Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Stratex Oil & Gas Holdings, Inc. | Financial_Report.xls |

| EX-32.1 - CERTIFICATION - Stratex Oil & Gas Holdings, Inc. | f10k2014ex32i_stratexoil.htm |

| EX-31.1 - CERTIFICATION - Stratex Oil & Gas Holdings, Inc. | f10k2014ex31i_stratexoil.htm |

| EX-32.2 - CERTIFICATION - Stratex Oil & Gas Holdings, Inc. | f10k2014ex32ii_stratexoil.htm |

| EX-23.1 - CONSENT OF PINNACLE ENERGY SERVICES, LLC - Stratex Oil & Gas Holdings, Inc. | f10k2014ex23i_stratexoil.htm |

| EX-99.4 - PINNACLE ENERGY SERVUCES LLC ENGINEERING REPORT - Stratex Oil & Gas Holdings, Inc. | f10k2014ex99iv_stratexoil.htm |

| EX-31.2 - CERTIFICATION - Stratex Oil & Gas Holdings, Inc. | f10k2014ex31ii_stratexoil.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to ________

Commission File Number 333-164856

STRATEX OIL & GAS HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Colorado | 94-3364776 | |

(State or other jurisdiction of incorporation or organization) |

(IRS

Employer Identification No.) |

175 South Main Street, Suite 900

Salt Lake City, UT 84111

(Address of principal executive offices)

(801) 519-8500

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.01 par value per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed under Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer ☐ | Accelerated Filer ☐ |

| Non-Accelerated Filer ☐ (Do not check if a smaller reporting company) | Smaller Reporting Company ☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

The issuer had 120,737,337 shares of common stock outstanding as of March 31, 2015. The aggregate market value of the common stock held by non-affiliates was approximately $30,184,334 based upon the reported sales price of $0.25 which was the average price of the last business day of the previous second quarter on the OTCBB.

Stratex Oil & Gas Holdings, Inc.

Table of Contents

| Page | |

| Contents | |

| FORWARD-LOOKING STATEMENTS | 3 |

| GLOSSARY OF TERMS | 4 |

| PART I | 6 |

| ITEM 1. BUSINESS | 6 |

| ITEM 1A. RISK FACTORS | 31 |

| ITEM 1B. UNRESOLVED STAFF COMMENTS | 45 |

| ITEM 2. PROPERTIES | 45 |

| ITEM 3. LEGAL PROCEEDINGS | 45 |

| ITEM 4. MINE SAFETY DISCLOSURES | 45 |

| PART II | 46 |

| ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 46 |

| Market Information | 46 |

| ITEM 6. SELECTED FINANCIAL DATA | 49 |

| ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 49 |

| ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 56 |

| ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 56 |

| ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 56 |

| ITEM 9A. CONTROLS AND PROCEDURES | 56 |

| ITEM 9B. OTHER INFORMATION | 57 |

| PART III | 57 |

| ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 57 |

| ITEM 11. EXECUTIVE COMPENSATION | 60 |

| ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 63 |

| ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 64 |

| ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES | 65 |

| PART IV | 67 |

| ITEM 15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES | 67 |

| SIGNATURES | 68 |

| 2 |

FORWARD-LOOKING STATEMENTS

The statements contained in this annual report on Form 10-K that are not historical facts represent management’s beliefs and assumptions based on currently available information and constitute “forward-looking statements.” These statements include, but are not limited to, any statement that may predict, forecast, indicate or imply future results, performance, achievements or events. These forward-looking statements address matters that involve risks and uncertainties. Accordingly, there are or will be important factors that could cause our actual results to differ materially from those indicated in these statements. We believe that these factors include but are not limited to the following:

| ● | uncertainty regarding our ability to raise the funds necessary to pay our current liabilities and carry out our business plan; | |

| ● | the continuing adequacy of our capital resources and liquidity including, but not limited to, access to borrowing capacity; | |

| ● | the availability (or lack thereof) of acquisition, disposition or combination opportunities; | |

| ● | domestic and global supply and demand for oil and natural gas; | |

| ● | sustained, increased or further declines in the prices we receive for oil and natural gas; | |

| ● | the geologic quality of our properties with regard to, among other things, the existence of hydrocarbons in economic quantities; | |

| ● | uncertainties about the estimates of our oil and natural gas reserves; | |

| ● | our ability to increase our production of oil and natural gas income through exploration and development; | |

| ● | our ability to successfully apply horizontal drilling techniques and tertiary recovery methods; | |

| ● | the number of well locations to be drilled, the cost to drill, and the time frame within which they will be drilled; | |

| ● | the effects of adverse weather on operations; | |

| ● | drilling and operating risks; | |

| ● | the ability of contractors to timely and adequately perform their drilling, construction, well stimulation, completion and production services; | |

| ● | the availability of equipment, such as drilling rigs and related equipment and tools; | |

| ● | changes in our drilling plans and related budgets; | |

| ● | uncertainties associated with our legal proceedings and their outcome; | |

| ● | the effects of government regulation, permitting, and other legal requirements; | |

| ● | uncertainties regarding economic conditions in the United States and globally; | |

| ● | difficult and adverse conditions in the domestic and global capital and credit markets; and | |

| ● | other factors discussed under “Item 1A – Risk Factors”. |

You can often identify these and other forward-looking statements by the use of words such as “may,” “will,” “could,” “would,” “should,” “expects,” “plans,” “anticipates,” “estimates,” “intends,” “potential,” “projected,” “continue,” or the negative of such terms, or other comparable terminology. Forward-looking statements also include the assumptions underlying or relating to any of the foregoing statements.

These statements are based on current expectations and assumptions regarding future events and business performance and involve known and unknown risks, uncertainties and other factors that may cause industry trends or our actual results, level of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these statements.

Although we believe that expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. We will assume no obligation to update any of the forward-looking statements to conform these statements to actual results or changes in our expectations, except as required by law. You should not place undue reliance on these forward-looking statements.

| 3 |

GLOSSARY OF TERMS

The following definitions shall apply to the technical terms used in this report.

“Anticlinal structure or fold” are geological formations where layers of rock have been folded into an arch shape, which can include favorable formations for oil and gas drilling, such as doubly plunging or faulted anticlines, culminations, and structural domes.

“Bbl” means barrel or barrels.

“BOE” means barrels of crude oil equivalent.

“Boepd” means barrels of crude oil equivalent per day.

“Bopd” means barrels of crude oil per day.

“Condensates” are hydrocarbons that exist in a gaseous state within the native reservoir environment, but condense to a liquid state due to pressure and/or temperature changes caused during the drilling, completion, or production stages of well development.

“Development well” is a well drilled within the proved area of an oil or gas reservoir to the depth of a stratigraphic horizon known to be productive.

“Dry hole” is an exploratory or development well found to be incapable of producing either crude oil or natural gas in sufficient quantities to justify completion as a crude oil or natural gas well.

“Farm-in” is a contractual relationship where a company acquires an interest in an operation owned by another operator.

“Gross acres” refer to the number of acres in which we own a working interest.

“Gross well” is a well in which we own a working interest.

“MBbls ” means thousand barrels.

“MCF ” means thousand cubic feet of gas.

“MMBbls ” means million barrels.

“MMcf” means million cubic feet of gas.

“Mud-log report” is a report which sets forth data regarding geological structure and hydrocarbon presence maintained at the time a well is drilled.

“Net acres” represent Stratex’s percentage ownership of gross acreage. Net acres are deemed to exist when the sum of fractional ownership working interests in gross acres equals one (e.g., a 10% working interest in a lease covering 640 gross acres is equivalent to 64 net acres).

“Net well” represents Stratex’s percentage ownership of a gross well. A net well is deemed to exist when the sum of fractional ownership working interests in gross wells equals one.

“Probable reserves” are those additional reserves that are less certain to be recovered than proved reserves but which, together with proved reserves, are as likely as not to be recovered.

