Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - STREAMLINE HEALTH SOLUTIONS INC. | Financial_Report.xls |

| EX-31.2 - EXHIBIT 31.2 - STREAMLINE HEALTH SOLUTIONS INC. | strm20150131ex312.htm |

| EX-14.1 - EXHIBIT 14.1 - STREAMLINE HEALTH SOLUTIONS INC. | strm20150131ex141.htm |

| EX-23.2 - EXHIBIT 23.2 - STREAMLINE HEALTH SOLUTIONS INC. | strm20150131ex232.htm |

| EX-21.1 - EXHIBIT 21.1 - STREAMLINE HEALTH SOLUTIONS INC. | strm20150131ex211.htm |

| EX-32.2 - EXHIBIT 32.2 - STREAMLINE HEALTH SOLUTIONS INC. | strm20150131ex322.htm |

| EX-32.1 - EXHIBIT 32.1 - STREAMLINE HEALTH SOLUTIONS INC. | strm20150131ex321.htm |

| EX-23.1 - EXHIBIT 23.1 - STREAMLINE HEALTH SOLUTIONS INC. | strm20150131ex231.htm |

| EX-31.1 - EXHIBIT 31.1 - STREAMLINE HEALTH SOLUTIONS INC. | strm20150131ex311.htm |

| EX-10.13(A) - EXHIBIT 10.13(A) - STREAMLINE HEALTH SOLUTIONS INC. | strm20150131ex1013a.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

(Mark One)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended January 31, 2015

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 0-28132

STREAMLINE HEALTH SOLUTIONS, INC.

(Exact name of registrant as specified in its charter)

Delaware | 31-1455414 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

1230 Peachtree Street, NE, Suite 600,

Atlanta, GA 30309

(Address of principal executive offices) (Zip Code)

(404) 920-2396

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, $.01 par value

(Title of Class)

The NASDAQ Stock Market, Inc.

(Name of exchange on which listed)

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K, or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ | Accelerated filer x | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

(Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting stock held by non-affiliates of the registrant, computed using the closing price as reported by The NASDAQ Stock Market, Inc. for the Registrant’s Common Stock on July 31, 2014, was $90,947,975.

The number of shares outstanding of the Registrant’s Common Stock, $.01 par value, as of March 18, 2015: 18,603,289

FORWARD-LOOKING STATEMENTS

We make forward-looking statements in this Report and in other materials we file with the Securities and Exchange Commission (“SEC”) or otherwise make public. In this Report, both Part I, Item 1, “Business,” and Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contain forward-looking statements. In addition, our senior management makes forward-looking statements to analysts, investors, the media and others. Statements with respect to expected revenue, income, receivables, backlog, client attrition, acquisitions and other growth opportunities, sources of funding operations and acquisitions, the integration of our solutions, the performance of our channel partner relationships, the sufficiency of available liquidity, research and development, and other statements of our plans, beliefs or expectations are forward-looking statements. These and other statements using words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “project,” “target,” “can,” “could,” “may,” “should,” “will,” “would” and similar expressions also are forward-looking statements. Each forward-looking statement speaks only as of the date of the particular statement. The forward-looking statements we make are not guarantees of future performance, and we have based these statements on our assumptions and analyses in light of our experience and perception of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances. Forward-looking statements by their nature involve substantial risks and uncertainties that could significantly affect expected results, and actual future results could differ materially from those described in such statements. Management cautions against putting undue reliance on forward-looking statements or projecting any future results based on such statements or present or historical earnings levels.

Among the factors that could cause actual future results to differ materially from our expectations are the risks and uncertainties described under “Risk Factors” set forth in Part I, Item 1A, and the other cautionary statements in other documents we file with the SEC, including the following:

• | competitive products and pricing; |

• | product demand and market acceptance; |

• | new product development; |

• | key strategic alliances with vendors that resell our products; |

• | our ability to control costs; |

• | availability of products produced by third party vendors; |

• | the healthcare regulatory environment; |

• | potential changes in legislation, regulation and government funding affecting the healthcare industry; |

• | healthcare information systems budgets; |

• | availability of healthcare information systems trained personnel for implementation of new systems, as well as maintenance of legacy systems; |

• | the success of our relationships with channel partners; |

• | fluctuations in operating results; |

• | critical accounting policies and judgments; |

• | changes in accounting policies or procedures as may be required by the Financial Accounting Standards Board or other standard-setting organization; |

• | changes in economic, business and market conditions impacting the healthcare industry, the markets in which we operate and nationally; and |

• | our ability to maintain compliance with the terms of our credit facilities. |

Most of these factors are beyond our ability to predict or control. Any of these factors, or a combination of these factors, could materially affect our future financial condition or results of operations and the ultimate accuracy of our forward-looking statements. There also are other factors that we may not describe (generally because we currently do not perceive them to be material) that could cause actual results to differ materially from our expectations.

We expressly disclaim any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

2

PART I

ITEM 1. Business

Company Overview

Founded in 1989, the Company is a leading provider of transformational data-driven solutions for healthcare organizations. The Company provides computer software-based solutions through its Looking Glass® platform. Looking Glass® captures, aggregates and translates structured and unstructured data to deliver intelligently organized, easily accessible predictive insights to its clients. Hospitals and physician groups use the knowledge generated by the Looking Glass® platform to help them reduce exposure to risk, improve clinical, financial and operational performance and improve patient care.

The Company’s software solutions are delivered to clients either by purchased fixed-term or perpetual license, where such software is installed locally in the client’s data center, or by access to the Company’s data center systems through a secure connection in a software as a service (SaaS) delivery method.

The Company operates exclusively in one segment as a provider of health information technology solutions that improve healthcare processes and information flows within a healthcare facility. The Company sells its solutions and services in North America to hospitals and health systems, including physician practices, through its direct sales force and its reseller partnerships.

Unless the context requires otherwise, references to “Streamline Health,” the “Company,” “we,” “us” and “our” are intended to mean Streamline Health Solutions, Inc. All references to a fiscal year refer to the fiscal year commencing February 1 in that calendar year and ending on January 31 of the following calendar year.

Solutions

The Company offers solutions to assist its clients in all areas of the patient care lifecycle including Patient Engagement, Patient Care, Health Information Management (HIM), Coding and Clinical Documentation Improvement (CDI), and Financial Management. Each suite of solutions is designed to improve the flow of critical patient information throughout the enterprise. Each of the Company’s solutions helps to transform and structure information between disparate information technology systems into actionable data, giving the end user comprehensive access to clinical and business intelligence to enable better decision-making. All solutions can be delivered either by perpetual license or fixed-term installed locally or accessed securely through SaaS.

Patient Engagement Solutions - These solutions assist clients with patient access at the very beginning of the care continuum, before care has been provided. Individual workflows include a patient portal, physician referral, patient eligibility and authorization, patient payment including charity management and patient scheduling. Many of these solutions assist clients in the completion of patient records by capturing, storing and intelligently distributing the unstructured data that exists at all touch points throughout the patient care continuum. They create a permanent, document-based repository of historical health information that integrates seamlessly with existing clinical, financial and administrative information systems.

Patient Care Solutions - These solutions enable healthcare providers to improve their patient care through individual workflows such as clinical analytics, operating room management, physician portal and care coordination. The Company’s Looking Glass® platform delivers industry leading clinical analytics that foster an open, continuous learning culture inside a healthcare organization empowering it with real-time, on-demand predictive insight for improved patient outcomes.

HIM, Coding & CDI Solutions - These solutions provide an integrated web-based software suite that enhances the productivity of CDI and Coding staff and enables the seamless sharing of patient data. This suite of solutions includes individual workflows such as content management, release of information, computer-assisted coding (eCAC), CDI, abstracting and physician query. The eCAC solution includes patented Natural Language Processing (NLP) that streamlines concurrent chart review and coding workflows.

