

5,000 |

|||||||

|

TOTAL CURRENT ASSETS |

$ |

5,000 |

$ |

- |

||||

|

LIABILITIES AND STOCKHOLDERS’ DEFICIENCY |

||||||||

|

CURRENT LIABILITIES |

||||||||

|

Accounts payable |

$ |

16,230 |

$ |

21,506 |

||||

|

Advances from related parties |

32,341 |

20,665 |

||||||

|

TOTAL CURRENT LIABILITIES |

48,571 |

42,171 |

||||||

|

STOCKHOLDERS’ DEFICIENCY |

||||||||

|

Common stock |

||||||||

|

Issued and outstanding |

||||||||

|

750,000,000 shares authorized, at $0.001 par value |

||||||||

|

63,800,000 shares of common stock issued and outstanding (December 31, 2013 –63,800,000) |

63,800 |

63,800 |

||||||

|

Additional paid-in capital |

41,900 |

41,900 |

||||||

|

Accumulated Deficit |

(149,271 |

) |

(147,871 |

) |

||||

|

TOTAL STOCKHOLDERS’ DEFICIENCY |

(43,571 |

) |

(42,171 |

) |

||||

|

TOTAL LIABILITIES AND STOCKHOLDERS’ DEFICIENCY |

$ |

5,000 |

$ |

- |

||||

The accompanying notes are an integral part of these financial statements.

|

16

|

PLATA RESOURCES, INC.

STATEMENTS OF OPERATIONS

| Year ended December 31, 2014 |

Year ended December 31, 2013 |

|||||||

|

REVENUE |

$ |

- |

- |

|||||

|

OPERATING EXPENSES |

||||||||

|

General and administrative |

1,400 |

15,261 |

||||||

|

Total Operating Expenses |

1,400 |

15,261 |

||||||

|

NET LOSS |

$ |

(1,400 |

) |

(15,261 |

) |

|||

|

BASIC AND DILUTIVE LOSS PER COMMON SHARE |

$ |

(0.00 |

) |

(0.00 |

) |

|||

|

WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING-BASIC AND DILUTED |

63,800,000 |

63,800,000 |

||||||

The accompanying notes are an integral part of these financial statements.

|

17

|

PLATA RESOURCES, INC.

STATEMENT OF STOCKHOLDERS’ DEFICIENCY

| Number of common shares | Stock Amount | Additional Paid-in Capital | Accumulated Deficit | Total | ||||||||||||||||

|

Balance, January 1, 2013 |

63,800,000 |

63,800 |

41,900 |

(132,610 |

) |

(26,910 |

) |

|||||||||||||

|

Net loss for the year ended December 31, 2013 |

- |

- |

- |

(15,261 |

) |

(15,261 |

) |

|||||||||||||

|

Balance, December 31, 2013 |

63,800,000 |

63,800 |

41,900 |

(147,871 |

) |

(42,171 |

) |

|||||||||||||

|

Net loss for the year ended December 31, 2014 |

- |

- |

- |

(1,400 |

) |

(1,400 |

) |

|||||||||||||

|

Balance, December 31, 2014 |

63,800,000 |

$ |

63,800 |

$ |

41,900 |

$ |

(149,271 |

) |

$ |

(43,571 |

) |

|||||||||

The accompanying notes are an integral part of these financial statements.

|

18

|

PLATA RESOURCES, INC.

STATEMENTS OF CASH FLOWS

| Year ended December 31, 2014 |

Year ended December 31, 2013 |

|||||||

|

OPERATING ACTIVITIES |

||||||||

|

Net loss for the period |

$ |

(1,400 |

) |

$ |

(15,261 |

) |

||

|

Adjustments to reconcile net loss to net cash used in operating activities: |

||||||||

|

Expenses paid by officers |

11,676 |

3,500 |

||||||

|

Changes in operating assets and liabilities: |

||||||||

|

Prepaid expenses |

(5,000 |

) |

- |

|||||

|

Accounts payable |

(5,276 |

) |

11,392 |

|||||

|

NET CASH USED IN OPERATING ACTIVITIES |

- |

(369 |

) |

|||||

|

INVESTING ACTIVITIES |

- |

- |

||||||

|

FINANCING ACTIVITIES |

- |

- |

||||||

|

NET INCREASE (DECREASE) IN CASH |

- |

(369 |

) |

|||||

|

CASH AT BEGINNING OF PERIOD |

- |

369 |

||||||

|

CASH AT END OF PERIOD |

$ |

- |

- |

|||||

The accompanying notes are an integral part of these financial statements.

|

19

|

PLATA RESOURCES, INC.