“Productive well” is an exploratory or a development well that is not a dry hole.

| 4 |

“Proved developed reserves (PDPs)” are proved reserves that can be expected to be recovered:

| 1. | Through existing wells with existing equipment and operating methods or in which the cost of the required equipment is relatively minor compared with the cost of a new well; or |

| 2. | Through installed extraction equipment and infrastructure operational at the time of the reserves estimate if the extraction is by means not involving a well. |

“Proved reserves” or “reserves” are the estimated quantities of crude oil, natural gas, and natural gas liquids which geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions, i.e., prices and costs as of the date the estimate is made. Prices include consideration of changes in existing prices provided only by contractual arrangements, but not on escalations based upon future conditions.

| 1. | Reservoirs are considered proved if economic producibility is supported by either actual production or conclusive formation test. The area of a reservoir considered proved includes (A) that portion delineated by drilling and defined by gas-oil and/or oil-water contacts, if any, and (B) the immediately adjoining portions not yet drilled, but which can be reasonably judged as economically productive on the basis of available geological and engineering data. In the absence of information on fluid contacts, the lowest known structural occurrence of hydrocarbons controls the lower proved limit of the reservoir. |

| 2. | Reserves which can be produced economically through application of improved recovery techniques (such as fluid injection) are included in the proved classification when successful testing by a pilot project, or the operation of an installed program in the reservoir, provides support for the engineering analysis on which the project or program was based. |

| 3. | Estimates of proved reserves do not include the following: (A) oil that may become available from known reservoirs but is classified separately as indicated additional reserves; (B) crude oil, natural gas, and natural gas liquids, the recovery of which is subject to reasonable doubt because of uncertainty as to geology, reservoir characteristics, or economic factors; (C) crude oil, natural gas, and natural gas liquids, that may occur in undrilled prospects; and (D) crude oil, natural gas, and natural gas liquids, that may be recovered from oil shales, coal, gilsonite and other such sources. |

“Proved undeveloped reserves (PUDs)” are proved reserves that are expected to be recovered from new wells on undrilled acreage, or from existing wells where a relatively major expenditure is required for recompletion.

Reserves on undrilled acreage shall be limited to those directly offsetting development spacing areas that are reasonably certain of production when drilled, unless evidence using reliable technology exists that establishes reasonable certainty of economic producibility at greater distances.

Undrilled locations can be classified as having undeveloped reserves only if a development plan has been adopted indicating that they are scheduled to be drilled within five years, unless the specific circumstances justify a longer time.

Under no circumstances shall estimates for proved undeveloped reserves be attributable to any acreage for which an application of fluid injection or other improved recovery technique is contemplated, unless such techniques have been proved effective by actual projects in the same reservoir or an analogous reservoir, or by other evidence using reliable technology establishing reasonable certainty.

“Seismic imaging” is a tool that bounces sound waves off underground rock structures to reveal possible oil- and gas-bearing formations. Seismologists use ultrasensitive devices called geophones to record the sound waves' echoes within the earth. By studying the echoes, petroleum geologists seek to calculate the depth and structures of buried geologic formations. This analysis may help them identify oil- and gas-bearing reservoirs hidden beneath the earth's surface.

“Sidetrack” is a process using a whipstock, turbodrill, or other mud motor to drill around broken drill pipe or casing that has become lodged permanently in the hole, or is used to bypass other formation damage.

“SWD” means saltwater disposal well.

| 5 |

PART I

| ITEM 1. | BUSINESS |

Stratex Oil & Gas Holdings Inc. (“Stratex,” “we,” “us” or “our”). We are an independent oil and gas exploration and production company with projects in Texas, Montana, Colorado, Kansas, North Dakota and Utah. The focus of our business is acquiring, retrofitting and operating or selling oil and gas assets and related production.

Our History

We were originally incorporated as Poway Muffler and Brake Inc. in California on August 15, 2003 to enter the muffler and brakes business. On December 15, 2008, a merger was effected with Ross Investments Inc., a Colorado shell corporation. Ross Investments was the acquirer and the surviving corporation. Ross Investments Inc. then changed its name to Poway Brake and Muffler Inc. On May 25, 2012, we filed an Amendment to our Certificate of Incorporation by which we changed our name from Poway Muffler and Brake, Inc., a Colorado corporation, to Stratex Oil and Gas Holdings, Inc., with the Secretary of the State of Colorado.

On July 6, 2012, Stratex Acquisition Corp., a wholly-owned subsidiary of Stratex Oil & Gas Holdings, Inc. merged with and into Stratex Oil & Gas, Inc., a Delaware corporation (“SOG”), (the “Merger”). SOG was the surviving corporation of that Merger. As a result of the Merger, we acquired the business of SOG, and continue the business operations of SOG as a wholly-owned subsidiary.

On December 1, 2014, pursuant to the terms and condition of the Agreement and Plan of Merger dated May 6, 2014 by and among Stratex, Richfield Acquisition Corp. (“Merger Sub”), and Richfield Oil & Gas Company (“Richfield”), as amended by Amendment No. 1 to Agreement and Plan and Merger dated July 17, 2014 (the Agreement and Plan of Merger, as so amended, the “Merger Agreement”), Merger Sub merged with and into Richfield, with Richfield continuing as the surviving corporation and as a wholly owned subsidiary of Stratex (the “Richfield Merger”). Prior to the completion of the transaction, the Merger Agreement and related transactions were approved by Richfield’s stockholders at a special meeting held on November 24, 2014.

As a result of the Richfield Merger, each outstanding share of Richfield common stock was converted into the right to receive one share of our common stock. As a result of the Richfield Merger, we delivered an aggregate of 60,616,448 shares of our common stock to the Richfield stockholders. Those shares are registered under the Securities Act of 1933, as amended, on Stratex’s Registration Statement on Form S-4 (File No.333-198384) which included a Proxy Statement/Prospectus (the “Proxy Statement/Prospectus”).

Neither Richfield nor any of its predecessors, subsidiaries or affiliates has been affiliated with or in any way related to Richfield Oil Corporation, an oil company based in California that was merged out of existence in 1966, or its successor, Atlantic Richfield Company.

| 6 |

Corporate Structure

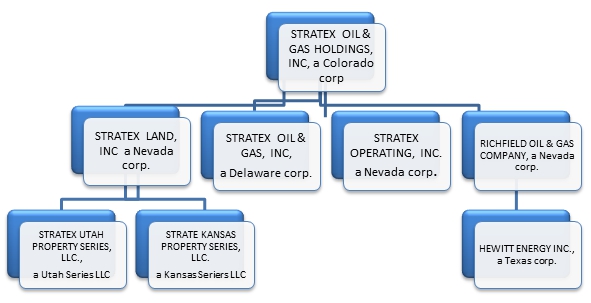

The following chart shows the current corporate structure of Stratex and its subsidiaries.

Stratex Oil & Gas Holdings, Inc., a Colorado corporation was formally known as Poway Muffler and Brake Inc. and was formed on August 15, 2003. On May 25, 2012 Stratex changed its name from Poway Muffler and Brake Inc to Stratex Oil & Gas Holdings, Inc. Richfield Oil & Gas Company, a Nevada corporation was formally known as Hewitt Petroleum, Inc and was formed on May 18, 2008. On March 4, 2011 Richfield changed its name from Hewitt Petroleum to Richfield Oil & Gas Company. Hewitt Energy, Inc. was acquired by Hewitt Petroleum, Inc. from Hewitt Energy Group, LLC effective on January 1, 2009 Hewitt Energy, Inc. is licensed and bonded in Kansas to be an Operator. Stratex Operating, Inc. was formed on December 2, 2014, and is licensed to be an Operator in Kansas, Texas and Montana. Stratex Land, Inc, a Nevada corporation was incorporated to hold the oil & gas leases of the Company. The two subsidiaries of Stratex Land, Inc. were formed to hold oil and gas leases within Utah and Kansas. On June 25, 2013 HOI Kansas Property Series, LLC, a Kansas series limited liability company, was organized to hold the oil and gas leases within the State of Kansas. On December 2, 2014 the name for HOI Kansas Property Series, LLC was changed to Stratex Kansas Property Series, LLC. On August 5, 2013 HOI Utah Property Series, LLC, a Utah series limited liability company, was organized to hold the oil and gas leases within the State of Utah. On December 9, 2014 the name for HOI Utah Property Series, LLC was changed to Stratex Utah Properties Series, LLC.