Financial Management Solutions - These solutions enable staff across the healthcare enterprise to drill down quickly and deeply into actionable and real-time financial data and key performance indicators to improve revenue realization and staff efficiency. This suite of solutions includes individual workflows such as accounts receivable management, denials management, claims processing, spend management and audit management. These solutions provide dashboards, data mining tools and prescriptive reporting, which help to simplify, facilitate and optimize overall revenue cycle performance of the healthcare enterprise. The financial management suite of solutions is used to improve the quality and accuracy of the data captured via our Patient Engagement solutions during patient admission, registration and scheduling. These solutions are also used to increase the completion and accuracy of patient charts and related coding, improve accounts receivable collections, reduce and manage denials, and improve audit outcomes.

3

Services

Custom Integration Services — The Company’s professional services team works with clients to design custom integrations that integrate data to or from virtually any clinical, financial, or administrative system. By taking data and documents from multiple, disparate systems and bringing them into one streamlined system, clients are able to maximize efficiencies and increase operational performance. The Company’s professional services team also creates custom integrations that transfer data from the Company’s solutions into the client’s external or internal systems.

Training Services — Training courses are offered to help clients quickly learn to use our solutions in the most efficient manner possible. Training sessions are available on-site or off for as few as one person or multiple staff members.

Electronic Image Conversion — The Company’s electronic image conversion service allows organizations to protect their repository of images while taking advantage of its content management technology. Electronic image conversion creates one repository that integrates directly with our clinical content management system. This service is available via the SaaS model or for locally-installed solutions.

Database Monitoring Services — The Company’s advanced database monitoring services for locally-installed clients help lighten the burden of ongoing system monitoring by the client’s information technology staff and ensure a continual, stable production environment. The Company’s database administrators ensure the client’s system is running optimally with weekly, manual checks of the database environment to identify system issues that may require further attention. Monitoring is done through protected connections to data security.

Clients and Strategic Partners

The Company continues to provide transformational data-driven solutions to some of the finest, most well respected healthcare enterprises in the United States and Canada. Clients are geographically dispersed throughout North America, with heaviest concentration in the New York metropolitan area, Philadelphia, Texas, Southern California and the west coast of Florida.

In December 2007, the Company entered into an agreement with Telus Health (formerly Emergis, Inc.), a large international telecommunications corporation based in Canada, in which Telus Health is integrating the Company’s document management repository and document workflow applications into its Oacis (Open Architecture Clinical Information System) Electronic Health Record solution. Through this agreement, the Company receives revenues from Canadian hospitals where its document management system is deployed.

In the fiscal years ended January 31, 2015, 2014 and 2013, the Company received revenue of approximately $26.0 million, $26.8 million and $22.3 million, respectively, from its U.S. customers. The Company received revenue of approximately $1.6 million, $1.7 million, and $1.5 million from foreign customers in the fiscal years ended January 31, 2015, 2014 and 2013, respectively.

In May 2012, the Company entered into a cross marketing agreement with RevPoint Health (formerly nTelegent), an automated workflow process provider with embedded real-time quality assurance functionality designed to enhance the patient registration process, decrease denials, reduce returned mail and complement the solution’s core focus of improving upfront cash. Under the terms of the agreement, RevPoint is permitted to utilize the Streamline Health business analytics solution to facilitate the increase of upfront cash and cash on hand, as well as reduce accounts receivable days and bad debt for clients. The companies offer each other’s services to their respective client bases to help maximize revenue cycle performance.

In December 2012, the Company entered into a cross marketing agreement with RSource, a leading provider of receivables management recovery solutions for healthcare providers. Under the terms of the agreement, RSource utilizes the Streamline Health business analytics solution to facilitate the revenue recovery services it provides to its clients, known as RCover. With Streamline’s Looking Glass® Financial Management solutions, RSource is able to identify financial opportunities for its clients and to work with any data set to generate fast, sustainable return on investment. In addition, the companies offer each other's services to their respective client bases to help maximize revenue cycle performance.

During fiscal year 2014, no individual client accounted for 10% or more of our total revenues. Two clients represented 16% and 10%, respectively, of total accounts receivable as of January 31, 2015.

During fiscal year 2013, one client, Montefiore Medical Center, accounted for 11% of total revenues. Two clients represented 13% and 9%, respectively, of total accounts receivable as of January 31, 2014.

Business Segments

We manage our business as one single business segment. For our total assets at January 31, 2015 and 2014 and total revenue and net loss for the fiscal years ended January 31, 2015, 2014 and 2013, see our consolidated financial statements included in Item 8 herein.

4

Contracts

The Company enters into master agreements with its clients that specify the scope of the system to be installed and services to be provided by the Company, as well as the agreed-upon aggregate price and the timetable for services. Typically these are multi-element arrangements that include a perpetual or term license installed locally at the client site (or the right to use the Company’s solutions as a part of SaaS services), and an initial maintenance term and any third-party components including hardware and software (included with SaaS services), as well as professional services for implementation, integration, process engineering, optimization and training. If the client purchases solutions via SaaS, the client is billed periodically for a specified term from one to seven years in length. The SaaS fee includes all maintenance and support services. The Company also generally provides SaaS clients professional services for implementation, integration, process engineering, optimization and training. Professional services are typically fixed-fee or hourly arrangements billable to clients based on agreed-to milestones or monthly.

The commencement of revenue recognition varies depending on the size and complexity of the system, the implementation schedule requested by the client and usage by clients of SaaS. Therefore, it is difficult for the Company to accurately predict the revenue it expects to achieve in any particular period. The Company’s master agreements generally provide that the client may terminate its agreement upon a material breach by the Company or may delay certain aspects of the installation. A termination or installation delay of one or more phases of an agreement, or the failure of the Company to procure additional agreements, could have a material adverse effect on the Company’s business, financial condition, and results of operations. Historically, the Company has not experienced a material amount of contract cancellations; however, the Company sometimes experiences delays in the course of contract performance and the Company accounts for them accordingly.

License fees

The Company incorporates software licensed from various vendors into its proprietary software. In addition, third-party, stand-alone software is required to operate the Company’s proprietary software. The Company licenses these software products and pays the required license fees when such software is delivered to clients.

Associates

As of January 31, 2015, the Company had 123 associates, a net increase of 15 during fiscal 2014. The Company utilizes independent contractors to supplement its staff, as needed. None of the Company’s associates are represented by a labor union or subject to a collective bargaining agreement. The Company has never experienced a work stoppage and believes that its employee relations are good. The Company’s success depends, to a significant degree, on its management, sales and technical personnel.

For more information on contracts, backlog, acquisitions and research and development, see also ITEM 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Competition

Several companies historically have dominated the clinical information system software market and several of these companies have either acquired, developed or are developing their own document management and workflow technologies. The industry is undergoing consolidation and realignment as companies position themselves to compete more effectively. Strategic alliances between vendors offering HIM workflow and document management technologies and vendors of other healthcare systems are increasing. Barriers to entry to this market include technological and application sophistication, the ability to offer a proven product, a well-established client base and distribution channels, brand recognition, the ability to operate on a variety of operating systems and hardware platforms, the ability to integrate with pre-existing systems and capital for sustained development and marketing activities. The Company believes that these obstacles taken together represent a moderate to high-level barrier to entry. The Company has many competitors including clinical information system vendors that are larger, more established and have substantially more resources than the Company.

The Company believes that the principal competitive factors in its market are client recommendations and references, company reputation, system reliability, system features and functionality (including ease of use), technological advancements, client service and support, breadth and quality of the systems, the potential for enhancements and future compatible products, the effectiveness of marketing and sales efforts, price, and the size and perceived financial stability of the vendor. In addition, the Company believes that the speed with which companies in its market can anticipate the evolving healthcare industry structure and identify unmet needs are important competitive factors.

