Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ELAH Holdings, Inc. | sggh-8k_20150416.htm |

| EX-99.2 - EX-99.2 - ELAH Holdings, Inc. | sggh-ex992_2015041672.htm |

INVESTOR PRESENTATION April 16, 2015 Speakers: Craig Bouchard, Chairman and CEO of Signature Kyle Ross, Executive Vice President and CFO of Signature John Miller, Executive Vice President of Operations of Signature Terry Hogan, President of Real Alloy Mike Hobey, CFO of Real Alloy Exhibit 99.1

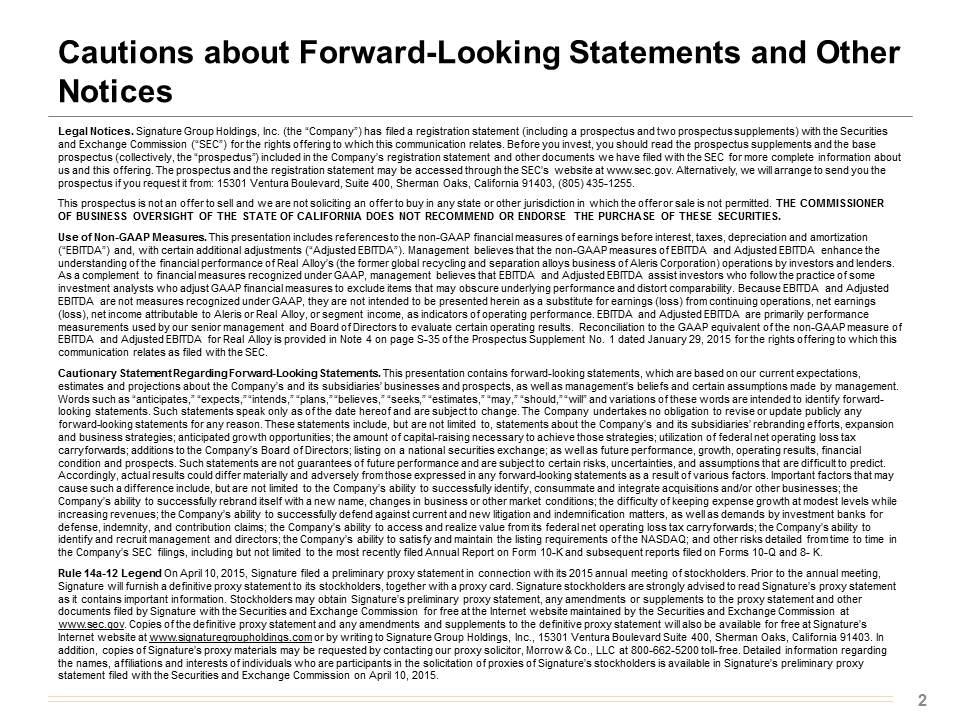

Cautions about Forward-Looking Statements and Other Notices Legal Notices. Signature Group Holdings, Inc. (the “Company”) has filed a registration statement (including a prospectus and two prospectus supplements) with the Securities and Exchange Commission (“SEC”) for the rights offering to which this communication relates. Before you invest, you should read the prospectus supplements and the base prospectus (collectively, the “prospectus”) included in the Company’s registration statement and other documents we have filed with the SEC for more complete information about us and this offering. The prospectus and the registration statement may be accessed through the SEC’s website at www.sec.gov. Alternatively, we will arrange to send you the prospectus if you request it from: 15301 Ventura Boulevard, Suite 400, Sherman Oaks, California 91403, (805) 435-1255. This prospectus is not an offer to sell and we are not soliciting an offer to buy in any state or other jurisdiction in which the offer or sale is not permitted. THE COMMISSIONER OF BUSINESS OVERSIGHT OF THE STATE OF CALIFORNIA DOES NOT RECOMMEND OR ENDORSE THE PURCHASE OF THESE SECURITIES. Use of Non-GAAP Measures. This presentation includes references to the non-GAAP financial measures of earnings before interest, taxes, depreciation and amortization (“EBITDA”) and, with certain additional adjustments (“Adjusted EBITDA”). Management believes that the non-GAAP measures of EBITDA and Adjusted EBITDA enhance the understanding of the financial performance of Real Alloy’s (the former global recycling and separation alloys business of Aleris Corporation) operations by investors and lenders. As a complement to financial measures recognized under GAAP, management believes that EBITDA and Adjusted EBITDA assist investors who follow the practice of some investment analysts who adjust GAAP financial measures to exclude items that may obscure underlying performance and distort comparability. Because EBITDA and Adjusted EBITDA are not measures recognized under GAAP, they are not intended to be presented herein as a substitute for earnings (loss) from continuing operations, net earnings (loss), net income attributable to Aleris or Real Alloy, or segment income, as indicators of operating performance. EBITDA and Adjusted EBITDA are primarily performance measurements used by our senior management and Board of Directors to evaluate certain operating results. Reconciliation to the GAAP equivalent of the non-GAAP measure of EBITDA and Adjusted EBITDA for Real Alloy is provided in Note 4 on page S-35 of the Prospectus Supplement No. 1 dated January 29, 2015 for the rights offering to which this communication relates as filed with the SEC. Cautionary Statement Regarding Forward-Looking Statements. This presentation contains forward-looking statements, which are based on our current expectations, estimates and projections about the Company’s and its subsidiaries’ businesses and prospects, as well as management’s beliefs and certain assumptions made by management. Words such as “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “may,” “should,” “will” and variations of these words are intended to identify forward-looking statements. Such statements speak only as of the date hereof and are subject to change. The Company undertakes no obligation to revise or update publicly any forward-looking statements for any reason. These statements include, but are not limited to, statements about the Company’s and its subsidiaries’ rebranding efforts, expansion and business strategies; anticipated growth opportunities; the amount of capital-raising necessary to achieve those strategies; utilization of federal net operating loss tax carryforwards; additions to the Company’s Board of Directors; listing on a national securities exchange; as well as future performance, growth, operating results, financial condition and prospects. Such statements are not guarantees of future performance and are subject to certain risks, uncertainties, and assumptions that are difficult to predict. Accordingly, actual results could differ materially and adversely from those expressed in any forward-looking statements as a result of various factors. Important factors that may cause such a difference include, but are not limited to the Company’s ability to successfully identify, consummate and integrate acquisitions and/or other businesses; the Company’s ability to successfully rebrand itself with a new name, changes in business or other market conditions; the difficulty of keeping expense growth at modest levels while increasing revenues; the Company’s ability to successfully defend against current and new litigation and indemnification matters, as well as demands by investment banks for defense, indemnity, and contribution claims; the Company’s ability to access and realize value from its federal net operating loss tax carryforwards; the Company’s ability to identify and recruit management and directors; the Company’s ability to satisfy and maintain the listing requirements of the NASDAQ; and other risks detailed from time to time in the Company’s SEC filings, including but not limited to the most recently filed Annual Report on Form 10-K and subsequent reports filed on Forms 10-Q and 8- K. Rule 14a-12 Legend On April 10, 2015, Signature filed a preliminary proxy statement in connection with its 2015 annual meeting of stockholders. Prior to the annual meeting, Signature will furnish a definitive proxy statement to its stockholders, together with a proxy card. Signature stockholders are strongly advised to read Signature’s proxy statement as it contains important information. Stockholders may obtain Signature’s preliminary proxy statement, any amendments or supplements to the proxy statement and other documents filed by Signature with the Securities and Exchange Commission for free at the Internet website maintained by the Securities and Exchange Commission at www.sec.gov. Copies of the definitive proxy statement and any amendments and supplements to the definitive proxy statement will also be available for free at Signature’s Internet website at www.signaturegroupholdings.com or by writing to Signature Group Holdings, Inc., 15301 Ventura Boulevard Suite 400, Sherman Oaks, California 91403. In addition, copies of Signature’s proxy materials may be requested by contacting our proxy solicitor, Morrow & Co., LLC at 800-662-5200 toll-free. Detailed information regarding the names, affiliations and interests of individuals who are participants in the solicitation of proxies of Signature’s stockholders is available in Signature’s preliminary proxy statement filed with the Securities and Exchange Commission on April 10, 2015.