Our Business Strategy

We have the following strategic direction:

| ● | We use our research technology to identify prospective properties in Kansas and Oklahoma that were initially developed between the 1920s and 1950s, but which may be subject to further development through the use of more modern production techniques. We refer to these properties as our “Mid-Continent Project,” which currently includes 2,186 gross (2,151 net) acres. We have identified significant oil and natural gas reserves from these early exploration properties, many of which were previously underdeveloped due to inefficient and antiquated exploration and production methods and low commodity prices. In most cases these wells were developed and left fallow by major oil and gas companies. Using current technology and methodologies, we have successfully developed both production and proved reserves within these fields, and we intend to continue to pursue this strategy in the future. | |

| ● | We have two properties on the Utah–Wyoming Overthrust. We currently own or lease 1,671 gross (1,671 net) acres on the Utah-Wyoming Overthrust, near the border between northern Utah and south-western Wyoming. We refer to these properties as our “Utah-Wyoming Overthrust Project.” We intend to conduct additional development activities with respect to our Utah-Wyoming Overthrust Project. |

| 7 |

| ● | We have participated in exploration for oil and natural gas reserves in the Central Utah Overthrust region, where we are participating in 27,293 gross (7,013 net) acres. In addition to that acreage, we have options on an additional 15,090 gross (13,669 net) acres. We refer to these properties as our “Central Utah Overthrust Project.” We and our partners intend to conduct further drilling operations, acquire additional acreage and to conduct further exploration activities with respect to our Central Utah Overthrust Project. | |

| ● | In Texas, we have interests in certain properties located in Zavala County. Our Zavala County acreage lies near the established oil rim of the very prolific Eagle Ford Shale play (“Eagleford”), one of the most actively drilled basins in the United States. The play is also known for multiple stacked pay zones and is also highly prospective for the San Miguel, Austin Chalk and Buda Limestone formations, which all produce within the general vicinity. We are currently participating in 19,792 gross (18,772 net) acres. Management views our Zavala County acreage as the cornerstone of its present development program. The Company currently owns interest in two wells which have been drilled, but not currently completed and one well which is currently being drilled. | |

| ● | In Roosevelt County Montana, we have interests in 420 gross (420 net) acres of leases with one producing well, which we operate. This well provides steady production and income for the company. In addition to this, the company has a small carried working interest in deeper formation, which may be drilled for, by other operators.

| |

| ● | The Company holds small, passive, non-operated working interests in Colorado, North Dakota, Montana and Kansas. The Company currently owns an interest in 40 wells, 39 of which are currently producing. We hold approximately 48,720 gross (411 net) leasehold acres in Weld County Colorado, Sheridan County Montana, Billings, Williams, Divide, Mountrail, and Stark Counties, North Dakota, and Ford and Lane Counties Kansas. | |

| ● | We also have undrilled leases in Montana and North Dakota, consisting of 4,916 gross (4,916 net) acres. |

Our approach to acquiring leases and developing producing properties focuses on three types of development activities:

| ● | Activities involving the identification, acquisition and development of leases of property in which oil or natural gas is known to exist. | |

| ● | Activities involving low or moderate exploration and development risk. These include leases of property where oil and natural gas has been produced in the past but there are no existing wells. | |

| ● | Activities involving the acquisition of properties where it is reasonably believed that potential hydrocarbon values exist based on analysis involving geochemical, radiometric, gravitational and seismic data. This may include projects that have never been drilled or tested for oil and natural gas in the past. |

We have developed a database to evaluate wells that are on record in our Kansas and Oklahoma areas of operation. The database contains extensive well records, including information on historic production, geological data, well depth, well logs and drilling records, and where available, handwritten driller notes concerning rock formation depths and other relevant information. This system has been developed internally from data obtained from appropriate state agencies and private organizations. The database enables us to identify potential bypassed hydrocarbons throughout the state of Kansas and parts of Oklahoma.

Through statistical modeling and data evaluation, we believe greater oil and natural gas reserves exist and can be found, measured and produced in areas where initial reserves were previously found but abandoned prior to full development. We believe that with our current technologies and systems, acquiring and developing older fields mitigates exploration risk and is a safe and predictable method of managing our business.

| 8 |

Properties

Office location

The Company maintains its corporate office at 175 S Main Street, Suite 900, Salt Lake City, UT 84111. Additionally, we have an office at 30 Echo Lake Road, Watertown, CT. 06795.

Oil & Gas Properties

We are an independent energy company focused on the acquisition and subsequent exploitation and development of predominantly crude oil as an Operator in Montana, Texas, Kansas and Utah as well as varied non-operated working interests in Colorado, North Dakota, Montana and Kansas. We are currently participating in 104,997 gross (35,317 net) acres of owned mineral rights and leasehold interests, and have been involved in conducting seismic surveys, and drilling projects in these states. As of March 31, 2015, we had 86 total wells, including 55 producing wells, 19 shut-in wells, nine active saltwater disposal wells and three wells that are currently in the process of drilling and completion. As set forth in our Reserves and Engineering Evaluation, dated March 24, 2015, and effective as of December 31, 2014 (the “2014 Pinnacle Reserve Report”), prepared by Pinnacle Energy Services L.L.C. (“Pinnacle”), as of December 31, 2014 we had 49 producing wells, 18 shut-in wells, nine active saltwater disposal wells and five wells that we were in the process of drilling and completing. For additional information, please see the 2014 Pinnacle Reserve Report which is filed herewith as Exhibit 99.4.

Since December 31, 2014 we have sold our Working Interest in one field located in Zavala Texas which contained 2,629 gross (1,315 net) leasehold acres and containing 1 producing well, and 5 shut in wells. This field was not economic due to the substantial fall in oil pricing.

Mid-Continent Project

In 2009, we began development of our Mid-Continent Project by selling working interests to third parties to provide development funding. As of March 31, 2015, we had three fields in our Mid-Continent Project, which contain 15 total wells, including six producing wells, five shut-in wells, and four saltwater disposal wells. We have three Kansas fields, which include:

| ● | The Perth Field, in Sumner County, which we own a 100% working interest and which contains four total wells, including two producing wells, one shut-in well, and one saltwater disposal well; |

| ● | The South Haven Field, in Sumner County, which we own a 100% working interest and which contains four total wells, including two producing wells, one shut-in well, and one saltwater disposal well; |

| ● | The Koelsch Field, in which we own an 85.5% working interest, with the exception of the RFO Koelsch #25-1 Well in which we own an 83.5% working interest. The Koelsch Field contains five total wells including two producing wells; two shut-in wells; and one saltwater disposal well; and | |

| ● | The Gorham Field, in which we own a 100% working interest and which contains 21 total wells, including seven producing wells, 10 shut-in wells, and four saltwater disposal wells. | |

| ● | The Trapp Field, in which we own a 100% working interest and which contains three total wells, including one producing well, one shut-in well, are one saltwater disposal well. |

We have one project in Oklahoma, the Bull Field, in which the leases have currently expired that contain two wells, including one shut-in well and one saltwater disposal well. Our current total acreage position in our Mid-Continent Project is 2,186 gross (2,151 net) acres.

Utah-Wyoming Overthrust Project

We have two prospects in the Utah-Wyoming Overthrust Project, the Hogback Ridge Prospect and the Spring Valley Prospect. The Hogback Ridge Prospect, located in Rich County, Utah, incorporates 1,511 acres, in which we own a 100% working interest. The Spring Valley Prospect, located in Uinta County, Wyoming, incorporates a 160 acre parcel of land, in which we own the mineral rights and a 100% working interest. Our total acreage position in the Utah-Wyoming Overthrust Project is 1,671 gross (1,671 net) acres.

| 9 |

Central Utah Overthrust Project

We have five prospects in the Central Utah Overthrust Project, the Liberty Prospect, the HUOP Freedom Trend Prospect, the Independence Prospect, the Pine Springs Prospect, and the Edwin Prospect, which include one producing well, one shut-in well and one well in the completion stage of development.