Requests for Documents

Copies of documents filed by the Company with the SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports, if any, can be found at the web site http://investor.streamlinehealth.net as soon as practicable after such material is electronically filed with, or furnished to, the SEC. The information contained on the Company's website is not part of, nor incorporated by reference into this annual report on Form

5

10-K. Copies can be downloaded free of charge from the Company's web site or directly from the SEC web site, http://www.sec.gov. Also, copies of the Company’s annual report on Form 10-K will be made available, free of charge, upon written request to the Company, attention: Corporate Secretary, 1230 Peachtree Street, NE, Suite 600, Atlanta, GA 30309.

Materials that the Company files with the SEC may also be read and copied at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549, on official business days during the hours of 10:00 am to 3:00 pm. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. The SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov.

ITEM 1A. Risk Factors

An investment in our common stock or other securities involves a number of risks. You should carefully consider each of the risks described below before deciding to invest in our common stock or other securities. If any of the following risks develops into actual events, our business, financial condition or results of operations could be negatively affected, the market price of our common stock or other securities could decline, and you may lose all or part of your investment.

Risks Relating to Our Business

Our sales have been concentrated in a small number of clients.

Our revenues have been concentrated in a relatively small number of large clients, and we have historically derived a substantial percentage of our total revenues from a few clients. For the fiscal years ended January 31, 2015 and 2014, our five largest clients accounted for 24% and 31% of our total revenues, respectively. If one or more clients terminate all or any portion of a master agreement or delay installations or if we fail to procure additional agreements, there could be a material adverse effect on our business, financial condition and results of operations.

A significant increase in new software as a service (“SaaS”) contracts could reduce near-term profitability and require a significant cash outlay, which could adversely affect near term cash flow and financial flexibility.

If new or existing clients purchase significant amounts of our SaaS services, we may have to expend a significant amount of initial setup costs and time before those new clients are able to begin using such services, and we cannot begin to recognize revenues from those SaaS agreements until the commencement of such services. Accordingly, we anticipate that our near-term cash flow, revenue and profitability may be adversely affected by significant incremental setup costs from new SaaS clients that would not be offset by revenue until new SaaS clients go into production. While we anticipate long-term growth in profitability through increases in recurring SaaS subscription fees and significantly improved profit visibility, any inability to adequately finance setup costs for new SaaS solutions could result in the failure to put new SaaS solutions into production, and could have a material adverse effect on our liquidity, financial position and results of operations. In addition, this near-term cash flow demand could adversely impact our financial flexibility and cause us to forego otherwise attractive business opportunities or investments.

Failure to manage our expenses and efficiently allocate our financial and human capital as we grow could limit our growth potential and adversely impact our results of operation and financial condition.

During periods of growth, our financial and human capital assets can experience significant pressures. We are currently experiencing a period of growth primarily through acquisitions and in our SaaS lines of business, and this could continue to place a significant strain on our cash flow. This growth also adds strain to our services and support operations, sales and administrative personnel and other resources as they are requested to manage the added work load with existing resources. We believe that we must continue to focus on remote hosting services, develop new solutions, enhance existing solutions and serve the needs of our existing and prospective client base. Our ability to manage our planned growth effectively also will require us to continue to improve our operational, management and financial systems and controls, to train, motivate and manage our associates and to judiciously manage our operating expenses in anticipation of increased future revenues. Our failure to properly manage resources may limit our growth potential and adversely impact our results of operation and financial condition.

The potential impact on us of new or changes in existing federal, state and local regulations governing healthcare information could be substantial.

Healthcare regulations issued to date have not had a material adverse effect on our business. However, we cannot predict the potential impact of new or revised regulations that have not yet been released or made final, or any other regulations that

6

might be adopted. The U.S. Congress may adopt legislation that may change, override, conflict with or preempt the currently existing regulations and which could restrict the ability of clients to obtain, use or disseminate patient health information. We believe that the features and architecture of our existing solutions are such that we currently support or should be able to make the necessary modifications to our solutions, if required, by legislation or regulations, but there can be no assurances.

The healthcare industry is highly regulated. Any material changes in the political, economic or regulatory healthcare environment that affect the group purchasing business or the purchasing practices and operations of healthcare organizations, or that lead to consolidation in the healthcare industry, could require us to modify our services or reduce the funds available to providers to purchase our solutions and services.

Our business, financial condition and results of operations depend upon conditions affecting the healthcare industry generally and hospitals and health systems particularly. Our ability to grow will depend upon the economic environment of the healthcare industry generally, as well as our ability to increase the number of solutions that we sell to our clients. The healthcare industry is highly regulated and is subject to changing political, economic and regulatory influences. Factors such as changes in reimbursement policies for healthcare expenses, consolidation in the healthcare industry, regulation, litigation and general economic conditions affect the purchasing practices, operation and, ultimately, the operating funds of healthcare organizations. In particular, changes in regulations affecting the healthcare industry, such as any increased regulation by governmental agencies of the purchase and sale of medical products, or restrictions on permissible discounts and other financial arrangements, could require us to make unplanned modifications of our solutions and services, or result in delays or cancellations of orders or reduce funds and demand for our solutions and services.

Our clients derive a substantial portion of their revenue from third-party private and governmental payors, including through Medicare, Medicaid and other government-sponsored programs. Our sales and profitability depend, in part, on the extent to which coverage of and reimbursement for medical care provided is available from governmental health programs, private health insurers, managed care plans and other third-party payors. If governmental or other third-party payors materially reduce reimbursement rates or fail to reimburse our clients adequately, our clients may suffer adverse financial consequences, which in turn, may reduce the demand for and ability to purchase our solutions or services.

We face significant competition, including from companies with significantly greater resources.

We currently compete with many other companies for the licensing of similar software solutions and related services. Several companies historically have dominated the clinical information systems software market and several of these companies have either acquired, developed or are developing their own content management, analytics and coding/clinical documentation improvement solutions as well as the resultant workflow technologies. The industry is undergoing consolidation and realignment as companies position themselves to compete more effectively. Many of these companies are larger than us and have significantly more resources to invest in their businesses. In addition, information and document management companies serving other industries may enter the market. Suppliers and companies with whom we may establish strategic alliances also may compete with us. Such companies and vendors may either individually, or by forming alliances excluding us, place bids for large agreements in competition with us. A decision on the part of any of these competitors to focus additional resources in any one of our three solutions stacks (content management, analytics and coding/clinical documentation improvement), workflow technologies and other markets addressed by us could have a material adverse effect on us.

The healthcare industry is evolving rapidly, which may make it more difficult for us to be competitive in the future.

The U.S. healthcare system is under intense pressure to improve in many areas, including modernization, universal access and controlling skyrocketing costs of care. We believe that the principal competitive factors in our market are client recommendations and references, company reputation, system reliability, system features and functionality (including ease of use), technological advancements, client service and support, breadth and quality of the systems, the potential for enhancements and future compatible solutions, the effectiveness of marketing and sales efforts, price and the size and perceived financial stability of the vendor. In addition, we believe that the speed with which companies in our market can anticipate the evolving healthcare industry structure and identify unmet needs are important competitive factors. If we are unable to keep pace with changing conditions and new developments, we will not be able to compete successfully in the future against existing or potential competitors.

Rapid technology changes and short product life cycles could harm our business.