NOTES TO FINANCIAL STATEMENTS

December 31, 2014

NOTE 1 – NATURE OF OPERATIONS AND BASIS OF PRESENTATION

Nature of Operations

The Company, Plata Resources, Inc., was incorporated under the laws of the State of Nevada on July 17, 2007 with the authorized capital stock of 750,000,000 shares at $0.001 par value.

The Company was organized for the purpose of acquiring and developing mineral properties. At the report date mineral claims, with unknown reserves, had been acquired. The Company has not established the existence of a commercially minable ore deposit.

NOTE 2 – GOING CONCERN

To date the Company has generated no revenues from its business operations and has incurred operating losses since inception of $149,271. As at December 31, 2014, the Company has a working capital deficit of $43,571. The Company requires additional funding to meet its ongoing obligations and to fund anticipated operating losses. The ability of the Company to continue as a going concern is dependent on raising capital to fund its initial business plan and ultimately to attain profitable operations. Accordingly, these factors raise substantial doubt about the Company’s ability to continue as a going concern. The Company intends to continue to fund its business by way of private placements and advances from related parties as may be required. These financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts, or amounts and classification of liabilities that might result from this uncertainty.

NOTE 3 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Accounting Method

The Company recognizes income and expenses based on the accrual method of accounting.

Dividend Policy

The Company has not yet adopted a policy regarding payment of dividends.

Basic and Diluted Loss Per Share

The Company computes loss per share in accordance with “ASC-260,” “Earnings per Share” which requires presentation of both basic and diluted earnings per share on the face of the statement of operations. Basic loss per share is computed by dividing net loss available to common shareholders by the weighted average number of outstanding common shares during the period. Diluted loss per share gives effect to all dilutive potential common shares outstanding during the period. Dilutive loss per share excludes all common stock equivalents if their effect is anti-dilutive. As of December 31, 2014 and 2013, there were no dilutive common stock equivalents outstanding.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

|

20

|

Income Taxes

The Company utilizes the liability method of accounting for income taxes. Under the liability method deferred tax assets and liabilities are determined based on differences between financial reporting and the tax bases of the assets and liabilities and are measured using the enacted tax rates and laws that will be in effect, when the differences are expected to be reversed. An allowance against deferred tax assets is recorded, when it is more likely than not, that such tax benefits will not be realized.

| Year End | Estimated NOL Carry-forward | NOL Expires | Estimated Tax Benefit from NOL | Valuation Allowance | Net Tax Benefit | ||||||||||||||||

|

2007 |

$ |

15,120 |

2027 |

$ |

5,141 |

$ |

(5,141 |

) |

$ |

- |

|||||||||||

|

2008 |

43,931 |

2028 |

14,937 |

(14,937 |

) |

- |

|||||||||||||||

|

2009 |

28,406 |

2029 |

9,658 |

(9,658 |

) |

- |

|||||||||||||||

|

2010 |

20,448 |

2030 |

6,952 |

(6,952 |

) |

- |

|||||||||||||||

|

2011 |

15,329 |

2031 |

5,212 |

(5,212 |

) |

- |

|||||||||||||||

|

2012 |

9,376 |

2032 |

3,188 |

(3,188 |

) |

- |

|||||||||||||||

|

2013 |

15,261 |

2033 |

5,189 |

(5,189 |

) |

- |

|||||||||||||||

|

2014 |

1,400 |

2034 |

476 |

(476 |

) |

- |

|||||||||||||||

|

$ |

149,271 |

$ |

50,753 |

$ |

(50,753 |

) |

$ |

- |

|||||||||||||

The total valuation allowance as of December 31, 2014 was $50,753, which increased by $476 for the year ended December 31, 2014.

As of December 31, 2014 and 2013, the Company has no unrecognized income tax benefits. The Company’s policy for classifying interest and penalties associated with unrecognized income tax benefits is to include such items as tax expense. No interest or penalties have been recorded during the years ended December 31, 2014, and 2013 and no interest or penalties have been accrued as of December 31, 2014 and 2013. As of December 31, 2014 and 2013, the Company did not have any amounts recorded pertaining to uncertain tax positions.