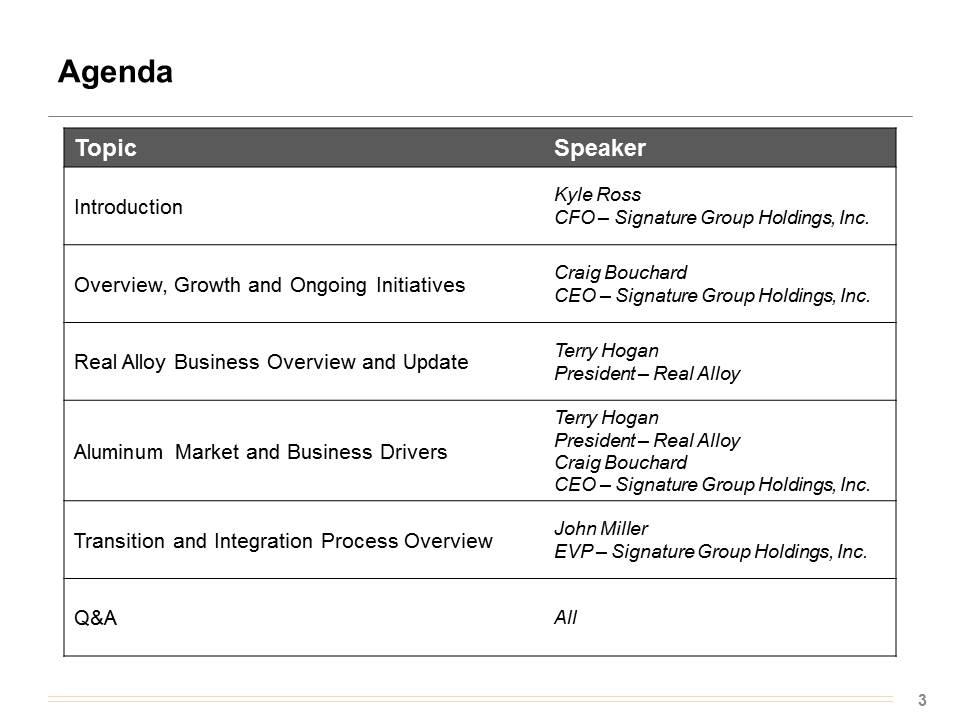

Agenda Topic Speaker Introduction Kyle Ross CFO – Signature Group Holdings, Inc. Overview, Growth and Ongoing Initiatives Craig Bouchard CEO – Signature Group Holdings, Inc. Real Alloy Business Overview and Update Terry Hogan President – Real Alloy Aluminum Market and Business Drivers Terry Hogan President – Real Alloy Craig Bouchard CEO – Signature Group Holdings, Inc. Transition and Integration Process Overview John Miller EVP – Signature Group Holdings, Inc. Q&A All