The market for our solutions and services is characterized by rapidly changing technologies, regulatory requirements, evolving industry standards and new product introductions and enhancements that may render existing solutions obsolete or less competitive. As a result, our position in the healthcare information technology market could change rapidly due to unforeseen changes in the features and functions of competing products, as well as the pricing models for such products. Our

7

future success will depend, in part, upon our ability to enhance our existing solutions and services and to develop and introduce new solutions and services to meet changing requirements. Moreover, competitors may develop competitive products that could adversely affect our operating results. We need to maintain an ongoing research and development program to continue to develop new solutions and apply new technologies to our existing solutions but may not have sufficient funds with which to undertake such required research and development. If we are not able to foresee changes or to react in a timely manner to such developments, we may experience a material, adverse impact on our business, operating results and financial condition.

Our intellectual property rights are valuable, and any inability to protect them could reduce the value of our solutions and services.

Our intellectual property, which represents an important asset to us, has some protection against infringement through copyright and trademark law. We generally have little patent protection on our software. We rely upon license agreements, employment agreements, confidentiality agreements, nondisclosure agreements and similar agreements to maintain the confidentiality of our proprietary information and trade secrets. Notwithstanding these precautions, others may copy, reverse engineer or design independently, technology similar to our solutions. If we fail to protect adequately our intellectual property through trademarks and copyrights, license agreements, employment agreements, confidentiality agreements, nondisclosure agreements or similar agreements, our intellectual property rights may be misappropriated by others, invalidated or challenged, and our competitors could duplicate our technology or may otherwise limit any competitive technology advantage we may have. It may be necessary to litigate to enforce or defend our proprietary technology or to determine the validity of the intellectual property rights of others. Any litigation could be successful or unsuccessful, may result in substantial cost and require significant attention by management and technical personnel.

Due to the rapid pace of technological change, we believe our future success is likely to depend upon continued innovation, technical expertise, marketing skills and client support and services rather than on legal protection of our property rights. However, we have in the past, and intend in the future, to assert aggressively our intellectual property rights when necessary.

We could be subjected to claims of intellectual property infringement, which could be expensive to defend.

While we do not believe that our solutions and services infringe upon the intellectual property rights of third parties, the potential for intellectual property infringement claims continually increases as the number of software patents and copyrighted and trademarked materials continues to rapidly expand. Any claim for intellectual property right infringement, even if not meritorious, would be expensive to defend. If we were to become liable for infringing third party intellectual property rights, we could be liable for substantial damage awards, and potentially be required to cease using the technology, to produce non-infringing technology or to obtain a license to use such technology. Such potential liabilities or increased costs could be materially adverse to us.

Over the last several years, we have completed a number of acquisitions and may undertake additional acquisitions in the future. Any failure to adequately integrate past and future acquisitions into our business could have a material adverse effect on us.

Over the last several years, we have completed several acquisitions of businesses through asset and stock purchases. We expect that we will make additional acquisitions in the future.

Acquisitions involve a number of risks, including, but not limited to:

• | the potential failure to achieve the expected benefits of the acquisition, including the inability to generate sufficient revenue to offset acquisition costs, or the inability to achieve expected synergies or cost savings; |

• | unanticipated expenses related to acquired businesses or technologies and its integration into our existing businesses or technology; |

• | the diversion of financial, managerial, and other resources from existing operations; |

• | the risks of entering into new markets in which we have little or no experience or where competitors may have stronger positions; |

• | potential write-offs or amortization of acquired assets or investments; |

• | the potential loss of key employees, clients, or partners of an acquired business; |

8

• | delays in client purchases due to uncertainty related to any acquisition; |

• | potential unknown liabilities associated with an acquisition; and |

• | the tax effects of any such acquisitions. |

If we fail to successfully integrate acquired businesses or fail to implement our business strategies with respect to acquisitions, we may not be able to achieve projected results or support the amount of consideration paid for such acquired businesses, which could have an adverse effect on our business and financial condition.

Finally, if we finance acquisitions by issuing equity or convertible or other debt securities, our existing stockholders may be diluted, or we could face constraints related to the terms of and repayment obligations related to the incurrence of indebtedness. This could adversely affect the market price of our common stock.

Third party products are essential to our software.

Our software incorporates software licensed from various vendors into our proprietary software. In addition, third-party, stand-alone software is required to operate some of our proprietary software modules. The loss of the ability to use these third-party products, or ability to obtain substitute third-party software at comparable prices, could have a material adverse effect on our ability to license our software.

Our solutions may not be error-free and could result in claims of breach of contract and liabilities.

Our solutions are very complex and may not be error-free, especially when first released. Although we perform extensive testing, failure of any solution to operate in accordance with its specifications and documentation could constitute a breach of the license agreement and require us to correct the deficiency. If such deficiency is not corrected within the agreed-upon contractual limitations on liability and cannot be corrected in a timely manner, it could constitute a material breach of a contract allowing the termination thereof and possibly subjecting us to liability. Also, we sometimes indemnify our clients against third-party infringement claims. If such claims are made, even if they are without merit, they could be expensive to defend. Our license and SaaS agreements generally limit our liability arising from these types of claims, but such limits may not be enforceable in some jurisdictions or under some circumstances. A significant uninsured or under-insured judgment against us could have a material adverse impact on us.

We could be liable to third parties from the use of our solutions.

Our solutions provide access to patient information used by physicians and other medical personnel in providing medical care. The medical care provided by physicians and other medical personnel are subject to numerous medical malpractice and other claims. We attempt to limit any potential liability of ours to clients by limiting the warranties on our solutions in our agreements with our clients (i.e., healthcare providers). However, such agreements do not protect us from third-party claims by patients who may seek damages from any or all persons or entities connected to the process of delivering patient care. We maintain insurance, which provides limited protection from such claims, if such claims result in liability to us. Although no such claims have been brought against us to date regarding injuries related to the use of our solutions, such claims may be made in the future. A significant uninsured or under-insured judgment against us could have a material adverse impact on us.

Our SaaS and support services could experience interruptions.

We provide SaaS for many clients, including the storage of critical patient, financial and administrative data. In addition, we provide support services to clients through our client support organization. We have redundancies, such as backup generators, redundant telecommunications lines and backup facilities built into our operations to prevent disruptions. However, complete failure of all generators or impairment of all telecommunications lines or severe casualty damage to the primary building or equipment inside the primary building housing our hosting center or client support facilities could cause a temporary disruption in operations and adversely affect clients who depend on the application hosting services. Any interruption in operations at our data center or client support facility could cause us to lose existing clients, impede our ability to obtain new clients, result in revenue loss, cause potential liability to our clients and increase our operating costs.

Our SaaS solutions are provided over an internet connection. Any breach of security or confidentiality of protected health information could expose us to significant expense and harm our reputation.

9

We provide remote SaaS solutions for clients, including the storage of critical patient, financial and administrative data. We have security measures in place to prevent or detect misappropriation of protected health information. We must maintain facility and systems security measures to preserve the confidentiality of data belonging to clients as well as their patients that resides on computer equipment in our data center, which we handle via application hosting services, or that is otherwise in our possession. Notwithstanding efforts undertaken to protect data, it can be vulnerable to infiltration as well as unintentional lapse. If confidential information is compromised, we could face claims for contract breach, penalties and other liabilities for violation of applicable laws or regulations, significant costs for remediation and re-engineering to prevent future occurrences and serious harm to our reputation.

The loss of key personnel could adversely affect our business.

Our success depends, to a significant degree, on our management, sales force and technical personnel. We must recruit, motivate and retain highly skilled managers, sales, consulting and technical personnel, including solution programmers, database specialists, consultants and system architects who have the requisite expertise in the technical environments in which our solutions operate. Competition for such technical expertise is intense. Our failure to attract and retain qualified personnel could have a material adverse effect on us.

Our future success depends upon our ability to grow, and if we are unable to manage our growth effectively, we may incur unexpected expenses and be unable to meet our clients’ requirements.