The tax years from 2012 and forward remain open to examination by federal and state authorities due to net operating loss and credit carry forwards. The Company is currently not under examination by the Internal Revenue Service or any other taxing authorities.

Foreign Currency Translations

The books of the Company are maintained in United States dollars and this is the Company’s functional and reporting currency. Translations denominated in other than the United States dollar are translated as follows with the related transaction gains and losses being recorded in the Statement of Operations:

|

(i) |

Monetary items are recorded at the rate of exchange prevailing as at the balance sheet date; |

|

(ii) |

Non-Monetary items including equity are recorded at the historical rate of exchange; and |

|

(iii) |

Revenues and expenses are recorded at the period average in which the transaction occurred. |

Impairment of Long-Lived Assets

The Company reviews and evaluates long-lived assets for impairment when events or changes in circumstances indicated that the related carrying amounts may not be recoverable. The assets are subject to impairment consideration in ASC 360-10-35-17 if events or circumstances indicate that heir carrying amounts might not be recoverable. When the Company determines that an impairment analysis should be done, the analysis will be performed using rules of ASC 930-360-35, Asset Impairment, and 360-10-15-3 through 15-5, Impairment of Disposal of Long-Lived Assets.

|

21

|

Fair Value of Financial Instruments

The estimated fair values of financial instruments were determined by management using available market information and appropriate valuation methodologies. The carrying amounts of financial instruments including cash approximate their fair value because of their short maturities.

Revenue Recognition

The Company has no revenues to date from its operations. Once revenues are generated, management will establish a revenue recognition policy.

Advertising Costs

The Company accounts for its advertising cost in accordance with ASC Topic 720. The Company expenses advertising costs as incurred. For the period ended December 31, 2014 and December 31, 2013 the Company incurred no advertising expenses.

Statement of Cash Flows

For the purposes of the statement of cash flows, the Company considers all highly liquid investments with a maturity of three months or less to be cash equivalents.

Mineral Claim Acquisition and Exploration Costs

Mineral property acquisition costs are initially capitalized when incurred. These costs are then assessed for impairment when factors are present to indicate the carrying costs may not be recoverable. Mineral exploration costs are expensed as incurred.

Environmental Requirements

At the report date environmental requirements related to the mineral claim acquired are unknown and therefore any estimate of any future cost cannot be made.

Recent Accounting Pronouncements

In June 2014, the FASB issued ASU 2014-10, “Development Stage Entities (Topic 915): Elimination of Certain Financial Reporting Requirements, Including an Amendment to Variable Interest Entities Guidance in Topic 810, Consolidation”. The guidance eliminates the definition of a development stage entity thereby removing the incremental financial reporting requirements from U.S. GAAP for development stage entities, primarily presentation of inception to date financial information. The provisions of the amendments are effective for annual reporting periods beginning after December 15, 2014, and the interim periods therein. However, early adoption is permitted. Accordingly, the Company has early adopted this standard for presentation purposes in these financial statements.

The Company does not expect the adoption of any other recent accounting pronouncements to have a material impact on its financial statements.

|

22

|

NOTE 4 – ACQUISITION OF MINERAL CLAIM

On August 1, 2007, the Company acquired the Bontoc Gold Claim located in the Republic of Philippines from Castillo Explorations LLC., an unrelated company, for considerations of $5,000. The Bontoc Gold Claim is located in the Philippines near the town of Bontoc. Under Philippine law, the claim remains in good standing as long as the Company has an interest in it. There is no annual maintenance fee or minimum exploration work required on the claim.

As of December 31, 2007, the Company determined the $5,000 mineral property acquisition cost was impaired, and recorded a related impairment loss in the statement of operations.

NOTE 5 – SIGNIFICANT TRANSACTIONS WITH RELATED PARTIES

The Company’s two directors have acquired 56% of the common stock issued and outstanding. During the years ended December 31, 2014 and 2013, the Company’s two directors paid expenses on behalf of the Company of $11,676 and $3,500, respectively (reported as advances from related parties on the balance sheet). Total advances from related parties at December 31, 2014 and 2013, were $32,341 and $20,665, respectively. Advances from related parties are non-interest bearing and payable on demand.