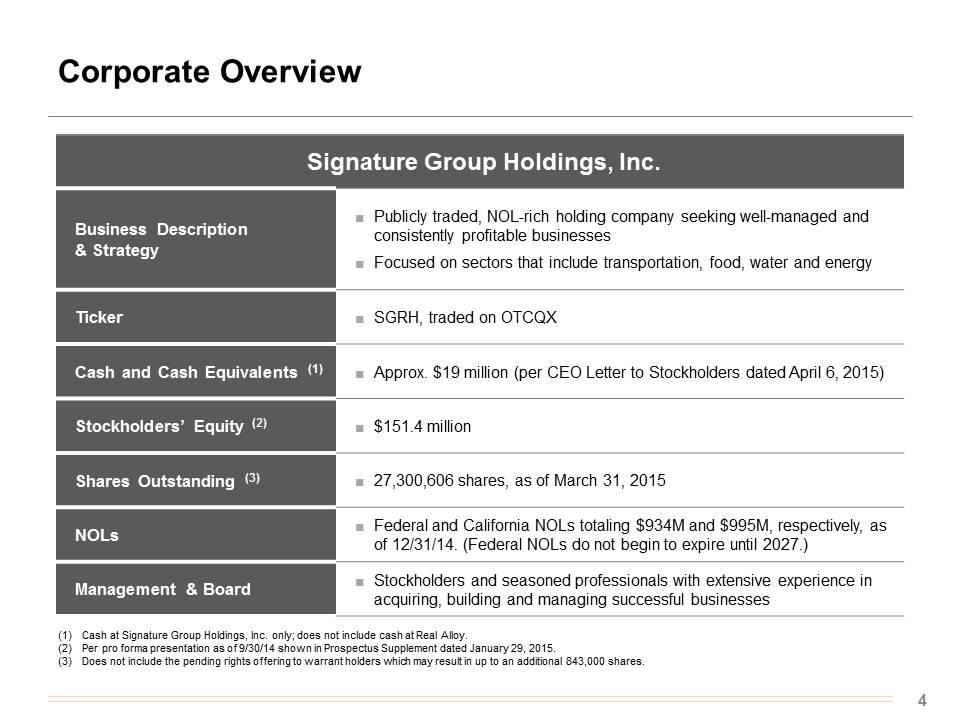

Corporate Overview Signature Group Holdings, Inc. Business Description & Strategy Publicly traded, NOL-rich holding company seeking well-managed and consistently profitable businesses Focused on sectors that include transportation, food, water and energy Ticker SGRH, traded on OTCQX Cash and Cash Equivalents (1) Approx. $19 million (per CEO Letter to Stockholders dated April 6, 2015) Stockholders’ Equity (2) $151.4 million Shares Outstanding (3) 27,300,606 shares, as of March 31, 2015 NOLs Federal and California NOLs totaling $934M and $995M, respectively, as of 12/31/14. (Federal NOLs do not begin to expire until 2027.) Management & Board Stockholders and seasoned professionals with extensive experience in acquiring, building and managing successful businesses Cash at Signature Group Holdings, Inc. only; does not include cash at Real Alloy. Per pro forma presentation as of 9/30/14 shown in Prospectus Supplement dated January 29, 2015. Does not include the pending rights offering to warrant holders which may result in up to an additional 843,000 shares.

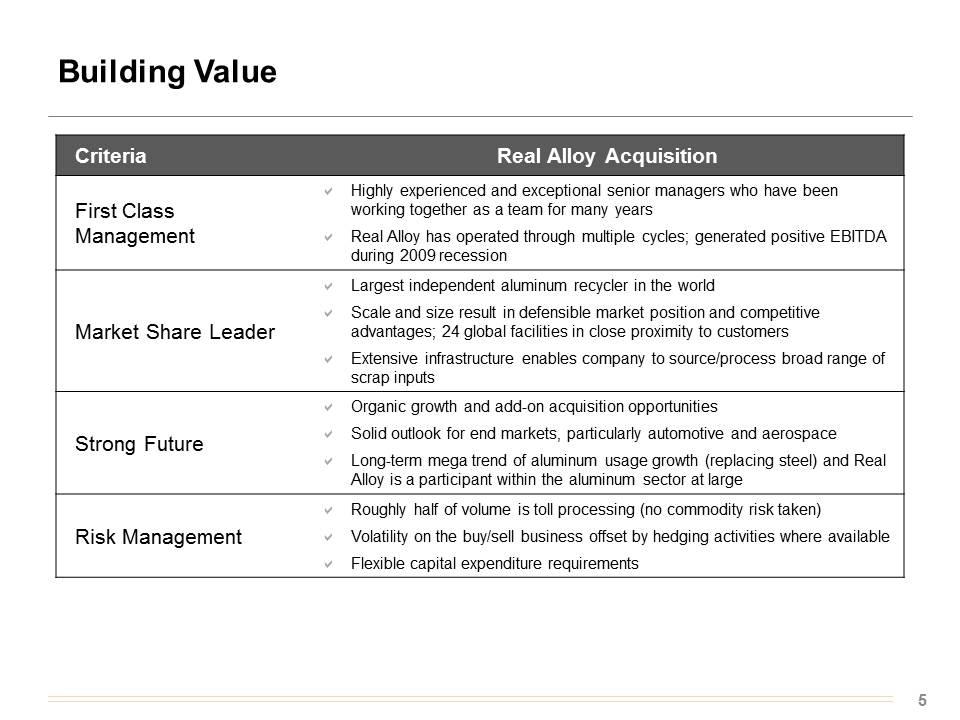

Building Value Criteria Real Alloy Acquisition First Class Management Highly experienced and exceptional senior managers who have been working together as a team for many years Real Alloy has operated through multiple cycles; generated positive EBITDA during 2009 recession Market Share Leader Largest independent aluminum recycler in the world Scale and size result in defensible market position and competitive advantages; 24 global facilities in close proximity to customers Extensive infrastructure enables company to source/process broad range of scrap inputs Strong Future Organic growth and add-on acquisition opportunities Solid outlook for end markets, particularly automotive and aerospace Long-term mega trend of aluminum usage growth (replacing steel) and Real Alloy is a participant within the aluminum sector at large Risk Management Roughly half of volume is toll processing (no commodity risk taken) Volatility on the buy/sell business offset by hedging activities where available Flexible capital expenditure requirements