We will need to expand our operations if we successfully achieve greater demand for our products and services. We cannot be certain that our systems, procedures, controls and human resources will be adequate to support expansion of our operations. Our future operating results will depend on the ability of our officers and employees to manage changing business conditions and to implement and improve our technical, administrative, financial control and reporting systems. We may not be able to expand and upgrade our systems and infrastructure to accommodate these increases. Difficulties in managing any future growth, including as a result of integrating any prior or future acquisition with our existing businesses, could cause us to incur unexpected expenses, render us unable to meet our clients’ requirements, and consequently have a significant negative impact on our business, financial condition and operating results.

We may not have access to sufficient or cost-efficient capital to support our growth, execute our business plans and remain competitive in our markets.

As our operations grow and as we implement our business strategies, we expect to use both internal and external sources of capital. In addition to cash flow from normal operations, we may need additional capital in the form of debt or equity to operate and to support our growth, execute our business plans and remain competitive in our markets. We may be limited as to the availability of such external capital or may not have any availability, in which case our future prospects may be materially impaired. Furthermore, we may not be able to access external sources of capital on reasonable or favorable terms. Our business operations could be subject to both financial and operational covenants that may limit the activities we may undertake, even if we believe they would benefit our company.

Potential disruptions in the credit markets may adversely affect our business, including the availability and cost of short-term funds for liquidity requirements and our ability to meet long-term commitments, which could adversely affect our results of operations, cash flows and financial condition.

If internally generated funds are not available from operations, we may be required to rely on the banking and credit markets to meet our financial commitments and short-term liquidity needs. Our access to funds under our revolving credit facility or pursuant to arrangements with other financial institutions is dependent on the financial institution's ability to meet funding commitments. Financial institutions may not be able to meet their funding commitments if they experience shortages of capital and liquidity or if they experience high volumes of borrowing requests from other borrowers within a short period of time.

We must maintain compliance with the terms of our existing credit facilities. The failure to do so could have a material adverse effect on our ability to finance our ongoing operations and we may not be able to find an alternative lending source if a default occurs.

In November 2014, we entered into a Credit Agreement (the “Credit Agreement”) with Wells Fargo Bank, N.A., as administrative agent, and other lender parties thereto. Pursuant to the Credit Agreement, the lenders agreed to provide a $10,000,000 senior term loan and a $5,000,000 revolving line of credit to our primary operating subsidiary. At closing, the Company repaid indebtedness under its prior credit facility using approximately $7,400,000 of the proceeds provided by the term loan. The prior credit facility with Fifth Third Bank was terminated concurrent with the entry of the Credit Agreement.

10

The Credit Agreement includes customary financial covenants, including the requirements that the Company maintain certain minimum liquidity and achieve certain minimum EBITDA levels.

On April 15, 2015, we received a waiver from the lender for noncompliance with the minimum EBITDA covenant at January 31, 2015. Pursuant to the terms of the waiver and amendment to the Credit Agreement, from April 30, 2016 and each quarter thereafter, we must reach agreement with the lenders as to the minimum applicable amount of EBITDA we are required to achieve based on the most recent financial projections we submit to the lenders under the Credit Agreement. If we are unable to reach agreement with the lenders, or if the lenders do not approve our projections, we will be in immediate breach of the minimum EBITDA covenant. Additionally, pursuant to the terms of the waiver and amendment to the Credit Agreement, we are required to maintain additional minimum liquidity of at least (i) $5,000,000 through April 15, 2015, (ii) $6,500,000 from April 16, 2015 through and including July 30, 2015, (iii) $7,000,000 from July 31, 2015 through and including January 30, 2016, and (iv) $7,500,000 from January 31, 2016 through and including the maturity date of the credit facility.

If we do not maintain compliance with all of the continuing covenants and other terms and conditions of the credit facility or secure a waiver for any non-compliance, we could be required to repay outstanding borrowings on an accelerated basis, which could subject us to decreased liquidity and other negative impacts on our business, results of operations and financial condition. Furthermore, if we needed to do so, it may be difficult for us to find an alternative lending source. In addition, because our assets are pledged as a security under our credit facilities, if we are not able to cure any default or repay outstanding borrowings, our assets are subject to the risk of foreclosure by our lenders. Without a sufficient credit facility, we would be adversely affected by a lack of access to liquidity needed to operate our business. Any disruption in access to credit could force us to take measures to conserve cash, such as deferring important research and development expenses, which measures could have a material adverse effect on us.

Our outstanding preferred stock and warrants have significant redemption and repayment rights that could have a material adverse effect on our liquidity and available financing for our ongoing operations.

In August 2012, we completed a private offering of preferred stock, warrants and convertible notes to a group of investors for gross proceeds of $12 million. In November 2012, the convertible notes converted into shares of preferred stock. The preferred stock is redeemable at the option of the holders thereof anytime after August 31, 2016 if not previously converted into shares of common stock. We may not achieve the thresholds required to trigger automatic conversion of the preferred stock, and alternatively, holders may not voluntarily elect to convert the preferred stock into common stock. The election of the holders of our preferred stock to call for redemption of the preferred stock could subject us to decreased liquidity and other negative impacts on our business, results of operations, and financial condition. For additional information regarding the terms, rights and preferences of the preferred stock and warrants, see Note 15 to our consolidated financial statements included herein and our other SEC filings.

Current economic conditions in the United States and globally may have significant effects on our clients and suppliers that would result in material adverse effects on our business, operating results and stock price.

Current economic conditions in the United States and globally and the concern that the worldwide economy may enter into a prolonged recessionary period may materially adversely affect our clients' access to capital or willingness to spend capital on our solutions and services or their levels of cash liquidity with which to pay for solutions that they will order or have already ordered from us. Continuing adverse economic conditions would also likely negatively impact our business, which could result in: (1) reduced demand for our solutions and services; (2) increased price competition for our solutions and services; (3) increased risk of collectability of cash from our clients; (4) increased risk in potential reserves for doubtful accounts and write-offs of accounts receivable; (5) reduced revenues; and (6) higher operating costs as a percentage of revenues.

All of the foregoing potential consequences of the current economic conditions are difficult to forecast and mitigate. As a consequence, our operating results for a particular period are difficult to predict, and, therefore, prior results are not necessarily indicative of future results to be expected in future periods. Any of the foregoing effects could have a material adverse effect on our business, results of operations, and financial condition and could adversely affect our stock price.

The variability of our quarterly operating results can be significant.

Our operating results have fluctuated from quarter-to-quarter in the past, and we may experience continued fluctuations in the future. Future revenues and operating results may vary significantly from quarter-to-quarter as a result of a number of factors, many of which are outside of our control. These factors include: the relatively large size of client agreements; unpredictability in the number and timing of system sales and sales of application hosting services; length of the sales cycle; delays in installations; changes in client's financial condition or budgets; increased competition; the development and

11

introduction of new products and services; the loss of significant clients or remarketing partners; changes in government regulations, particularly as they relate to the healthcare industry; the size and growth of the overall healthcare information technology markets; any liability and other claims that may be asserted against us; our ability to attract and retain qualified personnel; national and local general economic and market conditions; and other factors discussed in this report and our other filings with the SEC.

The preparation of our financial statements requires the use of estimates that may vary from actual results.

The preparation of consolidated financial statements in conformity with U.S. generally accepted accounting principles requires management to make significant estimates that affect the financial statements. Due to the inherent nature of these estimates, we may be required to significantly increase or decrease such estimates upon determination of the actual results. Any required adjustments could have a material adverse effect on us and on the results of operations, and could result in the restatement of our prior period financial statements.