| ● | The Liberty Prospect incorporates approximately 447 gross (106 net) acres, in which we own a 65.2% working interest before payout (“BPO”) and a 50.1% working interest after payout (“APO”). We have one well in the Liberty Prospect, which we refer to as the “HPI Liberty #1 Well.” We began drilling the HPI Liberty #1 Well in April 2010. On November 1, 2014 we sold most our interest in the Liberty #1 Well but retained a 7.5% carried working interest in the well and the 320 acre lease the well is located on. The Liberty #1 Well is currently in the completion stage of development. |

| ● | The HUOP Freedom Trend Prospect is located in Sanpete County Utah. As of March 31, 2015 we hold lease on approximately 5,316 gross (4,775 net) leasehold acres. The Company also holds an option to acquire an additional 13,531 gross (12, 110 net) leasehold acres within the HUOP Freedom Trend Prospect. This option may be exercised on or before June 30, 2015. The Company owns an 89.5% working interest BPO and APO in the deep zones and we own a 44.3% working interest BPO and a 41.3% working interest APO in the first well to be drilled in the shallow zones. We own a 44.3% working interest BPO and APO in all wells to be drilled in the other shallow zones. |

| ● | The Independence Prospect incorporates approximately 20,000 gross (600.0 net) acres, in which we own a 3.0% working interest and which contains one shut-in well we refer to as the “Moroni #1-AXZH and one well referred to as the Moroni #11M-1107 Well which is currently operated by Whiting Energy which was drilled in 2014, and is now producing. |

| ● | The Pine Springs Prospect incorporates 400 acres, in which we own a 100% working interest BPO and APO. The Company also holds an option to acquire an additional 1,558 gross (1,558 net) leasehold acres within the Pine Springs Prospect. |

| ● | The Edwin Prospect incorporates 1,131 acres, in which we own a 100% working interest BPO and APO. |

Our total acreage position in the Central Utah Overthrust Project is 27,293 gross (7,013 net) acres. The Company also holds an option to acquire an additional 15,090 gross (13,669 net) leasehold acres within the Central Utah Overthrust Project.

Zavala County, Texas Project

On December 3, 2013 we entered into a Joint Development Agreement (the “JDA”) with Eagleford Energy, Inc., (“Eagleford”) and its wholly owned subsidiary, Eagleford Energy, Zavala Inc. (“Eagleford Zavala”). Subject to the satisfaction of certain terms and conditions in the JDA, Eagleford Zavala granted the Company the exclusive right to operate and develop approximately 2,629 gross (1,315 net) leasehold acres under a certain lease, located in Zavala County, Texas. The Company performed its obligation to earn an interest in the lease. In March 2015 the Company determined that the cost of the Royalties under the lease made the operation of this lease uneconomic. The Company surrendered its interest in this lease to its partners under the terms of the JDA on March 31, 2015. The parties entered into a mutual release of all obligations.

The Company holds an interest in 19,792 gross (18,772 net) leasehold acres known as the Matthews Lease. The Companies interest in the lease is a 94.85% working interest. This lease currently has two wells which have been drilled, but not currently completed, and one well that is currently being drilled. The Company owns a 94.85% working interest in these two wells and a 71.25% net revenue interest. On March 13, 2015 the Company entered into a Joint Development Agreement with Itasca Energy LLC (“IE”) whereby IE will drill up to 6 wells in the Buda Limestone formation of the leasehold to earn a 77.5 % working interest in the 6 wells which are completed, the Company will retain a 21.3% working interest in each well. IE will pay all cost of development through the tanks on the six wells. If IE completes all six wells they will earn a 77.5 % working interest in 10,314 gross (7,994 net) working interest in the Matthews Lease and 50% working interest in 9,333 gross and (4,666 net) in the remaining portion of the Matthews Lease. The first well of this agreement was spudded on March 16, 2015 each of the 5 remaining wells must be spudded within 120 days of the prior well reaching total depth. If the wells are not spudded with the required time period then IE will earn its interest in the actual wells drilled only and will not earn an interest in the total lease.

Our total acreage position in the Zavala County Texas Project is 19,792 gross (18,772 net) acres.

| 10 |

Tininenko Project, Roosevelt, Co. Montana

Stratex owns a 100% Working interest in approximately 420 gross and 420 net mineral acres, with one producing well, in Roosevelt County, Montana with one operating well. The Operating well (Tininenko 4-19) is producing. Stratex holds a 100% working interest in this well.

In addition to this, the company has a small carried working interest in deeper formation, which may be drilled for, by other operators.

Non-Operated Working Interest

The Company presently owns small, non -operated working interests in the following fields as of March 31, 2015:

| ● | Kansas Wells – 2,080 gross and 88 net mineral acres located in Acres located in Lane County, Kansas with 8 producing wells. The lease currently has 4 producing wells with an average royalty interest of 1.20%, one producing well with a 5.0% working interest, and 3 producing wells with an average working interest of 8.048%. There is also additional spacing for 18 wells. |

| ● | Gunsmoke Field, in which we own a 75.0% working interest until payout and a 50.0% working interest after payout. This field contains one producing well, and approximately 160.0 gross (80.0 net) acres of leasehold. |

| ● | Olson Well – 640 gross and 2 net mineral acres in Divide County, North Dakota. We have acquired small leasehold in Divide County, North Dakota. The lease currently has 1 well with a working interest of 0.3125%. |

| ● | Fortuna Wells – Approximately 8,902 gross and 145 net mineral acres in Billings, Stark, and Williams Counties, North Dakota, , and Sheridan County Montana, with 7 operating wells. Stratex holds an average of 1.622797 % working interest in these wells. |

| ● | Double LL Wells – Approximately 20,480 gross and 53 net mineral acres in Billings and Stark County, North Dakota, with 15 producing wells, and one well in the completion stage of development. Stratex holds an average of 0.259433% working interest in these wells. |

| ● | Wattenberg Lease – Approximately 16,458 gross and 67 net mineral with 7 wells that are currently producing in Weld County Colorado. Stratex holds an average of 0.405563% working interest in these wells. |

The following represent our mineral lease holdings as of March 31, 2015. These leases contain no wells.

| ● | 3,853 gross and 3,853 net mineral acres in Golden Valley County, North Dakota. We have leaseholds totaling 3,853 gross acres in Golden Valley County, North Dakota which were acquired under a long-term lease option. The conventional oil play consists of two objective formations; 1) Bakken – A sandstone that has produced over 80M barrels of oil and is present over our acreage, 2) Three Forks/Sanish Formation. |

| ● | 786 gross and 786 net mineral acres located in Sheridan County, Montana. |

| ● | 121 gross and 121 net mineral acres in Stark County, North Dakota. Stark County has seen significant development recently as firms are exploring the potential of the Bakken play in the county. |

| ● | 120 gross and 120 net mineral acres in Mountrail County, North Dakota. We have gained a foothold in Mountrail County, which has been the focal point of drilling in the Williston Basin and the best performing county in North Dakota. The North Dakota State Industrial Commission has reported Mountrail’s most recent monthly production rate, December 2011, at 5.1 million barrels of oil. |

| ● | 32 gross and 32 net mineral acres in Williams County, North Dakota. Williams County has also been a top producing county in North Dakota and the most recent production statistics by the North Dakota Industrial Commission (NDIC) report monthly production at 2.4 million barrels of oil. |

| ● | 4 gross and 4 net mineral acres in Divide County, North Dakota. We have acquired small leasehold in Divide County, which has picked up in development lately. |

| 11 |

General Development of the Business

During the last three fiscal years, Stratex has raised capital through private placements of equity and debt financings. During the periods ended December 31, 2014, 2013, and 2012, Stratex raised $0, $35,000 and $1,512,735 in cash from the private placement of common stock and $18,402,210, $1,630,000 and $335,000 in cash from debt financings, respectively. On December 1, 2014 Stratex acquired Richfield Oil and Gas through the Richfield Merger in which Stratex assumed $4,114,183 in debt and issued 60,616,448 common shares valued at $8,183,220.

We have nine full-time employees and one consultant providing us services, and we expect that the number of our employees in 2015 will remain the same. Our technical staff focuses on the development and exploration of oil drilling projects, and evaluating the probability of encountering economically recoverable hydrocarbons.

We employ integrated analysis including geology, geophysics and reservoir engineering to determine the viability of a drilling prospect. We prefer to drill in areas where there are multiple zones potentially containing hydrocarbons rather than a single target, which we refer to as “stacked pay.” Although we cannot be certain whether any of the zones contain hydrocarbons, the stacked pay approach reduces the risk of a dry hole. Additionally, we look for properties with access to existing infrastructure to transport and process the products produced. Once we have conducted a full review of these factors and confirmed the viability of a prospect, we proceed with acquiring rights to the lands and resources. These lands may be acquired through direct acquisition of existing oil and natural gas production, leasehold acquisitions or farm-ins.