Objectives Support organic growth opportunities Manage liquidity De-leverage Optimize working capital Assess add-on acquisitions Minimize common share issuance in future acquisitions

Corporate Initiatives April 13, 2015 – announced Annual Stockholder Meeting date of May 28, 2015 Increased size of Board of Directors from five to seven Nominated two very experienced operational executives with history of serving on public company boards Proposing corporate name change to Real Industry, Inc.™ (subject to stockholder approval) Application to NASDAQ approved New ticker symbol planned: RELY Seeking more research analyst coverage

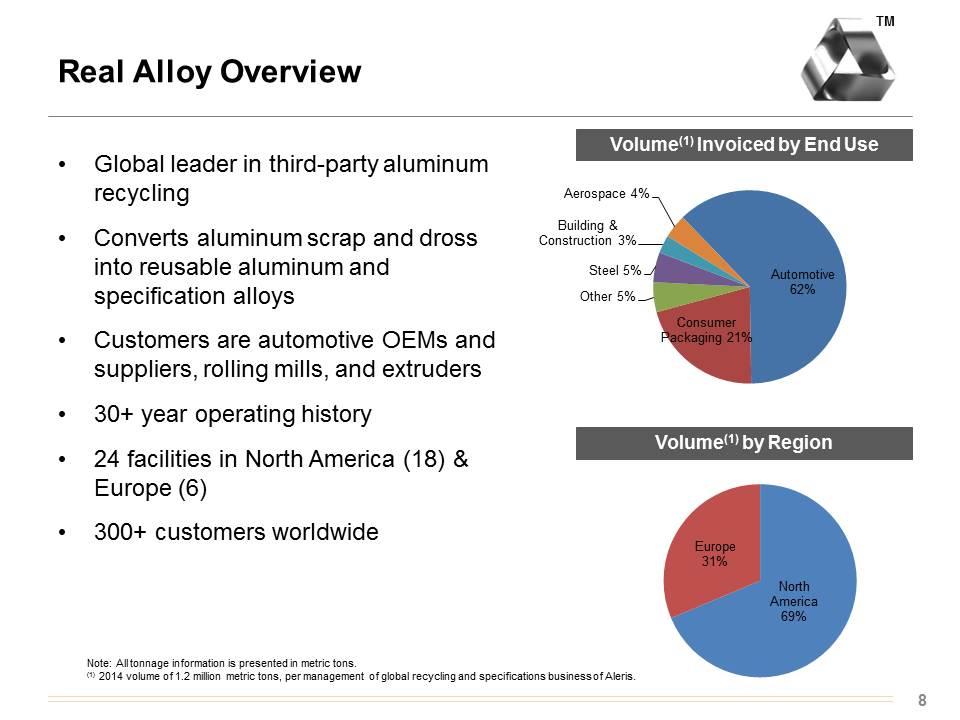

Real Alloy Overview Global leader in third-party aluminum recycling Converts aluminum scrap and dross into reusable aluminum and specification alloys Customers are automotive OEMs and suppliers, rolling mills, and extruders 30+ year operating history 24 facilities in North America (18) & Europe (6) 300+ customers worldwide Note: All tonnage information is presented in metric tons. (1) 2014 volume of 1.2 million metric tons, per management of global recycling and specifications business of Aleris. Volume(1) Invoiced by End Use Volume(1) by Region TM

Real Alloy Update Positive reaction to acquisition by customers and suppliers No major changes in customer lineup Continue to see new opportunities Lean / Six Sigma approach to improving operational efficiencies Continuing excellent relationship with Aleris Employee morale remains high Safety performance strong / remains key area of focus