Failure to improve and maintain the quality of internal control over financial reporting and disclosure controls and procedures or other lapses in compliance could materially and adversely affect our ability to provide timely and accurate financial information about us or subject us to potential liability.

In connection with the preparation of the consolidated financial statements for each of our fiscal years, our management conducts a review of our internal control over financial reporting. We are also required to maintain effective disclosure controls and procedures. Any failure to maintain adequate controls or to adequately implement required new or improved controls could harm operating results, or cause failure to meet reporting obligations in a timely and accurate manner.

Our operations are subject to foreign currency risk.

In connection with our expansion into foreign markets, which currently consists of Canada, we sometimes receive payment in currencies other than the U.S. dollar. Accordingly, changes in exchange rates, and in particular a strengthening of the U.S. dollar, will negatively affect our net sales and gross margins from our non-U.S. dollar-denominated revenue, as expressed in U.S. dollars. There is also a risk that we will have to adjust local currency solution pricing due to competitive pressures when there has been significant volatility in foreign currency exchange rates.

Risks Relating to an Investment in Our Securities

The market price of our common stock is likely to be highly volatile as the stock market in general can be highly volatile.

The public trading of our common stock is based on many factors that could cause fluctuation in the price of our common stock. These factors may include, but are not limited to:

• | General economic and market conditions; |

• | Actual or anticipated variations in annual or quarterly operating results; |

• | Lack of or negative research coverage by securities analysts; |

• | Conditions or trends in the healthcare information technology industry; |

• | Changes in the market valuations of other companies in our industry; |

• | Announcements by us or our competitors of significant acquisitions, strategic partnerships, divestitures, joint ventures or other strategic initiatives; |

• | Announced or anticipated capital commitments; |

• | Ability to maintain listing of our common stock on The Nasdaq Stock Market; |

• | Additions or departures of key personnel; and |

• | Sales and repurchases of our common stock by us, our officers and directors or our significant stockholders, if any. |

12

Most of these factors are beyond our control. These factors may cause the market price of our common stock to decline, regardless of our operating performance or financial condition.

If equity research analysts do not publish research reports about our business or if they issue unfavorable commentary or downgrade our common stock, the price of our common stock could decline.

The trading market for our common stock may rely in part on the research and reports that equity research analysts publish about our business and us. We do not control the opinions of these analysts. The price of our stock could decline if one or more equity analysts downgrade our stock or if those analysts issue other unfavorable commentary or cease publishing reports about our business or us. Furthermore, if no equity research analysts conduct research or publish reports about our business and us, the price of our stock could decline.

All of our debt obligations, our existing preferred stock and any preferred stock that we may issue in the future will have priority over our common stock with respect to payment in the event of a bankruptcy, liquidation, dissolution or winding up.

In any bankruptcy, liquidation, dissolution or winding up of the Company, our shares of common stock would rank in right of payment or distribution below all debt claims against us and all of our outstanding shares of preferred stock, if any. As a result, holders of our shares of common stock will not be entitled to receive any payment or other distribution of assets in the event of a bankruptcy or upon the liquidation or dissolution until after all of our obligations to our debt holders and holders of preferred stock have been satisfied. Accordingly, holders of our common stock may lose their entire investment in the event of a bankruptcy, liquidation, dissolution or winding up of our company. Similarly, holders of our preferred stock would rank junior to our debt holders and creditors in the event of a bankruptcy, liquidation, dissolution or winding up of the Company.

There may be future sales or other dilution of our equity, which may adversely affect the market price of our shares of common stock.

We are generally not restricted from issuing in public or private offerings additional shares of common stock or preferred stock (except for certain restrictions under the terms of our outstanding preferred stock), and other securities that are convertible into or exchangeable for, or that represent a right to receive, common stock or preferred stock or any substantially similar securities. Such offerings represent the potential for a significant increase in the number of outstanding shares of our common stock. The market price of our common stock could decline as a result of sales of common stock or preferred stock or similar securities in the market made after an offering or the perception that such sales could occur.

In addition to our currently outstanding preferred stock, the issuance of an additional series of preferred stock could adversely affect holders of shares of our common stock, which may negatively impact your investment.

Our Board of Directors is authorized to issue classes or series of preferred stock without any action on the part of the stockholders. The Board of Directors also has the power, without stockholder approval, to set the terms of any such classes or series of preferred stock that may be issued, including dividend rights and preferences over the shares of common stock with respect to dividends or upon our dissolution, winding-up and liquidation and other terms. If we issue preferred stock in the future that has a preference over the shares of our common stock with respect to the payment of dividends or upon our dissolution, winding up and liquidation, or if we issue preferred stock with voting rights that dilute the voting power of the shares of our common stock, the rights of the holders of shares of our common stock or the market price of shares of our common stock could be adversely affected.

As of January 31, 2015, we had 2,949,995 shares of preferred stock outstanding. For additional information regarding the terms, rights and preferences of such stock, see Note 15 to our consolidated financial statements included herein and our other SEC filings.

We do not currently intend to pay dividends on our common stock and, consequently, your ability to achieve a return on your investment will depend solely on appreciation in the price of our common stock.

We have never declared or paid any cash dividends on our common stock and do not currently intend to do so for the foreseeable future. We currently intend to invest our future earnings, if any, to fund our growth. Therefore, you are not likely to receive any dividends on your common stock for the foreseeable future and the success of an investment in shares of our common stock will depend upon any future appreciation in its value. There is no guarantee that shares of our common stock will appreciate in value or even maintain the price you paid for your shares.

13

Sales of shares of our common stock or securities convertible into our common stock in the public market may cause the market price of our common stock to fall.

The issuance of shares of our common stock or securities convertible into our common stock in an offering from time to time could have the effect of depressing the market price for shares of our common stock. In addition, because our common stock is thinly traded, resales of shares of our common stock by our largest stockholders or insiders could have the effect of depressing market prices for shares of our common stock.

Note Regarding Risk Factors

The risk factors presented above are all of the ones that we currently consider material. However, they are not the only ones facing our company. Additional risks not presently known to us, or which we currently consider immaterial, may also adversely affect us. There may be risks that a particular investor views differently from us, and our analysis might be wrong. If any of the risks that we face actually occur, our business, financial condition and operating results could be materially adversely affected and could differ materially from any possible results suggested by any forward-looking statements that we have made or might make. In such case, the trading price of our common stock or other securities could decline and you could lose all or part of your investment. We expressly disclaim any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

ITEM 1B. Unresolved Staff Comments

Not applicable.

ITEM 2. Properties

The Company’s principal offices are located at 1230 Peachtree Street, NE, Suite 600, Atlanta, GA 30309. The Company leases all of its properties. For fiscal 2014, the aggregate rental expense for the Company's leased properties was $1,470,000. The following table provides information regarding each property currently leased by the Company.

Location | Area (Sq. Feet) | Principal Business Function | End of Term | Renewal Option | ||||

Atlanta, GA | 24,335 | Corporate Office | November 30, 2022 | None | ||||

Cincinnati, OH | 21,700 | Vacated Office | July 15, 2015 | None | ||||

New York, NY | 10,350 | Satellite Office | November 29, 2019 | None | ||||

Cincinnati, OH | 1,166 | Vacated Data Center | February, 2015 | None | ||||

The Company believes that its facilities are adequate for its current needs and that suitable alternative space is available to accommodate expansion of the Company’s operations. During the third quarter of fiscal 2014, we vacated the leased office space in Cincinnati, Ohio as part of our plan to consolidate our operations in Atlanta and New York. In February 2015, we completed the migration of all data hosted in our Cincinnati data center to Atlanta.