Projects

Our development plans may be delayed and are dependent on certain conditions, including the receipt of necessary permits, the ability to obtain adequate financing and weather conditions. Uncertainties associated with these factors could result in unexpected delays. In addition, the feasibility of a number of the projects described below is still subject to further geological testing and/or drilling to determine whether commercial quantities of hydrocarbons are present.

In addition to the projects currently under development, we intend to initiate the development of additional projects from time to time. However, the number of development activities we initiate each year will depend on a number of factors, including the availability of adequate financing, the availability of mineral leases, the demand for oil and natural gas, the number of properties we have under development, and our available resources to devote to our project development efforts.

The current status of each of our projects is described below:

Mid-Continent Project

Our Mid-Continent Project includes five fields in Kansas, which are described below:

| 12 |

Perth Field

The Perth Field is located in Sumner County, Kansas. The Perth Field was discovered in 1945 and has produced a total of 1.84 million barrels of oil from the Wilcox Formation based on information maintained by the Kansas Corporation Commission. The field was mostly abandoned in the 1980s. Our research indicates that this field has high water content that is compatible with our production methodology and has the potential of producing a significant amount of additional oil. There are also other zones in this field, which have not been fully tested, that we believe could contain additional reserves. These zones include Lansing/Kansas City, Mississippi, and Arbuckle.

We have drilled and completed three production wells in the Wilcox Formation and equipped them with submersible pumps. We own a 100% working interest in the Perth Field, which incorporates 320 acres. As of March 31, 2015, the Perth Field contained two producing wells, one saltwater disposal well and one well that is shut in. Our development plan contained in the 2014 Pinnacle Reserve Report includes drilling three new wells, one recompletion, and one reentry, all for production from the Wilcox. We also anticipate the need for drilling one new saltwater disposal wells in the future.

South Haven Field

The South Haven Field is located in Sumner County, Kansas. The South Haven Field was discovered in 1954 and produced over 600,000 barrels of oil through 1977, when the field was abandoned, according to data maintained by the Kansas Corporation Commission. All of the oil production came from the Wilcox Formation. Our research indicates that this field has strong water drive compatible with our production methodology. We believe that the South Haven Field has the capability of producing substantially more oil than has been produced in the past. There have been excellent shows of oil and natural gas in both the Wilcox and the Mississippi Chat present during our testing of the field. However we have not completed any wells in the Layton, Cleveland, or Mississippi Chat Formations. We own a 100% working interest in the South Haven Field, which incorporates 247 acres.

We have drilled and completed two new wells, the RFO Helsel #3-1 and the Yearout #2-1, in the South Haven Field. The Helsel #3-1 well was put into production in September 2013; currently this well is producing. The Yearout #2-1 was drilled during 2014 and is also producing. We have recompleted the existing well, the Rusk #2, in the Wilcox Formation and it is in production. We have also washed down a previously plugged well for conversion to a saltwater disposal well and the well is now active. As of March 31, 2015, the South Haven Field contained two producing wells, one saltwater disposal well and one shut in well. Our development plan calls for drilling two new wells, and recompleting on well, for production from the Wilcox Formation, one horizontal well for production from the Mississippian Limestone and one new salt water disposable well.

Koelsch Field

The Koelsch Field, which includes the Prescott Lease, is located in Stafford County, Kansas, consists of 240 acres, in which we own an 85.50% working interest, with the exception of the RFO Koelsch #25-1 Well in which we own an 83.50% working interest. This field was discovered in 1952 and has produced over 500,000 barrels of oil with some reported natural gas production, according to data maintained by the Kansas Corporation Commission. The Arbuckle reservoir in this field has been largely abandoned since 1957. We believe that the Koelsch Field has the capability of producing substantially more oil than has been produced in the past. In January 2012, we drilled the RFO Koelsch #25-1 Well which went into production in April 2012. In March 2012, we drilled the RFO Prescott #25-6, which we put into production, but is currently shut-in. In 3Q 2014, we performed a polymer treatment on the Prescott #2 Well which increased the production and lowered the costs of operation. As of March 31, 2015, the Koelsch Field contained two producing wells, two shut-in wells and one active saltwater disposal well. Our plans relating to the Koelsch Field include: i) drilling three new wells for production from the Arbuckle Formation; ii) drilling one new horizontal well for production from the Mississippian Limestone; iii) reconfiguring two existing shut-in wells for production; iv) drilling an additional saltwater disposal well; and v) performing a polymer gel water shut off treatment on one of the existing producing wells.

Additionally, we have reviewed mud-log reports that indicate the presence of at least 22 shallow natural gas zones in the Koelsch Field, which exhibit low British Thermal Unit (“BTU”) content gas. The low BTU gas content of these wells is due in large part to significant Helium deposits together with Nitrogen. Helium by itself is a valuable gas and if we desire to produce gas, the wells will require the installation of portable separation plants to extract Helium and waste Nitrogen from the natural gas. This process is expected to increase the BTU content of the natural gas and create additional value from the sale of Helium.

| 13 |

Gorham Field

During 2014 we owned and operated a portion of the Gorham Field is located in Russell County, Kansas. Stratex’ Gorham Field leaseholds contained a total of 1,219 acres. The field was discovered in 1926 and has produced approximately 98,000,000 barrels of oil for former producers, 67% of which has come from the Upper Arbuckle and Reagan Reservoirs, and 25% of which has come from the Lansing/Kansas City formation, according to data maintained by the Kansas Corporation Commission as of December 31, 2014, the Gorham Field contained seven producing wells, 10 shut-in wells, and four active saltwater disposal wells. Our development plan included reworking nine shut-in wells and drilling 25 new wells for production from the Arbuckle Formation and Gorham Sand and five additional salt water disposal wells.

Trapp Field

During 2014 we owned a portion of the Trapp Field, located in Russell County Kansas. The Trapp Field is the largest producing oil field in Kansas and has produced approximately 310,000,000 barrels of oil with very little reported natural gas production for previous producers, according to data maintained by the Kansas Corporation Commission. The Hoffman lease is located in a portion of the Trapp Field. As of December 31, 2014 we owned a 100% working interest in the Hoffman lease. This field consisted of 160 acres with respect to which we lease 100% of the mineral rights. As of December 31, 2014, the Trapp Field contained three wells, including one producing well, one shut-in well, and one saltwater disposal well. Our development plan included reworking the shut-in well, drilling four new wells for production from the Arbuckle Formation and drilling one new saltwater disposal well.

Utah-Wyoming Overthrust Project

Our Utah-Wyoming Overthrust Project includes one prospect in Wyoming and one prospect in Utah, which are described below:

Hogback Ridge Prospect

The Hogback Ridge Prospect is located in Rich County, Utah, along the Utah-Wyoming Overthrust and consists of 1,511 acres of mineral leases, with 10-year terms, in which we own a 100% working interest. Our geological research shows that our acreage covers two separate structural highs in the Jurassic Nugget Sandstone, located along a back thrust on the hanging wall of the Crawford Thrust Plate. There are other potentially productive formations that have had favorable test results throughout the area.

A portion of our acreage is within 3 miles of a nearby field, where American Quasar drilled the Hogback Ridge #20-1 that produced natural gas from the Dinwoody Formation, at a depth of 9,400 feet. According to the public records of the Utah Division of Oil, Gas and Mining (“UDOGM”), this well had an initial production rate of 22.4 MMcf of natural gas per day, and produced a cumulative of 5,500 MMcf of natural gas, from 1977 to 1981, before being plugged. This well also had excellent drill stem tests results in several other formations, such as the Twin Creek Limestone at 1,041 feet with a test of 15 MMcf of natural gas per day, the Phosphoria Formation at 10,020 feet with a test of 9.9 MMcf of natural gas per day, and the Weber Sandstone at 10,522 feet with a test of 10.5 MMcf of natural gas per day. A 10 inch Questar gas pipeline crosses our acreage, and connects to a nearby 22 inch Western Gas pipeline, which could be used to sell gas produced by future wells.