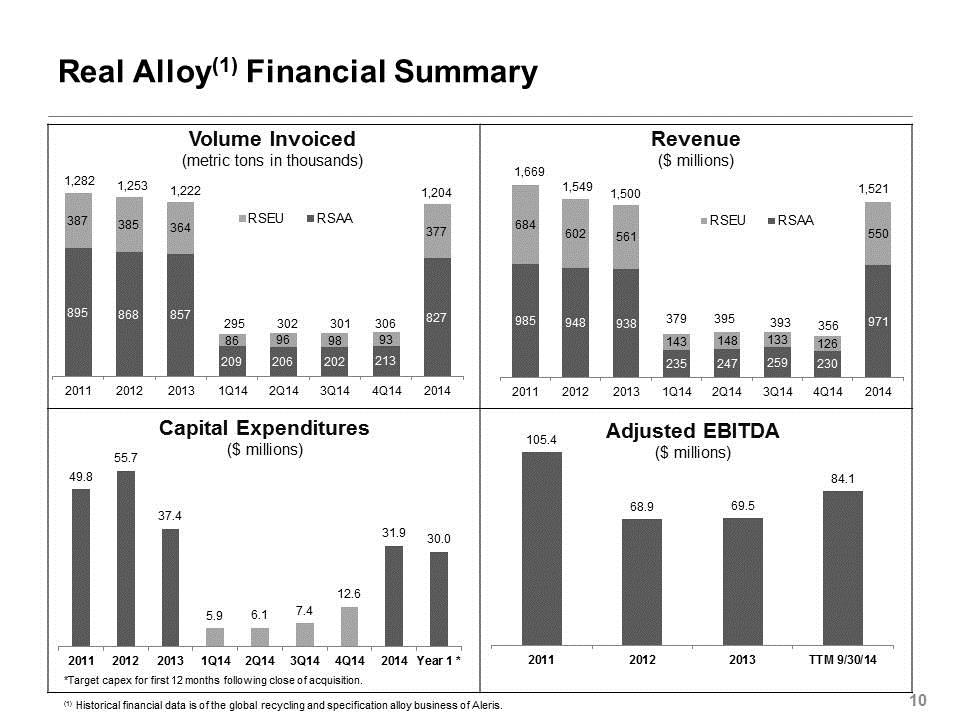

Real Alloy(1) Financial Summary Revenue ($ millions) Volume Invoiced (metric tons in thousands) *Target capex for first 12 months following close of acquisition. (1) Historical financial data is of the global recycling and specification alloy business of Aleris.

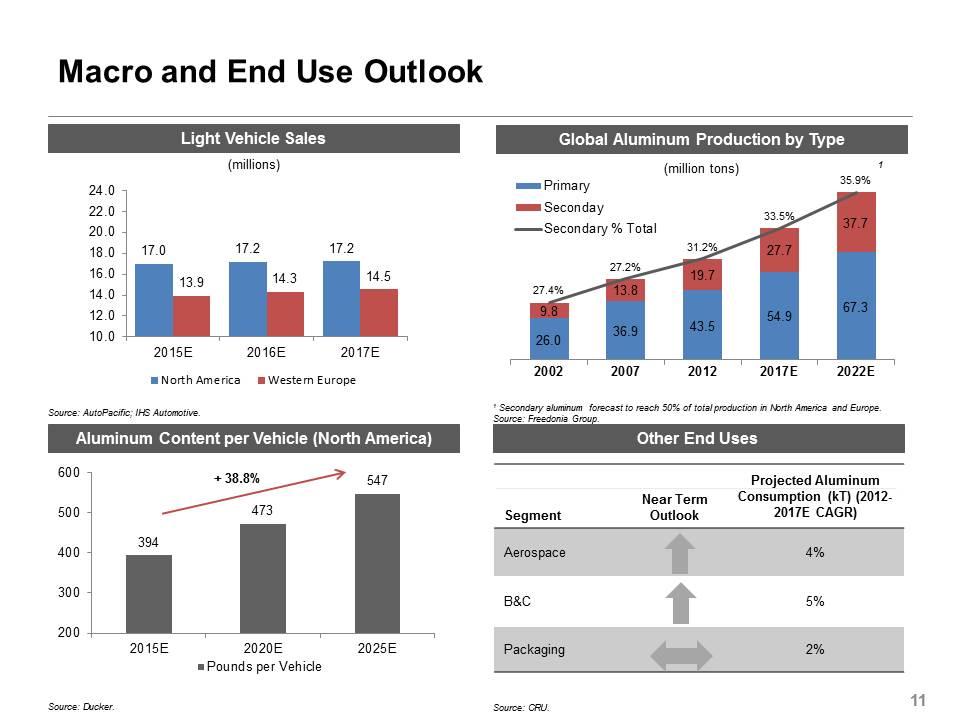

Macro and End Use Outlook Global Aluminum Production by Type Other End Uses Aluminum Content per Vehicle (North America) Light Vehicle Sales (million tons) (millions) Segment Near Term Outlook Projected Aluminum Consumption (kT) (2012-2017E CAGR) Aerospace 4% B&C 5% Packaging 2% 1 Secondary aluminum forecast to reach 50% of total production in North America and Europe. Source: Freedonia Group. Source: CRU. Source: AutoPacific; IHS Automotive. Source: Ducker. 1