NOTE 6 – CAPITAL STOCK

On September 18, 2007, the Company completed a private placement consisting of 40,000,000 post-split common shares sold to the directors and officers for a total consideration of $2,000. On October 31, 2007, the Company completed a private placement of 23,800,000 post-split common shares for a total consideration of $59,500.

On January 22, 2009, the shareholders of the Company approved a 20 to 1 forward split, resulting in an increase of the outstanding shares of common stock from 3,190,000 to 63,800,000.

On November 23, 2014, the directors approved the cancellation of a stock dividend in the amount of 127,600,000 common shares, which were issued on March 6, 2012, in error. All share capital amounts have been retroactively restated to reflect this cancellation.

|

23

|

Item 9. Changes in and Disagreements With Accountants on Accounting and Financial Disclosure.

None.

Item 9A. Controls and Procedures.

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. Internal control over financial reporting is defined in Rule 13a-15(f) or 15d-15(f) promulgated under the Securities Exchange Act of 1934 as a process designed by, or under the supervision of, the Company's principal executive and principal financial officers and effected by the Company's board of directors, management and other personnel to provide reasonable assurance regarding the reliability of our financial reporting and the preparation of financial statements for external purposes in accordance with accounting principles generally accepted in the United States of America and includes those policies and procedures that:

- Pertains to the maintenance of records that in reasonable detail accurately and fairly reflect our transactions and disposition of assets;

- Provide reasonable assurance that transactions are recorded as necessary to permit preparation of our financial statements in accordance with accounting principles generally accepted in the United States of America and receipts and expenditures are being made in accordance with authorizations of management and directors; and

- Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of company assets that could have a material effect on our financial statements.

Evaluation of Disclosure Controls and Procedures

Under the supervision and with the participation of our management, including our President and principal financial officer, an evaluation was performed on the effectiveness of the design and operation of our disclosure controls and procedures as of the end of the period covered by this report. Based on that evaluation, our President and principle executive officer and our principal financial officer, concluded that our disclosure controls and procedures were not effective as of the end of the period covered by this report for the purpose of gathering, analyzing and disclosing of information that the Company is required to disclose in the reports it files under the Securities Exchange Act of 1934, within the time periods specified in the SEC’s rules and forms.

Inherent Limitation on Effectiveness of Controls

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. All internal control systems, no matter how well designed, have inherent limitations. Therefore, even those systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation. Because of the inherent limitations of internal control, there is a risk that material misstatements may not be prevented or detected on a timely basis by internal control over financial reporting. However, these inherent limitations are known features of the financial reporting process. Therefore, it is possible to design into the process safeguards to reduce, though not eliminate, this risk.

Management’s Annual Report on Internal Control Over Financial Reporting

As of December 31, 2014 management assessed the effectiveness of the Company's internal control over financial reporting based on the criteria for effective internal control over financial reporting established in Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission ("COSO") and SEC guidance on conducting such assessments. Based on that evaluation, our President and principle executive officer and our principal financial officer, concluded that during the period covered by this report, such internal controls and procedures were not effective to detect the inappropriate application of US GAAP rules as more fully described below. This was due to deficiencies that existed in the design or operation of our internal control over financial reporting that adversely affected our internal controls and that may be considered to be material weaknesses.

|

24

|

The matters involving internal controls and procedures that the Company's management considered to be material weaknesses under the standards of the Public Company Accounting Oversight Board were: (1) lack of a functioning audit committee due to the lack of a majority of independent members and a lack of a majority of outside directors on our board of directors, resulting in ineffective oversight in the establishment and monitoring of required internal controls and procedures; (2) inadequate segregation of duties consistent with control objectives; and (3) ineffective controls over period end financial disclosure and reporting processes. The aforementioned material weaknesses were identified by our President and principle accounting officer in connection with the review of our financial statements as of December 31, 2014.

Management believes that the material weaknesses set forth in items (2) and (3) above did not have an effect on our financial results. However, management believes that the lack of a functioning audit committee and lack of a majority of outside directors on our board of directors, results in ineffective oversight in the establishment and monitoring of required internal controls and procedures which could result in a material misstatement in our financial statements in future periods.

In an effort to remediate the identified material weaknesses and other deficiencies and enhance our internal controls, we have initiated or plan to initiate the following series of measures.