ITEM 3. Legal Proceedings

We are, from time to time, a party to various legal proceedings and claims, which arise in the ordinary course of business. Other than the matter described under Note 13 to our consolidated financial statements included herein, we are not aware of any legal matters that could have a material adverse effect on our consolidated results of operations, or consolidated financial position, or consolidated cash flows.

ITEM 4. Mine Safety Disclosures

Not applicable.

14

PART II

ITEM 5. Market For Registrant’s Common Equity, Related Stockholder Matters And Issuer Purchases Of Equity Securities

The Company’s common stock trades on The NASDAQ Stock Market (“NASDAQ”) under the symbol STRM. The table below sets forth the high and low sales prices for the Company’s common stock for each of the quarters in fiscal years 2014 and 2013, as reported by NASDAQ. The closing price of the Company’s common stock on April 1, 2015 was $3.53 per share as reported by NASDAQ.

Fiscal Year 2014 | High | Low | |||||

4th Quarter (November 1, 2014 through January 31, 2015) | $ | 4.38 | $ | 3.25 | |||

3rd Quarter (August 1, 2014 through October 31, 2014) | 5.01 | 3.22 | |||||

2nd Quarter (May 1, 2014 through July 31, 2014) | 5.77 | 4.17 | |||||

1st Quarter (February 1, 2014 through April 30, 2014) | 6.75 | 4.70 | |||||

Fiscal Year 2013 | High | Low | |||||

4th Quarter (November 1, 2013 through January 31, 2014) | $ | 8.50 | $ | 5.53 | |||

3rd Quarter (August 1, 2013 through October 31, 2013) | 8.40 | 6.52 | |||||

2nd Quarter (May 1, 2013 through July 31, 2013) | 7.71 | 5.79 | |||||

1st Quarter (February 1, 2013 through April 30, 2013) | 7.42 | 5.12 | |||||

According to the stock transfer agent’s records, the Company had 215 stockholders of record as of April 1, 2015. Because brokers and other institutions on behalf of stockholders hold many of such shares, the Company is unable to determine with complete accuracy the current total number of stockholders represented by these record holders. The Company estimates that it has approximately 3,200 stockholders, based on information provided by the Company’s stock transfer agent from their search of individual participants in security position listings.

The Company has not paid any cash dividends on its common stock since its inception and dividend payments are prohibited or restricted under debt agreements.

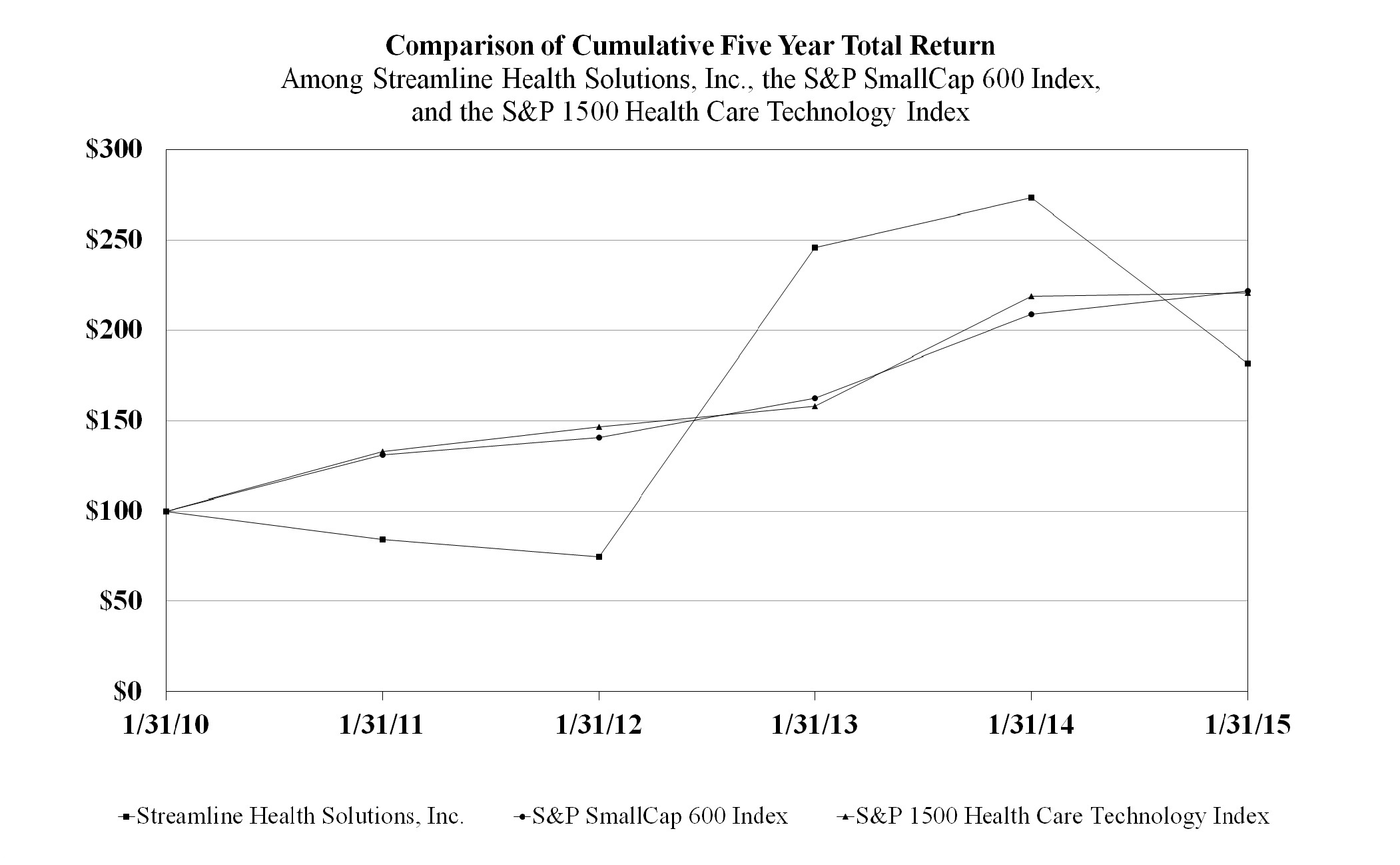

Stock Price Performance Graph

The graph below reflects the cumulative stockholder return on the Company’s shares compared to the return of the S&P SmallCap 600 index and the S&P 1500 Health Care Technology index on an annual basis. The graph reflects the investment of $100 (with reinvestment of all dividends) on January 31, 2010 in the Company’s stock, the S&P SmallCap 600 index and the S&P 1500 Health Care Technology index, a published industry peer group index. The total cumulative dollar returns shown below represent the value that such investments would have had on January 31, 2015. The stock price performance shown in this graph is not necessarily indicative of future stock price performance.

15

Total Return To Shareholders | ||||||||||||||||

(Includes reinvestment of dividends) | ||||||||||||||||

ANNUAL RETURN PERCENTAGE | ||||||||||||||||

Years ended January 31, | ||||||||||||||||

Company / Index | 2011 | 2012 | 2013 | 2014 | 2015 | |||||||||||

Streamline Health Solutions, Inc. | (15.84 | )% | (11.29 | )% | 229.09 | % | 11.23 | % | (33.44 | )% | ||||||

S&P SmallCap 600 Index | 30.93 | 7.50 | 15.45 | 28.44 | 6.15 | |||||||||||

S&P 1500 Health Care Technology Index | 32.71 | 10.42 | 7.83 | 38.55 | 0.79 | |||||||||||

INDEXED RETURNS | ||||||||||||||||

Base Period | Years ended January 31, | |||||||||||||||

Company / Index | 1/31/2010 | 2011 | 2012 | 2013 | 2014 | 2015 | ||||||||||

Streamline Health Solutions, Inc. | 100 | $ | 84.16 | $ | 74.66 | $ | 245.70 | $ | 273.30 | $ | 181.90 | |||||

S&P SmallCap 600 Index | 100 | 130.93 | 140.75 | 162.50 | 208.71 | 221.55 | ||||||||||

S&P 1500 Health Care Technology Index | 100 | 132.71 | 146.55 | 158.03 | 218.95 | 220.69 | ||||||||||

16

ITEM 6. Selected Financial Data

The selected consolidated financial data presented below as of and for the years ended January 31, 2015, 2014, 2013, 2012, and 2011 is derived from our audited consolidated financial statements.