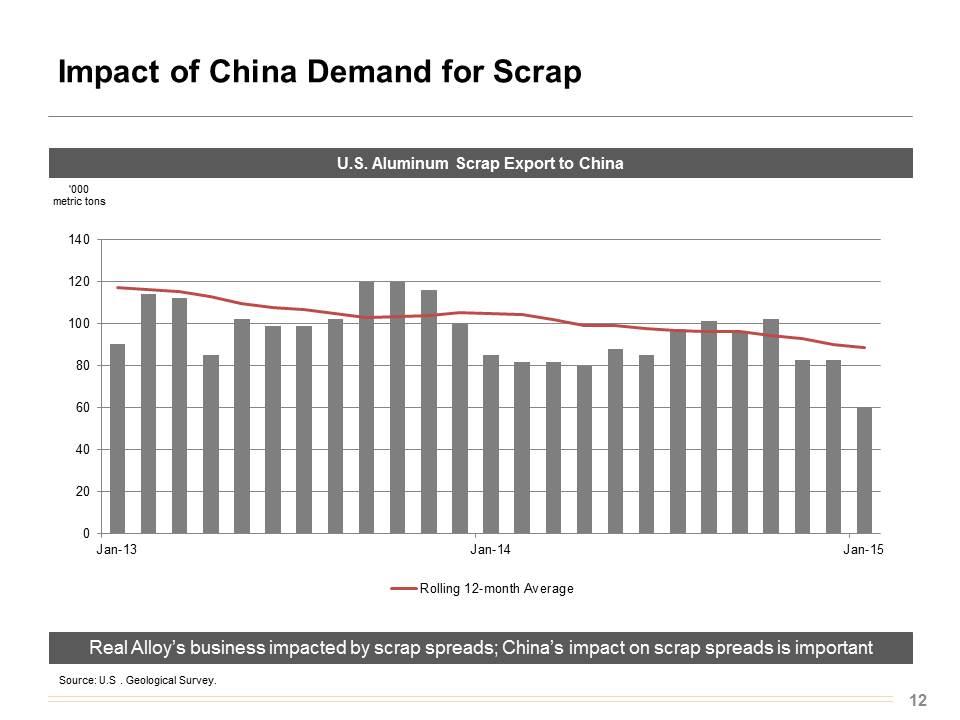

Impact of China Demand for Scrap U.S. Aluminum Scrap Export to China Real Alloy’s business impacted by scrap spreads; China’s impact on scrap spreads is important Source: U.S . Geological Survey.

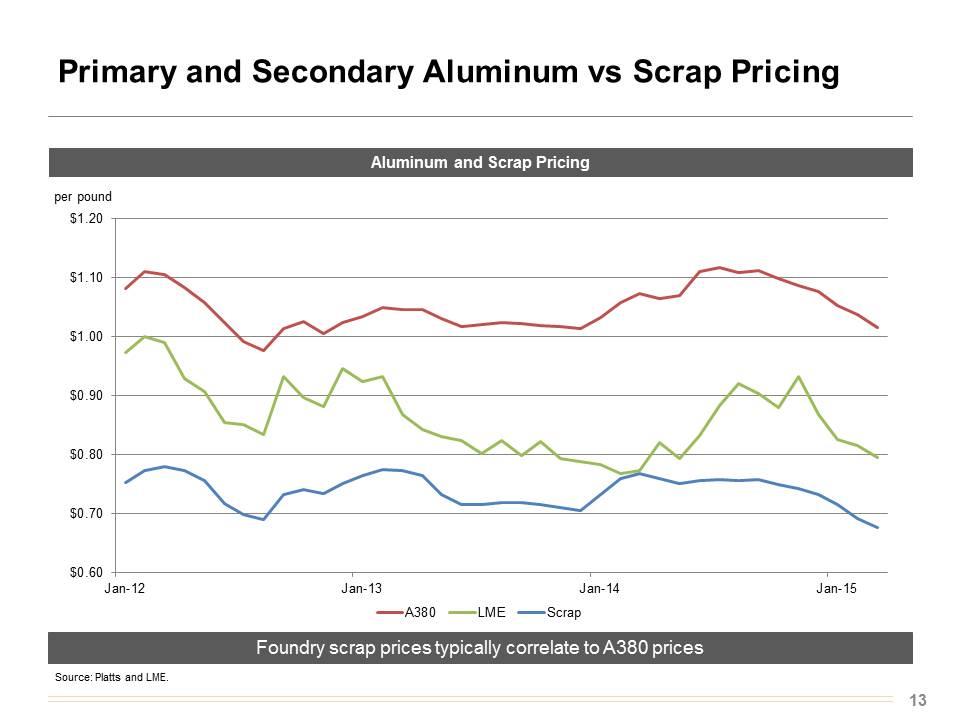

Primary and Secondary Aluminum vs Scrap Pricing Foundry scrap prices typically correlate to A380 prices Source: Platts and LME. Aluminum and Scrap Pricing