We will create a position to segregate duties consistent with control objectives and will increase our personnel resources and technical accounting expertise within the accounting function when funds are available to us. And we plan to appoint one or more outside directors to our board of directors who shall be appointed to an audit committee who will undertake the oversight in the establishment and monitoring of required internal controls and procedures such as reviewing and approving estimates and assumptions made by management when funds are available to us.

Management believes that the appointment of one or more outside directors, who shall be appointed to a fully functioning audit committee, will remedy the lack of a functioning audit committee and a lack of a majority of outside directors on our Board.

We will continue to monitor and evaluate the effectiveness of our internal controls and procedures and our internal controls over financial reporting on an ongoing basis and are committed to taking further action and implementing additional enhancements or improvements, as necessary and as funds allow.

Changes in Internal Controls

There have been no significant changes in our internal controls over financial reporting that occurred during the period covered by this report which has materially affected or are reasonably likely to materially affect, our internal controls over financial reporting.

This annual report does not include an attestation report of the Company's independent registered public accounting firm regarding internal control over financial reporting. Management's report was not subject to attestation by the Company's independent registered public accounting firm pursuant to rules of the Securities and Exchange Commission that permit the Company to provide management report in the Annual Report.

Item 9B. Other Information.

None

|

25

|

PART III

Item 10. Directors, Executive Officers and Corporate Governance.

Each of our directors serves until his or her successor is elected and qualified. Each of our officers is elected by the Board of Directors to a term of one (1) year and serves until his or her successor is duly elected and qualified, or until he or she is removed from office. The Board of Director has no nominating or compensation committees.

The name, address, age and position of our present officers and directors are set forth below:

|

Name and Address |

|

Age |

|

Positions |

|

Dexter R. Caliso 658 Pasay Blvd. Pasig City 1300 Philippines |

|

39 |

|

Chief Executive Officer and President |

|

Presentacion A. Coranes 2432 M. Dela Cruz Street Pasay City, Philippines |

|

35 |

|

Chief Financial Officer, Chief Accounting Officer, Secretary Treasurer |

Both Dexter Caliso and Presentaction Coranes have held their offices/positions since inception of Plata and are expected to hold their offices/positions until the first annual meeting of our shareholders.

Background of Officers and Directors

Dexter Caliso

Dexter Caliso attended and attained a High School Diploma from Our Lady of Sorrows Secondary School in 1991. Between 1991 and 1995 he attended PATT College Aeronautics and obtained a Bachelor of Science degree in Aircraft Technology. After graduation in 1995 and until 1999, he was employed by Philippines Airlines in Manila where he supervised night crews for maintenance of all Beoing 747-400 aircraft owned by Philippine Airlines. From 1999 to 2001 he was employed by Singapore Airlines in Manila as 2nd Aircraft Mechanic and was responsible for instruction of junior mechanics as to the repair and maintenance of aircraft. Between 2001 and 2004 he was employed by Emirates Airlines in Manila as Supervising Aircraft Mechanic and was the supervisor of all maintenance personal in his department which resulted in Dexter being promoted to Chief Supervising Aircraft Mechanic. After 2004, until the present time, he was employed with Cathy Pacific Airline in Manila as Department Head of Maintenance Operations and was responsible for managing a staff of 30 aircraft mechanics. During this time he was responsible for implementing all new security and safety measures for all incoming Cathy Pacific Aircraft in Manila. While working for Cathy Pacific he attended and obtained a Certificate of Completion from the Bureau of Mines and Geoscience in Aerial Mapping and Surveying.

Presentacion Coranes

Presentacion Coranes graduated and received a diploma from Pedro Diaz High School in 1995 before attending AMA Computer College where she graduated with diplomas in bookkeeping and accounting. In 2000 Presentacion attended the University of the Far East and earned a diploma in Advanced Audit Procedures qualifying her to do full audit procedures of both private and public companies in the Philippines. While attending AMA Computer College, she worked for Zamperla Asia Pacific in Manila, Philippines and was responsible for handling the payroll for the entire company. In 1999, while attending the University of the Far East, Presentacion was employed by Philippines Long Distance Telecommunication Co. and was responsible for accounts receivable, collections and worked part time in the internal audit department where she assisted with filing with the Securities Exchange Commission of the Philippines. After graduating from the University of the Far East, she became employed with UCPB Insurance where she was solely responsible for auditing the accounts receivable department and assisting in the filings with the Securities Exchange Commission of the Philippines. In 2004 she joined the firm of JV & Sons Corp. as Audit Co-ordinator and was responsible for compiling audit reports for management and preparing filing documents for submission to the Securities Exchange Commission of the Philippines. Since 2005 she has been employed with Mary Kel Company as Department Head of the Collections Department where Presentacion is responsible for conducting the audits of the company and overseeing a staff of 10 people. In addition, she is the signing officer on the full and final version of the audit that is filed with the relevant tax authorities and the Securities Exchange Commission of the Philippines.