We believe that this prospect warrants further geological research in order to determine where new acreage should be acquired, and where any new wells should be drilled. Plans to drill in the Hogback Ridge Prospect have not yet been determined and no reserves have been assigned to the Hogback Ridge Prospect in the 2014 Pinnacle Reserve Report.

Spring Valley Prospect

The Spring Valley Prospect lies between the Anschutz Ranch and Pinedale Fields in Uinta County, Wyoming, along the Utah-Wyoming Overthrust. We currently own 100% of the mineral rights in a 160 acre parcel of land, containing an active oil seep. Geological research into the Spring Valley Prospect is ongoing and reviewed on an annual basis. Plans to drill in the Spring Valley Prospect have not yet been determined as we are awaiting the results of additional geological research and no reserves have been assigned to the Spring Valley Prospect in the 2014 Pinnacle Reserve Report.

| 14 |

Central Utah Overthrust Project

Our Central Utah Overthrust Project includes five prospects in Utah, which are described below:

HUOP Freedom Trend Prospect

The HUOP Freedom Trend Prospect is currently owned by Hewitt Utah Overthrust Partners (“HUOP”). Ownership in the HUOP Freedom Trend Prospect has been split stratigraphically into two groups, deep rights and shallow rights. The working interest owners of the HUOP Freedom Trend Prospect have defined deep rights as all stratigraphic intervals located below the top of the Jurassic Twin Creek Formation, including the Jurassic Twin Creek Formation, and have defined shallow rights as all stratigraphic intervals located above, but not including, the Jurassic Twin Creek Formation. With respect to the HUOP Freedom Trend Prospect, we currently own an 89.50% working interest BPO and APO in the deep zones, and a 44.25% working interest BPO and APO in the shallow zones for each well, with the exception of the first well we complete in the shallow zones, in which we will own a 44.25% working interest BPO and a 41.25% working interest APO in the shallow zones.

The HUOP Freedom Trend Prospect consists of 5,315 gross (4,775 net) acres along the Central Utah Overthrust in Sanpete County, Utah, with respect to which we lease 100% of the mineral rights. The Company has an option to acquire an additional 13,531gross (12,110 net) acres within the HUOP Freedom Trend Prospect. This Option is exercisable on or before June 30, 2015. The HUOP Freedom Trend Prospect has attractive oil and natural gas potential relating to multiple large subsurface anticlinal structures near Fountain Green, Utah indicated by surface geology, gravity data, geochemical evidence and seismic surveys. We believe this data suggests structural closure over several square miles with a high possibility of the presence of oil and natural gas under the acres leased by HUOP. This evidence is bolstered by discoveries southwest of Fountain Green, Utah and traces of oil in wells surrounding the prospect. The main productive zones of the HUOP Freedom Trend Prospect are the Twin Creek and Navajo zones which are each repeated as three separate structures throughout the prospect, at approximate depths of 6,000, 9,000, and 12,000 feet, in separate locations on acres leased and optioned by us. A deeper Mississippian target exists at approximately 14,000 to 16,000’, which has never been drilled for in the Central Utah Overthrust.

There are also shallow targets within the anticlinal fold on the eastern edge of HUOP Freedom Trend Prospect’s leases at depths of 4,000 to 10,000 feet range. We believe the Entrada Sandstone and the Cretaceous zones of the Emery, Ferron, and Dakota formations could hold reserves. We have identified several drilling locations where these zones could be tested simultaneously by drilling one well. These zones are accessible through conventional drilling techniques.

There are no wells currently on the HUOP Freedom Trend Prospect. We plan to drill wells so that three overlapping Navajo layers in three different structures can be tested in one well, all within prospect boundaries. Our long-term development plans for the HUOP Freedom Trend Prospect include drilling on 80-acre spacing in multiple reservoirs. Immediate plans to drill in the HUOP Freedom Trend Prospect have not yet been determined and no reserves have been assigned to the HUOP Freedom Trend Prospect in the 2014 Pinnacle Reserve Report.

Liberty Prospect

The Liberty Prospect is owned by multiple parties. The Liberty Prospect incorporates 447 gross (115 net) mineral acres in which we lease, or own, 100% of the mineral rights. The Liberty Prospect is on the Paxton Thrust in the northernmost part of the Central Utah Overthrust in Juab County, Utah. One well has been drilled within the Liberty Prospect. We own a 7.5% carried working interest in the HPI Liberty #1 Well and the surrounding 320 acre lease in which the HPI Liberty #1 Well is located.

We drilled the HPI Liberty #1 Well in 2010, and as a result, we have discovered about 1,200 feet of hydrocarbon charged zone in the Twin Creek Limestone and the Navajo Sandstone, including oil, natural gas and condensates. These formations are naturally fractured, resulting in excellent permeability and enhanced secondary porosity. Petrographic analysis confirms the presence of natural gas and oil throughout the hydrocarbon charged zone, as well as 15% to 20% primary porosity in the Navajo Sandstone. The oil is similar to that of the Covenant Field and has been classified as coming from a Mississippian-aged source rock.

| 15 |

While the HPI Liberty #1 Well was spudded in April 2010, it remains in the completion stage of development. The initial drilling of the well resulted in formation damage. We have made attempts at remediating this damage, but these attempts have thus far been unsuccessful. On November 2014 we sold our interest in the Liberty #1 Well to partners who have participated in the well in the past, retaining a 7.5% carried working interest in the well for future completion attempts.

The current Operator plans to drill another sidetrack in 2015, to attempt to bypass and prevent formation damage. Stratex will be carried in this work. No reserves have been assigned to the Liberty Prospect in the 2014 Pinnacle Reserve Report.

Independence Prospect

The Independence Prospect lies directly east of the Gunnison Thrust of the Central Utah Overthrust belt, in Sanpete County, Utah. As of March 31, 2015, we owned a 3.00% working interest in approximately 20,000 gross (600.0 net) acres in the Independence Prospect, which includes the Moroni #1-AXZH Well and the Moroni #11M-1107 Well. This play targets the Tununk (Mancos) Shale, in a basin centered, highly organic, liquids rich shale play. Other potential pay zones include the Emery, Ferron, and Dakota Formations.

In 1976, Hanson Oil Co., Inc. and True Oil, LLC drilled the Moroni #1-AXZH Well to a total depth of 21,260 feet looking for a Mississippian zone. During the drilling process, mud circulation was lost in the Tununk Shale at 11,551 feet. In 1998, Cimarron Energy, Inc. drilled five horizontal sidetracks in the Tununk Shale in the Moroni #1-AXZH Well. On Cimarron’s final failed attempt, its drill pipe became stuck. Limited perforations through the drill pipe in the Tununk Shale have tested with rates equivalent to 720 Bopd, but such rates were only sustained for one to two hours at a time. Severe mechanical constrictions and formation damage have combined to make it uneconomical in its current mechanical configuration and have led to the well being shut-in.

On August 28, 2014 Whiting Oil & Gas Corp. began the drilling of the Moroni #11M-1107 well in Sanpete County Utah. We own a 3% working interest in the Moroni #11M-1107 well. As of March 31, 2015 the well has been drilled and fractured treated. First production began on February 19, 2015, but the well did not go into full production until March 17, 2015. While the well is now in production, a majority of the frac load still needs to be recovered, before full production rates can be realized. We plan to participate in the development of the Independence Prospect by funding our 3% working interest requirement on any further wells to be drilled within the 20,000 acre lease position. No reserves have been assigned to the Independence Prospect in the 2014 Pinnacle Reserve Report.

Pine Springs Prospect

The Pine Springs Prospect lies directly east of the Gunnison Thrust of the Central Utah Overthrust belt, in Sanpete County, Utah. As of March 31, 2015, we owned a 100.00% working interest in approximately 400 acres in the Pine Springs Prospect. The Company has an option to acquire an additional 1,558 gross (1,558 net) acres within the Prospect. This Option is exercisable on or before June 30, 2015. This acreage is in an up-dip location to a well drilled by Phillips Petroleum in 1971. The Phillips well had gas shows in the same Cretaceous formations contained in the Independence Prospect. Plans to drill in the Pine Springs Prospect have not yet been determined and no reserves have been assigned to the Pine Springs Prospect in the 2014 Pinnacle Reserve Report.