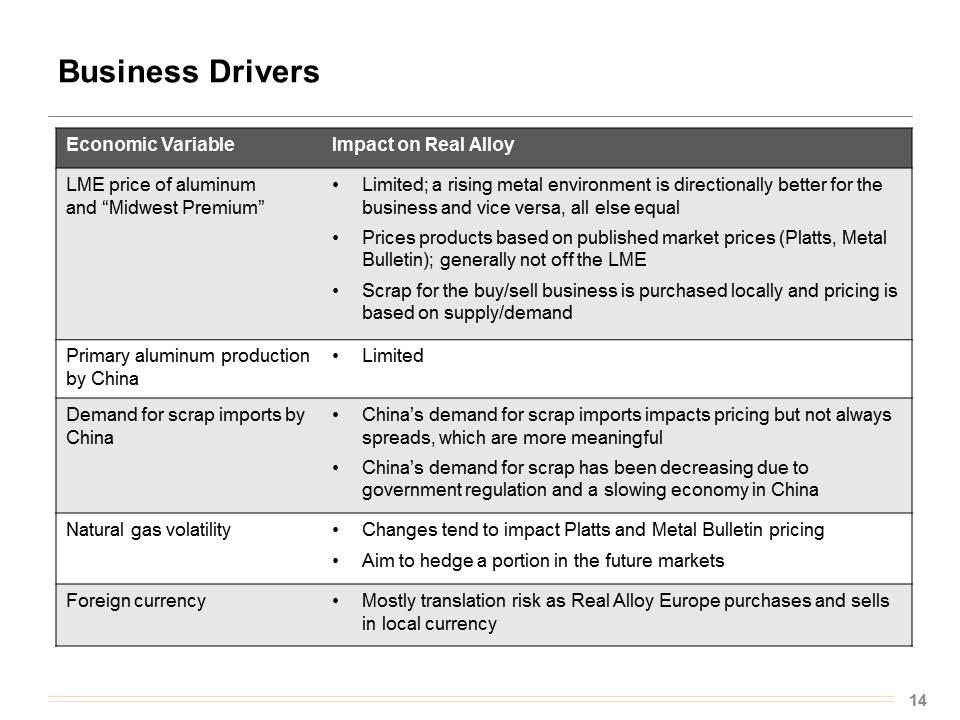

Business Drivers Economic Variable Impact on Real Alloy LME price of aluminum and “Midwest Premium” Limited; a rising metal environment is directionally better for the business and vice versa, all else equal Prices products based on published market prices (Platts, Metal Bulletin); generally not off the LME Scrap for the buy/sell business is purchased locally and pricing is based on supply/demand Primary aluminum production by China Limited Demand for scrap imports by China China’s demand for scrap imports impacts pricing but not always spreads, which are more meaningful China’s demand for scrap has been decreasing due to government regulation and a slowing economy in China Natural gas volatility Changes tend to impact Platts and Metal Bulletin pricing Aim to hedge a portion in the future markets Foreign currency Mostly translation risk as Real Alloy Europe purchases and sells in local currency

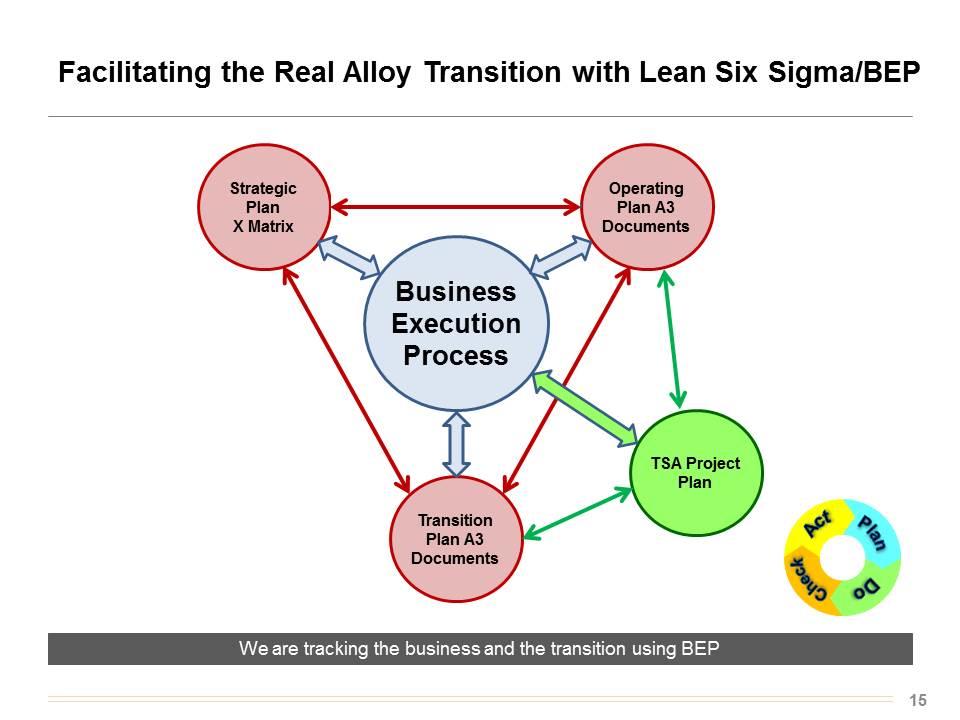

Facilitating the Real Alloy Transition with Lean Six Sigma/BEP Operating Plan A3 Documents Business Execution Process Strategic Plan X Matrix Transition Plan A3 Documents TSA Project Plan We are tracking the business and the transition using BEP Plan Check Do Act

Real Alloy BEP Transition Goals Phase 1 – Transition Plan and 2015 Operating Plan No disruption to our business, customers, or employees Exceed financial targets for 2015 Achieve standalone status by Q4 with TSA costs below budget Drive 1% Cost of Sales (COS) reduction through Lean Management/ Six Sigma Create a common language and culture around BEP Phase 2 – 2016 Strategic Business Plan Drive long-term business growth at Real Alloy Enhance EBITDA results and COS position Increase organizational and operational effectiveness Establish Lean/BEP as a benchmark for future acquisitions

Examples of Real Alloy A3’s Operational Plan Examples Achieve EBITDA, metal volume sales, and dollar sales above plan in 2015 Attain Worldwide Free Cash Flow at or above plan in 2015 Maintain Worldwide liquidity above plan in 2015 Attain Inventory Targets in North America and Europe in 2015 Exit the Transition Services Agreement with Aleris under budget and ahead of schedule Achieve monthly Cash Conversion Cost targets in North America and Europe Develop and execute on the CapEx plans for North America and Europe for 2015 Achieve Cost of Sales reduction of 1% vs. 2014 through Six Sigma and Lean Management Transition Plan Examples Establish critical internal operational financial systems and functionality for Real Alloy ahead of schedule Develop and implement a robust standalone HSE Plan for Real Alloy in 2015 Establish standalone compensation and benefits systems worldwide by year-end 2015 Establish standalone Human Resources processes worldwide by year-end 2015 Create a standalone network capability and IT operational environment for Real Alloy by October 2015