Consolidated Statements of Operations Data (a): | Fiscal Year | ||||||||||||||||||

2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||||||

Revenues: | |||||||||||||||||||

Systems sales | $ | 1,214,879 | $ | 3,239,569 | $ | 1,463,225 | $ | 722,195 | $ | 2,557,797 | |||||||||

Professional services | 2,580,167 | 3,641,731 | 3,792,569 | 3,369,875 | 3,641,265 | ||||||||||||||

Maintenance and support | 16,157,371 | 13,986,566 | 11,211,197 | 8,867,697 | 7,856,704 | ||||||||||||||

Software as a service | 7,672,990 | 7,626,837 | 7,299,812 | 4,156,441 | 3,550,225 | ||||||||||||||

Total revenues | 27,625,407 | 28,494,703 | 23,766,803 | 17,116,208 | 17,605,991 | ||||||||||||||

Operating expenses: | |||||||||||||||||||

Cost of systems sales | 3,536,495 | 3,142,525 | 2,747,230 | 2,237,899 | 3,827,313 | ||||||||||||||

Cost of services | 3,458,984 | 4,052,113 | 3,087,997 | 2,630,314 | 3,120,740 | ||||||||||||||

Cost of maintenance and support | 3,087,842 | 3,460,500 | 3,245,569 | 2,199,803 | 2,440,838 | ||||||||||||||

Cost of software as a service | 2,920,403 | 2,523,184 | 2,512,156 | 1,815,986 | 1,902,521 | ||||||||||||||

Selling, general and administrative | 16,225,574 | 14,546,335 | 10,060,469 | 6,577,101 | 6,406,190 | ||||||||||||||

Research and development | 9,756,206 | 7,088,077 | 2,948,313 | 1,408,749 | 1,759,694 | ||||||||||||||

Impairment of intangible assets (b) | 1,952,000 | — | — | — | — | ||||||||||||||

Total operating expenses | 40,937,504 | 34,812,734 | 24,601,734 | 16,869,852 | 19,457,296 | ||||||||||||||

Operating loss | (13,312,097 | ) | (6,318,031 | ) | (834,931 | ) | 246,356 | (1,851,305 | ) | ||||||||||

Other income (expense): | |||||||||||||||||||

Interest expense (c) | (748,969 | ) | (1,765,813 | ) | (1,957,010 | ) | (178,524 | ) | (116,392 | ) | |||||||||

Loss on conversion of convertible notes (d) | — | — | (5,970,002 | ) | — | — | |||||||||||||

Loss on early extinguishment of debt | (429,849 | ) | (160,713 | ) | — | — | — | ||||||||||||

Miscellaneous (expenses) income (e) | 1,592,449 | (3,573,091 | ) | 494,677 | (30,943 | ) | 34,080 | ||||||||||||

Loss before income taxes | (12,898,466 | ) | (11,817,648 | ) | (8,267,266 | ) | 36,889 | (1,933,617 | ) | ||||||||||

Income tax benefit | 887,009 | 100,458 | 2,888,537 | (24,315 | ) | (1,017,000 | ) | ||||||||||||

Net loss | (12,011,457 | ) | (11,717,190 | ) | (5,378,729 | ) | 12,574 | (2,950,617 | ) | ||||||||||

Less: deemed dividends on Series A Preferred Shares (d) | (1,038,310 | ) | (1,180,904 | ) | (176,048 | ) | — | — | |||||||||||

Net loss attributable to common shareholders | $ | (13,049,767 | ) | $ | (12,898,094 | ) | $ | (5,554,777 | ) | $ | 12,574 | $ | (2,950,617 | ) | |||||

Basic net loss per common share | $ | (0.71 | ) | $ | (0.94 | ) | $ | (0.48 | ) | $ | — | $ | (0.31 | ) | |||||

Number of shares used in basic per common share computation | 18,261,800 | 13,747,700 | 11,634,540 | 9,887,841 | 9,504,986 | ||||||||||||||

Diluted net loss per common share | $ | (0.71 | ) | $ | (0.94 | ) | $ | (0.48 | ) | $ | — | $ | (0.31 | ) | |||||

Number of shares used in diluted per common share computation | 18,261,800 | 13,747,700 | 11,634,540 | 9,899,073 | 9,504,986 | ||||||||||||||

_______________

(a) | Fiscal years 2011, 2012, 2013, and 2014 amounts include the results of operations of the following acquisitions: Interpoint Partners, LLC (“Interpoint”), from December 11, 2011; Meta Health Technology, Inc. (“Meta”), from August 16, 2012; Clinical Looking Glass (“CLG”), from October 25, 2013; and Unibased Systems Architecture, Inc., from February 3, 2014. |

(b) | In fiscal 2014, Meta trade name was deemed impaired and written off in full, resulting in a $1,952,000 loss. |

(c) | Interest expense increased during 2012 primarily as a result of increases in the term loans interest and success fees associated with the Fifth Third Bank credit agreements, entered into to fund the Interpoint and Meta acquisitions - Please refer to Note 6 - Debt to our consolidated financial statements included herein for additional details on these credit agreements. |

(d) | Please refer to Note 15 - Private Placement Investment to our consolidated financial statements included herein for details on convertible notes and Series A Preferred Shares. |

(e) | Fiscal 2013 includes expense related to cumulative change in value of the earn-out totaling $3,580,000. Fiscal 2014 includes $2,283,000 in income related to valuation adjustment for warrants liability. |

17

Consolidated Balance Sheets Data (a): | January 31 | ||||||||||||||||||

2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||||||

Cash and cash equivalents (b) | $ | 6,522,600 | $ | 17,924,886 | $ | 7,500,256 | $ | 2,243,054 | $ | 1,403,949 | |||||||||

Current assets | 16,505,723 | 29,688,229 | 19,877,778 | 8,408,243 | 5,938,415 | ||||||||||||||

Total assets | 55,779,115 | 65,578,874 | 55,266,578 | 25,141,058 | 16,015,422 | ||||||||||||||

Current liabilities | 14,299,591 | 15,411,979 | 17,325,422 | 8,742,621 | 8,159,949 | ||||||||||||||

Non-current liabilities | 15,839,758 | 15,076,180 | 16,716,138 | 8,399,913 | 1,261,034 | ||||||||||||||

Total liabilities | 30,139,349 | 30,488,159 | 34,041,560 | 17,142,534 | 9,420,983 | ||||||||||||||

Series A 0% Convertible Redeemable Preferred Stock (c) | 6,637,978 | 5,599,668 | 7,765,716 | — | — | ||||||||||||||

Total stockholders’ equity | $ | 19,001,788 | $ | 29,491,047 | $ | 13,459,302 | $ | 7,998,524 | $ | 6,594,439 | |||||||||

_______________

(a) | Overall increase in January 31, 2012, 2013, 2014 and 2015 amounts resulting from the following acquisitions: Interpoint in December 2011, Meta in August 2012, CLG in October 2013, and Unibased in February 2014. |

(b) | Increased January 31, 2014 balance is attributed to cash raised through the public offering of 3,450,000 shares of the Company’s common stock in November 2013, as described in Note 16 - Stockholders’ Equity to our consolidated financial statements included herein. |