Edwin Prospect

The Edwin Prospect lies directly east of the Gunnison Thrust of the Central Utah Overthrust belt, in Sanpete County, Utah. As of March 31, 2015, we owned a 100.00% working interest in approximately 1,131 acres in the Edwin Prospect. This acreage is located on a seismically defined structural high, which contains the same Cretaceous formations as the Independence Prospect. This play targets the Tununk (Mancos) Shale, which is a highly organic, liquids rich shale play. Plans to drill in the Edwin Prospect have not yet been determined and no reserves have been assigned to the Edwin Prospect in the 2014 Pinnacle Reserve Report.

Zavala County, Texas Project

The Zavala County, Texas Project is located on the edge of the Eagle Ford Shale play in northern Zavala County, Texas. There are several other formations that are prospective within Stratex acreage such as the San Miguel Formation, the Austin Chalk, and the Buda Limestone.

| 16 |

On December 3, 2013 we entered into a Joint Development Agreement (the “JDA”) with Eagleford Energy, Inc., (“Eagleford”) and its wholly owned subsidiary, Eagleford Energy Zavala, Inc. (“Eagleford Zavala”). Subject to the satisfaction of certain terms and conditions in the JDA, Eagleford Zavala granted the Company the exclusive right to operate and develop approximately 2,629 gross (1,315 net) leasehold acres under a certain lease, located in Zavala County, Texas. The Company performed its obligation to earn an interest in the lease. In March 2015 the Company determined that the cost of the Royalties under the lease made the operation of this lease uneconomic. The Company surrendered its interest in this lease to its partners under the terms of the JDA. On March 31, 2015, the parties entered into a mutual release of all obligations.

The Company holds an interest in 19,792 gross (18,772 net) leasehold acres known as the Matthews Lease. The Companies interest in the lease is a 94.85% working interest. This lease currently has two wells which have been drilled, but not currently completed, and one well that is currently being drilled. The Company owns a 94.85% working interest in these two wells and a 71.25% net revenue interest. On March 13, 2015 the Company entered into a Joint Development Agreement with Itasca Energy LLC (“IE”) whereby IE will drill 6 wells in the Buda Limestone formation of the leasehold to earn a 77.5 % working interest in those 6 wells which are completed, the Company will retain a 21.3% working interest in each well. IE will pay all cost of development through the tanks on the six wells. If IE completes all six wells they will earn a 77.5 % working interest in 10,314 gross (7,994 net) working interest in the Matthews Lease and 50% working interest in 9,333 gross and (4,666 net) in the remaining portion of the Matthews Lease. The first well of this agreement was spudded on March 16, 2015 each of the 5 remaining wells must be spudded within 120 days of the prior well reaching total depth. If the wells are not spudded with the required time period then IE will earn its interest in the actual wells drilled only and will not earn an interest in the total lease.

Tininenko Project, Roosevelt, Co. Montana

Stratex owns a 100% Working interest in approximately 420 gross and 420 net mineral acres, in the Red Bank Field, with one producing well, in Roosevelt County, Montana. The Operating well (Tininenko 4-19) is producing from the Ratcliffe Formation. Stratex holds a 100% working interest in this well.

In addition to this, the company has a small carried working interest in deeper formation, which may be drilled for, by other operators.

Small Non-Operated Properties

Lane County Kansas

Stratex owns approximately 2,080 gross and 88 net mineral acres located in Lane County, Kansas with 8 producing wells. The lease currently has 4 producing wells with an average royalty interest of 1.20%, one producing well with a 5.0% working interest, and 3 producing wells with an average working interest of 8.048%. There is also additional spacing for 18 wells.

Gunsmoke Project – Ford County, Kansas

On September 8, 2014, Stratex entered into a Joint Development Agreement (“JDA”) with Eagle Oil & Gas Co. (“Eagle”) and Eagle Dodge City Partners, LP (“EDC”), initially covering the development of approximately 35,000 acres in Ford County, Kansas. Pursuant to the JDA, Eagle, as operator, has initially drilled four (4) Obligation Wells. Three of the wells were plugged and abandoned. The fourth well is currently producing. Stratex currently has a fifty percent (50%) working interest in the O’Slash Cattle #11-1 Well. The JDA has also established an area of mutual interest (“AMI”) in Ford County, Kansas, pursuant to which Stratex and Eagle have each agreed to permit each other to acquire fifty percent (50%) of any undivided working interest in New Prospect Leases located within the AMI acquired obtained by either of us during the three (3) year term of the AMI.

Stratex’s current ownership in the Gunsmoke Project incorporates 160 gross (80 net) acres. As of March 31, 2015, the Gunsmoke Project contained one producing well, no saltwater disposal well and no wells that are shut in.

| 17 |

Wattenberg Field, Weld Co. Colorado

Stratex owns approximately 16,458 gross and 67 net mineral acres with 7 wells that are currently producing in Weld County Colorado. Stratex holds an average of .405563% working interest in these wells. These wells are producing from the Niobrara Shale.

Williston Basin, North Dakota and Montana

Stratex owns small, non-operated Working Interests in a total of 23 producing wells, and one shut in well, in the Williston basin. The total acreage that Stratex owns in conjunction with these wells is approximately 34,938 gross (5,117 net) acres.

| ● | Olson Well – 640 gross and 2 net mineral acres in Divide County, North Dakota. We have acquired small leasehold in Divide County, North Dakota. The lease currently has 1 well with a working interest of 0.3125%. |

| ● | Fortuna Wells – Approximately 8,902 gross and 145 net mineral acres in Billings, Stark, and Williams Counties, North Dakota, , and Sheridan County Montana, with 7 operating wells. Stratex holds an average of 1.622797 % working interest in these wells. |

| ● | Double LL Wells – Approximately 20,480 gross and 53 net mineral acres in Billings and Stark County, North Dakota, with 15 producing wells, and one well in the completion stage of development. Stratex holds an average of .259433% working interest in these wells. |

The following represent our mineral lease holdings in the Williston Basin, as of March 31, 2015. There are no wells associated with this acreage.

| ● | 3,853 gross and 3,853 net mineral acres in Golden Valley County, North Dakota. We have leaseholds totaling 3,853 gross acres in Golden Valley County, North Dakota which were acquired under a long-term lease option. The conventional oil play consists of two objective formations; 1) Bakken – An organic rich shale with interbedded sandstone that has produced over 80M barrels of oil and is present over our acreage, 2) Three Forks/Sanish Formation. |

| ● | 786 gross and 786 net mineral acres located in Sheridan County, Montana. |

| ● | 121 gross and 121 net mineral acres in Stark County, North Dakota. Stark County has seen significant development recently as firms are exploring the potential of the Bakken play in the county. |

| ● | 120 gross and 120 net mineral acres in Mountrail County, North Dakota. We have gained a foothold in Mountrail County, which has been the focal point of drilling in the Williston Basin and the best performing county in North Dakota. The North Dakota State Industrial Commission has reported Mountrail’s most recent monthly production rate, December 2011, at 5.1 million barrels of oil. |

| ● | 32 gross and 32 net mineral acres in Williams County, North Dakota. Williams County has also been a top producing county in North Dakota and the most recent production statistics by the North Dakota Industrial Commission (NDIC) report monthly production at 2.4 million barrels of oil. |

| ● | 4 gross and 4 net mineral acres in Divide County, North Dakota. We have acquired small leasehold in Divide County, which has picked up in development lately. |

| 18 |

Trends and Cycles

Over the past several years, the prices for oil and natural gas have been volatile. We expect this volatility to continue. Prolonged increases or decreases in the price of oil and natural gas could have a significant impact on our results of operations and our ability to execute our business plan. There is a strong relationship between energy commodity prices and access to both equipment and personnel. High commodity prices also affect the cost structure of services which may impact our ability to accomplish drilling, completion and equipping goals in a timely fashion. Low commodity prices affect the cash flow of the Company which in turn may affect the timing of new drilling or completion projects. In addition, weather patterns are unpredictable and can cause delays in implementing and completing projects.

The oil and gas business is cyclical by nature, due to the volatility of oil and natural gas commodity pricing as described above. Additionally, seasonal interruptions in drilling and construction operations can occur but are expected and accounted for in the budgeting and forecasting process.