|

26

|

None of our officers and directors work full time for our company. Dexter Caliso spends approximately 4 to 5 hours a week on administrative and accounting matters. With recent preparation of the 10-Ks Dexter Caliso’s time on Plata’s affairs is expected to continue at this pace for the foreseeable future. As Secretary Treasurer, Presentacion Coranes spends approximately 4 to 5 hours per month on corporate matters.

None of our directors is an officer or director of a company registered under the Securities and Exchange Act of 1934.

Board of Directors Audit Committee

Below is a description of the Audit Committee of the Board of Directors. The Audit Committee Charter of Plata sets forth the responsibilities of the Audit Committee. The primary function of the Audit Committee is to oversee and monitor the Company’s accounting and reporting processes and the audits of the Company’s financial statements.

Our Audit Committee is comprised of Dexter Caliso, our President and Chairman of the AuditCommittee, and Presentaction Coranes, our Chief Financial Officer and Secretary Treasurer neither of whom are independent. Only Presentacion Coranes can be considered an “audit committee financial expert” as defined in Item 401 of Regulation S-B based on her prior training and present occupation.

Apart from the Audit Committee, the Company has no other Board committees.

Since inception on July 17, 2007, our Board has conducted its business entirely by consent resolutions and has not met, as such.

Significant Employees

We have no paid employees as such. Our Officers and Directors fulfill many functions that would otherwise require Plata to hire employees or outside consultants. We anticipate engaging the services of workers to assist in the exploration of the Bontoc Claim. Due to neither of our directors being a trained geologist, other than Dexter Caliso having a diploma in aerial mapping and surveying, Plata will use the services of Geraldo Peralta if he is available when needed. We expect to engage a field worker(s) later this year to assist in conduct the Phase I exploration work to undertaken on the Bontoc claim by the end of 2013. Any field workers we engage will not be considered employees either on a full time or part time basis. This is because our exploration programs will not last more than a few weeks and once completed these individuals will no longer be required to fulfill such functions.

Family Relationships

Our President and our Chief Financial Officer and Secretary Treasurer are unrelated.

|

27

|

Involvement in Certain Legal Proceedings

To the knowledge of the Plata, during the past five years, none of our directors or executive officers:

|

(1) |

has filed a petition under the federal bankruptcy laws or any state insolvency law, nor had a receiver, fiscal agent or similar officer appointed by the court for the business or property of such person, or any partnership in which he was a general partner at or within two years before the time of such filings; |

|

(2) |

was convicted in a criminal proceeding or named subject of a pending criminal proceeding (excluding traffic violations and other minor offenses); |

|

(3) |

was the subject of any order, judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him from or otherwise limiting, the following activities: |

(i) acting as a futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, floor broker, leverage transaction merchant, associated person of any of the foregoing, or as an investment advisor, underwriter, broker or dealer in securities, or as an affiliate person, director or employee of any investment company, or engaging in or continuing any conduct or practice in connection with such activity;

(ii) engaging in any type of business practice; or

(iii) engaging in any activities in connection with the purchase or sale of any security or commodity or in connection with any violation of federal or state securities laws or federal commodities laws;

|

(4) |

was the subject of any order, judgment, or decree, not subsequently reversed, suspended, or vacated, of any federal or state authority barring, suspending or otherwise limiting for more than 60 days the right of such person to engage in any activity described above under this Item, or to be associated with persons engaged in any such activities; |

|

(5) |

was found by a court of competent jurisdiction in a civil action or by the SEC to have violated any federal or state securities law, and the judgment in such civil action or finding by the SEC has not been subsequently reversed, suspended, or vacated. |

|

(6) |

was found by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to have violated any federal commodities law, and the judgment in such civil action or finding by the Commodity Futures Trading Commission has not been subsequently reversed, suspended or vacated. |

|

28

|

Item 11. Executive Compensation.