Appendix

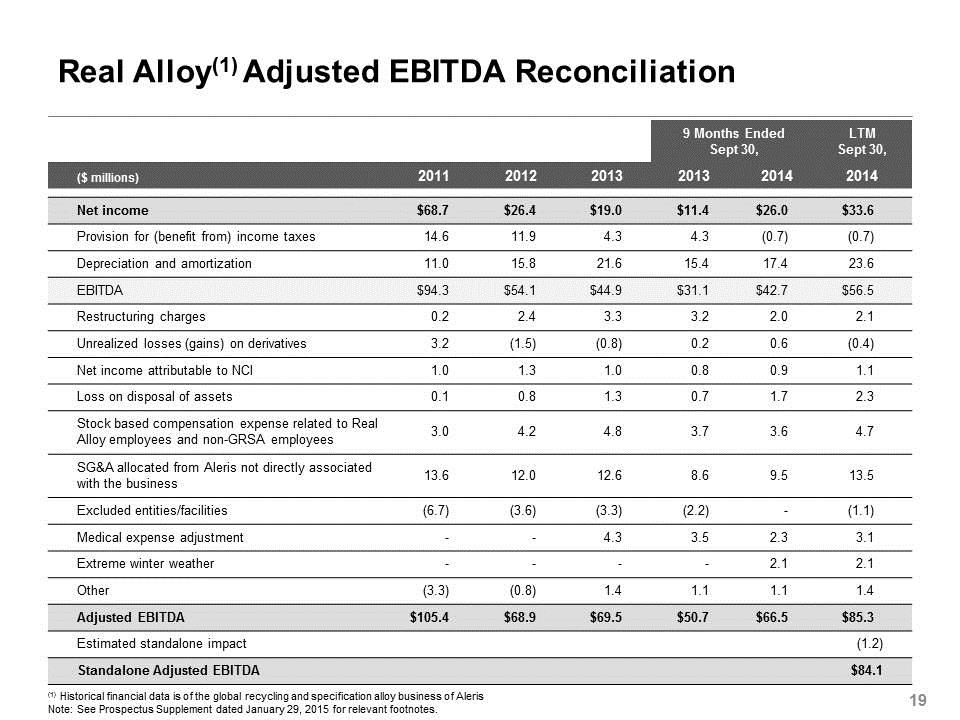

Real Alloy(1) Adjusted EBITDA Reconciliation 9 Months Ended Sept 30, LTM Sept 30, ($ millions) 2011 2012 2013 2013 2014 2014 Net income $68.7 $26.4 $19.0 $11.4 $26.0 $33.6 Provision for (benefit from) income taxes 14.6 11.9 4.3 4.3 (0.7) (0.7) Depreciation and amortization 11.0 15.8 21.6 15.4 17.4 23.6 EBITDA $94.3 $54.1 $44.9 $31.1 $42.7 $56.5 Restructuring charges 0.2 2.4 3.3 3.2 2.0 2.1 Unrealized losses (gains) on derivatives 3.2 (1.5) (0.8) 0.2 0.6 (0.4) Net income attributable to NCI 1.0 1.3 1.0 0.8 0.9 1.1 Loss on disposal of assets 0.1 0.8 1.3 0.7 1.7 2.3 Stock based compensation expense related to Real Alloy employees and non-GRSA employees 3.0 4.2 4.8 3.7 3.6 4.7 SG&A allocated from Aleris not directly associated with the business 13.6 12.0 12.6 8.6 9.5 13.5 Excluded entities/facilities (6.7) (3.6) (3.3) (2.2) - (1.1) Medical expense adjustment - - 4.3 3.5 2.3 3.1 Extreme winter weather - - - - 2.1 2.1 Other (3.3) (0.8) 1.4 1.1 1.1 1.4 Adjusted EBITDA $105.4 $68.9 $69.5 $50.7 $66.5 $85.3 Estimated standalone impact (1.2) Standalone Adjusted EBITDA $84.1 (1) Historical financial data is of the global recycling and specification alloy business of Aleris Note: See Prospectus Supplement dated January 29, 2015 for relevant footnotes.

Signature Board New Director Nominees Patrick Deconinck Mr. Deconinck served as Senior Vice President-West Europe for 3M Company from 2011 to 2015, with overall responsibility for 3M’s West Europe business, overseeing 16,000 employees in 16 countries. 3M’s West Europe business accounted for approximately 20% of 3M’s total revenues. During this period, Mr. Deconinck orchestrated the restructuring of 3M’s European supply chain organization. From 2005 to 2011, Mr. Deconinck was Vice President and General Manager of 3M’s Industrial Adhesives & Tapes Division where he provided global leadership for 3M’s largest operating unit. Mr. Deconinck retired in March 2015 after providing more than 38 years of service with 3M. Mr. Deconinck holds an Acceptance degree in Applied Sciences from Catholic University of Leuven (Belgium). William Hall Mr. Hall has over thirty years of senior operating executive experience at Procyon Technologies, Eagle Industries, Fruit of the Loom, Cummins Inc., and Falcon Building Products, Inc. Mr. Hall has served as the General Partner of Procyon Advisors LLP, a Chicago-based private equity firm providing consulting and growth capital for healthcare services companies, since 2006. Mr. Hall is currently a member of the board of directors of Stericycle, Inc. and serves as the Chairman of the Compensation Committee and formerly served as a member of the Audit Committee. He is also currently a member of the board of directors of W. W. Grainger, Inc. and serves on both the Audit Committee as a financial expert, and the Governance Committee. Mr. Hall was previously a member of the board of directors of Actuant Corporation and served on both the Audit and Governance Committees. He has also previously been a member of the board of directors of A. M. Castle and served as the chairman of the Governance Committee and members of the Audit and Compensation Committees. Mr. Hall holds degrees in aeronautical engineering (B.S.E.), mathematical statistics (M.S.) and business administration (M.B.A. and Ph.D.), all from the University of Michigan.