Competitive Conditions

We actively compete for reserve acquisitions, exploration leases, licenses and concessions and skilled industry personnel with a substantial number of competitors in the oil and gas industry, many of whom have significantly greater financial resources than we do. Competitors include major integrated oil and gas companies, numerous other independent oil and gas companies and individual producers and operators.

The oil industry is highly competitive. Our competitors for the acquisition, exploration, production and development of oil and natural gas properties, and for capital to finance such activities, include companies that have greater financial and personnel resources than we do.

Certain of our customers and potential customers are also exploring for oil and natural gas, and the results of such exploration efforts could affect our ability to sell or supply oil to these customers in the future. Our ability to successfully bid on and acquire additional property rights, to discover reserves, to participate in drilling opportunities and to identify and enter into commercial arrangements with customers will be dependent upon developing and maintaining close working relationships with our future industry partners and joint operators, our ability to select and evaluate suitable properties and to consummate transactions in a highly competitive environment. Hiring and retaining technical and administrative personnel continues to be a competitive process. We believe our distinct competitive advantage is through our unique projects, our use of innovative scientific and engineering methods, and our integrated approach to generating and implementing drilling projects.

Summary of Oil and Gas Reserves

The following table summarizes our estimated quantities of proved and probable reserves as of December 31, 2014. See “Preparation of Reserves Estimates" on page 21 of this annual report on Form 10-K and the 2014 Pinnacle Reserve Report attached hereto as Exhibit 99.7 attached hereto for additional information regarding our estimated proved reserves.

| Reserve Estimates as of December 31, 2014 | ||||||||||||||||

| Reserve Category | Oil (gross) | Oil (net) | Natural Gas (gross) | Natural Gas (net) | ||||||||||||

| MBbls | MBbls | MMcf | MMcf | |||||||||||||

| PROVED | ||||||||||||||||

| Developed | 5,058.4 | 709.0 | 9,196.2 | 272.5 | ||||||||||||

| Undeveloped | 1,848.1 | 1,477.3 | 873.1 | 698.1 | ||||||||||||

| TOTAL PROVED | 6,906.5 | 2,186.4 | 10,069.2 | 970.6 | ||||||||||||

| PROBABLE | ||||||||||||||||

| Developed | 1,457.3 | 1,157.8 | 659.6 | 527.1 | ||||||||||||

| Undeveloped | 2,336.6 | 1,870.5 | 1,133.3 | 907.2 | ||||||||||||

| TOTAL PROBABLE | 3,793.9 | 3,028.3 | 1,792.8 | 1,434.3 | ||||||||||||

| 19 |

During 2014, two factors impacted our total Net Proved Undeveloped Reserves:

| ● | We converted all of our Net Proved Undeveloped Reserves from our 2013 LaRoche Engineering report, into Net Proved Developed Reserves. |

| ● | We acquired a significant amount of Net Proved Undeveloped Reserves with the Richfield Merger. |

Estimated Future Income

The future net revenue set forth in our 2014 Pinnacle Reserve Report includes deductions for state production (severance) taxes. Future net income is calculated by deducting these taxes, future capital costs, and operating expenses, but before consideration of any state and/or federal income taxes. The future net income has not been adjusted for any outstanding loans that may exist nor does it include any adjustment for cash on hand or undistributed income. The future net income has been discounted at various annual rates, including the standard 10%, to determine its “present worth.” The present worth is shown to indicate the effect of time on the value of money.

| Discounted Present Values (in thousands) | ||||||||||||||||

| Category | 0% | 10% | ||||||||||||||

| 2013 | 2014 | 2013 | 2014 | |||||||||||||

| Proved | ||||||||||||||||

| Proved Developed | $ | 977 | $ | 28,244 | $ | 760 | $ | 13,448 | ||||||||

| Proved Undeveloped | $ | 76 | $ | 50,485 | $ | 30 | $ | 17,990 | ||||||||

| Total Proved | $ | 1,053 | $ | 78,729 | $ | 791 | $ | 31,438 | ||||||||

| Probable | ||||||||||||||||

| Probable Developed | - | $ | 65,834 | - | $ | 32,205 | ||||||||||

| Probable Undeveloped | - | $ | 105,523 | - | $ | 43,707 | ||||||||||

| Total Probable | - | $ | 171,357 | - | $ | 75,912 | ||||||||||

The reserve values in the table above are based upon the information found in the 2014 Pinnacle Reserve Report, and the 2013 La Roche Reserve Report attached as Exhibit 99.3 to Stratex’s 2013 Form 10K, filed March 31, 2014. The values as of December 31, 2014 are based on SEC pricing guidelines, adjusted to reflect estimated differentials in our fields, and use fixed oil prices. The oil price used, before the differentials, was $91.48, and the gas price used, before differentials, was $4.35. The values as of December 31, 2013 are based on SEC pricing guidelines, adjusted to reflect estimated differentials in our fields, and use fixed oil prices. The oil price used, before the differentials, was $96.94, and the gas price used, before differentials, was $3.67.

Economic Assumptions

Pricing

In accordance with applicable requirements under SEC rules, estimates of our net proved reserves and future net revenues were determined according to the SEC pricing guidelines adjusted for an effective date of January 1, 2014. The regulations state that the prices for each product are to be calculated by using the unweighted arithmetic average of the first-day-of-the-month price for each month of the 12-month reporting period.

| 20 |

The price of natural gas is based on the NYMEX Henry Hub postings and the price of oil is based on NYMEX Cushing postings. For January 1, 2014 through December 31, 2014, the unweighted arithmetic average of the first-day-of-the-month price was $4.35/MCF for natural gas and $91.48/Bbl for oil. Product prices for each well were adjusted from SEC prices to reflect estimated differentials, BTU content, field losses and usage, or gathering and processing costs.

Product Price with differentials, by Property

| Oil Prices Per bbl | ||||||||||||||||||||||||||

| SEC - Nymex | Gorham, Trapp, and Koelsch Fields, KS | Perth, South Haven, and Gunsmoke, KS | Lane Co. KS (avg.) | Williston Basin (avg.) | Tininenko | Wattenberg | ||||||||||||||||||||

| $ | 91.48 | $ | 81.32 | $ | 87.82 | $ | 84.62 | $ | 80.56 | $ | 77.99 | $ | 81.32 | |||||||||||||

| Natural Gas Prices per MCF | ||||||||||||||||||||||||||

| SEC - Nymex | Gorham, Trapp, and Koelsch Fields, KS | Perth, South Haven, and Gunsmoke, KS | Lane Co. KS (avg.) | Williston Basin (avg.) | Tininenko | Wattenberg | ||||||||||||||||||||

| $ | 4.35 | $ | 3.26 | $ | 3.26 | $ | 4.35 | $ | 6.07 | $ | 4.35 | $ | 4.35 | |||||||||||||

Expenses and Production Taxes

Well operating expenses reflect our historical cost levels applied to expected future operations. Expenses were held constant going forward. For non-producing (including behind pipe) and undeveloped locations, capital and operating expenses were based on analogy wells and provided by us, and are reasonable based on producing areas, depths, formations, and projected activity.

If a property is calculated to be uneconomic based on rate, expenses, and pricing, then the rate, reserves, and expenses will show zero in the reserves and economic results. However, the operator of many of these wells may continue to produce oil or gas and we will realize income and expenses from the properties not captured in this evaluation.

Abandonment costs were assumed to be offset by future salvageable equipment values for our properties in Kansa, which is a reasonable and common assumption for the activities projected and producing wells in the mid-continent region.

Severance and ad valorem taxes were applied to all wells in the economic evaluation. Severance (production) tax rates were based on applicable current state published rates for oil and natural gas. Ad valorem taxes on reserves and equipment vary by county within the states.

Preparation of Reserves Estimates

The 2014 Pinnacle Reserve Report relates to our oil and gas properties as of December 31, 2014. The 2014 Pinnacle Reserve Report was prepared by Pinnacle based on geological and production data, and other information provided by us. We accumulated historical production data for our wells, calculated historical lease operating expenses, obtained current lease ownership information, obtained authorizations for expenditures (“AFEs”) from our operations department and obtained geological and geophysical information from the geological department.

| 21 |