We have not paid any executive compensation during the five year period as can be noted from the following summary:

Summary Compensation Table

| Long Term Compensation | ||||||||||||||||||||||||||||

|

Annual Compensation |

Award | Payouts | ||||||||||||||||||||||||||

|

(a) |

(b) | (c) | (e) | (f) | (g) | (h) | (i) | |||||||||||||||||||||

|

Name and Principal position |

Year | Salary | Other annual Comp. ($) | Restricted stock awards ($) | Options/ SAR (#) | LTIP Pay-outs ($) | All other Compensation ($) | |||||||||||||||||||||

|

Dexter R. Caliso |

2010 |

-0- |

-0- |

-0- |

-0- |

-0- |

-0- |

|||||||||||||||||||||

|

Principal Executive |

2011 |

-0- |

-0- |

-0- |

-0- |

-0- |

-0- |

|||||||||||||||||||||

|

Officer, President |

2012 |

-0- |

-0- |

-0- |

-0- |

-0- |

-0- |

|||||||||||||||||||||

|

and Director |

2013 |

-0- |

-0- |

-0- |

-0- |

-0- |

-0- |

|||||||||||||||||||||

|

|

2014 |

-0- |

-0- |

-0- |

-0- |

-0- |

-0- |

|||||||||||||||||||||

|

Presentacion A. |

2010 |

-0- |

-0- |

-0- |

-0- |

-0- |

-0- |

|||||||||||||||||||||

|

Coranes |

2011 |

-0- |

-0- |

-0- |

-0- |

-0- |

-0- |

|||||||||||||||||||||

|

Principal Financial Officer, |

2012 |

-0- |

-0- |

-0- |

-0- |

-0- |

-0- |

|||||||||||||||||||||

|

Principal Accounting Officer, Secretary Treasurer |

2013 |

-0- |

-0- |

-0- |

-0- |

-0- |

-0- |

|||||||||||||||||||||

|

and Director |

2014 |

-0- |

-0- |

-0- |

-0- |

-0- |

-0- |

|||||||||||||||||||||

Compensation of Directors

We have no standard arrangement to compensate directors for their services in their capacity as directors. Directors are not paid for meetings attended. All travel and lodging expenses associated with corporate matters are reimbursed by us, if and when incurred.

Employment Agreements with Executive Officers and Directors

There are no employment agreements with any officers or directors of our Company.

Stock Option Plan

We have never established any form of stock option plan for the benefit of our directors, officers or future employees. We do not have a long-term incentive plan nor do we have a defined benefit, pension plan, profit sharing or other retirement plan.

Bonuses and Deferred Compensation

None

|

29

|

Compensation Pursuant to Plans

None

Pension Table

None

Termination of Employment

There are no compensatory plans or arrangements, including payments to be received from the Company, with respect to any person named in Summary of Compensation set out above which would in any way result in payments to any such person because of his resignation, retirement, or other termination of such person’s employment with the Company, or any change in control of the Company, or a change in the person’s responsibilities following a change in control of the Company.

Activities since Inception

Our President, Dexter Caliso, arranged for incorporation of our company, subscribed for shares to provide initial working capital, and identified the Bontoc Claim, arranged for its acquisition, commissioned a geological report on the Bontoc Claim obtaining the assistance of professionals as needed. Mr. Caliso has coordinated preparation of our effective registration statement and has principal responsibility for preparation of our periodic reports and all other matters normally performed by an executive officer. He was instrumental in identifying investors to participate in the private placement closed on October 31, 2007 and in administrating the Company during its application for a quotation on the OTC Bulletin Board.

Our Chief Financial Officer, Chief Accounting Officer and Secretary Treasurer, Presentacion Coranes, assisted in identifying investors to participate in the private placement closed on October 31, 2007 and also assisted in preparation of our effective registration statement and subsequent filings with the SEC.

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

The following table sets forth, as of April 8, 2015, the total number of shares owned beneficially by each of our directors, officers and key employees, individually and as a group, and the present owners of 5% or more of our total outstanding shares. The shareholder listed below has direct ownership of his/her shares and possesses sole voting and dispositive power with respect to the shares.

|

Title or Class of Share |

|

Name and address of Beneficial Owner (1) |